Management Representation Letter

Download this Management Representation Letter Design in Word, Google Docs, PDF Format. Easily Editable, Printable, Downloadable.

Our Management Representation Letter template is a valuable tool for businesses. Use it to formalize commitments, responsibilities, and acknowledgments between management and stakeholders. Available in both MS Word and Google Docs, this template streamlines the process, ensuring clarity and alignment in your business relationships.

Already a premium member? Sign in

- Microsoft Word

- , Google Docs

You may also like

Management Representation Letter: Format, Content, Signature

Home » Bookkeeping » Management Representation Letter: Format, Content, Signature

As of 2019, the FASB requires publicly traded companies to prepare financial statements following the Generally Accepted Accounting Principles (GAAP). Auditors are required by professional standards to report, in writing, internal control matters that they believe should be brought to the attention of those charged with governance (the board). Generally, if your auditor is going to put an internal control matter in a letter, they have assessed that the matter was the result of a deficiency in internal controls. This is an important part of that audit that the profession does not take lightly.

One common example of a deficiency in internal control that’s severe enough to be considered a material weakness or significant deficiency is when an organization lacks the knowledge and training to prepare its own financial statements, including footnote disclosures. The “SAS 115” letter is usually issued when any significant deficiencies or material weaknesses would have been discussed with management during the audit, but are not required to be communicated in written form. In performing an audit of your Plan’s internal controls and plan financials, your auditors are required to obtain an understanding of the Plan’s operations and internal controls.

A management representation letter is a form letter written by a company’s external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis. The CEO and the most senior accounting person (such as the CFO) are usually required to sign the letter. The letter is signed following the completion of audit fieldwork, and before the financial statements are issued along with the auditor’s opinion. External auditors follow a set of standards different from that of the company or organization hiring them to do the work.

In doing so, they may become aware of matters related to your Plan’s internal control that may be considered deficiencies, significant deficiencies, or material weaknesses. Audits performed by outside parties can be extremely helpful in removing any bias in reviewing the state of a company’s financials. Financial audits seek to identify if there are any material misstatements in the financial statements. An unqualified, or clean, auditor’s opinion provides financial statement users with confidence that the financials are both accurate and complete. External audits, therefore, allow stakeholders to make better, more informed decisions related to the company being audited.

The representation should reaffirm your client’s understanding of all significant terms in the engagement letter. A relevant assertion is a financial statement assertion that has a reasonable possibility of containing a misstatement or misstatements that would cause the financial statements to be materially misstated.

The purpose of an internal audit is to ensure compliance with laws and regulations and to help maintain accurate and timely financial reporting and data collection. It also provides a benefit to management by identifying flaws in internal control or financial reporting prior to its review by external auditors.

Depending on materiality and other qualitative factors, the auditors will consider the deficiency to be an “other” matter, significant deficiency, or material weakness. The auditor has discretion on which category the deficiency falls into, but are otherwise required to use the standard wording and definitions in the letter.

It serves to document management’s representations during the audit, reducing misunderstandings of management’s responsibilities for the financial statements. The definition of good internal controls is that they allow errors and other misstatements to be prevented or detected and corrected by (the nonprofit’s) employees in the normal course of performing their duties.

Material weaknesses or significant deficiencies may exist that were not identified during the audit, and auditors are required to disclose this in their written communication. The auditor’s report contains the auditor’s opinion on whether a company’s financial statements comply with accounting standards. The results of the internal audit are used to make managerial changes and improvements to internal controls.

What is a management representation letter?

A management representation letter is a form letter written by a company’s external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis.

A control objective provides a specific target against which to evaluate the effectiveness of controls. Management representation is a letter issued by a client to the auditor in writing as part of audit evidences. The representations letter must cover all periods encompassed by the audit report, and must be dated the same date of audit work completion.

These types of auditors are used when an organization doesn’t have the in-house resources to audit certain parts of their own operations. The assertion of completeness is an assertion that the financial statements are thorough and include every item that should be included in the statement for a given accounting period. The assertion of completeness also states that a company’s entire inventory, even inventory that may be temporarily in the possession of a third party, is included in the total inventory figure appearing on a financial statement. The compilation standards do not require practitioners to obtain a management representation letter, but this does not mean that it’s not a prudent thing to do. Obtaining a representation letter helps to ensure your client understands the services that you have provided, the limitations on the work you have completed, and that they are ultimately responsible for their financial statements.

The biggest difference between an internal and external audit is the concept of independence of the external auditor. When audits are performed by third parties, the resulting auditor’s opinion expressed on items being audited (a company’s financials, internal controls, or a system) can be candid and honest without it affecting daily work relationships within the company. Auditors evaluate each internal control deficiency noted during the audit to determine whether the deficiency, or a combination of deficiencies, is severe enough to be considered a material weakness or significant deficiency. In assessing the deficiency, auditors consider the magnitude of potential misstatements of your financial statements as well as the likelihood that internal controls would not prevent or detect and correct the misstatements.

Representation to Management

- In an audit of financial statements, professional standards require that auditors obtain an understanding of internal controls to the extent necessary to plan the audit.

- written confirmation from management to the auditor about the fairness of various financial statement elements.

- Auditors use this understanding of internal controls to assess the risk of material misstatement of the financial statements and to design appropriate audit procedures to minimize that risk.

The idea behind a management representation letter is to take away some of the legal burdens of delivering wrong financial statements from the auditor to the company. A material weakness is a deficiency, or combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected on a timely basis. Internal auditors are employed by the company or organization for whom they are performing an audit, and the resulting audit report is given directly to management and the board of directors. Consultant auditors, while not employed internally, use the standards of the company they are auditing as opposed to a separate set of standards.

If the auditors detect an unexpected material misstatement during your audit, it could indicate that your internal controls are not functioning properly. Conversely, lack of an actual misstatement doesn’t necessarily mean that your internal controls are working.

The determination of whether an assertion is a relevant assertion is based on inherent risk, without regard to the effect of controls. Financial statements and related disclosures refers to a company’s financial statements and notes to the financial statements as presented in accordance with generally accepted accounting principles (“GAAP”). References to financial statements and related disclosures do not extend to the preparation of management’s discussion and analysis or other similar financial information presented outside a company’s GAAP-basis financial statements and notes.

External audits can include a review of both financial statements and a company’s internal controls. When a company’s financial statements are audited, the principal element an auditor reviews is the reliability of the financial statement assertions. In the United States, the Financial Accounting Standards Board (FASB) establishes the accounting standards that companies must follow when preparing their financial statements.

In an audit of financial statements, professional standards require that auditors obtain an understanding of internal controls to the extent necessary to plan the audit. Auditors use this understanding of internal controls to assess the risk of material misstatement of the financial statements and to design appropriate audit procedures to minimize that risk. written confirmation from management to the auditor about the fairness of various financial statement elements. The purpose of the letter is to emphasize that the financial statements are management’s representations, and thus management has the primary responsibility for their accuracy.

Expert Social Media Tips to Help Your Small Business Succeed

This letter is useful for setting the expectations of both parties to the arrangement. Almost all companies receive a yearly audit of their financial statements, such as the income statement, balance sheet, and cash flow statement. Lenders often require the results of an external audit annually as part of their debt covenants. For some companies, audits are a legal requirement due to the compelling incentives to intentionally misstate financial information in an attempt to commit fraud.

Management representation letter

As long as there’s a reasonable possibility for material misstatement of account balances or financial statement disclosures, your internal controls are considered to be deficient. An auditor typically will not issue an opinion on a company’s financial statements without first receiving a signed management representation letter. An audit engagement is an arrangement that an auditor has with a client to perform an audit of the client’s accounting records and financial statements. The term usually applies to the contractual arrangement between the two parties, rather than the full set of auditing tasks that the auditor will perform. To create an engagement, the two parties meet to discuss the services needed by the client.

As a result of the Sarbanes-Oxley Act (SOX) of 2002, publicly traded companies must also receive an evaluation of the effectiveness of their internal controls. As noted above, an internal control letter is usually the result of a deficiency in internal controls discovered during the audit, most commonly from a material audit adjustment. The letter includes required language regarding the severity of the deficiency.

Real Business Owners,

The parties then agree on the services to be provided, along with a price and the period during which the audit will be conducted. This information is stated in an engagement letter, which is prepared by the auditor and sent to the client. If the client agrees with the terms of the letter, a person authorized to do so signs the letter and returns a copy to the auditor. By doing so, the parties indicate that an audit engagement has been initiated.

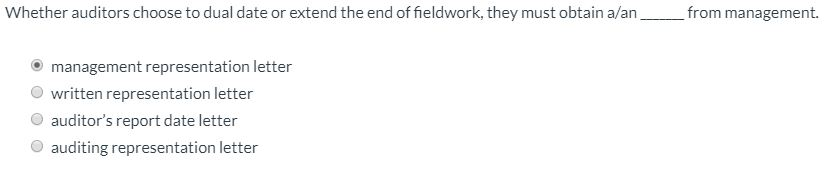

Also, the letter provides supplementary audit evidence of an internal nature by giving formal management replies to auditor questions regarding matters that did not come to the auditor’s attention in performing audit procedures. Some auditors request written representations of all financial statement items. All auditors require representations regarding receivables, inventories, plant and equipment, liabilities, and subsequent events. The letter is required at the completion of the audit fieldwork and prior to issuance of the financial statements with the auditor’s opinion.

Auditors spend a lot of time assessing how material audit adjustments and immaterial adjustments that have the potential to be material will be communicated in the internal control letter. The Representation Letter is issued with the draft audit and is required by auditing standards to finalize the audit. The Representation Letter is a letter from the Association to our firm confirming responsibilities of the board and management for the financial statements, as well as confirming information provided to us during the audit. The President or Treasurer and Management need to sign the Representation Letter and return it back to our office within 60 days from the date the draft audit was issued. Representation Letters received after the 60-day mark may result in additional auditing procedures in order to finalize the audit and comply with auditing standards at an additional expense to the Association.

- Kandivali West Mumbai 400067, India

- 02246022657

- [email protected]

Download Format of Management Representation Letter for Company Audit

Management representation is a letter issued by a client to the auditor in writing as part of audit evidences. It serves to document management’s representations during the audit, reducing misunderstandings of management’s responsibilities for the financial statements.

[the_ad id=’4558′]

Below is the format of Managmenet representation letter:

On the letter head of the company

Name and address of auditors

Sub: Representation for the purpose of audit for the financial year 2019-20 (Assessment year 2020-21 )

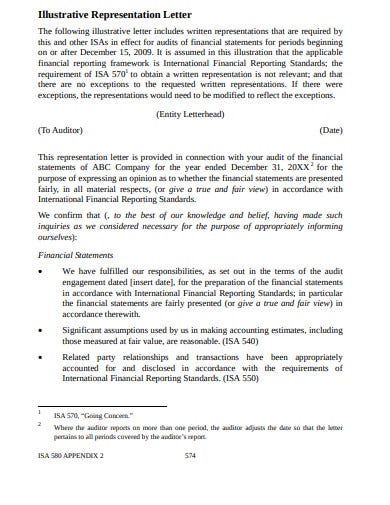

This representation letter is provided in connection with your audit of the financial statements of «Name of the company» for the year ended 31.03.2020 for the purpose of expressing an opinion as to whether the financial statements give a true and fair view of the financial position of «Name of the company» , as on 31.03 .2020 and of the results of operations for the year then ended. We acknowledge our responsibility for preparation of financial statements in accordance with the requirements of the Companies Act, 2013 and recognized accounting policies and practices, including the Accounting Standards issued by the Institute of Chartered Accountants of India.

We confirm, to the best of our knowledge and belief, the following representations;

Accounting Policies

- The accounting policies which are material or critical in determining the results of operations for the year or financial position is set out in the financial statements are consistent with those adopted in the financial statements for the previous year. The financial statements are prepared on accrual basis except discounts claims and rebates, which cannot be determined with certainty in the respective accounting year.

- Significant assumptions used by us in making accounting estimates, including those measured at fair value, are reasonable.

- All events subsequent to the date of the financial statements and for which applicable accounting standards in India require adjustment or disclosure have been adjusted or disclosed.

- The effects of uncorrected misstatements are immaterial, both individually and in the aggregate, to the financial statements as a whole.

- We have fulfilled our responsibilities, as set out in the terms of the audit engagement, for the preparation of the financial statements in accordance with Financial Reporting Standards; in particular, the financial statements give a true and fair view in accordance with the applicable accounting standards in India.

Enter your email address:

Subscribe to faceless complainces

6. The company has satisfactory title to all assets.

The company has satisfactory title to all assets and is subject to first charge to _______________ for securing the working capital loan/ Term loan.

Fixed Assets

7. The net book values at which fixed assets are stated in the balance sheet are arrived at;

- After taking into account all capital expenditure on additions thereto, but no expenditure being chargeable to revenue.

- After eliminating the cost and accumulated depreciation relating to items sold, discarded, demolished or destroyed.

- After providing adequate depreciation on fixed assets during the period.

Capital Commitments

8. At the balance sheet date, there were no outstanding commitments for capital expenditure.

Investments

9. The company does not have any investments.

10. All the investments shown in the balance sheet are “Long Term Investment’.

11. Long-term quoted investments are valued cost less provision for permanent diminution in their value.

12. Long term unquoted investments are valued at cost.

13. All the investments belong to the entity and they do not include any investments held on behalf of any other persons.

14. The entity has clear title to all of its investments. There are no charges against the investments of the entity except those appearing in the records of the entity.

Inventories

15. Inventories at the year-end consisted of the following:

| Raw Materials & consumables | |

| Work-in-Progress | |

| Finished Goods | |

| Other Stock | |

16. All quantities were determined by actual physical count or weight that was taken under our supervision and in accordance with written instructions, on 31.3.2020.

17. All goods included in the inventory are the property of the entity, and none of the goods are held as consignee for others or as bailee.

18. All inventories owned by the entity, wherever located, have been recorded.

19. Inventories do not include goods sold to customers for which delivery is yet to be made.

20. Inventories have been valued at cost or net-realizable value, whichever is less.

21. In our opinion, there is no excess, slow moving, damaged or obsolete inventories, hence no provision is required to be made.

22. No item of inventories has a net realizable value in the ordinary course of business, which is less than the amount at which it is included in inventories.

Debtors, Loans and Advances

23. The following items appearing in the books as at 31.3.«YearClos» are considered good and fully recoverable.

| Trade Receivables | |

| Considered good | |

| Considered Doubtful | |

| Less : Provision | |

| Net Sundry Debtors | |

| Loans and Advances | |

| Considered good | |

| Considered Doubtful | |

| Less : Provision | |

| Net Loans & Advances |

Liabilities

24. We have recorded all known liabilities in the financial statements except retirement benefits, discounts claims and rebates.

25. We have disclosed in Notes on Accounts all guarantees that, if any we have given to third parties.

26. There are no Contingent Liabilities as on 31.3.2020.

Provisions for Claims and Losses

27. There are no known losses and claims of material amounts for which provision is required to be made.

28. There have been no events subsequent to the balance sheet date which require adjustment of or disclosure in, the financial statements or notes thereto.

Statement of Profit and Loss

29. Except as disclosed in the financial statements, the results for the year were not materially affected by;

- Transactions of a nature not usually undertaken by the company.

- Circumstances of an exceptional or non-recurring nature.

- Charges or credits relating to prior years

- Changes in accounting policies

30. The following have been properly recorded and, when appropriate, adequately disclosed in the financial statements;

- Loss arising from sale and purchase commitments.

- Agreements and options to buy back assets previously sold.

- Assets pledged as collateral.

31. All transactions have been recorded in the accounting records and are reflected in the financial statements.

32. There have been no irregularities involving management or employees who have a significant role in the system of internal control that could have a material effect on the financial statements.

33. The financial statements are free of material misstatements, including omissions.

34. The Company has complied with all aspects of contractual agreements that could have a material effect on the financial statements in the event of non-compliance. There has been no non-compliance with requirements of regulatory authorities that could have a material effect on the financial statements in the event of non-compliance.

35. We have no plans or intentions that may materially affect the carrying value or classification of assets and liabilities reflected in the financial statements.

36. The allocation between capital and revenue has been correctly done and that no items of capital nature have been debited to Statement of Profit & Loss and vice versa.

37. The Cash balance as on 31.3.2020 has been physically verified by the management at Rs. ________.

38. The details of disputed dues in case of GST/VAT/sales tax/ income tax/ customer tax/ excise duty/ cess/PF/ESI which have not been deposited on account of dispute is as under:

| Name of Statue | Nature of the Dues | Amount (Rs.) | F. Y. to which the amount relates | Forum where dispute is pending |

| Income Tax | ||||

39. The company has not defaulted in repayment of dues to financial institution or bank.

40. The company has not given any guarantee for loans taken by others from bank or financial institutions.

41. No personal expenses have been charged to revenue accounts

42. We have provided you with:

- Access to all information of which we are aware that is relevant to the preparation of the financial statements such as records, documentation and other matters;

- Additional information that you have requested from us for the purpose of the audit; and

- Unrestricted access to persons within the entity from whom you determined it necessary to obtain audit evidence.

- We have disclosed to you the results of our assessment of the risk that the financial statements may be materially misstated as a result of fraud.

43. We have disclosed to you all information in relation to fraud or suspected fraud that we are aware of and that affects the entity and involves:

- Management;

- Employees who have significant roles in internal control; or

- Others where the fraud could have a material effect on the financial statements.

45. Related party relationships and transactions have been appropriately accounted for and disclosed in accordance with the requirements of applicable accounting standards in India. We have disclosed to you the identity of the entity’s related parties and all the related party relationships and transactions of which we are aware.

46. The payments covered under section 40A (3) were made by account payee cheques drawn on a bank or account payee bank draft.

47. All the loans, deposits or specified sum exceeding the limit specified in section 269SS/T are accepted or repaid through an account payee cheque or an account payee bank draft.

48. The information regarding applicability of MSMED Act 2006 to the various supplier/parties has not been received from the suppliers. Hence information as required vide clause 22 of chapter V of MSMED Act 2006 is not being given.

49. The loans taken from directors of the company or their relatives are out of their own funds and not any borrowed funds in pursuance of relevant provisions of Companies Act, 2013. Necessary declarations in this behalf have been obtained by the company from them.

By order of the Board

For «Name of the company»

«Director 1 name» Director «Director 2 name» Director

DIN : DIN :

Dated:- «Balancesheet Date»

Share this Article

Leave a reply cancel reply.

Discover more from Faceless Compliance

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

Accounting Documents Library

Representation letter, guide to understanding and writing the representation letter (management representation letter).

In the realms of auditing and compliance, the Representation Letter, often known as the Management Representation Letter, is a vital document that acts as a bridge between the management and the auditors. It signifies management’s acknowledgment of the statuses, obligations, and responsibilities related to the financial statements and the auditing process. This guide is meticulously designed to assist internal auditors, financial managers, compliance officers, accountants, and accounting students in fully grasping the depth and detail involved in this process.

Understanding the Representation Letter

Definition and purpose.

At its core, the Representation Letter is a written confirmation and assurance from management, principally the top management, that they have made all relevant disclosures to the auditors. It’s a statement that supports the truthfulness of the information provided and asserts that management has fulfilled its responsibilities with regard to the financial reporting process.

Contents and Key Components

The letter is loaded with significance as it encompasses a range of declarations. The key components include affirmations about the accuracy and completeness of records, unrestricted access to all information, and the provision of external confirmations when necessary. These declarations are vital for the external and internal auditors in assessing the company's financial health.

Writing a Comprehensive Representation Letter

Ensuring the representation letter is comprehensive and robust is non-negotiable. Here are the detailed steps to draft it effectively:

Step-by-Step Instructions

1. identify the audience and purpose.

Start by identifying to whom the letter is addressed, whether it is external auditors, regulatory authorities, or internal audit committees. This reflects in the tone and the level of detail the letter requires.

2. Understand the Scope and Requirements

The letter must cover the entire financial statement period and all significant elements. Understanding the specific requirements as per the jurisdiction’s laws or regulatory standards is crucial for compliance.

3. Collect Necessary Information and Documentation

Gather all supporting documentation such as financial statements, reports, and any relevant communication from auditors to ensure accuracy and precision in the letter.

4. Draft the Letter with Clarity and Precision

The actual writing process should begin by explicitly stating the assertions being made by the management. Use a formal, professional tone, and ensure that language is clear and straightforward to avoid misinterpretation.

5. Review and Seek Approval

Prioritize review and approval from the relevant parties within the management to ensure that the letter is legally binding and aligns with the company’s policies and regulatory frameworks.

Best Practices and Tips

Clear communication.

Clarity in the representation letter is as critical as the accuracy of the information. Avoid using vague terms that could be interpreted differently by the audience.

Avoiding Ambiguities

The management needs to be specific in its representations, particularly when confirming the absence of certain conditions or events.

Ensuring Alignment with Regulations and Standards

The content of the representation letter should not only be accurate but should also reflect complete conformity with the required accounting standards and regulations.

In summary, the Representation Letter is not just a formality, but a serious and considered affirmation by management that they stand behind the financial information reported. It is imperative for any organization serious about maintaining trust with key stakeholders. By following the guide provided, professionals are better equipped to create and understand the vital role played by the representation letter in the audit process. This letter not only bolsters the confidence of auditors, but also reassures investors and regulatory bodies of the credibility of the financial statements. Engaging in this process with precision and earnestness yields an invaluable asset in the company’s reputation.

Learn how Ramp makes accounting easy

.png)

14+ Management Representation Letter Format, What is It, Examples

- Letter Format

- January 24, 2024

- Business Letters , Contract Letters , Legal Letters

Management Representation Letter Format : A management representation letter format is a formal document used by auditors to obtain written confirmation from management about certain financial and non-financial matters . The Business letter is an important part of the audit process as it helps auditors gain a better understanding of the client’s business operations, accounting policies, and financial reporting practices .

- Business Inauguration Invitation Letter

- Business Proposal Acceptance Letter Format

- Business Invitation Letter Format

- Business Agreement Letter Format

- Business Contract Letter Format

Management Representation Letter Format

Content in this article

The management representation letter format is typically including the following components:

- Opening Paragraph: The Legal letter begins with a formal greeting and an explanation of the purpose of the letter. It may also include the date of the audit and the reporting period.

- Responsibilities of Management: This section outlines the responsibilities of management in relation to the financial statements and the audit process. It confirms that management is responsible for the preparation and presentation of the financial statements in accordance with accounting principles, maintaining adequate internal controls, and providing the auditor with access to all relevant information.

- Representations: This is the main body of the letter, where management makes specific representations about various financial and non-financial matters. These may include statements about the completeness and accuracy of financial statements, compliance with laws and regulations, the absence of fraud, and the adequacy of internal controls.

- Closing Paragraph: The Contract letter concludes with a statement confirming that management has disclosed all relevant information to the auditor and that the representations made in the letter are true and accurate.

It is important to note that the management representation letter Format is a legal document and should be drafted with care. Management should review the letter carefully before signing it, as they are legally responsible for the accuracy of the information provided.

In addition to providing auditors with important information about the client’s business, the management representation letter can also serve as a valuable communication tool between management and the auditor . It can help to identify potential issues early in the audit process and facilitate a smoother and more efficient audit.

Management Representation Letter Format – Sample Format

Below is a Sample Format of Management Representation Letter Format:

[Your Company Letterhead]

[External Auditor’s Name]

[External Auditor’s Firm]

[Address Line 1]

[Address Line 2]

[City, State, ZIP Code]

Dear [External Auditor’s Name],

Re: Management Representation Letter

We appreciate the opportunity to work with your firm in connection with the audit of the financial statements of [Your Company Name] for the fiscal year ended [Date]. In connection with your audit, we are providing you with this representation letter.

We, the management of [Your Company Name], confirm the following representations:

- The financial statements have been prepared in conformity with the generally accepted accounting principles (GAAP) and present fairly the financial position, results of operations, and cash flows of the company.

- Management is responsible for establishing and maintaining effective internal control over financial reporting, and there have been no significant changes in the internal control over financial reporting that could have a material effect on the company’s ability to record, process, summarize, and report financial data.

- To the best of our knowledge, there has been no fraud or illegal acts that have materially affected or are reasonably likely to materially affect the financial statements.

- Except as disclosed in the financial statements or in the notes thereto, there are no pending or threatened legal actions, claims, or assessments that could have a material effect on the financial statements.

- All significant information and documentation related to the company’s operations and financial transactions have been made available to your firm.

- We have disclosed all significant events occurring after the balance sheet date that would require adjustment to, or disclosure in, the financial statements.

This representation letter is provided to you in connection with your audit of the financial statements of [Your Company Name] and should be read in conjunction with the auditor’s report. We acknowledge our responsibility for the design and implementation of internal controls to prevent and detect fraud, as well as the preparation of financial statements.

Please let us know if you need any further information or clarification. We appreciate your professional services and look forward to a successful audit.

[Your Name]

[Your Title]

[Your Company Name]

[Your Contact Information]

This is a general template for a management representation letter. Specific content may vary based on the company’s circumstances and the requirements of the external auditor. It is advisable to consult with legal and accounting professionals when preparing such letters.

Email Ideas about Management Representation Letter Format

Here’s an Email Ideas for Management Representation Letter Format:

Subject: Request for Management Representation Letter

Dear [Manager’s Name],

I am writing to request your assistance in providing a management representation letter format to complete our audit process. As you are aware, the management representation letter is a crucial document that provides written confirmation from management on the accuracy and completeness of financial statements and related disclosures.

The representation letter helps our auditors to obtain evidence in support of the financial statements and to obtain assurance that management has fulfilled its responsibilities. It also serves as a tool for our auditors to document the representations made by management during the course of the audit.

We would appreciate it if you could provide the management representation letter as soon as possible, but no later than [date]. We understand that the process of preparing this letter can take some time and we are available to discuss any questions or concerns you may have.

Please let us know if you need any further information or assistance in preparing the letter. We appreciate your cooperation and look forward to completing the audit process.

Thank you for your attention to this matter.

Management Representation Letter Format to Auditor

This letter, presented to auditors, formalizes the company’s commitments, affirming the accuracy of financial data, adherence to accounting standards, and cooperation with auditors to ensure a transparent and accurate audit process.

We appreciate the opportunity to collaborate with your firm for the audit of the financial statements of [Your Company Name] for the fiscal year ended [Date]. In connection with the audit, we are pleased to provide you with the following representations:

- The management of [Your Company Name] is responsible for the preparation and fair presentation of the financial statements in conformity with the generally accepted accounting principles (GAAP).

Should you require any further information or clarification, please do not hesitate to contact us. We appreciate your professional services and look forward to a successful audit.

This letter is a general format for a management representation letter to an auditor. Specific content may vary based on the company’s circumstances and the requirements of the external auditor. Always consult with legal and accounting professionals when preparing such letters.

Management Representation Letter Format to Bank

This Management Representation Letter Format serves to affirm the accuracy of financial information, adherence to credit terms, and compliance with agreements, fostering transparency in the company’s dealings with the bank.

[Bank Name]

[Bank Address Line 1]

[Bank Address Line 2]

Dear [Bank Manager’s Name],

Re: Management Representation Letter for Banking Purposes

We hereby provide this Management Representation Letter in connection with our banking relationship with [Bank Name]. This letter is to confirm certain representations to assist the bank in its assessment of our financial standing and creditworthiness.

- We confirm that the financial statements provided to the bank are prepared in accordance with generally accepted accounting principles (GAAP) and present fairly our financial position as of [Date].

- All information provided regarding our credit facilities, loans, and guarantees is accurate, complete, and reflective of our current financial obligations to the best of our knowledge.

- We confirm that we are in compliance with all terms and conditions outlined in our loan agreements, credit facilities, and any other financial arrangements with the bank.

- We have disclosed any material changes in our financial condition, business operations, or other relevant matters that may impact our ability to meet our financial obligations to the bank.

- There are no pending or threatened legal proceedings, disputes, or litigation that could materially affect our ability to fulfill our financial commitments to the bank.

- The undersigned individuals have the authority to provide these representations on behalf of the company, and all necessary corporate approvals have been obtained.

This Management Representation Letter is provided solely for the purpose of supporting our banking relationship with [Bank Name]. We acknowledge our responsibility to promptly inform the bank of any material changes that may affect the accuracy of these representations.

If you require any additional information or documentation, please do not hesitate to contact us. We appreciate your continued support and understanding.

This Management Representation Letter to the bank is a formal document confirming key financial and operational details. Customize it as needed based on your specific banking relationship and requirements.

Management Representation Letter Format – Template

Here’s a Template of Management Representation Letter Format:

[Company Letterhead]

[External Auditor Name] [External Auditor Address] [External Auditor City, State ZIP Code]

Dear [External Auditor Name],

We are pleased to provide you with this management representation letter in connection with the audit of our financial statements for the year ended [Date]. As management of [Company Name], we acknowledge our responsibility for the preparation and presentation of the financial statements in accordance with generally accepted accounting principles.

We confirm that we have provided you with all relevant information necessary for the audit and that we have disclosed all known or suspected fraud, illegal acts, or non-compliance with laws and regulations that may have a material effect on the financial statements.

We represent that the financial statements are complete and accurate, and that they fairly present, in all material respects, the financial position of [Company Name] as of [Date], and the results of its operations and cash flows for the year then ended.

We also confirm that the representations made in this letter are true and accurate as of the date of this letter.

[Your Name] [Your Title] [Your Company Name]

Management Representation Letter for External Audit

This letter reinforces the company’s commitment to transparency, providing essential assurances to external auditors regarding the accuracy of financial information and cooperation throughout the audit, crucial for ensuring the integrity of the audit process.

[Audit Firm Name]

[Audit Firm Address]

Re: Management Representation for the External Audit of [Company Name]

We, the undersigned management of [Your Company Name], hereby provide this letter to confirm certain representations in connection with the external audit of our financial statements for the fiscal year ending [Date].

- We confirm that the financial statements, including the balance sheet, income statement, and cash flow statement, present a true and fair view of the financial position of [Your Company Name] as of [Date].

- The financial statements have been prepared in accordance with generally accepted accounting principles (GAAP) [or International Financial Reporting Standards (IFRS)].

- We have established and maintained effective internal controls to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with applicable accounting standards.

- All significant information and disclosures related to our operations, financial position, and business transactions that may affect the understanding and interpretation of the financial statements have been disclosed to the best of our knowledge.

- All assets and liabilities, including contingent liabilities, have been properly recorded and disclosed in the financial statements.

- We have disclosed to you all known and potential legal claims, disputes, and litigations that may have a material impact on the financial statements.

- We acknowledge our responsibility to provide you and your team with complete access to all information and documents requested during the audit process.

- We confirm that there have been no changes in accounting policies or practices that materially affect the financial statements without appropriate disclosure.

This letter is provided solely for the purpose of supporting the external audit of our financial statements. We understand the importance of your audit in providing assurance to our stakeholders, and we commit to providing all necessary cooperation throughout the audit process.

If you require any additional information or clarification, please do not hesitate to contact us.

This Management Representation Letter for an external audit assures the auditor of the accuracy and completeness of financial statements, compliance with accounting standards, and cooperation during the audit process. Customize it as per your specific company and audit requirements.

Management Representation Letter to Investors

This letter serves as a transparent communication tool, instilling confidence among investors by affirming the company’s commitment to sound financial practices, compliance, and overall business stability.

[Investor’s Name]

[Investor’s Company/Organization]

[Investor’s Address]

Dear [Investor’s Name],

Re: Management Representation Letter to Investors

We, the undersigned management of [Your Company Name], are pleased to provide this letter to investors to affirm certain key aspects of our operations and financial position. This representation is made as of [Date] in connection with your investment in our company.

- We confirm that the financial statements provided to investors accurately represent the financial position of [Your Company Name] as of [Date]. The statements have been prepared in accordance with generally accepted accounting principles (GAAP) [or International Financial Reporting Standards (IFRS)].

- The management assures investors that the operational performance of the company is in line with the disclosed business plans and strategies. Any material changes have been duly communicated.

- We confirm that the company is in compliance with all applicable laws and regulations relevant to its operations. Any deviations have been appropriately addressed or disclosed.

- All material contracts and agreements that may impact the company’s financial position have been accurately disclosed to investors. There have been no material breaches of these contracts.

- The management has disclosed all known risk factors that may materially affect the company’s financial position or future prospects. We are committed to proactive risk management.

- Funds invested by our esteemed investors have been utilized in accordance with the stated purposes and business plans as communicated during the investment process.

- Any forward-looking statements made by the management are based on reasonable assumptions. However, actual results may vary, and the company is not obligated to update these statements.

- The management is dedicated to maintaining open lines of communication with investors. Any significant developments or changes in the company’s status will be promptly communicated.

This letter is intended to provide additional assurance and transparency to our valued investors. We appreciate your trust in [Your Company Name] and remain committed to creating value and fostering a mutually beneficial partnership.

If you have any questions or require further clarification, please do not hesitate to contact us.

This Management Representation Letter to Investors affirms key aspects of the company’s financial position, operational performance, and commitment to transparency, providing reassurance to investors about their investment in the company. Customize it as per your specific company and investor relations.

Management Representation Letter to Regulators

This letter serves as a formal commitment from the company’s management to regulatory bodies, ensuring transparency, accountability, and adherence to regulatory requirements, thereby fostering trust and regulatory compliance.

[Regulatory Authority Name]

Subject: Management Representation Letter

Dear [Regulatory Authority Name],

Re: Management Representation for Compliance with [Applicable Laws/Regulations]

We, the undersigned management of [Your Company Name], hereby provide this letter to confirm our commitment to compliance with all applicable laws, regulations, and industry standards under the jurisdiction of [Regulatory Authority Name].

- We affirm that our company operates in full compliance with all relevant laws and regulations governing our industry and business operations.

- The financial statements of [Your Company Name], including the balance sheet, income statement, and cash flow statement, have been prepared in accordance with applicable accounting standards, providing a true and fair view of the company’s financial position.

- We have established and maintained effective internal controls to ensure the accuracy and reliability of financial reporting and compliance with regulatory requirements.

- All material information, events, and transactions that may affect the company’s compliance status or financial position have been transparently disclosed.

- We commit to timely and accurate filing of all required reports, statements, and documentation as per the regulations enforced by [Regulatory Authority Name].

- We acknowledge our responsibility to fully cooperate with any regulatory inspections or inquiries that may arise, providing all necessary information and documentation as requested.

- Our management is dedicated to continuous improvement in our compliance practices, ensuring that we stay abreast of any changes in laws or regulations that may impact our business.

This letter is provided for the purpose of assuring [Regulatory Authority Name] of our dedication to compliance and transparent business practices. We understand the importance of regulatory oversight in maintaining market integrity and protecting the interests of stakeholders.

This Management Representation Letter to Regulators emphasizes the company’s commitment to compliance with applicable laws and regulations, providing assurance to regulatory authorities and fostering transparency in business operations. Customize it based on your specific company and regulatory requirements.

Management Representation Letter Format – Example

Here’s an Example of Management Representation Letter Format:

As management of [Company Name], we acknowledge our responsibility for the preparation and presentation of the financial statements in accordance with generally accepted accounting principles. We understand that you will be conducting an audit of our financial statements for the year ended [Date].

We confirm that we have disclosed all known or suspected fraud, illegal acts, or non-compliance with laws and regulations that may have a material effect on the financial statements. We also confirm that we have provided you with access to all relevant information necessary for the audit.

We understand that this letter is a legal document and that we are responsible for the accuracy of the information provided. We confirm that the representations made in this letter are true and accurate as of the date of this letter.

Management Representation Letter Format – Example

Formal Management Representation Letter Format

This Management Representation Letter Format serves to provide external auditors with essential assurances from management regarding the accuracy and completeness of financial information, adherence to legal and regulatory requirements, and the effectiveness of internal controls.

Re: Management Representation for [Year/Period] Ended [End Date]

We, the undersigned management of [Your Company Name], are providing this letter to confirm certain representations made to you during the audit of our financial statements for the [Year/Period] ended [End Date].

- We acknowledge our responsibility for the preparation and fair presentation of the financial statements in accordance with the applicable financial reporting framework.

- To the best of our knowledge and belief, the company has complied with all relevant laws and regulations that may materially affect the financial statements.

- We have established and maintained effective internal control over financial reporting, and any identified deficiencies have been disclosed to you.

- We have made you aware of any known or suspected instances of fraud or illegal acts affecting the company.

- All related party transactions have been accurately identified, disclosed, and recorded in accordance with the applicable financial reporting framework.

- We have disclosed to you all known actual or potential litigation and claims that may have a material effect on the financial statements.

- We have assessed the company’s ability to continue as a going concern and disclosed any uncertainties related to going concern appropriately.

- The information provided to you during the audit is complete and accurate, and we have disclosed all significant matters relevant to the financial statements.

This representation is provided to assist you in obtaining reasonable assurance that the financial statements are free from material misstatement. If there are any additional matters or information you require, please contact us promptly.

We appreciate your professional services and look forward to a successful completion of the audit.

This Formal Management Representation Letter Format is designed to provide external auditors with assurances on various aspects related to financial statements, compliance, internal controls, and more. Customize it based on your specific company and audit requirements.

Fraud and Illegal Acts Representation Letter

This letter underscores the company’s dedication to integrity and transparency, outlining measures taken to prevent and address fraudulent activities, and providing assurances to external auditors regarding compliance with legal and ethical standards.

Subject: Representation Regarding Fraud and Illegal Acts

Re: Fraud and Illegal Acts Representation

We, the undersigned management of [Your Company Name], hereby provide this representation regarding the prevention, detection, and reporting of fraud and illegal acts within the organization for the [Year/Period] ended [End Date].

- We acknowledge our responsibility for the prevention and detection of fraud and illegal acts within the organization.

- We have established and maintained internal controls and procedures designed to prevent and detect fraud and illegal acts.

- Employees are provided with adequate training and awareness programs to understand the risks associated with fraud and illegal acts and are encouraged to report any concerns through appropriate channels.

- We have communicated ethical standards and expectations to all employees, emphasizing our commitment to conducting business with integrity and in compliance with applicable laws and regulations.

- Any known or suspected instances of fraud or illegal acts are promptly reported to the appropriate levels of management and, if necessary, to the board of directors.

- In the event of identified fraud or illegal acts, we conduct thorough investigations and implement remedial actions, including disciplinary measures and corrective measures to prevent recurrence.

- We have established mechanisms to protect whistleblowers from retaliation and encourage the reporting of concerns without fear of reprisal.

- We commit to cooperating fully with external authorities, including law enforcement agencies and regulatory bodies, in the investigation of fraud or illegal acts.

- All representations made to you regarding the prevention, detection, and reporting of fraud and illegal acts are accurate and complete.

This representation is provided to assist you in obtaining reasonable assurance that the financial statements are free from material misstatement, including those resulting from fraud or illegal acts.

If you have any questions or require further clarification on any matters related to fraud and illegal acts, please do not hesitate to contact us.

This Fraud and Illegal Acts Representation Letter is designed to assure external auditors of the company’s commitment to preventing, detecting, and reporting fraud and illegal acts. Customize it based on your specific company policies and procedures.

FAQS About Management Representation Letter Format, What is It, Examples

What is a management representation letter format.

A Management Representation Letter Format is a formal document issued by a company’s management to external auditors, confirming certain representations related to financial statements, compliance, internal controls, and other crucial aspects during an audit.

What is the Purpose of a Management Representation Letter Format?

The primary purpose is to provide external auditors with written representations from management regarding various aspects of the company’s operations. Management Representation Letter Format helps auditors obtain assurance on the accuracy and completeness of financial information and other relevant matters.

What Information is Typically Included in a Management Representation Letter Format?

The Management Representation Letter Format typically includes representations related to financial statements, compliance with laws and regulations, internal controls, fraud and illegal acts, related party transactions, litigation, and the going concern assumption.

Why is a Management Representation Letter Format is Important in an Audit?

The Management Representation Letter Format is crucial as it formalizes management’s acknowledgment of its responsibilities and provides auditors with assurances on key matters. It enhances the audit process by obtaining explicit confirmations from management regarding the information and processes being audited.

Is a Management Representation Letter Standardized?

While there are common elements, the letter is often customized to suit the specific circumstances and requirements of the company and the audit. It may vary in content based on industry practices, regulatory requirements, and the auditor’s specific requests.

Are There Risks Associated with Providing Management Representation Letter Format?

Yes, Management Representation Letter Format, there are risks, and management should carefully consider the accuracy of the representations made. Providing false or misleading information in the representation letter can have legal and financial consequences.

The Management Representation Letter Format is a formal document that serves as an important part of the audit process . It outlines the responsibilities of management and makes specific representations about various financial and non-financial matters. The Management Representation Letter Format should be carefully reviewed and signed by management to ensure that the information provided is accurate and complete .

Related Posts

25+ Complaint Letter Format Class 11 – Email Template, Tips, Samples

15+ Business Letter Format Class 12 – Explore Writing Tips, Examples

21+ Black Money Complaint Letter Format, How to Write, Examples

11+ Authorized Signatory Letter Format – Templates, Writing Tips

20+ Authorization Letter Format for ICEGATE Registration – Examples

28+ Assurance Letter Format – How to Start, Examples, Email Template

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment

Save my name, email, and website in this browser for the next time I comment.

Post Comment

An official website of the United States government

Here's how you know

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. A lock ( ) or https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

Keyboard Navigation

| Function | Key |

|---|---|

| Primary menu: | ↑ |

| Sub menu: | ↓ |

| Primary menu: | Alt + o |

| Close menu: | Esc |

- Agriculture and Food Security

- Anti-Corruption

- Conflict Prevention and Stabilization

- Democracy, Human Rights, and Governance

- Economic Growth and Trade

- Environment, Energy, and Infrastructure

- Gender Equality and Women's Empowerment

- Global Health

- Humanitarian Assistance

- Innovation, Technology, and Research

- Water and Sanitation

- Burkina Faso

- Central Africa Regional

- Central African Republic

- Côte d’Ivoire

- Democratic Republic of the Congo

- East Africa Regional

- Power Africa

- Republic of the Congo

- Sahel Regional

- Sierra Leone

- South Africa

- South Sudan

- Southern Africa Regional

- West Africa Regional

- Afghanistan

- Central Asia Regional

- Indo-Pacific

- Kyrgyz Republic

- Pacific Islands

- Philippines

- Regional Development Mission for Asia

- Timor-Leste

- Turkmenistan

- Bosnia and Herzegovina

- North Macedonia

- Central America and Mexico Regional Program

- Dominican Republic

- Eastern and Southern Caribbean

- El Salvador

- Middle East Regional Platform

- West Bank and Gaza

- Dollars to Results

- Data Resources

- Strategy & Planning

- Budget & Spending

- Performance and Financial Reporting

- FY 2023 Agency Financial Report

- Records and Reports

- Budget Justification

- Our Commitment to Transparency

- Policy and Strategy

- How to Work with USAID

- Find a Funding Opportunity

- Organizations That Work With USAID

- Resources for Partners

- Get involved

- Business Forecast

- Safeguarding and Compliance

- Diversity, Equity, Inclusion, and Accessibility

- Mission, Vision and Values

- News & Information

- Operational Policy (ADS)

- Organization

- Stay Connected

- USAID History

- Video Library

- Coordinators

- Nondiscrimination Notice and Civil Rights

- Collective Bargaining Agreements

- Disabilities Employment Program

- Federal Employee Viewpoint Survey

- Reasonable Accommodations

- Urgent Hiring Needs

- Vacancy Announcements

- Search Search Search

H - Sample Management Representation Letter (MS Word)

- Submit Post

- Budget 2024

Draft Format Engagement letter & Management representation on Tax Audit

The main purpose of Management Representation Letter on various matters is to focus the management’s attention on those matters so that the management can specifically address those matters in more detail than would otherwise be the case.

However the Auditor needs to understand the limitations of management representations as audit evidence. Getting a Management Representation Letter does not absolve the auditor of its responsibilities. He has to exercise professional care in conducting the audit.

Article contains Draft Format of Engagement letter on Tax Audit and Draft Format of Management Representation letter related to Tax Audit –

Draft Format of Engagement letter on Tax Audit

Date: XX/XX/2020

The Executive Director

(Mention the name & Address of client)

We refer to the letter dated informing us about our (re) appointment as the tax auditors of the Company/Partnership/LLP/individual. You have requested our firm “ XYZ & Co.” to do the tax audit of the Company/ Partnership/LLP/individual as defined in Section 44AB of the Income Tax Act, 1961, for the previous year(s) ending March 31, 2020. The tax audit of the Company/Partnership/LLP/individual include issuance of Tax Audit Report in Form Nos. 3CA/3CB and 3CD & filing the same with Income Tax Department. We are pleased to confirm our acceptance and our understanding of this audit engagement by means of this letter.

Our audit will be conducted for the purpose to ascertain/derive/report the requirements of Form Nos. 3CA/3CB and 3CD, to ensure that the books of account and other records are properly maintained, that they truly reflect the income of the taxpayer and claims for deduction/relief are correctly made by him & to checking fraudulent practices. In ascertaining/deriving/reporting the requirements of tax audit, we will rely on the work of statutory auditors appointed by the Company, to the extent it will required.

We will conduct the tax audit in accordance with the Provisions of Income Tax Act, 1961 & rules and regulations made thereunder. This tax audit involves performing procedures to ascertaining/deriving/reporting the requirements and the disclosures required in Form 3CA/CB & 3CD. Tax audit also includes evaluating the compliances with the provisions of Income Tax, TDS and with other laws.

Form 3CD should be duly filled & authenticated by the Management. We will only verify and confirm the same & on that basis form our opinion & issue the report in Form 3CA/3CB as the case may be.

This tax audit will be conducted on the basis that the Management and those charged with governance (Audit Committee / Board) acknowledge and understand that they have the responsibility:

1. For the preparation of tax audit report that give assurance in accordance with the provision of the Act, This includes:

- Compliance with the applicable provisions of the Income Tax Act, TDS Provisions & GST Provisions;

- Proper maintenance of accounts and other matters connected therewith;

2. Identifying and informing us of financial transactions or matters that may have any adverse effect on the tax compliance of the

3. Providing the required information completely and accurately in required

4. To provide us, inter alia, with:

a. Access, at all times, to all information, including the books, accounts, vouchers and other records and documentation of the Company, whether kept at the Head Office or elsewhere, of which the Management is aware that are relevant to the “books of account” such as records, documentation and other

b. Access to reports, if any, relating to internal reporting on frauds (e.g., vigil mechanism reports etc.), including those submitted by cost accountant or company secretary in practice;

- Additional information that we may request from the Management for the purposes of our audit;

1. Unrestricted access to persons within the Company from whom we deem it necessary to obtain audit evidence. This includes our entitlement to require from the officers of the Company such information and explanations as we may think necessary for the performance of our duties as the tax auditors of the Company; and

2. All the required support to discharge our duties as the tax

As part of our audit process, we will request from the Management written confirmation concerning representations made to us in connection with our audit.

Our report prepared in accordance with relevant provisions of the Act would be addressed to the Company. The form and content of our report may need to be amended in the light of our audit findings.

Our fees will be billed as follows”

The total audit fee of Rs…… (Excluding GST) (Rupees………………only) which will be billed on submission of the audit report.

We wish to emphasis that our audit report will be exclusively for income-tax purposes. We shall not be liable for any way to any third party to whom you may make the audit report available.

We also wish to invite your attention to the fact that our audit process is subject to ‘peer review’ under the Chartered Accountants Act, 1949. The reviewer may examine our working papers during the course of the peer review.

Please sign and return the attached copy of this letter to indicate that it is in accordance with your understanding of the arrangement for our audit of the financial statements.

Thanking you

Yours faithfully

For ……..

Chartered Accountants

(Mention n ame & Designation of Partner)

Draft Format of Management Representation letter on Tax Audit

[ON THE LETTER HEAD OF AUDITEE]

M/s ……

Sub: Management Representation in course of Tax Audit for A.Y……

Please find enclosed a copy of Form 3 CD alongwith all relevant details for the purpose of conducting the Tax Audit of XYZ Company , for the year ended 31st March, 2020. In this connection, we further confirm that

1. The address that we have reported in Clause 2 of the form 3CD is same as we have informed to the income tax department, there is no change in the same.

2. That the registration or identification number, if any, under indirect tax laws including excise duty, goods & service tax, sales tax, customs duty, etc. as informed to you and reported in Clause 4 of Form 3CD are correct and there is no other number other than what is reported in said clause.

3. We certify, there has been no change in the partners or members or in their profit sharing ratio since the last date of the preceding year during the year under report as stated in clause 9 (b) of form 3 CD.

4. We certify, there has been no change in the nature of business during the year under report as stated in clause 10 (a) of form 3 CD.

5. That the List of books of account as prescribed u/s 44AA have been maintained and the address at which the books of accounts are kept as reported in Clause 11 has been informed by us and there are no other books and no other location at which books are kept.

6. We confirm that the profit and loss account does not include any profits and gains assessable on presumptive basis under relevant sections 44AD , 44AE, 44AF, 44B, 44BB, 44BBA, 44BBB or any other relevant section as stated in clause 12 of form 3 CD.

7. The company has followed the mercantile system of accounting & there is no change in the method of accounting employed in the immediately preceding previous year, for the preparation of final accounts for the financial year 2019-2020 as stated in clause 13 of form 3 CD.

8. We certify that the valuation of closing stock is on the same basis & there is no deviation from the method of valuation prescribed under section 145A as stated in clause 14 of form 3 CD.

9. We certify that there are no capital assets which are converted into stock in trade as stated in clause 15 of form 3 CD.

10. We certify there is no capital receipt which is credited to Profit & Loss Account as stated in clause 16 of form 3 CD.

11. We certify that the items falling within the scope of section 28 have been correctly stated in clause 16.

12. That there is no land or building or both which is transferred during the previous year for a consideration less than value adopted or assessed or assessable by any authority of a State Government referred to in section 43CA or 50C, other than what is informed by us and has been reported in Clause 17 of Form 3CD.

13. We follow a policy of capitalizing an asset only after the asset has been purchased and has been put to use. The date on which the asset is put to use is as certified by us in Clause 18 of Form 3CD.

14. We certify that particulars of depreciation allowable as per the Income-tax Act, 1961 in respect of each asset or block of assets, as the case may be are correct.

15. We certify that there is no sum paid to an employee as bonus or commission for service rendered, where such sum was otherwise payable to him as profit or dividend as stated in clause 20 of form 3 CD.

16. The employee’s and employer’s share contributed towards provident fund, pension fund and ESI, date of deposit and amount of deposit is correctly stated in clauses 20 (b) of Form 3CD.

17. No Capital Expenses have been debited to any Revenue Accounts as stated in clause 21 (a) of form 3 CD.

18. All the expenses incurred on during the Year by us are for the purpose of business only.

19. No personal expenses, except those under contractual obligations or by generally accepted business practice, have been charged to the profit & loss account.

20. We certify that there is no expenditure on advertisement in any souvenir, broucher, tact, pamphlet etc. published by a political party. Further we confirm that we have not made any expenditure at clubs.

21. There have been no amounts in the nature of penalties or fines levied on us other than what has been disclosed in Clause 21 (a).

22. We have not made any payments otherwise than Account payee cheque, above Rs. 10,000/- (Rs.35,000 in case of Transporters) covered u/s 40A(3) or Section 40A(3A) during the year except those which have been disclosed in Clause 21(d).

23. No sums have been paid by the company as an employer which is not allowable U/s 40A (7) of the Income Tax Act, 1961 as stated in Clause 21(e).

24. We have not incurred any liability of a contingent nature as stated in Clause 21(g).

25. No amount of interest inadmissible under section 23 of the Micro, Small and Medium Enterprises Development Act, 2006 other than stated in Clause 22.

26. All transactions with any related party within the meaning of section 40(A)(2)(b) of the Act, have been disclosed in Clause 23.

27. No amounts deemed to be profits and gains under section 32AC or 32AD or 33AB or 33ABA or 33AC other than stated in Clause 24.

28. There is no amount of profit chargeable to tax u/s. 41 as disclosed under clause 25 of Form 3CD.

29. All the statutory dues have been deposited on time as disclosed under clause 26.

30. That during the previous year we have not received any property, being share of a company not being a company in which the public are substantially interested, without consideration or for inadequate consideration as referred to in section 56(2)(viia) under clause 28 of Form 3CD.

31. That during the previous year we have not received any consideration for issue of shares which exceeds the fair market value of the shares as referred to in section 56(2)(viib) under clause 29 of Form 3CD.

32. That we have not accepted or repaid any amount borrowed on hundi or any amount due thereon in contravention to Section 269SS and 269T of the Act (including interest on the amount borrowed), otherwise than through an account payee cheque, bank draft, Online payments as stated in clause 30 & 31 of Form 3CD.

33. That we have not incurred any loss referred to in section 73A of the Act in respect of any specified business during the previous year as stated in clause 32 of Form 3CD.

34. That the company is not deemed to be carrying on a speculation business as referred in explanation to section 73 as stated in clause 32 of Form 3CD.

35. There are no deductions under Chapter VI A other than those stated in Clause 33.

36. The taxes deducted at source by us under the provisions of the Income-tax Act during the year have been paid to the Central Government except those which have been disclosed in Clause 34(a).

37. The statement of tax deducted or collected contains information about all transactions which are required to be reported under Clause 34(b) of the Form 3CD.

38. Interest payable u/s 201(1A) and 206C(7) of the Act have been paid which have been disclosed in Clause 34(c).

39. We certify that stock quantities furnished in Clause 35 of Form 3CD has been valued & certified by us.

40. No Cost Audit was carried out during the relevant Assessment year as reported in the clause 37.

41. No audit under Central Excise Act was carried out during the relevant Assessment year as reported in the clause 38.

42. No audit was conducted under section 72A of the Finance Act, 1994 in relation to valuation of taxable services during the relevant Assessment year as reported in clause 39.

43. The basis of calculation of ratios as specified in clause 40 of Form 3CD is correct.

44. That there is no demand raised or refund issued during the previous year under any tax laws other than Income Tax Act, 1961 and Wealth tax Act, 1957 as required in Clause 41.

45. We also certify information furnished in Clause 1 to 44 & Annexures 1 to ….. of Form 3CD are true and correct.

By order of the Board

For «Name of company»

Sd/- Name Director DIN-

Disclaimer:-

The above articles on the basis of the available study material & my understanding. Anyone opinion may differ from my opinion.

- « Previous Article

- Next Article »

Name: CA Gaurav Singla

Qualification: ca in job / business, company: ca gaurav singla, location: 1027, sector-55, faridabad-121004, haryana, in, member since: 12 feb 2020 | total posts: 6, my published posts, join taxguru’s network for latest updates on income tax, gst, company law, corporate laws and other related subjects..

- Join Our whatsApp Group

- Join Our Telegram Group

Can anyone please send me word format of certifctaes that one needs to obtain from client while doing tax audit?

Very useful information in preparing Management representation letter Thanks you very much

Very helpful information sir.

Leave a Comment

Your email address will not be published. Required fields are marked *

Post Comment

Subscribe to Our Daily Newsletter