Government expenditure on education, total (% of GDP) - Bangladesh

Selected Countries and Economies

All countries and economies.

- Privacy Notice

- Access to Information

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here.

- Laws & Rights

- Stock Market

- Real Estate

- Middle East

- North America

- Formula One

- Other Sports

- Science, Technology & Environment

- Around the Web

- Webiners and Interviwes

- Google News

- Today's Paper

- Webinars and Interviews

Budget FY23: 81,449C budget proposed for education sector

Allocation increased by Tk9,495 crore

The government has proposed a budget of Tk81,449 crore for the education sector in the budget for the 2022-2023 fiscal year, up from Tk71,954 crore in the current fiscal year – an increase of Tk9,495 crore.

In his budget proposals placed in parliament on Thursday, Finance Minister AHM Mustafa Kamal set aside an allocation of Tk31,761 crore for the primary education sector, up from Tk26,314 crore in the 2021-2022 fiscal year.

Tk39,961 crore was allocated for secondary and higher education, up from Tk36,487 crore in the current fiscal year.

Besides, the finance minister laid aside Tk9,727 crore for the technical and madrasa education sector, a slight increase from the current fiscal year’s Tk9,153 crore.

Experts seek flat 20% corporate tax for listed companies

Laptops and pcs could cost 55% more with new tax, zaidi sattar: budget fy23 misses scope to tame inflation with tariff cuts, spot assessment to determine new taxpayers from fy23, rehab wants undisclosed money invested real estate, exporters: please don’t raise source tax, kolkata police claim recovering dismembered body part of mp azim, 4 shoe factory workers shot during agitation in barisal, are amanullah, extremist leader shimul the same person, gold price sees drop, wbc belt fight comes to bangladesh saturday.

Popular Links

- Terms of Use

- Privacy Notice

- Advertisement

Connect With Us

- Environment

- Middle East

- Entertainment

May 24, 2024

Business & Economy

- BUDGET 2021-22

Despite pandemic effects, Bangladesh leaves education budget almost unchanged, again

The government has increased the allocation for the education sector in the national budget by 8.36 percent to Tk 719.51 billion, but it remains almost unchanged in proportion despite the ripple effects of the pandemic.

bdnews24.com

Published : 03 Jun 2021, 05:14 PM

Updated : 03 Jun 2021, 05:14 PM

Authorities at Phulkundi Kindergarten School of Nabinagar Housing in Dhaka's Mohammadpur are struggling to run the school amid the coronavirus epidemic. There may be no students now as the school is closed but its expenditures remain. Unable to bear the expenses, the authorities have now put the school, established in 2004, up for sale. Photo: Mahmud Zaman Ovi Authorities at Phulkundi Kindergarten School of Nabinagar Housing in Dhaka's Mohammadpur are struggling to run the school amid the coronavirus epidemic. There may be no students now as the school is closed but its expenditures remain. Unable to bear the expenses, the authorities have now put the school, established in 2004, up for sale. Photo: Mahmud Zaman Ovi

With schools and universities shut since mid-March last year as part of the efforts to keep coronavirus infections under control, the education sector has continued to reel from the effects of the pandemic.

The disruption led to calls for greater attention to the education sector but the proposed allocation for the education and technology sectors combined has increased by only 0.6 percentage points in proportion to the size of the Tk 6.04 trillion budget unveiled on Thursday.

The Tk 948.76 billion allocation for the sectors in 2021-22 represents 15.7 percent of the total budget.

In the budget for FY2021, Tk 857.62 billion was set aside for the sectors, making up 15.1 percent of the total budget.

Finance Minister AHM Mustafa Kamal mentioned in his budget speech that the government’s fourth priority sector now is the overall development of human resources, including education and skills enhancement, after health, implementation of stimulus packages, and agriculture.

Authorities at Phulkundi Kindergarten School of Nabinagar Housing in Dhaka's Mohammadpur are struggling to run the school amid the coronavirus epidemic. There may be no students now as the school is closed but its expenditures remain. Unable to bear the expenses, the authorities have now put the school, established in 2004, up for sale. Photo: Mahmud Zaman Ovi

To prepare for future pandemics, the government is prioritising medical education. Like last year, Kamal proposed the allocation of Tk 1 billion for an Integrated Health Science Research and Development Fund.

The government has set up several medical universities and the work to construct more is going on.

Kamal said soft loans have been provided to 41,501 financially insolvent students to purchase smartphones so that they can participate in online classes at the university level.

To check dropouts, the government allocated Tk 37.12 billion in the outgoing fiscal year for kit allowance and stipend for primary school students.

In FY2022, over Tk 21 billion will be provided to the students at the secondary, higher secondary and graduation (pass) level as well.

‘NOT ENOUGH’

Experts believe a Tk 55.51 billion increase in the allocation for the sector is not sufficient to help recover the losses caused by the huge gap in study and dropouts.

They said government needs to make huge investments in the sector to pull it out of the crisis.

Rasheda K Choudhury, executive director of Campaign for Popular Education, said along with businesses, educational institutions need incentives as well to save jobs.

“This budget will save lives and livelihoods, but no economic development will be sustainable if you don’t make proper investment in education for the development of human resources,” said a former adviser to the caretaker government.

She thinks the government is not right to claim that it has allocated a huge amount for human resource development.

The government has made 11.91 percent of the total budget available for the education sector, much less than the 15 percent expected by Rasheda.

“How will we be able to keep up the achievements in the sector?” she wondered.

Raisi buried in Mashhad as mourners pack Iranian city

Court orders attachment of ex-IGP Benazir’s properties

Evaly's Rassel, Shamima cleared of fraud charges

Biden welcomes Kenya's Ruto to White House

Tasneem hossain.

Laughter is the best medicine. Is it?

Mahmudur R Manna

Balancing act: The journey of Bangladesh's IT industry

Is China stockpiling oil and other resources in case of future war?

Oil bulls lack conviction about sustainability of higher prices

- Market Assessment

- Value Chain Assessment

- Policy Advocacy

- Inclusive Market Systems

- Monitoring, Evaluation, and Learning (MEL)

- Project Management

- Accelerator and Incubator Management

- Investment Advisory

- Blended Finance and Catalytic Funding

- Advanced Learning Center

- Technology for Social Good

- Advanced Analytics Engine Development

Market Entry Strategy and Support Services

Resources for entrepreneurs.

- Construction and Real Estate

- Digital Services and ICT

- Consumer Products

- Financial Services

- Pharmaceuticals and Healthcare

- Power & Energy

- RMG, Textile and Footwear

- Water, Sanitation and Hygiene

- Case Studies

- Directors’ Message

- LightCastle Live

- Pitch Templates

- GET IN TOUCH

CONSULTING SERVICES

Management & development consulting, technical assistance, strategy implementation, ecosystem & investments, digital transformation, key industries.

- Food and Agriculture

- Power and Energy

- View All Industries

- Directors' Message

Recent Insights

- Please wait...

Overview of the National Budget for the FY 2021-22

LightCastle Analytics Wing

Want to learn more about the National Budget 2022-23?

Bangladesh’s National Budget 2022-23: Banking On Resilient Business Output During Global Challenges [Part 1]

Bangladesh is embarking on its 50th year of sustaining as a sovereign nation this year. The budget for the Fiscal Year 2021-22 (FY 21-22) has certainly generated significant discourse already. It is important to evaluate the allocation of the Budget to different sectors, such as Health, Agriculture, Tax Structure Reformations, SMEs, and Education. [1] Analysis of this budget should evaluate how effective it would be in paving a way towards salvaging the economy from its battle against the pandemic.

This year’s budget amounted to BDT 6037 billion [2] with Public Administration having the lion’s share at 19%, followed by Education and Technology at 16%, and Transport and Communication at 12%. The budget allocation in some of the other areas is as follows: Health (5%), Agriculture (5%), Industrial and Economic Services (1%). An exhibition of this budget segregation is shown in Figure 1.

A cross-comparison of the budget with the previous fiscal year, FY 2020-21, reveals the changes in the major development sectors. The amount allocated as a percentage of the total budget to the Education and Technology Sector and Health Sector has increased, but by less than 1% for each sector. The percentage allocated to the Power and Energy and Public Administration Sectors has decreased. This is summarized below in Table 1.

Health Sector

This year’s Health sector allocation only comprises 0.95% of the total Gross Domestic Product (GDP) as compared to 0.84% in 2020. [3] The general expectation was a larger budget allocation for the health sector. The reasoning behind this is the looming fear of the ongoing COVID-19 crisis worsening with the recent infiltration of the Delta variant into Bangladesh. The budget transcript did not reveal any new project to battle the ramifications of the pandemic. The two ongoing projects (initiated in 2020) related to COVID-19 are – ‘COVID-19 Emergency Response and Pandemic Preparedness’ and ‘COVID-19 Response Emergency Assistance’, which are co-financed by World Bank and Asian Development Bank (ADB).

Previous data suggest that the Public Health Sector of Bangladesh receives little to no attention when it comes to budget allocation. In this ongoing health crisis, the total expenditure on healthcare in FY 2021-22 stands at BDT 327.31 billion, which composes around 5% of the total budget and 0.94% of the total GDP. For FY 2020-21, this allocation has been around BDT 293.47 billion. The allocation expectation for this year was much higher as COVID-19 still looms over this country. [3] However, as an attempt to make COVID-19 testing more feasible, the exemption of Value Added Tax (VAT) on the COVID-19 test kits, Personal Protective Equipment (PPE), Vaccination, and Medication services will be continued this year as well. [3]

Sub-sectors such as Women’s Health are receiving help as VAT has been removed from the production of sanitary napkins, at the local manufacturing stage, to increase the supply of proper and affordable sanitary napkins. [4] In addition, an expansion of the existing concessional facilities has been proposed, particularly for the import of raw materials which are required to produce medical products. This will reduce the cost of making medicines and in fact, make medicines more accessible for the lower-income groups. [5]

Want to learn more about Management Consulting?

Tax structure reformation on industries and the small and medium enterprises (smes).

There are 79,00,000 [4] SME establishments in Bangladesh and this sector is one of the vulnerable and most hard-hit sectors due to COVID-19. As persistent lockdowns have been imposed to mitigate the spread of the virus, many SMEs struggled to stay afloat. Declining demand coupled with persistent high fixed costs made it difficult for these enterprises to continue production as profit became more marginal. This pushed the SMEs into a situation where demand is continuously spiraling down. [6] As an attempt to help fight this low demand, tax reformation has been introduced. In addition to this, a few fiscal incentives have been proposed to encourage investment and reduce operational costs, such as corporate tax cuts. This would thereby promote employment. Most of these incentives are enterprise-oriented, which will help reduce operational costs by reducing tax on imports of capital and core raw materials. [8]

Furthermore, tax breaks and tax reductions have been introduced in this budget as an attempt to promote aggregate demand. Tax breaks will allow firms to sustain more profits, re-invest back in the economy. Corporate Income Tax (CIT) has been reduced on entities that identify as Partnerships, Private Limited Companies, Sole Traders, and Public Limited Companies. Table 2 shows the changes from FY 2020-21 to FY 2021-22.

Tax holidays have also been extended for companies operating in the Information and Technology (IT) sector. The existing twenty-two IT enabler services will be subscribed to another year of enjoying tax exemptions and this provision has been expanded to six more services, i.e., cloud services, system integration, e-learning platform, e-book publications, mobile apps development service, and IT freelancing until 2024. This will create employment opportunities for new start-ups, and fresh IT and STEM graduates. [8]

In addition, tax has been exempted for the production of three and four-wheeler and home appliances from FY 2021-22 till FY 2029-30. Home appliances will include microwave ovens, blenders, other cooking equipment, washing machines, and electric sewing machines. Products that promote ‘Made in Bangladesh’ will also be given tax exemption. Currently, the size of the domestic home appliance market is worth BDT 100 billion and this market is surging, given that consumer purchasing power is on the rise. [8] Development of the domestic home appliance market will create aid in generating more jobs in the manufacturing sector. The unemployment rate was recorded at 5.3% in 2020 for Bangladesh, [9], and widening the parameters of this industry will allow more people to find work. This will create a substantial multiplier effect, and thus, lead to higher levels of consumption in the economy. In addition, the expansion of this sector will also allow Bangladesh to expand its export portfolio and in the long run, aid in reducing import dependency. [9]

Besides, in the FY 2021-22 Budget, Advance Tax (AT) on imported raw materials for manufacturing industries has been reduced to 3% from 4%, which will reduce the cost of production in the secondary sector. Some existing VAT policies have been extended as well to curb down the manufacturing cost. For example, the 5% VAT on LPG Cylinders will be extended for another year. In addition, VAT will be exempted for the following:

- Refrigerator (up to FY 23)

- Polypropylene staple fiber (Up to FY 24)

- Air conditioner (Up to FY 25)

- Motor vehicle (Up to FY 26)

- Manufacturing and Assembling of mobile phone (Up to FY 24)

A summary of the changes is shown in Table 3.

Agriculture Sector

The agriculture sector in Bangladesh employs around 38.3% [8] of the labor force and contributes to 12.7% [9] of the GDP and ensures higher food security for this country. This contribution to GDP can be even more substantial, given that this country has alluvial soil. But the limiting factor that holds this sector back is soil erosion and lack of technology. The amount allocated for Agriculture in FY 2021-22 is BDT 319.12 billion which is 7.4% higher than the amount allocated in FY 2020-21. [10]

To make this sector more automated, the budget also revealed a VAT exemption at the manufacturing and trading stages for Weeders and Winnowers. The Weeders will allow farmers to break the soil crust and create soil mulch and remove the weeds from vegetable plantations. The Winnowers are used for the separation of grains from the chaff. Both will reduce the time and effort given by manual agricultural labor. Moreover, an exemption of tariff for importing major agricultural inputs, especially fertilizers, seeds, pesticides is included in the budget as well. This will reduce the cost of inputs for the existing farmers and will help set up new Agri-tech startups.

In addition, to protect some domestic markets, a tariff has been imposed and a minimum value has been fixed on the imports of carrots, mushrooms, green chilies, tomatoes, oranges, and capsicum. This will level the playing field for the local farmers. Furthermore, exemptions on tax have been made for ten years for industries engaged in processing locally grown fruits and vegetables, producing milk and dairy products, and manufacturing agricultural machinery. [3] This will help promote new entrepreneurs in the agriculture sector and increase food security by reducing the dependency on imports. However, the integral concern for this sector is the untapped application of the allotted budget amount as, in recent years, almost 9.5% of the previously allotted budget tends to remain unutilized. [2] This is shown in Table 3. Some of the reasons contributing to this underutilization are – loss of arable lands, sudden climate changes, and inefficient management practices. [3]

For better utilization of existing resources, training centers for vocational training in the Agriculture Sector are required. The tax exemption that is given for ten years to agriculture and fisheries institutions to provide vocational education should aid in this process.

Education Sector

Education will be a critical determinant of sustainable economic development – something that Bangladesh strives to attain. The benefits of education are reaped in the long run and to achieve this, the allocation of Budget this year to education increased by 7% [3] to BDT 719.53 billion, compared to BDT 662.07 billion in FY 2020-21. The segregation of this allotted amount is as follows – BDT 263.1 billion for the Primary and Mass Education Ministry, BDT 364.86 billion for the Secondary and Higher Education Division, and BDT 91.54 billion for the Madrasa and Technical Education division. [13] The amount allocated this year as a percentage of GDP – 2.09% – is lower than that of last year, 2.14%. This may not be a welcome move for the Education Sector, given that the amount allocated to Education as a percentage of GDP is the lowest in Bangladesh, amongst the South Asian Countries. [13]

Over the last 18 months, around 42 million children were affected by COVID-19, due to school closures. This forced students to start remote learning but not all students had access to the required technology that will enable them to attend virtual classes. [14] Almost 22 million [14] students are from rural areas and they come from underprivileged circumstances, and therefore, are unable to access remote learning opportunities. It is also estimated by UNICEF that 63% of the students do not have internet access. [15] It is also disclosed that 69.5% of Primary and Secondary School students did not participate in remote learning classes, which were conducted via television, radio, and the internet. [13]

To increase the enthusiasm and participation of students, especially from underprivileged and rural communities, a primary kit allowance of BDT 1000 has been allotted, and the total budget allocation for this is BDT 12 billion. This kit will allow students to purchase new school uniforms, shoes, and bags. In addition, students will be given an allowance of BDT 150 instead of BDT 100 per month. [3]

The Way Forward

In the context of Bangladesh, more than a hefty budget allocation, proper implementation is necessary and essential. Money can be injected into the economy, but it will only translate to improved living standards when the allocated budget is utilized to its maximum potential. To attain the predicted growth rate of 5.1% [17] as per the World Bank, Bangladesh needs to deploy resources efficiently and put special emphasis on sectors that aid human development, such as Health and Education. This is especially important in the light of COVID-19.

The burden of COVID-19 on the Health Sector should have been prioritized further while formulating the allocations for the Sector. The Health Sector was in a dismal state pre-COVID. For example, according to the World Health Organization (WHO), there were 0.79 beds per 1,000 people in Bangladesh in 2016 [21] whereas the recommended rate by WHO is 5 beds per 1,000 people. In addition, the ratio of physicians to the population was 0.581 per 1,000 people in the same year. [21] Therefore, it is clear that the Health Sector needs more consideration in budget allocation and utilization.

The Budget for FY 2021-22 focuses on the reduction of the corporate tax to churn the wheels of the economy. This type of expansionary fiscal policy of tax reduction should allow enterprises to reinvest back into the economy, creating jobs that would, in turn, raise consumption and influence higher aggregate demand. However, many enterprises in Bangladesh do not disclose their actual profits. Furthermore, a reduction in corporate tax is one of the factors that influence investment. Other paramount factors include – state of business confidence, ease of doing business in the economy, and overall aggregate demand in the economy. In this scenario, this tax cut would rather raise inequality [19] as this tax break is most likely to benefit the rich, making them richer. Therefore, a corporate tax reduction may further fuel income inequality and poverty – crises that have already been exacerbated by COVID-19. [20]

References:

1. Expectations for the Health Sector in a Pandemic Budget – The Daily Star

2. Budget at a Glance – The Ministry of Finance, Government of Bangladesh (GoB)

3. An Analysis of the National Budget for FY2021-22 – Centre For Policy Dialogue (CPD)

4. Ministry of Planning – Government of Bangladesh (GoB)

5. Budget FY22: VAT exemption on sanitary napkin production proposed – The Dhaka Tribune

6. SMEs need credit the most – The Daily Star

7. Budget FY22: IT sector gets tax exemptions for 22 tech services – The Dhaka Tribune

8. New manufacturers of home appliance likely to get tax exemptions – The Dhaka Tribune

9. Unemployment, total (% of total labor force) (modeled ILO estimate) – Bangladesh – The World Bank

10. Agriculture, forestry, and fishing, value added (% of GDP) – Bangladesh – The World Bank

11. Employment in agriculture (% of total employment) (modeled ILO estimate) – Bangladesh- The World Bank

12. Budget for coronavirus-battered education sector unchanged – The Daily Star

13. Education gets little attention – The Business Standard

14. Covid -19 divide deepens between Bangladesh’s Urban and Rural Students – Deutsche Welle

15. Bangladeshi children share experiences of remote learning and the challenges they face – UNICEF

16. 69.5% didn’t take part in remote learning classes during a pandemic – The Financial Express

17. Bangladesh economy to grow 5.1pc in FY22 says World Bank – The Financial Express

18. Proposed Budget may raise Inequality – The Daily Star

19. Why inequality still matters – The Daily Star

20. Hospital beds (per 1,000 people) – Bangladesh – The World Bank

WRITTEN BY: LightCastle Analytics Wing

At LightCastle, we take a data-driven approach to create opportunities for growth and impact. We consult and collaborate with development partners, the public sector, and private organizations to promote inclusive economic growth that positively changes the lives of people at scale. Being a data-driven and transparent organization, we believe in democratizing knowledge and information among the stakeholders of the economy to drive inclusive growth.

For further clarifications, contact here: [email protected]

LATEST INSIGHTS

Want to collaborate with us?

Our experts can help you solve your unique challenges

Join Our Newsletter

Stay up-to-date with our Thought Leadership and Insights

Please Enter your email address

Please Enter your valid email address

Your email address is already subscribed

Your message has been successfully sent. We will contact you very soon!

Ministries & Divisions

- History & Activities

- Vision & Mission

- Hon'ble Finance Minister

- List of Ex-Ministers

- List of Ex-Secretaries

- Allocation of Business

- Success & Achievements

- Officers (Wing wise)

- Officer List (One Page Summary)

- Work Distribution

- Information Officer

- GRS Officer

- Appellate Officer

- Focal Point Officers

Services of Ministries/Divisions

- Citizen Charter

- List of Citizen e-Services

- List of Other Services

Committees of Ministry/Divisions

- Committees Chaired by Honorable PM & Honorable Minister Regarding Ministry/Division

Affiliated Officer/Institutions

- Office of the Controller General of Accounts

Running & Completed Projects

- Running Projects

- Completed Projects

- Office Address

- Your Question & Comment

- Photo Gallery

- Video Gallery

Budget Documents (2023-24)

- Budget Speech

- Budget in Brief

- Annual Financial Statement

- Supplementary Financial Statement

- Consolidated Fund Receipt

- Development Budget

- Combined Demand for Grants

- Public Accounts

- Information Regarding Climate

- Gender Budget Report

- Social Security Programs

- Information Regarding Poverty & Gender

- All Statements

- Report of the Committee on Reforms in Budgeting and Expenditure Control (CORBEC)

- Reforms in Budgeting and Expenditure Control

- Child Budget

- Debt Service Liability (DSL) Accounts and Guidelines (upto FY 2008-2009)

- District Budget

- SOE Budget Summary

- SOE Archive

Budget Imp. & Planning

Budget execution.

- Quarterly Budget Execution

- Annual Budget Execution

Budget Imp. Reports

- ADP Utilization

- Division Wise Expenditure

Budget Preparation (24-25)

- Revised Budget 23-24

- Budget Circular-1

- MBF Templete

- Gender Budget Template

- Child Budget Template

- Budget Circular-2

- BACS All Segment

- Reform Activities (iBAS++)

Fiscal Reports

- Monthly Fiscal Reports

- Monthly Report on Fiscal-Macro Position

- Year-End Fiscal Report

Economic Reports

- Bangladesh Economic Review 2023

- Bangladesh Economic Review Archive

- Annual Report of Finance Division

- Macroeconomic Stability

- Socio-economic Advancement

Others Publication

- Bangladesh PEFA Assessment 2021

- Field Inspection Report

- How Bangladesh Manages Its Public Money

- BANGLADESH AT 50 : Realization of Dreams Through Humane and Patriotic Leadership

- Socio-Economic Development in Bangladesh & Stimulus Packages to Combat COVID-19

- Post Creation, Abolition and Organogram Approval Guideline

- CLIMATE PUBLIC FINANCE TRACKING IN BANGLADESH

- Bangladesh Marches On

- Annual Activity Report

- Achievements in Last 10 Years (2008-09 to 2017-18)

- Poverty & Gender

- Other Useful Information

- Lending & Re-lending Terms

- Budget Booklets

- Pathway to Prosperity

- RESEARCH WORK

Debt Publication

- Debt Bulletin

- Medium-Term Debt Management Strategy

National Pay Scale-2015

- Pay Fixation

- Socio-Economic Advancment

- Research Work

- Govt Equity Accounts

- Share Market Equity

- Delegation of Financial Power

- PFM Reform Activities

- Digital Task Force

- Public Private Partnership

- সার্বজনীন পেনশন ব্যবস্থাপনা আইন ২০২৩

- সার্বজনীন পেনশন ব্যবস্থাপনা আইন ২০২৩ এর সংশোধনী

- Notification on Issuance and Re-issuance of Bangladesh Government Treasury Bonds-

- Public Debt Act 2022

- Treasury Rules

- Budget Management Act

- Sukuk Guideline

- Financial Reporting Act-2015

- Surplus Fund Act-2020

- Fund Release Procedure-2018

- Cadre Rules

- General Financial Rules

- Sovereign Guarantee Guideline

- Acts Related to Finance

- সার্বজনীন পেনশন ব্যবস্থাপনার আওতাভুক্তকরণ।

- Officers (Wing Wise)

কনটেন্টটি শেয়ার করতে ক্লিক করুন

National Portal Bangladesh

পোর্টাল সাবস্ক্রাইব করুন

Share with :

- Secrecy Policy

Planning and Implementation: Cabinet Division , a2i , BCC , DOICT , BASIS .

Technical Support:

- Investigative Stories

- Entertainment

- Life & Living

- Tech & Startup

- Rising Star

- Star Literature

- Daily Star Books

- Roundtables

- Star Holiday

- weekend read

- Environment

- Supplements

- Brand Stories

- Law & Our Rights

Most Viewed

Missing AL MP found in Kolkata

Banks sell dollar at more than Tk 118 as pressure mounts

Gas supply to remain shut in parts of Dhaka for 10hrs tomorrow

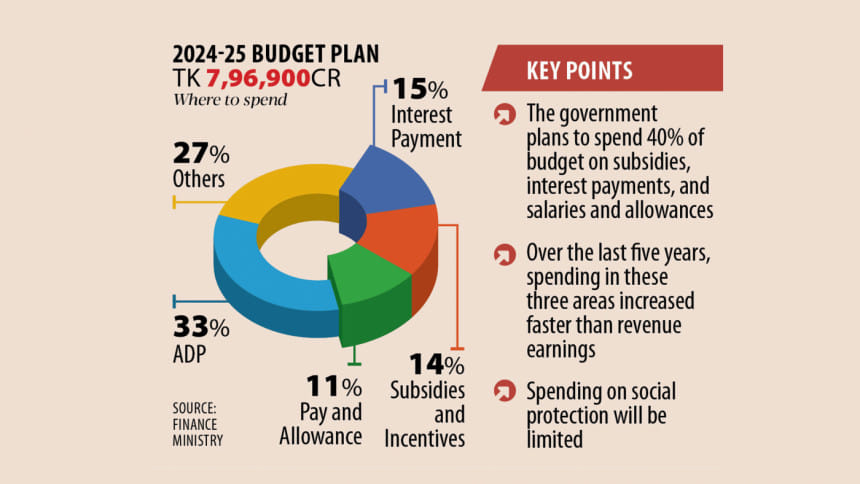

Fixed expenses to eat up 40pc of next budget

The government has to spend about 40 percent of the next budget on subsidies, interest payments, and salaries and allowances of government employees, which will limit its ability to spend on social safety net, health and education.

According to a finance ministry plan, the government may allocate Tk 3,14,700 crore for the three sectors from the total budget of Tk 7,96,900 crore in fiscal 2024-2025.

For all latest news, follow The Daily Star's Google News channel.

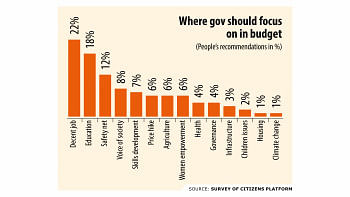

Decent jobs, quality education should get top priority in budget

Of the allocation, Tk 1,16,000 crore will be spent on interest payments, Tk 1,11,000 crore on subsidies and incentives, and Tk 87,700 crore for paying government employees.

Over the last five years, expenditures on wages, pensions, subsidies, and interest increased faster than the revenue earnings, narrowing the government's fiscal space.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said, "If the non-discretionary expenditures eat up most of the budget allocation, then not much is left."

He said they had predicted a sharp rise in expenditures on wages, subsidies, and interest five to seven years ago.

"It took about 10 years for the government to fall into this pit, and it would take another 10 years to get out of it."

However, the country needs to address the problem and for this, a reform initiative is needed, he added.

He suggested bringing down domestic borrowings, subsidies and other unnecessary expenditures, and increasing revenue.

Finance ministry officials said the government was unable to increase allocation for safety net programmes, healthcare, and education due to resource constraints though it intended to spend more in those sectors.

The government spending on interest payments, both foreign and domestic, has been increasing every year.

Interest payment rates have risen in recent years, and the finance ministry projects that it may go up even more.

In the current fiscal year, the government allocated Tk 94,376 crore for interest payments, which crossed Tk 1,00,000 crore in the revised budget for the first time.

The finance ministry is going to increase the allocation by 23 percent in the next fiscal year.

Seeking anonymity, a finance ministry official said the increase in the government's treasury bond interest rate and taka's depreciation could drive up the allocation for interest payments when the next year's budget will be revised.

Finance ministry data shows that in July-January of the current fiscal year, interest payments totalled Tk 60,555 crore, a year-on-year increase of 26 percent.

The payment on the domestic front rose 15 percent to Tk 51,213 crore. Interest payment on foreign loans went up threefold.

The cost of funds, mobilised through the sales of treasury bonds, has been on the rise. This has led to an increase in the interest expenditure.

The interest rate of treasury bonds has gone past 12 percent from 8 percent in June 2023, shows Bangladesh Bank data.

Though the sales of savings instruments such as national savings certificates are currently low and the interest rates against them have fallen, many of the schemes have matured. This means the government's expenses in this segment have also gone up.

As of September 30, the government's outstanding debt stock was Tk 16,55,156 crore.

In the current fiscal year, the government's allocation for subsidies and incentives is Tk 1,11,000 crore.

A finance ministry official said that though a final figure was not fixed, it was likely that the next year's allocation would be close to that of the current fiscal year.

In several years before FY19, the government didn't provide subsidy to the power sector.

From FY19 to FY22, the government subsidy in the sector was between Tk 7,000 crore and Tk 11,000 crore. In FY23, it rose to Tk 22,000 crore.

The subsidy in the power sector stands at Tk 35,000 crore in the current fiscal year. The government is likely to keep the amount of subsidy the same in the next budget.

Though the government hiked the prices of electricity, gas and fuel several times over the last two years, subsidy expenditure in the sector is yet to come down due to huge arrears, said the official.

The government, however, is planning to reduce subsidy in power sector gradually. For this, it could hike electricity price on four to five times a year, the official added.

In the current fiscal year, allocation for government employees' salaries and allowance is Tk 80,463 crore.

Officials said the allocation would increase by 9 percent in the next fiscal year.

However, if pension and gratuity are included, the expenditure in the sector will surpass Tk 1,00,000 crore.

Though the government's expenditures in several priority sectors increased over the years, it could not make allocations for the health and education sectors in line with the Eighth Five-Year-Plan.

Due to resource constraint, the government cannot raise allocation for social safety net significantly.

In the case of old age allowance, elderly people get only Tk 600 a month.

Though the social welfare ministry asked for an increase in the monthly allowances under several safety net schemes, the finance ministry did not raise the allocation due to resource constraint.

Related News

Make budget tight, control inflation

Inflation and not so SMART interest rates

CPD prescribes 3-point recipe to fix economy

A third of budget spent on interest payments, subsidies

বে অব বেঙ্গলে ঘাঁটি করবে, হতে দিচ্ছি না সেটাও আমার অপরাধ: প্রধানমন্ত্রী

তিনি বলেন, বাংলাদেশে একটি বিমান ঘাঁটি করতে দেওয়ার প্রস্তাব তার কাছে এসেছিল, নির্বাচন ও তার পুনর্নির্বাচিত হওয়ার ব্যবস্থা তারাই করবে।

বেনজীরের ৮৩ স্থাবর সম্পদ ‘ক্রোক’, ৩৩ ব্যাংক অ্যাকাউন্ট ‘ফ্রিজের’ নির্দেশ

What's in this year's federal budget? Here are all of the announcements we already know about

Treasurer Jim Chalmers will hand down his third budget on Tuesday night, but has been tempering expectations for weeks in the lead-up, warning Australians not to expect a "cash splash".

Inflation remains a key challenge for the government, and we already have a pretty good idea of how Mr Chalmers plans to use his budget to provide cost-of-living relief while also trying to jump-start a slowing economy and navigate growing uncertainty overseas.

Here are the measures we already know about before the treasurer reveals all at 7:30pm AEST.

Short on time?

There's been no shortage of announcements in the lead-up to the budget. If you're interested in a specific topic, tap on the links below to take you there:

Cost-of-living relief

Education, training and hecs changes, tax changes, future made in australia, health and aged care, paid parental leave, domestic violence, defence and foreign affairs, environment, infrastructure, additional announcements.

Is your area of interest not covered?

- Tell us what other cost-of-living measures you're hoping to see included in this year's budget .

The bottom line

Will the budget be in surplus or deficit?

- The budget will deliver a surplus of $9.3 billion for the 2023-24 financial year, making it the second consecutive budget surplus in almost two decades

- That said, the following three financial years are all forecasted to have larger deficits than previously expected in December, but the size of each deficit is not yet known

- Overall, the treasurer says Australia's total debt has been reduced by $152 billion in the 2023-24 financial year, and the budget will benefit by a $25 billion boost in revenue upgrades

What does the budget mean for inflation and interest rates?

- The treasurer has repeatedly said he's kept inflation in mind when crafting this year's budget, and is confident that the measures won't contribute to it

- In fact, Treasury predicts inflation will fall to 2.75 per cent by December — well before the Reserve Bank's most recent forecast for the end of 2025 — due to yet-to-be-announced budget measures taking pressure off inflation

- For what it's worth, RBA governor Michele Bullock wasn't too concerned about the upcoming budget last Tuesday, saying she would wait to see its impact first , but she said the treasurer reassured her that he was focused on curbing inflation

The reworked stage 3 tax cuts form the centrepiece of the government's budget. They were announced in January, legislated in February and come into effect on July 1.

The changes to tax cuts originally legislated by the Morrison government mean that all Australian taxpayers who earn more than $18,200 (that is, more than the tax-free threshold) will get a tax cut.

Before Labor's changes, the original stage 3 tax cuts were skewed more heavily to higher-income earners .

A person with a taxable income between $45,000 and $120,000 will receive a tax cut of $804 more come July 1 under the revised stage 3 changes compared to the Morrison government's tax plan.

However, the government has hinted at other cost-of-living measures, with the treasurer calling the tax cuts the "foundation stone" of broader assistance.

Among those measures appears to be energy bill relief (in addition to what some states have already announced), with the treasurer pointing out that last year's measure curbed living costs and eased inflation.

Adjustments to rent assistance also seem likely, as do increases to JobSeeker and the aged pension.

Back to top

The biggest announcement in this area is the wiping out of $3 billion worth of HECS debts triggered by last year's indexation of 7.1 per cent.

It means student debts will be lowered for more than 3 million Australians, with the average student receiving an indexation credit of about $1,200 for the past two years.

The debt relief will also apply for apprentices who owe money through the VET Student Loan program or the Australian Apprenticeship Support Loan.

Speaking of university, the government is aiming to tackle "placement poverty" by providing financial support to students to help make ends meet while they complete practical hands-on training as part of their course.

Under the scheme, those studying nursing, teaching or social work will receive a Commonwealth Prac Payment of up to $319.50 a week, but they will be subjected to means testing.

Similarly, apprentices willing to learn clean energy skills as part of their trade will be eligible to receive up to $10,000 in payments . The scheme already exists, but the government has broadened the eligibility to include apprentices in the automotive, electrical, housing and construction sectors based on industry feedback.

Universities will also be required to stop a surge in the number of international students, as part of the government's broader plans to cut annual migration levels back to 260,000 a year — much to the concern of peak education bodies .

Another $90 million will be put towards 15,000 fee-free TAFE and VET places to get more workers into the housing construction sector , with an extra 5,000 pre-apprenticeship places provided from 2025.

While we can expect to hear more about the stage 3 tax cuts, it seems likely that the government will unveil other changes to tax in the budget to encourage business investment.

One such change will be the extension of the government's instant asset write-off scheme for small businesses for another year, allowing businesses with a turnover of less than $10 million to claim $20,000 from eligible assets.

However, the same measure from last year's budget is still yet to pass parliament — and businesses are urgently calling on them to pass the measure before it expires on June 30 .

In addition to spending more to attract skilled workers in the housing and construction sectors, the government is also tipping billions of dollars into building new homes across the country .

It's estimated the government will be putting roughly $11.3 billion towards housing, as the government works to deliver its promised 1.2 million new homes by 2030.

$1 billion will be spent on crisis and transitional accommodation for women and children fleeing family violence and youth through the National Housing Infrastructure Facility, which is re-allocated funding.

The government has also committed to providing $9.3 billion to states and territories under a new five-year agreement to combat homelessness, assist in crisis support, and to build and repair social housing — including $400 million of federal homelessness funding each year, matched by the states and territories.

Another $1 billion will be given to states and territories to build other community infrastructure to speed up the home-building process, including roads, sewerage, energy and water supplies.

The government has also committed to consulting with universities to construct more purpose-built student accommodation.

Overall, the funding announcements for housing build on the $25 billion already committed to new housing investments, with $10 billion of that in the Housing Australia Future Fund, which is designed to help build 30,000 social and affordable rental homes.

The government says the housing funding measures will also help take the pressure off the private rental market, which is experiencing record-low vacancy rates and surging growth in weekly rent prices.

Aside from the revised stage 3 tax cuts, the revival of local manufacturing is the other centrepiece of the government's budget this year.

The Future Made in Australia Act (which is often referred to without the "act" on the end) is bringing together a range of new and existing manufacturing and renewable energy programs under one umbrella, totalling in excess of $15 billion.

In other words, the government is putting serious taxpayer money towards supporting local industry and innovation, especially in the renewable energy space.

A number of measures have already been announced (or re-announced), including:

- $1 billion for the Solar SunShot program to increase the number of Australian-made solar panels

- $2 billion for its Hydrogen Headstart scheme to accelerate the green hydrogen industry

- $470 million to build the world's first "fault-tolerant" quantum computer in Brisbane , matching the Queensland government's contribution

- $840 million for the Gina Rinehart-backed mining company Arafura to develop its combined rare earths mine and refinery in Central Australia

- $230 million for WA lithium hopeful Liontown Resources , which is also partly owned by Gina Rinehart

- $566 million over 10 years for Geoscience Australia to create detailed maps of critical minerals under Australia's soil and seabed

- $400 million to create Australia's first high-purity alumina processing facility in Gladstone

- $185 million to fast-track Renascor Resources' Siviour Graphite Project in South Australia

- A $1 billion export deal to supply Germany with 100 infantry fighting vehicles , manufactured at Rheinmetall's facility in Ipswich

All up, the government is spending an extra $8.5 billion on health and Medicare in this year's federal budget, with $227 million of that put towards creating another 29 urgent care clinics.

Millions of dollars are also being poured into medical research, including $20 million for childhood brain cancer research , and a $50 million grant for Australian scientists developing the world's first long-term artificial heart .

Another $49.1 million is being invested to support people who have endometriosis and other complex gynaecological conditions such as chronic pelvic pain and polycystic ovarian syndrome. The funding will allow for extended consultation times and increased rebates to be added to the Medicare Benefits Schedule.

As for aged care, the government hasn't announced anything specific for the sector, nor has it outlined its response to the Aged Care Taskforce report that was delivered in March.

Parents accessing the government-funded paid parental leave scheme will be paid superannuation in addition to their payments from next July .

Under the current program, a couple with a newborn or newly adopted child can access up to 20 weeks of paid parental leave at the national minimum wage — however that figure will continue to rise until it reaches 26 weeks in July 2026 .

The plan, which Labor will take to the next election, would see superannuation paid at 12 per cent of the paid parental leave rate, which is based on the national minimum wage of $882.75 per week.

The cost to the budget is not yet known, however a review commissioned by the former government estimated that paying super on top of paid parental leave would cost about $200 million annually.

About 180,000 families access the government paid parental leave payments each year.

The federal government has pledged almost $1 billion to combat violence against women , including permanent funding to help victim-survivors leave violent relationships, and a suite of online measures to combat online misogyny and prevent children from viewing pornography.

The $925.2 million will go towards permanently establishing the Leaving Violence Program over five years, after it was established as a pilot program in October 2021 known as the Escaping Violence Program.

The program will provide eligible victim-survivors with an individualised support package of up to $1,500 in cash and up to $3,500 in goods and services, plus safety planning, risk assessment and referrals to other essential services for up to 12 weeks.

While the funding has been broadly welcomed, survivors and advocates want to see more investment .

The package also includes funding to create a pilot of age verification technology to protect children from harmful content, including the "easy access to pornography" online, which the government says will tackle extreme online misogyny that is "fuelling harmful attitudes towards women".

The federal government is planning to spend an extra $50 billion on defence over the next decade , meaning Australia's total defence spend will be equivalent to 2.4 per cent of its gross domestic product (GDP) within 10 years.

All up, the government is planning to invest a total of $330 billion through to 2033-34, which includes the initial cost for the AUKUS initiative to purchase nuclear-powered submarines.

Part of that $50 billion will be spent on upgrading defence bases across northern Australia, with $750 million to be allocated in the budget for the "hardening" of its bases in the coming financial year.

More than $1 billion of that funding will also be spent on an immediate boost on long-range missiles and targeting systems.

In the Pacific, Australia has committed $110 million to fund development initiatives in Tuvalu , including an undersea telecommunications cable and direct budget support.

The government has also pledged $492 million to the Asian Development Bank to provide grants to vulnerable countries in the Asia-Pacific.

The only dedicated announcement for the environment so far is the scrapping of the waste export levy , also known as a "recycling tax".

The proposed $4 per tonne levy was first legislated by the Morrison government in 2020 in a bid to reduce and regulate waste exports, after China announced it would no longer handle Australian rubbish.

Waste industry players had been concerned that once the levy was introduced in July, it would have caused more waste to be sent to landfill instead of being recycled.

The scrapping of the waste export levy is part of Australia's broader move to manage its own waste.

A slew of funding commitments have been made around the country, including a $1.9 billion funding commitment for upgrades in Western Sydney, ranging from road improvements to planning projects and train line extensions.

The government is also putting $3.25 billion towards Victoria's North East Link, which is being built between the Eastern Freeway and M80 Ring Road in Melbourne.

Ahead of the Brisbane Olympics in 2032, the government is also chipping in $2.75 billion to fund a Brisbane to Sunshine Coast rail link , matching the amount promised by Queensland Premier Steven Miles. (That said, $1.6 billion had been previously announced by the federal government.)

Also in Queensland, the Bruce Highway will receive $467 million for upgrades, while Canberra will receive $50 million to extend its light rail.

A proposed high-speed train line between Sydney and Newcastle will also receive $78.8 million to deliver a business case for the project.

The government will also put $21 million towards the creation of a national road safety data hub.

There are several other funding commitments the government has made in the lead-up to the budget that don't fit neatly into the categories above.

The government will spend $161.3 million on creating a national firearms register , which will give police and other law-enforcement agencies near real-time information on firearms and who owns them across the states and territories.

The money will be spent over four years to establish the register, and comes after state and territory leaders agreed to set up the register in December last year. The government has described the register as the biggest change to Australia's firearm management systems in almost 30 years.

Another $166.4 million will be spent on expanding anti-money-laundering reporting obligations , requiring real estate agents, lawyers and accountants to report dodgy transactions in a move that will bring Australia in line with the rest of the developed world.

And ahead of the 2032 Brisbane Olympic Games, the government has given the Australian Institute of Sport (AIS) a $249.7 million funding boost to upgrade its facilities to support local athletes.

The government has also committed to a $107 million support package for farmers, after announcing it will end Australia's live sheep export trade by 2028 .

Farmers and regional communities will also benefit from a $519.1 million funding boost to the government's Future Drought Fund.

- X (formerly Twitter)

- Business, Economics and Finance

- Cost of Living

- Economic Growth

- Economic Trends

- Federal Government

- Money and Monetary Policy

The Federal Register

The daily journal of the united states government, request access.

Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs.

If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access". This process will be necessary for each IP address you wish to access the site from, requests are valid for approximately one quarter (three months) after which the process may need to be repeated.

An official website of the United States government.

If you want to request a wider IP range, first request access for your current IP, and then use the "Site Feedback" button found in the lower left-hand side to make the request.

COMMENTS

The national parliament approved the budget for FY2023-24 on 26 June 2023. The education sector received an allocation of BDT 70,507 crore in the revised budget for the FY2022-23 budget, accounting for 10.7 per cent of the total revised budget. For the upcoming FY2023-24 budget, BDT 88,162 crore has been allocated for the education sector ...

The national parliament approved the budget for FY2023-24 on 26 June 2023. The education sector received an allocation of BDT 70,507 crore in the revised budget for the FY2022-23 budget, accounting for 10.7 per cent of the total revised budget. For the upcoming FY2023-24 budget, BDT 88,162 crore has been allocated for the education sector ...

Mamun Abdullah. Publish : 01 Jun 2023, 04:04 PM Update : 02 Jun 2023, 01:48 AM. The education sector has received a Tk7,000 crore boost in the proposed budget for the 2023-24 fiscal year. The allocation for education has been increased to Tk88,162 crore, as compared to Tk81,449 crore in the revised budget for FY2022-23.

Government expenditure on education, total (% of GDP) - Bangladesh from The World Bank: Data

The government has increased the allocation for the education sector by Tk 94.95 billion in the proposed budget for the financial year 2022-23, comparing to the previous year. Finance minister AHM Mustafa Kamal revealed this in his budget speech in the parliament on Thursday. The sector, under the ministries of education and primary and mass education, got an allocation of Tk 814.49 billion ...

BANGLADESH EDUCATION SECTOR PUBLIC EXPENDITURE REVIEW Saurav Dev Bhatta (Sr. Economist, GED06) Maria Eugenia Genoni (Sr. Economist, GPV06) Uttam Sharma (Consultant, GED06)

The government has proposed a budget of Tk81,449 crore for the education sector in the budget for the 2022-2023 fiscal year, up from Tk71,954 crore in the current fiscal year - an increase of Tk9,495 crore. In his budget proposals placed in parliament on Thursday, Finance Minister AHM Mustafa Kamal set aside an allocation of Tk31,761 crore ...

Out of the total budget of Tk 678,064 crore for FY23, the allocation for the education sector is Tk 81,449 crore or 12 percent of the total, compared to 11.9 percent in FY22.

The government has increased the allocation for the education sector in the national budget by 8.36 percent to Tk 719.51 billion, but it remains almost unchanged in proportion despite the ripple ...

Education will be a critical determinant of sustainable economic development - something that Bangladesh strives to attain. The benefits of education are reaped in the long run and to achieve this, the allocation of Budget this year to education increased by 7% [3] to BDT 719.53 billion, compared to BDT 662.07 billion in FY 2020-21. The ...

General government usually refers to local, regional and central governments. Bangladesh education spending for 2022 was 11.73%, a 1.51% increase from 2021. Bangladesh education spending for 2021 was 10.22%, a 0.17% decline from 2020. Bangladesh education spending for 2020 was 10.39%, a 0.94% decline from 2019.

Bangladesh Education Sector Public Expenditure Review. Adequate investment in human capital development is critical for enabling Bangladesh to reach its goal of becoming an upper middle-income country. Bangladesh, currently a lower-middle country with an annual per capita gross national income (GNI) of USD 1,470 (WDI 2019), aims to attain upper ...

i education sector plan (esp) for bangladesh fiscal years 2020/21 - 2024/25 10 december 2020

The budget allocation for the education sector made up 11.91 percent of the total outlay in the 2020-21 fiscal year. ... Budget 2022-23 national budget 2022-23 Bangladesh National Budget 2022-23 ...

BANGLADESH AT 50 : Realization of Dreams Through Humane and Patriotic Leadership ... Ministry of Primary and Mass Education: 2022-23 Gender Budget G-1_01_124_Primary_Bangla.pdf: 5: Statement 4 : Consolidated Fund : Operating Expenditure (Economic Analysis Summary) ... Graph III: Operating Budget: 2022-23, Details of Sector-wise Allocation: 2022 ...

Despite Compulsory Primary Education Act enacted in 1990 in Bangladesh, due to inadequate budgetary allocation and comprehensive effort, Bangladesh primary education subsector had been suffered ...

The World Education Forum 2015 in Incheon, Korea, in setting the agenda for Education 2030, has urged countries to increase their public spending for education to at least 4-6% of GDP and/or at least 15-20% of total budget The Education 2030 agenda is reflected in SDG 4 adopted at the United Nations in September 2015

National education budget (2020) Budget: US$ 7.832 billion (6,640 crore Taka) General details; ... Education in Bangladesh is administered by the country's Ministry of ... for FY23, the allocation for the education sector is taka 81,449 crore (approximately 7.5 billion dollars) or 12 percent of the total, compared to 11.9 percent in FY22. In ...

Bangladesh has not been fulfilling the recommendations of different education commissions, 4 to 5 percent of GDP/NI to be allocated for education. Government budget allocation on HE is 1.0 percent of National budget in Bangladesh. This budget allocation is not enough to meet the minimum demand of public universities (UGC 2012).

The budget shows allocation in education and technology together. The finance ministry source said the education sector would get Tk 1 trillion and the health sector Tk 420 billion in the next budget. ... Bangladesh is followed by Bermuda, Haiti, Mauritania, Cambodia, Laos, Monaco, Papua New Guinea, Somali and South Sudan. Most of them are ...

According to a finance ministry plan, the government may allocate Tk 3,14,700 crore for the three sectors from the total budget of Tk 7,96,900 crore in fiscal 2024-2025.

Cost-of-living relief. The reworked stage 3 tax cuts form the centrepiece of the government's budget. They were announced in January, legislated in February and come into effect on July 1.

The Federal Transit Administration (FTA) announces the availability of $10,496,164 in Fiscal Year (FY) 2024 funding under the Pilot Program for Transit-Oriented Development Planning (TOD Pilot Program). As required by Federal public transportation law and subject to funding availability, funds...

National Budget 2023-24: Summary. 2. Health Sector in the budget for FY2023-24. The national parliament approved the budget for FY2023-24 on 26 June 2023. The health sector's budget allocation is set to increase in the FY2023-24. The revised budget for the sector in FY2022-23 allocated 4.5 per cent, which has increased to 5 per cent in FY2023-24.