Financial Results

- Email Alerts

- RSS News Feed

- News & Analysis for the Beverage Industry

Coca-Cola: ‘Our 2021 innovation pipeline has been shaped and coordinated for scale and impact’

11-Feb-2021 - Last updated on 11-Feb-2021 at 15:42 GMT

- Email to a friend

With the company releasing its FY2020 results yesterday, Quincey paints a cautious picture of optimism for the year ahead – noting that vaccination campaigns are still in the early stages and better visibility for the business will emerge in the months ahead.

But he says carefully targeted innovations – such as Topo Chico Hard Seltzer, Coca-Cola Energy and regional bets like Authentic Tea House in Asia – will be how the company does innovation in 2021.

'We're not going to stifle innovation - quite the opposite'

Among the products cut in the US have been Odwalla, Zico coconut water, TaB soda, Coca-Cola Life and Diet Coke Feisty Cherry, as well as regional offerings like Northern Neck Ginger Ale and Delaware Punch. In Coca-Cola’s international portfolio, Vegitabeta (Japan) and Kuat (Brazil) have also been discontinued.

The logic is to prioritise on stronger brands with clear potential. But does the company’s ruthless approach to ‘killing the zombies’ – essentially halving the number of master brands – create a company culture with an aversion to risk-taking?

“We don't think we're going to stifle innovation, quite the opposite,” said Quincey. “We're looking, actually, for innovation to continue where it was in 2018 and 2019 in terms of playing an important role in driving consumer engagement, interest to customers, and, therefore, revenue growth and on to profitability.

“Clearly, we did less innovating in 2020. We'll be increasing meaningfully the degree of innovation in 2021, very focused on [questions like] are these attracting more consumers to our portfolios? Is it allowing them to enjoy our beverages perhaps more frequently?

“Ultimately, we're looking for more impact.

“We'll continue to learn more as we go through 2021. But none of this rationalization of the portfolio is about stopping anything, quite the contrary: it's about clearing away the least successful, so there's more room for the most successful, and for the next generation of innovation.”

What to look out for in 2021

Quincey highlights global bets like a new taste and design for Coke Zero Sugar, and regional bets such as the expansion of its Authentic Tea House franchise across Asia.

“We're still pursuing intelligent local experimentation, like adding functional benefits to some of our local hydration brands,” he added.

Topo Chico Hard Seltzer has already launched across markets in Latin America and Europe with the US launch set for this year. Coca-Cola Energy, meanwhile, is back on the US agenda for 2021 (the beverage launched in Europe in 2020 but its US launch was affected by the pandemic) – and Quincey says the product is one the company will double-down on in 2021 as it believes it can attract new drinkers into the energy category.

And there's also innovation in packaging, such as 100% rPET bottles in the US for smartwater and DASANI, along with a new 13.2-ounce 100% recycled PET bottle for Trademark Coca-Cola.

Setting up the company for 2021

With the hit from the pandemic, Coca-Cola’s global volumes declined 6% in 2020 while net revenues were down 11% for the year.

Coca-Cola highlights the fourth quarter continued to see improvements in trends compared to the previous quarters of the year (net revenues, for example, decreased 5% in Q4); but warns that the early weeks of 2021 have been under pressure as countries again introduced lockdowns or restrictions.

“There is no doubt the near-term trajectory of our recovery will still be impacted by the presence of the virus in most markets,” said Quincey. “It is still early days in the vaccination process. And we'd expect to see further improvements in our business as vaccinations become more widely available over the coming months.

“It's clear that the pace and availability of vaccines will look different around the world, and, therefore, we'll likely see some level of asynchronous recovery, depending both on vaccine distribution and other macroeconomic factors.

“Amidst this backdrop, we will ensure that the system remains flexible to adjust to near-term uncertainties, while, at the same time, continuing to push forward on initiatives we have championed to emerge stronger.”

Initiatives in 2020 involved restructuring to cut 17 business units down to nine hubs.

“Our ultimate goal is to scale our resources and capabilities to drive value and growth, including investing in new consumer analytics and digital tools," continued Quincey.

“Our long-term profitable growth will be powered by our optimized brand portfolio. We streamlined our portfolio, allowing global category teams to identify the greatest opportunities and allocate investments accordingly. These targeted investments will leverage our leader brands more effectively, and convert challenger and explorer brands into leaders more quickly and consistently. Additionally, our portfolio streamlining allows us to focus attention and resources on what we do best, brand building and innovation. This will make room for more consumer-centric products down the road.

“At the same time, we are optimizing our marketing spend, focusing on our strongest brands and most compelling opportunities. We have a global creative and media-agency review underway, which will improve processes, eliminate duplication and drive efficiency to fuel reinvestment in our brands.

“The global pandemic has undoubtedly expedited the shift to a digital world. And we're structuring the organization around this opportunity. We've been digitizing the enterprise for several years and have stepped up our evolution into an organization that can skillfully execute marketing, commercial, sales and distribution, both offline and online. We're also leveraging existing pockets of excellence in e-commerce around the globe.”

Related news

- TRANSITION FROM HOT FILL TO SUSTAINABLE ASEPTIC PACKAGING Husky Injection Molding Systems Ltd. | Download Insight Guide

- Functional acids with added value in effervescent beverage tabs Jungbunzlauer | Download Technical / White Paper

- What consumers are looking for in alcohol drinks ADM | Download Application Note

- Redefine resilience with IMMUSE Kyowa Hakko (US) | Download Technical / White Paper

- Your End-to-End Energy Drink Solution Provider ADM | Download Technical / White Paper

- Life is better with more fizz CO2Sustain | Download Product Brochure

On-demand webinars

- Free-From Webinar

- Food for Kids Webinar

- Personalised Nutrition: Tapping into data for healthier diets Webinar

- Food as Medicine Webinar

- Plant-based under the Microscope Webinar

- Reformulation & fortification: Changing trends in healthier foods Webinar

BeverageDaily

- Advertise with us

- Apply to reuse our content

- Press Releases – Guidelines

- Contact the Editor

- Report a technical problem

- Why Register?

- Whitelist our newsletters

- Editorial Calendar

Coca Cola Marketing Strategy, Plan & Mix (4Ps)

Last Sunday, I went to my nearby Kirana store to get some bread. As I was waiting for the shopkeeper to fetch me a loaf, the TV in his store caught my attention. Some news channel was showing the horror that is going on some parts of the world.

Noticing this, the shopkeeper told me something, which translated in English, is “Only if humans could forget the differences and enjoy the commonality, the world would be a better place…” I nodded in agreement but kept thinking, people everywhere are so different, be it culture, race, nationality, etc. So how do we find something familiar?… The answer to my question was resting right next to the TV, in its iconic shape, chilled as everyone likes it…A bottle of Coke.

What is it about Coke that makes it so much more than a refreshment? How has it transcended from being a refreshment drink to a feeling? Let’s deep dive into all of this and much more as we take a look at the marketing mix (4Ps), plan, and strategy of Coca-Cola.

View this post on Instagram A post shared by Coca-Cola (@cocacola)

The Marketing mix (4Ps), plan, and strategy of Coca-Cola.

A big buffet of products.

Coca-Cola has five major categories for Beverages; Sparkling Soft Water, Waters and Hydration, Juices, Dairy and Plant-based, Coffees, and Teas. There are roughly 500 beverages that make up these categories—the most popular are Coca-Cola, Sprite, Fanta, Dasani.

Let me share a brief history of Coca-Cola. It was first produced as syrup by Dr. John Stith Pemberton, a local pharmacist in Atlantia, Georgia, on May 8, 1886. He then carried a jug of this syrup to Jacobs’ Pharmacy, which was sampled pronounced “excellent” and placed on sale for five cents a glass as a soda fountain drink. Carbonated water was teamed with the new syrup to produce the drink we know as Coca-Cola.

Fun Fact: Did you know that Dr. Pemberton’s friend, Frank M Robinson, came up with the name Coca‑Cola. He wrote it out by hand in the Spencerian script that is still used as the logo.

So precisely what is the product when it comes to Coca-Cola? Is it the drink that you and I enjoy on a hot summer afternoon?… Or is it the iconic contour design bottle conceptualized in 1916, and to date, remains the same?… Actually, it is none of these. Leave alone bottling; Coca-Cola doesn’t even complete most of their products!

Coca-Cola manufacturers sell syrups to authorized bottlers. These bottlers then add water and perform carbonation to make and sell finished Coca-Cola products. This is called Concentrate Operations.

Having many independent bottlers created several macros and macro-economic challenges for the firm, as smaller independent bottlers may face problems in continuing business when faced with economic hurdles. The Company started its Bottling Investments Group, identifying struggling franchisees , providing them with financial and institutional support.

Historically, the most considerable risk that the Company ever took came on April 23, 1985. It announced that it was changing the formula of the world’s most popular soft drink! It was called “new Coke.” The Company wanted to revamp the formula and the whole soft drinks segment, and they did just that!

We set out to change the dynamics of sugar colas in the United States, and we did exactly that — albeit not in the way we had planned. Then Chairman Roberto Goizueta

The decision to change Coke’s original formula was based on the fact that Coca-Cola was losing the market share, intensified by the lack of consumer preference and awareness. Over 200,000 consumers tested the change in formula and its taste, but these tests failed to show consumers’ emotional bonding with Coke.

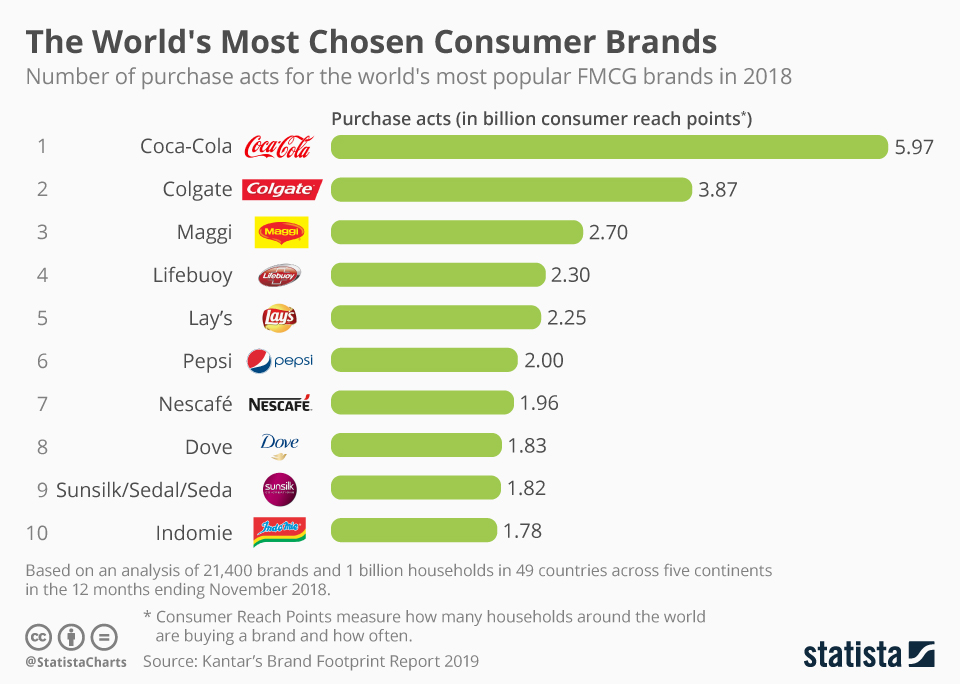

The below visualization shows the world’s most chosen consumer brands, and Coca-Cola tops the chart!

Coca-Cola’s first stint in the Indian market was in 1950 with the opening of the first bottling plant by Pure Drinks Ltd., in New Delhi. The Company had to exit the country in 1977 due to India’s Foreign Exchange Act. In 1992, Coca-Cola returned to India. It bought Parle and hence acquired Thums Up, Limca, and Gold Spot. Thums Up- The Phoenix of the Indian Cola industry

Flexible Pricing Strategy

Coca-Cola, in its marketing mix, follows a pricing strategy called price discrimination. Price discrimination is a microeconomic pricing strategy where identical or largely similar goods or services are sold at different prices by the same provider in different markets. In general, an oligopoly is a market characterized by a small number of firms that realize they are interdependent in their pricing and output policies. The beverages market is an oligopoly, with a small number of manufacturers and many purchasers.

Between 1886 and 1959, the price of Coca-Cola was set at five cents or one nickel. This was possible for reasons including bottling contracts the Company signed in 1899, advertising, vending machine technology, and a relatively low inflation rate.

In 1899, when approached by two lawyers, the then Coca-Cola president, Asa Candler, sold the bottling rights to them for a meager amount of one dollar, thinking bottling would never take off, as soda fountains were the predominant way of consuming carbonated beverages in the United States. Bottling did become popular, surpassing fountain sales in 1928.

Since the contract was non-expiring, Coca-Cola had to sell their syrup at a fixed price. This meant that Coca-Cola’s profits could be maximized only by maximizing the amount of product sold, minimizing the price to the consumer. This led to Coca-Cola aggressively associating their product with a five-cent price tag, providing incentive for retailers to sell at that price even though a higher price at a lower volume would have brought them profit otherwise.

Another aspect to consider was that vending machines were prevalent during that time, and Coca-Cola owned around 85% of the total vending machines in the US in the 1950s. These existing vending machines couldn’t reliably make the change, and hence the Company feared requiring multiple coins from the customer may deter them from buying the product. Reluctant to double the price, the Company preferred to stick to five cents.

When it comes to developing countries like India, where consumers are very price-sensitive and may flip to competitors, especially Pepsi, keeping this in mind, both parties agree to price parity in each segment.

The way Coca-Cola prices its product is exciting. For the sake of this article, we will use one product as an example here, the Classic Coca-Cola. As we know, Coca-Cola’s price in the modern day is not fixed. We can purchase it for as low as 50 cents a can and as high as $5.

To illustrate, if you buy a can for 50 cents, you are buying the product as a slab of 24 cans. So, there is saving, but it’s a quantity-buy. For a little more, $1.49, you will get a chilled can at the supermarket. You’ll have to pay a little more in a petrol station or convenience store since it is more of an impulse buy. In a vending machine, which is generally located at places with no other food source, the price is higher at around $2.50. In a cafe, it would cost approximately $4.50. And the same Coke in a hotel would cost about $5.

The different price points for Coke are driven by the type of consumption, “the need state”, or “the desire state”. Therefore, the pricing power resides in the usage and the location, and the utility that the customer derives from that.

When it tries to enter a new market, mainly those sensitive to price, Coca-Cola prices its products at lower price points than its competitors in that segment. Once the brand is established, it repositions itself as a premium brand through various promotions.

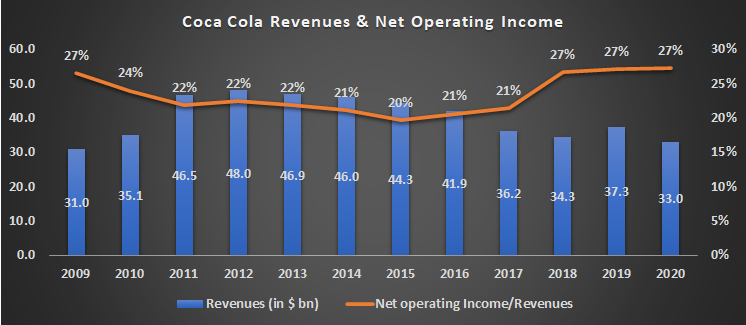

With such a genius pricing strategy in its marketing mix, Coca-Cola has been able to achieve such a high margin of 27%. The below graph shows Coca-Cola’s global revenues from 2009 to 2020, as we see its revenues peaked in 2012:

Creative Promotional Strategy

If we had to choose one brand that has always been consistent with its promotions in marketing strategy, it is Coca-Cola. Never deviating from the basics, Coke has always been consistent with its projection.

From Santa Clause, as we know him, to the coupon culture we see every day, there are many such things like these that we owe to Coca-Cola. They have had such diverse campaigns, yet their underlying theme has been the same throughout history, Happiness! With slogans like “Enjoy,” “You can’t beat the feeling,” “Happiness,” coke has never been a beverage, but a “feeling.”

Coca-Cola did not create the legend of Santa Claus. But Coca-Cola advertising did play a big role in shaping the jolly character we know today. The Coca Cola Company

Bill Backer, the creative director on the Coca-Cola account, was once flying to London to meet up with music director Billy Davis to shoot a new ad for Coke. The plane had to be rerouted to Ireland due to heavy fog in London. Most of the passengers were irritated by the situation. The next day Backer saw many of the passengers, some of whom were the most irate the previous day, laughing and sharing stories over a bottle of Coke. This was an eye-opener for Backer; he realized Coke wasn’t just a refresher but a commonality shared by people worldwide.

This set Bill Backer and team to shoot the famous “I’d like to buy the world a Coke.” When released in the US in July 1971, the Coca-Cola company received more than 100,000 letters about the commercial. Billy Davis, the music director on Coke’s account, wanted to produce a record version of the commercial, releasing two versions, by a group of studio singers who called themselves “The Hillside Singers” and later New Seekers. Both versions topped charts and were recorded in a wide range of languages, and sheet music is one of the top-selling to date.

The “I’d like to buy the world a Coke” ad:

In the context of India, Coca-Cola has had a mix of jingles with celebrity endorsements. One of the most iconic ads was the “Thanda Matlab Coca-Cola,” released in 2003, featuring Amir Khan. This ad highlighted how Indians related to the brand as cool relief. Coca-Cola also understood the importance of festivals and cricket in Indian culture and targeted the same.

Campaigns like “Share a Coke Campaign,” “Fifa World Cup Campaign,” “Happiness Machine Campaign” helped Coca-Cola become an industry leader and become a part of the everyday lives of its consumers.

View this post on Instagram A post shared by Coca-Cola India (@cocacola_india)

The “Share a Coke” campaign:

The “Happiness Machine” campaign:

Coca-Cola at international Places

Coca-Cola is present in more than 200 countries and territories. Being in the business for more than 135 years, Coca-Cola has a vast and extensive distribution network. It has a total of 6 geographic regions of operations, including Europe, Latin America, North America, the Pacific, Eurasia & Africa. As mentioned earlier, Coca-Cola relies on its bottling partners for the packaging and distribution of its products.

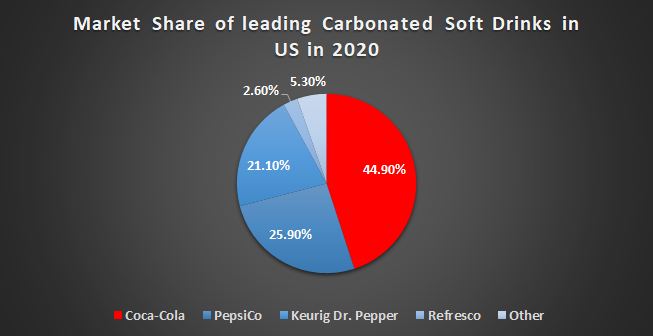

The visualization below shows the Market Share of leading Carbonated Soft Drinks companies in the United States. Coca-Cola has been a clear market leader.

While many view our Company as simply “Coca-Cola,” our system operates through multiple local channels. Our Company manufactures and sells concentrates, beverage bases, and syrups to bottling operations, owns the brands, and is responsible for consumer brand marketing initiatives. Our bottling partners manufacture, package, merchandise and distribute the final branded beverages to our customers and vending partners, who then sell our products to consumers. The Coca Cola Company

Once the bottlers are done with the packaging (predefined by the Company), the bottles are transported to the stockists, distributors, and retailers from where the final consumers buy the product. Coca-Cola has a pervasive distribution channel. In India, Coca-Cola has around 2.6 million outlets to sell its products.

Coca-Cola has a reverse supply chain where they collect the leftover glass bottles from the retailers and convert them into reusable products, thus saving cost and additional resources.

In its latest News Release, the Company reported strong results in the second quarter. The Coca-Cola Company reported strong second-quarter 2021 results and year-to-date performance.

Our results in the second quarter show how our business is rebounding faster than the overall economic recovery, led by our accelerated transformation. As a result, we are encouraged, and, despite the asynchronous nature of the recovery, we are raising our full-year guidance. We are executing against our growth plans, and our system is aligned. We are better equipped than ever to win in this growing, vibrant industry and to accelerate value creation for our stakeholders. James Quincey, Chairman, and CEO of The Coca-Cola Company

This signifies a strong recovery from the setback caused by the pandemic. As we see, all of the above Ps in its marketing strategy and mix have contributed to Coca-Cola’s success, both during pre-pandemic and in its recovery post-pandemic.

That’s it for this one; I need a Coke now 🙂

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Starbucks prices products on value not cost. Why?

In value-based pricing, products are price based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit-based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

Yahoo! The story of strategic mistakes

Yahoo’s story or case study is full of strategic mistakes. From wrong to missed acquisitions, wrong CEOs, the list is endless. No matter how great the product was!!

Apple – A Unique Take on Social Media Strategy

Apple’s social media strategy is extremely unusual. In this piece, we connect Apple’s unique and successful take on social media to its core values.

-AMAZONPOLLY-ONLYWORDS-END-

In my current role, I work with a Marketing Insights firm to serve clients across all domains. In my free time, I like to read books, cook, work out and write occasionally. I'm also a huge Chelsea FC fan.

Related Posts

Dior Marketing Strategy: Redefining Luxury

Dunkin-licious marketing mix and Strategy of Dunkin Donuts

Healthy business model & marketing strategy of HelloFresh

Twist, Lick, and Dunk- Oreo’s Marketing Strategy

The Inclusive Marketing Strategy of ICICI Bank

Nestle’s Marketing Strategy of Expertise in Nutrition

How does Vinted make money by selling Pre-Owned clothes?

N26 Business Model: Changing banking for the better

Sprinklr Business Model: Managing Unified Customer Experience

How does OpenTable make money | Business model

How does Paytm make money | Business Model

How does DoorDash make money | Business Model

Innovation focused business strategy of Godrej

How does Robinhood make money | Business Model

How does Venmo work & make money | Business Model

How does Etsy make money | Business Model & Marketing Strategy

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

Coca-Cola leans on early pandemic lessons to prepare for Delta variant hit

- Medium Text

Sign up here.

Reporting by Uday Sampath in Bengaluru; Editing by Sriraj Kalluvila

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Thomson Reuters

Uday has been reporting on U.S. retail and consumer companies for over five years and has written multiple analysis pieces on the space, including about a flurry of mergers in the toy industry, how an aging population benefited the golf industry and how weak sales from retailers spooked global markets. Uday has a bachelor's degree in commerce from Christ University Bangalore, India.

Business Chevron

Focus: Huawei flagship store surge in China signals showdown with Apple

Huawei is revamping its retail strategy and aggressively opening flagship stores in China, with some just a stone's throw away from Apple shops, as it seeks to retake the premium electronics throne in the world's biggest smartphone market.

- Coca-Cola Bottling-stock

- News for Coca-Cola Bottling

Coca-Cola Consolidated Reports First Quarter 2024 Results and Announces the Intention to Repurchase Up to $3.1 Billion of its Common Stock

- Income from operations for the first quarter of 2024 was $215 million, up $9 million, or 5%, versus the first quarter of 2023.

- Operating margin for the first quarter of 2024 was 13.5% as compared to 13.1% for the first quarter of 2023, an increase of 40 basis points.

- The Company intends to purchase up to $3.1 billion of its Common Stock through both a modified “Dutch auction” tender offer for up to $2.0 billion of its Common Stock and a separate share purchase agreement with The Coca‑Cola Company.

Key Results

First Quarter 2024 Review

CHARLOTTE, N.C., May 06, 2024 (GLOBE NEWSWIRE) -- Coca‑Cola Consolidated, Inc. (NASDAQ: COKE) today reported operating results for the first quarter ended March 29, 2024.

“Our solid first quarter results build on the improved profit margins and strong free cash flow we achieved in 2023,” said J. Frank Harrison, III, Chairman and Chief Executive Officer. “Our sustained strong performance gives us the confidence to announce our intended repurchase of up to $3.1 billion of our outstanding Common Stock. We believe this is an ideal time to leverage the strength of our balance sheet by taking on a prudent amount of debt to return cash to stockholders and build long-term value.”

Net sales increased 1% (a) to $1.6 billion in the first quarter of 2024. Sparkling and Still net sales increased 3.4% and 0.4%, respectively, compared to the first quarter of 2023. Net sales growth was driven by our annual price increase that took effect during the quarter.

Standard physical case volume was down 0.4%, which was attributable to an extra selling day in the first quarter of 2023. Comparable (b) standard physical case volume increased 0.7% versus the first quarter of 2023. Comparable (b) Sparkling category volume grew 2.0% with strong performance of multi-serve packages sold in larger retail stores. The Sparkling category also benefited from Easter holiday sales activity shifting into the first quarter of 2024. Comparable (b) Still category volume declined 3.1% during the first quarter of 2024.

Gross profit in the first quarter of 2024 was $640.6 million, an increase of $16.5 million, or 3%. Gross margin improved 50 basis points to 40.2%. Pricing actions taken during the first quarter, stable commodity prices and higher Sparkling sales contributed to the overall improvement in gross margin.

“We’re very pleased with our balanced profit growth and overall margin performance in the first quarter,” said Dave Katz, President and Chief Operating Officer. “We achieved a solid mix of volume and pricing growth while tightly managing our operating expenses. Our comparable volume growth of almost 1% reflects the continued strength of our brands and the success of new product launches such as Coke Spiced and the addition of Bang to our Energy portfolio.”

Selling, delivery and administrative (“SD&A”) expenses in the first quarter of 2024 increased $7.1 million, or 2%. SD&A expenses as a percentage of net sales increased 10 basis points to 26.7% in the first quarter of 2024. The increase in SD&A expenses as compared to the first quarter of 2023 was primarily driven by an increase in labor costs related to annual wage adjustments.

Income from operations in the first quarter of 2024 was $215.4 million, compared to $206.1 million in the first quarter of 2023, an increase of 5%. Operating margin for the first quarter of 2024 was 13.5% as compared to 13.1% for the first quarter of 2023, an increase of 40 basis points.

Net income in the first quarter of 2024 was $165.7 million, compared to $118.1 million in the first quarter of 2023, an improvement of $47.6 million. On an adjusted (b) basis, net income in the first quarter of 2024 was $162.5 million, compared to $151.8 million in the first quarter of 2023, an increase of $10.7 million. Income tax expense for the first quarter of 2024 was $57.1 million, compared to $41.1 million in the first quarter of 2023. The effective income tax rate for the first quarter of 2024 was 25.6%, compared to 25.8% for the first quarter of 2023.

Cash flows provided by operations for the first quarter of 2024 were $194.3 million, compared to $184.7 million for the first quarter of 2023. Cash flows from operations reflected our strong operating performance during the first quarter of 2024. In the first quarter of 2024, we invested $77 million in capital expenditures as we continue to enhance our supply chain and invest for future growth. For the full year of 2024, we expect our capital expenditures to be between $300 million and $350 million. During the first quarter of 2024, we made dividend payments of $155 million, which included a special dividend payment of $150 million.

Intention to Repurchase Shares

The Company currently intends to purchase up to $3.1 billion in value of its Common Stock through both a modified “Dutch auction” tender offer for up to $2.0 billion of its Common Stock and a separate share purchase agreement (the “Purchase Agreement”) with a subsidiary of The Coca‑Cola Company. The Company expects the price range for the tender offer to be $850 to $925 per share of Common Stock.

Under the Purchase Agreement, the Company has agreed to buy, and a subsidiary of The Coca‑Cola Company has agreed to sell, at a purchase price equal to the price paid by the Company in the tender offer, a number of shares of Common Stock such that The Coca‑Cola Company would beneficially own 21.5% of the Company’s outstanding shares of Common Stock after the repurchase and completion of the tender offer. The purchase of shares under the Purchase Agreement is conditioned on the purchase price applicable to the tender offer and the Share Repurchase being no less than $925 per share. Should the applicable price in the tender offer be less than $925 per share, The Coca‑Cola Company shall have the option, but not the obligation, to sell their shares at that price. The tender offer is expected to be launched on or about May 20, 2024 and the purchase of shares under the Purchase Agreement is expected to occur on the 11 th business day following the expiration of the tender offer.

“We believe that the proposed share repurchase enables us to optimize our balance sheet by raising a prudent amount of debt in order to return cash to stockholders,” said Mr. Harrison. “We intend to utilize our solid financial position and projected strong cash flow to delever over the coming years while maintaining our current regular quarterly dividend and a solid investment grade rating profile.”

J. Frank Harrison, III will not participate in the tender offer with respect to the Common Stock he beneficially owns.

The Company intends to fund the repurchase with a combination of new funded debt and cash on hand.

A PDF accompanying this release is available at: https://ml.globenewswire.com/Resource/Download/861a9ae2-3a03-49d2-8559-45e866072618

About Coca-Cola Consolidated, Inc.

Coca‑Cola Consolidated is the largest Coca‑Cola bottler in the United States. Our Purpose is to honor God in all we do, to serve others, to pursue excellence and to grow profitably. For over 122 years, we have been deeply committed to the consumers, customers and communities we serve and passionate about the broad portfolio of beverages and services we offer. We make, sell and distribute beverages of The Coca‑Cola Company and other partner companies in more than 300 brands and flavors across 14 states and the District of Columbia, to approximately 60 million consumers.

Headquartered in Charlotte, N.C., Coca‑Cola Consolidated is traded on The Nasdaq Global Select Market under the symbol “COKE”. More information about the Company is available at www.cokeconsolidated.com. Follow Coca‑Cola Consolidated on Facebook, X, Instagram and LinkedIn.

Additional Information Regarding the Tender Offer

The information in this press release describing the Tender Offer is for informational purposes only and does not constitute an offer to buy or the solicitation of an offer to sell shares in the Tender Offer. Coca-Cola Consolidated has not yet commenced the Tender Offer described herein, and there can be no assurance that Coca-Cola Consolidated will commence the Tender Offer on the terms described in this press release. The Tender Offer will be made only pursuant to an Offer to Purchase and the related materials that Coca-Cola Consolidated will file with the SEC, and will distribute to its stockholders on the commencement date of the Tender Offer. Stockholders should read the Offer to Purchase and related materials carefully and in their entirety because they will contain important information, including the terms and conditions of the Tender Offer. When they are available, stockholders of the Company may obtain a free copy of the Tender Offer statement on Schedule TO, the Offer to Purchase and other documents that the Company will file with the SEC from the SEC’s website at www.sec.gov. When they are available, stockholders also will be able to obtain a copy of these documents, without charge, from Innisfree M&A Incorporated, the information agent for the Tender Offer, toll free at 1-877-456-3507. Stockholders are urged to carefully read all of those materials when they become available prior to making any decision with respect to the Tender Offer.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release are “forward-looking statements” that involve risks and uncertainties which we expect will or may occur in the future and may impact our business, financial condition and results of operations. The words “anticipate,” “believe,” “expect,” “intend,” “project,” “may,” “will,” “should,” “could” and similar expressions are intended to identify those forward-looking statements. Such forward-looking statements include our plan to commence the tender offer and ability to complete the share repurchase on the terms and timing described herein, or at all. These forward-looking statements reflect the Company’s best judgment based on current information, and, although we base these statements on circumstances that we believe to be reasonable when made, there can be no assurance that future events will not affect the accuracy of such forward-looking information. As such, the forward-looking statements are not guarantees of future performance, and actual results may vary materially from the projected results and expectations discussed in this news release. Factors that might cause the Company’s actual results to differ materially from those anticipated in forward-looking statements include, but are not limited to: increased costs (including due to inflation), disruption of supply or unavailability or shortages of raw materials, fuel and other supplies; the reliance on purchased finished products from external sources; changes in public and consumer perception and preferences, including concerns related to product safety and sustainability, artificial ingredients, brand reputation and obesity; changes in government regulations related to nonalcoholic beverages, including regulations related to obesity, public health, artificial ingredients and product safety and sustainability; decreases from historic levels of marketing funding support provided to us by The Coca‑Cola Company and other beverage companies; material changes in the performance requirements for marketing funding support or our inability to meet such requirements; decreases from historic levels of advertising, marketing and product innovation spending by The Coca‑Cola Company and other beverage companies, or advertising campaigns that are negatively perceived by the public; any failure of the several Coca‑Cola system governance entities of which we are a participant to function efficiently or on our best behalf and any failure or delay of ours to receive anticipated benefits from these governance entities; provisions in our beverage distribution and manufacturing agreements with The Coca‑Cola Company that could delay or prevent a change in control of us or a sale of our Coca‑Cola distribution or manufacturing businesses; the concentration of our capital stock ownership; our inability to meet requirements under our beverage distribution and manufacturing agreements; changes in the inputs used to calculate our acquisition related contingent consideration liability; technology failures or cyberattacks on our information technology systems or our effective response to technology failures or cyberattacks on our customers’, suppliers’ or other third parties’ information technology systems; unfavorable changes in the general economy; the concentration risks among our customers and suppliers; lower than expected net pricing of our products resulting from continued and increased customer and competitor consolidations and marketplace competition; the effect of changes in our level of debt, borrowing costs and credit ratings on our access to capital and credit markets, operating flexibility and ability to obtain additional financing to fund future needs; the failure to attract, train and retain qualified employees while controlling labor costs, and other labor issues; the failure to maintain productive relationships with our employees covered by collective bargaining agreements, including failing to renegotiate collective bargaining agreements; changes in accounting standards; our use of estimates and assumptions; changes in tax laws, disagreements with tax authorities or additional tax liabilities; changes in legal contingencies; natural disasters, changing weather patterns and unfavorable weather; climate change or legislative or regulatory responses to such change; and the impact of any pandemic or public health situation. These and other factors are discussed in the Company’s regulatory filings with the United States Securities and Exchange Commission, including those in “Item 1A. Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023. The forward-looking statements contained in this news release speak only as of this date, and the Company does not assume any obligation to update them, except as may be required by applicable law.

Results for the first quarter of 2023 include one additional selling day compared to the first quarter of 2024. For comparison purposes, the estimated impact of the additional selling day in the first quarter of 2023 has been excluded from our comparable (b) volume results.

Coca-Cola Bottling News MORE

Related stocks.

- Our company

- Sustainability

- Social impact

years of refreshing the world

The Coca‑Cola Company has been refreshing the world and making a difference for over 137 years. Explore our Purpose & Vision, History and more.

- Purpose & Company Vision

- The Coca‑Cola System

- Our Board of Directors

- COCA-COLA HISTORY

- Our Origins

- Our First Bottle

- Sustainability History

- Advertising History

brands worldwide

We've established a portfolio of drinks that are best positioned to grow in an ever-changing marketplace.

From trademark Coca‑Cola to Sports, Juice & Dairy Drinks, Alcohol Ready-to-Drink Beverages and more, discover some of our most popular brands in North America and from around the world.

- Coca‑Cola

- + View More

- COFFEE & TEA

- Costa Coffee

- Gold Peak Tea

- JUICES & DAIRY

- Minute Maid

- Fresca Mixed

- Jack Daniel's & Coca‑Cola

- Simply Spiked

- Topo Chico Hard Seltzer

OUR PLANET MATTERS

Our purpose is to refresh the world and make a difference. See how our company and system employees make this possible every day and learn more about our areas of focus in sustainability.

- Water Stewardship

- 2030 Water Strategy Key Goals

- Sustainable Agriculture

- Principles for Sustainable Agriculture (PSAs)

- Sustainable Packaging

- Collection Strategy

- Packaging Design

- Partnership

- In Our Products

- Sugar Reduction

- 2022 Business & Sustainability Report

- Sustainability & Governance Resource Center

PEOPLE MATTER

We aim to improve people's lives, from our employees to those who touch our business to the many communities we call home.

- Diversity, Equity and Inclusion

- Leadership Council

- Employee Groups

- People & Communities

- Women Empowerment

- Project Last Mile

- HUMAN RIGHTS

- Human Rights Governance

- Stories of IMPACT

- Coca‑Cola Foundation

- Partnerships

- Supplier Diversity

- Sports & Entertainment

We believe working at The Coca‑Cola Company is an opportunity to build a meaningful career while helping us make a real difference on a global scale.

- LIFE AT COCA-COLA

- Career Development

- Work With Us

- CAREER AREAS

- Early Career

- Experienced Professionals

- Accessible Workplace

- HIRING PROCESS

- Application Process

Coca‑Cola Company Jobs

- Coca‑Cola System Jobs

GET THE LATEST

Catch up on the latest Coca‑Cola news from around the globe - from exciting brand innovation to the latest sustainability projects.

- WHAT OTHERS ARE READING

- Taste the Transformation: Coca‑Cola and Grammy-Award Winning Artist Rosalía Break Boundaries With Limited-Edition Coke Creation

- Coca‑Cola Brings Together Iconic Andy Warhol Painting with Illustrious Roster of Master Classics and Contemporary Works in New Global 'Masterpiece' Campaign

- A Deeper Look at Coca‑Cola's Emerging Business in Alcohol

- LATEST ARTICLES

- Coca‑Cola Zero Sugar Invites Fans to #TakeATaste

- Simply Mixology Raises the Bar of the At-Home Mocktail and Cocktail Experience

- Sprite, Fresca and Seagram's Tap Mark Ronson and Madlib to Create a 'Clear' Connection

- View all news

- Always Innovating

- Water Leadership

- Refreshingly Local

- World Without Waste

- Creating a diverse, equal and inclusive culture

Our Sustainability Goals and Progress

2022 business & sustainability report.

We build loved brands that bring joy to our consumers’ lives with beverage choices for all occasions, tastes and lifestyles. Our growth strategy is grounded in our core values and commitment to social and environmental responsibility.

SUSTAINABILITY RESOURCE CENTER

At The Coca‑Cola Company, our sustainability goals and initiatives are anchored by our purpose — to refresh the world and make a difference — and are core to our growth strategy. Get an overview of our efforts to create a more sustainable business and better shared future.

.jpg)

Featured News

Coca‑cola® happy tears zero sugar celebrates acts of kindness with tiktok-exclusive creation.

Celebrate "Real Magic" with a limited-edition drink inspired by acts of kindness, available exclusively on TikTok Shop.

How The Coca‑Cola System Refreshes Local Economies and Communities in Markets Around the World

The Coca‑Cola system creates local jobs to make, distribute and sell our drinks that refresh local communities.

- Jack & Daniels and Coca‑Cola RTD Launches in US

Jack Daniel’s & Coca‑Cola RTD – a pre-mixed, canned cocktail that first launched last fall in Mexico – is set to hit stores in the United States.

- Dasani and Sprite Boost Sustainability Packaging Credentials

Two of The Coca‑Cola Company’s biggest brands in North America are taking major steps to support a circular economy for plastic packaging.

Our 2030 Water Strategy Key Goals

The Coca‑Cola Company announced three goals accelerating its action on water during the UN 2023 Water Conference.

- Happy Tears

- Economic Impact

We seek employees that embrace change, champion diversity and push for progress. Your skills and experience will help us navigate the ever-changing global landscape and guide us into the next chapter and beyond.

A Purpose-Driven History

The Coca‑Cola Company’s purpose is to refresh the world and make a difference and we have remained true to that purpose for 137 years. Our strategy is centered around people—our consumers and employees—and driving sustainable solutions that build resilience into our business to respond to current and future challenges, while creating positive change for the planet.

Explore Our Brands

ASUMH and Baxter Health receive $625,175 grant for Nursing Programs

MOUNTAIN HOME, Ark. (KAIT/Edited News Release) - Arkansas State University-Mountain Home and Baxter Health received a grant in the amount of $625,175 on Monday, May 13, through the American Rescue Plan Act of 2021 for the Arkansas Linking Industry to Grow Nurses Program.

The award, presented by Governor Sarah Sanders in Little Rock, will allow ASUMH and Baxter Health to develop an innovative new partnership that will create a clinical pre-residency experience for students at Baxter Health.

This collaborative initiative aims to enhance nursing education by expanding simulation lab experiences and by standardizing nursing clinical practices.

The objective is to increase the LPN and RN nursing admission capacity at ASUMH to actively recruit and retain clinical nurse educators, and decrease the time required for graduates to integrate into hospital operations.

Dr. Bentley Wallace, chancellor of ASUMH, said the grant will create pipelines into the workforce for students that are critical.

“This partnership between Baxter Health and ASUMH is a perfect example of how workforce education can be streamlined and elevated in a way that allows for higher completion and employment rates. Baxter Health’s commitment to this process is an industry-leading example of creating education-to-career pipelines. ASUMH is very proud to be partnered with such an innovative and future-minded organization.”

Students that sign to be future Baxter Health nurses will be supported by scholarships and additional funding to help with personal expenses by Baxter Health during their nursing education through ASUMH. The grant will serve approximately 75 students across the timeline.

The project draws inspiration from the innovative approach implemented by Baxter Health, a hospital distinguished by its Magnet status, the highest mark of excellence in nursing globally.

Similar to other hospitals of its size, Baxter Health faces challenges in attracting and retaining nursing personnel in a rural market, while faced with increasing demands for patient care services.

“We are thrilled to add new nurses into the Baxter Health family through this exciting collaboration with ASUMH,” said Sarah Brozynski, director of education at Baxter Health. “Our goal is to provide a comprehensive and enriching experience for nurse residents, ensuring they are well-prepared to deliver exceptional care to our patients.”

The nurse residency pipeline program will include preceptorship opportunities, specialized training, hands-on experience, and ongoing support to help new nurses thrive in their roles.

“This initiative not only benefits the graduates and Baxter Health, but also contributes to elevating the standard of healthcare in our community,” said Brozynski.

To achieve the goals of the program, ASUMH will hire a Clinical Nursing Educator to oversee all aspects of the LPN and RN pre-residency program who will be housed at Baxter Health.

Additionally, a Clinical Nursing Coordinator will be hired to oversee the clinical scheduling, recruitment, retention of clinical nursing instructors, White Coat Program, and student nursing education for the apprenticeship program. This position will be located on the ASUMH campus.

The grant will also facilitate the acquisition of additional simulation equipment for use on the ASUMH campus and at Baxter Health.

The state-of-the-art equipment at Baxter Health provided by the grant will include:

- Apollo Manikin

- Aria Manikin

- Learning Space Technology – Medical Trainer

At ASUMH, equipment will include:

- Laerdal SimBaby

- Laerdal SimJunior

- Nursing Kelly Manikin

The partnership this grant creates between ASUMH and Baxter Health provides an innovative program to meet the demands of the local hospital while nurturing the growth and development of future nurses in our region through advanced education locally.

For more information, contact ASUMH at 870-508-6100 or Baxter Health at 870-508-1000.

To report a typo or correction, please click here .

Copyright 2024 KAIT. All rights reserved.

ASP: Couple flying to Batesville killed in plane crash

Pillar of Jonesboro community dies

Jonesboro man dies following crash

![coca cola business plan 2021 "Our hearts and prayers go out to [their] two daughters and family,” the mayor said. “It’s...](https://gray-kait-prod.cdn.arcpublishing.com/resizer/v2/GLFBO5YGZJCHFIJNIVR3EH4KBA.jpg?auth=38b72b4e938933af727e70c8009aac508ee1aef8eb1db90eeda26d084336533e&width=800&height=450&smart=true)

‘It’s heartbreaking’: Batesville mourning death of business owner, wife in plane crash

Curtain closing on Paragould theater

Latest news.

Readers retreat to feature Hemingway novel at Hemingway-Pfeiffer Museum

Surgery successful for Poplar Bluff baby born with rare genetic disorder

Medical marijuana sales reach $1 billion in 5 years

Gosnell coach encourages players, students to do their best

ATLANTA--( BUSINESS WIRE )--The Coca-Cola Company today reported fourth quarter and full-year 2021 results, including another quarter of sequential improvement in volume trends compared to 2019. “In 2021, our system demonstrated resilience and flexibility by successfully navigating through another year of uncertainty,” said James Quincey, Chairman and CEO of The Coca-Cola Company. “We focused on our key strategies and emerged stronger. We are confident that progress on our strategic transformation has made us a nimbler total beverage company. While the environment remains dynamic, we will build on the momentum from 2021 to drive topline growth and maximize returns.”

- Revenues: For the quarter, net revenues grew 10% to $9.5 billion, resulting in net revenues ahead of 2019, and organic revenues (non-GAAP) grew 9%. Revenue performance included 10% growth in price/mix and a decline of 1% in concentrate sales. The quarter included six fewer days, which resulted in an approximate 6-point headwind to revenue growth. The quarter was also impacted by the timing of concentrate shipments. For the full year, net revenues grew 17% to $38.7 billion, and organic revenues (non-GAAP) grew 16%. This performance was driven by 9% growth in concentrate sales and 6% growth in price/mix.

- Margin: For the quarter, operating margin, which included items impacting comparability, was 17.7% versus 27.2% in the prior year, while comparable operating margin (non-GAAP) was 22.1% versus 27.3% in the prior year. For the full year, operating margin, which included items impacting comparability, was 26.7% versus 27.3% in the prior year, while comparable operating margin (non-GAAP) was 28.7% versus 29.6% in the prior year. For both the quarter and the full year, operating margin compression was primarily driven by a significant increase in marketing investments versus the prior year. Additionally, fourth quarter operating margin was impacted by topline pressure from six fewer days in the quarter along with the timing of concentrate shipments.

- Earnings per share: For the quarter, EPS grew 65% to $0.56, and comparable EPS (non-GAAP) declined 5% to $0.45. For the full year, EPS grew 26% to $2.25, and comparable EPS (non-GAAP) grew 19% to $2.32. Both fourth quarter and full-year comparable EPS (non-GAAP) performance included the impact of a 2-point currency tailwind.

- Market share: For both the quarter and the full year, the company gained value share in total nonalcoholic ready-to-drink (NARTD) beverages, which included share gains in both at-home and away-from-home channels. The company’s value share in total NARTD beverages, and in both at-home and away-from-home channels, remains ahead of 2019.

- Cash flow: Cash flow from operations for the year was $12.6 billion, up $2.8 billion versus the prior year, driven by strong business performance and working capital initiatives. Full-year free cash flow (non-GAAP) was $11.3 billion, up $2.6 billion versus the prior year, driven by strong cash flow from operations.

- Business environment: Compared to 2019, global unit case volume sequentially improved each quarter in 2021, resulting in full-year unit case volume being ahead of 2019. This performance was driven by ongoing, asynchronous recovery in many markets and the company’s ability to better adapt to successive waves of the pandemic. The fourth quarter marked the first quarter in which away-from-home volume was ahead of 2019, while strength in at-home channels also continued. Although reopenings continue to vary across the world, the company is combining the power of scale with the deep knowledge required to win locally and is continuing to invest ahead of the recovery in a targeted way.

- Strengthening a consumer-centric portfolio through strategic acquisitions: During the fourth quarter, the company acquired the remaining 85% ownership interest in BODYARMOR, a line of sports performance and hydration beverages that has significant potential for long-term growth. Since gaining access to the company’s bottling system three years ago, BODYARMOR has driven continuous innovation in hydration products. For full-year 2021, BODYARMOR was the #2 sports drink in the category in measured retail channels in the United States, with retail value growth of approximately 50%. BODYARMOR will continue to be distributed by the company’s U.S. bottling system and will be managed as a separate business within the company’s North America operating unit.

- Transforming and modernizing marketing through one global marketing network partner: After an extensive review in 2021, the company named WPP as its global marketing network partner. WPP will play a key role in executing a new marketing model to drive long-term growth for the company’s global portfolio of brands. The new, integrated agency model is consumer-centric and leverages the power of big, bold ideas and creativity within experiences. The company intends to create end-to-end experiences that are grounded in data-rich consumer insights, optimized in real-time and implemented at scale. WPP, supported by a common data and technology platform that connects marketing teams throughout the company, will work with a strategic roster of approved agencies to provide access to the best creative minds and ideas.

In addition to the data in the preceding tables, operating results included the following:

- Unit case volume grew 9% for the quarter and 8% for the year, resulting in volume ahead of 2019. Volume growth was strong across most markets. The volume performance was driven by investments in the marketplace, ongoing recovery in markets where coronavirus-related uncertainty was abating, and the benefit from cycling the impact of the pandemic in the prior year. For both the quarter and the year, growth in developing and emerging markets was led by China, India and Russia, while growth in developed markets was led by the United States, Mexico and the United Kingdom.

Category performance was as follows:

- Sparkling soft drinks grew 8% for the quarter and 7% for the year, resulting in volume ahead of 2019, driven by strong performance across all geographic operating segments. Trademark Coca-Cola grew 7% for both the quarter and the year, resulting in volume ahead of 2019, led by Europe, Middle East & Africa and Asia Pacific. Coca-Cola® Zero Sugar grew double digits for both the quarter and the year. Sparkling flavors grew 9% for both the quarter and the year, led by Europe, Middle East & Africa and Asia Pacific.

- Nutrition, juice, dairy and plant-based beverages grew 11% for the quarter and 12% for the year, resulting in volume ahead of 2019. For both the quarter and the year, there was strong growth across all geographic operating segments.

- Hydration, sports, coffee and tea grew 12% for the quarter and 7% for the year. Hydration grew 11% for the quarter and 5% for the year, with growth across all geographic operating segments. Sports drinks grew 18% for the quarter and 13% for the year, resulting in volume ahead of 2019, primarily driven by strong growth of BODYARMOR in the United States. Tea grew 10% for the quarter and 6% for the year, led by growth in Japan and the United States. Coffee grew 17% for the quarter and 15% for the year, primarily driven by the ongoing reopening of Costa® retail stores in the United Kingdom.

- Price/mix grew 10% for the quarter and 6% for the year, driven by pricing actions in the marketplace along with favorable channel and package mix due to cycling the impact of the pandemic in the prior year. Price/mix for the quarter was further benefited by positive segment mix. For the quarter, concentrate sales were 10 points behind unit case volume. This was primarily attributable to six fewer days in the quarter, which resulted in an approximate 6-point impact on concentrate sales, along with the timing of concentrate shipments. For the full year, concentrate sales were 1 point ahead of unit case volume, primarily due to bottler inventory build to manage near-term supply disruption.

- Operating income declined 28% for the quarter and grew 15% for the year, which included items impacting comparability and currency tailwinds. Comparable currency neutral operating income (non-GAAP) declined 12% for the quarter, driven by a significant increase in marketing investments versus the prior year. Additionally, fourth quarter operating income was impacted by topline pressure from six fewer days in the quarter. Comparable currency neutral operating income (non-GAAP) grew 12% for the full year, driven by strong organic revenue (non-GAAP) growth across all operating segments, partially offset by a significant increase in marketing investments versus the prior year.

- Unit case volume grew 11% for the quarter, a low single-digit increase versus 2019, driven by ongoing recovery in markets where coronavirus-related uncertainty was abating, along with the benefit from cycling the impact of the pandemic in the prior year. Growth was led by Russia and Spain in Europe, Nigeria in Africa, and Turkey in Eurasia and Middle East.

- Price/mix grew 13% for the quarter, driven by favorable channel and package mix due to cycling the impact of the pandemic in the prior year, along with positive geographic mix. For the quarter, concentrate sales were 7 points behind unit case volume, primarily due to six fewer days in the quarter.

- Operating income grew 1% for the quarter, which included items impacting comparability. Comparable currency neutral operating income (non-GAAP) grew 8% for the quarter, primarily driven by solid organic revenue (non-GAAP) growth across all operating units, partially offset by a significant increase in marketing investments versus the prior year.

- For the year, the company gained value share in total NARTD beverages, which included share gains across most categories.

- Unit case volume grew 5% for the quarter, a mid single-digit increase versus 2019. Growth was led by Mexico, Argentina and Chile, driven by growth in most categories.

- Price/mix grew 11% for the quarter, driven by pricing actions in the marketplace, favorable channel and package mix, along with the timing of deductions. For the quarter, concentrate sales were 15 points behind unit case volume, primarily due to six fewer days in the quarter and the timing of concentrate shipments.

- Operating income was even for the quarter, which included items impacting comparability and a 3-point currency tailwind. Comparable currency neutral operating income (non-GAAP) declined 3% for the quarter, driven by an increase in marketing investments versus the prior year.

- For the year, the company gained value share in total NARTD beverages, led by share gains in Mexico, Argentina, Brazil and Colombia.

- Unit case volume grew 8% for the quarter, resulting in even performance versus 2019. Growth was driven by recovery in the fountain business as coronavirus-related uncertainty abated. Sparkling soft drinks and sports drinks led the growth during the quarter.

- Price/mix grew 9% for the quarter, primarily driven by pricing actions in the marketplace, recovery in the fountain business and away-from-home channels, and strong growth in premium offerings. For the quarter, concentrate sales were 4 points behind unit case volume, primarily due to six fewer days in the quarter.

- Operating income declined 17% for the quarter, which included items impacting comparability. Comparable currency neutral operating income (non-GAAP) declined 1% for the quarter, driven by a significant increase in marketing investments versus the prior year.

- The company gained value share in total NARTD beverages for the year, driven by recovery in away-from-home channels along with strong performance in at-home channels for sparkling flavors, sports drinks and dairy.

- Unit case volume grew 11% for the quarter, resulting in a low single-digit increase versus 2019. Growth was driven by China, India and the Philippines, partially offset by pressure in Australia due to the impact of the pandemic. Growth was led by Trademark Coca-Cola and sparkling flavors.

- Price/mix declined 8% for the quarter due to negative channel mix in key markets along with 4 points of negative geographic mix due to growth in emerging and developing markets outpacing developed markets. For the quarter, concentrate sales were 7 points behind unit case volume, primarily due to six fewer days in the quarter.

- Operating income declined 31% for the quarter, which included a 2-point currency headwind. Comparable currency neutral operating income (non-GAAP) declined 29% for the quarter, driven by topline pressure along with a significant increase in marketing investments versus the prior year.

- The company’s value share in total NARTD beverages was even for the year, as strong underlying share gains in most markets were offset by the impact of negative geographic mix in the operating segment.

- Net revenues grew 27% for the quarter, which included a 2-point currency tailwind. Organic revenues (non-GAAP) grew 25%. Revenue growth was primarily driven by the ongoing reopening of Costa retail stores in the United Kingdom.

- Operating income growth and comparable currency neutral operating income (non-GAAP) growth for the quarter were driven by strong organic revenue (non-GAAP) growth.

- Unit case volume grew 13% for the quarter, driven by strong growth in the key markets of India and the Philippines.

- Price/mix declined 3% for the quarter, primarily due to weather-related disruption and negative package mix in South Africa.

- Operating income declined 11% for the quarter, including items impacting comparability and a 5-point tailwind from currency. Comparable currency neutral operating income (non-GAAP) declined 12% for the quarter, driven by an increase in operating expenses versus the prior year.

- Reinvesting in the business: The company continued to invest in its various lines of business and spent $1.4 billion in capital expenditures in 2021, an increase of 16% versus the prior year.

- Continuing to grow the dividend: The company paid dividends totaling $7.3 billion during 2021. The company has increased its dividend in each of the last 59 years.

- Consumer-centric M&A: The company acquired the remaining 85% ownership interest in BODYARMOR, a line of sports performance and hydration beverages, in November 2021 for $5.6 billion.

- Share repurchases: In 2021, the company did not repurchase any shares under the existing share repurchase authorization. The company’s remaining share repurchase authorization is approximately $10 billion.

The 2022 outlook information provided below includes forward-looking non-GAAP financial measures, which management uses in measuring performance. The company is not able to reconcile full-year 2022 projected organic revenues (non-GAAP) to full-year 2022 projected reported net revenues, full-year 2022 projected comparable net revenues (non-GAAP) to full-year 2022 projected reported net revenues, full-year 2022 projected comparable cost of goods sold (non-GAAP) to full-year 2022 projected reported cost of goods sold, full-year 2022 projected underlying effective tax rate (non-GAAP) to full-year 2022 projected reported effective tax rate, full-year 2022 projected comparable currency neutral EPS (non-GAAP) to full-year 2022 projected reported EPS or full-year 2022 projected comparable EPS (non-GAAP) to full-year 2022 projected reported EPS without unreasonable efforts because it is not possible to predict with a reasonable degree of certainty the actual impact of changes in foreign currency exchange rates throughout 2022; the exact timing and amount of acquisitions, divestitures and/or structural changes throughout 2022; the exact timing and amount of items impacting comparability throughout 2022; and the actual impact of changes in commodity costs throughout 2022. The unavailable information could have a significant impact on the company’s full-year 2022 reported financial results.

Full Year 2022

The company expects to deliver organic revenue (non-GAAP) growth of 7% to 8%.

For comparable net revenues (non-GAAP), the company expects a 2% to 3% currency headwind based on the current rates and including the impact of hedged positions, in addition to a 3% tailwind from acquisitions.

The company expects commodity price inflation to be a mid single-digit percentage headwind on comparable cost of goods sold (non-GAAP), based on the current rates and including the impact of hedged positions.

The company’s underlying effective tax rate (non-GAAP) is estimated to be 20%. This does not include the impact of ongoing tax litigation with the U.S. Internal Revenue Service, if the company were not to prevail.

Given the above considerations, the company expects to deliver comparable currency neutral EPS (non-GAAP) growth of 8% to 10% and comparable EPS (non-GAAP) growth of 5% to 6%, versus $2.32 in 2021.

Comparable EPS (non-GAAP) percentage growth is expected to include a 3% to 4% currency headwind based on the current rates and including the impact of hedged positions, in addition to a minimal tailwind from acquisitions.

The company expects to generate free cash flow (non-GAAP) of approximately $10.5 billion through cash flow from operations of approximately $12.0 billion, less capital expenditures of approximately $1.5 billion. This does not include any potential payments related to ongoing tax litigation with the U.S. Internal Revenue Service.

First Quarter 2022 Considerations

Comparable net revenues (non-GAAP) are expected to include an approximate 3% currency headwind based on the current rates and including the impact of hedged positions, in addition to a 3% tailwind from acquisitions.

Comparable EPS (non-GAAP) percentage growth is expected to include an approximate 5% currency headwind based on the current rates and including the impact of hedged positions.

The first quarter has one less day compared to first quarter 2021.

- All references to growth rate percentages and share compare the results of the period to those of the prior year comparable period, unless otherwise noted.

- All references to volume and volume percentage changes indicate unit case volume, unless otherwise noted. All volume percentage changes are computed based on average daily sales for the fourth quarter, unless otherwise noted, and are computed on a reported basis for the full year. “Unit case” means a unit of measurement equal to 192 U.S. fluid ounces of finished beverage (24 eight-ounce servings), with the exception of unit case equivalents for Costa non-ready-to-drink beverage products which are primarily measured in number of transactions. “Unit case volume” means the number of unit cases (or unit case equivalents) of company beverages directly or indirectly sold by the company and its bottling partners to customers or consumers.

- “Concentrate sales” represents the amount of concentrates, syrups, beverage bases, source waters and powders/minerals (in all instances expressed in equivalent unit cases) sold by, or used in finished beverages sold by, the company to its bottling partners or other customers. For Costa non-ready-to-drink beverage products, “concentrate sales” represents the amount of coffee (in all instances expressed in equivalent unit cases) sold by the company to customers or consumers. In the reconciliation of reported net revenues, “concentrate sales” represents the percent change in net revenues attributable to the increase (decrease) in concentrate sales volume for the geographic operating segments and the Global Ventures operating segment after considering the impact of structural changes, if any. For the Bottling Investments operating segment for the fourth quarter, this represents the percent change in net revenues attributable to the increase (decrease) in unit case volume computed based on total sales (rather than average daily sales) in each of the corresponding periods after considering the impact of structural changes, if any. For the Bottling Investments operating segment for the full year, this represents the percent change in net revenues attributable to the increase (decrease) in unit case volume after considering the impact of structural changes, if any. The Bottling Investments operating segment reflects unit case volume growth for consolidated bottlers only.

- “Price/mix” represents the change in net operating revenues caused by factors such as price changes, the mix of products and packages sold, and the mix of channels and geographic territories where the sales occurred.

- First quarter 2021 financial results were impacted by five additional days as compared to first quarter 2020, and fourth quarter 2021 financial results were impacted by six fewer days as compared to fourth quarter 2020. Unit case volume results for the quarters are not impacted by the variances in days due to the average daily sales computation referenced above.

The company is hosting a conference call with investors and analysts to discuss fourth quarter and full-year 2021 operating results today, Feb. 10, 2022, at 8:30 a.m. ET. The company invites participants to listen to a live webcast of the conference call on the company’s website, http://www.coca-colacompany.com , in the “Investors” section. An audio replay in downloadable digital format and a transcript of the call will be available on the website within 24 hours following the call. Further, the “Investors” section of the website includes certain supplemental information and a reconciliation of non-GAAP financial measures to the company’s results as reported under GAAP, which may be used during the call when discussing financial results.

Investors and Analysts : Tim Leveridge, [email protected] Media : Scott Leith, [email protected]

Jimmie Johnson to attempt his own version of Indy 500 & NASCAR doubleheader

- Show more sharing options

- Copy Link URL Copied!

Jimmie Johnson will attempt his own version of “The Double” when he becomes the first driver to be part of the Indianapolis 500 broadcast team hours before he competes in NASCAR’s Coca-Cola 600.

Johnson, who ran the Indy 500 in 2022, was part of NBC Sports’ broadcast booth in 2021 when he ran only the road and street courses on IndyCar’s schedule. He added ovals in his second and final season in American open-wheel racing.

NBC said Tuesday that Johnson will be part of the broadcast team at Indianapolis Motor Speedway for the May 26 race. It will be the first of recurring analyst opportunities for Johnson with the network this year.

“To have the opportunity to experience ‘The Greatest Spectacle in Racing’ once again is such an honor,” Johnson said. “I was part of the NBC broadcast team in 2021 and it just fueled the fire I needed to make my childhood dream of racing in the Indianapolis 500 one day a reality. Competing in this race as a driver was a chance of a lifetime, so to be able to experience the pageantry again is just so special.”

Johnson will fly to Charlotte, North Carolina, after the Indy 500 to compete in NASCAR’s longest race of the year. The Hall of Famer won the Coca-Cola 600 four times as a full-time NASCAR driver. Johnson now races a partial schedule as co-owner of Legacy Motor Club.

For NBC, Johnson will also be an analyst later this season for NASCAR races at Daytona and Talladega, as well as races he’s schedule to compete in.

“Any time you can add one of the greatest drivers of all time and an icon of the sport, you jump at the opportunity,” said Sam Flood, lead producer for NBC Sports’ motorsports coverage. “We are thrilled to be working with Jimmie and adding his unique perspective on every race he covers, as well as having him become the first person ever to do the ‘Double’ — history awaits.”

Kyle Larson will become the fifth driver to attempt to complete both the Indy 500 and the Coca-Cola 600 on the same day. Tony Stewart in 2001 became the only driver to complete all 1,100-miles of racing.

AP Motorsports: https://apnews.com/hub/auto-racing

Top headlines by email, weekday mornings

Get top headlines from the Union-Tribune in your inbox weekday mornings, including top news, local, sports, business, entertainment and opinion.

You may occasionally receive promotional content from the San Diego Union-Tribune.

More in this section

Nation-World

11 people die in shootings in small town in southern Mexico state of Chiapas, prosecutors say

Authorities in Mexico say 11 people have been killed by shootings in a small town in the southern of Chiapas

From Hogan to a Trumpier Senate: Early takeways from Tuesday’s primaries

The presidential primary may be decided, but election season marches on

Pete Ricketts wins Republican nomination for U.S. Senate in Nebraska special primary election

Deb Fischer wins Republican nomination for U.S. Senate in Nebraska primary election

Wong will be sworn in as Singapore’s prime minister, as Lee Hsien Loong bows out after 20 years

Singapore’s deputy leader Lawrence Wong is set to be sworn in as the nation’s fourth prime minister in a carefully planned political succession to ensure continuity and stability in the Asian financial hub

Joe Biden wins the Democratic presidential primary in Nebraska

IMAGES

VIDEO

COMMENTS

In 2022, we continued to build a portfolio of loved beverage brands while building a more sustainable future for our business, communities and planet. We have an opportunity to use our scale to address global challenges and create a force for good. Our Business & Sustainability Report aims to provide a transparent look at our actions, progress ...

Digital is beginning to play an integral role in our RGM strategy, providing competitive advantages which allow us to make better, more informed decisions faster, by translating data into actionable insights. Digital is improving our perception both at the consumer experience level as well as at the bottler level, driving improved execution.

291 billion liters of water returned to nature and communities in 2022. ~68% of the products in our beverage portfolio have less than 100 calories per 12-ounce serving. 29% of our volume sold in 2022 was low- or no-calorie. 90% of our packaging is recyclable. 15% of PET used is recycled.

ATLANTA--(BUSINESS WIRE)-- The Coca-Cola Company today reported fourth quarter and full-year 2021 results, including another quarter of sequential improvement in volume trends compared to 2019. "In 2021, our system demonstrated resilience and flexibility by successfully navigating through another year of uncertainty," said James Quincey ...

ATLANTA--(BUSINESS WIRE)--The Coca-Cola Company today reported strong third quarter 2021 results and year-to-date performance.". Our strategic transformation is enabling us to effectively ...

Confident In Our Long-Term Targets. At The Coca-Cola Company, our strengths give us confidence in our ability to deliver long-term, sustainable shareowner value. Our long-term targets consist of solid revenue growth of 4% to 6%, strong operating leverage driving 6% to 8% operating income growth, delivering meaningful EPS growth and improving on ...

EPS Grew 48% to $0.61; Comparable EPS (Non-GAAP) Grew 61% to $0.68. ATLANTA, July 21, 2021 - The Coca-Cola Company today reported strong second quarter 2021 results and year-to-date performance. "Our results in the second quarter show how our business is rebounding faster than the overall economic recovery, led by our accelerated ...

Fourth Quarter and Fiscal Year 2021 Review. CHARLOTTE, N.C., Feb. 22, 2022 (GLOBE NEWSWIRE) -- Coca-Cola Consolidated, Inc. (NASDAQ: COKE) today reported operating results for the fourth quarter and the fiscal year ended December 31, 2021. "2021 was a tremendous year for our Company as we achieved record revenue, income from operations and operating cash flow.