ATM Business Plan Template

Written by Dave Lavinsky

ATM Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their ATM companies.

If you’re unfamiliar with creating an ATM business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write an ATM business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is an ATM Business Plan?

A business plan provides a snapshot of your ATM business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for an ATM Business

If you’re looking to start an ATM business or grow your existing ATM company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your ATM business to improve your chances of success. Your ATM business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for ATM Businesses

With regards to funding, the main sources of funding for an ATM business are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for ATM companies.

Finish Your Business Plan Today!

How to Write a Business Plan for an ATM Business

If you want to start an ATM business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your ATM business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of ATM business you are running and the status. For example, are you a startup, do you have an ATM business that you would like to grow, or are you operating a chain of ATM businesses?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the ATM industry.

- Discuss the type of ATM business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of ATM business you are operating.

For example, you might specialize in one of the following types of ATM businesses:

- Independent ATM owner/operator: This is the most common type of ATM business in which an individual owns one or multiple ATM machines that can be located in a variety of places such as retail stores, shopping malls, and more.

- Mobile ATM: The owner/operator of this type of ATM business will book their mobile ATMs for events such as festivals or conventions.

- Bitcoin ATM: This type of ATM machine is for cryptocurrency transactions rather than traditional banking transactions.

- ATM installation and maintenance: This type of business provides installation and maintenance services for an ATM owner/operator.

In addition to explaining the type of ATM business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of customers served, the number of transactions completed, and reaching $X amount in revenue, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the ATM industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the ATM industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your ATM business plan:

- How big is the ATM industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your ATM business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your ATM business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, schools, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of ATM business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your ATM Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other ATM businesses.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes online money transfer apps and traditional banking establishments. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of ATM business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you make it easier for customers to access your ATM?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a ATM business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of ATM company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide mobile ATMs, bitcoin ATMs, or ATM installation services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your ATM company. Document where your company is situated and mention how the site will impact your success. For example, is your ATM business located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your ATM marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your ATM business, including answering calls, planning and providing therapy sessions, billing insurance and/or patients, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to install your Xth ATM, or when you hope to reach $X in revenue. It could also be when you expect to expand your ATM business to a new city.

Management Team

To demonstrate your ATM business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing ATM businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing an ATM business.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you install 5 ATMs in retail locations around your city, and will you charge a $2.00 fee for each transaction? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your ATM business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a ATM business:

- Cost of the ATMs

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or a list of locations in which your ATMs will be installed.

Writing a business plan for your ATM business is a worthwhile endeavor. If you follow the free template above, by the time you are done, you will have an expert ATM business plan; download it to PDF to show banks and investors. You will understand the ATM industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful ATM business.

Don’t you wish there was a faster, easier way to finish your ATM business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Learn about Growthink’s business plan writing services .

Other Helpful Business Plan Articles & Templates

ATM Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business ideas » Financial Service Industry » ATM

Are you about starting an ATM business ? If YES, here is a complete sample ATM business plan template & feasibility report you can use for FREE .

An automated teller machine is an electronic device that enables customers of financial institutions to perform financial transactions such as cash withdrawals, deposits, transfer of funds, or obtaining account information at any time and without the need for direct interaction with bank staff.

Suggested for You

- Bitcoin ATM Business Plan [Sample Template]

- Microfinance Bank Business Plan [Sample Template]

- Bail Bond Business Plan [Sample Template]

- Credit Card Processing Business Plan [Sample Template]

- 6 Best ATM Machines to Buy [Prices Included]

ATMs were originally developed as cash dispensers, but have evolved to provide many other bank-related functions. Anyone can start an automated teller machine business as long as they have the financial capacity, license, network and business exposure. Below is a sample ATM business plan template that will help you to successfully write yours within record time.

A Sample ATM Business Plan Template

1. industry overview.

Independent ATM business operators are not banks but they install their ATM machines, fill them with cash and earn money every time a customer withdraws money from their ATM machines.

Once the money is taken out of your ATM, it is re-deposited into a bank account of your choice on a daily basis along with the surcharge fees. A portion of the surcharge fee is typically paid to the merchant in the form of a commission or split.

Additional revenue can be made on each ATM transaction in the form of interchange. All your machines can be monitored online through a portal where you can see real time information about how much cash is in each machine and how many transactions and fees have occurred.

The total cost of ownership of ATM network services is high, wherein buyers can expect to pay more than 100 percent of the benchmark purchase price per year in additional fees. Besides annual membership fees, buyers must pay transaction fees every time their cardholders use ATMs in the network. These fees include per-transaction switch fees paid to the ATM network provider, usually about two to ten.

The Automated Teller Machine industry is a thriving sector of the economy of the united states and statistics shows that the total number of ATMs in the United States is 425,000 (source-National ATM Council), Independently owned ATMs deployed- 222,000 (source-National ATM Council) and Average ATM fee/Convenience fee- $2.77 (source-National ATM Council).

Average commission payment-$.50-$1.00 (based on my analysis of 100+ portfolios and 10,000+ locations), and Average interchange net income-$.10-.20 (based on my analysis of 100+ portfolios and 10,000+ locations).

The costs for new machine, is between $2000 – $2500 and higher end machine with multiple cassettes and dispensers can run anywhere from $3000 and $6000. Fiserv Inc., CU Cooperative Systems Inc., Vantiv Inc., First Data Corporation and US Bancorp, ATM Network Services are the leaders in this industry.

A recent report published by IBISWorld shows that the ATM industry is highly concentrated, with the two largest companies controlling an estimated 66.7 percent of revenue in 2018. Major players have been extremely aggressive in acquiring smaller payment software companies and expanding their operations over the past five years, and IBISWorld expects further concentration as these trends continue.

Currently, NCR Corporation and Diebold are the largest US-based ATM manufacturers. Competition from abroad has tightened profit margins and prices on ATM systems. Consequently, most of the industry’s largest players operate in related industries to diversify their revenue sources.

There is a particular emphasis on self-service kiosk stations, payment, cash handling software and maintenance services. The ATM machine industry is a profitable industry and it is open for any aspiring entrepreneur to come in and establish his or her business.

2. Executive Summary

Fin Tech® ATM Services, Inc. is a US licensed and incorporated business that will operate independent automated teller machine services all across the United States.

Although our business will be based in Santa Fe – New Mexico where we intend positioning our automated teller machines (ATM) all across the city, but we have the plans to spread across major cities in the United States within record time.

We are in the business to perform financial transactions such as cash withdrawals, deposits, transfer funds, obtaining account information and other sundry services, at any time and without the need for direct interaction with bank staff. We are aware that there are several independent ATM service operators with ATM outlets all around Santa Fe – New Mexico, which is why we spent time and resources to conduct our feasibility studies and market survey.

Our customer care is going to be second to none in the whole of Santa Fe – New Mexico. We know that our customers are the reason why we are in business which is why we will go the extra mile to get them satisfied when they make use of any of our automated teller machines.

Fin Tech® ATM Services, Inc. will ensure that all our customers are given first class treatment whenever they use our ATM machines. We have a CRM software that will enable us manage a one on one relationship with our customers no matter how large they are.

We have put plans in place to operate a mini but standard call center/customer complaint center that will operate on a 24 hours basis for the sole purpose of resolving customer’s complaints. Fin Tech® ATM Services, Inc. is a family business that is owned by Lawrence Mullen and his immediate family members.

The business will be managed by his son Johnson Lawrence, a graduate of Business Administration who has extensive experience working with one of the leading ATM machine services companies in the United States of America. He will bring his wealth of experience and expertise to help build and grow Fin Tech® ATM Services, Inc.

3. Our Products and Services

Fin Tech® ATM Services, Inc. is in the industry for the purpose of making profits and we will ensure that we go all the way to make available a wide range of services as it relates to the industry in the United States of America. Here are some of the services that will be available in our ATM machines;

- Cash withdrawals, deposits, transfer funds, or obtaining account information

- Paying routine bills, fees, and taxes (utilities, phone bills, social security, legal fees, income taxes, etc.)

- Printing or ordering bank statements

- Updating passbooks

- Cash advances

- Cheque Processing Module

- Paying (in full or partially) the credit balance on a card linked to a specific current account.

- Transferring money between linked accounts (such as transferring between accounts)

4. Our Mission and Vision Statement

- Our vision is to build an ATM machine service that will have active presence all over Santa Fe – New Mexico and other key cities in the United States of America

- Our mission is to establish an ATM machine business that will make available a wide range of services at affordable charges to residents of Santa Fe – New Mexico and other key cities in the United States of America where we intend installing our ATM machines.

Our Business Structure

Our intention of starting an automated teller machine (ATM) services business is to build a standard business that has ATM machines in strategic positions in key cities around Santa Fe – New Mexico and of course other key cities across the United States.

We will ensure that we put the right structures in place that will support the kind of growth we have in mind while setting up the business. In putting in place a good business structure, we will ensure that we hire only people that are qualified, honest, customer centric and are ready to work to help us build a prosperous business.

As a matter of fact, profit-sharing arrangement will be made available to all our management staff and it will be based on their performance for a period of three years or more. In view of that, we have decided to hire qualified and competent hands to occupy the following positions;

- Chief Executive Officer (Owner)

- ATM Custodian/Manager

- Admin and Human Resources Manager

Sales and Marketing Manager

Information Technologist

- Client Services Executive

5. Job Roles and Responsibilities

Chief Executive Officer – CEO:

- Increases management’s effectiveness by recruiting, selecting, orienting, training, coaching, counseling, and disciplining managers; communicating values, strategies, and objectives; assigning accountabilities; planning, monitoring, appraising job results and developing incentives

- Creates, communicates and implements the organization’s vision, mission, and overall direction – i.e. leading the development and implementation of the overall organization’s strategy.

- Accountable for fixing prices and signing business deals

- Responsible for providing direction for the business

- In charge of signing checks and documents on behalf of the company

- Evaluates the success of the organization

Admin and HR Manager

- Responsible for overseeing the smooth running of HR and administrative tasks for the organization

- Defines job positions for recruitment and managing interviewing process

- Carries out induction for new team members

- Responsible for training, evaluation and assessment of employees

- Answerable for arranging travel, meetings and appointments

- Oversees the smooth running of the daily office activities.

ATM Custodian/Manager:

- Ensures that proper records of transactions are kept and our ATM machines does not run out of cash

- Ensures that all our automated teller machines are in tip top state and function efficiently at all times

- Interfaces with third – party suppliers (vendors) and our banks

- Controls cash distribution and supply inventory all across our ATM machine locations

- Models demographic information and analyze the volumes of transactional data generated by customers

- Identifies, prioritizes, and reaches out to new partners, and business opportunities et al

- Represents the company in strategic meetings

- Helps to increase sales and growth for the company

- Manages and monitors the organizations ATM machine network and website

- Responsible for installing and maintenance of ATM machines, computer software and hardware for the organization

- Manages the organization’s CCTV

- Handles any other technological and IT related duties.

- Responsible for preparing financial reports, budgets, and financial statements for the organization

- Provides managements with financial analyses, development budgets, and accounting reports

- Responsible for financial forecasting and risks analysis.

- Performs cash management, general ledger accounting, and financial reporting

- Responsible for developing and managing financial systems and policies

- Responsible for administering payrolls

- Ensures compliance with taxation legislation

- Handles all financial transactions for the organization

- Serves as internal auditor for the organization

Client Service Executive

- Ensures that all contacts with clients (e-mail, walk-In center, SMS or phone) provides the client with a personalized customer service experience of the highest level

- Through interaction with clients on the phone, uses every opportunity to build client’s interest in the company’s products and services

- Manages administrative duties assigned by the manager in an effective and timely manner

6. SWOT Analysis

Our intention of starting our automated teller machine (ATM) business with a dozen machines installed in strategic locations around Santa Fe – New Mexico is to test run the business for a period of 3 to 6 months to know if we will invest more money, expand the business and then install more machines.

We are aware that there are several ATM machines in Santa Fe – New Mexico and even in the same locations where we intend installing ours, which is why we are following the due process of establishing a business.

We know that if a proper SWOT analysis is conducted for our business, we will be able to position our business to maximize our strength, leverage on the opportunities that will be available to us, mitigate our risks and be equipped to confront our threats.

Fin Tech® ATM Services, Inc. employed the services of an expert HR and Business Analyst with bias in retailing to help us conduct a thorough SWOT analysis and to help us create a Business model that will help us achieve our business goals and objectives. This is the summary of the SWOT analysis that was conducted for Fin Tech® ATM Services, Inc.;

The strategic locations we intend installing our ATM machines, the business model we will be operating on, wide range of functions in our ATM machines, competent team members and our excellent customer service culture will definitely count as a strong strength for Fin Tech® ATM Services, Inc.

A major weakness that may count against us is the fact that we are a new automated teller machine (ATM) business and we don’t have the financial capacity to compete with older independent ATM companies when it comes to spread.

- Opportunities:

The fact that we are going to install our ATM machines in some of the busiest streets in Santa Fe – New Mexico, provides us with unlimited opportunities to reach out to a large number of people who are likely going to make use of our ATM machines.

We have been able to conduct thorough feasibility studies and market survey and we know what our potential clients will be looking for when they visit our ATM locations; we are well positioned to take on the opportunities that will come our way.

Just like any other business, one of the major threats that we are likely going to face is economic downturn. It is a fact that economic downturn affects purchasing power which will ultimately affect ATM transactions. Some other threats that may likely confront us is the arrival of a new ATM machine in same location where ours is located and also down time due to technical problems from our technical partners.

7. MARKET ANALYSIS

- Market Trends

The recent trend in this line of business shows that the price of ATM network services has been increasing at an estimated annualized rate of 1.0 percent in the three years to 2017. Greater demand for services and a lack of competition have facilitated this upturn in service prices.

Still, a decline in some of vendors’ input costs has tempered the magnitude of growth in rates for services. Meanwhile, price volatility has been low in recent time. External factors such as demand from commercial banking and consumer spending will impact industry performance.

It is now a common phenomenon for ATM machines companies to leverage on technology to effectively predict consumer demand patterns and to strategically position their ATM machines to meet their needs; in essence, the use of technology helps ATM machine businesses to maximize supply chain efficiencies.

No doubt data collected from customers goes a long way to help automated teller machine businesses serve their customers better.

8. Our Target Market

Perhaps the ATM machines business has the widest range of customers; everybody who owns a bank account has one or more things that they would need in an ATM machine. It is difficult to find people who own bank account and ATM cards who don’t make use of ATM machines.

Our competitive advantage

The competition that exists in the automated teller machine line of business is stiff because anyone can start the business despite the fact that it can be financial demanding. The automated teller machine (ATM) business requires expertise and any serious minded entrepreneur is likely to make good profit out of it.

One thing is certain, we will ensure that we have a wide range of services available in our ATM machines at all times. It will be difficult for customers to visit our ATM machines and not see the product that they are looking for. One of our business goal is to make Fin Tech® ATM Services, Inc. a one stop ATM machine.

We can boast of our ability to quickly adopt new technology, effective cost controls and proximity to key markets. So also, our excellent customer service culture, highly competitive services, reliable and easy to use automated teller machines and the visibility of our ATM machines and competent team members will serve as a competitive advantage for us.

9. SALES AND MARKETING STRATEGY

- Sources of Income

Fin Tech® ATM Services, Inc. is established with the aim of maximizing profits in the automated teller machine line of business and we are going to go all the way to ensure that we do all it takes to sell our services to a wide range of customers.

Fin Tech® ATM Services, Inc. will generate income by offering the following services via our automated teller machines (ATM);

10. Sales Forecast

One thing is certain when it comes to automated teller machine (ATM) business, if your machines can perform a wide variety of services and are centrally positioned, you will always attract customers cum sales and that will sure translate to increase in revenue generation for the business.

We are well positioned to take on the available market in Santa Fe – New Mexico and we are quite optimistic that we will meet our set target of generating enough income/profits from the first six months of operation and grow the business and our clientele base.

We have been able to critically examine the automated teller machine industry, we have analyzed our chances in the industry and we have been able to come up with the following sales forecast. The sales projection is based on information gathered on the field and some assumptions that are peculiar to startups in Santa Fe – New Mexico.

Below are the sales projections for Fin Tech® ATM Services, Inc., it is based on the location of our business and other factors as it relates to automated teller machine (ATM) services startups in the United States;

- First Year: $240,000

- Second Year: $550,000

- Third Year: $950,000

N.B : This projection was done based on what is obtainable in the industry and with the assumption that there won’t be any major economic meltdown and or major competitors positioning their ATM machines in same locations where ours are. Please note that the above projection might be lower and at the same time it might be higher.

- Marketing Strategy and Sales Strategy

Before choosing locations to install our ATM machines, we conducted a thorough market survey and feasibility studies in order for us to penetrate the available market and become the preferred choice for residents of Santa Fe – New Mexico.

We hired experts who have good understanding of the industry to help us develop marketing strategies that will help us achieve our business goal of winning a larger percentage of the available market in Santa Fe – New Mexico and every other city we intend installing our ATM machines.

In summary, Fin Tech® ATM Services, Inc. will adopt the following sales and marketing approach to win customers over;

- Give our ATM machines a unique look, by painting them with bright colors or putting a large neon sign on it, so that it is easily recognizable to customers.

- Creates a basic website for our business, so as to give our business an online presence (list the locations of our ATM machines)

- Joins local independent automated teller machine associations for industry trends and tips

11. Publicity and Advertising Strategy

Despite the fact that our ATM machines will be well located, we will still go ahead to intensify publicity for the business. We are going to explore all available means to promote our automated teller machine (ATM) business.

Fin Tech® ATM Services, Inc. has a long term plan of installing our ATM machines in various locations in major cities in the United States of America which is why we will deliberately build our brand to be well accepted in Santa Fe – New Mexico before venturing out.

Here are the platforms we intend leveraging on to promote and advertise Fin Tech® ATM Services, Inc.;

- Sponsor relevant community programs

- Distribute our fliers and handbills in target areas

- Position our Flexi Banners at strategic positions in the location where our ATM machines are located.

12. Our Pricing Strategy

We will ensure that we conform to the price model as established by the regulatory body in the United States of America.

- Payment Options

Due to the nature of ATM machines, there are no options when it comes to payment for services other than to insert your ATM card in the ATM machine and then the machine will dispense cash or provide the information or services you requested for. We will make money from the service charge per transaction.

13. Startup Expenditure (Budget)

When it comes to starting an automated teller machine (ATM) business, the major areas you would spend the bulk of your cash is in the purchase of ATM machines, loading the ATM machines with cash and of course renting or leasing warehouse facility.

Aside from that, you are not expected to spend much except for paying of your employees, and the purchase of vans. These are the key areas where we will spend our startup capital;

- The total fee for registering the business in the United States of America – $750.

- Legal expenses for obtaining licenses and permits as well as the accounting services (software, P.O.S machines and other software) – $1,300.

- Marketing promotion expenses for flyer printing (2,000 flyers at $0.04 per copy) for the total amount of $3,580.

- The cost for hiring Business Consultant – $2,500.

- Insurance ( general liability , workers’ compensation and property casualty) coverage at a total premium – $2,400.

- Cost for payment of rent for 12 months at $1.76 per square feet in the total amount of $105,600.

- Cost for Warehouse remodeling (construction of racks and shelves) – $20,000.

- Other start-up expenses including stationery ( $500 ) and phone and utility deposits – ( $2,500 ).

- Operational cost for the first 3 months (salaries of employees, payments of bills et al) – $60,000

- The cost for the purchase of ATM machines – $25,000

- The cost for the purchase of 2 fairly used delivery vans- $20,000

- Cost of purchase and installation of CCTVs: $10,000

- The cost for the purchase of furniture and gadgets for the office (Computers, Printers, Telephone, TVs, Sound System, tables and chairs et al): $50,000.

- The cost of launching a website: $600

- Miscellaneous: $10,000

We would need an estimate of five hundred thousand dollars ($500,000) excluding the working capital to successfully set up our automated teller machine (ATM) business in Santa Fe – New Mexico. Our target working capital is five hundred thousand dollars ( 500,000 ) and that is what we intend loading in our various ATM machines.

Generating Startup Capital for Fin Tech® ATM Services, Inc.

Fin Tech® ATM Services, Inc. is a family registered business that is owned and financed by Lawrence Mullen and his immediate family members. They do not intend to welcome any external business partners which is why he has decided to restrict the sourcing of the startup capital to 3 major sources.

- Generate part of the startup capital from personal savings

- Source for soft loans from family members and friends

- Apply for loan from the bank

N.B: We have been able to generate about $200,000 ( Personal savings $150,000 and soft loan from family members $50,000 ) and we are at the final stages of obtaining a loan facility of $800,000 from our bank. All the papers and documents have been signed and submitted, the loan has been approved and any moment from now our account will be credited with the amount.

14. Sustainability and Expansion Strategy

It is an established fact that the future of a business lies in the number of loyal customers that they have, the capacity and competence of their employees, their investment strategy and the business structure. If all of these factors are missing from a business, then it won’t be too long before the business closes shop.

One of our most important goals of starting Fin Tech® ATM Services, Inc. is to build a business that will survive off its own cash flow without the need for injecting finance from external sources once the business is officially running.

We know that one of the ways of gaining approval and winning customers over is to offer our services (services charges) a little bit cheaper than what is obtainable in the market and we are prepared to survive on lower profit margin for a while.

Fin Tech® ATM Services, Inc. will make sure that the right foundation, structures and processes are put in place to ensure that our staff welfare are well taken of. Our company’s corporate culture is designed to drive our business to greater heights and training and retraining of our workforce is at the top burner.

As a matter of fact, profit-sharing arrangement will be made available to all our management staff and it will be based on their performance for a period of three years or more. We know that if that is put in place, we will be able to successfully hire and retain the best hands we can get in the industry; they will be more committed to help us build the business of our dreams.

Check List/Milestone

- Business Name Availability Check: Completed

- Business Registration: Completed

- Opening of Corporate Bank Accounts: Completed

- Securing ATM machines: In Progress

- Opening Mobile Money Accounts: Completed

- Opening Online Payment Platforms: Completed

- Application and Obtaining Tax Payer’s ID: In Progress

- Application for business license and permit: Completed

- Purchase of Insurance for the Business: Completed

- Leasing of facility for warehouse and remodeling: In Progress

- Conducting Feasibility Studies: Completed

- Generating capital from family members: Completed

- Applications for Loan from the bank: In Progress

- Writing of Business Plan: Completed

- Drafting of Employee’s Handbook: Completed

- Drafting of Contract Documents and other relevant Legal Documents: In Progress

- Design of The Company’s Logo: Completed

- Printing of Promotional Materials: In Progress

- Recruitment of employees: In Progress

- Purchase of the Needed furniture, racks, shelves, computers, electronic appliances, office appliances and CCTV: In progress

- Creating Official Website for the Company: In Progress

- Creating Awareness for the business both online and around the community: In Progress

- Health and Safety and Fire Safety Arrangement (License): Secured

- Establishing business relationship with banks and vendors – suppliers of all our needed products and ATM machines: In Progress

ATM Business Plan Template

Written by Dave Lavinsky

ATM Business Plan

You’ve come to the right place to create your ATM business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their ATM businesses.

Below is a template to help you create each section of your ATM business plan.

Executive Summary

Business overview.

SecureVault ATM Company is a startup ATM machine business located in Santa Cruz, California. The company is founded by Lacie Bryon, a vending machine manager who owns multiple machines throughout the city of Santa Cruz. She has built excellent relationships with the business owners from whom she rents space and electricity and, as a result, has several offers to place her ATM machines in the current locations where her name and reputation precedes her.

SecureVault ATM Company will provide reliable and secure ATM services to customers while creating mutually beneficial relationships with the location providers. There is an increased drive by consumers for cash and SecureVault ATM Company plans to build profit from that increase, particularly as the business grows. All SecureVault ATM machines will be in convenient and easily accessible locations, making it especially easy for consumers to access the ATM machines and return to it whenever needed.

Product Offering

The following are the services that SecureVault ATM Company will provide:

- Convenient and secure ATM cash withdrawals

- ATM cash machine services for tourists and out-of-country visitors

- Bank deposits that will transact within 24 hours

- Secure video panels and safety mechanisms within the machines ensure secure and safe transactions

- Proprietary app “ATM @My Location,” quickly sources and offers driving instructions to the nearest available ATM within the SecureVault ATM machines in the region

- Secure account information printouts with receipts

- Day to day management of ATM locations to maintain clean machines and surrounding areas

Customer Focus

SecureVault ATM Company will target residents of Santa Cruz. They will also target visitors from the U.S. and international visitors within the popular beach city. They will target business owners who are interested in partnerships built via the ATM machine locations. They will target businesses who will want to market services or products via the ATM app.

Management Team

SecureVault ATM Company will be owned and operated by Lacie Byron, a vending machine entrepreneur who owns multiple vending machines throughout the city of Santa Cruz. She has recruited her virtual assistant, Kayleigh Thompson, to join the startup on-site.

Lacie Byron has been a self-employed entrepreneur for over fifteen years. She has built excellent relationships with the business owners from whom she rents space and electricity and, as a result, has several offers to place her ATM machines in the current vending locations where her name and reputation precede her.

Kayleigh Thompson, the former virtual assistant, will join SecureVault ATM Company as an Administrative Assistant on-site. She will oversee all day-to-day administrative tasks. She will also be on-call for ATM emergencies 24/7 each day.

Success Factors

SecureVault ATM Company will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly-qualified team of SecureVault ATM Company

- Secure ATM machines that accept out-of-country debit and credit cards

- SecureVault ATM Company creates partnerships with area businesses with the intention of building up both businesses and creating mutually beneficial profitability.

Financial Highlights

SecureVault ATM Company is seeking $200,000 in debt financing to launch its SecureVault ATM Company. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and marketing costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

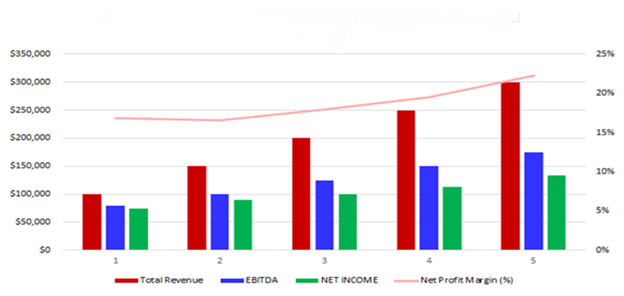

The following graph outlines the financial projections for SecureVault ATM Company.

Company Overview

Who is securevault atm company.

SecureVault ATM Company is a newly established, full-service ATM machine business in Santa Cruz, California. SecureVault ATM Company will be the most reliable, secure and convenient choice for residents, visitors and tourists from out of the country, as well as those from the surrounding communities. SecureVault ATM Company will provide a comprehensive menu of ATM choices and services for any customer to utilize. Their full-service approach includes a comprehensive set of options for cash withdrawals, deposits and other banking transactions.

SecureVault ATM Company will be able to serve hundreds of customers on a regular basis. The team of professionals in SecureVault ATM Company are highly qualified and experienced and each member of the team is trained to easily serve customers. SecureVault ATM Company removes all the headaches and issues of trying to find an ATM machine, particularly in an unfamiliar city, and ensures all issues are taken care of expeditiously while delivering the best customer service.

SecureVault ATM Company History

SecureVault ATM Company is owned and operated by Lacie Bryon, a vending machine entrepreneur who operates multiple vending machines throughout the city of Santa Cruz. She has been in business for over 15 years and has built excellent relationships with the business owners from whom she rents space and electricity and, as a result, has several offers to place her ATM machines in the current locations where her name and reputation precede her.

Since incorporation, SecureVault ATM Company has achieved the following milestones:

- Registered SecureVault ATM Company, LLC to transact business in the state of California.

- Has a contract in place for a 10,000 square foot office in a midtown building.

- Reached out to numerous contacts to include SecureVault ATM Company in their current and future location plans.

- Began recruiting a staff of three and two office personnel to work at SecureVault ATM Company.

SecureVault ATM Company Services

The following will be the services SecureVault ATM Company will provide:

Industry Analysis

The ATM machine industry is expected to grow during the next five years to over $30 million. The growth will be driven by ATM machines placed in new locations, particularly as new communities form. The growth will also be driven by new industries or sectors that conduct business in rapidly-growing cities. The growth will be driven by entrepreneurs who prefer to own and operate a business without an employer or oversight by others. Costs will likely be reduced as ATM partnerships share the costs on a more equitable level of a 50/50 split. Costs will also be reduced as new technology paves the way for improvements to ATM servicing capabilities.

Customer Analysis

Demographic profile of target market, customer segmentation.

SecureVault ATM Company will primarily target the following customer profiles:

- Residents of Santa Cruz

- U.S. visitors and international tourists

- Potential business partners for ATM placement/services

- Potential business partners who will market their business via the ATM app

Competitive Analysis

Direct and indirect competitors.

SecureVault ATM Company will face competition from other companies with similar business profiles. A description of each competitor company is below.

Quick Cash Company

Quick Cash Company provides ATM machine access throughout the Santa Cruz and Highway 1 Corridor. ATM machines are located within strip malls and adjacent to laundry facilities. The ATM machines provide cash in twenty-dollar increments up to a value of $200. The ATM machines do not accept bank deposits, nor do the ATMs accept cash deposits. There are no receipts provided. Quick Cash Company is owned and operated by Gerrie and Sandy Doney, entrepreneurs who have been in the ATM business for over ten years. The ATM machines provided by Quick Cash Company are utilized heavily near the beach amusement park area and are also popular near the southern beach portion of the Santa Cruz city. Quick Cash Company has a singular goal: that of providing cash; all other transactions are omitted from the services provided.

MoneyLink ATM Services

MoneyLink ATM Services is bank-owned and operated as a convenience for the customers of the Redwood Bank. The day-to-day management of the ATM machines owned is contracted out to a security company that refills the ATM machines with cash on a regular basis and maintains the ATM machines as needed. The Redwood Bank provides services for customers of the bank, including conducting transactions if cash or checks are deposited and paying out up to $400 if the withdrawals are from a bank customer.

MoneyLink ATM Services operates 10 ATM machines in various parts of the city of Santa Cruz, with two ATM machines near tourist shops and mini-mall stores in the downtown area of the city. The ATM servicing company maintains the ATM machine by filling them with cash as needed; however there is no cleaning of the areas around the machines, nor cleaning of the machines themselves. There are no services offered at the ATM machines, other than withdrawals and deposits.

Harrison & Company

Harrison & Company is a legal limited liability company formed between four brothers who own and operate ATM and vending machines throughout the Santa Barbara, California area. They recently expanded their business to include Santa Cruz and other beach areas. There are twenty food vending machines in the business and 15 cash vending machines within the company, each serviced and maintained by the siblings in Harrison & Company.

The food vending machines owned by Harrison & Company are located primarily in strip malls and convenience stores, where visitors can access easy and convenient cash. Harrison & Company carefully evaluates each suggested location before placing a vending or ATM machine on any site, due to the increased risk of theft or other invasive tactics by unscrupulous visitors. Harrison & Company maintain the ATM machines and food vending machines on a daily basis and have created strong and lasting partnerships with other businesses in the area in order to secure the prime locations for their machines.

Competitive Advantage

SecureVault ATM Company will be able to offer the following advantages over their competition:

- SecureVault ATM Company creates partnerships with area businesses with the intention of building up both businesses and creating mutually beneficial profitability

Marketing Plan

Brand & value proposition.

SecureVault ATM Company will offer the unique value proposition to its clientele:

- Highly-qualified team of skilled employees who are able to provide a comprehensive array of services and cash products to consumers.

- SecureVault ATM Company offers reasonable partnership value and steady income levels for partners.

Promotions Strategy

The promotions strategy for SecureVault ATM Company is as follows:

Word of Mouth/Referrals

SecureVault ATM Company has built up an extensive list of contacts over the years by providing exceptional service and expertise to her clients. Current partners and potential partners are eager to take part in the relationships of SecureVault ATM Company and help spread the word of SecureVault ATM Company.

Digital Advertising

SecureVault ATM Company will contract with a digital marketing expert to access local and regional marketing campaigns.

Social Media Campaign

SecureVault ATM Company will also contract with a social media manager to announce the launch via a series of call outs across several channels to build up to the launch date. ATM locations and specifics of the services offered will be included in the social media campaign efforts.

Print Advertising

SecureVault ATM Company will secure local newspaper ads to announce the new ATM machines in the targeted communities and regional areas. They will also send a direct mail targeted flyer to all residents within Santa Cruz county.

Website/SEO Marketing

SecureVault ATM Company will fully utilize their website. The website will be well organized, informative, and list all the services and products that SecureVault ATM Company provides. The website will list their contact information and will engage in SEO marketing tactics so that anytime someone types in the Google or Bing search engine “ATM machine that accepts international debit and credit cards” or “ATM machine near me”, SecureVault ATM Company will be listed at the top of the search results.

The pricing of SecureVault ATM Company will be moderate and on par with competitors so customers feel they receive excellent value when purchasing their services.

Operations Plan

The following will be the operations plan for SecureVault ATM Company. Operation Functions:

- Lacie Byron will be the Owner and President of the company. She will oversee all staff and manage partners and new partnership relations. She has spent the past year recruiting the following staff:

- Kayleigh Thompson, who will take on the role of Administrative Assistant and manage the office administration and act as the emergency contact.

Milestones:

SecureVault ATM Company will have the following milestones completed in the next six months.

- 5/1/202X – Finalize contract to lease office space

- 5/15/202X – Finalize personnel employment contracts for the SecureVault ATM Company

- 6/1/202X – Finalize contracts for SecureVault ATM Company partnerships

- 6/15/202X – Begin networking to find potential partners and ATM locations

- 6/22/202X – Begin moving into the SecureVault ATM Company office

- 7/1/202X – SecureVault ATM Company opens its office for business

Financial Plan

Key revenue & costs.

The revenue drivers for SecureVault ATM Company are the fees they will charge to customers for the usage of their ATM services.

The cost drivers will be the overhead costs required in order to staff SecureVault ATM Company. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

SecureVault ATM Company is seeking $200,000 in debt financing to launch its ATM machine business. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and association memberships. The breakout of the funding is below:

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of ATM Customers Per Month: 1,600

- Average Revenue per Month: $56,500

- Office Lease per Year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, atm business plan faqs, what is an atm business plan.

An ATM business plan is a plan to start and/or grow your ATM business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your ATM business plan using our ATM Business Plan Template here .

What are the Main Types of ATM Businesses?

There are a number of different kinds of ATM businesses , some examples include: Independent ATM owner/operator, Mobile ATM, Bitcoin ATM, and ATM installation and maintenance.

How Do You Get Funding for Your ATM Business Plan?

ATM businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start an ATM Business?

Starting an ATM business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An ATM Business Plan - The first step in starting a business is to create a detailed ATM business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your ATM business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your ATM business is in compliance with local laws.

3. Register Your ATM Business - Once you have chosen a legal structure, the next step is to register your ATM business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your ATM business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary ATM Equipment & Supplies - In order to start your ATM business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your ATM business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful ATM business:

- How to Start an ATM Business

Need a consultation? Call now:

Talk to our experts:

- Strategic Planning

- E1 Treaty Trader Visa

- E2 Treaty Investor Visa

- Innovator Founder Visa

- UK Start-Up Visa

- UK Expansion Worker Visa

- Manitoba MPNP Visa

- Start-Up Visa

- Nova Scotia NSNP Visa

- British Columbia BC PNP Visa

- Self-Employed Visa

- OINP Entrepreneur Stream

- LMIA Owner Operator

- ICT Work Permit

- LMIA Mobility Program – C11 Entrepreneur

- USMCA (ex-NAFTA)

- Online Boutique

- Mobile Application

- Food Delivery

- Real Estate

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- Business Valuation

- How it works

- Business Plan Templates

How to Start an ATM Business With a Business Plan

Published Jan.26, 2024

Updated Sep.14, 2024

By: Noor Muhammad

Average rating 5 / 5. Vote count: 8

No votes so far! Be the first to rate this post.

Table of Content

An ATM business is a type of business that operates and owns automated teller machines that dispense cash and offer other banking services to customers. Customers find ATMs easy and dependable to get cash from, and business owners can earn extra money from transaction fees and ads. But to start an ATM business, you need to plan, research, and invest in how to run an ATM if you’re an ATM business beginner. This ATM business plan sample will provide an idea for writing a successful ATM plan.

How to Write a Business Plan For an ATM Business

A business plan is a roadmap that explains how to start an ATM business step by step. A business plan like a microfinance business plan lays out what you want to achieve, how to set up an ATM, and the strategies. So, whether you are looking to secure funding or keep tabs on your progress, a solid business plan is the key.

Your ATM machine business plan should explain how to start an ATM business with no money and cover the following sections:

- Executive Summary – A brief overview of your entire business plan, highlighting the key points and the primary purpose of your ATM business. Should make the reader curious, and tell your business idea, market chance, edge over others, money highlights, and pros and cons of the ATM business.

- Company Overview – A full explanation of starting an ATM business, with its past, mission, vision, values, goals, and objectives. Should also have information about your ATM business license, legal form, owners, managers, and place, as explained in our collection agency business plan .

- Market Analysis – A complete study of the market you work in, with the industry changes, size, growth, and future. Should study the customer groups, needs, likes, and actions, as well as the competition, strengths, weaknesses, chances, and risks.

- Business Strategy – A clear explanation of how you will operate your ATM business, including your business model, your value proposition, your revenue streams, your cost structure, your pricing strategy, your distribution strategy, your customer service strategy, and your risk management strategy.

- Financial Plan – A projection of your business’s financial performance, including your income statement, balance sheet, cash flow statement, break-even analysis, and financial ratios. It should also include your funding requirements, your sources of funding, and your assumptions and estimates. For example, refer to our credit repair business plan .

- Marketing Plan – A detailed plan of how you will promote and market your business, including your marketing objectives, your marketing strategy, your marketing mix, your marketing budget, and your marketing metrics.

What is the Growth Potential for an ATM Business?

According to a report by Grand View Research, the global ATM market size reached USD 22.80 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.0% from 2023 to 2030.

Image Source – Grand View Research

Here’s some more intriguing insight that shows the growing ATM market:

- There are around 3.5 million ATMs installed worldwide.

- The total number of active ATMs in the US is between 520,000 and 540,000.

- The average withdrawal at an ATM amounts to around $80. (Source – Astute Analytica )

More and more people want automation, convenience, and security in the banking sector, especially in countries like China and India. This makes the industry grow. Also, new technologies, such as biometric authentication, smart ATMs, and mobile ATMs, can create more chances for the industry.

How much an ATM business can grow depends on many things, such as the place, the customers, the competitors, the number of transactions, the transaction fee, and the costs of running the business. Usually, an ATM business can profit 15% to 40% based on the number of machines, the number of transactions, and the bank business plan . But an ATM business also has problems, such as security risks, rules to follow, and costs of keeping and filling them.

Composition of an ATM Business Plan

To illustrate the composition of a business plan for ATM machines, we will use a sample ATM business plan for a fictional ATM business start-up called CashZone. CashZone is an independent ATM deployer (IAD) that operates and owns a network of ATMs in Florida. CashZone offers cash withdrawal, fund transfer, bill payment, and mobile top-up services. CashZone generates revenue from surcharge fees, interchange fees, and advertising fees.

Here is the company overview section of CashZone’s business plan that will explain how to start an ATM business in Florida:

Company Overview

CashZone is a start-up company that operates and owns ATMs in Florida. CashZone was founded in 2023 by Alex Right and Lucie Haynes, two entrepreneurs with experience and expertise in the ATM and banking industry. CashZone is registered as a limited liability company (LLC) in Florida and operates under the trade name CashZone Services.

CashZone wants to give customers easy, dependable, and safe cash access and make extra money for the business owners. CashZone wants to be the best ATM owner and operator in Florida, with top-quality machines having new features and functions and good advertising chances for local businesses.

CashZone’s goals and objectives are to:

- Start its ATM business in 2024, starting with 10 machines in strategic locations in Florida.

- Expand its ATM network to 50 machines by 2026, covering more areas and customer segments in Florida.

- Achieve a market share of 10% in the industry in Florida by 2026.

- Generate USD 500,000 in revenue and USD 100,000 in net profit by 2026. Refer to our financial advisor business plan to learn more.

- Establish strategic partnerships and alliances with local businesses and financial institutions to increase its customer base and market share.

CashZone’s management team and staff consist of:

- Alex Right, Co-Founder, and CEO, oversees strategy and vision with 10+ years in banking. Has an MBA and bachelor’s in business.

- Lucie Haynes, Co-Founder and COO, manages daily operations and supervision with 8+ years in banking. Has a bachelor’s in engineering and ATM certification.

- Chang Lee, CFO, handles financial planning, analysis, and reporting with 6+ years in accounting and finance. Has a bachelor’s in accounting and is a licensed CPA.

- Lisa Kirk, CMO, leads marketing and sales with 5+ years in marketing and advertising. Has a bachelor’s in marketing and digital marketing certificate.

- Tom Smith, CTO, oversees technology and innovation with 4+ years in IT and software. Has a bachelor’s in computer science and a software/security certificate.

- 5 ATM operators and technicians maintain and repair machines, load cash, and reconcile. Have ATM operations experience and training.

Keys to Success

The keys to success for CashZone are:

- Providing high-quality ATM machines that are secure, reliable, and user-friendly.

- Choosing strategic locations with high traffic, visibility, and demand for ATM services.

- Offering competitive surcharge fees that are affordable for customers and profitable for the business.

- Building a strong relationship with customers.

- Leveraging technology and innovation to enhance the functionality and efficiency of the ATMs.

- Marketing and branding the business effectively to attract and retain customers.

Industry Analysis

The ATM industry is a large and growing industry. ATMs provide cash and convenience services to millions of customers worldwide. According to Market Research Community, ATM Market size was worth USD 21.41 Billion in 2022, accounting for a CAGR of 4.8% during the forecast period (2023-2030), and is projected to be worth USD 32.65 Billion by 2030.

Image Source – Market Research Community

ATMs are very popular and widely used in the US. But the US ATM market also has some problems, like less people using cash, more people using digital payments, too many ATMs in some places, and higher costs and risks of running ATMs.

CashZone ATM wants to serve the people of Florida, who are about 22 million in 2024. Florida is a big and diverse state in the US, where many people need cash and convenient services. Florida is an appropriate place to do business because of:

- Flexible rules

- Affordable expenses

- Strong economy

- Great infrastructure

- Booming tourism industry.

CashZone ATM’s target market segments are:

- Tourists – Florida is a popular tourist destination. Florida received approximately 137.6 million visitors in 2022 (Source – Visit Florida). Cash is helpful for tourists who want to give tips, go street shopping, try local food, and have fun. They also like ATMs that are easy to use, trustworthy, and safe and have options for different languages, money types, and cash amounts.

- Retirees – Florida is a retirement haven, hosting over 4.2 million seniors (20.1%) aged 65 and above (Source – Consumer Affairs). Retirees need cash for paying day-to-day bills, meeting medical expenses, shopping for groceries, etc. Retirees also prefer ATMs that are accessible, easy to use, and safe, as well as offer features such as big fonts, voice guidance, and fraud prevention.

- Immigrants – Florida is a melting pot of cultures, with over 4.6 million foreign immigrants (21.2%) living in Florida (Source – Migration Policy Institute). Immigrants spend cash on things like sending money home, buying what they need, and more. Immigrants also prefer ATMs that are multilingual, multicultural, and affordable, as well as offer features such as currency conversion, money transfer, and low fees.

- Low-income households – Florida is a state with high poverty and income inequality. According to U.S. Census Bureau data, over 2.87 million (12.7%) people are living in poverty in Florida. Low-income households need cash for various purposes, such as paying rent, utilities, transportation, etc. Low-income households also prefer ATMs that are convenient, reliable, and economical, as well as offer features such as no minimum balance, no surcharge, and no overdraft.

Your ATM Marketing Strategy

The marketing strategy section of CashZone’s business plan should include the following information:

- The marketing objectives, such as increasing brand awareness, customer acquisition, customer retention, and revenue growth.

- The marketing mix, such as the product, price, place, and promotion strategies for the ATM business.

- The marketing budget, such as the allocation of funds for each marketing channel, method, and tool.

- The marketing metrics, such as the key performance indicators (KPIs) and targets for measuring the effectiveness and efficiency of the marketing strategy.

For example, CashZone’s marketing strategy can be summarized as follows:

Marketing Objective

CashZone aims to increase the number of customers and transactions by 20% in the first year of operation.

Marketing Mix

- Product – ATMs with cash withdrawal, fund transfer, bill payment, and mobile top-up. ATMs have biometric authentication, mobile integration, and smart features.

- Price – $2.50 surcharge fee per transaction. Interchange fees from banks and advertising fees from merchants and advertisers.

- Place – 50 ATMs in Florida at gas stations, convenience stores, shopping malls, and hotels. High traffic, visibility, and demand.

- Promotion – Online advertising, social media, flyers, referrals, and word-of-mouth. Discounts, coupons, and loyalty programs for customers and merchants.

Marketing Budget

$10,000 for the first year of operation, which is allocated as follows:

- Online advertising – $4,000 for Google Ads, Facebook Ads, and Instagram Ads, targeting customers by location, demographics, interests, and behaviors.

- Social media – $2,000 for Facebook and Instagram, posting content and engaging with followers and customers.

- Flyers – $1,000 for printing and distributing 10,000 flyers, featuring CashZone’s logo, slogan, services, locations, and contact information.

- Referrals – $1,000 for a referral program, where customers and merchants earn $10 for each referral.

- Word-of-mouth – $2,000 for building a positive reputation and image by providing excellent service, quality ATMs, and competitive prices.

Marketing Metrics

- Brand awareness – The percentage of potential customers and merchants aware of CashZone and its services, measured by online impressions, social media followers, and flyer distribution.

- Customer acquisition – The number of new customers who use CashZone’s ATMs, measured by the number of transactions, surcharge fees, and interchange fees.

- Customer retention – The number of repeat customers who use CashZone’s ATMs, measured by the frequency of transactions, loyalty program enrollment, and referral program participation.

- Revenue growth – The increase in the total revenue of CashZone, measured by the sum of surcharge fees, interchange fees, and advertising fees.

OGSCapital for Your ATM Business Plan

If you are confused about how to make an ATM business plan and looking for a professional and reliable business plan service, you have come to the right place. At OGSCapital, we have a team of experienced and qualified business plan consultants who can help you understand how to start an ATM machine business with our ATM business plan and related consultation services. We have been experts in making business plans for more than 17 years, and we have helped over 5,000 clients from 42+ industries get over $2.7 billion in money with our top-notch and tailored business plans.

We understand it’s a challenge of how to open an ATM business. We can help you create a strong and strategic business plan highlighting your benefits, market size, edge over competitors, and financial goals. We will also offer helpful tips and support on how to start and run an ATM business. No matter what your purpose is for having a business plan, we can make one that suits your requirements and expectations.

We have reasonable and flexible prices based on how challenging and urgent your project is. We ensure timely delivery, confidentiality, and quality of our work. Contact us today to get started!

Frequently Asked Questions

How much does it cost to start an ATM business?

Starting an ATM machine in the US costs between $1,200 for a used model to $3,000 for a new, freestanding machine. But that’s not all. Setting it up and maintaining it costs extra. Hence, expect to budget $2,000-$5,000 or more to start an ATM business when accounting for all costs.

Is it worth it to start an ATM business?

Are you confused about how to own an ATM machine for profit? ATM business profit in the US can be significant, with estimates of $450-$750 per month per machine. Starting ATMs in high-traffic areas can process over 800 transactions monthly, with potential gross profits of $6,624+ annually per machine. However, profitability depends on location, surcharge fees, and transaction volume.

Download ATM Business Plan Sample in pdf

OGSCapital’s team has assisted thousands of entrepreneurs with top-rated document, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

IMAGES

VIDEO

COMMENTS