Labor requirements for business

The following laws are in place to protect workers and potential hires, and require that you treat your workers fairly, provide them with benefits and a safe workplace, and contribute to California’s unemployment insurance.

Understand whether they should be employees or independent contractors

Understanding the labor laws for different types of workers–employees, independent contractors, and volunteers–can be confusing. Sometimes employers improperly classify employees as independent contractors, which have different rules on payroll taxes, minimum wage, overtime, and other labor laws.

If you aren't sure how to classify a potential hire as an employee or independent contractor, you can use this "test" to help you figure it out: https://www.dir.ca.gov/dlse/faq_independentcontractor.htm

Some questions are off limits

During the hiring process, it is unlawful to ask about a job applicant’s age, sexual orientation, marital status, religious affiliation or race. Additionally, questions related to a physical, emotional or mental handicap can only be asked if an applicant will need special accommodations for performing a specific job. The US Department of Labor and the Equal Employment Opportunity Commission explains these rules in more detail.

Give potential hires a fair chance

Businesses located or doing business in the City, that have 5 or more employees (regardless of the employees’ locations), cannot discriminate against potential hires who may have a criminal record. Learn more about the Fair Chance Ordinance from the SF Office of Labor Standards Enforcement.

Set up employee benefits

If your business has established employee benefit programs like health insurance or a 401(k) plan, you’ll need a sign-up procedure so employees can enroll, name their dependents, and select options.

Follow San Francisco labor laws

Minimum wage.

The San Francisco minimum wage is higher than most cities to reflect the cost of living in the city. The current minimum wage is updated every year .

- Paid sick leave

All employers must provide paid sick leave to each employee (including temporary and part-time employees) who performs work in San Francisco. Learn more about the Paid Sick Leave Ordinance from the SF Office of Labor Standards Enforcement and the Healthy Workplace Healthy Family Act from the CA Department of Industrial Regulations.

Flexible work arrangements

Employees with families in San Francisco have the right to request a flexible work arrangement (though employers also have the right to refuse for legitimate business reasons). Learn more about the Family Friendly Workplace Ordinance from the SF Office of Labor Standards Enforcement.

Healthcare security spending

In San Francisco, you must pay toward health care coverage for all your employees. The size of this payment depends on the size of your business, where a small business has 19 employees or less, a medium business has 20-99 employees, and a large business has over one hundred employees. Learn more about the Health Care Security Ordinance from the SF Office of Labor Standards Enforcement.

Commuter benefits

Businesses located or doing business in the City that have 20 or more employees must provide commuter benefits to encourage their employees to take public transit, bike, or rideshare to work. Learn more about the Commuter Benefits Ordinance from the SF Department of the Environment.

Retail employees

Beginning July 3, 2015, all Formula Retail Establishments with at least 20 retail stores, must follow the San Francisco Retail Worker Bill of Rights . These employers must provide schedules in advance, give prior notice for schedule changes, and offer predictability pay among other requirements. Sign up for updates and reminders about Formula Retail Labor Protections through the SF Office of Labor Standards and Enforcement.

Provide workers’ compensation insurance

In California, if you have one employee or more, you must have workers’ compensation insurance to protect workers who might suffer on-the-job injuries. If your employees get hurt or sick because of work, you are required to pay for workers' compensation benefits. Workers’ comp insurance provides six basic benefits: medical care, temporary disability benefits, permanent disability benefits, supplemental job displacement benefits or vocational rehabilitation and death benefits.

You may obtain workers’ compensation insurance in California in the following ways:

- Through a broker

- Directly with an insurance carrier

If you currently do not have a broker or insurance carrier and would like to search for a list of carriers, you can learn more from the CA Department of Industrial Relations .

NOTE: If you are a roofer and don’t have any employees, you are still required to carry workers’ comp insurance .

Deduct temporary disability insurance

Employers are required by law to withhold and remit State Disability Insurance (SDI) contributions and to inform their employees of SDI benefits. To inform employees, you must provide them with the publications listed below. You can find these publications through the CA Employment Development Department .

- Notice to Employees: Unemployment Insurance/Disability Insurance Benefits (DE 1857A) – Advises employees of their right to claim Unemployment Insurance (UI), DI, and PFL benefits.

- State Disability Insurance Provisions (DE 2515) – For new hires and again when the employee notifies the employer they need to take time off from work due to their non-industrial medical condition.

- Paid Family Leave Benefits (DE 2511) – For new hires and again when the employee notifies the employer they need to take time off from work to care for a seriously ill family member or to bond with a new child.

Register with the state

Once you bring on employees, you must pay California unemployment insurance taxes. First, register with the CA Department of Industrial Relations . Later, at tax time, your payments will go to the state’s unemployment compensation fund, which provides short-term relief to workers who lose their jobs.

Unemployment Insurance (UI) is paid by every employer in California. Tax-rated employers pay a percentage on the first $7,000 in wages paid to each employee in a calendar year. The UI rate schedule and amount of taxable wages are determined annually.

Adopt workplace safety measures

Almost every employer must comply with the requirements of the Occupational Safety and Health Act (OSHA) by, among other things, providing a workplace free of hazards, training employees to do their jobs safely, notifying government administrators about serious workplace accidents, and keeping detailed safety records.

Post required notices

Employers are required to display certain posters in the workplace that inform employees of both their rights and employer responsibilities under labor laws. California employers must post all state and federal required posters, but San Francisco has some additional notices that must be displayed.

City-Required Posters

- Minimum Wage Ordinance Official Poster. Find poster and read more .

- Fair Chance Ordinance Notice. Find poster and read more .

- Paid Sick Leave Ordinance Official Poster. Find poster and read more .

- Health Care Security Ordinance (HCSO) Notice. Find poster and read more .

- Family Friendly Workplace Ordinance Notice. Find poster and read more .

State and Federal Required Posters

The CA Department of Industrial Relations maintains an updated list of the following posters, which are required for all employers. The list also includes notices that only apply to specific business types and sizes.

- Payday notice

- Safety and health protection on the job

- Emergency phone numbers

- Notice to employees – injuries caused by work

- Notice to employees – workers’ compensation carrier and coverage

- Whistleblower protections

- No smoking signage

- Discrimination and harassment in employment

- Notice to employees – unemployment insurance benefits

- Notice to employees – time off to vote

- Equal employment opportunity

- Notice to employees – Employee Polygraph Protection Act

Posters required by the US Department of Labor (DOL) and other federal agencies can also be found using the DOL FirstStep Poster Advisor search tool.

Featured resources

Hire your first employee.

The US Small Business Administration (SBA) explains how to start the hiring process and ensure you are compliant with key federal and state regulations.

Nolo, formerly known as Nolo Press, is a Bay Area publisher that produces do-it-yourself legal books and software that reduce the need for people to hire lawyers for simple legal matters.

Hiring Your First Employee: 13 Things You Must Do

A to-do list for new employers produced by Nolo, a Berkeley-based legal advice publisher.

Recruitment assistance to find local talent

The Office of Economic and Workforce Development (OEWD) knows that finding good talent in a market like San Francisco can be a challenge—but the Employer Engagement Team is here to help. Services range from presenting qualified and screened candidates that match your job requirements to assisting you in scheduling interviews in our recruitment facilities. OEWD can also help connect you to local hiring events.

Tax credits and incentives

Certain employers can be eligible for thousands of dollars in Local, State, and Federal tax credits and incentives based on hiring and other business expenses.

CityBuild Employment Networking Services

The Office of Workforce and Economic Development' s CityBuild Employment Networking Services connect contractors with qualified San Francisco resident trades workers. CityBuild maintains a database of over 4,000 local workers and can assist contractors in meeting workforce hiring requirements.

Layoff response assistance

The Office of Economic and Workforce Development can provide services through the Rapid Response Program that will assist you in easing the transition of your workforce when a downsizing event cannot be averted. Staff will conduct on-site or virtual orientations and inform your employees about resources and services that can assist them with applying for unemployment, access to career coaching, and healthcare options.

The following requirements are in place for reporting and tax purposes. They ask that you obtain an EIN, verify your worker’s eligibility before hiring and registering them with the state, and that you withhold taxes.

Find out where to begin, what you need, and how to plan for success.

Select one of our country-specific markets here:

- Strategy Consulting

- Performance Improvement

- Business Process Management

- Supply Chain Management

- Supplier Management

- Quality Management

- Lean Management

- Equipment effectiveness

- Assembly line planning

- Logistics planning

- Ramp-Up Management

- Factory planning

- Project Management

- Industrial Engineering

- Automotive body construction

- Implementation of the Digital Transformation

- Digital Transformation and Industry 4.0 Consulting

- Training Opportunities

- Trainer profiles

- Agricultural Technology

- Automotive OEM

- Automotive Supplier

- Electrical-Technology Industry

- Plant Engineering and High Tech

- Medical Technology

- Commercial Vehicle

- Space industry

- Transport and Logistics

- What We Stand for

- Working at Ingenics

- Experienced Professionals

- University Graduates

- University Students

- About the Application Process

- Ingenics Group

- Association memberships

- Operations Transformation

- Zero Emission

- New Ways of Working

- Smart Factory – Planning a Future-Proof Factory

- Driving E-Mobility

Qualitative and quantitative labor requirements planning

With a regular, systematic labor requirements plan, you can ensure that your company is able to continue operations and secure its long-term success.

Qualitative and quantitative staff planning means you will have the right number of the right people with the necessary qualifications – at right time and place.

The experts at Ingenics offer decades of project experience in factory and production planning. With the right tools, Ingenics can also actively support your company when it comes to efficient and successful labor requirements planning. The resulting staff structure is made transparent for all the relevant areas.

Based on this requirements plan, your potential can be identified and quantified. Appro-priate measures are then established to achieve this potential over the long term. These include regular audits and inspections using key performance indicators (KPIs). Offering added value, Ingenics will also present you with the optimal organizational structure for your production and administrative departments.

Methods of qualitative and quantitative labor requirements planning

First, basic information is collected and analyzed so that a requirements plan can be developed. This basic data should include relevant information such as the number of units to be produced, the shift pattern, and the number of working days per week and year.

The qualitative perspective takes into account responsibilities concerning work tasks as well as the mental and physical demands on employees. One tool that is used here is a qualification matrix to identify skills and qualification levels.

Furthermore, quantitative staffing needs play an especially important role in labor re-quirements planning – the determination of gross and net staffing needs, among other things. With respect to net staffing needs, a further distinction is made between direct and indirect employees.

The results of the qualitative and quantitative labor requirements plan are documented in the form of job charts, organizational structures, and organizational charts. At the same time, the required staffing needs are monitored over defined periods in a process known as “calendarization”. This breakdown of capacity planning makes it possible to determine in advance which (and how many) employees have to be available in the immediate future, and in what areas of the company.

Appropriate measures are derived from the labor requirements plan so that the company remains sufficiently staffed at all times now and in the future, while also avoiding expensive overstaffing situations. Ingenics actively supports your company with the creation of a structured, clear, and transparent labor requirements plan. This also serves as an early warning system so that you can estimate future developments, identify risks, and introduce new measures where appropriate.

Johann Kablutschkin

Associate Partner Phone: +49 731 93680 225

Dennis Schunigl

Associate Partner Phone: +52 222 549 32 19

The New Ingenics Magazine Is Available Now!

The newly released ingenics magazine no. 11 / 2024 is now available for download..

Manpower Requirements and Operations in a Business Proposal

Writing a winning business proposal can be a critical part of expanding your business. An informal meeting with a potential new client sets the stage, but a thoughtful, personalized business proposal can help you seal the deal. As you craft your business proposal, two important areas to consider are the manpower requirements of the project and the operational requirements of the project. These areas will help inform the project deliverables, milestones and overall budget.

Writing a Business Proposal

The purpose of a business proposal is to win new business, so it should be written with sales in mind. Some industries have a specific template that's commonly used, so if you're uncertain of the correct format, connect with peers in your network to find out proposal specifics. In particular, federal and state governments bids may have specific requirements that you need to meet.

In general, business proposals have five to six sections. These include an introduction, an executive summary, details about the project, deliverables and project milestones, a breakdown of the budget for the project and the conclusion. In the introduction, you can provide a brief overview of your business and why it's well-suited for this particular project. In the executive summary, you can provide an overview of the project itself. Next, give more details about the project, including your operational and manpower planning.

Advertisement

Article continues below this ad

More For You

How to create a business plan as an entrepreneur, how to write a proposal on the introduction & marketing of bakery products, 6 types of business plans, professional service agreement, how to develop an organizational plan & strategy to get project staff.

Your deliverables and project milestones can be spelled out in the simple table. Your budget breakdown can also be delivered in a table and should include your manpower proposal for the project. Overall, business proposals tend to be relatively short and easy-to-read.

Manpower Proposal Considerations

Before you write your business proposal, consider the manpower you'll need for this project. Your manpower requirements definition may include managers, front-line employees and employees with special skill sets required for this project. Define the roles of each member of your proposed team and how they will interact with each other. Estimate how long it will take for each team member to complete their portion of the project. Use that estimate to determine your manpower costs, keeping in mind their salary, their employee benefits, payroll taxes and other costs associated with their employment.

When you address manpower requirements in your business proposal, you may not need to include this level of detail. This level of planning can help you develop an accurate budget, though. Be sure to include a cushion for unexpected costs such as overtime.

Operations Proposal Considerations

Your operational plan will influence several areas of your business proposal. For example, it will play a large role in the section where you spell out the details of your project. You may want to include a brief description of how your product is made, as well as your supply chain. You should also describe the quality control measures you have in place to ensure a high-quality product or service.

As you develop your project budget, keep in mind operational requirements such as the type of physical space you'll need, any special equipment you will need to purchase, any special materials you'll need to obtain, storage costs and delivery costs. You may not need to go into this level of detail in your proposed budget, but using a high level of detail for planning ensures a higher level of accuracy, which can help prevent cost overruns.

- Fundera: How to Write a Business Proposal in 6 Steps to Win Clients

- Inc.: Business Proposals

- The Balance Small Business: Including Management and Human Resources in Your Business Plan

- The Balance Small Business: The Operations Plan Section of the Business Plan

Melinda Hill Sineriz has been writing professionally for over 10 years. She worked as an editorial assistant for Forward Movement Publications in Cincinnati, Ohio. She wrote for several years for allmusic.com and edited and wrote a chapter for a book with Wooster Press. She graduated from Miami University in Ohio with a Bachelor of Arts in English. She has a master's degree in teaching.

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

Workforce Planning: Definition & Best Practices

Updated: Feb 11, 2024, 3:58pm

Table of Contents

What is workforce planning, why workforce planning is important, benefits of workforce planning, 6 steps to effective workforce planning, 7 workforce planning best practices, frequently asked questions (faqs).

In today’s ever-changing workplace environment, it is more important than ever that businesses use workforce planning to ensure that their workforce aligns with their business strategy. Workforce planning is the process of analyzing workforce supply and demand, and then making adjustments as necessary to meet business needs and goals. This article explains the definition of workforce planning, the process of engaging in workforce planning, and best practices.

Workforce planning is the process of leveraging data to ensure that a business’s workforce supports business needs, goals and strategic plans. By utilizing workforce planning, businesses can set themselves up for success and empower their HR department to make more informed decisions about their talent needs. After assessing business needs and strategic plans, workforce planning looks at possible solutions, including staffing and technology solutions.

Featured Partners

$40 per month + $6 per user

On OnPay's Website

SurePayroll

$29.99/mo plus $5 per employee

On SurePayroll's Website

$40 per month plus $6 per user

On Gusto's Website

$35/month plus $8 PEPM

On Rippling's Website

$50/month + $8/user

On Justworks' Website

Workforce planning is essential to keeping your business appropriately staffed. Without workforce planning, businesses can easily become overstaffed with excessive payroll expenses or understaffed and unable to meet customer or client needs. Workforce planning can help keep the business on track to meet customer and client needs, to achieve business goals and strategic plans, and avoid excessive overhead costs.

When trying to juggle all of the responsibilities of running a business, it might seem as though taking the time to sit down and plan your personnel strategy is a poor use of time. But taking the care to practice effective workforce planning can pay off greatly in the long run.

When done correctly, benefits of workforce planning include:

- Creating a road map for achieving business goals. Rather than just words on paper, the strategic plan comes to life through workforce planning. Because workforce planning aligns the workforce supply and demand with the business’s strategic plan, it provides a path to making the strategic plan a reality.

- Preparing for the future. Rather than focusing on immediate staffing needs, workforce planning takes a longer view to prepare for future needs by looking to labor market trends, technological alternatives, sustainable ways to streamline job responsibilities and other workforce options.

- Discovering staffing gaps or opportunities for increased efficiency. Workforce planning requires an evaluation process, through which staffing gaps and inefficiencies can be discovered and corrected.

- Providing data to support HR decisions. Rather than making impulsive decisions, workforce planning relies on data and stats to make informed decisions. Accordingly, HR leaders and company management can be confident in their decisions and have the data to support their decisions to various stakeholders.

- Facilitating succession planning. Because workforce planning looks beyond the horizon to future needs, the process can assist with succession planning. If there are gaps in succession planning, the business can take steps to train and develop future leaders so they aren’t scrambling when leaders retire.

- Improving retention rates. Because there is a clear road map, transparent standards and appropriate staffing levels, businesses often realize improved retention rates when they practice effective workforce planning. Employees are not overworked or underutilized. Instead, talent is developed and given opportunities for growth. And because the workforce planning program aligns with strategic planning, the workforce can feel united in a common goal.

Workforce planning essentially consists of six steps:

- Determine your business strategy. A business plan details your goals, budget and other needs to get your business up and running. A strategic plan can be developed at any point during a business’s life cycle and outlines the company’s strategy for the next three to five years.

- Assess workforce supply. Look at your talent pool, including current employees and potential candidates.

- Assess workforce demand. Determine the number of employees needed to meet current business needs and achieve strategic plans.

- Develop a workforce plan. Analyze your workforce supply and demand in the context of your strategic plans. If there are gaps between supply and demand, consider ways to close those gaps. If there is a misalignment between workforce supply and demand, consider ways to create alignment.

- Implement your workforce plan. The workforce plan might include hiring additional staff, using temporary employees, working with contractors or rolling out technological solutions to meet business needs. Conversely, it might also mean consolidating departments or teams.

- Monitor progress. After the workforce adjustments are implemented, continue to monitor the impact of these solutions to ensure that they have the desired outcomes.

The specific workforce planning process varies depending on the size of your business, industry and the labor market. In an unpredictable labor market or for a startup company, the workforce planning process may look out a year or two in the future. In contrast, a well-established company in a steady labor market might take a longer view. Below are some best practices to consider regardless of the specific duration of your workforce planning program:

1. Take the time to create a strategic plan

Effective workforce planning relies on having a concrete and actionable strategic plan. Not only does a well-formed strategic plan serve as a “north star” to guide you through the workforce planning process, but it can also help monitor progress and evaluate the impact of your proposed solutions.

2. Make workforce planning a collaborative process

Workforce planning works best when there is input from a wide range of stakeholders and there is buy-in across all facets of the business. Consult with different business teams and seek feedback from employees. When communicating the workforce plan, share information regarding the “why” and “how” so that employees throughout the organization understand the goal of any workforce changes.

3. Engage senior leadership in the process

Although workforce planning impacts HR, the process shouldn’t be delegated solely to the HR department. To be effective and sustainable, the workforce planning program should involve senior leadership, who should consider factors such as organization structure, succession planning, budgets, risk reduction and strategic plans.

4. Define your KPIs

To track progress and assess the impact of workforce planning solutions, it is crucial to have appropriate KPIs in place. Some common KPIs to include in your workforce planning program include employee head count, attrition rate, retention rate, promotion rate, tenure, quality of hire, voluntary vs. involuntary turnover rate, eNPS and diversity metrics.

5. Leverage data

Data is your workforce planning friend. By relying on data, you can make informed decisions and justify staffing decisions. Look at current staffing, employee retention rates, employee promotion rates, time-to-hire period and other vital measurements.

6. Pay attention to labor market insights

Understanding labor market trends, especially in your industry, will help you assess potential staffing needs. If multiple competitors are on a hiring spree, it could give you some key insights into where your industry is going and what your organization needs to do to prepare for it.

7. Consider alternative solutions

Workforce planning extends beyond hiring and terminating employees. Workforce planning should consider several options, including technological solutions, temporary employees and contractors. Workforce planning might also include adjustments to operations to remove bottlenecks, enhance efficiency, scale operations and employee transfers. The most effective workforce planning programs use a combination of talent strategies to meet their needs, including hiring talent, developing talent, redesigning workflow, redeploying talent and contracting with talent.

Bottom Line

Workforce planning isn’t a quick fix; it takes time, effort and careful deliberation. But workforce planning is well worth the time and effort it takes. When done well, workforce planning can boost retention rates, minimize inefficiencies and help the business achieve its goals.

How is workforce planning different from workforce management?

Workforce management is a set of techniques to manage your current workforce by allocating resources, improving efficiency and managing schedules. On the other hand, workforce planning takes a more big-picture view and predicts future workforce needs according to the company’s strategic plan.

Why is workforce planning important?

For many businesses, human capital is their most valuable asset. Workforce planning can ensure that your talent strategy aligns with your overall business strategy.

What are the key steps to effective workforce planning?

When it comes time to create a workforce plan, employ the following steps:

- Determine your business strategy

- Assess workforce supply

- Assess workforce demand

- Develop a workforce plan

- Implement your workforce plan

- Monitor progress

Are there technologies to assist with workforce planning?

Several technological solutions can assist with workforce planning and other strategic human resource management needs, including Vena, Planful and Workday Adaptive Planning.

- Best HR Software

- Best HCM Software

- Best HRIS Systems

- Best Employee Management Software

- Best Onboarding Software

- Best Talent Management Software

- Best HR Outsourcing Services

- Best Workforce Management Software

- Best Time And Attendance Software

- Best Employee Scheduling Software

- Best Employee Time Tracking Apps

- Best Free Time Tracking Apps

- Best Employee Training Software

- Best Employee Monitoring Software

- Best Enterprise Learning Management Systems

- Best Time Clock Software

- Best ERP Systems

- Zenefits Review

- Oracle HCM Review

- UKG Pro Review

- IntelliHR Review

- ADP Workforce Now Review

- ADP TotalSource Review

- SuccessFactors Review

- Connecteam Review

- What is Human Resources?

- Employee Benefits Guide

- What is Workforce Management?

- What is a PEO?

- What is Human Capital Management?

- HR Compliance Guide

- Strategic Human Resource Management

- Onboarding Checklist

- Benefits Administration Guide

- What Is Employee Training?

- Employee Development Plan

- 30-60-90 Day Plan Guide

- How To Calculate Overtime

- What Is Outplacement?

- New Hire Orientation Checklist

- HR Analytics Guide

Next Up In Business

- Offboarding Definition & Best Practices

- Essential HR Metrics

- Contact Center Workforce Management

- What Is Furlough

- What Is Full-Time Equivalent (FTE)?

- Best Learning Management Systems (LMS)

What Is SNMP? Simple Network Management Protocol Explained

What Is A Single-Member LLC? Definition, Pros And Cons

What Is Penetration Testing? Definition & Best Practices

What Is Network Access Control (NAC)?

What Is Network Segmentation?

How To Start A Business In Louisiana (2024 Guide)

Christine is a non-practicing attorney, freelance writer, and author. She has written legal and marketing content and communications for a wide range of law firms for more than 15 years. She has also written extensively on parenting and current events for the website Scary Mommy. She earned her J.D. and B.A. from University of Wisconsin–Madison, and she lives in the Chicago area with her family.

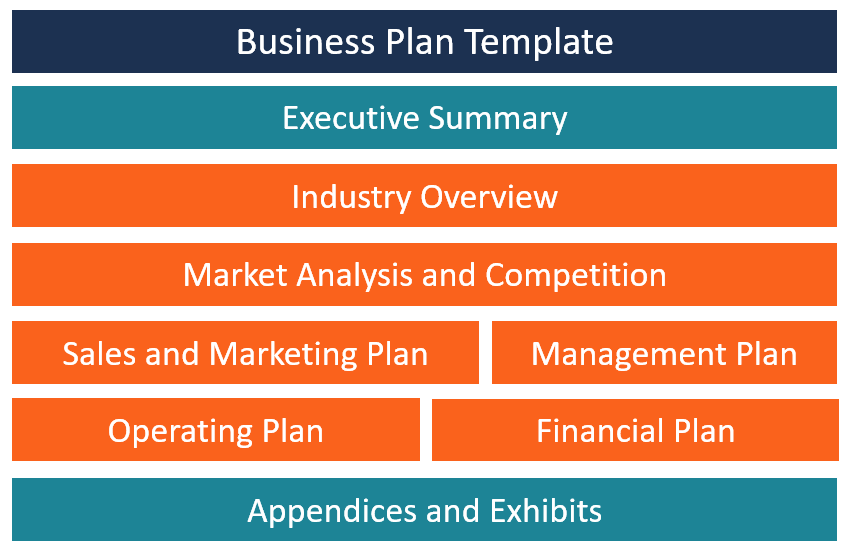

Business Plan Example and Template

Learn how to create a business plan

What is a Business Plan?

A business plan is a document that contains the operational and financial plan of a business, and details how its objectives will be achieved. It serves as a road map for the business and can be used when pitching investors or financial institutions for debt or equity financing .

A business plan should follow a standard format and contain all the important business plan elements. Typically, it should present whatever information an investor or financial institution expects to see before providing financing to a business.

Contents of a Business Plan

A business plan should be structured in a way that it contains all the important information that investors are looking for. Here are the main sections of a business plan:

1. Title Page

The title page captures the legal information of the business, which includes the registered business name, physical address, phone number, email address, date, and the company logo.

2. Executive Summary

The executive summary is the most important section because it is the first section that investors and bankers see when they open the business plan. It provides a summary of the entire business plan. It should be written last to ensure that you don’t leave any details out. It must be short and to the point, and it should capture the reader’s attention. The executive summary should not exceed two pages.

3. Industry Overview

The industry overview section provides information about the specific industry that the business operates in. Some of the information provided in this section includes major competitors, industry trends, and estimated revenues. It also shows the company’s position in the industry and how it will compete in the market against other major players.

4. Market Analysis and Competition

The market analysis section details the target market for the company’s product offerings. This section confirms that the company understands the market and that it has already analyzed the existing market to determine that there is adequate demand to support its proposed business model.

Market analysis includes information about the target market’s demographics , geographical location, consumer behavior, and market needs. The company can present numbers and sources to give an overview of the target market size.

A business can choose to consolidate the market analysis and competition analysis into one section or present them as two separate sections.

5. Sales and Marketing Plan

The sales and marketing plan details how the company plans to sell its products to the target market. It attempts to present the business’s unique selling proposition and the channels it will use to sell its goods and services. It details the company’s advertising and promotion activities, pricing strategy, sales and distribution methods, and after-sales support.

6. Management Plan

The management plan provides an outline of the company’s legal structure, its management team, and internal and external human resource requirements. It should list the number of employees that will be needed and the remuneration to be paid to each of the employees.

Any external professionals, such as lawyers, valuers, architects, and consultants, that the company will need should also be included. If the company intends to use the business plan to source funding from investors, it should list the members of the executive team, as well as the members of the advisory board.

7. Operating Plan

The operating plan provides an overview of the company’s physical requirements, such as office space, machinery, labor, supplies, and inventory . For a business that requires custom warehouses and specialized equipment, the operating plan will be more detailed, as compared to, say, a home-based consulting business. If the business plan is for a manufacturing company, it will include information on raw material requirements and the supply chain.

8. Financial Plan

The financial plan is an important section that will often determine whether the business will obtain required financing from financial institutions, investors, or venture capitalists. It should demonstrate that the proposed business is viable and will return enough revenues to be able to meet its financial obligations. Some of the information contained in the financial plan includes a projected income statement , balance sheet, and cash flow.

9. Appendices and Exhibits

The appendices and exhibits part is the last section of a business plan. It includes any additional information that banks and investors may be interested in or that adds credibility to the business. Some of the information that may be included in the appendices section includes office/building plans, detailed market research , products/services offering information, marketing brochures, and credit histories of the promoters.

Business Plan Template

Here is a basic template that any business can use when developing its business plan:

Section 1: Executive Summary

- Present the company’s mission.

- Describe the company’s product and/or service offerings.

- Give a summary of the target market and its demographics.

- Summarize the industry competition and how the company will capture a share of the available market.

- Give a summary of the operational plan, such as inventory, office and labor, and equipment requirements.

Section 2: Industry Overview

- Describe the company’s position in the industry.

- Describe the existing competition and the major players in the industry.

- Provide information about the industry that the business will operate in, estimated revenues, industry trends, government influences, as well as the demographics of the target market.

Section 3: Market Analysis and Competition

- Define your target market, their needs, and their geographical location.

- Describe the size of the market, the units of the company’s products that potential customers may buy, and the market changes that may occur due to overall economic changes.

- Give an overview of the estimated sales volume vis-à-vis what competitors sell.

- Give a plan on how the company plans to combat the existing competition to gain and retain market share.

Section 4: Sales and Marketing Plan

- Describe the products that the company will offer for sale and its unique selling proposition.

- List the different advertising platforms that the business will use to get its message to customers.

- Describe how the business plans to price its products in a way that allows it to make a profit.

- Give details on how the company’s products will be distributed to the target market and the shipping method.

Section 5: Management Plan

- Describe the organizational structure of the company.

- List the owners of the company and their ownership percentages.

- List the key executives, their roles, and remuneration.

- List any internal and external professionals that the company plans to hire, and how they will be compensated.

- Include a list of the members of the advisory board, if available.

Section 6: Operating Plan

- Describe the location of the business, including office and warehouse requirements.

- Describe the labor requirement of the company. Outline the number of staff that the company needs, their roles, skills training needed, and employee tenures (full-time or part-time).

- Describe the manufacturing process, and the time it will take to produce one unit of a product.

- Describe the equipment and machinery requirements, and if the company will lease or purchase equipment and machinery, and the related costs that the company estimates it will incur.

- Provide a list of raw material requirements, how they will be sourced, and the main suppliers that will supply the required inputs.

Section 7: Financial Plan

- Describe the financial projections of the company, by including the projected income statement, projected cash flow statement, and the balance sheet projection.

Section 8: Appendices and Exhibits

- Quotes of building and machinery leases

- Proposed office and warehouse plan

- Market research and a summary of the target market

- Credit information of the owners

- List of product and/or services

Related Readings

Thank you for reading CFI’s guide to Business Plans. To keep learning and advancing your career, the following CFI resources will be helpful:

- Corporate Structure

- Three Financial Statements

- Business Model Canvas Examples

- See all management & strategy resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Tips White Papers

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- United Kingdom

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

Elements of a Business Plan There are seven major sections of a business plan, and each one is a complex document. Read this selection from our business plan tutorial to fully understand these components.

Now that you understand why you need a business plan and you've spent some time doing your homework gathering the information you need to create one, it's time to roll up your sleeves and get everything down on paper. The following pages will describe in detail the seven essential sections of a business plan: what you should include, what you shouldn't include, how to work the numbers and additional resources you can turn to for help. With that in mind, jump right in.

Executive Summary

Within the overall outline of the business plan, the executive summary will follow the title page. The summary should tell the reader what you want. This is very important. All too often, what the business owner desires is buried on page eight. Clearly state what you're asking for in the summary.

The statement should be kept short and businesslike, probably no more than half a page. It could be longer, depending on how complicated the use of funds may be, but the summary of a business plan, like the summary of a loan application, is generally no longer than one page. Within that space, you'll need to provide a synopsis of your entire business plan. Key elements that should be included are:

- Business concept. Describes the business, its product and the market it will serve. It should point out just exactly what will be sold, to whom and why the business will hold a competitive advantage.

- Financial features. Highlights the important financial points of the business including sales, profits, cash flows and return on investment.

- Financial requirements. Clearly states the capital needed to start the business and to expand. It should detail how the capital will be used, and the equity, if any, that will be provided for funding. If the loan for initial capital will be based on security instead of equity, you should also specify the source of collateral.

- Current business position. Furnishes relevant information about the company, its legal form of operation, when it was formed, the principal owners and key personnel.

- Major achievements. Details any developments within the company that are essential to the success of the business. Major achievements include items like patents, prototypes, location of a facility, any crucial contracts that need to be in place for product development, or results from any test marketing that has been conducted.

When writing your statement of purpose, don't waste words. If the statement of purpose is eight pages, nobody's going to read it because it'll be very clear that the business, no matter what its merits, won't be a good investment because the principals are indecisive and don't really know what they want. Make it easy for the reader to realize at first glance both your needs and capabilities.

Business Description

Tell them all about it.

The business description usually begins with a short description of the industry. When describing the industry, discuss the present outlook as well as future possibilities. You should also provide information on all the various markets within the industry, including any new products or developments that will benefit or adversely affect your business. Base all of your observations on reliable data and be sure to footnote sources of information as appropriate. This is important if you're seeking funding; the investor will want to know just how dependable your information is, and won't risk money on assumptions or conjecture.

When describing your business, the first thing you need to concentrate on is its structure. By structure we mean the type of operation, i.e. wholesale, retail, food service, manufacturing or service-oriented. Also state whether the business is new or already established.

In addition to structure, legal form should be reiterated once again. Detail whether the business is a sole proprietorship, partnership or corporation, who its principals are, and what they will bring to the business.

You should also mention who you will sell to, how the product will be distributed, and the business's support systems. Support may come in the form of advertising, promotions and customer service.

Once you've described the business, you need to describe the products or services you intend to market. The product description statement should be complete enough to give the reader a clear idea of your intentions. You may want to emphasize any unique features or variations from concepts that can typically be found in the industry.

Be specific in showing how you will give your business a competitive edge. For example, your business will be better because you will supply a full line of products; competitor A doesn't have a full line. You're going to provide service after the sale; competitor B doesn't support anything he sells. Your merchandise will be of higher quality. You'll give a money-back guarantee. Competitor C has the reputation for selling the best French fries in town; you're going to sell the best Thousand Island dressing.

How Will I Profit?

Now you must be a classic capitalist and ask yourself, "How can I turn a buck? And why do I think I can make a profit that way?" Answer that question for yourself, and then convey that answer to others in the business concept section. You don't have to write 25 pages on why your business will be profitable. Just explain the factors you think will make it successful, like the following: it's a well-organized business, it will have state-of-the-art equipment, its location is exceptional, the market is ready for it, and it's a dynamite product at a fair price.

If you're using your business plan as a document for financial purposes, explain why the added equity or debt money is going to make your business more profitable.

Show how you will expand your business or be able to create something by using that money.

Show why your business is going to be profitable. A potential lender is going to want to know how successful you're going to be in this particular business. Factors that support your claims for success can be mentioned briefly; they will be detailed later. Give the reader an idea of the experience of the other key people in the business. They'll want to know what suppliers or experts you've spoken to about your business and their response to your idea. They may even ask you to clarify your choice of location or reasons for selling this particular product.

The business description can be a few paragraphs in length to a few pages, depending on the complexity of your plan. If your plan isn't too complicated, keep your business description short, describing the industry in one paragraph, the product in another, and the business and its success factors in three or four paragraphs that will end the statement.

While you may need to have a lengthy business description in some cases, it's our opinion that a short statement conveys the required information in a much more effective manner. It doesn't attempt to hold the reader's attention for an extended period of time, and this is important if you're presenting to a potential investor who will have other plans he or she will need to read as well. If the business description is long and drawn-out, you'll lose the reader's attention, and possibly any chance of receiving the necessary funding for the project.

Market Strategies

Define your market.

Market strategies are the result of a meticulous market analysis. A market analysis forces the entrepreneur to become familiar with all aspects of the market so that the target market can be defined and the company can be positioned in order to garner its share of sales. A market analysis also enables the entrepreneur to establish pricing, distribution and promotional strategies that will allow the company to become profitable within a competitive environment. In addition, it provides an indication of the growth potential within the industry, and this will allow you to develop your own estimates for the future of your business.

Begin your market analysis by defining the market in terms of size, structure, growth prospects, trends and sales potential.

The total aggregate sales of your competitors will provide you with a fairly accurate estimate of the total potential market. Once the size of the market has been determined, the next step is to define the target market. The target market narrows down the total market by concentrating on segmentation factors that will determine the total addressable market--the total number of users within the sphere of the business's influence. The segmentation factors can be geographic, customer attributes or product-oriented.

For instance, if the distribution of your product is confined to a specific geographic area, then you want to further define the target market to reflect the number of users or sales of that product within that geographic segment.

Once the target market has been detailed, it needs to be further defined to determine the total feasible market. This can be done in several ways, but most professional planners will delineate the feasible market by concentrating on product segmentation factors that may produce gaps within the market. In the case of a microbrewery that plans to brew a premium lager beer, the total feasible market could be defined by determining how many drinkers of premium pilsner beers there are in the target market.

It's important to understand that the total feasible market is the portion of the market that can be captured provided every condition within the environment is perfect and there is very little competition. In most industries this is simply not the case. There are other factors that will affect the share of the feasible market a business can reasonably obtain. These factors are usually tied to the structure of the industry, the impact of competition, strategies for market penetration and continued growth, and the amount of capital the business is willing to spend in order to increase its market share.

Projecting Market Share

Arriving at a projection of the market share for a business plan is very much a subjective estimate. It's based on not only an analysis of the market but on highly targeted and competitive distribution, pricing and promotional strategies. For instance, even though there may be a sizable number of premium pilsner drinkers to form the total feasible market, you need to be able to reach them through your distribution network at a price point that's competitive, and then you have to let them know it's available and where they can buy it. How effectively you can achieve your distribution, pricing and promotional goals determines the extent to which you will be able to garner market share.

For a business plan, you must be able to estimate market share for the time period the plan will cover. In order to project market share over the time frame of the business plan, you'll need to consider two factors:

- Industry growth which will increase the total number of users. Most projections utilize a minimum of two growth models by defining different industry sales scenarios. The industry sales scenarios should be based on leading indicators of industry sales, which will most likely include industry sales, industry segment sales, demographic data and historical precedence.

- Conversion of users from the total feasible market. This is based on a sales cycle similar to a product life cycle where you have five distinct stages: early pioneer users, early users, early majority users, late majority users and late users. Using conversion rates, market growth will continue to increase your market share during the period from early pioneers to early majority users, level off through late majority users, and decline with late users.

Defining the market is but one step in your analysis. With the information you've gained through market research, you need to develop strategies that will allow you to fulfill your objectives.

Positioning Your Business

When discussing market strategy, it's inevitable that positioning will be brought up. A company's positioning strategy is affected by a number of variables that are closely tied to the motivations and requirements of target customers within as well as the actions of primary competitors.

Before a product can be positioned, you need to answer several strategic questions such as:

- How are your competitors positioning themselves?

- What specific attributes does your product have that your competitors' don't?

- What customer needs does your product fulfill?

Once you've answered your strategic questions based on research of the market, you can then begin to develop your positioning strategy and illustrate that in your business plan. A positioning statement for a business plan doesn't have to be long or elaborate. It should merely point out exactly how you want your product perceived by both customers and the competition.

How you price your product is important because it will have a direct effect on the success of your business. Though pricing strategy and computations can be complex, the basic rules of pricing are straightforward:

- All prices must cover costs.

- The best and most effective way of lowering your sales prices is to lower costs.

- Your prices must reflect the dynamics of cost, demand, changes in the market and response to your competition.

- Prices must be established to assure sales. Don't price against a competitive operation alone. Rather, price to sell.

- Product utility, longevity, maintenance and end use must be judged continually, and target prices adjusted accordingly.

- Prices must be set to preserve order in the marketplace.

There are many methods of establishing prices available to you:

- Cost-plus pricing. Used mainly by manufacturers, cost-plus pricing assures that all costs, both fixed and variable, are covered and the desired profit percentage is attained.

- Demand pricing. Used by companies that sell their product through a variety of sources at differing prices based on demand.

- Competitive pricing. Used by companies that are entering a market where there is already an established price and it is difficult to differentiate one product from another.

- Markup pricing. Used mainly by retailers, markup pricing is calculated by adding your desired profit to the cost of the product. Each method listed above has its strengths and weaknesses.

- Distribution

Distribution includes the entire process of moving the product from the factory to the end user. The type of distribution network you choose will depend upon the industry and the size of the market. A good way to make your decision is to analyze your competitors to determine the channels they are using, then decide whether to use the same type of channel or an alternative that may provide you with a strategic advantage.

Some of the more common distribution channels include:

- Direct sales. The most effective distribution channel is to sell directly to the end-user.

- OEM (original equipment manufacturer) sales. When your product is sold to the OEM, it is incorporated into their finished product and it is distributed to the end user.

- Manufacturer's representatives. One of the best ways to distribute a product, manufacturer's reps, as they are known, are salespeople who operate out of agencies that handle an assortment of complementary products and divide their selling time among them.

- Wholesale distributors. Using this channel, a manufacturer sells to a wholesaler, who in turn sells it to a retailer or other agent for further distribution through the channel until it reaches the end user.

- Brokers. Third-party distributors who often buy directly from the distributor or wholesaler and sell to retailers or end users.

- Retail distributors. Distributing a product through this channel is important if the end user of your product is the general consuming public.

- Direct Mail. Selling to the end user using a direct mail campaign.

As we've mentioned already, the distribution strategy you choose for your product will be based on several factors that include the channels being used by your competition, your pricing strategy and your own internal resources.

Promotion Plan

With a distribution strategy formed, you must develop a promotion plan. The promotion strategy in its most basic form is the controlled distribution of communication designed to sell your product or service. In order to accomplish this, the promotion strategy encompasses every marketing tool utilized in the communication effort. This includes:

- Advertising. Includes the advertising budget, creative message(s), and at least the first quarter's media schedule.

- Packaging. Provides a description of the packaging strategy. If available, mockups of any labels, trademarks or service marks should be included.

- Public relations. A complete account of the publicity strategy including a list of media that will be approached as well as a schedule of planned events.

- Sales promotions. Establishes the strategies used to support the sales message. This includes a description of collateral marketing material as well as a schedule of planned promotional activities such as special sales, coupons, contests and premium awards.

- Personal sales. An outline of the sales strategy including pricing procedures, returns and adjustment rules, sales presentation methods, lead generation, customer service policies, salesperson compensation, and salesperson market responsibilities.

Sales Potential

Once the market has been researched and analyzed, conclusions need to be developed that will supply a quantitative outlook concerning the potential of the business. The first financial projection within the business plan must be formed utilizing the information drawn from defining the market, positioning the product, pricing, distribution, and strategies for sales. The sales or revenue model charts the potential for the product, as well as the business, over a set period of time. Most business plans will project revenue for up to three years, although five-year projections are becoming increasingly popular among lenders.

When developing the revenue model for the business plan, the equation used to project sales is fairly simple. It consists of the total number of customers and the average revenue from each customer. In the equation, "T" represents the total number of people, "A" represents the average revenue per customer, and "S" represents the sales projection. The equation for projecting sales is: (T)(A) = S

Using this equation, the annual sales for each year projected within the business plan can be developed. Of course, there are other factors that you'll need to evaluate from the revenue model. Since the revenue model is a table illustrating the source for all income, every segment of the target market that is treated differently must be accounted for. In order to determine any differences, the various strategies utilized in order to sell the product have to be considered. As we've already mentioned, those strategies include distribution, pricing and promotion.

Competitive Analysis

Identify and analyze your competition.

The competitive analysis is a statement of the business strategy and how it relates to the competition. The purpose of the competitive analysis is to determine the strengths and weaknesses of the competitors within your market, strategies that will provide you with a distinct advantage, the barriers that can be developed in order to prevent competition from entering your market, and any weaknesses that can be exploited within the product development cycle.

The first step in a competitor analysis is to identify the current and potential competition. There are essentially two ways you can identify competitors. The first is to look at the market from the customer's viewpoint and group all your competitors by the degree to which they contend for the buyer's dollar. The second method is to group competitors according to their various competitive strategies so you understand what motivates them.

Once you've grouped your competitors, you can start to analyze their strategies and identify the areas where they're most vulnerable. This can be done through an examination of your competitors' weaknesses and strengths. A competitor's strengths and weaknesses are usually based on the presence and absence of key assets and skills needed to compete in the market.

To determine just what constitutes a key asset or skill within an industry, David A. Aaker in his book, Developing Business Strategies , suggests concentrating your efforts in four areas:

- The reasons behind successful as well as unsuccessful firms

- Prime customer motivators

- Major component costs

- Industry mobility barriers

According to theory, the performance of a company within a market is directly related to the possession of key assets and skills. Therefore, an analysis of strong performers should reveal the causes behind such a successful track record. This analysis, in conjunction with an examination of unsuccessful companies and the reasons behind their failure, should provide a good idea of just what key assets and skills are needed to be successful within a given industry and market segment.

Through your competitor analysis, you will also have to create a marketing strategy that will generate an asset or skill competitors don't have, which will provide you with a distinct and enduring competitive advantage. Since competitive advantages are developed from key assets and skills, you should sit down and put together a competitive strength grid. This is a scale that lists all your major competitors or strategic groups based upon their applicable assets and skills and how your own company fits on this scale.

Create a Competitive Strength Grid

To put together a competitive strength grid, list all the key assets and skills down the left margin of a piece of paper. Along the top, write down two column headers: "weakness" and "strength." In each asset or skill category, place all the competitors that have weaknesses in that particular category under the weakness column, and all those that have strengths in that specific category in the strength column. After you've finished, you'll be able to determine just where you stand in relation to the other firms competing in your industry.

Once you've established the key assets and skills necessary to succeed in this business and have defined your distinct competitive advantage, you need to communicate them in a strategic form that will attract market share as well as defend it. Competitive strategies usually fall into these five areas:

- Advertising

Many of the factors leading to the formation of a strategy should already have been highlighted in previous sections, specifically in marketing strategies. Strategies primarily revolve around establishing the point of entry in the product life cycle and an endurable competitive advantage. As we've already discussed, this involves defining the elements that will set your product or service apart from your competitors or strategic groups. You need to establish this competitive advantage clearly so the reader understands not only how you will accomplish your goals, but also why your strategy will work.

Design and Development Plan

What you'll cover in this section.

The purpose of the design and development plan section is to provide investors with a description of the product's design, chart its development within the context of production, marketing and the company itself, and create a development budget that will enable the company to reach its goals.

There are generally three areas you'll cover in the development plan section:

- Product development

- Market development

- Organizational development

Each of these elements needs to be examined from the funding of the plan to the point where the business begins to experience a continuous income. Although these elements will differ in nature concerning their content, each will be based on structure and goals.

The first step in the development process is setting goals for the overall development plan. From your analysis of the market and competition, most of the product, market and organizational development goals will be readily apparent. Each goal you define should have certain characteristics. Your goals should be quantifiable in order to set up time lines, directed so they relate to the success of the business, consequential so they have impact upon the company, and feasible so that they aren't beyond the bounds of actual completion.

Goals For Product Development

Goals for product development should center on the technical as well as the marketing aspects of the product so that you have a focused outline from which the development team can work. For example, a goal for product development of a microbrewed beer might be "Produce recipe for premium lager beer" or "Create packaging for premium lager beer." In terms of market development, a goal might be, "Develop collateral marketing material." Organizational goals would center on the acquisition of expertise in order to attain your product and market-development goals. This expertise usually needs to be present in areas of key assets that provide a competitive advantage. Without the necessary expertise, the chances of bringing a product successfully to market diminish.

With your goals set and expertise in place, you need to form a set of procedural tasks or work assignments for each area of the development plan. Procedures will have to be developed for product development, market development, and organization development. In some cases, product and organization can be combined if the list of procedures is short enough.

Procedures should include how resources will be allocated, who is in charge of accomplishing each goal, and how everything will interact. For example, to produce a recipe for a premium lager beer, you would need to do the following:

- Gather ingredients.

- Determine optimum malting process.

- Gauge mashing temperature.

- Boil wort and evaluate which hops provide the best flavor.

- Determine yeast amounts and fermentation period.

- Determine aging period.

- Carbonate the beer.

- Decide whether or not to pasteurize the beer.

The development of procedures provides a list of work assignments that need to be accomplished, but one thing it doesn't provide are the stages of development that coordinate the work assignments within the overall development plan. To do this, you first need to amend the work assignments created in the procedures section so that all the individual work elements are accounted for in the development plan. The next stage involves setting deliverable dates for components as well as the finished product for testing purposes. There are primarily three steps you need to go through before the product is ready for final delivery:

- Preliminary product review . All the product's features and specifications are checked.

- Critical product review . All the key elements of the product are checked and gauged against the development schedule to make sure everything is going according to plan.

- Final product review . All elements of the product are checked against goals to assure the integrity of the prototype.

Scheduling and Costs

This is one of the most important elements in the development plan. Scheduling includes all of the key work elements as well as the stages the product must pass through before customer delivery. It should also be tied to the development budget so that expenses can be tracked. But its main purpose is to establish time frames for completion of all work assignments and juxtapose them within the stages through which the product must pass. When producing the schedule, provide a column for each procedural task, how long it takes, start date and stop date. If you want to provide a number for each task, include a column in the schedule for the task number.

Development Budget

That leads us into a discussion of the development budget. When forming your development budget, you need to take into account all the expenses required to design the product and to take it from prototype to production.

Costs that should be included in the development budget include:

- Material . All raw materials used in the development of the product.

- Direct labor . All labor costs associated with the development of the product.

- Overhead . All overhead expenses required to operate the business during the development phase such as taxes, rent, phone, utilities, office supplies, etc.

- G&A costs . The salaries of executive and administrative personnel along with any other office support functions.

- Marketing & sales . The salaries of marketing personnel required to develop pre-promotional materials and plan the marketing campaign that should begin prior to delivery of the product.

- Professional services . Those costs associated with the consultation of outside experts such as accountants, lawyers, and business consultants.

- Miscellaneous Costs . Costs that are related to product development.

- Capital equipment . To determine the capital requirements for the development budget, you first have to establish what type of equipment you will need, whether you will acquire the equipment or use outside contractors, and finally, if you decide to acquire the equipment, whether you will lease or purchase it.

As we mentioned already, the company has to have the proper expertise in key areas to succeed; however, not every company will start a business with the expertise required in every key area. Therefore, the proper personnel have to be recruited, integrated into the development process, and managed so that everyone forms a team focused on the achievement of the development goals.

Before you begin recruiting, however, you should determine which areas within the development process will require the addition of personnel. This can be done by reviewing the goals of your development plan to establish key areas that need attention. After you have an idea of the positions that need to be filled, you should produce a job description and job specification.

Once you've hired the proper personnel, you need to integrate them into the development process by assigning tasks from the work assignments you've developed. Finally, the whole team needs to know what their role is within the company and how each interrelates with every position within the development team. In order to do this, you should develop an organizational chart for your development team.

Assessing Risks

Finally, the risks involved in developing the product should be assessed and a plan developed to address each one. The risks during the development stage will usually center on technical development of the product, marketing, personnel requirements, and financial problems. By identifying and addressing each of the perceived risks during the development period, you will allay some of your major fears concerning the project and those of investors as well.

Operations & Management

The operations and management plan is designed to describe just how the business functions on a continuing basis. The operations plan will highlight the logistics of the organization such as the various responsibilities of the management team, the tasks assigned to each division within the company, and capital and expense requirements related to the operations of the business. In fact, within the operations plan you'll develop the next set of financial tables that will supply the foundation for the "Financial Components" section.

The financial tables that you'll develop within the operations plan include:

- The operating expense table

- The capital requirements table

- The cost of goods table

There are two areas that need to be accounted for when planning the operations of your company. The first area is the organizational structure of the company, and the second is the expense and capital requirements associated with its operation.

Organizational Structure

The organizational structure of the company is an essential element within a business plan because it provides a basis from which to project operating expenses. This is critical to the formation of financial statements, which are heavily scrutinized by investors; therefore, the organizational structure has to be well-defined and based within a realistic framework given the parameters of the business.

Although every company will differ in its organizational structure, most can be divided into several broad areas that include:

- Marketing and sales (includes customer relations and service)

- Production (including quality assurance)

- Research and development

- Administration

These are very broad classifications and it's important to keep in mind that not every business can be divided in this manner. In fact, every business is different, and each one must be structured according to its own requirements and goals.

The four stages for organizing a business are:

Calculate Your Personnel Numbers

Once you've structured your business, however, you need to consider your overall goals and the number of personnel required to reach those goals. In order to determine the number of employees you'll need to meet the goals you've set for your business, you'll need to apply the following equation to each department listed in your organizational structure: C / S = P

In this equation, C represents the total number of customers, S represents the total number of customers that can be served by each employee, and P represents the personnel requirements. For instance, if the number of customers for first year sales is projected at 10,110 and one marketing employee is required for every 200 customers, you would need 51 employees within the marketing department: 10,110 / 200 = 51

Once you calculate the number of employees that you'll need for your organization, you'll need to determine the labor expense. The factors that need to be considered when calculating labor expense (LE) are the personnel requirements (P) for each department multiplied by the employee salary level (SL). Therefore, the equation would be: P * SL = LE

Using the marketing example from above, the labor expense for that department would be: 51 * $40,000 = $2,040,000

Calculate Overhead Expenses

Once the organization's operations have been planned, the expenses associated with the operation of the business can be developed. These are usually referred to as overhead expenses. Overhead expenses refer to all non-labor expenses required to operate the business. Expenses can be divided into fixed (those that must be paid, usually at the same rate, regardless of the volume of business) and variable or semivariable (those which change according to the amount of business).

Overhead expenses usually include the following:

- Maintenance and repair

- Equipment leases

- Advertising & promotion

- Packaging & shipping

- Payroll taxes and benefits

- Uncollectible receivables

- Professional services

- Loan payments

- Depreciation