Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

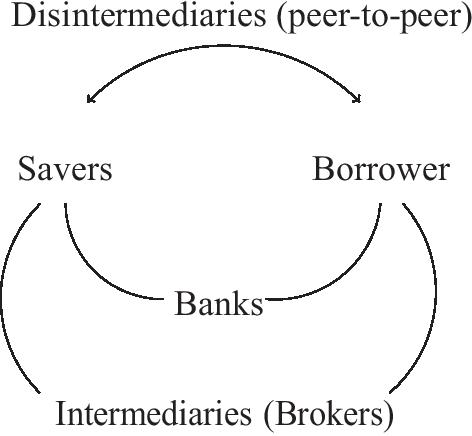

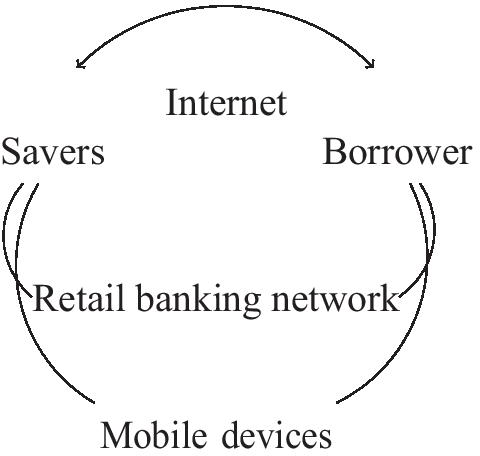

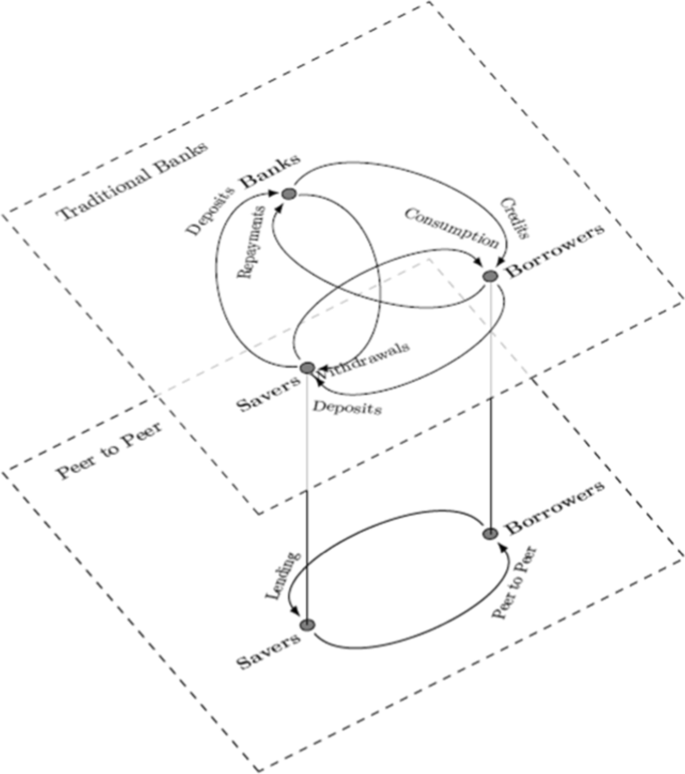

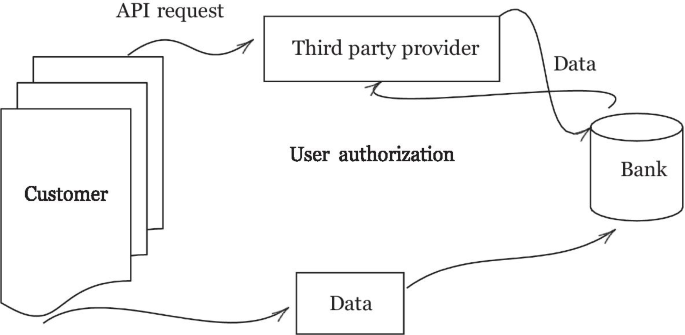

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

151+ Good Banking And Finance Research Topics For Students [2024 Updated]

Are you curious about Banking and Finance Research Topics? In this blog, we explore various banking and finance-related research topics. What drives the banking sector’s resilience in the face of challenges? How do financial markets influence our economic well-being?

Let’s find the good topics of personal finance, corporate decision-making, risk management, and more. From the fundamental principles of accounting to the latest trends in fintech, this collection of research topics spans various fields, offering a comprehensive view of the ever-evolving finance domain.

Discover the impact of digital currencies, the role of central banks, and the effectiveness of credit scoring models. Explore the importance of real estate finance and know the behavioral aspects influencing investment decisions. We also examine the intersection of finance with emerging technologies and its role in sustainable development.

Whether you are a student researching finance or the banking sector with good research ideas about economic difficulties. These Banking and Finance Research Topics provide a gateway to understanding the pivotal role finance plays in our global society. Let’s know all about them here.

Table of Contents

What Is Banking And Finance Research Topics?

Banking and finance research topics refer to specific questions that researchers investigate related to financial systems and institutions. These topics help explore how banks, investments, financial markets, and economic policies work.

Some examples of banking and finance research topics include:

- How new technologies like mobile apps are changing banking

- What causes stock market prices to rise and fall

- How government regulations impact financial institutions

- Why do people make certain financial decisions?

- Ways to improve risk management for banks

- The future of cryptocurrencies as an investment

- How fintech companies are competing with traditional banks

Researching these topics aims to gain a deeper understanding of the financial world. The knowledge can then be used to inform better policies, practices, and decisions related to banking and finance.

How To Find Banking And Finance Research Topics For Students?

Here are some tips for students on finding good banking and finance research topics:

- Look at current events in the banking and finance industries for inspiration. Pay attention to what’s happening with major banks, new technologies, economic policies, financial crises, and industry trends.

- Review finance publications, academic journals, magazines, and websites to discover recent research studies related to banking and see what knowledge gaps they identify that require further investigation.

- Browse research paper databases for sample banking and finance essays to find potential topics or note areas requiring additional up-to-date research.

- Align topics with your existing interests and course curriculum. If you enjoy technology, explore fintech questions. If macroeconomics fascinates you, investigate the implications of monetary policies.

- Consider meaningful real-life research questions, like how underprivileged groups are financially underserved or how developing nations can gain affordable banking access.

- Brainstorm ideas and get input from professors who will guide you in refining topics based on viability, available data sources, analytical methods, and relevance to the current finance field.

List of Good Banking And Finance Research Topics

Here are the most interesting banking and finance research topics:

Good Banking And Finance Research Topics For Students

- Comparative analysis of traditional banking vs. online banking.

- The impact of mergers and acquisitions on bank performance.

- Assessing the role of central banks in ensuring financial stability.

- Investigating the effectiveness of bank stress tests in predicting financial crises.

- Analyzing the factors influencing customer satisfaction in banking services.

- The role of blockchain technology in enhancing banking security.

- Examining the impact of interest rate fluctuations on bank profitability.

- Evaluating the role of government intervention in preventing bank failures.

- Analyzing the challenges and opportunities of Islamic banking.

- The impact of Basel III regulations on banking risk management.

Best Banking And Finance Sector Research Topics For MBA Students

- The role of the stock market in economic development.

- Examining the factors affecting stock market volatility.

- Impact of high-frequency trading on financial markets.

- Exploring the relationship between corporate governance and stock prices.

- The role of derivatives in managing financial market risks.

- Analyzing the impact of macroeconomic indicators on stock prices.

- The role of insider trading in financial markets.

- Investigating the efficiency of emerging financial markets.

- The impact of market sentiment on stock prices.

- Analyzing the role of financial analysts in shaping market perceptions.

Personal Finance-Related Research Topics

- The impact of financial literacy on personal finance management.

- Evaluating the effectiveness of budgeting tools in personal finance.

- The role of behavioral economics in understanding individual investment decisions.

- Investigating the factors influencing retirement savings decisions.

- The impact of socio-economic factors on household debt levels.

- Assessing the effectiveness of financial planning in achieving financial goals.

- The role of technology in personal financial management.

- Analyzing the impact of tax policies on personal savings.

- The relationship between education and income levels in personal finance.

- Investigating the role of psychological biases in personal investment decisions.

Corporate Banking And Finance Research Topics

- The impact of capital structure on firm profitability.

- Evaluating the role of financial leverage in corporate decision-making.

- Analyzing the factors influencing dividend payout policies.

- The impact of corporate governance on firm performance.

- Investigating the relationship between CEO compensation and firm performance.

- The role of working capital management in corporate finance.

- Analyzing the impact of exchange rate fluctuations on multinational corporations.

- The influence of financial disclosure on investor decisions.

- Evaluating the impact of corporate social responsibility on shareholder value.

- The role of venture capital in financing innovation and startups.

Risk Management Research Topics For College Students

- The impact of credit risk on financial institutions.

- Analyzing the role of derivatives in hedging financial risks.

- Evaluating the effectiveness of value-at-risk (VaR) models in risk management.

- The impact of operational risk on financial institutions.

- Exploring the relationship between risk-taking and financial performance.

- Analyzing the role of insurance in managing financial risks.

- The impact of climate change on financial risk assessment.

- Evaluating the role of stress testing in assessing systemic risk.

- The influence of cyber threats on financial institutions’ risk management.

- The role of artificial intelligence in enhancing risk management practices.

Accounting and Auditing Research Topics

- Analyzing the impact of International Financial Reporting Standards (IFRS) on financial reporting quality.

- Evaluating the role of forensic accounting in fraud detection.

- The impact of audit quality on financial statement reliability.

- Investigating the role of auditor independence in ensuring financial transparency.

- Analyzing the effectiveness of fair value accounting in financial reporting.

- The influence of accounting conservatism on financial decision-making.

- Evaluating the impact of accounting information on investment decisions.

- The role of big data analytics in modern accounting practices.

- Analyzing the challenges and opportunities of sustainability reporting.

- The impact of earnings management on financial statement reliability.

Financial Regulation and Policy Research Topics

- The role of government intervention in preventing financial crises.

- Evaluating the impact of Dodd-Frank Wall Street Reform and Consumer Protection Act.

- Analyzing the effectiveness of Basel III in regulating global banking.

- The role of regulatory bodies in promoting financial market integrity.

- Investigating the impact of tax policies on corporate financial decisions.

- Analyzing the challenges and opportunities of cross-border financial regulation.

- The role of ethics in financial decision-making and regulation.

- Evaluating the impact of monetary policy on inflation and economic growth.

- The influence of political factors on financial regulation.

- The impact of regulatory changes on financial innovation.

Real Estate Finance Related Research Topics

- Analyzing the factors influencing real estate prices and investment.

- The impact of interest rate changes on real estate markets.

- Evaluating the role of mortgage-backed securities in real estate finance.

- The influence of housing policies on real estate market dynamics.

- The role of real estate crowdfunding in property financing.

- Analyzing the impact of urbanization on real estate development.

- The role of sustainability in real estate investment decisions.

- Evaluating the impact of economic downturns on real estate values.

- The influence of demographic trends on real estate market dynamics.

- Analyzing the challenges and opportunities of real estate finance in emerging markets.

Behavioral Finance Research Paper Topics

- Investigating the role of behavioral biases in investment decisions.

- The impact of overconfidence on financial decision-making.

- Analyzing the influence of social networks on investment behavior.

- Evaluating the role of emotions in financial decision-making.

- The impact of financial news and media on investor sentiment.

- Investigating the role of heuristics in shaping financial perceptions.

- Analyzing the impact of market bubbles on investor behavior.

- The influence of framing effects on investment choices.

- Evaluating the role of financial education in mitigating behavioral biases.

- The impact of cultural factors on individual investment decisions.

Financial Technology (Fintech) Research Topics

- Analyzing the impact of robo-advisors on traditional investment advisory services.

- The role of blockchain in reshaping payment systems.

- Evaluating the potential of cryptocurrencies as a mainstream means of exchange.

- The impact of artificial intelligence on credit scoring models.

- Analyzing the challenges and opportunities of regulating fintech startups.

- The role of big data analytics in personalized financial services.

- Evaluating the impact of open banking on financial innovation.

- The influence of cybersecurity threats on fintech adoption.

- Analyzing the role of regulatory sandboxes in fostering fintech innovation.

- The impact of fintech on financial inclusion in developing economies.

Economics and Finance Sector Related Research Topics

- Investigating the relationship between economic indicators and financial markets.

- The impact of trade policies on exchange rates and international finance.

- Analyzing the role of economic sanctions in shaping financial landscapes.

- Evaluating the impact of globalization on financial stability.

- The role of monetary policy in addressing economic inequality.

- Analyzing the impact of economic recessions on financial decision-making.

- The influence of political instability on financial markets.

- The impact of demographic trends on economic and financial dynamics.

- Evaluating the role of economic forecasting in financial decision-making.

- The relationship between economic growth and financial development.

Sustainable Banking And Finance Research Topics

- Analyzing the impact of environmental, social, and governance (ESG) factors on investment decisions.

- The role of green finance in promoting sustainable development.

- Evaluating the impact of carbon pricing on financial markets.

- The influence of sustainable investing on corporate decision-making.

- Analyzing the challenges and opportunities of integrating sustainability into financial reporting.

- The role of impact investing in addressing social and environmental issues.

- Evaluating the impact of climate change on financial risk assessment.

- The influence of corporate sustainability on shareholder value.

- The role of green bonds in financing environmentally friendly projects.

- Analyzing the effectiveness of sustainable finance policies in achieving global goals.

Recent Banking And Finance Research Topics

- Investigating the potential of decentralized finance (DeFi) in traditional banking services.

- The impact of quantum computing on financial modeling and risk management.

- Analyzing the challenges and opportunities of central bank digital currencies (CBDCs).

- The role of augmented reality (AR) and virtual reality (VR) in financial services.

- The impact of 5G technology on financial transactions and services.

- Evaluating the potential of tokenization in transforming financial markets.

- Analyzing the role of artificial intelligence in credit scoring and lending decisions.

- The influence of geopolitical factors on global financial markets.

- The impact of regulatory technology (RegTech) in compliance and risk management.

- The role of smart contracts in streamlining financial transactions.

Cross-Border Finance Research Paper Topics

- Investigating the impact of exchange rate fluctuations on cross-border investments.

- The role of currency unions in promoting cross-border trade and investments.

- Analyzing the challenges and opportunities of cross-border banking operations.

- Evaluating the impact of trade agreements on cross-border financial flows.

- The influence of political and economic integration on cross-border finance.

- Analyzing the role of international financial institutions in cross-border finance.

- The impact of capital controls on cross-border investments.

- The role of cross-border financial services in promoting global economic integration.

- Evaluating the impact of cross-border financial regulations on multinational corporations.

- The influence of cross-border financial crimes on international cooperation.

Financial Education and Literacy Research Topics

- Investigating the impact of financial education programs on students’ financial literacy.

- The role of technology in enhancing financial education and literacy.

- Evaluating the effectiveness of workplace financial wellness programs.

- Analyzing the impact of cultural factors on financial literacy levels.

- The influence of family background on financial literacy.

- The impact of early financial education on long-term financial behavior.

- Analyzing the relationship between financial literacy and retirement planning.

- The role of schools and universities in promoting financial literacy.

- The influence of gender on financial literacy and decision-making.

- Evaluating the impact of online resources on improving financial literacy.

Banking and Finance in Developing Economies

- Analyzing the challenges and opportunities of financial inclusion in developing economies.

- The role of microfinance in poverty alleviation and economic development.

- Evaluating the impact of foreign aid on financial stability in developing countries.

- The influence of corruption on financial development in developing economies.

- Analyzing the role of remittances in shaping economic landscapes in developing countries.

- The impact of informal financial services on rural communities.

- Evaluating the role of government policies in promoting financial development.

- The influence of economic and political instability on financial systems in developing countries.

- The role of international financial institutions in supporting economic growth in developing economies.

- Analyzing the impact of technology adoption on financial inclusion in developing regions.

What Are Some Good Topics In The Area Of Finance And Accounting For A Ph.D. Research?

Here are some current Banking And Finance research topics for students:

Recent Project Topics On Banking And Finance PDF

Here are the most recent project topics on banking and finance pdf:

These Are the best Banking and Finance Research Topics. These topics serve as gateways to understanding the nature of banking, finance, and other research topics. As you find a good research topic, consider your interests and the current trends shaping the financial domain. Whether it’s the impact of technology on banking, the dynamics of stock markets, or the role of sustainable finance.

Engage with your coursework, delve into academic journals, and attend seminars to find the latest understandings and potential research questions. Consulting with professors and advisors offers valuable guidance, helping refine your focus. Keep an eye on industry reports and financial news for inspiration, considering contemporary challenges and emerging trends.

Remember, your research can contribute to understanding financial systems and inform real-world practices. Choose a topic that not only captivates your interest but also addresses relevant issues, and you’ll find yourself good banking and finance research topics. Happy exploring!

Related Posts

Top 300+ Qualitative Research Topics For High School Students

100+ Most Interesting Google Scholar Research Topics For Students [Updated 2024]

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- How it works

Useful Links

How much will your dissertation cost?

Have an expert academic write your dissertation paper!

Dissertation Services

Get unlimited topic ideas and a dissertation plan for just £45.00

Order topics and plan

Get 1 free topic in your area of study with aim and justification

Yes I want the free topic

Banking and Finance Dissertation Topics – Selected for Business Students

Published by Owen Ingram at January 2nd, 2023 , Revised On August 16, 2023

Looking for an interesting banking and finance research idea for your dissertation? Your search for the best finance and banking dissertation topics ends right here because, a t ResearchProspect, we help students choose the most authentic and relevant topic for their dissertation projects.

Bank taxes, financial management, financial trading, credit management, market analysis for private investors, economic research methods, the economics of money and banking, international trade and multinational business, the wellbeing of people and society, principles and practices of banking, management and cost accounting, governance and ethics in banking, investment banking, introductory econometrics, and capital investment management are among the many topics covered in banking and finance.

Without further ado, here is our selection of the besting banking and finance thesis topics and ideas.

Other Useful Links:

- Law Dissertation Topics

- Human Rights Law Dissertation Topics

- Business Law Dissertation Topics

- Employmeny Law Dissertation Topics

- Contract Law Dissertation Topics

- Commercial Law Dissertation Topics

- EU Law Dissertation Ideas

- Sports Law Dissertation Topics

- Medical Law Dissertation Topics

- Maritime Law Dissertation Topics

The following dissertation topics for banking will assist students in achieving the highest possible grades in their dissertation on banking finance:

List of Banking and Finance Dissertation Topics

- A Comprehensive Analysis of the Economic Crisis as It Relates to Banking and Finance

- A Critical Review of Standard Deviation in Business

- The Political and Economic Risks Involving National Bank Transactions

- A Study of Corporate Developments in European Countries Regarding Banking and Finance

- Security Measures Implemented in Financial Institutions Around the World

- Banking and Finance Approaches from Around the World

- An in-depth study of the World Trade Organization’s role in banking and finance

- A Study of the Relationship Between Corporate Strategy and Capital Structures

- Contrasting global, multinational banks with regional businesses

- Preventing Repetitive Economic Collapse in National and Global Finances

- The Motivations for Becoming International Expats All Over the World

- The Difference Between Islamic Banking and Other Religious Denominations in Banking and Financial Habits

- How Can Small-Scale Industries Survive the Global Banking Demands?

- A Study of the Economic Crisis’s Impact on Banking and Finance

- The Impact of the International Stock Exchange on Domestic Bank Transactions

- A 2025 Projected Report on World Trade and Banking Statistics

- How Can We Address the Issue of the Government’s Financial Deficit in Banking?

- A Comparison of Contemporary and Classic Business Models and Companies’ Banking and Financial Habits

- Which of the following should be the principal area of money investment that has arrived at the bank in the form of deposits?

- How to strike a balance between investing money in various plans to generate a profit and managing depositor trust

- What are banks’ responsibilities to their depositors, and how may such liabilities be managed without jeopardising depositor trust?

- How the new banking financing laws enacted by governments throughout the world are better protecting depositors’ rights?

- What is the terminology related to banking finance, which oversees the investment of deposited funds as well as the banks’ responsibilities to depositors?

- Explain the most recent developments in research related to the topic of banking finance

- How research in the banking finance industry assists governments and banking authorities in properly managing their finances?

- What is the most recent credit rating software that assists in determining the rewards and dangers of investing bank funds in the stock market?

- How banking finance assists the world’s top banks in managing consumer expectations and profit?

- The negative impact of a manager’s poor management of a bank’s banking financing

- Is it feasible to conduct a banking firm without the assistance of banking finance management?

- What are the most significant aspects of banking financing that allow businesses to develop without constraints?

The importance of banking finance cannot be overstated. These are only a few of the most extensive subjects on which you may write a banking and finance dissertation. Remember that if you want to succeed in your studies, you must be able to offer reliable numbers and facts on the history and current state of banking and finance throughout the world. Otherwise, you will very certainly be unable to justify your study effectively. We hope you can take some inspiration and ideas from the above banking and finance dissertation topics .

Need professional dissertation help? Click here .

Free Dissertation Topic

Phone Number

Academic Level Select Academic Level Undergraduate Graduate PHD

Academic Subject

Area of Research

Frequently Asked Questions

How to find banking and finance dissertation topics.

To find banking and finance dissertation topics:

- Follow industry news and trends.

- Study regulatory changes.

- Explore emerging technologies.

- Analyze financial markets.

- Investigate risk management.

- Consider ethical and global aspects.

You May Also Like

As a computer networking student, you have a variety of networking topics to choose from. With the field evolving with each passing day.

Nurses provide daily clinical care based on evidence-based practice. They improve patient health outcomes by using evidence-based practice nursing. Take a look at why you should consider a career as an EBP nurse to contribute to the healthcare industry.

Need interesting and manageable management dissertation topics or thesis? Here are the trending management dissertation titles so you can choose the most suitable one.

USEFUL LINKS

LEARNING RESOURCES

COMPANY DETAILS

- How It Works

299+ Engaging Banking And Finance Project Topics

Hello! Have you ever wondered how money works in our world? Well, get ready to dive into the depth of interesting banking and finance project topics.

You might think banks are only about saving money or getting loans, but there’s a whole lot more to explore. In this amazing list of project ideas, we’ll uncover cool things like how banks help businesses grow, why saving money is super important, and even how they keep our money safe.

Ever heard of things like ‘investments’ or ‘global connections’? We’ll solve these mysteries together and see how they make our world a more connected and interesting place.

From learning about how banks support big projects in our cities to understanding how our money can actually make more money there’s a whole financial universe waiting for us to discover! Let’s start this journey together and unlock the secrets of banking and finance.

Contribution Of Banking And Finance In A Country’s Economy

Table of Contents

Banking and finance play an important role in how a country’s economy works. They’re like the heart and blood vessels in our bodies, helping money flow through the economy and keeping it healthy. Here are some key contributions they make in a Country’s economy:

- Savings and Loans: Banks help people save money and also lend money to others. When we save money in a bank, it’s like putting it in a safe place where it can grow. And when someone needs money for a house, a car, or to start a business, banks can lend it to them.

- Business Growth: Finance helps businesses grow. Imagine someone has a fantastic idea for a new company but doesn’t have enough money to start. Banks can provide loans to turn these ideas into real businesses, creating jobs and products we use every day.

- Investments: Finance helps people invest. When we invest, we’re using our money to buy things that can grow in value, like stocks or properties. This helps our money grow over time.

- Supporting Government: Banks help governments run countries smoothly. They manage money for things like building roads, schools, and hospitals. Without banks, it would be tough for governments to do these big projects.

- Stability and Security: Finance helps keep our money safe. Banks use security measures to protect our savings. Imagine if we had to keep all our money at home—there might be a risk of it getting lost or stolen.

- Global Connections: Banks help countries work together. They allow people and businesses from different countries to trade and do business with each other easily, which makes the world more connected.

- Interest and Savings: When we save money in a bank, they pay us interest. That means they give us a little bit more money over time. It’s like a reward for letting them keep our money safe.

- Economic Growth: All these things together—saving, lending, investing, and more—help the economy grow. When the economy grows, it means there are more opportunities for everyone to have jobs and better lives.

So, banking and finance are really important because they help us manage our money, make it grow, and make sure our economy stays strong and healthy.

299+ Banking And Finance Project Topics

Top 15 project topics on risk management in banking.

- Credit Risk Assessment Models in Banking

- Market Risk Management Strategies and Techniques

- Operational Risk Frameworks: Implementation and Analysis

- Liquidity Risk Management in Financial Institutions

- Stress Testing: Methods and Applications in Banking

- Basel III Regulations: Impact and Compliance in Risk Management

- Cybersecurity Threats and Risk Mitigation in Banking

- Fraud Detection and Prevention Mechanisms in Financial Institutions

- Risk Management in Investment Banking: Challenges and Best Practices

- Derivatives and Risk Hedging Strategies in Banking

- Systemic Risk Analysis in the Banking Sector

- Risk Governance and Frameworks in Financial Institutions

- Model Risk Management in Banking

- Non-Performing Loans: Assessment and Risk Mitigation Strategies

- Technology and Innovation in Risk Management for Banks

Top 15 Project Topics On Financial Inclusion Strategies

- Impact Assessment of Financial Inclusion Programs

- Microfinance Institutions and Economic Empowerment

- Mobile Banking for Rural Financial Inclusion

- Role of Technology in Promoting Financial Inclusion

- Community-Based Financial Services for Inclusion

- Government Policies and Financial Inclusion Initiatives

- Gender Inequality and Financial Inclusion Challenges

- Financial Literacy Campaigns for Inclusive Banking

- Challenges and Opportunities in Banking the Unbanked

- Inclusive Banking for Persons with Disabilities

- Innovations in Payment Systems for Financial Inclusion

- Social Entrepreneurship and Financial Inclusion

- Impact Investing and Financial Inclusion

- Partnerships and Collaborations in Promoting Financial Inclusion

- Regulatory Frameworks and Financial Inclusion Strategies

Top 15 Banking And Finance Project Topics On Fintech Innovations In Banking

- Blockchain Technology and its Impact on Banking

- Artificial Intelligence Applications in Financial Services

- Digital Wallets and Payment Innovations

- Peer-to-Peer Lending Platforms

- Robo-Advisors in Investment Management

- Biometric Authentication in Financial Transactions

- Cryptocurrency and its Role in Banking

- Smart Contracts and Banking Operations

- RegTech Solutions for Regulatory Compliance

- Open Banking and API Integration

- Big Data Analytics in Risk Management

- Insurtech Innovations in Insurance Services

- Machine Learning in Credit Scoring and Underwriting

- Chatbots and Customer Service in Banking

- Internet of Things (IoT) Applications in Banking Services

Top 15 Project Topics On Impact Of Cryptocurrency On Finance

- Cryptocurrency and Monetary Policy Implications

- Regulatory Challenges and Frameworks for Cryptocurrency

- Cryptocurrency Adoption in Emerging Economies

- Decentralized Finance (DeFi) and its Impact on Traditional Finance

- Cryptocurrency Market Volatility and Risk Management

- Central Bank Digital Currencies (CBDCs) and their Role in Finance

- Cryptocurrency Exchanges: Analysis and Comparison

- Smart Contracts and their Role in Financial Transactions

- Cryptocurrency and Cross-Border Transactions

- Privacy and Security in Cryptocurrency Transactions

- Tokenization of Assets and its Impact on Finance

- Cryptocurrency Mining and its Environmental Impact

- Cryptocurrency and Financial Inclusion Efforts

- Cryptocurrency and its Impact on Investment Portfolios

- Social Implications of Cryptocurrency Adoption

Top 15 Banking And Finance Project Topics On Banking Regulations And Compliance

- Basel Accords: Evolution and Impact on Banking Regulations

- Anti-Money Laundering (AML) Compliance in Banking

- Know Your Customer (KYC) Regulations in Financial Institutions

- Dodd-Frank Act: Compliance and Implications for Banks

- GDPR Compliance in Banking: Data Protection Regulations

- FATCA (Foreign Account Tax Compliance Act) and Banking

- Consumer Protection Regulations in Banking

- Impact of IFRS 9 (International Financial Reporting Standards) on Banks

- Risk-Based Approach to Regulatory Compliance in Banking

- Compliance Challenges in Cross-Border Banking Operations

- Technology and Compliance: RegTech Solutions in Banking

- Insider Trading Regulations in Financial Institutions

- Operational Risk Management and Compliance Frameworks

- Compliance Audits and Governance in Banking

- Ethical Compliance in Banking Practices

Top 15 Project Topics On Corporate Governance In Financial Institutions

- Board Diversity and its Impact on Corporate Governance

- Shareholder Activism and Corporate Governance Practices

- Corporate Governance Codes and Best Practices in Financial Institutions

- Executive Compensation and Corporate Governance

- Role of Independent Directors in Financial Institution Governance

- Risk Management Oversight by Boards in Financial Institutions

- Corporate Governance Failures and Lessons Learned

- Corporate Social Responsibility (CSR) and Governance in Finance

- Transparency and Disclosure Requirements in Governance

- Role of Ethics in Financial Institution Governance

- Stakeholder Engagement in Corporate Governance

- Governance of Financial Holding Companies

- Regulatory Compliance and Corporate Governance

- Technology and Innovation in Enhancing Governance Practices

- Governance Challenges in Global Financial Institutions

Top 15 Project Topics On Credit Risk Assessment Models

- Comparative Analysis of Credit Scoring Models

- Machine Learning Models in Credit Risk Assessment

- Behavioral Scoring Models in Credit Evaluation

- Stress Testing Credit Portfolios: Methods and Approaches

- Credit Rating Agencies and their Role in Risk Assessment

- Default Probability Models in Credit Risk Assessment

- Importance of Alternative Data in Credit Scoring

- Application of Artificial Intelligence in Credit Risk Modeling

- Credit Risk Management in Peer-to-Peer Lending Platforms

- Credit Risk Assessment for Small and Medium Enterprises (SMEs)

- Dynamic Models for Assessing Credit Risk in Banking

- Credit Scoring for Retail Loans: Trends and Innovations

- Impact of Economic Factors on Credit Risk Models

- Hybrid Models in Credit Risk Assessment

- Evaluating Credit Risk in the Mortgage Industry

Top 15 Banking And Finance Project Topics On Behavioral Finance In Investment Decisions

- Prospect Theory and Investor Decision-Making

- Herd Behavior and its Impact on Investment Decisions

- Overconfidence Bias in Investment Choices

- Loss Aversion and its Influence on Investor Behavior

- Anchoring Effect in Investment Decision-Making

- Role of Emotional Intelligence in Financial Decision-Making

- Framing Effects in Investment Choices

- Cognitive Biases and their Impact on Investment Behavior

- Impact of Social Influence on Investment Decisions

- Neurofinance: Understanding Brain Mechanisms in Decision-Making

- Behavioral Biases in Market Bubbles and Crashes

- Investor Sentiment and Market Performance

- Cultural Differences and Behavioral Finance

- Role of Financial Advisors in Mitigating Behavioral Biases

- Nudging Strategies for Improved Investment Decision-Making

Top 15 Project Topics On E-Commerce And Online Payments

- Evolution of E-commerce: Trends and Future Prospects

- Impact of Mobile Commerce on E-commerce Growth

- Cross-Border E-commerce: Opportunities and Challenges

- User Experience Design in E-commerce Websites

- Omnichannel Retailing: Integrating Online and Offline Sales

- Payment Gateway Technologies in E-commerce

- Cryptocurrency and its Role in Online Payments

- Fraud Prevention Mechanisms in E-commerce Transactions

- Personalization Strategies in E-commerce

- Logistics and Supply Chain Management in E-commerce

- Social Commerce: Utilizing Social Media for Sales

- Subscription-Based E-commerce Business Models

- Regulatory Frameworks and Compliance in E-commerce

- AI and Machine Learning Applications in E-commerce

- Sustainability and Ethical Practices in Online Retail

Top 15 Banking And Finance Project Topics On Financial Derivatives And Hedging

- Understanding Futures Contracts and their Applications

- Options Trading Strategies in Financial Markets

- Hedging Strategies using Forward Contracts

- Swaps: Types, Uses, and Risk Management

- Interest Rate Derivatives and their Impact on Financial Markets

- Currency Derivatives and Hedging Foreign Exchange Risk

- Commodity Derivatives: Trading and Risk Management

- Credit Derivatives: Types and Applications

- Hedging Techniques for Portfolio Risk Management

- Volatility Trading using Derivative Instruments

- Real Options Analysis in Investment Decision-Making

- Derivatives and Speculation: Risks and Benefits

- Arbitrage Strategies using Derivatives

- Legal and Regulatory Frameworks for Derivatives Markets

- Role of Derivatives in Risk Mitigation for Corporates

Top 15 Project Topics On Microfinance And Economic Development

- Impact of Microfinance on Poverty Alleviation

- Role of Microfinance in Women Empowerment

- Microfinance and Rural Economic Development

- Microfinance Institutions and Financial Inclusion

- Microfinance and Entrepreneurship Development

- Sustainability of Microfinance Programs

- Impact of Microcredit on Small-Scale Businesses

- Microfinance and Agricultural Development

- Microfinance and Access to Education

- Microfinance and Health Improvement

- Microfinance and Urban Economic Growth

- Microfinance and Sustainable Development Goals (SDGs)

- Microfinance and Employment Generation

- Challenges in Microfinance Governance and Regulation

- Innovations in Microfinance Models for Economic Development

Top 15 Project Topics On Merger And Acquisition Trends In Banking

- Analysis of Recent Merger and Acquisition Trends in the Banking Sector

- Impact of Mergers on Financial Performance of Acquiring Banks

- Factors Driving Mergers and Acquisitions in the Banking Industry

- Cross-Border Mergers in Banking: Challenges and Opportunities

- Regulatory Implications of Mergers and Acquisitions in Banking

- Merger and Acquisition Strategies in the Banking Sector

- Post-Merger Integration Challenges and Best Practices in Banking

- Valuation Methods in Banking Mergers and Acquisitions

- Effects of Mergers on Customer Experience and Satisfaction in Banking

- Role of Technology in Driving Mergers and Acquisitions in Banking

- Cultural Integration in Banking Mergers: Impact on Organizational Performance

- Mergers and Acquisitions in Emerging Markets’ Banking Sectors

- Impact of Mergers on Market Concentration and Competition in Banking

- Mergers and Acquisitions as a Growth Strategy for Banks

- Analysis of Failed Mergers in the Banking Industry: Lessons Learned

Top 15 Banking And Finance Project Topics On Financial Market Volatility Analysis

- Analysis of Historical Financial Market Volatility Patterns

- Impact of Macroeconomic Indicators on Financial Market Volatility

- Volatility Spillover Effects among Global Financial Markets

- Behavioral Finance Perspectives on Market Volatility

- Forecasting Financial Market Volatility using Statistical Models

- Volatility Clustering and its Implications in Financial Markets

- COVID-19 Pandemic Effects on Financial Market Volatility

- Options Pricing Models and Volatility Estimation

- Measuring and Managing Systemic Risk through Volatility Analysis

- High-Frequency Trading and Volatility in Financial Markets

- Impact of Geopolitical Events on Financial Market Volatility

- Volatility Index (VIX) Analysis and Market Sentiment

- Volatility Skewness in Financial Markets: Causes and Consequences

- Volatility in Cryptocurrency Markets: Comparative Analysis

- Impact of Central Bank Policies on Financial Market Volatility

Top 15 Project Topics On Sustainable Finance And Green Banking

- Green Banking Initiatives: A Comparative Analysis of Global Practices

- Impact Investing and Sustainable Finance: Case Studies and Analysis

- Role of Financial Institutions in Promoting Green Projects and Sustainability

- Carbon Finance and Emission Trading in Sustainable Banking

- Green Bonds: Evolution, Performance, and Future Trends

- Sustainable Development Goals (SDGs) Integration in Banking Practices

- Greenwashing in Banking: Challenges and Strategies for Transparency

- Renewable Energy Financing Models in Green Banking

- Socially Responsible Investing (SRI) and its Influence on Banking

- Climate Risk Assessment and Mitigation in Banking Portfolios

- Green Technologies Adoption by Financial Institutions: Opportunities and Challenges

- Circular Economy Financing in the Banking Sector

- Environmental, Social, and Governance (ESG) Metrics in Banking Decision-Making

- Regulatory Implications and Compliance in Sustainable Finance

- Innovation and Future Directions in Green Banking Practices

Top 15 Banking And Finance Project Topics On Banking Technology And Cybersecurity

- Blockchain Technology and its Impact on Banking Security

- Artificial Intelligence Applications in Banking Cybersecurity

- Biometric Authentication Systems in Banking: Advancements and Challenges

- Risks and Security Challenges of Open Banking APIs

- Cybersecurity Threats in Mobile Banking Applications

- Implementing Zero Trust Architecture in Banking Systems

- Machine Learning for Fraud Detection in Banking Transactions

- Role of Big Data Analytics in Enhancing Banking Cybersecurity

- Cloud Computing Security Measures in the Banking Sector

- Regulatory Compliance and Cybersecurity in Banking (e.g., GDPR, PSD2)

- Incident Response and Recovery Strategies in Banking Cybersecurity

- Role of Cryptography in Securing Financial Transactions

- Cybersecurity Awareness and Training Programs in Banking Institutions

- Internet of Things (IoT) Security in Banking Operations

- Ethical Hacking and Penetration Testing in Banking Security Assessment

Top 15 Project Topics On Capital Structure And Firm Performance

- Impact of Capital Structure on Firm Profitability

- Debt-Equity Mix and Financial Performance: Evidence from Different Industries

- Optimal Capital Structure Theories and their Practical Implications

- Capital Structure Dynamics during Economic Downturns and Recoveries

- Trade-off Theory vs. Pecking Order Theory: Empirical Analysis in Firm Performance

- Capital Structure and Stock Market Performance: A Comparative Study

- Determinants of Capital Structure: Evidence from Emerging Markets

- Long-term vs. Short-term Debt and Firm Performance Analysis

- Impact of Taxation Policies on Capital Structure and Firm Value

- Financial Flexibility and its Relationship with Capital Structure

- Capital Structure and Risk Management: Effects on Firm Performance

- Impact of Leverage on Firm Growth and Stability

- Capital Structure Adjustments and Market Reaction: Case Studies

- Corporate Governance and its Influence on Capital Structure Decision-making

- Capital Structure and Mergers/Acquisitions: Implications for Firm Performance

Top 15 Banking And Finance Project Topics On Financial Literacy Initiatives

- Effectiveness of Financial Literacy Programs in Schools

- Impact Assessment of Financial Literacy Workshops in Different Demographics

- Role of Technology in Enhancing Financial Literacy Outreach

- Financial Literacy and its Influence on Retirement Planning

- Cultural Factors Affecting Financial Literacy: Comparative Analysis

- Financial Literacy and Investment Behavior: Empirical Studies

- Evaluation of Government-led Financial Literacy Campaigns

- Behavioral Economics in Designing Effective Financial Literacy Programs

- Financial Literacy for Entrepreneurs and Small Business Owners

- Financial Literacy and its Impact on Debt Management

- Gender Disparities in Financial Literacy: Challenges and Solutions

- Role of Nonprofit Organizations in Promoting Financial Literacy

- Assessing the Long-term Impact of Childhood Financial Education Programs

- Innovative Approaches to Enhancing Financial Literacy in Underserved Communities

- Financial Literacy and Consumer Decision-making: Case Studies and Analysis

Top 15 Project Topics On Real Estate Financing And Investment

- Trends and Dynamics in Real Estate Investment Trusts (REITs)

- Impact of Interest Rates on Real Estate Financing and Investment

- Analysis of Risk and Return in Commercial Real Estate Investments

- Role of Private Equity in Real Estate Financing

- Real Estate Crowdfunding Platforms: Opportunities and Challenges

- Sustainable Real Estate Investment and Financing Practices

- Real Estate Development Financing Models: Case Studies

- Impact of Regulatory Changes on Real Estate Investment Strategies

- Behavioral Finance in Real Estate Investment Decision-making

- Real Estate Investment Strategies in Emerging Markets

- Real Estate Financing and Urban Development: Case Studies

- Leveraging Technology in Real Estate Investment Analysis

- Real Estate Syndication and Joint Ventures: Evaluation and Risks

- REITs vs. Direct Real Estate Investments: Comparative Analysis

- Real Estate Investment Due Diligence and Risk Management

Top 15 Project Topics On International Financial Reporting Standards (Ifrs)

- Adoption and Implementation Challenges of IFRS in Different Countries

- Impact of IFRS on Financial Reporting Quality and Transparency

- IFRS Convergence and its Effect on Global Financial Reporting Standards

- Comparative Analysis of IFRS and Local GAAP: Implications for Businesses

- Role of IFRS in Harmonizing Global Financial Reporting Practices

- IFRS and Financial Statement Analysis: Case Studies and Applications

- The Evolution of IFRS: Changes, Updates, and Future Developments

- IFRS and Corporate Governance: Influence on Reporting and Disclosures

- IFRS Interpretation and Implementation Challenges in Complex Industries (e.g., Extractive, Insurance)

- IFRS 9 (Financial Instruments) Implementation and Its Impact on Financial Institutions

- IFRS 16 (Leases) and its Effect on Lease Accounting Practices

- IFRS and Small and Medium-sized Enterprises (SMEs): Challenges and Adaptations

- Investor Perceptions and Reactions to IFRS Adoption: Empirical Studies

- The Role of International Accounting Standards Board (IASB) in IFRS Development

- Implications of IFRS on Taxation and Regulatory Compliance in Different Jurisdictions

Top 15 Banking And Finance Project Topics On Role Of Central Banks In Economic Stability

- Monetary Policy Tools and Their Impact on Economic Stability

- Role of Central Banks in Financial Crises: Lessons from Global Instances

- Inflation Targeting and its Effectiveness in Achieving Economic Stability

- Quantitative Easing Policies and their Impact on Economic Stability

- Exchange Rate Policies and Economic Stability: Comparative Analysis

- Central Bank Independence and its Role in Ensuring Economic Stability

- Financial Stability Oversight by Central Banks: Frameworks and Strategies

- Central Bank Communication Strategies and their Impact on Markets and Stability

- The Role of Central Banks in Mitigating Systemic Risks in Financial Systems

- Macroprudential Policies and Central Banks: Their Role in Ensuring Stability

- Central Banks and Crisis Management: Case Studies and Analysis

- Digital Currencies and Central Banks: Implications for Economic Stability

- Role of Central Banks in Addressing Income Inequality and Economic Stability

- Central Bank Reserves Management and its Impact on Economic Stability

- Central Bank Lender-of-Last-Resort Function and its Impact on Financial Stability

It’s impressive to see the vast collection of banking and finance project topics. From understanding risk management in banking to exploring sustainable finance and even checking the role of central banks in economic stability, these project ideas offer a glimpse into the complex world of money and its management.

In learning about these topics, we’ve discovered how crucial banking and finance are for a country’s economy. Banks aren’t just places to save money or get loans they’re like engines driving economic growth. They help businesses start and grow, keep our money safe, and even support big projects like building schools or hospitals.

When we hear about things like investments, global connections, or even the impact of digital currencies, it’s all about how money moves and shapes the world around us. Learning about these topics can help us understand how economies grow and how our own money choices can make a difference. Banking and finance may seem complicated, but they’re essential for making our world work smoothly.

Related Posts

Step by Step Guide on The Best Way to Finance Car

The Best Way on How to Get Fund For Business to Grow it Efficiently

Home » Blog » Dissertation » Topics » Finance » Banking and Finance » Banking and Finance Dissertation Topics (28 Examples) For Research

Banking and Finance Dissertation Topics (28 Examples) For Research

Mark May 26, 2020 Jun 5, 2020 Banking and Finance , Finance No Comments

Are you searching for banking and finance dissertation topics? We understand that selecting a dissertation topic is one of the biggest challenges. So, we offer a wide range of banking and finance dissertation topics and project topics on banking and finance. You can also visit our site for corporate finance dissertation topics and other business […]

Are you searching for banking and finance dissertation topics? We understand that selecting a dissertation topic is one of the biggest challenges. So, we offer a wide range of project topics on banking and finance.

Our team of writers can provide quality work on your selected banking and finance research topics. Once you select from the research topics on banking and finance, we will provide an outline, which can provide guidance on how the study should be carried out .

If you have come to this post after searching for corporate finance or finance topics, following are the seperate posts made on these topics.

- Finance Research Topics

- Corporate Finance Research Topics

Banking and finance dissertation topics

Role of micro-loans in the modern financial industry.

Online currencies like Bitcoin brought changes in the concept of fiat currencies.

Identifying the forces causing American retail banking centres to change.

Analysing the treatment of off-balance sheet activities.

Examining the role of internet banking in society.

Evaluating how the modern economy prevents a run on the banks from happening.

To find out whether the technology can replace the role of retail banking centre.

Relationship between housing loans and the 2008 recession.

Impact of foreign direct investment on the emerging economies.

Identifying the best capital structure for a retail bank.

To study the effect of mergers and acquisition on employee’s morale and performance in the case of banks.

Evaluating the credit management and issues of bad debts in commercial banks in the UAE.

To what extent the electronic banking has affected customer satisfaction.

Portfolio management and its impact on the profitability level of banks.

Impact of interest rate on loan repayment in microfinance banks.

An appraisal of operational problems facing micro-finance banks in delta state.

Studying the impact of risk management on the profitability of banks.

Evaluation of bank lending and credit management.

Role of automated teller machine on customer satisfaction and retention.

Examining the impact of bank consolidation on operational efficiency.

Competitive strategies and changes in the banking industry.

Development of rural banking in the case of developed countries.

The effect of electronic payment systems on the behaviour and satisfaction level of customers.

How does the organisational structure affect the commercial banks and their performance?

How can banks use ratio analysis as a bank lending tool?

Evaluating the relationship between e-banking and cybercrime.

Studying the importance of credit management in the banking industry.

Problems related to loan granting and recovery.

Topic With Mini-Proposal (Paid Service)

Along with a topic, you will also get;

- An explanation why we choose this topic.

- 2-3 research questions.

- Key literature resources identification.

- Suitable methodology with identification of raw sample size, and data collection method

- View a sample of topic consultation service

Get expert dissertation writing help to achieve good grades

- Writer consultation before payment to ensure your work is in safe hands.

- Free topic if you don't have one

- Draft submissions to check the quality of the work as per supervisor's feedback

- Free revisions

- Complete privacy

- Plagiarism Free work

- Guaranteed 2:1 (With help of your supervisor's feedback)

- 2 Instalments plan

- Special discounts

Other Posts

- Corporate Finance Dissertation Topics (29 Examples) For Your Research December 28, 2019 -->

- Finance Dissertation Topics Examples List (37 Ideas) For Research Students May 29, 2017 -->

Message Us On WhatsApp

Home » Blog » Dissertation » Topics » Finance » Banking and Finance » 80 Banking and Finance Research Topics

80 Banking and Finance Research Topics

FacebookXEmailWhatsAppRedditPinterestLinkedInAre you a student embarking on the exciting journey of research and looking for captivating topics in banking and finance to fuel your thesis or dissertation? Look no further! Selecting the proper research topics is pivotal to the success of your academic endeavor. Whether you’re pursuing an undergraduate, master’s, or doctoral degree, the world of […]

Are you a student embarking on the exciting journey of research and looking for captivating topics in banking and finance to fuel your thesis or dissertation? Look no further! Selecting the proper research topics is pivotal to the success of your academic endeavor. Whether you’re pursuing an undergraduate, master’s, or doctoral degree, the world of banking and finance offers a plethora of intriguing avenues to explore.

Banking and finance are often used interchangeably; the keywords “financial research” and “banking study” encompass the intricate mechanisms that drive the global economy, managing the flow of funds, investments, and financial instruments.

This comprehensive guide will delve into diverse research topics that will captivate your interest and contribute to growing knowledge in this dynamic field.

A List Of Potential Research Topics In Banking and Finance:

- Analyzing the effect of Bank of England policies on interest rates and inflation.

- Exploring the determinants and consequences of bank liquidity creation.

- A critical analysis of Dodd-Frank Wall Street Reform and Consumer Protection Act.

- Reviewing the role of systemically important financial institutions (sites) in the 2008 crisis.

- Evaluating the effects of mergers and acquisitions on bank performance.

- Evaluating the role of credit unions in promoting financial inclusion.

- Analyzing the effects of financial market volatility on investor behavior.

- Investigating the relationship between financial inclusion and economic growth.

- Analyzing the risks and benefits of open banking implementation in the UK.

- Exploring the role of insurance in reshaping the insurance industry after COVID-19.

- Investigating the implications of negative interest rates on banking profitability.

- Evaluating the impact of Brexit on London as a global financial hub.

- Analyzing the challenges and opportunities of sustainable finance in the post-covid era.

- Analyzing the implications of the London Interbank offered rate (LIBOR) transition in the UK.

- Analyzing the resilience of microfinance institutions during and after the pandemic.

- Exploring the relationship between UK taxation policies and investment decisions.

- Examines Basel iii regulations’ impact on bank capital adequacy.

- Examining the effects of political risk on international banking operations.

- Reshaping investment strategies: a study of behavioral changes post-pandemic.

- The role of credit rating agencies in financial markets: an empirical study.

- Reviewing the effects of quantitative easing programs on financial markets .

- Investigating the influence of behavioral biases on investment decisions.

- Investigating the factors affecting customer loyalty in retail banking.

- Impact of the pandemic on credit risk assessment and bank loan defaults.

- Examining the determinants of corporate credit ratings and their implications.

- Investigating the link between corporate social responsibility and financial performance.

- The changing landscape of risk management in banking: a literature review.

- The role of central banks in addressing systemic banking crises: a historical perspective.

- Evaluating the effectiveness of risk management strategies in the banking sector.

- Analyzing the impact of microfinance initiatives on rural economic empowerment.

- Assessing the impact of economic uncertainty on investment behavior.

- The role of e-commerce and online platforms in shaping post-pandemic retail banking.

- Investigating the relationship between macroeconomic indicators and stock market performance.

- A review of behavioral finance theories and their practical implications.

- Sustainability reporting practices in banking: a global review.

- Assessing the adoption and implementation of sustainable finance practices in banking.

- Impact of Brexit on UK-EU financial services trade: challenges and opportunities.

- Reviewing the effects of high-frequency trading on market liquidity and stability.

- Impact of digital currencies on cross-border payments and remittances.

- Impact of UK carbon pricing on financial institutions’ risk management strategies.

- Analyzing remote work’s impact on financial institutions’ cybersecurity risks.

- Analyzing the shift in consumer payment preferences post-COVID-19.