5 questions about Grab’s epic SPAC investor deck

As expected, Southeast Asian superapp Grab is going public via a SPAC.

The combination, which TechCrunch discussed over the weekend , will value Grab on an equity basis at $39.6 billion and will provide around $4.5 billion in cash, $4 billion of which will come in the form of a private investment in public equity, or PIPE. Altimeter Capital is putting up $750 million in the PIPE — fitting, as Grab is merging with one of Altimeter’s SPACs.

Grab, which provides ride-hailing, payments and food delivery, will trade under the ticker symbol “GRAB” on Nasdaq when the deal closes. The announcement comes a day after Uber told its investors it was seeing recovery in certain transactions, including ride-hailing and delivery.

Uber also told the investing public that it’s still on track to reach adjusted EBITDA profitability in Q4 2021. The American ride-hailing giant did a surprising amount of work clearing brush for the Grab deal. Extra Crunch examined Uber’s ramp toward profitability yesterday .

This morning, let’s talk through several key points from Grab’s SPAC investor deck. We’ll discuss growth, segment profitability, aggregate costs and COVID-19, among other factors. You can read along in the presentation here .

How harshly did COVID-19 impact the business?

The impact on Grab’s operations from COVID-19 resembles what happened to Uber in that the company’s deliveries business had a stellar 2020, while its ride-hailing business did not.

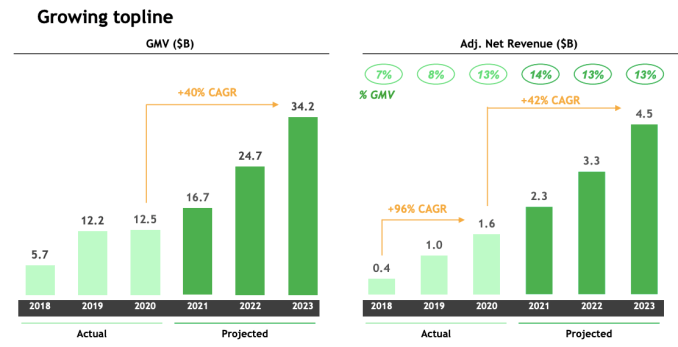

From a high level, Grab’s gross merchandise volume (GMV) was essentially flat from 2019 to 2020, rising from $12.2 billion to $12.5 billion. However, the company did manage to greatly boost its adjusted net revenue over the same period, which rose from $1 billion to $1.6 billion.

Inside of the company’s business units, ups and downs were stark. After deliveries GMV grew from $600 million to $2.9 billion to $5.5 billion from 2018 to 2020; Grab’s rides business GMV grew from $4.6 billion to $5.7 billion in 2018 and 2019, only to tumble to $3.2 billion in 2020.

However, Grab’s overall business was more profitable in 2020 than 2019, seeing its post-combination EBITDA loss narrow from -$2.3 billion in 2019 to -$800 million in 2020.

In short, Grab’s transportation business was hit hard due to COVID, its delivery efforts soared, and the company grew while losing less money.

Which segments are profitable?

Grab has four businesses, of which two — ride-hailing and deliveries — account for the vast majority of its revenues. The company’s financial business generates comparatively modest revenues when stacked against its more established efforts.

Financial services brought in around $200 million in revenue during both 2019 and 2020. However, the segment’s EBITDA losses of $400 million in 2020 mattered. Grab’s deliveries business had a smaller $200 million 2020 EBITDA loss, and its rides business generated $300 million in 2020 EBITDA. (All figures in this section are post -InterCo, taking into account the impact of the transaction, which will eliminate the impacts of “intragroup transactions.”)

Grab’s “Enterprise & Others” segment generates effectively no revenues and has a negligible impact on profitability. It can be ignored.

In short, ride-sharing is a profitable business for Grab, though the segment did take a pandemic-induced whacking; deliveries form a rapidly growing segment at the company that has greatly improved in profitability terms — in 2020, it lost just 25% of its 2019 negative adjusted EBITDA. And Grab’s financial services business is a drag on its bottom line while not helping its top line much.

How close to breakeven is the company as a whole?

Not close at all. Considering its net income, Grab lost $2.7 billion in 2020. That was down from $4 billion in 2019, but up from its 2018 net loss of $2.5 billion.

The caveat is that quite a lot of the company’s recent net losses stem from costs sourced from redeemable convertible preferred stock, or RCPS. That expense, a form of interest, came to $1.1 billion in 2019 and $1.4 billion in 2020. Given that RCPS is, to our understanding, a non-cash cost, how much investors will mind the implied dilution in the company’s net losses and thus be willing to forgive some of their scale, is not clear.

Even discounting 100% of its RCPS expense, the company’s net loss was still greater than $1 billion last year.

What sort of growth does Grab anticipate?

Here’s the chart:

You can see the COVID-19 impact on Grab’s GMV in the first chart. From here, the company expects total platform spend to grow rapidly. And that results in pretty strong net revenue growth.

Do note that the company does not expect its adjusted net revenue as a percentage of GMV to grow after 2021 — Grab actually anticipates adjusted net revenue to decline to 13% of GMV in 2022 after rising to 14% in 2021.

Still, the company expects a 40% compound annual growth rate (CAGR) in GMV from 2020 to 2023, and a 42% CAGR of adjusted net revenue over the same time period. That’s pretty good given the company’s scale, but a drastic slowdown from its pre-2021 growth pace of 96% CAGR.

What SPAC-ish shenanigans do we need to understand?

Oh boy. Well, let’s start with one of the numbers we just talked about: adjusted net revenue. What is that? Well net revenue is the company’s gross billings minus “Drivers and Merchants Base Incentives” and “Drivers and Merchants Excess Incentives.” Adjusted net revenue adds back in the second category of incentive.

Here’s how Grab defines the bucket:

Adjusted Net Revenue is a non-IFRS financial measure, which adjusts our net revenue by adding back excess incentives. Excess incentives occur when payments made to driver/merchant partners exceed Grab’s revenue received from such driver/merchant partners (excess incentives are calculated on a monthly basis for each country and not on a driver-by-driver basis).

So when Grab overpays someone, it doesn’t want that to count against its revenue. Sure. Cool. Judge that as you will, but reading this Grab deck, it is impossible to not get shades of the same joy that one beholds when trying to parse Uber’s earnings.

Finally, pay attention to the charts that show pre- InterCo data — the company’s performance before it was consolidated — and the tables that adjust for things that won’t stick around post-combination. The charts are often prettier than the tables. The charts, in essence, are what the company told itself before the deal. The tables, like the dataset featured on page 26 of the presentation, undercut some of Grab’s own hype.

Overall, this is a fun deal that will be exciting to see trade.

Ride-hailing’s profitability promise is in its final countdown

More TechCrunch

Get the industry’s biggest tech news, techcrunch daily news.

Every weekday and Sunday, you can get the best of TechCrunch’s coverage.

Startups Weekly

Startups are the core of TechCrunch, so get our best coverage delivered weekly.

TechCrunch Fintech

The latest Fintech news and analysis, delivered every Tuesday.

TechCrunch Mobility

TechCrunch Mobility is your destination for transportation news and insight.

Top court orders ban on Elon Musk’s X in Brazil

A top court in Brazil ordered an immediate, country-wide suspension of the X platform on Friday after a months-long legal battle with Elon Musk’s social media company over content moderation,…

Investors are already valuing OpenAI at over $100B on the secondaries market

OpenAI is in talks to raise a new round of funding at an eye-popping $100 billion-plus valuation, sources told The Wall Street Journal this week. It turns out investors have…

California’s legislature just passed AI bill SB 1047; here’s why some hope the governor won’t sign it

SB 1047 has drawn the ire of Silicon Valley players large and small, including venture capitalists, big tech trade groups, researchers and startup founders.

Carta’s ill-fated secondaries business finally found a buyer

Stock-trading startup Public has acquired the brokerage accounts of Carta’s secondaries business, TechCrunch has confirmed.

Redfin is already trying to defend against a new flat-fee real estate startup

Redfin is responding to a new startup that is hoping to upend the way people search for and buy homes by offering a flat-fee service. On August 29, TechCrunch reported…

Apple stands by decision to terminate account belonging to WWDC student winner

Apple moved to terminate the Appstun developer account after multiple rejections of its app that Apple says violates its App Store guidelines.

Airbnb and fashion app By Rotation partner for free destination wedding outfits

By Rotation has a partnership with Airbnb to let those who’ve booked an Airbnb receive a complimentary outfit rental.

The org behind the dataset used to train Stable Diffusion claims it has removed CSAM

LAION, the German research org that created the data used to train Stable Diffusion, among other generative AI models, has released a new dataset that it claims has been “thoroughly…

North Korean hackers exploited Chrome zero-day to steal crypto

The North Korean hackers’ attack started by tricking a victim into visiting a web domain under the hackers’ control.

Fundraising is a lot easier when you have traction

Some stories emerge and die in a matter of days. Others require us to stay tuned for more, and this week brought us several of these.

Google rolls out safeguards for more of its AI products ahead of the US presidential election

Google is gearing up for the upcoming U.S. presidential election by rolling out safeguards for more of its generative AI products. Although the company already previously announced that it would…

Hello Wonder is building an AI-powered browser for kids

Across the world, regulators have ramped up their efforts to try and increase the safety of kids on the internet. Major social networks are facing scrutiny, and as a countermeasure,…

Former Riot Games employees leverage generative AI to power NPCs in new video game

Jam & Tea Studios is the latest gaming startup implementing generative AI to transform the way players interact with non-playable characters (NPCs) in video games. Traditionally, video game NPCs are…

Elle Family Office and Keebeck Wealth Management are coming to TechCrunch Disrupt 2024

Traditionally seen as private financial entities, family offices are key players in the supply of venture capital, using startup investments as a way to diversify their portfolios and engage with…

Be a volunteer at TechCrunch Disrupt 2024

TechCrunch Disrupt 2024 in San Francisco is just two months away, and we’re still looking for enthusiastic and driven volunteers to assist our events team. Don’t miss this opportunity to…

Last Day: Exhibit your startup with big savings at TechCrunch Disrupt 2024

Don’t miss out! Today is the last day to apply and scale your Series A to B startup at a significantly reduced exhibit cost with the ScaleUp Startup Exhibitor Package.…

Dailyhunt parent VerSe’s valuation gets slashed 42% to $2.9B: investor note

Indian tech and media startup VerSe, which operates popular news aggregator Dailyhunt, is worth about 42% below its last private valuation, according to estimates by its investor 360 One. The…

Uber drives deeper into South Korea to take on Kakao Mobility

After seeing double-digit growth in South Korea, Uber Technologies has announced a strategic plan to double down in the country — directly challenging market leader Kakao Mobility, the ride-hailing unit…

TikTok’s new ‘Manage Topics’ tool gives you more control over your For You feed; here’s how to use it

TikTok is introducing a new “Manage Topics” feature that will give you more control over what you see on your For You feed, the company announced on Friday. The new…

Google is working on AI that can hear signs of sickness

Given everything you’ve already heard about AI, you may not be surprised to learn that Google is among other outfits beginning to use sound signals to predict early signs of…

Apple and Nvidia could be OpenAI’s next big investors

Nvidia and Apple are reportedly in talks to contribute to OpenAI’s next fundraising round — a round that could value the ChatGPT maker at $100 billion. Per its sources, The…

India’s Agrim snags $17.3M to help farmers get inputs like seeds and pesticides more easily

Agrim has raised $17.3 million to expand its B2B agri-inputs platform to more manufacturers and retailers in India.

Intuitive Machines wins $116.9M contract for a moon mission in 2027

Intuitive Machines, the venture-backed startup that went public last year, will send a moon lander to the lunar south pole in 2027 as part of a $116.9 million contract awarded…

South Korean tech giant Naver launches crypto wallet in partnership with Chiliz

Many tech companies are expanding their reach into the web3 market, integrating blockchain and web3 technologies into their products and services. In the latest development, South Korean internet giant Naver…

Atlassian acquires Rewatch as it gets into AI meeting bots

Atlassian plans to integrate Rewatch into its recently launched Rovo AI platform so that transcripts become searchable within the overall business context.

Sub.club aims to fund the fediverse via premium feeds

Sub.club thinks premium feeds could also serve other use cases, like supporting helpful bots or generating funds to help maintain a community’s Mastodon server, for instance.

Gmail users on Android can now chat with Gemini about their emails

Gmail users on Android devices can now chat directly with Google’s AI assistant, Gemini, about their emails in the Gmail app. Google rolled out the new feature, Gmail Q&A, on…

Tesla keeps putting its digital history in the memory hole

It seems that the Ministry of Truth has been busy at Tesla. Some sharp-eyed folks, including reporters at Electrek, noticed that Tesla has deleted all of its blog posts prior…

Spotify points finger at Apple over an unwelcome change to volume control technology

When streaming to connected devices via Spotify Connect on iOS, users were previously able to use the physical buttons on their iPhone to adjust the volume. But this will no…

Generative AI coding startup Magic lands $320M investment from Eric Schmidt, Atlassian and others

Magic, an AI startup creating models to generate code and automate a range of software development tasks, has raised a large tranche of cash from investors, including ex-Google CEO Eric…

- Subscription

- Advertise With Us

Here’s A Look At Grab’s Latest Investor Presentation Slides Ahead Of Its S$53B US Listing

In this article

Singapore-based technology company and super app Grab announced yesterday that it intends to go public in the US in partnership with Altimeter Growth Corp.

The proposed transactions value Grab at an initial pro-forma equity value of approximately US$39.6 billion (S$53.16 billion) at a PIPE size of more than US$4.0 billion (S$5.37 billion) and will provide Grab with approximately US$4.5 billion (S$6.04 billion) in cash proceeds.

Ahead of its listing plan in the US , Grab has released an investor presentation featuring key statistics on the company’s growth in Singapore and the Southeast Asian region.

Southeast Asia’s Leading Super App

Grab was launched as MyTeksi in Malaysia in 2012, which allowed the booking of a ride via an app.

They later expanded into the region from 2013 onwards as GrabTaxi. It moved into Singapore, the Philippines, and Thailand in that year and four other Southeast Asian countries over the next four years, rebranding themselves as Grab along the way.

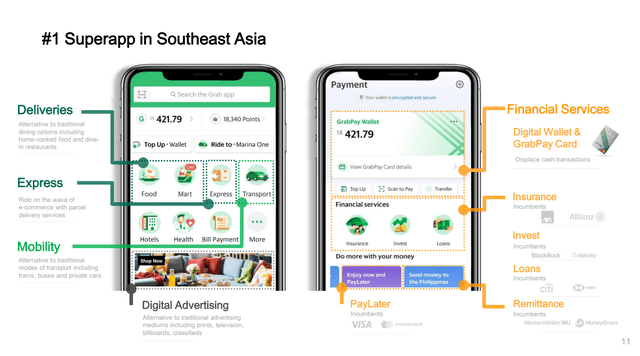

It has since grown to become Southeast Asia’s leading super app, boasting a suite of services from transport and delivery to micro investments, insurance and financial services.

This suite of services are integrated into what a consumer will do daily in their lives, from ordering your breakfast, grabbing a ride to your office to online shopping after work.

Grab’s Latest Financials

Here are some key statistics as shown in the investor presentation:

In 2020, Grab has attained $12.5 billion in gross merchandise value, surpassing pre-pandemic levels and more than doubling from 2018. Grab’s adjusted net revenue was $1.6 billion in 2020, with over 1.9 billion transactions completed on Grab.

It is available in over 400 cities in 8 countries. As of December 2020, Grab has 5 million registered driver partners and 2 million merchant partners

It has also managed to diversify its business model across the eight countries, with no one country accounting for more than 35 per cent of its revenue.

The investor presentation also states that Grab is in the top position in mobility with the largest last-mile transportation network, deliveries, with the largest delivery platform, and financial services.

The company has made significant strides towards profitability, achieving positive segment EBITDA in mobility across all markets, and positive segment EBITDA in deliveries in five out of six countries. Furthermore, it expects to hit profitability by 2023.

Post-IPO Vision

According to the company, it believes that it is perfectly positioned to serve the needs of consumers, merchants and drivers in Southeast Asia through its super app strategy, and it will continue to expand its offerings in the region.

It already offers an ecosystem of complementary services, addressing high-frequency, everyday needs, all via one app.

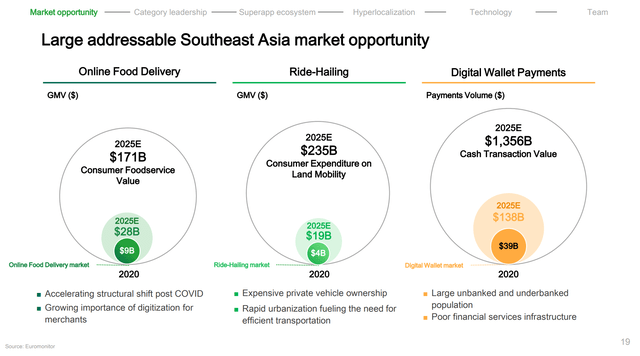

Across online food delivery, ride-hailing and digital wallet payments, Grab expects its total addressable market to grow from approximately US$52 billion (S$69.59 billion) in 2020 to more than US$180 billion (S$134.50 billion) by 2025.

“It gives us immense pride to represent Southeast Asia in the global public markets. This is a milestone in our journey to open up access for everyone to benefit from the digital economy,” said Grab founder and CEO Anthony Tan.

Featured Image Credit: ucars.sg

Also Read Grab President Says Revenue Has Jumped 70% In 2020 – What Can We Expect From Grab In 2021?

Subscribe to our newsletter

Stay updated with Vulcan Post weekly curated news and updates.

MORE FROM VULCAN POST

- 30 Aug 2024

Where can you demand more? SBF survey reveals 7 industries desperate to employ S’poreans.

- 29 Aug 2024

Unhappy with S’pore’s pricey pet-sitting rates, he left retirement to start his own platform

Entrepreneur

She started a poké bowl biz right out of uni, now it’s grown to 2 brands and 4 outlets in JB

Boss’ nightmare or new work perk? We tried no working hours for 2 weeks, here’s our verdict.

News Reader

Qoo10 reportedly lays off over 80% of its employees, only 20 staff remain in its S’pore office

S’pore wages to rise by ca. 11% in the next 12 months. Here are your odds of getting a raise.

MDEC CEO Mahadhir Aziz exits after a transformative 3-year tenure

The Hive closes down its last store in Bangsar after 8 yrs, but that doesn’t mean it’s failed

International

Vulcan Post aims to be the knowledge hub of Singapore and Malaysia.

© 2021 GRVTY Media Pte. Ltd. (UEN 201431998C.)

Grab Holdings: Speculative, Despite 85% Sell-Off

- Grab Holdings Limited is a major tech/internet company based in Singapore. Grab operates a Super App that connects drivers/merchants and consumers in four major service brackets.

- The challenge in evaluating Grab is given by the tension between extremely high growth potential on one hand and scary economics/financials on the other hand.

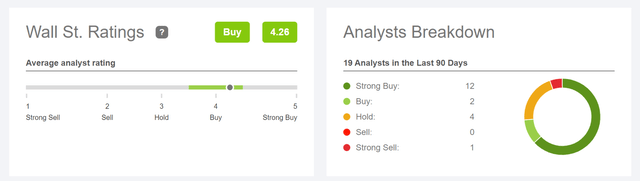

- In general, analysts are quite bullish on Grab, with a consensus target price of $4.74/share – indicating approximately 70% upside.

- To value Grab, I would suggest using a x20 EV/EBITDA multiple, anchored on Grab's 2025 financial numbers and discounted back to 2020.

- I initiate with a HOLD recommendation and a $2.19/share target price.

Luis Alvarez/DigitalVision via Getty Images

Should you buy Grab ( NASDAQ: GRAB ), as the stock is down approximately 85% from ATH? Depends: On one hand, you have extremely high growth potential and on the other hand, you have truly scary economics/financials. Thus, investing in Grab is all about speculation, in my opinion. I initiate with a HOLD recommendation and a $2.19/share target price.

Grab Holdings Limited is a major tech/internet company based in Singapore. Grab operates a Super App Platform in SEA connects drivers/merchants and consumers in four major service brackets: 1) food and groceries deliveries, 2) mobility and ride-hailing services, 3) financial services and 4) new initiatives. Grab has presence in Singapore, Philippines, Malaysia, Thailand, Indonesia, Vietnam, Cambodia and Myanmar. Widely considered amongst the world’s highest potential growth assets, Grab was one of the most strongly expected IPOs in 2021 – as the company went public via SPAC and raised $4.5 billion in equity funding.

Grab Investor Presentation, April 2021

No profitability vs Strong growth

The challenge in evaluating Grab is given by the tension between extremely high growth potential on one hand and scary economics/financials on the other hand. The question for shareholder is: what side will persevere? Will the company grow to become profitable as Amazon managed to do? Or are Grab’s fundamentals going to break the company? In the past few years the growth narrative prevailed, as funding was cheap and easy. Now, however, the market appears to value profitability, as funding becomes hard and expensive. And so Grab might have a hard time to sustain the company’s operations. Let's have a look at the growth/potential versus profitability/financials tension in more detail.

If I were to bet on a growth asset, I would look for exposure in South East Asia — a market with approximately 600 million population, accelerating digital penetration and attractive GDP growth. And, Grab is well positioned to capture a large market opportunity in this economy with a leading position in grocery and food delivery (1) and ride-hailing (2) and attractive growth optionality in fintech (3). According to company presentations , Grab management estimates the company’s addressable market at $250 billion.

Grab’s technology-centric super-app strategy enables the company to cross-sell on multiple growth verticals and tap in virtuous tailwinds from network effects. As of 2021, Grab had 72% market share of the region's ride-hailing market. In addition, the market holds a 50% market share in food and grocery delivery. While the company’s fintech operations are still in early stages, Grab managed to obtain a digital banking license in Malaysia, Indonesia and Singapore.

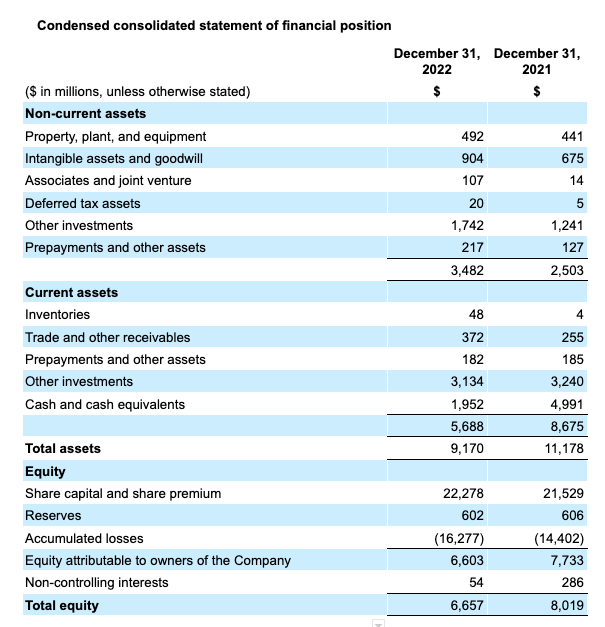

In 2021, Grab recorded revenues of $675 million and lost scary -$3.5 billion attributable to shareholders, or -$0.95/share. However, $1.99 billion of this loss were due to non-operating loss (finance-costs). That said, cash from operations was a little more comforting at negative $1 billion – but still a danger signal. My personal takeaway is that Grab currently finances loss-making operations with significant funding costs (be it equity or debt). And as the market is turning cautious with giving funding to growth companies, this might not only pressure Grab’s operations, but also the company’s future—if funding freezes for too long.

On the positive site, Grab’s balance sheet looks solid and could sustain a few more years of considerable losses and growth investing. As of Q1 2022, Grab records. $7.5 billion in cash and cash equivalents and $2.34 of total debt. Moreover, the company’s asset quality looks solid, with only $675 million of intangibles and no significant position in inventories or accounts receivable. Moreover, Grab records no significant mark-to-market investments and derivatives that could hurt investors on a re-valuation.

How analysts see it

In general, analysts are quite bullish on Grab, with a consensus target price of $4.74/share – indicating approximately 70% upside. According to the Bloomberg Terminal, as of June 2022, analyst see Grab’s revenues in 2025 at $4.55 billion. This would equal a 3-year CAGR of approximately 30%, from 2022 to 2025. Moreover, the company is expected to break-even in the same year, recording EBITDA of $450 million and a net-income attributable to shareholders of $0.11/share.

Seeking Alpha

While it is difficult to value Grab – especially since the company’s operations need to be projected for multiple years into the future, I would like to draft a multiples valuation to give investors and readers an anchor for their decision-making. Specifically, I would suggest using a x20 EV/EBITDA multiple, anchored on Grab's 2025 financial numbers and discounted back to 2020. This multiple is in line with Amazon's trading price. That said, based on a $450 million EBITDA and a 10% WACC, I calculate a 2022 enterprise value of $6.7 billion and an equity value of $8.4 billion, or $2.19/share. Please note, however, that this model should only be taken as a very rough reference.

In my opinion, Grab is high-risk/high-reward. If the company manages to capture the large market in SEA, then stock valuation could possibly surpass $100 billion. If, however, Grab cannot sustain operations due to non-existent profitability -- paired with frozen capital markets -- the stock could still go much lower. I initiate with a HOLD recommendation and a $2.19/share target price.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. not financial advise

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

About grab stock.

| Symbol | Last Price | % Chg |

|---|

More on GRAB

Related stocks.

| Symbol | Last Price | % Chg |

|---|---|---|

| GRAB | - | - |

Trending Analysis

Trending news.

If you're seeing this message, that means JavaScript has been disabled on your browser .

Please enable JavaScript to make this website work.

Press Centre

We blog about driver events, product updates, driving tips, driver stories and more.

- PRODUCT UPDATES

- DRIVER STORIES

Grab Reports Fourth Quarter and Full Year 2022 Results

Excerpt here. allow the user to have fully control on excerpt.

Grab Holdings Limited (NASDAQ: GRAB) today announced unaudited financial results for the fourth quarter and full year ended December 31, 2022.

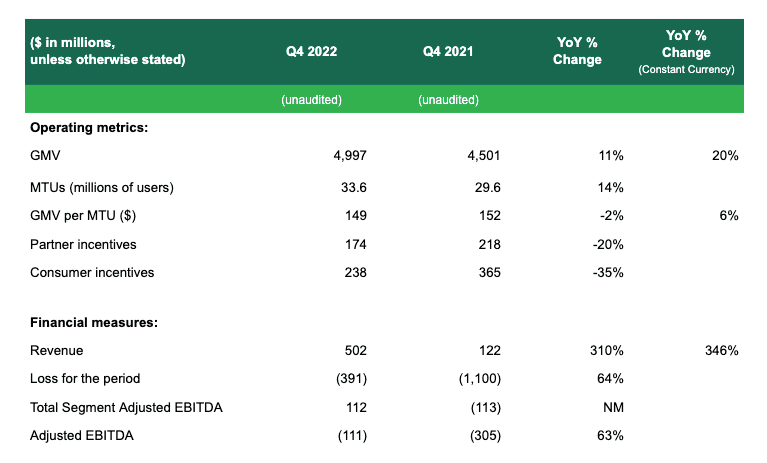

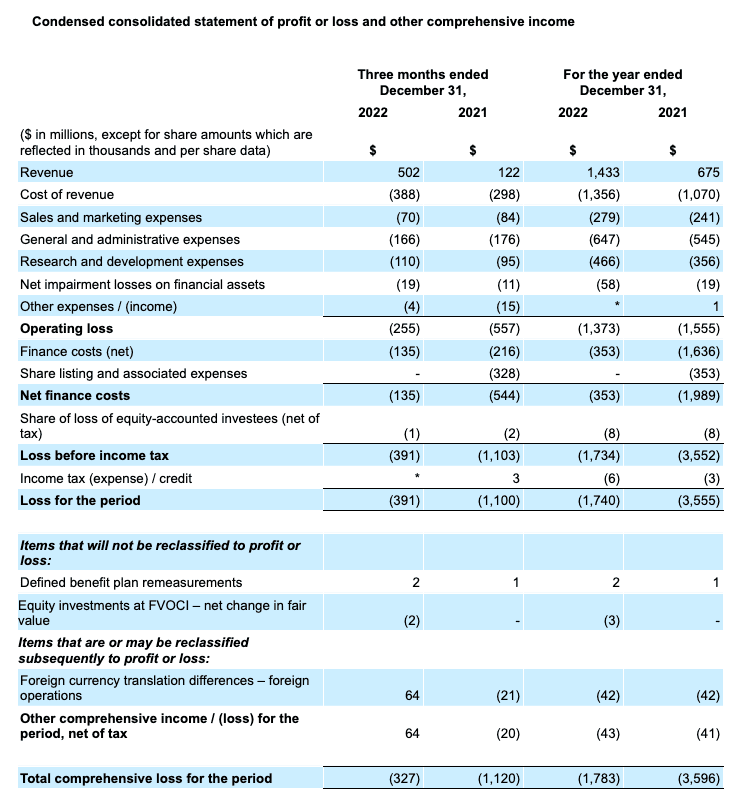

- Q4 2022 Revenue grew 310% year-over-year to $502 million, and 2022 Revenue grew by 112% year-over-year to $1,433 million [1]

- Q4 2022 GMV grew 11% year-over-year to $5.0 billion, and 2022 GMV grew by 24% year-over-year to $19.9 billion

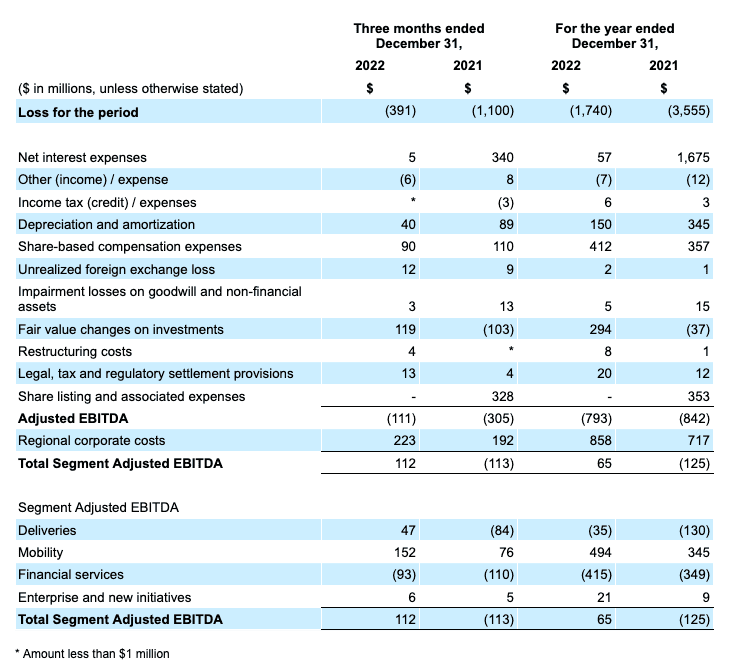

- Q4 2022 Loss for the period improved by 64% year-over-year to $391 million, with 2022 Loss for the year improving by 51% year-over-year to $1,740 million

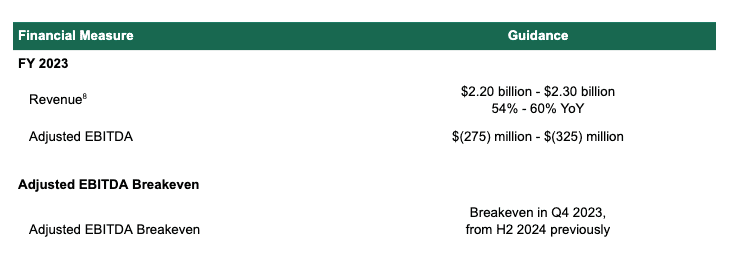

- Group Adjusted EBITDA breakeven guidance brought forward to the fourth quarter of 2023 from the second half of 2024

SINGAPORE, February 23, 2023 – Grab Holdings Limited (NASDAQ: GRAB) today announced unaudited financial results for the fourth quarter and full year ended December 31, 2022.

“Our 2022 and fourth quarter results demonstrate our commitment to accelerating our path to profitability. In the fourth quarter, we achieved revenue growth of 310% year-over-year (“YoY”) [1] , while improving our Group and Deliveries Segment Adjusted EBITDA margins and maintaining regional category leadership across our Mobility and Food Deliveries businesses. We achieved these results by focusing on capturing the rebound in Mobility demand, optimizing our costs, reducing our cost-to-serve and innovating on products and services that drive stickiness and engagement within our ecosystem. As we look ahead, we will remain laser-focused on driving sustainable growth, and improving the efficiency of our ecosystem,” said Anthony Tan, Group Chief Executive Officer and Co-Founder of Grab .

“We are pleased to report a strong set of results, with full year revenues and second half 2022 Adjusted EBITDA coming in well above our guidance ranges. In the fourth quarter, we recorded strong year-ov er-year growth in Mobility revenue of 78%, and in our Deliveries segment, we focused on driving a more profitable and sustainable business, which resulted in Deliveries Segment Adjusted EBITDA margins improving substantially on a year-over-year and quarter-over-quarter basis. This sets us up for a strong 2023 as we continue to focus on growing in a sustainable manner by driving cost efficiencies across our organization, and driving margin improvements whilst being prudent with our capital. We are accelerating our group breakeven outlook on an Adjusted EBITDA basis to the fourth quarter of 2023, earlier than our prior expectations of the second half of 2024,” said Peter Oey, Chief Financial Officer of Grab .

Group Fourth Quarter 2022 Key Operational and Financial Highlights

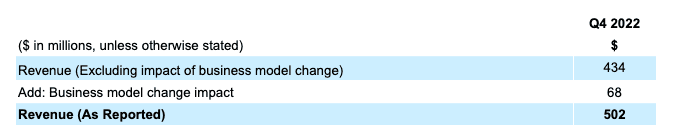

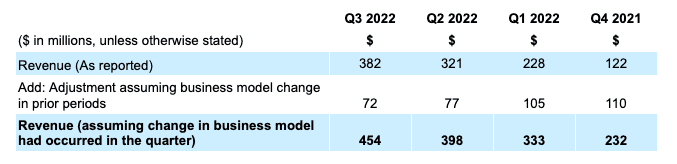

- Revenue grew 310% YoY to $502 million in the fourth quarter of 2022, or 346% on a constant currency basis [2] , attributable to growth in our Mobility and Deliveries segments, a reduction in incentives and a change in business model for certain delivery offerings in one of our markets [3] . Excluding the impact of the business model change, revenue growth would have been 255% YoY and 14% quarter-over-quarter (“QoQ”).

- Total GMV grew 11% YoY, or 20% YoY on a constant currency basis, primarily due to the continued recovery in Mobility and growth in Financial Services.

- Foreign exchange currency fluctuations impacted our results during the quarter. QoQ revenue grew 31% and GMV declined 2%, respectively, while on a constant currency basis, they grew by 36% and 2%, respectively.

- During the quarter, total incentives were further reduced to 8.2% of GMV, compared to 13.0% for the same period in 2021 and 9.4% for the previous quarter, demonstrating our continued focus on sustainable growth.

- Loss for the quarter was $391 million, a 64% improvement YoY, primarily due to the improvement in Group Adjusted EBITDA, with Total Segment Adjusted EBITDA turning profitable, and the elimination of the non-cash interest expense of Grab’s convertible redeemable preference shares that converted to ordinary shares in December 2021. Our loss for the quarter included a $119 million non-cash expense from fair value changes on investments, and $90 million in non-cash stock-based compensation expense.

- Group Adjusted EBITDA was negative $111 million for the quarter, an improvement of 63% compared to negative $305 million for the same period in 2021 as we continued to grow GMV while improving profitability on a Segment Adjusted EBITDA basis from lowered incentive spend.

- Group Adjusted EBITDA margin was (2.2)% for the quarter, an improvement from (6.8)% in the fourth quarter of 2021 and from (3.2)% in the third quarter of 2022.

- Regional corporate costs [4] for the quarter were $223 million, as compared to $192 million in the same period a year ago and $208 million in the prior quarter. On a YoY basis, regional corporate costs were relatively flat after excluding a non-recurring benefit recorded in the fourth quarter of 2021.

- The QoQ increase in regional corporate costs was predominantly driven by an increase in direct marketing costs due to seasonally higher spend in the fourth quarter amidst the festive period, and an increase in professional fees due to higher expenses associated with being a publicly-listed company, coupled with a one-off systems implementation cost to improve automation.

- Cash liquidity [5] totaled $6.5 billion at the end of the fourth quarter, compared to $7.4 billion at the end of the prior quarter, with a substantial part of the cash outflow attributed to the repurchase of our Term Loan B in the aggregate principal amount of $750 million for an aggregate consideration of $738 million completed in November 2022. Our net cash liquidity [6] was $5.1 billion at the end of the fourth quarter, as compared to $5.3 billion in the prior quarter. Amidst our focus to improve profitability and to preserve capital, the reduction in our net cash liquidity in H2 2022 was $430 million, and is 65% lower than the reduction in our net cash liquidity of $1,223 million in H1 2022.

- Group MTUs grew 14% YoY in the fourth quarter, primarily driven by the continued recovery in Mobility MTUs.

- GMV per MTU declined by 2% in the fourth quarter compared to the same period of last year, but grew 6% on a constant currency basis.

- Grab continues to drive cross-vertical penetration rates, with 61% of MTUs using two or more offerings on the Grab platform in 2022, up from 56% in 2021.

- 74% of our two-wheel drivers [7] performed both food delivery and mobility jobs on the Grab platform, up from 67% in the fourth quarter 2021. On a full year basis, 71% of our two-wheel drivers 7 performed both food delivery and mobility jobs on the Grab platform in 2022, up from 69% in 2021.

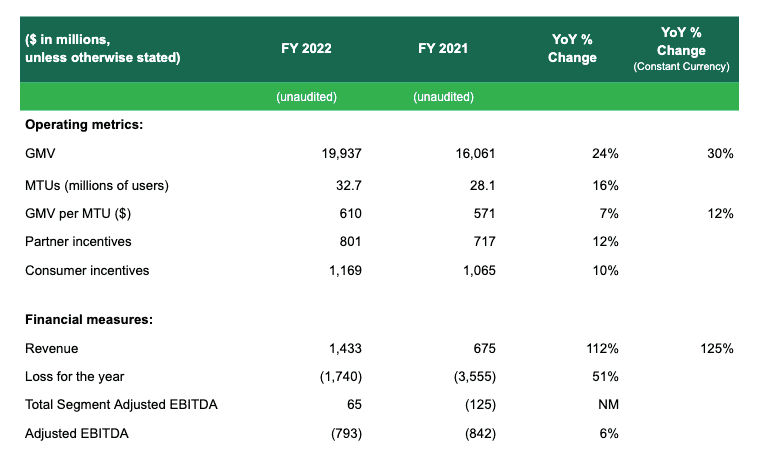

Group Full Year 2022 Key Operational and Financial Highlights

- Revenue for the full year grew 112% YoY, or 125% YoY on a constant currency basis, to $1,433 million. Excluding the $68 million uplift in revenues from the change in business model in certain Deliveries offerings in one of our markets, full year revenues would be $1,365 million, which exceeded our guidance range of $1,320 million to $1,350 million.

- Full year GMV was $19,937 million and grew 24% YoY, in line with our GMV growth guidance of 22% to 25% YoY. On a constant currency basis, GMV grew 30% YoY.

- Loss for the year was $1,740 million, a 51% improvement YoY, primarily due to the improvements in Adjusted EBITDA, with Total Segment Adjusted EBITDA turning profitable, and the elimination of the non-cash interest expense of Grab’s convertible redeemable preference shares that converted to ordinary shares in December 2021. Non-cash expenses included a $412 million expense in stock-based compensation expenses, $294 million in fair value changes on investments and $150 million of depreciation and amortization.

- Full year Adjusted EBITDA was negative $793 million, an improvement of 6% compared to negative $842 million for 2021. Adjusted EBITDA over the second half of 2022 was negative $272 million, above our guidance of negative $315 million.

Business Outlook

The guidance represents our expectations as of the date of this press release, and may be subject to change.

Segment Financial and Operational Highlights

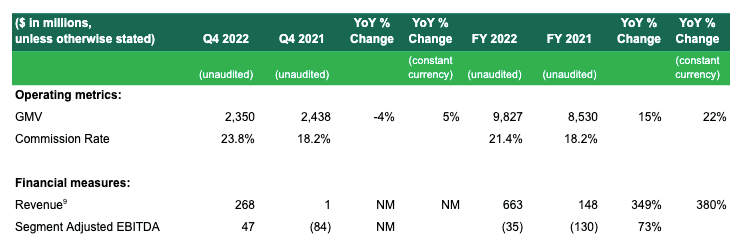

- Deliveries revenue grew to $268 million in the fourth quarter 2022 from $1 million in the same period in 2021, and by 349% YoY for the full year 2022. The strong growth was primarily attributed to contributions from Jaya Grocer, a reduction in incentives as a percentage of GMV, coupled with the change in business model of certain Deliveries offerings in one of our markets [9] .

- Commission rate for the quarter rose to 23.8%, up from 18.2% for the same period in 2021, and on a full year basis, rose to 21.4% from 18.2% in the prior year. The increase was primarily driven by contributions from Jaya Grocer and the change in business model of certain Deliveries offerings in one of our markets.

- Fourth quarter 2022 Deliveries GMV declined 4% YoY, but grew 5% YoY on a constant currency basis. On a full year basis, Deliveries GMV grew 15% YoY, or 22% YoY on a constant currency basis.

- Deliveries segment adjusted EBITDA as a percentage of GMV expanded to 2.0% in the fourth quarter of 2022 from negative 3.5% in the same period in 2021 and after achieving breakeven in the prior quarter. For full year 2022, Deliveries segment adjusted EBITDA improved by 73% YoY.

- In the fourth quarter of 2022, the majority of our six core markets were profitable on a Deliveries segment adjusted EBITDA basis and in those respective markets, Deliveries segment adjusted EBITDA as a percentage of GMV were nearing or exceeding 3%.

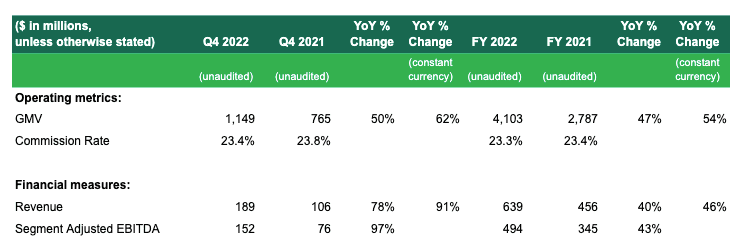

- Mobility revenues grew strongly and rose 78% YoY, or 91% YoY on a constant currency basis, in the fourth quarter 2022, and grew by 40% YoY, or 46% YoY on a constant currency basis, for the full year 2022. The strong YoY growth in Mobility was underpinned by the continued demand recovery amidst the reopening, which drove a normalization in local commutes and increase in airport rides, and our efforts to improve supply across the region.

- Commission rate for the quarter was 23.4% from 23.8% for the same period in 2021, and on a full year basis, was 23.3% from 23.4% for the same period in 2021.

- Mobility GMV was up 50% YoY, or 62% YoY on a constant currency basis, in the fourth quarter and grew 47% YoY, or 54% YoY on a constant currency basis, on a full year basis.

- Mobility segment adjusted EBITDA as a percentage of GMV was 13.2% in the fourth quarter of 2022 and 12.0% for full year 2022.

- During the quarter, we continued our focus on increasing active driver supply and optimizing our existing supply to cater to the strong demand recovery. We have re-launched GrabShare, our car-pooling service in the Philippines and Singapore, to provide more affordable Mobility options for our users, while optimizing driver supply.

Financial Services

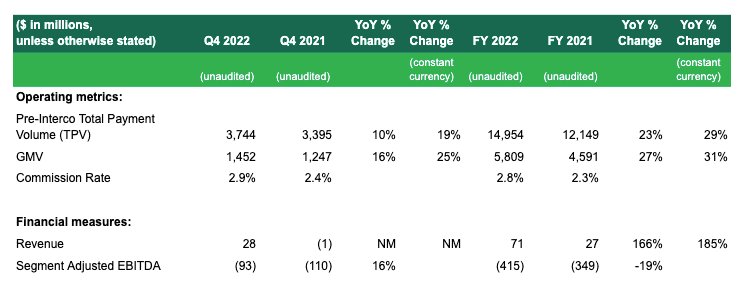

- Revenue for Financial Services grew to $28 million in the fourth quarter 2022, from negative $1 million in the same period in 2021, and by 166% YoY or 185% YoY on a constant currency basis for the full year 2022. The strong YoY growth was primarily attributed to higher contributions from our lending business, and lowered incentives as a percentage of GMV.

- Commission rate increased to 2.9% in the fourth quarter of 2022 from 2.4% in the same period in 2021, and to 2.8% in the full year 2022 from 2.3% in 2021. The increase in commission rates was primarily attributable to higher contributions from our lending business.

- GMV for Financial Services was up 16% YoY in the quarter, or 25% YoY on a constant currency basis, and by 27% YoY or 31% YoY on a constant currency basis for the full year.

- Segment adjusted EBITDA loss for the quarter improved 16% YoY, but declined 19% YoY for the full year, primarily attributed to higher expenses from Digibank operations. We have also continued to streamline our cost base in GrabFin, which declined by 4% YoY and 11% QoQ.

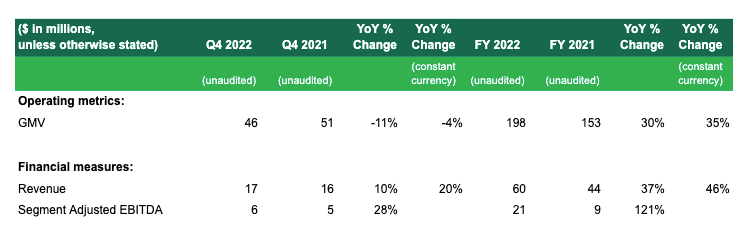

Enterprise and New Initiatives

- Revenue from Enterprise and New Initiatives rose 10% YoY or 20% YoY on a constant currency basis for the fourth quarter 2022, and by 37% YoY, or 46% YoY on a constant currency basis for the full year 2022, mainly driven by growing contributions from our advertising services.

- GMV for the fourth quarter declined 11% YoY, or 4% YoY on a constant currency basis, attributed to our focus on driving profitable transactions. On a full year basis, GMV grew 30% YoY, or 35% YoY on a constant currency basis.

- Segment adjusted EBITDA grew 28% YoY in the quarter compared to the same period in 2021, and by 121% YoY for the full year, primarily attributed to lowered incentives as a percentage of GMV.

Grab is a leading superapp in Southeast Asia, operating across the deliveries, mobility and digital financial services sectors. Serving over 500 cities in eight Southeast Asian countries – Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam – Grab is the regional category leader in food deliveries and mobility based on GMV in 2022, according to Euromonitor. Every day, Grab enables millions of people to order food or groceries, send packages, hail a ride or taxi, pay for online purchases or access services such as lending and insurance, all through a single app. Grab was founded in 2012 with the mission to drive Southeast Asia forward by creating economic empowerment for everyone, and strives to serve a triple bottom line: to simultaneously deliver financial performance for its shareholders and have a positive social and environmental impact in Southeast Asia.

Forward-Looking Statements

This document and the announced investor webcast contain “ forward-looking statements” within the meaning of the “ safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this document and the webcast, including but not limited to, statements about Grab’s goals, targets, projections, outlooks, beliefs, expectations, strategy, plans, objectives of management for future operations of Grab, and growth opportunities, are forward-looking statements. Some of these forward-looking statements can be identified by the use of forward-looking words, including “ anticipate,” “expect,” “suggest,” “plan,” “believe,” “intend,” “estimate,” “target,” “project,” “should,” “could,” “would,” “may,” “will,” “forecast” or other similar expressions. Forward-looking statements are based upon estimates and forecasts and reflect the views, assumptions, expectations, and opinions of Grab, which involve inherent risks and uncertainties, and therefore should not be relied upon as being necessarily indicative of future results. A number of factors, including macro-economic, industry, business, regulatory and other risks, could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to: Grab ’ s ability to grow at the desired rate or scale and its ability to manage its growth; its ability to further develop its business, including new products and services; its ability to attract and retain partners and consumers; its ability to compete effectively in the intensely competitive and constantly changing market; its ability to continue to raise sufficient capital; its ability to reduce net losses and the use of partner and consumer incentives, and to achieve profitability; potential impact of the complex legal and regulatory environment on its business; its ability to protect and maintain its brand and reputation; general economic conditions, in particular as a result of COVID-19, currency exchange fluctuations and inflation; expected growth of markets in which Grab operates or may operate; and its ability to defend any legal or governmental proceedings instituted against it. In addition to the foregoing factors, you should also carefully consider the other risks and uncertainties described in the “ Risk Factors” section of Grab ’ s registration statement on Form F-1 and the prospectus therein, and other documents filed by Grab from time to time with the U.S. Securities and Exchange Commission (the “ SEC”).

Forward-looking statements speak only as of the date they are made. Grab does not undertake any obligation to update any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required under applicable law.

Unaudited Financial Information

Grab ’ s unaudited selected financial data for the three months and twelve months ended December 31, 2022 and 2021 included in this document and the investor webcast is based on financial data derived from the Grab ’ s management accounts that have not been reviewed or audited.

Non-IFRS Financial Measures

This document and the investor webcast include references to non-IFRS financial measures, which include: Adjusted EBITDA, Segment Adjusted EBITDA, Total Segment Adjusted EBITDA and Adjusted EBITDA margin. Grab uses these non-IFRS financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons, and Grab ’ s management believes that these non-IFRS financial measures provide meaningful supplemental information regarding its performance by excluding certain items that may not be indicative of its recurring core business operating results. For example, Grab ’ s management uses: Total Segment Adjusted EBITDA as a useful indicator of the economics of Grab ’ s business segments, as it does not include regional corporate costs. However, there are a number of limitations related to the use of non-IFRS financial measures, and as such, the presentation of these non-IFRS financial measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with IFRS. In addition, these non-IFRS financial measures may differ from non-IFRS financial measures with comparable names used by other companies. See below for additional explanations about the non-IFRS financial measures, including their definitions and a reconciliation of these measures to the most directly comparable IFRS financial measures. With regard to forward-looking non-IFRS guidance and targets provided in this document and the investor webcast, Grab is unable to provide a reconciliation of these forward-looking non-IFRS measures to the most directly comparable IFRS measures without unreasonable efforts because the information needed to reconcile these measures is dependent on future events, many of which Grab is unable to control or predict.

Explanation of non-IFRS financial measures:

- Adjusted EBITDA is a non-IFRS financial measure calculated as net loss adjusted to exclude: (i) interest income (expenses), (ii) other income (expenses), (iii) income tax expenses (credit), (iv) depreciation and amortization, (v) share-based compensation expenses, (vi) costs related to mergers and acquisitions, (vii) unrealized foreign exchange gain (loss), (viii) impairment losses on goodwill and non-financial assets, (ix) fair value changes on investments, (x) restructuring costs, (xi) legal, tax and regulatory settlement provisions and (xii) share listing and associated expenses.

- Segment Adjusted EBITDA is a non-IFRS financial measure, representing the Adjusted EBITDA of each of our four business segments, excluding, in each case, regional corporate costs.

- Total Segment Adjusted EBITDA is a non-IFRS financial measure, representing the sum of Adjusted EBITDA of our four business segments.

- Adjusted EBITDA margin is a non-IFRS financial measure calculated as Adjusted EBITDA divided by Gross Merchandise Value.

This document and the investor webcast also includes “ Pre-InterCo” data that does not reflect elimination of intragroup transactions, which means such data includes earnings and other amounts from transactions between entities within the Grab group that are eliminated upon consolidation. Such data differs materially from the corresponding figures post-elimination of intra-group transactions.

We compare the percent change in our current period results from the corresponding prior period using constant currency. We present constant currency growth rate information to provide a framework for assessing how our underlying GMV and revenue performed excluding the effect of foreign currency rate fluctuations. We calculate constant currency by translating our current period financial results using the corresponding prior period ’ s monthly exchange rates for our transacted currencies other than the U.S. dollar.

Operating Metrics

Gross Merchandise Value (GMV) is an operating metric representing the sum of the total dollar value of transactions from Grab’s services, including any applicable taxes, tips, tolls and fees, over the period of measurement. GMV is a metric by which Grab understands, evaluates and manages its business, and Grab’s management believes is necessary for investors to understand and evaluate its business. GMV provides useful information to investors as it represents the amount of a consumer’s spend that is being directed through Grab’s platform. This metric enables Grab and investors to understand, evaluate and compare the total amount of customer spending that is being directed through its platform over a period of time. Grab presents GMV as a metric to understand and compare, and to enable investors to understand and compare, Grab’s aggregate operating results, which captures significant trends in its business over time.

Total Payments Volume (TPV) means total payments volume received from consumers, which is an operating metric defined as the value of payments, net of payment reversals, successfully completed through our platform.

Monthly Transacting User (MTUs) is defined as the monthly transacting users, which is an operating metric defined as the monthly number of unique users who transact via Grab’s products, where transact means to have successfully paid for any of Grab’s products. MTUs is a metric by which Grab understands, evaluates and manages its business, and Grab’s management believes is necessary for investors to understand and evaluate its business.

Commission rate represents the total dollar value paid to Grab in the form of commissions and fees from each transaction, without any adjustments for incentives paid to driver- and merchant-partners or promotions to end-users, as a percentage of GMV, over the period of measurement.

Partner incentives is an operating metric representing the dollar value of incentives granted to driver- and merchant-partners. The incentives granted to driver- and merchant-partners include base incentives and excess incentives, with base incentives being the amount of incentives paid to driver- and merchant-partners up to the amount of commissions and fees earned by Grab from those driver- and merchant-partners, and excess incentives being the amount of payments made to driver- and merchant-partners that exceed the amount of commissions and fees earned by Grab from those driver- and merchant-partners.

Consumer incentives is an operating metric representing the dollar value of discounts and promotions offered to consumers. Partner incentives and consumer incentives are metrics by which we understand, evaluate and manage our business, and we believe are necessary for investors to understand and evaluate our business. We believe these metrics capture significant trends in our business over time.

Industry and Market Data

This document also contains information, estimates and other statistical data derived from third party sources (including Euromonitor), including research, surveys or studies, some of which are preliminary drafts, conducted by third parties, information provided by customers and/or industry or general publications. Such information involves a number of assumptions and limitations and due to the nature of the techniques and methodologies used in market research, and as such neither Grab nor the third-party sources (including Euromonitor) can guarantee the accuracy of such information. You are cautioned not to give undue weight on such estimates. Grab has not independently verified such third-party information, and makes no representation as to the accuracy of such third-party information.

Business Model Change Impact on Group Revenue

Deliveries and Group Revenues benefited by $68 million in Q4 2022 due to a business model change for certain delivery offerings in one of our markets from being an agent arranging for delivery services to be provided by our driver-partners to end-users, to being a principal whereby Grab is the delivery service provider contractually responsible for the delivery services provided to end-users. Revenue from these transactions is the amount of the delivery fees paid by end users for the delivery service, and the amount paid to driver-partners to carry out the delivery is recognised as an expense under cost of revenue. Revenues, excluding the impact of business model change, would have been $434 million in Q4 2022.

This business model change is a prospective change starting from and including Q4 2022. For reference purposes only, if the change in business model had occurred with effect from Q4 2021, we estimate the impact on revenue for the previous four quarters to be as follows.

Unaudited Summary of Financial Results

As we incurred net losses for the years ended December 31, 2022 and 2021, basic loss per share was the same as diluted loss per share.

The number of outstanding Class A and Class B ordinary shares was 3,736 million and 104 million, respectively, for the year ended December 31, 2022, and 3,619 million and 90 million, respectively, for the year ended December 31, 2021. 314 million and 224 million potentially dilutive outstanding securities were excluded from the computation of diluted loss per ordinary share because their effects would have been antidilutive for the years ended December 31, 2022 and 2021, respectively, or issuance of such shares is contingent upon the satisfaction of certain conditions which were not satisfied by the end of the period.

[1] Deliveries Revenues benefited by $68 million in Q4 2022 due to a business model change for certain delivery offerings in one of our markets from being an agent arranging for delivery services provided by our driver-partners to end-users, to being a principal whereby Grab is the delivery service provider contractually responsible for the delivery services provided to end-users. Excluding the change in business model, Q4 2022 and FY 2022 revenue growth would have been 255% YoY and 102% YoY, respectively. We expect this new business model to remain in place for those delivery offerings in that market going forward. On a constant currency basis and excluding the change in business model, we estimate revenue growth in 2023 to be 45% to 55%.

[2] We calculate constant currency by translating our current period financial results using the corresponding prior period ’ s monthly exchange rates for our transacted currencies other than the U.S. dollar.

[3] Deliveries revenues benefited by $68 million in Q4 2022 due to a business model change for certain delivery offerings in one of our markets from being an agent arranging for delivery services provided by our driver-partners to end-users, to being a principal whereby Grab is the delivery service provider contractually responsible for the delivery services provided to end-users.

[4] Regional corporate costs are costs that are not attributed to any of the business segments, including certain regional research and development expenses, general and administrative expenses and marketing expenses. These regional research and development expenses also include mapping and payment technologies and support and development of the internal technology infrastructure. These general and administrative expenses also include certain shared costs such as finance, accounting, tax, human resources, technology and legal costs. Regional corporate costs exclude share-based compensation expenses.

[5] Cash liquidity includes cash on hand, time deposits, marketable securities and restricted cash.

[6] Net cash liquidity includes cash liquidity less loans and borrowings.

[7] Based on Indonesia, Vietnam and Thailand driver base.

[8] Deliveries Revenues benefited by $68 million in Q4 2022 due to a business model change for certain delivery offerings in one of our markets from being an agent arranging for delivery services provided by our driver-partners to end-users, to being a principal whereby Grab is the delivery service provider contractually responsible for the delivery services provided to end-users. We expect this new business model to remain in place for those delivery offerings in that market going forward. On a constant currency basis and excluding the change in business model, we estimate revenue growth in 2023 to be 45% to 55%.

[9] Deliveries revenues benefited by $68 million in Q4 2022 due to a business model change for certain delivery offerings in one of our markets from being an agent arranging for delivery services provided by our driver-partners to end-users, to being a principal whereby Grab is the delivery service provider contractually responsible for the delivery services provided to end-users.

Visit our country press centres

- Philippines

Media Library

Media inquiries, follow us on grab social channels.

- Inside Grab

Engineering Stories

Contact the grab media team.

Please complete the fields below and a member of the Grab media team will respond to your inquiry regarding news stories. For customer support inquiries, do use the contact details found at the bottom of the webpage.

Press Contact

- Your Name *

- Email Address *

- Your Country Your Country Singapore Malaysia Indonesia Thailand Philippines Vietnam Afghanistan Albania Algeria American Samoa Andorra Angola Antigua and Barbuda Argentina Armenia Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia Bosnia and Herzegovina Botswana Brazil Brunei Bulgaria Burkina Faso Burundi Cambodia Cameroon Canada Cape Verde Cayman Islands Central African Republic Chad Chile China Colombia Comoros Congo, Democratic Republic of the Congo, Republic of the Costa Rica Côte d'Ivoire Croatia Cuba Curaçao Cyprus Czech Republic Denmark Djibouti Dominica Dominican Republic East Timor Ecuador Egypt El Salvador Equatorial Guinea Eritrea Estonia Ethiopia Faroe Islands Fiji Finland France French Polynesia Gabon Gambia Georgia Germany Ghana Greece Greenland Grenada Guam Guatemala Guinea Guinea-Bissau Guyana Haiti Honduras Hong Kong Hungary Iceland India Iran Iraq Ireland Israel Italy Jamaica Japan Jordan Kazakhstan Kenya Kiribati North Korea South Korea Kosovo Kuwait Kyrgyzstan Laos Latvia Lebanon Lesotho Liberia Libya Liechtenstein Lithuania Luxembourg Macedonia Madagascar Malawi Maldives Mali Malta Marshall Islands Mauritania Mauritius Mexico Micronesia Moldova Monaco Mongolia Montenegro Morocco Mozambique Myanmar Namibia Nauru Nepal Netherlands New Zealand Nicaragua Niger Nigeria Northern Mariana Islands Norway Oman Pakistan Palau Palestine, State of Panama Papua New Guinea Paraguay Peru Poland Portugal Puerto Rico Qatar Romania Russia Rwanda Saint Kitts and Nevis Saint Lucia Saint Vincent and the Grenadines Samoa San Marino Sao Tome and Principe Saudi Arabia Senegal Serbia Seychelles Sierra Leone Sint Maarten Slovakia Slovenia Solomon Islands Somalia South Africa Spain Sri Lanka Sudan Sudan, South Suriname Swaziland Sweden Switzerland Syria Taiwan Tajikistan Tanzania Togo Tonga Trinidad and Tobago Tunisia Turkey Turkmenistan Tuvalu Uganda Ukraine United Arab Emirates United Kingdom United States Uruguay Uzbekistan Vanuatu Vatican City Venezuela Virgin Islands, British Virgin Islands, U.S. Yemen Zambia Zimbabwe

- Media Title *

For members of the media who have inquiries about Grab for your reporting, kindly fill in the form below and our Grab Communications team will reach out to assist you.

We will only be able to reply to media inquiries. For all other questions, please visit our Help Center.

Forward Together

3 Media Close, Singapore 138498

Follow us and keep updated!

- Investor Relations

- Sustainability

- Grab Financial Group

- GrabForGood Fund

- Airport Guides

- GrabExpress

- GrabRewards

- Financial services

- Family Account BETA

- Help Centre

- Drive with us

- Deliver with us

- Driver Centre

- GrabAcademy

- Partner with us

- Financial resources

- Grab for Business

- GrabFinance

- GrabDefence

- Business Delivery Service

Quick Links

- Developer Portal

Komsan Chiyadis

GrabFood delivery-partner, Thailand

COVID-19 has dealt an unprecedented blow to the tourism industry, affecting the livelihoods of millions of workers. One of them was Komsan, an assistant chef in a luxury hotel based in the Srinakarin area.

As the number of tourists at the hotel plunged, he decided to sign up as a GrabFood delivery-partner to earn an alternative income. Soon after, the hotel ceased operations.

Komsan has viewed this change through an optimistic lens, calling it the perfect opportunity for him to embark on a fresh journey after his previous job. Aside from GrabFood deliveries, he now also picks up GrabExpress jobs. It can get tiring, having to shuttle between different locations, but Komsan finds it exciting. And mostly, he’s glad to get his income back on track.

Delivering… happiness and experiences full of flavor

Investor Relations

Reports center, presentations.

- CNA Explains

- Sustainability

- Latest News

- News Reports

- Documentaries & Shows

- TV Schedule

- CNA938 Live

- Radio Schedule

- Singapore Parliament

- Mental Health

- Interactives

- Entertainment

- Style & Beauty

- Experiences

- Remarkable Living

- Send us a news tip

- Events & Partnerships

- Business Blueprint

- Health Matters

- The Asian Traveller

Trending Topics

Follow our news, recent searches.

Commentary commentary

Commentary: Why Grab is in such a rush to get listed

Advertisement.

commentary Commentary

CEO Anthony Tan is in a rush to build Grab into a super app and achieve profitability, and the company’s listings will help him do that without too much public scrutiny, say IMD Business School’s Howard Yu and Angelo Boutalikakis.

A man walks past a Grab office in Singapore. (File photo: Reuters/Edgar Su)

LAUSANNE: Grab battled Uber. It survived a merger fallout with Gojek. It coaxed tolerance out of regulators in a fragmented region of Southeast Asia.

Most recently, the Securities and Exchange Commission (SEC) has threatened to put a brake on the frantic SPAC (special purpose acquisition companies) activities. Despite all this, Grab managed to land a US$40 billion merger with the US-based Altimeter Capital.

“You need to be hyper paranoid and constantly thinking that the guy on your right is trying to murder you,” CEO Anthony Tan of Grab said in an interview with Financial Times in 2014.

READ: Commentary: Anthony Tan, the ‘unabashedly ambitious’ man behind Grab

His paranoia has been justified - Anthony is restless. His “workhorse” nature has been known since his days at Harvard Business School. He has been seen taking calls and reading case studies while running on a treadmill.

What he’s running against now is time. He needs Grab to become a super app before others. He needs to do so before Grab’s core business shows any signs of plateauing.

TOO MUCH MONEY IS CHASING TOO FEW GREAT IDEAS

The rise of SPACs is closely tied to one of the biggest wealth transfers of modern economic times. The purpose of a SPAC is to raise capital through an initial public offering (IPO).

Only later will a SPAC buy a start-up.

READ: Commentary: Grab’s blockbuster deal comes at questionable time for SPAC market

In this twisted arrangement, the start-up can effectively bypass all the compliance hurdles of a traditional IPO.

There’s no public scrutiny of financial disclosure and no formal filing of a detailed prospectus in the form of S-1. That’s why SPACs are referred to as blank cheque companies. They give whatever a start-up needs without asking too many questions.

For instance, through a regular IPO, Mr Tan would have faced lots of challenges in securing his 60.4 per cent voting rights that he has once the company is listed even though he only owns 2.2 per cent of ordinary shares.

The recent experiences of the founders of WeWork and Deliveroo show that investors can scupper such disproportionate control of power in an IPO.

During most of financial history, SPACs had been a minor play. After all, what respectable investors are going to put money in a shell company in the hope that it would one day successfully pick a high-flying unicorn? But the COVID-19 crisis changed all that.

Multi-trillion-dollar stimulus packages have flooded the market with liquidity never seen before. The record highs of Dow Jones and Nasdaq mean that the wealthy - family offices and hedge funds -have become obscenely wealthier.

READ: Commentary: Deliveroo’s IPO is a lesson to not underestimate investors

Meanwhile, the number of publicly listed companies has been dropping over the last three decades, dropping from 8,000 to just over 4,000 today. All that money needs to find new investment opportunities.

So, Altimeter Capital becomes the blank cheque company for Grab. And in this deal, Grab will receive a maximum of about US$4.5 billion in cash from the SPAC merger.

A BIG BUSINESS THAT MAKES NO MONEY

For Grab though, there may be other reasons why the SPAC route was preferred, to escape public scrutiny over financial disclosure compulsory under an IPO.

For venture capitalists or the financial market, no business model is more attractive than a platform - a marketplace that enables the exchange of goods or services and has purported “network effects”.

READ: Commentary: What’s behind Grab’s reported SPAC listing

This so-called network effect has been a common refrain among economists and academics to explain the spectacular growth of these businesses.

They argue the more people use a platform, the more inherently attractive it becomes, leading even more people to use it. And once a platform reaches a certain size, it becomes too dominant to unseat.

The problem is this argument ignores the profitability issue. In ride-sharing, it turns out that the mere presence of one additional competitor can lead to ruinous, undifferentiated competition.

Plus ride-sharing’s network effect is also limited within one location. For instance, if you are using Grab in Singapore, you don’t necessarily care about the service level in Manila.

This is unlike Facebook, which has a global network. It is also difficult for another company to give Airbnb, for example, a run for its money as that competitor needs to have a global reach and network that Airbnb has. For companies like Grab, competition can easily spring up locally.

Advertisers like P&G or Nike actually care a lot about the size of Facebook’s audience from London to Hong Kong and so companies like Grab who don’t have that global network lose out on large advertising money.

As a result of a more open playing field locally, ride-sharing can easily succumb to a price war. Discount coupons and driver incentives quickly eat into profit margins.

That’s how Grab, Gojek, Uber, and Lyft have lost money.

But Uber in Southeast Asia is no more. And so the bleeding on that front has stopped.

Yet here is exactly why Grab prefers the SPAC route. According to the details revealed in its investor presentation , Grab will have to shave off hundreds of millions of dollars each year, in order to reach profitability.

It only aims to get to positive EBITDA (earnings before interest, tax, depreciation and amortisation) in 2023.

READ: Commentary: What is the logic of AirAsia entering Singapore’s food delivery market?

Read: commentary: the gig economy – a surprise boost from the pandemic and in singapore, it’s not going anywhere.

How will it do that? Grab’s ride-hailing business – which achieved positive EBITDA just last year - shows the way.

Already, to save costs in 2020, it may have cut off more than S$600 million worth of incentives for drivers and merchants – a figure larger than the increase it earned in billings that year.

No surprises then if Grab slashes incentives further to achieve the targeted profitability in the next few years. Such information, if disclosed through an IPO prospectus, may have seen a public backlash, which could have affected its listing returns or share pricing.

The question is, can Grab still maintain market share in the currently loss-making food delivery business if it cuts incentives? Why wouldn’t Foodpanda, Deliveroo and others swoop in to scoop up the clientele? Why wouldn’t people simply switch when Foodpanda has full-time deliverers on shifts and therefore may be potentially more reliable?

Regardless, these shaky profitability concerns are also why Mr Tan must move Grab into online food delivery, which since last year is now the biggest contributor to the company’s revenue.

This brings us to Grab’s second listing in Singapore.

FINTECH IS WHERE THE MONEY LIES

Today, Grab is expanding into a “super app.” It offers everything from food and parcel delivery to hotels and airline bookings and access to financial and health services. But being a super app can’t promise profitability; only being in the financial sector does.

It’s a sector full of slow-moving incumbents - and one stuck with obscenely high margins. And most attractive of all, it’s an industry teeming with paperwork and manual processes that should have been automated through technologies decades ago.

And Singapore, being the financial hub, will be Grab’s toehold for its financial service ambition. It has already acquired a banking license together with Singtel.

READ: Commentary: Why a bumper crop of Southeast Asian tech unicorns look set to IPO this year

That’s also why Mr Tan is also considering a second listing in Singapore. He doesn’t need additional money, but a second listing will buy him goodwill from the Singapore Government.

Grab has already acquired a banking license together with Singtel in Singapore, which as a financial hub, will be Grab’s toehold for its financial service ambition. However, Grab will need ongoing accommodation from regulators to navigate any resistance from traditional banks.

Since the company has sufficient cash reserves, it would only raise a small amount on the SGX, but this very symbolic listing would mark a big win for the Singapore Exchange.

The deal will put SGX in the international spotlight to rival its bigger counterpart of Hong Kong.

Because in Asia, you “had to work with individual government stakeholders, people of power and influence, in the highest echelons,” said Anthony.

It’s never too early to buy public goodwill.

Howard Yu is the author of LEAP: How to Thrive in a World Where Everything Can Be Copied (PublicAffairs; June 2018), LEGO professor of management and innovation at the IMD Business School in Switzerland, and director of IMD’s signature Advanced Management Program. Angelo Boutalikakis is a research associate at Center for Future Readiness at IMD Business School in Switzerland and Singapore.

Sign up for our newsletters

Get our pick of top stories and thought-provoking articles in your inbox

Get the CNA app

Stay updated with notifications for breaking news and our best stories

Get WhatsApp alerts

Join our channel for the top reads for the day on your preferred chat app

Related Topics

Also worth reading, this browser is no longer supported.

We know it's a hassle to switch browsers but we want your experience with CNA to be fast, secure and the best it can possibly be.

To continue, upgrade to a supported browser or, for the finest experience, download the mobile app.

Upgraded but still having issues? Contact us

Stay in the loop

Presentations.

Press Releases

Meritage homes releases fourth annual environmental, social, and governance report.

SCOTTSDALE, Ariz., Aug. 29, 2024 (GLOBE NEWSWIRE) -- Meritage Homes (NYSE: MTH), the fifth largest homebuilder in the U.S., today published its fourth annual environmental, social, and governance report (the “2023 ESG Report”), which outlines the Company’s efforts and progress related to sustainability and social initiatives.

Given its longstanding legacy of transparency, Meritage continued to provide its ESG disclosures under the shareholder-endorsed reporting frameworks of the Sustainability Accounting Standards Board, the Global Reporting Initiative, the United Nations Sustainable Development Goals and the Task Force on Climate-Related Financial Disclosures.

“Our evergreen ESG efforts are central to our purpose and a driving force behind every affordable, energy-efficient and quality home we build,” said Hilla Sferruzza, chief financial officer at Meritage Homes. “Through our engagement with customers, employees, vendors, peers, shareholders and other stakeholders, we continue to focus on the themes of affordability, sustainability, belonging and community, and to deliver a Life. Built. Better.® everyday.”

Key highlights from Meritage’s 2023 ESG Report include:

Environmental:

- Delivered 13,308 ENERGY STAR® certified homes.

- Reported an average HERS Index energy efficiency score of 52.

- Recognized as an eleven-time recipient of the U.S. Environmental Protection Agency’s ENERGY STAR® Partner of the Year.

- Achieved Great Place to Work® Certified status for the first time.

- Launched the Company’s inaugural employee resource groups.

- Received the prestigious Avid Cup – Production award, the highest customer satisfaction honor for any builder, for the third year in a row.

- Earned the highly coveted Hearthstone BUILDER Humanitarian Award for the Company’s long-time philanthropic efforts.

Meritage’s 2023 ESG Report and the related statistics in excel format can be found in full here .

About Meritage Homes

Meritage is the fifth-largest public homebuilder in the United States, based on homes closed in 2023. The Company offers energy-efficient and affordable entry-level and first move-up homes. Operations span across Arizona, California, Colorado, Utah, Texas, Florida, Georgia, North Carolina, South Carolina and Tennessee.

Meritage has delivered over 185,000 homes in its 38-year history, and has a reputation for its distinctive style, quality construction, and award-winning customer experience. The Company is an industry leader in energy-efficient homebuilding, an eleven-time recipient of the U.S. Environmental Protection Agency’s (EPA) ENERGY STAR® Partner of the Year for Sustained Excellence Award and Residential New Construction Market Leader Award, as well as a three-time recipient of the EPA's Indoor airPLUS Leader Award.

For more information, visit www.meritagehomes.com .

| Contacts: | Emily Tadano, VP Investor Relations and ESG |

| (480) 515-8979 (office) | |

| [email protected] |

Released August 29, 2024

- Email Alerts

- RSS News Feed

Reports and presentations

Kemira’s Half-Year Financial Report 2024

Our end-markets continued to recover during the second quarter and Kemira’s performance was solid, particularly in Industry & Water. I was pleased to see considerable year-on-year sales volume growth as well as slight volume growth from the previous quarter. Antti Salminen, President and CEO

Equity story in brief (fact sheet) Key financials

Watch a short interview on Kemira’s Q2 2024 results

Mikko Pohjala , Head of Investor Relations of Kemira commenting briefly on Kemira’s Q2 2024 results.

Watch previous result videos

IMAGES

COMMENTS

The Investor Relations website contains information about Grab Holdings's business for stockholders, potential investors, and financial analysts.

The Investor Relations website contains information about Grab Holdings's business for stockholders, potential investors, and financial analysts.

The Investor Relations website contains information about Grab Holdings's business for stockholders, potential investors, and financial analysts.

Grab today announced financial results for the fourth quarter and full year ended December 31, 2021. Strong end to 2021 with another record quarter and year in Gross Merchandise Value ("GMV"), exceeding the high end of full year 2021 guidance range. 2021 GMV grew 29% year-over-year ("YoY") to $16.1 billion, and Q4 GMV grew 26% YoY to $4 ...

Grab Announces Strong First Quarter 2021 Results as Company Progresses Towards U.S. Public Listing in Partnership with Altimeter Growth Corp. Grab today announced financial results for the quarter ended March 31, 2021. Grab and Altimeter Growth Corp. today also filed with the U.S. SEC a draft registration statement on Form F-4.

Grab's senior management team including Anthony Tan, Group CEO and Co-Founder, Ming Maa, President, and Peter Oey, CFO, will host an investor webcast via Zoom to present its second quarter 2021 financial results and business updates.

Grab is going public via a SPAC, so let's talk through key points from the investor deck — we'll discuss growth, segment profitability, aggregate costs and COVID-19.

Grab's Latest Financials. Here are some key statistics as shown in the investor presentation: In 2020, Grab has attained $12.5 billion in gross merchandise value, surpassing pre-pandemic levels and more than doubling from 2018. Grab's adjusted net revenue was $1.6 billion in 2020, with over 1.9 billion transactions completed on Grab.

Grab Investor Presentation April 2021 When you look at Grab's principal shareholders (excluding the SPAC's sponsor promote and the US$4 billion PIPE (Private Investment in Public Equity), some ...

Information with respect to after the closing of the Business Combination is based on the assumptions described in slide 44, titled "Transaction structure summary", of the Grab Investor Presentation April 2021.

Grab, the Singapore-based startup and Southeast Asian ride-hailing giant, is setting the stage for a record-breaking initial public offering in the United States.

Grab Investor Presentation, April 2021 Grab's technology-centric super-app strategy enables the company to cross-sell on multiple growth verticals and tap in virtuous tailwinds from network effects.

The deck clearly illustrates to investors Grab's current revenue and its projected revenue growth for the next three years. It also shares figures and charts of how its different businesses are ...