CPA PEP – What Is The Extended Module And How Does It Work Exactly?

If you have been following my journey for a while, you probably know that I chose the extended pace for both Core 2 and Finance . I have also written a comparison post in the past talking about who the two paces are perfect for. The other day, a reader reached out to me asking some questions about the format of an extended module so I decided a post will be helpful.

As the registration deadline is approaching for the 2021 Winter term (the session begins on Jan 30, 2021), time is running out for you to decide which pace to take next.

RELATED POST – CPA PEP Module – Regular Module or Extended Module?

Are The Module Materials Different Between The Regular And Extended?

No, the module materials are exactly the same between the regular and the extended modules. The only difference is how the assignments are named.

For a regular module, the course is broken down by the week’s number. The 8 sets of assigned readings, MC, PC and IP are named Week #1 to #8. For an extended module, the assignment sets are referred to as Assignment Set #1 to #8.

Both formats have a module workshop weekend (except for Core 1 where there is an additional orientation module workshop weekend) and the materials are also the same.

How Long Is The Extended Pace?

The extended modules are 20 weeks compared to the 8-week regular module. So, the time it takes a candidate to finish one extended module, another candidate taking the regular pace could have done 2 modules in the same time frame. Note, regular and extended module candidates write their exams together (i.e., the second module exam for the regular candidate will be on the same day as the first module exam for the extended candidate).

When Are Assignments Due For The Extended Pace?

In case you didn’t already know, MC, PC and IP are all due on Fridays for a regular module. For extended, the MC from the first assignment set is due on the second Tuesday and the PC and IP are due on the Friday of the same week. Then, the next set of assignments is due 3 weeks later. However, you will then have only 2 weeks to complete the 3rd set of assignments.

To make it simple for you, below is the schedule (as per Summer 2020 session):

This took a little bit of getting used to for me so I would suggest using either an online calendar or a paper calendar to keep track of deadlines.

Also, even though you are allowed to submit your assignments way before the deadlines, your facilitator most likely will not be returning the assignments to you early. From my experience with two different facilitators, you might get your assignments graded a day or two before the deadline for the facilitator (i.e., 96 hours after submission deadline or 48 hours after the last set of assignment) but never much earlier.

~ More CPA Posts ~ CPA PEP Core 1 – How to Study for the Module and the Exam What I Learned At The CPA Financial Literacy Virtual World Tour (Financial Literacy Month #1) My CPA Journey – My Finance Exam Study Plan + Densmore Finance Elective Essentials

The Extended Module Sounds Awesome (It Could Be). So, What’s The Catch?

I love the extended module for reasons I have mentioned in my comparison post here . However, it is clear that it is not the best solution for everyone. Also, you can always go back and forth with regular and extended like I am doing in order to work with your schedule.

For me, since I plan on writing the CFE next September, I will have to finish my last elective in March. I work as a Corporate Accountant in the industry so I report CPA PERT via EVR. If all goes as planned (i.e., getting the duration and all of the level 1s & 2s I need), I will apply for certification in early 2022. Therefore, I can’t take another extension without postponing my certification until after writing the May 2022 CFE.

RELATED POST – CPA PERT – Ultimate Guide on How to Get Your First Experience Report via EVR Approved

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

You Might Be Interested

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- ACCOUNTING EDUCATION

NASBA approves one-year extension to CPA Exam window

- Accounting Education

An amendment adopted by the National Association of State Boards of Accountancy (NASBA) opens the door for states to extend the window for completing the CPA Exam by one year.

NASBA announced a change to its Uniform Accountancy Act (UAA) Model Rules that increases from 18 months to 30 months the time frame for a CPA candidate to complete the Exam once the candidate passes the first section.

"Providing an additional year of conditional credit to candidates for Exam sections passed provides more flexibility to those seeking licensure as a CPA," NASBA President and CEO Ken Bishop said in a news release . "The additional time also provides greater latitude to firms and candidates as they negotiate the demands of today's complex career environment."

Action on the state level is required for the UAA amendment to take effect. Current Exam candidates will remain under the 18-month rule until such action, but Monday's announcement by the membership body for all 55 U.S. boards of accountancy followed a 60-day comment period that generated more than 850 responses and contributed to NASBA's decision to go beyond a six-month extension proposed in the exposure draft of the amendment.

"Extending the 18-month credit rule for taking all parts of the CPA Exam is a key pillar of the AICPA's pipeline acceleration plan ," said Mike Decker, vice president–CPA Examination and Pipeline for AICPA & CIMA, together as the Association of International Certified Professional Accountants. "This proposed change to the model rules better accommodates the conflicting demands many prospective CPA candidates face as they strive to make a living, pay off student loans, juggle family obligations, and take steps to advance their careers. While there is work to be done to make these amendments a reality in all jurisdictions, this is a positive step for future CPAs and the profession."

In consideration of a revamped CPA Exam format beginning in 2024 , the NASBA board of directors included descriptive language in the amendment aimed at providing uniformity among jurisdictions on the timing of granting Exam credits in an effort to curb the impact of any score delays. The NASBA board, at the same meeting, continued discussions on a policy change that would provide relief for CPA Exam candidates who lost credits during the COVID-19 pandemic .

"On behalf of the NASBA board of directors, we would like to thank the Uniform Accountancy Act Committee and the many stakeholders who provided valuable input to the rule-making process," Richard N. Reisig, CPA, 2023–2024 NASBA chair, said in the release. "We believe this amendment made to the UAA Model Rules will support the best interests of the candidates in their journey to entering the profession."

— To comment on this article or to suggest an idea for another article, contact Bryan Strickland at [email protected] .

Where to find May’s flipbook issue

The Journal of Accountancy is now completely digital.

SPONSORED REPORT

Manage the talent, hand off the HR headaches

Recruiting. Onboarding. Payroll administration. Compliance. Benefits management. These are just a few of the HR functions accounting firms must provide to stay competitive in the talent game.

FEATURED ARTICLE

2023 tax software survey

CPAs assess how their return preparation products performed.

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- TAX PRACTICE & PROCEDURES

The Need for Increased Due Diligence in Filing Extensions

- IRS Practice & Procedure

The complexities associated with return preparation, tax law, and the April 15 deadline have required practitioners to devote more time to preparing returns. As a consequence, more extensions of time to file are being filed.

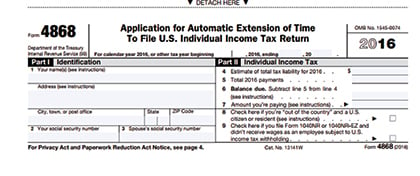

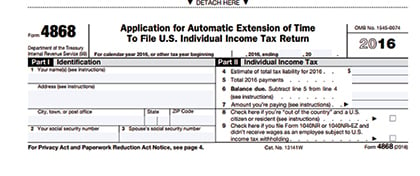

The IRS has indicated that taxpayers should file a Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return . The instructions for filing a Form 4868 require taxpayers to:

- Properly estimate their tax liability using the information available to them;

- Enter their total tax liability on line 4 of Form 4868; and

- File Form 4868 by the regular due date of their return.

Normally, filing this form results in an automatic six-month extension of time to file without any late-filing penalty. However, filing the form does not extend time to pay any income tax liability due. The estimated taxes due should be paid with the extension application. Interest is charged on a material underpayment of tax from the original due date of the return until the tax is paid, and a late payment penalty may also be due. The interest rate varies quarterly with the federal short-term interest rate.

Regulations provide relief from penalties only if the balance due on Form 1040 is less than 10% of the total tax shown on that form and is remitted with the return. If the balance due is more than 10% or is not remitted with the return, the penalty may apply to the total of the balance due from the original due date of Form 1040 to the date of payment, unless the taxpayer establishes reasonable cause (Regs. Sec. 301.6651-1(c)(3)).

In addition to these concerns with the federal extension, applicable state extensions and the rules and regulations associated with them require the same careful consideration. The requirement to electronically file some state extensions raises the due diligence required by practitioners.

Office Procedures

Increased monitoring by the states and the IRS of both practitioners and tax returns may cause many practitioners to rethink their office procedures in dealing with clients who desire to extend their individual income tax returns.

First, there is the need to accurately estimate a client’s tax liability when an extension is filed. Second, the practitioner should advise clients that if an extension is filed on their behalf, it is an extension of time to file only and not an extension of time to pay. Some clients have the misconception that the filed extension extends not only the time for filing but the time for paying the tax due. Clients should also know that penalty and interest apply to any balances due in excess of 10% of the total tax shown on the tax return. This could be done in the engagement letter with the client. Sample language can be found in the engagement letters included in the AICPA Tax Practice Guides and Checklists:

If an extension of time to file is required, any tax due with this return must be paid with the extension. Any amounts not paid by the filing deadline may be subject to interest and penalties.

More information on sample engagement letters is available here . Third, the practitioner may want to have an affirmative indication from the client authorizing the filing of an extension, including the amount of federal and state withholding and estimated tax payments. This should contain language indicating that the taxpayer understands he or she may also be required to make estimated tax payments for the current tax year.

These office procedures would be consistent with IRS rules in Circular 230, particularly Sections 10.22 (Diligence as to Accuracy) and 10.33 (Best Practices). In addition, the IRS has indicated its desire for more oversight of all income tax preparers. Kip Dellinger argues that courts—and in particular the IRS—are increasing what constitutes return preparer due diligence (see Dellinger, “Return Preparer Due Diligence and the IRS: The Looming Battle,” 128 Tax Notes 889 (August 23, 2010)). It is not inconceivable that the IRS could develop computer criteria in the future to invalidate extensions if the requirements of Sec. 6651 are not met. State revenue departments could also do this.

Reasons for Additional Office Procedures

Liability insurers have noted an increased number of claims resulting from extensions (Lee, “Frequent Tax Claims Against CPAs,” AZ CPA (February 2007)). In addition, there have been some court cases that merit consideration of additional office procedures in the preparation of extensions.

In Crocker , 92 T.C. 899 (1989), the Tax Court held that the IRS could void the automatic extension because the taxpayers “did not make a bona fide and reasonable estimate of their tax liabilities nor did they make a bona fide and reasonable attempt to secure the information necessary to make such an estimate.”

In Haddad Motor Group, Inc. v. Karp, Ackerman, Skabowski & Hogan, P.C., 603 F.3d 1 (1st Cir. 2010), accountants were held liable in a civil suit brought by the client for the client’s nonpayment of estimated quarterly taxes and estimated tax due with the extension of time to file the return. The court found the accountants liable for deceiving the client as to its tax liability related to the closeout of a margin-against-the-box transaction and conversion to an S corporation.

The client closed out the transaction in February 1999, thus incurring a built-in gains tax liability on the transaction. The accountants failed to have the client make any estimated payments based on the liability from the transaction. In December 1999, the accountants advised the client of the built-in gains tax liability and for other reasons recommended that the client file an extension of time to file taxes (Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns ). However, the accounting firm did not consider the large built-in-gains tax in the estimated tax liability shown on Form 7004. Therefore, the IRS assessed penalties against the client for underpayment of estimated taxes and assessed interest for failing to pay tax from the original due date of the return through the extended due date.

In the client’s suit against the accountants, the jury awarded damages for federal and state interest and penalties incurred (only) from the original due date through the extended due date. The judge also awarded damages for the interest and penalties on the failure to make adequate quarterly estimated tax payments, plus treble damages and attorneys’ fees and court costs under MA Gen. Law, ch. 93A. Although the total amount the client was charged in interest and penalties attributable to the transaction was about $12,350, the firm ended up paying over $250,000 to the client as a result of the litigation.

Practitioners should consider including language on extensions in their engagement letters, regardless of whether positive or negative letters are used. The client should provide written confirmation of authorization to file the extension with withholding and estimated tax payments included. The extension authorization letter should include a notation that the client may be required to make estimated tax payments for the current year. In addition, documentation of any estimates and calculations should be retained in the client file for future reference. It takes only one engagement that goes astray to cause many sleepless nights for a practitioner. These ideas are a means of preventing this from this happening.

Editor Notes

Valrie Chambers is a professor of accounting at Texas A&M University–Corpus Christi in Corpus Christi, TX. Gerard Schreiber is with Schreiber and Schreiber in Metairie, LA. They are both members of the AICPA Tax Division’s IRS Practice and Procedures Committee. For more information about this column, contact Prof. Chambers at [email protected] .

Sale of clean-energy credits: Traps for the unwary

Tax consequences of employer gifts to employees, top 8 estate planning factors for real estate, success-based fees safe harbor: a ruling raises concerns, pond muddies the waters of the mailbox rule.

This article discusses the history of the deduction of business meal expenses and the new rules under the TCJA and the regulations and provides a framework for documenting and substantiating the deduction.

PRACTICE MANAGEMENT

CPAs assess how their return preparation products performed.

- Firm Culture

- Our Mission

- Partner & Manager Profiles

- Firm History

- Client Testimonials

- Peer Review

- Accounting Services

- Tax Services

- Audit & Assurance Services

- Business Advisory Services

- Individual and Family Advisory Services

- Professional Services

- Real Estate

- Not-for-Profit

- Manufacturing & Distribution

- Medical & Dental Practice

- Financial Calculators

- Our Publications

- Secure File Exchange

- Professional Positions

- Tax Season Internship

- CPA Success Program

Blog & Newsroom

My CPA Says, “Extend.” What Does That Mean to Me?

Each year, some taxpayers find themselves scrambling to find their income tax return paperwork, a year's worth of receipts, and ultimately becomes stressed in the attempt to file their tax return by April 18. Others know and understand that simply filing a tax extension can earn them time, reduce their stress, and possibly, incur a lower tax bill.

“We explain to clients the many advantages of filing an extension. Not only do they gain six more months to file their return, but they also have the ability to review their options and understand their return a little better. This helps plan strategically not only for the current tax year, but this extra time also enables us to potentially project a client’s tax position for the following year as well. By having the ability to look at two years at once, we can provide the client with an optimal strategy to reduce their tax obligations,” said Senior Tax Manager Gary Sigman, CPA, M.Tax, PFS, AEP.

You'll also avoid failure-to-file penalties, which can add up to 25% of the tax due. If you file an extension but miss the extended deadline, you will be subject to this penalty. Keep in mind that filing an extension when you owe taxes only gives you more time to file , not more time to pay – your payment is still due at the April deadline. What does filing an extension do?

- An extension is a form filed with the IRS to request additional time to file your federal tax return. The extension period is six months, which extends the due date for submitting your final returns from April 15 to Oct. 15*. In some states, filing an extension with the IRS will automatically extend the time to complete a state income tax return.

- Filing an extension grants you additional time to submit your complete and accurate return, but you still need to estimate whether you will owe any taxes and pay that estimated balance by April 18.

- Extending your return allows you and your CPA more time to prepare your tax return to ensure filing of an accurate tax return. In many cases, you may still be waiting for additional information (e.g., Schedule K-1, corrected 1099s, etc.) to complete your return.

- The volume of data or complexity of certain transactions (e.g., sale of a rental property) on your return requires additional time.

- The amount of time remaining in filing season is limited for the CPA to complete client returns by April 15* due to late information received from numerous clients.

- Many CPAs have a “cutoff” or deadline for clients submitting their tax information so they can plan their workload to ensure all client returns and extensions are completed by April 15*.

Am I more likely to be audited if I extend?

- Extending will NOT increase your likelihood of being audited by the IRS.

- It is better to file an extension rather than to file a return that is incomplete or that you have not had time to review carefully before signing.

What are the primary benefits of extending my tax return?

- It provides for additional time to file returns without penalty when you are waiting for missing information or tax documents (such as corrected 1099s). Just remember that an extension provides additional time to file, but not additional time to pay. Penalties may be assessed if sufficient payment is not remitted with the extension.

- You may qualify for additional retirement planning opportunities or additional time to fund certain types of retirement plans (e.g., SEP IRA).

- It is often less expensive (and easier) to file an extension rather than rushing now, then possibly needing to amend your return later.

Should I do anything differently if I am filing an extension or “going on extension”?

- No, you still should give your CPA whatever information you have as early as possible or as soon as it becomes available.

- Expect to pay any anticipated taxes owed by April 18. You still need to submit all available tax information to your CPA promptly so he/she can determine if you will have a balance due or if you can expect a refund.

- If you are required to make quarterly estimated tax payments, your first quarter estimated tax payment is due April 18. Your CPA may recommend that you pay the balance due for last year and your first quarter estimated tax payment for this year with your extension.

- If you are anticipating a large refund, chances are your CPA will likely try to get your extended return done as soon as possible once all tax information is available. Your CPA may also want to discuss tax planning opportunities with you so that in future years, you don’t give the IRS an interest-free loan all year!

Is there anything I can do to avoid filing an extension if I know I am missing some

information now?

- If you already know you will be waiting until the last minute for one or two documents, you may be able to minimize the chance of having to file an extension by providing all other available documents to your CPA as soon as you receive them. By doing so, your CPA can prepare a draft return for you to review and discuss in advance. He or she may be able to add the missing piece of data or last-minute information and still be able to complete your returns by April 15* (depending on their workload).

I heard about changes to due dates beginning with 2016 tax returns filed in 2017. Will that affect me?

- Changes in due dates relate to partnership and some business (C corporation) returns, not individual tax returns.

- If you have a partnership interest, the completion of your individual tax return maybe affected. One purpose in changing the due dates was to allow for completion of these returns in order to have the information available to be included in an individual’s tax return. In this instance, your chances of having to file an extension for your individual return may actually be alleviated.

- Due dates and extension periods for various other returns have been revised. Contact us to learn if you will be affected by the changes. Read about the due dates and changes in Gary’s recent blog.

Tax planning is essential to builidng a succesful business foundation and changes in due dates can create confusion and, if not addressed in a timely manner, costly. If you have any questions about due date changes, tax planning, or compliance, contact us at [email protected] or 216.831.0733. We are happy to help and ready to start the conversation.

Zinner & Co. Tax Department

Since 1938, Zinner has counseled individuals and businesses from start-up to succession. At Zinner, we strive to ensure we understand your business and recognize threats that could impact your financial situation.

Recent Blog Posts

Have nagging financial questions.

Send us your questions and we’ll share our insights with you on our blog!

- 1031 Exchange (2)

- 529 plan (4)

- ABLE Act (1)

- account systems (3)

- accounting (8)

- Affordable Care Act (8)

- alimony (2)

- American Rescue Plan Act (1)

- Ask the Expert (5)

- Audit and Assurance Department (14)

- Barbara Theofilos (6)

- Bitcoin (1)

- block chain (2)

- Bookkeeping (1)

- Brett W. Neate (28)

- budgets (1)

- Bureau of Worker's Compensation (12)

- Business - Management, Issues & Concerns (46)

- business income deduction (3)

- business succession (7)

- business travel expense (3)

- business valuation (5)

- capital gains (2)

- careers (7)

- cash flow (2)

- Child Tax Credit (2)

- Chris Valponi (8)

- City of Cleveland (1)

- Cleveland COVID-19 Rapid Response Fund (1)

- Cleveland Rape Crisis Center (2)

- college (3)

- Community (24)

- Coronavirus (24)

- COVID-19 (30)

- Credit card fraud (4)

- credit reporting (1)

- cryptocurrency (2)

- cybersecurity (14)

- DeAnna Alger (6)

- deductions (14)

- Deferring Tax Payments (4)

- Department of Job and Family Services (2)

- depreciation (1)

- Digital Tax Payment (1)

- divorce (4)

- Economic Impact Payments (2)

- Economic Injury Disaster Loan (4)

- education (8)

- electronic filing (4)

- Electronic Tax Payments (2)

- Emergency Working Capital Program (1)

- employee benefit plan auditor (1)

- Employee Leave (2)

- Employee or Independent Contractor (5)

- Employee Retention Credit (3)

- employment (2)

- Eric James (8)

- Estates, Gifts & Trusts (47)

- expenses (5)

- Families First Coronavirus Response Act (2)

- FDIC coverage (1)

- Federal Assistance (4)

- financial planning (8)

- Financial Planning - College (9)

- financing (3)

- Firm news (119)

- first responders (1)

- foreign assets (3)

- fundraising (9)

- Gabe Adler (1)

- gift tax (5)

- health care (3)

- home office (1)

- Howard Kass (2)

- identity theft (28)

- income tax (56)

- independent contractor (1)

- Inflation (1)

- Insurance (7)

- internal control (4)

- international (2)

- investments (4)

- John Husted (1)

- Laura Haines (2)

- Layoffs (1)

- leadership (3)

- lease accounting standards (1)

- life insurance (1)

- longevity income annuities (1)

- Lorenzo's Dog Training (1)

- Magic of Lights (1)

- management advisory (3)

- manufacturing (2)

- Matt Szydlowski (3)

- medical (7)

- Medicare (2)

- mergers and acquisitions (1)

- Mike DeWine (2)

- Millennial Concepts (2)

- minimum wage (1)

- non-profit reporting (10)

- non-profits (38)

- not-for-profit (26)

- Ohio business owners (18)

- Ohio Department of Jobs and Family Services (3)

- Ohio Incumbent Workforce Training Voucher Program (1)

- Online Tax Payment (2)

- Operations (2)

- owners of foreign entities (1)

- partnerships (5)

- Paycheck Protection Program (9)

- payroll (8)

- penalties (3)

- pension (2)

- personal finance (2)

- planning (4)

- Productivity (5)

- Qualified Business Income (1)

- quickbooks (10)

- real estate (13)

- record retention (2)

- records (2)

- Republican National Convention (1)

- Retirement Planning & IRAs (52)

- Richard Huszai, CPA (5)

- Robin Baum (6)

- S Corporation (1)

- SECURE 2.0 Act (1)

- security (5)

- SharedWorks (1)

- Shutdown (3)

- Silver Linings (9)

- simplified employee pension (1)

- Small Business (5)

- Social Media (1)

- social security (4)

- Speaker Series (2)

- start ups (8)

- Stay at Home Order (3)

- Steven Mnuchin (1)

- Sue Krantz (6)

- tangible property (1)

- tax avoidance (11)

- Tax Credit (5)

- Tax Cuts and Jobs Act of 2017 (31)

- Tax Interns (2)

- tax services (28)

- Taxes - Corporate & Business (98)

- Taxes - Individual (114)

- Taxes - Planning, Rules and Returns (185)

- technology (6)

- The CARES Act (6)

- The SOURCE (1)

- transaction advisory (2)

- Treasury Department (4)

- tuition (3)

- U.S. Department of the Treasury (1)

- U.S. Small Business Administration (6)

- Unemployment Benefits (4)

- withdrawls (2)

- withholding (6)

- Workers Comp Billing Changes (1)

- Zinner & Co. (28)

- Zinner News (27)

Share Your Idea For A Zinner Blog Article

Latest Posts

Latest tweets, newsletter sign up, client resources.

Welcome to the official CQUniversity Student Blog – CQUniLife. This blog follows the experiences of a diverse group of CQUniversity students from different countries, studying various programs and at various campuses throughout Australia.

Understanding Assessment Extensions

Everyone knows that sometimes life throws unavoidable curve balls that get in the way of completing assessments. For some, applying for an extension may be considered as failing or they may feel like they are not meeting expectations – this is not the case!

Our Student Accessibility and Equity team have explained assessment extensions and shared why you should not be ashamed of asking for an extension.

It is week 5 of term, and you have deadlines looming.

The term has not gone as planned.

You know you can apply for an assignment extension if needed. But you do not apply as you do not want your academics to think less of you. You spend the next week pulling all-nighters. You get your assignment in a day late, but it is rushed, you are exhausted, you will receive a late penalty, and for the next week, your health is impacted as a direct result.

This is a common occurrence for students and our Student Accessibility and Equity team are here to break down this notion. Know that your health is a priority and CQUni is here to support you throughout your time at university.

Academics want you to succeed, and to enjoy learning. You will not get in trouble or have academics think less of you by asking for an extension.

In fact, the Assessment Policy and Procedure exists for that reason. Because life happens, especially when you are managing ongoing health challenges. It may be disappointing for you to delay the submission of your assignment, but it is crucial to allow yourself to re-frame timelines. We are all people, and sometimes as people, we need a little extra time to complete tasks, and there is no shame in asking for help.

Did you know, with appropriate supporting documentation and approval from your School’s Deputy Dean of Learning & Teaching, you can get an extension up to 4 weeks? Of course, you may just need an extra day or two, and in those situations, your Unit Coordinator can approve that.

Your Unit Coordinator can authorise up to 14 days, and you can be granted an extension, and if you need extra time, you can apply again. Just keep a note of the 4-week limit and the supporting documentation requirements.

To apply for an extension, visit your unit’s Moodle site, click on the Support tab at the top, select the assessment extension request and pick the assessment you need the extension on. Attach your documentation, note your reasons for applying for the extension in the available comment box, and then submit. It is that easy, but if you get stuck, you can review Moodle’s student help guide to applying for assessment extensions.

If you have more questions about the process or support available or have ongoing health concerns that you would like to discuss, you can contact the Student Accessibility & Equity Service on 07 4930 9456 or email [email protected] .

Share this post:

Related posts.

All students start their journey at CQUni with a unique…

This week I’m going to talk to you about an…

I should probably kick things off by introducing myself. My…

Leave a Reply Cancel reply

Discover more from cqunilife.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

Agribusiness

Construction, financial services, food, beverage, hospitality, manufacturing, professional services, real estate, state and local tax (salt), wineries & vineyards, forms and resource links.

- Send / Receive Files

REMOTE SUPPORT

- 503-362-9152

- April 19, 2022

My CPA Says, “Extend.” What Does That Mean to Me?

Each year, some taxpayers find themselves scrambling to find their income tax return paperwork, a year’s worth of receipts, and ultimately become stressed in the attempt to file their tax return by April 18. Others know and understand that simply filing a tax extension can earn them time, reduce their stress, and possibly, incur a lower tax bill.

A tax extension is free, easy and automatic. Just submit Form 4868 electronically or on paper by the April 18 filing deadline.

“We explain to clients the many advantages of filing an extension. Not only do they gain six more months to file their return, but they also have the ability to review their options and understand their return a little better. This helps plan strategically not only for the current tax year, but this extra time also enables us to potentially project a client’s tax position for the following year as well. By having the ability to look at two years at once, we can provide the client with an optimal strategy to reduce their tax obligations,” said Senior Tax Manager Gary Sigman, CPA, M.Tax, PFS, AEP.

You’ll also avoid failure-to-file penalties, which can add up to 25% of the tax due. If you file an extension but miss the extended deadline, you will be subject to this penalty. Keep in mind that filing an extension when you owe taxes only gives you more time to file, not more time to pay – your payment is still due at the April deadline. What does filing an extension do?

- An extension is a form filed with the IRS to request additional time to file your federal tax return. The extension period is six months, which extends the due date for submitting your final returns from April 15 to Oct. 15*. In some states, filing an extension with the IRS will automatically extend the time to complete a state income tax return.

- Filing an extension grants you additional time to submit your complete and accurate return, but you still need to estimate whether you will owe any taxes and pay that estimated balance by April 18.

- Extending your return allows you and your CPA more time to prepare your tax return to ensure filing of an accurate tax return. In many cases, you may still be waiting for additional information (e.g., Schedule K-1, corrected 1099s, etc.) to complete your return.

Why does my CPA suggest we extend my tax return? If your CPA has recommended that you file an extension, it may be due to many reasons, such as:

- The volume of data or complexity of certain transactions (e.g., sale of a rental property) on your return requires additional time.

- The amount of time remaining in filing season is limited for the CPA to complete client returns by April 18* due to late information received from numerous clients.

- Many CPAs have a “cutoff” or deadline for clients submitting their tax information so they can plan their workload to ensure all client returns and extensions are completed by April 18*.

Am I more likely to be audited if I extend?

- Extending will NOT increase your likelihood of being audited by the IRS.

- It is better to file an extension rather than to file a return that is incomplete or that you have not had time to review carefully before signing.

What are the primary benefits of extending my tax return?

- It provides for additional time to file returns without penalty when you are waiting for missing information or tax documents (such as corrected 1099s). Just remember that an extension provides additional time to file, but not additional time to pay. Penalties may be assessed if sufficient payment is not remitted with the extension.

- You may qualify for additional retirement planning opportunities or additional time to fund certain types of retirement plans (e.g., SEP IRA).

- It is often less expensive (and easier) to file an extension rather than rushing now, then possibly needing to amend your return later.

Should I do anything differently if I am filing an extension or “going on extension”?

- No, you still should give your CPA whatever information you have as early as possible or as soon as it becomes available.

- Expect to pay any anticipated taxes owed by April 18. You still need to submit all available tax information to your CPA promptly so he/she can determine if you will have a balance due or if you can expect a refund.

- If you are required to make quarterly estimated tax payments, your first quarter estimated tax payment is due April 18. Your CPA may recommend that you pay the balance due for last year and your first quarter estimated tax payment for this year with your extension.

- If you are anticipating a large refund, chances are your CPA will likely try to get your extended return done as soon as possible once all tax information is available. Your CPA may also want to discuss tax planning opportunities with you so that in future years, you don’t give the IRS an interest-free loan all year!

Is there anything I can do to avoid filing an extension if I know I am missing some information now?

- If you already know you will be waiting until the last minute for one or two documents, you may be able to minimize the chance of having to file an extension by providing all other available documents to your CPA as soon as you receive them. By doing so, your CPA can prepare a draft return for you to review and discuss in advance. He or she may be able to add the missing piece of data or last-minute information and still be able to complete your returns by April 18* (depending on their workload).

Tax planning is essential to building a successful business foundation and changes in due dates can create confusion and, if not addressed in a timely manner, costly. If you have any questions about due date changes, tax planning, or compliance, contact us at [email protected] or 503.362.9152. We are happy to help and ready to start the conversation.

Featured articles and alerts

Navigating NIL Income: A Guide to Preparing Your Taxes as an Athlete with DPW

As you revel in the financial benefits of your endorsements and partnerships, it’s crucial to remember the responsibility that comes with it—taxes. The tax deadline

Important 2024 Tax Deadlines and Cutoff Dates

Forms 1099 Businesses (including Schedule C’s; farms, rentals, etc.) are required to prepare these annual informational returns for certain amounts paid during the conduct of

IRS announces 2024 retirement account contribution limits: $23,000 for 401(k) plans, $7,000 for IRAs

The Internal Revenue Service (IRS) has released the new 2024 contribution limits for investors’ retirement accounts, bringing some noteworthy changes. These adjustments impact 401(k) plans,

The Oregon National Guard Tax Change: Supporting Our Troops on the Homefront

A Tax Break with a Patriotic Purpose Oregon has taken a remarkable step in recognizing the sacrifices and contributions of National Guard members by implementing

PORTLAND OFFICE

- 16037 SW Upper Boones Ferry Rd Suite 135 Portland, OR 97224 Directions

- Monday - Friday: 8 am - 5 pm by appointment only

Salem Office (MAILING)

- 447 State Street Salem, Oregon 97301 Directions

- Monday - Friday: 8 am - 5 pm

- Business Services

- Personal Services

Information

- Forms and Resources

- Insights and Alerts

- Our Culture

- The DPW Team

- BDO Alliance

- Insights and Stories

Client Resources

Client resouces.

- Remote Support

- Privacy Policy

- Cookie Policy

- Terms of Service

School of Social and Political Science

Reasons for requesting an extension, suitable reasons for requesting extensions.

Good reasons for coursework extensions are unexpected short-term circumstances which are exceptional for the individual student, beyond that student’s control, and which could reasonably be expected to have had an adverse impact on the student’s ability to complete the assessment on time.

These may include:

- Recent short-term physical illness or injury;

- Recent short-term mental ill-health;

- A long-term or chronic physical health condition, which has recently worsened temporarily or permanently;

- A long-term or chronic mental health condition, which has recently worsened temporarily or permanently;

- The recent bereavement or serious illness of a person with whom the student has a close relationship;

- The recent breakdown in a long-term relationship, such as a marriage;

- Emergencies involving dependents;

- Job or internship interview at short notice that requires significant time, e.g. due to travel;

- Victim of a crime which is likely to have significant emotional impact;

- Military conflict, natural disaster, or extreme weather conditions.

In addition to these unexpected circumstances, Schools will also consider requests for coursework extensions in relation to:

- A student’s disability where the student’s Learning Profile includes relevant provisions (please note aLearning Profile will be treated sympathetically as part of the case for an extension. A Learning Profile itself does not guarantee an extension.

- Representation in performance sport at an international or national championship level, in line with the University’s Performance Sport Policy.

Unsuitable reasons

The following are examples of circumstances which would not be considered good reasons for coursework extensions:

- A long-term or chronic health condition (including mental ill-health or similar ill-health) which has not worsened recently or for which the University has already made a reasonable adjustment;

- A minor short-term illness or injury (e.g. a common cold), which would not reasonably have had a significant adverse impact on the student’s ability to complete the assessment on time;

- Occasional low mood, stress or anxiety;

- Circumstances which were foreseeable or preventable;

- Pressure of academic work (unless this contributes to ill-health);

- Poor time-management;

- Proximity to other assessments;

- Lack of awareness of dates or times of assessment submission;

- Failure, loss or theft of data, a computer or other equipment;

- Commitments to paid or voluntary employment.

Where a student has good reason for requiring a coursework extension of more than seven calendar days , the student should submit the coursework when able to do so and apply via the Special Circumstances process for the Board of Examiners.

Accessibility and accommodation requests

The CPA profession is committed to treating all people in a way that allows them to maintain their dignity and independence. We believe in integration and equal opportunity. We are committed to meeting the needs of persons with disabilities in a timely manner and will do so by preventing and removing barriers to accessibility and meeting accessibility requirements under each respective provincial government’s applicable act or guidelines.

All policies, procedures and plans are consistent with the requirements of the various provincial acts. These will be reviewed and updated regularly as we make continuous improvements in our efforts to remove barriers and increase accessibility for persons with disabilities. Accommodation requests are assessed on a case-by-case basis to ensure equal opportunity for individuals to fully demonstrate their qualifications without altering the nature or level of the qualification being assessed. We consider each case after carefully reviewing the submitted documentation; however, submitting a request does not guarantee receiving an accommodation.

Accommodation application submission process and forms

Application request forms.

Complete the following accommodation request forms:

- Accommodation Request Individual Form 1 (required)

- Accommodation Request Medical Form 2 (required)

- Current psychological assessment (if applicable)

Application submission process

- Follow the submission instructions outlined on each request form.

- You will receive an email upon receipt of your application.

- You will receive an email outlining the decision shortly after the Accommodation Panel’s next meeting date.

Application submission deadlines

The deadline for submitting an application is 10 weeks prior to the examination for which the applicant is seeking accommodations. Applications will be accepted after the deadline for any extenuating circumstances.

Applicants can direct questions to their respective regional office:

- CPA Western School of Business

- CPA Ontario

- Quebec CPA Order

- CPA Atlantic School of Business

Accommodation panel

To ensure all applicants are treated fairly and equally regardless of their location, the panel will normally be comprised of a designate(s) from each region (West, Ontario, Quebec, Atlantic and National). Specifically:

- at least one member per CPA member region

- one CPA Canada staff member representing the Board of Examiners

- two mental health experts (i.e., psychologist or psychiatrist or neuropsychologist)

- additional experts as required (e.g., lawyer, audiologist, optometrist, etc.)

IMAGES

COMMENTS

Candidates. CPA Canada and CPAWSB Candidate Guides state that late submissions will not be accepted. However, in some cases, there may be extenuating circumstances that make it challenging to complete and submit module assignments before the stated deadlines. In extenuating circumstances, candidates may request an extension.

Learn about online learning formats, assignment focus time, activity extension, etc. Future Learners Current Learners Learning Partners Contractors News Portals My CPA Portal ... Meet Owen Kot, CPA, 2023 Exemplary New Professional Award Winner. By CPAWSB. Apr 24, 2024.

Resources available for memorandum of understanding (MOU) candidates attempting the CFE. This week's blog focuses on the FAQs asked by MOU candidates, such as when to enroll and what resources are available to prepare for an attempt at the CFE. By CPAWSB. May 12, 2023. CPA PEP.

Tips for Requesting an Extension. Check Circle. Read the syllabus or assignment. Check Circle. Ask your instructor as early as possible. Check Circle. Reach out via email with a specific request. Check Circle. Ask for a shorter extension if possible.

Best practices for engagement letters, POAs, and tax return extensions. By Pamela Slatten, J.D., and Larry Marietta, CPA. February 1, 2022. Engagement letters. Client communications. Professional liability. Provide clarity and avoid scope creep with a carefully drafted engagement letter. This discussion focuses on how and why to use engagement ...

Effective Jan. 1, 2024, an 18-month extension will be granted for all unexpired sections of the CPA Exam that have been passed by test-takers. This extension provides a crucial lifeline, affording candidates the time and flexibility needed to prepare and excel in the remaining sections without the pressure of expiring credits. Dec 5, 2023, 23: ...

The only difference is how the assignments are named. For a regular module, the course is broken down by the week's number. The 8 sets of assigned readings, MC, PC and IP are named Week #1 to #8. For an extended module, the assignment sets are referred to as Assignment Set #1 to #8. Both formats have a module workshop weekend (except for Core ...

By Bryan Strickland. April 25, 2023. TOPICS. An amendment adopted by the National Association of State Boards of Accountancy (NASBA) opens the door for states to extend the window for completing the CPA Exam by one year. NASBA announced a change to its Uniform Accountancy Act (UAA) Model Rules that increases from 18 months to 30 months the time ...

In December 1999, the accountants advised the client of the built-in gains tax liability and for other reasons recommended that the client file an extension of time to file taxes (Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns). However, the accounting firm did not ...

An extension is a form filed with the IRS to request additional time to file your federal tax return. The extension period is six months, which extends the due date for submitting your final returns from April 15 to Oct. 15*. In some states, filing an extension with the IRS will automatically extend the time to complete a state income tax ...

Just keep a note of the 4-week limit and the supporting documentation requirements. To apply for an extension, visit your unit's Moodle site, click on the Support tab at the top, select the assessment extension request and pick the assessment you need the extension on. Attach your documentation, note your reasons for applying for the ...

My CPA says, 'extend.' What does that mean to me? What does filing an "extension" do? • An extension is a form filed with the IRS to request additional time to file your federal tax return. The extension period is six months, which extends the due date for submitting your final returns from April 15 to Oct. 15.

An extension is a form filed with the IRS to request additional time to file your federal tax return. The extension period is six months, which extends the due date for submitting your final returns from April 15 to Oct. 15*. In some states, filing an extension with the IRS will automatically extend the time to complete a state income tax ...

By mail, in a sealed envelope sent directly from the institution's Registrar's Office to CPA Ontario. Address for couriered mail: Chartered Professional Accountants of Ontario. Attn: Transcript Assessments & Registration. 130 King Street West. Suite 3400, Mailroom. Toronto, ON M5X 1E1. Address for regular mail:

CA PROGRAM Candidate Assessment and Grading Policy and Procedure Document ID 07-03-00-50-P Policy Name Candidate Assessment and Grading Policy and Procedure Document Owner(s) Chair, CA ANZ Teaching and Learning Panel Owner Division Education and Marketing Approved by CA ANZ Education Board Date Approved 13 September 2022 Date Effective 26 February 2024 Next Review Date September 2026

To ensure eligibility to proceed to the module-end examination, candidates must achieve a minimum overall module grade of 75 percent and attend the module workshop. The overall module grade is a cumulative number and increases from week-to-week as various module activities and assignments are completed. This running total is viewable in the ...

Poor time-management; Proximity to other assessments; Lack of awareness of dates or times of assessment submission; Failure, loss or theft of data, a computer or other equipment; Commitments to paid or voluntary employment. Where a student has good reason for requiring a coursework extension of more than seven calendar days, the student should ...

What does filing an "extension" do? • An extension is a form filed with the IRS to request additional time to file your federal tax return. The extension period is six months, which extends the due date for submitting your final returns from April 15 to Oct. 15. In some states, filing an extension with the IRS will

What does filing an "extension" do? • An extension is a form filed with the IRS to request additional time to file your tax return. The extension period is 6 months, which extends the due date for submitting your final returns from April 15 to Oct. 15. • Filing an extension grants you additional time to submit your complete

Accommodation panel. To ensure all applicants are treated fairly and equally regardless of their location, the panel will normally be comprised of a designate (s) from each region (West, Ontario, Quebec, Atlantic and National). Specifically: at least one member per CPA member region. one CPA Canada staff member representing the Board of Examiners.