Sample Loan Request Letter To Employer: Free & Effective

In this article, I’m eager to share a comprehensive, step-by-step guide on how to write an effective loan request letter to your employer, including our customizable templates to get you started.

Key Takeaways Understanding the Purpose: Learn the importance of a loan request letter and how it can facilitate your loan process. Key Components: Discover the essential elements that make your letter clear and compelling. Tone and Structure: Guidance on maintaining a professional tone and a structured format. Free Template: Access a user-friendly template that you can adapt to your specific needs. Follow-Up Strategies: Tips on how to follow up after sending your letter.

Understanding the Purpose of Your Letter

Your loan request letter is more than just a formality. It’s your opportunity to explain your financial situation and demonstrate how the loan would benefit you.

For instance, when I needed funds for a medical emergency , articulating my needs clearly helped my employer understand the urgency and legitimacy of my request.

Key Components of the Letter

Your loan request letter should include:

- Introduction: Briefly introduce yourself and your position in the company.

- Statement of Purpose: Clearly state that you are requesting a loan.

- Explanation of Need: Detail the reason for the loan request.

- Loan Amount and Repayment Plan: Specify the amount needed and propose a feasible repayment plan.

- Gratitude and Professionalism: Express your appreciation for considering your request and maintain a professional tone.

Crafting the Letter: Tone and Structure

Maintaining a respectful and professional tone is crucial. Address your employer formally, and ensure that your letter is error-free. The structure should be simple and straightforward, making your request and reasons easy to understand.

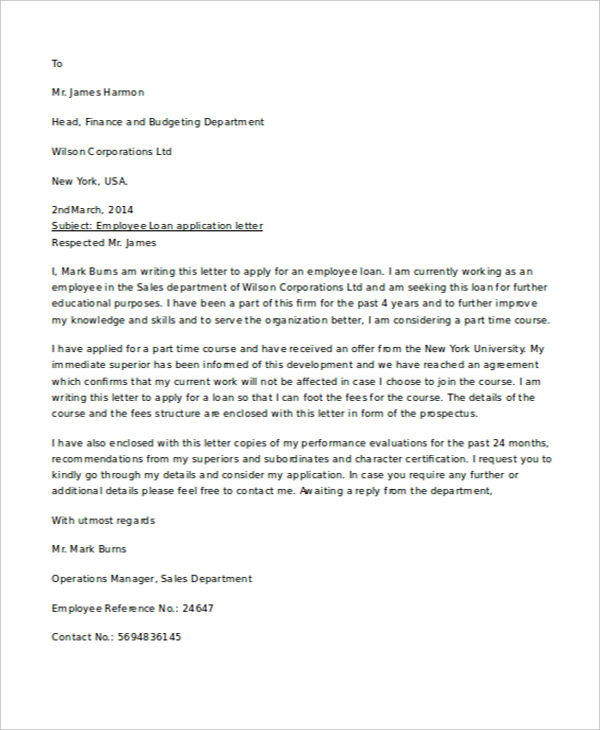

Sample Loan Request Letter To Employer

Trending now: find out why.

To help you get started, here’s a customizable template:

[Insert Your Name] [Insert Your Job Title] [Insert Date]

[Employer’s Name] [Company’s Name] [Company’s Address]

Dear [Employer’s Name],

I am writing to formally request a personal loan from [Company’s Name] to [briefly explain the purpose of the loan]. As a dedicated [Your Job Title] for [number of years] years, I’ve always admired our company’s support for its employees in times of need.

[Explain your situation and why you need the loan. Be honest but concise.]

I am seeking a loan of [Insert Loan Amount] and propose a repayment plan of [detail your repayment plan]. I am confident that this arrangement will not impact my ongoing commitments and responsibilities towards my role at [Company’s Name].

I appreciate your consideration of my request and am available to discuss this matter further at your earliest convenience.

Thank you for your time and understanding.

Sincerely, [Your Name]

Follow-Up Strategies

After sending your letter, wait for a reasonable amount of time before following up. If you haven’t received a response in a week or two, a polite inquiry to confirm receipt of your letter is appropriate.

Tips for Success

- Personalize Your Letter: Tailor the template to fit your specific situation.

- Be Honest and Direct: Clearly state your needs and reasons.

- Proofread: Ensure your letter is free from errors.

- Follow Company Protocol: Understand and adhere to your company’s policies regarding loans.

Remember, a well-written loan request letter can significantly increase your chances of having your request approved.

By following these guidelines and using the provided template, you can craft a letter that effectively communicates your needs and maintains your professionalism.

Related Posts

- Emergency Loan Request Letter Sample: Free & Effective

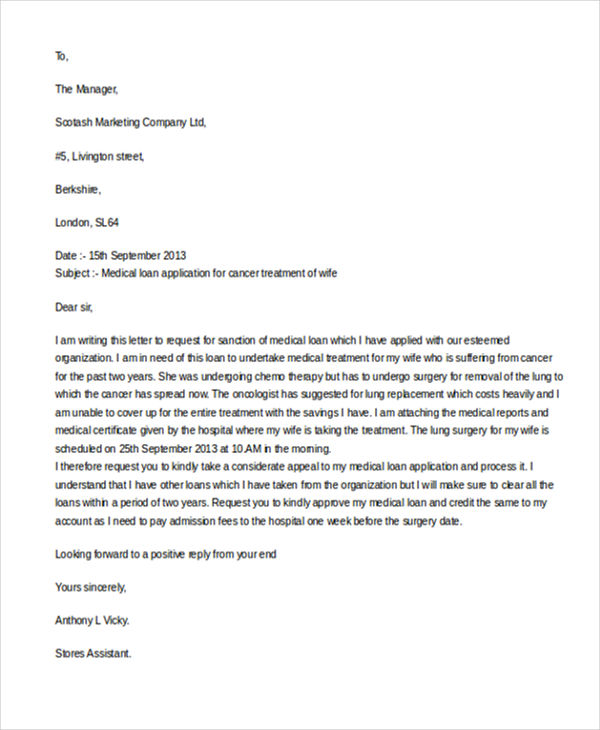

- Sample Loan Application Letter to Company for Medical Treatment

- Bank Loan Request Letter Sample: Free & Effective

Frequently Asked Questions (FAQs)

Q: How Do I Write a Loan Request Letter to My Employer?

Answer: When I needed to write a loan request letter to my employer, I started by addressing the letter to my direct supervisor or the HR department, since they are typically in charge of handling such requests. I made sure to include the date and a formal greeting.

In the first paragraph, I clearly stated my request for a loan and the specific amount I needed. I found it important to be straightforward and concise.

In the second paragraph, I explained why I needed the loan. For instance, I might have mentioned an unexpected medical expense or urgent home repair. It’s crucial to provide a legitimate and compelling reason, as this helps in making your request more understandable and relatable.

Then, I proposed a repayment plan. I detailed how I intended to repay the loan, including the time frame and whether the repayments would be deducted from my salary. Being clear about repayment showed responsibility and planning on my part.

I concluded the letter by expressing my gratitude for considering my request and provided my contact information for any further discussion. I signed off the letter with a formal closing, like “Sincerely,” followed by my name.

It’s important to proofread the letter for any errors and ensure it maintains a professional tone throughout. Remember, a well-written and thoughtful letter can greatly increase your chances of your request being considered favorably.

Q: What Information Should I Include in My Loan Request Letter to My Employer?

Answer: When I wrote my loan request letter to my employer, I made sure to include several key pieces of information:

Personal Information: I started with my full name, employee ID (if applicable), department, and position within the company. This helped to identify me clearly to the employer.

Loan Amount and Purpose: I specified the exact amount I was requesting and gave a clear and honest explanation of why I needed the loan. Whether it was for medical bills, education, or home repairs, being transparent about the purpose was crucial.

Repayment Plan: I outlined a feasible repayment plan. This included how much I could pay per month and for how long. I also suggested if the repayments could be deducted directly from my salary, which showed my commitment to repaying the loan.

Gratitude and Understanding: I expressed my appreciation for their consideration of my request. I also acknowledged that they might need time to make a decision or require additional information from me.

Contact Information: I included my contact details, such as my phone number and email address, making it easy for them to reach out to me for any further discussions.

By including these details, I ensured that my letter was comprehensive and respectful, increasing the likelihood of a positive response.

Related Articles

Sample request letter for air conditioner replacement: free & effective, goodbye email to coworkers after resignation: the simple way, sample absence excuse letter for work: free & effective, salary negotiation counter offer letter sample: free & effective, formal complaint letter sample against a person: free & effective, medical reimbursement letter to employer sample: free & effective, 2 thoughts on “sample loan request letter to employer: free & effective”.

This post is well-structured and informative, making it a valuable resource for anyone needing to approach their employer for a loan.

This is a great resource for anyone unsure about how to approach their employer for a loan.

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Start typing and press enter to search

Home > Finance > Loans

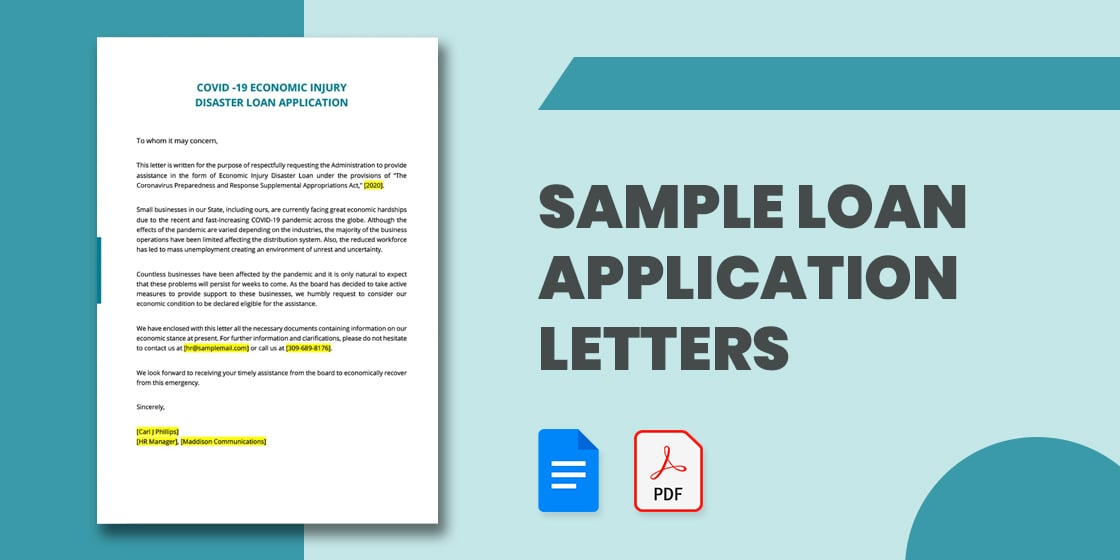

How to Properly Write a Business Loan Request

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Have to submit a business loan request letter as part of your loan application? Not sure how to get started?

We don’t blame you. These kinds of letters aren’t as common as they used to be. While online lenders don’t usually ask for small-business loan requests, some traditional banks and credit unions still do. And if you apply for an SBA business loan (a loan backed by the US Small Business Administration), you’ll need a small-business loan request as part of your loan application package.

No matter which lender you’re applying with, this guide will help you write a strong business loan request letter―and to get the business loan you need.

How to write a business loan request letter

- Start with the easy stuff

- Write a brief summary

- Add information about your business

- Explain your financing needs

- Discuss your repayment plan

- Close the letter

1. Start with the easy stuff

Writing a loan request can feel overwhelming. After all, it’s not an everyday part of being a small-business owner. What do you say when applying for a bank loan? How do you write a business proposal for your loan application? What’s your lender even looking for in a business loan request letter?

That’s why we suggest starting your request writing process with the easy bits: formatting.

You’ll want to begin your business loan request with some pretty standardized formatting that includes your contact information, the date, your lender’s contact information, a subject line, and a greeting.

Typically, you’ll want to format the beginning of your small-business loan request roughly like this:

First and last name

Business’s name

Business’s phone number

Business’s address (this one is optional)

Lender name (or loan agent’s name and title, if you have one)

Contact information for your lender or loan agent

Subject line

Obviously you can simply plug in the relevant information for most of this. Easy peasy, right?

You’ll really only have to come up with your own subject line and greeting. But don’t overthink it. Something like this will work just fine for your subject line:

- Re: [Your business’s name] business loan request for [loan amount]

Likewise, keep your greeting simple. “Dear [lender]” or “Dear [loan agent]” will do quite nicely.

Got all that? Then you’re ready to get into the actual loan request.

By signing up I agree to the Terms of Use.

2. Write a brief summary

Before you dive into the meat of your loan request, you should give a brief summary of your letter. Just write a short paragraph that says why you’re writing and what you want.

So you’ll probably want to include the following details:

- Business name

- Business industry

- Desired loan amount

- What you’ll use the loan for

No need to get fancy with this. You’re trying to condense the most important information into one or two sentences.

For example, your summary might look something like this:

- I’m writing to request a [loan amount] loan for my small business in the [industry name] industry, [business name]. With this loan, [business name] would [describe your intended business loan use].

As you can see, you don’t need much detail here. You’re just giving the reader a quick overview of what’s to come.

And now that you’ve given them that preview, it’s time to get more in depth.

Remember, your lender isn’t here to grade your writing. Try to use good spelling, grammar, and punctuation―but don’t stress about crafting beautiful sentences.

3. Add information about your business

Your next section should add more detail about your business. You’ll want to include information like this:

- Business’s legal name (if different than name used)

- Business’s legal structure (LLC, partnership, S corp, sole proprietorship, etc.)

- Business’s purpose

- Business’s age (or date it began operating)

- Annual revenue

- Annual profit (if applicable)

- Number of employees

Now, keep in mind that you’re not trying to give your reader an encyclopedic history of your business. Instead, you’re trying to show that you have a well-established business―one that’s solid enough to deserve a business loan. So focus on relevant details that show your business’s maturity.

You can keep this section as short as a few sentences or as long as a few (brief) paragraphs. Just make sure you leave plenty of room for the next two sections.

4. Explain your financing needs

After discussing your business, it’s time to explain why you need a bank loan.

That means you’ll want to offer some details about how you plan to use your business financing. For example, you can talk about the employees you plan to hire, the building you want to expand, or whatever else you intend to do with your term loan .

Take note, though, that you also need to explain why your loan request makes sense. Because your lender doesn’t really care that you want a loan―it cares whether or not it makes sense to lend to you. You need to convince your lender that you have a good plan for your loan―one that will make it easy to repay the money you borrow.

Try to answer questions like these as you write this section:

- Why should your lender want to approve your loan application?

- What happens to your business if you get your small-business loan?

- What kind of growth will your business loan allow for?

Dig into your business plan and projections to find some good stats. Explain how hiring those additional employees will increase your revenue by a certain percentage or dollar amount. Break down how opening that add-on to your restaurant will allow you to seat a number of additional customers, and how much revenue you expect that to bring in.

The more specific you can get, the better. Because again, you’re trying to convince your lender that you’re borrowing as part of a thoughtful business plan ―not just because you want some cash.

And take your time with this part. In most cases, this section and the next one will form the meat of your business loan request letter.

As a rule, you should keep your business loan request letter to one page.

5. Discuss your repayment plan

By this point, your lender should understand what your business does and why a loan would help it grow. Now you need to prove to your lender that you can repay your small-business loan.

This doesn’t mean you have to show precise calculations breaking down your desired interest rate and monthly payment. (After all, your bank probably hasn’t even committed to a specific interest rate yet.)

Instead, talk about things like your business’s past finances, other existing debts, and any projections can you offer.

So if you have a profitable business, point that out, and discuss how that will free up cash flow to repay your loan. Offer summaries of profit-and-loss statements that show your business has been growing. Tell your lender how you’ll pay off that existing loan within a few months, so they don’t need to worry about it interfering with repayment of your new term loan.

Put simply, this is your chance to convince your lender of your creditworthiness. Especially if you have a slightly low credit score or some other concern, you want to use this section to show that you will absolutely repay your loan.

6. Close the letter

Finally, you can add a few finishing touches.

Usually you should close with a short paragraph or two that refers the reader to any attached documents (like financial statements) and asks them to review your loan application.

You may also want to include a sentence expressing willingness to answer any questions―or just saying you’re looking forward to hearing back.

Then end things with your signature, list any enclosed documents, and you’re done!

Well, sort of.

At this point, we strongly recommend you print off your business loan request letter and read it―out loud, if possible. This will help you catch any errors. Because no, your lender isn’t a writing teacher, but you still want to make a good impression.

Plus, if you make typos on something like your business name or desired loan amount, that inaccuracy could lead to confusion from your lender―slowing down your loan approval process.

Once you’ve proofread your loan request letter, you’re ready to submit it to your lender. With any luck, your thoughtful letter will help convince your lender to give you that loan you want.

Loan proposal letter template

So how do all those steps look when you put them together? Something like this:

First and last name

Business’s name

Business’s phone number

Business’s address (this one is optional)

Date

Lender name (or loan agent’s name and title, if you have one)

Contact information for your lender or loan agent

Subject line

Greeting

This first paragraph should summarize the rest of your letter. Keep it to just a couple sentences.

The next one to three paragraphs add more detail about your business. Include facts about its age, revenue, profit, employees, and other relevant information.

Then explain why you need financing and how you’ll use it to grow your business. This section can be a little longer (but remember your whole letter should fit on one page).

Next, talk about how your business will repay your loan. You may want to mention how financial documents show your business’s financial health, for example.

Finally, close with a short paragraph or two that list any enclosed documents and invite the lender to consider your loan application.

Printed name

List of enclosed financial documents

That’s not so hard, is it? With this basic business loan request letter template, you can easily write your own personalized business loan proposal.

The takeaway

So there you have it―that’s how to properly write a business loan request.

Get your formatting right, include a short summary, talk about your business, explain your loan needs, prove you can repay your loan, and close things off. (And don’t forget to proofread.)

We believe in you. You can write this thing.

And good luck getting your loan application approved!

Don’t just tell your lender you can repay your business loan―make sure you can with our business loan calculator .

Related reading

Best Small Business Loans

- How to Get a Small Business Loan in 7 Simple Steps

- 6 Most Important Business Loan Requirements

- How Long Does It Take To Get a Business Loan?

- Commercial Loan Calculator

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

How to Write a Loan Application Letter

Table of Contents

Sometimes, taking out a loan can become inevitable. Whether dealing with piled-up medical bills or a financial emergency, it’s common to turn to fast and convenient borrowing options. According to statistics, advances and loans accounted for more than 60% of bank assets in the European Union in 2021.

If you wish to take out a loan, you’ll have to fill out a loan application or request letter that details what you need the money for and how you’ll use it. The best way to appeal to a lender is by using a convincing tone and showcasing a clear plan for the money. Keep reading as we look at ways you can achieve this and ensure that your loan is granted successfully.

What is a Loan Application Letter?

A loan application letter is a typed or handwritten letter provided to your lender, helping them decide whether to approve your loan request. This letter is written when the borrower is seeking financial assistance from a lender to pay off some bills or other expenses.

When Do You Need One?

You might require a loan application letter in the following financing situations:

- When you wish to borrow money from the SBA (Small Business Administration) since it recommends and encourages applicants to start their loan proposals with an executive summary or a loan application letter

- When a borrower opts for a loan from a conventional bank lender and has to demonstrate that their business is financially viable and experiencing growth

In some situations, you aren’t required to write a loan application letter. These include scenarios like when a borrower is seeking equipment financing and said equipment serves as collateral, when someone requests a business line of credit with business bank statements or financial statements, and when a borrower seeks a term loan online using alternative lenders who want to go over your recent bank statements.

Essential Loan Application Elements

There are specific guidelines you need to follow when writing a loan application:

1. Header and Greeting

Whether you’re filling out a loan application letter for a personal or business loan, it’s crucial that you start with a header and greeting. Include several sentences that outline the necessary, accurate details of your loan request in the header. If you’re opting for a business loan, then you need to include the following details:

- Company name

- Company phone number

- Company address

- Loan agent or lender’s name and title

- Loan agent or lender’s contact details

- A subject line stating the desired loan amount

Follow this by incorporating a greeting right below the header so that you introduce your application with a friendly tone.

2. Loan Request Summary

You will have to provide your lender or loan agent with an overview of your loan request in this section. Ensure this section is concise, detailing only crucial information that’ll enable the lender to reach the letter’s body quickly. Entrepreneurs applying for a business loan should state why they are trustworthy borrowers, basic business details, the ideal loan amount, and the use of the loan.

3. Basic Business Details

It would be best if you started by making a clear loan request which includes the amount you wish to borrow. When you write a few sentences about the workings of your business, they should include the following information:

- The legal business name

- Any DBA used by the organization

- The amount of time the business has been operating

- The business structure

- Number of employees

- An overview of what the company does

- Profits and annual revenue, if applicable

Once this is done, you can move on to the next step, which is explaining why you need a loan. Don’t also forget to outline how you plan to repay the owed amount if the lender grants the loan.

4. Loan Usage

Every lender’s goal is to minimize risk as much as possible, so don’t be surprised if they carefully scrutinize your application before deciding whether to accept or disapprove it. They will assess whether you can pay back the loan entirely on time. Make a solid outline of how you intend to use the loan and why granting you the funds is a wise investment. It’s essential to inform the lender that you have clear goals you will accomplish if the loan application is approved.

5. Proof of How You’ll Pay Back the Loan

In order to show your company’s financial health, you’ll need to use figures from the latest balance sheet or income statement. These records are essential because they demonstrate that you can repay the loan.

Additionally, you must include any additional business finances to prove you’re a low-risk investment. State down any existing debt and a schedule detailing how you’ll pay it back if you owe someone else money. Perhaps, you’re a new business, but profits are stable. In that case, ensure you mention this, as it proves your ability to repay the loan.

Once you achieve this, you can add a particular cash flow prediction to give the lender an idea of your payback plan, including the principal and interest amount.

6. Give Accurate Information

There’s no doubt that lending money is a risky investment. You can make your lender’s life easier by providing factual and correct details to ensure both parties agree with the terms of the deal. For example, include your accurate credit history. If you are dishonest during the loan application process, you will be considered a fraud, and there will be repercussions for your actions.

Tips for Writing a Loan Application Letter

- Before sending a loan letter request, check your business and personal credit scores and whether you need to take specific steps to improve them

- Provide transparent, genuine, and concise explanations

- Ensure all information is factual and relevant

- Keep all your financial statements ready, such as business balance sheets, cash flow statements, PSL statements, etc

- Submit every relevant credential with your loan application request letter

- Include the date, time, method, and manner you’ll use to make your payment

- Avoid writing a letter that is unnecessarily wordy and long

- Follow the rules available online on writing formal letters, so you don’t use an informal tone while assembling your loan application letter

- Whether including your business’s current assets, liabilities, or financial health, don’t jot down false information that can get you into legal trouble.

Loan Terms and Penalties

If you fail to pay your loan on time, cancellation fees or penalties may apply that depend on the number of days you’re overdue on the payment. For example, if you’ve looked into how to get a title loan with a lien , you know that your car will be used as collateral. In case you default on payment or provide false information, you are likely to lose ownership of the vehicle.

You should go through the loan terms and conditions as this will enable you to determine how many days your payments can be delayed, how much penalties are for late payments, and the amount you’ll be charged if you cancel your loan. Choosing a loan provider that offers the lowest and most amenable terms is recommended.

Whatever reason you have for acquiring a loan, writing a solid loan application letter will improve your chances of obtaining the financial help you need. This application letter should be composed in a polite, convincing tone and include accurate information. You can do thorough research to pick a lender whose provided options align with your requirements. Consider beforehand how much money you need and apply for the relevant loan.

Join the thousands who have sharpened their business writing skills with our award winning courses.

Copyright © 2024 Businesswritingblog.com.

Published In: Applications

How to Write a Loan Application Letter (with Samples)

Sometimes we need financial assistance to push through with our business idea, education, medical emergencies, or any other personal project or goals that require a huge amount of money for its realization. Basically, it is for this reason that banks and other money lending institutions exist.

Applying for a loan from any lending institution requires the applicant to first fill out a form. Along with this form, the applicant can attach a loan application letter that provides more details on what he/she intends to do with the money and an overview of how the loan will be paid.

As a loan applicant, you need to learn how to write the loan request letter in a polite and convincing tone to appeal to your lender for your loan to be granted successfully.

What is a Loan Application Letter?

A Loan application letter is a document that informs the financial lending institution of the amount of money you are asking for, a clear outline of what you intend to do with the money, and convinces the bank why you are a good investment risk. Because it is a request, a loan application letter should be written in a polite tone, short and to the point.

The Loan Application Process

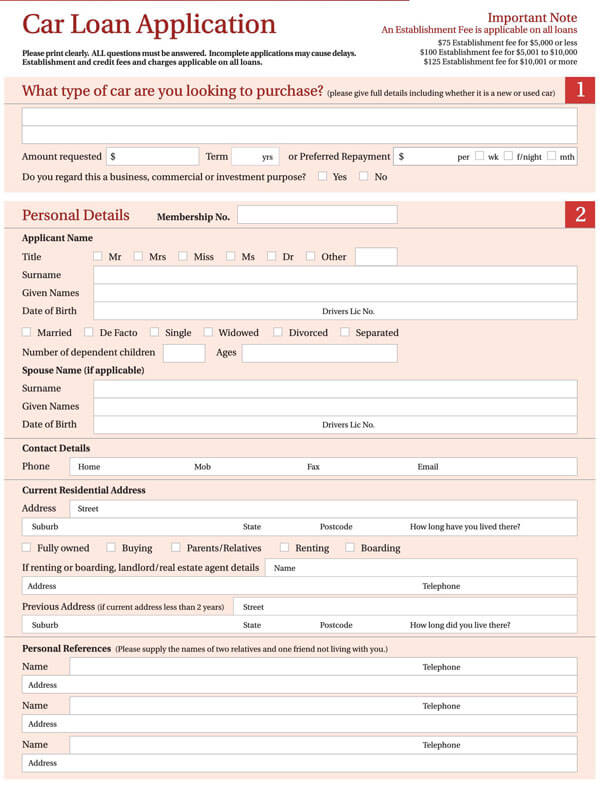

Based on the financial institution you choose, the process and time it takes for you to receive funding may vary. However, the typical loan application process may take on the following critical stages:

Pre-qualification stage

Prior to the loan contract, the potential borrower receives a list of items that they need to submit to the lender for them to get a loan. This may include Identification proof, credit score, current employment information, bank statements as well as previous loan statements.

Immediately this information is submitted, the lender reviews the documents and makes a pre-approval- meaning the borrower can move on to the next phase of the loan application process.

Loan application

In the second phase of the loan origination process, the borrower fills-in the loan application form either electronically- through mobile apps, websites, or paper-based. The data collected is then tailored to specific loan products.

The aspects that are included in the loan application form include the following;

The payment method- if it will be personal, through a check, or via online banking.

The payment frequency- There are several payment frequency methods, for example, Monthly installments, annually, or if the loan will be paid once.

The amount of interest accumulated on the loaned amount. This is the amount of money charged by the lender to the borrower on top of the amount which he/she has loaned.

The assets in the form of properties of the borrower will serve as collateral damage/guarantees in case the borrower defaults loan repayment or is unable to make his payments as per the agreed time.

Application processing

Once the application is received by the credit department, it is reviewed for accuracy, genuineness, and completeness. Lenders then use Loan Originating Systems to determine an applicant’s creditworthiness.

Underwriting process

This process only begins after an application is totally completed. In this stage, the lender checks the application in consideration of various accounts, such as an applicant’s credit score, risk scores, and other industry-based criteria. Today, this process is fully automated using Rule Engines and API integrations with credit scoring engines.

Credit Decision

Based on the results from the underwriting phase, the lender makes a credit decision. The loan is either approved, denied, or sent back to the originator for additional information. If the criteria used do not match with what is set in the engine system, there is an automatic change in the loan parameters, for instance, reduced loan amount or a different interest rate on the loaned amount.

Quality Check

Quality check of the loan application process is very critical since lending is highly regulated. The loan application is then sent to the Quality Control Team to analyze critical variables of the loan against internal and external regulations on loans. This is often the last step of the application process before funding is approved.

Loan funding

Once the loan documents are signed by both the borrower and the lender, funds are released shortly after. Nevertheless, business loans, loans on properties, and second mortgage loans may comparatively take more time to be approved due to legal and compliance reasons.

Essential Elements of a Loan Application Letter

Now that you have already understood the complex loan application process, it is important that you know the critical points to include in your loan request letter to convince your lender to give you a business loan.

Here is how to effectively write a loan application letter:

Header and greetings

The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting.

In your header, include the following details:

- Your business names

- The physical address of your business

- Business telephone and cell phone numbers

- Lender’s contact details

- Lender’s or Loan Agent’s Name and Title

- A subject line stating the loan amount you are requesting for.

Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

Business Loan Request Summary

The body of your business or personal loan request letter should start with a brief summary of your loan request amount, why you need the loan, your basic business information, and why you are an ideal risk investment for the lender. This section should be brief and concise. Only include the relevant information to capture your loan agent’s interest and keep them reading the body of your loan application letter.

Basic Details about your Business

Ideally, this is the third paragraph of your loan application letter. Use a few short and concise sentences to give a clear outline of your business.

Be sure to include the details below:

- The legal name of your business and any DBA that your business uses

- Your business structure- if it is a corporation- partnership, individually owned, etc.

- A summary of what your business does.

- How long your business has been operational

- Total number of employees

- A brief description of your current annual revenue

Once you have provided your basic business information, it is time to write the meat of your business loan request letter- clearly explaining why you need the business loan and how you intend to recuperate the investment.

The purpose of the business loan

In the fourth paragraph of your loan application letter, explain succinctly how you will use the business loan. Additionally, tell the lender why your intended use of the business loan will be a wise business investment.

While detailing this section, be as specific as possible and demonstrate to the lender that you have carefully considered the kind of revenue generation this new debt will accomplish for your business. for instance, don’t just say that you intend to use the loan for working capital. Rather, say that you plan to increase your inventory by 45% or that you need to increase your Human Resources to 4 to generate more income by 6%.

In the same paragraph, inform the lender exactly how the loaned amount will help generate more profits necessary to cover repayment plus the interest accumulated on loan.

Proof that you’ll be able to fully repay the loan

In this section, you need to demonstrate to the lender that you can pay back the loaned amount together with interest as per the agreed repayment period. You will want to use any figures from your latest income statements or balance sheets to prove your business is financially healthy and that it is a low-risk investment decision for your lender. In case you have other existing debts, be sure to mention them and include a business debt schedule if possible. If your business is profitable, highlight that in your letter since it something that most lenders pretty much look for in successful loan applicants.

In addition to that, consider including specific cash flow projections to demonstrate to your lender how you plan to fit repayment of the loaned amount plus interest into your budget.

Sample: Loan Application Letter

Sample 1: business loan application letter.

Samira Mitchell,

Mitchell Face Masks Limited,

4680 Forest Road

939, New York.

January 17, 2021

Mr. Wesley Kingston

Guarantor Trust Bank

679, New York State

Ref: Loan Request for $10,000

Exactly two years ago, I started my small face mask vending business in our local market. Over the last two years, my business has picked up really well to an extent where I need to expand to a bigger face mask vending company.

It is for this reason that I am writing this letter. I am confident that there is a great market niche for face masks, especially due to the current worldwide Novel Covid-19 Pandemic. Thus far, I have had many repeat customers, new customer links through referrals, and my client base has grown rapidly. Generally, there is an increase in demand for my products; therefore, I am requesting for a loan amounting to $10,000 to be able to supply more and satisfy all my clients.

This money, along with the amount that I have saved up from my profits, will enable me to lease a large, modern storefront and to import supplies that will help me launch my business plan.

I have attached my business plan, my latest business balance sheets, current business schedules, as well as my credit history statements for your perusal and review. If you have any questions or need any further clarifications, please contact me directly on (111) 345 679 or email me at Mitchel.facemasksltd.co.ke. Thank you for your consideration.

Samira Mitchel.

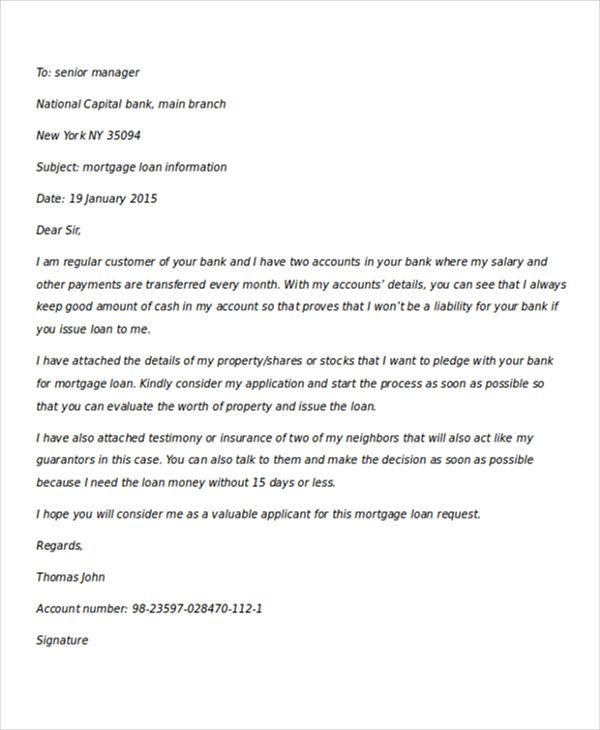

Sample 2: Personal Loan Application Letter

Dear Michael,

It is common for everyone to face difficult situations and bitter realities in life. I am currently facing a situation where everything seems bleak, and there seems to be no way out of this difficult situation. I am in debt, and I need to pay at least 30% of my house’s mortgage will be taken over by the bank, and I am currently ailing and weak, I’ll not be able to survive such a nervewrecking situation.

The only way I can avoid such a fate is by paying the full amount that is needed by the bank. I can be able to do so if I am allowed to take out a loan from the office, which is a privilege that the company has granted to all the employees. I would be thankful if the company allows me to borrow the money against my monthly pay.

Mr Brandon Brown

Do’s and Don’ts of Writing a Loan Request Letter

A loan application letter may increase or break your chances of receiving funding from any lending institution. This is because it is the first thing that lenders look for in the underwriting process when you submit an application. That said, you must know the dos and don’ts of writing a winning loan request letter to help you receive the funding that you really need.

- Check your personal and business credit scores before sending a loan request letter and take the necessary steps to improve them.

- Have all your financial statements ready, including cash flow statements, business balance sheets, P$L statements, etc

- Make sure to submit all your relevant credentials along with your loan application request letter.

- Always provide the correct and factual information to avoid fraudulent consequences.

- Don’t make your letter too long and unnecessarily wordy

- Don’t use an informal format while writing the loan application letter. Instead, follow the proper rules on writing formal letters

- Don’t include any false information in your loan request letter- be it your business’s current financial health, assets, and liabilities that may be used as collateral damage in case you default payment or why you need the money.

Things to Remember When Writing a Loan Application Letter

Generally, you should always consider the following essential tips if you want to write a winning loan application letter:

- The loan application letter is a formal document. Therefore, observe the proper rules of writing a formal letter.

- Clearly state your intent to borrow a given amount of money

- Provide a vivid but brief description of why you need the money. Your explanation should be concise, genuine, and transparent. While at it, explain how you plan to use the loaned amount and be very sincere about it.

- Explain why your business is a low-risk investment decision for the lender.

- Enumerate your assets and liabilities

- Include the time, date, manner, and method that you will use to make your payment.

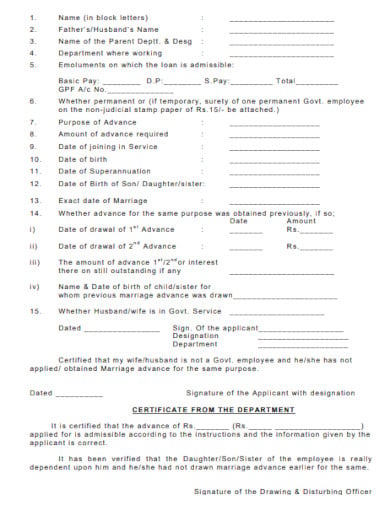

Free Loan Application Letter Templates

Are you looking to get some financing for your business or personal emergency? Download our free, well-crafted Loan application letter templates to help you customize your loan request letter. Our Templates includes all the critical elements of a winning loan request letter that will successfully help convince your lender to grant you the funding you need. Download our templates today to help you get started!

Collateral is defined as something that helps secure a loan. Generally, based on the type of lending institution you pick, the lender will give you less than your pledged asset value. Lenders every so often quote an acceptable loan to value ratio, meaning that if you borrow against your house, for example, and it worth $400,000, you will be given a loan amounting to $380,000. Again, this depends on the bank.

The prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan before the loan’s maturity date. These do not usually apply if you pay extra principal on your loaned amount in small amounts at a time. However, it is good that you counter check with your lender.

Every lender follows a different criterion to approve a business or personal loan. The application process depends on several factors; therefore, the time taken to receive funding in your account may take anywhere from a few minutes to several days. This depends on the type of institution you choose and the type of loan you are asking for.

Acquiring a loan is sometimes a necessity in one’s business or personal life. Nonetheless, it is not always easy to get a loan as lenders are wary of granting loans due to loan repayment defaults and fraudulent borrowers. This article has provided you with great insight on loan application letters, the loan application process, essential tips for writing a winning loan application letter, and the dos and don’ts of writing a convincing loan request letter. If you keep these things in mind every time you are thinking of applying for a loan, you are sure to get the funds you need to ensure the smooth running of your business and sort any personal emergency that may come your way.

Related Documents

Word & Excel Templates

Printable Word and Excel Templates

Loan Application Letter

Applying for the loan requires you to provide a lot of documentation. Some organizations ask you to fill out the loan application form, while in some cases, you have to write a loan application letter to the institute to apply for the loan.

The loan application letter allows you to add all the details that you are required to provide. The letter is written to the loan manager of the company, and he then decides whether he should accept the application or not. The letter should include the personal information of the applicant, and since it is a formal letter, it should be written to the point by avoiding unnecessary details. The lender should follow a standard format while writing the loan application letter. The loan manager should be told about the intended use of the money.

The first paragraph of the letter should state the reason for lending the money. It should be assured in the letter that you will not use this money for any illegal purpose. The date on which the applicant will return the borrowed money should be mentioned in the letter.

You should also include information about you in the letter that can make the reader feel that you are a trustworthy person. Here is a sample letter that can help you learn about the structure and format of the letter.

Loan application letter:

Dear [Recipient’s Name],

It is stated that I am writing this letter to request a loan from the finance office of your company because of some of my very peculiar and essential needs. My mother is seriously ill, and I must get her treated at the hospital, for which I need money. Please accept my loan application and sanction me $2000. I assure you that I will return you the loan from the deductions of my gross salary.

I will be highly grateful for this favor of yours.

I am looking forward to your reply.

[Your Name]

Preview and Details of Template

File: Word ( .doc ) 2003 + and iPad Size: 31 KB

More options

I am writing this letter to get a loan from your bank branch situated in New Jersey. Currently, I am working as a sales executive for ABC Organization and need a $10,000 loan. I am in utmost need of this amount as I have to meet the surgery expenses of my father. I have gone through all the requirements related to the loan process and have enclosed the necessary documents along with this email. Please let me know what other documents I need to send you, and you can call me at any time for further queries. I hope you will give a positive response to my request.

This application is a request to ask for a loan from your organization. I am Christiana Roseland, and I am currently running a bakery in New Jersey. I am planning to open a new branch according to the rising demand of people. For this purpose, I need $70,000/- and I will return the amount in installments. I have thoroughly read the rules and policies for the loan process and hopefully, I will return the entire amount within the given time period and the financial pronouncement has been affixed with this application. Waiting to get positive feedback from you.

This letter is a request for a loan application to construct a house. I am the managing director at ABC Company, and my monthly salary is not adequate to meet the construction expenses. I will return the due amount according to the company’s rules and policies and will not let you be disappointed. I contacted the admin office to find out the details, and Mr. Jackson has provided me with all the information. If you need additional information, you can ask me at any time. Thank you for taking my request into account.

Dear Madam, I, Darcy Louis, work in the security office of your company. I live in Valley Stream and travel two hours daily to come to the office. I do not have a personal vehicle, and sometimes it creates a lot of difficulties, and I often arrive late to the workplace. I want to apply for a loan because I have to buy a motorcycle. I need $10,000 in this regard. I have chosen a six-month installment plan, and 20% of my salary will be deducted each month. I request that you accept my loan application. I will be grateful to you. Thanking in anticipation.

Dear Sir, I am Dorothy John, and I live in Toronto. I am running a branch of ABC School. The strength of students is increasing with each session, and it is becoming difficult to adjust to the large number of students in a limited space. Therefore, I need to open a new branch adjacent to the current school and construct a new building, but I do not have enough money. I learned about your loan policy and want to apply for it. I have attached the needed documents along with the application. I am hoping to hear a quick response from you.

I am Julia Hughes, and I am writing this message to ask for a loan from your bank. I have an account in your Brooklyn branch, and my account number is [#]. I have a small business marketing in Brooklyn, and I intend to open a new branch in the Netherlands. Hence, it can be a source of ease for hundreds of people. The savings I have and the loan I am asking for will be of great help in expanding my business. Kindly send me an email detailing all the formalities for the loan process. I would like to ask you to send me a confirmation message so I may visit your branch on an immediate basis.

- Letter Requesting Transfer to another Department

- Letter Requesting Promotion Consideration

- Umrah Leave Request Letter to Boss

- Ramadan Office Schedule Announcement Letters/Emails

- Letter to Friend Expressing Support

- Letter to Employer Requesting Mental Health Accommodation

- Letter Requesting Reference Check Information

- Letter Requesting Salary Certificate

- Letter Requesting Recommendation from Previous Employer

- One Hour Off Permission Letter to HR

- Payroll Apology Letter to Employee

- Advice Letter to Subordinate on Effective Communication

- Advice Letter to Subordinate on Time Management

- Letter to Patient for Feedback/Responding Survey/Online Form

- Holiday Cocktail Party Invitation Messages

Verification of employment letter template and guide

Speed up your home loan application by making sure your lender has everything they need..

In this guide

Download this template as a:

Why does my lender need a verification of employment letter, what needs to be included in the letter, will all lenders require a letter to verify my employment, can i provide my lender with a faxed copy or does it need to be the original, how recent does the employment letter need to be, bottom line.

Mortgage guides

We compare the following lenders and brokers

Term length

Mortgage cost by amount

Mortgage calculators

Loan categories

A verification of employment letter is a document provided by your employer that confirms your current employment status and income. Some lenders will need to verify your employment when you apply for a mortgage, line of credit, lease or loan.

- Word document (.docx)

- Google document

- Employer information. Most lenders require your employment letter to be issued on an official company letterhead that contains the company’s name, address, logo and contact details.

- Employment status. The letter should contain information about your employment status, including how many hours you work, your position title and how long you’ve been employed.

- Financial information. The letter should state whether you’re an hourly or salaried employee, how much you make and if you get bonuses.

- Date and signature. Make sure the letter is dated and signed.

Looking to buy a home? Get started

What does a verification of employment letter look like?

New York, NY 10005

To whom it may concern,

I am writing this letter to verify that Laura A. Baxley is currently employed with XYZ Pty Ltd as a Digital Marketing Manager. She has been employed with us since March 2016.

Laura currently works on a full-time basis, averaging 40 hours per week. She earns a salary of $65,000 per year, paid biweekly, plus potential yearly bonuses.

Should you have any questions, please do not hesitate to contact me at (123)456-7890

Kind regards,

(SIGNATURE)

Justin Hamilton

Human Resources Manager

XYZ Pty Ltd

No, but most lenders will require some sort of verification. Aside from a letter, your lender may call or email your employer or give you a form for them to fill out and sign.

What if it’s a phone call?

If your lender lets you know that they’ll be calling your employer to verify your employment, let your boss know to expect the call. It’s also a good idea to ask your employer if they need any information from you and thank them for helping you.

This will vary depending on the lender’s individual policies and eligibility requirements, but most lenders will accept a faxed copy of the employment letter.

Most lenders require the employment letter to be no older than 60 days from the date of receipt, but it can vary from lender to lender. If you have a letter that’s more than a couple of weeks old, ask your lender if you’ll need a copy that’s been signed and dated more recently.

Find the best mortgage lender for you Get started

Most lenders will want to verify your employment. This can involve getting a letter from your employer, having them fill out a form or having your lender call or email them. Whichever option they choose, the process is generally pretty simple.

If you’re just getting started researching the mortgage process, compare home loan lenders to find one that fits your needs.

Belinda Punshon

Belinda Punshon worked for Finder as a writer on home loans and property and as a corporate communications executive. She has a Masters in Advertising, Public Relations and Journalism from the University of New South Wales and a Bachelors in Business from the University of Technology Sydney. See full profile

More guides on Finder

Comparing investment returns vs. mortgage savings.

- ¿Cuánto pagaría por una hipoteca de 400.000 dólares?

- ¿Cuánto pagaría por una hipoteca de 300.000 dólares?

Cornerstone Home Lending offers a standard list of mortgage loans with some portfolio options, but you have to contact a loan officer for rates and fees.

Learn what to look for in a mortgage, what to avoid and what to research if you’re thinking about moving into a retirement community.

Shopping for a new home? Here are seven of the best mortgage lenders in America.

How to successfully transfer your property to someone else.

It’s not just a fairy tale — you can really buy your own castle.

Working out how interest is calculated on a home loan can help you figure out how much you can borrow and how to pay it off sooner.

A change in personal circumstances may make it necessary to remove a name from a property deed. Here’s how to go about it.

Ask a Question

Click here to cancel reply.

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Guide to writing a mortgage letter of explanation (with template)

Your lender asked for a letter of explanation. what now.

When you apply for a home loan, your lender will do a deep dive into your financial history. Depending on what it finds in your bank statements or credit report, additional documentation may be necessary.

You may be asked for a “letter of explanation” during the application process. Fear not. Letters of explanation are fairly standard and nothing to worry about.

However, you want to make sure you write this letter correctly, as it could be crucial to your mortgage approval.

Here’s everything you need to know so you can hit a home run with your letter of explanation.

In this article (Skip to...)

- What is a letter of explanation?

- How to write one

- Sample letter

- Final advice

What is a mortgage letter of explanation?

Commonly referred to as an ‘LOE’ or ‘LOX,’ letters of explanation are often requested by lenders to gain more specific information on a mortgage borrower and their situation.

An LOX can necessary when there is inconsistent, incomplete, or unclear information on a loan application.

Letters of explanation may be required if any red flags turn up during the underwriting process, such as:

- Declining income

- Gaps in your employment history

- Differing names on your credit report

- Large deposits or withdrawals in your bank account

- Recent credit inquiries

- An address discrepancy on your credit report

- Derogatory items in your credit history

- Late payments on credit cards or other debts

- Overdraft fees on an account

There are many other situations where an LOX may be requested, too.

If you need to write one, be sure to ask your loan officer what exactly the underwriter wants to see, and whether you need to provide any supporting documentation along with the letter.

How to write a letter of explanation for your mortgage lender

When it comes to mortgage letters of explanation, less is typically more.

Too much unnecessary information may lead to confusion, or at minimum, additional questions about your file — questions that may have been avoided if it weren’t for some of the details in your letter.

The most important elements of your letter of explanation should include the following:

- Facts — Be honest. Never be tempted to write a letter based on solely on what you may think your lender wants to hear. You shouldn’t fabricate any aspect of your letter. Include correct dates, dollar amounts, and any other pertinent details for your situation

- Resolution — Your lender wants to know how and when the situation that led up to certain events was resolved. For instance, if you were temporarily furloughed during COVID, but you’ve since returned to full employment, you should be able to document your recent paystubs and have your employer verify that you’ll continue working full time for the foreseeable future

- Acknowledgement — This one is important and shouldn’t be left out of your letter. Mortgage underwriters want to know why it is that something happened, and how or why it won’t happen again in the future

Remember that a letter of explanation is a professional document that will go into your loan file.

Be mindful of things like spelling, grammar, and punctuation. Create a letter that’s visually appealing, properly formatted, and communicates the relevant information.

Providing additional documentation with your letter can be helpful. For example, if hospitalization was the culprit behind some missed payments on your credit report, it may be helpful to include hospital bills.

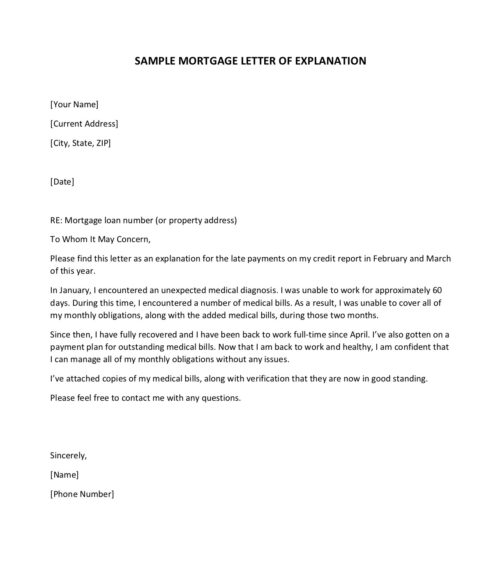

Sample letter of explanation and template

Remember to be honest, formal, and concise when writing a letter of explanation for your mortgage lender.

The exact content will vary based on your situation, but here’s a general letter template you can use as a guide. (Click the image to open a PDF version.)

Remember to include your mailing address, phone number, and the number of your mortgage loan application (or the property address for which you’re applying).

Final advice on writing a letter of explanation

You’ll be asked to submit a pile of documentation during the mortgage loan process, including bank statements, tax returns, pay stubs, and more.

Depending on your financial situation, your lender may also request a letter of explanation. Many first-time home buyers think being asked to provide a letter of explanation means their mortgage application may be doomed.

Remember, this type of request is usually a good thing. The underwriter may be looking for this last item before signing off on your final approval.

When your lender requests a mortgage letter of explanation, remember this first: don’t panic.

Next, double-check with your lender on exactly what is being requested.

Then write a clear, concise letter that’s free of emotional language, negativity, or excessive detail. There’s a good chance that the next time you hear from your lender, it will be to let you know you’re fully approved.

- Land and Build

The ULTIMATE mortgage e-book

View all articles on Home Buying

View all articles on Refinance

- How Much Can I Borrow

- Mortgage Refinance Calculator

- Home Loan Comparison Calculator

- Mortgage Repayment Calculator

- Australian Stamp Duty Guide

- Property Buying Cost Calculator

- Why Invest in Australian Property

- Buying Aussie property to Get a PR

- Australia's Housing Market in 2025

- Australian Expat Tax Rules

- Home Loans for Foreign Nationals

- Home Buying Process

- Australian Home Loan Features

- Home Loan Terms in Australia

- Home Loan Packages

- Non-Resident Mortgage Documents

- Home Loan Approval Time

- Mortgage Glossary for Expats

- Buying Your First House

- Home Loan Interest Rates

- Choosing a Mortgage Broker

- Applying For a Mortgage

- Deposit For a Home Loan

- Increase Your Borrowing Power

- Refinancing Home Loans

- Refinance Process and Timeline

- Documents for Refinance

- When Is It Best to Refinance

- Refinancing Fees and Stamp Duty

- How Does Refinancing Work

- Home Loan Types

- Financing Investment Property

- Fixed Rate Loans

- Construction Loans

- Commercial Loans

- Commercial Investment Loans

View all Resources

- United Kingdom

- Saudi Arabia

Letter Of Employment For A Mortgage

Whether you are a first time homebuyer or a seasoned homeowner, you need to be ble to write an effective employment letter for your mortgage application. An employment letter for mortgage is a document that confirms your current employment status, income, and job stability, and is used by lenders to assess your ability to make mortgage payments. It is an important part of the mortgage application process and can significantly impact your chances of approval.

Writing a employment letter can be complex. You need to include all your relevant information and convey them in a professional tone.

What is a letter of employment?

A letter of employment is a document that shows someone’s current job status. It’s usually given by the employer to the employee when requested. The letter includes information such as the employee’s job title, start date, salary, and employment type (full-time, part-time, or contract). It’s used to prove job stability and income, and may be required in situations like applying for loans or renting apartments.

What is the purpose of an employment letter for your mortgage?

Mortgage lenders typically mandate that your employer provide details about your employment status to evaluate your job stability and verify your application. It especially allows banks to determine whether you have the regular income required to make the mortgage payments or not.

What should it include? Essential requirements for your employment letter for a bank

The letter must include things such as job title, salary, years of employment, and more. Your employment letter when you’re applying for a mortgage should include the following essential requirements:

- Letterhead and signature: The letter should be written on an official company letterhead and signed by an authorized representative of the company.

- Contact information: The letter should include your employer’s contact information, such as the company name, logo, address, and phone number, so that the bank can verify the information.

- Dates: The employment letter should be current and include the date it was issued. It should be no older than 60 days.

- Verification of employment: This confirms that you are currently employed and the duration of your employment.

- Job title and salary: This information is needed to determine your income and ability to make loan payments.

- Employment type: Banks want to know if you are a full-time or part-time employee, or if you are a contractor.

- Length of employment: This is important because banks want to see that you have a stable job and are likely to continue to receive an income.

- Pay deductions

- Overtime income

- End of probation period

- Changes in income

- Year to date income

- Employment stability

- Maternity or Paternity leave

- Employment probation

- Seasonal pay fluctuations

- Self employer contractor

The bank evaluates your employment letter to assess your ability to repay a loan and make a decision on your loan application.

Get a free Australian mortgage assessment today.

How to create an effective letter of employment confirmation.

Now that you have a comprehensive understanding about the letter of employment and its purpose towards your mortgage application, we can finally get started on how you can write one for yourself.

We have created a letter of employment confirmation template for you. All you have to do is download the template, send the sample letter to your employer to amend the informations about your job, include their letterhead, relevant name and signature and fax it back to you. Once you receive the letter, proofread the letter for all the requirements we talked about earlier.

Letter of employment template

Here is the letter of employment confirmation template for your mortgage loan application:

[Your Company Letterhead]

Dear Sir/Madam,

We are writing to confirm that [Employee Name] is an employee of [Your Company Name] and currently holds the position of [Job Title] with our organization. Their employment commenced on [Start Date], and they are based at [Work Location].

They are hired as [permanent/ contract] worker.

[Employee Name]’s starting salary is [Salary], and they are paid on a [Weekly/Monthly] basis.

Only if the employee was paid bonus in the last 2 years:

The [Year] discretionary bonus was paid in [Month/Year] and for [Bonus Amount].

[Employee Name] also entitled to the below benefits (delete if not applicable):

- Housing Allowance of [Amount] per [month/ year]

- Living Allowance of [Amount] per [month/ year]

- Education Allowance of [Amount] per [month/ year], and this is paid per dependent. The max number of dependent covered by us is [number]

- Any other allowance if applicable

If you require any further information regarding [Employee Name]’s employment with our organization, please do not hesitate to contact us.

[HR Position]

[Your Company Name]

You can download this employment template here.

Other employment confirmation template samples:

We have also created several other templates for different scenarios where the bank might request you additional clarifications. You can download the other employment confirmation samples here:

- Year-to-date income

- Self-employed contractor

What if I’m self employed?

For self-employed contractors, you can download the template here.

If you’re a sole trader, in a partnership or operate via a company and unable to prove your income through traditional means, alternative options are available. You may provide older tax returns, Business Activity Statements (BAS) or an accountant’s letter for a low doc loan.

For more assistance, please contact our sister company, Odin Tax. Our experienced tax advisors at Odin Tax can help you understand the complex rules and regulations involved in this process and provide practical solutions tailored to your unique situation.

Will the bank accept employment letters from a foreign company?

The acceptance of employment letters from foreign companies for mortgage applications depends on the bank’s specific requirements and policies.

- Some lenders may accept confirmation of employment from overseas companies if it’s in an acceptable format.

- Lenders may request additional documentation such as payslips, bank statements, tax returns, and employment contracts to verify income.

- The specific requirements for verifying income may vary from lender to lender.

At Odin Mortgage, we can assist you in your quest to apply for a mortgage . If you’re seeking assistance with verifying foreign income or obtaining an employment confirmation letter for your mortgage application, our expert brokers can help you connect with the right mortgage lenders from our selected panel.

Our brokers possess specialized knowledge and resources to help guide our clients through the mortgage application process and facilitate the verification of their income.

Contact Odin Mortgage today.

Frequently asked questions

To get a letter of employment for a mortgage, speak to your employer and provide necessary details such as the lender’s name and specific requirements.

Wait for the letter, review it for accuracy, and submit it to the lender. The letter should include your job title, start date, employment status, and salary, be on company letterhead, and signed by an authorized representative.

As mentioned above, the employment letter should be recent and include the date it was issued. It should be no older than 60 days.

Related Posts:

See What You Qualify For

Pre-approval (still searching), purchase (already found), refinance and cash-out, detached house, apartment unit, land or build, investment property, owner occupier, holiday home, sole borrower, joint borrower, trust entity, non-trading company, australian citizen, australian pr visa, foreign national, self employed / contractor, unemployed / home duties.

- Country of Residence * Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antigua and Barbuda Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia Bosnia and Herzegovina Botswana Bouvet Island Brazil British Indian Ocean Territory British Virgin Islands Brunei Bulgaria Burkina Faso Burundi Cambodia Cameroon Canada Cape Verde Caribbean Netherlands Cayman Islands Central African Republic Chad Chile China Christmas Island Cocos (Keeling) Islands Colombia Comoros Congo Cook Islands Costa Rica Cote d'Ivoire Croatia Cuba Curaçao Cyprus Czech Republic Democratic Republic of the Congo Denmark Djibouti Dominica Dominican Republic East Timor Ecuador Egypt El Salvador Equatorial Guinea Eritrea Estonia Ethiopia Europe Falkland Islands Faroe Islands Fiji Finland France French Guiana French Polynesia Gabon Gambia Georgia Germany Ghana Gibraltar Greece Greenland Grenada Guadeloupe Guam Guatemala Guernsey Guinea Guinea-Bissau Guyana Haiti Honduras Hong Kong Hungary Iceland India Indonesia Iran Iraq Ireland Isle of Man Israel Italy Jamaica Japan Jersey Jordan Kazakhstan Kenya Kiribati Kosovo Kuwait Kyrgyzstan Laos Latvia Lebanon Lesotho Liberia Libya Liechtenstein Lithuania Luxembourg Macau Macedonia (FYROM) Madagascar Malawi Malaysia Maldives Mali Malta Marshall Islands Martinique Mauritania Mauritius Mayotte Mexico Micronesia Moldova Monaco Mongolia Montenegro Montserrat Morocco Mozambique Myanmar (Burma) Namibia Nauru Nepal Netherlands Netherlands Antilles New Caledonia New Zealand Nicaragua Niger Nigeria Niue Norfolk Island North Korea Northern Mariana Islands Norway Oman Pakistan Palau Palestine Panama Papua New Guinea Paraguay Peru Philippines Pitcairn Islands Poland Portugal Puerto Rico Qatar Réunion Romania Russia Rwanda Saint Barthélemy Saint Helena Saint Kitts and Nevis Saint Lucia Saint Martin Saint Pierre and Miquelon Saint Vincent and the Grenadines Samoa San Marino Sao Tome and Principe Saudi Arabia Senegal Serbia Seychelles Sierra Leone Singapore Sint Maarten Slovakia Slovenia Solomon Islands Somalia South Africa South Georgia and the South Sandwich Islands South Korea South Sudan Spain Sri Lanka Sudan Suriname Svalbard and Jan Mayen Swaziland Sweden Switzerland Syria Taiwan Tajikistan Tanzania Thailand Togo Tokelau Tonga Trinidad and Tobago Tunisia Turkey Turkmenistan Turks and Caicos Islands Tuvalu U.S. Virgin Islands Uganda Ukraine United Arab Emirates United Kingdom United States Uruguay Uzbekistan Vanuatu Vatican City Venezuela Vietnam Wallis and Futuna Western Sahara Yemen Zambia Zimbabwe Country

- Phone Number *

- First Name *

- Last Name *

- Email Address *

Featured In

10 Best Tips for Australian Expats to Maximise Borrowing Power & Approval Success

Table of contents.

Talk to a lender: (866) 240-5121

Home Buying · Understanding Mortgages

How to Write a Letter of Explanation | Template & Examples

When you’re asked to write a letter of explanation by a mortgage underwriter, look at this as a valuable opportunity to clearly communicate your situation.

Standard mortgage forms often don’t leave space for you to explain any unusual or problematic components of your application. A letter of explanation can allow you to clarify any complications, including glitches in your credit history or employment, to help you qualify for a home loan. And this guide will tell you how to do it.

Check today's mortgage rates. Start here (Jun 7th, 2024)

What’s a letter of explanation?

A letter of explanation (sometimes called an LOE or LOW) is a document requested by mortgage lenders when they want more details about your financial situation. An underwriter may request a letter of explanation if they run into questions about your finances during the mortgage approval process.

Why do lenders ask for a letter of explanation?

Typically, mortgage lenders will request a letter of explanation when they want to know more about your income, employment or credit. Technically, the lender can ask anything about your financial situation. Anything that strikes the lender as a red flag is fair game for a letter of explanation.

Mortgage lenders express interest in out-of-the-ordinary happenings with your finances because those could prevent you from making future house payments. Check your underwriter’s request to understand what needs explaining.

There are a number of reasons a lender might request a letter of explanation, but here are six of the most common.

Differences in addresses

The Federal Trade Commission (FTC) enforces an address discrepancy rule which puts the burden on mortgage loan originators, brokers, lenders and banks to report your correct address to the various credit agencies. When you apply with an address that differs from the one at the credit bureaus, the lenders view ID theft as a distinct possibility. If you have a valid reason for the inconsistency in addresses, this is your chance to clear up any confusion. For example, perhaps you moved to an apartment while house shopping, weren’t sure how long you’d be renting and applied using your parent’s address.

Interruption in employment

If you’ve experienced a significant gap between jobs and subsequently failed to meet a financial obligation, you can explain the situation and why it won’t happen again.

A letter of explanation can also help if your employment gap was an anomaly. For instance, many workers were laid off during the Covid pandemic but otherwise have an excellent track record of employment. Lenders can be more flexible when they have all the details about your scenario.

Sizeable deposits into one of your accounts

If the underwriter doesn’t recognize the source of a large deposit into your bank account, they’ll ask you to explain why it’s there and where it originated. An example would be that you sold a car to someone and then deposited the check they wrote you.

Late or missing payments

If you’ve made late payments — or missed payments — to creditors then a lender will want to understand why. The cause may be an interruption in employment or a medical issue. If most of your history suggests you pay on time, a letter stating your case should be sufficient to put your lender at ease.

Erratic income

When your income decreases or vanishes, it’s a red flag to the mortgage loan company. Lots of reasons may have caused this decline in income, including having a baby, getting divorced, advancing your education, traveling or starting your own business. In your letter spell out the cause and let the underwriter know that you’ll still be able to make your mortgage payments.

Miscellaneous circumstances

Your credit report may be cause for concern if it shows overdraft fees, considerable cash withdrawals or some other unexplained financial irregularity. If you were a victim of monetary fraud or identity theft, that’s not a deal-breaker, but you will need to include the specifics in your letter.

How to write a letter of explanation

You don’t need to worry if your lender requests a letter of explanation. These letters are a pretty standard part of mortgage applications.

Here are the important elements that your letter should include:

- Facts. Include all the details with correct dates and dollar amounts.

- Resolution. Explain how and when the situation was resolved.