Britannia Industries Ltd Case Study: Business Segments, KPIs, Financials, and SWOT Analysis

We all have experienced the brilliance of Britannia, but very few know its story. So today, we will explore Britannia’s success story. We’ll start with the company’s overview.

Table of Contents

Established in 1892, Britannia Industries Ltd. is one of India’s oldest food product companies and holds a significant position in the country’s biscuit industry. It is Kolkata-based and a part of the WADIA Group.

It is an iconic brand and reaches over 50% of Indian homes. Britannia has been in this business for over a century, building a loyal consumer base with strong and deep emotional connections. The company’s R&D team plays a vital role in maintaining and innovating a vast portfolio, ensuring it aligns with consumer preferences while prioritizing quality.

Awards and Recognition

- 2011 – The Indian Merchants’ Chamber.

- 2012 – The Golden Peacock National Quality Award.

- 2014 – 100 Most Trusted Brands of India list.

- 2016 – Renewable Energy India Awards.

- 2019 – Brand Equity’s Most Trusted Brands.

- 2022 – Ranked 4th in the list of India’s most chosen FMCG brands.

Britannia served many finger-licking products. Such as:

- Biscuits : Britannia is one of the leading biscuit manufacturers in India, with popular brands such as NutriChoice, Milk Bikis, Bourbon, Good Day, 50-50, Marie Gold, Nice Time, and Little Hearts. Britannia biscuits are available in various segments, such as cookies, crackers, cream, health, and treats.

- Rusk : Britannia Rusk is a crispy and crunchy snack made from wheat flour, sugar, and butter and comes with various flavours of elaichi, milk, and suji toast

- Cakes : Britannia cakes include fruit cake, nut & raisin cake, chocolate cake, muffins, cupcakes, and brownies.

- Snacks : Britannia snacks are tasty and ideal for enjoyment anytime, anywhere. Britannia snacks include wafers, salted snacks, and nuts.

- Bread : Britannia Breads offers wheat bread, multigrain bread, fruit bread, sandwich bread, pav, bun, and kulcha. They are made from high-quality ingredients and are enriched with essential nutrients.

Competitors

The company faces tough competition from the following players:

- Mother dairy

Market Data

Financial highlights, income statement.

The graph indicates a growing trend in both Operating income and Net Profit. This shows a healthy state of the business.

Balance Sheet:

The company has seen a consistent level of current liabilities but an increase in current assets. They have also witnessed an increase in non-current assets, which are primarily fueled by growing non-current liabilities.

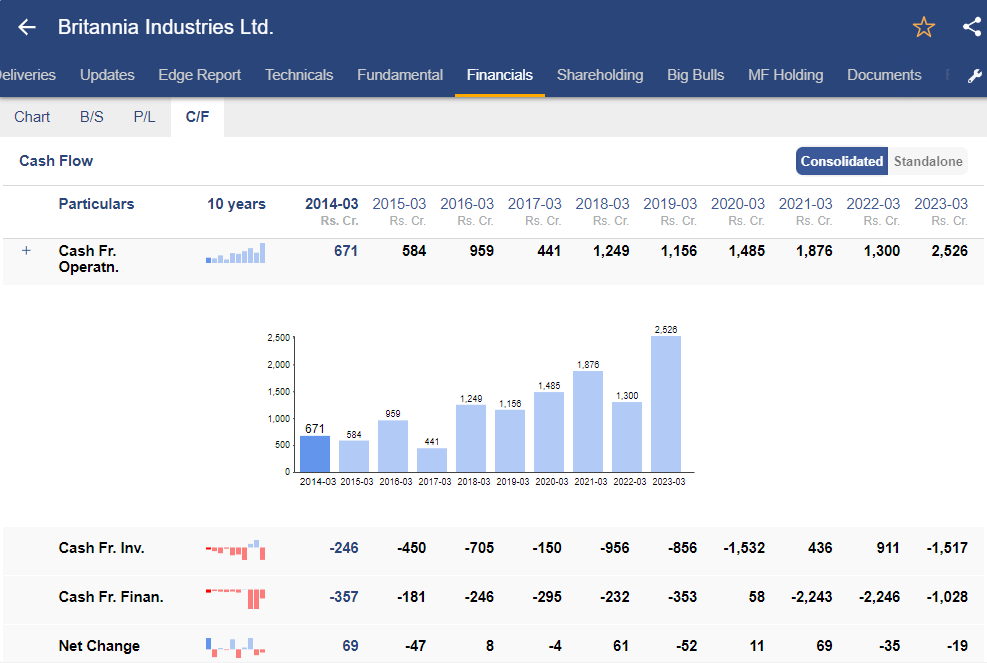

Cash Flow Statement

The Cash Flow situation indicates a strong operating position but a weak investing position. This means that the company invests heavily in the long run, which is financed by financing activities.

Profitability Ratios

Peer comparison, swot analysis.

- Britannia has been in the industry for more than 100 years. The company has created its space in every Indian household and a strong brand identity.

- The company used an 80:20 growth strategy where it focused on 20% of the brands like Marie Gold, Good Day, Milk Bikis & Nutri Choice, which contribute 80% of the company revenue. This process of putting some products on a priority list enabled the company to increase the efficiency of the production line.

- The company is working on new market innovations, which means adjusting the market according to consumer tastes and preferences. It helps to explore new flavours while leveraging current and new technologies.

- Britannia is not able to maintain a proper overseas presence because of tough competition in the international market.

- The competitors in the Food Processing industry can easily imitate the business model.

Opportunities

- Accelerating technological innovation can lead to an increase in industrial productivity, allowing the company to capture greater market share.

- The company can choose to acquire other companies in the dairy industry to increase its market share.

- An increase in the price of the raw materia l will eventually increase the cost of the product, leading to a slowdown in sales.

- Changing political environments can impact the industry’s growth both in the local and international markets.

Britannia Industries Ltd has established itself as a prominent player in the Indian food industry with a strong brand identity and loyal consumer base. The company’s focus on key brands, innovation, and market adaptation presents growth opportunities, while challenges such as international competition and raw material price fluctuations pose threats to its continued success. Over the next five years, the company expects to increase the contribution of its non-biscuit portfolio to approximately 35% of total revenue, up from the current 23%. Additionally, there is an ambition to scale the dairy sector to ₹2,000 crore within the same time.

However, it is important to know that investing before conducting prior research can expose you to undue risks.

Frequently Asked Questions (FAQs)

- What are the problems faced by Britannia?

Ans. The problems faced by Britannia are rising interest rates, high commodity prices, and geopolitical conflicts disrupting supply chains.

- Who is the CEO of Britannia?

Ans. Rajneet Singh Kohli is the CEO of Britannia.

- What is the market cap of Britannia Industries Ltd.?

Ans. As of 2nd April 24, the market cap of the company is ₹1,18,024 Cr.

- What are the main segments of Britannia?

Ans. The company’s key segments are Biscuits, Rusk, Cakes, Snacks, and Bread.

- What is the parent company of Britannia?

Ans. Wadia Group is the parent company of Britannia Industries Ltd.

Disclaimer: The securities, funds, and strategies mentioned in this blog are purely for informational purposes and are not recommendations.

Related Posts

Adani Enterprises Case Study: Business Model And SWOT Analysis

MCX Exchange Case Study: Evolution, Products, And Financials

Jio Financial Services: Business Model And SWOT Analysis

Pocketful is an advanced trading platform that empowers traders with cutting-edge technology. we provide innovative tools and resources to make trading more accessible and practical., quick links.

- Open an Account

- Pocketful Web

- Pocketful App

- Investment Tool

- Trading Tool

- Support Portal

- Referral Program

- Calculators

- Stocks Pages

- Government Schemes

- Index Heat Map

- Stock Screener

- Mutual Funds

- Terms & Conditions

- Policies & Procedures

- Privacy Policy

- Press & Media

We are a concern of PACE Group. Pocketful is an investing platform that helps people be better investors. Pocketful unlocks the discoverability of new investment and trading ideas.

Join the waitlist.

Add your details and start your journey toward a better future with Pocketful in your investing career.

You have successfully subscribed to the newsletter

There was an error while trying to send your request. Please try again.

- BRITANNIA INDUSTRIES LTD.

- SECTOR : FMCG

- INDUSTRY : PACKAGED FOODS

Britannia Industries Ltd.

NSE: BRITANNIA | BSE: 500825

Expensive Star

5250.55 38.30 ( 0.73 %)

Near 52W High of ₹5386.05

262.8K NSE+BSE Volume

NSE 28 May, 2024 3:31 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

Operating Revenue TTM

High in industry

Net profit TTM

Market Runner Up

Net Profit Margin TTM %

Revenue Growth (TTM)

Below industry Median

Net Profit TTM Growth %

Negative Net Profit TTM Growth %

Britannia Industries Ltd. Investor Presentations

- Investor Relations

- Initiatives

- News & Media

Impact - Britannia

We look after things that look after us

At Britannia, we believe that sustainability is the key to ensuring a safe environment

OUR APPROACH

Our Sustainability Vision is to be a Responsible Global Total Foods Company driven by a commitment to minimise the environmental footprint of our operations and enhance the goodness in the food value chain.

4 pillars of Responsible Goodness

We have developed a strategic framework for our Sustainability Vision which rests on these 4 core pillars

Highlights of our Initiatives

RENEWABLE ENERGY

Renewable energy in energy mix

Reduce Water consumption

Most of our plants run on wind & solar energy. For greater fuel efficiency, we use clean fuels & new ovens. Our water management systems help reduce & recycle.

DIVERSITY & INCLUSION

Women in senior management

Women in our factories

We are an equal opportunities employer, providing similar growth opportunities to all employees of any given level across functions regardless of age, gender, religion or any other factor.

Dietary Fibers

Sugar Reduction

We continue to reduce fats and sugar in our products while enhancing quantities of nutritious and healthy ingredients, incorporating high protein foods and exploring Immunity and Wellbeing.

COMMUNITIES

Malnourished beneficiaries reached

Malnourished children have moved to a healthy status

We address the nutrition requirements of Severe and Moderately Acute Malnutrition in children, adolescents and women, to help break the intergenerational cycle of malnutrition.

Elimination of plastic trays in our packaging

Reduction in paper consumption per tonne

We are reducing the quantity of plastic used, eliminating trays, partnering with Urban Local Bodies & recycling organisations and using scientifically designed corrugated boxes.

locations in the vicinity of our Ranjangaon plant

Women trained in Dairy Farming

High standards of professionalism, honesty, integrity & ethical behaviour guide all facets of our business.

Download our past sustainability Reports

- Investor Center

- Consumer Feedback

- Link to Smart ODR

- Complaints Policy

- Distributors

- Our Offices

Connect with us

©Copyright 2023 Britannia Industries, All rights reserved.

- Disclaimers

- Privacy Policy

- Cookie Policy

Success Story of Britannia Industry : How Britannia is Leading the Biscuit Industry since Decades?

Sarika Anand

Company Profile is an initiative by StartupTalky to publish verified information on different startups and organizations. The content in this post has been approved by Britannia.

Britannia Industries is one of India’s leading food companies with a 100-year legacy and annual revenues in excess of Rs. 9000 Cr. Britannia’s product portfolio includes Biscuits, Bread, Cakes, Rusk, and Dairy products including Cheese, Beverages, Milk and Yoghurt .

Britannia is a brand which many generations of Indians have grown up with and is cherished and loved in India and the world over. Brand Britannia is listed amongst the most trusted, valuable and popular brands in various surveys conducted by prestigious organizations.

Know the Success Story of Britannia in the article ahead. Also get a glance on Britannia company profile and know about Britannia's History, Business Model, Founders, Revenue Model & more...

Britannia - Company Highlights

Britannia - Recent News Britannia - About and How it Works? Britannia - Logo and its Meaning Britannia - Founder and History Britannia - Mission Britannia - Products Britannia - Business Model Britannia - Revenue and Growth Britannia - Acquisitions Britannia - Competitors Britannia - Challenges Faced Britannia - Future Plans Britannia - FAQs

Britannia - Recent News

22 June, 2021 - Britannia Industries Limited announced relief measures to support over 10,000 frontline personnel impacted by the covid-19 pandemic. The company will provide term insurance policy and hospitalization insurance of ₹2 lakh and ₹1 lakh respectively to their sales personnel and merchandisers employed with its distributors across the country.

3 June, 2021 - Britannia Industries has approved a proposal to raise Rs 698.51 crore by issuing bonus debentures to eligible equity shareholders. The bonus debenture committee of the board of directors of the company has approved the allotment.

Britannia - About and How it Works?

Britannia Industries Limited is a food company , which is engaged in the manufacture of Biscuits, Bread, Cakes, Rusk, and Dairy products including Cheese, Beverages, Milk and Yoghurt. The Company operates through the Foods segment, which comprises bakery and dairy products.

The Company's product brands under the biscuits' category include Good Day, Crackers, NutriChoice, Marie Gold, Tiger, Milk Bikis, Jim Jam + Treat, Bourbon, Little Hearts, Pure Magic and Nice Time. Its products under breads include Whole Wheat Breads, White Sandwich Breads and Bread Assortment. Its products under diary category include Cheese, Fresh Dairy and Accompaniments. Its products under the cakes' category include Bar Cakes, Veg Cakes, Chunk Cake, Nut & Raisin Romance, and Mufills. Its product under rusk category includes Premium Bake.

The products of the Company are exported across the world , which include Gulf Cooperation Council Countries (GCC), African Countries and American Countries. Its subsidiaries include Manna Foods Private Limited and International Bakery Products Limited.

Britannia - Logo and its Meaning

As explained by a spokesperson of Britannia, Britannia's new logo signifies, "rebranding as the Total Foods Company from now on with the expansion of its offerings in both healthy and indulgent products. The wings of a bird signify freedom to choose, whenever and wherever you want to enjoy your food."

Britannia - Founder and History

Britannia Industry was founded in 1892 by a group of British businessmen with an investment of ₹295 . Initially, biscuits were manufactured in a small house in central Kolkata.

1918 - The Company was born on 21st March of the year 1918 as a public limited company.

1921 - Britannia became the first company east of the Suez Canal to use imported gas ovens. Britannia's business was flourishing. But more importantly Britannia was acquiring a reputation for quality and value. As a result during the tragic World War II the Government reposed its trust in Britannia by contracting it to supply large quantities of 'service biscuits' to the armed forces.

1924 - A new factory was established in the year 1924 in Mumbai . In the same year the Company became a subsidiary of Peek Frean & Company Limited UK, a leading biscuit manufacturing company and further strengthened its position by expanding the factories at Calcutta and Mumbai.

1952 - The Kolkata factory was shifted from Dum Dum to spacious grounds at Taratola Road in the suburbs of Kolkata. During the same year automatic plants were installed in Calcutta.

1954 - The automatic plants were installed in Mumbai plant also in the same year the development of high quality sliced and wrapped bread in India was initiated by the company and was first manufactured at Delhi .

1965 - A new bread bakery was set up at Delhi in the year 1965.

1975 - Britannia Biscuit Company takes over biscuit distribution from Parry's during the year 1975.

1976 - The company had introduced Britannia bread in Calcutta and Chennai .

1978 - The company made Public issue, in that Indian shareholding crossed 60%.

1979 - The Company redefined itself from Britannia Biscuit Company Limited to Britannia Industries Limited.

Fast forward to Current Status, 2021 - Britannia is one of India's oldest existing companies. It is now part of the Wadia Group headed by Nusli Wadia. Britannia's revenue stood at 11,878.95 crores INR (US$1.7 billion) in 2020.

Britannia - Mission

The mission statement of Britannia says, "To improve the financial health of our members and customers by satisfying their evolving borrowing, investment and housing needs."

Britannia - Products

Bakery Products : Biscuits account for 95% of Britannia's annual revenue. The company's factories have an annual capacity of 433,000 tonnes. The brand names of Britannia's biscuits include VitaMarieGold, Tiger Biscuits , Nutrichoice, Good day, 50-50, Treat, Pure Magic, Milk Bikis, Bourbon, Nice Time and Little Hearts amongst others.

In 2006, Tiger, the mass market brand, realized $150.75 million in sales, including exports to the U.S. and Australia . This amounts to 20% of Britannia revenues for that year.

Dairy Products : Dairy products contribute close to 5% to Britannia's revenue. The company not only markets dairy products to the public but also trades dairy commodities business-to-business. Its dairy portfolio grew to 47% in 2000-01 and by 30% in 2001-02.

Britannia - Business Model

The company operates in two business segments, namely, bakery products and dairy products. The company derives ~95% of its revenue from the biscuits segment while, ~5% of its total sales coming from non-biscuits category (dairy) and International market.

The company’s Dairy business contributes close to 5 per cent of revenue and Britannia dairy products directly reach 100,000 outlets. Britannia Bread is the largest brand in the organized bread market with an annual turnover of over 1 lac tons in volume and Rs.450 crores in value. The business operates with 13 factories and 4 franchisees selling close to 1 mn loaves daily across more than 100 cities and towns of India.

Britannia - Revenue and Growth

Between 1998 and 2001, the company's sales grew at a compound annual rate of 16% against the market, and operating profits reached 18%. Presently, the company has been growing at 27% a year, compared to the industry's growth rate of 20%. At present, 90% of Britannia's annual revenue of Rs 22 billion comes from biscuits.

Britannia is one of India's 100 Most Trusted brands listed in The Brand Trust Report. Britannia has an estimated market share of 38%.

Britannia - Acquisitions

- Britannia Industries, India's largest processed food company, has announced that it has entered into an agreement with Fonterra Brands (Mauritius Holding) Ltd, Mauritius, for acquiring the latter's 49 per cent Equity and Preference shareholding in Britannia New Zealand Foods Pvt Ltd (BNZF), their Joint Venture Company engaged in Dairy business. This acquisition is subject to Reserve Bank of India approval.

- The company and its associates acquired majority stakes in Dubai-based Strategic Foods International LLC and Oman-based Al Sallan Food Industries in March 2007.

Britannia - Competitors

The top 10 competitors in Britannia Industry Limited's competitive set are:

- Parle Products

- Richfield Industries

- Frisco Foods

- MTR Foods Pvt. Ltd.

- Milo Australia & New Zealand

- Complan and Cadbury Bournvita

Its top Dairy competitors are:

- Nestlé India

- The National Dairy Development Board

Britannia - Challenges Faced

- A businessman from Kerala , Rajan Pillai secured control of the group in the late 1980s, becoming known in India as the 'Biscuit Raja'. In 1993, the Wadia Group acquired a stake in Associated Biscuits International (ABIL), and became an equal partner with Groupe Danone in Britannia Industries Limited. It was referred to as India's most dramatic corporate sagas, Pillai ceded control to Wadia and Danone after a bitter boardroom struggle, then fled his Singapore base to India in 1995 after accusations of defrauding Britannia, and died the same year in Tihar Jail.

- Biscuit major Britannia Industries, the star amongst the Indian FMCG pack of late, says generating consumer demand remains the biggest challenge in the new year. FMCG companies in general reported lacklustre results in recent quarters. But the biscuit maker's numbers beat expectations, with the Bengaluru-based company's profit margins at a record high in the last two quarters.

- In a separate dispute from the shareholder matters, the company alleged in 2006 that Danone had violated its intellectual property rights in the Tiger brand by registering and using Tiger in several countries (in Indonesia in 1998, and later in Malaysia, Singapore , Pakistan and Egypt) without its consent. Whilst it was initially reported in December 2006 that agreement had been reached, it was reported in September 2007 that a solution remained elusive. In the meantime since Danone's biscuit business has been taken over by Kraft, the Tiger brand of biscuits in Malaysia was renamed Kraft Tiger Biscuits in September 2008.

- Britannia is also facing the challenge of rising employee attrition after the recent change of guard.

Britannia - Future Plans

"CCD Dairy Bread is an instance. We are looking for more such acquisitions in India covering a larger domain. But in the international market we will look at acquisitions in our core areas of biscuits and bakery," - Vinita Bali, managing director of Britannia.

- The maker of Good Day and Tiger Biscuits now plans to invest ₹700 crore over the next two years to set up greenfield facilities and scale up capacities of core products and another ₹300 crore for new launches including dairy, taking total investment to over ₹1,000 crore, said Varun Berry Managing Director, Britannia.

- Britannia Industries said it will invest ₹700 crore to open more factories as demand for packaged food , including biscuits, has exceeded production capacity with rural markets outpacing urban sales.

Britannia - FAQs

Is britannia a fmcg company.

Yes, Britannia is a FMCG company and one of the favourite and oldest brands in India.

How many products are in Britannia?

Britannia's product portfolio includes Biscuits, Bread, Cakes, Rusk, and Dairy products including Cheese, Beverages, Milk and Yoghurt. Its brand portfolio includes Tiger, Marie Gold, Good Day, 50:50, Treat, NutriChoice and Milk Bikis. BIL has a presence in more than 60 countries across the globe.

Which country owns Britannia?

Britannia is an Indian Company with headquarters in Kolkata.

How does Britannia make money?

Britannia company operates in two business segments to make money, namely, bakery products and dairy products.

When was Britannia founded?

Britannia was launched on 16 April 1953.

How many employees are there in Britannia?

There are 4480 employees in Britannia.

Who founded Britannia Biscuit Company?

A British businessman C.H. Holmes founded Britannia Biscuit Company in 1918.

Who is the owner of Britannia company?

Wadia group is owner of Britannia.

Must have tools for startups - Recommended by StartupTalky

- Manage your business smoothly- Google Workspace

Groww Business Model - How Does Groww Earn Money?

With 2024 beginning, the millennials have already crossed their 30s, they have become parents, and have got responsibilities on their shoulders. To begin a family and have a smooth-running life, you ought to have investments and should know at least the basics of the market. Especially when you live in

The Future of Indian Hospitality: A Perfect Blend of AI and Human Touch

This article has been contributed by Mr. Ameet Patil, Tech. Entrepreneur & Founder, CEO of Ecobillz Private Limited. The Indian hospitality sector is poised for a transformative era driven by Artificial Intelligence (AI). This isn't just about flashy gadgets or gimmicks; it's about fundamentally reshaping guest experiences and operational efficiency. Fueled

PR Agency Founders Shares How Compelling Storytelling Impacts Brand Visibility

Why are stories important for businesses, and what makes them effective? That's what we're exploring next. The art of storytelling has a unique ability to catch attention and leave a lasting impression on people. To understand this better, StartupTalky connected with some awesome PR agency founders and asked them about

How PR Impacts Market Visibility in Crowded Industries: Insights from PR Agency Founders

In today's crowded industries, standing out can be a challenge for companies. Public relations (PR) plays a crucial role in enhancing market visibility and establishing a strong brand presence. But how exactly does PR make a difference, and what data backs up its effectiveness? With the Advertising market in India

- Preferences

Britannia Company PowerPoint PPT Presentations

- StockEdge Premium

- StockEdge Pro

- StockEdge Club

- Trending Stocks

- Technical Analysis

- Fundamental Analysis

- StockEdge Tutorials

- Mutual Fund

Britannia Industries Share: A Bullish Tale

Table of Contents

Britannia Industries Ltd. is an Indian Fast-Moving Consumer Goods (FMCG) company, previously recognized as “ Britannia Biscuit Company Limited .” It originated during the pre-independence period in Calcutta, founded by a British entrepreneur in the year 1892. The company is currently owned by the Wadia group, headed by Nusli Wadia, an Indian billionaire businessman.

In the course of World War II, the British Indian government necessitated a consistent provision of biscuits to cater to the requirements of British soldiers. Hence, the company was established. As of today, Britannia Industries manufactures and sells biscuits all over the world. Being a public limited company, Britannia Industries shares have been listed on the National Stock Exchange (NSE) since 1998. Additionally, it is a part of the market benchmark index Nifty 50.

In today’s blog, let’s find out whether to invest in a century-old biscuit company. Britannia Industries shares have given more than a 1000% return in the last 10 years. Is it still worth investing in Britannia shares? Here is a complete fundamental analysis of Britannia Industries’ share.

Company Overview

Britannia Industries Ltd stands as one of India’s oldest food product companies and holds a significant position in the country’s biscuit industry. While the majority of its revenue is generated from the biscuits segment, the company has expanded its presence into various other sectors, such as bread, dairy products, cakes, snacks, milkshakes, croissants, wafers, and rusks. Some of its prominent brands include Good Day, Marie Gold, Tiger, Nutri Choice, Milk Bikis, and others. Operating with a total of 23 factories (19 national and 4 international), Britannia also exports its products to over 79 countries spanning the Middle East, North America, Europe, Africa, and Southeast Asia.

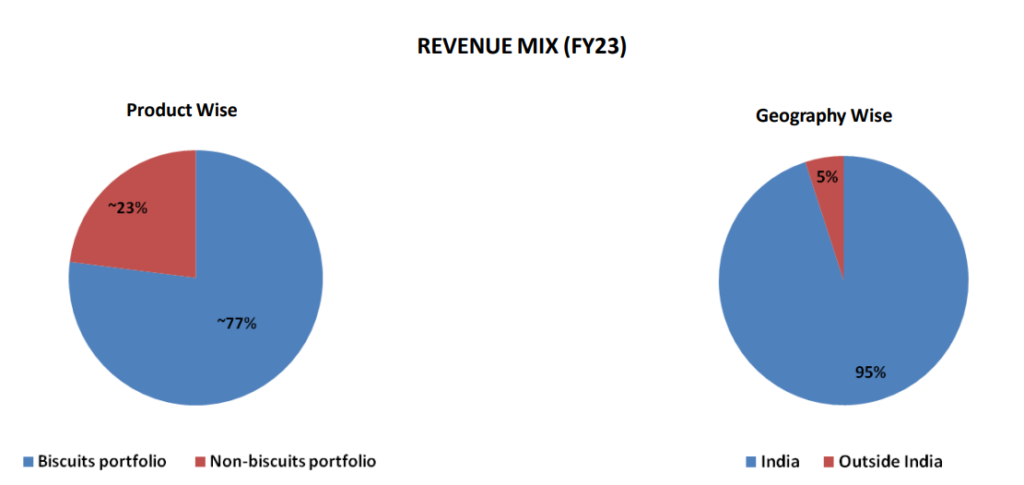

Here is the revenue mix of the company as of FY 23:

As you see, 77% of the revenue comes from the biscuits segment, while the rest comes from bread, dairy products, cakes, etc. Also, geographically, 95% of revenue comes from India and the remaining 5% is from other countries globally.

Sectoral Outlook – FMCG Sector

The overall size of the Food & Beverages market in India is estimated at USD 800 billion. Within this, the packaged food market constitutes USD 100 billion, with the branded packaged market accounting for USD 40 billion. This indicates significant potential for expansion. Presently, India lags behind China in the packaged food industry by 4.2 times and other Southeast Asian nations, such as the Philippines, by 3.3 times, highlighting substantial room for growth in this sector.

The shift from an unorganized to an organized segment within the industry is expected to persist in India in the upcoming years. Changing consumer preferences and a growing inclination towards adopting branded products in small towns and villages contribute to the expansion of Fast-Moving Consumer Goods (FMCG) companies.

Financial Highlights

Analyzing financial statements such as income statements, balance sheets, and cash flow statements helps investors assess the company’s ability to generate returns, manage debt, and sustain growth, enabling informed and prudent investment choices.

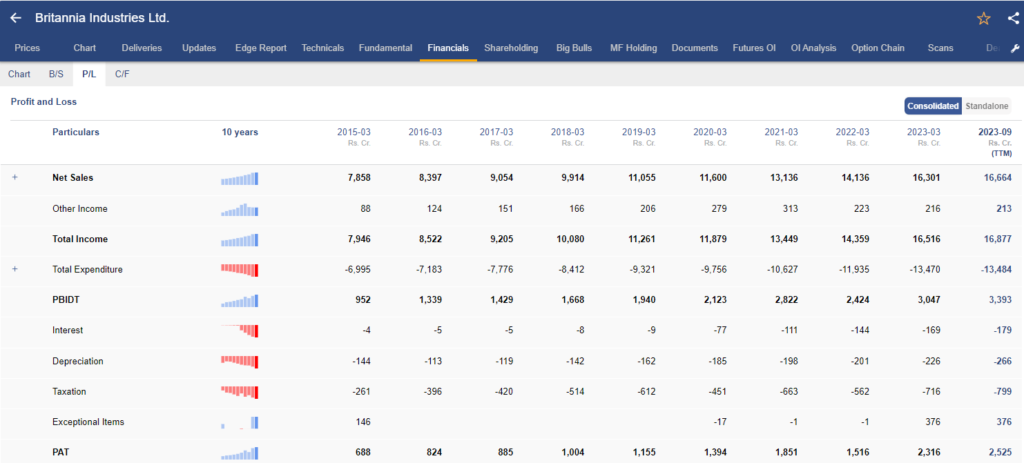

Income statement of Britannia Industries Ltd.

The income statement, commonly known as the profit and loss statement, gives you an understanding of its financial performance, such as its sales growth, profitability, etc.

At StockEdge, we have organized the income statement in a way that will help you analyze it with ease rather than going through the conventional way of downloading the documents from the stock exchanges, which could be time-consuming and tiresome to many.

In the above image, you can see the annual income statement of Britannia Industries . Every detail is in front of your eyes, starting from the top-line sales figures to the bottom-line Net profit of the company.

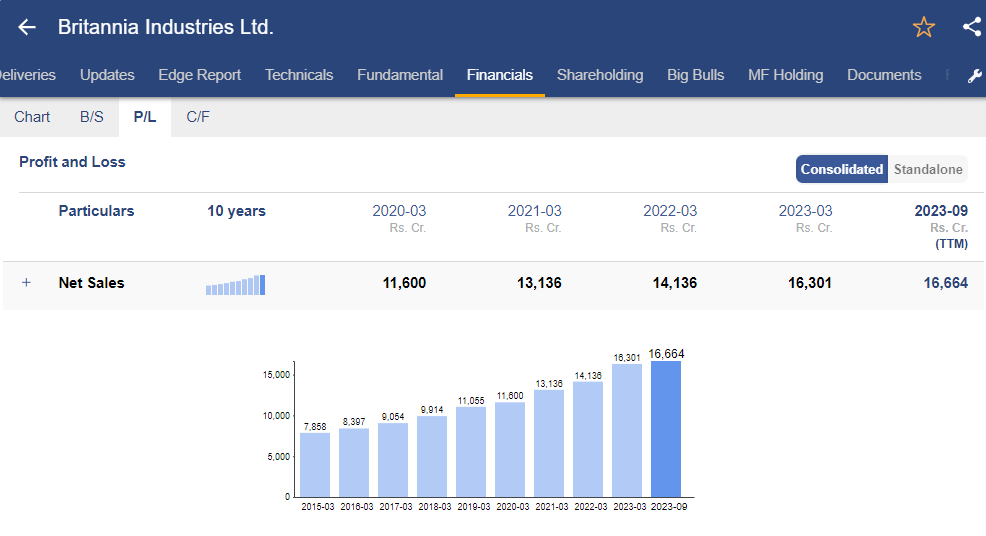

Sales Growth

Although there was a 15% year-on-year increase in sales during the fiscal year 2023, the initial half of fiscal year 2024 recorded net sales of ₹8,444 crore, reflecting a 4% year-on-year growth with no change in volume. The positive performance of the international business was overshadowed by a slowdown in rural areas and increased competition from local players in the domestic market, affecting the overall growth.

EBITDA Growth

In H1 FY24, EBITDA was ₹1,561 cr, a growth of 29% YoY due to its cost efficiency programs across all functions so as to remain the lowest cost operators in its categories. Nevertheless, there is a simultaneous effort to boost advertising and sales promotion initiatives, aiming to support its brands and foster innovation within the business.

In the initial half of fiscal year 2024, the Profit After Tax (PAT) amounted to ₹1,040 crore, demonstrating a 12% year-on-year growth. This growth was facilitated by an enhanced operating profit and increased other income. However, the overall growth was somewhat affected by elevated depreciation and interest costs.

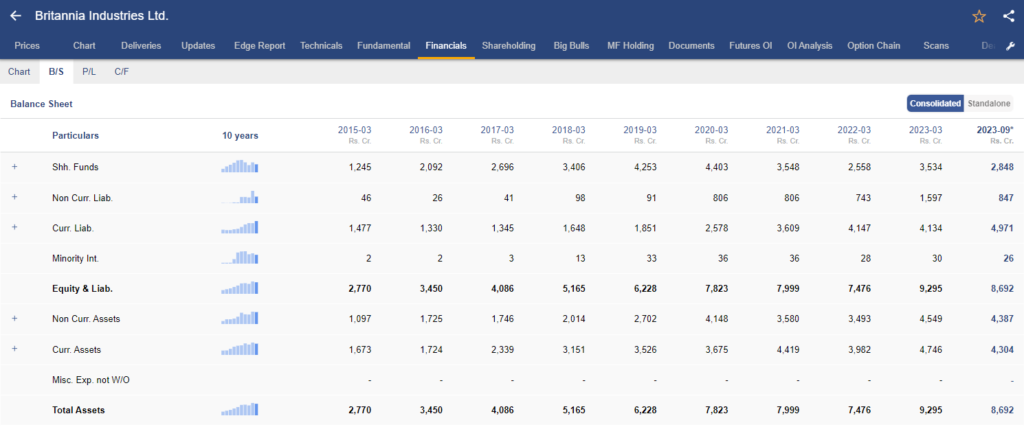

Balance Sheet of Britannia Industries Ltd.

The balance sheet follows the accounting equation: Assets = Liabilities + Equity . It provides a company’s financial position, stability, and overall health.

In the above image, you can see the balance sheet of Britannia Industries Ltd. It provides an overview of the financial position as on date. What are the assets and liabilities of the company? Liabilities of a company can be both short term and long term.

As of 30th September 2023, total debt stood at ₹2,761 cr v/s total debt of ₹2,981 cr as of 31st March 2023. Post the COVID era, the company’s overall debt went up, but compared to its total assets, the liabilities are reasonable.

Cash Flow Statement of Britannia Industries Ltd.

A cash flow statement provides a summary of how a company generates and uses cash over a specific period of time. It has three different sections:

- Operating cash flow statement

- Financing cash flow statement

- Investing cash flow statement

Out of these the most important one being the cash flow from operations as it provides you with an understanding of how the company generated cash from its core business operations. A positive cash flow from operation signifies that the company has generated higher cash revenue than its expenditure.

In FY 2023, the Cash Flow from Operations (CFO) amounted to ₹2,526 crore, a significant increase from ₹1,300 crore in FY22. This improvement was driven by enhanced operating profit and adjustments in working capital.

Cash Flow from Investments (CFI) experienced an outflow of ₹1,517 crore, attributable to the acquisition of current investments, inter-corporate deposits (ICDs) extended to group companies, and the procurement of property, plant & equipment.

On the other hand, Cash Flow from Financing (CFF) showed a lower outflow compared to the previous year, as the company secured long-term debt amounting to ₹1,010 crore.

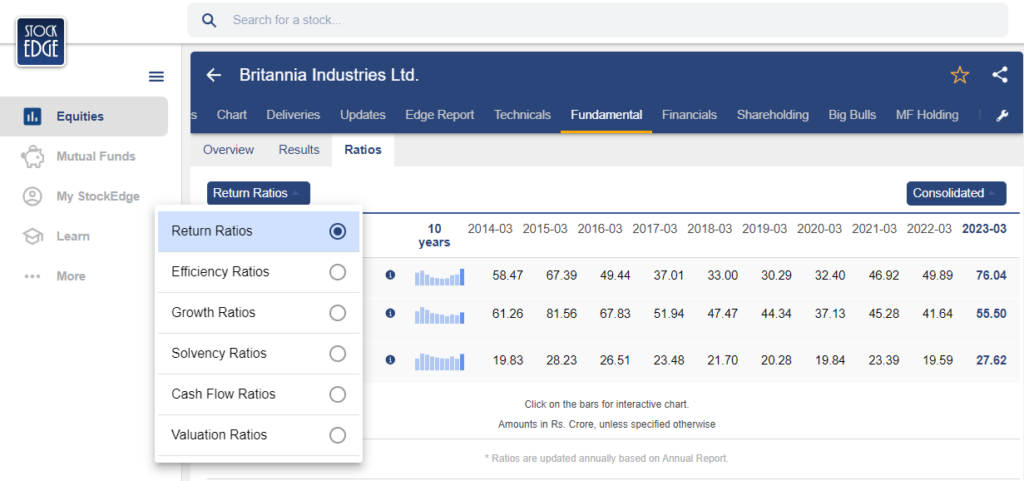

Ratio Analysis of Britannia Industries Share

Ratio analysis of a company involves evaluating a company’s financial performance by examining certain ratios which are derived from its financial statements. It makes easy comparing the financial performance to its industry benchmarks or competitors.

Ratio has different classifications like profitability ratios, solvency ratios, return ratios and more as you can see in the image below, you can analyze all such ratios directly from StockEdge.

Here are the return ratios of the Britannia Industries share, starting with the two most important ratios which are ROE and ROCE.

What is ROE and ROCE? ROE is a profitability ratio that measures the company’s ability to generate net income as a percentage of shareholders’ equity, whereas ROCE assesses the efficiency of a company in utilizing its total capital, including both equity and debt.

Return on Equity (ROE)

In FY 2023, the Return on Equity (ROE) reached 76.04%, primarily driven by substantial profit growth. This increase in profit was supported by an exceptional gain of ₹376 crore.

Return on Capital Employed (ROCE)

The robust ROCE of 55.50% in FY23 signifies the efficiency with which the company utilized its capital to generate operating profits. This improvement reflects the company’s effective management of its resources and a positive impact on overall financial performance.

Debt to Equity Ratio (D/E Ratio)

In FY 2023, the company’s debt-to-equity ratio was approximately 0.84x. This ratio indicates that the company had a moderate level of financial leverage. A debt-to-equity ratio of less than 1 is generally considered favorable as it suggests a lower financial risk and indicates a more conservative capital structure.

Price to Equity Ratio

As of the latest data, Britannia Industries is trading at a Trailing Twelve Months (TTM) Price-to-Earnings (PE) multiple of 49.45x. The elevated PE multiple is likely a result of Britannia’s strong brand recall and its leadership position in the domestic market.

The PE multiple reflects the market’s confidence in Britannia’s growth prospects and its ability to capitalize on opportunities in the evolving market conditions.

Management Quality & Shareholding Pattern

The leadership is directing efforts towards implementing localized strategies, consistently innovating products through renovation, introducing new items, and revamping existing ones. Additionally, there is a focus on expanding into related product categories alongside a concerted effort to enhance direct distribution channels and strengthen the company’s presence in rural areas. Management expects the rural segment to improve to 35% of total revenue in the next few months.

Coming to the shareholding pattern of Britannia Industries share , you can check it from the StockEdge App itself.

The promoter shareholding continues to remain at 50.55%. FII decreased their stake from 21.29% in Q1 FY24 to 19.66% in Q2 FY24. DII increased their stake from 12.46% in Q1 FY24 to o 13.85% in Q2 FY24.

The changes in shareholding patterns indicate a dynamic shift in investor interest in Britannia Industries shares as both FIIs and DIIs strategically adjust their positions. Notably, the unwavering promoter’s stake emphasizes a consistent and resolute dedication to the company’s growth and performance.

Future Outlook of Britannia Industries Share

The company maintains its commitment to four key strategic pillars: distribution and marketing, cost leadership, innovation, and sustainability. The overarching goal is to achieve well-rounded growth encompassing margin, revenue, volume, and market share. Over the next five years, the company anticipates increasing the contribution of its non-biscuit portfolio to approximately 35% of total revenue, up from the current 23%. Furthermore, there is an ambition to scale the dairy segment to ₹2,000 crore within the same timeframe. These initiatives underscore a comprehensive approach to business development and diversification.

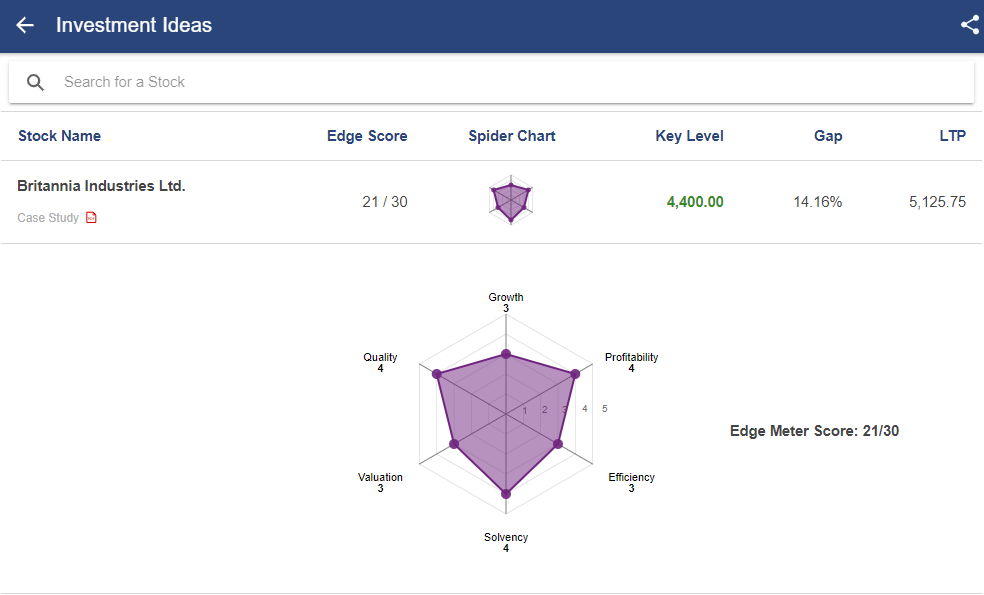

Case Study on Britannia Industries Share

We have a case study report prepared by our team of analysts. This fundamental report on Britannia Industries shares provides you with a detailed analysis of the company as well as how it stands among its competitors.

As you can see, Britannia Industries Share has rating based on 6 parameters:

- Quality

- Profitability

Based on the above parameters, Britannia Industries Share scored 21/30. Read the case study report on Britannia Industries Share .

In conclusion, Britannia Industries emerges as a compelling long-term investment opportunity. With a solid foundation anchored in strategic pillars such as distribution, cost leadership, innovation, and sustainability, the company demonstrates a robust commitment to balanced growth. The resilience of its promoter shareholding, coupled with evolving investor interest, reflects confidence in the company’s trajectory. Britannia’s ambitious targets, including expanding its non-biscuit portfolio and scaling its dairy segment, further position it as a forward-looking player in the market. As it continues to navigate dynamic market conditions, Britannia Industries stands out as a promising choice for investors seeking enduring value and growth in their portfolios.

Apart from Nestle India stock, there are other stocks which are part of the Nifty 50 index. Read this blog All About NIFTY50, Components of NIFTY50, and How to Invest in it .

Happy Investing!!

Unlocking Potential: HDFC Bank Stock Analysis

Icici bank stock analysis: a comprehensive guide, vineet patawari.

Top 5 Sectors for Lok Sabha Election 2024

The Success Story of Rakesh Jhunjhunwala

- Timing (Mon-Sat): 10 am to 7 pm

- Sales: +919830994463

- Support: +919830994402

- Club Support: +916289906895

- Affiliate: +917003567131

- StockEdge.com

- Compare Plans

Get StockEdge App

- Visit StockEdge.com

© 2024 Kredent InfoEdge Pvt Ltd.

Premier says sex education group will be banned from giving school presentations

Organization disputes suggestion that material delivered was outside curriculum.

Social Sharing

Premier Blaine Higgs says he will ban a Quebec-based sex education group from presenting at schools in New Brunswick after a presentation he believes was "clearly inappropriate."

The premier took to X, formerly Twitter, to express his displeasure with a presentation given at several New Brunswick high schools.

"To say I am furious would be a gross understatement," he said. "This presentation was not part of the New Brunswick curriculum and the content was not flagged for parents in advance.

"The fact that this was shared shows either improper vetting was done, the group misrepresented the content they would share ... or both."

Higgs said the Department of Education told his office the presentation was supposed to be about the sexually transmitted infection human papillomavirus – but it went beyond that.

He shared and criticized a presentation slide that includes questions like "do girls masturbate" and "is it good or bad to do anal?"

Teresa Norris, who delivered the presentation to several New Brunswick schools last week, denied that schools were misled about what the presentation would cover.

The president and founder of the charity HPV Global Action, which also operates a youth sexual education resource called Thirsty for the Talk, said she was surprised and disappointed at Higgs's reaction.

She said the slide Higgs shared was the presentation's cover slide. She said it reflects actual questions her group receives from students.

"That excerpt that was taken is an extraction of something that's very grossly misrepresenting what this presentation is about," Norris said.

"All of the topics that we cover are supporting the learning areas. This is something that your province has decided ... We're not creating something that the province hasn't already put in place."

Norris said she has been giving presentations at New Brunswick schools for several years. All schools receive an outline of the topics to be covered and the school must give its consent prior to the presentation, she said.

The presentation is called Healthy Relationships 101. Norris said it is an "A to Z" about relationships and sexuality.

"We are not promoting any of these sexual behaviours ... we talk about abstinence in the presentation, we empower students to help them make decisions about their relationships," she said.

"We teach them to understand when they are not comfortable, or that they don't feel ready, and to pay attention so that they have those boundaries. Our goal is always to destigmatize conversations about sexual health."

Objectives in the province's high school sex education curriculum include having students define sexuality, discuss safe sex practices that include abstinence, masturbation, condom use and birth control options, and how to handle sexual feelings and sexual pressure.

Andrea Anderson-Mason, MLA for Fundy-the Isles-Saint John West, said she has heard about the presentation from teachers and constituents with family members who attend Fundy Middle-High School.

The Anglophone South School District has not responded to a request for comment.

Anderson-Mason said she has a daughter in Grade 12 at the school, but the presentation was only delivered to Grade 9 to Grade 11 students.

The MLA said reaction has been mixed and she is hoping to see a balanced conversation on the issue.

"When I was in high school, I had a male teacher teach me about breast self-examination, and at 47 years old I am still grateful for that information and use it," she said. "There is a time and a place and an appropriateness to talk about our bodies."

For Norris, the ultimate goal is to help students stay informed and avoid getting into relationship situations they are not ready for.

Despite Higgs's statement, she has not been given any formal message from the province banning the presentation.

Requests to the premier's office for comment have not been answered.

ABOUT THE AUTHOR

Savannah Awde is a reporter with CBC New Brunswick. You can contact her with story ideas at [email protected].

Related Stories

- Premier defends banning sex ed group despite not seeing presentation

- Sask. developing framework that could let 3rd-party organizations teach sex ed. in schools

- Education minister says francophone schools are following Policy 713

- High school students in Moncton say cellphone restrictions help concentration in class

- Quarterly Results

- Interactive Analyst Center

- Annual Reports

- SEC Filings

- Events & Presentations

- News Releases

- Board of Directors & Committee Composition

- Executive Officers

- Contact the Board

- Sustainability

- Stock Chart

- Dividend History

- Analyst Coverage

- Shareholder Overview

- Annual Meeting

- Investor Contacts

Email Alerts

- Earnings Reports & Financials

- Annual Reports & SEC Filings

- Corporate Governance

- Stock Information

- Shareholder Services

Sysco to Webcast Presentation at the Deutsche Bank Access Global Consumer Conference 2024

May 28, 2024

HOUSTON , May 28, 2024 (GLOBE NEWSWIRE) -- Sysco Corporation (NYSE:SYY) today announced that the Company will webcast its presentation from the 2024 Deutsche Bank Access Global Consumer Conference in Paris, France on Tuesday, June 4 , at 5:15 a.m. EDT or 11:15 a.m. CEST .

The live webcast for the event can be accessed at investors.sysco.com . An archived replay of the webcast will be available shortly after the live event is completed.

For purposes of public disclosure, including this and future similar events, Sysco uses the investor relations portion of its website as the primary channel for publishing key information to its investors, some of which may contain material and previously non-public information.

About Sysco

Sysco is the global leader in selling, marketing and distributing food products to restaurants, healthcare and educational facilities, lodging establishments and other customers who prepare meals away from home. Its family of products also includes equipment and supplies for the foodservice and hospitality industries. With more than 74,000 colleagues, the company operates 334 distribution facilities worldwide and serves approximately 725,000 customer locations. For fiscal year 2023 that ended July 1, 2023 , the company generated sales of more than $76 billion . Information about our Sustainability program, including Sysco’s 2023 Sustainability Report and 2023 Diversity, Equity & Inclusion Report, can be found at www.sysco.com .

For more information, visit www.sysco.com or connect with Sysco on Facebook at www.facebook.com/SyscoFoods . For important news and information regarding Sysco, visit the Investor Relations section of the company’s Internet home page at investors.sysco.com , which Sysco plans to use as a primary channel for publishing key information to its investors, some of which may contain material and previously non-public information. In addition, investors should continue to review our news releases and filings with the SEC . It is possible that the information we disclose through any of these channels of distribution could be deemed to be material information.

Back to 2024

Quick Links

- At a Glance

Sign up to receive email alerts of our latest events & webcasts, financial reports, SEC filings and more.

Site Services

- Terms of Use

- Privacy Policy

All Rights Reserved. Sysco Corporation

Keep in Touch

Get the IR App

Delivered by Investis

- Weather

Search location by ZIP code

Stop & shop parent company reveals plans to close underperforming stores.

- Copy Link Copy {copyShortcut} to copy Link copied!

GET LOCAL BREAKING NEWS ALERTS

The latest breaking updates, delivered straight to your email inbox.

Ahold Delhaize, the parent company of Quincy, Massachusetts-based Stop & Shop, announced plans to close an unspecified number of grocery stores, part of its plan to improve the performance of the supermarket chain.

The long term vision for the grocery store brand was made public at the parent company's investor strategy day held last Thursday outside of Amsterdam in The Netherlands.

"As Stop & Shop embarks on its next phase, we will be decisive and take deliberate and appropriate actions to ensure a stable future for the brand," Ahold Delhaize USA CEO JJ Fleeman said at the investor day.

Fleeman said the company was focusing on improving the cost structure of the grocery store brand. He says the company intends to "optimize the store portfolio" over time, while focusing immediately on bringing down costs for customers.

The CEO said Stop & Shop would "focus on the markets that are most important, including those where the brand has strong density, holds a strong market position, or has stores that are performing well."

"Stop and Shop has already evaluated its overall portfolio and will make difficult decisions to close underperforming stores to create a healthy store base for the long term and grow the brand," Fleeman said.

WCVB reached out directly to Stop & Shop directly for comment following the comments made by the CEO at investor day.

"Stop & Shop will make some difficult decisions to close select underperforming store locations to help ensure the long-term health and future growth for our business," a spokesperson said in a written response.

Fleeman said Stop & Shop customers were responding positively to the company's remodeling program, which has taken place in nearly half of its close to 400 stores across Massachusetts, New England and the Northeast.

The company’s remodeling efforts slowed during the COVID-19 pandemic, contributing to a loss in market share.

Fleeman said the company would continue to invest in stores and attempt to create value for customers.

"Stop and Shop will have a relentless focus on operational excellence and efficiency at every level of its organization," Fleeman told investors. "This will include a more efficient organizational structure, along with a focus on quality, fresh products, well-stocked shelves, further supply chain efficiency and fantastic service in each of its stores."

In addition to Stop & Shop, Ahold Delhaize operates five different grocery store brands in the United States, including Food Lion, Hannaford, Giant Food and The Giant Company.

IMAGES

VIDEO

COMMENTS

Britannia company. Apr 24, 2017 • Download as PPTX, PDF •. 57 likes • 55,714 views. A. Arpit Sem. In his ppt one can get all the information about Britannia company swot , pest analysis ,logo , market share, advertising , history, sub products , sales promotion strategy. Read more. Business. 1 of 41.

Britannia believes that our actions today will shape the future. Britannia Industries is a company with a rich legacy and a commitment to innovation, sustainability, and responsibility. Britannia ##### Company Analysis and Report Presentation on Britannia Industries Ltd ##### SITAMS Page 6. 1 Product Profile Biscuits 1.

Britannia Marketing Strategy. Britannia Industries Limited is an Indian food firm formed in Kolkata in 1892 with a small investment of Rs. 295 and is now headquartered in Mumbai. The firm is most known for its many brands of biscuits, but it also sells a wide range of packaged foods, dairy products, and bread to suit a variety of lifestyles.

Strengths. Britannia has been in the industry for more than 100 years. The company has created its space in every Indian household and a strong brand identity.; The company used an 80:20 growth strategy where it focused on 20% of the brands like Marie Gold, Good Day, Milk Bikis & Nutri Choice, which contribute 80% of the company revenue.This process of putting some products on a priority list ...

Britannia Industries Ltd. Investor Presentation: Get insights into company performance, financials, capex plans and more. Markets Today Top Gainers Top Losers Discover Search all filings. 2 FDA warnings today 4 major resignations today ...

Gain valuable insights and essential information about Britannia's stock market presence and potential of investing in Britannia shares today.

At Britannia, we believe that sustainability is the key to ensuring a safe environment Sustainability reports OUR APPROACH. Our Sustainability Vision is to be a Responsible Global Total Foods Company driven by a commitment to minimise the environmental footprint of our operations and enhance the goodness in the food value chain.

A presentation on Britannia Ltd, one of India's leading FMCG companies. It is a comprehensive analysis covering qualitative factors such as the company's products, R&D, manufacturing, distribution channels, etc, along with a look at its' fundamentals such as CAGR, Net profit growth, margins, expenditures, cash flow and balance sheet. Made by Anurag Bhuwania during an internship working at ...

Britannia Industry Britannia - Recent News. 22 June, 2021 - Britannia Industries Limited announced relief measures to support over 10,000 frontline personnel impacted by the covid-19 pandemic.The company will provide term insurance policy and hospitalization insurance of ₹2 lakh and ₹1 lakh respectively to their sales personnel and merchandisers employed with its distributors across the ...

This document provides an overview of Britannia Industries Limited's annual report for the financial year 2021-2022. Some key highlights include an increase in revenue from operations but a decrease in profit after tax compared to the previous year. The company faced challenges from high inflation and supply chain issues but focused on cost efficiency, innovation, and distribution. Digital ...

Britannia Industries Limited is an Indian multinational food products company, which sells biscuits, breads and dairy products.Founded in 1892, it is one of India's oldest existing companies and currently part of the Wadia Group headed by Nusli Wadia. As of 2023, about 80% of its revenues came from biscuit products.

View Britannia Company PPTs online, safely and virus-free! Many are downloadable. Learn new and interesting things. Get ideas for your own presentations. ... SamLab.ws Created Date: 2/16/2001 9:37:32 AM Document presentation format: Company. Title: PowerPoint Presentation Author: PGS Last modified by: SamLab.ws Created Date: 2/16/2001 9:37:32 ...

Britannia Final Ppt - Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online. This document provides an overview of Britannia Industries Limited, a leading Indian food company. It outlines the company's history, leadership, locations, products, vision to dominate the Indian food market, and marketing strategies.

Britannia Industries Ltd. is an Indian Fast-Moving Consumer Goods (FMCG) company, previously recognized as " Britannia Biscuit Company Limited .". It originated during the pre-independence period in Calcutta, founded by a British entrepreneur in the year 1892. The company is currently owned by the Wadia group, headed by Nusli Wadia, an ...

This presentation deals with the marketing front of various Britannia biscuits and is marketability in current indian market. apart from that this presentation also tries to derive customer value proposition by the means of segmentation targeting and positioning. various elements of marketing apart from STP has been used such as USP tag line, competition, pricing comparison in contrast to its ...

In 1938, it was granted town status. [citation needed]Administrative and municipal status. Within the framework of administrative divisions, it is incorporated as Elektrostal City Under Oblast Jurisdiction—an administrative unit with the status equal to that of the districts. As a municipal division, Elektrostal City Under Oblast Jurisdiction is incorporated as Elektrostal Urban Okrug.

Elektrostal is a city in Moscow Oblast, Russia, located 58 kilometers east of Moscow. Elektrostal has about 158,000 residents. Mapcarta, the open map.

Presentation Date & Time: Sunday, June 2, 5:06 p.m. - 5:12 p.m. CDT Location: S504 (On Demand) Presenter: Daniel Morgenstern. Presentation Title: Intracranial outcomes of 1L selpercatinib in advanced RET fusion-positive NSCLC: LIBRETTO-431 study Abstract Number: 8547 Presentation Date & Time: Monday, June 3, 1:30 p.m. - 4:30 p.m. CDT

Elektrostal, city, Moscow oblast (province), western Russia.It lies 36 miles (58 km) east of Moscow city. The name, meaning "electric steel," derives from the high-quality-steel industry established there soon after the October Revolution in 1917. During World War II, parts of the heavy-machine-building industry were relocated there from Ukraine, and Elektrostal is now a centre for the ...

Premier Blaine Higgs says he will ban a Quebec-based sex education group from presenting at schools in New Brunswick after a presentation he believes was "clearly inappropriate." The premier took ...

HOUSTON, May 28, 2024 (GLOBE NEWSWIRE) -- Sysco Corporation (NYSE:SYY) today announced that the Company will webcast its presentation from the 2024 Deutsche Bank Access Global Consumer Conference in Paris, France on Tuesday, June 4, at 5:15 a.m. EDT or 11:15 a.m. CEST.. The live webcast for the event can be accessed at investors.sysco.com.An archived replay of the webcast will be available ...

Elektrostal. Elektrostal ( Russian: Электроста́ль) is a city in Moscow Oblast, Russia. It is 58 kilometers (36 mi) east of Moscow. As of 2010, 155,196 people lived there.

NANOBIOTIX (Euronext: NANO -- NASDAQ: NBTX - the ''Company'') today announced the presentation of updated data from the completed dose escalation part and first data from the ongoing expansion part of Study 1100, a US Phase 1 study evaluating NBTXR3 followed by anti-PD-1 in patients with recurrent or metastatic head and neck ...

QUINCY, Mass. — Ahold Delhaize, the parent company of Quincy, Massachusetts-based Stop & Shop, announced plans to close an unspecified number of grocery stores, part of its plan to improve the ...

The presentation will take place on Tuesday, June 4, 2024 at 10:45 a.m. PT in Theater 1 at the San Diego Convention Center. To schedule a meeting with the Company's management at the convention, please submit a meeting request through the BIO One-on-One Partnering™ system or contact [email protected].

DuPont de Nemours, the American multinational chemical company which traces its history back to 1802, announced plans to split into three publicly traded companies.

The poster presentation describes preliminary findings from the company's Phase 1a study of HFK1 for HER2 low expression cancers. The first patient dosed suffers from lung metastasis of a rare HER2 low cancer. The patient has been treated with HFK1 for more than five months with no dose-limiting toxicity and stable disease.