.webp)

What is Product Research? Methods, Process, and Benefits

Product research is a vital initial stage that starts well before the product development process . Successful product research teaches product teams about

- how to shape a product idea

- what similar products there are on the market already

- what is the best way to develop and advertise the product

- whether the product will be a success in its market

The process of product research will also teach you about what customers want and how to adjust your strategy to meet their needs. Surveys are a great tool to get this process started.

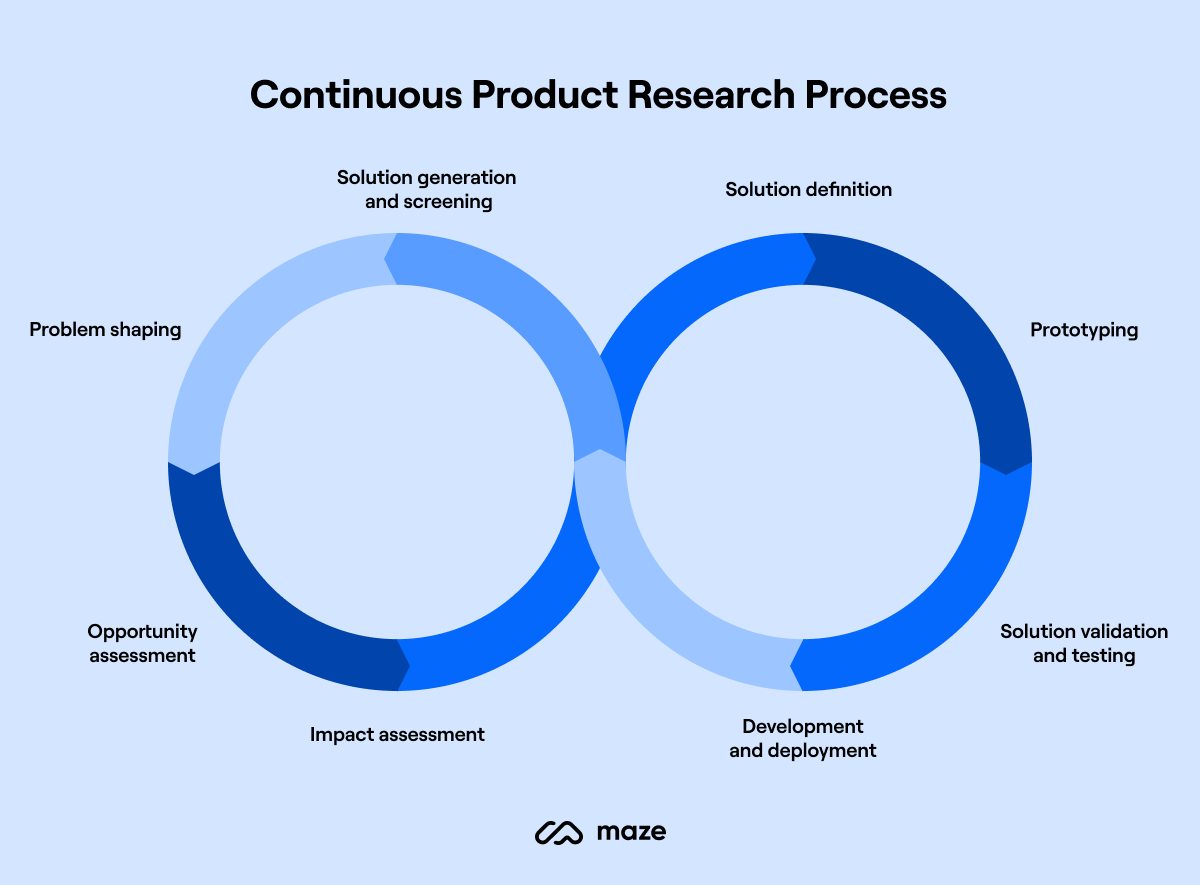

But product research does not just happen in the initial stages of product development. Well-seasoned product managers know that the process should be continuous. Businesses that perform best conduct regular product research to stay ahead of their competitors .

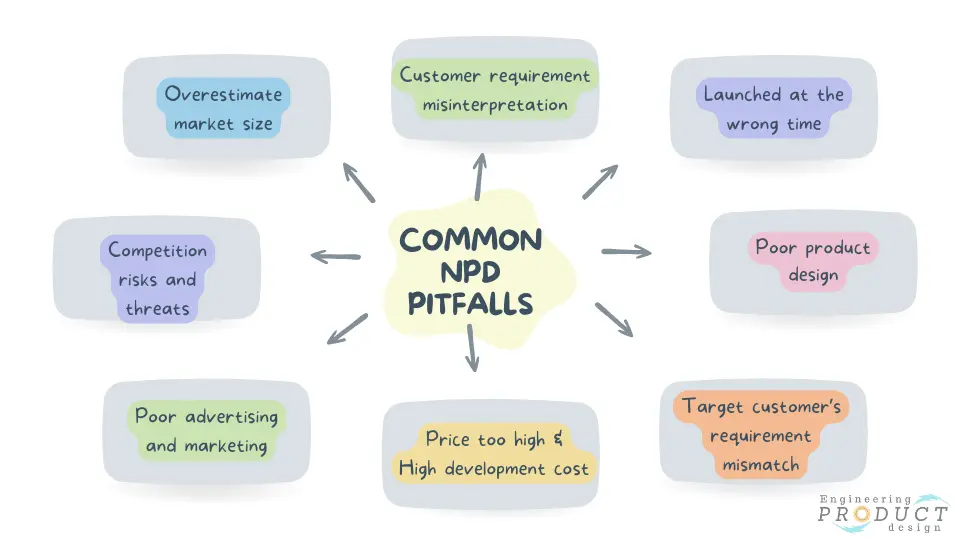

Without proper product research your chances of success, like your product decisions , will be random. Learn from the market and your customers to perform data-driven and customer-centric decisions.

Product research methods

The optimal method of gathering product research data will vary depending on whether you are launching a completely new product or a product update.

If you are working on new features for an existing product, your goal is to examine product satisfaction

- customer needs and pain points

- how those needs have changed over time

- how users are adopting new features

Then use this information to decide which initiatives you should prioritize and what to concentrate on within the updates.

If, however, you are developing an entirely new product, you likely won’t yet have a customer base or any historical information about user behavior. You’ll have to concentrate on learning about competitors and the existing market your product will fit into.

Let’s have a look at some ways you can obtain this information.

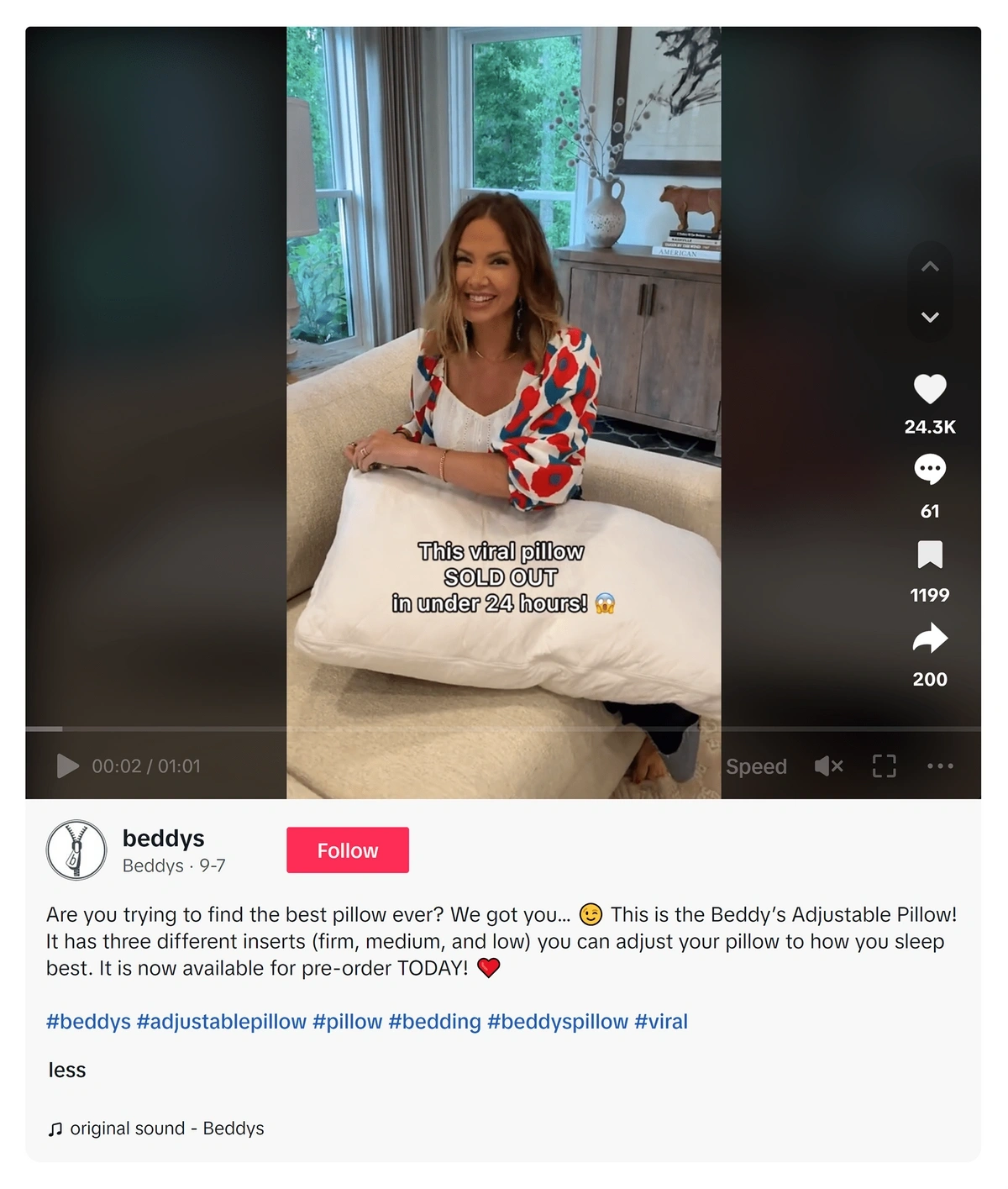

Product surveys are a great way to learn how existing and potential customers feel about your product.

These surveys can include questions about what consumers think of your product

- what frustrates them the most

- what the most needed improvements include

- what their favorite features are, and more.

- You can also gain insights into how these aspects compare to that of your competitors.

Product surveys can be sent via email or link , in-app , in-product , or through your website . This is probably the most convenient, affordable, and effort-efficient way of gathering information to fuel your product research.

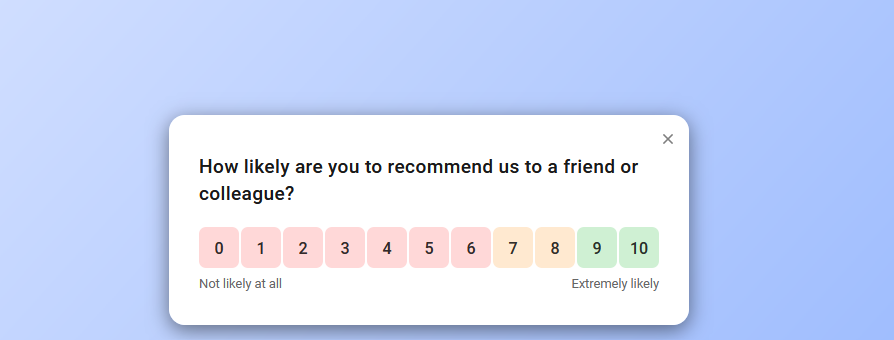

Another kind of survey that can prove useful is a quarterly-basis NPS survey . The open follow-up question can be a great source of new product and feature ideas.

You can also run in-product surveys to see what potential struggles your customers come across. Pair this with session recordings and heatmaps to get a complete picture. Survicate integrates with products like FullStory and SessionCam to facilitate this process.

💡 YOU MAY BE INTERESTED IN: After scenario questionnaire survey template

Customer interviews

At Survicate, we run product research surveys in which we ask customers about their needs. The surveys end with the following question:

“Would you be interested in talking with our team once we work on that feature?”

That way, we can recruit candidates for user interviews and usability testing .

This feedback from sales calls is a great way to get qualitative data on product ideas and concepts.

Lastly, we use Intercom conversations with customers to gather additional feedback and input on silent launches. Respondent attributes identify customers who would be good candidates for product testing .

Concept testing

Concept testing is the process of surveying users about a potential product . You can learn how they feel about it and whether they would be willing to purchase such a product were it available on the market.

This method is very versatile, as it can happen online, over the phone, or through real-life interviews. It can be difficult to obtain a sample of potential clients willing to provide you with feedback, so we recommend using a customer feedback tool to facilitate the process.

Focus groups

You can find focus groups of people who already use a product similar to the one you are thinking of developing. You can enquire about things like an optimal price , the most important features , and features they are missing in their current solution.

This can help you estimate your budget, product development strategy, spending, and profit margins. You can also find out about the qualities of your product that will make it unique and outbid your competitors.

To eliminate bias , choose third-party interviews or online surveys .

Usability testing and demos

Conduct product testing once you create a test model of your product. Show it to potential customers to get their feedback. This can also include having them watch a demo if you don’t yet have a beta version of your idea.

As above, surveys can be a great way of learning about their experience.

When to perform product research

Product research usually happens at these four stages of a product’s (or product update’s) lifecycle.

Before launch

Product research before launch lets you figure out what the competitive market is like, what features are missing but in demand, and what aspects of your product you should prioritize.

Testing and feedback

Once you have a beta version of your product, you can perform testing. This will help you understand how customers perceive your product or its new iterations, what they like and don’t like, and how you can still improve your product.

Soft launch

A soft launch means releasing the product to a part of your customer base to see how it will work in a “real world environment”. At this stage, there is usually still no advertising, so research should focus on usability and value rather than pricing or market fit .

Post-launch

Product research after launch should focus on customers’ behavior, satisfaction , and potential struggles.

Product research process

Product research is essentially studying users to learn their needs and expectations for your product. Start with general information about the competitor landscape and end with detailed data like pricing , subscription plans, and visual design.

Analyze the competitive landscape

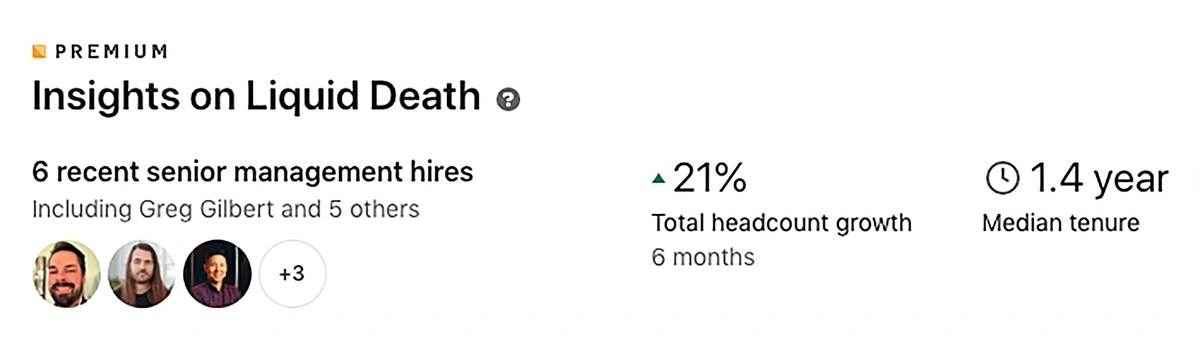

A part of product research should always include an analysis of your competitors' products, audiences, and processes.

Even if you are the first to market, you’ll have some indirect competition you need to be aware of or maybe even drive inspiration from. You’ll also likely need to do extra research to ensure there is in fact a demand for your product.

The existence of competitors is not always a bad thing. It at least confirms that the market has been validated. But you will need to come up with ways to differentiate your product and break through the crowd.

Find out how competitors reach their audience and what they do to retain customers for as long as possible.

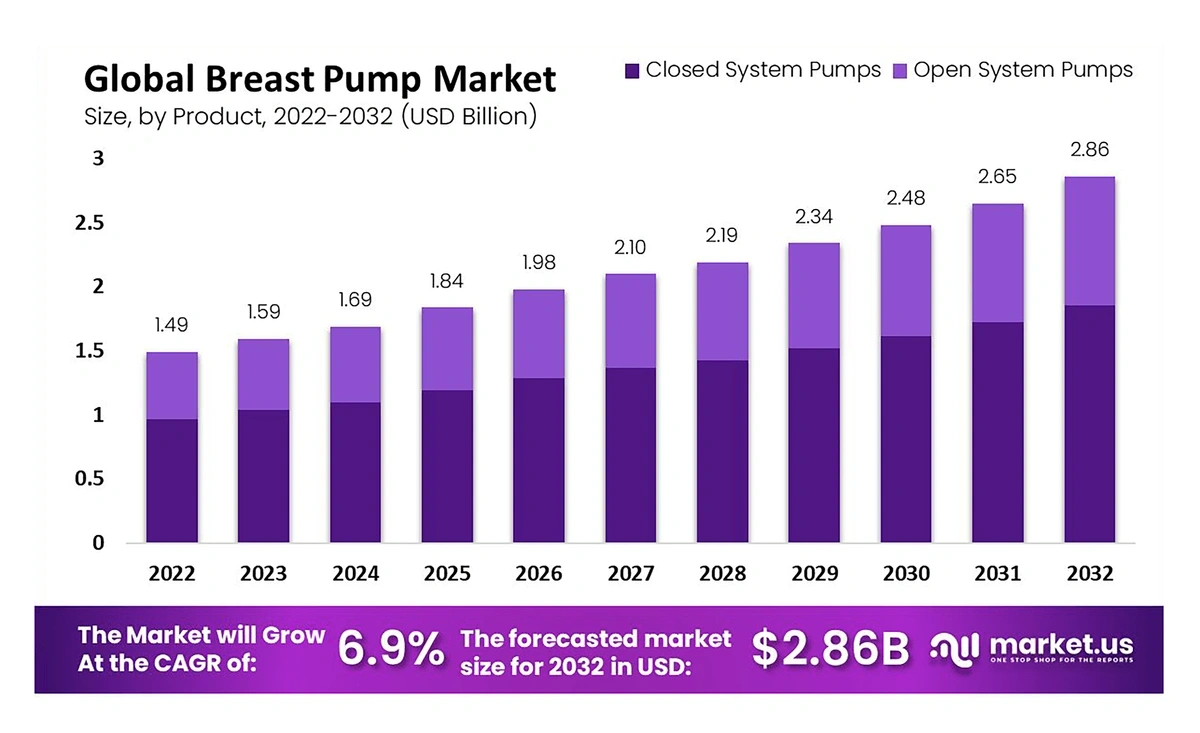

Evaluate the size of your market

The first step in determining your market size is defining your potential customer . You have to know who you are going to cater to in order to estimate how large that target market is.

We recommend running a demographic survey among users of your competitors.

Market segmentation research

Once you have an idea of who your customers are or are going to be, you can categorize them into segments based on specific characteristics.

This will help you figure out the optimal ways of reaching them, meeting their needs and expectations, understanding struggle points, and learning about their goals.

Product feedback

Test your product before launching it. Use different marketing strategies, pricing options, and distribution methods to learn what conditions your product will thrive in.

We have many product feedback surveys that can help evaluate key aspects of your idea. Most notably, examine your users’ onboarding process …

… product experience …

…and usability of your product .

Price testing

The price is a huge aspect of your product. Of course, you want to be as competitive as possible, but at the same time, you want to make the biggest profits possible.

Use a product pricing survey to learn about demand elasticity and the relationship between product demand and pricing.

Customer research

Learning about your customers or who your customers will be can help you make better product development and advertising decisions.

For example, you may find you have an international audience, in which case it may make sense to make your product or service available in multiple languages .

Find out who your existing customers are to come up with ways to reach new potential clients.

You can also query customers who have recently stopped using your product to learn about ways of preventing churn .

Ask your customers about features they are missing in your product . If they are considering switching to a competitor, you may be able to prevent this by ensuring them you are working on an update.

And always stay on top of customer satisfaction to learn when you need to make changes to your product or its aspects.

Automate your product research

Product research and development should be a continuous process. In the modern world, it’s not enough to develop a great product and call it a day . Use a great product feedback tool to keep gathering customer insights that will drive growth to your business.

With a tool like Survicate, you can automate your surveys to be sent at regular intervals as to reduce your employees’ workload.

All results are compiled in one place - our dashboard. The analysis panel generates survey reports in real-time.

You can also use ready-made visuals to get information across your entire team.

Segment results

Product research does not end with successfully gathered data. The last step is to use it to fuel product decisions that will realistically improve your product and customer experience , and drive brand growth.

Segmentation of results should be based on business goals and your KPIs. This step ensures data is not wasted and reaches appropriate teams. It will also help plan short-term and long-term goals so you know what data you might need in the future.

For example, tracking user pain points that an update didn’t solve might be helpful in the future when building new features. Documenting what went well during your last product update will help you design your roadmap more efficiently.

Benefits of successful product research

Let’s quickly run through what you can gain through thorough product research.

Identify user needs that your product can solve

Product research will not only help you boost innovation within your product, but it will keep your accuracy in check, too. You’ll be sure that the changes you are implementing actually align with user needs.

Understand the struggles and pain points of your customers

While customer feedback like your CSAT and CES scores are great ways to find pain points, you have to remember they are tied to your customer service and are solicited in nature.

No great business strategy should rely on great customer service to fix issues with the product setup. Make sure you are surveying your customers on the developments they’d like to see. Product research also provides you with behavioral data and insights to build optimal solutions.

Identify potential wins that will differentiate you from the competition

Product research will also help you gain a competitive edge. Researching the market and competitive landscape with help uncover market gaps you can fill with new features or products.

Design modifications in your roadmap to successfully hit KPIs

Successful product research will make prioritization simpler and more efficient. You’ll know what features users want and which ones make them consider leaving you for a competitor.

You can make sure the most important changes are lined up in the near future and your backlog is optimized. The entire team will be aware of which initiatives to work on next to improve customer satisfaction .

Use Survicate to make your product research effective

The best way to learn about your customers’ needs is to understand their behavior in context. Place surveys and feedback widgets in high-traffic visitor points for optimal feedback.

Survicate offers both website and in-product surveys to help you gain insights into customer needs, pain points, and feature ideas. There are over 125 survey templates that go well beyond your usual NPS , CSAT , and CES campaigns.

💡 YOU MAY ALSO BE INTERESTED IN: Product research survey template

Survicate integrations with tools like Slack also make closing the loop an automated process. Set up notifications and communicate with customers immediately after receiving responses.

Wrapping up

Product management centres around product feedback . If you don’t take advantage of this process, you are at risk of missing users' needs and wasting your product development budget.

Understand what will make your customers happy and build a customer-centric product that will break through the competition. Organize your product research with Survicate to get insightful and contextual customer experience data .

The free trial offers 10 days of access to Business plan features and up to 25 survey responses. Sign up today!

.webp)

We’re also there

- Product-led Growth

What is Product Research: A Guide for Founders

I don’t think there’s ever been a founder who succeeded with the first iteration of their product idea. For most of us, building a product means constant discovery and iteration, or product research , for short.

In this guide, I’ll explain what product research is and show you the best methods to do product research for your startup.

And there’s a very good reason for you to keep on reading…

We, founders, have really just one objective, after all – To create a product that will pretty much rock our customers’ worlds.

Sure, we can say that we want to exit and get a bucket load of cash for our product.

Or that we want to conquer the world.

Or build another SaaS unicorn…

And even if that is the case, we still need to build that perfect product first. Perfect in a sense that our customers won’t be able to live without it.

The thing is – It’s almost impossible to do it right off the bat. No matter what ideas we have, we still need more insights, data, and feedback to fine-tune it. And the only way to get it is through product research.

Below, I’ve included what I know about it, and what I’ve done to create Refiner. Full disclaimer, I also plugged my product there because, let’s be fair, it does help with product research too.

But on the whole, the below guide contains what you need to know about product research to refine your idea and build a product that’ll delight your audience.

So, let’s get on with it, then.

What does it really mean to conduct product research?

I ask this because the term – product research – could, at first, be misleading.

It’s easy to consider it referring to the process of researching products to buy, for example but that’s not it.

So what is product research? Various definitions call it a process focusing on gathering insights and information that, once analyzed, can help us build and improve our products.

There is far more in making it happen, of course. However, on the whole, I think that’s probably the easiest way to explain what product research is.

There are several other reasons to conduct product research beyond just learning what your users want.

- Product research is your gateway to becoming a user-centric company. It’s how you understand the target audience, their needs, pain points, and desires, and develop products that meet those requirements, rather than do what you’d like them to do.

- Secondly, product research also helps you validate ideas and assumptions. This last item is of particular interest here. After all, how often do we come up with ideas, and then rationalize them in our minds by assuming certain things about our audience or their needs? Now, these assumptions may as well be true. But you can only know that if you’ve validated them through product research.

- Thanks to different product research methods (more on those in just a moment), we get to find out which features our audience really want us to build. And needless to say, that’s a huge help that can also prevent us from spending time and effort on the wrong feature.

- Finally, product analysis can tell us a whole lot about our competitors , far more than other research methods could uncover. Why? Because through product research, you learn what your customers think of the competition. You discover how they perceive other similar products on the market, what value they (meaning, your customers) think those products deliver, and the reasons why they could consider using those products.

Worth to note – Product research is an iterative process. It’s not something you do once and then, forget about it but a continuous process that helps you refine anything from questions you ask to insights you collect.

As a result, product research is also quite an undertaking. It’s not something you should be doing on a whim, or to plug leaks in your funnel. Instead, product research is a process you should do continuously, and tap into those insights when you need data to fuel a specific project (like plugging leaks in a funnel, for example.)

In other words, product research is where you continuously collect data that you then turn to when needed, not the other way around.

So, how do you do it, then? How do you collect product research data?

Product research methods

Let me start by saying that there is no single, ideal product research method. It’s also impossible to tell which product research method is better than others, and so on. All of the methods I’ve listed below work exceptionally well in their respective best use case scenarios.

But as you can imagine, I’m still a little biased towards surveys. That’s what my product, Refiner , does, after all. Surveys are also the method I’ve used the most in the past, and that’s what helped me drive the development of Refiner.

Nonetheless, here are all the most popular product research methods, including surveys, of course.

Surveys: Surveys rely on you sending questionnaires to a pre-selected audience segment to collect quantitative and qualitative data about those people’s opinions, insights, and so on.

What makes surveys so incredible for product research is their:

- Wide reach – You can send a survey to a large number of people, and collect insights from them without much effort.

- Scalability – Similarly, surveys don’t require additional time or effort from you to scale the research.

- Low cost – Again, surveys are relatively inexpensive to run.

Some of the most common product research surveys include:

- NPS – a survey that allows you to evaluate the customers’ attitudes towards your product.

- CSAT , which helps you learn more about your customer satisfaction and draw actionable insights based on that.

- CES which reveals how easy (or not) customers find your product to use.

Here’s an example of an NPS survey used in product research.

FEATURED READING: How to run a perfect customer survey for a digital product

User Interviews: This method is all about sitting down with your customers one-on-one to discuss their needs, uncover pain points, or their product preferences. User interviews are all about asking open-ended questions and letting the person reveal their opinions. Unfortunately, this makes it a time-consuming method for product research, particularly if compared with surveys.

Focus groups: Running a focus group is like conducting user interviews at scale. In this method, you bring a small group of users together to discuss your product, provide feedback on issues you want to research, and so on.

Usability testing: This method focuses on observing users as they interact with the product (or its prototypes.) By observing how users complete predefined actions in the product, you can identify usability issues and gather insights for improvement.

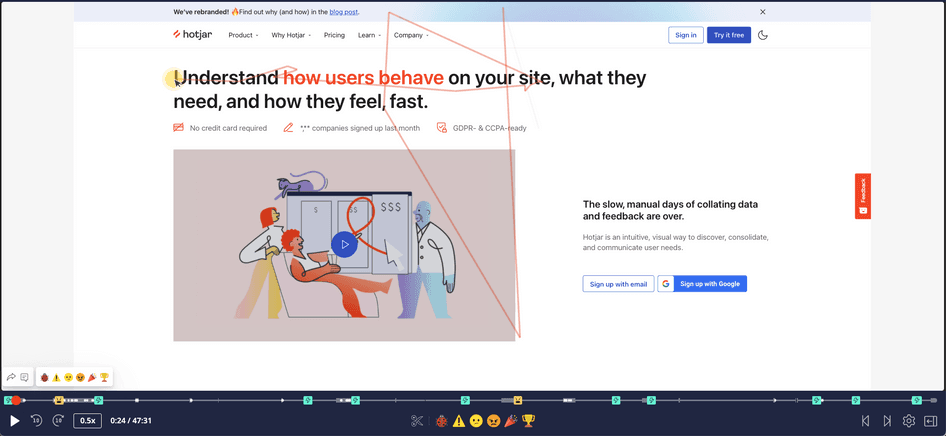

User behavior tracking: In this method, you’re also drawing conclusions based on user behavior. However, unlike usability testing, behavioral tracking focuses on analyzing data that you collect using different user behavior tracking tools (like Hotjar, for example) to understand user behavior, spot patterns, and collect benchmarks.

A/B testing: A/B or split tests allow you to uncover the audience’s preferences by eliminating product or UI elements that fail to engage them successfully. In this product research method, you present different versions of a product to different user segments and monitor their engagement with those to determine which variation performs better.

Customer journey mapping: This method relies less on collecting specific insights than using your data so far to understand the entire customer journey, from initial product discovery to post-purchase experience. This is an important product research method, as it allows you to map pain points to specific stages of the buyer’s journey, and spot opportunities for improvement.

How product research works in practice – Key elements of a product research project

It’s quite easy to assume that to launch a product research project, you just need to, a.) pick a research method, and b.) figure out how to use it, and off you go but no, that’s not how it works.

Successful product research strategy relies on several key elements:

Clearly defined objectives

It’s as obvious as it sounds, actually. For your project to work out, you need to set specific objectives and communicate them in a clear and understandable way. These objectives will guide the entire project, from selecting the target audience, research method, to what you’re going to do with the data.

Specific target audience

Again, quite an obvious element but also, often one that we tend to forget about. Naturally, we always have an audience for research. There is no such project without it, after all. But at the same time, we often tend to jump in and invite all customers for research, whereas we should be gathering insights from a specific audience or customer segment only.

This product research element focuses on selecting the right people who have the insights and knowledge that you seek. For example, if you’re evaluating advanced product functionality, you should focus exclusively on experienced users. New users mightn’t have even discovered those advanced features. And even if they did, their level of product knowledge mightn’t be sufficient for them to provide any meaningful insights for your research.

Research method

In most cases, once you set clear objectives, and pick the target audience that has insights to help you achieve those, choosing the research method is relatively easy. But you still have to do it. And I recommend that you evaluate all potential options (we’ve covered them above,) and select the method that’s the most appropriate for your goals and the audience.

TIP: It pays off to select several research methods sometimes. For example, if your goal is to improve the usability of your interface, you might start by tracking user behavior to identify potential challenges users experience. Then, hold usability sessions to confirm your assumptions, and finally, interview most engaged users about their challenges.

Notice how each method in this example allows you to go deeper into the problem. You start by collecting data that allows you to make hypotheses about potential usability problems. You, then, observe how users engage with those tasks in real-life, and finally, you get their opinion about those challenges.

Research instruments

I have to be honest – I’m not particularly fond of this label, research instrument. It’s quite misleading. But that’s what it is so I’m sticking with it here too. However, what we really mean by research instruments are materials that you’re going to use in the research methods you’ve selected.

These can be questions that you’ll be asking customers to answer in a survey, tasks for the usability session, questions for user interviews, and so on.

And needless to say, these are hugely important to prepare upfront, test, validate, and only put into use when you’re absolutely certain that they can deliver the insights you’re after without causing any form of bias.

Panel recruitment

In an earlier step, you’ve selected your target audience. Now, you need to recruit at least some of those people to participate in your product research. How you’re going to do it will largely depend on the research method you’ve selected.

For example, if you’re using behavioral data like heatmaps, then you don’t really need to recruit anyone for the study. Whatever heatmap software you’ll be using will collect the data for you.

If you run a survey, then you, most likely, will email it or display the survey in-app to your customer segment. Again, it’s not going to take much time and effort.

But the situation is different if you plan to run a user group, for example. In this case, you need to go through a formal process of approaching participants, getting their consent to participate in the study, and so on.

IMPORTANT: Note I mentioned collecting user consent before research. This is a hugely important step to remember, particularly in the face of GDPR and similar privacy laws.

As Phil Hesketh of ConsentKit explains :

“To ensure your research panel is compliant with data protection regulations in your country or state, it’s essential that you get consent from each panelist to collect and store their personal information.

You’ll need to get consent when a person agrees to join your panel for the purposes of recruiting for research, and you’ll need to ask for consent again when they agree to take part in a specific project.”

Data collection

This element is all about launching your research method to collect the data. Simply.

Data analysis and insights synthesis

In a typical product research project, you collect data for a specified period of time, after which you begin to analyze and synthesize that information. The goal here is to identify patterns, trends, and specific insights within the data, and document those so that you have a clear record of your findings.

Actionable insights

The project, typically, concludes not with documented data but a list of actionable recommendations drawn from it. In other words, with product research, you complete a full circle, starting with a problem, conducting research to generate data, and ending up facing the same problem again. This time, however, you’re equipped with insights and actionable recommendations to tackle it successfully.

And that’s it

That’s a typical product research project in a nutshell.

Naturally, there is more to each of its elements than I was able to fit into this guide. But I’m hoping that I was able to provide you with a solid foundation and general understanding of the process.

Also, if you’re interested in digging deeper into how to use surveys for product research, I recommend the my other guides:

- Product discovery process – the do’s and don’ts

- How to collect and measure user feedback for a digital product

- How to use UX research surveys for product development

- In-app feedback – How to capture user feedback within your app

- 15 best product feedback tools to help you improve your app

And if you want to see how Refiner, my survey software, could help you run successful product research surveys, sign up for a free trial or check out these live survey demos .

Related posts

This is How You Run a Perfect Customer Survey for a Digital Product

12 Customer Effort Score Questions to Use Right Away (with Examples)

How to Calculate and Measure the Customer Effort Score in SaaS

What is a Customer Effort Score: Everything You Need to Know About CES Surveys

- Legal Notice

- Privacy Policy

- Terms of Service

Learn / Guides / Product research basics

Back to guides

A step-by-step guide to the product research process

A strong product research process ensures product teams maximize resources, meet key business goals, and make confident decisions that will deliver successful products and features to create customer delight.

But, how do you conduct effective product research?

Just as there’s no single way to develop a product, no single research process fits all product teams. But there are key steps that will help you balance business goals and user needs for actionable product research .

This article takes you through the factors you should consider to tailor product research to your desired outcomes and provides a step-by-by-step guide to doing research right.

Use Hotjar to streamline your product research process

Hotjar offers product teams a rich stream of quantitative and qualitative data that keeps you connected to user needs at every stage of research.

What to consider before starting product research

Before jumping into the research process , product managers prepare their team. Take time to consider the why and determine how you can design the process to meet your unique product requirements.

Reflect on:

Why you’re doing the research

Get connected with the deep purpose of your research: what you need to understand to create a profitable and effective product .

Determine specific outcomes of the research process.

During the early product discovery stages, generating new product ideas for innovation and getting to know your users better will serve as a solid foundation throughout the research process. At later stages, look for concrete feedback on a new product, or possible upgrades and feature updates for an existing product. The why behind the research should guide your process.

Categorizing your users

Determining customer needs and segmenting users are crucial steps that impact the success of any product research strategy.

You might use a random sample of potential or existing customers; or segment users according to region, industry, or other criteria to spot patterns across different demographics.

Trial users can give immediate product feedback, which is usually incredibly easy to implement (a new theme, for example) or incredibly difficult, like an entirely new functionality or platform for your product. Your long-time users can give nuanced feedback, but they overlook what doesn't work due to their expertise.

Finding that middle ground of users who like what you offer but aren't stuck to your brand is essential. These users appreciate being treated like their insights matter most—because they do.

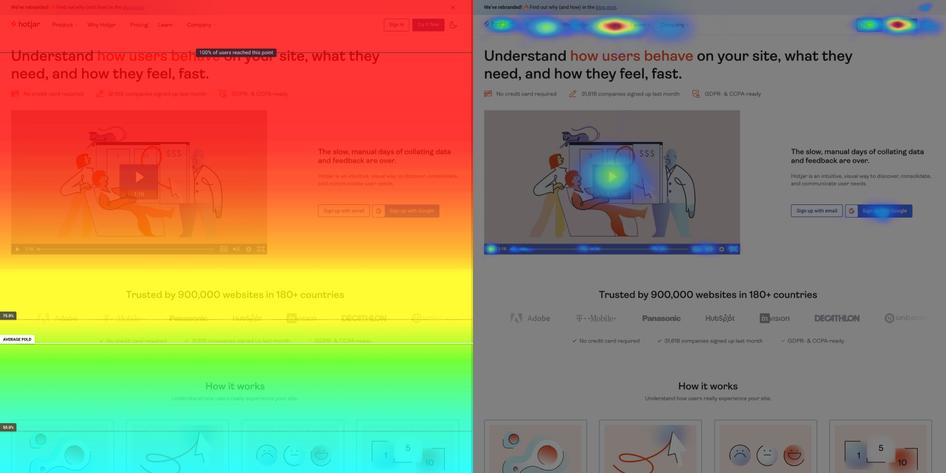

Finding impartial user insights can be tricky since many tools track users who’ve been paid or incentivized to click through to your website or product. Product experience insights software like Hotjar can help by providing organic, unbiased user data that gives you a clear picture of your customer experience (CX) .

Pro tip: Hotjar Highlights lets you sort and curate user insights and attributes, and share them with your product team. You can also watch Session Recordings of users from specific countries or industries—or filter recordings to see only satisfied or dissatisfied user experiences, which can provide valuable information on what’s working (and what’s not).

A Hotjar Session Recording

Your core business goals

The best product research processes overlap with the overall organizational vision, so update your research goals in line with company goals to ensure alignment.

Designing your research process with cross-functional collaboration in mind is a great way to eliminate any communication issues, ensure all departments collect data that tests product profitability, business goals, and user satisfaction.

Your team’s methodology

Different product methodologies emphasize different aspects of product research throughout its lifecycle, so it’s important to consider techniques that will fit your team’s working stages.

Teams who use waterfall methodologies usually rely on bursts of intense research before development and again during pre-launch. They also make a clear distinction between the product’s research and development phases.

Teams who use agile, lean, or DevOps methods usually integrate research with the broader product development process, engaging in continuous discovery methods.

Whatever your methodology, infuse research into every stage of the product lifecycle to achieve business goals like increased revenue, acquisitions, and user adoption.

Choosing which research tools to use

When you’re deciding how to do product research, you’ll need to consider your budget and company size to pick out your tool stack.

Manual research techniques like user interviews can be time-consuming and cost-intensive, but useful to forge a personal connection with users and ask improvised questions based on their responses.

Automated research tools (like Hotjar 👋) increase speed, efficiency, and cost-effectiveness, and reduce human error. They allow you to reach a larger target audience and ensure you’re getting clean, unbiased product feedback —in person, users are more likely to feel pressure to compliment your product or underplay their concerns, but with tools like Hotjar, you’ll get genuine, in-the-moment feedback from users as they engage with your product.

Which team members will contribute

Involve different team members at each stage of the product workflow. For example, when you’re validating product ideas, you may want to include marketing and technical departments; and when you’re testing product usability , you may want to rely on the expertise of your engineers.

It’s also important to consider what research other departments have done before launching your own process, so you don’t waste resources duplicating generic market research.

8 steps for amazing product research

Amazing product research is all about doing smart research to unearth effective insights without getting lost in an information overload that derails your product workflow .

Follow these eight steps to guide your product research strategies to achieve valuable, actionable product insights that will inform your product’s entire lifecycle, from ideation to execution.

1. Define your research goals

First, set your high-level goals, which should test business objectives as well as customer-centric product discovery. These are often drawn directly from the product vision and strategy.

Then, create attainable, specific goals or questions for your team to focus on during each stage of their research. This might include:

Conducting market research for the product’s adoption before its launch

Identifying areas where key features can be improved after the product launch

Evaluating the product’s performance throughout the product lifecycle

2. Understand your users

User needs are at the center of effective product research processes.

Engage in user discovery—identify and understand your customer—as early as possible , even before you have definite product or feature ideas. Open-ended user research is a key source of product inspiration and innovation, and an essential step in determining product-market fit .

Then, when you have product proposals, prototypes, or a minimum viable product ( MVP) , you can start seeking more specific feedback.

User research is all about interacting with your current or potential users and learning what they want and need . Developing a user-centric culture of ongoing research will help you gauge the market demand, position your product against the competition, and generate customer delight .

To create a user-centric research culture, conduct user interviews and create user personas. You can also connect more passively with your user demographic by looking at forums, Facebook groups, or sites like Reddit that are used by your customer niche.

The more organic the research process, the better. It’s ideal to catch users in situations where they answer by instinct instead of having carefully crafted answers. It's what they say instinctively that leads to better product solutions.

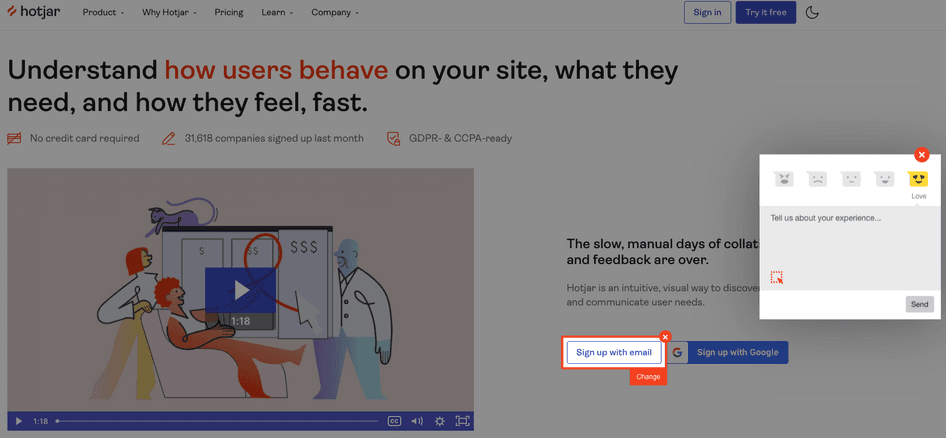

Pro tip: use Feedback widgets to gather user feedback in a non-invasive way.

Hotjar’s Feedback widgets are integrated into the product interface , so users can give quick feedback and then carry on with their tasks. This means you can survey your users and gain valuable insights by learning what they’re thinking and feeling as they interact with the product.

A Hotjar feedback widget

3. Do market research for your product

Run thorough competitive and comparative analyses to test the business potential of your product against other solutions on the market , and engage in opportunity mapping to get stakeholder buy-in.

You can also use historical market data and trade reports to predict potential profitability and run keyword research to understand users and what potential customers are searching for to generate product ideas.

Once you’ve validated whether there’s a viable market for your product and determined how saturated that target market is, focus on your product’s unique selling points.

Pro tip: even if you already have a product established in a specific market, make sure to assess the market periodically. Markets and competitors change, and making assumptions because of your initial research processes can be a costly mistake. Work with your marketing team here to validate your ideas and avoid guesswork.

Evaluate your product regularly against the industry by creating a value curve. The value curve plots the product offerings currently available in the market on one axis, and the factors the industry is competing on and investing in heavily on the other. This can help you spot market opportunities, ensure product relevance, and get ideas for features you could add to increase user demand and open up new user bases.

Check out how Gavin increased conversions for his lead generation agency by 42% with Hotjar.

4. Get to know industry trends

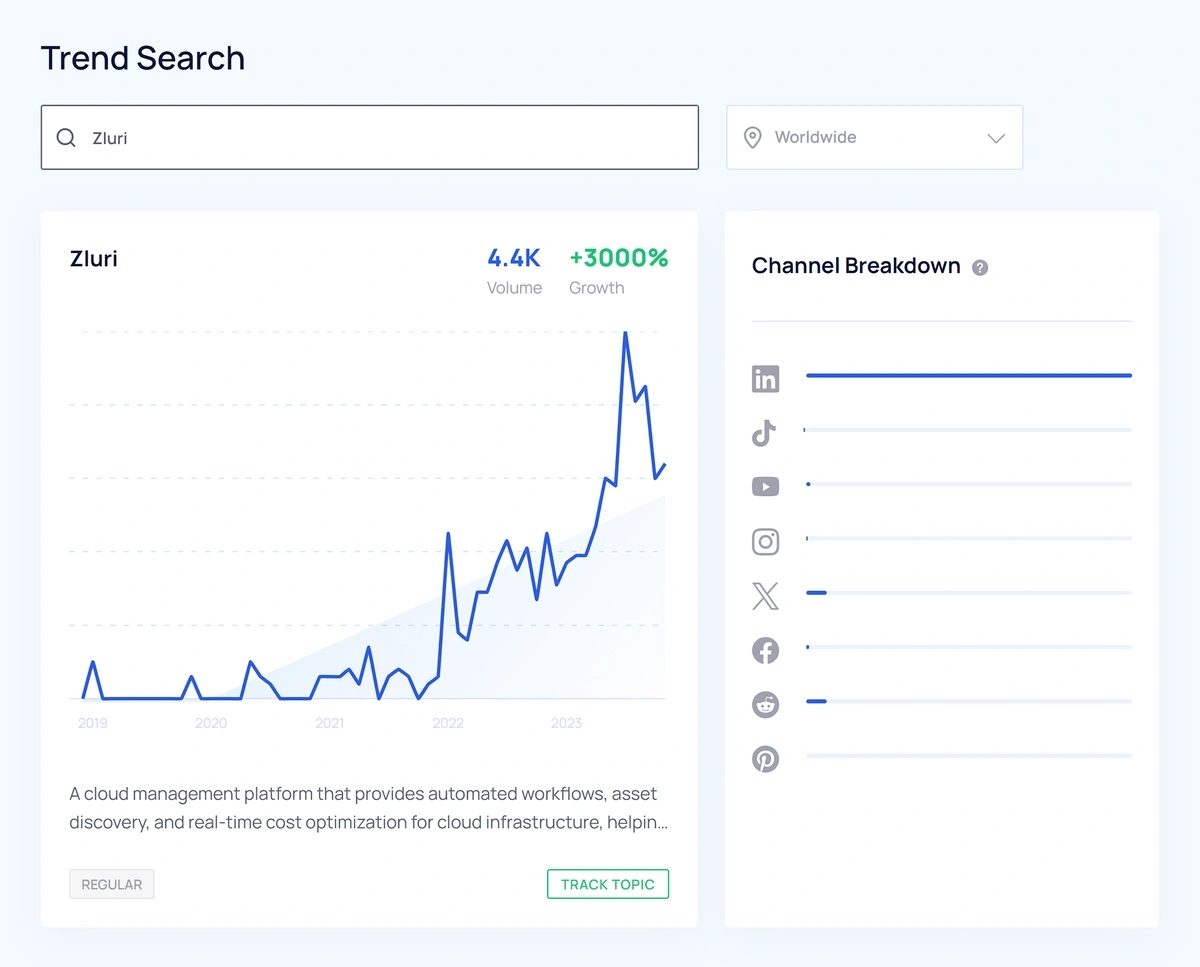

Next, combine your understanding of your users and market with research on technology trends that may affect user expectations of your product or its long-term viability.

Stay on top of trends by regularly engaging with tech cultures —read trade magazines and news sites, listen to tech news podcasts, and follow key trendspotters on social media and specialist forums. You can also use tools like Google Trends , Trend Hunter , and PSFK .

Another key source of tech trend information is your engineering team . Chances are, you have plenty of techies on your team who are up to speed on different aspects of technology and what’s forecasted to change.

Pro tip: rigorously analyze trends and put them into context to understand what has staying power, as you avoid jumping on every passing fad. Create a learning culture that embraces experimentation and gives team members the opportunity to share their knowledge.

Analyze the latest trending topics and projects in mainstream open-source communities across the Internet such as GitHub. These communities are an incredible resource for identifying tech trends that are sustainable, disruptive, and have immense staying power.

It's also important to subscribe to prominent tech publications and leading technology platforms such as Azure and AWS to get the latest tech news and new feature announcements delivered directly to your inbox. This way, your product team is always in the know about the most important tech trends that are shaping product development and product markets.

5. Validate ideas with current or potential users

Once you’ve developed a strong sense of your users, market, and technology, it’s time to start testing concrete ideas and solutions.

Based on your early research, identify possible products, features, or upgrades that could meet user needs as well as business goals. Then, run concept testing to evaluate the user experience.

First, identify key users or user types to test. Recruit participants for customer interviews or focus groups, or deploy Hotjar Surveys , Incoming Feedback tools, and Session Recordings to test ideas with existing users.

Then, ask questions or set tasks and observe user responses. You may just want to explain concepts to users at this stage—or you can use wireframes or mockups; or, at later stages, prototypes or MVPs.

Make sure you account for confirmation bias and false-positive responses from users when designing the validation process. Include open- and closed-ended questions and use measures like purchase intent to determine customer adoption.

Pro tip: use fake door testing to gauge interest in new features across your existing user base.

In fake door tests, you show users a call-to-action for a product action that doesn’t exist yet. Once they click to perform the action, they’ll be taken to a page that explains this feature isn’t available yet—you may also choose to include a short survey on this page to learn more about their interest. By reviewing answers to survey questions and the click-through rate , product teams can quickly validate ideas for new features or improvements with users.

6. Test your MVP

The next step in your product research process is to develop a Minimum Viable Product based on validated ideas and run tests to improve subsequent iterations.

This is a critical stage in product research that you shouldn’t skip. Waiting for the fully developed product before running tests makes it harder to fix software and prioritize bug issues, causing major delays.

Quality assurance (QA) testing, regression testing, and performance testing check the MVP’s functionality and show developers where they need to make product changes .

User tests are also key at this stage. Different types of product testing , like tree testing and card sorting, can confirm whether users can easily navigate your product to find the functionality they need.

A/B tests and multivariate tests , where you split your user base into groups and give them different versions of a product or feature, can help you decide which iteration to run with. Hotjar Heatmaps allow you to easily compare where users click and scroll on different versions of the product.

7. Continue research after the product launch

Consider doing a soft launch—or even canary deployment—where you release new products or features to a small group of users

Gather data to weed out bugs

Finally, adapt the product based on user responses

Then you can roll it out to all users.

But even once you’ve launched the final product, your research isn’t over. The best product teams stay connected with their users and regularly analyze market trends and tech changes.

After the product is released, either through a soft launch or a regular launch, implementing a data-driven approach to the go-to-market strategy is crucial in parsing consumer reports and validating trends and customer opinions.

Continuous research ensures that your product stays relevant and successfully meets customer needs, which will boost user metrics and business metrics alike.

So how can you continue your research throughout the product lifecycle?

Watch session recordings to spot blockers and bugs where users are rage clicking or dropping off the product journey

Use heatmaps to understand which product elements are most popular—and unpopular—with users

Measure product analytics like click-through rate (CTR) and product conversion rate

Stay up to date on industry and market trends

Incorporate regular opportunities for cross-team discussions to get different research perspectives

Schedule regular user and customer interviews

Use product experience insights tools like Hotjar to give you a steady stream of user feedback through Surveys and Feedback widgets

8. Turn research into action

The final step in any product research process is to organize your research and turn insights into action.

Curate your research into specific, actionable themes to cut through the noise and gather valuable, user-centric insights.

Then, use your research to establish a strong product strategy and roadmap to guide your product development process. Make sure you compare the strategy and roadmap with new research at regular intervals and update where needed, though it’s important to strike a balance: these documents should be dynamic but relatively stable touchpoints.

Your product research should also drive your day-to-day decisions and product backlog management , and form the basis of your product storytelling to help get stakeholder buy-in.

Why creating a user-centric research culture is essential

Remember: at heart, all product research is user research.

Product teams who are endlessly curious about their users—who they are, what they need, how they experience your product—can better meet the demands of an ever-evolving market, inspire customer loyalty, and increase their Net Promoter Score (NPS) . With a learning mindset and a commitment to customer-centric product discovery, you can transform research into innovation and sustainable business growth .

FAQs on the product research process

What is product research.

Product research is the process of gathering data about your product’s purpose, intended users, and market to meet user needs and achieve business goals.

What are the steps in the product research process?

The 8 steps in an effective product research process are:

1) Define your research goals

2) Understand your users

3) Do market research for your product

4) Get to know industry trends

5) Validate ideas with current or potential users

6) Test your MVP

7) Continue research after the product launch

8) Turn research into action

Why is product research important?

Strong product research is critical to product management because:

It ensures the product will meet customer needs and hit business targets

It helps product managers (PMs) develop a data-informed product vision, strategy, and roadmap

It helps PMs make confident decisions on the product backlog and day-to-day tasks

It keeps the product team motivated and connected with the purpose of their work

It helps the product team communicate product value to stakeholders to get buy-in and secure resources

Prioritize product features

Previous chapter

Guide index

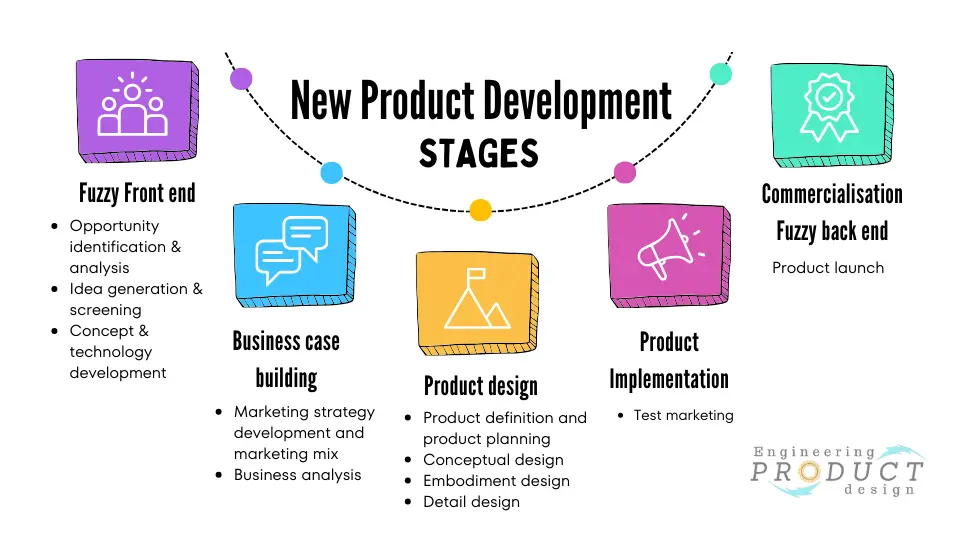

A practical guide to product development research

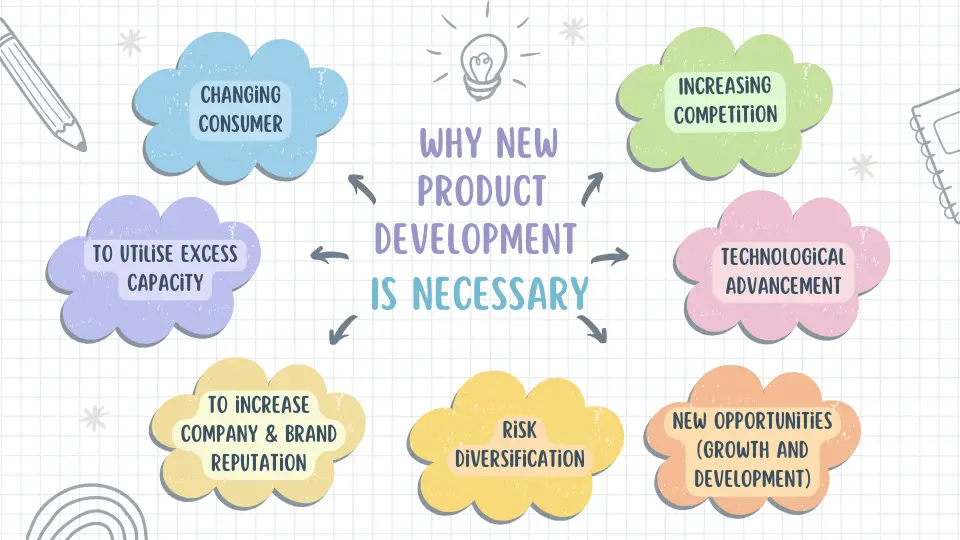

Understanding your target customers' needs and behaviours is a crucial step in the new product development process. Here we explore product development research and how it can give your brand the direction is needs.

What is product development research?

Why is product development research important, stages of product development research, types of product development testing.

Product development research is the process of finding out how the product or feature you’re currently working on is progressing, whether there are any changes in your target audience’s needs and whether you need to make any adjustments to the product.

Depending on where you are in your product’s life cycle will dictate the kind of product development research you do and how it might impact your overall product development process.

In your product research process you can find out things like what features customers might be willing to pay more for, or figuring out how you can increase customer loyalty. And you might want to investigate a decline in interest or sales to make sure your product maintains success.

Whatever stage your product development is at, you’ll definitely want to keep track of its progress and stay on top of any emerging trends that might affect your product life cycle. You can do all of this with research into your product development.

It’s vital for businesses to develop products that fulfil the needs and desires of customers. This is what will keep customers happy and loyal, and it’ll ensure that the business’s products remain successful, and, better still, become even more successful.

Gauging market demand through product development research – easily done with platforms like Attest – is a surefire way to get to the root of what consumers want, allowing you to offer them truly useful and desirable products.

Surveying your target audience throughout your product development process, from its initial stages through to its final stage, launch and future iterations, is key to staying on top of trends and changes in customer needs.

Your marketing research and exploratory research should reveal the insights you need to continue reaching and satisfying your target customers. You’ll hear opinions directly from your customers, meaning that the products you go on to develop will be made for and with your customers.

Launch your product development research

Attest’s advanced market research platform and quick turnaround of survey results help you take the guesswork out of product development.

There are a few key stages of the product development research process that you should know about to make sure you create successful products that are right for your customers.

Take a look at our intro to the new product development market research (NPD) process, summarising the 9 key steps to explore throughout your project:

Exploratory

Exploratory research is what usually happens at the earliest stage of the new product development process.

During this stage you might not necessarily know what your outcome will be, what your product will look like, how exactly it’ll address potential customers’ needs and ensure customer satisfaction. This is when you’ll explore these areas and more to find out what direction you’ll take with your new products.

At the exploratory stage, market researchers will delve into data around consumers, their pain points and their general product usage, usually working closely with the Product team to make sure these insights are reflected in the product roadmap.

Once ideas about products and features have been developed during the exploratory stage, many companies then take an even deeper look into issues and topics that emerged in the previous stage.

Ideas you might have had earlier on in the product development process will be scrutinised here to help you understand the value of your offering to your potential customers.

Iterative development

Later in the product life cycle process is when you’ll carry out iterative development research. At this stage you’ll analyse and refine your product and its features to make sure the final product you provide to your customers is comprehensive and eliminates their pain points.

Iterative market research can be intricate and involve in-depth analysis of seemingly insignificant features. Things like A/B testing can be done at this stage – that might be testing different versions of a website button or packaging design.

There are a range of product research types that businesses typically explore when they’re defining customer preferences and prepping their potential product for the marketplace.

Each of these types of product development testing cover the spectrum of new product research, all the way from concept testing to post-launch satisfaction and ongoing success. And these testing types can be done in many different ways, ranging from small, intimate, mainly qualitative market research and focus groups to large, mainly quantitative surveys. Let’s get right into the different types of product development testing.

Concept testing

There’s absolutely no point in launching a product without being confident that the idea will resonate with consumers, and will ultimately be a success.

That’s why, right at the beginning of the new product life cycle you should carry out concept testing . This is where you’ll figure out, through extensive research, whether that product or feature you’ve been mulling over will actually give people what they’re looking for- by appealing to consumer preferences .

Concept testing can involve testing anything from brand assets like a new logo or website page to commercial features like the pricing structure, or even as a way to uncover a new customer segment.

Gain confidence in your concepts

Test your concepts with Attest’s quality audiences to help you launch successful products.

User experience research

It’s crucial for marketing, product, insights and innovation professionals to have a full understanding of how an end user interacts with the product or service on a functional level. Are customers able to navigate around the website or platform easily? Or open the physical product quickly? How do they feel as they interact with the product? How easy is it for them to complete their ultimate task?

These are the kinds of questions you should hope to answer through your user experience testing.

It’s super important at this stage to enlist real consumers who might be interested in your product. Even if the users uncover issues with your product or don’t immediately fall in love with it, that’s fine – what matters is that it’s useful insight directly from the people your product is targeted at.

Pricing research

Knowing where to price your product is a battle all companies face at some point. You need your brand to offer a quality product at a price that’s cost effective and competes with other market leaders, but you don’t want your price to be so high that people buy elsewhere, or so low that you miss out on revenue.

Through pricing research you’ll find out what your target customers are willing to pay for what you offer, allowing you to find the sweet spot – the price at which you can maximise revenue, profit and market share.

This is also the perfect time for you to find out if it’s worth your while to offer your customers any discounts, and if so, where in their journey these are most likely to be effective.

Market and competitor research

While it’s obviously super important to carry out research into your own product and offering, don’t forget to stay on top of what’s going on in your industry.

Conducting market and competitor research is vital if you want to offer your potential customers an industry-beating product.

And remember to iterate on your market and competitor research – repeat and build on your research to make sure you have a full understanding of industry trends and so you can identify new ones.

Satisfaction and loyalty research

And your product development research doesn’t end once your product’s out there in the market. Are your customers truly satisfied with your offering? Are you giving them reasons to be loyal to your brand?

It’s a mistake to assume that your customers are satisfied just because they chose to buy from your company. It’s vital that you continue assessing your customers’ happiness and desires, and to make sure you’re on top of any unmet needs.

We hope this practical guide to product development research has been useful for you, and that you can take this insight and continue developing concepts and products that wow your customers.

Always-on, iterative market research is a key way for you to discover ways you can enhance your product offering and make sure you leave customers satisfied with and loyal to your brand.

Create products that your customers really want

Gauge market demand and understand consumer preferences to create the best possible product by running NPD research with Attest.

Elliot Barnard

Customer Research Lead

Elliot joined Attest in 2019 and has dedicated his career to working with brands carrying out market research. At Attest Elliot takes a leading role in the Customer Research Team, to support customers as they uncover insights and new areas for growth.

Related articles

People want to shop green – what can brands and retailers do to help them, sustainability, why do uk consumers love neobanks, how close is the uk to becoming a cashless society, subscribe to our newsletter.

Fill in your email and we’ll drop fresh insights and events info into your inbox each week.

* I agree to receive communications from Attest. Privacy Policy .

You're now subscribed to our mailing list to receive exciting news, reports, and other updates!

- Agile & Development

- Prioritization

- Product Management

- Product Marketing & Growth

- Product Metrics

- Product Strategy

Home » What Is Product Research? Definition & Process

What Is Product Research? Definition & Process

July 31, 2023 max 7min read.

This article contains,

What Is Product Research?

The dynamics of product research across product teams, how to do product research, the importance of data in product research, steps to make your product research successful.

Product Research Definition: Product research is a systematic process of gathering and analyzing information to gain insights into a product or idea. It involves studying the market, target audience, competitors, and relevant industry trends to make informed decisions about the product’s design, development, and marketing.

The main goal of product research is to understand potential customers’ needs, preferences, and pain points, ensuring that the final product meets their demands and expectations.

By conducting product research, businesses can identify opportunities for improvement, uncover potential obstacles, and refine their product strategy to create a successful and competitive offering in the market.

Several methods are used in product research, such as surveys, focus groups, interviews, observational studies, and data analysis. The findings from these research activities are crucial in guiding product development, pricing, positioning, and marketing efforts, ultimately increasing the chances of creating a product that resonates with the target market and generates positive outcomes for the company.

Let’s dive deeper into the product research process for a better understanding.

Product research is a critical part of the product development process. It helps teams to understand their users, identify their needs, and validate their ideas. However, how product research is conducted can vary across different product teams.

In some teams, product research is conducted by a dedicated team of researchers. These researchers have the expertise and experience to collect and analyze data, and they work closely with product managers to ensure that the research findings are used to inform product decisions.

In other teams, product research is conducted by product managers themselves. These product managers may have some training in research methods. Still, they often rely on various other sources of information, such as user feedback, market data, and competitive analysis.

The way that product research is conducted can also vary depending on the product team’s methodology. Waterfall teams tend to conduct product research more linearly, clearly distinguishing between the research and development phases. Agile teams, on the other hand, are more likely to integrate research with the broader product development process using continuous discovery methods.

No matter how it is conducted, product research is an essential part of the product development process. Product teams can create more successful products by understanding their users and their needs.

Here are some additional factors that can influence the dynamics of product research across product teams:

- The size and maturity of the team. Larger teams with more resources may have dedicated research teams. In comparison, smaller groups may rely on product managers to conduct research.

- The industry that the team is in. Some industries, such as healthcare and finance, require a high degree of regulatory compliance, which can impact how product research is conducted.

- The company’s culture. Some companies have a strong culture of data-driven decision-making, while others rely on gut instinct. This can also influence the way that product research is conducted.

The dynamics of product research across product teams can be complex. However, by understanding these dynamics, product teams can ensure they use research effectively to create successful products.

To embark on a successful product research journey, follow these essential steps that prioritize understanding your target audience and meeting their needs:

- Define Your Target Audience: Clearly identify your potential customers’ specific demographic and psychographic characteristics. Understand their preferences, pain points, and behaviors to tailor your research accordingly.

- Conduct Market Research: Analyze the current market trends, industry dynamics, and potential opportunities for your product. Look into existing competitors and their offerings to uncover gaps your product could fill.

- Set Clear Objectives: Define the goals of your product research. Whether enhancing an existing product or developing a new one, having clear objectives will help focus your efforts and measure success.

- Choose Appropriate Research Methods: Utilize a mix of research techniques like online surveys, interviews, focus groups, and data analysis. Each method offers unique insights into your target audience’s preferences and expectations.

- Create Customer Personas: Based on your research findings, develop detailed customer personas that represent different segments of your target audience. These personas will serve as fictional representations of real customers and guide product development decisions.

- Analyze Competitor Offerings: Study your competitors’ products to understand their strengths and weaknesses. Identify opportunities for differentiation and improvement in your product.

- Gather Feedback Iteratively: Involve your target audience in product development by collecting Feedback at various stages. Iteratively refine your product based on this Feedback to ensure it aligns with customer expectations.

- Test Prototypes: Create prototypes or minimum viable products (MVPs) to gather user feedback early in development . Identifying potential issues before the final product launch can save time and resources.

- Consider Pricing and Positioning: Determine the appropriate pricing strategy and how you will position your product in the market. The perceived value of your product influences customers’ purchasing decisions.

- Stay Open to Adaptation: Be willing to adapt your product based on the insights gained throughout the research process. Consumer preferences and market dynamics can change, and flexibility will keep your product relevant.

Remember, product research is an ongoing process that should continuously inform your decision-making. Focusing on the needs and expectations of your target audience will increase the likelihood of creating a successful and well-received product in the market.

Data is essential for product research. It helps teams to understand their users, identify their needs, and validate their ideas. By collecting and analyzing data, product teams can better decide what features to build, how to improve the user experience, and how to market their products.

Many different types of data can be used for product research. Some familiar sources of data include:

- User feedback: This can be gathered through surveys, interviews, and user testing.

- Market data: This includes information about the target market size, the competition, and the trends in the industry.

- Product data: This includes information about how users are using the product, such as what features they use, how often they use them, and what problems they are having.

By collecting and analyzing this data, product teams can deeply understand their users and their needs. This information can then be used to make better decisions about the product, such as:

- Which features to build: By understanding what features are most important to users, product teams can prioritize their development efforts.

- How to improve the user experience: By understanding where users are having problems, product teams can make changes to the product to enhance the experience.

- How to market the product: By understanding the target market, product teams can create marketing campaigns that are more likely to be successful.

Data is an essential tool for product research. By collecting and analyzing data, product teams can make better decisions about the product, leading to increased user satisfaction and market success.

A study by the Harvard Business Review found that companies that use data-driven decision-making are 23 times more likely to be profitable than those that don’t. The study also found that these companies are more likely to be innovative and grow faster.

Making your product research successful involves a systematic and customer-centric approach. Follow these steps to ensure you gather valuable insights and develop a winning product:

- Clearly Define Objectives: Start by setting specific goals and objectives for your product research. Understand what you want to achieve and the questions you need answers to.

- Know Your Target Audience: Identify your target audience and their characteristics. Understand their needs, preferences, and pain points to tailor your research accordingly.

- Utilize Multiple Research Methods: Employ a mix of research techniques, such as surveys, interviews, focus groups, and data analysis. Each method provides unique insights into your target audience’s behavior and preferences.

- Create Detailed Customer Personas: Develop well-defined customer personas based on your research findings. These personas will represent your ideal customers and guide product development decisions.

- Analyze Market Trends and Competitors: Study the current market trends and analyze your competitors’ offerings. Identify gaps and opportunities to differentiate your product.

- Iterate and Gather Feedback: Involve your target audience throughout product development. Gather Feedback at different stages to iterate and refine your product based on real user insights.

- Test Prototypes and MVPs: Create prototypes or minimum viable products (MVPs) to obtain early user feedback. This helps identify potential issues and make necessary improvements.

- Consider Pricing and Positioning: Develop a pricing strategy that aligns with the perceived value of your product. Determine how to position your product in the market to stand out.

- Stay Agile and Adaptable: Be open to adapting your product based on the insights gained during the research process. Market dynamics can change, and staying agile ensures your product remains relevant.

- Involve Cross-Functional Teams: Collaborate with different departments, including marketing, design, and engineering, to gain diverse perspectives and expertise during the research and development phases.

- Stay Customer-Centric: Keep the needs and expectations of your target audience at the forefront of your decision-making. A customer-centric approach increases the chances of delivering a product that resonates with the market.

- Learn from Failures: Embrace failures and setbacks as opportunities for learning and improvement. Use Feedback from unsuccessful attempts to refine your product and strategy.

By following these steps, you can ensure a comprehensive and compelling product research process, leading to the development of a successful product that meets customer needs and achieves business objectives.

More Like This :-

- What is Deployment? Meaning and Process

- What are WIP Limits? Definition and Set them in Kanban

- What Is Low Code Development? Definition and Platforms

Google Trends can be used for product research by analyzing search trends to identify the popularity and interest in specific products over time. It helps businesses understand consumer preferences and anticipate market demands.

An example of product research would be conducting surveys and focus groups to gather Feedback on a new smartphone design. This research helps the company understand customer preferences, desired features, and potential improvements for the final product.

Crafting great product requires great tools. Try Chisel today, it's free forever.

Product Research

Relevant templates

Product research is the systematic process of gathering, analyzing, and interpreting data and insights related to a specific product or service. It encompasses various methodologies and techniques to understand customer needs, market dynamics, competitor offerings, and industry trends to inform strategic decisions throughout the product lifecycle. Product research is the foundation for developing successful products, guiding innovation, and ensuring alignment with customer expectations and market demands.

Significance of Product Research

Product research plays a pivotal role in guiding strategic decision-making and mitigating risks associated with product development and launch. By conducting thorough research, businesses can gain valuable insights into customer preferences, market trends, and competitive landscapes, enabling them to make informed decisions, minimize uncertainties, and maximize the likelihood of success for their products.

Key Components of Product Research

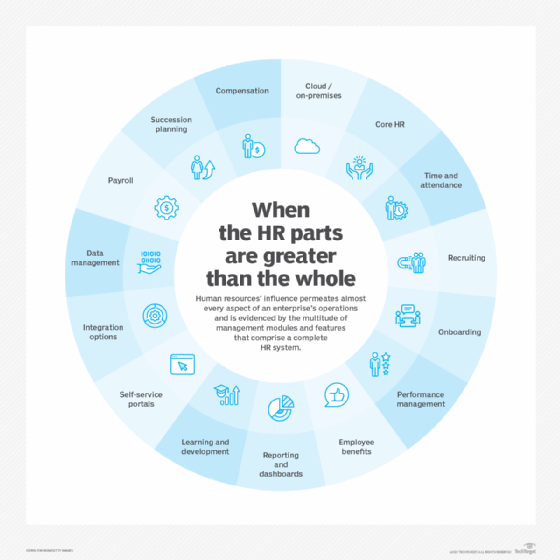

Product research containes various components and methodologies, including:

- Market Research: Gathering data and insights on market size, segmentation, trends, and dynamics to understand the broader market and identify opportunities and threats.

- Customer Research: Conducting surveys , interviews , and observational studies to understand customer needs, preferences, behaviors, and pain points related to the product or service.

- Competitor Analysis: Analyzing competitor offerings, strategies, strengths, and weaknesses to identify gaps in the market and inform differentiation strategies.

- Trend Analysis: Monitoring industry trends, technological advancements, and consumer behaviors to anticipate future demands and stay ahead of market shifts.

- Usability Testing: Evaluating the usability , functionality, and user experience of prototypes or existing products to identify areas for improvement and optimization.

Methods of Product Research

Product research employs a variety of methods and techniques, including:

- Surveys and Questionnaires: Administering structured surveys and questionnaires to collect quantitative data on customer preferences, attitudes, and behaviors.

- Interviews and Focus Groups: Conducting in-depth interviews and focus group discussions to gather qualitative insights and explore customer motivations, needs, and pain points.

- Market Analysis: Utilizing secondary research sources such as industry reports, market data, and competitor analyses to understand market trends and dynamics.

- Prototype Testing: Creating prototypes or minimum viable products (MVPs) to gather feedback from users through usability testing and iterative design processes.

- Data Analytics: Leveraging data analytics tools and techniques to analyze customer interactions, behaviors, and engagement patterns to derive actionable insights.

Importance of Product Research in Business Development

Product research is indispensable for businesses seeking to develop successful products and drive sustainable growth. Its importance lies in:

- Identifying Opportunities: Product research helps businesses identify unmet customer needs, market gaps, and emerging trends, enabling them to capitalize on opportunities for innovation and differentiation.

- Minimizing Risks: By conducting thorough research, businesses can mitigate risks associated with product development, market entry, and investment decisions, reducing the likelihood of product failures or market setbacks.

- Informing Strategy: Product research provides valuable insights for formulating product strategies, pricing strategies, marketing campaigns, and go-to-market plans, ensuring alignment with customer preferences and market demands.

- Enhancing Competitiveness: By staying informed about market trends, customer preferences, and competitor offerings, businesses can maintain a competitive edge and adapt quickly to changing market conditions.

Product research is a fundamental aspect of business development, providing valuable insights that inform strategic decision-making, drive innovation, and ensure the successful development and launch of products and services. By investing in comprehensive product research methodologies and techniques, businesses can maximize their chances of success, foster customer satisfaction, and achieve sustainable growth in competitive markets

Relevant terms

How To Do Market Research For New Product Development

Market research for new product development can be overwhelming.

It’s easy to get lost in a mountain of market reports with thousands of data points…. yet get no clear insights on which product is best for your brand.

Instead of aimlessly searching for new product ideas and sifting through endless market reports, this post will walk you through a simple step-by-step process that outlines:

- How to quickly find relevant new product ideas.

- Specific data and metrics you need to analyze each product opportunity (and how to find these metrics).

- How to use market research data to assess a product opportunity.

What Is Market Research For New Product Development?

Market research for new product development is the process of evaluating the demand, growth, and gaps in a market for a particular product (typically a physical product sold in a retail setting or direct to consumer).

These insights help you understand which products your target market wants, which ones are most profitable, and the key characteristics customers like and dislike about competitors' products.

With this data, you can more accurately predict which product will perform best for your business.

Types Of Market Research For New Product Development

There are four types of market research typically used for researching and developing products:

- Qualitative research

- Quantitative research

- Primary research

- Secondary research

Quantitative Research

Examples of quantitative data you might collect during the product market research process include:

- Market size and growth rates

- Pricing data

- Sales forecasts

- Website traffic data

- Market share of the top competitors

Quantitative data is helpful for benchmarking and is often the main type of research used to quickly gauge the potential of market opportunities.

Quantitative data can be fact-checked, but accuracy still varies depending on factors like sample size and data collection methods.

Qualitative Research

Qualitative research is data based on subjective opinions.

An example of qualitative data is customer feedback.

This data is helpful for product market research, as you can better understand customer pain points and what they like and dislike about what's already out there.

Some examples of qualitative research methods include:

- Interviews with potential customers

- Customer reviews

- Questionnaires and surveys

- Discussion analysis (monitoring conversations on social media, in forums, etc.)

- Feedback from focus groups

Primary Research

Primary research is data collected by you or your company.

Here are some examples of primary research:

- Results from a survey you conducted

- A report from sales data your team analyzed

- Customer interviews conducted by your team

The advantage of primary market research is that it's proprietary data your company owns. So your competitors won't have access to it. You can also tailor the data to answer your specific questions about the market.

The downside of primary research is that it’s expensive and time-consuming. You'll have to conduct the research, clean the data, and analyze it yourself.

You can hire a market research firm to help, but this will make it even more costly.

Secondary Research

Secondary research is data collected and published by other third-party sources, like an industry publication or government agency.

Here are some examples of secondary research:

- Free and paid market reports published by a source like Grand View Research or MarketResearch.com .

- Statistics published by a source like The U.S. Bureau of Labor Statistics or the U.S. Energy Information Administration .

- Data in the Census Business Builder .

Secondary research is usually cheaper than primary research, so it's great for the early stages of product market research when you're narrowing down your list of product ideas.

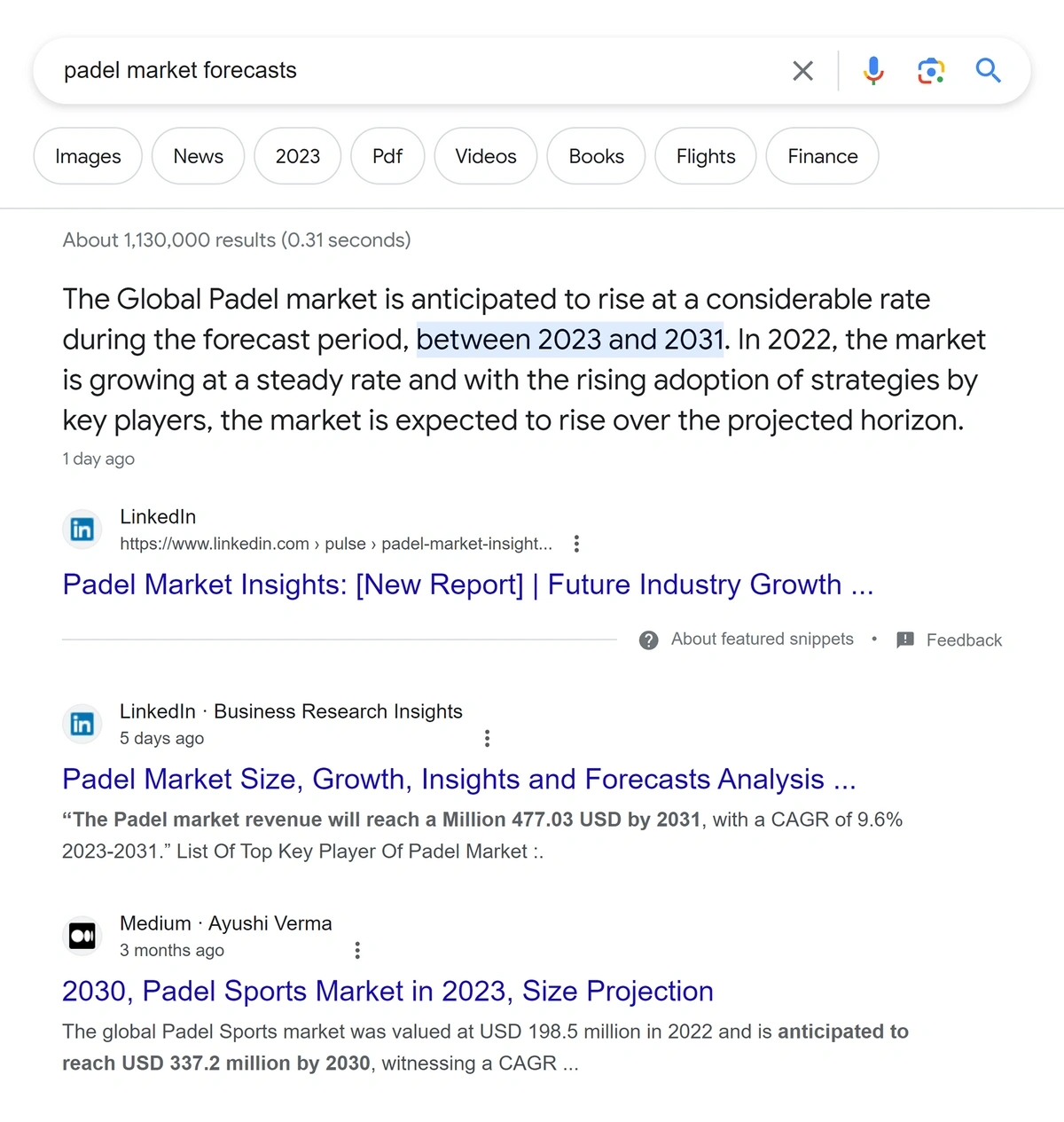

For example, if you're interested in the padel market, search "padel market forecast" to find free industry reports. You can look at statistics like compounding annual growth rate and market size to quickly gauge if the padel market is worth exploring in more detail.

The drawback of secondary research is that the data quality may vary as you can't control data quality.

So research how each provider collects and cleans the data they publish.

Step By Step Process To Conduct Market Research For Product Development