The Benefits and Drawbacks of Different Business Plans

- Fundrising Ready

- MAC & PC Compatible

- Immediate Download

Related Blogs

- Estimating startup costs for your business

- How to Secure the Right Financing

- What Every Business Owner Should Know About Intellectual Property

- Ideas for Developing a Successful Distribution Plan

- Understanding the Benefits of Business Plan Software

Understanding the benefits and drawbacks of different business plans is essential for entrepreneurs seeking success in today's competitive landscape. From the comprehensive nature of traditional business plans to the agility of lean startup approaches, each type offers unique advantages and challenges that can significantly impact your business journey. Dive into this guide to discover which plan aligns best with your goals and needs.

What are the main types of business plans?

Traditional business plans.

A traditional business plan is a comprehensive document that outlines the complete vision for a business. Typically spanning 20 to 40 pages, it includes sections such as executive summary, market analysis, organizational structure, and financial projections. This type of plan is often used when seeking investment or loans, as it provides detailed insights into the business's potential for success.

Lean startup business plans

The lean startup business plan is designed for businesses that prioritize speed and adaptability. Unlike traditional plans, which are extensive and detail-oriented, lean startup plans focus on rapid iterations, customer feedback, and validation. These plans are generally shorter and emphasize key metrics to help guide decision-making and pivoting strategies based on market responses.

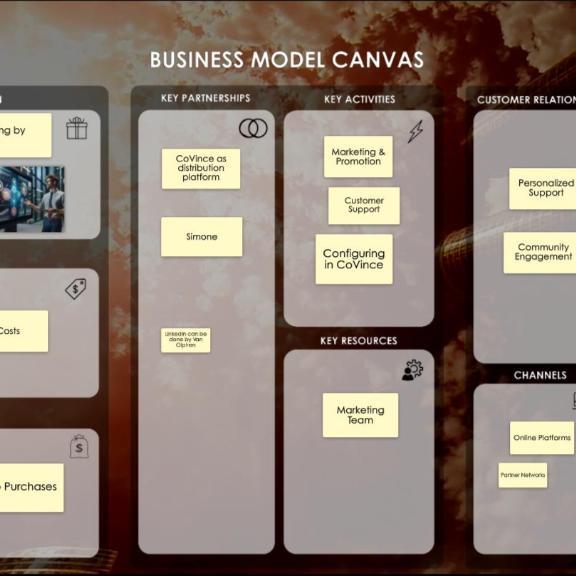

Business model canvas

The business model canvas is a visual tool that enables entrepreneurs to map out the essential components of their business model on a single page. It encourages creativity and collaboration, making it easier for teams to brainstorm and adjust their business strategies. While it simplifies complex business concepts, it may lack the detailed financial projections found in more traditional approaches.

Operational plans

Operational plans are focused on the day-to-day activities necessary to run a business efficiently. These plans break down the larger strategic goals into actionable tasks and set short-term objectives and targets. They are particularly beneficial in organizations that prioritize productivity and require alignment among team members to achieve strategic goals.

Strategic plans

Strategic plans are long-term roadmaps that define a company's vision, mission, and overarching goals. These plans help in aligning resources and efforts towards achieving significant milestones over several years. Unlike operational plans, which focus on the short term, strategic plans consider market trends, competitive advantage, and overall business direction.

What are the benefits of a traditional business plan?

Provides a comprehensive overview of the business.

A traditional business plan offers a detailed and structured overview of the business, encompassing various aspects such as market analysis, product offerings, and operational strategies. This comprehensive nature allows entrepreneurs to clearly outline their business vision, mission, and objectives, making it easier for stakeholders to understand the direction and purpose of the business.

Helps in securing funding from investors

One of the primary benefits of a traditional business plan is its role in securing funding . Investors and financial institutions often require a well-prepared business plan to assess the viability and potential return on investment. A traditional business plan includes financial projections, market analysis, and operational plans, all of which are crucial in convincing potential investors of the business's potential for success.

Facilitates long-term strategic planning

A traditional business plan is not just a tool for raising funds; it also serves as a roadmap for long-term strategic planning . By outlining the business's goals and the strategies to achieve them, entrepreneurs can effectively plan for future growth and navigate the challenges of the business landscape. This foresight is essential for adapting to market changes and ensuring sustainability.

Enhances organizational alignment

Another significant advantage of traditional business plans is their ability to enhance organizational alignment . When all team members are on the same page regarding the business's objectives and strategies, it fosters collaboration and teamwork. A well-articulated business plan serves as a reference point, helping employees understand their roles and how they contribute to the overall success of the organization.

Serves as a reference for performance measurement

Finally, a traditional business plan acts as a benchmark for measuring performance. By establishing clear goals and objectives, businesses can track their progress and make necessary adjustments. This performance measurement capability is vital for maintaining accountability and ensuring that the business remains aligned with its strategic vision.

- Regularly review and update your traditional business plan to reflect changes in the market and your business environment.

- Involve key team members in the planning process to enhance buy-in and alignment.

- Utilize the traditional business plan as a living document that guides daily operations and strategic initiatives.

What are the drawbacks of a traditional business plan?

Time-consuming to create and update.

One of the most significant drawbacks of a traditional business plan is the amount of time it requires to create and maintain. Entrepreneurs often find themselves dedicating weeks or even months to research, drafting, and refining their plans. This lengthy process can divert attention from other critical aspects of running a business, such as product development or market engagement. Furthermore, updating the plan to reflect changing market conditions or business objectives can also be a time-consuming endeavor.

May become outdated quickly

In today’s fast-paced business environment, a traditional business plan can quickly become outdated. Market dynamics, consumer preferences, and competitive landscapes evolve continuously, rendering a static document less relevant. As a result, businesses relying heavily on a traditional plan may miss opportunities or fail to respond effectively to challenges. This risk is particularly pronounced for startups and businesses in rapidly changing industries.

Can be overly rigid, limiting flexibility

Another notable disadvantage of a traditional business plan is its inherent rigidity. These plans often follow a structured format that can stifle creativity and adaptability. Entrepreneurs may feel compelled to stick to their original strategies, even in the face of new information or unexpected challenges. This rigidity can hinder a business's ability to pivot or innovate, which is crucial for long-term success.

Risk of overestimating market potential

Traditional business plans often include detailed market analyses and projections. However, there is a significant risk of overestimating market potential. Entrepreneurs may become overly optimistic about their product or service's demand, leading to unrealistic sales forecasts and financial projections. Such overestimations can result in inadequate preparation for less favorable market conditions, jeopardizing the business’s viability.

Complexity may deter some entrepreneurs

The complexity of a traditional business plan can be a barrier for some entrepreneurs, particularly those who are new to the business landscape. The need to include extensive data, charts, and financial forecasts can be intimidating. This complexity can discourage potential business owners from even attempting to develop a plan, resulting in a lack of strategic direction and focus for their ventures.

- Consider breaking down your traditional business plan into smaller, more manageable sections to reduce complexity.

- Regularly schedule reviews of your business plan to ensure it remains relevant and aligned with current market conditions.

- Utilize feedback from trusted advisors or mentors to refine your market analyses and projections, helping to mitigate the risk of overestimation.

How do lean startup business plans differ from traditional plans?

Focus on short-term goals and rapid iterations.

A lean startup business plan is distinctly structured around achieving short-term goals, allowing businesses to pivot quickly based on immediate results. Unlike a traditional business plan, which may be comprehensive and long-term in scope, the lean startup approach encourages constant testing and refinement of ideas. This iterative process makes it possible for entrepreneurs to adapt their strategies and offerings in response to real-world feedback and changing market conditions.

Emphasizes Customer Feedback and Validation

One of the core principles of a lean startup business plan is the emphasis on customer feedback . By prioritizing direct input from potential customers, businesses can validate their product concepts before committing significant resources. This focus on customer feedback in lean startup plans ensures that offerings are closely aligned with consumer needs, ultimately leading to higher chances of success and market acceptance.

Encourages Adaptability Based on Market Response

Adaptability is a hallmark of the lean startup methodology. Unlike traditional business plans that may lock a company into a specific direction, the lean startup model allows for flexibility. Businesses can quickly respond to market demands, adjusting their strategies, products, or services as necessary. This adaptability not only fosters innovation but also mitigates risks associated with pursuing outdated or irrelevant business models.

Simplicity Aids in Quick Decision-Making

The simplicity of a lean startup business plan facilitates quick decision-making. By distilling complex ideas into straightforward, actionable steps, entrepreneurs can make informed choices without becoming bogged down by extensive documentation. This streamlined approach enables teams to maintain momentum and focus on executing their strategies, a significant advantage in fast-paced markets.

Often Less Costly to Develop and Maintain

Developing a lean startup business plan generally incurs lower costs compared to a traditional business plan. The reduced need for exhaustive research, lengthy projections, and formal presentations translates into savings in both time and resources. This cost-effectiveness makes the lean startup approach particularly appealing to entrepreneurs and small businesses operating with limited budgets.

- Conduct regular surveys or interviews with your target audience to gather meaningful customer feedback .

- Use tools like the business model canvas to visualize and adjust your business strategy effectively.

- Set specific, measurable short-term goals to guide your decision-making process.

What are the pros and cons of using a business model canvas?

Visual representation aids in understanding key elements.

The business model canvas offers a clear and concise visual format that succinctly captures the essential components of a business. This visual layout helps entrepreneurs and stakeholders quickly grasp how different elements—such as value propositions, customer segments, and revenue streams—interact with one another. By presenting information in a visual manner, the canvas encourages better communication among team members and stakeholders, facilitating a shared understanding of the business model.

Encourages collaboration and creativity

One of the standout benefits of a business model canvas is its ability to foster collaboration and creativity within teams. Because it is typically created in a workshop setting, team members can contribute their ideas in real-time, leading to innovative solutions and strategies. This collaborative approach can also enhance team alignment, ensuring that everyone is on the same page regarding the business's goals and objectives.

Quick to create and modify

In contrast to traditional business plans, which can be lengthy and complex, the business model canvas is designed for rapid development and iteration. Entrepreneurs can draft their initial ideas quickly and make adjustments as new insights emerge. This flexibility is particularly advantageous in today’s fast-paced business environment, where the ability to pivot in response to changing market conditions is crucial.

May lack detailed financial projections

While the business model canvas captures essential components of a business model, it often lacks detailed financial projections . This absence can be a significant drawback for entrepreneurs seeking to secure funding or attract investors. Without comprehensive financial data, stakeholders may find it challenging to evaluate the business's viability and profitability, which could hinder efforts to secure necessary resources.

Can oversimplify complex business strategies

Another potential drawback is that the simplicity of the business model canvas may lead to the oversimplification of complex business strategies. While it effectively highlights core elements, it may not adequately represent intricate operational processes or multifaceted market dynamics. Entrepreneurs relying solely on the canvas for strategic planning might overlook critical details necessary for navigating challenges or capitalizing on opportunities.

- Consider combining the business model canvas with detailed financial projections to create a more comprehensive overview of your business.

- Use the canvas as a living document that evolves with your business, allowing for continual adaptation and refinement.

- Encourage team members from various departments to contribute to the canvas, enhancing collaboration and diverse perspectives.

In what situations is an operational plan most beneficial?

When needing to outline day-to-day activities.

An operational plan is essential for clarifying the daily operations of a business. It provides a detailed roadmap that defines the specific tasks and processes required to achieve short-term objectives. By outlining these day-to-day activities, businesses can ensure that everyone is on the same page and that operational efficiency is maintained.

For setting short-term objectives and targets

Operational plans are particularly valuable when businesses need to establish short-term objectives and measurable targets. These plans allow teams to focus on immediate goals while aligning their efforts with the overall strategic vision of the organization. Keeping objectives short-term ensures that businesses can adapt quickly to changes in the market or shifts in consumer demand.

In businesses focused on efficiency and productivity

For organizations that prioritize efficiency and productivity, an operational plan serves as a guiding framework. It details optimized workflows, resource allocation, and performance metrics, all of which can streamline operations. By emphasizing efficiency, businesses can reduce waste and enhance output, ultimately leading to greater profitability.

When aligning team efforts with strategic goals

Alignment is crucial for any organization aiming for success. An operational plan fosters team alignment by clearly communicating how daily tasks contribute to broader strategic goals. This ensures that every team member understands their role within the larger context, which can enhance motivation and commitment to achieving the company’s objectives.

To manage resource allocation effectively

Effective resource management is a cornerstone of any successful business. An operational plan helps identify resource needs and allocate them efficiently. This includes human resources, financial investments, and physical assets. By managing resources effectively, businesses can avoid bottlenecks and ensure that all necessary components are in place for smooth operations.

- Regularly review and update your operational plan to reflect changes in business conditions.

- Involve team members in the planning process to gain insights and foster buy-in.

- Use key performance indicators (KPIs) to measure the effectiveness of your operational plan.

How can choosing the right business plan impact overall success?

Affects funding opportunities and investor interest.

Choosing the appropriate type of business plan can significantly influence your ability to secure funding. For instance, a well-structured traditional business plan often appeals to investors because it provides a detailed roadmap of your business model, market analysis, and financial projections. This comprehensive overview not only demonstrates your preparedness but also instills confidence in potential investors.

Conversely, using a lean startup business plan might attract a different type of investor who values agility and innovation. These investors may prefer to see your ability to adapt and respond to customer feedback rather than a rigid long-term forecast.

Influences strategic direction and decision-making

The type of business plan you choose serves as a guiding document for strategic planning. A business model canvas , with its visual representation of key components, can help you quickly assess the viability of your business strategy and make informed decisions. This visual tool encourages collaboration, allowing stakeholders to contribute to and refine the strategic direction.

In contrast, a more detailed operational plan may be necessary as your business grows, ensuring that day-to-day activities align with long-term goals. This alignment is crucial for maintaining focus and ensuring that all team members are working towards a common objective.

Impacts team motivation and alignment

The clarity provided by a well-defined business plan can enhance team motivation. When employees understand the business goals and their roles within the larger framework, they are more likely to feel engaged and committed. A traditional business plan that outlines responsibilities and expectations can foster a sense of purpose among team members.

On the other hand, lean startup plans promote a culture of experimentation and learning, which can invigorate teams by emphasizing innovation and responsiveness to customer needs. This adaptability often leads to higher morale as team members see their input valued and their efforts contributing to real-time improvements.

Determines the ability to pivot and respond to challenges

The flexibility of your business plan is crucial for navigating unforeseen challenges. A lean startup business plan allows for rapid iterations based on customer feedback, empowering businesses to pivot when necessary. This adaptability is vital in today’s fast-paced market where consumer preferences can shift quickly.

In contrast, a more rigid traditional business plan may hinder a company's ability to pivot, potentially leading to missed opportunities. As such, it is essential to assess how responsive your chosen plan is to market changes and customer needs.

Shapes the business’s long-term sustainability and growth

The choice of business plan has lasting implications for your company’s sustainability and growth trajectory. A comprehensive traditional business plan can lay a solid foundation for long-term success, outlining a clear vision for the future and the steps needed to achieve it. This foresight is crucial for maintaining focus and resilience in the face of challenges.

Additionally, utilizing a business model canvas can facilitate ongoing adjustments to your strategy, ensuring that your business remains relevant and competitive. Regularly revisiting and refining your plan in response to market dynamics is essential for sustaining growth.

- Consider your target audience when selecting a business plan ; different investors and stakeholders may respond better to specific formats.

- Regularly update your business plan to reflect changes in the market, team structure, and business goals.

- Leverage team insights when creating your business plan to ensure alignment and foster a sense of ownership.

- Choosing a selection results in a full page refresh.

Advantages vs Disadvantages of the Traditional Business Model

What is a traditional business model.

A traditional business model is a well-established approach that defines how a company operates, generates revenue, and serves its customers. It stands in contrast to digital businesses, which rely heavily on online platforms and technologies. Traditional businesses often maintain a brick-and-mortar presence, engaging in face-to-face interactions with customers and adhering to conventional methods of production, distribution, and sales.

Definition of traditional business model

The traditional business model encompasses a diverse array of business types, ranging from local retailers to large-scale manufacturers and various service providers. Typically, it entails the physical presence of a business, such as a brick-and-mortar store, where customers visit to purchase products or receive services. This model relies on established business processes and practices, following a tried-and-true path to profitability that has been honed over many years.

Types of traditional business models

Traditional business models manifest in several forms. Retailers sell products directly to consumers through physical stores, providing a tangible shopping experience. Manufacturers craft goods using raw materials and supply chains, relying on established production methods. The hospitality industry offers accommodations and dining experiences, emphasizing in-person interactions. Professional services encompass fields like law, finance, and healthcare, where expertise is delivered through personal consultations.

Examples of traditional businesses

Examples of traditional businesses are abundant in our everyday lives. Grocery stores, restaurants, factories, hotels, law firms, and healthcare clinics are all quintessential representations of traditional business models. These businesses have thrived for decades by catering to local or regional markets and providing face-to-face interactions with customers, fostering trust and loyalty.

Criticism of traditional business models

Critics argue that traditional business models can face challenges in adapting to rapidly changing consumer preferences and technological advancements. They may struggle with higher operating costs associated with maintaining physical locations and a substantial workforce. Additionally, traditional businesses can be susceptible to economic downturns and disruptive competitors who leverage digital technologies to streamline operations and reach wider audiences.

Challenges faced by traditional businesses

Traditional businesses encounter various challenges in today’s dynamic business landscape. They contend with fierce competition from e-commerce companies, which can offer convenience and broader product selections. Rising operational costs, including rent, utilities, and labor, can strain profit margins. Complying with evolving regulations and effectively managing a workforce in an era of shifting labor dynamics are additional hurdles. Adapting to the digital age and finding ways to stay relevant while preserving the essence of face-to-face interactions are ongoing challenges for many traditional businesses.

Comparison with Digital Business Models

Differences between traditional and digital business models.

Traditional business models refer to conventional setups where companies have a physical presence, engage in face-to-face interactions, and use established methods for production, distribution, and sales. In contrast, digital business models are characterized by a strong online presence, reliance on e-commerce, and the use of digital technologies for various business functions. The primary difference lies in the medium through which these business models operate, impacting customer engagement, scalability, and cost structures.

Evaluating successful traditional businesses in the digital age

In the digital age, successful traditional businesses must adapt to changing consumer behaviors and preferences. Many have done so by embracing e-commerce, implementing digital marketing strategies, and enhancing their online presence. For instance, well-established retail brands have extended their reach through online stores, catering to a broader audience.

Impact of digital marketing on traditional businesses

Digital marketing has transformed the landscape for traditional businesses, offering cost-effective tools to reach and engage with customers. Through social media, search engine optimization (SEO), and email campaigns, businesses can enhance their visibility, attract new customers, and retain existing ones. Embracing digital marketing is crucial for traditional businesses seeking to remain competitive and relevant.

Adapting to the digital business model

Adapting to a digital business model often involves transitioning from brick-and-mortar operations to e-commerce, optimizing online stores, and incorporating digital tools for inventory management, customer relationship management, and analytics. This shift enables businesses to harness the scalability and global reach offered by digital platforms.

Advantages and disadvantages of digital business models

Digital business models offer advantages such as expanded market reach, lower overhead costs, and the ability to collect and analyze vast amounts of data for informed decision-making. However, they also bring challenges, including cybersecurity concerns, intense online competition, and the need for continuous technological innovation. Traditional businesses venturing into the digital realm must carefully weigh these advantages and disadvantages to build a sustainable digital presence.

Building a Successful Traditional Business

Developing a business plan for traditional businesses.

Developing a comprehensive business plan is a crucial step in building a successful traditional business. This plan should outline the company’s vision, mission, and objectives, as well as its unique value proposition. It should also include financial projections, market research, competitive analysis, and a detailed marketing strategy. A well-crafted business plan provides a roadmap for the business, guiding its operations and helping secure funding or investments if needed.

Identifying the target market for traditional businesses

Identifying and understanding the target market is essential for traditional businesses. This involves defining the ideal customer profile, demographics, and psychographics. Traditional businesses should use market research and data analysis to pinpoint their target audience accurately. Tailoring products, services, and marketing efforts to meet the specific needs and preferences of this audience is crucial for success.

Effective business processes for traditional business models

Effective business processes are the backbone of traditional business models. These processes encompass production, supply chain management, inventory control, customer service, and more. Streamlining these processes and implementing efficient management models can reduce costs, improve quality, and enhance customer satisfaction. Traditional businesses often rely on tried-and-true methods to ensure consistency and reliability in their operations.

Challenges faced by new traditional businesses

New traditional businesses face several challenges, including competition from established companies, rising operational costs, and the need to build brand recognition. Adapting to changing consumer preferences and incorporating modern technologies into traditional business models can also be challenging. However, with strategic planning, effective marketing, and a focus on customer satisfaction, new traditional businesses can overcome these hurdles and establish themselves in the market.

Examples of successful traditional businesses

Many traditional businesses have thrived for decades, demonstrating the enduring value of their business models. Examples include well-known brands like Coca-Cola, Ford, and McDonald’s. These companies have consistently delivered quality products and services, maintained strong customer relationships, and adapted to market changes over time. Successful traditional businesses often attribute their longevity to a commitment to core values and a willingness to evolve while preserving the essence of their business model.

Adapting to New Business Trends

The impact of e-commerce on traditional business models.

E-commerce has had a profound impact on traditional business models. The convenience of online shopping and the ability to reach a global customer base have shifted consumer preferences away from brick-and-mortar stores. Traditional retailers have had to adapt by establishing an online presence, offering e-commerce options, and optimizing their supply chain and delivery systems. This shift has forced traditional businesses to rethink their strategies and find innovative ways to compete in the digital age.

Innovative approaches to traditional retail business

Innovative approaches to traditional retail involve embracing technology and data-driven insights. For example, retailers can use customer data to personalize shopping experiences, implement contactless payment systems, and create immersive in-store experiences. Pop-up shops, subscription services, and collaborations with online marketplaces are also innovative strategies that traditional retailers can employ to attract and retain customers.

Integrating digital elements into traditional business models

Integrating digital elements into traditional business models is essential for staying competitive. Businesses can leverage social media for marketing, develop user-friendly mobile apps, and implement digital payment solutions. Additionally, digital tools can enhance inventory management, customer relationship management, and data analytics, providing valuable insights for decision-making.

Shifts in consumer behavior and the traditional business model

Consumer behavior has evolved significantly with the rise of digital technology. Customers now expect convenience, speed, and personalization. Traditional businesses must adapt to these shifts by offering online shopping options, improving customer service, and tailoring their product offerings to meet changing preferences.

Opportunities and threats for traditional business owners

Traditional business owners face both opportunities and threats in the evolving business landscape. Opportunities include expanding into e-commerce, leveraging technology for operational efficiency, and differentiating their brand through exceptional customer service. However, threats such as increased competition from e-commerce giants, changing regulations, and economic uncertainties also exist. To thrive, traditional business owners must remain agile, embrace innovation, and continually assess market trends to seize opportunities and mitigate threats.

Conclusion: The Future of Traditional Business Models

Challenges and opportunities in the traditional business environment.

The traditional business environment faces a dynamic landscape filled with both challenges and opportunities. Challenges include adapting to changing consumer preferences, competing with digital platforms, and navigating evolving regulations. However, opportunities arise from the enduring value of traditional business models, loyal customer bases, and the ability to blend digital elements with traditional practices. Successfully navigating these challenges while harnessing the opportunities is essential for the longevity and growth of traditional businesses.

The significance of traditional business models in the modern economy

Traditional business models continue to hold significance in the modern economy. They provide stability, generate employment, and contribute to the local communities they serve. Their long-standing presence fosters trust among consumers. Additionally, traditional businesses can adapt and innovate, incorporating digital technologies and modern marketing strategies to stay relevant and competitive in the digital age. Their resilience and ability to evolve make them integral players in the modern economic landscape.

Strategies for sustaining traditional business models

Sustaining traditional business models requires a combination of strategies. These include embracing digital marketing techniques, enhancing customer experiences, optimizing operations through technology, and diversifying product or service offerings. Collaboration with digital platforms or expanding e-commerce capabilities can also open new revenue streams. Moreover, fostering a culture of innovation, ongoing research and development, and adaptability are vital for the continued success of traditional businesses.

Innovations in traditional business practices

Innovations in traditional business practices are essential for staying competitive. Examples include adopting sustainable and eco-friendly practices, improving supply chain management, and enhancing data analytics for better decision-making. Leveraging technology for business process management can streamline operations and reduce costs. Furthermore, embracing innovative marketing strategies, such as content marketing and influencer collaborations, can help traditional businesses connect with new audiences.

Embracing the unique value of traditional business models

Traditional business models offer a unique value proposition rooted in personal interactions, local presence, and established trust. Embracing this value and combining it with digital enhancements positions traditional businesses for success. Recognizing their strengths in customer relationships, community engagement, and the ability to adapt over time, traditional businesses can thrive in the ever-evolving business landscape by continuing to provide reliable and valuable offerings to their customers.

Introducing School of Money

Looking to monetize your passion and skills? Dive into the School of Money – your one-stop platform for mastering the art of earning.

Whether you’re an aspiring entrepreneur , trader , or just someone keen on financial growth, our comprehensive insights on personal development, finance, and leadership are tailored for you.

Embark on a transformative journey to financial literacy and independence with School of Money and unlock your true earning potential!

Recent Posts

Lifetime ISA vs Pension: Which is Better for Your Retirement?

Understanding Annuity vs Drawdown: Which is Right for Your Pension?

A Guide to What a Good Pension Pot is?

School Of Money

All Subjects

Entrepreneurship

Study guides for every class, that actually explain what's on your next test, traditional business plan, from class:.

A traditional business plan is a comprehensive document that outlines the details of a business, including its goals, strategies, target market, financial projections, and operational plans. It serves as a roadmap for entrepreneurs and business owners to guide the development and growth of their venture.

congrats on reading the definition of Traditional Business Plan . now let's actually learn it.

5 Must Know Facts For Your Next Test

- A traditional business plan is often required by lenders, investors, and other stakeholders to evaluate the feasibility and potential of a business venture.

- The level of detail and complexity in a traditional business plan can vary depending on the size, industry, and stage of the business, but it typically covers key elements such as the company description, products or services, marketing strategy, and management team.

- The process of creating a traditional business plan can help entrepreneurs identify and address potential challenges, refine their business model, and develop a comprehensive strategy for success.

- Traditional business plans are often more static and less flexible than alternative planning approaches, such as the lean startup method, which emphasizes rapid iteration and customer feedback.

- Well-crafted traditional business plans can serve as a valuable tool for securing funding, communicating the business's vision and strategy to stakeholders, and tracking progress towards established goals.

Review Questions

- A traditional business plan serves as a comprehensive roadmap for entrepreneurs and business owners, outlining the key elements of their venture, including the company's goals, strategies, target market, financial projections, and operational plans. This document is often required by lenders, investors, and other stakeholders to evaluate the feasibility and potential of the business. The process of creating a traditional business plan can help entrepreneurs identify and address potential challenges, refine their business model, and develop a comprehensive strategy for success. Additionally, a well-crafted business plan can be a valuable tool for securing funding, communicating the business's vision and strategy to stakeholders, and tracking progress towards established goals.

- A traditional business plan typically includes the following key components: an executive summary, a company description, a market analysis, a description of the products or services, a marketing and sales strategy, an operational plan, a management team overview, and detailed financial projections. The executive summary provides a concise overview of the key elements of the plan, while the market analysis examines industry trends, competitor analysis, and the potential customer base to assess the viability and potential for the business. The product or service description outlines the unique features and benefits, and the marketing and sales strategy details how the business will reach and retain customers. The operational plan addresses the day-to-day logistics of running the business, and the management team overview highlights the skills and experience of the key personnel. Finally, the financial projections, including income statements, balance sheets, and cash flow statements, estimate the financial performance of the business over a specific time period. Together, these components provide a comprehensive and strategic framework for the business, contributing to its overall effectiveness and likelihood of success.

- While traditional business plans are often more detailed and comprehensive than alternative planning approaches, such as the lean startup method, they also tend to be more static and less flexible. The lean startup method emphasizes rapid iteration and customer feedback, allowing for more agile and responsive business development. However, traditional business plans can still offer significant advantages in certain circumstances. For example, a traditional business plan may be the most appropriate choice for larger, more established businesses or those seeking significant external funding, as it provides a detailed roadmap that can reassure lenders and investors. The level of detail and analysis required in a traditional business plan can also be beneficial for entrepreneurs who are entering a highly competitive or regulated industry, as it helps them thoroughly evaluate the market, competitors, and potential risks. Additionally, the process of creating a traditional business plan can be valuable for entrepreneurs, as it encourages them to thoroughly research and plan their business, leading to a more comprehensive understanding of their venture and its potential challenges. Ultimately, the choice between a traditional business plan and alternative planning approaches will depend on the specific needs and circumstances of the entrepreneur or small business owner.

Related terms

A concise overview of the key elements of the business plan, typically one to two pages in length, that provides a high-level summary of the business.

Detailed financial forecasts, including income statements, balance sheets, and cash flow statements, that estimate the financial performance of the business over a specific time period.

An in-depth examination of the target market, including industry trends, competitor analysis, and the potential customer base, to assess the viability and potential for the business.

" Traditional Business Plan " also found in:

Subjects ( 1 ).

- Intro to Business

© 2024 Fiveable Inc. All rights reserved.

Ap® and sat® are trademarks registered by the college board, which is not affiliated with, and does not endorse this website..

Blog » Startup Hints: Idea Stage » The Lean Startup vs Traditional Business Plan? Sorting out

The Lean Startup vs Traditional Business Plan? Sorting out

Posted on September 30, 2021 |

The Lean Startup Methodology or Traditional Business Plan… Which is the right choice for your brand-new business? In this article, we’ll be comparing and contrasting the two and helping you decide which option is best for your startup.

In the past, if you wanted to start a new business, you had to do a lot of planning first. Before you even considered launching your product or service, it was essential to do weeks, months… even years of comprehensive business research. This is known as a traditional business model or plan.

In 2010 though, this all changed with Eric Ries and the launch of his book: The lean startup . The focus was now on businesses to launch as quickly as they possibly could, learning and gathering feedback as they went.

If you own a startup, you will naturally want to do all you can to give it the best chance of survival. You will want to know if going slow and steady will win the race, or whether it is best to get your business to market as quickly as you can.

In this blog, we’ll be taking a look at both types of business plans and seeing which is the best choice for startups to take.

Table of contents

What is a traditional business plan, you can reduce the lean startup methodology to three simple steps., a lean startup methodology includes the following:, it can help you eliminate the risk, it can help you get financing, it’s ideal for larger products, it can get you to market quicker, you can walk away if your product or service doesn’t work, you’re more likely to attract investors, the lean startup vs traditional business plan: which is best for my business, need a little extra support getting your lean startup off the ground you are launched is here to help.

The traditional business plan is often known as a formal business plan. This plan goes into a lot of detail about a business and can often be forty or fifty pages long!

The content a traditional business plan includes can vary depending on the type of business and the specific industry. However, the plans typically stick to this structure:

- An executive summary. This is a concise description that summarises the entire document and explains what the business plan includes

- A description of your startup and the goals you have. What do you want to achieve, and how will you measure your success?

- An explanation of your product or service. You may not have created or designed it just yet, but go into as much detail as you can.

- Market research . This identifies your target audience, your competitors, and the price you should sell your product or service at.

- Biographies of the people involved in your business, as well as an organizational structure. What skills will they bring to your startup?

- Detailed financial projections, including cash flow, profits, and losses. If you are looking for financing, either from an investor or a bank, you will want to mention how much money you are looking for, and what you will do with the capital you receive;

- Finally, include any relevant documents in your appendix, including legal documents and certificates

Think of a traditional business plan as a thorough blueprint for your startup. It not only details your current position but where you see yourself and the company in several years.

What is the lean startup methodology?

Although the term ‘lean startup’ was devised by Eric Ries over a decade ago, the concept of lean startup methodology has been used long since then! One of the first entrepreneurs to use a similar concept was Henry Ford back at the start of the 20 th century.

Lean startup methodology is simple. It is focused on getting a product or service to market as quickly as possible.

Many successful businesses like Dropbox, Zappos, and Buffer all used lean startup planning. They launched a no-frills version of their product or service and gathered valuable customer feedback as they went along.

1. Firstly, find your business idea – something that solves a customer’s pain points. If you can’t do this, then your idea is not a viable one. At this stage, you will create your business plan (more on that in a little while)

2. Secondly, execute your business idea. One of the critical concepts of the lean startup is the creation of a minimal viable product or MVP . This is a simple version of your product that you can quickly build and get to market. By reducing the number of features the product has, you can save a lot of valuable time.

More information about building a minimum viable product can be found here

3. Finally, validate your business idea. Feedback is critical to lean startup methodology and can be used to either make amends to your MVP or abandon it and start again.

With the lean startup methodology, you create a business plan to identify your business needs and see if your idea is feasible. However, unlike a traditional business plan, a lean startup plan is only one or two pages long.

Many of the clients we have worked with have likened a lean startup business plan to the equivalent of the executive summary in a traditional business plan!

- The problem your startup solves;

- Your target audience;

- How your product or service makes things easier for your target audience;

- What makes your product or service different from your competitors;

- How much you will charge for your product or service, and what your costs will be?

As you can see, the Lean Startup covers less than the traditional business plan but still focuses on your product or service’s salient points.

What are the advantages of a traditional business plan?

A traditional business plan allows you to be thorough and meticulous. In fact, an Australian study found that a more formalized business plan led to higher gross revenues and an increase in sales.

Here are some of the advantages of taking the time to create a detailed business plan.

With a lean startup methodology, there is the risk that you could rush your product to market too soon. This could potentially lead to a wide range of issues. At best, you could see your product fail. At worst, you could find yourself in legal trouble or see damage to your brand’s reputation.

As an example of where more thorough planning could have helped, take Clairol. They launched their ‘ Touch of Yoghurt’ shampoo in the late 1970s, wanting to launch quickly to capitalize on people wanting to use natural beauty products.

The problem was that many people got confused and thought the shampoo was food. They then tried to eat it, becoming extremely ill in the process. It also didn’t help that the shampoo was promoted alongside a yogurt cookery book!

Although all-natural, food-based shampoos are the rage nowadays, the product bombed back then. Taking the time to research the market and see what customers really wanted would have helped the product to thrive.

A traditional business plan can be helpful if you are trying to get a loan from your bank, especially if they have very strict lending criteria .

Your bank will want to see through financial planning over the next few years, so they can determine how likely you are to pay them back.

The lean startup methodology may not be the best option when you have larger, more ambitious products to consider. For example, you may struggle with a minimum viable product for expensive products like cars and smartphones as you won’t be able to release several iterations over time.

Take, for example, Elon Musk. With products like SpaceX and Tesla electric vehicles, a lot of work needs to be done behind the scenes to change customer mindsets, something which can’t really be done with lean methodologies.

With a traditional business plan, you can thoroughly analyze your product and the market, making sure that when you launch, everything is accounted for.

What are the advantages of lean startup methodology?

Previously, we’ve written about creating Business plans for startups here.

Many businesses use the lean startup methodology to determine product viability and gather customer feedback. It’s estimated that one in two businesses use the lean startup method.

Here are some of the ways that using The Lean Startup methodology in comparison with traditional business plans can help your company to grow.

Comparing The Lean Startup vs Traditional Business plans vs lean startups, we would like to point out one of the main highlights. The key benefit of the lean startup methodology is that you can launch your product or service quickly. This can be a great advantage when you are in a very competitive industry or have a highly time-sensitive idea.

You can pivot more quickly if you need to as well. Many companies did this during the pandemic. As bars and pubs closed during the lockdown, breweries and distilleries started to use the alcohol they had on-site to produce hand sanitizer instead.

When you have spent weeks, perhaps even months, working on a thorough business plan, you’re going to be incredibly frustrated if your idea falls flat with customers.

Lean startup methodology has a lot less risk attached. As less time has been spent on planning and creating a basic MVP, if customer feedback determines that your idea is not a viable one, you can wrap things up. As you have spent less time and money on your concept , you can quickly move on to the next idea.

With lean startups, you’re encouraged to ‘fail fast and learn from the mistakes you make.

Comparing The Lean Startup with traditional business plans, we would like to point out one more lean startup highlight. Investors have a lot of money, but not a lot of time. As a result, they’re more likely to react positively to a one-page plan or a pitch deck than a fifty-page document.

This means that you’re more likely to attract funding from angel investors or venture capitalists if you need it.

Many investors like to see a tangible product, which means a brief business plan and an MVP can be a winning combination when it comes to achieving investment.

SWOT analysis may help you with this. Here you can find a list of SWOT templates.

In the world of business, there seems to be an automatic assumption that the traditional business model is outdated and bad, and that the lean startup methodology is modern and good.

In the modern-day world, anything that can save us time or money is often seen as a bonus. However, sometimes taking the time to do thorough research and analysis can have its benefits.

So, which type of business plan should you use? The honest answer is… you need to choose the model that is the right match for your business and its specific needs.

If you have a lot of competitors or a time-sensitive product, it makes sense to get your product or service to market as quickly as possible. However, if you have a unique product that you don’t mind waiting to launch, creating a traditional business plan can work to your advantage.

You’re not restricted to one type of business plan either. You may choose to start with a one-page lean model and decide to expand on it later on. Alternatively, you may decide to pare your traditional business plan down to a one-page summary and that’s where lean startup wins in opposition – The Lean Startup vs traditional business plan.

Your business has a 30% higher chance of growth with a business plan , regardless of what type you choose to use! So, whether your business plan is 100,000 or 1,000 words long, spending time creating one will definitely give your startup the edge.

Lean Startup & Traditional Business Plan (FAQ):

A traditional business plan is a comprehensive and formal document that outlines various aspects of a business, such as goals, products/services, market research, financial projections, and organizational structure. On the other hand, the lean startup methodology focuses on quickly launching a product or service, gathering customer feedback, and making iterative improvements based on that feedback

A traditional business plan typically includes an executive summary, a description of the startup and its goals, details about the product or service, market research, information about team members and the organizational structure, financial projections, and relevant documents in the appendix. It serves as a thorough blueprint for the business.

The lean startup methodology emphasizes launching a minimal viable product (MVP) quickly to gather customer feedback and validate the business idea. The process involves identifying a customer problem, creating an MVP, and iteratively refining the product based on feedback. Lean startup plans are concise and focus on essential elements like the problem solved, target audience, value proposition, differentiation from competitors, pricing, and costs

A traditional business plan offers thorough planning and risk reduction. It is suitable for larger and more complex products, provides detailed financial projections that can help secure financing, and allows for in-depth market analysis. It also helps avoid rushing products to market prematurely

The lean startup methodology facilitates quicker time-to-market, encourages faster iterations and pivots, and reduces the risk of investing too much in an idea that doesn’t resonate with customers. It’s ideal for competitive industries and time-sensitive ideas. Lean startup plans are concise, attract investors’ attention, and allow for rapid experimentation.

The choice between a traditional business plan and the lean startup methodology depends on your business’s nature, goals, and circumstances. If you’re in a competitive industry or have a time-sensitive idea, the lean startup approach could be more suitable. For unique products or when you can afford a longer development phase, a traditional business plan might be beneficial. You can also customize and adapt either approach to meet your startup’s specific needs.

Absolutely! You’re not limited to using just one approach. Some startups choose to start with a lean startup plan for quick validation and then expand it into a more comprehensive traditional business plan as the business grows. Alternatively, you can distill a detailed traditional plan into a concise lean startup summary. Flexibility allows you to tailor your approach to your startup’s requirements.

Yes, regardless of whether you choose a traditional business plan or a lean startup plan, having a business plan increases your chances of success. Studies suggest that businesses with a plan have a 30% higher chance of growth. The process of planning, regardless of the approach, helps you clarify your business’s goals, strategies, and potential challenges.

Using the lean startup methodology to accelerate your new startup can be challenging, but extremely rewarding.

If you need additional support and assistance to guide you through the process and help you create a lean business plan, You are launched has the experience you need.

Our team of experts has been working alongside a wide range of lean startups since 2016, helping them to quickly scale and gain an advantage in the marketplace

Contact us today, and let’s see how we can work together to apply lean startup techniques to your new business.

Support us by sharing this:

- Click to share on X (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to email a link to a friend (Opens in new window)

Launching Startups that get Success Stories

Contact us:

Quick links

© 2016 - 2024 URLAUNCHED LTD. All Rights Reserved

Home » Pros and Cons » 14 Pros and Cons of a Business Plan

14 Pros and Cons of a Business Plan

Should you create a business plan? Most people will say that you should have at least some sort of outline that helps you guide your business. Yet sometimes an opportunity is so great that you’ve just got to jump right in and grab it before it disappears. If you want funding or growth to be sustainable, however, there is a good chance that you’ll need to create a business plan of some sort in order to find success. Here are some of the pros and cons of a business plan to consider as you go about the process of creating and then running your business.

What Are the Pros of a Business Plan?

A business plan is a guide that you can use to make money. By understanding what your business is about and how it is likely to perform, you’ll be able to see how each result receive can impact your bottom line. With comprehensive plans in place, you’ll be prepared to take action no matter what happens over the course of any given day. Here are some more benefits to think about.

1. It gives you a glimpse of the future. A business plan helps you to forecast an idea to see if it has the potential to be successful. There’s no reason to proceed with the implementation of an idea if it is just going to cost you money, but that’s what you do if you go all-in without thinking about things. Even if the future seems uncertain, you’ll still get a glimpse of where your business should be.

2. You’ll know how to allocate your resources. How much inventory should you be holding right now? What kind of budget should you have? Some resources that your business needs to have are going to be scare. When you can see what your potential financial future is going to be, you can make adjustments to your journey so that you can avoid the obstacles that get in your way on the path toward success.

3. It is necessary to have a business plan for credit. In order for a financial institution to give you a line of credit, you’ll need to present them with your business plan. This plan gives the financial institution a chance to see how organized you happen to be so they can more accurately gauge their lending risks. Most institutions won’t even give you an appointment to discuss financing unless you have a formal business plan created and operational.

4. A business plan puts everyone onto the same page. When you’re working with multiple people, then you’re going to have multiple viewpoints as to what will bring about the most success. That’s not to say that the opinions of others are unimportant. If there isn’t any structure involved with a business, then people with a differing opinion tend to go rogue and just do their own thing. By making sure that everyone is on the same page with a business plan, you can funnel those creative energies into ideas that bring your company a greater chance of success.

5. It allows others to know that you’re taking this business seriously. It’s one thing to float an idea out to the internet to see if there is the potential of a business being formed from it. Creating a business plan for that idea means you’re taking the idea more seriously. It shows others that you have confidence in its value and that you’re willing to back it up. You are able to communicate your intentions more effectively, explain the value of your idea, and show how its growth can help others.

6. It’s an easy way to identify core demographics. No matter what business idea you have, you’re going to need customers in order for it to succeed. Whether you’re in the service industry or you’re selling products online, you’ll need to identify who your core prospects are going to be. Once that identification takes place, you can then clone those prospects in other demographics to continue a growth curve. Without plans in place that allow you to identify these people, you’re just guessing at who will want to do business with you and that’s about as reliable as throwing darts at a dartboard while blindfolded.

7. There is a marketing element included with a good business plan. This allows you to know how you’ll be able to reach future markets with your current products or services. You’ll also be able to hone your value proposition, giving your brand a more effective presence in each demographic.

What Are the Cons of a Business Plan?

A business plan takes time to create. Depending on the size of your business, it could be a time investment that takes away from your initial profits. Short-term losses might happen when you’re working on a plan, but the goal is to great long-term gains. For businesses operating on a shoestring budget, one short-term loss may be enough to cause that business to shut their doors. Here are some of the other disadvantages that should be considered.

1. A business plan can turn out to be inaccurate. It is important to involve the “right” people in the business planning process. These are the people who are going to be influencing the long-term vision of your business. Many small business owners feel like they can avoid this negative by just creating the business plan on their own, but that requires expertise in multiple fields for it to be successful. A broad range of opinions and input is usually necessary for the best possible business plan because otherwise the blind spots of inaccuracy can lead to many unintended consequences.

2. Too much time can be spent on analysis. Maybe you’ve heard the expression “paralysis by analysis.” It cute and catchy, but it also accurately describes the struggle that many have in the creation of a business plan. Focus on the essentials of your business and how it will grow. Sure – you’ll need to buy toilet paper for the bathroom and you’ll want a cleaning service twice per week, but is that more important than knowing how you can reach potential customers? Of course not.

3. There is often a lack of accountability. Because one person is generally responsible for the creation of a business plan, it is difficult to hold that person accountable to the process. The plans become their view of the company and the success they’d like to see. It also means the business plan gets created on their timetable instead of what is best for the business and since there isn’t anyone else involved, it can be difficult to hold their feet to the fire to get the job done.

4. A great business plan requires great implementation practices. Many businesses create a plan that just sits somewhere on a shelf or on a drive somewhere because it was made for one specific purpose: funding. When a solid business plan has assigned specific responsibilities to specific job positions and creates the foundation for information gathering and metric creation, it should become an integral part of the company. Unfortunately poor implementation has ruined many great business plans over the years.

5. It restricts the freedom you once had. Business plans dictate what you should do and how you should do it. A vibrant business sometimes needs its most creative people to have the freedom to develop innovative new ideas. Instead the average plan tends to create an environment where the executives of the company dictate the goals and the mission of everyone. The people who are on the front lines are often not given the chance to influence the implementation of the business plan, which ultimately puts a company at a disadvantage.

6. It creates an environment of false certainty. It is important to remember that a business plan is nothing more than a forecast based on plans and facts that are present today. We live in a changing world where nothing is 100% certain. If there is too much certainty in the business plan that has been created, then it can make a business be unable to adapt to the changes that the world is placing on it. Or worse – it can cause a business to miss an exciting new opportunity because they are so tunnel-visioned on what must be done to meet one specific goal.

7. There are no guarantees. Even with all of the best research, the best workers, and a comprehensive business plan all working on your behalf, failure is more likely to happen than success. In the next 5 years, 95 out of 100 companies that start-up today will be out of business and many of them will have created comprehensive business plans.

The pros and cons of a business plan show that it may be an essential component of good business, but a comprehensive plan may not be necessary in all circumstances. The goal of a business plan should be clear: to analyze the present so a best guess at future results can be obtained. You’re plotting out a journey for that company. If you can also plan for detours, then you’ll be able to increase your chances to experience success.

Related Posts:

- 25 Best Ways to Overcome the Fear of Failure

- 30 Best Student Action Plan Examples

- 100 Most Profitable Food Business Ideas

- 10 Amazon Pricing Strategies with Examples

Description

Business Model Canvas vs. Traditional Business Plans: A Comparison

This article explores the differences between the business model canvas and traditional business plans. it provides an overview of each approach, discussing their values and how they work. the article also offers detailed background information to help readers understand the context behind these two methods., what is the business model canvas.

The Business Model Canvas is a strategic management and lean startup template that allows businesses to visually represent and evaluate their business model. It was developed by Alexander Osterwalder in his book 'Business Model Generation.' The canvas consists of nine building blocks, including customer segments, value proposition, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure. Each block represents a key aspect of the business model and helps entrepreneurs analyze and modify their existing or potential frameworks to increase the chances of success.

What are Traditional Business Plans?

Traditional business plans are comprehensive documents that outline a company's goals, strategies, market analysis, financial projections, and other relevant information. They are typically lengthy and require a significant amount of research and analysis. Traditional business plans follow a linear, step-by-step approach that guides entrepreneurs through the process of starting a business or introducing a new product/service. These plans often have sections addressing executive summary, company description, market analysis, organization structure, product/service details, marketing strategy, financial projections, and more.

Comparing the Values of Both Approaches

The Business Model Canvas and traditional business plans serve different purposes and have distinct values depending on the business context. The Business Model Canvas excels in its ability to visually represent and evaluate the entire business model in a simplified manner. It promotes collaboration, agility, and adaptability, making it well-suited for startups and businesses operating in dynamic environments. Traditional business plans, on the other hand, offer a more detailed and comprehensive analysis of the business environment, market research, and financial projections. They provide a structured approach for entrepreneurs needing to present their plans to investors, lenders, or stakeholders.

Understanding How Each Approach Works

The Business Model Canvas works by visually mapping out the key elements of a business model onto a single canvas. Entrepreneurs can use sticky notes, drawings, or digital tools to populate each building block, enabling them to have a holistic overview of their business model. They can easily identify areas that need improvement or modification and can experiment with different strategies. This approach encourages creativity and collaboration within cross-functional teams. Traditional business plans, on the other hand, follow a linear and text-based format that requires entrepreneurs to write detailed sections addressing various aspects of their business. The plans are often revised and edited multiple times before being finalized.

Background Information

The shift from traditional business plans to the Business Model Canvas can be attributed to the increasing need for agility and flexibility in today's business landscape. Traditional business plans were often criticized for being too rigid and time-consuming, hindering startups and fast-growing companies. The Business Model Canvas emerged as a response to these challenges, offering a more visual and collaborative approach to business modeling. It gained popularity among entrepreneurs, innovators, and investors due to its simplicity and effectiveness. However, it's important to note that traditional business plans still hold value for certain industries and scenarios where a more detailed analysis and formal documentation are necessary.

More backgrounds

Learn about the advantages of implementing the Business Model Canvas in your company to enhance strategic planning and improve business outcomes.

This article explores the integration of Lean Startup principles with the Business Model Canvas, providing a comprehensive understanding of how these two methodologies can work together to optimize bu...

This article provides a concise definition and detailed explanation of the Business Model Canvas (BMC). It explores the values of using the BMC, describes how it works, and offers relevant background ...

The Key Resources in a Business Model Canvas (BMC) refer to the essential assets and capabilities that a business needs to operate and deliver value to its customers.

In a Business Model Canvas (BMC), Key Partners refer to the strategic alliances or relationships that a business forms in order to create and deliver value to its customers.

Learn how to effectively use a SWOT analysis and a Business Model Canvas to analyze and strategize your business.

The Business Model Canvas (BMC) and a traditional business plan serve different purposes. While a business plan outlines the overall strategy and detailed aspects of a business, the BMC focuses on visualization and summarizing key components of business operations...

This article provides a comprehensive explanation of the Business Model Canvas, including its definition, values, and how it works. It also includes detailed background information to help beginners understand.

Try yourself

Cookies & Privacy

This website uses cookies to ensure you get the best experience on our website.

Maintenance break

Monday (16.06.2024), 05:30 - 09:30 UTC

Our system will be temporarily unavailable due to new features implementation

Traditional business plan vs. lean startup business plan. Which is best for your business?

- Launch your startup , Blog

A startup business plan can take many forms. A traditional business plan is quite extensive and detailed. A lean startup business plan, in turn, is fairly simple and requires less time to prepare. Which format of the business plan is better? Each of them has its advantages and disadvantages, which are worth keeping in mind. Read on to find out more.

Traditional business plan vs. lean startup plan – table of contents:

Traditional business plan, lean startup methodology, lean startup business plan, benefits of a traditional business plan, benefits of a lean startup business plan, which one is better.

A traditional business plan takes a traditional approach to planning a business venture. What does this actually mean? First of all, this approach requires putting a lot of work into preparing a startup and getting it off the ground. It involves a lot of effort before the product or service is launched, which can take not only weeks, but months. Before we move on to the alternative approach, let’s take a closer look at the traditional business plan, which is often also called a formal one.

A traditional business plan contains a lot of details about the company. It is 50-60 pages long, which doesn’t make it a quick read. It usually has the following structure:

- summary of the document,

- a description of the startup and the goals that have been set for the company,

- a detailed description of the product or service offered,

- an analysis of the market and target group,

- a description of the people involved in the startup,

- financial analysis,

- implementation plan and overall schedule,

- attachments.

A traditional business plan describes the company in detail, shows its current position in the market and forecasts its future.

In 2010, a book written by Eric Reis, titled “Lean Startup” appeared. The author presented a different view of business in it. In fact, the lean startup methodology is very simple. According to the proposed concept, you should start a business as soon as possible, at the same time gathering feedback and learning the market.This is what many startups that are widely known today have done (e.g. Dropbox). The lean startup methodology can be described in three steps:

- finding a business idea that solves customers’ problems (you start creating a business plan at this stage),

- executing your business idea and creating an MVP,

- validating your business concept. Here you will receive information on whether the MVP has worked or whether another one should be prepared.

You already know what the lean startup concept focuses on. But what does a lean startup plan look like? Such a document is created to determine the business needs and to verify the idea, to check if it can be implemented. At first glance, you can see the difference between a traditional business plan and a lean startup plan. The latter is only one or two pages long, which is as much as the summary of a traditional business plan.

Lean startup plan usually includes:

- a description of the problem the startup is solving,

- characteristics of the target audience for the product or service,

- an explanation of how the product or service solves the customer’s problem,

- information on what differentiates your product or service from competing solutions,

- the cost of producing the product or launching the service.

The advantages of a traditional business plan certainly include:

- eliminating risk – in the case of the lean startup methodology, there is a high risk that the product will be launched too quickly,

- easier acquisition of external financing – banks and other financial institutions are more attached to a traditional business plan and, having seen such a document, it is easier for them to decide whether to grant a loan or not,

- a better presentation of larger, more expensive and more exclusive products – in this case, it is not always possible to prepare several versions of the MVP, as each of them will be quite expensive.

How do the advantages of a lean startup plan compare to a traditional business plan? Without a doubt, its advantages include:

- you can get your company on the market faster which is especially important in a highly competitive industry,

- you can abandon your business idea more easily if it turns out to be wrong as you haven’t spent so much time preparing and writing a business plan,

- you are more likely to get investors because a concise business plan is an asset to them and they can get a quicker look at it.

Unfortunately, there is no clear answer to this question. It seems that the solution that is more concise will be more attractive, but this doesn’t have to be the case at all. What matters, after all, is saving time. A traditional business plan and a lean startup plan are two different approaches to business development. Each has its advantages and disadvantages. Choosing the right option should really depend on the specifics of a particular startup and its product.

Read also: 7 important startup roles.

If you like our content, join our busy bees community on Facebook, Twitter, LinkedIn, Instagram, YouTube, Pinterest.

Author: Andy Nichols A problem solver with 5 different degrees and endless reserves of motivation. This makes him a perfect Business Owner & Manager. When searching for employees and partners, openness and curiosity of the world are qualities he values the most. View all posts

Launch your startup:

- What is a startup?

- Pros and cons of creating a startup

- 8 best industries for startups

- Top 5 skills every highly successful startup founder needs

- How to create a startup? 7 simple and easy steps

- 6 essential startup development stages

- How to create a startup growth strategy?

- General startup statistics you need to know

- Startup vs. corporate job. Which is right for you?

5 incredible companies that started in a garage

- How to find a business idea?

- How to check if your startup idea already exists?

- How to name a startup? Useful tips and strategies

- How to gain business knowledge quickly? 5 best practices

- Why do startups fail? 6 startup ideas you should avoid

5 weird business ideas that made millions

- Top 6 most profitable small businesses