- How it works

Useful Links

How much will your dissertation cost?

Have an expert academic write your dissertation paper!

Dissertation Services

Get unlimited topic ideas and a dissertation plan for just £45.00

Order topics and plan

Get 1 free topic in your area of study with aim and justification

Yes I want the free topic

50+ Focused Taxation Research Topics For Your Dissertation

Published by Ellie Cross at December 29th, 2022 , Revised On May 2, 2024

A thorough understanding of taxation involves drawing from multiple sources to understand its goals, strategies, techniques, standards, applications, and many types. Tax dissertations require extensive research across a variety of areas and sources to reach a conclusive result. It is important to understand and present tax dissertation themes well since they deal with technical matters.

Choosing the right topic in the area of taxation can assist students in understanding how much insight and knowledge they can contribute and the tools they will need to authenticate their study.

If you are not sure what to write about, here are a few top taxation dissertation topics to inspire you .

The Most Pertinent Taxation Topics & Ideas

- The effects of tax evasion and avoidance on and the supporting data

- How does budgeting affect the management of tertiary institutions?

- How does intellectual capital affect the development and growth of huge companies, using Microsoft and Apple as examples?

- The importance and function of audit committees in South Africa and China: similarities and disparities

- How taxation can aid in closing the fiscal gap in the UK economy’s budget

- A UK study comparing modern taxation and the zakat system

- Is it appropriate to hold the UK government accountable for subpar services even after paying taxes?

- Taxation’s effects on both large and small businesses

- The impact of foreign currencies on the nation’s economy and labour market and their detrimental effects on the country’s tax burden

- A paper explaining the importance of accounting in the tax department

- To contribute to the crucial growth of the nation, do a thorough study on enhancing tax benefits among American residents

- A thorough comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- According to the most recent academic study on tax law, what essential improvements are needed to implement tax laws in the UK?

- A thorough investigation of Australian tax department employees’ active role in assisting residents of all Commonwealth states to pay their taxes on time.

- Why establishing a taxation system is essential for a country’s growth

- What is the tax system’s greatest benefit to the poor?

- Is it legitimate to lower the income tax so that more people begin paying it?

- What is the most significant investment made using tax revenue by the government?

- Is it feasible for the government to create diverse social welfare policies without having the people pay the appropriate taxes?

- How tax avoidance by people leads to an imbalance in the government budget

- What should deter people from trying to avoid paying taxes on time?

- Workers of the tax department’s role in facilitating tax evasion through corruption

- Investigate the changes that should be made to the current taxation system. A case study based on the most recent UK tax studies

- Examine the variables that affect the amount of income tax UK people are required to pay

- An analysis of the effects of intellectual capital on the expansion and development of large businesses and multinationals. An Apple case study

- A comparison of the administration and policy of taxes in industrialised and emerging economies

- A detailed examination of the background and purposes of international tax treaties. How successful were they?

- An examination of the effects of taxation on small and medium-sized enterprises compared to giant corporations

- An examination of the effects of tax avoidance and evasion. An analysis of the worldwide Panama crisis and how tax fraud was carried out through offshore firms

- A critical analysis of how the administration of higher institutions is impacted by small business budgeting

- Recognising the importance of foreign currency in a nation’s economy. How can foreign exchange and remittances help a nation’s finances?

- An exploration of the best ways tax professionals may persuade customers to pay their taxes on time

- An investigation of the potential impact of tax and accounting education on the achievement of the nation’s leaders

- How the state might expand its revenue base by focusing on new taxing areas. Gaining knowledge of the digital content creation and freelance industries

- An evaluation of the negative impacts of income tax reduction. Will it prompt more people to begin paying taxes?

- A critical examination of the state’s use of tax revenue for human rights spending. A UK case study

- A review of the impact of income tax on new and small enterprises. Weighing the benefits and drawbacks

- A comprehensive study of managing costs so that money may flow into the national budget without interruption. A study of Norway as an example

- An overview of how effective taxes may contribute to a nation’s development of a welfare state. A study of Denmark as an example

- What are the existing problems that prevent the government systems from using the tax money they receive effectively and completely?

- What are people’s opinions of those who frequently avoid paying taxes?

- Explain the part tax officials play in facilitating tax fraud by accepting small bribes

- How do taxes finance the growth and financial assistance of the underprivileged in the UK?

- Is it appropriate to criticise the government for not providing adequate services when people and businesses fail to pay their taxes?

- A comprehensive comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- A critical evaluation of the regulatory organisations was conducted to determine the tax percentage on different income groups in the UK.

- An investigation into tax evasion: How do wealthy, influential people influence the entire system?

- To contribute to the crucial growth of the nation, conduct a thorough investigation of enhancing tax benefits among British nationals.

- An assessment of the available research on the most effective ways to manage and maintain an uninterrupted flow of funds for a better economy.

- The effect and limitations of bilateral and multilateral tax treaties in addressing double taxation and preventing tax evasion.

- Assess solutions: OECD/G20 Base Erosion and Profit Shifting (BEPS) project and explore the implications for multinational corporations.

- The Impact of Tax cuts in Obtaining Social, monetary, and Aesthetic Ends That Benefit the Community.

- Exploring the Effect of Section 1031 of the Tax Code During Transactions on Investors and Business People.

- Investigating the role of environmental taxes and incentives in addressing global environmental challenges.

- Evaluating the impact of increased transparency on multinational enterprises and global efforts to combat tax evasion and illicit financial flows.

- Exploring the health and financial effects of a proposed policy to increase the excise tax on cigarettes.

Hire an Expert Writer

Orders completed by our expert writers are

- Formally drafted in an academic style

- Free Amendments and 100% Plagiarism Free – or your money back!

- 100% Confidential and Timely Delivery!

- Free anti-plagiarism report

- Appreciated by thousands of clients. Check client reviews

We hope that you will be able to write a first-class dissertation or thesis on one of the issues identified above at your own pace and submit a solid draft. If you wish to use any of the above taxation dissertation topics directly, you may do so. Many people, however, prefer tailor-made topics that meet their specific needs. If you need help with topics or a taxation dissertation, you can also use our dissertation writing services . Place your order now !

Free Dissertation Topic

Phone Number

Academic Level Select Academic Level Undergraduate Graduate PHD

Academic Subject

Area of Research

Frequently Asked Questions

How to find taxation dissertation topics.

To find taxation dissertation topics:

- Study recent tax reforms.

- Analyse cross-border tax issues.

- Explore digital taxation challenges.

- Investigate tax evasion or avoidance.

- Examine environmental tax policies.

- Select a topic aligned with law, economics, or business interests.

You May Also Like

Need interesting and manageable law dissertation topics or thesis? Here are the trending law dissertation titles so you can choose the most suitable one.

The study of cognitive psychology focuses on how the brain processes and stores information. The underlying mechanisms are investigated using experimental methods, computer modeling, and neuropsychology.

Are you looking for unique and intriguing branding dissertation topics, ideas and topic examples? If yes, continue reading this article because it provides several branding dissertation topic suggestions for your consideration.

USEFUL LINKS

LEARNING RESOURCES

COMPANY DETAILS

- How It Works

A Systems View Across Time and Space

- Open access

- Published: 16 February 2021

Factors influencing taxpayers to engage in tax evasion: evidence from Woldia City administration micro, small, and large enterprise taxpayers

- Erstu Tarko Kassa ORCID: orcid.org/0000-0002-8199-4910 1

Journal of Innovation and Entrepreneurship volume 10 , Article number: 8 ( 2021 ) Cite this article

72k Accesses

15 Citations

6 Altmetric

Metrics details

The main purpose of this paper is to investigate factors that influence taxpayers to engage in tax evasion. The researcher used descriptive and explanatory research design and followed a quantitative research approach. To undertake this study, primary and secondary data has been utilized. From the target population of 4979, by using a stratified and simple random sampling technique, 370 respondents were selected. To verify the data quality, the exploratory factor analysis (EFA) was conducted for each variable measurements. After factor analysis has been done, the data were analyzed by using Pearson correlation and multiple regression analysis. The finding of the study revealed that the relationship between the study independent variables with the dependent variable was positive and statistically significant. The regression analysis also indicates that tax fairness, tax knowledge, and moral obligation significantly influence taxpayers to engage in tax evasion, and the remaining moral obligation and subjective norms were not statistically significant to influence taxpayers to engage in tax evasion.

Introduction

In developed and developing countries, business owners, government workers, service providers, and other organizations are forced by the government to pay a tax for a long period in human being history, and no one can escape from the tax of the country. To support this, there is an interesting statement mentioned by Benjamin Franklin “nothing is certain except death and taxes”. This statement confirmed that every citizen should be subjected to the law of tax, and they are obliged to pay the tax from their income. To build large dams, to construct transportation infrastructures, and to provide quality social services for the community, collecting a tax from citizens plays a significant role for the governments (Saxunova and Szarkova, 2018 ).

Tax is the benchmark and turning point of the country’s overall development and changing the livelihoods and enhancing per capital income of the individuals. The gross domestic product of the developed countries and average revenue ratio were 35% in the year 2005, whereas in developing countries the share was 15% and in third world countries also not more than 12% (Mughal, 2012 ).

In the developing world, countries have no system to collect a sufficient amount of tax from their taxpayers. The expected amount of revenue cannot be enhanced due to different reasons. Among the reasons tax operation of the system may not be smooth, tax evasion and lack of awareness creation for the taxpayers are common in the developing world, and citizens are not committed to paying the expected amount of tax for their countries (Fagbemi et al., 2010 ). In today’s world, this remains very much the same as persons now pay taxes to their governments. As the world has evolved, tax compliance has taken a back seat with tax avoidance and tax evasion being at the forefront of the taxpayer’s main objective. Tax avoidance is the use of legal means to reduce one’s tax liability while tax evasion is the use of illegal means to reduce that tax liability (Alleyne & Harris, 2017 ). Tax evasion is a danger to the community; the countries and international organizations have been making an effort to fight undesirable phenomena related to taxation, the tax evasion, or tax fraud (Saxunova and Szarkova, 2018 ).

Tax evasion may brings a devastating loss for the country's GDP at the micro level, and it became a debatable and a special concern for tax collector authorities (Aumeerun et al., 2016 ). The participants in tax evasion activity critized by different individuals and groups by considering the loss that brings to the country economy (Alleyne & Harris, 2017 ).

According to Dalu et al., ( 2012 ) state that in the Zimbabwe tax system there are identical devils tax evasion and tax avoidance that create a problem for the government to collect a tax from taxpayers. Like Zimbabwe, many nations have faced challenges to cover the annual budget and to construct different infrastructures due to the budget deficit created by tax evasion (Alleyne & Harris, 2017 ; Turner, 2010 ).

Scholars especially economists agreed that tax evasion may be considered a technical problem that exists in the tax collection system, whereas psychologists believed that tax evasion is a social problem for the countries (Terzić, 2017 ).

Tax evasion practices are more worsen in developing countries than when we compare against the developed countries. Tax evasion is like a pandemic for the countries because they are unable to control it. Therefore, governments were negatively affected by tax evasion to improve the life standard of its citizens and to allocate a budget for public expenditure, and it became a disease for the country’s economy and estimated to cost 20% of income tax revenue (Ameyaw et al., 2015 ; degl’Innocenti & Rablen, 2019 ; Palil et al., 2016 ).

Several factors may lead taxpayers to engage in tax evasion. Among the factors, tax knowledge, tax morale, tax system, tax fairness, compliance cost, attitudes toward the behavior, subjective norms, perceived behavioral control, and moral obligation are major factors (Alleyne & Harris, 2017 ; Rantelangi & Majid, 2018 ). Other factors have also a significant effect on taxpayers to engage in tax evasion practice such as capital intensity, leverage, fiscal loss, compensation, profitability, contextual tax awareness, interest rate, inflation, average tax rate, gender, and ethical tax awareness on tax evasion (Annan et al., 2014 ; AlAdham et al., 2016 ; Putra et al., 2018 ).

According to Woldia City Administration Revenue Office annual report ( 2019/2020 ) from July 1, 2019, to June 30, 2020, 232,757,512 birr was planned to be collected from taxpayers; however, the office was able to collect only 198,537,785.25 birr; however, the remaining 34,219,726.75 birr have not been collected by the office from the taxpayers. The reason behind this was there might be some factors that lead to taxpayers not to pay the annual tax from their annual income. Based on the review of the previous studies and by diagnosing the tax collection system in the city administration, the researcher identified the gaps. The first gap that motivated the researcher to undertake this study is that the prior studies did not address the factors that influence the tax collection system of Ethiopia, specifically, there is no research result that was able to show which factors influence taxpayers to engage in tax evasion in the Woldia city administration. The other gap is the previous study focused on the demographic, economic, social, and other factors. However, this study mainly focused on the behavioral and other factors that lead taxpayers to engage in tax evasion.

To indicate the benefit of this study, the study specifies on which critical factors the authority will focus on to enhance annual revenue and to aware tax payers of the devastating impact of tax evasion. Moreover, the paper may bring new insights on tax evasion influential non-economic factors that the researchers may give more emphasis on the upcoming researches. This paper will also contribute innovative ways to know the reasons why tax payers engage in tax evasion and inform the authority at which factors they will struggle to reduce their influence and to enhance revenue. The study can be an evidence that the tax authority should launch innovative techniques to control tax evasion practices. Moreover, applying fair tax system in the collectors’ side, the enterprises become innovative and will expand their business.

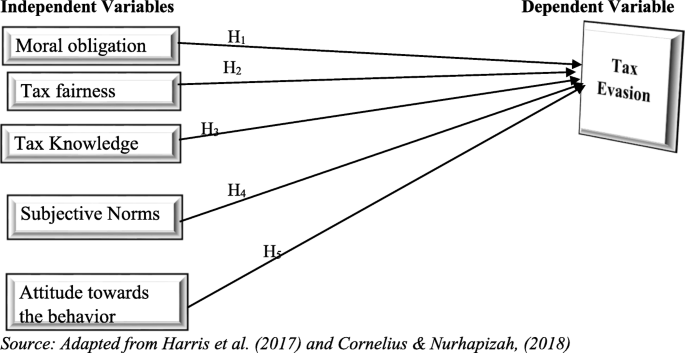

To sum up, in this study, the researcher examined which factor (tax knowledge, tax fairness, subjective norms, moral obligation, and attitude towards the behavior) influences taxpayers to engage in tax evasion activities. Based on the above discussion, the objective of the study is to examine factors that influence taxpayers to engage in tax evasion in Woldia city administration.

Literature review

Tax and tax evasion.

Tax is charged by the government to the business, governmental organization, and individual without any return forwarded from the authority. Tax can be categorized as direct tax which is collected from the profit of the companies and the incomes of individuals, and the other category of tax is an indirect tax collected from consumers’ payment (James and Nobes, 1999 ).

Tax evasion is a word explaining individuals, groups, and companies rejecting the expected amount of payment for the authority. It is a criminal offense on the view of law (Nangih & Dick, 2018 ). The overall procedure of tax collection faced different challenges especially tax evasion the most important one. Tax evasion is done intentionally by taxpayers by avoiding and hiding different documents that become evidence for the tax collection authorities. It is simply an illegal act to pay the true amount of the tax (Aumeerun et al., 2016 ; Storm, 2013 ). Tax evasion is a crime that is able to distort the overall economic, political, and social system of the country. The economic aspect of tax evasion affects fair distribution of wealth for the citizens. The social aspect also creates different social groups motivated by tax evasion discouraged by these individuals due to unfair competition (AlAdham et al., 2016 ). Tax evasion is a mal-activity that reduces the amount of tax paid by the payers. Perhaps the taxpayers who engaged in evasion activity may be supported by the legislative of the country (Kim, 2008 ; Putra et al., 2018 ; Allingham & Sandmo, 1972 ). According to Al Baaj et al. ( 2018 ) argument, there are two types of tax evasions. The first one is the legal evasion or tax avoidance which is supported by the legislation of the countries and the right is given for the taxpayer, but it is not constitutional (Gallemore & Labro, 2015 ; Zucman, 2014 ).

Theoretical reviews on factors affecting tax evasion

The illegal activity done by taxpayers has many determinants that lead them to engage in tax evasion. Among the factors that trigger taxpayers who participate in this activity are the economic factors. Under the economic factors, business sanctions, business stagnation, and the amount of tax burden are considered as influential factors. On the other hand, legal factors, social factors, demographic factors, mental factors, and moral factors are the most important factors (Saxunova and Szarkova, 2018 ). Many factors determine the taxpayers’ interest to engage in tax evasion. Among the factors, the following are considered under this review.

The factors that able to influence taxpayers to engage in tax evasion are moral obligation . It is a principle and a duty of taxpayers by paying a reasonable amount of tax for the tax authorities without the enforcement of others. It is an intrinsic motivation of payers paying the tax (Sadjiarto et al., 2020 ). When taxpayers have low tax morals, they will become negligent to pay their allotted tax, and they will engage in tax evasion (Alm & Torgler, 2006 ; Frey & Oberholzer-Gee, 1997 ; Torgler et al., 2008 ). According to Feld and Frey ( 2007 ), when tax officials are responsible and provide respect in their duties toward taxpayers, tax morale or the honesty of taxpayers will increase. Tax morals may be affected by a demographic and another factor like income level, marital status, and religion (Rantelangi & Majid, 2018 ). It is the determinant behavior of tax payers whether they participate or not. Tax morals can affect positively taxpayers to engage in tax evasion (Nangih & Dick, 2018 ; Terzić, 2017 ). It is known that taxes levied by the concerned authority are ethical. As cited by Ozili ( 2020 ), McGee ( 2006 ) argues that there are three basic views on the ethics and moral of tax evasion. The first view is tax evasion is unethical and should not be practice by any payer, the second argument deals that the state is illegal and has no moral authority to take anything from anyone, and the last argument is tax evasion can be ethical under some conditions and unethical under other situations; therefore, the decision to evade tax is an ethical dilemma which considers several factors (Robert, 2012 ). Therefore, the discussion leads to the following hypothesis:

H 1 . Moral obligation has a negative influence on taxpayers to engage in tax evasion.

The other factor that influences taxpayers to engage in tax evasion is tax fairness . Tax fairness is a non-economic factor that determines the tax collection of the country (Alkhatib et al., 2019 ). It is known that the tax collection procedures, principles, and implementation must be fair. Unethical behavior may happen due to the unfairness of the tax collection process. The fairness of tax may influence payers positively to pay the tax. When the tax rate is not reasonable and fair, the payers will regret to engage in the tax evasion practices and they will inform authorities their annual income without denying the exact amount. Considering the ability of paying or acceptable tax rates helps to maintain the fairness of the taxation system (Rantelangi & Majid, 2018 ). The governments choose to levy in what amounts and on whom will pay a high tax rate (Thu, 2017 ). The tax rate is a factor that induces taxpayers to pay less amount from their income. The rate of tax should be fair and reasonable for the payers (Ozili, 2020 ). As cited by Gandhi et al. ( 1995 ) the Allingham and Sandmo’s model, Allingham and Sandmo ( 1972 ) shows that the tax rate on payment can be positive, zero, or negative, which implies that an increase in the tax rate may cause the tax payment to increase, remain the same, or decrease. The theoretical literature could not evidence the claim that an increase in the tax rate will lead to an increase in tax evasion (Gandhi et al., 1995 ). The fairness of tax is controversial and argumentative because there may not happen a similar amount of tax for all payers (Abera, 2019 ). Thus, based on this ground the study hypothesis would be:

H 2 . Tax fairness has a positive influence on taxpayers to engage in tax evasion.

Tax knowledge is vital for taxpayers to know the cause and effect brought to them to engage in tax evasion. If tax payers are well informed about tax evasion, their participation in tax evasion would be infrequent; the reverse is true for a taxpayer who is not well informed. Tax-related information should give more emphasis to enhance the knowledge of taxpayers and experts of the authority (Poudel, 2017 ). Tax knowledge is a means to enhance the revenue of the country from the side of tax payers (Sadjiarto et al., 2020 ). If the authorities cascade different training for taxpayers about tax evasion and other tax-related issues, taxpayers become reluctant to engage in tax evasion (Rantelangi & Majid, 2018 ). Tax knowledge is a determinant factor for the taxpayer to engage and retain from the tax evasion activities (Abera, 2019 ). When taxpayers are undertaking their routine tasks without tax knowledge, they may involve in certain risks that expose them to engage in tax evasion (Thu, 2017 ). Thus, the discussion leads to the following hypothesis:

H 3 . Tax knowledge has a negative influence on taxpayers engaged in tax evasion.

The stakeholders, government experts, families, individuals, groups, and peers influence taxpayers whether they engaged in tax evasion or not (Alleyne & Harris, 2017 ). As cited by Alkhatib et al. ( 2019 ), the influence of peer groups on tax taxpayers is high, thus affecting the taxpayers’ preferences, personal values, and behaviors to engage in tax evasion (Puspitasari & Meiranto, 2014 ). The stakeholders around the taxpayers might be motivators to push taxpayers in the criminal act of tax evasion. This act called subjective norms meant that the payers are influenced by peers and other stakeholders. When the tax payer is reluctant to pay a tax for the authority, his/her friends are more likely to hide tax. As cited by Abera ( 2019 ), there is a strong relationship between social norms and subjective norms with tax evasion and affects the small business taxpayers (Nabaweesi, 2009 ). The above discussion can support the following hypothesis of the study:

H 4 . Subjective norms have a positive influence on taxpayers to engage in tax evasion.

The other factor that influences taxpayers to engage in tax evasion is an attitude towards the behavior of taxpayers. Attitude is a means of evaluating the activities whether they are positive or negative of any object. Many studies have been done by different scholars by defining and identifying the relationship between the attitudes of taxpayers with tax evasion (Alleyne & Harris, 2017 ). If the attitude of taxpayers towards taxation is negative, they will be reluctant to pay their obligation to the authority; the reverse is true when taxpayers have positive attitudes towards taxation (Abera, 2019 ). Based on the above discussion, the hypothesis of the study would be as follows:

H 5 . Tax payers’ attitude towards the behavior has a positive influence on taxpayers to engage in tax evasion.

Conceptual framework of the study

The researcher identified the variables and presented the relationship between independent and dependent variables as follows (Fig. 1 ):

Conceptual framework of the study. Adapted from Alleyne and Harris ( 2017 ) and Rantelangi and Majid ( 2018 )

Materials and methods

The researcher applied descriptive and explanatory research design to carry out this study. The explanatory research design enables the researcher to show the cause and effect relationship between independent and dependent variables, and the descriptive research also helps to describe the event as it is. The quantitative approach has been followed by the researcher to analyze and interpret the numerical data collected from the respondents. The researcher used primary and secondary data. The primary data was collected from the respondents by using questionnaires, and the secondary data was also collected from the reports, websites, and other sources.

The target population of the study was 4979 taxpayers (micro, small, and large enterprises). From the total taxpayers, 377 are categorized under level “A,” 207 are under level “B,” and the remaining 4395 taxpayers are categorized under level “C”. From the target population by using a stratified sampling technique, the respondents have been selected. The target population has been divided by the level of taxpayers; after dividing the population by level, the researcher applied a simple random sampling technique to select respondents. To identify the target participants or sample size in this study, the researcher used Yamane’s ( 1967 ) formula. Hence, the formula is described as follows:

where N = target population, n = sample size, e = error term

Based on the sample size, the respondents have participated proportionally as follows from each level. The total population was divided by strata based on the level categorized by the authorities. By using a simple random sampling technique, 28 respondents were from level “A,” 15 respondents from level “B,” and 327 respondents from level “C” have participated.

Regarding data collection instruments , the data was collected by self-administered standardized questionnaires. The variable of the study a moral obligation was measured by 4 items; after conducting factor analysis, the fourth variable or questionnaire has been removed and after that correlation and regression analysis has been done for 3 items; the value of Cronbach’s alpha was .711; the other factor attitude towards the behavior was measured by 4 items with a value of .804 Cronbach’s alpha; the third variable subjective norms was also measured by 4 items; the value of Cronbach’s Alpha was .887, and tax evasion was measured by 5 items; the Cronbach’s alpha value was .868. For the above-listed variables, the questionnaires were adapted from Alleyne and Harris ( 2017 ), and the remaining variable tax fairness was measured by 7 items, the Cronbach’s alpha value was .905, the items were adapted from Benk et al. ( 2012 ), and the last variable tax knowledge was measured by 5 items. However, after conducting factor analysis, the fifth item has been removed due to low value of the variable. After the removal of the fifth item, the Cronbach’s alpha value for the remaining items was .800, the items were adapted from Poudel ( 2017 ). For all variables, the researcher has used a five-point Likert scale from strongly agree to strongly disagree.

To analyze the collected data, the researcher used descriptive statistics analysis, factor analysis, correlation analysis, and multiple regression analysis to know the result of variables by using SPSS Version 22. Moreover, the model of the study is described as follows:

where Y = tax evasion, X 1 = moral obligation, X 2 = tax fairness, X 3 = tax knowledge, X 4 = subjective norms, and X 5 = attitude towards the behavior, β = beta coefficient, B 0 = constant, e = other factors not included in the study (0.05 random error).

Results and discussion

Level of respondents.

As indicated in Table 1 from the total respondents, 88.4% are categorized under level “C,” 4.1% are leveled under “B,” and the remaining 7.6% of respondents have been categorized under level “A”.

Factor analysis of the study variables

To undertake exploratory factor analysis, the data should fulfill the following assumptions. The first assumption is the variables should be ratio, interval, and ordinal; the second one is within the variables there should be linear associations; the third assumption is a simple size should range from 100 to 500; and the last assumption is the data without outliers. Thus, this study data have been checked by the researcher whether the data meets the assumption or not. After checking the assumptions, factor analysis was conducted as follows.

KMO and Bartlett’s test

Conducting KMO and Bartlett’s test is a precondition to conduct the factor analysis of the study measuring variables. KMO measures the adequacy of the sample of the study. In the result reported in Table 2 , the value was 0.883 and enough for the factor analysis. Related with Bartlett test as shown in Table 2 , the value is 5727.623 ( p < 0.001), which reveals the adequacy of data using factor analysis.

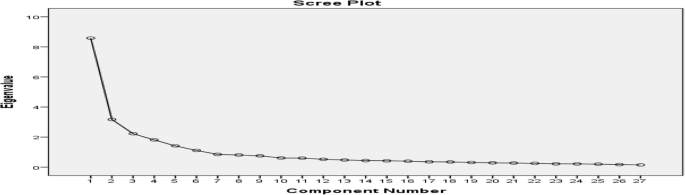

As shown in Table 3 , factors were extracted from study data; there was a linear relationship between variables. From the table, we can understand that 6 variables have more than one eigenvalue. The first factor scored the value 31.782 of the variance, the second value is 11.739 of the variance, the third factor scored 8.246 of the variance, the fourth factor accounts for 6.725 of the variance, the fifth factor also accounts for 5.233, and the last factor scored 4.123 of the variance. All six factors were explained cumulatively by 67.85% of the variance.

As shown in the Fig. 2 , the scree plot starts to turn down slowly at the low eigenvalue which is less than 1. The six factors eigenvalue is greater than one.

Scree plot. Source: own survey (2020)

The pattern matrix is shown in Table 4 which is able to show the loading of each variable and the relationship of variables in the study. The highest value among the factors measured the variable considerably. The cutoff point of loading was set at .35 and above. Based on the loading cutoff point except two factors, all are significant and analyzed under this study. From the six variables (five independent and one dependent) incorporated under this study, the identified factors show that how significantly enough to measure the situation. These factors have scored greater than 1 eigenvalue and able to explain 67.85% of the variance. In general, the detail variables and their factor are described as follows:

The first component tax fairness has 7 factors; the eigenvalue is 8.58 and able to explain 31.78 of the total variance. In this component, the highest contributed factor was item TF3 (weight = .925), TF5 (weight = .865), TF1 (weight = .859), TF2 (weight = .778), TF4 (.668), TF6 (weight = .614), and TF7 (weight = .568). The second component was tax evasion and has 5 items; the eigenvalue is 3.17 and explaining 11.73 of the variance. The factor weight of the items, TE4 (factor weight = .860), TE5 (factor weight = .810), TE3 (factor weight = .730), TE2 (factor weight = .650), and the last one is TE1 (factor weight = .606). The third component was subjective norms; it has 4 factors the weight of each factor described as follows. The first item SNS1 weight = .898, SNS2 factor weight = .887, SNS4 factor weight = .846, and SNS3 factor weight = .820. Moreover, the eigenvalue of this component is 2.226 and explained 8.246 of the variance of the study. The fourth component is an attitude towards the behavior. This variable has four factors that have 1.816 eigenvalue and explained 6.725 of the total variance. Among the items, ATB2 factor weight = .863, ATB1 factor weight = .792, ATB3 factor weight = .791 and the last factor is ATB4 factor weight = .500. The fifth component of the study is tax knowledge; at the very beginning of this variable, the researcher adapted five items. However, one item (TK5) was not significant and removed from this analysis. In this component, the highest value was scored by TK3 (factor weight = .866), the second highest TK2 (factor weight = .801), the third highest factor weight (weight = .700), and the last factor is TK4 (weight = .690). The eigenvalue of this component was 1.413 and explained 5.233% of the variance. The last component is a moral obligation; like tax knowledge, the researcher adapted for this variable 4 items, though, one item (MO4) was not significant and removed from the items list. The eigenvalue of this component was 1.113 and explained 4.123 of the variance. From the items, MO1 scored the highest factor weight of .891, the second highest weight in this component was MO3 with a factor weight of .854, and the third highest factor weight was scored by MO3 with a value of .508.

Association analysis of the study variables

To analyze the correlation between variables as shown in the Table 5 , the relation between subjective norms with taxpayers engaged in tax evasion is r = 0.240 ( p < 0.05); this indicates that there is a statistically significant relationship between the two variables. The relationship between ATB with TE, MO with TE, TK with TE, and TF with TE, the Pearson correlation result is r = 0.318 ( p < 0.05), r = 0.371 ( p < 0.05), .446, and r = 0.691 ( p < 0.05) respectively and statistically significant. It implies that the independent variables have a positive relationship with the dependent variable of the study with a statistically significant level of p < 0.05 and n = 370.

Effect analysis of the study variables

As shown in Table 6 , the study independent variables (SNS, ATB, MO, TK, and TF) explained the study dependent variable (TE) by 54.9%. This result indicates that there are other variables that explain the dependent variable by 45.1% which has not been investigated under this study.

Hypothesis test

The proposed hypothesis of the study has been tested based on the coefficient of regression and the “ p ” value of the study variables. The detail result is described as follows:

As shown in Table 7 , moral obligation influences positively the taxpayers to engage in tax evasion activities with a beta value of .177 and p < .05. This result entails that the taxpayers are influenced by other stakeholders to engage in tax evasion, and they have low moral value to pay the tax levied by the government. This result is supported by the finding of Alleyne and Harris ( 2017 ), Rantelangi and Majid ( 2018 ), and Sadjiarto et al. ( 2020 ). Thus, the hypothesis related to this variable has been rejected because moral obligation influences positively taxpayers to engage in tax evasion.

H 2 . Tax fairness has a positive influence on taxpayers to engage in tax evasion

To minimize the participation of taxpayers engaged in tax evasion, tax fairness plays a significant role. The regression result indicates in Table 7 that tax fairness positively influences the taxpayers to engage in tax evasion. This result is similar to the finding of Majid et al., ( 2017 ) and contradicts with the finding of Rantelangi and Majid ( 2018 ) and Alkhatib et al. ( 2019 ). Accordingly, the proposed hypothesis has been accepted because the beta value is .563 and the p value is less than .05.

H 3 . Tax knowledge has a negative influence on taxpayers to engage in tax evasion

Table 7 shows that tax knowledge influences the taxpayers positively to engaged in tax evasion. The beta value is .183 and the value is p = 0.00. It is known that when the taxpayers were not well informed about the importance of tax for the country development and the devastating issues of tax evasion, they will be forced to engage in tax evasion. This finding contradicts the finding of Rantelangi and Majid ( 2018 ) and is supported by the finding of AlAdham et al. ( 2016 ). To conclude, the proposed hypothesis rejected because tax knowledge positively influenced the taxpayers to engage in tax evasion.

H 4 . Subjective norms have a positive influence on taxpayers engaged in tax evasion

Table 7 indicates that subjective norms have not been significantly influenced positively by the taxpayers engaged in tax evasion, which means taxpayers were not influenced by others to participate in tax evasion activities. This result is consistent with the finding of Alleyne and Harris ( 2017 ). Thus, the proposed hypothesis is rejected because the variable of subjective norms was not statistically significant with a p value of .099.

H 5 . Tax payers’ attitude towards the behavior has a positive influence on taxpayers to engage in tax evasion

As indicated in Table 7 , attitudes toward the behavior were not significantly influencing the taxpayers to participate in tax evasion with the p value of .985. However, according to the study conducted by Alleyne and Harris ( 2017 ), attitude toward the behavior significantly predicts the intentions of taxpayers to engage in tax evasion. This finding contradicts with this study result. To conclude, the proposed hypothesis has been rejected because the variable is not statistically significantly influencing the taxpayers to engage in tax evasion activities.

According to Table 7 through the examination of coefficients, moral obligation had a positive effect on tax evasion having a coefficient of .197. This means that a 1% change in moral obligation keeping the other things remain constant can result to motivate taxpayers to engage in tax evasion by 19.7% in the same direction. This finding is similar to the result of Alleyne and Harris ( 2017 ), Nangih and Dick ( 2018 ), Rantelangi and Majid ( 2018 ), and Sadjiarto et al. ( 2020 ). Tax knowledge had a positive effect on tax evasion having a coefficient of .174. This indicates that a 1% change in tax knowledge keeping the other things constant can result in a change in taxpayers to engage in tax evasion by 17.4% in the same direction. This finding contradicts the finding of Rantelangi and Majid ( 2018 ) and is similar to the finding of AlAdham et al. ( 2016 ) and Thu ( 2017 ). Tax fairness also had a positive effect on tax evasion having a coefficient of .468. This implies that a 1% change in tax fairness keeping the other things remain constant can result in a change in taxpayers engage in tax evasion by .468% in the same direction. This result is similar to the finding of Majid et al. ( 2017 ) and contradicts the finding of Alkhatib et al. ( 2019 ) and Rantelangi and Majid ( 2018 ). Thus, the final model of the study would be:

Tax evasion = .623 + .197MO + .174TK + .468TF

To generalize, the standardized beta coefficient indicates that tax fairness highly affects taxpayers to engage in tax evasion by 56.3%, tax knowledge affects secondly taxpayers to engage in tax evasion by 18.3%, and moral obligation affects taxpayers to engage in tax evasion by 17.7%. The remaining variables subjective norms and attitude towards the behavior were not statistically significant.

Conclusion and recommendations

Every citizen of the country was subjected to pay the tax of the country levied by the authority that administered the revenue. However, the taxpayer may be reluctant to pay a tax based on their revenue. There are push factors that instigate payers to engage in tax evasion. Sometimes the payers may be convinced themselves that being engaged in tax evasion is ethical, others may consider it unethical. They may argue “I Do Not Receive Benefits, Therefore I Do Not Have to Pay” (Robert, 2012 ). This study tried to examine the factors that influence taxpayers to engage in tax evasion by identifying five factors namely moral obligation , tax fairness , tax knowledge , subjective norms , and taxpayers’ attitude towards the behavior . The study findings based on the result analysis described as follows.

The correlation analysis of the study shows that there was a positive and statistically significant relationship between independent variables with the dependent variable (tax evasion). The regression result, on the other hand, revealed that tax knowledge affects taxpayers to participate in tax evasion activities with a statistically significant level. This finding can be evidence that the knowledge of the taxpayers regarding the importance of tax is limited. Because according to the regression result, they engaged in the tax evasion activities in the study area. The other factor that affects taxpayers to engage in tax evasion is tax fairness. The regression result of tax fairness supported that taxpayers have been affected by the fairness of the tax system in the study area to participate in tax evasion. The finding confirms that the tax charged by the government is not fair for payers. Thus, we can conclude that due to the absence of tax fairness taxpayers are engaged in tax evasion in the city administration. The other variable moral obligation regression result confirms that moral obligation affects positively taxpayers to engage in tax evasion. This is signal that taxpayers did not know the moral value of retaining from tax evasion that is why the moral obligation results in positive and statistical significance. Generally, tax fairness highly affects taxpayers to evade taxes, tax knowledge affects secondly, and moral obligation affected tax payers thirdly to evade tax in the city administration.

Based on the findings, the following recommendations have been forwarded by the researcher. The first one is creating a fair tax payment system, or charging fair tax for the payers helps to reduce the participation of payers in tax evasion. The second recommendation is cascading different training related to tax will help taxpayers to pay a tax based on their annual income. The last recommendation is related to tax moral or moral obligation. The moral is an abounding rule for human beings to know the right and wrong activities. The authority is better to strive to recognize the payers about the moral obligations of the payers and better to inform to the payers to think about the shattering effect of tax evasion for the country development and city as well.

Further future lines of research will attempt to:

Investigate the employees’ side of tax authority and the perception of the community towards tax evasion.

Explore other influencing factors that affect tax payers to engage in tax evasion which are not incorporated under this study.

Conducting a comparative study on one city, region, and country with others.

Suggestion for future study

This study addresses only one city administration in Amhara region; other researchers are better to undertake the study on one more cities.

Availability of data and materials

All data are included in the manuscript and available on hand too.

Abbreviations

Attitude towards the behavior

- Moral obligation

Micro and small enterprises

Subjective norms

- Tax evasion

- Tax fairness

- Tax knowledge

Abera, A. A. (2019). Factors affecting presumptive tax collection in Ethiopia: Evidence from category “C” taxpayers in Bahir Dar City. Journal of Tax Administration , 5 (2), 74–96.

Google Scholar

Al Baaj, Q. M. A., Al Marshedi, A. A. S., & Al-Laban, D. A. A. (2018). The impact of electronic taxation on reducing tax evasion methods of Iraqi companies listed in the Iraqi stock exchange. Academy of Accounting and Financial Studies Journal , 22 (4) Retrieved from: www.abacademies.org/articles/ .

AlAdham, M. A. A., Abukhadijeh, M. A., & Qasem, M. F. (2016). Tax evasion and tax awareness evidence from Jordan. International Business Research , 9 (12) https://doi.org/10.5539/ibr.v9n12p65 .

Alkhatib, A. A., Abdul-Jabbar, H., Abuamria, F., & Rahhal, A. (2019). The effects of social influence factors on income tax evasion among the Palestinian SMEs. International Journal of Advanced Science and Technology , 28 (17), 690–700.

Alleyne, P., & Harris, T. (2017). Antecedents of taxpayers’ intentions to engage in tax evasion: Evidence from Barbados. Journal of Financial Reporting and Accounting (Emerald Publishing Limited) , 15 (1), 2–21 https://doi.org/10.1108/JFRA-12-2015-0107 .

Article Google Scholar

Allingham, M. G., & Sandmo, A. (1972). Income tax evasion: a theoretical analysis. Journal of Public Economics , 1 (3-4), 323–338.

Alm, J., & Torgler, B. (2006). Culture differences and tax morale in the United States and in Europe. Journal of Economic Psychology , 27 (2), 224–246.

Ameyaw, B., Addai, B., Ashalley, E., & Quaye, I. (2015). The effects of personal income tax evasion on socio-economic development in Ghana: A case study of the informal sector. British Journal of Economics, Management & Trade (Sciencedomain international) , 10 (4), 1–14 https://doi.org/10.9734/BJEMT/2015/19267 .

Annan, B., Bekoe, W., & Nketiah-Amponsah, E. (2014). Determinants of Tax Evasion in Ghana: 1970-2010. International Journal of Economic Sciences and Applied Research , 6 ( 3 ), 97 – 121 .

Aumeerun, B., Jugurnath, & Soondrum, H. (2016). Tax evasion: Empirical evidence from sub-Saharan Africa. Journal of Accounting and Taxation (Academic Journals) , 8 (7), 70–80 https://doi.org/10.5897/JAT2016.022 .

Benk, S., Budak, T., & Cakmak, A. F. (2012). Tax professionals’ perceptions of tax fairness: Survey evidence in Turkey. International Journal of Business and Social Science , 3 (2) Centre for Promoting Ideas, USA.

Dalu, T., Maposa, V. G., Pabwaungana, S., & Dalu, T. (2012). The impact of tax evasion and avoidance on the economy: a case of Harare, Zimbabwe. African Journal Economic and Sustainable Development , 1 (3), 284–296.

degl’Innocenti, D. G., & Rablen, M. D. (2019). Tax evasion on a social network. Journal of Economic Behavior and Organization (Elsevier B.V) , 79–91 https://doi.org/10.1016/j.jebo.2019.11.001 .

Fagbemi, T. O., Uadiale, O. M., & Noah, A. O. (2010). The ethics of tax evasion: Perceptual evidence from Nigeria. European Journal of Social Sciences , 17 ( 3 ).

Feld, L. P., & Frey, B. S. (2007). Tax Compliance as the Result of a Psychological Tax Contract: The Role of Incentives and Responsive Regulation. Law & Policy , 29 (1), 102–120.

Frey, B. S., & Oberholzer-Gee, F. (1997). The Cost of Price Incentives: An Empirical Analysis of Motivation Crowding- Out. The American Economic Review , 87 (4), 746–755.

Gallemore, J., & Labro, E. (2015). The importance of the internal information environment for tax avoidance. Journal of Accounting and Economics , 60 (1), 149–167.

Gandhi, V. P., Edrill, L. P., Mackenzie, G. A., Manas-Anton, L. A., Modi, J. R., Richupan, S., … Shome, P. (1995). Supply-side tax policy: Its relevance to developing countries . International Monteray Fund.

James, S. R., & Nobes, C. (1999). The Economics of Taxation: Principles, Policy, and Practice , (vol. 7). Financal Times Management.

Kim, S. (2008). Does political intention affect tax evasion? Journal of Policy Modeling , 30 (3), 401–415.

Majid, N., Rantelangi, C., & Iskandar (2017). Tax evasion: Is it ethical or unethical? (based on Samarinda taxpayers’ perception). In Mulawarman international conference on economics and business (MICEB 2017) , (pp. 13–18). Atlantis Press http://creativecommons.org/licenses/by-nc/4.0/ .

McGee, R. W. (2006). Three views on the ethics of tax evasion. Journal of Business Ethics , 67 (1), 15–35.

Mughal, M. M. (2012). Reasons of Tax Avoidance and Tax Evasion: Reflections from Pakistan. Journal of Economics and Behavioral Studies , 4 (4), 217–222.

Nabaweesi, J. (2009). Social norms and tax compliance among small business enterprises in Uganda (Master’s thesis) . Retrieved from http://makir.mak.ac.ug/handle/10570/2525

Nangih, E., & Dick, N. (2018). An empirical review of the determinants of tax evasion in Nigeria: Emphasis on the informal sector operators in Port Harcourt Metropolis. Journal of Accounting and Financial Management , 4 (3) http://www.iiardpub.org/ .

Ozili, P. K. (2020). Tax evasion and financial instability. Journal of Financial Crime. Emerald Publishing Limited , 27 (2), 531–539 https://doi.org/10.1108/JFC-04-2019-0051 .

Palil, M. R., Malek, M. M., & Jaguli, A. R. (2016). Issues, challenges and problems with tax evasion: The institutional factors approach. Gadjah Mada International Journal of Busines , 18 (2), 187–206.

Poudel, R. L. (2017). Tax knowledge among university teachers in Pokhara. The Journal of Nepalese Bussiness Studies , 10 ( 1 ).

Puspitasari, E., & Meiranto, W. (2014). Motivational postures in tax compliance decisions: An experimental studies. International Journal of Business, Economics and Law , 5 (1), 100–110.

Putra, P. D., Syah, D. H., & Sriwedari, T. (2018). Tax avoidance: Evidence of as a proof of agency theory and tax planning. International Journal of Research and Review , 5 (9), 2454–2223.

Rantelangi, C., & Majid, N. (2018). Factors that influence the taxpayers’ perception on the tax evasion. In Advances in economics, business and management research (AEBMR) , (p. 35). Atlantis Press.

Robert, W. M. G. (2012). The ethics of tax evasion; perspectives in theory and practice . North Miami: Springer Science+Business Media https://doi.org/10.1007/978-1-4614-1287-8 .

Sadjiarto, A., Susanto, A. N., Yuniar, E., & Hartanto, M. G. (2020). Factors affecting perception of tax evasion among Chindos. In Advances in economics, business and management research:23rd Asian Forum of Business Education(AFBE 2019),144 , (pp. 487–493). Atlantis Press SARL.

Saxunova, D., & Szarkova, R. (2018). Global Efforts of Tax Authorities and Tax Evasion Challenge. Journal of Eastern Europe Research in Business and Economics , 2018 , 1–14.

Storm, A. (2013). Establishing The Link Between Money Laundering And Tax Evasion. International Business & Economics Research Journal (IBER) , 12 (11), 1437.

Terzić, S. (2017). Model for determining subjective and objective factors of tax evasion. Notitia - Journal for Economic, Business and Social Issues, Notitia Ltd. , 1 (3), 49–62.

Thu, H. N. (2017). Determinants to tax evasion behavior in Vietnam. Journal of Management and Sustainability Canadian Center of Science and Education. https://doi.org/10.5539/jms.v7n4p123 .

Torgler, B., Demir, I. C., Macintyre, A., & Schaffner, M. (2008). Causes and Consequences of Tax Morale: An Empirical Investigation. Economic Analysis and Policy , 38 (2), 313–339.

Turner, Sean C. (2010). Essays on Crime and Tax Evasion . Dissertation, Georgia State University, 2010. https://scholarworks.gsu.edu/econ_diss/64

Woldia City Administration Revenue Office (2019/2020). 2012E.C annual report. Woldia .

Yamane, T. (1967). Statistics: An Introductory Analysis , (2nd ed., ). New York: Harper and Row.

Zucman, G. (2014). Taxing accross borders: Tracking personal wealth and corporate profits. The Journal of Economic Perspectives , 28 (4), 121–148.

Download references

Acknowledgements

I am grateful to all anonymous reviewers, my respondents, and Woldia City administration revenue office experts sharing the required information.

The author has not received a fund from any organization.

Author information

Authors and affiliations.

Woldia University, Woldia, Ethiopia

Erstu Tarko Kassa

You can also search for this author in PubMed Google Scholar

Contributions

The research was done independently. I have carried out the whole work of the study. The author read and approved the final manuscript.

Corresponding author

Correspondence to Erstu Tarko Kassa .

Ethics declarations

Competing interests.

The author declares that there are no competing interest.

Additional information

Publisher’s note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Kassa, E.T. Factors influencing taxpayers to engage in tax evasion: evidence from Woldia City administration micro, small, and large enterprise taxpayers. J Innov Entrep 10 , 8 (2021). https://doi.org/10.1186/s13731-020-00142-4

Download citation

Received : 01 October 2020

Accepted : 09 December 2020

Published : 16 February 2021

DOI : https://doi.org/10.1186/s13731-020-00142-4

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

Does Tax Evasion in Foreign Countries Incentivize or Deter Foreign Investment by U.S. Firms?

Add to collection, downloadable content.

- March 2, 2021

- Affiliation: Kenan-Flagler Business School

- I investigate the effect of tax evasion – illegal underpayment of taxes – by firms in foreign countries on the investment decisions of U.S. multinational corporations (MNCs). Using World Bank survey data to construct two country-level measures of tax evasion, I find that greater evasion by firms in foreign countries increases the probability that U.S. MNCs will locate subsidiaries in those jurisdictions. This effect is concentrated in countries with high statutory rates and is less pronounced in firms with high reputational costs. I find no evidence that the effect is stronger for countries where corruption and tax bribery are more pervasive. This study contributes to the broad literature on how corporate taxation affects location of investment by exploring the effect of tax evasion on the foreign investment decisions of U.S. MNCs.

- foreign investment

- tax evasion

- https://doi.org/10.17615/qv0j-y259

- Dissertation

- Hoopes, Jeff

- Landsman, Wayne

- Doctor of Philosophy

- University of North Carolina at Chapel Hill Graduate School

This work has no parents.

Select type of work

Master's papers.

Deposit your masters paper, project or other capstone work. Theses will be sent to the CDR automatically via ProQuest and do not need to be deposited.

Scholarly Articles and Book Chapters

Deposit a peer-reviewed article or book chapter. If you would like to deposit a poster, presentation, conference paper or white paper, use the “Scholarly Works” deposit form.

Undergraduate Honors Theses

Deposit your senior honors thesis.

Scholarly Journal, Newsletter or Book

Deposit a complete issue of a scholarly journal, newsletter or book. If you would like to deposit an article or book chapter, use the “Scholarly Articles and Book Chapters” deposit option.

Deposit your dataset. Datasets may be associated with an article or deposited separately.

Deposit your 3D objects, audio, images or video.

Poster, Presentation, Protocol or Paper

Deposit scholarly works such as posters, presentations, research protocols, conference papers or white papers. If you would like to deposit a peer-reviewed article or book chapter, use the “Scholarly Articles and Book Chapters” deposit option.

- Search Menu

- Browse content in Arts and Humanities

- Browse content in Archaeology

- Anglo-Saxon and Medieval Archaeology

- Archaeological Methodology and Techniques

- Archaeology by Region

- Archaeology of Religion

- Archaeology of Trade and Exchange

- Biblical Archaeology

- Contemporary and Public Archaeology

- Environmental Archaeology

- Historical Archaeology

- History and Theory of Archaeology

- Industrial Archaeology

- Landscape Archaeology

- Mortuary Archaeology

- Prehistoric Archaeology

- Underwater Archaeology

- Urban Archaeology

- Zooarchaeology

- Browse content in Architecture

- Architectural Structure and Design

- History of Architecture

- Residential and Domestic Buildings

- Theory of Architecture

- Browse content in Art

- Art Subjects and Themes

- History of Art

- Industrial and Commercial Art

- Theory of Art

- Biographical Studies

- Byzantine Studies

- Browse content in Classical Studies

- Classical History

- Classical Philosophy

- Classical Mythology

- Classical Literature

- Classical Reception

- Classical Art and Architecture

- Classical Oratory and Rhetoric

- Greek and Roman Papyrology

- Greek and Roman Epigraphy

- Greek and Roman Law

- Greek and Roman Archaeology

- Late Antiquity

- Religion in the Ancient World

- Digital Humanities

- Browse content in History

- Colonialism and Imperialism

- Diplomatic History

- Environmental History

- Genealogy, Heraldry, Names, and Honours

- Genocide and Ethnic Cleansing

- Historical Geography

- History by Period

- History of Emotions

- History of Agriculture

- History of Education

- History of Gender and Sexuality

- Industrial History

- Intellectual History

- International History

- Labour History

- Legal and Constitutional History

- Local and Family History

- Maritime History

- Military History

- National Liberation and Post-Colonialism

- Oral History

- Political History

- Public History

- Regional and National History

- Revolutions and Rebellions

- Slavery and Abolition of Slavery

- Social and Cultural History

- Theory, Methods, and Historiography

- Urban History

- World History

- Browse content in Language Teaching and Learning

- Language Learning (Specific Skills)

- Language Teaching Theory and Methods

- Browse content in Linguistics

- Applied Linguistics

- Cognitive Linguistics

- Computational Linguistics

- Forensic Linguistics

- Grammar, Syntax and Morphology

- Historical and Diachronic Linguistics

- History of English

- Language Evolution

- Language Reference

- Language Acquisition

- Language Variation

- Language Families

- Lexicography

- Linguistic Anthropology

- Linguistic Theories

- Linguistic Typology

- Phonetics and Phonology

- Psycholinguistics

- Sociolinguistics

- Translation and Interpretation

- Writing Systems

- Browse content in Literature

- Bibliography

- Children's Literature Studies

- Literary Studies (Romanticism)

- Literary Studies (American)

- Literary Studies (Asian)

- Literary Studies (European)

- Literary Studies (Eco-criticism)

- Literary Studies (Modernism)

- Literary Studies - World

- Literary Studies (1500 to 1800)

- Literary Studies (19th Century)

- Literary Studies (20th Century onwards)

- Literary Studies (African American Literature)

- Literary Studies (British and Irish)

- Literary Studies (Early and Medieval)

- Literary Studies (Fiction, Novelists, and Prose Writers)

- Literary Studies (Gender Studies)

- Literary Studies (Graphic Novels)

- Literary Studies (History of the Book)

- Literary Studies (Plays and Playwrights)

- Literary Studies (Poetry and Poets)

- Literary Studies (Postcolonial Literature)

- Literary Studies (Queer Studies)

- Literary Studies (Science Fiction)

- Literary Studies (Travel Literature)

- Literary Studies (War Literature)

- Literary Studies (Women's Writing)

- Literary Theory and Cultural Studies

- Mythology and Folklore

- Shakespeare Studies and Criticism

- Browse content in Media Studies

- Browse content in Music

- Applied Music

- Dance and Music

- Ethics in Music

- Ethnomusicology

- Gender and Sexuality in Music

- Medicine and Music

- Music Cultures

- Music and Media

- Music and Religion

- Music and Culture

- Music Education and Pedagogy

- Music Theory and Analysis

- Musical Scores, Lyrics, and Libretti

- Musical Structures, Styles, and Techniques

- Musicology and Music History

- Performance Practice and Studies

- Race and Ethnicity in Music

- Sound Studies

- Browse content in Performing Arts

- Browse content in Philosophy

- Aesthetics and Philosophy of Art

- Epistemology

- Feminist Philosophy

- History of Western Philosophy

- Metaphysics

- Moral Philosophy

- Non-Western Philosophy

- Philosophy of Language

- Philosophy of Mind

- Philosophy of Perception

- Philosophy of Science

- Philosophy of Action

- Philosophy of Law

- Philosophy of Religion

- Philosophy of Mathematics and Logic

- Practical Ethics

- Social and Political Philosophy

- Browse content in Religion

- Biblical Studies

- Christianity

- East Asian Religions

- History of Religion

- Judaism and Jewish Studies

- Qumran Studies

- Religion and Education

- Religion and Health

- Religion and Politics

- Religion and Science

- Religion and Law

- Religion and Art, Literature, and Music

- Religious Studies

- Browse content in Society and Culture

- Cookery, Food, and Drink

- Cultural Studies

- Customs and Traditions

- Ethical Issues and Debates

- Hobbies, Games, Arts and Crafts

- Lifestyle, Home, and Garden

- Natural world, Country Life, and Pets

- Popular Beliefs and Controversial Knowledge

- Sports and Outdoor Recreation

- Technology and Society

- Travel and Holiday

- Visual Culture

- Browse content in Law

- Arbitration

- Browse content in Company and Commercial Law

- Commercial Law

- Company Law

- Browse content in Comparative Law

- Systems of Law

- Competition Law

- Browse content in Constitutional and Administrative Law

- Government Powers

- Judicial Review

- Local Government Law

- Military and Defence Law

- Parliamentary and Legislative Practice

- Construction Law

- Contract Law

- Browse content in Criminal Law

- Criminal Procedure

- Criminal Evidence Law

- Sentencing and Punishment

- Employment and Labour Law

- Environment and Energy Law

- Browse content in Financial Law

- Banking Law

- Insolvency Law

- History of Law

- Human Rights and Immigration

- Intellectual Property Law

- Browse content in International Law

- Private International Law and Conflict of Laws

- Public International Law

- IT and Communications Law

- Jurisprudence and Philosophy of Law

- Law and Politics

- Law and Society

- Browse content in Legal System and Practice

- Courts and Procedure

- Legal Skills and Practice

- Primary Sources of Law

- Regulation of Legal Profession

- Medical and Healthcare Law

- Browse content in Policing

- Criminal Investigation and Detection

- Police and Security Services

- Police Procedure and Law

- Police Regional Planning

- Browse content in Property Law

- Personal Property Law

- Study and Revision

- Terrorism and National Security Law

- Browse content in Trusts Law

- Wills and Probate or Succession

- Browse content in Medicine and Health

- Browse content in Allied Health Professions

- Arts Therapies

- Clinical Science

- Dietetics and Nutrition

- Occupational Therapy

- Operating Department Practice

- Physiotherapy

- Radiography

- Speech and Language Therapy

- Browse content in Anaesthetics

- General Anaesthesia

- Neuroanaesthesia

- Clinical Neuroscience

- Browse content in Clinical Medicine

- Acute Medicine

- Cardiovascular Medicine

- Clinical Genetics

- Clinical Pharmacology and Therapeutics

- Dermatology

- Endocrinology and Diabetes

- Gastroenterology

- Genito-urinary Medicine

- Geriatric Medicine

- Infectious Diseases

- Medical Toxicology

- Medical Oncology

- Pain Medicine

- Palliative Medicine

- Rehabilitation Medicine

- Respiratory Medicine and Pulmonology

- Rheumatology

- Sleep Medicine

- Sports and Exercise Medicine

- Community Medical Services

- Critical Care

- Emergency Medicine

- Forensic Medicine

- Haematology

- History of Medicine

- Browse content in Medical Skills

- Clinical Skills

- Communication Skills

- Nursing Skills

- Surgical Skills

- Browse content in Medical Dentistry

- Oral and Maxillofacial Surgery

- Paediatric Dentistry

- Restorative Dentistry and Orthodontics

- Surgical Dentistry

- Medical Ethics

- Medical Statistics and Methodology

- Browse content in Neurology

- Clinical Neurophysiology

- Neuropathology

- Nursing Studies

- Browse content in Obstetrics and Gynaecology

- Gynaecology

- Occupational Medicine

- Ophthalmology

- Otolaryngology (ENT)

- Browse content in Paediatrics

- Neonatology

- Browse content in Pathology

- Chemical Pathology

- Clinical Cytogenetics and Molecular Genetics

- Histopathology

- Medical Microbiology and Virology

- Patient Education and Information

- Browse content in Pharmacology

- Psychopharmacology

- Browse content in Popular Health

- Caring for Others

- Complementary and Alternative Medicine

- Self-help and Personal Development

- Browse content in Preclinical Medicine

- Cell Biology

- Molecular Biology and Genetics

- Reproduction, Growth and Development

- Primary Care

- Professional Development in Medicine

- Browse content in Psychiatry

- Addiction Medicine

- Child and Adolescent Psychiatry

- Forensic Psychiatry

- Learning Disabilities

- Old Age Psychiatry

- Psychotherapy

- Browse content in Public Health and Epidemiology

- Epidemiology

- Public Health

- Browse content in Radiology

- Clinical Radiology

- Interventional Radiology

- Nuclear Medicine

- Radiation Oncology

- Reproductive Medicine

- Browse content in Surgery

- Cardiothoracic Surgery

- Gastro-intestinal and Colorectal Surgery

- General Surgery

- Neurosurgery

- Paediatric Surgery

- Peri-operative Care

- Plastic and Reconstructive Surgery

- Surgical Oncology

- Transplant Surgery

- Trauma and Orthopaedic Surgery

- Vascular Surgery

- Browse content in Science and Mathematics

- Browse content in Biological Sciences

- Aquatic Biology

- Biochemistry

- Bioinformatics and Computational Biology

- Developmental Biology

- Ecology and Conservation

- Evolutionary Biology

- Genetics and Genomics

- Microbiology

- Molecular and Cell Biology

- Natural History

- Plant Sciences and Forestry

- Research Methods in Life Sciences

- Structural Biology

- Systems Biology

- Zoology and Animal Sciences

- Browse content in Chemistry

- Analytical Chemistry

- Computational Chemistry

- Crystallography

- Environmental Chemistry

- Industrial Chemistry

- Inorganic Chemistry

- Materials Chemistry

- Medicinal Chemistry

- Mineralogy and Gems

- Organic Chemistry

- Physical Chemistry

- Polymer Chemistry

- Study and Communication Skills in Chemistry

- Theoretical Chemistry

- Browse content in Computer Science

- Artificial Intelligence

- Computer Architecture and Logic Design

- Game Studies

- Human-Computer Interaction

- Mathematical Theory of Computation

- Programming Languages

- Software Engineering

- Systems Analysis and Design

- Virtual Reality

- Browse content in Computing

- Business Applications

- Computer Security

- Computer Games

- Computer Networking and Communications

- Digital Lifestyle

- Graphical and Digital Media Applications

- Operating Systems

- Browse content in Earth Sciences and Geography

- Atmospheric Sciences

- Environmental Geography

- Geology and the Lithosphere

- Maps and Map-making

- Meteorology and Climatology

- Oceanography and Hydrology

- Palaeontology

- Physical Geography and Topography

- Regional Geography

- Soil Science

- Urban Geography

- Browse content in Engineering and Technology

- Agriculture and Farming

- Biological Engineering

- Civil Engineering, Surveying, and Building

- Electronics and Communications Engineering

- Energy Technology

- Engineering (General)

- Environmental Science, Engineering, and Technology

- History of Engineering and Technology

- Mechanical Engineering and Materials

- Technology of Industrial Chemistry

- Transport Technology and Trades

- Browse content in Environmental Science

- Applied Ecology (Environmental Science)

- Conservation of the Environment (Environmental Science)

- Environmental Sustainability

- Environmentalist Thought and Ideology (Environmental Science)

- Management of Land and Natural Resources (Environmental Science)

- Natural Disasters (Environmental Science)

- Nuclear Issues (Environmental Science)

- Pollution and Threats to the Environment (Environmental Science)

- Social Impact of Environmental Issues (Environmental Science)

- History of Science and Technology

- Browse content in Materials Science

- Ceramics and Glasses

- Composite Materials

- Metals, Alloying, and Corrosion

- Nanotechnology

- Browse content in Mathematics

- Applied Mathematics

- Biomathematics and Statistics

- History of Mathematics

- Mathematical Education

- Mathematical Finance

- Mathematical Analysis

- Numerical and Computational Mathematics

- Probability and Statistics

- Pure Mathematics

- Browse content in Neuroscience

- Cognition and Behavioural Neuroscience

- Development of the Nervous System

- Disorders of the Nervous System

- History of Neuroscience

- Invertebrate Neurobiology

- Molecular and Cellular Systems

- Neuroendocrinology and Autonomic Nervous System

- Neuroscientific Techniques

- Sensory and Motor Systems

- Browse content in Physics

- Astronomy and Astrophysics

- Atomic, Molecular, and Optical Physics

- Biological and Medical Physics

- Classical Mechanics

- Computational Physics

- Condensed Matter Physics

- Electromagnetism, Optics, and Acoustics

- History of Physics

- Mathematical and Statistical Physics

- Measurement Science

- Nuclear Physics

- Particles and Fields

- Plasma Physics

- Quantum Physics

- Relativity and Gravitation

- Semiconductor and Mesoscopic Physics

- Browse content in Psychology

- Affective Sciences

- Clinical Psychology

- Cognitive Psychology

- Cognitive Neuroscience

- Criminal and Forensic Psychology

- Developmental Psychology

- Educational Psychology

- Evolutionary Psychology

- Health Psychology

- History and Systems in Psychology

- Music Psychology

- Neuropsychology

- Organizational Psychology

- Psychological Assessment and Testing

- Psychology of Human-Technology Interaction

- Psychology Professional Development and Training

- Research Methods in Psychology

- Social Psychology

- Browse content in Social Sciences

- Browse content in Anthropology

- Anthropology of Religion

- Human Evolution

- Medical Anthropology

- Physical Anthropology

- Regional Anthropology

- Social and Cultural Anthropology

- Theory and Practice of Anthropology

- Browse content in Business and Management

- Business Ethics

- Business Strategy

- Business History

- Business and Technology

- Business and Government

- Business and the Environment

- Comparative Management

- Corporate Governance

- Corporate Social Responsibility

- Entrepreneurship

- Health Management

- Human Resource Management

- Industrial and Employment Relations

- Industry Studies

- Information and Communication Technologies

- International Business

- Knowledge Management

- Management and Management Techniques

- Operations Management

- Organizational Theory and Behaviour

- Pensions and Pension Management

- Public and Nonprofit Management

- Strategic Management

- Supply Chain Management

- Browse content in Criminology and Criminal Justice

- Criminal Justice

- Criminology

- Forms of Crime

- International and Comparative Criminology

- Youth Violence and Juvenile Justice

- Development Studies

- Browse content in Economics

- Agricultural, Environmental, and Natural Resource Economics

- Asian Economics

- Behavioural Finance

- Behavioural Economics and Neuroeconomics

- Econometrics and Mathematical Economics

- Economic History

- Economic Systems

- Economic Methodology

- Economic Development and Growth

- Financial Markets

- Financial Institutions and Services

- General Economics and Teaching

- Health, Education, and Welfare

- History of Economic Thought

- International Economics

- Labour and Demographic Economics

- Law and Economics

- Macroeconomics and Monetary Economics

- Microeconomics

- Public Economics

- Urban, Rural, and Regional Economics

- Welfare Economics

- Browse content in Education

- Adult Education and Continuous Learning

- Care and Counselling of Students

- Early Childhood and Elementary Education

- Educational Equipment and Technology

- Educational Strategies and Policy

- Higher and Further Education