Resume Worded | Career Strategy

14 credit manager cover letters.

Approved by real hiring managers, these Credit Manager cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Credit Manager

- Assistant Credit Manager

- Senior Credit Analyst

- Credit Risk Manager

- Alternative introductions for your cover letter

- Credit Manager resume examples

Credit Manager Cover Letter Example

Why this cover letter works in 2024, highlighting relevant experience.

This sentence emphasizes the candidate's years of experience in credit management and implies their expertise in the field. It's important to highlight your relevant experience so the hiring manager can quickly see your qualifications.

Specific Accomplishments

By providing specific numbers and accomplishments, this sentence demonstrates the candidate's ability to make a positive impact in their previous roles. Make sure to include quantifiable achievements that showcase your skills and expertise.

Expressing Gratitude

A simple, genuine thank you goes a long way. It shows appreciation for the hiring manager's time and consideration, and leaves a positive impression. Make sure to include a brief, heartfelt thank you in your cover letter.

Link your professional experience to the job role

In your cover letter, it's crucial to directly tie your current or past roles to the position you're applying for. Here, you're showing that you've already mastered similar responsibilities in your current role as a Senior Credit Analyst - and that's exactly what the hiring manager wants to see. This gives me confidence that you're already familiar with the tasks you'll be undertaking and won't need a lot of hand-holding.

Highlighting successful negotiations

By mentioning a specific project where you successfully negotiated credit terms with over 50 clients, you're showing that you're not just a credit analyst, but also a savvy negotiator. It's essential to highlight such 'extra' skills that may not be explicitly mentioned in the job description but are incredibly valuable in the workplace. It also shows that you're proactive and you can handle challenging tasks.

Highlighting Proven Abilities

This cover letter does a fantastic job of highlighting the candidate's proven ability to transform credit management strategies into tangible results. It's not just about saying you have a knack for something, but backing it up with concrete examples and achievements from previous roles.

Expressing Enthusiasm to Apply Existing Skills

What I appreciate here is the excitement expressed about applying existing skills to a new role. It's essential to communicate that you're not just looking for any job, but specifically excited about what you can do in the role you're applying for.

Emphasizing Role Alignment

This line does an excellent job of expressing why the role is a good fit. It's important to tell your potential employer that you understand what the role entails and why it suits you. This shows you have a thoughtful approach to your job search.

Polite and Gracious Sign-Off

Ending with a note of thanks shows consideration and leaves a positive impression. It may seem like a small thing, but it can differentiate you from candidates who fail to express gratitude for the opportunity to apply.

Show your enthusiasm for the credit manager role

Expressing excitement about the job and how the company's goals match yours makes your cover letter feel personal and genuine.

Demonstrate your credit analysis expertise

Detailing your specific achievements and how you improved your past employers' operations shows you have the skills necessary for the job.

Highlight your asset to the team

Talking about your experience in ways that show you can bring value to the new team reassures employers of your potential impact.

Share your passion for innovation in credit

When you mention looking forward to working with a team to drive innovation, it shows you're ready to contribute and grow with the company.

Close with a strong call to action

Ending on a note that invites further discussion about your fit for the role shows confidence and eagerness to move forward in the hiring process.

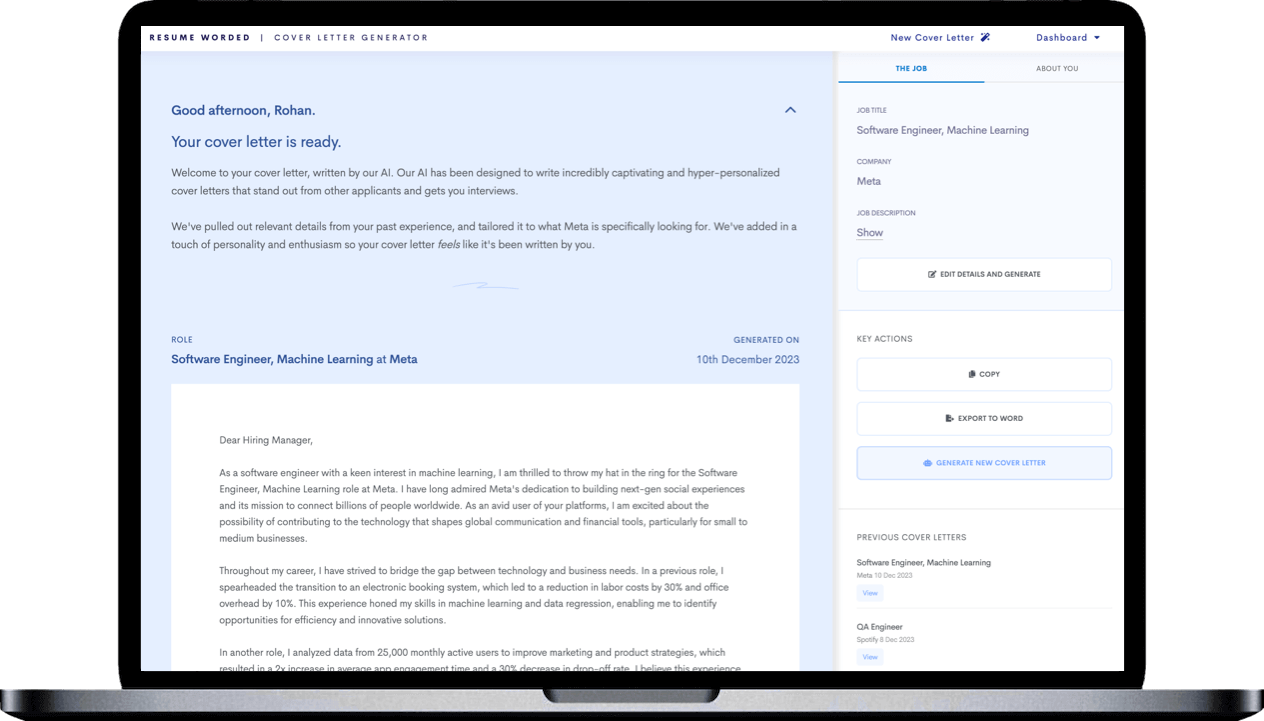

Does writing cover letters feel pointless? Use our AI

Dear Job Seeker, Writing a great cover letter is tough and time-consuming. But every employer asks for one. And if you don't submit one, you'll look like you didn't put enough effort into your application. But here's the good news: our new AI tool can generate a winning cover letter for you in seconds, tailored to each job you apply for. No more staring at a blank page, wondering what to write. Imagine being able to apply to dozens of jobs in the time it used to take you to write one cover letter. With our tool, that's a reality. And more applications mean more chances of landing your dream job. Write me a cover letter It's helped thousands of people speed up their job search. The best part? It's free to try - your first cover letter is on us. Sincerely, The Resume Worded Team

Want to see how the cover letter generator works? See this 30 second video.

Show enthusiasm for the company's financial leadership

Starting your cover letter with admiration for the company's financial excellence not only shows you've done your homework but also that you're genuinely interested in contributing to its success.

Detail your credit management expertise

Describing your proficiency in core tasks like credit analysis and risk assessment sends a clear message: you have the skills necessary to manage and improve the company's credit operations.

Highlight successful negotiations and risk reduction

Discussing specific achievements, like negotiating payment plans and reducing bad debt, demonstrates your ability to handle challenging situations and contribute to the company's financial health.

Express interest in the company's global and diverse operations

Your excitement about managing risks in a complex, international context shows you're ready for the challenges unique to a global company like PepsiCo.

Connect your passion with your potential contribution

Closing by linking your experience and enthusiasm for the role with how you can help the team signifies you're not just looking for a job but aiming to make a difference.

Show your enthusiasm for the credit management role

When you express excitement about applying for the position and acknowledge the company's strengths, it builds a good first impression. It shows you have done your homework about the company's mission and values.

Quantify your achievements in credit risk management

By stating how your efforts led to a decrease in default rates and supported portfolio growth, you effectively showcase your direct impact on business outcomes. This makes it easier for employers to visualize your potential contribution to their team.

Align your skills with the company’s goals

Mentioning how your ability to manage risk while focusing on business growth fits with the company’s objectives demonstrates you understand their key priorities. It suggests you can seamlessly integrate into their strategic vision.

Highlight your commitment to team growth

Discussing your passion for nurturing talent and enhancing a team's skill set emphasizes your leadership qualities and your value beyond just technical skills. It aligns with companies looking to build strong, supportive cultures.

Express eagerness for a follow-up

Concluding with a polite thank you and a look forward to discussing your application further shows professionalism and reiterates your interest in the position. It keeps the door open for future conversations.

Assistant Credit Manager Cover Letter Example

Showcase your achievements with hard data.

Using specific, quantifiable achievements is a great way to make your case. Here, you've shared that you managed a substantial portfolio and maintained an impressively low delinquency rate. This tells me two things: firstly, you can handle the responsibility of managing large sums of money, and secondly, you're effective at what you do. It's one thing to say you're good at your job, but showing me with solid data convinces me.

Illustrate your ability to leverage technology

Sharing an example of a time when you used technology to improve performance is brilliant. It lets me know that you're not stuck in old ways of doing things and that you're open to leveraging technology to enhance efficiency and accuracy. In a rapidly evolving industry like finance, this willingness to adapt and innovate is highly appreciated.

Senior Credit Analyst Cover Letter Example

Presenting past achievements.

I like how this cover letter zeroes in on the writer's past achievements. Mentioning a specific project or initiative that you contributed to significantly provides a strong proof of your abilities. It's always a good idea to quantify your successes when possible.

Expressing Eagerness to Contribute

It's good to show enthusiasm for the potential role, and this sentence does that well. It shows that the candidate is not just interested in the job, but is looking forward to bringing their skills to bear in a new environment.

Aligning with Company Values

Here, the writer expresses their excitement about working in an environment that values the same things they do. It's always a good idea to show that you've done your homework about the company's culture and values.

Appreciating the Opportunity

Again, ending with a note of gratitude is a nice touch that shows consideration and polite professionalism. It leaves a positive impression and signals that you're someone who understands the value of appreciation.

Expressing Confidence

This last line effectively communicates the candidate's confidence in their ability to contribute to the team. It's important to convey your belief in your ability to succeed in the role, without sounding arrogant or overconfident.

Connect your passion with the company's mission

Starting your cover letter by aligning your professional interests with the company's goals makes a compelling introduction.

Showcase your impact as a senior credit analyst

Providing examples of your past successes gives concrete evidence of your ability to perform well in the role.

Translate data into results

Illustrating how you can turn complex data into actionable insights demonstrates critical thinking and problem-solving skills.

Express excitement about contributing to risk management solutions

Your enthusiasm for the opportunity to bring your skills to a new team highlights your motivation and dedication to the role.

End with gratitude and a forward-looking statement

Thanking the reader for their time and expressing interest in further discussing your fit for the role leaves a positive, lasting impression.

Show enthusiasm for the company's values

Talking about your respect for a company’s way of doing things makes your interest in the job feel more real and shows you've done your homework.

Demonstrate impact with numbers

Mentioning specific outcomes like reducing payment terms or increasing sales by certain percentages provides solid proof of your effectiveness in previous roles.

Highlight key credit analysis skills

Detailing your experience with financial modeling and data analysis directly relates to core senior credit analyst responsibilities and shows you have the technical skills needed.

Connect skills to company needs

By expressing excitement to apply your analytical skills and business understanding at the company, you effectively link your strengths to how you can contribute to their success.

Value alignment enhances fit

Stating your appreciation for a company’s culture of innovation and improvement suggests a natural fit, making you a more appealing candidate for the role.

Connect your admiration with the company’s methodology

Starting by mentioning your respect for the company's approach to credit risk management instantly creates a connection. It shows you're aligned with their values and methodologies, making you a potentially great fit.

Balance risk management with operational efficiency

Detailing your success in optimizing processes while upholding standards of credit quality illustrates your ability to contribute to both operational efficiency and strategic risk management. Employers will value this dual capability.

Emphasize your commitment to staying updated on industry trends

Your passion for keeping abreast of industry developments and applying them to your work speaks volumes about your proactive nature and dedication to excellence. It suggests you will bring valuable insights and innovations to the team.

Share your enthusiasm for innovation in finance

Expressing excitement about bringing your innovative mindset to a company known for its forward-thinking is compelling. It shows you not only admire the company's achievements but are eager to contribute to its future successes.

Close with a courteous follow-up invitation

Ending your cover letter with gratitude and an openness to discuss how you can add value underscores your professionalism and eagerness to engage further. It's a positive note that encourages a response.

Credit Risk Manager Cover Letter Example

Show your passion for the credit risk sector.

Expressing admiration for a company's mission, like financial inclusion, shows you're not just looking for any job, but you're passionate about making a meaningful impact in the credit risk field.

Highlight your experience in credit risk management

Talking about your skills in risk assessment and leadership directly tells me you're not starting from scratch. You have a solid foundation that's ready to be put to use in new ways.

Demonstrate the impact of your analytical skills

By detailing your achievements with data and analytics, you're showing that you understand the key challenges in the credit industry and have practical solutions to offer.

Express eagerness to innovate in credit management

Highlighting your excitement to join a company known for innovation makes you stand out as someone ready to contribute fresh ideas and help the company stay at the forefront.

Convey readiness to contribute to financial inclusion

This wraps up your cover letter on a high note, reinforcing your enthusiasm to use your skills for a cause that aligns with the company's goals.

Express genuine admiration for the company

Starting with a personal connection to the company sets a positive tone and demonstrates that your interest goes beyond just the job.

Showcase a track record in credit risk management

Describing your comprehensive experience and success in the field establishes your credibility and suggests you can achieve similar results for Coca-Cola.

Negotiation skills are a plus

Detailing successful negotiations with suppliers not only highlights your skills in credit management but also your ability to positively affect supply chain costs.

Illustrate leadership in process improvements

Mentioning your role in leading teams to enhance accounts receivable processes underscores your leadership skills and your impact on financial health.

Emphasize adaptability and global perspective

Your enthusiasm for working in a diverse and dynamic environment like Coca-Cola’s indicates your readiness to handle the complexities of a global role.

Show your enthusiasm for the credit risk manager role

Starting your cover letter by expressing genuine excitement for the job and the company makes me feel you're truly interested. This is a good way to begin.

Highlight your data analytics expertise in risk management

You should tell us about specific projects where you used your skills to make a big difference. Mentioning the use of advanced analytics is especially valuable in the credit risk field.

Demonstrate leadership in credit risk teams

Talking about your experience in leading teams shows you're not just good on paper but also in guiding others to success. This is important for roles that need teamwork.

Link your values to the company’s culture

When you talk about your commitment to helping team members grow, and connect it with the company’s commitment to its employees, it tells me you've done your homework about what we value.

Ending your cover letter by expressing a clear desire to discuss how you can contribute shows confidence and proactiveness, which are qualities I look for in a candidate.

Alternative Introductions

If you're struggling to start your cover letter, here are 6 different variations that have worked for others, along with why they worked. Use them as inspiration for your introductory paragraph.

Cover Letters For Jobs Similar To Credit Manager Roles

- Commercial Credit Analyst Cover Letter Guide

- Credit Analyst Cover Letter Guide

- Credit Manager Cover Letter Guide

Other Finance Cover Letters

- Accountant Cover Letter Guide

- Auditor Cover Letter Guide

- Bookkeeper Cover Letter Guide

- Claims Adjuster Cover Letter Guide

- Cost Analyst Cover Letter Guide

- Finance Director Cover Letter Guide

- Finance Executive Cover Letter Guide

- Financial Advisor Cover Letter Guide

- Financial Analyst Cover Letter Guide

- Financial Controller Cover Letter Guide

- Loan Processor Cover Letter Guide

- Payroll Specialist Cover Letter Guide

- Purchasing Manager Cover Letter Guide

- VP of Finance Cover Letter Guide

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

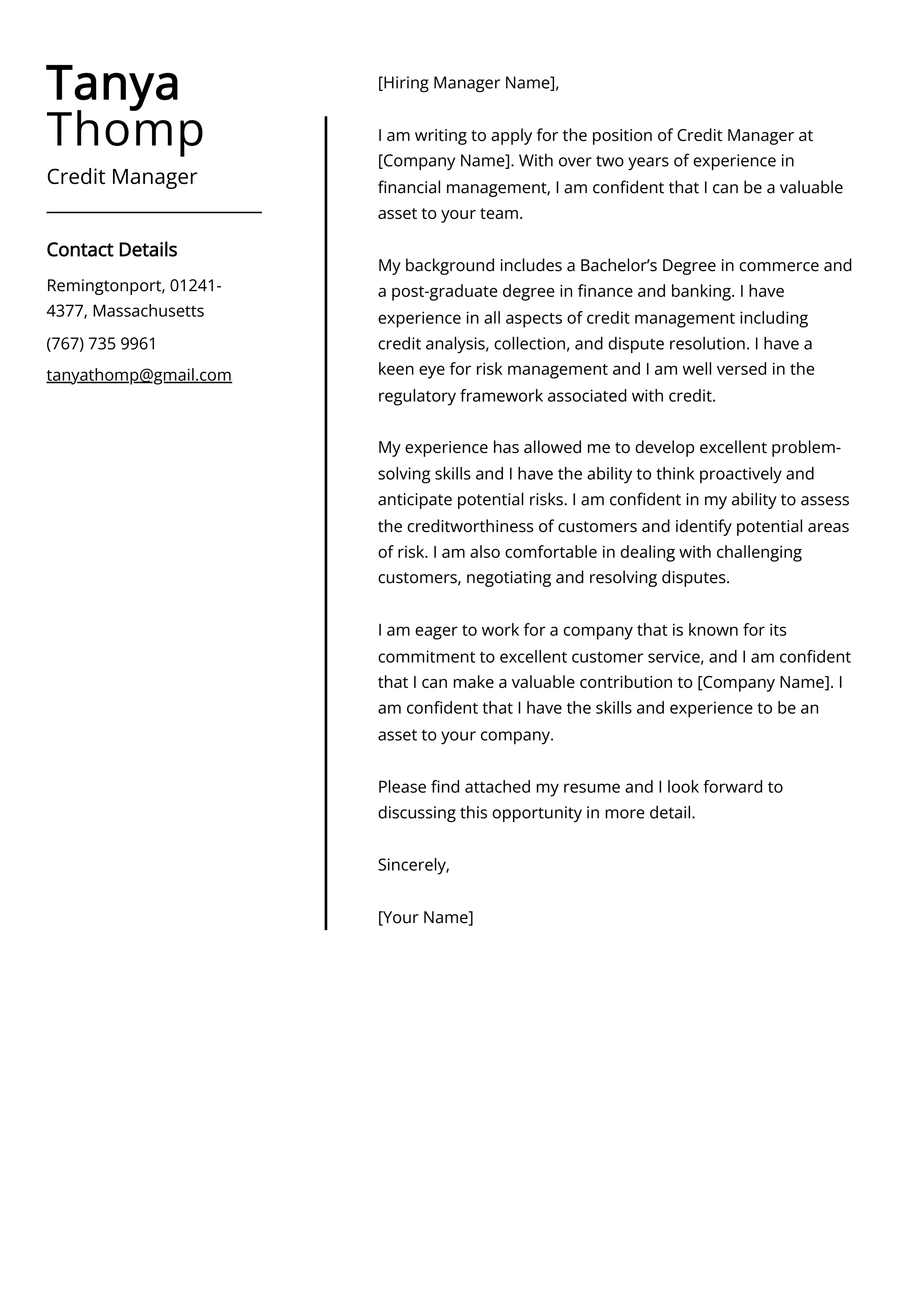

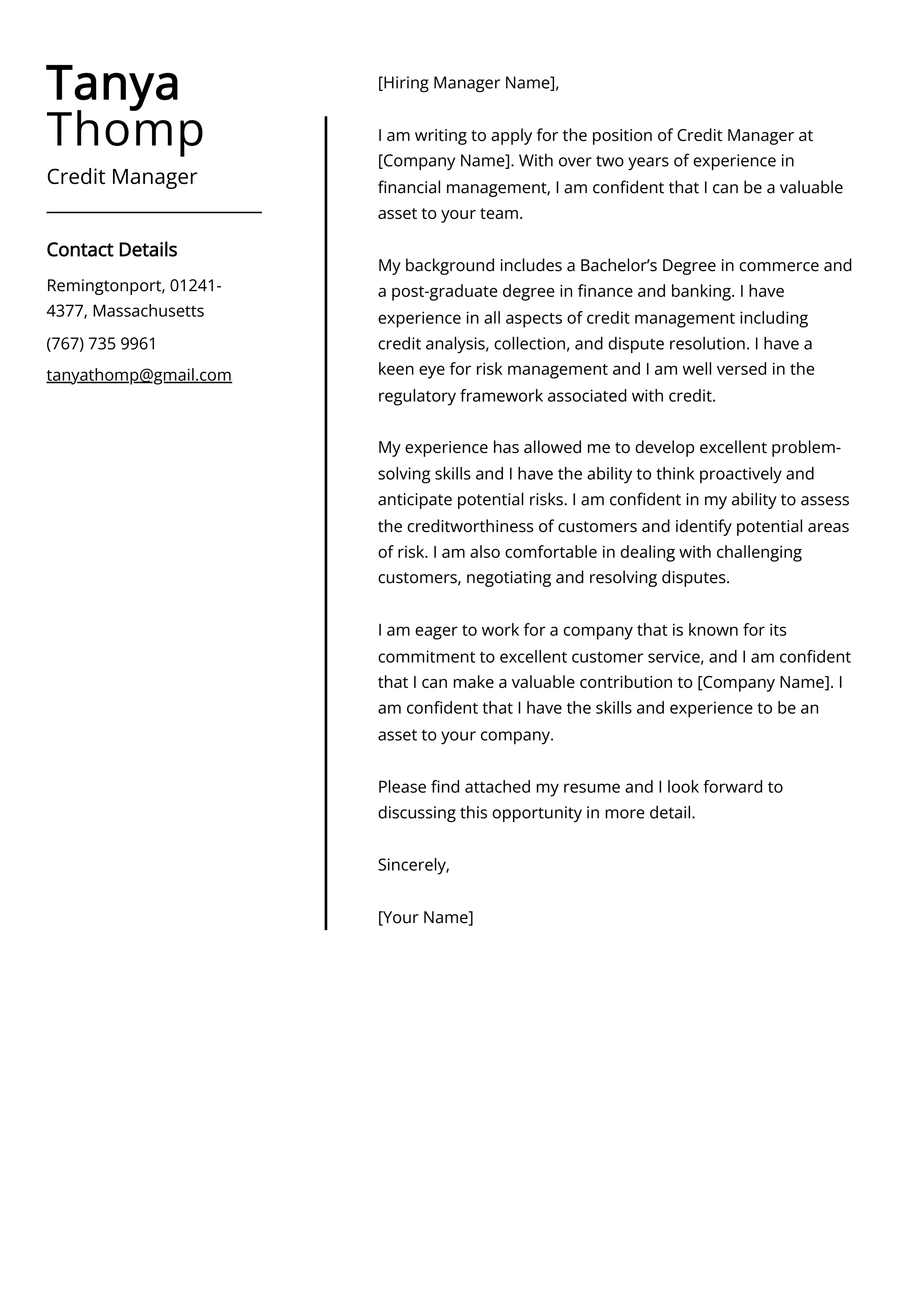

Credit Manager Cover Letter Example (Free Guide)

Create an credit manager cover letter that lands you the interview with our free examples and writing tips. use and customize our template and land an interview today..

Are you looking to apply for a Credit Manager position? Our Credit Manager Cover Letter Guide is here to help. We will provide you with tips on how to create a great cover letter and the key elements to include in your letter. We’ll also share some helpful samples and templates to get you started. Follow our guide and you’ll have a great cover letter that will get you noticed.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- What a cover letter template is, and why you should use it.

Related Cover Letter Examples

- Finance Advisor Cover Letter Sample

- Experienced Real Estate Agent Cover Letter Sample

- Experienced Mortgage Advisor Cover Letter Sample

- Compliance Analyst Cover Letter Sample

- Credit Administrator Cover Letter Sample

Credit Manager Cover Letter Sample

- Finance Manager Cover Letter Sample

- Actuary Cover Letter Sample

- Claim Specialist Cover Letter Sample

- Account Administrator Cover Letter Sample

- Account Analyst Cover Letter Sample

- Accounting Analyst Cover Letter Sample

- Accounting Assistant Cover Letter Sample

- Accounting Associate Cover Letter Sample

- Accounting Auditor Cover Letter Sample

- Accounting Consultant Cover Letter Sample

- Accounting Coordinator Cover Letter Sample

- Accounting Manager Cover Letter Sample

- Accounting Specialist Cover Letter Sample

- Audit Director Cover Letter Sample

Dear Hiring Manager

I am writing to apply for the Credit Manager position at [Company Name], as advertised on [Job Site]. With my extensive knowledge of credit management and experience in customer service, I am confident I would be a great asset to the team.

I have six years of experience in credit management and customer service. During my time in this role, I have developed an excellent ability to manage customer accounts and relationships. I have a proven track record of successfully collecting and analyzing customer data, developing strategies to reduce bad debts, and managing customer disputes. I have a deep understanding of the financial industry and I am knowledgeable in credit compliance and risk management.

I am also highly skilled in problem-solving and decision-making. I have excellent communication and interpersonal skills, which I have utilized to effectively build relationships with customers and colleagues. I am comfortable working in a fast-paced and highly-regulated environment, as I have demonstrated the ability to multi-task and prioritize tasks according to deadlines.

I have also earned my Bachelor’s Degree in Business Administration. This has enabled me to develop my understanding of financial accounting, economics, and other related topics. I am also certified by the Association of Credit Management (ACM) and have been a member for four years.

I am confident I can bring my knowledge and experience to the role of Credit Manager and make a positive contribution to [Company Name]. I am eager to further discuss my qualifications and how I can help your team reach its goals. Please do not hesitate to contact me if you have any questions or would like to schedule an interview.

Sincerely, [Your Name]

Why Do you Need a Credit Manager Cover Letter?

- A Credit Manager cover letter is a great way to show employers that you are the right candidate for the job.

- It allows you to showcase your abilities and experience in the field, as well as demonstrate your passion for the role.

- Your cover letter also provides an opportunity to explain why you are the best choice for the job, and how you can help the company reach its goals.

- It will also help to highlight any special qualifications you have that may not be apparent from your resume.

- Finally, a Credit Manager cover letter can help you stand out from other applicants, making it easier to get noticed by employers.

A Few Important Rules To Keep In Mind

- Keep the cover letter short and to the point. Aim for a maximum of one page.

- Avoid using cliches such as "I'm the perfect candidate for the job". Instead, focus on specific qualities and experience that you possess.

- Address the letter to a specific contact in the company, either by name or title.

- Make sure to reference the position you are applying for in the first sentence.

- Mention relevant experience that you have that directly relates to the job you are applying for.

- Emphasize any unique traits that make you stand out from other applicants.

- Include your contact information at the top of the letter.

- Proofread the letter for any spelling or grammar errors.

- End the letter on a positive note, thanking the recipient for their time and consideration.

What's The Best Structure For Credit Manager Cover Letters?

After creating an impressive Credit Manager resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Credit Manager cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Credit Manager Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

As a Credit Manager, I have a strong understanding of the financial and credit policies and procedures necessary for successful operations. My experience includes overseeing accounts receivable, managing credit policies, and minimizing risk. I have a proven track record of success in identifying and mitigating risk, while maintaining a high level of customer satisfaction.

I am a highly organized professional with strong communication, interpersonal, and problem-solving skills. I am confident I can bring the same level of excellence to your organization. I have the knowledge and experience needed to effectively manage credit and collections, as well as the ability to foster strong relationships with clients and vendors.

My key qualifications include:

- Risk Management: I have extensive experience in assessing, monitoring, and mitigating risk. I am adept at identifying potential risks and implementing strategies to reduce them.

- Financial Analysis: I am skilled in analyzing financial information to ensure accuracy and timeliness of payments. I also have experience in preparing financial reports.

- Credit and Collections: I have a strong understanding of credit and collections policies and procedures. I am adept at managing customer accounts and establishing payment plans.

- Customer Service: I am an excellent communicator, and I am committed to providing the highest level of customer service. I am experienced in resolving customer disputes and ensuring customer satisfaction.

I am a highly motivated professional with the experience and skills to be an asset to your organization. I am confident that I can help you achieve your goals. I look forward to discussing this opportunity further and thank you for your consideration.

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing a Credit Manager Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Not customizing the cover letter to the job posting.

- Including irrelevant information.

- Focusing too much on your qualifications and not enough on the company’s needs.

- Using a generic salutation.

- Writing a cover letter that is too long.

- Using incorrect grammar and spelling mistakes.

- Not proofreading the cover letter.

- Failing to follow up after submitting the cover letter.

Key Takeaways For a Credit Manager Cover Letter

- Demonstrate a thorough understanding of the role of a credit manager and how it contributes to the success of the company.

- Highlight any relevant experience managing credit and collections, including any key successes.

- Showcase strong analytical and organizational skills.

- Mention any experience in financial analysis, budgeting and forecasting.

- Discuss any experience in performing credit and risk analysis.

- Highlight any knowledge of legal aspects of credit and collections.

- Emphasize excellent communication skills, both written and verbal.

- Discuss any proficiency in using computer systems and software related to managing credit and collections.

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Credit Manager Cover Letter Example

Get more job offers & learn how to improve your new cover letter with our free, professionally written Credit Manager cover letter example. Copy and paste this cover letter sample at no cost or alter it with ease in our simple yet powerful cover letter maker.

Related resume guides and samples

How to build a professional executive resume?

Handy tips on how to build an effective product manager resume

How to build an effective project manager resume

How to craft an appealing risk manager resume?

How to write a top-notch strategy manager resume

Credit Manager Cover Letter Example (Full Text Version)

Saara rootare.

Dear Head of Talent,

I am writing to express my interest in the Credit Manager position with your organization. With over 4 years of experience in credit and risk management, I am confident in my ability to contribute positively to your team.

Currently, I hold the position of Senior Credit Specialist at BR Bank, where I oversee the credit granting process and lead a team of 10 individuals across various branches. My responsibilities include assessing client creditworthiness, managing financial documents, and implementing new corporate financing programs.

I am known for my strong communication and analytical skills, as well as my problem-solving abilities. Last year, I was honored to receive the Manager of the Year Award for exceeding targets and objectives.

In addition to my professional experience, I hold a Bachelor of Business Administration from Stanford University. During my time at the university, I was a top-performing student and served as President of the FinTech Society.

I have attached my resume for your review and consideration. Thank you for taking the time to consider my application. I am looking forward to hearing from you regarding next steps.

Sincerely, Saara Rootare 555-555-5555 | [email protected]

Milan Šaržík, CPRW

Milan’s work-life has been centered around job search for the past three years. He is a Certified Professional Résumé Writer (CPRW™) as well as an active member of the Professional Association of Résumé Writers & Careers Coaches (PARWCC™). Milan holds a record for creating the most career document samples for our help center – until today, he has written more than 500 resumes and cover letters for positions across various industries. On top of that, Milan has completed studies at multiple well-known institutions, including Harvard University, University of Glasgow, and Frankfurt School of Finance and Management.

Edit this sample using our resume builder.

Don’t struggle with your cover letter. artificial intelligence can write it for you..

Similar job positions

Accountant Auditor Strategic Manager Investment Advisor Bookkeeper Executive Manager Product Manager Project Manager Risk Manager Tax Services Insurance Agent Finance Analyst

Related management resume samples

Related management cover letter samples

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

Credit Manager Cover Letter Example

A Credit Manager is responsible and accountable for all the granting processes of the company. His primary function is to analyze a loan application and permit it or reject it based on creditworthiness.

Writing a cover letter to land your dream job has just become quick and accessible. Use our easy-to-use builder to draft your cover letter using our Credit Manager Cover Letter sample.

- Cover Letters

- Accounting & Finance

What to Include in a Credit Manager Cover Letter?

Roles and responsibilities.

Typically a Credit Manager reviews applications of existing customers create credit score models, analyses the company’s sales and bad debt loss, negotiates the loan terms , sets the interest rate, maintains a record of all the loan applications. He also ensures that the standard procedures for loan procurement have adhered at all times.

- Evaluating the creditworthiness of potential customers.

- Creating credit scoring models for risk assessments.

- Approving and rejecting loans based on available data.

- Calculating and setting loan interest rates.

- Negotiating the terms of the loan with new clients.

Education & Skills

The skills of a successful Credit Manager are as follows:

- Excellent financial acumen.

- Knowledge of sales.

- Good communication skills.

- Attention to detail.

- Accuracy in checking information.

- Negotiation skills.

- Ability to handle stress.

- Address client grievances.

Qualifications of a successful Credit Loan Manager are as follows:

- A bachelor’s degree in banking or accounting or a relevant field.

- A master’s degree in finance or banking or a relevant field.

Credit Manager Cover Letter Example (Text Version)

Dear Mr./Ms. [Hiring Officer Name],

This letter is in response to the job opening at [XXX Company] for the position of Credit Manager. I am sending my resume for your consideration. As an experienced professional with an experience of six years in this field, I can provide excellent customer services and strategize for the optimization of crediting processes.

My experience and background in banking and finance provide me with comprehensive knowledge of banking acumen. [XXX Company] is leading in the innovative credit system, which is not only my forte but also my future interest for career advancement. I am adept at the documentation and analyzing sales, and bad debt losses, which is an essential step towards optimization. At my previous company [YYY Company] I was responsible for the following tasks:

- Analyzing the client’s assets for loan approval or disapproval or creditworthiness(as per the standards).

- Analyze the credit score model to predict risks.

- Provide the junior employee’s guidance on tasks related to loans.

- Connect with high-value clients to improve business.

- Discuss new policies and strategies to improve the existing structure of banking and move towards optimization.

- Provided excellent customer service and retained high-value clients successfully.

- Worked towards efficiency and collaborated with various departments to reach organizations’ goals.

My leadership skills, hard-working and motivated nature combined with the analyzing skills, attention to detail will prove to be outstanding and fit in perfectly for your requirements. I am sure I will bring success to your company as your new Credit Manager.

Thank you for your time and consideration. I am looking forward to meeting you to discuss the position in further detail.

Sincerely, [Your Name]

Tips for writing an impeccable Credit Manager cover letter:

- Present experience and recommendation letter to further your chance of landing the job.

- Mention the qualities required for the job and certifications acquired.

- Highlight educational achievements, knowledge, and experience in the field of work.

- Include appreciation received or awards received.

You can use our Credit Manager Resume Sample to create a good resume and increase your chances of getting the job.

Customize Credit Manager Cover Letter

Get hired faster with our free cover letter template designed to land you the perfect position.

Related Accounting & Finance Cover Letters

- Create a Cover Letter Now

- Create a Resume Now

- My Documents

- Examples of cover letters /

Credit Manager

Credit Manager Cover Letter

You have the skills and we have tricks on how to find amazing jobs. Get cover letters for over 900 professions.

- Artyom Krasavin - Career Expert, Marketing specialist

How to create a good cover letter for a credit manager: free tips and tricks

For a credit manager position, you’re expected to have 5+ years of experience. Use it properly to show the employer that you’re a strong candidate for the position and should be reviewed and invited to interview. Here are our top six recommendations for matching your skills to the job. For your convenience, we have provided the credit manager cover letter example below that further demonstrates how you need to draft your letter.

Address the letter properly. You might think it is insignificant. However, a lack of personalized greeting points out that you failed to treat the application process seriously.

Don’t make paragraphs too long. You letter must be easy to skim. If you have too dense text and too long text, there’s a high chance that the hiring specialist will not move on to your resume at all. Don’t risk it!

Look at yourself through the employer’s eyes. Understand the employer’s needs. It will show you what exactly you should write. In contrast, there’s no need for you to inform the employer what you get from the job.

Don’t be negative. You should not mention things you don’t like or didn’t want to happen, either about your prospect job or current position. Only positivity!

Praise yourself but moderately. You look most of all when you show your accomplishments by giving examples of how much money you earned or saved. Rely on figures and statistics.

Avoid excessiveness. Neither exaggerated modesty nor excessive flattery sound genuine and adequate. Create an impression of a normal and adequate employee who can work well.

Sample cover letter for a credit manager position

The most effective way to digest the tips is to see their practical application. We have used all the important tips of the above units into a single a credit manager cover letter sample to demonstrate a winning document that can be created in GetCoverLetter editor.

Dear Xavier, Expressing my interest in the Credit Manager position you posted on LinkedIn, I would like to let you know that I possess the necessary competences you are looking for and I would like to suggest you my candidacy.

Having worked in a similar role for over 5 years at Alfa Bank, I was primarily in charge of managing customer credit files, evaluating the credit worthiness of client and monitoring periodic credit reviews. I would carry out cost-benefit analysis, implement financial control, and write sale reports. As an avid communicator, I would communicate with clients and ensure that payments are made on time.

Although I enjoyed my work at Alfa Bank, my position was eliminated a month ago following a round of layoffs. I would like to continue my career in the field of finance, and I believe my strong work ethics and professionalism is a perfect fit for Raiffeisen Bank.

I hope to see you at an interview. Looking forward to speaking with you regarding my ideas for.

Sincerely, Carol.

This example is not commercial and has a demonstrative function only. If you need unique Cover Letter please proceed to our editor.

Do not waste on doubts the time that you can spend on composing your document.

How to save time on creating your cover letter for a credit manager

Our Get Cover Letter editor will help you make the process easy and fast. How it works:

Fill in a simple questionnaire to provide the needed information about yourself.

Choose the design of your cover letter.

Print, email, or download your cover letter in PDF format.

Why the Get Cover Letter is the best solution

The GetCoverLetter editor is open to any goals of applicants. Whether it be a presentation of a craft professional with a great list of achievements or even a credit manager without experience. Rest assured, the opportunities are equal for all the candidates.

We'll help you not only to tell about your working experience but also to show how your performance as an employee will be supported by your best personal traits.

We keep your document short, sweet and to the point.

We show your superiority over the other candidates. You know that the applicant, who makes the cover letter outstanding, gets more chances to be noticed.

All the above and other benefits of using our editor are only one click away.

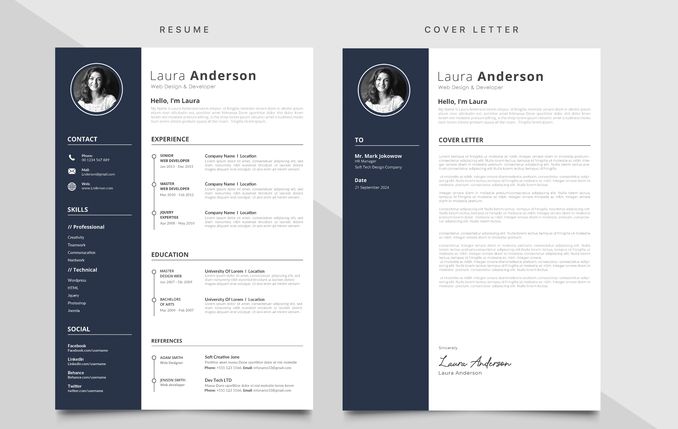

Templates of the best a credit manager cover letter designs

Any example of the document for a credit manager has a precise design per the requirements of the company or the general rules of business correspondence. In any case, the selection of templates in our editor will meet any expectations.

Or choose any other template from our template gallery

Overall rating 4.3

Overall rating 4.4

Get Cover Letter customer’s reviews

“To be honest, I emptied all my creativity on my resume. Where am I supposed to get more creativity for my cover letter for resume? I don’t know. So I was relieved that I should not use the same generic phrases I always use. GetCoverLetter helped a lot!”

“This online service is so simple and easy to use. I just pressed a few buttons, filled in some personal information. And within minutes I had my cover letter fresh and ready to be sent.”

“I was entry level, and GetCoverLetter drafted an amazing cover letter for me! I am so thankful for their experts’ help.”

Frequently Asked Questions

The more unique the knowledge you get, the more space for new questions. Do not be affraid to miss some aspects of creating your excellent cover letter. Here we took into account the most popular doubts to save your time and arm you with basic information.

- What should my a credit manager cover letter contain? The main purpose of a cover letter is to introduce yourself, mention the job you’re applying for, show that your skills and experience match the needed skills and experience for the job.

- How to properly introduce yourself in a cover letter? Greet the correct person to which your cover is intended for. Introduce yourself with enthusiasm.

- How many pages should my cover letter be? Your cover letter should only be a half a page to one full page. Your cover letter should be divided into three or four short paragraphs.

- Don't focus on yourself too much

- Don't share all the details of every job you've had

- Don't write a novel

You have finished your acquaintance with valuable tips and tricks. Now is the time to create your own perfect cover letter.

Other cover letters from this industry

Want to see more formats and layouts, follow the links below, and you will find more applications for qualifications similar to yours.

- Credit Analyst

- Investment Analyst

15 Supervisor Cover Letters That Will Get Hired (NOW)

Are you are looking to write a cover letter for Supervisor jobs that will impress recruiters and get you noticed by hiring managers? You need one to apply for a job, but you don’t know what to say.

Cover letters are an important tool for any job seeker, as they can provide a chance for the applicant to sell themselves without having to come into the interview. It’s also an opportunity to ensure that your qualifications are relevant, which increases your chances of being considered for the position. An effective cover letter should be about two pages long, and should include a brief summary of your experience in relation to the job, why you want it, and how you think you can make a valuable contribution.

Here are 15 amazing Supervisor cover letters that are professionally written and will help you stand out and get that job!

Supervisor Cover Letters

Each cover letter is written with a different focus. Review all of them and pick the ones that apply to your situation. Take inspiration from multiple samples and combine them to craft your unique cover letter.

Supervisor Sample 1

Dear ____, I believe that I am the perfect candidate for the Supervisor position you’re looking to hire for. I come with a solid work experience in customer service and in management. I am hard-working and responsible, and your company would benefit from my skills. I look forward to hearing from you soon about when we can set up an interview appointment. Thanks in advance for considering me! Sincerely, __________

Supervisor Sample 2

I am very interested in your Supervisor position. I bring many years of experience in management, evaluation, and leadership to the table. I have always had a keen interest in systems development and implementation; hence my expertise is implementing new strategies for improvement, restructuring programs to better meet objectives, evaluating the effectiveness of programs and initiatives. Additionally, I am adept at conducting research surveys with quantitative data collection methods that involve sampling techniques such as random digit dialing or stratified random sampling to obtain samples representative of population groups. Finally, I am eager to learn more about your supervision requirements so that I can tailor my skillset accordingly.

Supervisor Sample 3

Dear Mr. Smith,

I am writing this letter because I am interested in the position of Supervisor at your company. I would like to tell you about myself and why I believe that I am qualified for the position. At my current job, I manage a team of four employees and have successfully supervised them for three years now. As a supervisor, I make sure that all tasks are completed timely and efficiently without errors to ensure quality assurance in the work place. My current responsibilities include budgeting, scheduling, assigning daily tasks accordingly with deadlines, tracking progress on all projects through reports submitted by my team members every work day during our morning meetings. If you are interested in my services please feel free to contact me via phone or email at any

Supervisor Sample 4

I am seeking a position as a Supervisor at ___________. I have over 10 years of experience in retail and inventory management, and can assure you that I will be able to successfully manage your company’s business operations. My resume is attached for your perusal. If you would like to schedule an interview with me, please contact my email or phone number below:

-Name -email address -Phone Number

Supervisor Sample 5

I am writing this letter to express my interest in the Supervisor position you are hiring for. I have 12 years of experience in supervising employees at various levels of responsibility and have been successful at every job I’ve held. My leadership skills and strong work ethic make me a great candidate for this role. As such, please consider me as a candidate for the Supervisor position you are hiring for. Thank you for your time and consideration, _____

Supervisor Sample 6

I am writing to express my interest in the Supervisor position at _____. I am confident that I would be an asset to your company, and genuinely interested in this opportunity. I am confident that my qualifications and experience make me a great candidate for this position, and would welcome any opportunity to learn more about this role by talking with you. If you have any questions or need additional information, please contact me at (202) 555-1234 or email me at [email protected]

Supervisor Sample 7

Dear Hiring Manager,

I am writing to express my interest in the position of Supervisor at _____. “Qualifications” I have over 10 years of experience supervising employees within a wide range of capacities. My strong work ethic and leadership skills will be an asset to your company. Please reach out if you would like to discuss my qualifications further.

Supervisor Sample 8

I am a recent graduate with a Bachelor’s degree in Business Administration. As such, I am looking for an entry-level position in the field of human resources or management that would enable me to use my knowledge and skills. Please consider my qualifications when you are hiring for your supervisor position at _____.

Supervisor Sample 9

Dear HR Department,

I am a hardworking and motivated individual with a strong background in customer service. I have 10 years of experience working with customers, and I am excited to apply my skills in a new position. I am qualified for this Supervisor position and would welcome the opportunity to be interviewed. Thank you for your consideration.

Supervisor Sample 10

Dear [recipient],

Thank you for your consideration. I am a [insert relevant qualifications] with [insert relevant experience] and have been in the field of [insert applicable field] for over 10 years. The skills that I can bring to your company are excellent organizational skills, proven leadership abilities, and a high level of customer service skills. Please feel free to contact me by phone or email if there is anything else you would like to know about my qualifications or experience before making a decision on who will fill the Supervisor position at your company.

Sincerely, [signature].

Supervisor Sample 11

Dear Sir or Madam:

I am applying for the supervisor position. I possess a strong work ethic and am able to meet deadlines. I am also able to work well on a team and take constructive criticism without getting defensive. I have excellent written and verbal communication skills, which would make me an asset in this position. My experience includes managing staff, scheduling employees, dealing with vendors, providing training courses for new hires, and providing customer service for clients on the phone.

Supervisor Sample 12

I am applying for the Supervisors position at the company. I have extensive experience in this role, having supervised a team of 20 people on a regular basis for over 15 years. I am confident that my skills and qualifications are well suited to this role, specifically my experience overseeing staff recruitment, training, coaching, motivating staff to perform better and execution of projects. I am available for an interview any time that suits your schedule. I look forward to hearing from you soon.

Supervisor Sample 13

Dear Mr. James,

I am excited to apply for the position of Supervisor at your company. I am currently completing an Associate Degree in mechanical engineering and have been working as a Mechanical Engineer for 10 years with a focus on technical and manufacturing industries. My qualifications include: · 10 years of experience working in manufacturing and technical industry; 8 of those 10 years was spent as a Mechanical Engineer who focused on automation systems, pneumatics, hydraulics and CAD design; And · I am currently enrolled in an Associate Degree program for Mechanical Engineering at Penn State Harrisburg which will be completed this coming summer. To read more about me or my qualifications please visit https://www.linkedin.com/in/cher

Supervisor Sample 14

Dear Mr. or Ms. ________,

I hope that this email finds you well and that the new year is off to a great start! I am currently seeking a supervisor position and I think my skills would be an excellent match for your company’s needs. As such, please let me know if you have any openings available at this time. I appreciate the opportunity to share my qualifications with you and look forward to hearing from you soon. Thank you for taking the time to consider me as a potential candidate for your team!

Supervisor Sample 15

I am writing in response to your job posting for a Supervisor position. As the sole proprietor of my own business, I have proven time and again that I am able to handle this type of responsibility.

-My corporation’s revenue has increased by 100% in the past year alone – -I currently employ over 10 full time employees (ranging from administrative staff, marketing professionals, accountants) -After responding to an increase in demand for our services at home and abroad, I expanded my company’s operations with an additional manufacturing facility which is now fully operational. This new chapter in my company’s growth was accomplished through careful planning and diligent execution.

Recruiters and hiring managers receive hundreds of applications for each job opening.

Use the above professionally written Supervisor cover letter samples to learn how to write a cover letter that will catch their attention and customize it for your specific situation.

Related Careers:

- 15 Fashion Stylist Cover Letters That Will Get Hired (NOW)

- 15 Maintenance Worker Cover Letters That Will Get Hired (NOW)

- 15 Program Manager Cover Letters That Will Get Hired (NOW)

- 15 Research Scientist Cover Letters That Will Get Hired (NOW)

- 15 Kennel Assistant Cover Letters That Will Get Hired (NOW)

- 15 IT Intern Cover Letters That Will Get Hired (NOW)

- 15 Technical Support Cover Letters That Will Get Hired (NOW)

- 15 School Secretary Cover Letters That Will Get Hired (NOW)

- 15 Data Analyst Cover Letters That Will Get Hired (NOW)

- 15 Park Ranger Cover Letters That Will Get Hired (NOW)

Leave a Comment Cancel reply

You must be logged in to post a comment.

Credit Manager Cover Letter / Job Application Letter

Cover letter to potential employer, credit manager sample cover letter in response to job ad, credit manager sample cover letter when you know the company or person, credit manager sample cover letter to recruitment agency, credit manager sample cover letter - general purpose, credit manager sample cover letter - checking for vacancy.

- • Directed a credit team of 20, implementing strategic initiatives to reduce bad debt expenses by 15% within one fiscal year.

- • Developed and executed a new credit risk assessment framework, resulting in a 10% improvement in portfolio risk profile.

- • Spearheaded the integration of AI-based credit scoring techniques, enhancing underwriting efficiency by 25%.

- • Managed the credit cycle for accounts worth over $500M, maintaining a 97% collection rate through proactive customer engagement.

- • Orchestrated cross-departmental collaboration, reducing turnaround time for credit analysis by 30% and boosting customer satisfaction.

- • Championed a financial literacy program for clients, which improved payment timeliness by 20% and deepened business relationships.

- • Led credit risk evaluations for corporate clients, optimizing credit exposure for a $300M portfolio.

- • Initiated a risk mitigation plan that reduced portfolio defaults by 18% by aligning with business growth objectives.

- • Delivered comprehensive credit risk training to over 35 team members, enhancing departmental knowledge and capabilities.

- • Collaborated closely with sales and operations teams to align credit risk policies with overarching business strategies.

- • Negotiated and structured workout arrangements for high-risk accounts, preserving customer relationships and minimizing losses.

- • Managed a team of 10 credit analysts, achieving a 5% year-on-year decrease in delinquency rates.

- • Designed and implemented credit evaluation tools that increased risk assessment accuracy by 12%.

- • Played a pivotal role in restructuring credit processes, enhancing team productivity by 20%.

- • Fostered strong working relationships with clients, contributing to a client retention rate of over 95%.

5 Credit Manager Resume Examples & Guide for 2024

As a credit manager, your resume must showcase your ability to assess credit risk. Highlight your proficiency in analyzing financial statements and credit data. You need to demonstrate a history of successful credit portfolio management. Detail your experience in setting credit policies and recovery strategies to capture the reader's attention.

All resume examples in this guide

Resume Guide

Resume Format Tips

Resume Experience

Skills on Resume

Education & Certifications

Resume Summary Tips

Additional Resume Sections

Key Takeaways

As a credit manager, articulating your complex risk analysis and decision-making experiences on your resume can be challenging. Our guide is designed to help you distill these intricate responsibilities into clear, impactful bullet points that will catch an employer's eye.

- credit manager resumes that are tailored to the role are more likely to catch recruiters' attention.

- Most sought-out credit manager skills that should make your resume.

- Styling the layout of your professional resume: take a page from credit manager resume examples.

How to write about your credit manager achievements in various resume sections (e.g. summary, experience, and education).

- Junior Financial Analyst Resume Example

- Assistant Finance Manager Resume Example

- Fund Accountant Resume Example

- Hotel Night Auditor Resume Example

- IT Auditor Resume Example

- Management Accounting Resume Example

- Construction Accounting Resume Example

- Full Cycle Accounting Resume Example

- Tax Director Resume Example

- Purchase Accounting Resume Example

Designing your credit manager resume format to catch recruiters' eyes

Your credit manager resume will be assessed on a couple of criteria, one of which is the actual presentation.

Is your resume legible and organized? Does it follow a smooth flow?

Or have you presented recruiters with a chaotic document that includes everything you've ever done in your career?

Unless specified otherwise, there are four best practices to help maintain your resume format consistency.

- The top one third of your credit manager resume should definitely include a header, so that recruiters can easily contact you and scan your professional portfolio (or LinkedIn profile).

- Within the experience section, list your most recent (and relevant) role first, followed up with the rest of your career history in a reverse-chronological resume format .

- Always submit your resume as a PDF file to sustain its layout. There are some rare exceptions where companies may ask you to forward your resume in Word or another format.

- If you are applying for a more senior role and have over a decade of applicable work experience (that will impress recruiters), then your credit manager resume can be two pages long. Otherwise, your resume shouldn't be longer than a single page.

Upload & Check Your Resume

Drop your resume here or choose a file . PDF & DOCX only. Max 2MB file size.

If you happen to have plenty of certificates, select the ones that are most applicable and sought-after across the industry. Organize them by relevance to the role you're applying for.

Fundamental sections for your credit manager resume:

- The header with your name (if your degree or certification is impressive, you can add the title as a follow up to your name), contact details, portfolio link, and headline

- The summary or objective aligning your career and resume achievements with the role

- The experience section to curate neatly organized bullets with your tangible at-work-success

- Skills listed through various sections of your resume and within an exclusive sidebar

- The education and certifications for more credibility and industry-wide expertise

What recruiters want to see on your resume:

- Proven experience in credit risk analysis and decision-making.

- Capability to develop and implement credit policies and procedures.

- Proficiency with credit management software and financial analysis tools.

- Demonstrated experience managing and leading a team of credit analysts or related staff.

- Strong understanding of financial regulations and compliance as it pertains to credit and lending.

What is the resume experience section and how to write one for your past roles

The experience section in a credit manager resume is critical for your profile and overall application. It should not only display your work history, but also highlight your achievements in previous roles .

Many candidates either simply list their duties or provide excessive details about past, irrelevant jobs. A more effective approach involves first examining the job advertisement for keywords - specifically, skills essential for the role . Then, demonstrate these key requirements throughout different parts of your resume, using accomplishments from your roles.

Format each bullet point in your experience section by starting with a strong action verb . Follow this with a description of your role and its impact on the team or organization.

Aim to include three to five bullet points for each role.

Finally, gain insights into how professionals have crafted their credit manager resume experience sections by exploring some best practice examples.

- Spearheaded the restructuring of the credit evaluation process, introducing data analytics tools that improved the accuracy of credit scoring by 30%.

- Negotiated and implemented new credit terms with key vendors, improving cash flow by 20% and reducing average days sales outstanding by 15 days.

- Led a cross-functional team in a successful pilot program to automate risk assessment, which was then adopted company-wide, decreasing processing times by 40%.

- Managed a portfolio of over 500 commercial accounts, reducing delinquency rates from 7% to 4.5% within the first year.

- Developed and conducted credit management training for new team members, enhancing department expertise and reducing onboarding time by 25%.

- Established and led quarterly credit review meetings that contributed to strategic planning, resulting in a 20% reduction in credit losses.

- Implemented an innovative credit scoring model using predictive analytics that led to a 12% improvement in loan performance.

- Collaborated with IT to launch a new credit reporting system, improving reporting efficiency and cutting errors by 25%.

- Drove company policy changes that aligned credit risk objectives with overall business strategy, improving risk-adjusted returns on the portfolio.

- Oversaw a team that successfully reduced credit card fraud by 40% through implementing advanced fraud detection systems.

- Played a key role in the negotiation of a multimillion-dollar loan syndication transaction that expanded the company’s market presence.

- Initiated and managed a comprehensive debt recovery program that increased recoveries on impaired loans by 35%.

- Optimized credit line increases, reducing churn by 18% and simultaneously maintaining a healthy risk profile for the credit portfolio.

- Developed a standardized credit risk reporting framework that enhanced visibility for executive decision-making and was later adopted across regional offices.

- Championed a client retention program that incorporated credit incentives, resulting in the retention of key accounts and an increase in profitability by 10%.

- Re-engineered underwriting policies for SMB lending, leading to a portfolio growth of $100M while maintaining loss rates below industry average.

- Orchestrated the transition to a new credit monitoring platform that increased operational efficiency by streamlining credit reviews and approvals.

- Drove international credit expansion initiatives, successfully penetrating new markets in Europe and Asia, resulting in a 15% portfolio growth in those regions.

- Designed a comprehensive risk assessment model tailored for SMEs that improved credit decision turnaround times by 30%.

- Directed the successful integration of a newly acquired company's credit processes, maintaining service levels throughout the transition.

- Achieved a 20% efficiency gain in the collections process through the implementation of a new CRM system, enhancing customer payment behaviors.

- Enhanced credit risk assessment for high-net-worth individuals, increasing the portfolio under management by $50 million with an improved risk profile.

- Contributed to interdepartmental teams that developed new financial products which aligned with emerging market demands and credit trends.

- Aligned credit approval processes with regulatory requirements, ensuring 100% compliance with local and federal financial regulations.

Quantifying impact on your resume

- Include the total value of receivables managed to showcase financial stewardship.

- Specify the percentage reduction in bad debt achieved through credit policies to demonstrate risk mitigation effectiveness.

- Highlight the number of credit analysis reports produced to show analytical productivity.

- Mention the dollar amount of loans or credit lines approved to convey the scale of credit authority.

- State the percentage of credit limit increases granted to illustrate strategic account growth support.

- List the number of clients managed to reflect customer relationship and portfolio management skills.

- Provide the frequency of financial reviews conducted to emphasize due diligence and ongoing creditworthiness assessment.

- Detail any process improvements made in terms of reduced processing time or increased efficiency, using percentages or time saved to demonstrate operational enhancements.

Action verbs for your credit manager resume

Experience section for candidates with zero-to-none experience

While you may have less professional experience in the field, that doesn't mean you should leave this section of your resume empty or blank.

Consider these four strategies on how to substitute the lack of experience with:

- Volunteer roles - as part of the community, you've probably gained valuable people (and sometimes even technological capabilities) that could answer the job requirements

- Research projects - while in your university days, you may have been part of some cutting-edge project to benefit the field. Curate this within your experience section as a substitute for real-world experience

- Internships - while you may consider that that summer internship in New York was solely mandatory to your degree, make sure to include it as part of your experience, if it's relevant to the role

- Irrelevant previous jobs - instead of detailing the technologies you've learned, think about the transferable skills you've gained.

Recommended reads:

- How to List Expected Graduation Date on Your Resume

- Perfecting the Education Section on Your Resume

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

In-demand hard skills and soft skills for your credit manager resume

A vital element for any credit manager resume is the presentation of your skill set.

Recruiters always take the time to assess your:

- Technological proficiency or hard skills - which software and technologies can you use and at what level?

- People/personal or soft skills - how apt are you at communicating your ideas across effectively? Are you resilient to change?

The ideal candidate presents the perfect balance of hard skills and soft skills all through the resume, but more particular within a dedicated skills section.

Building your credit manager skills section, you should:

- List up to six skills that answer the requirements and are unique to your expertise.

- Include a soft skill (or two) that defines you as a person and professional - perhaps looking back on feedback you've received from previous managers, etc.

- Create up to two skills sections that are organized based on the types of skills you list (e.g. "technical skills", "soft skills", "credit manager skills", etc.).

- If you happen to have technical certifications that are vital to the industry and really impressive, include their names within your skills section.

At times, it really is frustrating to think back on all the skills you possess and discover the best way to communicate them across.

We understand this challenge - that's why we've prepared two lists (of hard skills and soft skills) to help you build your next resume, quicker and more efficiently:

Top skills for your credit manager resume:

Credit Analysis

Financial Statement Analysis

Risk Management

Credit Policy Creation

Debt Collection

Account Reconciliation

Regulatory Compliance

Financial Reporting

Credit Scoring Models

Business Acumen

Communication

Problem-Solving

Negotiation

Attention to Detail

Decision Making

Analytical Thinking

Time Management

Customer Service

The more trusted the organization you've attained your certificate (or degree) from, the more credible your skill set would be.

Credit Manager-specific certifications and education for your resume

Place emphasis on your resume education section . It can suggest a plethora of skills and experiences that are apt for the role.

- Feature only higher-level qualifications, with details about the institution and tenure.

- If your degree is in progress, state your projected graduation date.

- Think about excluding degrees that don't fit the job's context.

- Elaborate on your education if it accentuates your accomplishments in a research-driven setting.

On the other hand, showcasing your unique and applicable industry know-how can be a literal walk in the park, even if you don't have a lot of work experience.

Include your accreditation in the certification and education sections as so:

- Important industry certificates should be listed towards the top of your resume in a separate section

- If your accreditation is really noteworthy, you could include it in the top one-third of your resume following your name or in the header, summary, or objective

- Potentially include details about your certificates or degrees (within the description) to show further alignment to the role with the skills you've attained