Connecting small business owners with financing solutions

Grow efficiently with low-interest SBA loans - tailored for small businesses.

Secure stable funding for growth - flexible terms, fixed rates.

- Line of Credit

Flexible funds on hand to manage your cash flow seamlessly.

Small Business Stories

Hear from small businesses, like yours, that have accessed funding to drive success.

Learn how we make the complex clear and the process seamless

- Loan Process

Our streamlined loan process blends innovative technology with personalized service.

- SBA Loan Calculator

Review potential payments and navigate the SBA 7(a) loan confidently with our SBA loan calculator.

Learn more about SmartBiz and small business financing. Explore our frequently asked questions.

- Small Business Blog

Unlock invaluable insights and tips for small business success.

We’re your dedicated small business financial partner

- Our Company

Discover our story and our commitment to supporting small businesses.

Join a dynamic team dedicated to driving innovation and growth.

Stay informed with our latest announcements and industry updates.

Customer Reviews

Hear from our customers - real stories of success and satisfaction.

- Source of Funds Examples in a Business Plan: 8 Suggestions

- Learning Center

- Small Business Loans

A solid business plan is one of the most important documents you’ll need to create for your company. This document provides a roadmap for your company’s future developments. However, no growth can occur without a sufficient amount of working capital. That’s why your business plan should include a source of funds section – it can remind you how to maintain the cash flow your company needs.

There’s another reason this part of your business plan matters. It can show certain lenders how much money you need beyond what the funding sources in your business plan can get you. That said, not all lenders will require you to share a business plan. For example, SmartBiz’s loan approval requirements don’t include business plans among the necessary paperwork. Either way, below are some source of funds examples in business plans.

What is a business plan?

A business plan is a document that guides your company’s growth. It helps define your business goals and provides a clear overview of how you’ll achieve them. You can also use it to plot out your marketing, operational, and sales approaches. Your business plan can be the foundation of a strategy to minimize risk and maximize growth.

Another reason why solid business plans are essential is that you’ll often need to provide them as you apply for business loans. Business plans provide an in-depth look at a company’s plan for profits, so lenders can more easily judge the borrower’s likelihood of repayment. Lenders are much more likely to finance borrowers whom they believe can pay back the loan amount in a reasonable timeframe.

8 source of funds examples

Having a source of funds – sometimes several sources of funding – is vital to growing your business . Common funding options include business loans, and sometimes, to qualify for them, you must show lenders your other funding sources. Understanding the below source of funds examples in business plans can help you better structure yours.

1. Personal savings

When you’re just getting your business off the ground, sometimes, the fastest way to fund it is directly from your current savings. However, entwining your personal savings into a company that could fail is a risky prospect – but it also shows commitment. Lenders and investors often respond well to a borrower who’s ready to go the distance with their ideas.

2. Money from friends and family

Money from family and friends, which you’ll also see called “love money,” is a viable source of funds in your business plan. However, just as it’s risky to get your own money wrapped up in a business, it’s dangerous with other people’s finances too. Plus, accepting money from a loved one can come with drawbacks. For starters, not everyone in your life has much to spare in the first place. Furthermore, if you borrow money from friends or family and you can’t repay it, the relationship could be damaged.

3. Federal and private grants

Occasionally, your business model can put you in line for federal grants. That said, rare is the business that qualifies for federal grants – technically, the government does not provide grants for small businesses growth. However, private companies ranging from FedEx to the NBA offer grants to small businesses that fit certain criteria. If there’s a chance your company could fit these criteria, you can include private grants as sources of funding in your business plan.

4. Share sales and dividends

Selling shares of your company to investors – as in, anyone who buys stocks – falls under a category of funding known as equity financing. This arrangement can be lucrative, which is a main reason why you see so many companies having initial public offerings (IPOs).

However, equity financing has a few drawbacks. For one, you’ll no longer have complete control over your company's future, as stockholders dilute your ownership. Additionally, you’ll have to account for dividends in your financial planning. You pay these sums to your shareholders every quarter.

5. Venture capital

If you need a large amount of cash, venture capitalists can be a viable option. Typically, though, venture capitalists are only interested in funding startup businesses in the tech sector with high growth potential.

Venture capital is a high-reward but high-risk funding source. It often requires you ceding a certain amount of ownership – and thus control – of your business. Furthermore, if your business fails, you may still need to repay any venture capitalists or firms that have funded your operations.

6. Angel investors

An angel investor is a wealthy private individual who invests in small businesses to help them get off the ground. They tend not to offer as much starting capital as a venture capitalist, but they can make up for the smaller amount with experience. Angel investors are often experts within a specific industry and put money back into it by investing in newer businesses within that sphere.

Although you’ll have to give an angel investor some control over your company, their experience and network can help your business grow. Additionally, the word “angel” in their name reflects that they typically don’t ask for their money back if your business fails. That makes them a safer bet than venture capitalists.

7. Business incubators

Unlike the previous funding options, a business incubator doesn’t offer direct monetary support. Instead, incubators help fledgling businesses thrive by allowing them into their workspace and letting them share resources as they get started. This type of funding is indirect – you’ll rarely get direct cash infusions, but you’ll get resources that would otherwise cost you money. It’s common in high-tech industries such as biotechnology, industrial technology, and multimedia.

8. Bank loans

Bank loans probably ring a bell for you. When a current or aspiring small business owner needs additional funds, these loans are often the first thing that comes to mind. They’re among the most in-demand funding options available given their large funding amounts, long-term repayment periods, and low interest rates . However, their high amounts introduce lender risk that can make them difficult to obtain. To minimize risk, most lenders impose strict qualification criteria that you might not make.

Why do you need to provide sources of funds in your business plan?

Providing a source of funds in your business plan paves a path toward obtaining and using your funding. Knowing where your money is coming from and what you’re spending can help with strategic financial planning. It also minimizes the chances of your business partners spending money the company doesn’t actually have.

In a lending context, your sources of funds may help you qualify for any loans you need in the future. Depending on the funding sources you’re using, lenders may view you as someone able to repay the debt financing they offer. For example, using personal savings shows your commitment to your business, meaning you’re likely a reliable borrower who won’t flake on a loan. You’ll show your commitment to your company and your business at the same time.

Parting thoughts

Reliable funding sources are essential to achieving your company’s objectives, and their presence in your business plan can help you obtain more funding. Namely, certain entities that offer small business loans require business plans as part of the borrower approval process. When your approval plan clearly shows why you need the loan money and how else you’re getting funding, lenders may trust you more.

However, certain lenders don’t require business plans. In fact, when you apply for SBA 7(a) loans , bank term loans, or custom financing through SmartBiz ® , you don't need a business plan. Check now to see if you pre-qualify * – the business funding you need might be closer than you think.

Have 5 minutes? Apply online

- Follow SmartBiz

Access to the right loan for right now

- Business Credit

- Business Finances

- Business Marketing

- Business Owners

- Business Stories

- Business Technologies

- Emergency Resources

- Employee Management

- SmartBiz University

- More SBA Articles

Related Posts

Small business guide to filing a beneficial ownership report, national small business week 2024: the ultimate guide, smartbiz helps facilitate access to financing for underrepresented entrepreneurs, smart growth is smart business.

See if you pre-qualify, without impacting your credit score. 1

*We conduct a soft credit pull that will not affect your credit score. However, in processing your loan application, the lenders with whom we work will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and happens after your application is in the funding process and matched with a lender who is likely to fund your loan.

The SmartBiz® Small Business Blog and other related communications from SmartBiz Loans® are intended to provide general information on relevant topics for managing small businesses. Be aware that this is not a comprehensive analysis of the subject matter covered and is not intended to provide specific recommendations to you or your business with respect to the matters addressed. Please consult legal and financial processionals for further information.

Plan Projections

ideas to numbers .. simple financial projections

Home > Business Plan > Funding Requirements in a Business Plan

Funding Requirements in a Business Plan

… our funding requirements are …

The summary given in the funding requirement section should be consistent with the rest of the business plan. The amount needed, and when it is needed should follow from the detailed financial projections, and the purpose of the funding, sales and marketing, hire of employees, to achieve a milestone etc. should again link in with the rest of the plan,

Funding Requirements Presentation

This is part of the financial projections and Contents of a Business Plan Guide , a series of posts on what each section of a simple business plan should include. The next post in this series is the final section, and deals with the planned exit for investors.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

- Build your business

Business Tools

- Profit Margin Calculator

- Business Name Generator

- Slogan Generator

- Traffic Calculator

- Ecommerce Statistics

- Ecommerce Wiki

Free business tools

Start a business and design the life you want – all in one place.

- © 2015-2024 Oberlo

The 7 Best Business Plan Examples (2024)

As an aspiring entrepreneur gearing up to start your own business , you likely know the importance of drafting a business plan. However, you might not be entirely sure where to begin or what specific details to include. That’s where examining business plan examples can be beneficial. Sample business plans serve as real-world templates to help you craft your own plan with confidence. They also provide insight into the key sections that make up a business plan, as well as demonstrate how to structure and present your ideas effectively.

Example business plan

To understand how to write a business plan, let’s study an example structured using a seven-part template. Here’s a quick overview of those parts:

- Executive summary: A quick overview of your business and the contents of your business plan.

- Company description: More info about your company, its goals and mission, and why you started it in the first place.

- Market analysis: Research about the market and industry your business will operate in, including a competitive analysis about the companies you’ll be up against.

- Products and services: A detailed description of what you’ll be selling to your customers.

- Marketing plan: A strategic outline of how you plan to market and promote your business before, during, and after your company launches into the market.

- Logistics and operations plan: An explanation of the systems, processes, and tools that are needed to run your business in the background.

- Financial plan: A map of your short-term (and even long-term) financial goals and the costs to run the business. If you’re looking for funding, this is the place to discuss your request and needs.

7 business plan examples (section by section)

In this section, you’ll find hypothetical and real-world examples of each aspect of a business plan to show you how the whole thing comes together.

- Executive summary

Your executive summary offers a high-level overview of the rest of your business plan. You’ll want to include a brief description of your company, market research, competitor analysis, and financial information.

In this free business plan template, the executive summary is three paragraphs and occupies nearly half the page:

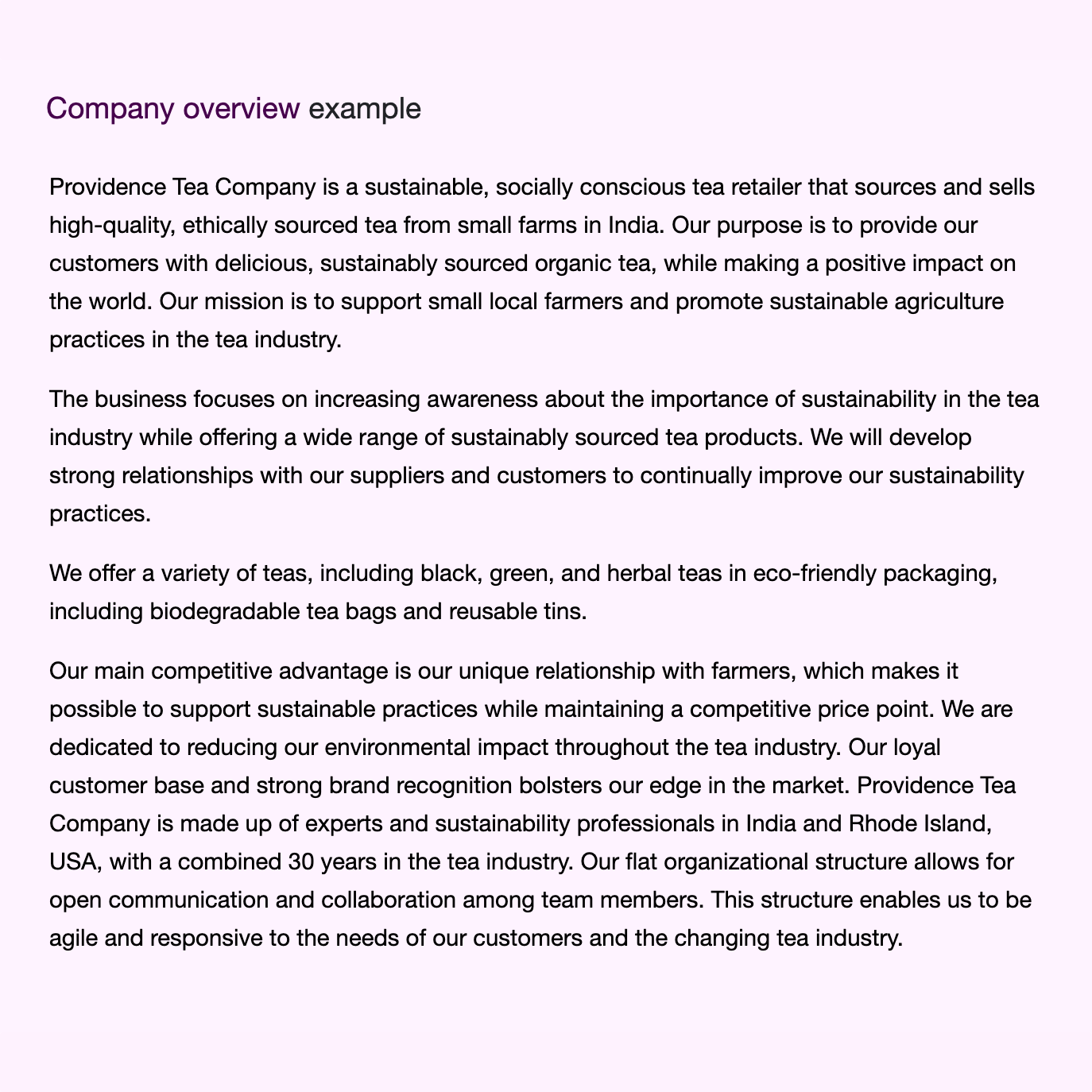

- Company description

You might go more in-depth with your company description and include the following sections:

- Nature of the business. Mention the general category of business you fall under. Are you a manufacturer, wholesaler, or retailer of your products?

- Background information. Talk about your past experiences and skills, and how you’ve combined them to fill in the market.

- Business structure. This section outlines how you registered your company —as a corporation, sole proprietorship, LLC, or other business type.

- Industry. Which business sector do you operate in? The answer might be technology, merchandising, or another industry.

- Team. Whether you’re the sole full-time employee of your business or you have contractors to support your daily workflow, this is your chance to put them under the spotlight.

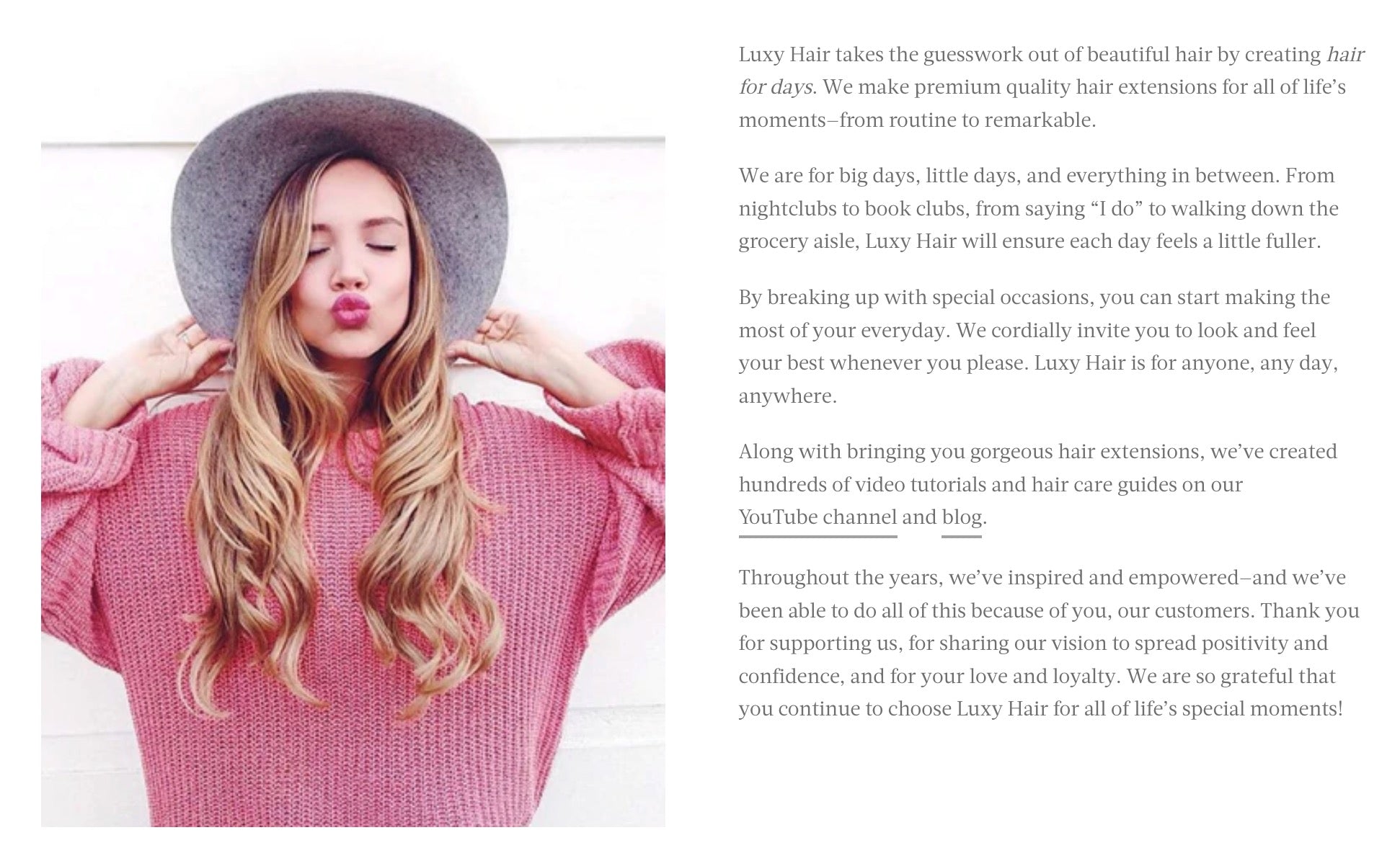

You can also repurpose your company description elsewhere, like on your About page, Instagram page, or other properties that ask for a boilerplate description of your business. Hair extensions brand Luxy Hair has a blurb on it’s About page that could easily be repurposed as a company description for its business plan.

- Market analysis

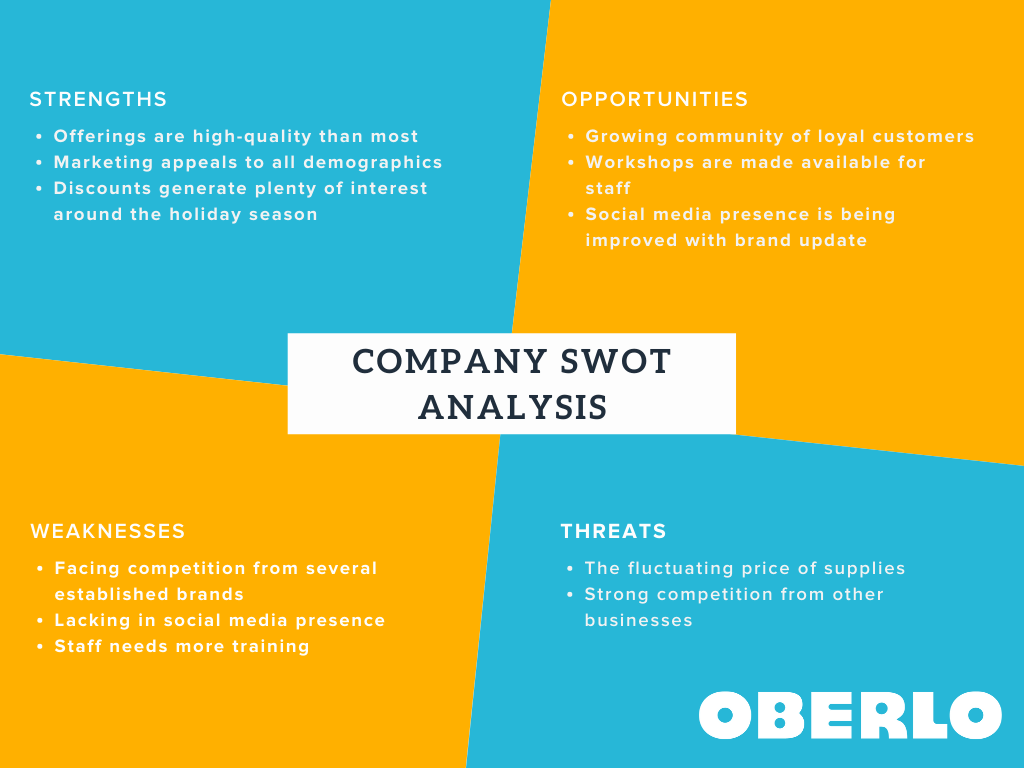

Market analysis comprises research on product supply and demand, your target market, the competitive landscape, and industry trends. You might do a SWOT analysis to learn where you stand and identify market gaps that you could exploit to establish your footing. Here’s an example of a SWOT analysis for a hypothetical ecommerce business:

You’ll also want to run a competitive analysis as part of the market analysis component of your business plan. This will show you who you’re up against and give you ideas on how to gain an edge over the competition.

- Products and services

This part of your business plan describes your product or service, how it will be priced, and the ways it will compete against similar offerings in the market. Don’t go into too much detail here—a few lines are enough to introduce your item to the reader.

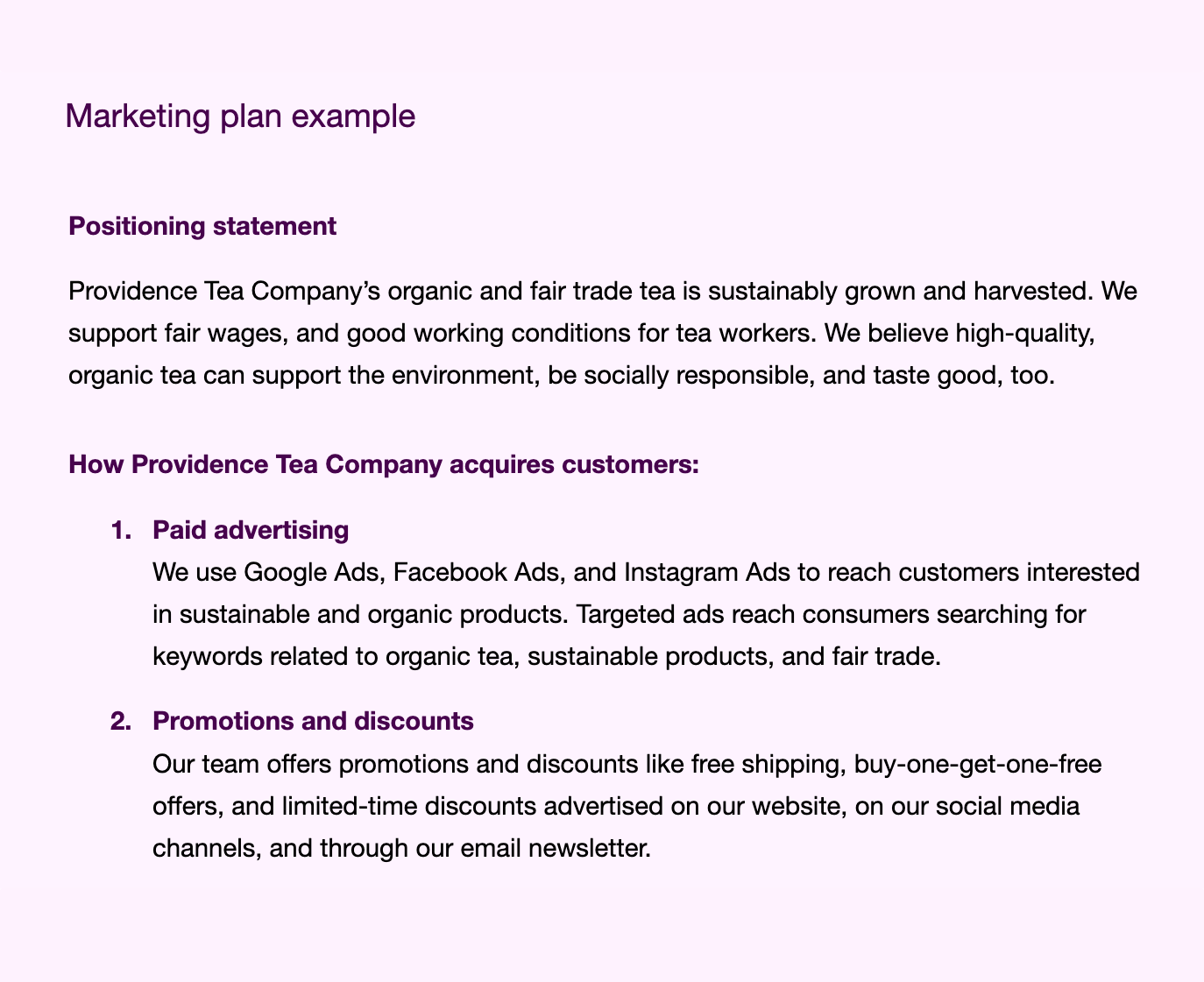

- Marketing plan

Potential investors will want to know how you’ll get the word out about your business. So it’s essential to build a marketing plan that highlights the promotion and customer acquisition strategies you’re planning to adopt.

Most marketing plans focus on the four Ps: product, price, place, and promotion. However, it’s easier when you break it down by the different marketing channels . Mention how you intend to promote your business using blogs, email, social media, and word-of-mouth marketing.

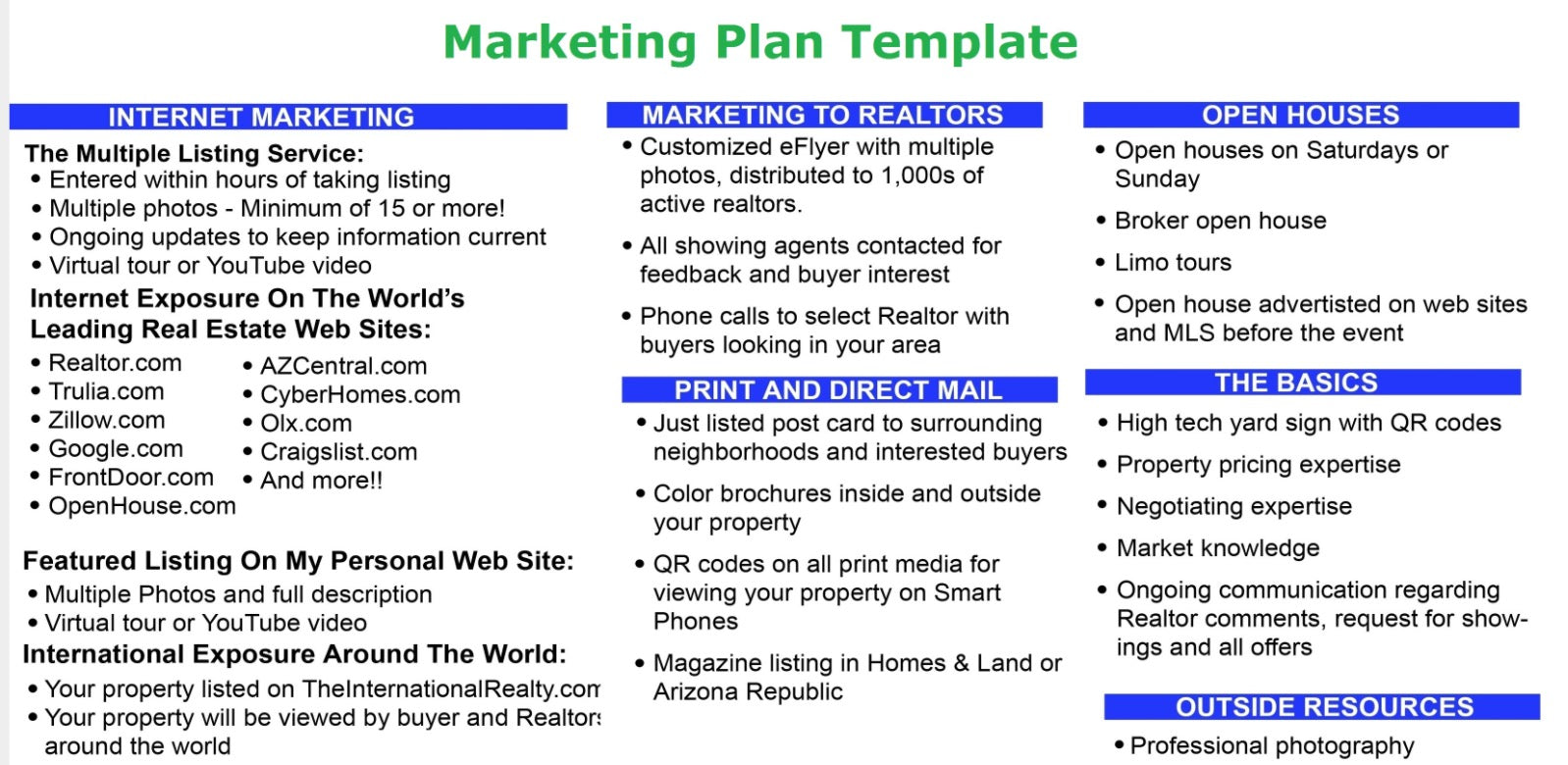

Here’s an example of a hypothetical marketing plan for a real estate website:

Logistics and operations

This section of your business plan provides information about your production, facilities, equipment, shipping and fulfillment, and inventory.

Financial plan

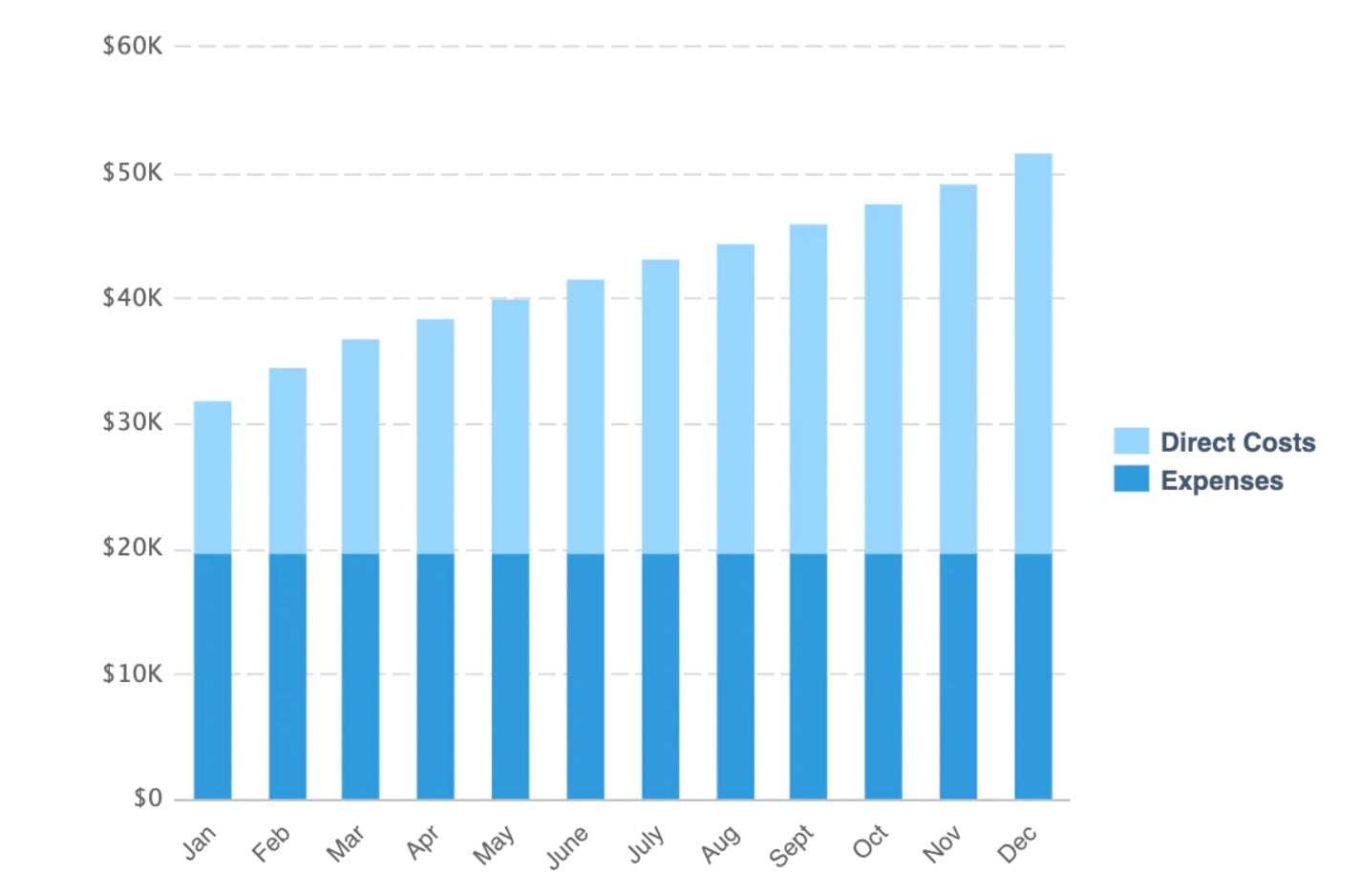

The financial plan (a.k.a. financial statement) offers a breakdown of your sales, revenue, expenses, profit, and other financial metrics. You’ll want to include all the numbers and concrete data to project your current and projected financial state.

In this business plan example, the financial statement for ecommerce brand Nature’s Candy includes forecasted revenue, expenses, and net profit in graphs.

It then goes deeper into the financials, citing:

- Funding needs

- Project cash-flow statement

- Project profit-and-loss statement

- Projected balance sheet

You can use Shopify’s financial plan template to create your own income statement, cash-flow statement, and balance sheet.

Types of business plans (and what to write for each)

A one-page business plan is a pared down version of a standard business plan that’s easy for potential investors and partners to understand. You’ll want to include all of these sections, but make sure they’re abbreviated and summarized:

- Logistics and operations plan

- Financials

A startup business plan is meant to secure outside funding for a new business. Typically, there’s a big focus on the financials, as well as other sections that help determine the viability of your business idea—market analysis, for example. Shopify has a great business plan template for startups that include all the below points:

- Market research: in depth

- Financials: in depth

Your internal business plan acts as the enforcer of your company’s vision. It reminds your team of the long-term objective and keeps them strategically aligned toward the same goal. Be sure to include:

- Market research

Feasibility

A feasibility business plan is essentially a feasibility study that helps you evaluate whether your product or idea is worthy of a full business plan. Include the following sections:

A strategic (or growth) business plan lays out your long-term vision and goals. This means your predictions stretch further into the future, and you aim for greater growth and revenue. While crafting this document, you use all the parts of a usual business plan but add more to each one:

- Products and services: for launch and expansion

- Market analysis: detailed analysis

- Marketing plan: detailed strategy

- Logistics and operations plan: detailed plan

- Financials: detailed projections

Free business plan templates

Now that you’re familiar with what’s included and how to format a business plan, let’s go over a few templates you can fill out or draw inspiration from.

Bplans’ free business plan template

Bplans’ free business plan template focuses a lot on the financial side of running a business. It has many pages just for your financial plan and statements. Once you fill it out, you’ll see exactly where your business stands financially and what you need to do to keep it on track or make it better.

PandaDoc’s free business plan template

PandaDoc’s free business plan template is detailed and guides you through every section, so you don’t have to figure everything out on your own. Filling it out, you’ll grasp the ins and outs of your business and how each part fits together. It’s also handy because it connects to PandaDoc’s e-signature for easy signing, ideal for businesses with partners or a board.

Miro’s Business Model Canvas Template

Miro’s Business Model Canvas Template helps you map out the essentials of your business, like partnerships, core activities, and what makes you different. It’s a collaborative tool for you and your team to learn how everything in your business is linked.

Better business planning equals better business outcomes

Building a business plan is key to establishing a clear direction and strategy for your venture. With a solid plan in hand, you’ll know what steps to take for achieving each of your business goals. Kickstart your business planning and set yourself up for success with a defined roadmap—utilizing the sample business plans above to inform your approach.

Business plan FAQ

What are the 3 main points of a business plan.

- Concept. Explain what your business does and the main idea behind it. This is where you tell people what you plan to achieve with your business.

- Contents. Explain what you’re selling or offering. Point out who you’re selling to and who else is selling something similar. This part concerns your products or services, who will buy them, and who you’re up against.

- Cash flow. Explain how money will move in and out of your business. Discuss the money you need to start and keep the business going, the costs of running your business, and how much money you expect to make.

How do I write a simple business plan?

To create a simple business plan, start with an executive summary that details your business vision and objectives. Follow this with a concise description of your company’s structure, your market analysis, and information about your products or services. Conclude your plan with financial projections that outline your expected revenue, expenses, and profitability.

What is the best format to write a business plan?

The optimal format for a business plan arranges your plan in a clear and structured way, helping potential investors get a quick grasp of what your business is about and what you aim to achieve. Always start with a summary of your plan and finish with the financial details or any extra information at the end.

Want to learn more?

- Question: Are You a Business Owner or an Entrepreneur?

- Bootstrapping a Business: 10 Tips to Help You Succeed

- Entrepreneurial Mindset: 20 Ways to Think Like an Entrepreneur

- 101+ Best Small Business Software Programs

How to Write Your Business Plan to Secure Funding

Unlock funding for your business! Master the art of writing a funding-worthy business plan with our ultimate guide.

Introduction to Writing a Funding-Worthy Business Plan

When it comes to securing funding for your business, a well-written business plan plays a pivotal role. It serves as a roadmap that outlines your goals, strategies, and financial projections, giving potential investors or lenders a comprehensive understanding of your business. In this section, we will explore the importance of a well-written business plan and delve into the purpose it serves.

Importance of a Well-Written Business Plan

A well-crafted business plan is essential for multiple reasons. Firstly, it showcases your professionalism and commitment to your business idea. It demonstrates that you have thoroughly thought through every aspect of your venture and have a solid plan in place.

Additionally, a well-written business plan acts as a communication tool between you and potential investors or lenders. It allows you to effectively convey your business concept, market analysis, and financial projections, helping them understand the viability and potential of your business.

Moreover, a comprehensive business plan can help you identify any potential pitfalls or gaps in your strategy. By thoroughly analyzing your business model, market conditions, and financial projections, you can proactively address any weaknesses and make necessary adjustments.

Understanding the Purpose of a Business Plan

The purpose of a business plan extends beyond just securing funding. It serves as a strategic document that guides your business operations and helps you stay focused on your goals. Some key purposes of a business plan include:

- Attracting Investors and Lenders: A well-written business plan provides potential investors or lenders with the information they need to make an informed decision about whether to invest in your business or provide financial support. It showcases the potential return on investment and outlines the steps you will take to achieve success.

- Setting Clear Goals and Strategies: A business plan helps you define your short-term and long-term goals, as well as the strategies you will implement to achieve them. It provides a roadmap that keeps you on track and allows you to measure your progress along the way.

- Identifying Strengths and Weaknesses: By conducting a thorough market analysis and assessing your business's strengths and weaknesses, a business plan helps you identify areas where you excel and areas that require improvement. This enables you to develop strategies to leverage your strengths and mitigate any weaknesses.

- Guiding Financial Decision-Making: A business plan includes financial projections and analysis that help you make informed financial decisions. It provides a clear understanding of your revenue streams, costs, and potential profitability, enabling you to allocate resources effectively.

- Facilitating Collaboration and Communication: A business plan serves as a tool for collaboration and communication within your organization. It ensures that all team members are aligned with the business goals and strategies, fostering a cohesive and unified approach.

Understanding the importance and purpose of a well-written business plan is the first step towards creating a document that effectively communicates your vision and secures the funding you need. In the following sections, we will explore the key components, step-by-step guide, and best practices for crafting a funding-worthy business plan.

Key Components of a Funding-Worthy Business Plan

To create a business plan that attracts funding, it's essential to include key components that provide a comprehensive overview of your business. These components will help potential investors understand your business's potential and make informed decisions. Here are the key components you should include in your funding-worthy business plan:

Executive Summary

The executive summary is a concise overview of your entire business plan. It should provide a clear and compelling summary of your business, highlighting its unique selling proposition, market opportunities, and financial projections. This section should be written in a way that captures the attention of potential investors and encourages them to read further.

Company Overview

The company overview section provides an introduction to your business. It should include details about your company's mission, vision, and values. Additionally, this section should highlight key information such as the legal structure of your business, its history, location, and any notable achievements or milestones.

Market Analysis

The market analysis section presents a thorough examination of your target market, industry trends, and competitors. It should showcase your understanding of the market dynamics, customer needs, and competitive landscape. Including market research, data, and relevant statistics can strengthen your analysis and demonstrate the market opportunity your business intends to tap into.

Product or Service Description

In this section, you should provide a detailed description of your product or service. Explain how it addresses a need or solves a problem in the market. Include information about its features, benefits, and any unique selling points. Use this section to showcase the value proposition of your offering and differentiate it from competitors.

Marketing and Sales Strategy

The marketing and sales strategy section outlines how you plan to promote and sell your product or service. It should include your target market segmentation, pricing strategy, distribution channels, and promotional activities. Demonstrating a well-thought-out marketing and sales strategy can instill confidence in investors regarding your ability to reach and attract customers.

Organizational Structure and Management

In this section, provide an overview of your organizational structure, including key personnel and their roles. Highlight the qualifications and experience of your management team, as well as any advisors or board members. Investors want to see that your team has the expertise and capabilities to execute your business plan successfully.

Financial Projections and Analysis

The financial projections and analysis section is crucial for illustrating the financial viability of your business. Include projected income statements, balance sheets, and cash flow statements for at least the next three years. Additionally, provide a detailed analysis of your financial assumptions and key performance indicators. It's important to present realistic and well-supported financial projections.

Funding Request and Use of Funds

In this section, clearly state the amount of funding you are seeking and how you intend to use it. Break down the allocation of funds, highlighting specific areas such as product development, marketing, operations, or expansion. Providing a detailed breakdown of the use of funds demonstrates your ability to effectively utilize the investment.

The appendix section serves as a supplemental section that includes any additional information that supports your business plan. This may include market research data, product samples, patents, licenses, permits, or any other relevant documents. The appendix provides investors with access to more detailed information without overwhelming the main body of the business plan.

By including these key components in your funding-worthy business plan, you can present a comprehensive overview of your business and increase your chances of securing the funding you need to bring your entrepreneurial vision to life.

Step-by-Step Guide to Writing a Funding-Worthy Business Plan

Writing a business plan that is compelling and attractive to potential investors is a crucial step in securing funding for your venture. To help you navigate this process, here is a step-by-step guide to writing a funding-worthy business plan.

Research and Gather Information

Before diving into the writing process, it's essential to conduct thorough research and gather all the necessary information. This includes understanding your industry, target market, competitors, and potential investors. Collecting data and market insights will provide a solid foundation for your business plan.

Define Your Business and Goals

Clearly define your business and outline your goals. Describe the nature of your business, the products or services you offer, and what sets you apart from your competitors. Additionally, establish both short-term and long-term goals for your business, focusing on specific, measurable, achievable, relevant, and time-bound (SMART) objectives.

Conduct a Comprehensive Market Analysis

Perform a comprehensive market analysis to gain insights into your target market, customer demographics, and industry trends. Identify your target audience's needs, preferences, and purchasing behavior. Analyze your competitors to understand their strengths, weaknesses, and market positioning. Presenting this information in tables can help organize and present the data effectively.

Market Analysis Factors Data

Target Market Size

Customer Demographics

Industry Trends

Competitor Analysis

Develop a Strong Marketing and Sales Strategy

Outline a robust marketing and sales strategy that highlights how you plan to reach and attract customers. Define your unique selling proposition (USP) and outline your pricing strategy, distribution channels, and promotional activities. This section should demonstrate your understanding of your target market and how you plan to position your business in the competitive landscape.

Outline Your Organizational Structure and Management

Describe your organizational structure and management team. Provide an overview of key personnel, their roles, and their qualifications. Highlight any relevant industry experience, expertise, or accomplishments that make your team well-equipped to execute the business plan successfully. A clear and concise organizational chart can help visualize the structure.

Create Financial Projections and Analysis

Develop financial projections that estimate your business's future revenue, expenses, and profitability. Include a projected income statement, balance sheet, and cash flow statement. Use realistic assumptions based on your market research and industry benchmarks. Additionally, conduct a comprehensive financial analysis that evaluates the financial health and viability of your business.

Craft a Compelling Executive Summary

The executive summary is a concise overview of your entire business plan and should entice readers to continue reading. Summarize the key elements of your plan, including your business concept, market opportunity, competitive advantage, and financial projections. Craft a compelling and engaging executive summary that captures the attention of potential investors.

Polish and Revise Your Business Plan

Once you have completed the initial draft of your business plan, take the time to polish and revise it. Review the content for clarity, coherence, and accuracy. Ensure that your plan flows logically and presents a compelling case for investment. Proofread for grammar and spelling errors. Consider seeking feedback from trusted advisors or professionals to refine your plan further.

By following this step-by-step guide, you can create a comprehensive and compelling business plan that increases your chances of securing funding for your venture. Remember to tailor your plan to the specific needs and preferences of your target audience, providing them with all the necessary information to make an informed investment decision.

Tips and Best Practices for Writing a Funding-Worthy Business Plan

Writing a business plan that is compelling and effective in securing funding requires careful attention to detail and adherence to best practices. Here are some tips to help you create a funding-worthy business plan:

Keep it Clear and Concise

When writing your business plan, it's essential to communicate your ideas clearly and concisely. Avoid using unnecessary jargon or technical terms that may confuse your readers. Use straightforward language and structure your content in a logical manner. Remember, clarity and simplicity are key to ensuring that your business plan is easily understood by potential investors.

Tailor Your Plan to the Target Audience

Each business plan should be tailored to the specific needs and expectations of the target audience. Consider the preferences and priorities of potential investors or lenders and customize your plan accordingly. For example, venture capitalists may be more interested in growth potential and return on investment, while traditional lenders may focus on cash flow and collateral. Understanding your audience will allow you to highlight the aspects of your business that are most relevant to them.

Support Claims with Data and Research

To instill confidence in your business plan, it's important to back up your claims with data and research. Provide market research, industry trends, and competitive analysis to support your assertions about the viability and potential of your business. Including relevant statistics, market projections, and customer surveys can help validate your assumptions and demonstrate that your business plan is grounded in reality.

Seek Professional Help if Needed

Writing a funding-worthy business plan can be a complex and time-consuming task. If you are unsure about certain aspects or need assistance in crafting a compelling plan, consider seeking professional help. Business consultants, accountants, or industry experts can provide valuable insights and guidance to ensure that your business plan is comprehensive, accurate, and persuasive.

Remember, a well-written business plan is not only a tool for securing funding but also a roadmap for the success of your business. By following these tips and best practices, you can increase your chances of creating a business plan that effectively communicates your vision and attracts the attention of potential investors or lenders.

Q: What is a funding-worthy business plan?

A: A funding-worthy business plan is a comprehensive document that outlines your business concept, market opportunity, competitive advantage, financial projections, and other key components to attract potential investors or lenders.

Q: What are the key components of a funding-worthy business plan?

A: The key components of a funding-worthy business plan include an executive summary, company overview, market analysis, product or service description, marketing and sales strategy, organizational structure and management, financial projections and analysis, funding request and use of funds, and appendix.

Q: How long should my business plan be?

A: While there is no strict rule on the length of a business plan, it's generally recommended to keep it concise and focused. A typical business plan can range from 15 to 30 pages. However, the most important thing is to provide all the necessary information in a clear and compelling manner.

Q: Do I need professional help to write my business plan?

A: While you can certainly write your own business plan with careful research and attention to detail, seeking professional help can provide valuable insights and guidance. Business consultants, accountants or industry experts can offer specialized knowledge that can enhance the quality of your business plan.

Q: How often should I update my business plan?

A: Your business plan should be viewed as a living document that evolves over time. It's recommended to review and update your plan regularly to reflect changes in your industry or market conditions. You may need to update it annually or even more frequently if significant changes occur in your business operations or financial performance.

By addressing these frequently asked questions about writing a funding-worthy business plan in your document or during presentations with investors or lenders can demonstrate that you have thoroughly thought through the planning process.

As an entrepreneur seeking funding for your business, a well-crafted and comprehensive business plan is essential. By following the step-by-step guide outlined in this article, you can create a funding-worthy business plan that effectively communicates your vision, market opportunity, competitive advantage, and financial projections to potential investors or lenders. Remember to tailor your plan to the specific needs and expectations of your target audience, keep it clear and concise, support claims with data and research, and seek professional help if needed. With a compelling business plan in hand, you'll be one step closer to turning your entrepreneurial dreams into reality.

https://blog.hubspot.com/sales/how-to-write-business-proposal

https://www.etu.org.za/toolbox/docs/finances/proposal.html

https://www.mybusiness.com.au/how-we-help/grow-your-business/increasing-sales/how-to-write-a-funding-proposal

Related Blog Post

Medical Equipment Financing

June 4, 2024

Achieve expansion with medical equipment financing. From needs assessment to repayment management, unlock growth opportunities today!

Types of Commercial Insurance

Safeguard your business with comprehensive commercial insurance coverage. Explore types, from general liability to industry-specific options

What Are the Types of CapEx (Capital Expenditures)?

Discover the different types of capex and master the money game! From maintenance to strategic, we've got you covered.

Top Line and Bottom Line

Demystifying financial metrics! Discover the power of top line and bottom line for strategic decision making.

Auto Repair Loans for Businesses

Grow your business with auto repair loans! Get the funds you need for maintenance and repairs to enhance efficiency and customer service.

Net Income Formula | Calculation and Examples

Discover the net income formula and simplify your calculations with our handy calculator. Master your finances like a pro!

Simple Path Financial Overview

Discover financial empowerment with Simple Path Financial! Personalized guidance and transparent fees for your long-term financial journey.

Instructions for Form 4562

Master Form 4562 with ease! Find step-by-step instructions for completing your tax forms and avoid common mistakes.

17 Big Tax Deductions (Write Offs) for Businesses

Discover the 17 biggest business tax write-offs and maximize your savings! Unveiling strategic deductions and tax planning strategies.

Break-Even Analysis: Formula and Calculation

Master your business potential! Discover the break-even analysis formula and calculation to optimize profitability and decision-making.

How to Get a Construction Business Line of Credit

Unlock your construction business potential with a line of credit! Learn how to get one and maximize its benefits for success.

Bridge Lending Solutions

Discover bridge lending solutions to bridge the gap between you and your financial goals. Explore the pros and cons, and eligibility

Learn How to Calculate Owner's Equity

Master the art of calculating owner's equity and unlock the secrets to financial wizardry. Learn how in a few simple steps!

What Is Form 4562: Depreciation and Amortization?

Demystifying Form 4562: Discover the ins and outs of depreciation and amortization for tax benefits!

Gross Revenue vs. Net Revenue Reporting

Crack the code on gross vs. net revenue! Unveiling the key differences and their implications for business operations.

Introduction to .NET Framework

Demystify the magic of the .NET Framework! Discover its key features, benefits, and common uses for your development needs.

The Significance of Proper Funding

Unlock success with proper funding! Discover the significance of funding for business growth and long-term triumph.

Benefits of Heavy Equipment Financing

Unlock business growth with heavy equipment financing! Discover how to enhance operations and seize growth opportunities today.

Credits and Deductions for Individuals

Unlock the power of tax credits and deductions for individuals. Maximize savings with expert strategies and essential tips.

Bad or No Credit Loan Options

Discover bad or no credit loan options to turn rejection into approval. Explore types, factors, and alternatives for your financial needs.

Understanding Construction Lines of Credit

Unlock the potential of construction lines of credit! Discover the benefits, qualifications, and tips for maximizing this financing tool.

.jpg)

How to Calculate Capital Expenditures (CapEx)

Master the art of calculating capital expenditures (capex) effortlessly! Learn the formula and steps to make informed financial decisions.

Financial Assistance For Parents Of Autistic Children

Unlock financial support for parents of autistic children. Discover government assistance programs, educational support, and more.

Grants for Families Living With Autism

Unlock grants for families living with autism! Discover financial support options to create a brighter future for your loved ones.

What is Net Revenue

Demystifying net revenue: Learn what it is, how it impacts businesses, and strategies to enhance it. Uncover the key to financial success!

Money Management Idea for Aging Seniors

May 30, 2024

Discover essential money management ideas for aging seniors. Safeguard your savings and secure your financial future.

Equity Meaning: How It Works and How to Calculate It

Demystifying equity: learn how it works and calculate it like a pro. Unlock the secrets of equity distribution and stake calculation.

Multi-Purpose Loan (MPL)

Unlock financial possibilities with multi-purpose loans (MPL). Break barriers and achieve your dreams with flexibility and ease.

What is a Statement of Shareholder Equity?

Unveiling the purpose of the statement of owner's equity - gain financial clarity and assess your business's health.

How to Calculate Sales Tax?

Cracking the code: Learn how to calculate sales tax effortlessly and avoid any financial surprises.

How Bridging Loans Work

Unveiling bridge loans: discover how they work and why they matter in real estate transactions.

3 Short-Term Loan Options

Discover 3 short-term loan options for financial freedom. Explore payday loans, installment loans, and lines of credit to find your solution

How to Help Seniors Manage their Finances

Discover how to help seniors manage their finances with empathy and empowerment.

Net Income vs. Profit: What's the Difference?

Unraveling the mystery: Net income vs. profit. Discover the key differences and their impact on financial decisions.

The Many Financial Effects of Addiction

Unveiling the financial effects of addiction. From strained relationships to damaged credit, discover the true cost of addiction.

What Is Bonus Depreciation? Definition and How It Works

Demystifying bonus depreciation: Learn its definition and operational framework for maximizing tax benefits.

Financial Stress and Substance Abuse

Unveiling the hidden link: Financial stress and substance abuse. Discover the impact and ways to break the cycle. Seek support today.

Bottom-Line Growth vs. Top-Line Growth

Uncover the secrets of business growth: top-line vs. bottom-line. Unlock your potential for success!

How to Financially Recover after Addiction

Recover financially after addiction! Rebuild your life and gain control of your finances with expert advice and practical steps.

What is Net Income? How to Calculate

Master the art of calculating net income! Learn how to evaluate profitability and make informed business decisions.

How to Calculate Cost of Goods Sold in Your Business

Master the art of calculating Cost of Goods Sold (COGS) to maximize profits in your business. Learn the COGS formula and strategies.

Financing Your Move to Senior Living

Discover how to finance your move to senior living and empower your transition.

Do You Know How to Find Net Income?

Unlock the financial secrets of net income. Discover how to calculate and interpret this crucial metric for decision-making.

CAPEX vs. OPEX: What's the Difference?

Deciphering Capex vs. Opex: Uncover the financial distinctions and decision-making factors - a must-read for business owners!

Understanding the Section 179 Deduction

Demystifying the Section 179 Deduction: Discover eligibility, benefits, and how to claim this tax-saving opportunity.

What is a Bridge Loan and How Does it Work?

Decode the functionality of bridge loans! Learn how they bridge the gap in financing and serve as a temporary solution.

What does DBA Mean?

Discover the meaning of DBA across various fields! From business to technology, unravel the acronym's mysteries. What does DBA mean?

Gross Profit vs. Net Income: What's the Difference?

Demystifying profit and income: Unveiling the difference between gross and net. Master your financial understanding now!

Financial Effects of Drug Addiction

Discover the financial effects of drug addiction and how it impacts lives. Unveil the hidden costs and find resources for recovery.

3 Pieces of Advice for Financing Senior Living

Unlock expert insights on financing senior living! Discover retirement savings options and government assistance programs.

SBA PPP Application Process

May 23, 2024

Master the SBA PPP application process with our seamless guide. Demystify eligibility, documentation, and submission for success!

What are Assets and Liabilities

Unlock financial secrets! Discover the power of assets and liabilities for a healthy financial future.

How Can I Check My Navy Federal Credit Union Loan Status?

Easily check your Navy Federal Credit Union loan status! Discover online, mobile, phone, and in-person options for updates.

How to Fill Out a Personal Loan Application

Simplify the personal loan application process with expert tips. From gathering information to submission, we've got you covered!

The Causes and Propagation of Financial Instability

Uncover the causes and propagation of financial instability. Explore the impact on markets and strategies for mitigation.

Refund Anticipation Loans (RALs)

Unlock fast cash with refund anticipation loans (RALS). Discover the benefits of early funds and covering immediate expenses.

How Do Banks Make Money?

Demystifying how banks make money! Uncover the secrets behind their profit from your transactions.

758 Credit Score: Is it Good or Bad?

Unveiling the truth: Is a 758 credit score good or bad? Discover the impact, benchmarks, and ways to improve your credit score.

Setting up a Financial Advisory Business

Master the art of setting up a financial advisory business with expert tips and strategies for success. Unlock the secrets now!

How to Write a Good Financial Plan

Unlock financial success with a comprehensive guide to writing a good financial plan. Start planning today!

8 Advantages and Disadvantages of Business Grants

Discover the pros and cons of business grants. Access funding, support growth, but beware of competition and eligibility criteria.

10 Questions to Ask a Financial Advisor

Discover the questions to ask a financial advisor! Take control of your finances with confidence and find the perfect advisor for your needs

What is the First Step in Financial Planning?

Discover the vital first step in financial planning. Set goals, assess your situation, and build a budget for a secure financial future.

My Chase Loan

Unlock financial freedom with My Chase Loan! Discover credit-building benefits, flexible repayment options, and competitive interest rates.

What Credit Score Do I Need For A Business Loan?

Unlock the secret to business loan success: What credit score do you need? Discover the winning number now!

How to Start a Financial Advisor Business in 6 Steps

Start your financial advisor business in 6 steps! From regulations to marketing, build your empire with confidence.

Your 4-Step Guide to Financial Planning

Master financial planning with your ultimate 4-step guide! Take control of your wallet and empower your future.

.jpg)

How Do Business Grants Work?

Discover how business grants drive growth and success! Uncover the secrets to securing funding for your business.

How To Secure Grants To Start A Business

Unlock financial success with grants for starting a business. Learn how to secure grants and maximize their impact.

Small Business Grants: Where to Find Funds

Discover the path to small business grants! Unlock funding solutions and find the grants you need to fuel your entrepreneurial journey.

PPP Loan Application

Unlock financial relief with our ultimate guide to the PPP loan application. Discover eligibility, steps, and tips for success. Apply now!

5 Ways To Find Grants For Your Small Business

Discover 5 proven strategies to secure grants for your small business. Maximize your potential and unlock funding opportunities today!

What are my Financial Liabilities?

Discover and manage your financial liabilities. Understand the impact, reduce stress, and achieve long-term goals.

How to Qualify for a Small Business Grant

Turn your small business dream into reality! Discover how to qualify for a small business grant and secure the funding you need.

What is a Business Grant?

Demystify the business grant process and unlock opportunities. Discover the purpose, types, and eligibility criteria of grants.

How to Apply for a Small Business Grant

May 18, 2024

Unlock funding for your business! Learn the essential steps to apply for small business grants and fuel your success.

How Much Equity Should I Offer to Investors?

Discover how to determine the perfect equity offer for investors. Navigate valuation methods and negotiation strategies like a pro!

Raise Funding and Connect With Investors

Unlock growth potential with funding! Connect with investors and raise capital to propel your business forward.

Do Angel Investors Get Equity and How Much?

Unveil the truth: Do angel investors receive equity, and how much? Get insights in the equity distribution process and investment structure

24 Hour Payday Loan

Get fast cash in a flash with a 24 hour payday loan! Discover eligibility, pros and cons, and repayment terms now.

.jpg)

Types of Funding Options Available to Private Companies

Discover the types of funding options available to private companies. Unlock the path to success with equity, debt, venture capital and more

Buying an Existing Business

Considering acquiring an established business? Discover the pros and cons of buying an existing business for a successful venture.

Private Equity: Advantages And Disadvantages

Discover the advantages and disadvantages of private equity. Capital infusion, growth potential, and potential risks uncovered.

Provident Funding

Discover the world of Provident Funding: competitive rates, flexible options, and exceptional support for your mortgage journey.

Financing Your Poultry Farming Venture

Unlock the keys to financing your poultry farming venture. Discover self-financing options and external funding sources.

10 Steps to Get Government Grants for Poultry Farm

Unlock government grants for your poultry farm with these 10 steps! Learn how to secure funding and maximize your farm's potential.

Recommended Finance Books for Small Business Owners

Level up your financial IQ with recommended finance books for small business owners. Master money management and grow your business!

How Much Do Business Loan Brokers Make

Unveiling the earnings of business loan brokers. Discover the factors influencing commissions and additional income sources.

Free Grants and Programs for Small Business

Unlock free grants and programs for small business success! Discover government assistance and nonprofit support

How to Grow a Small Poultry Business

Grow your small poultry business with proven strategies! From market research to marketing campaigns, master the art of poultry building.

Success Story Of Bill Gates

Uncover the success story of Bill Gates, from his early life to founding Microsoft and his impactful philanthropy efforts.

10 Startup Financing Models to Fund a Business

Discover the perfect funding model for your startup! Explore 10 financing options to fuel your business growth.

National Funding: Fast Small Business Loans

Break barriers with National Funding's fast small business loans. Get quick access to capital and fuel your growth opportunities!

Seven Business Funding Options and Advice

Unlock the secrets of business funding! Discover seven powerful options and expert advice to fuel your growth.

Building a Funding Strategy - Startup Guide

Unleash your startup's potential with a rock-solid funding strategy. The definitive guide to building a funding strategy.

5 Must-Read Books for Small Business Financing

Unlock small business financing success with 5 must-read books! Learn financial literacy and apply strategies for rags to riches.

How to Finance a Capital Intensive Business

Unlock the secrets to financing a capital intensive business and fuel your growth with strategic funding strategies.

Best Entry-Level Finance Jobs

Discover the top entry-level finance jobs! From financial analysts to auditors, find your perfect path to financial success.

Providence Business Loan Fund

Unlock opportunities with the Providence Business Loan Fund! Discover funding, support, and networking for business success.

Business Lending Career Opportunities

Discover exciting business lending career opportunities! Explore skills, qualifications, and paths to success in this thriving industry.

.png)

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How To Write the Funding Request for Your Business Plan

What goes into the funding request, parts of the funding request, important points to remember when writing your request, frequently asked questions (faqs).

MoMo Productions / Getty Images

A business plan contains many sections, and if you plan to seek funding for your business, you will need to include the funding request section. The good news is that this section of your business plan is only needed if you plan to ask for outside business funding. If you're not seeking financial help, you can leave it out of your business plan. There are a variety of ways to fund your business without debt or investors. Below, we'll cover how to write the funding request section of your business plan.

Key Takeaways

- The funding request section of your business plan is required if you plan to seek funding from a lender or investors.

- You'll want to include information on the business, your current financial situation, how the money will be used, and more.

- Tailor each funding request to the specific funding source, and make sure you ask for enough money to keep your business going.

The funding request section provides information on your future financial plans, such as when and how much money you might need. You will also include the possible sources you could consider for securing your funds, such as loans or crowdfunding. Later, you can update this section when you need outside funding again for business growth.

An Outline of the Business

Yes, you've done this already in past sections, but you want to give potential lenders and investors a recap of your business. In some cases, you might simply share the funding request section so you need to have your business details such as what you provide, information about your target market, your structure (i.e. LLC), owners' and members' information (for partnerships and corporations), and any successes you've had to date in your business.

Current Financial Situation

Again, you've provided some financial information in the financial data section , but it doesn't hurt to summarize. If you're submitting just the funding request, you'll need this information to help financial sources understand your money situation.

Provide financial details such as income and cash flow statements, and balance sheets in your funding request section.

Offer your projected financial information as well. If you're asking for a loan for which you'll be offering collateral, include information about the asset. If the business had debt, outline your plan for paying it off. Finally, share how you'll pay the loan or what sort of return on investment (ROI) investors can expect by investing in your business.

How Much Money Do You Need Now and in the Future?

Indicate what type of funding you're asking for such as a loan or investment. Outline what you need now and what you might need in the future as far as five years out.

How Will the Funds Be Used?

Detail how you'll be using the money, whether it's for inventory, paying a debt, buying equipment, hiring help, and more. If you plan to use the money for several things, highlight each and how much money will go to each.

Most financial sources would rather invest in things that grow a thriving business than things that pay for debt or overhead expenses.

Current and Future Financial Plans

Current and future financial plans include items such as loan repayment schedules or plans to sell the business. If you're getting a loan, outline your plans for repayment (although most lenders will have their own schedules). If you have plans to sell the business, let the lender know that and how it will affect them. Other issues to consider are relocation (if you move) or a buyout. Finally, let investors know how they can exit the deal, such as cashing out (and how long before they can do that).

You're asking for money, so you need to always be professional and know your business inside and out. Here are some other things to keep in mind:

- Tailor your funding request to each financial source : Lenders and investors need different information, such as loan repayment versus ROI, so create different reports for each.

- Keep your funding sources in mind : Each resource will have different questions and concerns. Do a little research so you can address them in your report.

- Ask for enough to keep your business going : Don't be stingy, as you don't want your business to fail from a lack of money. At the same time, don't be greedy, asking for more than you need.

How do you request funding for a nonprofit?

Most nonprofits seek funding in the form of grants. Write a grant proposal that includes information on the project or organization, preliminary budget needs, and more. Be sure to format it with a cover letter, proposal summary, the introduction of the organization, problem statement, objectives, methods, evaluation, future funding needs, and the budget.

What are three methods of funding?

Grants and scholarships, equity financing, and debt financing are the main three methods of funding for small businesses . Grants and scholarships do not need to be repaid and are often best for nonprofit organizations. Equity financing is when you receive money in exchange for ownership and profits. Debt financing is when you borrow money that needs to be repaid.

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Small Business Administration. " Fund Your Business ."

Congressional Research Service. " How To Develop and Write a Grant Proposal ."

Library of Congress Research Guides. " Types of Financing ."

This device is too small

If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience.

- Small Business

How to Maximize Your Business Plan to Secure Funding

Updated Aug. 5, 2022 - First published on May 18, 2022

By: Jennifer Post

Writing a business plan for your small business should be one of the first steps you take when a business idea pops into your head. This is how you’ll discover whether your idea can actually be a profitable business. Lenders will want to know the business you plan on starting will make enough money for you to be able to pay back a loan or other forms of investment.

Why is having a business plan important to get funding?

Investors want to invest in a business projected to be profitable within a certain amount of time, has a marketing strategy ready to go, and will exist in a receptive market. All of that information is provided in a business plan. Here are a few reasons why having a business plan is crucial to get funding.

Credibility

Before anyone invests money in your business, lenders will want to know you have a concrete, detailed plan for paying the loan back. Provide information such as:

- Market value of your product or service

- Projected sales in the first year against projected expenses

- Projected profit during your first five years in business

Going through the process of putting all of this together is just another aspect of your credibility as a future business owner, no matter how much money you’re asking for.

If you’re not serious about your business, why should potential investors be? The investing community isn’t as big as you might think, especially once you get to a certain caliber of investor. If you show up to a meeting and don’t have your business plan at the ready, you might not even get to your opening statement before the meeting is over.

You don’t want to earn the reputation of being an ill-prepared entrepreneur. If you take your business idea seriously, show it.

Business need

Just because you’ve thought of a business idea and have outlined every aspect of it doesn’t mean investors and banks will feel the same way. Banks mostly care about whether or not you can pay back a loan, while investors tend to back businesses they connect with.

The need for your business is much more important than it might seem. In order to pay back a loan, your business needs to be profitable. In order for that to happen, you need customers. To get customers, you have to offer something they can’t get anywhere else, whether that’s a product, a service, or an experience.

What should you include in your business plan for funding?

Be detailed and thorough in every idea you present since you’ll most likely have to explain yourself and your business idea. Here’s what should be included in your business plan if you’re seeking funding.

1. Details about your business and company as a whole

It’s important to think about how you plan on setting up your business -- and for more than one reason. Some things to consider:

- Will you be a sole proprietor?

- Do you have a business partner?

- LLC vs. incorporation?

Business structure also matters for paying back a loan. If your business is unable to pay back a loan, the legal structure can be the difference between you having to pay it back somehow (with your home or other assets) or splitting the remaining balance among shareholders or partners.

2. Target market

At the risk of sounding like a broken record, your business can’t make money without customers. Take your business idea and research different locations to find your customers, and ask yourself a few questions:

- Are there a lot of other businesses like yours already out there?

- Are those businesses doing well?

- Is there a gap in what they offer?

You could also pick your target audience first. Let’s say you want young adults between the ages of 25 and 40 to be your main customers. You need to find where those people are and ask the questions noted above. Either way, those questions need to be answered and in a lot of detail.

3. How you plan to make money

This is so much more than just saying, “by selling a lot of product,” or “having a long list of clients.” Anyone can say that. Ask yourself a few questions, just like you did with the market aspect above:

- How much will you charge for your offerings?

- Will people actually pay that amount?

- How much do you need to sell to break even? To make a profit?

Even if your product is worth x amount of dollars in market terms, the harsh reality is it’s only worth what people are actually willing to pay for it. It’s best to underestimate and over-deliver -- as long as your plan still guarantees your ability to pay off a loan.

4. How much funding you’re seeking and its intended use

You need to have a firm grasp on how much funding you need to accomplish your goal, and don’t be shy about it. If you’re seeking a bank loan, it’s a little different because you will qualify for a certain amount based on a number of factors.

Some lenders also have use case limitations, where there are restrictions on what you can use the money for. Consider that, among all of the other qualifications, before deciding if that type of loan is the way you want to go.

If you’re going with an investor, it’s not usually a make-or-break factor to detail what you plan on using the money for, but the more information you provide, the better.

How to write your business plan for funding

Now that you know why a business plan is crucial for funding and what needs to be included in one, let’s get to actually writing it. There are also business plan templates and sample business plans available online that are a good guide to get you started.

Step 1: Write your executive summary

This is generally the first section of your business plan and your first chance to make an impression. As with most introductions, this is where you’ll summarize all the other sections of the business plan, such as your mission statement , general company information, products or services, and financials.

Step 2: Explain your company overview

All that time you spent researching different business formation options will pay off in this section. You’ll explain the structure of your company, exactly what your business does, and the target market you plan on addressing. You’ll want to get into detail about the market you’ve chosen, why you fit into that market, and how you plan on expanding within it.

Step 3: Detail your market analysis

This is the section where you will dive into the nitty-gritty of your intended market. Explain the following aspects:

- What audience lives within that market?

- What do they want?

- How do you plan on providing what they want?

- How much is your product worth?

- What are your plans for growth?

- Are there setbacks you might run into? How will you overcome them?

As anyone who has started a business knows, it’s not all gains. Letting investors know that you recognize there will be obstacles shows that you’ve really thought all of this out.

Step 4: Describe your product/service

In this section, you’ll do more than just explain what you will sell, although that’s part of it. If you’ve invented something or patented something, include that in this section. Don’t only show what you’re offering but explain how it works and how it improves on what’s already out there. If it’s a service, explain how you will produce better results than others.

Additionally, if you have to source materials or equipment from somewhere else, outline whom you will work with and what the process will be to secure those materials.

Step 5: Write out your sales plan

Here are a couple of steps you’ll want to take to outline your sales plan.

- Have some branding ideas on hand: These might include a company name, logo, color scheme, and sample materials, such as business cards or brochures. This will position your product for sale.

- Explain how you’ll market your product: Decide whether you will go with free online marketing, such as social media, or paid marketing, such as online or print ads. While you can choose among options, it will come down to your target audience. Do they spend most of their time online, or do they still read the newspaper every morning? That will determine where you should put your marketing efforts, and since ad return is a business metric you’ll want to track later on, having a solid plan in the initial stages will make that process smoother.

Step 6: Detail and explain your financial projections

This section should come fairly easily once you’ve completed the others. You should have an idea of what it will cost to produce your product or service, how much you can charge for it, your market share, and how you will spend money on marketing.

Do your projections in time increments for the lifecycle of your business , such as the first year, first five years, and looking ahead at 10 years and beyond.

The first couple of years you can be pretty specific about your projections, whereas your long-term projections can be offered up more as goals you would like your company to reach in a certain period of time and how you plan to achieve them.

4 tips for writing effective business plans to secure funding

Now that you have a firm grasp on what needs to be in your business plan, how you obtain that information, and how you actually create a business plan, here are some tips to make sure you’re getting the most out of it.

1. Don’t leave anything out

Leaving bits and pieces of your business up for interpretation or guessing will only hurt your chances of securing funding. If investors are left to fill in the blanks, you have no control over what they fill them with. Make sure you’re as thorough as possible in your research and writing so that nothing is left out.

2. Write with personality

There’s a scene from Parks and Recreation where Tom is presenting a business to a potential investor. His original idea, Tom’s Bistro, is one he’s extremely passionate about. Ben comes in with another idea that has a greater chance of being profitable. Tom starts presenting that and soon finds both he and the investor are bored. As soon as he switches back to Tom’s Bistro, the mood in the room completely changes.

Even though that’s a scene from a television show, it’s a good representation of how adding a little bit of your personality and passion into your business plan can pay off, literally.

3. Don’t speak in general terms

Be as detailed as you possibly can. Use exact numbers, names, dates, etc. Doing this will not only show that you’ve done your homework, but that you’re committed to reaching those numbers by the dates you list.

It can seem daunting to feel like you’re committing to so much, but commitment is what investors are looking for. They need to see that you’re serious about your business, and the amount of detail you include in your business plan will reinforce that.

4. Be upfront about what you’re asking for

Don’t be afraid to ask for the amount you really need, even if it’s high. Being wishy-washy about the number might not present so well. As previously mentioned, bank loans are different in that you only receive an amount you qualify for. If you’re meeting with angel investors , it’s important to go in with a specific number in mind.

While the process doesn’t need to be as dramatic as Shark Tank , expect some back and forth once you present your business plan and offer up how much money you’re asking for.

Final thoughts

A business plan is one of the most important documents you’ll create for your business. It’s where you introduce who you are, what your business is, and how it will be successful. If, as most people do, you’re using your business plan to secure funding, you’ll want to be as detailed and thorough as possible in your research and writing.

You want potential investors to be as serious about your business as you are, so convey to them why you’re serious and how you’re bringing something unique to the table that they would be lucky to be a part of.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

Jennifer Post writes about marketing and software for small businesses for The Ascent and The Motley Fool.

Share this page

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Related Articles

By: Brittney Myers | Published on May 10, 2024

By: Dana George | Published on May 13, 2024

By: Chris Neiger | Published on May 24, 2024

By: Christy Bieber | Published on May 13, 2024

By: Lyle Daly | Published on May 14, 2024

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Copyright © 2018 - 2024 The Ascent. All rights reserved.

Funding Request

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets. Start Free

What is a Funding Request?

The funding request section of a business plan is an outline of the future funding requirements of a company. Usually, the time scale is limited to the next five years, especially in cases of startups with an uncertain future. Information needs to be provided about the company’s future financial plans, such as the amount of funding required at different phases or the different sources of capital.

- The funding request section of a business plan is an outline of the future funding requirements of a company.