- Monetary Economics

- Economic Inflation

THEORETICAL RELATIONSHIP BETWEEN INFLATION AND UNEMPLOYMENT: A MACRO STUDY

- September 2020

- Babasaheb Bhimrao Ambedkar University

Abstract and Figures

Discover the world's research

- 25+ million members

- 160+ million publication pages

- 2.3+ billion citations

- V.V. Bezpalov

- S.A. Lochan

- D.V. Fedyunin

- Tatiana V. Gorina

- Deni Kusumawardani

- Irene van Staveren

- Fred R. Glahe

- E. S. Phelps

- A. William Phillips

- Irving Fisher

- Recruit researchers

- Join for free

- Login Email Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google Welcome back! Please log in. Email · Hint Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google No account? Sign up

- Search Search Please fill out this field.

- What Is Macroeconomics?

Gross Domestic Product (GDP)

The unemployment rate, demand and disposable income, what the government can do, the bottom line.

- Macroeconomics

Explaining the World Through Macroeconomic Analysis

:max_bytes(150000):strip_icc():format(webp)/0__mary_hall-5bfc262446e0fb005118b2a7.jpeg)

When the price of a product you want to buy goes up, it affects you. But why does the price go up? Is demand greater than supply? Does the cost go up because of the raw materials needed to make it? Or, is it a war in an unknown country that affects the price?

To answer these questions, we need to turn to macroeconomics. Macroeconomic analysis provides a way to understand the world through studying the economy.

Key Takeaways

- Macroeconomics is the branch of economics that studies the economy as a whole.

- Macroeconomics focuses on three things: National output, unemployment, and inflation.

- Governments can use macroeconomic policy including monetary and fiscal policy to stabilize the economy.

- Central banks use monetary policy to increase or decrease the money supply, and use fiscal policy to adjust government spending.

What Is Macroeconomics?

Macroeconomics is the study of the behavior of the economy as a whole. This is different from microeconomics, which concentrates more on individuals and how they make economic decisions. While microeconomics looks at single factors that affect individual decisions, macroeconomics studies general economic factors.

Macroeconomics is very complicated, with many factors that influence it. These factors are analyzed with various economic indicators that tell us about the overall health of the economy.

The U.S. Bureau of Economic Analysis provides official macroeconomic statistics.

Macroeconomists try to forecast economic conditions to help consumers, firms, and governments make better decisions:

- Consumers want to know how easy it will be to find work, how much it will cost to buy goods and services in the market, or how much it may cost to borrow money.

- Businesses use macroeconomic analysis to determine whether expanding production will be welcomed by the market. Will consumers have enough money to buy the products, or will the products sit on shelves and collect dust?

- Governments turn to macroeconomics when budgeting spending, creating taxes, deciding on interest rates, and making policy decisions.

Macroeconomic analysis broadly focuses on three things—national output (measured by gross domestic product), unemployment, and inflation.

Output, the most important concept of macroeconomics, refers to the total amount of goods and services a country produces, commonly known as the gross domestic product (GDP) . This figure is like a snapshot of the economy at a certain point in time.

When referring to GDP, macroeconomists tend to use real GDP , which takes inflation into account, as opposed to nominal GDP , which reflects only changes in price. The nominal GDP figure is higher if inflation goes up from year to year, so it is not necessarily indicative of higher output levels, only of higher prices.

The drawback of GDP is that information has to be collected after a specified time period has passed. Therefore a figure for the GDP today would have to be an estimate.

GDP is nonetheless a stepping stone into macroeconomic analysis. Once a series of figures is collected over a period of time, they can be compared, and economists and investors can begin to decipher business cycles, which are made up of the periods alternating between economic recessions (slumps) and expansions (booms) that occur over time.

From there we can begin to look at the reasons why the cycles took place, which could be government policy, consumer behavior, or international phenomena, among other things. Of course, these figures can be compared across economies as well. Hence, we can determine which foreign countries are economically strong or weak.

Based on what they learn from the past, analysts can then begin to forecast the future state of the economy. It is important to remember that what determines human behavior and ultimately the economy can never be forecasted completely.

The unemployment rate tells macroeconomists how many people from the available pool of labor (the labor force) are unable to find work.

Macroeconomists agree when the economy witnesses growth from period to period, which is indicated in the GDP growth rate, unemployment levels tend to be low . This is because, with rising (real) GDP levels, we know the output is higher and, hence, more laborers are needed to keep up with the greater levels of production.

The third main factor macroeconomists look at is the inflation rate , or the rate at which prices rise. Inflation is primarily measured in two ways: the Consumer Price Index (CPI) and the GDP deflator. The CPI gives the current price of a selected basket of goods and services that is updated periodically. The GDP deflator is the ratio of nominal GDP to real GDP.

If nominal GDP is higher than real GDP, we can assume the prices of goods and services have been rising. Both the CPI and GDP deflator tend to move in the same direction and differ by less than 1%.

What ultimately determines output is demand . Demand comes from consumers, from the government, and from imports and exports.

Demand alone, however, will not determine how much is produced. What consumers demand is not necessarily what they can afford to buy, so to determine demand, a consumer's disposable income must also be measured. This is the amount of money left for spending and/or investment after taxes.

Disposable income is different from discretionary income, which is after-tax income, less payments to maintain a person's standard of living.

To calculate disposable income, a worker's wages must be quantified as well. Salary is a function of two main components: the minimum salary for which employees will work and the amount employers are willing to pay to keep the employee. Given that demand and supply go hand in hand, salary levels will suffer in times of high unemployment, and prosper when unemployment levels are low.

Demand inherently will determine supply (production levels) and an equilibrium will be reached. But in order to feed demand and supply, money is needed. A country's central bank (the Federal Reserve in the U.S.) typically puts money in circulation in the economy. The sum of all individual demand determines how much money is needed in the economy. To determine this, economists look at the nominal GDP, which measures the aggregate level of transactions, to determine a suitable level of the money supply .

There are two ways the government implements macroeconomic policy. Both monetary and fiscal policy are tools the government uses to help stabilize a nation's economy. Below, we take a look at how each works.

Monetary Policy

A simple example of monetary policy is the central bank's open market operations . When there is a need to increase cash in the economy, the central bank will buy government bonds (monetary expansion). These securities allow the central bank to inject the economy with an immediate supply of cash. In turn, interest rates—the cost to borrow money—are reduced because the demand for the bonds will increase their price and push the interest rate down. In theory, more people and businesses will then buy and invest. Demand for goods and services will rise and, as a result, the output will increase. To cope with increased levels of production, unemployment levels should fall and wages should rise.

On the other hand, when the central bank needs to absorb extra money in the economy and push inflation levels down, it will sell its Treasury bills , or T-bills. This will result in higher interest rates, which will cause less borrowing, less spending, and less investment. It will also decrease demand, which will ultimately push down the price level (inflation) and result in less real output.

Fiscal Policy

The government can also increase taxes or lower government spending in order to conduct a fiscal contraction . This lowers real output because less government spending means less disposable income for consumers. And, when more of a consumer's wages go to taxes, demand will also decrease.

A fiscal expansion by the government would mean taxes are decreased or government spending is increased. Either way, the result will be growth in real output because the government will stir demand with increased spending. In the meantime, a consumer with more disposable income will be willing to buy more.

A government will tend to use a combination of both monetary and fiscal options when setting policies that deal with the economy.

What Are the Key Macroeconomic Indicators?

The key macroeconomic indicators are the gross domestic product, the unemployment rate, and the rate of inflation.

What Is the Purpose of Macroeconomic Analysis?

Macroeconomic analysis allows a country to monitor its economic health, develop sound policies and practices, and sustain suitable growth.

How Does the Government Influence Macroeconomics?

The two main ways a government can influence macroeconomics is through monetary policy and fiscal policy. Monetary policy helps control the flow and quantity of money in an economy while fiscal policy uses government spending and taxation to influence economic conditions.

The performance of the economy is important to all of us. We analyze the economy by primarily looking at the national output, unemployment, and inflation. Although it is consumers who ultimately determine the direction of the economy, governments also influence it through fiscal and monetary policy.

International Monetary Fund. " Macroeconomic Policy and Poverty Reduction ."

International Monetary Fund. " Monetary Policy: Stabilizing Prices and Output ."

U.S. Bureau of Labor Statistics. " Comparing the Consumer Price Index With the Gross Domestic Product Price Index and Gross Domestic Product Implicit Price Deflator ."

Federal Reserve System. " Open Market Operations ."

:max_bytes(150000):strip_icc():format(webp)/headline-inflation.asp-Final-79a692de95064b889104abbf66076cc0.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

The PMC website is updating on October 15, 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- Entropy (Basel)

Coupled Criticality Analysis of Inflation and Unemployment

Zahra koohi lai.

1 Department of Physics, Islamic Azad University, Firoozkooh Branch, Firoozkooh 3981838381, Iran; moc.oohay@yalihook_z

2 Department of Finance, Faculty of Management, University of Tehran, Tehran 1411713114, Iran

3 Iran Finance Association, Tehran 1411713114, Iran

Ali Hosseiny

4 Department of Physics, Shahid Beheshti University, Tehran 1983969411, Iran; ri.ca.ubs@yniessoh_la (A.H.); ri.ca.ubs@irafaj_g (G.J.)

Gholamreza Jafari

5 Center for Network Science, Central European University, 1051 Budapest, Hungary

Marcel Ausloos

6 School of Business, College of Social Sciences, Arts, and Humanities, Brookfield, University of Leicester, Leicester LE2 1RQ, UK; ku.ca.el@386am

7 Group of Researchers for Applications of Physics in Economy and Sociology (GRAPES), Rue de la belle jardinière, 483, Sart Tilman, Angleur, B-4031 Liege, Belgium

8 Department of Statistics and Econometrics, Bucharest University of Economic Studies, Calea Dorobantilor 15–17, Sector 1, 010552 Bucharest, Romania

In this paper, we focus on the critical periods in the economy that are characterized by unusual and large fluctuations in macroeconomic indicators, like those measuring inflation and unemployment. We analyze U.S. data for 70 years from 1948 until 2018. To capture their fluctuation essence, we concentrate on the non-Gaussianity of their distributions. We investigate how the non-Gaussianity of these variables affects the coupling structure of them. We distinguish “regular” from “rare” events, in calculating the correlation coefficient, emphasizing that both cases might lead to a different response of the economy. Through the “multifractal random wall” model, one can see that the non-Gaussianity depends on time scales. The non-Gaussianity of unemployment is noticeable only for periods shorter than one year; for longer periods, the fluctuation distribution tends to a Gaussian behavior. In contrast, the non-Gaussianities of inflation fluctuations persist for all time scales. We observe through the “bivariate multifractal random walk” that despite the inflation features, the non-Gaussianity of the coupled structure is finite for scales less than one year, drops for periods larger than one year, and becomes small for scales greater than two years. This means that the footprint of the monetary policies intentionally influencing the inflation and unemployment couple is observed only for time horizons smaller than two years. Finally, to improve some understanding of the effect of rare events, we calculate high moments of the variables’ increments for various q orders and various time scales. The results show that coupling with high moments sharply increases during crises.

1. Introduction

Unemployment and inflation are two important economic features; their relation is highly meaningful for policymakers. It is common knowledge of experts that the possible relation that holds between these two variables has been a key controversial issue among different schools of economic thought.

Indeed, historically, this controversy flared up with the observation of Alban W. Phillips’ report on a negative relationship between unemployment and the growth of wages from 1861 until 1957 in the United Kingdom [ 1 ]. Such a negative relation was named after him, i.e., the Phillips curve [ 2 ].

A few months after the publication of A.W. Phillips, Robert Solow, and Paul Samuelson published related findings. They observed a similar negative correlation between unemployment and inflation in the United States [ 3 ]. These findings begot an illusion that policymakers can permanently decrease unemployment at the cost of high inflation. Warnings about such a policy however were made by the new classical economists such as Milton Friedman and Edmund Phelps [ 2 , 4 , 5 , 6 ]. They argued that if, in the long run, policymakers increase the volume of money, agents realize the policy and increase prices. As a consequence of these situations, price growth would not be accompanied by a decline in unemployment, as wished.

In the 1970s, the prediction by these new classical economists came true. A long-lasting period of stagnation started during which expansionary monetary policies failed to downturn unemployment; a positive relationship between unemployment and inflation emerged during a decade [ 7 ].

Currently, in the mainstream, one believes that the growth of money cannot boost the economy and decrease unemployment if one imposes a sustained and permanent inflation policy. If policymakers aim to let the money volume increase permanently, agents become so accustomed that the government policies become ineffective in the long run. Nevertheless, the Federal Reserve looks at the volume of money and at the interest rate as apparatuses, even levers, to influence the economy in the short run. In other words, policymakers at the Federal Reserve believe that unexpected changes in the volume of money influence economic conditions in the short run. However, an interesting question pertains to the time scale that distinguishes the short run from the long run relationship between inflation and unemployment.

Thus, the true relation between unemployment and inflation and especially the causality direction between them are still serious controversial issues in economics; see for example [ 8 , 9 , 10 , 11 , 12 , 13 , 14 , 15 , 16 , 17 , 18 , 19 ] and the references therein. The debate especially finds a crucial meaning if policymakers aim to impose expansionary monetary policies to boost production during recessions. There is no need to observe that this controversy is a quite pertinent dilemma at the time of writing (during the COVID-19 pandemic) [ 20 , 21 ].

Yet, few works have considered the so-called theoretical complexity of these variables. This gap thereby leads to the research questions of this paper, as in [ 22 , 23 ].

On the other hand, complexity economics has attracted a great deal of attention in recent years [ 24 , 25 , 26 , 27 , 28 , 29 , 30 , 31 , 32 , 33 , 34 , 35 ]. Indeed, the economy can be considered as a huge network of heterogeneous agents who interact with each other and with their environment [ 34 , 36 , 37 , 38 , 39 , 40 , 41 , 42 , 43 ]. It is reasonable to expect that inflation and unemployment, as outcomes of these complex systems, inherent complexity theory features. This suggests considering a thorough analysis of these variables along with advanced techniques available in the complexity theory approach, itself found to be of interest in many applications [ 44 , 45 , 46 , 47 ].

Looking at unemployment and inflation indices as simple variables forces one to ignore some rich knowledge about their complexity. It has been shown for example that economic indicators and their coupling have nice scaling and present multifractal features [ 22 , 48 , 49 , 50 , 51 , 52 ]. Scaling analysis has proven successful to address a wide range of phenomena in nature; see for example [ 53 , 54 , 55 , 56 , 57 , 58 ]. Economic indices are not an exception [ 49 , 50 , 59 , 60 , 61 , 62 ]. Moreover, these multiscaling features can be also described through an entropy function and free energy as introduced for multifractals [ 63 , 64 , 65 ].

In this work, to grab scaling features of unemployment and inflation, and to analyze the role of large fluctuations, we focus on the non-Gaussianities in their probability density functions (PDF). For illustration, we focus on monthly records of inflation and unemployment rates, provided by the U.S. Inflation Calculator [ 66 ] and U.S. Bureau of Labor Statistics [ 67 ], for the period lasting from January 1948 until October 2018 [ 68 ].

Figure 1 a illustrates such monthly data during the period. The mean (standard deviation) % values of inflation and unemployment for this term are 3.51 ( 2.93 ) and 5.76 ( 1.64 ) , respectively. The correlation coefficient between unemployment and inflation for the whole data depicted in Figure 1 is less than ∼0.05, which is not statistically meaningful.

Unemployment vs. inflation. Each point represents the unemployment vs. inflation rate. The inflation rate is the year-on-year consumer price index (CPI) reported monthly for the period ranging from January 1948 till October 2018; ( a ) All data points, 850. ( b ) Regular events (greenish blue points, 702 points) and the rare events (dark blue, 148 points) via an ellipse. The center of this ellipse has to coordinate the mean value of each data. Each chord of the ellipse in whatever direction is three times the standard deviation of the data in that direction. This means that points outside the ellipse are three standard deviations away from the mean value. Source: U.S. Inflation Calculator [ 66 ] and Bureau of Labor Statistics [ 67 ].

Figure 1 b shows two areas for the data points: “regular” and “rare” events. Regular events are those events that are inside an ellipse centered on the mean value coordinates of both data with a “chord” of three standard deviations ( 3 σ ) in each possible direction in the plane. In other words, we consider that the rare events are those events that are at least 3 σ away from the mean value.

If we exclude regular events and focus on the tail of the distribution illustrated in Figure 1 b, then the correlation coefficient is ≃−0.24. This means that the response of the economy to rare events might be different from regular events.

2.1. Multifractal Random Walk (MRW)

In essence, the Multifractal Random Walk (MRW) is used to analyze time series stems from turbulent cascade models [ 69 ]. MRW is a model to study multifractality based on the non-Gaussianity of the PDF. The model generates a non-Gaussian time series of fluctuations through protecting two-time series, a Gaussian and a log-normal, such that the non-Gaussian parameter is the standard deviation of the log-normal signal. One can show that in an MRW, the non-Gaussianity parameter is related to multifractality features [ 56 , 70 ].

Thus, MRW processes are useful for representing the non-Gaussian behavior of time series. Practically, the temporal fluctuations increment of a process at scale s , δ s x ( t ) = x ( t + s ) − x ( t ) , are modeled by the product of a normal and a log-normal process:

where ϵ s ( t ) and ω s ( t ) are normal processes with zero mean and standard deviations equal to σ ( s ) and λ ( s ) , respectively.

Based on Equation ( 1 ), we can write a probability density function for δ s x ( t ) as:

Since λ 2 ( s ) is the variance of the log-normal part of the process. This parameter is the key representative measure of the non-Gaussianity of the process; if λ 2 ( s ) → 0 , the PDF of δ s x ( t ) converges to a Gaussian distribution. An estimation of λ 2 ( s ) versus a scale s is our way of presenting the effect of large fluctuations over different time scales. Furthermore, for showing the effects of the rare events (in the PDF tails), high order moments of fluctuations of order q , denoted by m q , can be calculated:

A large value of m q implies a significant role of rare events. If this is found to be independent of q , the process is called monofractal; otherwise, it is called a multifractal [ 56 ].

2.2. Joint Multifractal Approach: The Bi-MRW Method

Muzy et al. [ 71 , 72 ] proposed the Bivariate Multifractal Random Walk (Bi-MRW) method for analyzing two coupled non-Gaussian stochastic processes ( x ( t ) = { x 1 ( t ) , x 2 ( t ) } ) simultaneously, when the increments of each time series are supposed to be generated by the product of normal and log-normal processes:

in which ( ϵ 1 ( s ) , ϵ 2 ( s ) ) and ( ω 1 ( s ) , ω 2 ( s ) ) have a joint normal PDF with zero mean.

Practically, ( ϵ 1 ( s ) , ϵ 2 ( s ) ) have a covariance matrix:

where Σ ( s ) = ρ ϵ ( s ) σ 1 ( s ) σ 2 ( s ) [ 71 ].

The covariance matrix of ( ω 1 ( s ) , ω 2 ( s ) ) is denoted by Λ ( s ) and called a “multifractal matrix” [ 71 ]; it is given by:

where Λ ( s ) = ρ ω ( s ) λ 1 ( s ) λ 2 ( s ) and ρ ω ( s ) is the “multifractal correlation coefficient”. The PDFs of ( ϵ 1 ( s ) , ϵ 2 ( s ) ) , and ( ω 1 ( s ) , ω 2 ( s ) ) have the following form:

Therefore, the joint PDF of the fluctuations increment vector ( δ s x 1 , δ s x 2 ) is given by:

It follows from the above definitions of G s ( ln σ 1 ( s ) , ln σ 2 ( s ) ) and F s δ s x 1 σ 1 ( s ) , δ s x 2 σ 2 ( s ) that:

It can be observed that P s ( δ s x 1 , δ s x 2 ) becomes equal to P s ( δ s x 1 ) P s ( δ s x 2 ) when Λ ( s ) and Σ ( s ) tend to zero.

The q -th order moment of fluctuation increments for such two processes at scale s can be written as:

The non-Gaussian parameter λ 2 ( s ) and the joint multifractal coefficient Λ ( s ) at scale s are obtained from the integral form of cascading rules in Equations ( 2 ) and ( 11 ). The best values, for λ 2 ( s ) and Λ ( s ) at scale s , are found from the global minimum of the chi-squared, χ 2 [ 73 , 74 ]:

where P data ( δ s x ) is the joint PDF computed from data, while P theory ( δ s x ; Λ ( s ) , Σ ( s ) ) is the theoretical joint PDF proposed in Equation ( 11 ). By definition, σ data 2 ( δ s x ) and σ theory 2 ( δ s x ; Λ ( s ) , Σ ( s ) ) are the mean standard deviation of P data ( δ s x ) and of P theory ( δ s x ; Λ ( s ) , Σ ( s ) ) , respectively.

The best value of Λ ( s ) for the theoretical joint PDF is obtained from the fit of the joint PDF to the data:

The parameter λ 2 ( s ) is depicted for inflation, λ 1 2 ( s ) , and unemployment, λ 2 2 ( s ) , in Figure 2 . It is seen that λ 1 2 ( s ) is large at all scales, whereas λ 2 2 ( s ) is large at scales smaller than one year. Large values of λ 1 2 ( s ) imply that rare events occurring in the inflation rate make its PDF non-Gaussian. For unemployment, λ 2 2 ( s ) tends to zero at scales larger than one year. This scaling dependency of λ 2 2 ( s ) implies that the occurrence of rare events in unemployment provides a non-Gaussian behavior at short time scales, but, after one year, it tends to a Gaussian state.

λ 2 ( s ) as a measure of the non-Gaussianity for unemployment and inflation index fluctuation distribution and the coefficient Λ ( s ) for the joint distribution, for different time scales “s”.

Concerning the joint multifractal coefficient Λ ( s ) (see Figure 2 ), we observe that it has its highest values for scales lower than one year. Thereafter, Λ ( s ) decreases relatively fast and becomes rather small over the scales over two years. This is compatible with some beliefs about the effect of inflation on the joint relation in the short run and its ineffectiveness in the long run [ 75 ].

Next, to improve our understanding of the behavior of the rare events, we turn to higher moments of the variables’ increments. We calculated the moments for various q orders and various time scales s . Recall that high order moments are much more influenced by the rare events in the tails of the PDF than by small fluctuations.

In Figure 3 , color intensity plots of high q value moments are depicted for different time scales s , for inflation or unemployment cases, i.e., m q ( δ s x ) , from Equation ( 5 ), as well as for the joint distribution. It can be seen that the high moments of the unemployment rates find their largest values for scales below six months. Beyond six months, the moments drop rapidly. In contrast to the unemployment case, the value variation of high moments for the inflation rates is relatively noticeable for all scales.

The color map of the inflation or unemployment moment m q ( δ s x ) (from Equation ( 5 )) and joint moment m q j o i n t ( δ s x 1 , δ s x 2 ) (from Equation ( 14 )), for different values of q and different time scales s .

The right panel in Figure 3 illustrates that the behavior of the joint moment is more similar to the inflation case: a noticeable reduction can be observed for scales above two years. This means that large fluctuations in inflation and unemployment are more strongly coupled above this time interval.

Inflation and unemployment are non-Gaussian series. We know that large events have much more effects on higher moments. The magnitude and intensity of large events in different moments have different effects. Furthermore, since the occurrence of these large events has no specific pattern, we can see a rise and fall in different moments. Therefore, the volatility in the moments is the outcome of these large and unexpected (or rare) events. These rare events could be the effect of political and economic policies.

In the next step, the behavior of the high moments of inflation and unemployment are investigated as time evolved between January 1948 and October 2018. A sliding window of five years was chosen; the moments m q ( δ s x ) were calculated for the one year scale ( s = 1 ). The five year window size was chosen since this window size is considered large enough for calculating a meaningful average in such a problem, as in Equations ( 5 ) and ( 14 ).

Selecting a larger window would flatten the fluctuations, and as a result, the evolution would not be well studied. Moreover, in [ 22 ], it was shown that these three variables have different scaling behaviors below and above the five year scale.

In Figure 4 , we depict the result for this sliding window. It can be seen, from the red bands, that the joint relation sharply grew at critical periods in the modern history of the U.S. economy, i.e., one can pin the volatile postwar period, the stagflation of the 1970s, the period of the Volcker deflationary program, in the 1980s, and the (recent) Great Recession of 2008–2009.

The moments m q ( δ s x ) and m q j o i n t ( δ s x 1 , δ s x 2 ) of order q are estimated at Scale 1 year from 1948 to 2018 for inflation ( left ), unemployment ( middle ), and the pair of variables ( right ).

Moreover, the colors indicate that the inflation rate likely dominates the coupled relation at the post-WWII time; in contrast, the unemployment rate seems to dominate the joint relation in the other historical cases.

4. Conclusions

Inflation and unemployment are dependent variables with non-Gaussian PDFs. The scale and intensity of this dependency and their coupling effects have been much debated. The controversy finds its importance when the government aims to impose an expansionary monetary policy over the economic crises. Many researchers have discussed the relation between inflation and unemployment; recall Phillips [ 1 ], Friedman [ 4 , 5 ], and many others [ 6 , 8 , 9 , 10 , 11 , 12 ].

In our work, we focus on the non-Gaussianity of the PDF for the fluctuations of unemployment, inflation, and their coupling. Under the central limit theorem, one should expect that a small fluctuation has a normal distribution. It is however expected that large and rare changes present non-Gaussianity features. Such changes can occur either through unusual market phenomena, such as bubbles and bursts, or through exogenous shocks imposed by a government.

The Multifractal Random Walk (MRW) is known to be a suitable approach to detect the non-Gaussianity of PDFs, through the variance of the log-normal process, i.e., the parameter λ 2 ( s ) , in Equations ( 3 ) and ( 4 ). Moreover, the Bivariate Multifractal Random Walk (Bi-MRW) method is useful for analyzing two joint non-Gaussian stochastic processes through the corresponding covariance of Λ ( s ) , Equation ( 8 ).

By analyzing 70 years of U.S. data via these techniques, the non-Gaussianity of the PDFs of unemployment and inflation and also that of their joint relation were detected. The non-Gaussianity parameter λ 2 ( s ) of the unemployment rate is smaller than that for the inflation and that for the coupled relation Λ ( s ) . It is observed that for scales larger than one year, the behavior of this λ 2 ( s ) parameter for the unemployment tends toward a “normal state”; on the contrary, for the inflation data, the non-Gaussianity parameter persists for all studied scales. This means that unexpected fluctuations are observed in a wide range of scales in the inflation phenomenon.

According to Mortensen and Pissarides [ 76 ], fluctuations in inflation being larger than the fluctuations in unemployment (we quote) can be attributed to a large extent to differences in policy towards employment protection legislation (which increases the duration of unemployment and reduces the flow into unemployment) and the generosity of the welfare state (which reduces job creation).

Classical economics is interested in long run equilibrium and long run prices. In this school, economists rule out the important role of money value in economic conditions. New Keynesian economics however emphasizes the role of sticky prices. They accept that in the long run, prices are adopted based on the forces in the market. They however claim that if a sudden growth of money value occurs, it takes time for prices to be adjusted to the new values. Therefore, they expect the short-run effects to help policymakers to impose effective stimulation either through a shock in money value or a shock in fiscal stimulation. Interestingly, for policymakers, the non-Gaussianity of the joint relation tends to zero for periods larger than one and up to two years. This means that large and unexpected fluctuations in inflation, either endogenously caused in the market or exogenously imposed by policymakers, have no footprint on the coupling for scales larger than two years. A concrete statement needs further analysis. However, the time window of one to two years might be the time window that divides the short-run and the long-run effects in the market. In other words, for shocks in money volume through the effects of inflation, we observe that the coupling does not inherit such fluctuations in scales above the one to two year time window.

We pointed out that this behavior is further observable in the high-order moments of these (three) variables. Moving the observation window over time, it is discovered that the non-Gaussianities of the parameters λ 2 ( s ) and of their coupling Λ ( s ) substantially grow over the critical (crises) periods of the economy.

In so doing, it seems that we convincingly show that the controversial issue in economics [ 8 , 9 , 10 , 11 , 12 ] about the true relation between unemployment and inflation depends greatly on the considered time scales. This means that policymakers should be flexible and sharply minded, about (their) political horizons, in imposing expansionary monetary policies given boosting production, whence employment, through consumption during and after recessions. Notice that if one still accepts Mortensen and Pissarides’s claims [ 76 ], one should wonder whether similar policies should be implemented in Europe and the USA, as well as in other countries. Indeed, if large fluctuations in inflation with respect to unemployment may be ascribed to different degrees of employment protection and the generosity of the welfare state, then this argument may fit quite well some European stories, as compared to the U.S. economy, but one could still argue that this is less convincing in interpreting the joint dynamics of the two variables in the Unites States.

Abbreviations

The following abbreviations are used in this manuscript:

| MRW | Multifractal Random Walk |

| Probability Density Function | |

| Bi-MRW | Bivariate Multifractal Random Walk |

Author Contributions

Conceptualization, Z.K.L., A.N., A.H., G.J. and M.A.; methodology, Z.K.L., A.N., A.H., G.J. and M.A.; software, Z.K.L., A.N., A.H., G.J. and M.A.; validation, Z.K.L., A.N., A.H., G.J. and M.A.; formal analysis, Z.K.L., A.N., A.H., G.J. and M.A.; investigation, Z.K.L., A.N., A.H., G.J. and M.A.; resources, Z.K.L., A.N., A.H., G.J. and M.A.; data curation, Z.K.L., A.N., A.H., G.J. and M.A.; writing–original draft preparation, Z.K.L., A.N., A.H., G.J. and M.A.; writing–review and editing, Z.K.L., A.N., A.H., G.J. and M.A.; visualization, Z.K.L., A.N., A.H., G.J. and M.A.; supervision, Z.K.L., A.N., A.H., G.J. and M.A.; project administration, Z.K.L., A.N., A.H., G.J. and M.A.; funding acquisition, Z.K.L., A.N., A.H., G.J. and M.A., All authors have read and agreed to the published version of the manuscript.

This research received no external funding.

Conflicts of Interest

The authors declare no competing interests.

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Advertisement

Impact of corruption, unemployment and inflation on economic growth evidence from developing countries

- Published: 09 August 2022

- Volume 57 , pages 2759–2779, ( 2023 )

Cite this article

- Ijaz Uddin ORCID: orcid.org/0000-0002-7231-109X 1 , 2 &

- Khalil Ur Rahman 3

2718 Accesses

20 Citations

1 Altmetric

Explore all metrics

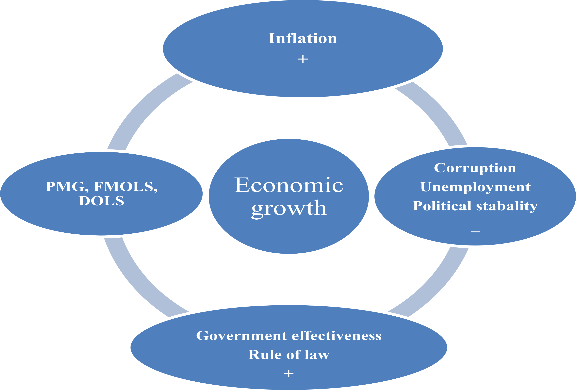

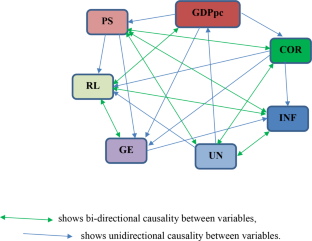

The main objective of this empirical study to examine the impact of corruption, unemployment and inflation on economic growth for seventy nine (79) developing countries of the world for the period from 2002 to 2018. This study uses Panel unit root tests (PUT), Pooled Mean Group (PMG), Fully modified ordinary least square (FMOLS), and Dynamic least square (DOLS), for the data estimation. The estimates of PUT reveal that all the variables are mixed order of integration. The PMG, FMOLS and DOLS estimates reveal that corruption, unemployment and political stability have negative effect on GDP per capita, while Inflation, governance effectiveness and rule of law have positive effect on GDP per capita. This empirical study has some policy implication for government and policy makers.

Graphical Abstract

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Global Evidence on the Impact of Globalization, Governance, and Financial Development on Economic Growth

Underlying the Relationship Between Governance and Economic Growth in Developed Countries

Governance and economic growth: evidence from 14 latin america and caribbean countries.

A.C.Pigou, „The Theory of Unemployment‟, Macmillan, London . (1993)

Abed, G.T., Davoodi, H.R.: Corruption. Structural Reforms, and Economic Performance in the Transtition Economies. (2002)

Adaman, F., Çarkoğlu, A., Şenatalar, B.: Causes of corruption in Turkey through the eyes of household and recommendations on the prevention of corruption. (2001)

Adaramola, A.O., Dada, O.: Impact of inflation on economic growth: evidence from Nigeria. Invest. Manage. Financial Innovations. 17 (2), 1–13 (2020)

Google Scholar

Agbu, O.: Corruption and human trafficking: The Nigerian case. West Afr. Rev. 4 (1), 1–13 (2001)

Aghion, P., Howitt, P.: Growth and unemployment. Rev. Econ. Stud. 61 (3), 477–494 (1994)

Ahmad, S., Mortaza, M.G.: Inflation and economic growth in Bangladesh: 1981–2005 (No. id: 3033). (2010)

Akçay, S.: Economic Analysis of Corruption in Developing Countries. Unpublished PhD. Thesis, Afyon Kocatepe University, Instıtute of Socıal Scıences, Afyon . (2001)

Al Qudah, A.M.H.: The Impact of Corruption on Economic Development-the Case of Jordan. University of Newcastle (2009)

Ali, A.M., Isse, H.S.: Determinants of economic corruption: A cross-country comparison. Cato J. 22 , 449 (2003)

Ali, A., Zulfiqar, K.:An assessment of association between natural resources agglomeration and unemployment in Pakistan. (2018)

Aliyu, S.U.R., Elijah, A.O.: Corruption and economic growth in Nigeria: 1986–2007. (2017)

Alrayes, S.E., Wadi, R.M.A.: Determinants of unemployment in Bahrain. Int. J. Bus. Social Sci. 9 (12), 64–74 (2018)

Anoruo, E., Braha, H.: Corruption and economic growth: the African experience. J. Sustainable Dev. Afr. 7 (1), 43–55 (2003)

Anwer, M.S., Sampath, R.K.: Investment and economic growth (No. 1840-2016-152256). (1999)

Awan, R.U., Akhtar, T., Rahim, S., Sher, F., Cheema, A.R.: Governance, corruption and economic growth: A panel data analysis of selected SAARC countries. Pak. Econ. Soc. Rev. 56 (1), 1–20 (2018)

Aydin, C.: The inflation-growth nexus: A dynamic panel threshold analysis for D-8 countries. Romanian J. Economic Forecast. 20 (4), 134–151 (2017)

Azeng, T.F., Yogo, T.U.: Youth unemployment and political instability in selected developing countries. African Development Bank, Tunis, Tunisia (2013)

Bakare, A.S.: The crowding-out effects of corruption in Nigeria: An empirical study. J. Bus. Manage. Econ. 2 (2), 059–068 (2011)

Banda, H., Ngirande, H., Hogwe, F.: The impact of economic growth on unemployment in South Africa: 1994–2012. Invest. Manage. Financial Innovations. 13 (contin1), 246–255 (2016)

Bardhan, P.: Corruption and development: a review of issues. J. Econ. Lit. 35 (3), 1320–1346 (1997)

Barro, R.J.: Inflation and economic growth. (1995)

Becherair, A., Tahtane, M.: The causality between corruption and human development in MENA countries: A panel data analysis. East-West Journal of Economics and Business , 20 (2).\ (2017)

Ben, E.U., Udo, E.S., Abner, I.P., Ibekwe, U.J.: The effect of corruption on economic sustainability and growth in Nigeria. Int. J. Econ. Commer. Manage. 6 (4), 657–669 (2018)

Calişkan, N., Kadiu, F.A.T.B.A.R.D.H.A.: Corruption and Economic Development in Albania. Interdisciplinary J. Res. Dev. 2 (1), 76 (2015)

Cheema, A.R., Atta, A.: Economic determinants of unemployment in Pakistan: Co-integration analysis.International journal of business and social science, 5 (3). (2014)

De Gregorio, J.: Inflation, growth, and central banks: theory and evidence, vol. 1575. World Bank Publications (1994)

Dike, V.E.: Corruption in Nigeria: A new paradigm for effective control. Afr. economic Anal. 24 (08), 1–22 (2005)

Dinh, D.V.: Impulse response of inflation to economic growth dynamics: VAR model analysis. J. Asian Finance Econ. Bus. 7 (9), 219–228 (2020)

Duhu, I.G.: Democratic Stability in Mitigating the Impact of Corruption on Economic Growth in Nigeria. (2019)

Dumitrescu, E.I., Hurlin, C.: Testing for Granger non-causality in heterogeneous panels. Econ. Model. 29 (4), 1450–1460 (2012)

Durguti, E.A.: How Does the Budget Deficit Affect Inflation Rate–Evidence from Western Balkans Countries. Int. J. Finance Bank. Stud. 9 (2147–4486), 01–10 (2020)

Dzhumashev, R.: Corruption and growth: The role of governance, public spending, and economic development. Econ. Model. 37 , 202–215 (2014)

Egunjobi, T.A.: An econometric analysis of the impact of corruption on economic growth in Nigeria. (2013)

Ehrlich, I., Lui, F.T.: Bureaucratic corruption and endogenous economic growth. J. Polit. Econ. 107 (S6), S270–S293 (1999)

Fischer, S., Modigliani, F.: Towards an understanding of the real effects and costs of inflation. Rev. World Econ. 114 (4), 810–833 (1978)

Gokal, V., Hanif, S.: Relationship between inflation and economic growth, vol. 4. Economics Department, Reserve Bank of Fiji, Suva (2004)

Grabova, P.: Corruption impact on Economic Growth: An empirical analysis. J. Economic Dev. Manage. IT Finance Mark. 6 (2), 57 (2014)

Gyang, E.J., Anzaku, E., Iyakwari, A.D.B., Eze, F.: An Analysis of the Relationship Between Unemployment, Inflation and Economic Growth in Nigeria: 1986–2015. (2018)

Haider, A., ud Din, M., Ghani, E.: Consequences of political instability, governance and bureaucratic corruption on inflation and growth: The case of Pakistan.The Pakistan Development Review,773–807. (2011)

Herbener, J.M.: The Fallacy of the Phillips Curve”. Dissent on Keynes: A Critical Appraisal of Keynesian Economics. New York: Praeger (2011)

Huang, Q.G., Wang, K., Wang, S.: Inflation model constraints from data released in 2015. Phys. Rev. D. 93 (10), 103516 (2016)

Hussain, S., Malik, S.: Inflation and economic growth: Evidence from Pakistan. Int. J. Econ. Finance. 3 (5), 262–276 (2011)

Ibrahim, W., Sheu, O.A.: Corruption and economic growth in Nigeria (1980–2013). Artha J. Social Sci. 14 (4), 1–17 (2015)

Im, K.S., Pesaran, M.H., Shin, Y.: Testing for unit roots in heterogeneous panels. J. Econ. 115 (1), 53–74 (2003)

Imran, M., Mughal, K.S., Salman, A., Makarevic, N.: Unemployment and economic growth of developing Asian countries: A panel data analysis.European Journal of Economic Studies, (3),147–160. (2015)

Jain, A.K.: Corruption: A review. J. economic Surv. 15 (1), 71–121 (2001)

Johansen, S.: Statistical analysis of cointegration vectors. J. economic dynamics control. 12 (2–3), 231–254 (1988)

Karki, S., Banjara, S., Dumre, A.: A review on impact of inflation on economic growth in Nepal. Archives of Agriculture and Environmental Science. 5 (4), 576–582 (2020)

Kayode, A., Arome, A., Silas, A.: The rising rate of unemployment in Nigeria: the socio-economic and political implications.Global Business and Economics Research Journal, 3 (1). (2014)

Levin, A., Lin, C.F., Chu, C.S.J.: Unit root tests in panel data: asymptotic and finite-sample properties. J. Econ. 108 (1), 1–24 (2002)

Lin, J.Y.: Development strategies for inclusive growth in developing Asia. Asian Dev. Rev. 21 (2), 1–27 (2004)

Lipset, S.M., Lenz, G.S.: Corruption, culture, and markets. Cult. matters: How values shape Hum. progress. 112 , 112 (2000)

Lipsey, R.G.: The relation between unemployment and the rate of change of money wage rates in the United Kingdom, 1862–1957: a further analysis.Economica,1–31. (1960)

Malla, S.: Inflation and economic growth: Evidence from a growth equation. Department of Economics, University of Hawaiâ™ I at Monoa, Honoulu, USA . (1997)

Mallik, G., Chowdhury, A.: Inflation and economic growth: evidence from four south Asian countries. Asia-Pac. Dev. J. 8 (1), 123–135 (2001)

Mauro, M.P.: The Effects of Corruptionon Growth, Investment, and Government Expenditure. International Monetary Fund (1996)

Mauro, P.: Corruption and growth. Q. J. Econ. 110 (3), 681–712 (1995)

Mo, P.H.: Corruption and economic growth. J. Comp. Econ. 29 (1), 66–79 (2001)

Mubarik, Y.A., Riazuddin, R.: Inflation and growth: An estimate of the threshold level of inflation in Pakistan. State Bank of Pakistan, Karachi (2005)

Mundell, R.A.: Growth, stability, and inflationary finance. J. Polit. Econ. 73 (2), 97–109 (1965)

Murphy, K.M., Shleifer, A., Vishny, R.W.: Why is rent-seeking so costly to growth? Am. Econ. Rev. 83 (2), 409–414 (1993)

Omenka, I.J.: The effect of corruption on development in Nigeria. IOSR J. Humanit. Social Sci. 15 (6), 39–44 (2013)

Patton, M.: Government Corruption and Economic Growth: The 21 Least Corrupt Nations. (2012)

Perotti, R.: Growth, income distribution, and democracy: What the data say. J. Econ. Growth. 1 (2), 149–187 (1996)

Pesaran, M.H., Shin, Y.: An autoregressive distributed lag modelling approach to cointegration analysis. (1995)

Pesaran, M.H., Shin, Y., Smith, J.R.: Bond testing approach to the analysis of long run relationship. J. Am. Stat. Assoc. 94 , 621–634 (1999)

Pesaran, M.H., Shin, Y., Smith, R.J.: Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 16 (3), 289–326 (2001)

Peterson, E.W.F.: Is economic inequality really a problem? A review of the arguments. Social Sci. 6 (4), 147 (2017)

Phillips, P.C., Hansen, B.E.: Statistical inference in instrumental variables regression with I (1) processes. Rev. Econ. Stud. 57 (1), 99–125 (1990)

Popova, Y., Podolyakina, N.: Pervasive impact of corruption on social system and economic growth. Procedia-Social and Behavioral Sciences. 110 , 727–737 (2014)

Prachowny, M.F.: Okun’s law: theoretical foundations and revised estimates.The review of Economics and Statistics,331–336. (1993)

Rivera, J.P.R., Tullao, T.S. Jr.: Investigating the link between remittances and inflation: evidence from the Philippines. South. East. Asia Research. 28 (3), 301–326 (2020)

Saad, M., Uddin, I.: The impact of unemployment, money supply, financial development, FDI, population growth, and inflation on Economic growth of Pakistan. Meritorious Journal of Social Sciences and Management (E-ISSN# 2788–4589| P-ISSN# 2788–4570) , 4 (3), 1–17. (2021)

Samadi, A.H., Farahmandpour, B.: The effect of income inequality on corruption in selected countries (1995–2007). J. Emerg. Issues Econ. Finance Bank. 1 (3), 214–231 (2013)

Samuelson, P.A., Solow, R.M.: Analytical aspects of anti-inflation policy. Am. Econ. Rev. 50 (2), 177–194 (1960)

Shahid, M.: Effect of inflation and unemployment on economic growth in Pakistan. J. Econ. sustainable Dev. 5 (15), 103–106 (2014)

Mallik, G., & Chowdhury, A. (2001). Inflation and economic growth: evidence from four south Asian countries. Asia-Pacific Development Journal, 8(1), 123-135.

Strobl, E., Byrne, D.M.: Defining unemployment in developing countries: evidence from Trinidad and Tobago. Available at SSRN 372465 . (2002)

Šumah, Å., Mahić, E.:Impact On The Perception Oc Corruption. (2015)

Swedberg, R.: The doctrine of economic neutrality of the IMF and the World Bank. J. Peace Res. 23 (4), 377–390 (1986)

Sweidan, O.D.: Does inflation harm economic growth in Jordan? An econometric analysis for the period 1970–2000. Int. J. Appl. Econometrics Quant. Stud. 1 (2), 41–66 (2004)

Tanzi, V., Davoodi, H.: Corruption, growth, and public finances. political Econ. corruption. 2 , 89–110 (2001)

Tobin, J.: Money and economic growth.Econometrica: Journal of the Econometric Society,671–684. (1965)

Uddin, I.: Impact of inflation on economic growth in Pakistan.Economic Consultant, 34 (2). (2021)

Viner, J.: Mr. Keynes on the causes of unemployment (1936)

Download references

Author information

Authors and affiliations.

Visiting Lecturer, Department of economics, Government AFzal Khan LaLa Postgraduate college Matta Swat, Pakistan, Matta

PhD Scholar School of Economics,, Abdul Wali khan university Mardan, 23200, Mardan KPK, Pakistan

Master Student, Department of economics, Government AFzal Khan LaLa Postgraduate college Matta Swat, 19040, Matta, Pakistan

Khalil Ur Rahman

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Ijaz Uddin .

Additional information

Publisher’s note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

List of sample countries .

Countries | Countries | Countries | Countries |

|---|---|---|---|

Albania | Chad | Iran | Oman |

Algeria | Chile | Jamaica | Pakistan |

Angola | China | Jordan | Papua New Guinea |

Armenia | Colombia | Kenya | Paraguay |

Azerbaijan | Costa Rica | Libya | Peru |

Bahrain | Croatia | Malawi | Poland |

Bangladesh | Dominican Rep | Malaysia | Rwanda |

Barbados | Ecuador | Mali | Saudi Arabia |

Belarus | El Salvador | Mauritius | South Africa |

Benin | Gabon | Mexico | Sri Lanka |

Bhutan | Georgia | Moldova | Tanzania |

Bolivia | Ghana | Mongolia | Thailand |

Bosnia/Herzegovina | Guatemala | Morocco | Trinidad and Tobago |

Botswana | Guinea | Mozambique | Tunisia |

Brazil | Guyana | Myanmar | Turkey |

Bulgaria | Haiti | Namibia | Uganda |

Burkina Faso | Honduras | Nepal | Ukraine |

Burundi | Hungary | Nicaragua | Uruguay |

Cambodia | India | Niger | Zambia |

Cameroon | Indonesia | Nigeria |

Rights and permissions

Reprints and permissions

About this article

Uddin, I., Rahman, K.U. Impact of corruption, unemployment and inflation on economic growth evidence from developing countries. Qual Quant 57 , 2759–2779 (2023). https://doi.org/10.1007/s11135-022-01481-y

Download citation

Received : 03 October 2021

Revised : 09 June 2022

Accepted : 18 June 2022

Published : 09 August 2022

Issue Date : June 2023

DOI : https://doi.org/10.1007/s11135-022-01481-y

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Unemployment

- Economic growth

- Developing countries

- Find a journal

- Publish with us

- Track your research

Pardon Our Interruption

As you were browsing something about your browser made us think you were a bot. There are a few reasons this might happen:

- You've disabled JavaScript in your web browser.

- You're a power user moving through this website with super-human speed.

- You've disabled cookies in your web browser.

- A third-party browser plugin, such as Ghostery or NoScript, is preventing JavaScript from running. Additional information is available in this support article .

To regain access, please make sure that cookies and JavaScript are enabled before reloading the page.

The impact of Fintech on inflation and unemployment: the case of Asia

Arab Gulf Journal of Scientific Research

ISSN : 1985-9899

Article publication date: 28 March 2023

Issue publication date: 5 January 2024

This study attempts to explain the impact of Fintech on the Asian economies through two main indicators, inflation and unemployment over the period 2011-2014-2017.

Design/methodology/approach

This study uses panel data regression models to explain the relationship between Fintech, inflation as an indicator of currency circulation and unemployment since Fintech has disrupted the labor market.

Empirical results show a consistently strong and positive relationship between the development of financial technologies and the reduction of inflation and unemployment unless these technologies are actively used. Digital finance has become a new driver of economic development. Therefore, governors should not only improve their economies but also expand their information and communication technologies to develop their digital infrastructure, especially for businesses.

Originality/value

The present study contributes to the existing literature on the impact of disruptive digital innovation on the socioeconomic development of emerging countries. The empirical evidence highlights the importance of distinguishing between active and passive uses of Fintech in order to anticipate its economic impact.

- Unemployment

Ben Romdhane, Y. , Kammoun, S. and Loukil, S. (2024), "The impact of Fintech on inflation and unemployment: the case of Asia", Arab Gulf Journal of Scientific Research , Vol. 42 No. 1, pp. 161-181. https://doi.org/10.1108/AGJSR-08-2022-0146

Emerald Publishing Limited

Copyright © 2023, Youssra Ben Romdhane, Souhaila Kammoun and Sahar Loukil

Published in Arab Gulf Journal of Scientific Research . Published by Emerald Publishing Limited. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this licence may be seen at http://creativecommons.org/licences/by/4.0/legalcode

Introduction

Digitization is ranked among the main engines of economic development in the countries ( Gonzalez Fernandez, González, & Fanjul-Suárez Velasc, 2020 ). Several researchers have studied the impact of technology on the economies of countries, such as Jagtiani (2018) , Kammoun, Loukil, and Ben Romdhane (2020) , Ben Romdhane, Loukil, and Kammoun (2020) , Ben Romdhane Loukil, Loukil, and Kammoun (2021) , Loukil, Ben Romdhane, Kammoun, and Ibenrissoul (2019) . However, other studies focused their research on Fintech, ( Haddad & Hornuf, 2019 ). Fundamentally, Fintech is using technology to provide new and improved financial services. These new financial technologies (Fintech) have burst into the world. The academic literature on Fintech has developed considerably recently but is generally not linked to a coherent research program. Significant gaps and important questions remain. Much remains to be done before this area becomes an established academic discipline. This paper suggests studying the impact of Fintechs in the context of Asian countries since Asia is well ahead in the adoption of Fintechs services compared to Europe or North America. From 2008 to 2013, investments in Fintech startups in venture capital have increased fourfold. The growing number of new Fintech startups created following the 2008 crisis and their ability to integrate disruptive technologies and offer innovative services in niche segments have attracted venture capital funds. Particularly, Japan has a penetration rate of 69% in terms of online buyer and in China 15.9% of retail sales are made online. Since 2014, Alibaba’s interest in the region has grown steadily. In July 2014, Alibaba acquired a 10.32% stake in Sing-Post (a national postal service provider in Singapore) for $220 m, followed in April 2016 by the acquisition of a controlling interest in Lazada (e-commerce platform in Southeast Asia) for a billion dollars.” This article proposes coherent research themes based on a critical evaluation of the existing literature. Our empirical study is the first to highlight the importance of distinguishing between active and passive use of Fintech to anticipate its socioeconomic impact. It contributes to the existing literature on the impact of disruptive digital innovation on the socioeconomic development of emerging countries, more precisely, the empirical study.

Empirical evidence points to the importance of distinguishing between active and passive uses of Fintech in order to anticipate its economic impact. We prove that without actively making digital transactions, we cannot get up to Fintech’s advantage in terms of inflation and unemployment reduction. It would be necessary for governments to promote phone use, internet expansion and, most importantly, encourage people to engage in digital transactions actively. In other words, supporting double-sense transactions ensures adherence to the economic cycle. In addition, today’s technology does not involve the replacement of humans with machines in the job market. That is why industry experts believe that the analysis will likely improve human capabilities if current technological developments require employees to have new skills. So, we can conclude that if machines and humans worked together, the results would be better. In brief, Fintech has disrupted the labor market, not only by destroying some jobs or creating new job opportunities, but also by transforming work tasks. In a global socioeconomic context characterized, among other things, by the innovation of new ways of regulating the labor market and the persistence of unemployment, a number of questions arise which give rise to in-depth reflection on the future of employment. The empirical research developed in this article draws several political conclusions and recommendations.

The remainder of the paper is structured as follows. The second section describes the literature review. The third section explains the empirical methodology and data set used to test the relationship between Fintech, inflation and unemployment. Section 3 presents and discusses the estimated results. The policy conclusions and implications are shown in the last section.

Theoretical framework

In an economic and financial sphere marked by great upheaval, inflation control and employment management are proving to be extremely delicate and practically complex exercises. Economic theory and previous empirical studies have identified the causes of inflation and the determinants of unemployment.

The study of the causes of inflation remains an important macroeconomic issue for researchers and policymakers. Indeed, understanding the internal and external factors that influence inflation will help policymakers develop strategies to contain inflation and ensure price stability. However, while the theoretical and empirical literature on the causes of inflation has focused on a number of factors, it has shown inconclusive results. From a theoretical point of view, two main schools of thought, namely Keynesian and monetarist, or neoclassical, thought, have addressed the issue. The monetarists developed the concept of inflation through money. According to monetarists, inflation is caused by an increase in the money supply that is more than proportional to the increase in the production of goods and services ( Barro, 1997 ). Keynesians distinguish between demand-side and cost-side inflation. Demand-pull inflation occurs when aggregate demand for goods and services increases while aggregate supply remains constant or unchanged. The increase in demand may be due to an increase in government spending, household consumption expenditures or additional income coming into the country, such as a trade surplus or capital inflow. Cost-push inflation is caused by rising production costs, such as labor costs (wages) or raw material costs. According to other researchers, inflation can also be caused by the structures of the economic system, such as the malfunctioning of markets or the behavior of actors. With regard to the causes of unemployment, the literature has focused on variables such as active labor market programs, employment protection legislation (EPL), unemployment benefits and the tax wedge. However, these studies differ in several respects. The inclusion of macroeconomic variables in different ways is at the root of these differences. In the work of Belot and Van Ours (2001) only inflation was used as a control variable. In contrast, Nicoletti and Scarpetta (2002) used the output gap as a control variable. In a context of macroeconomic instability, several variables are added to the models in addition to the real interest rate and labor productivity. On the one hand, some microeconomic studies examining different types of labor market programs have indicated that the impact on unemployment varies with the type of program. On the other hand, in the macroeconomic context, some empirical studies have found that interest rates have significant effects on unemployment.

In recent decades, there has been a global trend towards digitization, particularly in Asia, as this technological revolution is solving financial sector problems and improving macroeconomic aggregates ( AFD, 2019 ). Digitalization has played a major role in ensuring the competitiveness of firms and nations. Recently, several researchers have studied the effects of the technological revolution on financial markets and the macroeconomic environment in Asian countries. In this context, Accenture (2016) found that global investment in new technologies in Asia is at 62%. Among the technologies in demand are Fintechs. They are a combination of finance and technology. There are four types of Fintech in the country: mobile payment services, mobile cash transfer services, mobile money transfer services abroad and lending services. Barjot (2018) found that Fintech is essential to the development and creation of innovative applications and new business and financial products. This technology attracts new consumers who prefer to use smartphones or debit or credit cards to conduct financial transactions remotely ( Ben Romdhane Loukil et al ., 2021 ). In addition, Truong (2016) found that Fintech is involved in value creation in the world as consumers can use financial services via social media and the internet rather than traditional types of transactions.

The motivation for this research stems from a growing number of empirical studies examining the relationship between Fintech and macroeconomic aggregates. However, the study of the effect of digitalization on inflation and employment remains to be determined. To the best of our knowledge, our study is the first to offer a theoretical and practical explanation that chooses Fintech as an endogenous variable to know the nature of the relationship between this new technology, inflation and unemployment in the Asian region. We chose the Asian region because it is characterized by technological production like China.

The main objective is to explain the relationship between Fintech and inflation and unemployment. We performed econometric modeling based on data from 17 Asian countries to measure this relationship using linear regression in the least-squares sense. Alexander Aitken first described the generalized least squares (GLS) technique in 1934 ( Aitken, 1936 ). We find that Fintech improves economic development unless we talk about the active use of financial products. Using a behavioral perspective, we contribute to reviewing the current literature on the impact of disruptive digital innovation on the socioeconomic development of emerging countries. Therefore, we do not actively trade digitally; we take advantage of the benefits of Fintech in terms of inflation and reduced unemployment. In doing so, we try to bridge the gap between thoroughness and relevance in our quest to understand Fintech and suggest some practical implications for Fintech practitioners.

In Asia, the participation of information and communication technologies in gross domestic product (GDP) has increased much faster than economic growth, as shown by Iwasaki (2018) . Nowadays, the technological revolution is analyzed in articles where we can measure the progress of this sector in the world, Jaewoo and Woonsun (2014) , Rezaeian, Hamid, and Roel (2017) , Chen, Zhang, Zhu, and Lu (2017) and Loukil et al . (2019) . Asia is a wealthy region of advanced countries in the technology sector, like China and Malaysia. Among the technological services used, Fintech has excellent added value for the development of countries in general and, particularly, for the financial markets and the economic environment. Fintech combines the terms “finance” and “technology”; it indicates an innovative start-up that uses technology to rethink financial and banking services. Following the economic crisis of 2008, many bankers and traders left the major financial centers of the planet. They are embarking on entrepreneurial adventures to rethink the financial model through technological innovation. Crowdfunding activities, mobile apps and platforms, crypto-currencies and electronic payments are all examples of Fintechs.

That being said, it’s worth noting that the study of the economic impact of technologies has received considerable attention in the existing literature. In contrast, little theoretical and empirical work has been done on the economic impact of fintechs. This section depicts the history of Fintech and its emergence in Asia and provides an overview of the relationship between Fintech, inflation and unemployment. The main empirical findings on the link between the three concepts are also presented.

Relationship between fintech and inflation

A thorough review of the existing literature on the main determinants of inflation reveals the demand and supply-side determinants of inflation. These include economic growth ( Bruno & Easterly, 1998 ; Pollin & Zhu, 2005 ; Eftekhari Mahabadi & Kiaee, 2015 ; Nigusse et al ., 2019 ), money supply ( Mohanty & Klau, 2001 ; Kandil & Morsy, 2009 ), wage levels as well as factors such as import prices and oil prices ( Mohanty & Klau, 2001 ; Eftekhari Mahabadi & Kiaee, 2015 ), government expenditure, exchange rates ( Mohanty & Klau, 2001 ; Kandil & Morsy, 2009 ; Eftekhari Mahabadi & Kiaee, 2015 ). In addition to the traditional main determinants of inflation, some researchers studied the impact of Fintech on inflation. Kammoun et al. (2020) analyzed the effect of Fintech on economic performance in the context of the political instability of the middle east and north africa (MENA) zone for three years (2011, 2014, and 2017). Empirical results show that FinTech’s lending activities increase inflation. According to Xiang, Huang, and Cheng (2019) , FinTech significantly affects a country’s inflation since it directly influences consumer choice, especially in China and Malaysia. This is due to the ease of transactions, online chat, checking the balance of their account and funds transfers ( Taherdoost, 2018 ). The potential impact of mobile money on inflation has been addressed for the first time by Simpasa and Gurara (2012) . They argue that the increase in monetary speed could spread inflation, thus complicating the implementation of monetary policy. Some empirical studies confirm these results.

Moreover, Agarwal (2014) confirmed in his study that Bitcoin could reduce governments’ costs of generating income with inflation. These technologies can create a balance in which a digital currency has a positive value. After the financial crisis, several business bankers lost their jobs and have sought new positions to remain competitive in their fields through the innovation of software applications and innovative products. These results are confirmed by the study of Mumtaz and Zachary (2020) . Narayan and Sahminan (2018) studied the impact of FinTech on the Indonesian exchange rate (rupee against the United States (US) dollar) and the inflation rate. Empirical results show that FinTech can reduce inflation and appreciate the rupee against the US dollar. Jagtiani (2018) examined the impact of the Fintech lending platform and consumer credit access based on lending club account-level data and Y-14M data reported by US banks with assets of over $50 bn. They found that lending club’s consumer lending activities have penetrated areas that may be underserved by traditional banks, such as in highly concentrated markets and areas with fewer bank branches per capita. They concluded the share of Lending Club loans is increasing in areas where the local economy is not functioning well.

Digital platforms are redesigning relationships between customers, workers and employers due to the practice of purchasing grocery products online in search of a partner on a dating site. As a growing number of people worldwide participate in the digital economy, we should carefully consider the relationship between Fintech and unemployment.

Relationship between fintech and unemployment

In the literature, studies of the determinants of unemployment generally include variables such as unemployment benefits, EPL and unionization rates. However, these studies show differences in various aspects. The use of macroeconomic variables in different ways is at the root of these differences. In the study by Nicoletti and Scarpetta (2002) , the output gap was used as a control variable. In addition, macroeconomic shocks are included in the models with variables of real interest rate, inflation, foreign investment and economic growth ( Nickell, 1997 ). Recently, some researchers have taken advantage of innovation by studying the effect of new technologies such as Fintech on unemployment.

The decline in employment in existing banks could be significant. This is shown in the study by Fong (2017) , who noted that more than 1.8 m workers in US and European banks could lose their jobs after ten years. On the one hand, Fintech services significantly and negatively affect employment worldwide and in Asia ( Thiel & Masters, 2014 ). They found that the efficiency gains of artificial intelligence and robotics would lead to more than 1 million job losses in Europe. This leads to social tensions by increasing the asymmetry of the income distribution. On the other hand, there are positive effects on firms where technological advances increase their competitiveness, income and employment.

The IMF (2018) noted that significant job disappearances and transformations are likely to be seen across all sectors and levels, including in categories that we thought were sheltered so far. In addition, they confirmed that automation and the increasing use of robots had had an overall positive effect on domestic employment and income growth. Based on data from Japanese prefectures, Acemoglu and Restrepo (2017) confirmed that the increasing density of robots in the manufacturing sector is linked to higher productivity, employment and wages at the local level. In contrast, Morikawa (2014) shows that the quality of services is deteriorating in Japan due to labor shortages. He noted that the sectors most severely affected are parcel delivery services, hospitals, restaurants, elementary and college schools, convenience stores and utilities.

Based on the above developments, this study seeks to answer the following question: what is the role of Fintech in developing Asian countries, given their macroeconomic aggregates and political instability?

Data and methodology

Several motivations are behind our action research. First, Fintech emerges as a value driver through digital innovation with new types of financial services. In this sense, several researchers argue that financial technologies are living organisms, given that this domain is by nature flexible, changing and not stable. Moreover, these Fintechs have the potential to carry out structural changes, modify some aspects of the system under investigation, and transform business models. Finally, Fintech is not a clearly understood notion by academia and the media. Despite the extensive research on digital technologies in financial services, only a few academic researchers have investigated the Fintech industry and its impact on the Asian economy.

The empirical investigation aims at testing the validity of the assumption of the positive role of digital transformation in the financial sector for the relationship between Fintech and economic development, approximated by inflation and unemployment. We also test the impact of traditional determinants of both economic indicators side to side to Fintech measures. We start with a descriptive analysis to better understand the state of the art in Fintech inclusion in Asia. Then, we test the potential impact of Fintech and traditional determinants on economic indicators such as inflation and the unemployment rate. We use general least square regression to anticipate the proxies’ coefficients. We approximate Fintech through mobile money, the use of the internet to make digital transactions and payments, making digital payment and making or receiving digital payment. On the other hand, we approximate degree of financial inclusion through the banking system by the variable bank account, credit card and debit card ownership. We also estimate social welfare using the unemployment rate and consumer price index. Finally, to assess the effect of economic indicators, we include other control variables such as exchange rate, interest rates, human capital index, GDP growth, FDI, gross fixed capital formation and broad money.

Empirical model

Because Fintech is considered a new and fast-growing financial service, there is a lack of understanding studies in this domain due to new and emerging phenomena. In our research, we intend to examine the potential impact of Fintech on economic development. We preciously study the two most common indicators: unemployment measured by the annual rate of unemployment and inflation measured by the annual price index of consumption. To deal with it, we gathered data on 17 Asian countries from the 2017 Global Findex data during 2011–2014–2017 using GLS. This method of linear regression is a generalization of the ordinary least squares (OLS) estimator. It deals with non-BLUE (best linear unbiased estimator) estimators (one of the main assumptions of the Gauss-Markov theorem). It is the case when homoskedasticity and the absence of serial correlation hypotheses are violated. In such situations, the GLS estimator is BLUE. Specifically, GLS models allow us to completely remove the spatial correlation of residuals ( Mediero & Kjeldsen, 2014 ). The GLS regression procedure accounts for differences in available record lengths and spatial correlation in concurrent events by using an estimator of the sampling covariance matrix ( Griffis & Stedinger, 2007 ). They proved that the GLS model is more appropriate than the OLS analysis. Thus, the GLS model is adapted to our estimation.

The GLS method is to minimize the sum of the random squares. The GLS estimator remains one of the most frequently used. It has many uses, and more precisely in the description of the data. They show which variables best reflect the variability of a variable of interest.

Table 1 reports the variable indications and measurements used in this study (see Table 1 below).

In Table 2 , we present variable descriptions by analyzing some statistical indicators (mean, standard deviation, minimum and maximum).

A global survey from 2007 to 2017 shows that, on average, the unemployment rate is about 5.39%, slightly lower than the world average (5.9% in 2011, 2014 and 2017) (see en.statista.com ). But we notice the high standard deviation, reflecting the remarkable dispersion of the statistical sample values. The following figure shows that Cambodia records the highest unemployment rate in Asia with a percentage of 8.34%, while Nepal presents the lowest rate with a rate of 1% in 2017. Generally, big and smaller cities suffer from the same expected trend of the scarcity of reasonable jobs. The global recession hitting nearly every country due to growing political instability is behind the challenge of unsustainable employment. Concerning other countries, and according to the 2017 Global Least & Most Stressful Cities Ranking report, the unemployment rate is about 4.81% in the Bangladesh capital. According to some researchers, this rate is explained by the scarcity of skills and education (see Figure 1 ).