Expert business plan and financial models

How to Present Your Business’ Location & Facility

- September 4, 2024

When drafting a business plan, detailing your business’s location and facility is not merely about stating an address or describing a building. Instead it’s about showcasing how your choice of location and the specifics of your facility are important to your business’s success.

This section of your business plan goes beyond mere logistics. Indeed it communicates to potential investors, partners, and lenders the thought process behind selecting a location that enhances market visibility, customer access, and operations efficiency.

In this guide, we’ll guide you through the importance of these elements and how to incorporate them in your business plan. Let’s dive in!

Why Do We Include it in a Business Plan?

In a business plan, the section on a business’s location and facility is crucial for providing readers with essential context about where and how the company operates.

This information typically resides in the business overview section. It should includes details on location and facilities helps stakeholders understand the strategic choices behind site selection. Especially it should be clear as how these decisions support the business’s operations, market presence (visibility), and growth potential.

It conveys to investors, lenders, and partners the thoughtfulness behind location selection (highlighting access to markets, resources, and talent – see more on that below) while the description of the facility underscores the business’s capacity for production, service delivery, and scalability.

Why Location is Important

The choice of location and facility is more than just a logistical decision; it is a strategic one that can significantly influence the overall success and growth trajectory of a business.

Indeed, a prime location enhances visibility, ensuring your business is easily accessible and noticeable to your target market . This visibility is crucial for attracting foot traffic in retail, but it’s equally important for businesses in the service sector to be within reach of their client base.

Furthermore, being situated in a vibrant, thriving area can boost brand recognition and help in crafting a strong, positive public perception.

Simplify operations

Operational efficiency is yet another factor directly impacted by the choice of location. The right location minimizes logistical hurdles and can significantly reduce costs and time associated with transportation and distribution.

For businesses that rely heavily on shipping or receiving goods, being near major highways, ports, or logistics hubs can streamline operations and improve supply chain efficiency.

Access to talent

Access to talent is another critical consideration that depends heavily on location. Operating in or near urban centers or regions known for specific industries can make it easier to attract and retain skilled employees.

For example, proximity to universities, technical schools, and other educational institutions can also be beneficial, providing a steady pipeline of qualified graduates eager to join the workforce. This access to a diverse talent pool can drive innovation, enhance service delivery, and ultimately contribute to the competitive edge of a business.

Why Facility is Important

It’s very important to give details on the business’ facility especially if it is a customer-facing or a manufacturing / supply-side operations business.

For customer-facing businesses (clinics, hotels, restaurants gyms, retail stores, real estate agencies, etc.), the facility’s design, ambiance, and accessibility play a significant role in attracting and retaining customers.

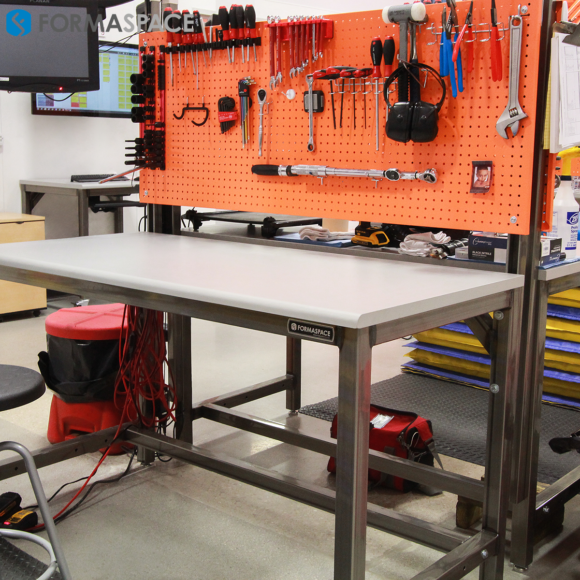

For manufacturing or supply-side operations (brewery, equipment rental, courier, storage, etc.), a facility with the right technical specifications and equipment ensures quality and efficiency in production and supply chain.

Important factors to include here:

- Size and Scalability: Guide readers on choosing a facility size that not only meets current needs but also allows for future growth.

- Layout Efficiency: Discuss how the layout affects operational efficiency, employee productivity, and customer satisfaction.

- Technology and Infrastructure: Highlight the necessity of technological infrastructure and other facilities for business operations.

- Safety and Compliance: Remind readers of the importance of safety standards and compliance with regulations in facility selection.

How to Present Location and Facility in Your Business Plan

Here are 5 simple steps to present location and facility in your business plan:

- Describe the Location: Provide detailed information about the business location, including the address, the geographical area, and why this location is strategic.

- Outline the Facilities: Describe the physical premises of the business. Include details about the size, layout, capacity, and any unique features of the facility.

- Justify the Choices: Explain why the chosen location and facility are optimal for the business objectives. Include data or research that supports these choices.

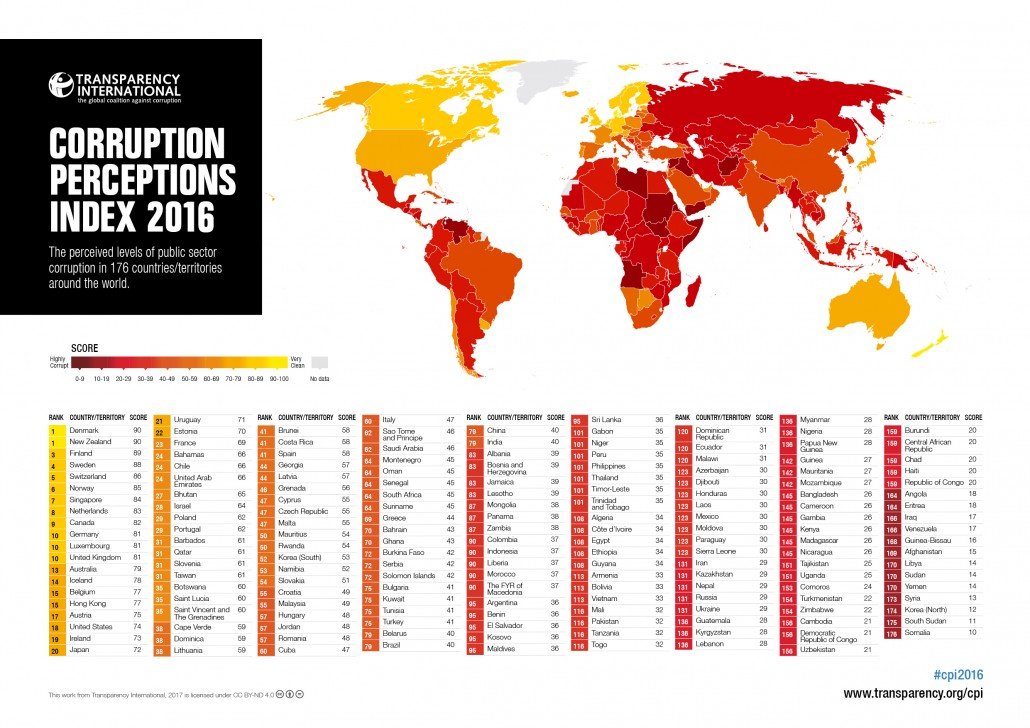

- Visual Elements: Encourage the use of photographs, maps, and floor plans to give readers a visual understanding of the location and facility.

- Future Plans: Discuss any future plans for expansion or relocation, if applicable, and how this fits into the business’s growth strategy.

Related Posts

How Much It Costs to Open a Chiropractic Clinic: Examples

- September 18, 2024

- Startup Costs

How Much It Costs to Start a Medical Practice: Examples & Budget

- September 14, 2024

How Much It Costs to Start a Pilates Studio: Examples & Budget

Privacy overview.

| Cookie | Duration | Description |

|---|---|---|

| BIGipServerwww_ou_edu_cms_servers | session | This cookie is associated with a computer network load balancer by the website host to ensure requests are routed to the correct endpoint and required sessions are managed. |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| language | session | This cookie is used to store the language preference of the user. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _ga_QP2X5FY328 | 2 years | This cookie is installed by Google Analytics. |

| _gat_UA-189374473-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| browser_id | 5 years | This cookie is used for identifying the visitor browser on re-visit to the website. |

| WMF-Last-Access | 1 month 18 hours 11 minutes | This cookie is used to calculate unique devices accessing the website. |

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How to Write the Operations Plan Section of a Business Plan

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

How to Write the Operations Plan Section of the Business Plan

Stage of development section, production process section, the bottom line, frequently asked questions (faqs).

The operations plan is the section of your business plan that gives an overview of your workflow, supply chains, and similar aspects of your business. Any key details of how your business physically produces goods or services will be included in this section.

You need an operations plan to help others understand how you'll deliver on your promise to turn a profit. Keep reading to learn what to include in your operations plan.

Key Takeaways

- The operations plan section should include general operational details that help investors understand the physical details of your vision.

- Details in the operations plan include information about any physical plants, equipment, assets, and more.

- The operations plan can also serve as a checklist for startups; it includes a list of everything that must be done to start turning a profit.

In your business plan , the operations plan section describes the physical necessities of your business's operation, such as your physical location, facilities, and equipment. Depending on what kind of business you'll be operating, it may also include information about inventory requirements, suppliers, and a description of the manufacturing process.

Staying focused on the bottom line will help you organize this part of the business plan.

Think of the operating plan as an outline of the capital and expense requirements your business will need to operate from day to day.

You need to do two things for the reader of your business plan in the operations section: show what you've done so far to get your business off the ground and demonstrate that you understand the manufacturing or delivery process of producing your product or service.

When you're writing this section of the operations plan, start by explaining what you've done to date to get the business operational, then follow up with an explanation of what still needs to be done. The following should be included:

Production Workflow

A high-level, step-by-step description of how your product or service will be made, identifying the problems that may occur in the production process. Follow this with a subsection titled "Risks," which outlines the potential problems that may interfere with the production process and what you're going to do to negate these risks. If any part of the production process can expose employees to hazards, describe how employees will be trained in dealing with safety issues. If hazardous materials will be used, describe how these will be safely stored, handled, and discarded.

Industry Association Memberships

Show your awareness of your industry's local, regional, or national standards and regulations by telling which industry organizations you are already a member of and which ones you plan to join. This is also an opportunity to outline what steps you've taken to comply with the laws and regulations that apply to your industry.

Supply Chains

An explanation of who your suppliers are and their prices, terms, and conditions. Describe what alternative arrangements you have made or will make if these suppliers let you down.

Quality Control

An explanation of the quality control measures that you've set up or are going to establish. For example, if you intend to pursue some form of quality control certification such as ISO 9000, describe how you will accomplish this.

While you can think of the stage of the development part of the operations plan as an overview, the production process section lays out the details of your business's day-to-day operations. Remember, your goal for writing this business plan section is to demonstrate your understanding of your product or service's manufacturing or delivery process.

When writing this section, you can use the headings below as subheadings and then provide the details in paragraph format. Leave out any topic that does not apply to your particular business.

Do an outline of your business's day-to-day operations, including your hours of operation and the days the business will be open. If the business is seasonal, be sure to say so.

The Physical Plant

Describe the type, size, and location of premises for your business. If applicable, include drawings of the building, copies of lease agreements, and recent real estate appraisals. You need to show how much the land or buildings required for your business operations are worth and tell why they're important to your proposed business.

The same goes for equipment. Besides describing the equipment necessary and how much of it you need, you also need to include its worth and cost and explain any financing arrangements.

Make a list of your assets , such as land, buildings, inventory, furniture, equipment, and vehicles. Include legal descriptions and the worth of each asset.

Special Requirements

If your business has any special requirements, such as water or power needs, ventilation, drainage, etc., provide the details in your operating plan, as well as what you've done to secure the necessary permissions.

State where you're going to get the materials you need to produce your product or service and explain what terms you've negotiated with suppliers.

Explain how long it takes to produce a unit and when you'll be able to start producing your product or service. Include factors that may affect the time frame of production and describe how you'll deal with potential challenges such as rush orders.

Explain how you'll keep track of inventory .

Feasibility

Describe any product testing, price testing, or prototype testing that you've done on your product or service.

Give details of product cost estimates.

Once you've worked through this business plan section, you'll not only have a detailed operations plan to show your readers, but you'll also have a convenient list of what needs to be done next to make your business a reality. Writing this document gives you a chance to crystallize your business ideas into a clear checklist that you can reference. As you check items off the list, use it to explain your vision to investors, partners, and others within your organization.

What is an operations plan?

An operations plan is one section of a company's business plan. This section conveys the physical requirements for your business's operations, including supply chains, workflow , and quality control processes.

What is the main difference between the operations plan and the financial plan?

The operations plan and financial plan tackle similar issues, in that they seek to explain how the business will turn a profit. The operations plan approaches this issue from a physical perspective, such as property, routes, and locations. The financial plan explains how revenue and expenses will ultimately lead to the business's success.

Module 12: Managing Processes

Facility location and layout, learning outcomes.

- Explain facility location

- Explain facility layout

Facility Location

Of all the pieces of the planning puzzle, facility location is the most strategic and critical. Once you build a new manufacturing facility, you have made a substantial investment of time, resources, and capital that can’t be changed for a long time. Selecting the wrong location can be disastrous. Some of the key factors that influence facility location are the following:

- Proximity to customers, suppliers, and skilled labor

- Environmental regulations

- Financial incentives offered by state and local development authorities

- Quality-of-life considerations

- Potential for future expansion

The next step, after planning the production process, is deciding on plant layout—how equipment, machinery, and people will be arranged to make the production process as efficient as possible.

Practice Question

Facility layout.

After the site location decision has been made, the next focus in production planning is the facility’s layout. The goal is to determine the most efficient and effective design for the particular production process. A manufacturer might opt for a U-shaped production line, for example, rather than a long, straight one, to allow products and workers to move more quickly from one area to another.

Service organizations must also consider layout, but they are more concerned with how it affects customer behavior. It may be more convenient for a hospital to place its freight elevators in the center of the building, for example, but doing so may block the flow of patients, visitors, and medical personnel between floors and departments.

There are four main types of facility layouts: process, product, fixed-position, and cellular.

The process layout arranges workflow around the production process. All workers performing similar tasks are grouped together. Products pass from one workstation to another (but not necessarily to every workstation). For example, all grinding would be done in one area, all assembling in another, and all inspection in yet another. The process layout is best for firms that produce small numbers of a wide variety of products, typically using general-purpose machines that can be changed rapidly to new operations for different product designs. For example, a manufacturer of custom machinery would use a process layout.

Figure 1. An Example of a Process Facility Layout. Source: Adapted from Operations Management, 9th edition, by Gaither/Frazier.

Products that require a continuous or repetitive production process use the product (or assembly-line ) layout . When large quantities of a product must be processed on an ongoing basis, the workstations or departments are arranged in a line with products moving along the line. Automobile and appliance manufacturers, as well as food-processing plants, usually use a product layout. Service companies may also use a product layout for routine processing operations.

Figure 2. An Example of a Product Facility Layout. Source: Adapted from Operations Management, 9th edition, by Gaither/Frazier.

In the following video, Jansen, a Swiss steel maker, describes how the company’s offices were designed to maximize the productivity and creativity of its engineers:

You can view the transcript for “Office Space – Jansen” (opens in new window) or text alternative for “Office Space – Jansen” (opens in new window ).

Some products cannot be put on an assembly line or moved about in a plant. A fixed-position layout lets the product stay in one place while workers and machinery move to it as needed. Products that are impossible to move—ships, airplanes, and construction projects—are typically produced using a fixed-position layout. Limited space at the project site often means that parts of the product must be assembled at other sites, transported to the fixed site, and then assembled. The fixed-position layout is also common for on-site services such as housecleaning services, pest control, and landscaping.

Figure 3. An Example of a Fixed-Position Facility Layout. Source: Adapted from Operations Management, 9th edition, by Gaither/Frazier.

To see an excellent example of fixed-position layout, watch the following video that shows how Boeing builds an airplane. (Note that this video has no narration; only instrumental music. Access audio description by using the widget below the video.)

Access the text alternative for “Making of a Boeing Airplane” (opens in new window).

Cellular layouts combine some aspects of both product and fixed-position layouts. Work cells are small, self-contained production units that include several machines and workers arranged in a compact, sequential order. Each work cell performs all or most of the tasks necessary to complete a manufacturing order. There are usually five to 10 workers in a cell, and they are trained to be able to do any of the steps in the production process. The goal is to create a team environment wherein team members are involved in production from beginning to end.

- Facility Location. Authored by : Linda Williams and Lumen Learning. License : CC BY: Attribution

- Facility Location and Layout. Authored by : Linda Williams and Lumen Learning. License : CC BY: Attribution

- Practice Questions. Authored by : Robert Danielson. Provided by : Lumen Learning. License : CC BY: Attribution

- rover 200 framing line. Authored by : spencer cooper. Located at : https://www.flickr.com/photos/spenceyc/7481166880/ . License : CC BY-ND: Attribution-NoDerivatives

- Office Space: Jansen. Provided by : BBC. Located at : https://youtu.be/aT-eZXDLQl0 . License : CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives

- Facility Layout. Provided by : OpenStax CNX. Located at : http://cnx.org/contents/[email protected] . License : CC BY: Attribution . License Terms : Download for free at http://cnx.org/contents/[email protected]

- Modification of Image: Process Facility Layout. Authored by : OpenStax CNX; Modification by Lumen Learning. Located at : http://cnx.org/contents/[email protected] . License : CC BY: Attribution

- Making of a Boeing air plane. Authored by : Dial647. Located at : https://youtu.be/-ovNi1cB7a4 . License : All Rights Reserved . License Terms : Standard YouTube License

Business Location Analysis: The Key to Strategic Decision Making

.png)

- Remove the current class from the content27_link item as Webflows native current state will automatically be applied.

- To add interactions which automatically expand and collapse sections in the table of contents, select the content27_h-trigger element, add an element trigger, and select Mouse click (tap).

- For the 1st click, select the custom animation Content 27 table of contents [Expand], and for the 2nd click, select the custom animation Content 27 table of contents [Collapse].

- In the Trigger Settings, deselect all checkboxes other than Desktop and above. This disables the interaction on tablet and below to prevent bugs when scrolling.

Table Of Content

Location, location, location! It's a mantra we've all heard before, but how many of us truly understand its significance in the business world? This isn't just about picking any spot on the map. It's about making strategic choices that propel your business towards remarkable growth and success. Let's delve into the crucial factors to consider during business location analysis.

What is business location analysis?

Business location analysis is the process of studying and evaluating potential physical locations for business operations. It's the cornerstone of strategic planning, with a powerful influence on a company's performance, profitability, and overall success. The significance of choosing the right location cannot be overstated—it provides easy access to customers, employees, and suppliers, and can greatly enhance your brand's visibility.

Choosing the right business location is a crucial step in your company's journey. It's more than just a place—it's the setting for your story and the stage for your success.

Why do businesses use location analysis?

Location analysis pops up as a champion in the realm of business operations, offering a strategic edge to businesses across the globe. It's more than just pinning a spot on the map – it's about designing a roadmap to successful business outcomes. It's the silent hero behind boosting your business' competitive edge, accessibility, and brand visibility.

1. Competitive Edge: Become the Market Leader

Location analysis aids in identifying the best locales to set foot in, where competition is minimal and opportunities are abundant. This is where the magic of strategic positioning comes into play.

By understanding the competition landscape, businesses can strategically place themselves in a position that sets them apart, helping them get ahead in the race.

2. Customer Accessibility: Be Where Your Customers Are

Location analysis also plays a vital role in making businesses more accessible to customers. It’s not about being in the most popular spot, but being in the right spot where customers can easily find and reach you.

- Convenience: A location that's easy for customers to reach can significantly boost your business.

- Visibility: Being in a spot where you’re easily seen can naturally attract more customers.

3. Brand Visibility: Shine Above the Rest

Brand visibility is about more than just being seen – it’s about being remembered. Location analysis helps position your business in an area that not only garners high foot traffic, but also aligns with your brand identity.

Whether it's a bustling city center or a serene suburb, the right location can amplify your brand’s presence, ensuring you're not just seen, but also remembered.

4. Optimizing Operational Efficiency

Location analysis optimizes business efficiency. A strategic location enhances logistics, influencing factors such as supply chain efficiency , distribution convenience, delivery speed, and employee commute. The right location streamlines operations, saving time and resources.

Beyond operations, an ideal location grants access to crucial business services like banking, legal, and marketing consultancy. It facilitates not just survival, but also growth.

Because when we think location, we think efficiency. And in business, efficiency isn't just a buzzword - it's a lifeline. So, are you ready to optimize?

Components of Effective Business Location Analysis:

Data Collection:

Any savvy entrepreneur knows that location is key. But how do you determine the right location for your business? It starts with data collection. You'll need to gather and analyze a variety of data types to make an informed decision. Let's break it down:

- Demographic Data: This is the first type of information you need. Who are your customers? What are their ages, income levels, and occupations? You'll want a location surrounded by your target demographic.

- Traffic Data: How many people walk or drive by the potential location each day? More foot traffic could lead to more customers. But remember, that traffic needs to align with your target demographic.

- Competition Data: What other businesses are in the area? Other businesses could be complementary, boosting your sales. Or they could be competitors, potentially taking away customers.

Remember, data should guide your decision, but it shouldn't make it. Use the data to inform your choices and align them with your business goals.

It's a tricky balance, but armed with the right data, you can make a choice that sets your business up for success.

2. Spatial Analysis & Visualization:

Gas Station Density in Saudi Arabia's Key Regions

When it comes to running a successful business, location is key. That's where Spatial Analysis and Visualization come into play, taking us on a deep dive into the world of Geographic Information Systems (GIS).

GIS serves as a powerful tool in the analysis and interpretation of geographic relationships, patterns, and trends. It integrates hardware, software, and data to capture, store, analyze, and interpret all forms of geographically referenced information. Essentially, it allows us to view and understand data in ways that reveal relationships, patterns, and trends in the form of maps, globes, reports, and charts.

"A Geographic Information System (GIS) helps businesses to visualize, question, analyze, and interpret data to understand relationships, patterns, and trends."

- Mapping: GIS converts complex data into a visual format, simplifying the process of decision making. It can display demographic data, consumer behavior, and competitor locations in an easy-to-understand map.

- Analysis: GIS analyzes the data to identify patterns and trends. It provides insights into the best locations for business expansion or the areas that are most profitable.

Incorporating GIS into your business location analysis allows you to make informed decisions based on concrete data. It's like turning on a light in a dark room, illuminating opportunities and potential challenges that were previously hidden.

Benefits of Using GISExamplesEnhanced Decision MakingChoosing the best location for a new store or officeImproved CommunicationVisualizing potential business growth areas for stakeholdersIncreased EfficiencyRouting deliveries to reduce fuel consumption and save time

As we dive deeper into the realm of location analysis, it's crucial to recognize the role of Geographic Information System (GIS). In today's tech-savvy world, GIS tools are transforming the way businesses analyze their location choices. These powerful tools offer a range of benefits, all contributing to a more informed and smart decision making.

3. Predictive Analytics:

Imagine having a crystal ball that foretells how your business would fare in different locations before you even set foot there. That's precisely what predictive analytics offers! This remarkable blend of technology and statistical methods can help you anticipate potential performance in various locations based on historical data, customer behavior, market trends, and more.

How does it work?

- Predictive models gather data: First, these tools collect a wealth of valuable data from various sources, such as customer databases, demographic information, and market research.

- They analyze the data: Next, they use advanced algorithms to analyze this data, identifying patterns and trends that could impact business performance.

- They forecast future outcomes: Based on these patterns, the models can then make predictions about how a business might perform in different locations.

Businesses can use these forecasts to guide their location-based decisions, helping them choose spots with the highest potential for success. But remember, while predictive analytics can be an incredibly valuable tool, it's not infallible. It's always important to consider other factors, such as your business goals, target audience , and competition, to make the most informed decision possible.

Ultimately, predictive analytics is like a compass guiding your business through the complex landscape of location-based decision-making. It helps you avoid the pitfalls of choosing a location based on gut feelings alone and increases your chances of setting up shop in the most favorable locations.

Real-world Applications and Success Stories:

Let's look at some real-world applications and success stories that exemplify the power of strategic business location analysis.

Case Study 1: Starbucks

Starbucks, a global coffee juggernaut, is renowned for its strategic location choices. The company uses a sophisticated location analysis system, incorporating data like traffic flow, area demographics, and nearby businesses. This strategy has been key in their worldwide growth and success. source

Case Study 2: Walmart

Walmart, a multinational retail corporation, stands as a testament to the effectiveness of location analysis. The company focuses on establishing its stores in small towns, where competition is minimal. This strategy, combined with its vast product range and competitive pricing, has led to Walmart's dominance in the retail market. source

Case Study 3: McDonald's

McDonald's, a global fast-food chain, attributes much of its success to location analysis. The company strategically places its restaurants near highway exits, busy city centers, and suburbs. This approach, paired with their quick service and popular menu, has solidified McDonald's status as a fast-food leader. source

In conclusion, these case studies highlight the immense power of location analysis in business strategy. It demonstrates how, with careful consideration and smart decision-making, businesses can leverage location to maximize brand visibility, profitability, and growth.

Challenges in Business Location Analysis:

Choosing a business location is akin to playing a high-stakes game of chess. One wrong move can spell disaster for your venture. Yet, while choosing the right location can be daunting, understanding common pitfalls can ease the process.

- Common Pitfalls and Misconceptions: Many entrepreneurs fall prey to the misconception that a cheap location means higher profits. It's crucial to understand that a location's value is not solely determined by its cost, but also by its accessibility, demographic alignment, and potential for growth. Weigh these factors before making a decision.

- Overcoming Data Inaccuracies: Quality data is the bedrock of informed decision-making. Ensure the data you base your choice on is accurate, up-to-date, and relevant. Misinterpreted or outdated data can lead to costly mistakes.

- The Evolving Nature of Neighborhoods and Local Markets: Neighborhoods and markets are fluid, continually changing and evolving. A location that seems perfect today might not be the same in a few years. Always consider long-term projections and future growth trends in your analysis.

Remember: You're not just choosing a location, you're choosing a future. Make sure it's one where your business can thrive.

How xMap Can Empower Your Location Analysis?

Unlock the potential of your business with xMap , a cutting-edge platform that transforms location analysis. With a plethora of features at your disposal, xMap empowers you to make strategic, data-backed decisions about your business location. Here's how:

- Data Visualization:

xMap's intuitive interface presents data in a visually appealing and easy-to-understand format. This enables businesses to analyze complex data sets effectively and make informed location decisions.

- Comprehensive Database:

database of all the restaurants in dubai with their key information

With xMap, gain access to a vast database of demographic, geographic, and economic data that can be crucial in selecting the perfect location for your business.

- Advanced Analytics:

Use the power of xMap's advanced analytics to uncover hidden patterns, trends, and insights that can significantly impact your location strategy.

With xMap, the power to choose the right location for your business is literally at your fingertips. The platform's unique combination of data richness and user-friendly design makes it an invaluable tool for businesses of all sizes.

Now, let's talk benefits. The advantages of incorporating xMap into your business strategy are manifold:

- Increased Profitability: By providing you with actionable insights based on data, xMap aids in selecting locations that promise maximum profitability.

- Improved Decision Making: xMap's data visualization and advanced analytics facilitate better, quicker decision-making, saving valuable time and resources.

- Competitive Edge: With access to comprehensive data and analytics, you can stay ahead of the competition and identify untapped market opportunities.

Ready to take your business to new heights? Don't wait any longer to harness the power of location analytics with xMap. Whether you're a small startup or a well-established corporation, xMap has got you covered. Explore xMap today or get in touch for a personalized demo.

Subscribe for advanced Data analysis Tips and Reports

Get in Touch

Whatever your goal or project size, we will handle it. We will ensure you 100% satisfication.

"We focus on delivering quality data tailored to businesses needs from all around the world. Whether you are a restaurant, a hotel, or even a gym, you can empower your operations' decisions with geo-data.”

What is Plant Location? Factors, Analysis, Significance, Selection Criteria

- Post last modified: 3 September 2023

- Reading time: 16 mins read

- Post category: Production Management

What is Plant Location?

Plant location refers to the process of selecting a suitable site or place for establishing a manufacturing facility or industrial plant. It is a critical decision for businesses, as the location of a plant can significantly impact the company’s overall success and competitiveness. Plant location considerations are important across various industries, including manufacturing, agriculture, energy generation, and more.

Table of Content

- 1 What is Plant Location?

- 2.1 Availability of Raw Materials

- 2.2 Proximity to Market

- 2.3 Transportation

- 2.4 Availability of Labour

- 2.5 Availability of Power, Fuel or Gas

- 2.6 Supply of Water

- 2.7 Climatic Conditions

- 3 Location Analysis

- 4 Significance of Plant Location

- 5.1 Materials

- 5.2 Machinery

- 5.4 Safety and Security

- 5.5 Future Operations

Entrepreneurs face a major problem with plant location in deciding the best location for their factory or plant. The utmost care must be exercised in selecting the plant location and many different factors must be taken into account. Primarily, the plant must be located where the minimum cost of production and distribution can be obtained but, other factors such as room for expansion and safe living conditions for plant operation as well as the surrounding community are also important. The location of the plant can also have a crucial effect on the profitability of a project.

For example, Consumer industries like televisions, washing machines and other luxury goods are set up near the marketing centers, while producer industries like steel mills are located near the vicinity of raw materials. Plant location is the choice of region and the site selection to set up a business or a factory.

The choice is primarily made after considering all the benefits and costs of various alternative areas. Moreover, it is a strategic plan which cannot be changed after deciding. The location chosen should be selected according to the specific circumstances and requirements. Each entrepreneur has an individual plant and makes an optimum attempt.

Factors Influencing Plant Location

There are several factors that influence plant location. Moreover, moving forward by resolving all other problems and considering these factors leads to success in business. The major factors affecting the plant location are listed as follows:

Availability of Raw Materials

Proximity to market, transportation, availability of labour, availability of power, fuel or gas, supply of water, climatic conditions.

The source of raw materials is one of the most important factors influencing the selection of a plant location. Attention should be given to the purchased price of raw materials, distance from the source of supply, freight and transportation expenses, availability and reliability of supply, purity of raw materials and storage requirements.

The location of markets or intermediate distribution centers affect the cost of product distribution and time required for shipping. Proximity to major markets is important consideration in the selection of the plant location because the buyer usually finds advantageous to purchase from near-by sources.

The transportation of materials and products to and from plant will be an overriding consideration in the selection of plant location. If practicable, a site that it is close to at least two major forms of transport: road, rail, waterway or a seaport, should be selected. Road transport is being increasingly used, and is suitable for local distribution from a central warehouse.

Rail transport will be cheaper for long-distance transport. If possible, the plant location should have access to all three types of transportation. There is usually a need for convenient rail and air transportation facilities between the plant and the main company headquarters, and the effective transportation facilities for the plant personnel are necessary.

Labour will be needed for the construction of plant and its operation. Skilled construction workers will usually be brought in from outside the site, but there should be an adequate pool of unskilled labours available locally; and labour suitable for training to operate the plant. Skilled tradesmen will be needed for plant maintenance. Local trade union customs and restrictive practices will have to be considered when assessing the availability and suitability of labour for recruitment and training.

It is important for an organisation to ensure the continuous supply of power, fuel and gas before selecting a plant location. For example, the location of thermal power plants and steel plants near coal fields is crucial for reducing cost of the fuel transportation.

Water is important for survival. It is required for processing in industries like chemical, sugar and paper industries. Also, water is used for drinking and sanitary purposes. It is important for an organisation to investigate a quality and probable source of supply. In addition, the chemical properties like hardness, alkalinity and acidity level of water should be checked. Apart from that, a thorough study should be conducted related to the disposal of water like effluents, solids, chemicals and other waste products.

The climate of a region where the plant is to be located has great impact on both capital and operational costs. Various aspects related to climatic conditions to be considered by an organisation include the level of snow fall or rain fall in the region, humidity, velocity of wind, frequency of natural calamities and so on.

In most plant locations, the target is to reduce cost. Some items of cost, like freight, could also be higher for one city and lower for the other city, but power costs, for instance, may have the reverse pattern. A little labour supply may cause labour rates to be bid up beyond rates measured during a location survey.

The sort of labour available may indicate future training expenditures. Thus, although a comparative analysis of varied locations may point toward one community, an appraisal of intangible factors could also be the idea of the choice to pick another. The example of a managerial decision with multiple criteria, where trade-offs must be made between the varied values and criteria.

Location Analysis

Every organisation attempts to find an ideal or optimum location. An optimum location is a place where the product cost is less with a huge market share and less risk. To find such location, an organisation needs to perform vast analysis. Business location analysis is a reliable process where an organisation weighs down the pros and cons of each alternative site.

Location analysis is based on the following aspects:

- Demographic analysis

- Competitive analysis

- Site economics

- Trade area analysis

- Traffic analysis

The following are the objectives of location analysis:

- To make sure the smooth running of the business

- To hold minimum investment and operational cost

- To co-ordinate with government policies

- To promote employee welfare

Significance of Plant Location

Strategic significance of plant location is connected with capacity decisions. Plant location involves commitment towards resources to a long-range plan. The criterion for the selection of location should be profit maximisation and cost minimisation. If the costs of products are uniform altogether, then the criterion becomes one among minimising relevant costs. Plant location is generally a stable decision that cannot be changed frequently and requires a lot of cost and efforts.

Any wrong decision can bring huge losses for the organisation. Therefore, it is important for an organisation to consider all the factors that impact the plant location before making the selection. If all processes and costs are independent of location, choices are going to be guided by proximity to potential customers or clients or similar and competing organisations and centres of economic activity generally.

Plant Location Selection Criteria

Most new investments in land, machines, buildings and expertise are made for the long run. This is furthermore important in terms of manufacturing plants. Being the global business environment, the company requires a location that every single day it holds a major role in the new production plant. Organisations can have several reasons to start the location selection process for their new manufacturing plant, cost reduction, the capacity expansion for business growth, new market entries, the pools of labour coping with geopolitical developments.

The factors that play a crucial role in plant location selection are as follows:

Safety and Security

Future operations.

- The layout of the productive equipment will depend on the characteristics of the product to be managed at the facility, as well as different parts and materials to work on.

- Main factors to be considered: size, shape, volume, weight and the physical-chemical characteristics, since they influence the manufacturing methods and storage and material handling processes.

- The sequence and order of operations will affect plant layout as well, taking into account the variety and quantity to produce.

- Having information about the processes, machinery, tools and necessary equipment, as well as their use and requirements is essential to design a correct layout.

- The methods and time studies to improve the processes are closely linked to the plant layout.

- Regarding machinery, we have to consider the type, total availability for each type, as well as quantity of tools and equipment.

- Labour has to be organised in the production process (direct labour, supervision etc.)

- Environment considerations: employees’ safety, light conditions, ventilation, temperature, noise, etc.

- Process considerations: personnel qualifications, flexibility, number of workers required at a given time as well as the type of work to be performed by them.

- Safety always be a consideration in the design or layout of the facility.

- A company can design the most efficient production layout but if it places employees at risk or places the product at risk from the layout, it cannot be implemented.

- Providing a quality product with the least amount of movement and material handling is important, but the most important asset that any company has is its employees. If the safety of those employees is jeopardised, the layout should not imperil employee’s safety.

- Every plan should include a consideration for the future of operations. Whether it is a manufacturing facility that needs to consider future products or variations of the same product or a distribution centre that needs to consider future storage requirements and product configurations, as well as the ability to expand capacity in the future.

- It is important to forecast future changes to avoid having an inefficient plant layout in a short term.

- Flexibility can be reached keeping the original layout as free as possible regarding fixed characteristics, allowing the adjustment to emergencies and variations of the normal process activities.

- Possible future extensions of the facility must be taken into account, as well as the feasibility of production during re-layout.

You Might Also Like

Quality certifications and award, what is quality measurement, cost of quality, learning from quality gurus, what is material handling objectives, principles, control, what is dmaic process, what is quality improvement basics, models and tools, what is inventory categories, importance, cost of holding inventory, what is purchasing management meaning, importance, aspects, objectives,, process of purchasing management, garvin eight dimensions quality framework, what is quality circle objectives, advantages, factors,, types of production system, what is economic order quantity advantage, limitations, leave a reply cancel reply.

You must be logged in to post a comment.

World's Best Online Courses at One Place

We’ve spent the time in finding, so you can spend your time in learning

Digital Marketing

Personal Growth

Development

- Start Business

- Grow Business

How to Select a Factory Location for Manufacturing Business in 14 Steps

- by Next What Business Research Team

- December 5, 2023

Choosing and selecting a factory location rightfully is a difficult task for entrepreneurs, especially for beginners. The right plant location is a ‘make or break’ decision from an owner’s point of view.

The location of the business is the most important factor influencing its success or failure. It is a long-term decision that should take into consideration not only the present requirements of the organization but also its future expansion plans. Choosing an inappropriate factory location may be very difficult and expensive to rectify.

Also, the location of a plant has a bearing on the layout of machinery and equipment as well as on the process of production. There is no ideal location for all or even one firm at all times. The choice of location depends on several important factors. It is influenced by the products being manufactured and the production and distribution costs.

A sound business plan should be the foundation of your site-selection process, detailing the goods the plant will produce, the number of goods the plant will produce, five years of production planning, and future growth expectations.

The objective of a locational plan is to find out the optimum or best location for the particular plant. Such a location not only results in the lowest cost per unit but also facilitates the orderly growth of the firm. In this article, we intend to explore 14 things to consider in selecting a factory location.

Related: Things To Consider Before Starting a Manufacturing Busines s

Table of Contents

14 Steps to Follow Before Selecting a Factory Location

#1. availability of raw materials.

Raw materials are the basic components of finished products. This is one of the most important considerations when selecting a factory location.

If your required raw materials are perishable items, then you must tend to locate the plant nearer to the raw material source. Moreover, it also reduces transportation costs which affects hugely the cost of production.

#2. Proximity to Market

Every finished product needs to go to the market for consumer consumption. Here also transportation overhead increases the cost of the finished product.

In case you are initiating a fully export-oriented plant, the availability of processing facilities gains importance in deciding the location of one’s industry. Export Promotion Zones (EPZ) are such examples.

#3. Infrastructural Facilities

This is important because all supporting services are required for the successful operation of the plant. The availability of communication facilities is also an important part of the infrastructure.

Existing vibrant infrastructure in the vicinity is much preferred to the need-based infrastructure getting developed after the plant commissioning.

Related: Things To Consider In Purchasing Machine & Equipment

#4. Government Policy

The Government offers several incentives, concessions, tax holidays for a few years, cheaper power supply, factory sheds, etc., to attract entrepreneurs to set up industries in less developed and backward areas. In this scenario, you must prioritize this factor in selecting a factory location.

#5. Get N.O.C

Neighbours play sometimes a vital role in getting license permissions from different Govt. authorities. If you are establishing the plant near a domestic area, then authorities may ask you to get a ‘No Objection’ from your neighbours.

#6. Availability of Manpower

Local availability of skilled and semi-skilled manpower will add to the efficient running of the plant. Besides, you must study labour relations through turnover rates, absenteeism, and the liveliness of trade unionism in a particular area.

#7. Availability Of Utilities

Utilities like electricity, water resources, etc. play an important role in almost every factory’s operation. Stable and uninterrupted power is a required magnitude, without fluctuations in voltage and frequency is important for the successful operation of the plant.

#8. Local Laws, Regulations, and Taxation

You must check the laws related to the pollution control board. In food products, you must check the FPO regulations. In the case of the wood industry, you must maintain the distance from forestry. Taxation is also an important factor as well as a State Subject.

In some highly competitive consumer products, its high quantum may turn out to be the negative factor while its relief may become the final deciding factor for some other industries.

Related: How to Register a Company/ Startup

#9. Ecology & Pollution

Nowadays, there is a great deal of awareness towards the maintenance of natural ecological balance. Regarding the effect of pollution from the specific type of plants, social obligations are to be met.

The nature of the site selected should preferably have some advantages to meet these requirements. You must be careful about effluent disposal, in the cases, it is needed.

#10. Distance from Your Residence

Yes, it’s important. In a small-scale factory operation, an entrepreneur plays a vital role. You should not select a place that has adequate distance from your residence.

#11. Competition

If you are dealing with an innovative product and your plant is in an industrial zone, then you might face competition in manufacturing automation from other companies.

#12. Incentives, Land costs. Subsidies for Backward Areas

In some cases, the Government offers several incentives, concessions, tax holidays, cheaper lands, assured and cheaper power supply, price concessions for departmental (state) purchases, etc. to make the backward areas also conducive for setting up industries. You must take into consideration these issues in selecting a factory location.

Read: Best Small Manufacturing Business Ideas

#13. Climatic Conditions

Climatic conditions affect both people and manufacturing activity. Additionally, certain industries require a specific type of climatic conditions to produce their goods. For example, jute and textile manufacturing industries require high humidity.

#14. Political conditions

The stability of the political environment is essential for industrial growth. It builds confidence and political instability causes a lack of confidence among the prospective and present entrepreneurs to venture into the industry which is filled with risks.

Hence, the most advantageous location is that at which the cost of gathering material and fabricating it plus the cost of distributing the finished product to the customers will be at a minimum. The choice of an optimum location requires a judicious balancing of all these factors.

This list of 14 things to consider in selecting a factory location helps you to get almost the right plant location for your manufacturing operation.

Discover more from NextWhatBusiness

Subscribe to get the latest posts sent to your email.

Type your email…

Search from the site

Industry | December 28, 2021

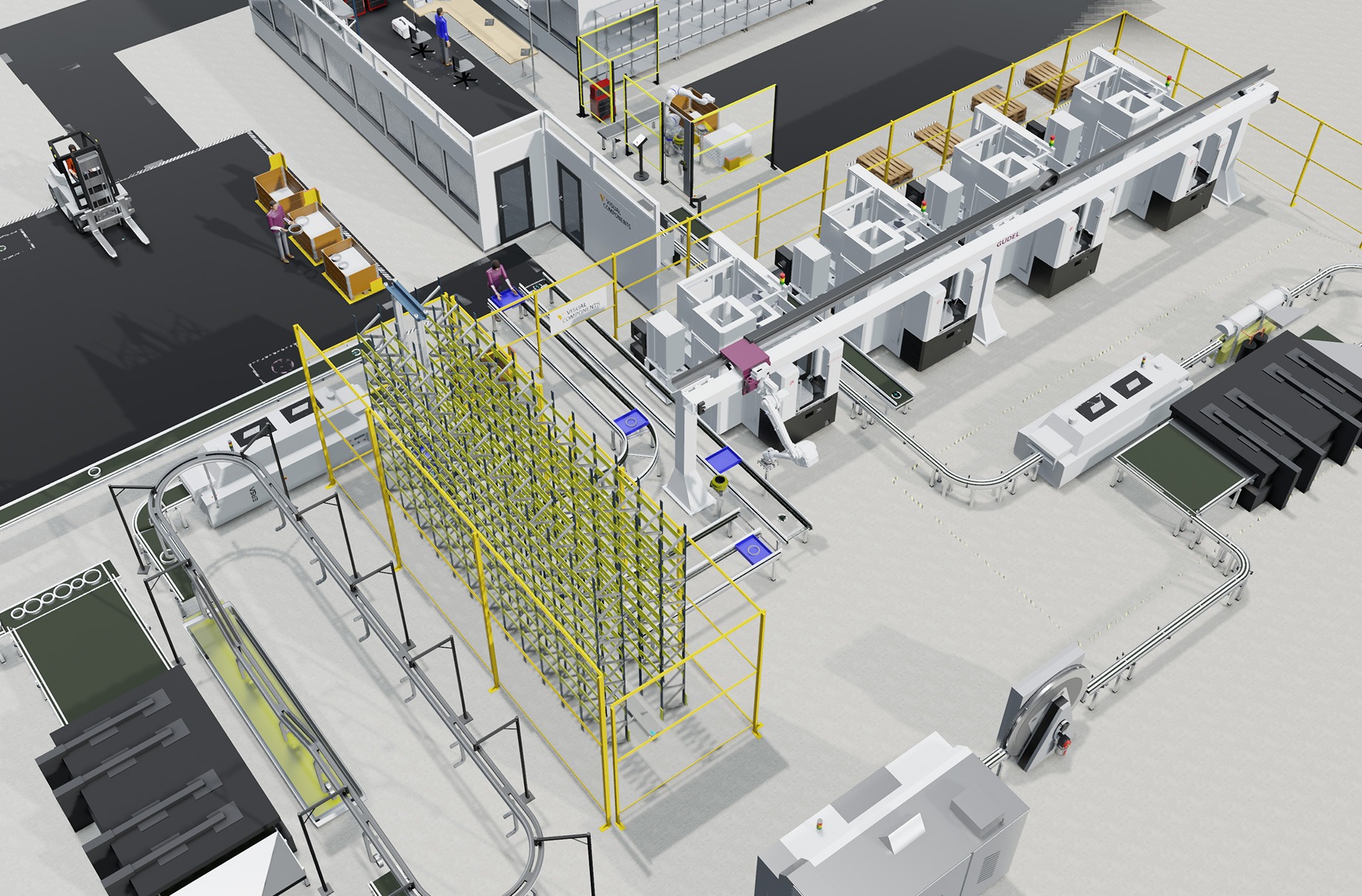

How to plan & design a manufacturing plant layout? (video examples included)

Our experts at Visual Components discuss how to plan and design a manufacturing plant layout with a simulation case. We review the benefits, process, and necessity for a high-quality plant layout in your business organization.

When it comes to running a manufacturing facility, there are a lot of things to consider. As an owner or manager, you’re probably looking for ways to speed up your process, improve your yield, and increase your profit. Did you know that a simple plant layout can achieve all three of these goals?

Layouts are often overlooked, despite their huge money-saving potential.

In this piece, we’ll discuss what is meant by a plant layout, some benefits of a layout, an example, and our step-by-step process for laying out a plant.

These are the topics we’ll cover. You can also jump to the part that interests you the most

- What is meant by a plant layout?

- What is a lean plant layout?

- What are the characteristics of a good plant layout?

- Plant layout design benefits

Plant layout example

- Step-by-step plant layout design process

- Case: tire assembly and warehousing layout

Let’s go!

What is meant by a plant layout?

The plant layout definition is simple: it’s a way to draw your facility’s building, equipment, and major components on paper. It’s typically done through 2D CAD (2-dimensional Computer-Aided Drafting and Design) software.

The designer will use real-world dimensions of your equipment and facility and layout a scaled model of your plant. Without using real dimensions, the final layout won’t be as helpful for your plant.

In a lot of cases, the designer will submit a final layout that allows the viewer to fly through the building, seeing the equipment in motion and observing how the process looks. Since everything is a scale model, the viewer can find out how much distance there is between equipment, for walkways, and so on.

Since it’s all done on paper, this can be done before getting equipment or before having a warehouse. It also allows the designer to change the layout as much as they’d like.

The layout includes a lot of different features:

- How product moves through your building

- Equipment

- Building floorplan

- Dimensional distances between everything

- Visualization of your process

What is a lean plant layout?

If you take the concept one step further, you can start optimizing everything. In a lean plant layout, the designer will start incorporating lean principles into the floorplan.

A big principle in lean layouts is adding sections for different operations. If your process has multiple steps, like cutting, organizing, and packing your product, then it will be broken into different physical areas.

Cutting will be done in one zone, organizing in another, and packing in a third. This also groups together the required machinery and personnel to expedite the process.

Why does this work? Material and people travel shorter distances, the layout is more compact, and everything is streamlined.

There are a lot of other concepts that go into lean principles (a lean layout). For the sake of brevity, we’ll leave it there.

What are the characteristics of a good plant layout?

Knowing whether a plant layout is good or not really depends on your operations and needs. In general, there are a few characteristics to look for:

- Effectively uses the space . One of the limiting factors in your operation is how much space you have. You can’t just invent new space, so you have to get creative with the space you have. A good plant layout effectively uses every square inch of operation space.

- Accessible design . At the end of the day, there should be enough space between items for the full floorplan to be accessible. This means that material handlers need enough space for themselves as well as the product they’re carrying around the building.

- Flexibility for future growth . Make sure that the floorplan isn’t going to constrict your operation. A lot of manufacturing plants benefit by adding a potential for 20-40% growth. This doesn’t mean that you have to predict exactly how much you’ll grow in a decade, just design with future growth in mind.

- Has your operation in mind . You need a layout that works for your individual operation. There are very few cookie-cutter solutions that fit the needs of your business — your layout is the same way. A good plant layout is specialized to what your business needs.

If you want to oversimplify this idea, a good plant layout is one that achieves the goals of your operation while optimizing every possible parameter.

Plant layout design benefits

Why do people spend so much time putting together a plant layout? There are a number of benefits. Let’s quickly review some of the top reasons why people opt for a plant layout in their business organization.

Reduce cycle time

Cycle time is a term that quantifies how long it takes a business to make a product. It’s the combination of every process step that’s required to make your end product.

With a good plant layout, everything is set up with the operation in mind. As a result, businesses will see a reduced cycle time.

Increase operational speed

On top of an overall speed increase, you’ll find speed increases in every step of the process. This goes back to the idea of splitting your operation into different zones.

Rather than an operator walking across your warehouse to perform a task, everything will be centralized. Think of it as storing the knives next to the cutting board in your kitchen.

Maximize your square footage

Depending on where you’re located, the price of your land could be your biggest expense. Due to that fact, most people want to maximize their square footage.

With a manufacturing plant layout, you have the ability to move equipment around on paper in order to maximize your square footage.

The designer can do things like relocating, rotating, and reorienting equipment to see which option makes the most sense for your facility. Clearly, this is a lot faster and less expensive than physically changing around equipment and testing the new layout.

Visualize and tweak your operational process

Once things are laid out, it might help you to see a potential shortcut in your operation. Maybe you can save time and money by moving one step of your process to another part of the cycle.

This is highly dependent on your operation, but we’ve seen it happen in the past: a company thinks their operation is optimized until they do a plant layout and notice some shortcomings.

Maximize profits

When you combine all of these factors, you’re left with one big benefit: maximized profits. This is the major reason why a lot of businesses opt for putting together a plant layout.

You save time, space, and create more products each year. That should sound like millions of dollar signs annually.

To help illustrate this idea, let’s look at an example. Our team at Visual Components lead the design for a company called Midea.

Here’s a case study of one of our previous clients, Midea . They’re the world’s largest producer of major appliances. Before adding a new, high-end production line, they decided to get a plant layout.

Our simulation looked at the real-world size and operational speed of their different machines. We worked closely with their team to understand how the process works, what the limiting factors were, and what kind of flow their operation had.

After we produced some rounds of layouts, we arrived at, what both parties deemed to be, the best possible arrangement. We saved their operation a lot:

- Floor space used was reduced by 10%

- Production capacity increased 10%

- Reduced product defects by 10x

- Construction schedule expedited 20%

- Total project cost savings: $879,000, roughly 15%

- Long-term labor cost reduction, operational efficiency increase, and projected profit increase

This project for Midea shows the importance of lean plant layouts. We foresee an increase in their profits year over year — this isn’t just a short-term, upfront cost saving. The future of their operation will benefit thanks to an initial plant layout.

Step-by-step plant layout design process with a case example

Curious about what the plant layout design process looks like? Here’s a step-by-step process that we typically follow for our clients. Here’s our workflow for planning and building a plant layout:

1. Understanding clients’ needs

It all starts with understanding our clients’ needs. Before a plant layout can be generated, some information about the operation needs to be explored.

This entails a few conversations going over some basics like floor space, equipment, flow, and more.

For example, our customer Firac received a clear request from their client — to automate a manual screw tightening process. Read the whole story.

2. Planning manufacturing system design

Now it’s time to start drafting. Different companies will opt for different manufacturing programs in this step.

Some companies will only provide a 2D layout with no motion included. Others will use a 3D layout that shows how the equipment will move and how the product goes through the cycle.

At Visual Components, we typically use a 2D layout for the building and add a static 3D layout on top. This overlay ensures dimensional accuracy which is paramount in making a plant layout.

3. Equipment selection

Now it’s time to select and add equipment. This will go right into our static 3D layout, so it can be changed later.

Things like the overall size, motion constraints, and equipment parameters will be inputted during this step. This is done to ensure the model is precise and accurate.

As you probably noticed from our Midea case study, the equipment physically moves and operates in our model. During this step, we’re making sure our clients get the best visual of their potential layout.

To help our clients save time on equipment selection, we offer ready-made components. Visual Components eCatalog has a library of virtual models of robots, machines, and equipment from dozens of leading brands in industrial automation. We have over 1,500 pre-defined and ready-to-use components, to be exact.

4. Layout design

Once the equipment is selected, the designer can start moving around components. This is part of the optimization process where items are moved around until they’re in the perfect place.

Since the equipment and building are already drawn on the computer, this step is more of a “drag and drop” process. On the computer, the designer will move around equipment, change its orientation, and find the best place for the physical pieces.

Jump to 2:34-5:50 in the video below to see how it works in practice.

5. Define the flow

In step 5, we’ll start optimizing the flow. There are three major parts of this step:

- Defining the products

- Defining the processes

- Defining the process flow

There’s some overlap between this and the first step on the list. However, this step focuses on optimizing everything from a layout perspective.

This might mean changing the location of equipment, storage, and walkways to improve the overall process.

The flow is how the material cycle looks in your operation. In other words, when you trace the product from raw material to shipment, that’s the flow.

Jump to 6:43-9:22 in the same video below to see how it works in practice.

6. Simulation

With all of these parameters in mind, our team is ready to put together a simulation. The simulation will show the material and how it physically moves down the line.

A simulation is a 3D video that shows a flyby through your facility. It shows how the equipment and product move throughout. The Midea video discussed earlier is a great example of a simulation that our team makes.

However, this isn’t the final stage. Part of the simulation entails finding bottlenecks. This is where your operation is slowing down and hurting the production speed.

After finding a bottleneck, our team will work to alleviate them. Removing even one bottleneck in your operation can result in a huge performance improvement.

Some of our design software comes with plant layout analysis that aides us in targeting and alleviating these bottlenecks. This is another benefit of using computer-based plant layouts.

Read more: Manufacturing simulation: how it works and why you should do it?

7. Modify And Validate the Changes

The final stage is all about making changes to improve the design. We typically target metrics when it comes to the use of space, operation cycle time, and the ability for product defects.

These changes result in faster speeds and more room for profit within your business on an annual scale.

If this layout is done before construction, you’ll also find some construction cost savings built into this step.

The validation stage involves our clients and getting valuable feedback from you.

Case: Tire assembly and warehousing layout

Let’s discuss a case where the task was to design, simulate, analyze and optimize a manufacturing and warehousing system based on predefined production and layout goals.

This case is about a tire assembly and warehousing facility that is capable of handling a certain number of tires before they are supplied to a downstream assembly line. We can assume that the downstream is a car manufacturing plant.

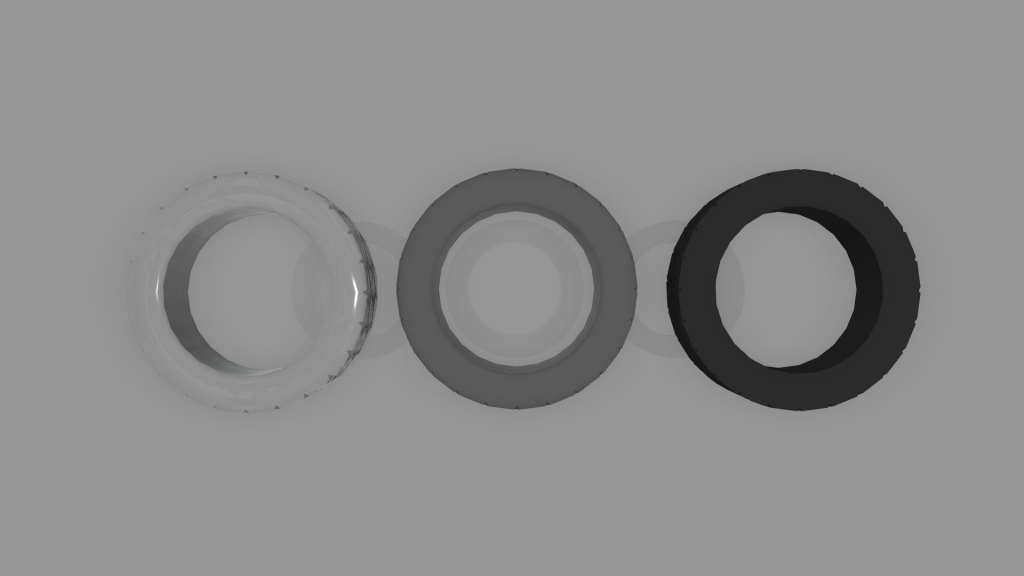

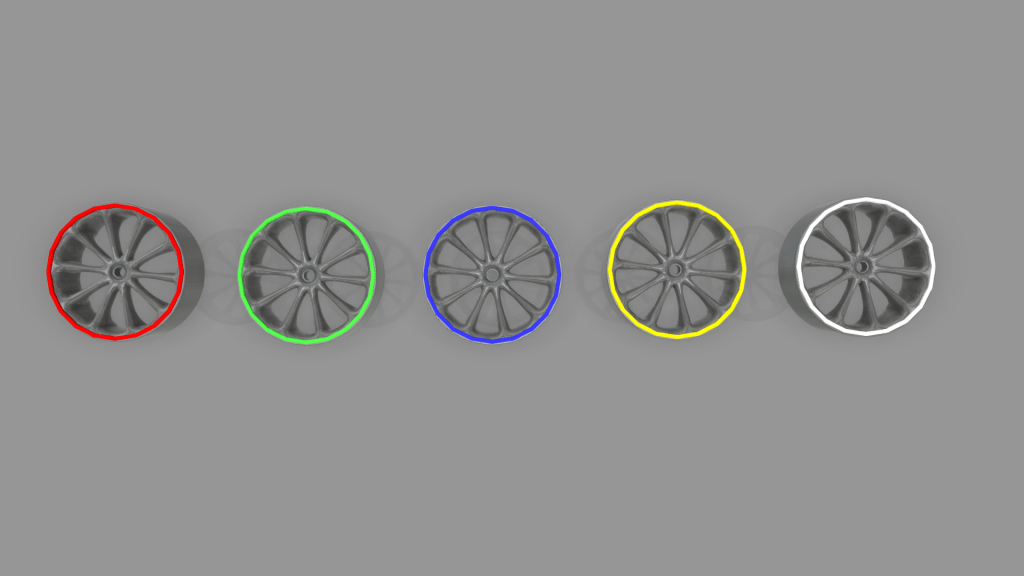

Products and product variants

The product that we had to work with in this case was tires however there were many product variants.

First, we had three tires types meaning tires in three different materials.

Next, we had five tire sizes in the three tire types. These sizes are represented in different colors of tire rims.

So including all the product variants, we had to design a system that could handle 15 different tires.

Production goals

Once the products and product variants were clear, the next step was to evaluate the pre-defined goals. Here’s the list of the production goals that we had to meet,

- The customer needed a setup that was capable of handling all these tires in batches of 4.

- The downstream assembly required that this tire plant could supply 720 tires per hour regardless of how many it can store. The main objective was to have a functional system that provides uninterrupted supply to the downstream assembly regardless of how many tires it could store.

- Since we were working with batches of 4, 720 tires per hour meant that the goal was to supply 3 sets of tires per minute.

Layout goals

Based on the production goals, there were also some layout goals,

- There must be enough buffer to recover from possible machine downtime.

- There must be enough warehouse to store tires for 5 hours of production meaning 900 sets in 5 hours and they must be available at all times to ensure any downtime does not interrupt the downstream supply.

- Also, in addition to storage, we needed to ensure that we had enough conveyor capacity to handle this amount and variety of products.

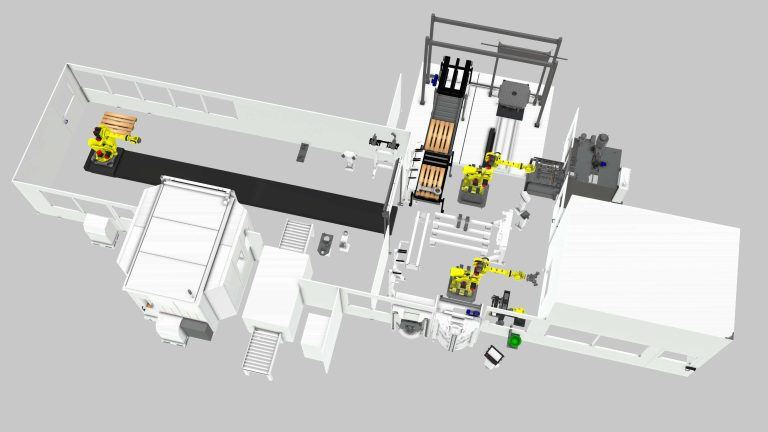

Layout overview and functionality

Their layout was then designed based on the given production and layout goals. Here is a video for a closer look at the layout design and functionality of different sections,

1. The tire types are fed to the robot cell as a batch of 4.

2. Next, Tire rims which represent different sizes of the tires are incoming through conveyors behind the robot cell.

3. The robot cell is designed with 4 assembly lines. Each of these has a Yaskawa HP20RD robot on top of a smart pedestal with a tire tool. This tire tool helps to pick the tire type, lubricate it and assemble it with the rim.

4. Once Assembled, these tires go through a different set of machines where they are fixed and balanced before they are ready to be stored in the warehouse.

5. The tires are then sent towards the warehousing side with five storage sections, one for each tire size and four cartesian robots.

6. Each of these robots has certain tasks assigned to them shortly explained here,

- The first red cartesian robot sorts the tires by sizes onto their specific conveyors

- The second dark grey cartesian robot picks one stack of tires at a time and places them in their relevant tire size storage section.

- The third dark grey cartesian robot with beige pillars stores the tires by their sizes in the storage section and also supplies the sets forward when needed.

- The fourth steel-blue robot that is closer to the entrance of the warehousing collects the supplied stacks of tires released by the previous robot and places them in the rack. These racks are then picked and stored by the forklift in the next storage area.

7. From the last storage, the tires are then supplied to the downstream assembly as they’re needed.

Performance evaluation of the designed systems

Initially, two scenarios were designed and their simulation performance was evaluated.

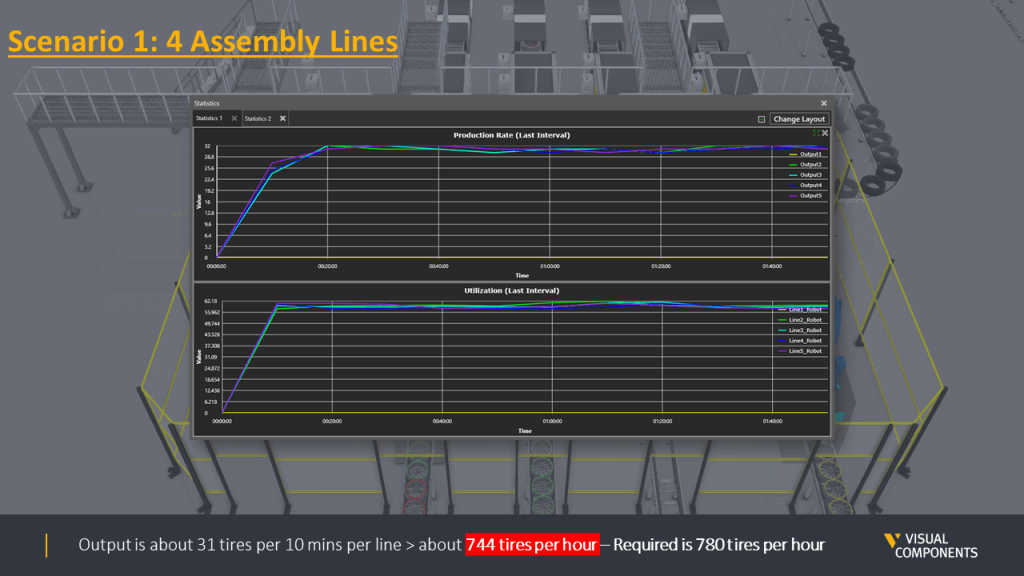

The first scenario consisted of 4 robot assembly lines.

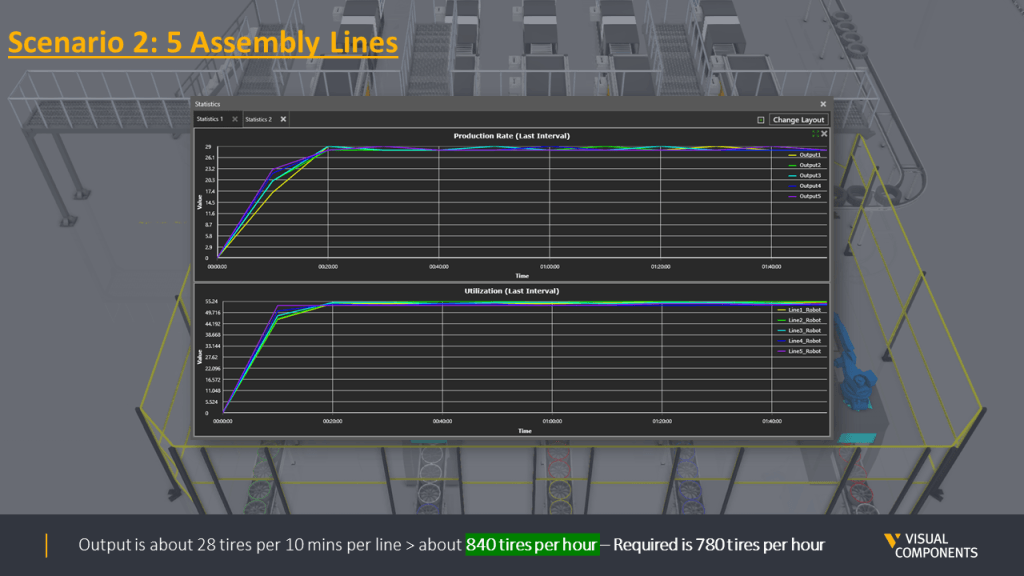

The second one had 5 robots assembly lines.

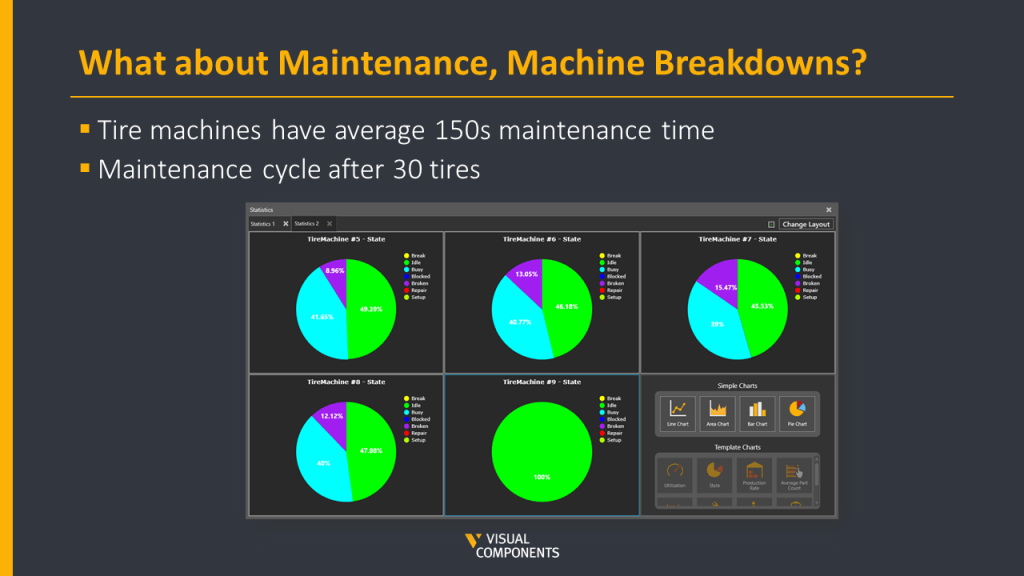

Later, we realized that machine breakdowns are not taken into account in the first two scenarios. Machine breakdowns could be due to many reasons but the most common reason for a production stoppage is usually Maintenance. So, the Maintenance times or Mean Time Between Failures (MTBF) averaging 150 seconds were added to the machines in the robot cell. Also, the maintenance cycle was defined which meant the machine maintenance had to be carried out after every 30 tires were produced.

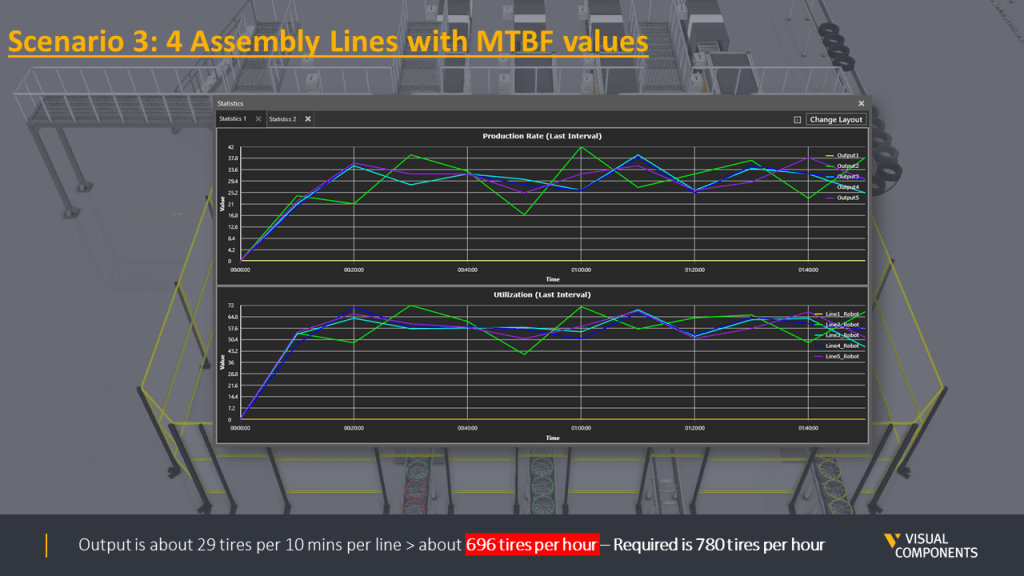

After these metrics were clear and defined, two more scenarios were built, basically, the same and 1st and 2nd scenarios but now with MTBF values included.

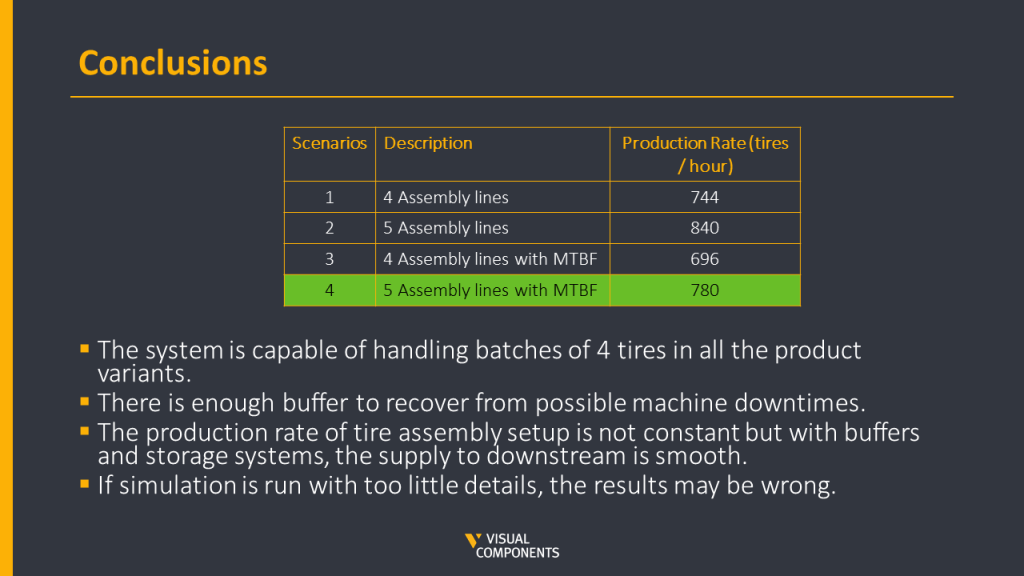

Overall, four scenarios were designed and simulated. Here is the summary of all scenarios with their production output.

The difference in the production output is quite clear between scenarios where MTBF values were not considered and once they were. Based on the scenarios, it was safe to say that Scenario four with five assembly lines was able to generate the required goal of 780 tires per hour. This scenario was then locked as the final design for this case.

Summary of case results

Some important conclusions of this case were,

- The designed system was capable of handling batches of four tires in all the product variants.

- There was enough buffer to recover from possible machine downtimes.

- The production rate of tire assembly was not constant after the maintenance times were added but with enough buffers and storage systems, the supply to downstream was smooth.

- The last but one of the most important lessons to learn from this case was if the simulation is run with too few details, the results may be wrong like the clear difference between the production outputs in the first two scenarios compared to the last two.

Conclusion

We just reviewed how to plan and design a manufacturing plant layout. Now, you should know the benefits and process that goes into making a layout for your plant. With Visual Components , designing a plant layout is more logical, visual, and easier to do. Contact us today to get started. We’ll show you how your operation can save time and money thanks to our services.

Curious to learn more on the topic? Be sure to download our eBook about planning and optimizing your manufacturing plant layout.

Further reading

Boosting production line efficiency: a guide on improving production output

Production efficiency is the cornerstone of success in manufacturing. It measures the effectiveness of resource utilization in the manufacturing process, aiming to maximize output while minimizing costs and waste. The...

An introduction to virtual commissioning

Virtual commissioning is reshaping the manufacturing landscape by employing computer simulations for testing and optimizing production systems before they're physically built. This approach not only simplifies the setup process and...

Are manufacturers really ready for the digital era? (survey results)

Legacy equipment and outdated practices can seem like relics from another age, especially as the world zooms ahead with digital innovations. Yet, they're more prevalent in the manufacturing sector than...

Account Management

Log in to manage your policy, generate a certificate of insurance (COI), make a payment, and more.

Log in to your account to update your information or manage your policy.

Download a Certificate of Insurance (COI) to provide to your employer.

Make a Payment

Make a one-time payment, set up autopay, or update your payment information.

Submit a notice of an incident or claim in just minutes.

Topics on this page:

What Is a Business Location Strategy?