- Performance & Yields

- Ultra-Short

- Short Duration

- Empower Share Class

- Academy Securities

- Cash Segmentation

- Separately Managed Accounts

- Managed Reserves Strategy

- Capitalizing on Prime Money Market Funds

Liquidity Insights

- Liquidity Insights Overview

- Audio Commentaries

- Case Studies

- Leveraging the Power of Cash Segmentation

- Cash Investment Policy Statement

- China Money Market Resource Centre

Market Insights

- Market Insights Overview

- Eye on the Market

- Guide to the Markets

- Market Updates

Portfolio Insights

- Portfolio Insights Overview

- Fixed Income

- Long-Term Capital Market Assumptions

- Sustainable investing

- Strategic Investment Advisory Group

MORGAN MONEY

- Global Liquidity Investment Academy

- Account Management & Trading

- Announcements

- Navigating market volatility

- 2024 US Money Market Fund Reform

- Diversity, Equity & Inclusion

- Spectrum: Our Investment Platform

- Sustainable and social investing

- Our Leadership Team

- LinkedIn Twitter Facebook

Case studies

Working with clients to solve short-term fixed income needs

FEATURED CASE STUDIES

Guazi: Driving home a treasury framework fit for purpose

Meituan-Dianping: A unicorn’s path to achieve world-class treasury

All case studies, vertex pharmaceuticals.

Vertex Pharmaceuticals transforms its investment processes with Morgan Money.

Kulicke & Soffa

Kulicke & Soffa meets strong risk management standard with MORGAN MONEY’s cash optimizer.

Nigeria LNG

Harnessing the Power of Technology. Nigeria LNG transforms Money Market Fund investments with MORGAN MONEY.

Micro Focus

Short-term AAA-rated money market funds provide short-term investment opportunities for divestment proceeds.

Liquidity and security over yield deliver investment benefits to NIO

Active Super (previously known as Local Government Super)

Prioritizing cash management at scale, Active Super (previously known as Local Government Super), an Australian superannuation fund, found “operational alpha”.

Guazi’s rapid expansion created a cash placement challenge for the treasury function. Its operating cash was unpredictable, whilst its liquidity needs were extremely high.

Meituan-Dianping

Meituan-Dianping, a growing unicorn, had a major challenge to accurately forecast its cash flow beyond three months.

Alkane Resources

Like many others in the sector, Australian mining company Alkane Resources has to set aside a portion of surplus cash to cover any unexpected costs or delays.

NTUC Income

Singapore-based insurance provider NTUC Income had always handled its investments entirely through its internal portfolio management team.

J.P. Morgan liquidity solutions help solve SEEK employment marketplace build up of surplus cash.

The challenge: a solution that delivers increased returns for onshore and offshore cash holdings.

AstraZeneca

J.P. Morgan Global Liquidity provided a successful short-term investment solution to AstraZeneca, a global science-led biopharmaceutical company.

Recruit Holdings

As the business has grown globally, liquidity and cash positions outside of Japan have expanded, creating foreign exchange (FX) exposure.

The challenge: to assess the optimal level of liquidity required to ensure John Lewis Partnership has continued financial sustainability.

Explore more

Cash investment policy statement

How to write an investment policy statement for your organization.

Leveraging the power of cash segmentation

The most effective strategy incorporates a clear investment policy, well-defined goals and parameters for liquidity, quality and return.

Invest with ease, operational efficiency and effective controls via our state-of-the-art trading and analytics platform.

Modernizing enterprise asset management

- Call for Change

- When Tech Meets Human Ingenuity

- A Valuable Difference

- Meet the Team

- Related Capabilities

Call for change

To manage Accenture’s enterprise assets, teams across Accenture were using a variety of solutions and processes. Much of the data capturing was manual and inconsistent across systems, driving the need for a modern, integrated system.

Our global IT and Corporate Services & Sustainability organizations collaborated to develop a solution. As we continually look to obtain new value from our ServiceNow platform , we recognized that the ServiceNow IT Asset Management solution held the potential to address enterprise asset management (EAM) needs across Accenture.

As a result, we partnered with ServiceNow to influence the solution road map. This joined effort between global IT and Corporate Services & Sustainability teams such as Local Technology Services, Procurement, and Workplace, also collaborated with Controllership within Accenture Finance , to ultimately enable a cross-function, integrated approach.

Our objective was to launch a program to create a single system to manage software, hardware and workplace assets, establishing standard processes and facilitating consistent accounting and end-to-end life cycle management. Software covers license management and modernization of our current software catalog. Hardware assets include such items as workstations, mobile devices, servers, and video conferencing devices. And, workplace assets include such items as office furniture, fixtures, kitchen equipment and TVs.

A single solution would allow us to decommission the disparate range of tools that teams were using across the organization, reducing manual efforts and improving data quality and centralized management with better visibility on asset location and movement.

Accenture Enterprise Asset Management solution overview

Asset management process reengineering and software implementation: software, hardware and workplace

Estimated number of assets for migration

Software spend tracked

Estimated asset value

Software products tracked

When tech meets human ingenuity

Our cross-functional, enterprise asset management (EAM) program team needed to address an environment of disparate solutions and processes in order to migrate asset information to the ServiceNow Asset Management product. The goal was to have consistent global processes across Accenture and a capability to track assets from end to end with a single enterprise system.

Getting to this end state would require three phases of effort over a three-year period: establishing a foundational capability, deploying targeted geographies, and evolving the enterprise asset management (EAM) solution.

Establishing the foundation centered around rationalizing processes, data and establishing core integrations. Our project team migrated an initial 800,000 assets from disparate tools to the ServiceNow platform. This number is projected to reach 4 million. We rationalized data and implemented system controls to drive standardization and data integrity across asset information. Data governance controls and legal compliance guidelines were automated. Global ownership of data governance was established as well.

In addition, our team built integrations with ServiceNow and core platforms to drive automation with SAP Ariba for asset procurement and a single global SAP system instance for financial data. These connections help facilitate an integrated, end-to-end asset management life cycle by tracking assets from procurement until disposal, along with real-time audit and reconciliation capabilities.

During this time and in the subsequent phases, our team focused development on four key elements:

Global processes

Our team inventoried existing asset management processes across Accenture’s geographies and selected the best of them. We used these to reengineer new, end-to-end asset life cycle processes to get to a standard, global solution.

This solution can be customized at local levels to address specific regulatory compliance requirements. Designing this global process flow formed the "core" for deploying the asset management application in stages to Accenture’s 50 countries.

Custom portal

To provide an enhanced user experience, the team developed a custom, mobile-friendly service portal with an intuitive and interactive user interface. Key features include auto-generation of standardized asset tags and QR codes when assets are received. The asset manager capability lets asset teams view and edit assets, check the activity log as well as reprint asset tags. Asset teams can upload assets in bulk using an intuitive and easy-to-use template.

The portal is also accessible on mobile devices via a browser, making it easy for asset managers to tag assets and generate bar codes directly from their devices. For software managers, the portal enables end-user license management giving software owners the capability to allocate and manage the licenses they are responsible for. In addition, all Accenture people are able to view assets assigned to them and confirm receipt of assets shipped to them. This ability was especially important when thousands of laptops needed to be shipped to our people who needed to work remotely due to the COVID-19 pandemic.

The team created several role-based dashboards that provide real-time reporting to govern data. The dashboard for asset managers provides the ability to precisely track all their assets, confirm data governance and accurately forecast stock refresh.

Those in asset operations can monitor and directly engage in asset life cycle activities (movement, maintenance and disposal) and related compliance tasks. The dashboards for Accenture Controllership give users end-to-end visibility on fixed-asset creation, accruals and overall reconciliation of physical assets in the EAM system and fixed assets in SAP. The dashboard for software asset administrators displays actionable information, trends and a cost-savings view.

The integration of the dashboards with Accenture’s SAP ERP system facilitates financial reconciliation of assets and eliminates the need for users to toggle between ServiceNow and SAP to download and compare records. Manual effort is greatly reduced, and users now have one unified view of asset records and consolidated reports.

Working jointly with ServiceNow, the team developed a powerful mobile app to register, manage and periodically audit assets from anywhere. The app has several distinct features, one of which is a multi-scan capability that enables asset teams to scan QR or bar codes on multiple assets in one pass. The mobile app is integrated with the overall solution and automates and accelerates the amount of time it takes to register assets, resulting in increased operational efficiencies and major time savings.

Collaboration counts

The EAM program teams consist of many members with specialized skills from different locations, working on different areas but toward one common goal. In our day-to-day efforts, our teams engaged more than 200 global stakeholders representing 50 countries. Team members and stakeholders participated in design thinking workshops to complete a gap assessment of the current processes and then developed "to-be" processes to finalize designs. Business analysts converted those processes into user stories that were then passed to the development team to write the code.

Other teams at Accenture’s Innovation Centers collaborated on the mobile app development together with ServiceNow. The collaboration of all our teams made tremendous progress in deploying the asset management solution to nearly all of Accenture’s geographic units globally. We continue to evolve and improve the solution.

A valuable difference

Accenture is transforming the way the company tracks and manages software, hardware and workplace assets globally. This single, integrated solution significantly streamlines the process and helps to manage the life cycle of assets from beginning to end.

In just one Accenture location alone, the introduction of the mobile application to manage assets through their life cycles reduced time spent resolving location discrepancies by 40 percent, reduced the time to perform asset audits by 50 percent and improved asset issue resolution time by 25 percent.

When the COVID-19 pandemic set in and Accenture needed to move desktops and other hardware assets to employee homes quickly, our EAM program team was able to take advantage of the work accomplished to date. We quickly spun up an ad hoc asset tracking solution onto the ServiceNow platform, made some enhancements to the mobile app to enable check-in and check-out of the assets, as well as developed a way to automate the return-to-office process . These capabilities helped other Accenture teams quickly and effectively perform large numbers of equipment moves.

In terms of software, the management of software publishers that have previously audited Accenture has currently surpassed 67% and will continue to climb. The EAM system will provide time-saving reconciliation reports to possibly eliminate or avoid future software audits.

Data from the EAM system is also providing functionality previously unavailable for tracking workplace assets related to furniture moves within an office or between different office locations and managing the refurbishment and recycling of furniture. The data is helping to deliver cost benefits, enable depreciation and support our our sustainability efforts .

Benefits of Accenture’s enterprise asset management system on ServiceNow:

"This intelligent, automated asset management system is enabling a whole new level of agility, tracking and forecasting in our workplace. It is accessible and meets Web Content Accessibility Guidelines." — Margaret Smith , Senior Managing Director and Executive Director – Corporate Services & Sustainability and Business Operations, Accenture

Centralizes software, hardware and workplace assets, providing enterprise visibility

Standardizes the asset management process

Performs auto-discovery of software and hardware assets

Enables end-user license management and software requests

Enables anytime, anywhere access with a mobile app

Meets Web Content Accessibility Guidelines (WCAG)

Automates data controls, governance, and risk and compliance activities

Established governance and compliance policies

Meet the team

Tami McNairy

David Schneiderman

Renee Cordova Lottes

Indranil Datta

Related capabilities, how accenture does it, corporate services & sustainability.

These teams are enabling innovation, growth and business continuity for Accenture.

Accenture + ServiceNow

You are using an outdated browser. Please upgrade your browser to improve your experience.

- Manage operational risk

- Engage investors effectively

- Enhance and simplify portfolio management

- Access unique distribution insights

- Maximize marketing communications

- Drive a successful proxy outcome

- Maximize investor communications

- Simplify regulatory reporting

- Optimize trade processing

- Simplify regulatory and compliance reporting

- Maximize participant and plan sponsor engagement

- Equip advisors to grow their business

- Manage risk and optimize operational efficiency

- Adapt to growing investment complexity and regulatory burden

- Support operational control and scalability

- Transform trade life cycle

- Optimize operating model with financial services business process outsourcing

- Streamline trade support, governance and compliance services

- Enhance accuracy and visibility across the entire data life cycle

- Empower transformation with expertise

- Reach customers across print and digital channels

- Measure the impact of your communications

- Deliver relevant, personalized digital and print communications

- Turn information into intelligence

- Gain a single view of customer identities and preferences

- Transform your print and digital communications

- Enhance advisor marketing

- Tackle your Reg BI obligations with confidence

- Enhance the client experience with dynamic advisor tools

- Advance control, risk and support services

- Transform your trade life cycle

- Optimize your operating model with business process outsourcing

- Empower your transformation with confidence

- Optimize business operations

- Simplify the annual meeting process

- Simplify transfer agent services

- Build your brand and engage shareholders

- Gain insights and uncover opportunities

- Streamline communications to drive down cost

- Streamline disclosure and stay in compliance

- Maximize ESG impact and bolster long-term sustainability

- Increase efficiencies in managing cash and risk

- Streamline proxy and annual meeting services for your clients

- Take companies public with single-source simplicity

- Simplify capital markets and annual compliance disclosure

- Enhanced shareholder engagement for alternative investments

- Enhance marketing and sales, empower agents and brokers, and engage members

- Onboard members with personalized documents and experiences, including ID cards and welcome kits

- Make an impact with your correspondence, statements, bills and wellness programs

- Optimize and customize patient communications, including statements, Explanation of Payment (EOP) and claims

- 15(c) Board Reporting

22c-2 Compliance

- For Mutual Funds and ETF Providers

- For Retirement Services Providers

- Advisor Compensation

- Advisor Desktop Solutions

- Advisor Onboarding

Advisor Resource Center

- For Trust Services Providers

- For Wealth Management Firms

- Advisor Targeting

- Advisor Websites

- AdvisorStream

Annual Compliance

- For Corporate Issuer

- For Law Firms

- artificial intelligence

- Assessment of Value and Board Reporting

Asset Servicing

- For Capital Markets

- Association Election Management

Bank Debt and Loan Trading

- For Alternative Managers

- For CLO Managers

- For Fund Administrators and Prime Brokers

- Banking Book Collateral Management

Beneficial Proxy Services

Billing and expense management.

- Branded Shareholder Portal

Broadridge Alternative Investments Hub

Broadridge global custody solutions.

- Broadridge Intelligent Analytics

- Broadridge Wealth Aggregation & Insights

- BRx Match APAC

- Call Center

Capital Markets Disclosures

Cash management.

- Client Information Management

- Client Portal

Collateral Management

- For Global Investment Managers

- For Institutional Investors

- For Private Debt

- Communications Consulting

- Compliance and Regulatory Accounting

- Compliance and Regulatory Accounting Process Outsourcing

- Compliance Reporting

- Composition

- Composition and Publishing for Legal Documents

- Comprehensive management of EETs

Connectivity

Consumer preference and profile management.

- For Insurance

- For Retail Banking

- For Utilities

- Content Design and Management

- Content Management and Distribution

- Continuing Education

- Corporate Action

- Corporate Action Services

- Corporate Content

- Corporate Trade Confirmation Service

Credit and Market Risk

- Cross-border Fund Data & Document Distribution

- Customer Security Programme (CSP)

- Data Control Business Process Outsourcing

- Data Control Intelligent Automation

- Data Control Messaging and Connectivity

- Data Control Reconciliations

- Data Management Analytics and Reporting

Data Management and Archival

- Data Management Warehouse and Reporting

Data Management, Analytics and Reporting

- Deliver intelligent liquidity

- Derivatives Trade Processing

Digital Delivery

- For Consumer Finance

- For Telecom

- Digital Document Delivery

Digital Experience Management

- Digital Makes It Easy

- Digital Solutions

- Direct Marketing

- Disclosures for Mutual Funds

- Distributed Ledger Repo

Distributed Marketing Solution

Distribution 360.

- For Global Funds

- Distributor Feedback Template service for Consumer Duty

- DocuBuilder for Legal

- DocuBuilder for Marketing

Document Composition

- Document Composition and SEC Filing

- Dynamic Fund Board Reporting

- eCards and Custom Email

- Elevate Disclosures

- End to end Securities Based Lending

- Engagement Simplified

Enhanced Packaging

- For Non-Listed Issuer

Enhanced Proxy Design

- Equity Trade Processing

- ESG Advisory Services

- ESG Analyzer

- ESG Consulting Solutions

- European Fund Market Intelligence

- Expense Management

- Expense Management business process outsourcing

Fact Sheets

- FBF Intelligence

- fee and expense management

Fi360 Data and Analytics

Fi360 learning and development, fi360 software and technology.

- Finance and Accounting

- Financial Report Preparation and Filing

Financial Reporting

- Fixed Income Trade Processing

- Foreign Exchange Trade Processing

- Full Service Tender Processing

- Fully Paid Lending

- Fund Data Distribution with the Galaxia Data API

- Fund Investor Portal

- Fund Partner Reporting

Global Market Intelligence

- Global Post Trade Management

Global Securities Class Action Services

Global swift services.

- For Corporate Treasury

- Global Tax Reclaim and State Tax Reporting

- Intelligent Prospecting

- Interactive Online Document Management

- Intraday Repo Has Arrived on Scale

Intraday Risk Monitoring

Investment accounting.

- Investor and Advisor Mailbox

- Investor Intelligence

InvestorView

- IPO End to End Services

- Key Information Documents

- Legal Remediation Engine

Local Business Listings

- Managed Reference Data Service

Managed Services, Hosting and Integration

Market analytics, mifid ii compliance.

- Mortgage Backed Securities

- Multi-Channel Participant Communications

- Mutual Fund Data and Suitability

- Newsletters

- North American Post-Trade Processing

- Notice and Access & Inventory Management and Fulfillment

Operational Risk Management

- Pass-through Voting Insights

- Performance Analytics

Performance and Attribution

Performance dashboards and operational reports.

- Point-of-Sale Prospectus

Portfolio and Order Management

- Portfolio Management for CLOs

- Portfolio Management for Private Debt

Portfolio Securities Voting

Post trade and regulatory compliance.

- Post trade FastStart

- Post Trade Matching

- Post Trade Processing Business Process Outsourcing

- Post Trade Processing Business Process Outsourcing for EMEA and APAC

- Post-Trade Processing

Pricing and Valuation

- PRIIP KID and EPT Production Reporting and Distribution

- Principal Risk Trading and Market Making

Print Delivery and Postal Optimization

- Print Marketing

- Print Solutions

- Professional Services

- Proxy Management

- Proxy Policies and Insights

Proxy Services

- ProxyDisclosure

- RealTime Content

Reconciliation

- Reconciliation for Corporate Treasury

- Reconciliation Managed Services

- Reference Data Business Process Outsourcing

Reference Data Management

Registered proxy services.

- Regulatory and Investor Communications

Regulatory Communications

- Regulatory Trade and Transaction Reporting

- Retirement CX

- Revport custodian bank billing management

- Risk and Transparency Reporting

Sales and Asset Reporting

Securities finance.

- SFT Submission Service

- Share Management Solution

- Shareholder Communications

Shareholder Data Services

- Shareholder Meeting Registration

- Smart Solutions for Reg BI

- Solvency II Reporting

Sponsored Name Placement

Stock transfer, tax services, trade processing and settlement.

- Trade Surveillance and Compliance

Trading Platforms

Translation services, trust and custody services.

- UCITS KIIDs and EMT Production and Distribution

- Video Studio

Virtual Shareholder Meeting

Visual analytics.

- Wealth Insight Services

- Welcome Kits and ID Cards

- Practice Areas

- Communications and Customer Experience Consulting

- Operations Innovation and Execution

- ICON. Search Search

- Solutions & Products

- Client Support

- Corporate Issuer

- Corporate Treasury

- Non-Listed Issuer

Segment Title

Solution title, the right insights, right now.

Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

About broadridge.

Global websites:

How can we help?

Additional Broadridge resources:

View our Contact Us page for additional information.

One of our sales representatives will email you about your submission.

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.

Want to speak with a sales representative?

Thank You for reaching our sales rep

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Let’s talk about what’s next for you Talk to us

Our representatives and specialists are ready with the solutions you need to advance your business.

Thank you .

Parlons de ce qui vous attend talk to us.

Nos représentants et nos spécialistes sont prêts à vous apporter les solutions dont vous avez besoin pour faire progresser votre entreprise.

Vous voulez parler à un représentant commercial?

Votre soumission a été reçue. Nous communiquerons avec vous sous peu.

Vous souhaitez parler à un commercial ?

Asset Management Operations Case Studies

- Sustainability

- Case Studies

- Asset Management

- Operations & Maintenance

- Financial Services

- Strategic Control Services

- Ancillary Services

- Consulting Services

- Explore Opportunities

- Employee Portal

Driving ESG results for diverse investments

CAMS eSPARC implemented an investor-responsive ESG program and supported development of Annual General Meeting materials and an annual ESG report.

See what Industries we serve

- Case Studies

Case Study Basics

What is a case study *.

A case study is a snapshot of an organization or an industry wrestling with a dilemma, written to serve a set of pedagogical objectives. Whether raw or cooked , what distinguishes a pedagogical case study from other writing is that it centers on one or more dilemmas. Rather than take in information passively, a case study invites readers to engage the material in the case to solve the problems presented. Whatever the case structure, the best classroom cases all have these attributes: (1)The case discusses issues that allow for a number of different courses of action – the issues discussed are not “no-brainers,” (2) the case makes the management issues as compelling as possible by providing rich background and detail, and (3) the case invites the creative use of analytical management tools.

Case studies are immensely useful as teaching tools and sources of research ideas. They build a reservoir of subject knowledge and help students develop analytical skills. For the faculty, cases provide unparalleled insights into the continually evolving world of management and may inspire further theoretical inquiry.

There are many case formats. A traditional case study presents a management issue or issues calling for resolution and action. It generally breaks off at a decision point with the manager weighing a number of different options. It puts the student in the decision-maker’s shoes and allows the student to understand the stakes involved. In other instances, a case study is more of a forensic exercise. The operations and history of a company or an industry will be presented without reference to a specific dilemma. The instructor will then ask students to comment on how the organization operates, to look for the key success factors, critical relationships, and underlying sources of value. A written case will pre-package appropriate material for students, while an online case may provide a wider variety of topics in a less linear manner.

Choosing Participants for a Case Study

Many organizations cooperate in case studies out of a desire to contribute to management education. They understand the need for management school professors and students to keep current with practice.

Organizations also cooperate in order to gain exposure in management school classrooms. The increased visibility and knowledge about an organization’s operations and culture can lead to subsidiary benefits such as improved recruiting.

Finally, organizations participate because reading a case about their operations and decision making written by a neutral observer can generate useful insights. A case study preserves a moment in time and chronicles an otherwise hidden history. Managers who visit the classroom to view the case discussion generally find the experience invigorating.

The Final Product

Cases are usually written as narratives that take the reader through the events leading to the decision point, including relevant information on the historical, competitive, legal, technical, and political environment facing the organization. A written case study generally runs from 5,000 to 10,000 words of text supplemented with numerous pages of data exhibits. An online raw case may have less original text, but will require students to extract information from multiple original documents, videos of company leaders discussing the challenges, photographs, and links to articles and websites.

The first time a case is taught represents something of a test run. As students react to the material, plan to revise the case to include additional information or to delete data that does not appear useful. If the organization’s managers attend the class, their responses to student comments and questions may suggest some case revisions as well.

The sponsoring professor will generally write a “teaching note” to give other instructors advice on how to structure classroom discussion and useful bits of analysis that can be included to explicate the issues highlighted in the case study.

Finally, one case may inspire another. Either during the case writing process or after a case is done, a second “B” case might be useful to write that outlines what the organization did or that outlines new challenges faced by the organization after the timeframe of the initial case study.

* Portions of this note are adapted from E. Raymond Corey, “Writing Cases and Teaching Notes,” Harvard Business School case 399-077, with updates to reflect Yale School of Management practices for traditional and raw cases.

- The Case for MR

- The Case for AM

- Strategic Plan

- Board of Directors

- Corporate Members

- Allied Members

- Individual Members

- Technical Project Teams

- Chapters / les réseaux

- Association Partnerships

- Shared Learning Library

- Discussion Forums

- Glossary of Terms

- Submit Content

- MMP Program

- AMP Program

- CAMA Prep Course

- Private Offerings

- Teaching Institution Contacts

- PEMAC Instructors

- Information Session

- Funding for PEMAC Education

- Certified Individuals

- Maintenance Management Professional (MMP)

- Certified Asset Management Professional (CAMP)

- Globally Aligned Certifications: CTAM, CPAM, CSAM

- CAMA Certification

- NEW | Maintenance Strategy Development Certificate

- Maintenance Work Management Certificate

- Maintenance Management

- Asset Management

- Member Awards

- Call for Abstracts

- Registration

- Sponsorship

- Plan Your Trip & Hotel Info

- Current Sponsors

- MainTrain History

- Certification et Adhésion (FR)

- Certification & Membership (EN)

The Case for Asset Management

What is asset management.

It's a balancing act between cost, risk and performance. We invite you to watch this 5 minute video for a great overview:

Why Asset Management?

Case studies that highlight the benefits of asset management.

PEMAC is producing a series of Canadian case studies in video format that highlight the real-world benefits of applying Asset Management principles. These will be organized according to the four fundamentals, "Assurance", "Alignment", "Value", and "Leadership".

The initial funding for this project has come from a grant that we received through FCM’s Municipal Asset Management Program (MAMP) (see bottom of the page for more information). Asset Management benefits are not only being realized by municipalities. We will start with municipal stories and move on from there.

Questions leaders can ask to drive the conversation

This initiative is delivered through the Municipal Asset Management Program, which is delivered by the Federation of Canadian Municipalities and funded by the Government of Canada.

Funding for this initiative is provided through FCM’s Municipal Asset Management Program (MAMP), an eight-year, $110-million program, delivered through the Federation of Canadian Municipalities and funded by the Government of Canada.

- Open opportunities

- Working with AWS

- In the News

- Clients Clients Our Clients Clients Case Studies Client News

- Resources Resoures Solution Resources Brochures Analyst Reports Case Studies Videos Webinars More Resources Whitepapers Reports Podcasts Newsroom Press room In den Nachrichten Insights Blog Events Global AML Fines Research Report 2023 KYC Trends in 2023 – A Global Research Report The Expert’s Guide to Digitalizing Compliance

Global Asset Management Firm

Find out how a Global Asset Management firm keeps up with onboarding demands of new, complex regulatory jurisdictions through digital transformation.

Fill form to unlock content

Error - something went wrong!

Access the resource now

This US-headquartered global Asset Management firm has implemented Client Lifecycle Management (CLM) from Fenergo in a complete digital transformation of its client onboarding systems. The transformation, undertaken to adapt to specific regulatory challenges in new jurisdictions, started in its wealth management division.

The firm, which operates mainly in the US but is actively globally, focuses on retail and institutional investing, offering its clients comprehensive financial planning and educational resources on investing and other financial topics.

“The Fenergo implementation team worked well with our internal team and delivered real change to our client onboarding process in a few months” – Product Owner at Asset Management Firm.

This digital transformation project went beyond customer onboarding and know your customer (KYC) processes to encompass the full breadth of the client lifecycle, as the previous approach was manual, error-prone, inefficient, lacked an audit trail, had no automation and inefficient workflow paths, and was siloed. All these shortcomings in the system led to excessive onboarding times, high abandonment rates, and significant churn of internal compliance staff - all issues that Fenergo is designed to overcome.

Digital CLM has a huge impact on the operating efficiency of any business, especially one that is active in multiple jurisdictions.

For this global asset management firm, Fenergo:

- Reduced anti-money laundering (AML) and KYC processing times by an average of 77%

- Enabled the firm to move rapidly into new markets and respond to regulatory demands

- Optimized onboarding, allowing relationship managers to focus on revenue generation

Download the full case study to see how the firm overcame complex jurisdictional regulatory requirements and achieved success by implementing Fenergo.

- Browse All Articles

- Newsletter Sign-Up

- 23 Jan 2024

More Than Memes: NFTs Could Be the Next Gen Deed for a Digital World

Non-fungible tokens might seem like a fad approach to selling memes, but the concept could help companies open new markets and build communities. Scott Duke Kominers and Steve Kaczynski go beyond the NFT hype in their book, The Everything Token.

- 12 May 2020

- Working Paper Summaries

Elusive Safety: The New Geography of Capital Flows and Risk

Examining motives and incentives behind the growing international flows of US-denominated securities, this study finds that dollar-denominated capital flows are increasingly intermediated by tax haven financial centers and nonbank financial institutions.

- 31 May 2017

Stock Price Synchronicity and Material Sustainability Information

This paper seeks to understand and provide evidence on the characteristics of emerging accounting standards for sustainability information. Given that a large number of institutional investors seek sustainability data and have committed to using it, it is increasingly important to develop a robust accounting infrastructure for the reporting of such information.

- 15 Aug 2016

Liquidity Transformation in Asset Management: Evidence from the Cash Holdings of Mutual Funds

A key function of many financial intermediaries is liquidity transformation: creating liquid claims backed by illiquid assets. To date it has been difficult to measure liquidity transformation for asset managers. The study proposes a novel measure of liquidity transformation: funds’ cash management strategies. The study validates the measure and shows that liquidity transformation by asset managers is highly dependent on the traditional and shadow banking sectors.

- 15 Feb 2016

Replicating Private Equity with Value Investing, Homemade Leverage, and Hold-to-Maturity Accounting

This paper studies the asset selection of private equity investors and the risk and return properties of passive portfolios with similarly selected investments in publicly traded securities. Results indicate that sophisticated institutional investors appear to significantly overpay for the portfolio management services associated with private equity investments.

- 25 Sep 2015

Invest in Information or Wing It? A Model of Dynamic Pricing with Seller Learning

Dealers who need to price idiosyncratic products--like houses, artwork, and used cars--often struggle with a lack of information about the demand for their specific items. Analyzing sales data from the used-car retail market, the authors of this paper develop a model of dynamic pricing for idiosyncratic products, showing that seller learning has an impact on pricing dynamics through a rich set of mechanisms. Overall, findings suggest a potentially high return to taking a more serious information-based approach to pricing idiosyncratic products.

- 20 Jan 2009

- Research & Ideas

Risky Business with Structured Finance

How did the process of securitization transform trillions of dollars of risky assets into securities that many considered to be a safe bet? HBS professors Joshua D. Coval and Erik Stafford, with Princeton colleague Jakub Jurek, authors of a new paper, have ideas. Key concepts include: Over the past decade, risks have been repackaged to create triple-A-rated securities. Even modest imprecision in estimating underlying risks is magnified disproportionately when securities are pooled and tranched, as shown in a modeling exercise. Ratings of structured finance products, which make no distinction between the different sources of default risk, are particularly useless for determining prices and fair rates of compensation for these risks. Going forward, it would be best to eliminate any sanction of ratings as a guide to investment policy and capital requirements. It is important to focus on measuring and judging the system's aggregate amount of leverage and to understand the exposures that financial institutions actually have. Closed for comment; 0 Comments.

- 30 Aug 2004

Real Estate: The Most Imperfect Asset

Real estate is the largest asset class in the world—and also the most imperfect, says Harvard Business School professor Arthur Segel. He discusses trends toward institutionalization, environmentalism, and globalization. Closed for comment; 0 Comments.

How do Private Equity Fees Vary Across Public Pensions?

As state and local defined-benefit pensions increasingly shift capital from traditional asset classes to private-market investment vehicles, this analysis shows that public pensions investing in the same private-market fund can experience very different returns.

Please update your browser.

- Careers Home

- Student & Graduate Careers

- Jobs, Student Programs & Internships

Asset and Wealth Management Challenge

Discover where your skills can take you.

Our Asset & Wealth Management business provides strategies that encompass the full spectrum of asset classes. Our global investment professionals provide personalized service and advice for individuals, advisors and institutions. Learn about Asset & Wealth Management by immersing yourself in the dynamics and decisions of this case challenge. Through a hypothetical case study, you’ll find out what it takes to work as an Analyst in Asset Management or Global Private Bank. Take this opportunity to learn more about the industry and the important role we play in it.

Program information

Learn more about our Asset and Wealth Management Challenge

What you'll do

Who we're looking for

What we offer

As part of the challenge, you’ll compete in a team of four across different locations in Asia by completing a case study. You’ll gain knowledge of how the business works, get access to senior leaders and gain invaluable skills to prepare you for future opportunities at the firm. The Competition will consist of written submissions and presentations. It will be held independently in each location with two phases – “First Round” and “Second Round”. Finalists of each location will move on to compete in the Final Round.

Desired qualities

We're looking for motivated and driven team players with excellent communication and analytical skills; highly inquisitive, focused and collaborative. You enjoy tackling new challenges and solving intellectual problems.

We're looking for excellent problem solvers with a strong interest in financial markets and economic trends.

On-the-job experience

The Challenge puts you right in the middle of the action. Through a hypothetical case study, you'll find out what it takes to work as an Analyst in Global Private Bank. Students will work in teams of 4 to complete a case study analysis, gaining exposure to asset allocation, client management and scenario analysis. You’ll develop valuable industry knowledge, communication and analytical skills.

Teams that move past the first round will work with J.P. Morgan business representatives and mentors to provide guidance and advice on their presentations from second round to final round.

Career Progression

Participants who perform well may have the opportunity to have their application prioritized for review in consideration for our upcoming summer internships.

Our people

How we hire

Where we work

Our presence in over 100 markets around the globe means we can serve millions of consumers, small businesses and many of the world's most prominent corporate, institutional and government clients.

Keep in touch

Join our Talent Network to stay informed on news, events, opportunities and deadlines.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.

Global Consultant Relations

Case Study: Advantage Factor Portfolios

The consultant.

We worked with a global investment consultant operating in more than 140 countries with a client base spanning all types of institutional investors. The consultant’s mandate was to design and deliver solutions that manage risk, cultivate talent, and expand the power of lower downside capture to strengthen the investment returns of institutions and individuals.

The Objective

The consultant wanted a customized solution for its soon-to-be-launched sub-advised fund. The fund targeted US defined benefit plans as part of its outsourced chief investment officer business. We created a global equity portfolio with targeted risk exposures and core style exposures that also met fee requirements.

LAM’s Solution

We created a customized solution consisting of a diversified, active, and systematic equity portfolio. The potential alpha sources were growth, value, quality, and sentiment ̶ and the portfolio was managed versus the MSCI World IMI Index. We also worked with the client to develop the portfolio’s target outperformance per annum net of fees with lower volatility than the market, with an active risk target per annum.

Confirm or Change your Location

United States

Choose your professional status:

If you are not a United States investor, then the following pages are not directed at you. By continuing you agree to the Terms Of Use of this site.

Save my location preferences and remember me for later use. Read our Cookie Policy

Our Cookie Usage

We use cookies on our site in order to tailor our content to your needs. By continuing to use this site, you give us consent. Read our Cookie Policy for more details.

Log in to view your Bookmarks & Preferences

Don't have an Account?

Sign up to save your Bookmarks & Preferences

Looking for your Client Login?

Log Into your Client Account here

Contact Us page">For additional help, please visit our Contact Us page

Create an Account

Want to Bookmark Content?

Create an account to keep track of your interests and save your preferences for the site

Only 3 simple questions

Already have an account?

Professional Use Only

Are You a Professional?

The Following information is only appropriate for Professional Investors. If you are a professional investor, please change your professional role in Account Preferences. We will redirect you to the content after you make the necessary changes.

The Following information is only appropriate for Professional Investors . By clicking accept, you confirm that you have read the professional Terms of Use and can legally access this content.

Go Back to the Homepage

Your browser is not supported

Sorry but it looks as if your browser is out of date. To get the best experience using our site we recommend that you upgrade or switch browsers.

Find a solution

We use cookies to improve your experience on this website. To learn more, including how to block cookies, read our privacy policy .

- Skip to main content

- Skip to navigation

- Collaboration Platform

- Data Portal

- Reporting Tool

- PRI Academy

- PRI Applications

- Back to parent navigation item

- What are the Principles for Responsible Investment?

- PRI 2021-24 strategy

- A blueprint for responsible investment

- About the PRI

- Annual report

- Public communications policy

- Financial information

- Procurement

- PRI sustainability

- Diversity, Equity & Inclusion for our employees

- Meet the team

- Board members

- Board committees

- 2023 PRI Board annual elections

- Signatory General Meeting (SGM)

- Signatory rights

- Serious violations policy

- Formal consultations

- Signatories

- Signatory resources

- Become a signatory

- Get involved

- Signatory directory

- Quarterly signatory update

- Multi-lingual resources

- Espacio Hispanohablante

- Programme Francophone

- Reporting & assessment

- R&A Updates

- Public signatory reports

- Progression pathways

- Showcasing leadership

- The PRI Awards

- News & events

- The PRI podcast

- News & press

- Upcoming events

- PRI in Person 2024

- All events & webinars

- Industry events

- Past events

- PRI in Person 2023 highlights

- PRI in Person & Online 2022 highlights

- PRI China Conference: Investing for Net-Zero and SDGs

- PRI Digital Forums

- Webinars on demand

- Investment tools

- Introductory guides to responsible investment

- Principles to Practice

- Stewardship

- Collaborative engagements

- Active Ownership 2.0

- Listed equity

- Passive investments

- Fixed income

- Credit risk and ratings

- Private debt

- Securitised debt

- Sovereign debt

- Sub-sovereign debt

- Private markets

- Private equity

- Real estate

- Climate change for private markets

- Infrastructure and other real assets

- Infrastructure

- Hedge funds

- Investing for nature: Resource hub

- Asset owner resources

- Strategy, policy and strategic asset allocation

- Mandate requirements and RfPs

- Manager selection

- Manager appointment

- Manager monitoring

- Asset owner DDQs

- Sustainability issues

- Environmental, social and governance issues

- Environmental issues

- Circular economy

- Social issues

- Social issues - case studies

- Social issues - podcasts

- Social issues - webinars

- Social issues - blogs

- Cobalt and the extractives industry

- Clothing and Apparel Supply Chain

- Human rights

- Human rights - case studies

- Modern slavery and labour rights

- Just transition

- Governance issues

- Tax fairness

- Responsible political engagement

- Cyber security

- Executive pay

- Corporate purpose

- Anti-corruption

- Whistleblowing

- Director nominations

- Climate change

- The PRI and COP28

- Inevitable Policy Response

- UN-convened Net-Zero Asset Owner Alliance

- Sustainability outcomes

- Sustainable Development Goals

- Sustainable markets

- Sustainable financial system

- Driving meaningful data

- Private retirement systems and sustainability

- Academic blogs

- Academic Seminar series

- Introduction to responsible investing academic research

- The Reynolds & Gifford PRI Grant

- Our policy approach

- Policy reports

- Consultations and letters

- Global policy

- Policy toolkit

- Policy engagement handbook

- Regulation database

- A Legal Framework for Impact

- Fiduciary duty

- Australia policy

- Canada Policy

- China policy

- Stewardship in China

- EU taxonomy

- Japan policy

- SEC ESG-Related Disclosure

- More from navigation items

Sycomore Asset Management: Assessing the societal contribution of companies

2022-12-12T12:16:00+00:00

ORGANSATION DETAILS

Name: Sycomore Asset Management

Signatory type: Investment manager

HQ location: Paris

Assets under management: €7bn

COVERED IN THIS CASE STUDY

Asset class(es): Equity, Fixed Income

Geography: Global

Sector(s): Pharmaceuticals

Introduction

We invest to develop a more sustainable and inclusive economy and to generate positive impacts for all of our stakeholders. Our mission: make investment more human.

Our ambition to give meaning to our clients’ investments by creating sustainable and shared value is central to our mission. This is also reflected in our B-corp certification and Entreprise à mission status (obtained in 2020). Through our investments, we want to demonstrate that purpose and performance can be combined.

Why we focus on SDG outcomes

As a responsible investment manager, it is our duty to channel investments towards a more sustainable economy and to support companies seeking to address the UN Sustainable Development Goals (SDGs).

We believe that companies that meet the world’s fundamental societal and/or environmental needs, and that build strong and fair relationships with their stakeholders, will last and perform well in the long run.

How we focus on SDG outcomes

As part of our process for measuring the sustainability performance of our funds, we look at how companies’ products and services address societal challenges. We do this by calculating their Societal Contribution – the focus of this case study.

For funds with specific environment or social goals, we use the Societal Contribution metric (alongside an environmental metric – the Net Environmental Contribution ) to select suitable investments.

The Societal Contribution

We measure the Societal Contribution of a company by assessing the products and services it offers and the jobs generated by its activities, across four pillars:

- Access and Inclusion

- Health and Safety

- Economic and Human Progress

Methodology

The Societal Contribution is a quantitative metric – it ranges from -100% to +100% and aggregates the positive and negative societal contributions of a sector or company’s activities. Where we use this metric as part of our selection criteria for specific funds, we will only consider companies that score +10% or more.

Quantifying the societal impacts of economic activities is challenging – due to the diversity of issues and how they interlink, local particularities and the lack of consensus on solutions required, among others.

Through the Societal Contribution metric, which we started developing in 2016, we aim to objectively compare different business models and how they can address the major societal issues the world is facing.

Our methodology draws on the 17 SDGs and their 169 targets. It also includes macroeconomic and scientific data sourced from public research institutions, and from non-governmental organisations such as the Access to Medicine Foundation or the Access to Nutrition Initiative.

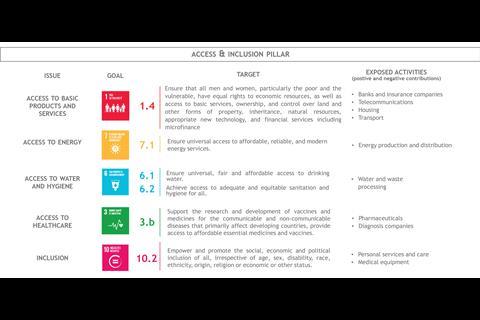

The main issues and related business activities covered by the four pillars, and the relevant SDGs and corresponding targets, are shown in Figure 1 below.

Not all pillars, SDG targets and sub-targets will apply to all companies. We outline which themes, issues and indicators are applicable to companies operating in particular sectors – which we call sector frameworks – based on where we think they can make a material contribution through their products and services.

Consequently, we only evaluate two or three pillars for some sectors, and companies. This is the case for the pharmaceutical sector, which we discuss in the example below.

We then use these sector frameworks to calculate the societal contribution of companies operating in those sectors.

Figure 1: Societal Contribution pillars

Assessing the four pillars

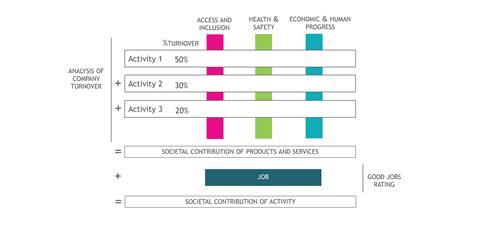

The Societal Contribution is the sum of a company’s positive and/or negative contributions to the relevant pillars. It includes:

- We assess how a company’s activities contribute to Access and Inclusion, Health and Safety and/or Economic and Human Progress, based on a sector framework.

- Each activity is scored on its contribution, and each score is weighted based on the percentage of revenue that activity represents.

- We assess positive and negative contributions in the same way – using a sector-level baseline; a specific product-level indicator or – where something is difficult to quantify – applying a bonus or penalty in the presence or absence of a certain factor.

- We assess a company’s contribution as an employer using The Good Jobs Rating , a dedicated tool we developed in partnership with The Good Economy.

- It can vary between -25% and +25%. This scale has been defined to give the contribution of products and services a greater weight in the Societal Contribution, because we view it as the main contribution lever of a company.

Figure 2: Societal Contribution assessment

A company creating moderate positive contributions towards several issues can display a Societal Contribution similar to a company that contributes more strongly to a single issue.

Example of a sector framework: The Societal Contribution of pharmaceutical companies

Below we outline how we use a sector framework to determine the Societal Contribution of companies in the pharmaceutical sector.

We believe the pharmaceutical sector contributes to two material social issues:

- Therapeutic innovation (SDG targets 3.3 and 3.4)

- Access to medicine (SDG targets 3.8 and 3.b)

Contribution to therapeutic innovation (Health and Safety)

We assign a basic contribution to health of +25% to all companies in the pharmaceutical sector. We then calculate specific contributions for the following elements:

- Prescription and reimbursement procedures (over-the-counter or prescription medications, original brand or generic)

- Diseases addressed

- External evidence of therapeutic innovation

To assess the extent of contribution, we look at:

- Global health estimates from the World Health Organization (WHO), to identify which diseases most contribute to the Global Burden of Disease ;

- The databases of the European Medicines Agency, US Food and Drug Administration and Haute Autorité de Santé, to measure the extent of a company’s therapeutic innovation.

Finally, we assign a -10% penalty to all pharmaceutical revenues, to take into account the risk of side effects.

Contribution to access to medicine (Access and Inclusion)

We attribute a +25% contribution to revenues generated in developing countries (those classified as low- and middle-income countries by the World Bank ).

We attribute a +25% contribution to revenue shares generated from generic drugs that help to reduce the price of medicines.

Some of the large pharmaceutical groups we evaluate are listed in the Access to Medicine Index . We give these companies a bonus score if they appear in the highest quartile for certain indicators from the ranking, such as the percentage of the product portfolio covered by equitable pricing strategies and the share of pipeline targeting health priorities in developing countries.

Contribution through employment

Finally, we assess a company’s contribution to employment based on The Good Jobs Rating . It assesses a company’s overall ability to create sustainable and quality job opportunities for all, and notably in areas – countries or regions – where employment is relatively scarce and therefore needed to ensure a sustainable and inclusive development.

We use three dimensions – quantity, quality & inclusion – to analyse the Employment factor. The methodology draws on company, regional and sector-based macroeconomic data.

Together, these contributions determine the Societal Contribution of pharmaceutical companies.

How the Societal Contribution is used in our investment process

We use the Societal Contribution metric as part of an in-house fundamental analysis model called SPICE, which focuses on five stakeholders ( Society and suppliers ; People (e.g. employees); Investors ; Customers ; and Environment ).

Before making an investment, we assess how companies integrate sustainable development into their operations and business practices and score them on each stakeholder group accordingly.

A company’s Societal Contribution and a separate corporate citizenship rating form their score for the society stakeholder component (the S in SPICE). [1]

We then use the overall SPICE rating as an investment selection criteria across all socially responsible investment funds.

In some cases, we also use the Societal Contribution as a standalone selection criteria for specific funds, and will only consider companies that score +10% or more.

[1] More information on these metrics, and the SPICE analysis, can be found in our responsible investment approach .

- Developed Markets

- SDG case studies

Related content

The role of the G7 in driving the economic transition

Investor briefing: EU Corporate Sustainability Due Diligence Directive (CSDDD)

PRI and IIGCC policy briefing on key sustainable finance policy priorities for the UK

Labelled bonds and loans: Do they do what they say on the tin?

More from Sustainability outcomes - case studies

Mirova: Using the SDGs to accelerate sustainable economic transformation

The Sustainable Development Investments Asset Owner Platform: Aligning portfolios with the SDGs

Volery Capital Partners: Economic inclusion

- News and press

- Annual Report

- PRI governance

- Privacy policy

- The PRI is an investor initiative in partnership with UNEP Finance Initiative and UN Global Compact .

- PRI Association, 25 Camperdown Street, London, E1 8DZ, UK

- Company no: 7207947

- +44 (0)20 3714 3141

- [email protected]

- PRI DISCLAIMER The information contained on this website is meant for the purposes of information only and is not intended to be investment, legal, tax or other advice, nor is it intended to be relied upon in making an investment or other decision. All content is provided with the understanding that the authors and publishers are not providing advice on legal, economic, investment or other professional issues and services. PRI Association is not responsible for the content of websites and information resources that may be referenced. The access provided to these sites or the provision of such information resources does not constitute an endorsement by PRI Association of the information contained therein. PRI Association is not responsible for any errors or omissions, for any decision made or action taken based on information on this website or for any loss or damage arising from or caused by such decision or action. All information is provided “as-is” with no guarantee of completeness, accuracy or timeliness, or of the results obtained from the use of this information, and without warranty of any kind, expressed or implied. Content authored by PRI Association For content authored by PRI Association, except where expressly stated otherwise, the opinions, recommendations, findings, interpretations and conclusions expressed are those of PRI Association alone, and do not necessarily represent the views of any contributors or any signatories to the Principles for Responsible Investment (individually or as a whole). It should not be inferred that any other organisation referenced endorses or agrees with any conclusions set out. The inclusion of company examples does not in any way constitute an endorsement of these organisations by PRI Association or the signatories to the Principles for Responsible Investment. While we have endeavoured to ensure that information has been obtained from reliable and up-to-date sources, the changing nature of statistics, laws, rules and regulations may result in delays, omissions or inaccuracies in information. Content authored by third parties The accuracy of any content provided by an external contributor remains the responsibility of such external contributor. The views expressed in any content provided by external contributors are those of the external contributor(s) alone, and are neither endorsed by, nor necessarily correspond with, the views of PRI Association or any signatories to the Principles for Responsible Investment other than the external contributor(s) named as authors.

Site powered by Webvision Cloud

A Case Study Regarding Asset Management at a Bakery Processing Industry and the Challenges Presented for the Maintenance of Its Industrial Equipment

- Conference paper

- First Online: 29 May 2024

- Cite this conference paper

- João Garrido 14 ,

- Ana C. V. Vieira 14 , 15 , 16 , 17 &

- José T. Farinha 14 , 15

Part of the book series: Mechanisms and Machine Science ((Mechan. Machine Science,volume 152))

Included in the following conference series:

- International conference on the Efficiency and Performance Engineering Network

- International Conference on Maintenance Engineering

- International Workshop on Defence Applications of Multi-Agent Systems

24 Accesses

The strict normative and regulatory requirements to which the food industry is subject, present challenges to its assets management. For these companies, proper maintenance management and organization of their industrial equipment is essential. It is important to guarantee the necessary safety and security conditions, supported in detailed and updated information regarding assets, aiming to manage its life cycle, namely the operation phase. The preceding permits to increase the competitiveness, because the production is directly related to the equipment’s Availability. In this context, this paper presents activities carried out at a bakery company at Portugal, with the main objective of introducing an asset management policy supported by preventive maintenance and continuous improvement of processes, such as issuing work orders and managing of spare parts, through a Computerized Maintenance Management System (CMMS), thus increasing the productivity of tasks inherent to the team. In the preparation of the preventive maintenance plan, the well-known and most common failures in the equipment, the criticality of the assets as well as the knowledge of maintenance technicians who worked with this equipment from the beginning of its life cycle were considered, based on the historical information available in the system. Connecting these plans with a perspective of continuous improvement growing within the organization, it was possible to set goals and strategically plan the management of these assets, focusing on maximizing their availability, adjusting tasks and periodicity preventing possible breakdowns.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

ISO 55000: Asset Management—Overview, Principles and Terminology (2014)

Google Scholar

Parra, C., González-Prida, V., Candón, E., De la Fuente, A., Martínez-Galán, P., Crespo, A.: Integration of asset management standard ISO55000 with a maintenance management model. In: Márquez, A.C., Komljenovic, D., Amadi-Echendu, J. (eds.), 14th WCEAM Proceedings, pp. 189–200. Springer, Cham (2021). https://doi.org/10.1007/978-3-030-64228-0_17

Farinha, J.: Asset Maintenance Engineering Methodologies, 1st edn. CRC Press, Coimbra (2018). https://doi.org/10.1201/9781315232867

EN 16646: Maintenance—Maintenance Within Physical Asset Management (2014)

Conceição, J.L., Vieira, A.C., Santos, R.M.: Maintenance management challenges for the region of Médio Tejo. In: Farinha, J.T., Galar, D. (eds.), Proceedings of Maintenance, Performance, Measurement and Management (MPMM 2018)—The Future of Maintenance, pp. 45–50. Faculdade de Ciências e Tecnologia da Universidade de Coimbra, Departamento de Engenharia Mecánica, Imprensa da Universidade de Coimbra, Coimbra (2018)

Savov, A., Kouzmanov, G.: Food quality and safety standards at a glance. Biotechnol. Biotechnol. Equip. 23 (4), 1462–1468 (2009). https://doi.org/10.2478/V10133-009-0012-8

Article Google Scholar

Condrea, E., Constatinescu, G., Stanciu, A., Constandache, M.: Particularities of FSSC 22000—food safety management system. J. Environ. Prot. Ecol. 16 (1), 274–279 (2015)

Smith, D.: Global Food Safety Initiative scheme audit requirements regarding cleaning tool and utensil selection and maintenance—a review. Qual. Assur. Saf. Crops Foods 11 (7), 603–611 (2019). https://doi.org/10.3920/QAS2018.1409

IFS Food: Food Standard for Auditing Quality and Food Safety Products, version 6.1. International Featured Standards (2017)

BRC Food: Global Standard Food Safety, issue 8. British Retail Consortium, London, UK (2018)

Koronios, A., Lin, S., Gao, J.: A data quality model for asset management in engineering organisations. In: International Conference on Information Quality (MIT IQ Conference) (2005)

Kans, M.: An approach for determining the requirements of computerised maintenance management systems. Comput. Ind. 59 (1), 32–40 (2008). https://doi.org/10.1016/j.compind.2007.06.003

Download references

Author information

Authors and affiliations.

Polytechnic Institute of Coimbra, Coimbra Institute of Engineering, Rua Pedro Nunes-Quinta da Nora, 3030-199, Coimbra, Portugal

João Garrido, Ana C. V. Vieira & José T. Farinha

RCM2+ Research Centre for Asset Management and Systems Engineering, Polytechnic Institute of Coimbra, Coimbra Institute of Engineering, Rua Pedro Nunes-Quinta da Nora, 3030-199, Coimbra, Portugal

Ana C. V. Vieira & José T. Farinha

CISE—Electromechatronic Systems Research Centre, Universidade da Beira Interior, Calçada Fonte do Lameiro, 6201-001, Covilhã, Portugal

Ana C. V. Vieira

Ci2—Smart Cities Research Center, Polytechnic Institute of Tomar, Tomar, Portugal

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to João Garrido .

Editor information

Editors and affiliations.

University of Huddersfield, Huddersfield, UK

Andrew D. Ball

Foundation Building, University of Liverpool, Liverpool, UK

Huajiang Ouyang

University of Manchester, Manchester, UK

Jyoti K. Sinha

Rights and permissions

Reprints and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper.

Garrido, J., Vieira, A.C.V., Farinha, J.T. (2024). A Case Study Regarding Asset Management at a Bakery Processing Industry and the Challenges Presented for the Maintenance of Its Industrial Equipment. In: Ball, A.D., Ouyang, H., Sinha, J.K., Wang, Z. (eds) Proceedings of the UNIfied Conference of DAMAS, IncoME and TEPEN Conferences (UNIfied 2023). TEPEN IncoME-V DAMAS 2023 2023 2023. Mechanisms and Machine Science, vol 152. Springer, Cham. https://doi.org/10.1007/978-3-031-49421-5_44

Download citation

DOI : https://doi.org/10.1007/978-3-031-49421-5_44

Published : 29 May 2024

Publisher Name : Springer, Cham

Print ISBN : 978-3-031-49420-8

Online ISBN : 978-3-031-49421-5

eBook Packages : Engineering Engineering (R0)

Share this paper

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

ORIGINAL RESEARCH article

This article is part of the research topic.

Structural Sensing for Asset Management, Volume II

Semi-automated creation of IFC bridge models from point clouds for maintenance applications Provisionally Accepted

- 1 University of Applied Sciences Western Switzerland, Switzerland

The final, formatted version of the article will be published soon.

Bridge maintenance activities benefit from digital models, provided in the interoperable IFC format. Such a model, enriched with up-to-date information, is an enabler for a wide range of applications. It opens new perspectives in asset information management. However, the manual creation of a digital replica, representing the actual state of the asset from point cloud data, is timeconsuming. Consequently, process automation is of particular interest. This paper proposes a systematic, semi-automatic approach for creating IFC bridge models from point clouds. It introduces new methods for semantic segmentation and 3D shape modeling. A case study demonstrates the feasibility of the process in practice. Compared to other solutions, proposed methods are robust when dealing with incomplete point clouds.Essentially, a digital twin refers to a Building Information Modeling (BIM) model that accurately represents the physical asset and includes up-to-date information. Creating DT from archived construction documentation is labor-intensive, as not only the as-built situation but also information about modifications applied during the lifecycle of a bridge as well as inspection reports must be considered. In addition, available documents might be incomplete or incorrect and should be validated with the asset on site. It is obvious that a DT should be established based on the current state of the structure. Point Cloud Data (PCD), generated through laser scanning and photogrammetry, are good candidates. Point clouds accurately reflect the actual geometrical and topological conditions of an asset (Vilgertshofer et al., 2023). Consequently, generating a DT from PCD ensures it has a true geometry (Vilgertshofer et al., 2023;Tang et al., 2010). Additionally, PCD can be used to highlight movements and deformations by comparing point clouds created at different times. Furthermore, when combined with images, PCD enable automated detection and analysis of defects (

Keywords: Bim, IFC, Point Clouds, Scan-to-BIM, Bridges, Maintenance, asset management, interoperability

Received: 24 Jan 2024; Accepted: 30 May 2024.

Copyright: © 2024 Schatz and Domer. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY) . The use, distribution or reproduction in other forums is permitted, provided the original author(s) or licensor are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

* Correspondence: Mx. Yohann Schatz, University of Applied Sciences Western Switzerland, Geneva, Switzerland

People also looked at

IMAGES

VIDEO

COMMENTS

Distribution: J.P. Morgan Funds are distributed by JPMorgan Distribution Services, Inc., which is an affiliate of JPMorgan Chase & Co. Affiliates of JPMorgan Chase & Co. receive fees for providing various services to the funds. JPMorgan Distribution Services, Inc. is a member of FINRA.

by Sergey Chernenko and Adi Sunderam. A key function of many financial intermediaries is liquidity transformation: creating liquid claims backed by illiquid assets. To date it has been difficult to measure liquidity transformation for asset managers. The study proposes a novel measure of liquidity transformation: funds' cash management ...

This case study is one of seven that captures good asset management practices documented in the 2019 transportation asset management plans (TAMPs) required by 23 U.S.C. 119(e). This series distills many of the good practices and presents them in a convenient format for use by other transportation agencies.

Our cross-functional, enterprise asset management (EAM) program team needed to address an environment of disparate solutions and processes in order to migrate asset information to the ServiceNow Asset Management product. The goal was to have consistent global processes across Accenture and a capability to track assets from end to end with a ...

The asset management case study interview may involve putting together a portfolio for a client. In this scenario, it is the interviewee's job to break down the problem and understand what specific points you need to learn about the client to make a tailored portfolio allocation.

The AMSF is an information meta-model, a set of processes and a collection of templates. The main premise of the AMSF is that an organisation's asset management information is captured in an information model rather than a set of documents. This shifts the focus of Asset Management System (AMS) implementation and management from document ...

Published: 2012. International Case Studies in Asset Management shows companies and interested parties at all levels how asset management can be used to provide organisations with the strategic perspective, transparency and tools required to make best use of budgets, maximise returns on capital and grow market value.

Top 40 Most Popular Case Studies of 2018. Case Study Research & Development (CRDT) | December 19, 2018. Cases about food and agriculture took center stage in 2018. A case on the coffee supply chain remained the top case and cases on burgers, chocolate, and palm oil all made the top ten. Cases about food and agriculture took center stage in 2018.