Item added to your cart

Here is a free business plan sample for a microlending organization.

If the idea of empowering individuals and small businesses through financial support sparks your interest, then launching a microlending company might be your calling.

In the following paragraphs, we will guide you through a comprehensive business plan tailored for a microlending enterprise.

As an aspiring microlender, you understand the importance of a robust business plan. It's not just a document; it's a roadmap that outlines your business objectives, operational strategies, and the impact you aim to create in the community.

To kickstart your journey with confidence and clarity, feel free to utilize our microlending business plan template. Our specialists are also on standby to provide a complimentary review and refinement of your plan.

How to draft a great business plan for your microlending organization?

A good business plan for a microlending business must be tailored to the unique aspects of financial services and microcredit operations.

To start, it's crucial to provide a comprehensive overview of the microfinance market. This should include current statistics and an analysis of emerging trends in the industry, similar to what we've outlined in our microlending business plan template .

Your business plan should articulate your vision clearly, define your target demographic (such as small business owners, individuals in underserved communities, or entrepreneurs), and establish your niche (like offering microloans for specific industries, green loans, or fast approval processes).

Market analysis is vital. It requires a thorough understanding of the competitive landscape, regulatory environment, risk assessment, and the needs of your potential clients.

For a microlending business, it's important to detail your loan products. Describe the types of loans you'll offer, the terms, interest rates, and how they cater to the financial gaps faced by your target market.

The operational plan should outline the infrastructure for loan distribution and collection, risk management strategies, credit scoring systems, and the technology that will support your operations.

Given the nature of microlending, it's essential to emphasize your approach to credit risk assessment, loan recovery methods, and compliance with financial regulations.

Discuss your marketing and client acquisition strategies. How will you reach out to potential borrowers and maintain a relationship with them? Consider your approach to financial education, community engagement, and the use of digital platforms for loan management.

Today, a digital strategy is not just an option but a necessity. A robust online presence, including a user-friendly website and active social media engagement, can help in reaching a broader audience.

The financial section is a cornerstone of your business plan. It should include your startup capital, projected loan volumes, operational expenses, revenue streams, and the point at which the business will become profitable.

In microlending, understanding the balance between interest rates, loan default risks, and operational costs is critical for sustainability. For this, you might find our financial projections for a microlending business useful.

Compared to other business plans, a microlending plan must address specific financial service concerns such as interest rate models, bad debt management, and the impact of financial regulations.

A well-crafted business plan will not only help you clarify your strategy and operational model but also serve as a tool to attract investors or secure funding from financial institutions.

Lenders and investors will look for a comprehensive risk assessment, a solid financial model, and a clear plan for loan disbursement and recovery.

By presenting a detailed and substantiated plan, you show your commitment to the responsible and profitable operation of your microlending business.

To achieve these goals efficiently, consider using our microlending business plan template .

A free example of business plan for a microlending organization

Here, we will provide a concise and illustrative example of a business plan for a specific project.

This example aims to provide an overview of the essential components of a business plan. It is important to note that this version is only a summary. As it stands, this business plan is not sufficiently developed to support a profitability strategy or convince a bank to provide financing.

To be effective, the business plan should be significantly more detailed, including up-to-date market data, more persuasive arguments, a thorough market study, a three-year action plan, as well as detailed financial tables such as a projected income statement, projected balance sheet, cash flow budget, and break-even analysis.

All these elements have been thoroughly included by our experts in the business plan template they have designed for a microlending .

Here, we will follow the same structure as in our business plan template.

Market Opportunity

Market overview and potential.

The microlending industry is a vital component of the financial sector, particularly in developing economies. It provides small loans to entrepreneurs and individuals who do not have access to traditional banking services.

As of recent estimates, the global microfinance market size is valued at over 100 billion dollars, with expectations for continued growth as financial inclusion becomes a priority worldwide.

In the United States, there are numerous microlending institutions that contribute significantly to the economy by empowering small business owners and individuals to achieve financial stability and growth.

This data underscores the critical role microlending plays in fostering entrepreneurship and economic development, especially among underserved communities.

Industry Trends

The microlending sector is witnessing several key trends that are shaping its future.

Technology is playing a transformative role, with fintech companies introducing mobile lending platforms that make it easier for borrowers to access funds. Digitalization of financial services is also enhancing the efficiency of loan disbursement and repayment processes.

There is a growing emphasis on social impact, with many microlenders focusing on empowering women, supporting sustainable practices, and promoting financial literacy among their clients.

Peer-to-peer lending platforms are gaining popularity, allowing individuals to lend directly to entrepreneurs and small businesses, bypassing traditional financial intermediaries.

Regulatory changes are also influencing the industry, with governments and international organizations advocating for policies that protect borrowers and promote responsible lending practices.

These trends indicate a dynamic and evolving industry that is adapting to meet the needs of a diverse and growing client base.

Key Success Factors

Several factors contribute to the success of a microlending institution.

First and foremost, trust and credibility are paramount. Clients must have confidence in the institution's ability to manage their funds responsibly and offer fair terms.

Understanding the local market and the specific needs of borrowers is crucial for tailoring financial products that are both accessible and impactful.

Efficient operations and risk management are essential to maintain low overhead costs and minimize defaults, ensuring sustainability and profitability.

Strong relationships with the community and local organizations can enhance outreach and support services for clients, furthering the institution's mission and growth.

Lastly, staying abreast of technological advancements and regulatory changes can help microlending institutions remain competitive and responsive to the evolving landscape of financial services.

The Project

Project presentation.

Our microlending initiative is designed to empower financially underserved communities by providing small, short-term loans to individuals and small business owners. Located in areas with limited access to traditional banking services, our microlending firm will offer loans that are tailored to the needs of entrepreneurs, artisans, and families who require capital to grow their businesses or meet urgent financial needs.

The focus will be on creating a simple, transparent, and accessible lending process to ensure that borrowers can obtain funds quickly and without undue burden.

This microlending firm aspires to become a catalyst for economic growth and financial inclusion, thus contributing to the prosperity and resilience of local communities.

Value Proposition

The value proposition of our microlending project is based on providing accessible and fair financial services to those who are often excluded from the traditional banking system.

Our commitment to offering microloans with reasonable interest rates and flexible repayment terms presents an opportunity for borrowers to invest in their futures, whether it's expanding a business, covering educational expenses, or managing unexpected costs.

We are dedicated to fostering financial literacy and empowerment, aiming to not only provide loans but also to educate our clients on managing finances and building creditworthiness.

Our microlending firm aspires to become a cornerstone of economic support, enabling clients to achieve their financial goals and contributing to the overall economic development of the communities we serve.

Project Owner

The project owner is a finance professional with a deep commitment to social impact and economic empowerment.

With a background in microfinance and community development, they are determined to create a microlending firm that stands out for its dedication to ethical lending practices and its focus on client success.

With a vision of financial inclusion and empowerment, they are resolved to provide financial solutions that are both impactful and sustainable, while contributing to the economic well-being of the community.

Their commitment to ethical finance and their passion for community development make them the driving force behind this project, aiming to bridge the gap between financial services and those who need them the most.

The Market Study

Target market.

The target market for our microlending business encompasses several key demographics.

Firstly, we focus on entrepreneurs and small business owners who lack access to traditional banking services and require capital to start or expand their businesses.

Additionally, we target individuals in underserved communities who are seeking small personal loans to overcome short-term financial hurdles.

Women and minorities, who often face barriers to obtaining credit, represent another significant segment for our services.

Lastly, we aim to serve young adults and recent graduates who may need loans for educational purposes or to fund innovative start-up ideas.

SWOT Analysis

Our SWOT analysis for the microlending business highlights several factors.

Strengths include a strong understanding of the microfinance sector, a commitment to ethical lending practices, and the ability to offer quick and accessible loans.

Weaknesses may involve the risk of default on loans and the challenge of maintaining profitability with low-interest margins.

Opportunities exist in leveraging technology to streamline the lending process and in expanding our reach to untapped markets with high demand for microloans.

Threats could come from regulatory changes, increased competition from both traditional banks and other microfinance institutions, and economic downturns affecting borrowers' ability to repay loans.

Competitor Analysis

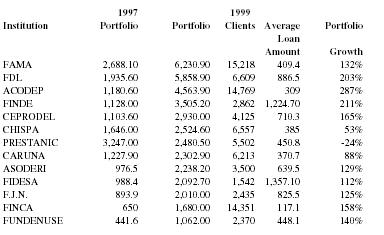

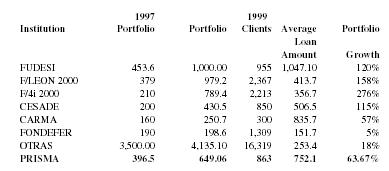

Our competitor analysis within the microlending industry indicates a varied landscape.

Direct competitors include other microfinance institutions, peer-to-peer lending platforms, and credit unions offering similar services.

These entities compete on interest rates, loan terms, and the speed of service delivery.

Potential competitive advantages for our business include personalized customer service, flexible repayment plans, and a strong community presence.

Understanding the strengths and weaknesses of these competitors is crucial for carving out a niche in the market and for developing strategies to attract and retain clients.

Competitive Advantages

Our microlending business prides itself on several competitive advantages that set us apart.

We offer a streamlined loan application process with minimal bureaucracy, enabling quick disbursement of funds to meet our clients' immediate needs.

Our interest rates are competitive and tailored to the financial situation of each borrower, ensuring affordability and promoting financial inclusion.

Moreover, our focus on financial literacy and borrower education helps clients make informed decisions and fosters long-term relationships built on trust and mutual benefit.

We also emphasize the use of technology to enhance user experience and maintain transparency throughout the loan lifecycle, reassuring clients of our commitment to fair and responsible lending practices.

You can also read our articles about: - how to establish a microlending organization: a complete guide - the customer segments of a microlending organization - the competition study for a microlending organization

The Strategy

Development plan.

Our three-year development plan for the microlending business is designed to empower individuals and small businesses financially.

In the first year, we will concentrate on building a solid foundation, establishing trust within the community, and refining our loan assessment processes.

The second year will be focused on expanding our reach by introducing mobile and online platforms to facilitate easier access to our services.

In the third year, we aim to diversify our loan products, offer financial literacy programs, and form strategic partnerships with local businesses to further support our clients' growth.

Throughout this period, we will remain committed to responsible lending, transparency, and adapting to the evolving financial needs of our customers while solidifying our presence in the microfinance sector.

Business Model Canvas

The Business Model Canvas for our microlending business targets underserved individuals and small businesses in need of financial services.

Our value proposition is providing accessible, fast, and fair microloans with a personal touch and financial guidance.

We deliver our services through both physical branches and digital platforms, utilizing key resources such as our credit assessment algorithms and customer service teams.

Key activities include loan processing, risk assessment, and customer support.

Our revenue streams are derived from interest on loans and nominal service fees, while our costs are mainly associated with loan capital, operations, and technology infrastructure.

Access a complete and editable real Business Model Canvas in our business plan template .

Marketing Strategy

Our marketing strategy is centered on building relationships and promoting financial inclusion.

We aim to reach potential clients through community engagement, educational workshops on credit and financial management, and through referrals from satisfied customers.

We will leverage social media and targeted online advertising to increase our visibility and emphasize the benefits of our services.

Partnerships with local businesses and organizations will also play a crucial role in expanding our reach and credibility.

Our commitment to customer success and community development will be at the forefront of all our marketing efforts.

Risk Policy

The risk policy for our microlending business is designed to mitigate financial risks while promoting responsible lending practices.

We employ stringent credit assessment techniques to ensure the creditworthiness of our clients and maintain a diversified loan portfolio to spread risk.

Regular audits and compliance checks are conducted to adhere to financial regulations and to protect against fraud and default.

We also maintain a reserve fund to cover potential loan losses and ensure the sustainability of our operations.

Insurance for loan defaults is also in place as a safeguard against unforeseen circumstances.

Why Our Project is Viable

We are committed to establishing a microlending business that serves as a catalyst for economic growth and empowerment.

With a focus on responsible lending, customer education, and innovative service delivery, we are poised to fill a gap in the financial market.

We are enthusiastic about the potential to make a positive impact on the lives of our clients and the communities we serve.

Adaptable to the changing financial landscape, we are prepared to make the necessary adjustments to ensure the success and viability of our microlending business.

You can also read our articles about: - the Business Model Canvas of a microlending organization - the marketing strategy for a microlending organization

The Financial Plan

Of course, the text presented below is far from sufficient to serve as a solid and credible financial analysis for a bank or potential investor. They expect specific numbers, financial statements, and charts demonstrating the profitability of your project.

All these elements are available in our business plan template for a microlending and our financial plan for a microlending .

Initial expenses for our microlending business include the costs associated with obtaining the necessary licenses and permits, investing in a secure IT infrastructure to manage loans and customer data, hiring experienced staff to evaluate loan applications, and developing marketing strategies to reach potential clients. Additionally, we will need to allocate funds for legal and accounting services to ensure compliance with financial regulations.

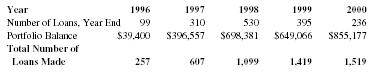

Our revenue assumptions are based on a thorough market analysis of the demand for microloans, particularly among small business owners and individuals who may not have access to traditional banking services.

We anticipate a steady increase in loan disbursement, starting conservatively and expanding as our reputation for reliable and accessible microlending services grows.

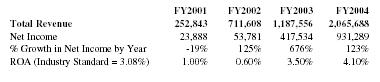

The projected income statement reflects expected revenues from interest and fees on microloans, operational costs (staff salaries, office rent, technology maintenance), and other expenses (marketing, legal, and accounting services).

This results in a forecasted net profit that is essential for assessing the long-term viability of our microlending venture.

The projected balance sheet will display assets such as cash reserves, loan receivables, and office equipment, against liabilities including any borrowed funds and operational payables.

It will provide a snapshot of the financial position of our microlending business at the end of each fiscal period.

Our projected cash flow statement will detail all cash inflows from loan repayments and outflows for business expenses and loan disbursements, enabling us to predict our financial needs and maintain adequate liquidity.

The projected financing plan outlines the sources of capital we intend to tap into for covering our initial costs, which may include a mix of owner's equity, loans, and grants.

The working capital requirement for our microlending business will be meticulously tracked to ensure we have sufficient funds to cover day-to-day operations, such as disbursing loans and managing repayments.

The break-even analysis will determine the volume of loan activity required to cover all our costs and begin generating a profit, marking the point at which our business becomes sustainable.

Key performance indicators we will monitor include the default rate on loans, the portfolio yield to measure the average return on our loan portfolio, and the efficiency ratio to evaluate our operational productivity.

These indicators will assist us in gauging the financial health and success of our microlending business.

If you want to know more about the financial analysis of this type of activity, please read our article about the financial plan for a microlending organization .

- Choosing a selection results in a full page refresh.

- Opens in a new window.

We earn commissions if you shop through the links below. Read more

Money Lending Business

Back to All Business Ideas

How to Start a Money Lending Business

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on June 15, 2022 Updated on June 5, 2024

Investment range

$8,550 - $18,100

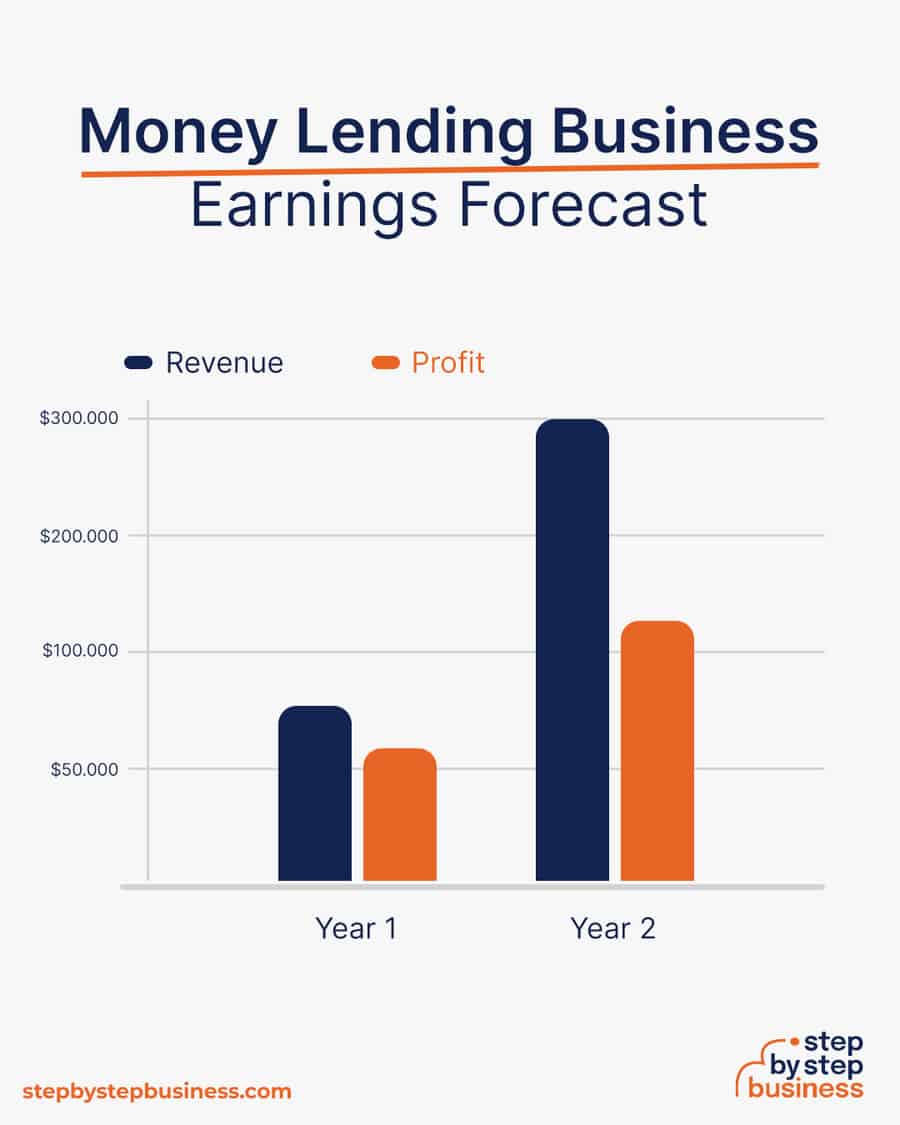

Revenue potential

$72,000 - $300,000 p.a.

Time to build

3 – 6 months

Profit potential

$58,000 - $120,000 p.a.

Industry trend

“Neither a borrower nor a lender be,” Shakespeare warned. Yet many have ignored his advice and today non-bank loans represent a $7 billion US industry. You could make good money with your own money lending business, as you’ll charge a higher interest rate and fees than those charged by banks because of the additional risk involved.

But before you start searching for investors, you’ll need to understand the process of launching a business. Luckily, this step-by-step guide has all the information you need to put you on the road to entrepreneurial success as a lender.

Looking to register your business? A limited liability company (LLC) is the best legal structure for new businesses because it is fast and simple.

Form your business immediately using ZenBusiness LLC formation service or hire one of the Best LLC Services .

Step 1: Decide if the Business Is Right for You

Pros and cons.

Before we get into the details, it’s important to clarify the type of business under discussion. Money lending businesses provide capital to individuals, generally those who cannot qualify for traditional bank loans. Money lending businesses can be structured in a number of ways:

- Private Lending – With a private lending company, you’d be lending your own personal funds to individuals, either unsecured or secured by collateral.

- Hard Money Lending – You would form relationships with money brokers and investors who would put up capital for you to use to make loans. The brokers or investors will take the interest earned and you would charge borrowers a loan fee.

- P2P Lending – Peer-to-peer lending is usually online and is basically a money lending app that connects individual lenders and borrowers. The P2P lending company usually takes a fee for the loan service.

This article will focus mainly on a hard money lending business, which requires much less capital to start. Even so, starting a money lending business has pros and cons to consider before deciding if it’s right for you.

- Good Money – Make 3-5% of each loan up front

- Flexibility – Run your business from home

- Large Market – Customers can be anywhere

- Build Relationships – Takes time to find investors, clients

- Attorney Fees – Need a prospectus for investors, plus loan documents

Money lending industry trends

Industry size and growth.

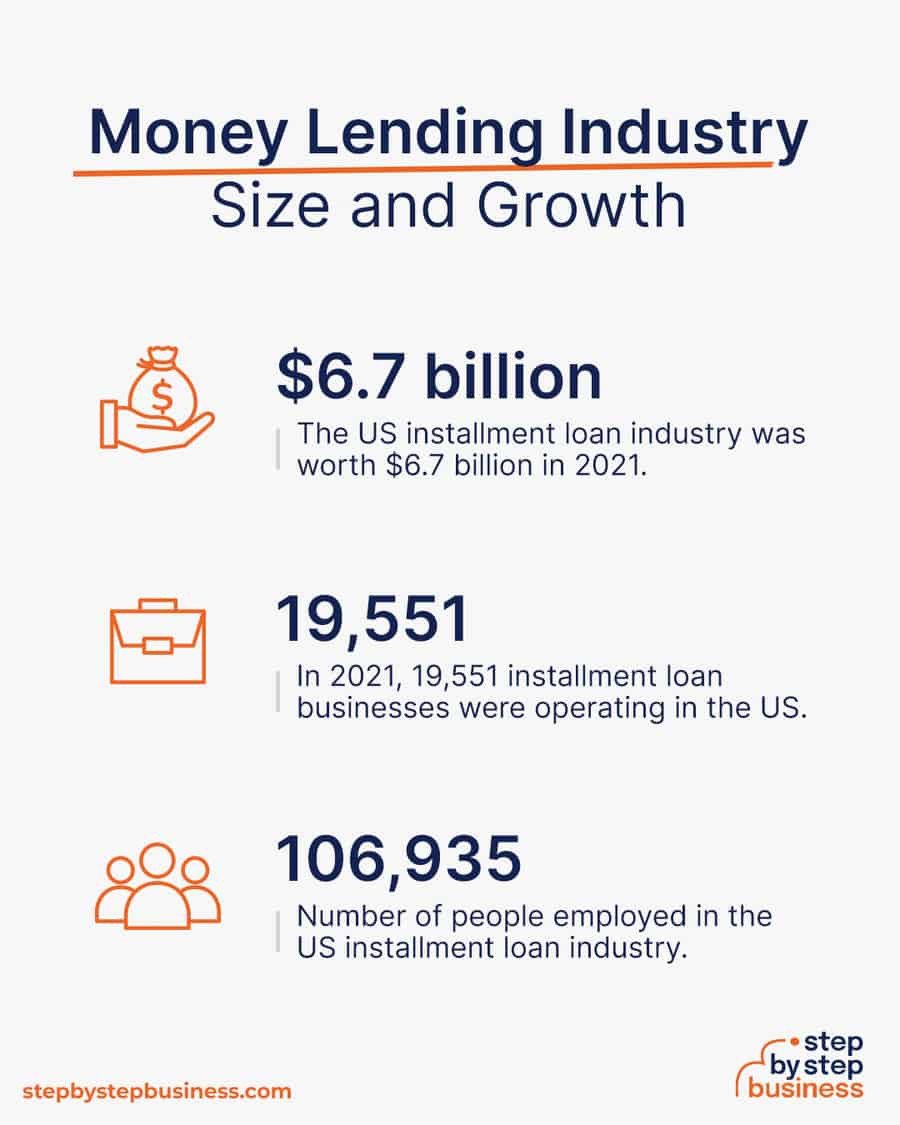

- Industry size and past growth – The US installment loan industry was worth $6.7 billion in 2021 after declining 1.3% annually over the previous five years.(( https://www.ibisworld.com/united-states/market-research-reports/installment-lenders-industry/ ))

- Growth forecast – The US installment loan industry is projected to continue to modestly decline over the next five years.

- Number of businesses – In 2021, 19,551 installment loan businesses were operating in the US.

- Number of people employed – In 2021, the US installment loan industry employed 106,935 people.

Trends and challenges

Trends in the money lending industry include:

- Hard money loans are growing in size and more often used for home purchases. This means higher fees for hard money lenders.

- More and more cross-border hard money loans are being made due to investors wanting to expand their reach globally.

Challenges in the money lending industry include:

- Money lenders have come under much scrutiny for alleged predatory lending practices and the high rates and fees they charge.

- Regulations are continuously tightening on money lenders, creating obstacles to doing business.

Demand hotspots

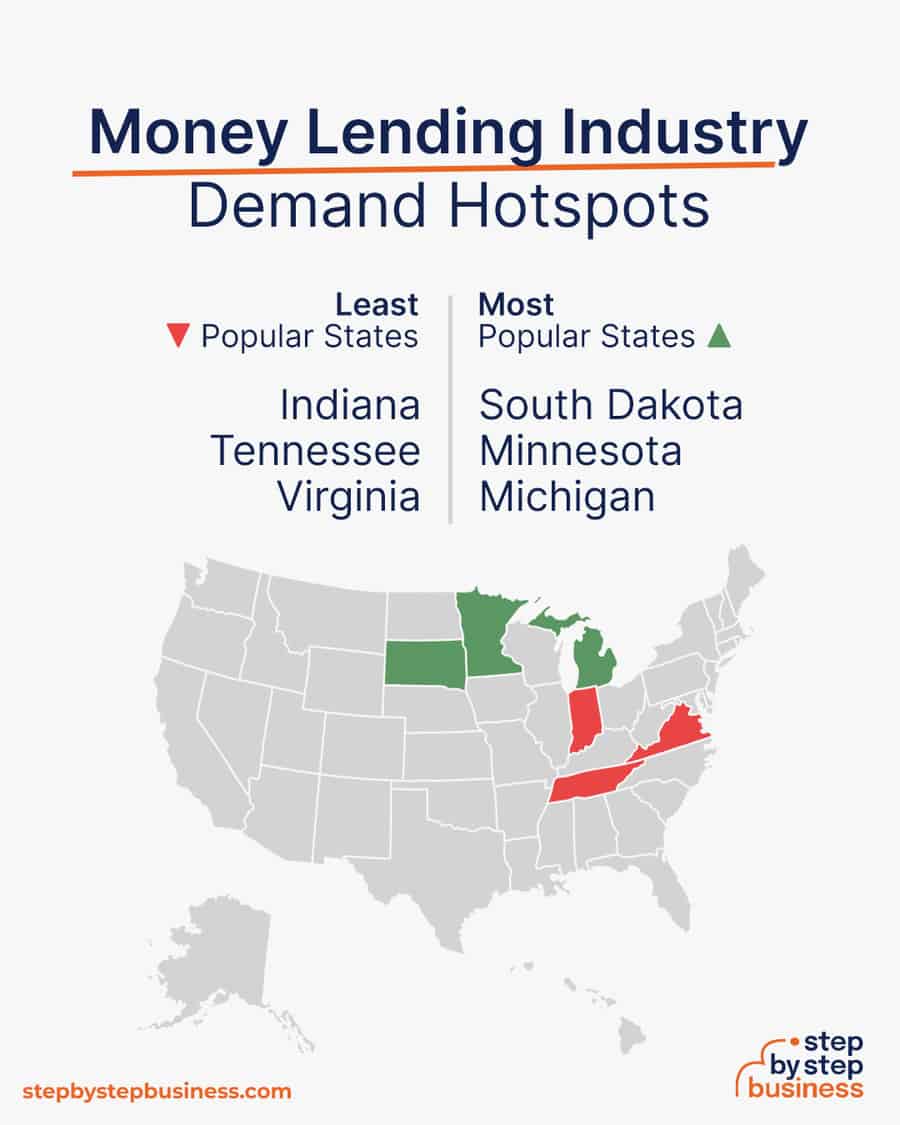

- Most popular states – The most popular states for lenders are South Dakota, Minnesota, and Michigan.(( https://www.zippia.com/lender-jobs/best-states/ ))

- Least popular states – The least popular states for lenders are Indiana, Tennessee, and Virginia.

What kind of people work in money lending?

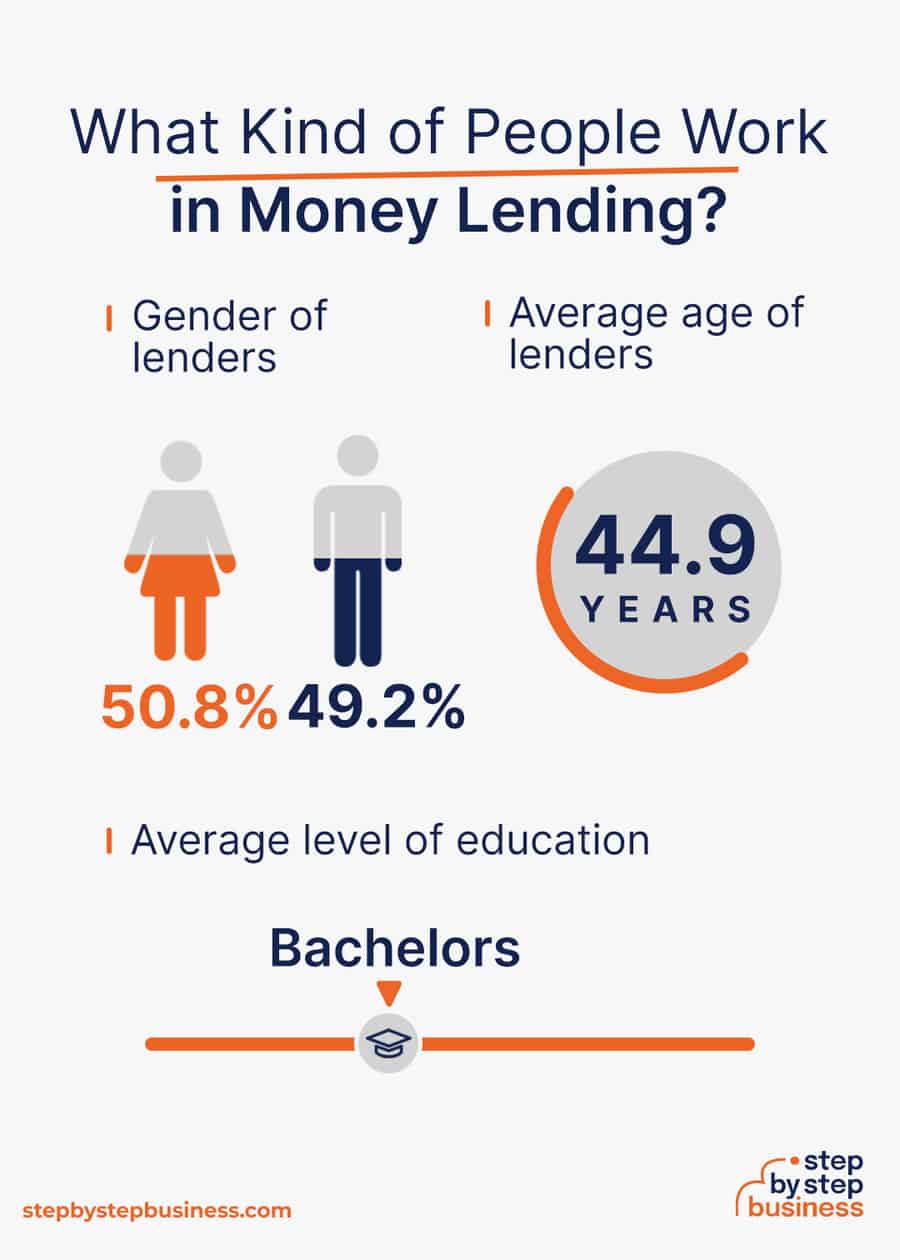

- Gender – 50.8% of lenders are female, while 49.2% are male . (( https://www.zippia.com/lender-jobs/demographics/ ))

- Average level of education – The average lender has a bachelor’s degree.

- Average age – The average lender in the US is 44.9 years old.

How much does it cost to start a money lending business?

If you decide to start a hard money lending business, your startup costs will range from $8,000 to $18,000. The largest cost will be attorney fees. You will need a prospectus to give to potential investors detailing how you will do business and how they will get a return on their investments. Such documents are complicated and costly. You’ll also need a website and a marketing budget.

| Start-up Costs | Ballpark Range | Average |

|---|---|---|

| Setting up a business name and corporation | $150 - $200 | $175 |

| Business licenses and permits | $100 - $300 | $200 |

| Insurance | $100-$300 | $200 |

| Business cards and brochures | $200 - $300 | $250 |

| Website setup | $1,000 - $3,000 | $2,000 |

| Legal fees | $5,000 - $10,000 | $7,500 |

| Marketing budget | $2,000 - $4,000 | $3,000 |

| Total | $8,550 - $18,100 | $13,325 |

How much can you earn from a money lending business?

Hard money lenders typically take a 3% to 5% fee of the total loan amount. Since a large portion of the loans you make will be for homes, these calculations will assume an average loan amount of $150,000, which would give you an average fee of $6,000 per loan.

The interest paid on the loans will go to the investors. Your profit margin should be high, at around 80%. In your first year or two, you could do 12 loans a year, bringing in $72,000 in annual revenue. This would mean $57,600 in profit, assuming that 80% margin.

As you build a reputation, you could increase that number to 50 loans a year. At this stage, you’d rent a commercial space and hire staff, reducing your profit margin to around 40%. With annual revenue of $300,000, you’d make a handsome profit of $120,000.

What barriers to entry are there?

The only barrier to entry for a money lending business is building relationships with investors, which often takes a lot of networking and leg work.

Related Business Ideas

How to Start a Credit Repair Business

How to Start a Check Cashing Business

How to Start a Finance Company

Step 2: hone your idea.

Now that you know what’s involved in starting a money lending business, it’s a good idea to hone your concept in preparation to enter a competitive market.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

Why? Identify an opportunity

Research money lending businesses in your area to examine their products and services, price points, and customer reviews. You’re looking for a market gap to fill. For instance, maybe the local market is missing a micro lending company or a money lender that will provide a business line of credit.

You might consider targeting a niche market by specializing in a certain aspect of your industry, such as term loans for those with bad credit, or hard money startup loans.

This could jumpstart your word-of-mouth marketing and attract clients right away.

What? Determine your services

You’ll need to determine what types of loans to offer, and how you will evaluate credit scores to determine whether to make the loans. You’ll need to lay out specific lending criteria in your investor prospectus.

As far as the types of loans, you can offer mortgage loans, business loans, personal unsecured loans, car loans, or lines of credit.

How much should you charge for money lending?

Hard money lenders typically take a 3% to 5% fee of the total loan amount. The interest paid on the loans will go to the investors. The interest rates you charge will depend on the interest rate limits in your state. Working alone, your profit margin should be high, at around 80%.

Once you know your costs, you can use this Step By Step profit margin calculator to determine your mark-up and final price points. Remember, the prices you use at launch should be subject to change if warranted by the market.

Who? Identify your target market

Your target market will generally be anyone with bad credit who needs a loan. You should market on TikTok, Instagram, Facebook, and even LinkedIn, which is also a good way to connect with potential investors.

Where? Choose your business premises

In the early stages, you may want to run your business from home to keep costs low. But as your business grows, you’ll likely need to hire workers for various roles and may need to rent out an office. You can find commercial space to rent in your area on sites such as Craigslist , Crexi , and Instant Offices .

When choosing a commercial space, you may want to follow these rules of thumb:

- Central location accessible via public transport

- Ventilated and spacious, with good natural light

- Flexible lease that can be extended as your business grows

- Ready-to-use space with no major renovations or repairs needed

Step 3: Brainstorm a Money Lending Business Name

Here are some ideas for brainstorming your business name:

- Short, unique, and catchy names tend to stand out

- Names that are easy to say and spell tend to do better

- Name should be relevant to your product or service offerings

- Ask around — family, friends, colleagues, social media — for suggestions

- Including keywords, such as “money lending” or “hard money loans”, boosts SEO

- Name should allow for expansion, for ex: “Instant Money Solutions” over “Home Sweet Loan”

- A location-based name can help establish a strong connection with your local community and help with the SEO but might hinder future expansion

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Find a Domain

Powered by GoDaddy.com

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that sets your business apart. Once you pick your company name, and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Step 4: Create a Money Lending Business Plan

Here are the key components of a business plan:

- Executive Summary: A brief summary of the business plan, highlighting its key points and objectives.

- Business Overview: An overview of the money lending business, including its mission, vision, and legal structure.

- Product and Services: Details about the types of loans or financial services offered, including terms, interest rates, and eligibility criteria.

- Market Analysis: An examination of the target market, including size, demographics, and trends, to identify potential customers.

- Competitive Analysis: Evaluation of competitors in the lending industry, assessing their strengths and weaknesses.

- Sales and Marketing: Strategies for attracting and retaining customers, including advertising and promotional efforts.

- Management Team: Introduction to the individuals leading the business, highlighting their qualifications and roles.

- Operations Plan: Information on day-to-day operations, such as loan application processing, risk management, and customer support.

- Financial Plan: Projections for revenue, expenses, and profitability, as well as funding requirements and financial forecasts.

- Appendix: Supporting documents, such as legal agreements, market research data, or additional information to enhance the plan’s credibility.

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

Step 5: Register Your Business

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Choose where to register your company

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people will register their business in the state where they live, but if you’re planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to money lenders.

If you’re willing to move, you could really maximize your business! Keep in mind, it’s relatively easy to transfer your business to another state.

Choose your business structure

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your money lending business will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Here are the main options:

- Sole Proprietorship – The most common structure for small businesses makes no legal distinction between company and owner. All income goes to the owner, who’s also liable for any debts, losses, or liabilities incurred by the business. The owner pays taxes on business income on his or her personal tax return.

- General Partnership – Similar to a sole proprietorship, but for two or more people. Again, owners keep the profits and are liable for losses. The partners pay taxes on their share of business income on their personal tax returns.

- Limited Liability Company (LLC) – Combines the characteristics of corporations with those of sole proprietorships or partnerships. Again, the owners are not personally liable for debts.

- C Corp – Under this structure, the business is a distinct legal entity and the owner or owners are not personally liable for its debts. Owners take profits through shareholder dividends, rather than directly. The corporation pays taxes, and owners pay taxes on their dividends, which is sometimes referred to as double taxation.

- S Corp – An S-Corporation refers to the tax classification of the business but is not a business entity. An S-Corp can be either a corporation or an LLC , which just need to elect to be an S-Corp for tax status. In an S-Corp, income is passed through directly to shareholders, who pay taxes on their share of business income on their personal tax returns.

We recommend that new business owners choose LLC as it offers liability protection and pass-through taxation while being simpler to form than a corporation. You can form an LLC in as little as five minutes using an online LLC formation service. They will check that your business name is available before filing, submit your articles of organization , and answer any questions you might have.

Form Your LLC

Choose Your State

We recommend ZenBusiness as the Best LLC Service for 2024

Step 6: Register for Taxes

The final step before you’re able to pay taxes is getting an Employer Identification Number , or EIN. You can file for your EIN online or by mail or fax: visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist , and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you’re completing them correctly.

Step 7: Fund your Business

Securing financing is your next step and there are plenty of ways to raise capital:

- Bank loans: This is the most common method but getting approved requires a rock-solid business plan and strong credit history.

- SBA-guaranteed loans: The Small Business Administration can act as guarantor, helping gain that elusive bank approval via an SBA-guaranteed loan .

- Government grants: A handful of financial assistance programs help fund entrepreneurs. Visit Grants.gov to learn which might work for you.

- Venture capital: Venture capital investors take an ownership stake in exchange for funds, so keep in mind that you’d be sacrificing some control over your business. This is generally only available for businesses with high growth potential.

- Angel investors: Reach out to your entire network in search of people interested in investing in early-stage startups in exchange for a stake. Established angel investors are always looking for good opportunities.

- Friends and Family: Reach out to friends and family to provide a business loan or investment in your concept. It’s a good idea to have legal advice when doing so because SEC regulations apply.

- Crowdfunding: Websites like Kickstarter and Indiegogo offer an increasingly popular low-risk option, in which donors fund your vision. Entrepreneurial crowdfunding sites like Fundable and WeFunder enable multiple investors to fund your business.

- Personal: Self-fund your business via your savings or the sale of property or other assets.

Bank and SBA loans are probably the best option, other than friends and family, for funding a money lending business. You might also try crowdfunding if you have an innovative concept.

Step 8: Apply for Money Lending Business Licenses and Permits

Starting a money lending business requires obtaining a number of licenses and permits from local, state, and federal governments.

You’ll need to meet the requirements to be a licensed money lender in your state. You’ll also need to follow federal and state regulations on lending practices.

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration ( OSHA ), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package . They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Step 9: Open a Business Bank Account

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account .

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you’re running your money lending business as a sole proprietorship. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN (or Social Security Number if you decide on a sole proprietorship), articles of incorporation, and other legal documents and open your new account.

Step 10: Get Business Insurance

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

- General liability: The most comprehensive type of insurance, acting as a catch-all for many business elements that require coverage. If you get just one kind of insurance, this is it. It even protects against bodily injury and property damage.

- Business Property: Provides coverage for your equipment and supplies.

- Equipment Breakdown Insurance: Covers the cost of replacing or repairing equipment that has broken due to mechanical issues.

- Worker’s compensation: Provides compensation to employees injured on the job.

- Property: Covers your physical space, whether it is a cart, storefront, or office.

- Commercial auto: Protection for your company-owned vehicle.

- Professional liability: Protects against claims from a client who says they suffered a loss due to an error or omission in your work.

- Business owner’s policy (BOP): This is an insurance plan that acts as an all-in-one insurance policy, a combination of the above insurance types.

Step 11: Prepare to Launch

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Essential software and tools

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You may want to use industry-specific software, such as HES , Black Knight , or Moneylender , to manage your loan processes, accounts, credit checks, and fees.

- Popular web-based accounting programs for smaller businesses include Quickbooks , Freshbooks , and Xero .

- If you’re unfamiliar with basic accounting, you may want to hire a professional, especially as you begin. The consequences for filing incorrect tax documents can be harsh, so accuracy is crucial.

Develop your website

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using services like WordPress, Wix, or Squarespace . This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech-savvy, you can hire a web designer or developer to create a custom website for your business.

They are unlikely to find your website, however, unless you follow Search Engine Optimization ( SEO ) practices. These are steps that help pages rank higher in the results of top search engines like Google.

Here are some powerful marketing strategies for your future business:

- Targeted Local Advertising: Utilize local newspapers, community bulletin boards, and radio stations to advertise your services, ensuring your message reaches the right audience within your community.

- Strategic Partnerships: Forge partnerships with local businesses like real estate agencies or car dealerships, creating a referral system where they recommend your lending services to their clients.

- Educational Seminars: Host free financial literacy seminars in your community to position yourself as an expert and attract potential borrowers seeking valuable insights into managing their finances.

- Social Media Engagement: Leverage social media platforms to engage with your audience, share financial tips, and create a community around your brand, fostering trust and credibility.

- Customer Testimonials: Showcase satisfied clients through testimonials in your marketing materials, emphasizing success stories and building credibility among potential borrowers.

- Loyalty Programs: Implement a loyalty program offering incentives or discounted rates for repeat borrowers, encouraging customer retention and word-of-mouth referrals.

- Direct Mail Campaigns: Design targeted direct mail campaigns to reach specific demographics, using compelling offers or promotions to capture the attention of potential borrowers.

- Online Reviews and Ratings: Encourage satisfied customers to leave positive reviews on online platforms, enhancing your online reputation and influencing potential borrowers in their decision-making process.

- Community Involvement: Actively participate in local events and sponsor community initiatives to increase your brand visibility and foster a positive image within the community.

- Referral Programs: Develop a referral program where existing customers are rewarded for referring new borrowers, creating a network of advocates who vouch for your services.

Focus on USPs

Unique selling propositions, or USPs, are the characteristics of a product or service that sets it apart from the competition. Customers today are inundated with buying options, so you’ll have a real advantage if they are able to quickly grasp how your money lending business meets their needs or wishes. It’s wise to do all you can to ensure your USPs stand out on your website and in your marketing and promotional materials, stimulating buyer desire.

Global pizza chain Domino’s is renowned for its USP: “Hot pizza in 30 minutes or less, guaranteed.” Signature USPs for your money lending business could be:

- Bad credit? We can put you back in the black

- Mortgage loan denied? We’ll finance your new home

- Affordable loans to build your business

You may not like to network or use personal connections for business gain. But your personal and professional networks likely offer considerable untapped business potential. Maybe that Facebook friend you met in college is now running a money lending business, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been working in money lending for years and can offer invaluable insight and industry connections.

The possibilities are endless, so it’s a good idea to review your personal and professional networks and reach out to those with possible links to or interest in money lending businesses. You’ll probably generate new customers or find companies with which you could establish a partnership.

Step 12: Build Your Team

If you’re starting out small from a home office, you may not need any employees. But as your business grows, you will likely need workers to fill various roles. Potential positions for a money lending business include:

- Loan Processors – handle loan paperwork

- Loan Originators – take loan applications, get loan informational documents

- General Manager – scheduling, accounting

- Marketing Lead – SEO strategies, social media

At some point, you may need to hire all of these positions or simply a few, depending on the size and needs of your business. You might also hire multiple workers for a single role or a single worker for multiple roles, again depending on need.

Free-of-charge methods to recruit employees include posting ads on popular platforms such as LinkedIn, Facebook, or Jobs.com. You might also consider a premium recruitment option, such as advertising on Indeed , Glassdoor , or ZipRecruiter . Further, if you have the resources, you could consider hiring a recruitment agency to help you find talent.

Step 13: Run a Money Lending Business – Start Making Money!

Money lenders provide a valuable service to people unable to obtain loans, which is why it’s big business. If you can build solid relationships with investors and are committed to helping people, you could build a lucrative lending operation, even starting from your own home!

Now that you know what’s involved from a business perspective, it’s time to launch your successful money lending business.

- Money Lending Business FAQs

You can make a 3% to 5% fee on each loan amount, so it can be very profitable. The key is to build relationships with investors who will fund your loans.

To differentiate your money lending business, focus on providing competitive interest rates, flexible repayment terms, exceptional customer service, quick loan processing, transparency in fees and charges, and personalized financial solutions tailored to individual borrower needs.

Yes, you can start a money lending business on the side, but it requires careful consideration of legal and regulatory requirements, managing risk effectively, and ensuring proper time management and resources to handle both your main job and the lending business.

Assess the creditworthiness of potential borrowers by conducting thorough credit checks, verifying their income and employment stability, reviewing their credit history and repayment patterns, and considering any collateral or guarantors provided. Additionally, evaluate their debt-to-income ratio and analyze their financial statements to gauge their ability to repay the loan.

Expand your money lending business by partnering with local businesses, using digital marketing, offering referral incentives, exploring new regions, providing online loan applications, and improving your reputation with positive reviews.

This was a good guide for me , Thank you

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Decide if the Business Is Right for You

- Hone Your Idea

- Brainstorm a Money Lending Business Name

- Create a Money Lending Business Plan

- Register Your Business

- Register for Taxes

- Fund your Business

- Apply for Money Lending Business Licenses and Permits

- Open a Business Bank Account

- Get Business Insurance

- Prepare to Launch

- Build Your Team

- Run a Money Lending Business - Start Making Money!

Subscribe to Our Newsletter

Featured resources.

No thanks, I don't want to stay up to date on industry trends and news.

Sample Micro Money Lending Firm Business Plan

Micro money lending business plan sample.

Starting a money lending business does not have to be an impossible idea. You will discover that my claims are not fraudulent if you can take your time to read through this post.

Most commercial banks make money in two major ways.

They give out grants and small business loans at particular interest rates, for instance, AB – MFB Microfinance Start-up loans. They also lend money to investors using funds that you deposit with them through cash, check deposit, or electronic money transfer.

Need to write a plan for your venture? Download a FREE Business Plan PDF Sample to develop a template for your own startup.

I won’t be referring to commercial banks’ subsidiary functions like giving out credit letters and Forex transactions.

GUIDE: HOW TO START A LOAN COMPANY

CASH LOAN BUSINESS PLAN – LENDING BUSINESS IDEAS

The truth is most of these functions are too technical for your own money lending business. The good news is many lending business ideas would be able to receive cash and give out advance money and will duly be registered. Here is how to open a small money lending business.

What Do I Need To Start A Money Lending Business

– Education – Passion – Close Monitoring – Capital Base (Less Than 100k)

How To Set Up a Money Lending Business

It is difficult to start your own money lending business that caters to the whole country considering your current resources. This is the reason you should think about localization. You will later need an official base where new and existing clients can come to get their issues sorted out. The place must be conspicuous, accessible, and presentable.

Good affordable furniture and a PC with the necessary money lending business software installed are important too.

How To Register A Money Lending Business

You will need to get your business register and secure the appropriate license. The requirement for lending out funds are country-specific but are generally lesser than those for establishing commercial and micro-finance banks.

Who Should I Target?

Since you don’t have what it takes to lend to big companies and corporations like P&G, MTN, BAT, SHELL, and others; you should target those investors and individuals at the bottom of the economic pyramid. Small salary earners, petty investors, market women, and artisans are a good market to generate a client base for your money lending business.

What Is The Best Money Lending Business Strategy?

Although there is no shortage of customers for the money lending business, you cannot take on everybody. This is due to what is called credit appraisal. To take care of the fund receipt and repayment process, each client should be made to deposit at least 20% of the loan sought. To protect your money, enable daily and weekly loan repayment and these people have a high tendency to become less aware of their obligations after receiving the loan.

Studying trends of operations and advertising in micro-finance banks and using it to develop marketing strategies for money lending business is recommended. You don’t have to hire a lot of people for a start. As your money-lending business expands its capital base, you would need to employ more people to do the footwork. If you want to start with say 90k, loan out 20k to each client. That is like 4 clients already. Don’t make the mistake of giving out all your funds at once. No business ever does that.

Call it whatever you like. Giving out loans as money lending business ideas, I call it smart banking 🙂

MONEY LENDING BUSINESS PLAN EXAMPLE

Here is a sample business plan for starting a micro-lending company.

If you are reading this, then I will agree that you are interested in starting a money lending business. So many have gone into this business and have greatly improved their status and their lifestyle, and in a very large way, they have helped those making use of their services.

Money is an essential part of living, sad though, humans will not always have the exact amount needed, and at such moments, they might need to borrow to sort the urgent situation they are in out, as a moneylender, that’s where your work comes in.

The way humans look at the idea differs, some see it as a good option, while others see it as something bad. Either way, only those who have once tried it can agree that the money lending business is a very good one.

The reward of starting a money lending business is unimaginable, your interest will keep growing, and you will always have people who need your services, some will pay back before the expected day; still, you will get your complete interest.

In this article, we are going to provide you with a guide that will help you in your endeavor to write your award-winning money lending business proposal sample which will help you get reasonable and willing investors to back your business up.

Here are the essential subheadings that must be included in your business plan to make it an award-winning and complete business plan.

- The Introduction Or The Overview Of The Industry

The Executive Summary

- Risk And Strength Analysis

The Market Analysis

The Competition

- The Sales And Marketing Strategy

- Financial Analysis And Forecast

- Sustainability And Expansion Strategy

Let us now discuss in detail how you can develop each of these points to get a unique business plan

Overview Of The Industry

The introductory part of the business plan is the part where you will be writing about the entire shape of the local and international money lending business, in this part, you need to provide a brief history of the money lending industry.

In this section of your money lending business plan, you will need to provide brief information about the company and the people setting it up. In this section too, you will need to provide the vision of the company as this helps your investors to see if there are plans for the future or not. Most prefer using terms like ‘’ to become a leading brand in the world’’

Your business mission will also be discussed in this section as this very important if you will get reasonable investors for your business. Your business structure is also fundamental, and as such it will be discussed in this part. Your structure will go a long way in defining your future so you must develop this very well.

The key roles to be filled will include Chief Executive Officer (CEO), Accountant, Sales, and Marketing Agent, Receptionist, etc.

Risk and Strength Analysis

In this section of your business plan, you will need to write about your understanding and analysis of your Strength, Weakness, Opportunities, and Threats This is popularly referred to as the SWOT ANALYSIS.

Your strength might involve the latest technology that will help you run a secure money lending business; your threats might be the effect of economic instability or late payment on the part of the borrowers.

This part is one of the essential parts of your business plan. The market analysis segment will prepare you for what you will meet in the money lending market. Your understanding of the business will be brought to the test to see if you have the basic needed understanding. There are trends that the market follows, some forces that define the activities of the market, the role of the economy, and the government in the business.

In this part, you will define your target market, those who will be using your services. Your services will be need by virtually everyone especially students, business owners, industries amongst others.

In this section, you will need to show that you understand the level of competition in the market, and your plans to succeed in the light of these competitions. Your competitive advantage will also be discussed. Your competition might include banks offering loans.

The Sales and Marketing Strategy

In this section, your strategy for advertising and publicizing your business to people both far and wide will be scripted, those mediums like social media, use of news media, and another advertising medium will be discussed.

Your interest rate or how much people will be charged for using your services will also be discussed.

Financial Analysis and Forecast The finance part of your business is very important. For that reason, you need to take this part seriously. Your source of income and the expected income will also be discussed. Other important points include your expenses and the total cost to be incurred, your projected profit for a set period (usually within 5 years)

Sustainability and Expansion Strategy

Your plans to and expand your money lending business will be discussed in this part.

At this point in your money lending business plan, you will be expected to summarise the entire content of the business plan and also include your concluding remarks.

Leave a Comment Cancel reply

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Successful Business Plan for a Loan

Lisa A. Anthony is a lead writer on NerdWallet’s small-business team, primarily covering small-business lending. She has over 20 years of diverse experience in finance, lending and taxes. Prior to joining NerdWallet, Lisa worked as a writer for Intuit Turbo Tax, loan officer for Bank of America and a business analyst for Wells Fargo Home Mortgage. Over the years, she has had the opportunity to interact directly with consumers on lending products and tax preparation software. Her work has appeared in The Associated Press, Washington Post and Entrepreneur, among other publications.

Sally Lauckner is an editor on NerdWallet's small-business team. She has over 15 years of experience in print and online journalism. Before joining NerdWallet in 2020, Sally was the editorial director at Fundera, where she built and led a team focused on small-business content and specializing in business financing. Her prior experience includes two years as a senior editor at SmartAsset, where she edited a wide range of personal finance content, and five years at the AOL Huffington Post Media Group, where she held a variety of editorial roles. She is based in New York City.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does a loan business plan include?

What lenders look for in a business plan, business plan for loan examples, resources for writing a business plan.

A comprehensive and well-written business plan can be used to persuade lenders that your business is worth investing in and hopefully, improve your chances of getting approved for a small-business loan . Many lenders will ask that you include a business plan along with other documents as part of your loan application.

When writing a business plan for a loan, you’ll want to highlight your abilities, justify your need for capital and prove your ability to repay the debt.

Here’s everything you need to know to get started.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

A successful business plan for a loan describes your financial goals and how you’ll achieve them. Although business plan components can vary from company to company, there are a few sections that are typically included in most plans.

These sections will help provide lenders with an overview of your business and explain why they should approve you for a loan.

Executive summary

The executive summary is used to spark interest in your business. It may include high-level information about you, your products and services, your management team, employees, business location and financial details. Your mission statement can be added here as well.

To help build a lender’s confidence in your business, you can also include a concise overview of your growth plans in this section.

Company overview

The company overview is an area to describe the strengths of your business. If you didn’t explain what problems your business will solve in the executive summary, do it here.

Highlight any experts on your team and what gives you a competitive advantage. You can also include specific details about your business such as when it was founded, your business entity type and history.

Products and services

Use this section to demonstrate the need for what you’re offering. Describe your products and services and explain how customers will benefit from having them.

Detail any equipment or materials that you need to provide your goods and services — this may be particularly helpful if you’re looking for equipment or inventory financing . You’ll also want to disclose any patents or copyrights in this section.

Market analysis

Here you can demonstrate that you’ve done your homework and showcase your understanding of your industry, current outlook, trends, target market and competitors.

You can add details about your target market that include where you’ll find customers, ways you plan to market to them and how your products and services will be delivered to them.

» MORE: How to write a market analysis for a business plan

Marketing and sales plan

Your marketing and sales plan provides details on how you intend to attract your customers and build a client base. You can also explain the steps involved in the sale and delivery of your product or service.

At a high level, this section should identify your sales goals and how you plan to achieve them — showing a lender how you’re going to make money to repay potential debt.

Operational plan

The operational plan section covers the physical requirements of operating your business on a day-to-day basis. Depending on your type of business, this may include location, facility requirements, equipment, vehicles, inventory needs and supplies. Production goals, timelines, quality control and customer service details may also be included.

Management team

This section illustrates how your business will be organized. You can list the management team, owners, board of directors and consultants with details about their experience and the role they will play at your company. This is also a good place to include an organizational chart .

From this section, a lender should understand why you and your team are qualified to run a business and why they should feel confident lending you money — even if you’re a startup.

Funding request

In this section, you’ll explain the amount of money you’re requesting from the lender and why you need it. You’ll describe how the funds will be used and how you intend to repay the loan.

You may also discuss any funding requirements you anticipate over the next five years and your strategic financial plans for the future.

» Need help writing? Learn about the best business plan software .

Financial statements

When you’re writing a business plan for a loan, this is one of the most important sections. The goal is to use your financial statements to prove to a lender that your business is stable and will be able to repay any potential debt.

In this section, you’ll want to include three to five years of income statements, cash flow statements and balance sheets. It can also be helpful to include an expense analysis, break-even analysis, capital expenditure budgets, projected income statements and projected cash flow statements. If you have collateral that you could put up to secure a loan, you should list it in this section as well.

If you’re a startup that doesn’t have much historical data to provide, you’ll want to include estimated costs, revenue and any other future projections you may have. Graphs and charts can be useful visual aids here.

In general, the more data you can use to show a lender your financial security, the better.

Finally, if necessary, supporting information and documents can be added in an appendix section. This may include credit histories, resumes, letters of reference, product pictures, licenses, permits, contracts and other legal documents.

| 5.0 | 5.0 | 4.5 |

| 20.00-50.00% | 27.20-99.90% | 15.22-45.00% |

| 625 | 625 | 660 |

Lenders will typically evaluate your loan application based on the five C’s — or characteristics — of credit : character, capacity, capital, conditions and collateral. Although your business plan won't contain everything a lender needs to complete its assessment, the document can highlight your strengths in each of these areas.

A lender will assess your character by reviewing your education, business experience and credit history. This assessment may also be extended to board members and your management team. Highlights of your strengths can be worked into the following sections of your business plan:

Executive summary.

Company overview.

Management team.

Capacity centers on your ability to repay the loan. Lenders will be looking at the revenue you plan to generate, your expenses, cash flow and your loan payment plan. This information can be included in the following sections:

Funding request.

Financial statements.

Capital is the amount of money you have invested in your business. Lenders can use it to judge your financial commitment to the business. You can use any of the following sections to highlight your financial commitment:

Operational plan.

Conditions refers to the purpose and market for your products and services. Lenders will be looking for information such as product demand, competition and industry trends. Information for this can be included in the following sections:

Market analysis.

Products and services.

Marketing and sales plan.

Collateral is an asset pledged to a lender to guarantee the repayment of a loan. This can be equipment, inventory, vehicles or something else of value. Use the following sections to include information on assets:

» MORE: How to get a business loan

Writing a business plan for a loan application can be intimidating, especially when you’re just getting started. It may be helpful to use a business plan template or refer to an existing sample as you’re going through the draft process.

Here are a few examples that you may find useful:

Business Plan Outline — Colorado Small Business Development Center

Business Plan Template — Iowa Small Business Development Center

Writing a Business Plan — Maine Small Business Development Center

Business Plan Workbook — Capital One

Looking for a business loan?

See our overall favorites, or narrow it down by category to find the best options for you.

on NerdWallet's secure site

U.S. Small Business Administration. The SBA offers a free self-paced course on writing a business plan. The course includes several videos, objectives for you to accomplish, as well as worksheets you can complete.

SCORE. SCORE, a nonprofit organization and resource partner of the SBA, offers free assistance that includes a step-by-step downloadable template to help startups create a business plan, and mentors who can review and refine your plan virtually or in person.

Small Business Development Centers. Similarly, your local SBDC can provide assistance with business planning and finding access to capital. These organizations also have virtual and in-person training courses, as well as opportunities to consult with business experts.

Business plan software. Although many business plan software platforms require a subscription, these tools can be useful if you want a templated approach that can break the process down for you step-by-step. Many of these services include a range of examples and templates, instruction videos and guides, and financial dashboards, among other features. You may also be able to use a free trial before committing to one of these software options.

A loan business plan outlines your business’s objectives, products or services, funding needs and finances. The goal of this document is to convince lenders that they should approve you for a business loan.

Not all lenders will require a business plan, but you’ll likely need one for bank and SBA loans. Even if it isn’t required, however, a lean business plan can be used to bolster your loan application.

Lenders ask for a business plan because they want to know that your business is and will continue to be financially stable. They want to know how you make money, spend money and plan to achieve your financial goals. All of this information allows them to assess whether you’ll be able to repay a loan and decide if they should approve your application.

On a similar note...

- Search Search Please fill out this field.

Why Do I Need a Business Plan?

Sections of a business plan, the bottom line.

- Small Business

How to Write a Business Plan for a Loan

How to secure business financing

Matt Webber is an experienced personal finance writer, researcher, and editor. He has published widely on personal finance, marketing, and the impact of technology on contemporary arts and culture.

:max_bytes(150000):strip_icc():format(webp)/smda1_crop-f0c167dd2b2144f68f352c63d17f7db5.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan CURRENT ARTICLE

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that explains what a company’s objectives are and how it will achieve them. It contains a road map for the company from a marketing, financial, and operational standpoint. Some business plans are more detailed than others, but they are used by all types of businesses, from large, established companies to small startups.

If you are applying for a business loan , your lender may want to see your business plan. Your plan can prove that you understand your market and your business model and that you are realistic about your goals. Even if you don’t need a business plan to apply for a loan, writing one can improve your chances of securing finance.

Key Takeaways

- Many lenders will require you to write a business plan to support your loan application.

- Though every business plan is different, there are a number of sections that appear in every business plan.

- A good business plan will define your company’s strategic priorities for the coming years and explain how you will try to achieve growth.

- Lenders will assess your plan against the “five Cs”: character, capacity, capital, conditions, and collateral.

There are many reasons why all businesses should have a business plan . A business plan can improve the way that your company operates, but a well-written plan is also invaluable for attracting investment.

On an operational level, a well-written business plan has several advantages. A good plan will explain how a company is going to develop over time and will lay out the risks and contingencies that it may encounter along the way.

A business plan can act as a valuable strategic guide, reminding executives of their long-term goals amid the chaos of day-to-day business. It also allows businesses to measure their own success—without a plan, it can be difficult to determine whether a business is moving in the right direction.

A business plan is also valuable when it comes to dealing with external organizations. Indeed, banks and venture capital firms often require a viable business plan before considering whether they’ll provide capital to new businesses.