Top 10 ways to fix an unbalanced balance sheet

By Shaun Comley

Tuesday 22nd June 2021

Financial statements are a series of double entries. When we are setting up our Financial Statements, we must make sure we bring in both sides of the double entries to ensure our balance sheet balances. As Isaac Newton’s Third Law states ‘For every action there is an equal and opposite reaction’; to become a balance sheet king you must remember, ‘For every Debit, there is an equal and opposite Credit’

A balance sheet that doesn’t balance is the nemesis of many a modeller. There is nothing more infuriating than needing to deliver a model and just not being able to track down a balance sheet error, especially as the clock ticks away late into the night.

Don’t worry, I have felt the pain. The below are 10 practical steps that have been finely tuned after sleepless nights and 15 accounting exams. This article will hopefully speed up the process of debugging what is causing the imbalance and help avoid this issue reoccurring during your modelling career.

1. Make sure your Balance Sheet check is correct and clearly visible

Making the correct Balance Sheet check may seem obvious however, there are a few things we must ensure:

a) Net assets equals total equity

Starting from the most basic item, we must make sure that we have correctly linked our formula and that we are checking that net assets less total equity is equal to zero.

b) Appropriate rounding

Excel isn’t perfect, despite what we all may think, Excel only stores up to 15 significant figures. When we are building complex financial models, we will use all 15 significant figures. This can cause really small differences in our net asset and equity. However, when decision making, we may only care to the nearest dollar or cent. Using the ROUND function will ensure that our check has the level of tolerance that is material.

c) Check the absolute difference

Rather than checking each period we should create a global check of each period’s deltas. The most efficient way to do this is by summing all the deltas however, we could have an equal and opposite delta. If this occurred the global check would provide a false result. To avoid this error, always calculate the absolute difference.

d) Clearly visible throughout the model

Once we achieve a balance sheet that does balance, we need to make this check visible throughout the model. This should sit on the top ribbon of our spreadsheet, above any freeze panes you have on your calculation sheet. This will ensure that when we make any updates to model, if we cause an imbalance, we can diagnose it straight away.

There are alternative methods to Balance Sheet checks. Many modellers will use a logic check to ensure that the delta between equity and net assets is below a certain tolerance number. This works effectively as a check; however, this method won’t help identify what is causing the imbalance.

2. Check that the correct signs are applied

Once we have created our check, our next step is to make sure income and assets are positive and costs and liabilities are negative. An extremely common mistake is missing a negative sign when incorporating items into financial statements. It is so easy to miss and can be hard to pick up. However, a run through of each line item on your Cashflow, Profit and Loss and Balance Sheet will help you identify these errors and is a super easy win.

3. Ensuring we have linked to the right time period

Two of Mazars’ guiding themes are “Keep it simple” and “Get it right”, this is extremely relevant when setting up financial statements.

To “ Keep it simple ”, Financial Statements should just be links to calculations within the workbook, we should not be performing calculations within them, otherwise there is a high potential for us to exclude this from another section of the statements.

To “ Get it right ”, we should ensure that we have consistent timing across all our sheets in the model. This will mean when we are linking on our financial statements, we are linking to the same column on our calculation sheet.

For example, if our calculation timeline starts in Column J, we are linking to Column J on our calculation sheets. By doing this we will avoid any misalignment error.

We can then do a simple check that we avoided any misalignment error for each of the first columns. A quick keyboard shortcut to help this is “Ctrl + `”, which will show formulas (“Ctrl + `” will switch it back to normal)

4. Check the consistency in formulae

A key pillar of almost every modelling best practice is consistency in formulae across the row. If we don’t have that consistency, it’s highly likely that your balance sheet doesn’t balance. A way to check formulae consistency is using Go to Special > Row differences. To do this highlight your financial statements formulae and use the shortcut “Ctrl + \”. This shortcut will highlight the cells in that range that have row inconsistencies. We then suggest colouring those cells in a bright colour to pick them out easily.

From here you then need to identify what is the correct formula to use. Don’t simply copy the formula on the left across, you may have corrected the formula midway across the sheet accidently (I’ve made this mistake before).

5. Check all sums

One of the most common errors when building financial models is missing rows within your summed range. When we insert a row above a sum, the range doesn’t update to include that new row.

A quick run through each of the Balance Sheet’s closing balances and your Financial Statement calculations to make sure you haven’t made this mistake. Check a couple throughout the row as another common error is to update the sum for the first column and not copying it across the row. This can also be done through checking the consistency in formulae as suggested in point 4.

It is also important to check the lines within your Cashflow and Profit and Loss to ensure that these are flowing down to your net cashflow and net profit after tax respectively. It’s very common to miss out a line reference in your Cashflow available for debt service (CFADS) or EBIT.

6. The delta in Balance Sheet checks

The above were the easy wins and hopefully you’ve been able to find your Balance Sheet differences. However, it becomes a little trickier from this point on, as its highly likely that you excluded something within your financial statements. So how do we find something that isn’t there?

This is where we create a second check, commonly known as “Balance sheet check 2”, which calculates the delta between two balance sheet checks.

This will allow us to see patterns in how our Balance Sheet imbalance changes,

which can be more informative than the value of the total imbalance. How then do we diagnose these:

a) Look for an exact match

Firstly, check to see if you have an exact match for difference within your financial statements. If you can find an exact match of the difference with one of the line items in your financial statements, it would suggest that you have only incorporated one side of the double entry

b) Consistently the same difference

This is highly likely to be a constant expense or revenue which is not escalated. An example of what is missing is straight line depreciation.

c) Slowly increasing/decreasing difference

When this is the case, we will need to look at things that are affected by inflation or interest rates. An increasing difference would suggest an item affected by inflation such as the revenue or expense, as these values would increase over time. A decreasing difference would suggest an item affected by interest rates, this is as over time the balance will decrease and thus the associated interest and payments. This is not necessarily always the case but should hopefully generate ideas of where to focus your efforts.

d) Jumps in the difference

This is a due to recurring items that don’t happen every period. Examples of this would be debt repayments or capex spend.

e) Unbalanced for a set period

Look at the time horizon that the balance sheet is imbalanced for, was a certain facility active during this period and no other period, this could be the cause of the difference.

Although this check won’t necessarily give you the exact reason for your balance sheet not balancing this will isolate your search. In addition, hopefully when you see the second check, you’ll start to recognise the numbers that you may be missing. You’ll be surprised how familiar numbers become from across the model. The more balance sheets you debug the more familiar you’ll become with this balance sheet check two.

7. Double and half the Balance Sheet check

This is a classic accounting trick; I was taught this while doing my accounting exams and financial audit. Within point 7 we have talked about identifying the difference using patterns, if we haven’t seen a pattern or a number, we are familiar with, by doubling or halving the difference this may allow us to find it. This will often help find items where we have put the incorrect sign and in which case have done two debits for example.

8. Work from right to left

While trying to debug what’s causing your imbalance, work from right to left. We need to identify the area where your Balance Sheet isn’t balancing and thus towards the end of your forecast there are likely to be less items active, for example debt facilities. This will allow us to refine our search, we can then work back to the start of the forecast, hopefully the items that aren’t active all the way to the end could be the causes of the imbalance.

9. Opening balance testing

When reforecasting of an existing Balance Sheet, it’s very easy to make mistakes and not properly incorporate all items. A way to check where these numbers are properly incorporated is changing the numbers and see what happens to your balance sheet check. When changing numbers in your opening Balance Sheet, the retained earnings should be the balancing number (net assets less share capital).

If you change an item on your opening Balance Sheet and your Balance Sheet delta changes, we know that there is an issue with this item. If there is no movement, it means that the appropriate debits and credits have been incorporated and we can move to the next Balance Sheet item.

10. Check changes period to period of Balance Sheet items

The last chance of resolving your issue, is to go through each item on the balance sheet from period to period (remember working right to left) and checking that the balance sheet movements are reflected in the profit and loss and or the cashflow. This can be quite a time-consuming activity but is a systematic way of ensuring all debits and credits have been correctly incorporated in the financial statements and should lead to you finding the imbalance.

Before your model is good to go

A test you should do before you’re finished is to run through all scenarios. Often in our base case financial model, certain functionality won’t be active for example, a Debt Service Reserve Account (DSRA). In our base case we might not expect to use the DSRA, but it may be required in some downside cases. An easy way to do this would be to include your checks within your scenario table to ensure you can detect balance sheet imbalances in non-active scenarios.

If your balance sheet still doesn’t balance after all these steps, you may benefit from attending one of our training courses. Our full course portfolio can be found here .

Digital Classrooms

Forvis Mazars – welcome to our Digital Classrooms! We are opening our Digital Classrooms to individual registrations, making our world-leading...

New course: Financial modelling of IFRIC 12 for Service Concessions

If your project falls under the scope of IFRIC 12 – Service Concession Arrangements it can be difficult to understand...

The rise and rise of lithium

What is not to like about the lithium success story for the production of batteries to power electric vehicles (EVs).

Financial modelling webinars: 2021 highlights

Now that our 2022 webinar series is well and truly underway, we thought it might be a good time to...

- Legal and privacy

Copyright 2024 - Forvis Mazars

This website uses cookies.

Some of these cookies are necessary, while others help us analyse our traffic, serve advertising and deliver customised experiences for you. For more information on the cookies we use, please refer to our Privacy Policy .

This website cannot function properly without these cookies.

Analytical cookies help us enhance our website by collecting information on its usage.

We use marketing cookies to increase the relevancy of our advertising campaigns.

- Financial modelling events

- New tutorials

- The latest blog posts

- Upcoming training courses

Call Us (877) 968-7147 Login

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

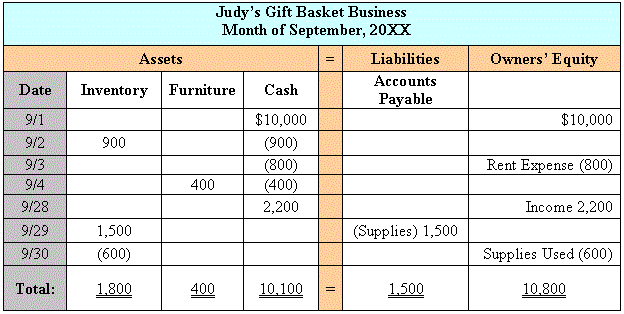

4 Balance Sheet Problems and Prevention Strategies for Business Owners

As a business owner, you’re going to run into a few accounting mistakes from time to time. Some of the biggest blunders you can make involve your business balance sheet. If you want to avoid balance sheet problems, learn about the most common errors you can make on your balance sheet and how to avoid them.

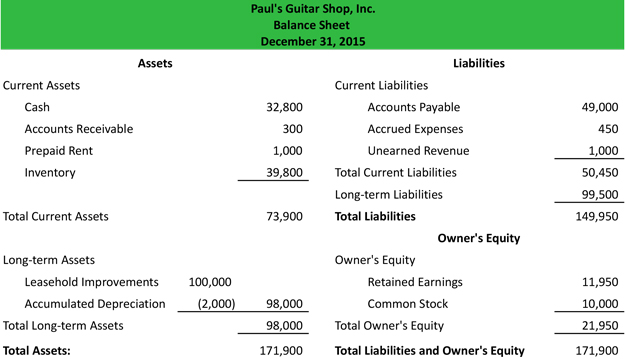

What is a balance sheet?

Before we can dive into balance sheet mistakes, let’s briefly review what a balance sheet is.

A balance sheet is a financial statement that tracks your company’s progress. Your balance sheet is broken down into three parts:

- Assets (what you own)

- Liabilities (what you owe)

- Equity (money left over after expenses)

On your business balance sheet, your assets should equal your total liabilities and total equity. If they don’t, your balance sheet is unbalanced. If your balance sheet doesn’t balance it likely means that there is some kind of mistake.

Keep this formula in mind for your balance sheet:

Assets = Liabilities + Equity

Your balance sheet is the best indicator of your business’s current and future health. If your balance sheet is chock-full of mistakes, you won’t have an accurate snapshot of your business’s financial health.

4 Balance sheet problems

All balance sheet problems are avoidable—you just have to know what to watch out for. Here are four balance sheet boo-boos you should be on the lookout for in your business.

1. Omitting transactions

At some point, recording a transaction on your balance sheet might slip your mind. Omitting accounting transactions is a fairly common (and very fixable) mistake.

Forgetting to record a transaction throws off the rest of your balance sheet. You might forget to record things like:

- Other expenses

Omitting transactions can cause your balance sheet to present an inaccurate financial future. To prevent this balance sheet issue, set reminders to record transactions regularly (e.g., monthly) to avoid missing information.

2. Recording transactions incorrectly

One major mistake business owners make with their books is incorrectly recording transactions and inverting numbers, known as transposition errors.

An accounting transposition error is when you reverse the order of two numbers when recording a transaction. For example, you might flip-flop two numbers (e.g., 52 vs. 25).

You can make a transposition error while writing down two numbers or a sequence of numbers on your balance sheet. This balance sheet error is super easy to make, and it can even happen to a seasoned business owner or bookkeeper.

Luckily, this error is just as easy to catch as it is to make. To avoid this balance sheet mistake, make sure you double-check any numbers you input on your balance sheet. Consider having another employee cross-check your transactions, too.

3. Forgetting to record inventory changes

Another common mistake that can plague your business balance sheet is forgetting to record inventory changes.

Sure, counting and changing inventory in your system is pretty straightforward. But some businesses tend to forget to tally up and update their inventory levels at the end of each period.

To remedy this, keep your inventory as up-to-date as possible. That way, you can avoid messing up your balance sheet and ensure your inventory is accurate in your records.

4. Not classifying data correctly

When you’re recording transactions on your balance sheet, you must correctly classify each transaction as an asset or liability. If you don’t accurately classify your transactions, you can wind up with a major balance sheet blunder.

As a brief recap, assets are physical or non-physical property that adds value to your business. Some examples of assets include your business’s computer, car, and trademarks. Here are a few types of asset accounts:

- Accounts receivable

Liabilities are current debts your business owes to other companies, organizations, employees, vendors, or government agencies. If you have more debts, you’ll have higher liabilities.

Your liabilities can be current (short-term) or noncurrent (long-term). Examples of liabilities include supplies, invoices, loans, and mortgages.

Types of liability accounts you may have include:

- Accrued expenses

- Unearned revenue

- Accounts payable

Clearly, assets and liabilities are not something you want to confuse on your business balance sheet.

Before recording a transaction on your balance sheet, make sure you’re classifying it correctly and recording it under the right liability or asset account. Double-check with an accountant or another professional if you’re unsure about how to classify a transaction.

How to prevent balance sheet mistakes

If you want to prevent common balance sheet errors, be on the lookout for red flags on your balance sheet. That way, you can catch errors before they snowball out of control.

Here are a few ways you can prevent balance sheet mistakes:

- Conduct a trial balance before creating your balance sheet

- Review balance sheet transactions regularly

- Pinpoint any problems ASAP

- Keep financial documents organized

When it comes to your balance sheet, the more organized you are, the better. The best thing your business can do is be as proactive as possible and keep detailed financial records for reference.

Mistakes are inevitable. But if you have a plan in place to track them down, you can avoid bigger balance sheet issues in the future.

Looking to avoid balance sheet mistakes? Patriot’s accounting software lets you streamline the way you record income and expenses. Say goodbye to accounting problems and try it out for yourself with a free trial!

Have questions, comments, or concerns about this post? Like us on Facebook , and let’s get talking!

This is not intended as legal advice; for more information, please click here.

Stay up to date on the latest accounting tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

Balance Sheet Practice Problems with Answers

Share This...

Introduction, explanation of the balance sheet and its importance in financial accounting.

In this article, we’ll cover balance sheet practice problems with answers. A balance sheet is one of the fundamental financial statements used by accountants and business owners to monitor the financial health of a company. It provides a snapshot at a specific point in time, usually at the end of an accounting period, of what a company owns (assets), what it owes (liabilities), and the residual interest owned by the shareholders (equity or owner’s equity). The balance sheet is crucial for financial accounting because it reflects the company’s financial position and stability. It serves as a basis for computing rates of return and evaluating the capital structure of the company. Investors, creditors, and regulatory agencies use the balance sheet to make critical decisions regarding investment, lending, and compliance.

Overview of the Key Components: Assets, Liabilities, and Equity

The balance sheet is structured around the basic accounting equation: Assets = Liabilities + Equity. Each of these components plays a vital role in providing insights into the financial status of a business:

- Assets : These are resources owned by the company that are expected to bring future economic benefits. Assets are classified into two main types: current assets, such as cash, inventory, and receivables, which can be converted into cash within one year; and non-current assets, like property, plant, and equipment (PPE), intangible assets, and long-term investments, which are held for more than one year.

- Liabilities : These are obligations that the company needs to settle in the future, resulting from past transactions or events. Liabilities are also categorized into current liabilities, which are due within one year (such as accounts payable, short-term loans, and taxes payable), and long-term liabilities that are due beyond one year (such as long-term debt and deferred tax liabilities).

- Equity : Also known as shareholders’ equity or owner’s equity, this represents the net assets of the company, which is the residual interest in the assets of the company after deducting liabilities. Equity includes funds contributed by the owners (capital stock), retained earnings (accumulated profits not distributed to shareholders as dividends), and other reserves.

Understanding these components and how they interrelate helps in analyzing a company’s financial condition, operational efficiency, and the effectiveness of its management strategies. Through the balance sheet, stakeholders can determine the liquidity, solvency, and investment value of a business, making it an indispensable tool in financial analysis and decision-making.

Understanding Balance Sheet Fundamentals

Definitions and examples of assets, liabilities, and equity.

To fully grasp balance sheet fundamentals, it’s essential to understand the three primary elements: assets, liabilities, and equity.

- Assets are resources controlled by the company as a result of past events and from which future economic benefits are expected to flow to the entity. For example, cash in the bank is an asset because it is a resource that can be used to pay expenses or purchase goods. Similarly, buildings and machinery are assets because they provide economic benefits through use in production or rental.

- Liabilities represent the company’s obligations to transfer resources to another entity in the future due to past transactions or events. An example of a liability is a bank loan, where the company is obligated to repay the borrowed amount along with interest. Accounts payable, arising from purchases of goods or services on credit, are also liabilities as they are future cash outflows.

- Equity refers to the residual interest in the assets of the company after deducting liabilities. It is essentially the net worth of the company, owned by its shareholders. For instance, if a business owner invests $100,000 in a company, this amount is recorded as equity, representing the owner’s stake in the company.

The Accounting Equation: Assets = Liabilities + Equity

The accounting equation forms the foundation of double-entry bookkeeping, a system that ensures the balance sheet remains balanced. In this equation, the total assets of a company must equal the sum of its liabilities and equity. This relationship is fundamental to the balance sheet and ensures that for every transaction, there is a corresponding and equal effect on both sides of the balance sheet, maintaining the equilibrium of the financial statement.

Importance of Balancing and What It Represents

The act of balancing in a balance sheet is not just a mathematical exercise; it represents the financial equilibrium of a company. The balance between assets, liabilities, and equity shows that the resources of the company (assets) are funded by debts (liabilities) and the owners’ claims (equity). A balanced balance sheet is crucial because it indicates that the company has adhered to the accounting principles and that its financial statements are accurate and complete. This balance provides a clear picture of a company’s financial health, enabling stakeholders to make informed decisions. In essence, a balanced balance sheet is a sign of the financial integrity and stability of a business, reflecting its capacity to meet obligations, sustain operations, and fund future growth.

Preparation Steps for a Balance Sheet

How to gather financial data for assets, liabilities, and equity.

The process of preparing a balance sheet begins with the gathering of financial data related to a company’s assets, liabilities, and equity. This involves collecting information from various sources within the company:

- Assets : Obtain detailed listings from the accounting system that include cash balances, accounts receivable aging reports, inventory lists, and summaries of property, plant, and equipment. Physical counts and external valuations might be needed for accuracy.

- Liabilities : Compile records of all debts the company owes, including loan statements, accounts payable ledgers, and accruals for expenses like wages or taxes that have not yet been paid.

- Equity : Access the company’s capital account records, which include initial capital contributions, retained earnings, and any additional investments made by the owners during the period.

Categorizing and Valuing Different Types of Assets and Liabilities

Once the data is collected, the next step is to categorize and value the assets and liabilities:

- Assets : Divide assets into current and non-current (or long-term) categories. Current assets, like cash and receivables, are those expected to be converted into cash within a year, while non-current assets, such as land and machinery, are held for longer periods. Valuation of assets should be at cost or market value, depending on accounting policies and applicable standards.

- Liabilities : Similarly, categorize liabilities into current (due within one year) and long-term. This includes everything from short-term borrowings and trade payables to long-term loans and bonds. The valuation of liabilities is typically at the amount to be repaid or settled.

Common Adjustments and Reconciliations before Finalizing the Balance Sheet

Before the balance sheet can be finalized, certain adjustments and reconciliations may be necessary to ensure the accuracy of the financial statements:

- Adjustments for Prepayments and Accruals : Prepaid expenses (assets) and accrued expenses (liabilities) need to be adjusted to reflect the correct period’s expense or income.

- Depreciation and Amortization : Non-current assets like equipment and buildings must be depreciated over their useful life, and intangible assets must be amortized.

- Inventory Valuation Adjustments : Inventory should be valued at the lower of cost or net realizable value to account for any potential decline in the value of the stock.

- Reconciliation of Intercompany Transactions : If the company is part of a larger group, any transactions between the company and its affiliates need to be eliminated to prevent double-counting.

These steps are crucial for preparing an accurate and reliable balance sheet that reflects the true financial position of the company at the end of the accounting period.

Balance Sheet Practice Problems

Problem 1: creating a basic balance sheet from a list of assets and liabilities.

In this problem, you will be given a list of assets and liabilities and asked to create a basic balance sheet. The task involves categorizing each item as either a current or non-current asset/liability and then calculating the total for each category. For example, given the following items:

- Cash: $10,000

- Accounts Receivable: $5,000

- Inventory: $3,000

- Long-term Loans: $15,000

- Accounts Payable: $2,000

You would organize these into a balance sheet format, ensuring that the total assets equal the total liabilities plus equity (with equity being the balancing figure).

Problem 2: Adjusting and Reconciling Discrepancies in a Trial Balance Sheet

This problem focuses on identifying and correcting errors in a trial balance sheet. You will be provided with a trial balance that does not equate (the total debits do not match the total credits) and must adjust the entries to balance. This involves analyzing each account, identifying mispostings or omissions, and making the necessary adjustments to ensure the trial balance is correct and can be used to prepare the final balance sheet.

Problem 3: Analyzing a Given Balance Sheet to Identify Financial Health and Potential Errors

In this scenario, you will analyze a completed balance sheet to assess the company’s financial health and identify any potential errors or red flags. This involves looking at key ratios such as the current ratio, debt-to-equity ratio, and asset turnover ratio. You will also need to scrutinize the balance sheet for any unusual or inconsistent figures that could indicate errors in accounting or financial reporting.

Problem 4: Comprehensive Exercise Involving the Calculation of Equity and Preparation of a Complete Balance Sheet

This comprehensive problem will require you to calculate the equity section of a company from provided financial information and then prepare a complete balance sheet. You will need to consider common equity items such as share capital, retained earnings, and any other reserves or equity adjustments. After calculating the total equity, you will complete the balance sheet by ensuring that the assets, liabilities, and equity sections are properly balanced and accurately reflect the company’s financial position.

Answers and Explanations

Detailed solutions to each practice problem.

- Current Assets: Cash $10,000, Accounts Receivable $5,000, Inventory $3,000

- Total Current Assets: $18,000

- Current Liabilities: Accounts Payable $2,000

- Non-Current Liabilities: Long-term Loans $15,000

- Total Liabilities: $17,000

- Equity: Calculated as the balancing figure = Total Assets – Total Liabilities = $1,000

- Identify and correct discrepancies, such as misclassified or omitted entries. If the trial balance’s debits and credits do not match, review each entry for accuracy and make necessary adjustments, ensuring the total debits equal total credits.

- Evaluate financial health through ratios like the current ratio (Current Assets/Current Liabilities) and debt-to-equity ratio (Total Liabilities/Total Equity). Identify any figures that seem unusually high or low, indicating potential errors or financial issues.

- Calculate equity using details like share capital and retained earnings. Ensure that the sum of liabilities and equity matches the total assets to confirm the balance sheet is balanced correctly.

Explanation of Common Mistakes and How to Avoid Them

- Misclassification of assets and liabilities between current and non-current categories.

- Overlooking or double-counting items, especially in manual calculations or when consolidating accounts from different sources.

- Failing to adjust for prepayments, accruals, or depreciations, leading to misstated figures.

Avoid these mistakes by double-checking the classification and calculations, using a checklist to ensure all items are accounted for, and performing regular reconciliations of accounts.

Tips for Ensuring Accuracy and Reliability in Balance Sheet Preparation

- Use a systematic approach to collect and verify financial data, ensuring all assets and liabilities are accurately recorded.

- Regularly reconcile bank statements and other accounts to catch and correct errors timely.

- Apply consistent accounting policies for valuation and classification of assets and liabilities.

- Employ internal controls and audits to detect and prevent inaccuracies and ensure compliance with applicable financial reporting standards.

- Stay updated with accounting best practices and changes in regulations to ensure the balance sheet preparation is in line with current standards and reflects the true financial position of the company.

Advanced Topics in Balance Sheet Management

Impact of depreciation and amortization on assets.

Depreciation and amortization are methods of allocating the cost of tangible and intangible assets over their useful lives, respectively. Depreciation affects physical assets like machinery and vehicles, reducing their book value on the balance sheet over time to reflect wear and tear or obsolescence. Amortization impacts intangible assets, such as patents or software, reducing their value as they are consumed or expire. These processes do not affect cash flow directly but reduce the asset’s value on the balance sheet and the company’s net income on the income statement due to the recorded expense.

Treatment of Intangible Assets and Goodwill

Intangible assets, such as intellectual property, brand recognition, and business licenses, are valued based on their purchase price or the fair market value at acquisition. These assets are amortized over their useful life, except for goodwill, which is not amortized but tested annually for impairment. Goodwill represents the excess of the purchase price over the fair value of the net identifiable assets acquired in a business combination. If the value of goodwill is deemed to be impaired, a loss must be recognized on the balance sheet, reducing equity.

Understanding Contingent Liabilities and How They Affect the Balance Sheet

Contingent liabilities are potential obligations that may arise in the future, depending on the outcome of a specific event. Examples include legal disputes, warranty claims, or tax audits. These liabilities are recorded on the balance sheet only if the occurrence of the liability is probable and its amount can be reasonably estimated. If these conditions are not met, the contingent liability is disclosed in the notes to the financial statements. Recognizing contingent liabilities is crucial as it provides a more comprehensive view of a company’s financial obligations and risks, affecting the assessment of its financial health and stability.

Recap of the Key Learning Points from the Practice Problems

The practice problems provided insights into the fundamental aspects of balance sheet preparation and analysis. We started with creating a basic balance sheet, highlighting the importance of correctly categorizing and valuing assets and liabilities. We then moved to adjusting and reconciling discrepancies in a trial balance, emphasizing the need for accuracy in financial reporting. Analyzing a balance sheet to assess financial health taught us to look beyond the numbers and understand what they indicate about a company’s financial stability and performance. Lastly, the comprehensive exercise of calculating equity and preparing a complete balance sheet reinforced the interconnectedness of financial statements and the critical role of equity in balancing the equation.

Importance of Mastering Balance Sheet Preparation for Financial Analysis and Decision-Making

Mastering the preparation and analysis of balance sheets is essential for anyone involved in financial analysis or decision-making. A well-prepared balance sheet provides a clear picture of a company’s financial position at a specific point in time, offering insights into its liquidity, solvency, and overall financial health. This information is crucial for investors, creditors, and management to make informed decisions regarding investment, lending, and operational strategies. Understanding the nuances of balance sheet items and their implications on the company’s financial performance enables better forecasting, budgeting, and strategic planning, ultimately leading to more informed and effective financial management and decision-making processes.

Additional Resources

Books, websites, and courses for further study.

For those interested in deepening their understanding of balance sheets and financial analysis, numerous resources are available:

- “Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports” by Thomas Ittelson is a great starting point for beginners.

- “Accounting for Non-Accountants” by Wayne Label provides an easy-to-understand overview of accounting basics, including balance sheet preparation.

- “The Interpretation of Financial Statements” by Benjamin Graham offers insights into analyzing and interpreting financial statements for better investment decisions.

- Investopedia (investopedia.com) offers a wealth of articles, tutorials, and glossaries on financial topics, including detailed sections on balance sheets.

- The Accounting Coach (accountingcoach.com) provides free online lessons covering basic to advanced accounting topics, with quizzes and exercises for practice.

- Coursera and edX offer online courses from universities and colleges worldwide, including financial accounting and analysis classes that cover balance sheet preparation and interpretation.

- The Chartered Financial Analyst (CFA) program includes comprehensive training in financial reporting, analysis, and decision-making, which extensively covers balance sheets.

Professional Organizations and Certifications in Accounting and Finance

Joining professional organizations and pursuing certifications can greatly enhance one’s knowledge and credibility in the field of accounting and finance:

- The American Institute of Certified Public Accountants (AICPA) offers resources, networking, and continuing education for accounting professionals.

- The Institute of Management Accountants (IMA) provides certification, research, and practice development for accountants and financial professionals involved in business management.

- Certified Public Accountant (CPA) is a well-recognized certification in the accounting field, emphasizing expertise in financial reporting, including balance sheet preparation and analysis.

- Chartered Financial Analyst (CFA) certification is prestigious in the finance industry, covering rigorous financial analysis, investment management, and decision-making skills.

These resources and affiliations can provide valuable knowledge, skills, and networks to help individuals excel in balance sheet management and financial analysis.

Other Posts You'll Like...

AUD CPA Exam: Understanding When an Entity Is Required to Have a Single Audit, Including Identifying Federal Awards and Major Programs

AUD CPA Exam: How to Perform Procedures to Identify Related Party Relationships and Transactions, Including Significant Unusual Transactions

AUD CPA Exam: How to Recognize the Potential Impact of Significant Accounting Estimates on the RMM, Including Indicators of Management Bias

AUD CPA Exam: How to Perform Tests of Compliance with Laws and Regulations Affecting an Entity But Without a Direct Affect on the Financial Statements

FAR CPA Practice Questions Explained: Adjusting Consolidated Financial Statements to Correct Errors

AUD CPA Exam: How to Perform Tests of Compliance with Laws and Regulations Affecting an Entity’s Financial Statements in an Engagement

Helpful links.

- Learn to Study "Strategically"

- How to Pass a Failed CPA Exam

- Samples of SFCPA Study Tools

- SuperfastCPA Podcast

From 8hrs a Day to 2hrs a Day: How Matt Passed the CPA Exams

How Brittany Crushed the CPA Exams, Despite Being Very Busy

How Jamie Passed Her CPA Exams by Constantly Improving Her Study Process

“I Shouldn’t Be Able to Do This”: How Colbi Passed Her CPA Exams

The 5 Biggest Myths About CPA Exam Study

From 8 Hours a Day to 8 Hours a Week, How Branden Passed His CPA Exams

Want to pass as fast as possible, ( and avoid failing sections ), watch one of our free "study hacks" trainings for a free walkthrough of the superfastcpa study methods that have helped so many candidates pass their sections faster and avoid failing scores....

Make Your Study Process Easier and more effective with SuperfastCPA

Take Your CPA Exams with Confidence

- Free "Study Hacks" Training

- SuperfastCPA PRO Course

- SuperfastCPA Review Notes

- SuperfastCPA Audio Notes

- SuperfastCPA Quizzes

Get Started

- Free "Study Hacks Training"

- Read Reviews of SuperfastCPA

- Busy Candidate's Guide to Passing

- Subscribe to the Podcast

- Purchase Now

- Nate's Story

- Interviews with SFCPA Customers

- Our Study Methods

- SuperfastCPA Reviews

- CPA Score Release Dates

- The "Best" CPA Review Course

- Do You Really Need the CPA License?

- 7 Habits of Successful Candidates

- "Deep Work" & CPA Study

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Creating Brand Value

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Prepare a Balance Sheet: 5 Steps for Beginners

- 10 Sep 2019

A company’s balance sheet is one of the most important financial statements it produces—typically on a quarterly or even monthly basis (depending on the frequency of reporting).

Depicting your total assets, liabilities, and net worth, this document offers a quick look into your financial health and can help inform lenders, investors, or stakeholders about your business. Based on its results, it can also provide you key insights to make important financial decisions.

When paired with cash flow statements and income statements , balance sheets can help provide a complete picture of your organization’s finances for a specific period. By determining the financial status of your organization, essential partners have an informative blueprint of your company’s potential and profitability.

Have you found yourself in the position of needing to prepare a balance sheet? Here's what you need to know to understand how balance sheets work and what makes them a business fundamental , as well as steps you can take to create a basic balance sheet for your organization.

Access your free e-book today.

What Is a Balance Sheet?

A balance sheet is a financial statement that communicates the “book value” of an organization, as calculated by subtracting all of the company’s liabilities and shareholder equity from its total assets.

A balance sheet offers internal and external analysts a snapshot of how a company is performing in the current period, how it performed during the previous period, and how it expects to perform in the immediate future. This makes balance sheets an essential tool for individual and institutional investors, as well as key stakeholders within an organization and any outside regulators who need to see the status of an organization during specific periods of time.

The Balance Sheet Format

Most balance sheet formats are arranged according to this equation : Assets = Liabilities + Shareholders’ Equity

The equation above includes three broad buckets, or categories, of value which must be accounted for:

An asset is anything a company owns which holds some amount of quantifiable value, meaning that it could be liquidated and turned to cash. They're the goods and resources owned by the company.

Assets can be further broken down into current assets and non-current assets:

- Current assets —or short-term assets—are typically what a company expects to convert into cash within a year’s time, such as cash and cash equivalents, prepaid expenses, inventory, marketable securities, and accounts receivable.

- Non-current assets —also called fixed or long-term assets—are investments that a company does not expect to convert into cash in the short term, such as land, equipment, patents, trademarks, and intellectual property.

Related: 6 Ways Understanding Finance Can Help You Excel Professionally

2. Liabilities

A liability is anything a company or organization owes to a debtor. This may refer to payroll expenses, rent and utility payments, debt payments, money owed to suppliers, taxes, or bonds payable.

As with assets, liabilities can be classified as either current liabilities or non-current liabilities:

- Current or short-term liabilities are typically those due within one year, which may include accounts payable and other accrued expenses.

- Non-current or long term liabilities are typically those that a company doesn’t expect to repay within one year. They're usually long-term obligations, such as leases, bonds payable, or loans.

3. Shareholders’ Equity

Shareholders’ equity refers generally to the net worth of a company, and reflects the amount of money that would be left over if all assets were sold and liabilities paid. Shareholders’ equity belongs to the shareholders, whether they're private or public owners.

Just as assets must equal liabilities plus shareholders’ equity, shareholders’ equity can be depicted by this equation: Shareholders’ Equity = Assets - Liabilities

Does a Balance Sheet Always Balance?

A balance sheet should always balance. The name itself comes from the fact that a company’s assets will equal its liabilities plus any shareholders’ equity that has been issued. If you find that your balance sheet is not truly balancing, it may be caused by one of these culprits:

- Incomplete or misplaced data

- Incorrectly entered transactions

- Errors in currency exchange rates

- Errors in inventory

- Incorrect equity calculations

- Miscalculated loan amortization or depreciation

How to Prepare a Basic Balance Sheet

Here are five steps you can follow to create a basic balance sheet for your organization. Even if some or all of the process is automated through the use of an accounting system or software, understanding how a balance sheet is prepared will enable you to spot potential errors so that they can be resolved before they cause lasting damage.

1. Determine the Reporting Date and Period

A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. Often, the reporting date will be the final day of the accounting period .

How Often Is a Balance Sheet Prepared?

Companies, especially publicly traded ones, prepare their balance sheet reports on a quarterly basis. When this is the case, the reporting date usually falls on the final day of the quarter. For companies that operate on a calendar year, those dates are:

- Q1: March 31

- Q2: June 30

- Q3: September 30

- Q4: December 31

Companies that report on an annual basis will often use December 31st as their reporting date, though they can choose any date.

It's not uncommon for a balance sheet to take a few weeks to prepare after the reporting period has ended.

Related: 10 Important Business Skills Every Professional Needs

2. Identify Your Assets

After you’ve identified your reporting date and period, you’ll need to tally your assets as of that date.

Typically, a balance sheet will list assets in two ways: As individual line items and then as total assets. Splitting assets into different line items will make it easier for analysts to understand exactly what your assets are and where they came from; tallying them together will be required for final analysis.

Assets will often be split into the following line items:

- Current Assets:

- Cash and cash equivalents

- Short-term marketable securities

- Accounts receivable

- Other current assets

- Non-current Assets:

- Long-term marketable securities

- Intangible assets

- Other non-current assets

Current and non-current assets should both be subtotaled, and then totaled together.

3. Identify Your Liabilities

Similarly, you will need to identify your liabilities. Again, these should be organized into both line items and totals, as below:

- Current Liabilities:

- Accounts payable

- Accrued expenses

- Deferred revenue

- Current portion of long-term debt

- Other current liabilities

- Non-Current Liabilities:

- Deferred revenue (non-current)

- Long-term lease obligations

- Long-term debt

- Other non-current liabilities

As with assets, these should be both subtotaled and then totaled together.

4. Calculate Shareholders’ Equity

If a company or organization is privately held by a single owner, then shareholders’ equity will be relatively straightforward. If it’s publicly held, this calculation may become more complicated depending on the various types of stock issued.

Common line items found in this section of the balance sheet include:

- Common stock

- Preferred stock

- Treasury stock

- Retained earnings

5. Add Total Liabilities to Total Shareholders’ Equity and Compare to Assets

To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity. To do this, you’ll need to add liabilities and shareholders’ equity together.

Example of a Finished Balance Sheet

It's important to note that this balance sheet example is formatted according to International Financial Reporting Standards (IFRS), which companies outside the United States follow. If this balance sheet were from a US company, it would adhere to Generally Accepted Accounting Principles (GAAP).

Related: GAAP vs. IFRS: What Are the Key Differences and Which Should You Use?

If you’ve found that your balance sheet doesn't balance, there's likely a problem with some of the accounting data you've relied on. Double check that all of your entries are correct and accurate. You may have omitted or duplicated assets, liabilities, or equity, or miscalculated your totals.

The Purpose of a Balance Sheet

Balance sheets are one of the most critical financial statements , offering a quick snapshot of the financial health of a company. Learning how to generate them and troubleshoot issues when they don’t balance is an invaluable financial accounting skill that can help you become an indispensable member of your organization.

Do you want to learn more about what's behind the numbers on financial statements? Explore our finance and accounting courses to find out how you can develop an intuitive knowledge of financial principles and statements to unlock critical insights into performance and potential.

This post was updated on May 9, 2024. It was originally published on September 10, 2019.

About the Author

- All Self-Study Programs

- Premium Package

- Basic Package

- Private Equity Masterclass

- VC Term Sheets & Cap Tables

- Sell-Side Equity Research (ERC © )

- Buy-Side Financial Modeling

- Real Estate Financial Modeling

- REIT Modeling

- FP&A Modeling (CFPAM ™ )

- Project Finance Modeling

- Bank & FIG Modeling

- Oil & Gas Modeling

- Biotech Sum of the Parts Valuation

- The Impact of Tax Reform on Financial Modeling

- Corporate Restructuring

- The 13-Week Cash Flow Model

- Accounting Crash Course

- Advanced Accounting

- Crash Course in Bonds

- Analyzing Financial Reports

- Interpreting Non-GAAP Reports

- Fixed Income Markets (FIMC © )

- Equities Markets Certification (EMC © )

- ESG Investing

- Excel Crash Course

- PowerPoint Crash Course

- Ultimate Excel VBA Course

- Investment Banking "Soft Skills"

- Networking & Behavioral Interview

- 1000 Investment Banking Interview Questions

- Virtual Boot Camps

- 1:1 Coaching

- Corporate Training

- University Training

- Free Content

- Support/Contact Us

- About Wall Street Prep

Balance Sheet

Step-by-Step Guide to Understanding the Balance Sheet (Assets = Liabilities + Shareholders Equity)

Learn Online Now

What is Balance Sheet?

The Balance Sheet —or Statement of Financial Position—is a core financial statement that reports a snapshot of a company’s assets, liabilities, and shareholders’ equity at a particular point in time.

In practice, the balance sheet offers insights into the current state of a company’s financial position at a predefined point in time, akin to a snapshot.

The composition of the balance sheet is composed of three pieces, which are assets, liabilities, and shareholders’ equity.

- The balance sheet is a financial statement that provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time.

- The fundamental accounting equation—Assets = Liabilities + Shareholders’ Equity—underpins the balance sheet and the interconnections among each line item.

- The assets section is listed in descending liquidity and separated into current assets and non-current assets.

- The liabilities section is listed in order of how close their due dates are and split between current liabilities (<12 months) and non-current liabilities (>12 months).

- The shareholders’ equity section represents the residual value—or “net worth”—remaining upon deducting total liabilities from the total assets of a company.

- The balance sheet offers practical insights into a company’s current financial position and is used to perform ratio analysis to measure operating efficiency, liquidity, solvency, and leverage risk.

Table of Contents

Balance Sheet Template: Standard Format

Balance sheet formula, how to prepare the balance sheet for beginners, sample balance sheet template: apple (aapl), how to analyze the balance sheet, how are the financial statements linked, balance sheet calculator — excel template, 1. basic balance sheet template build, 2. balance sheet calculation example.

The balance sheet reflects the carrying values of a company’s assets , liabilities , and shareholders’ equity at a specific point in time.

Conceptually, a company’s assets refer to the resources belonging to the company with positive economic value, which must have been funded somehow.

The two funding sources available for companies are liabilities and shareholders’ equity, which reflect how the resources were purchased.

In simple terms, the balance sheet—also known as the “statement of financial position”—provides a comprehensive overview of a company’s assets (“what is owned”) and liabilities (“what is owed”) in a given period.

The difference between a company’s total assets and total liabilities results in shareholders’ equity (or “net assets”).

The standard format and three components of the balance sheet are each described in the following illustrative chart:

| Balance Sheet | Section |

|---|---|

The fundamental accounting equation states that a company’s assets must be equal to the sum of its liabilities and shareholders’ equity.

If the fundamental accounting equation is not true in a financial model—i.e. the balance sheet does not “balance”—the financial model contains an error in all likelihood.

The three components of the equation will now be described in further detail in the following sections.

Once complete, we’ll undergo an interactive training exercise in Excel, where we’ll practice building a balance sheet template using the historical data pulled from the 10-K filing of Apple (AAPL) .

1. Assets Section (Current vs. Non-Current)

Assets describe resources with economic value that can be sold for money or have the potential to provide monetary benefits someday in the future.

The assets section is ordered in terms of liquidity , i.e. line items are ranked by how quickly the asset can be liquidated and turned into cash on hand.

On the balance sheet, a company’s assets are separated into two distinct sections:

- Current Assets ➝ The short-term assets that can or are expected to be converted into cash within one year (<12 months)

- Non-Current Assets ➝ The long-term assets expected to provide economic benefits to the company in excess of one year (>12 months).

While current assets can be converted into cash within a year, liquidating non-current assets, such as fixed assets (PP&E), can be a time-consuming process.

Furthermore, a substantial discount is normally necessary to find a suitable buyer to sell the fixed asset in the open markets.

The most common current assets are defined in the table below.

| Current Assets | Description |

|---|---|

The next section consists of non-current assets, which are described in the table below.

| Non-Current Assets | Description |

|---|---|

2. Liabilities Section (Current vs. Non-Current)

Similar to the order in which assets are displayed, liabilities are listed in terms of how near-term the cash outflow date is, i.e. the near-term liabilities coming due on an earlier date are listed at the top.

Liabilities are also separated into two parts on the basis of their maturity date:

- Current Liabilities ➝ Short-term liabilities are expected to be paid off within one year (e.g. accounts payable)

- Non-Current Liabilities ➝ Long-term liabilities are not likely to come due for at least one year (e.g. long-term debt).

The most frequent current liabilities that appear on the balance sheet are the following:

| Current Liabilities | Description |

|---|---|

The most common non-current liabilities include:

| Non-Current Liabilities | Description |

|---|---|

3. Shareholders Equity Section

The second source of funding—other than liabilities—is shareholders equity (or “stockholders equity”), which consists of the following line items.

| Shareholders Equity | Description |

|---|---|

The balance sheet of Apple (AAPL), a global consumer electronics and software company, for the fiscal year ending 2021 is shown below.

Sample Apple Balance Sheet Template (Source: AAPL 10-K )

While the financial statements are closely intertwined and necessary to understand a company’s financial health, the balance sheet is particularly useful for ratio analysis.

The following chart contains some of the most common metrics used in practice to analyze a company’s balance sheet.

| Financial Metric | Description |

|---|---|

The three core financial statements—income statement, balance sheet, and cash flow statement—are intricately connected and collectively present a comprehensive view of a company’s current financial condition.

- Income Statement ➝ The income statement, often used interchangeably with the term “profit and loss statement (P&L)”, records the revenue, costs, expenses, and net income (the “bottom line”) for a specified period. The net income, or accounting profitability, flows in as the starting line item on the cash flow statement (CFS).

- Cash Flow Statement ➝ The cash flow statement is composed of three sections—the cash from operating, investing, and financing activities—with each section reconciling the company’s reported net income to track the actual movement of cash in the stated period (i.e. the “inflow” and “outflow” of cash).

- Balance Sheet ➝ The balance sheet, or statement of financial position, presents a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. The cash flow statement captures the changes in working capital line items to ensure the reflected cash balance is the actual cash balance available at the end of the given period.

The retained earnings line item is the centerpiece that ties the three financial statements together.

Conceptually, retained earnings reflect the cumulative earnings kept by a company since its inception rather than distributing excess funds in the form of shareholder dividends.

The ending retained earnings balance recognized on the balance sheet equals the beginning balance plus net income, net of any dividend issuances to shareholders.

The ending cash balance on the cash flow statement (CFS) must match the cash balance recognized on the balance sheet for the current period.

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

Excel Template | File Download Form

By submitting this form, you consent to receive email from Wall Street Prep and agree to our terms of use and privacy policy.

Suppose we’re tasked with building a 3-statement model for Apple (NASDAQ: AAPL) and are currently preparing the company’s historical balance sheet data.

Using the screenshot from earlier, we’ll enter Apple’s historical balance sheet into Excel.

The hard-coded inputs are entered in blue font, while the calculations (i.e. the ending total for each section) are in black font.

Why? The color formatting abides by general financial modeling best practices, which make building a financial model easier for the one creating the model and for purposes of auditing.

However, rather than copying every data point in the same format as reported by Apple in its public filings, we must make discretionary adjustments that we deem appropriate for modeling purposes.

- Marketable Securities ➝ For instance, marketable securities are consolidated into the cash and cash equivalents line item because the underlying drivers are identical.

- Short-Term Debt ➝ The short-term portion of Apple’s long-term debt is consolidated into one combined line item since the mechanics of the debt schedule roll-forward are the same.

However, that does not mean all remotely similar line items should be combined, as seen in the case of Apple’s commercial paper .

Commercial paper is a form of short-term debt with a specific purpose, different from long-term debt . Since commercial paper is a debt-like security, certain financial models consolidate commercial paper with the revolving credit facility (“revolver”) line item.

Once Apple’s historical data is input in our Excel template, with the proper adjustments to streamline our financial model, we’ll calculate the profit metrics denoted in black font as a standard modeling convention (and “best practice”).

- Blue Font ➝ Hardcoded Input

- Black Font ➝ Calculation (or Cell Reference)

| Balance Sheet ($ in millions) | 2020A | 2021A |

|---|---|---|

| Cash and Cash Equivalents | $191,830 | $190,516 |

| Accounts Receivable, net | 16,120 | 26,278 |

| Inventories | 4,061 | 6,580 |

| Other Current Assets | 32,589 | 39,339 |

| Property, Plant and Equipment, net | $36,766 | $39,440 |

| Other Non-Current Assets | 42,522 | 48,849 |

| Accounts Payable | $42,296 | $54,763 |

| Other Current Liabilities | 42,684 | 47,493 |

| Commercial Paper | 4,996 | 6,000 |

| Deferred Revenue | 6,643 | 7,612 |

| Long-Term Debt | $107,440 | $118,719 |

| Other Non-Current Liabilities | 54,490 | 53,325 |

| Common Stock and APIC | $50,779 | $57,365 |

| Retained Earnings | 14,966 | 5,562 |

| Other Comprehensive Income / (Loss) | (406) | 163 |

The formula for each bolded cell is as follows:

- Total Current Assets = Cash and Cash Equivalents + Accounts Receivable, net + Inventories + Other Current Assets

- Total Assets = Total Current Assets + Property, Plant and Equipment, net + Other Non-Current Assets

- Total Current Liabilities = Accounts Payable + Other Current Liabilities + Commercial Paper + Deferred Revenue

- Total Liabilities = Total Current Liabilities + Long-Term Debt + Other Non-Current Liabilities

- Total Shareholders’ Equity = Common Stock and APIC + Retained Earnings + Other Comprehensive Income / (Loss)

Note that in our basic balance sheet template, the “Total Assets” and “Total Liabilities” line items include the values of the “Total Current Assets” and “Total Current Liabilities”, respectively.

In other cases, the balance sheet presentation will be divided into two parts: “Current” and “Non-Current.”

Upon completion, the final step is to ensure the fundamental accounting equation remains true by subtracting total assets from the sum of the total liabilities and shareholders’ equity, which comes out to zero, confirming our balance sheet is indeed “balanced.”

Everything You Need To Master Financial Modeling

Enroll in The Premium Package : Learn Financial Statement Modeling, DCF, M&A, LBO and Comps . The same training program used at top investment banks.

- Google+

- 100+ Excel Financial Modeling Shortcuts You Need to Know

- The Ultimate Guide to Financial Modeling Best Practices and Conventions

- What is Investment Banking?

- Essential Reading for your Investment Banking Interview

We're sending the requested files to your email now. If you don't receive the email, be sure to check your spam folder before requesting the files again.

Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO.

The Wall Street Prep Quicklesson Series

7 Free Financial Modeling Lessons

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

- Search Search Please fill out this field.

What Is a Balance Sheet?

How balance sheets work, special considerations.

- Why Is It Important?

- Limitations

- Balance Sheet FAQs

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Balance Sheet: Explanation, Components, and Examples

What you need to know about these financial statements

:max_bytes(150000):strip_icc():format(webp)/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

- Valuing a Company: Business Valuation Defined With 6 Methods

- Valuation Analysis

- Financial Statements

- Balance Sheet CURRENT ARTICLE

- Cash Flow Statement

- 6 Basic Financial Ratios

- 5 Must-Have Metrics for Value Investors

- Earnings Per Share (EPS)

- Price-to-Earnings Ratio (P/E Ratio)

- Price-To-Book Ratio (P/B Ratio)

- Price/Earnings-to-Growth (PEG Ratio)

- Fundamental Analysis

- Absolute Value

- Relative Valuation

- Intrinsic Value of a Stock

- Intrinsic Value vs. Current Market Value

- Equity Valuation: The Comparables Approach

- 4 Basic Elements of Stock Value

- How to Become Your Own Stock Analyst

- Due Diligence in 10 Easy Steps

- Determining the Value of a Preferred Stock

- Qualitative Analysis

- Stock Valuation Methods

- Bottom-Up Investing

- Ratio Analysis

- What Book Value Means to Investors

- Liquidation Value

- Market Capitalization

- Discounted Cash Flow (DCF)

- Enterprise Value (EV)

- How to Use Enterprise Value to Compare Companies

- How to Analyze Corporate Profit Margins

- Return on Equity (ROE)

- Decoding DuPont Analysis

- How to Value Private Companies

- Valuing Startup Ventures

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure .

In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Balance sheets can be used with other important financial statements to conduct fundamental analysis or calculate financial ratios.

Key Takeaways

- A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

- The balance sheet is one of the three core financial statements that are used to evaluate a business.

- It provides a snapshot of a company's finances (what it owns and owes) as of the date of publication.

- The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity.

- Fundamental analysts use balance sheets to calculate financial ratios.

Investopedia / Katie Kerpel

The balance sheet provides an overview of the state of a company's finances at a moment in time. It cannot give a sense of the trends playing out over a longer period on its own. For this reason, the balance sheet should be compared with those of previous periods.

Investors can get a sense of a company's financial well-being by using a number of ratios that can be derived from a balance sheet, including the debt-to-equity ratio and the acid-test ratio , along with many others. The income statement and statement of cash flows also provide valuable context for assessing a company's finances, as do any notes or addenda in an earnings report that might refer back to the balance sheet.

The balance sheet adheres to the following accounting equation, with assets on one side, and liabilities plus shareholder equity on the other, balance out:

Assets = Liabilities + Shareholders’ Equity \text{Assets} = \text{Liabilities} + \text{Shareholders' Equity} Assets = Liabilities + Shareholders’ Equity

This formula is intuitive. That's because a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity).

If a company takes out a five-year, $4,000 loan from a bank, its assets (specifically, the cash account) will increase by $4,000. Its liabilities (specifically, the long-term debt account ) will also increase by $4,000, balancing the two sides of the equation. If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholder equity. All revenues the company generates in excess of its expenses will go into the shareholder equity account. These revenues will be balanced on the assets side, appearing as cash, investments, inventory, or other assets.

Balance sheets should also be compared with those of other businesses in the same industry since different industries have unique approaches to financing.

As noted above, you can find information about assets, liabilities, and shareholder equity on a company's balance sheet. The assets should always equal the liabilities and shareholder equity. This means that the balance sheet should always balance , hence the name. If they don't balance, there may be some problems, including incorrect or misplaced data, inventory or exchange rate errors, or miscalculations.

Each category consists of several smaller accounts that break down the specifics of a company's finances. These accounts vary widely by industry, and the same terms can have different implications depending on the nature of the business. Companies might choose to use a form of balance sheet known as the common size , which shows percentages along with the numerical values. This type of report allows for a quick comparison of items.

There are a few common components that investors are likely to come across.

Theresa Chiechi {Copyright} Investopedia, 2019.

Components of a Balance Sheet

Accounts within this segment are listed from top to bottom in order of their liquidity . This is the ease with which they can be converted into cash. They are divided into current assets, which can be converted to cash in one year or less; and non-current or long-term assets, which cannot.

Here is the general order of accounts within current assets:

- Cash and cash equivalents are the most liquid assets and can include Treasury bills and short-term certificates of deposit, as well as hard currency.

- Marketable securities are equity and debt securities for which there is a liquid market.

- Accounts receivable (AR) refer to money that customers owe the company. This may include an allowance for doubtful accounts as some customers may not pay what they owe.

- Inventory refers to any goods available for sale, valued at the lower of the cost or market price.

- Prepaid expenses represent the value that has already been paid for, such as insurance, advertising contracts, or rent.

Long-term assets include the following:

- Long-term investments are securities that will not or cannot be liquidated in the next year.

- Fixed assets include land, machinery, equipment, buildings, and other durable, generally capital-intensive assets.

- Intangible assets include non-physical (but still valuable) assets such as intellectual property and goodwill. These assets are generally only listed on the balance sheet if they are acquired, rather than developed in-house. Their value may thus be wildly understated (by not including a globally recognized logo, for example) or just as wildly overstated.

Liabilities

A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Current liabilities are due within one year and are listed in order of their due date. Long-term liabilities, on the other hand, are due at any point after one year.

Current liabilities accounts might include:

- Current portion of long-term debt is the portion of a long-term debt due within the next 12 months. For example, if a company has a 10 years left on a loan to pay for its warehouse, 1 year is a current liability and 9 years is a long-term liability.

- Interest payable is accumulated interest owed, often due as part of a past-due obligation such as late remittance on property taxes.

- Wages payable is salaries, wages, and benefits to employees, often for the most recent pay period.

- Customer prepayments is money received by a customer before the service has been provided or product delivered. The company has an obligation to (a) provide that good or service or (b) return the customer's money.

- Dividends payable is dividends that have been authorized for payment but have not yet been issued.

- Earned and unearned premiums is similar to prepayments in that a company has received money upfront, has not yet executed on their portion of an agreement, and must return unearned cash if they fail to execute.

- Accounts payable is often the most common current liability. Accounts payable is debt obligations on invoices processed as part of the operation of a business that are often due within 30 days of receipt.

Long-term liabilities can include:

- Long-term debt includes any interest and principal on bonds issued

- Pension fund liability refers to the money a company is required to pay into its employees' retirement accounts

- Deferred tax liability is the amount of taxes that accrued but will not be paid for another year. Besides timing, this figure reconciles differences between requirements for financial reporting and the way tax is assessed, such as depreciation calculations.

Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet.

Shareholder Equity

Shareholder equity is the money attributable to the owners of a business or its shareholders. It is also known as net assets since it is equivalent to the total assets of a company minus its liabilities or the debt it owes to non-shareholders.

Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt. The remaining amount is distributed to shareholders in the form of dividends.

Treasury stock is the stock a company has repurchased. It can be sold at a later date to raise cash or reserved to repel a hostile takeover .