We use cookies to ensure that you are getting the best experience on our site.

We never store personal data in cookies. If you'd like to you can read more about our cookie policy and privacy policy .

- Login MyCipfa

- Bulletins \

Valuation Office Agency issue business plan for 2021-2022

The Valuation Agency Office (VOA) has issued its business plan that sets out what it's going to be doing over the next year. The plan sets out the key activities they will be undertaking over the next year to help them achieve their strategic objectives, as well as their work to build capability and modernise the agency. The business plan includes a full list of success measures by which their performance can be monitored.

The VOA compile and maintain statutory lists of council tax bands for approximately 26 million domestic properties, enabling the collection of approximately £38 billion in council tax across England and Wales.

Related links

- Valuation Office Agency business plan 2021-2022

Webchat is available Monday to Friday, 09:00 - 17:00 (excluding UK bank holidays).

Blog Valuation Office Agency

https://valuationoffice.blog.gov.uk/2022/11/23/revaluation-2023-and-business-rates/

Revaluation 2023 and business rates

The Valuation Office Agency regularly updates the rateable values of all business, and other non-domestic, properties in England and Wales.

We do this to reflect changes in the property market. In turn, this helps ensure business rates bills are based on up-to-date information.

It also helps redistribute the amount paid in business rates more fairly. And helps ensure bills reflect relative changes across sectors and locations.

Local councils use the rateable value to calculate a property’s business rates bill.

We publish future valuations now, before they come into effect on 1 April next year, to:

- help businesses to plan

- give ratepayers another opportunity to check the details we hold for their property.

I really encourage people to use our Find a Business Rates Valuation Service on GOV.UK. If there is anything that is wrong or needs updating, let us know as soon as possible.

Rateable values

Rateable values are the open market annual rental value a property could have been let for at a certain date. In this case, that date is 1 April 2021.

A property’s rateable value is not the same as its business rates bill. Business rates bills are worked out by multiplying the rateable value by a ‘multiplier’ then applying any rates relief. This multiplier is set by central government.

Bills will also take into account any reliefs that a property is eligible for. In 2021-22, small business rates relief meant 740,000 business did not pay any business rates at all.

If the rateable value goes up, it does not necessarily mean that the business rates bill will go up by the same amount.

The overall picture

There are 2.14 million non-domestic properties in England and Wales. Together, these properties have a total rateable value of £70.3bn, compared with £6 5.7bn in 2017.

It has been six years since the last revaluation. The new rateable values will reflect changes in rental values between 2015 and 2021.

For most valuations we use rental values as the basis. So, if rents have gone up, then rateable values will go up. Likewise, if rents have decreased, so will rateable values.

We do not set the market with our valuations; we reflect what occupiers are paying in rent to use their premises.

The economic factors influencing rents vary by property market sectors and location. At a revaluation, it is normal to see different changes in rateable value for different types of properties and locations. Some sectors, properties and locations do better than others in the years between revaluation dates. These differences are reflected when a revaluation occurs.

We are moving to valuing properties more frequently, as pledged in the Business Rates Review. This will ensure that changes in economic conditions are fed through more rapidly into business rates liabilities. It will also be fairer as revaluations redistribute the overall level of business rates collected, reflecting changes in relative property values.

COVID-19 impact

I know many ratepayers will want to know how COVID-19 has been reflected in their valuation. Ministers chose 1 April 2021 as the date we based our valuations on for this reason. It means our valuations will reflect the impact COVID-19 had on rental values at that time.

In every sector there are likely to be individual properties that buck the trend. This may be down to the particular characteristics of that property and its location relative to other properties.

Changes in value across sectors

These are the headline figures for 2023, by sector, looking at the percentage change in rateable value by sub-sector for both England and Wales.

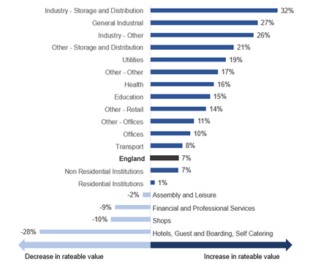

Here we can see the percentage change in rateable value by sub-sector for England:

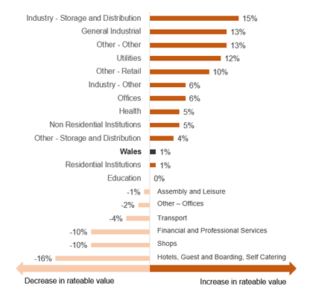

And for Wales, the percentage change in rateable value by sub-sector:

Of course, headline figures only ever tell part of the story.

Retail, pubs and hotels are some of the sectors where rateable values have generally decreased. The evidence we collected about rents in this market show COVID-19 had a big impact. In most cases this was greater than the growth in these sectors since the last valuation.

Here are some aspects of the revaluation that stand out to me.

Some retail sectors like shopping malls were already seeing a reduction in values, and the pandemic continued this trend. Overall, there has been a decrease in rateable value for retail properties.

But this is not universal across all retail sectors. There has been a general move to shopping locally in recent years. The evidence showed us that rents in neighbourhood parades and shops in many small-town centres and market towns or ‘staycation’ locations were stable. In some cases, they increased.

- In the 2023 list, the total rateable value is around £15bn, with approximately 517,000 properties.

- Retail properties have seen an average decrease in their rateable values of approximately 10%.

To support businesses facing changes in their bills, at the Autumn Statement the Chancellor announced a package of business rates support in England. This includes extending and expanding retail, hospitality and leisure relief. Read HMT’s business rates fact sheet for more information.

Pubs and leisure

Many licensed and leisure properties saw growth between 2015 and 2020 – but were then affected by the pandemic.

Some of these properties will see a reduction at revaluation and others will increase. Like for retail, this will depend on their location, and how much their growth between 2015 and 2020 was affected by the pandemic.

The VOA has agreed an adjustment for COVID-19 with representatives of the pub industry. This adjustment has been applied to each pub valuation. It acknowledges that, for many, it will take time for trade to bounce back.

A pub’s new rateable value will reflect growth in rent and turnover from 2015 to 2021. If that growth has been higher than the adjustment made for COVID-19, then the pub will see an increase in their rateable value.

- With approximately 42,000 properties (pubs, bars, pubs/restaurants), the current total rateable value for 2023 is £1.3bn.

- Pubs have seen an average decrease in their rateable values of approximately 17%.

Increasing costs

Properties that are valued using costs have seen their rateable values increase because building costs increased substantially between 2015 and 2021.

These increases reflect increased material and transportation costs. In fact, the Building Cost Information Service all-in Tender Price Index (TPI) shows a 21% increase in costs over the last six years. The TPI is a trusted measure of price movements in the construction industry. It shows the average increase in building costs. Cost increases could be higher depending on what materials are used and the type of building.

Specialised industrial properties are some that have been affected by this change, including steelworks, chemical works, cement works and breweries.

Warehouses and logistics

The demand for logistic properties such as warehouses has been growing for some time. There were steep increases in online shopping, even before the pandemic. This has driven demand for properties in the logistic sector.

Rents have increased significantly given this demand and the limited supply of this type of properties. Rateable values reflect this.

- In the 2023 list, the total rateable value is £2.43bn, with 1,550 properties.

- Distribution and logistics properties have seen an average increase in their rateable values of approximately 35%.

In this sector, London has seen the lowest increase in rateable values. The COVID-19 pandemic has had a large effect here. There were also higher increases in the East and South East, with the increases in the East driven by increases in value along M1/M25 corridor.

- In the 2023 list, the total rateable value is £16.3bn, with approximately 437,000 properties.

- Office properties have seen an average increase in their rateable values of approximately 10%.

Not all properties pay business rates

Around 1.5m properties in England and Wales have a rateable value which means they may qualify for small business rate relief. Find out more about business rates relief .

How we value

We use recognised valuation methods approved by the Royal Institution of Chartered Surveyors. These methods are used for many purposes, not just taxation.

They have been clarified and confirmed by decisions from the courts over many years. The methodology we use depends on the type of property, and the evidence available.

You can read more in our blog about the evidence we collect during revaluation.

More information

The VOA publishes official statistics on non-domestic rating, and you can read the full official statistics on revaluation 2023 . At this link you can find more information on the data shared in this article.

You can read more about what a revaluation is and what it means for businesses .

Tags: business rates , Revaluation

Sharing and comments

Share this page, related content and links, about this blog.

The Valuation Office Agency blog is a platform to share stories about our work and our people.

Sign up and manage updates

Recent posts.

- Council Tax: renovations and repairs May 8, 2024

- How we value: hotels April 24, 2024

- How to choose a business rates agent April 11, 2024

Comments and moderation

Read our guidelines.

PROPERTY JOURNAL

Revaluation 2023 and business rates

The Valuation Office Agency's Revaluation 2023 programme sets out new rateable values for business and related premises to reflect changes in the market since 2015. How will this affect you?

- Alan Colston MRICS

10 February 2023

Commercial property

Commercial valuation

At the Valuation Office Agency (VOA), we regularly update the rateable values of all business and other non-domestic properties in England and Wales to reflect changes in the property market. In turn, this helps ensure that business rates are based on up-to-date information.

The VOA revalued properties every five years from 1990 to 2010, then in 2017 and 2023. Proposed reforms are looking to move the revaluation cycle to every three years.

It also helps redistribute the amount paid in business rates more fairly and ensure that bills reflect relative changes across sectors and locations.

We have recently published the valuations for 2023 before they come into effect on 1 April, with the aim of:

- helping businesses to plan

- giving ratepayers another opportunity to check the details we hold for their properties.

We encourage those with a business property to use our online service, Find a business rates valuation , to check their property details now and get an estimate of what their rates will be.

How do rateable values relate to bills?

Rateable values represent the annual rental value a property could have been let for on the open market at a certain date; in this case, 1 April 2021.

Note that a property's rateable value is not the same as its business rates bill, although local authorities do use the former to calculate the latter. This is done by multiplying the rateable value by a factor set by central government, then applying any rates relief.

Bills will also take into account any reliefs for which a property is eligible. In 2021/22, small business rates relief meant that 740,000 businesses did not pay any rates at all.

Furthermore, if the rateable value goes up it does not necessarily mean that the business rates bill will go up by the same amount.

Increased overall value reflects market changes since 2015

There are 2.14m non-domestic properties in England and Wales. Together, these have a total rateable value of £70.3bn, compared with £65.7bn in 2017. This is a 7.1% increase in total rateable values in England and Wales.

Related article

Why business rates will be big concern in 2023

As it has been six years since the last revaluation, the new rateable values will reflect changes in rental values between 2015 and 2021. Most valuations are based on rental values, and if rents have gone up in that time then rateable values will also rise. Likewise, if rents have decreased, so will rateable values.

We do not set the market with our valuations; we reflect the rents being paid by occupiers. The economic factors influencing rents vary by property market sectors and location.

At a revaluation, it is therefore normal to see changes in rateable value differ according to property location and type. Some sectors, properties and places do better than others in the years between revaluation dates, and these differences are reflected in a revaluation.

To ensure that business rates liabilities more swiftly reflect changes in economic conditions, we are moving towards valuing properties more frequently, as the government stated in the October 2021 Business rates review . This will also mean the amounts paid will be fairer, as revaluations redistribute the overall level of business rates collected to reflect changes in relative property values.

Robust response to address pandemic impact

At each revaluation, we usually collect rental and other data over a two-year period around the valuation date. Ministers chose 1 April 2021 as the date in this instance due to the significant impact of the COVID-19 pandemic.

Market conditions on this date meant the evidence has been complex to analyse.

Nevertheless, we are confident that our valuations are robust. We had access to similar amounts of the best rental evidence – that is, evidence that more closely aligns with the statutory definition of rateable value – for this revaluation as for previous ones. And we have looked at more types of evidence than usual because of the market uncertainty caused by the pandemic.

In every sector, though, there are likely to be individual properties that buck the trend, perhaps as a result of their particular characteristics or their location relative to other properties.

RICS and business rates

The cost of business rates and their administration can be substantial, and the system is complex. RICS members play a key role across the business rates sector. They provide professional advice on establishing business rates liability and how assessments may be challenged, as well as members who work for the VOA compiling and maintaining rating lists. We also have members who work for local authorities and those who manage properties on behalf of businesses.

RICS supports the more frequent valuation policy referred to in the article and wider reform of the rating system.

Experts representing RICS and other professional bodies, including the Institute of Revenues Rating and Valuation and the Rating Surveyors' Association, make up the RICS Rating and Local Taxation Forum. The forum supports RICS on business rates matters.

Please contact Charles Golding at RICS with business rates queries related to RICS for any further information.

Value changes vary across sectors

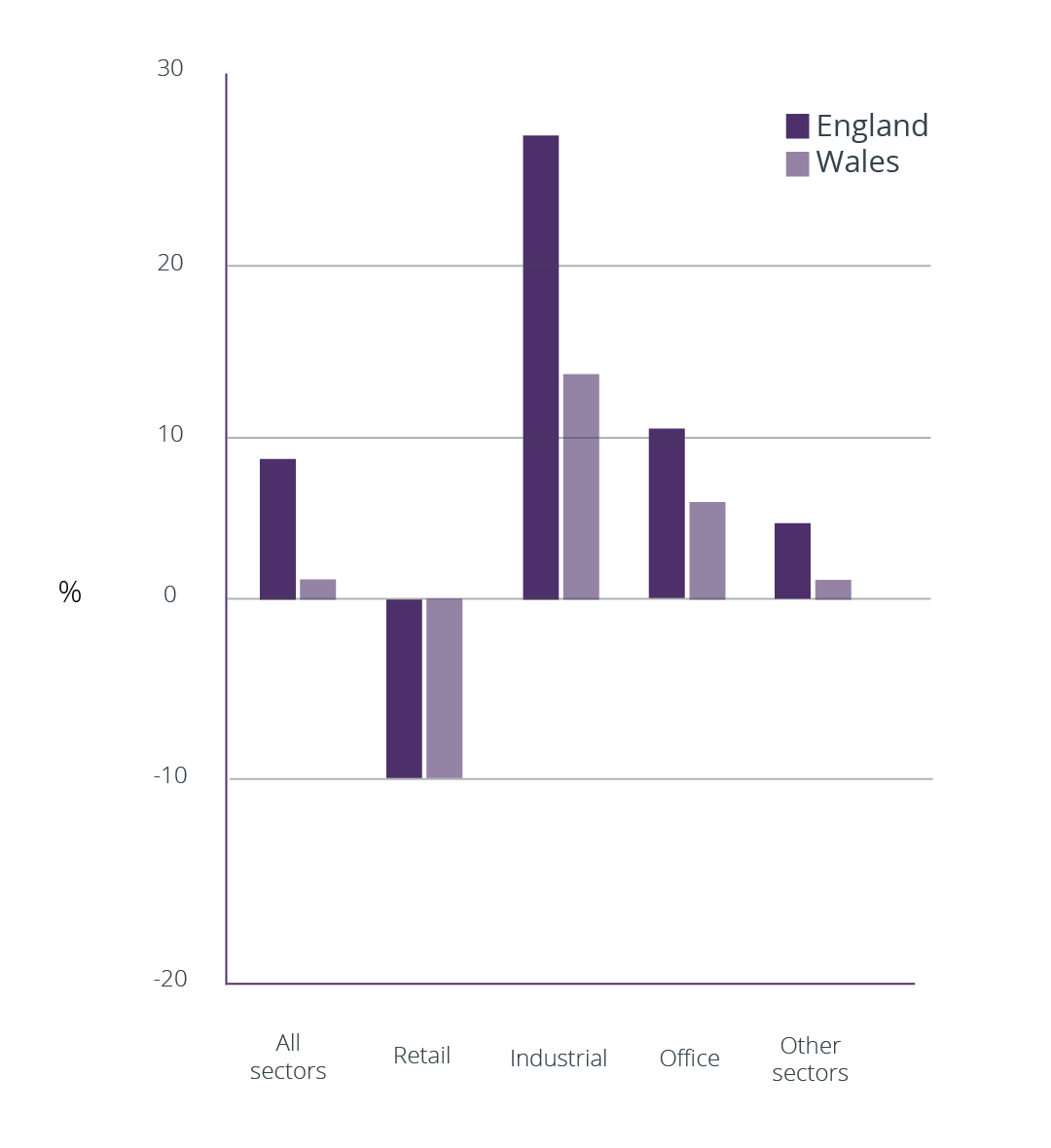

Figure 1 shows the main changes in value for 2023 by sector in England and Wales. But these headline figures only ever tell part of the story.

Figure 1: Percentage change in rateable value by sector for England and Wales Source: NDR Revaluation 2023 (draft list), published November 2022

To break this down by sector: in retail for instance, some subsectors such as shopping malls were already seeing values fall, and the pandemic continued this trend. But this is not universal across retail. There has been a general move towards shopping locally in recent years.

In the 2023 list, the total rateable value for retail is around £15bn, with around 517,000 properties. These have seen an average decrease in their rateable values of around 10%.

Meanwhile, many licensed premises and leisure properties saw growth between 2015 and 2020 – but then the pandemic also had an impact. Some of these properties will see a reduction at revaluation though others will increase. As with retail, this will depend on their location, and how much their growth between 2015 and 2020 was affected by the pandemic.

The VOA has agreed an adjustment for COVID-19 with representatives of the pub sector, and this adjustment has been applied to the valuation of each licensed premises. With around 42,000 pubs, bars, restaurants and similar property, the sector's current total rateable value is £1.3bn. Pubs have seen an average decrease in their rateable values of around 17%.

Industrial, logistics and offices see increases

Properties that are valued according to their building costs have conversely seen their rateable values increase because such costs rose substantially between 2015 and 2021.

These increases reflect higher material and transportation costs. Specialised industrial properties are among those that have been affected by this change, including steelworks, chemical plants, cement works and breweries. Other sectors valued according to their building cost are hospitals, schools, universities and some leisure centres.

Likewise, demand for logistics facilities such as warehouses has been growing for some time. Online shopping was increasing at a steep rate even before the pandemic, and has driven demand for properties in this sector.

This, along with the limited supply of such properties, has meant rents have increased significantly, and the new rateable values reflect this. In the 2023 list, the total rateable value of the sector's 1,550 properties is £2.43bn. Distribution and logistics properties have thus seen an average increase in their rateable values of around 35%.

When it comes to the office sector, London has seen the lowest increase in rateable values, with the pandemic having had a large effect. There were however higher increases in the East and South East of England, with rises in the former region resulting from increases in value along the M1–M25 corridor.

In the 2023 list, the total rateable value is £16.3bn, with around 437,000 office buildings. These have seen an average increase in rateable values of around 10%.

As well as checking your details and rates on our Find a business rates valuation service, you can consult the official statistics we publish on non-domestic rating , which give more information on the data discussed in this article.

Alan Colston MRICS is chief valuer and head of surveying profession at the VOA

Contact Alan: Email

Related competencies include : Valuation

Related Articles

BUILT ENVIRONMENT JOURNAL

go to article Why party wall surveyors must remain impartial

Irene Moore 21 May 2024

Building surveying

Residential

go to article BRE revises guidance on access to daylight and sunlight

Gareth Howlett 08 May 2024

go to article How social impact drives award-winning valuer's career

Joshim Uddin MRICS and Nicole Setterfield 03 May 2024

Learning and development

Planning and development

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

- Government efficiency, transparency and accountability

- Government spending

Procurement Act 2023 - Guidance documents

These documents cover all aspects of the Procurement Act 2023 and are intended to provide technical guidance and help with interpretation and understanding.

To support preparation for the Procurement Act 2023, we are publishing a suite of guidance documents addressing all aspects of the new regime, covering subjects from transitional arrangements and covered procurement through to pre-market engagement, award rules, exclusions and contract modifications.

These documents should be read in conjunction with the Procurement Act 2023 and its associated regulations and are aimed at procurement practitioners and commercial policy leads in contracting authorities. They are intended to provide technical guidance and help with interpretation and understanding of the new regime.

The documents will vary in length, but each will typically cover:

- Legal framework

- What has changed

- Key points and policy intent

- Linked notices or guidance, where relevant (hyperlinks to related guidance will be added once all documents are published)

- Where to find further information (hyperlinks will be added once all documents are published)

References to ‘regulations’ within this guidance should be interpreted as the Procurement Regulations 2024 unless specified otherwise. Guidance which discusses contracting authorities acting in accordance with the Act is to be read as complying with the provisions of both the Procurement Act 2023 and its associated regulations.Where the guidance refers to ‘previous legislation’, this means the Public Contracts Regulations 2015; the Defence and Security Public Contracts Regulations 2011; the Utilities Contracts Regulations 2016; and the Concession Contracts Regulations 2016.

The central digital platform referenced in the guidance comprises an enhanced version of Find a Tender (FTS), providing the new procurement notices, and a new Supplier Information Service (SIS). The central digital platform will be supported by a single place of registration for both parts of the service and suppliers will be able to access both FTS and SIS using the same account via: Find tender service - search

The Welsh Government is separately publishing its own guidance and devolved contracting authorities in Wales should consult the Welsh Government website for more information.

To aid navigation, we have arranged the guidance documents under the four stages of the commercial pathway: Plan; Define; Procure; Manage. You will be able to see from the list below which have been published, and for those which have been published a link to the sub-section where you will find the documents.

Evaluating bidder compliance with exclusion grounds and selecting suitable suppliers for the contract

- Publication of Information and the Central Digital Platform

- Time Periods

- Conditions of Participation

- Assessing Competitive Tenders

- Electronic Communications

- Modifying a Competitive Procurement

- Procurement Termination Notices

- Key Performance Indicators

- Assessment Summaries

- Contract Award NoticeS and Standstill

- Contract Details NoticeS and Contract Documents

Working with suppliers and managing the contract to ensure successful achievement of the contractual outcomes

- Electronic Invoicing and Payment

- Payments Compliance Notices

- Contract Performance Notices

- Contract Modifications

- Contract Termination

To aid navigation, we have arranged the guidance documents under the four stages of the commercial pathway. When published, each will be available from the sub-sections below

Having clear and transparent commercial pipelines and a good understanding of the market to plan for the procurement process.

- Transitionals (published)

- Contracting Authority Definition (published)

- Covered Procurement (published)

- Exempted Contracts (published)

- Devolved Contracting Authorities

- Covered Procurement Objectives

- NPPS (published)

- Utilities Contracts (published)

- Defence and Security Contracts (published)

- Concessions Contracts (published)

- Light Touch Contracts (published)

- Reserved Contracts for Supported Employment Providers (published)

- Intra-UK Procurement

- Pipeline Notices (published)

- 24 May 2024

Achieving flexible, efficient procurement process that encourage broad participation and are open and accessible to all.

- Valuation of Contracts (published)

- Thresholds (published)

- Below-Threshold Contracts

- Mixed Procurement (published)

- Planned Procurement Notices (published)

- Preliminary Market Engagement (published)

- Technical Specifications (published)

- Treaty State Suppliers

- Competitive Tendering Procedures

- Direct Award

- Dynamic Markets

- Conflicts of Interest

Is this page useful?

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. Please fill in this survey (opens in a new tab) .

IMAGES

VIDEO

COMMENTS

Valuation Office Agency business plan 2021 to 2022. PDF, 1 MB, 16 pages. This file may not be suitable for users of assistive technology. Request an accessible format.

agency's ability to adapt. Business Plan 2021-22 | 4 *327million business rates collected in 2019-20, reduction due to COVID-19 impacts £18 billion ... valued for council tax Introduction The Valuation Office Agency (VOA) is an executive agency of HM Revenue and Customs (HMRC). We employ approximately 3,310 people based on full-time

2 Business Plan 2016-18 Valuation Office Agency. In 2016-17, we will deliver 1.9m valuations for the non-domestic properties in England and Wales, in line with our statutory responsibility to carry out regular revaluations. We will publish the draft valuations by October 2016.

The Valuation Office Agency (VOA) is an executive agency of HM Revenue and Customs (HMRC). We employ approximately 3,200 people, based on full-time equivalents, with offices in 43 locations throughout England, Wales and Scotland. We provide valuation and property advice to support taxation and benefits. As

The Valuation Agency Office (VOA) has issued its business plan that sets out what it's going to be doing over the next year. The plan sets out the key activities they will be undertaking over the next year to help them achieve their strategic objectives, as well as their work to build capability and modernise the agency. The business plan ...

Corporate information. The Valuation Office Agency (VOA) provides valuations and property advice to support taxation and benefits to the government and local authorities in England, Wales and ...

The Valuation Office Agency is a government body in England and Wales. ... and office closures. The plan took into account the additional 20% cost cuts required by the government. ... organising staff by function into business streams rather than by location. During the period of 2015 - 2020, just about every aspect of the "Targeted Operating ...

Revaluation 2023 and business rates. The Valuation Office Agency regularly updates the rateable values of all business, and other non-domestic, properties in England and Wales. We do this to reflect changes in the property market. In turn, this helps ensure business rates bills are based on up-to-date information.

Valuation Office Agency annual report and accounts 2022 to 2023. PDF, 10.3 MB, 124 pages. This file may not be suitable for users of assistive technology. Request an accessible format.

allow the sharing of council tax valuation and non-domestic rating list appeal data with the Valuation Office Agency (VOA) • Impact on the VTS of the VOA Business System Transformation Programme and the Fundamental Business rates review. • Refresh of end-of-life laptops in line with our three-year and to reflect greater dependency on IT.

did not publish a 2020-21 Business Plan. Instead, we have set benchmark expectations against our key performance indicators based on the targets within our 2019-20 Business Plan. We have reviewed these each quarter and have monitored our performance against them. We have continued to deliver for our customers meeting the majority of our performance

For the 2023 valuation, that date was 1 April 2021. This was during the pandemic and the rent information the VOA used reflected this. Business rates - check your rateable value. The council uses the rateable value provided by the Valuation Office Agency (VOA) to work out your business rates bill.

In turn, this helps ensure that business rates are based on up-to-date information. The VOA revalued properties every five years from 1990 to 2010, then in 2017 and 2023. Proposed reforms are looking to move the revaluation cycle to every three years. It also helps redistribute the amount paid in business rates more fairly and ensure that bills ...

We've removed the Local Authority Partnership Charter from our website while we review and update it. Our '2019-20 Performance Targets' remain in place within our VOA Business Plan 2019-20 ...

Valuation Tribunal Service Corporate Plan 2023-26 incorporating the 2023-24 Business Plan . Chair's Introduction ... Valuation Office Agency (VOA). The VTE is headed by a President and is a separate statutory body charged with1:

2020-2025 Strategic Plan 3 The Mission of the Agency is to promote sustainable economic growth, vitality, and community enhancement through collaboration and community investment. Mission GROWTH Grow the local economy to increase community vitality, resilience, and strength ENHANCEMENT Enhance and contribute to community assets that make Moscow a great place to live, work, and play

Emotional Valuation. If you built your agency from the ground up, you may, understandably, have an emotional attachment to the business. Unfortunately, this can lead to an overvaluation of the agency. While it may be difficult, detaching personal sentiment from the agency's actual worth is crucial for a fair valuation.

Business Plan 2014-15 Valuation Office Agency Section Contents. Pages Section A ; Purpose and Vision : 2 - 5 : Section B : Coalition Priorities ; 6 - 7 : Section C ; Structural Reform Plans : 8 - 10 : ... (Business Rates) appeals We will play our part, together with the Valuation Tribunal Service, in delivering on the Chancellor's Autumn ...

1564 Driftwood Ln, Moscow Mills, MO 63362 is pending. Zillow has 1 photo of this 3 beds, 3 baths, 2,059 Square Feet single family home with a list price of $371,586.

ILM is a consultant for the sale and rental of commercial real estate in Moscow. We provide consulting services in the sector of office, retail, warehouse, luxury residential real estate, including transaction support, corporate customer service, market research, valuation, investment and asset management, project management.

valuation, office space,and college enrollment. The 2017population of the City was estimated at 25,146(2017U.S.Census est.), which places it as ... construction of improvements in conformance with the Legacy Crossing Plan. In May of 2013, the Agency was awarded an EPA Hazardous Substances Cleanup Grant to fund the removal of soils to

Agency for the life of the Plan, and which addresses the potential that the Agency may finance various improvements with bonds or other obligations; A listing of private properties which may be acquired by the agency (Attachment 6). The term "Project" is used herein to describe the overall activities defined in this Plan, and the

Valuation Office Agency business plan 2019 to 2020. PDF, 1.02 MB, 11 pages. Details The Valuation Office Agency's business plan sets out the key activities we will be undertaking over the next ...

This business plan sets out what the Valuation Office Agency (VOA) is going to do over the next year. ... Valuation Office Agency business plan 2015-2016. PDF, 4.07 MB, 14 pages.

PAVE Task Force Furthers Work Addressing Property Valuations. Appraisal bias—the artificial inflation or deflation of a home's appraised value based on a prohibited characteristic, such as race—continues to be a pressing topic in the housing market. Although various federal laws have addressed appraisal bias for decades, this topic has recently received a significantly increased degree ...

This business plan sets out what the Valuation Office Agency (VOA) is going to do over the next 2 years. VOA business plan 2017 to 2019 - GOV.UK Cookies on GOV.UK

These documents cover all aspects of the Procurement Act 2023 and are intended to provide technical guidance and help with interpretation and understanding.