Disney Investment Thesis

Disney Investment Thesis: Whether the economy is thriving or in crisis, one thing stays the same: Disney has a permanent place on Forbes’ list of the World’s Most Valuable brands . It’s the only leisure company to hold a spot in the top 10, joining names like McDonald’s ( MCD ), Louis Vuitton, Coca-Cola ( KO ), and Facebook ( FB ) .

With that said, it’s true Disney had a difficult 2020. The COVID-19 pandemic decimated large parts of the business. First, Disney share price went from approximately $140 per share to just $85 per share when the market crashed in March 2020. Then, theme parks and movie theaters closed for a period. When some were able to reopen, it was at limited capacity.

According to CNBC, Disney was essentially “ hemorrhaging money since the outbreak ,” and the company was forced to lay off 28,000 employees in early October. That news, combined with several other developments, allowed share prices to fully recover by November 2020.

Since then, Disney stock has been trending upwards, and that has new investors curious. If Disney can generate this much growth before parks, resorts, and movie theaters are back to business-as-usual, what does the future hold? In other words, is Disney stock a buy?

Analysts say yes – and the Disney investment thesis is compelling. Here’s what you need to know.

Disney Market Share Has Accelerated

The Walt Disney Company has businesses in multiple industries, from theme parks and resorts to at-home streaming services. Calculating market share requires a closer look at the organization’s major divisions.

The most remarkable story comes from Disney+, which launched in mid-November of 2019. Whether because of the pandemic or in spite of it, Disney+ grew its subscriber base shockingly fast. Today, it is four years ahead of schedule in terms of member enrollments.

At the end of 2020, Disney+ had six percent of the streaming market. At first glance, that isn’t impressive when compared to Netflix’s 28 percent. However, Netflix’s market share came down three percent year-over-year. That suggests Disney+ is making inroads.

At its current rate, Disney+ is likely to surpass Netflix in terms of subscribers within a few years. When Netflix announced its 2020 year-end numbers, it was at 203.67 million paid members. Disney+ is projecting between 230 and 260 million subscribers by 2024.

A look at Disney’s share of the movie box office market paints another impressive picture – assuming 2020 is left out of the equation. In 2019, Disney releases made up 33.1 percent of box office earnings in North America. That dropped to 11.5 percent in 2020, but the drop is expected to be temporary.

Disney theme parks also took a big hit in 2020, but the industry as a whole is expected to recover and grow through 2026. That’s good news for Disney and its investors, considering Disney controls nearly half of the total market.

These positions represent just a fraction of Disney’s total business. It owns a long list of media and entertainment companies that include ESPN, National Geographic and the ABC broadcast television network.

In addition, it has an entire unit devoted to content licensing and sales. By many measures, Disney is a winner in nearly every market where it has a presence.

Does Disney Stock Have a Moat?

Any review of the Disney investment thesis must include discussion of the company’s moat. However, the question is less “does Disney stock have a moat?” and more “can any company boast a moat as wide as Disney’s?”

The company’s brand is its first and most valuable asset – the Disney brand creates a moat on its own. However, the Walt Disney Company has other unique features that create an unbeatable economic moat.

Specifically, the size and scope of the company’s combined businesses are more valuable than the individual business units. Many are interconnected and reliant on each other – but they also support each other through economic ups and downs.

Disney films, theme parks, licensing, and streaming services rely on an underlying set of entertainment assets – movie franchises, individual films, and characters that have captured the world’s imagination. It would take generations for another company to develop the same level of passion sparked by the likes of Star Wars, Cinderella, and the entire Marvel Universe – assuming it is possible at all.

Is Disney Growing Revenues?

Aside from the anomaly that was 2020, Disney revenues have grown steadily in recent years. A 10-year history shows the following results:

- Fiscal 2020 – $65.4 billion

- Fiscal 2019 – $69.6 billion

- Fiscal 2018 – $59.4 billion

- Fiscal 2017 – $55.1 billion

- Fiscal 2016 – $55.6 billion

- Fiscal 2015 – $52.5 billion

- Fiscal 2014 – $48.8 billion

- Fiscal 2013 – $45 billion

- Fiscal 2012 – $42.3 billion

- Fiscal 2011 – $40.9 billion

It’s interesting to note that even in 2020 – a period during which the company was “hemorrhaging money” – the year-over-year decline in revenue was just 6.06 percent.

What Rate Are Disney Earnings Growing?

The picture painted by Disney’s earnings per share isn’t quite as positive as its revenues. Disney had a couple of down years, and they weren’t all COVID-related. The past decade of earnings per share results look like this:

- 2020 Annual Earnings per Share – $-1.58

- 2019 Annual Earnings per Share – $6.64

- 2018 Annual Earnings per Share – $8.36

- 2017 Annual Earnings per Share – $5.69

- 2016 Annual Earnings per Share – $5.73

- 2015 Annual Earnings per Share – $4.90

- 2014 Annual Earnings per Share – $4.26

- 2013 Annual Earnings per Share – $3.38

- 2012 Annual Earnings per Share – $3.13

- 2011 Annual Earnings per Share – $2.52

Given its long history of gains, most investors are comfortable that even though earnings per share occasionally dip, on the whole, the figures are trending upwards and will recover within the next 12 – 24 months.

Robert Iger’s Final Act Might Be His Best

Disney’s leadership team is often recognized among the best in the business. Executive Chairman and Chairman of the Board Robert Iger served as CEO for 15 years – through February 2020 – before handing the CEO title over to Bob Chapek, a 30-year veteran of the company.

While Iger was in the CEO seat, he acquired Pixar, Marvel, Lucasfilm, and 21st Century Fox. In addition, he expanded the business into new markets. For example, he opened Disney’s Shanghai park and resort.

Iger’s most important legacy may be the launch of Disney+. Most expect the streaming service to drive a substantial portion of Disney’s long-term growth.

Chapek was barely in his new role a month before the pandemic took over and the economy tanked. Perhaps he doesn’t have a collection of acquisitions and record-breaking films to boast about quite yet, but his ability to steer the company through one of the most trying times in its history is telling.

There is little doubt that Disney will come out intact on the other side, and Chapek can take some of the credit for that.

Headwinds Facing Disney

Disney’s stock has recovered since the March 2020 market crash, and it has neared all-time highs. Much of that is based on the company’s success in adapting to the unusual environment presented by the pandemic. For example, the company found a way to release and capitalize on big-budget films like the live-action Mulan though movie theaters were closed.

Part of the stock’s price trend is based on expectations for the company once the world returns to business-as-usual. The revenues lost during park, resort, and theater closures will pick up – and perhaps swell in response to pent-up demand.

The biggest headwinds facing Disney remain pandemic-related. Until the world achieves herd immunity, there will be some hesitation around traveling and spending time in crowds. In addition, the timeline for fully extinguishing COVID-19 is decidedly uncertain. That creates a difficult environment within which to run a leading entertainment and leisure company.

Disney Investment Thesis Conclusion

The bottom line is that Disney stock is a smart buy , particularly over the long term. The company holds a leadership position in multiple industries, and it is rapidly taking over new ones. The most notable advantage that Disney and its shareholders have is that other media, entertainment, and leisure companies simply can’t compete.

While they may pull a bit of market share away from Disney now and then, Disney always comes out on top due to the strength of its brand and its internal ecosystem.

#1 Stock For The Next 7 Days

When Financhill publishes its #1 stock, listen up. After all, the #1 stock is the cream of the crop, even when markets crash.

Financhill just revealed its top stock for investors right now... so there's no better time to claim your slice of the pie.

The author has no position in any of the stocks mentioned. Financhill has a disclosure policy . This post may contain affiliate links or links from our sponsors.

Where is DIS Headed Next?

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Newsletters

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- The Morning Brief

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Editor's Picks

- Investing Insights

- Trending Stocks

- Morning Brief

- Opening Bid

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Semper Augustus’ Walt Disney (DIS) Investment Thesis

In this article:.

Semper Augustus Investments Group , an investment management firm, published its fourth-quarter 2020 Investor Letter – a copy of which can be downloaded here . In the lengthy letter, the fund talked about the activities in their portfolio and other important updates which they quoted, "The Path From Deflation; Expedition Everest; and - Berkshire: The GOAT Goes Full Repo". You can view the fund’s top 5 holdings to have a peek at their top bets for 2021.

Semper Augustus Investments Group, in their Q4 2020 Investor Letter, said that they've initiated positions in The Walt Disney Company (NYSE: DIS ) at high single-digit expected earnings yields. The Walt Disney Company is mass media and entertainment conglomerate that currently has a $357.7 billion market cap. For the past 3 months, DIS delivered a decent 30.46% return and settled at $191.76 per share at the closing of February 22nd.

Here is what Semper Augustus Investments Group has to say about The Walt Disney Company in their Q4 2020 investor letter:

"With few exceptions, portfolio activity added tremendous earning power. Sales were generally undertaken at high prices where price gains had outstripped fundamentals and thus as earnings yields diminished. Buys added wholesale earnings power. When numerous holdings plunged in price in March and later, we both added to and initiated positions at high single-digit expected earnings yields.

Copyright: blanscape / 123RF Stock Photo

Our calculations show that The Walt Disney Company (NYSE: DIS ) ranks 11th in our latest list of the 30 most popular stocks among hedge funds . As of the end of the fourth quarter 2020, Disney was in 144 hedge fund portfolios, its all time high statistics. DIS delivered a 54.40% return in the past 12 months.

The top 10 stocks among hedge funds returned 216% since the end of 2014 and outperformed the S&P 500 Index ETFs by more than 121 percentage points. We know it sounds unbelievable. You have been dismissing our articles about top hedge fund stocks mostly because you were fed biased information by other media outlets about hedge funds’ poor performance. You could have doubled the size of your nest egg by investing in the top hedge fund stocks instead of dumb S&P 500 ETFs. Here you can watch our video about the top 5 hedge fund stocks right now. All of these stocks had positive returns in 2020.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock . We go through lists like the 11 best lithium stocks to buy now to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Our monthly newsletter's stock picks returned 197% over the last 4 years. You can subscribe to our free daily newsletter on our homepage :

Disclosure: None. This article is originally published at Insider Monkey .

Recommended Stories

More From Forbes

How disney’s financial wizardry boosted its return on investment.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Storm clouds are brewing over the Magic Kingdom (Photo by Roberto Machado Noa/LightRocket via Getty ... [+] Images)

Disney used unconventional financial principles to calculate its performance in a flattering business presentation designed to convince stockholders to vote in its favor at its annual meeting today.

The vote has been driven by Blackwells Capital and Trian Fund Management – two hedge funds which have amassed large stakes in Disney and are seeking board seats. Blackwells has asked for three whilst Trian wants two – one for its co-founder Nelson Peltz and another for Jay Rasulo, who was Disney's chief financial officer from 2010 to 2015. It is a highly personal and bitter battle.

Broadly speaking, both funds claim that Disney hasn’t delivered for stockholders in recent years and, testimony to this, its stock price has declined by almost 40% since its peak of $201.91 in March 2021. There is good reason for this.

The global cost of living crisis has cast a dark spell on all of Disney's key divisions since the coronavirus pandemic receded. Many people can no longer afford to visit Disney's theme parks or go to the theater whilst others have had to cancel their subscriptions to its Disney+ streaming platform and ESPN sports network, a process known as cord-cutting.

Compounding the problem, the economic downturn coincided with heavy investment by Disney in streaming content to try and draw subscribers away from its chief rival Netflix. It has left the streaming unit with losses of more than $11.3 billion since it launched in 2019 with profitability only forecast by the end of this year.

Best High-Yield Savings Accounts Of 2024

Best 5% interest savings accounts of 2024.

As I have written about previously , over the past few years Disney also placed massive bets on movies for the big screen which were anything but dream tickets. Indeed, in just the past few days it has come to light that Disney lost $130 million alone on last year's theatrical run of Indiana Jones and the Dial of Destiny .

The movie was given the green light in 2016 by Disney's chief executive Bob Iger who also presided over the skyrocketing price of its theme park tickets and hotels. Likewise, cord-cutting was also a worry under his watch and in 2019 he launched Disney+ before he stepped down the following year.

Iger handed the reins to Bob Chapek, then-head of Disney's parks division, who got the blame when Disney's stock price went into freefall in 2022. It lost 31.5% of its value in the first 11 months of the year and in a bid to bring back the magic, Disney tempted Iger take the top job at the media giant again.

Bob Iger is back in charge of Disney, but has not replicated his previous successes (Photo by ... [+] Charley Gallay/Getty Images for Disney)

Since then, Iger has cut $7.5 billion of costs and costly content which was in production. Disney is also planning an ESPN streaming service, has launched a cut-price, advertising-supported Disney+ package and has offered free water park access to on-site hotel guests at its sprawling Walt Disney World theme park complex in Orlando, Florida.

Blackwells doesn't believe that is enough to give Disney a happy ending and has suggested breaking it up into three separate public companies which would each have their own specialist management team. Disney has resisted this, arguing that it would spell the end of its synergy and the conglomerate that Walt Disney founded in 1923.

Remarkably, Trian's request for board seats is even more controversial than this. In February 2015, Rasulo was passed over for Disney's Number Two job and left the Mouse three months later after a total of 29 years with the company. He isn't the only former Disney staffer involved with Trian.

Another of Peltz's partners is Israeli-American billionaire Ike Perlmutter who was chairman of Disney's Marvel Entertainment super hero division. He famously butted heads with Iger and in March last year was sacked as part of the cost cuts.

Against this backdrop, Disney recently released a presentation entitled 'The Right Board, The Right Strategy: Disney's Plan For Shareholder Value Creation'. The 67-page screed gushes over Disney's achievements to try and convince stockholders to back Iger's vision for the company and vote in favor of his preferred directors. It even goes as far as to claim that between 2020 and 2022 the Disney "management and board deftly handled severe impacts from the global pandemic." If that was actually the case then it raises the question of why Disney needed to fire Chapek.

Peltz and Rasulo are the focus of the attention in the presentation and, strangely for a company which is usually cautious with its wording, the descriptions of them are replete with unverifiable opinionated statements.

Apparently written with a crystal ball in hand, the presentation claims that "Jay Rasulo will harm Disney" and, suggesting that the authors are also mind-readers, it adds that "Peltz knows nothing about managing creativity."

Indeed, the presentation goes to such great lengths to show that Disney is always in the right that it ends up contradicting itself. It claims that "neither Peltz, who does not understand media, nor Rasulo, who has not managed through the industry’s disruption, have the skills to help Disney." If this is true and not just a petty snipe, then why does the presentation later claim that Disney "already have in motion the vast majority of Peltz’s 'suggestions'"?

It doesn't just suggest that Disney is clutching at straws but also that its argument is circular. By objecting so strongly to Trian's directors, Disney comes across as being closed-minded which is the very thing that Trian and Blackwells are complaining about. They say that Disney is badly in need of a fresh perspective and its presentation simply serves to make it look desperate to demonstrate that this isn’t the case. It goes to astonishing lengths to do so.

Thanks to the history between Iger and Perlmutter, the presentation heaps as much praise on Disney's CEO as the company itself. The acrimony between the two men is so great that business network CNBC has even suggested that Iger could resign if Trian gets its way with its bid for board representation.

There is little doubt that whenever Iger leaves, his largest legacy will be four landmark acquisitions. They started less than a year after he first became Disney's big cheese when he approved the $7.4 billion buyout of computer-animated movie producer Pixar, owners of the Toy Story franchise, in January 2006.

He followed it up three years later by paying $4 billion for Marvel Entertainment, home of the beloved Avengers franchise. It helped Disney to appeal more to young boys and gave the company a counterpart to its successful franchise of princesses. Iger didn't stop there and in 2012 Disney bought Lucasfilm, owner of the rights to Star Wars and Indiana Jones. That too cost a cool $4 billion but this was nothing compared to what was yet to come.

Disney spent $4 billion on Marvel Entertainment ©Marvel Studios 2019

Iger saved his biggest deal for last when Disney bought 21st Century Fox for a staggering $71 billion in 2019. Fox gave Disney the movie rights to super hero squads the X-Men and the Fantastic Four as well as adult-focused content for its streaming platform which has yet to pay off.

Iger has become almost synonymous with these four deals so it's perhaps no surprise that they loom large in the presentation. It devotes a full page to the fruits of them under the title: 'Enduring franchises highlight our powerful IP and unique monetization capabilities'. This too comes across as being desperate.

The purpose of the page is to show the financial benefit that Iger's iconic transactions have brought to Disney. The logos of franchises linked to these deals are presented next to a chronology of the key developments such as the opening of theme park attractions based on them and the debut of new movies in the series. At the side of the timeline is a figure showing the alleged Return On Investment (ROI) that they have generated.

According to the document, Star Wars has generated a 2.9x ROI for Disney, whilst the Avengers has made 3.3x and Toy Story is even higher at 5.5x due to the lower costs of making computer-animated movies. This too is why the list is crowned by the wildly-popular computer-animated franchise Frozen which has supposedly yielded a return of 9.9 times Disney's investment. It all sounds sensible on the face of it but looking a little deeper soon reveals that Disney has used every trick in its spell book to arrive at these conclusions.

Under Disney's unconventional methodology, Frozen has generated a 9.9x ROI (Photo by Alberto E. ... [+] Rodriguez/Getty Images for Disney)

The smoking gun is Frozen as it was not part of one of Iger's four landmark deals. In fact, it was actually adapted from Hans Christian Andersen's story The Snow Queen . This immediately raises the question of how the ROI was calculated if there was no investment to acquire it. Surprisingly, the fine print at the bottom of the page doesn't answer this question but it does contain a blockbuster revelation.

The fine print states that the ROI calculation is based on "titles released following Disney’s acquisition of the IP." This doesn't solve the Frozen conundrum as it was not an established franchise which was acquired by Disney like the other three on the page. However, the presentation goes on to make it clear how the investment was calculated.

The fine print states that "investment reflects film production costs and print & advertising associated with the theatrical release of the titles, and in the case of animated titles it also includes production overhead." In short, the 'I' in ROI covers the movie's production expenses and marketing costs. There is no indication that the ROI calculation factors in Disney's acquisition cost of the companies which own the franchises and this isn't actually as significant an omission as it may seem.

Despite initial appearances, the page is not intended to show the ROI of Disney's acquisition of Lucasfilm, Pixar and Marvel but just the Star Wars, Toy Story and Avengers franchises within them. Lucasfilm, Pixar and Marvel all own a multitude of other franchises and assets so it wouldn't be logical to attribute the entire purchase price of those companies when calculating the ROI of Star Wars, Toy Story and Avengers. There is no doubt that this is what Disney intended to do as the fine print even lists the movies in those franchises which the ROI calculation is based on.

Accordingly, there is no question about the logic behind the calculation of the costs of the four franchises on the presentation page. However, the 'R' in ROI is a completely different story. The fine print is very clear about what the return doesn't include and this too is entirely logical.

It states that the return "does not include derivative revenue streams, such as park attractions, nor does it include DTC originals associated with those franchises or pre-established franchise consumer products revenue."

Starting at the end of this list, the pre-established franchise consumer products revenue refers to cashflow which was in place prior to Disney's acquisition of the franchises so it is perfectly reasonable to exclude that. Likewise, DTC, or Direct To Consumer, refers to streaming shows and the reason they too should be excluded is that subscribers pay to access Disney's entire library of content, not just specific shows. As a result, it isn't possible to attribute subscriber fees to specific franchises and the same goes for theme park attractions as guests get access to all of them for the entry price.

So far so good but then comes a disturbance in the force.

The fine print adds that the return is based on "directly associated theatrical releases, including theatrical, home entertainment, TV (pay and free), and consumer products" which, again makes perfect sense. However, it adds that the calculation is based on a 10-year period of "generated and expected" results. In other words, the ROI figure is partly based on a forecast which may not even prove to be accurate. Remarkably that is far from the most contrived aspect of the calculation.

Sitting there in plain sight in the fine print is the definition of 'return on investment' which is described as "the ratio between revenue and investment." Except that's not what return on investment is.

As the following definition shows, "ROI is expressed as a percentage and is calculated by dividing an investment's net profit (or loss) by its initial cost or outlay." Ditto from Harvard Business School , Pepperdine , and pretty much every major business school and financial institution.

The clue is in the word 'return'. Revenue is not a return for the owner as a cut of it has to be paid out in costs, unless there are none which certainly doesn't apply in Disney's case. Calculating ROI on revenue rather than profit ignores the costs so artificially inflates the result.

Take for example a movie which grosses $1 billion in ticket sales. The studio typically gets 50% of the box office giving it revenue of $500 million. Let's say the amount the studio actually invested in the picture (after any reimbursements or incentives for filming in particular jurisdictions) comes to $300 million, that gives it a $200 million profit.

Calculating the ROI by using a ratio of the $500 million revenue and the $300 million investment gives a 0.7x multiple. In contrast, using the actual ROI method involves dividing the $200 million profit by the $300 million investment which yields a loss for the studio.

Taking another example, if a movie generates $850 million in ticket sales, giving the studio revenue of $425 million, on an investment of $110 million, it makes a $315 million profit. Disney's definition of the ratio between revenue and investment yields a 2.9x ROI as the movie generated $315 million in revenue after it had returned the owner's $110 million investment. However, using the actual definition of the ratio between profit and investment yields an ROI multiple of 1.9x as the movie made $205 million of profits once the studio had got its $110 million investment back.

Try as many figures as you like and the result always comes out the same – using the ratio between revenue and investment will yield a higher result than the ratio between profit and investment which is the usual definition of ROI. The only exception is if the costs are zero which is not applicable in the case of Disney movies or consumer products.

This applies to any industry. Take for example a real estate owner who buys a hotel for $200 million. That cost isn't factored into Disney's examples so we should ignore it here too. The owner then makes a $25 million investment to renovate the hotel and it generates $100 million in revenue over 10 years. Its costs over that period come to $50 million leaving a $50 million profit for the owner.

Using Disney's definition of the ratio between revenue and investment yields a 3x ROI. This is because the hotel generated $75 million in revenue beyond the owner's $25 million investment. However, using the actual definition of ROI – the ratio between profit and investment – yields a 1x multiple as the hotel only generated $25 million in profit once it had returned the owner's investment of $25 million.

Again, try as many numbers as you like and the result will always be the same – Disney's definition inflates the ROI result unless the costs come to zero which isn't the case here. We have reached out to Disney to ask why it used this definition of ROI but have not received a reply.

It is understood that Disney hasn't misled investors as the methodology is in the fine print of the presentation. That said, using such a contrived definition makes the media giant look even more desperate and it is such an extraordinary decision that it calls into question the credibility of the entire presentation.

That doesn't just make Trian look sparkling but Blackwells too and this can be seen through its call to break up Disney. The media giant's current leisure strategy is to have a small number of theme parks scattered around the globe so that many tourists have to travel far to get to them which makes the experience a special occasion. As a result, they are prepared to pay more for it which raises the profit margins.

That's an admirable aim but it has also left Disney chronically under-exposed in major markets such as India, South Africa, Australia and the United Arab Emirates (UAE UAE ) which all lack a Disney park. The UAE in particular is one of the world's wealthiest nations and has tremendous pent-up demand for Disney. Not only are 88.5% of the population expats (including many Americans) but the remaining 11.5% are immensely wealthy and already spend big bucks at Disney parks elsewhere in the world.

The Disney vacuum in the UAE has led to the theme park sector in its key cities of Dubai and Abu Dhabi being dominated by Dreamworks, SeaWorld and Warner Bros. Iger shouldn't have a problem with the UAE as it is a more progressive country on almost all fronts than China which is home to two Disney parks.

SeaWorld opened in the United Arab Emirates in 2023

There isn't even a Disney store in the UAE despite it being home to one of the world's biggest malls and a tremendous number of other American retail chains including OshKosh B'gosh, Williams Sonoma, Payless ShoeSource, Bath & Body Works, Pottery Barn, ACE and The Children's Place which, ironically, once held the Disney Store license. The absence of Disney Stores isn't due to the shift away from bricks and mortar as nearby Qatar has one as we have reported .

If Disney's parks were run by a real estate company it may take the alternative strategy of wider distribution and lower entry prices which would greatly boost distribution and revenue. It would also ensure that Disney isn't left behind by its main rival NBCUniversal which is planning smaller parks in Frisco, Texas, and the United Kingdom as well as smaller attractions in major cities to capitalize on the booming trend for Location Based Entertainment.

It all contributes to the conclusion that Disney's presentation appears to be counter-productive. After all, if Trian and Blackwells are such insignificant adversaries then why was there a need to produce the presentation in the first place? Given some of the claims made in the document it could end up casting a dark spell over Disney even if it wins the board vote today.

- Editorial Standards

- Reprints & Permissions

Join The Conversation

One Community. Many Voices. Create a free account to share your thoughts.

Forbes Community Guidelines

Our community is about connecting people through open and thoughtful conversations. We want our readers to share their views and exchange ideas and facts in a safe space.

In order to do so, please follow the posting rules in our site's Terms of Service. We've summarized some of those key rules below. Simply put, keep it civil.

Your post will be rejected if we notice that it seems to contain:

- False or intentionally out-of-context or misleading information

- Insults, profanity, incoherent, obscene or inflammatory language or threats of any kind

- Attacks on the identity of other commenters or the article's author

- Content that otherwise violates our site's terms.

User accounts will be blocked if we notice or believe that users are engaged in:

- Continuous attempts to re-post comments that have been previously moderated/rejected

- Racist, sexist, homophobic or other discriminatory comments

- Attempts or tactics that put the site security at risk

- Actions that otherwise violate our site's terms.

So, how can you be a power user?

- Stay on topic and share your insights

- Feel free to be clear and thoughtful to get your point across

- ‘Like’ or ‘Dislike’ to show your point of view.

- Protect your community.

- Use the report tool to alert us when someone breaks the rules.

Thanks for reading our community guidelines. Please read the full list of posting rules found in our site's Terms of Service.

ValueAct's two-leg Disney thesis seeks running room

- Michael Flaherty

- facebook (opens in new window)

- twitter (opens in new window)

- linkedin (opens in new window)

- email (opens in new window)

Mason Morfit and Jordana Brewster. Photo by Axelle/Bauer-Griffin/FilmMagic

ValueAct's investment plan for Disney is centered on strong cash flows from its parks and consumer products, and the expectation that the streaming wars are ending , according to the activist fund.

Why it matters: If Disney's performance matches ValueAct's thesis, it will help solidify support around CEO Bob Iger and the board. If the stock continues to lag, ValueAct's patience will wear thin, as will its support.

Details: ValueAct's view on Disney was revealed not in a press release or a traditional financial media outlet but rather in an interview with 13DMonitor, a research firm that specializes in activist investing.

- The firm, run by founder Ken Squire, produces a monthly PDF newsletter, in which ValueAct co-CEO Mason Morfit was featured this month.

What they're saying: "Our thesis on Disney has two legs. First, Disney parks and consumer products are GREAT businesses that, on their own, we believe are worth $80 to shareholders. So you're getting the media assets for almost nothing," Morfit told the newsletter.

- Morfit added that Disney's parks are high-return assets that are growing fast and provide an "extra window" to monetize stories and IP. It's a cash flow boost that Netflix, Warner Media Discovery and Paramount don't have, he added.

Zoom in: Morfit said the second leg of the thesis is that the streaming wars are about to end.

- "At this point, I think everyone can admit that 13 different major streaming services all going it alone was a big mistake. In the future, there will be fewer streamers with bigger bundles of content that are easier to access," he said.

Of note: Morfit, when ValueAct was represented on Fox's board, sat across from Iger during the Fox-Disney entertainment assets deal in 2017-18. Morfit says he's since sought Iger's counsel on ValueAct investments in the New York Times, Nintendo and others.

- "His track record in media is pretty much unparalleled," Morfit said of Iger in the interview, touting Iger's diplomacy. "We are going to help him as best we can."

Editor's note: This story has been corrected to reflect that Morfit represented ValueAct (and was not on Fox's board) when he sat across from Iger in 2017-18.

Want more stories like this? Sign up for Tech Policy

Disney Investor Day 2020

The Walt Disney Company webcast its Investor Day 2020 on December 10, 2020. The event focused on the Company’s direct-to-consumer streaming services.

EVENT MATERIALS: Transcript Presentation Slides

- further changes in domestic and global economic conditions and competitive conditions;

- health concerns;

- consumer preferences; willingness to pay for an expanding set of direct-to-consumer services; and performance of the markets in which we operate, including the pay television ecosystem;

- government regulation, including revised foreign content and ownership regulations;

- poor quality broadband infrastructure in certain markets;

- international, political, or military developments;

- technological developments;

- labor markets and activities; and

- adverse weather conditions or natural disasters;

- demand for our products and services;

- performance of our direct-to-consumer technology platforms;

- performance of the Company’s theatrical and original direct-to-consumer releases;

- the advertising market for entertainment programming and services;

- expenses of providing medical and pension benefits;

- income tax expense; and

- performance or operations of some or all company businesses either directly or through their impact on those who distribute our products.

Investment thesis for Disney

HOSTS Maddy Guest & Sophie Dicker | 1 March, 2022

On today’s episode, Maddy shares her tips and tricks for finding a good investment. One of our favourite investing quotes is ‘know what you own and know why you own it’. That’s where an investment thesis comes in! And it doesn’t have to be tricky… Today Maddy shows you how, by building up an investment thesis for Disney (NYSE: DIS), whilst Sophie tries her best to pull it apart.

Keep track of Sophie and Maddy between the episodes on Instagram , or on TikTok , and come and be part of the conversation on Facebook with our You’re In Good Company Discussion Group . Got a question or a topic suggestion? Email us here .

In the spirit of reconciliation, Equity Mates Media and the hosts of You’re In Good Company acknowledge the Traditional Custodians of country throughout Australia and their connections to land, sea and community. We pay our respects to their elders past and present and extend that respect to all Aboriginal and Torres Strait Islander people today.

You’re In Good Company is a product of Equity Mates Media.

All information in this podcast is for education and entertainment purposes only. Equity Mates gives listeners access to information and educational content provided by a range of financial services professionals. It is not intended as a substitute for professional finance, legal or tax advice.

The hosts of You’re In Good Company are not financial professionals and are not aware of your personal financial circumstances. Equity Mates Media does not operate under an Australian financial services licence and relies on the exemption available under the Corporations Act 2001 (Cth) in respect of any information or advice given.

Before making any financial decisions you should read the Product Disclosure Statement and, if necessary, consult a licensed financial professional.

Do not take financial advice from a podcast.

For more information head to the disclaimer page on the Equity Mates website where you can find ASIC resources and find a registered financial professional near you.

You’re In Good Company is part of the Acast Creator Network.

Maddy: [00:00:19] Hello and welcome to youre in good company, a podcast that makes investing accessible for everyone. I'm Maddy, and as always, I'm in very good company with my co-host Sophie.

Sophie: [00:00:29] I'm really excited today for two reasons. One, because we're recording together in the same room. Love that. Better energy, good vibes. That number two, because you are giving me an investment thesis today for a stock that we both love, which is Disney.

Maddy: [00:00:45] Yes, I feel like this one is like, really defined our childhood. We've talked a few times on the podcast before randomly. Yeah, how I like Disney Kids. We've had a few arguments over which ones we love, which ones we listed, which films we watched.

Sophie: [00:00:58] The Aristocats is the best.

Maddy: [00:01:00] I mean, yeah. Anyway, what is your favourite? We'll say when we had this discussion, I went to Hannah Montana, but I'm like, Oh yeah, I've been actually reflecting on this. Quite. Here we. Sure, I'm glad. So you haven't? Oh, this is like I've never seen the aristocrats and I can. You have an older sister? So you like watched younger ones, old ones? I don't know. I mean, like, I feel like even though the oldest, I'm not trying to say that Hannah Montana is like the earliest Disney film I watched. Like that was made like 10 Disney Love. Yeah, but I felt like when I think about my Disney films, I think like Toy Story Monsters Inc, even like

Sophie: [00:01:40] all like the classic cartoon. Yeah, yeah. Right? Interesting. Anyway, anyway, I'm excited for this one because you our previous season, I pitched Sonos and I did an investment thesis and I built it up in a certain way, so I'm intrigued to see how you build up your thesis. Yeah, and I am not going to tear it down, but I'm going to, you know, test you nuts.

Maddy: [00:02:02] But before we get into today's episode, let's hear from a YIGC community member.

community member: [00:02:06] Show me the money, honey. Hi, everyone. I'm 25 years old and I work in retail part time while I'm in my last year of university studies and I'm currently earning around $2000 a month. Each month, I tried to invest at least $1000 into shares, particularly when everything has been so low. I was finding myself investing a little bit more. My portfolio has mainly consisted of ETFs and some individual blue chip companies. I started investing last year and my strategy was to invest in some stable shares and ETFs that pay dividends. Although after being influenced by some male figures, I found myself being caught up in FOMO and investing in overhyped speculative stocks. After being burnt with those stocks, I've been consistently sticking to buying and holding ETFs and some blue chip companies. Today, the total value of my portfolio is nineteen thousand one hundred and ninety two dollars, and I've made a profit of nine hundred and fifty dollars. I hope this motivates all of us to take the plunge into investing and that it's okay to stick with what you know and believe in and block out the other noise.

Sophie: [00:03:10] Love hearing how someone else is kind of building up their portfolio and getting, I guess, a bit of the insight to their strategy in their stocks or ETFs. All right, let's jump into your investment thesis.

Maddy: [00:03:19] Yes, so I'm a big believer when it comes to building up a thesis around a stock that you don't have to do too much work. Okay, all right. It's not i-, I'm really of the belief that if you have a good story and if you believe in the story and it makes sense to you, then it can often be a really good investment.

Sophie: [00:03:41] So but surely you have to have a bit of research into this story and

Maddy: [00:03:44] make sure the story is part of the research process, right? Like, that's when you look into it and you know, you might have an idea. Yeah, but I fill out the story a bit more, but I don't think it doesn't have to be complicated. I think it can actually be really simple. Idea is because at the end of the day, especially for a company like Disney, where the consumers.

Sophie: [00:04:03] OK, so your investment thesis is going to be on Disney, and you said that the way that you build up a thesis is kind of creating a story to why you really like this company. So why don't we start at the beginning then? And you can give us some background on Disney and what's been happening?

Maddy: [00:04:16] Yeah, great. So I think for Disney, this is particularly important because it was impacted like quite significantly by the pandemic, both positive and negative. First of all, we know that all of the theme parks were forced to close, and historically the theme parks have contributed like 50 percent of Disney's income. Wow. Huge, huge amount. So the fact that they were all shot and then even when they did reopen, you know, limited capacity people aren't travelling that were significantly impacted.

Sophie: [00:04:45] So this was over like the Covid period, like 2020. A bit of 2021.

Maddy: [00:04:49] Exactly. Yeah, OK. And then you've got the flip side of that, which is in November of 2019. So I guess five months before the pandemic sort of really hit Australia. Disney Plus. Launched and we all know how the streaming services Ren Covid,

Sophie: [00:05:03] yeah, so it's like such a diversified business has a bit of

Maddy: [00:05:06] both. Oh, this business is very diversified. My favourite thing about it. So if we take a step back and think about the stock price, when the pandemic hit theme parks and things with forced to shot, the stock price went from about $140 a share to eighty five when the market crashed,

Sophie: [00:05:24] and that was mainly because of lack of travel restrictions and people not visiting the park.

Maddy: [00:05:29] Correct. And I guess in the broader context like that was in March of 2020. So yes, the whole stock market was crashing, right? So it really has been quite a volatile time because obviously we know that a lot of their business had to shut down. Films couldn't be made, things like that. But then on the flip side, you've got these streaming services. And when they were releasing how fast their subscriptions were growing, you know, their share price went up quite significantly because investors really love to say that, especially in the context of like competing with Netflix and things like that.

Sophie: [00:05:56] OK, so this is where I'm kind of a little bit sceptical. So I'd like to get, I guess, your opinion because obviously during Covid times, a lot of companies did benefit. Like you look at the likes of like, you know, obviously the streaming services, but even like the likes of Zoom, and the growth is kind of unsustainable. Like, for example, Zoom is down 60 percent this year. And for me personally, I feel like we've really seen that with Disney as well, because their top share price was in March 2021, when a lot of other businesses were struggling, that hit around $200. But then, in December of last year, they posted that their subscription numbers were less than what was expected by the market. So, you know, we saw this growth, and that's great for Disney. But what does it mean now? Because subscriber numbers dwindling?

Maddy: [00:06:41] It's a fair call. I guess how I think about this is like, what were we doing in December of last year or in November of last year? Like we came out of lockdown, there was no way like, I don't think I picked up Netflix once like I was. We were out on the town. Oh, where are you? We said we skipping migrate is like, I think we were out of lockdown. It was summertime. And I'm sorry. I know this is in the context of Australia that was baking. But like I think in the post kind of pandemic phase, it'd be silly to think that subscriber numbers for things like Disney and Netflix aren't going to dwindle a little bit.

Sophie: [00:07:15] And I think you have mentioned before that, like with the Netflix thing, that subscriber numbers really do kind of drive the share price sometimes because of its growth. So maybe this was just a period that I don't know why I'm supporting your argument.

Maddy: [00:07:28] I will also add to that that the first quarter results this year were much better and they have seen accelerated subscribers again. So bam.

Sophie: [00:07:36] So we're talking about Disney Plus a little bit, and we've spoken about like that as the story. What are the elements that are building up like your conviction around a company like this?

Maddy: [00:07:45] Yes. I think the biggest reason that I love Disney and you kind of touched around a little bit then is like, how you know, Netflix, for example, is driven so directly by subscriber growth, and Disney experience is a little bit of the same. But and there's also so much more to the Disney story or the Disney company. Oh, God. So the main thing that I want to come back to on this and talk about with you because this honestly blew my mind when I first started really digging into it. Is the Disney franchises right?

Sophie: [00:08:12] OK, so what do you mean by franchise?

Maddy: [00:08:15] Yes. I want to chop through quickly what some of the brands or shows that Disney actually owns, because I think I definitely didn't realise just quite how overarching it was and how incredible it was.

Sophie: [00:08:28] So what you're saying is that Disney is a brand or a company, and it owns other brands and companies underneath it, but they all fall under like the Disney umbrella.

Maddy: [00:08:36] Exactly. Gotcha. So I guess traditional Disney, you've got things like Mickey Mouse, Lion King, Aladdin, Sleeping Beauty, all iconic. All love. Yeah. Then you've also got Pixar and say, This is where I started to click with where we have like different experiences because I kind of feel like you have the Disney experience you Aladdin, The Lion King, Sleeping Beauty, Little Mermaid. I have the Pixar experience. So that's like Toy Story, frozen. I mean, frozen was beyond my time, but Toy Story four, wasn't it? So wasn't so much frozen. Toy Story Finding Nemo Monsters Inc cause like The Incredibles, OK, or Disney. Then you've also got Marvel, where there's like a whole lot of shows under that Star Wars fox like The Simpsons, X-Men Family. Oh, wow, yeah, they aren't everything Disney

Sophie: [00:09:23] owns Fox

Maddy: [00:09:24] Plus a lot of is like broadcasting assets as well

Sophie: [00:09:28] random.

Maddy: [00:09:29] Then you've also got other iconic franchises things like Winnie the Pooh, The Muppets of Pirates of the Caribbean and other major entities as well, including Lucasfilm, National Geographic, ABC History, Lifetime Vice. Like, it's quite unbelievable just how much actually comes under the Disney umbrella.

Sophie: [00:09:46] I find that really interesting personally, because I didn't really know that about Disney. And one of the things that I was going to bring up because when you said you were pitching Disney stock, like I was having conversations with people about like, you know, why you wouldn't invest in Disney because we're trying to pull apart. Both arguments and one of them was a friend of mine at work had said that, you know, isn't Disney being a bit boycotted? Because when you think of the classic Disney brands of the movies that I used to really love, there's a lot of painting of the pictures of there's a damsel in distress and oh, true. Yeah, it is really true when you think about a lot of the films, and he was saying that there's going to be a next generation of children that might come through that won't be watching these movies because they don't want that picture painted of, you know, you've going to be this helpless woman that has to be saved by a prince or a man or whatever else. And I was like, Wow, I hadn't really thought about it, but I'm now contradicting myself a little bit because you've just explained that there's so many more areas that Disney is involved with.

Maddy: [00:10:42] Yeah, true. And I think like what I'm thinking when you say that because I think it's a very valid point is like the probably the real question is is is Disney going to actually be able to shift in the movies that they make? Going forward, they're going to be able to be more encompassing and more inclusive.

Sophie: [00:10:59] Yeah, I do actually agree with you there to some sense, and I feel like Disney is transformative in that way, because if you think about some of the more recent movies like Moana, make one of those people. I'm addicted to Moana. I don't know why I could watch it 10 times.

Maddy: [00:11:12] Again, I have to say, Oh my God,

Sophie: [00:11:14] you haven't watched Moana. I'm so sorry. Oh, okay. It's just like a really like on a Sunday watch miner makes you good. Makes you happy. But that kind of frames like a female heroine, you know who saves like the island. So I do feel like they do. They're very reactive to that kind of stuff.

Maddy: [00:11:31] One of my friends, actually, I want to give a shout out, has a great podcast called Conceiving It All. And she actually had this conversation about Disney princesses and in the context of disabled people and how, when like, how important representation is in this context, because we grow up watching these films and these shows and we become so engrossed in the storylines. And if you're someone who is not in any way, shape or form represented in that, like, that's a real issue. Hmm.

Sophie: [00:12:00] Well, it's interesting, then, I guess, to watch what Disney do in this space and how they keep evolving. We are taking a quick ad break for our sponsors, and we'll be right back to keep building up Maddie's Disney thesis. One thing I'm really curious about is that Disney is in a bit of a transformative spot at the moment in terms of its leadership, because you mentioned on our summer series, the Bob Iger book

Maddy: [00:12:24] such a good run ride of a lifetime New York bestseller, which I said

Sophie: [00:12:28] that I was going to write and I haven't yet, but I promise I will. But my question is, is that obviously we're moving over that to a new CEO because Bob is now retiring as CEO. So what do you think of the new leadership coming into the company?

Maddy: [00:12:41] Yes, it's an interesting one because the previous you oversee for 15 years, which is like an incredibly long time slate, a company which I mean economy is like potential red flags. When he laid the first thing that I saw that really put my mind to rest in this context is that the new CEO, whose name is also Bob, which is hilarious as Bob Bain at the company for 27 years. So it's not like he's a new guy coming in who has no idea what's going on. He knows how Disney works. He recently sort of spoke to the media and outlined what his three strategic pillars for 2022 was.

Sophie: [00:13:17] I love someone with gold.

Maddy: [00:13:19] Got me very excited. The first one very relevant for us today is all about the storytelling experience and really embracing like the Disney magic, which I just love it. The next one is all about innovation, which I'm going to touch on a little bit next. And then the third one is a relentless focus on audience when he says We must evolve with our audience and not against them. Yeah. Which I guess is what we were just kind of talking about prior to the ad break with like what people want to say in Disney films now and how that's completely shifting from what it was five 10 years ago.

Sophie: [00:13:53] So you're happy with the leadership at the moment because you think it's someone that's like really focussed on the audience and that are willing to innovate?

Maddy: [00:14:00] Yeah, new bob is a big tick for me.

Sophie: [00:14:02] You hear, Bob, what about Old Bob

Maddy: [00:14:05] also a big tick?

Sophie: [00:14:08] So turning the page from the past

Maddy: [00:14:10] to the future,

Sophie: [00:14:12] where is Disney headed? Can you build up more of this story of why you like it for a future investment? Yeah, for sure.

Maddy: [00:14:19] So I think the first one that comes to mind is box office, so we kind of coming out of lockdowns. Hopefully we are really putting Covid behind us for now, and we are able to stop making movies again, get back to cinemas. And I think there's a real potential upside. Yeah, box office revenue.

Sophie: [00:14:37] I actually think that's really a thing as well, because going to the movies is so nice

Maddy: [00:14:41] and I love it.

Sophie: [00:14:42] Yeah, I feel like it's such a nice thing to do.

Maddy: [00:14:44] I always forget how much I love it, and every time I go, I should do this more.

Sophie: [00:14:48] Yeah, I hope that like goes back, you know, go on a date to the movies.

Maddy: [00:14:51] And on the flip side, every time I go, I'm like, Wow, this gets more and more expensive, which I guess is maybe a good thing for Disney. Yeah, true. The other thing that's happening is they in parks and resorts reopening, we can get on planes again. It's all very exciting. And I think as people get more confident with travel, the theme parks are going to get busier and busier.

Sophie: [00:15:12] Have you been to Disneyland before?

Maddy: [00:15:15] I haven't. I always wanted to go so badly as a kid. I've never actually. I never even went to like the Queensland ones, the like waterpark.

Sophie: [00:15:22] Yeah, have you? I was actually so lucky as a kid like shout out to mom and dad because I know you guys listen. My dad actually

Maddy: [00:15:31] had Tony

Sophie: [00:15:33] and they surprised us. We were, I think, like they took us on like a little family trip when I don't know how old I was, but they surprised us at the very end and I cannot tell you that feeling it is the coolest viewing Baz Bryce to go to Disneyland as a kid like my heart. I know, and I think when you talk about theme parks and like, that's one of the things that's never going to die because the Disney magic is legitimately a thing.

Maddy: [00:15:56] The new CEO was actually the previous head of the theme park segment, which is exciting, and I know that there's been a lot of focus on how they can kind of elevate the experience of theme parks recently. So Disney has introduced sorry, this is a bit actually, it's not really off topic, but it's just a really cool thing that I was writing. They've introduced this thing called a janee plus service. Yeah. And it's like this thing where you go on and you pay $15 a day and it completely like plans at your Disney experience, which in turn is leading to much more revenue for them as well. But it's also elevating the experience of everyone who visits the parks,

Sophie: [00:16:28] and it's interesting to say that they're obviously trying to work out how they can use innovation or even like technology or automation to grow revenue within a, I guess, which segment of the business which is really traditional.

Maddy: [00:16:40] So funny, you bring that up. Speaking of innovation, in the last couple of weeks, Disney has appointed an executive to a new role, and they are responsible for leading its next generation storytelling, a.k.a. the Metaverse strategy.

Sophie: [00:16:55] Oh, I have read about Disney going into the Metaverse. Yes, it

Maddy: [00:16:59] there's been a few things happening that actually patented the technology for a theme park metaverse.

Sophie: [00:17:05] Before we jump into what's happening in the metaverse, can you quickly give me like what you think your definition is of the metaverse?

Maddy: [00:17:13] To be honest, no. Yeah, it's not like I kind of get it, but I don't really. And the hard thing is is it doesn't exist yet. Yeah, it's a virtual world.

Sophie: [00:17:23] Yeah, I think it's the easiest way to understand it for the moment is like virtual reality, I guess.

Maddy: [00:17:28] Yes, a few things have been happening in this space in the context of Disney, which is pretty cool to say that such a lack like your kind of same for traditional company is really embracing this new thing. Hmm. Their patented the technology for a theme park metaverse, which is pretty cool. And I mean, like I was saying before, like, what a great opportunity to make the theme park experience more accessible for people like all over the world.

Sophie: [00:17:52] Hmm. I think on the one hand here, I completely agree with what you're saying. But on the other hand, it makes me wonder. Playing devil's advocate here, you know, like you said, the metaverse is, you know, very much in its infancy, infancy, stages, and people really do like Disney because of that Disney magic, which is created because of like in-person experiences. So I wonder if putting its resources to something that might not even eventuate into, I guess, like a profit making area for them?

Maddy: [00:18:19] It's true, but I like I get what you're saying, but I kind of disagree.

Sophie: [00:18:24] Yeah, I think like it is.

Maddy: [00:18:26] Yes, the theme parks are magical, and that's one way to experience Disney. But I think, you know, we experience it in the cinema as we experience it at home, watching the movies, the stories. And I think if you can make virtual reality and we can experience a theme park in our own home, like even better.

Sophie: [00:18:41] Yeah, I'm just a sceptic of the metaverse at the moment.

Maddy: [00:18:45] No, I appreciate that, and I kind of agree. But I think what I find that's impressive. Even if you take like the metaverse specifically out of it is that such an old traditional company that's been around for so long is actually able to be agile enough to embrace this kind of stuff.

Sophie: [00:19:02] You make a very good point, and I can't argue with you much longer.

Maddy: [00:19:06] So before we finish, I guess the final chapter of my pitch, if you will, is I want to describe to you how I say the moat for Disney because.

Sophie: [00:19:16] And can you give us a quick recap of what a moat is?

Maddy: [00:19:19] It's basically

Sophie: [00:19:21] sorry. I'm asking you all the really hard questions. It's like a moat around a castle, because as a princess stuck in the coffin,

Maddy: [00:19:29] I guess you think of a moat as like, what's its competitive advantage? Like, what is going to stop another company from just replicating what Disney does and being better at it? So we like

Sophie: [00:19:38] to invest in things with a good moat. So what is Disney's moat?

Maddy: [00:19:42] Well, recently I read something that described Disney's business as a waterfall. So you've got great movies which drive box up big box office and streaming subscribers, which then drives content for TV networks and eventually rides at theme parks and sales of consumer products like everything flows into everything, and it's kind of a system that just self advertises itself. It's quite incredible.

Sophie: [00:20:04] So really, the business is making more business for itself just by going through its everyday kind of practises.

Maddy: [00:20:10] I think for me, it really all comes back to the franchises, like when I was writing them and listing them off before the stories that they have under the Disney umbrella are almost just impossible to compete with.

Sophie: [00:20:22] So that raises a good question then in my mind, who if if we're talking about them having a competitive advantage? Who are Disney's competitors? I mean,

Maddy: [00:20:32] I actually kind of struggled to think of this, to be honest, but I guess maybe it's like you break it up into the segments like we talk about how they're such a diversified business. I guess, you know, Netflix are a competitor to Disney Plus. There's like Sony or WarnerMedia competitors for their franchise business, but there's not really anyone else that I can think of that can fully encompass what Disney offers.

Sophie: [00:20:55] OK, so you've really carried this story for us? You know, it's got lots of different components. I am feeling a bit sold on Disney.

Maddy: [00:21:02] Thank you, but not financial advice. Why?

Sophie: [00:21:07] I guess my question is why now? And you know, when you do look at a share price and I think it's sitting at around like the $150 mark like, is that the peak it's going to go to and is that too expensive? Like, how do you see this going in the future and why you investing in it right now?

Maddy: [00:21:23] I mean, you raise a very good point. And I think often in the past when I have looked at companies individual stocks to invest in. To be honest, I'm not really someone that like gets into the financials. Like, I don't look at that stuff. And I guess over the last couple of years that I have been investing, I've gotten away with that because the markets have been going up. Yeah. So like when people say companies are overvalued, it kind of hasn't really mattered because everything has gone just continued to go up regardless.

Sophie: [00:21:50] So is it more important to you now to like even look at if the company is profitable?

Maddy: [00:21:55] Definitely. I think I I'm kind of taking a step back at the moment and maybe thinking that I should consider the financial aspect of businesses more because something that is overvalued. Actually, now that we are in more of a bear market that has a lot more weighting to it than what it ever has. Obviously, in the time that I've been investing,

Sophie: [00:22:15] I guess, considering all of that in mind, why do you think now is still a good time to be investing in Disney?

Maddy: [00:22:20] So I think if we go back to the key points that we've discussed today, we've got a CEO who has a lot of theme park experience who's really focussing on this on the backdrop of a world that is opening back up again and travel is coming through. So we've got a lot of upside in theme park revenue. Yeah. Number two is we were just saying how we want to get back to cinemas and that is the perfect time to be driving box office revenue. Yeah. Number three, you've got Disney Plus, who is looking to overtake Netflix in the next few years, which is unbelievable growth. Do you have a Disney Plus membership?

Sophie: [00:22:51] No, but Sam does bigger, and I watched Cruella de Vil on it.

Maddy: [00:22:56] You've got Disney Plus, which is kicking goals and has really good prospects for the next few years. And then you've got this house of franchises that is really hard to compete with with stories that I mean, we've kind of joked about it a few times that a quite magical. And finally, we have a new CEO at the helm of this company who has a really clear and core vision for where he wants to take the company into this new world that we're entering at the moment. I really like

Sophie: [00:23:23] how you built up the faces today. I think it is really important to have that story behind it. But on the same token, you've got to criticise the lack the good points, because otherwise you're going to have like all this happiness about the stock and not understand why it would go down.

Maddy: [00:23:36] Definitely. So out of interest. Have I sold you? Are you thinking about investing in Disney?

Sophie: [00:23:41] Well, this is a this is a really hard one, as is like, I love Disney and then you're like, I'm doing Disney and you've got to be against it. And I'm like, So yes, you've sold me nuts, and maybe we should do a little exercise. And like, you know, the end of the year, check in on Disney and so on us because it's on us. It's true it's gone down recently, but that's fine. Long term conviction, exactly. And see whose basis is holding strong

Maddy: [00:24:06] on that note would love to hear if you guys have any thoughts about the thesis and if we have missed any like weaknesses or even strengths, happy for my thesis to get even

Sophie: [00:24:14] better. Join our Facebook community at YIGC Investing Podcast Discussion Group. Because we're going to start a conversation about it in there. I actually love getting people's opinions about this stuff.

Maddy: [00:24:25] Jump onto Instagram @yigcpodcast or across on Tik-tok. We're trying very hard. Also @yigcpodcast

Sophie: [00:24:33] You will hear from us next week. Catch you then bye. [1368.5]

- Company Analysis

- You're In Good Company

- Investing Thesis

Companies Mentioned

- Walt Disney (NYSE: DIS)

Meet your hosts

Maddy Guest

Sophie Dicker

Get the latest

Receive regular updates from our podcast teams, straight to your inbox.

The Definitive Voice of Entertainment News

Subscribe for full access to The Hollywood Reporter

site categories

Bob iger’s reinforcements in disney proxy battle pitch shareholders ahead of showdown.

The investment firm ValueAct Capital, allied with Disney's board, published its whitepaper Thursday as the CEO looks to fend off a Nelson Peltz-led activist effort.

By Alex Weprin

Alex Weprin

Media & Business Writer

- Share on Facebook

- Share to Flipboard

- Send an Email

- Show additional share options

- Share on LinkedIn

- Share on Pinterest

- Share on Reddit

- Share on Tumblr

- Share on Whats App

- Print the Article

- Post a Comment

As Disney continues its proxy battle with a pair of activist investors (Nelson Peltz’s Trian Partners and Jason Aintabi’s Blackwells Capital), a high-profile activist firm has come forward with its own thesis for Disney’s future … and pledged support for CEO Bob Iger and the Disney board.

Related Stories

Harry styles' pleasing and disney unveil whimsical video ahead of 'fantasia' collaboration launch (exclusive), disney to cut staff amid review of corporate cost-structure.

The presentation notes ValueAct’s other media and tech investments, including 21st Century Fox, Spotify, Nintendo, Roblox and Microsoft, and laid out a fairly straightforward investment thesis: “Lean into parks,” and “move beyond the streaming wars” with “bigger bundles,” “better consumer experiences,” “better advertising technology,” and “work with the other studios to test new ideas and create wins.”

Value Act noted that Disney has already pledged a huge investment into its parks and experiences business and that there is still plenty of growth to come from the company’s strategy there.

In streaming, ValueAct noted that only Netflix is profitable in streaming, but that Disney has the advantage of broadcast reach, and a reputation for being creative-friendly.

It noted its work as an investor in The New York Times , and argued that a similar bundling experience could be created at Disney, noting the integration of Hulu into Disney+, and most recently the launch of a sports streaming bundle with Fox and Warner Bros. Discovery.

“Why did we commit out votes for the board and leadership?” the presentation concludes.

The company says its because “we have a thesis — informed by our network and toolkit,” “we have a positive collaboration — LOTS of learning and teaching — well underway,” and “we have tangible evidence of progress.”

THR Newsletters

Sign up for THR news straight to your inbox every day

More from The Hollywood Reporter

Gov. gavin newsom vetoes sweeping ai safety bill, songs by adele, kendrick lamar, bob dylan, nirvana, more blocked by youtube due to legal dispute, netflix loses bid to dismiss defamation claim in ‘baby reindeer’ lawsuit, casting directors reach tentative agreement on new contract with studios, comcast sues warner bros. discovery over refusal to partner on harry potter series, marvel’s dan buckley explains how digital comics inform its print business.

Add a bookmark to get started

Business Advisory: How to build investment thesis clarity for better M&A outcomes

In M&A, clarity on business rationale and investment thesis is critical.

So how do you build it?

Often the lack of specificity in M&A investment thesis leads to poor decision-making. It is crucial to determine at a detailed level “how” and “where” a deal will create value. This involves moving beyond generic assumptions to a detailed vision, rigorous due diligence and a robust implementation plan.

Common questions relating to the integration of operational platforms and the impacts of divestments need clear, granular answers.

The M&A investment thesis should guide deal objectives and execution performance tracking while ensuring alignment across all organisational levels. Initial stakeholder alignment on success metrics is key and while agility in approach is necessary, the core M&A investment thesis and goals must remain.

Ultimately a detailed understanding of value creation sharpens focus and drives success in M&A.

Access our free guide to build a robust M&A investment thesis for your business.

HOW DLA PIPER BUSINESS ADVISORY CAN HELP YOUR ORGANIZATION WITH M&A

We help clients to address the inherently complex risk of M&A by uplifting capability and overcoming any capacity challenges. Our integrated team accompanies you through the deal lifecycle with a single point of accountability from the pre-deal strategy and preparation, deal execution all the way through to close and integration/separation. We also provide specialised advice in M&A ESG, ventures and joint ventures.

For more information reach out to Guy Fisher .

Related capabilities

- Capabilities

- Find an office

DLA Piper is a global law firm operating through various separate and distinct legal entities. For further information about these entities and DLA Piper's structure, please refer to the Legal Notices page of this website. All rights reserved. Attorney advertising.

© 2024 DLA Piper

Unsolicited e-mails and information sent to DLA Piper or the independent DLA Piper Relationship firms will not be considered confidential, may be disclosed to others, may not receive a response, and do not create a lawyer-client relationship with DLA Piper or any of the DLA Piper Relationship firms. Please do not include any confidential information in this message. Also, please note that our lawyers do not seek to practice law in any jurisdiction in which they are not properly permitted to do so.

Walt Disney: Expansion And Innovations Driving The Growth

- The Walt Disney company is a leading entertainment and broadcasting company.

- The company is constantly innovating and introducing new movie series, products and services that are driving its growth.

- The company has consistently improving profitability metrics, sustainable amount of debt and borderline level of liquidity.

- Valuation suggests the company’s shares currently do not offer much upside but seem to be an attractive asset for the long run.

Investment Thesis

Shares of the Walt Disney Company ( NYSE: DIS ) have been gradually appreciating over the last decade and with constant innovation on the movie front, the company’s shares are very likely set for further gains. Even though Disney’s shares are currently fairly-priced, the company’s shares growth potential might surprise in the long run if the company finds a good way to translate its innovations into operating earnings.

Corporate profile

The Walt Disney Company is a leading entertainment and broadcasting company operating in four segments : Media Networks (41 percent of total revenue), Parks and Resorts (34 percent of total revenue), Studio Entertainment (17 percent of total revenue) and Direct-To-Consumer and International (8 percent of total revenue). Most of the company’s revenues come from the services segment (86 percent) and the rest from the product. In 2018, the company had a little over 200,000 employees.

Insights for the latest quarterly earnings call

Reading through the recent quarterly earnings call transcript , the company’s management gone over the success of its several movie series such as Avengers, Marvel, Star Wars and others. During the call, the management particularly emphasized a strong demand for Marvel in China where the company sees an opportunity and began building its presence.

Financial analysis

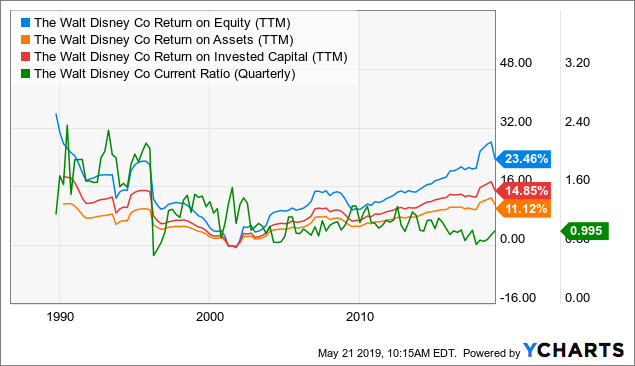

From financial statements perspective, the Walt Disney Company has strong profitability metrics which have considerably improved over time. Currently, according to Reuters ’ statistics, the company’s trailing twelve months ROE, ROA and ROI amount to 20, 9 and 12 percent respectively. The company has a sustainable level of debt, representing around a third of the company’s total capital. Over the last decade, the company’s liquidity position has been more or less moderate.

Plugging in Walt Disney's financial statements figures into my DCF template, the company’s shares show to be more or less fairly valued. Under perpetuity growth

This is a complimentary research article. To gain access to more ideas and not miss on stocks with alpha-generating potential, join Global Wealth Ideation subscription service.

This article was written by

Analyst’s Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Disclaimer: Please note that this article has an informative purpose, expresses its author's opinion, and does not constitute investment recommendation or advice. The author does not know individual investor's circumstances, portfolio constraints, etc. Readers are expected to do their own analysis prior to making any investment decisions.