Click here to place an order for topic brief service to get instant approval from your professor.

99 Top Environmental Accounting Dissertation Topics | Simple Research Ideas

Table of Contents

What is an Environmental Accounting Dissertation?

An Environmental Accounting Dissertation is a long research paper you write at the end of your studies. It focuses on how businesses and organizations track their impact on the environment. This might include things like pollution, waste, or energy use.

Environmental Accounting helps companies understand how their actions affect nature. In a dissertation, you choose a topic, research it deeply, and then write about your findings. It’s a big project, but it’s also a chance to learn a lot about how to protect the environment while running a business.

Why are Environmental Accounting Dissertation Topics Important?

Environmental Accounting Dissertation Topics are important because they help us think about the environment while doing business. In the past, companies only focused on making money. But now, we know that it’s also important to protect the environment. By choosing Environmental Accounting topics , students can explore ways to reduce harm to nature.

These topics encourage businesses to be responsible and consider how their actions affect the world. It’s about finding a balance between profit and protecting our planet. Plus, writing about these topics can make a big difference. Your research might help a company change how it works to be more eco-friendly.

Writing Tips for Environmental Accounting Dissertation

Writing an Environmental Accounting Dissertation can be challenging, but these tips will help you stay on track:

- Choose a Topic You Care About: Pick a topic that interests you. When you care about your topic, writing about it becomes easier and more enjoyable.

- Do a Lot of Research: Before you start writing, read everything you can about your topic. Look for books, articles, and studies that give you a strong understanding of Environmental Accounting.

- Make an Outline: Before you start writing, plan out your paper. Make an outline that includes all the main points you want to cover. This will help you stay organized.

- Write Clear and Simple: Use simple words and short sentences. Your goal is to make your paper easy to understand. Don’t use big words just to sound smart.

- Include Real-Life Examples: Show how Environmental Accounting works in real life. Use examples from companies that are doing a good job of protecting the environment.

- Review and Edit: After you finish writing, take some time to review your work. Look for any mistakes and fix them. Editing is a crucial part of writing a great dissertation.

List of Top 99 Environmental Accounting Dissertation Topics

Here is a list of top Environmental Accounting dissertation topics. These ideas can help you get started with your research:

- The Role of Environmental Accounting in Reducing Corporate Carbon Footprints

- How Environmental Accounting Can Help Companies Save Money

- The Impact of Environmental Accounting on Business Reputation

- Environmental Accounting and Government Regulations

- Comparing Traditional and Environmental Accounting Methods

- The Use of Environmental Accounting in the Renewable Energy Sector

- Environmental Accounting in the Food Industry

- How Small Businesses Can Benefit from Environmental Accounting

- The Challenges of Implementing Environmental Accounting in Developing Countries

- The Role of Environmental Accounting in Waste Management

- How Environmental Accounting Can Promote Sustainability

- Environmental Accounting and Its Role in Climate Change Mitigation

- The Impact of Environmental Accounting on Consumer Behavior

- The Use of Environmental Accounting in the Automotive Industry

- The Role of Environmental Accounting in Corporate Social Responsibility (CSR)

- Environmental Accounting and the Fashion Industry: Reducing Waste

- The Future of Environmental Accounting: Trends and Predictions

- Environmental Accounting in Public Sector Organizations

- How Environmental Accounting Can Help Reduce Water Pollution

- The Relationship Between Environmental Accounting and Eco-Labelling

- Environmental Accounting and Green Building Practices

- How Environmental Accounting Influences Corporate Decision-Making

- The Use of Environmental Accounting in Supply Chain Management

- Environmental Accounting in the Agriculture Industry

- The Role of Environmental Accounting in Protecting Biodiversity

- Environmental Accounting and the Circular Economy

- The Benefits of Environmental Accounting for Investors

- How Environmental Accounting Can Improve Employee Engagement

- The Impact of Environmental Accounting on Product Design

- Environmental Accounting and Its Role in Reducing Plastic Waste

- The Use of Environmental Accounting in the Tourism Industry

- How Environmental Accounting Can Help Companies Meet Sustainability Goals

- Environmental Accounting and Air Quality Management

- The Role of Environmental Accounting in Reducing Greenhouse Gas Emissions

- Environmental Accounting in the Construction Industry

- The Impact of Environmental Accounting on Corporate Tax Policies

- How Environmental Accounting Can Support Green Innovation

- Environmental Accounting and Marine Conservation

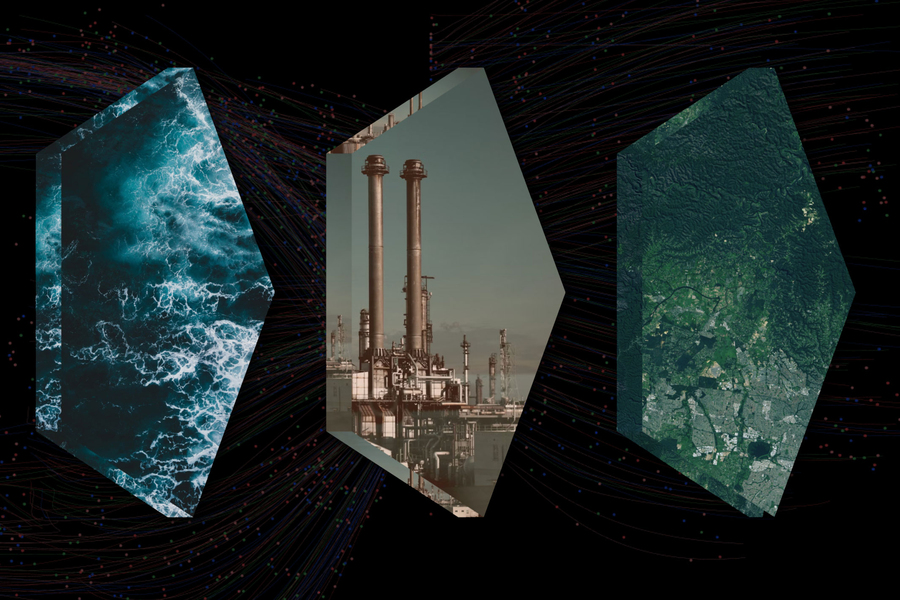

- The Use of Environmental Accounting in the Oil and Gas Industry

- The Role of Environmental Accounting in Achieving Net-Zero Emissions

- Environmental Accounting and the Financial Performance of Companies

- How Environmental Accounting Can Drive Business Growth

- The Use of Environmental Accounting in Packaging Solutions

- Environmental Accounting and Sustainable Urban Development

- The Impact of Environmental Accounting on Shareholder Value

- How Environmental Accounting Can Help Address Global Warming

- Environmental Accounting in the Pharmaceutical Industry

- The Role of Environmental Accounting in Reducing Energy Consumption

- Environmental Accounting and Sustainable Supply Chains

- The Use of Environmental Accounting in Environmental Impact Assessments

- How Environmental Accounting Can Influence Corporate Strategy

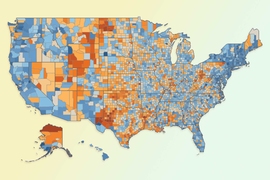

- The Impact of Environmental Accounting on International Trade

- Environmental Accounting in the Textile Industry

- The Role of Environmental Accounting in Reducing Deforestation

- Environmental Accounting and the Role of Technology

- How Environmental Accounting Can Improve Corporate Transparency

- The Use of Environmental Accounting in Disaster Risk Management

- Environmental Accounting and the Impact on Local Communities

- The Role of Environmental Accounting in Environmental Justice

- Environmental Accounting in the Education Sector

- How Environmental Accounting Can Help Achieve Sustainable Development Goals (SDGs)

- The Use of Environmental Accounting in Corporate Governance

- Environmental Accounting and the Role of Auditors

- How Environmental Accounting Can Influence Government Policy

- Environmental Accounting in the Mining Industry

- The Role of Environmental Accounting in Reducing Chemical Pollution

- Environmental Accounting and Corporate Ethics

- How Environmental Accounting Can Support Corporate Innovation

- The Use of Environmental Accounting in Urban Planning

- Environmental Accounting and Its Impact on Consumer Trust

- The Role of Environmental Accounting in Renewable Energy Adoption

- Environmental Accounting in the Beverage Industry

- How Environmental Accounting Can Help Companies Reduce Waste

- The Use of Environmental Accounting in Environmental Risk Management

- Environmental Accounting and Sustainable Investment Practices

- The Role of Environmental Accounting in Protecting Natural Resources

- Environmental Accounting and the Role of Environmental Taxes

- How Environmental Accounting Can Improve Public Health

- Environmental Accounting in the Transport Industry

- The Impact of Environmental Accounting on Global Supply Chains

- How Environmental Accounting Can Drive Corporate Responsibility

- The Role of Environmental Accounting in Reducing Landfill Waste

- Environmental Accounting and Climate Adaptation Strategies

- How Environmental Accounting Can Support Environmental Education

- The Use of Environmental Accounting in Corporate Reporting

- Environmental Accounting and the Role of Non-Governmental Organizations (NGOs)

- How Environmental Accounting Can Help Companies Achieve Carbon Neutrality

- The Role of Environmental Accounting in Sustainable Agriculture Practices

- Environmental Accounting in the Electronics Industry

- The Use of Environmental Accounting in Environmental Compliance

- How Environmental Accounting Can Influence Investor Decisions

- The Role of Environmental Accounting in Promoting Eco-Friendly Products

- Environmental Accounting and the Global Carbon Market

- How Environmental Accounting Can Support Corporate Sustainability Reporting

- The Use of Environmental Accounting in Water Management

- Environmental Accounting and the Role of Environmental Certifications

- How Environmental Accounting Can Promote Green Business Practices

- The Role of Environmental Accounting in Reducing Toxic Emissions

- Environmental Accounting and Its Impact on Corporate Profitability

Environmental Accounting is a crucial field that helps businesses understand and reduce their impact on the environment. By choosing an interesting dissertation topic, you can explore ways to make a positive change in the world. Remember to do thorough research, write clearly, and include real-life examples. This will make your dissertation not only informative but also engaging to read. Your work in Environmental Accounting could inspire businesses to be more responsible and help protect our planet.

What is Environmental Accounting?

- Environmental Accounting is a way for companies to track their impact on the environment, such as pollution and resource use.

Why is Environmental Accounting important?

- It helps businesses understand how their actions affect the environment and encourages them to be more responsible.

How do I choose a dissertation topic in Environmental Accounting?

- Pick a topic that interests you and is relevant to current environmental issues. Look for ideas that can make a real difference.

What are some challenges in writing an Environmental Accounting dissertation?

- Some challenges include finding reliable data, staying organized, and writing in a clear, simple way.

Paid Topic Mini Proposal (500 Words)

You will get the topics first and then the mini proposal which includes:

- An explanation why we choose this topic.

- 2-3 research questions.

- Key literature resources identification.

- Suitable methodology including raw sample size and data collection method

- View a Sample of Service

Note: After submitting your order please must check your email [inbox/spam] folders for order confirmation and login details. If the email goes in spam please mark not as spam to avoid any communication gap between us.

Get An Expert Dissertation Writing Help To Achieve Good Grades

By placing an order with us, you can get;

- Writer consultation before payment to ensure your work is in safe hands.

- Free topic if you don't have one

- Draft submissions to check the quality of the work as per supervisor's feedback

- Free revisions

- Complete privacy

- Plagiarism Free work

- Guaranteed 2:1 (With help of your supervisor's feedback)

- 2 Instalments plan

- Special discounts

Other Posts

- 201 Accounting and Finance Dissertation Topics and Research Ideas February 12, 2022 -->

- 201 Best Accounting Dissertation Topics and Research Ideas March 11, 2020 -->

- 99 Corporate Governance and Accounting Dissertation Topics August 12, 2024 -->

- 99 Forensic Accounting Dissertation Topics: Guide, Importance, & Tips August 8, 2024 -->

- 99 International Accounting Dissertation Topics August 8, 2024 -->

- 99 Latest Financial Accounting Dissertation Topics Ideas February 12, 2022 -->

- 99 Taxation Accounting Dissertation Topics Ideas, Tips, and Importance August 8, 2024 -->

- 99 Top Auditing Dissertation Topics ideas and Examples February 4, 2020 -->

- 99 Top Governmental Accounting Research Topics for College Students August 1, 2024 -->

- 99 Top Management Accounting Dissertation Topics Ideas February 12, 2022 -->

- Top 99 Behavioral Accounting Dissertation Topics | Research & Writing Guide August 12, 2024 -->

- Top 99 Public Sector Accounting Dissertation Topics | Essential Guide August 8, 2024 -->

WhatsApp and Get 35% off promo code now!

- Bibliography

- More Referencing guides Blog Automated transliteration Relevant bibliographies by topics

- Automated transliteration

- Relevant bibliographies by topics

- Referencing guides

Sustainability and Financial Accounting: a Critical Review on the ESG Dynamics

- Short Research and Discussion Article

- Published: 13 January 2022

- Volume 29 , pages 16758–16761, ( 2022 )

Cite this article

- Patrizia Tettamanzi 1 ,

- Giorgio Venturini 2 &

- Michael Murgolo ORCID: orcid.org/0000-0001-6328-4053 1

21k Accesses

38 Citations

Explore all metrics

This study gives a depiction of what are the general directions taken by international institutions so to tackle the current health emergency and the most pressing environmental issues, such as climate change and COVID-19 (Schaltegger, 2020; Adebayo et al., 2021).

The role of companies is crucial under disruptive events, such as a crisis or, more in line with the present time, a pandemic, and the pursue of the shareholder value cannot be the essence and the only objective in doing business anymore, since also ESG (i.e., environmental, social, and governance) dynamics have to be taken in due consideration. Moreover, an adequate and effective corporate governance should lead to higher disclosure quality, which subsequently should help protect the entire planet and ecosystems as well. In this context, the principal role of accounting and corporate reporting activities should be oriented towards making emerge what is and what is not done by companies in their business operations, and the disclosure of financial information is currently deemed inappropriate for pursuing a sustainable growth in the medium and long run (Schaltegger, J Account Org Change 16:613–619, 2020; Kirikkaleli & Adebayo, Sustain Dev 29:583–594, 2020; Tettamanzi, Venturini & Murgolo Wider corporate reporting: La possibile evoluzione della Relazione sulla Gestione Bilancio e Revisione, IPSOA - Wolters Kluwer, Philadelphia, 2021). Thus, the objective of this study is to investigate what international and European institutions have planned to do in order to align corporate objectives with environmental and societal needs in the coming years (Biondi et al., Meditari Account Res 28:889–914, 2020; Songini L et al. Integrated reporting quality and BoD characteristics: an empirical analysis. J Manag Govern, 2021).

As of today, our analysis finds that IFRS Foundation (at global level) and EFRAG (at European one) have been taking steps toward the aforementioned issues so to propose disclosure standards more in line with sustainability and environmental needed improvements. In fact, we tried to give a depiction of what are the actual and future strategies that both these institutions are going to put in place: this snapshot will give scientists, engineers, lawyers, and business people an overview of what should be like the corporate world of the near future, from a corporate reporting/accounting perspective (so to better understand what will be expected from companies of all the industries worldwide).

Similar content being viewed by others

Theoretical Insights on Integrated Reporting: Valuing the Financial, Social and Sustainability Disclosures

Corporate reporting practices concerning non-financial aspects: a possible prolix.

Sustainability Accounting: Upgrading Corporate Social Responsibility

Explore related subjects.

- Environmental Chemistry

Avoid common mistakes on your manuscript.

Introduction

As it is apparent in the international arena, a relevant review of the general rules and the standards of corporate reporting is taking place. The major drivers of it are the climate issues urgency and a “deeper and more focused” stakeholders’ engagement (Shan et al. 2021 ; Adebayo et al. 2021a , b ).

Both public and private entities and institutions worldwide have been trying so far to tackle these issues in the most effective way, but only with COVID-19 spreading across the globe, we could maintain that these actions have begun to be more tangible and explicit. Consider the COP26 meeting as an example (UK Government 2021 ). In November 2021, UK and Italy hosted an event considered the world last chance to get runaway climate change under control. Indeed, for nearly three decades, the UN has been bringing together almost every country on earth for global climate summits — called COPs, which stands for “Conference of the Parties” — and climate change, in that time, has “only” gone from being a fringe issue to a global priority. The COP held in November 2021 was the 26th annual summit and intended to reach an agreement with every nation on how to tackle climate change: 197 countries have agreed upon it, signing the “Glasgow Climate Pact”. The set of decisions consists of a range of agreed items, such as strengthened efforts to build resilience to climate change, to curb greenhouse gas emissions, and to provide the necessary finance for both (UN Climate Change 2021a , b ).

The UN 2030 Agenda as well as the most important international organizations have, therefore, managed to find an explicit solution to the issue in order to define a limit to, among others, those economic activities that — albeit profitable from a mere financial point of view — have, indeed, as a consequence, a negative impact for the environment and for the referential communities. In this, academic and scientific communities confirmed that accounting, reporting, and disclosure practices play a pivotal role in aligning the goals of the several stakeholders’ strategies adopted at corporate level (Schaltegger 2020 ; La Torre et al. 2020 ; Kose & Agdeniz 2021 ; Songini et al. 2021 ; Tettamanzi et al. 2021 ). In this regard, one of the COP26 outcomes was indeed related to “Transparency and Reporting”, making emerge a set of rules through which countries shall be held accountable for delivering results related to their climate action plans and self-set targets under their nationally determined contributions (Kirikkaleli & Adebayo, 2020 ; UN Climate Change 2021a , b ; Adebayo et al. 2021a , b ).

In Europe, this challenge has been faced by the European Commission which proposed in April 21, 2021 the draft for a directive regarding sustainability (i.e., CSRD “Corporate Sustainability Reporting Directive”) that would essentially amend the requirements already defined in the area of “non-financial disclosure” within the framework of another directive, the NFRD “Non-Financial Reporting Directive”. At the end of this drafting and enforcement legal procedure, we will be provided with a first set of sustainability accounting standards and principles to be potentially adopted starting from next October 2022. EFRAG “European Financial Reporting Advisory Group” (which is an association established in 2001 with the encouragement of the European Commission to serve the public interest with regards to international financial reporting standard initiatives at European level) has been appointed to define the aforementioned standards. Also the IFRS Foundation has been taking steps towards this issue, by means of the IASB “International Accounting Standards Board” (founded in 2001 and responsible for the development, promotion and adoption of international financial reporting standard rules IFRS Foundation 2021 ). In this discussion article, we shall provide a snapshot of some of the most relevant global activities regarding sustainability at corporate level (Biondi et al. 2020 ; Songini et al. 2021 ), since only if disclosure and reporting activities expected by companies in the coming years are finally effective and in line with all the aforementioned needed improvements and objectives, business choices and practices — from which environmental and social concerns might arise — shall come more easily under scrutiny and be appropriately monitored.

Sustainability Accounting: Initiatives at Global Level

In essence, through this study, we will make emerge where the IASB (IFRS Foundation) and the EFRAG are heading towards with regards to sustainability reporting.

In general, since 2005, Regulation 1606/02 requires Europe to apply, under certain conditions, the IAS/IFRS (i.e., the international accounting standards) drawn up by the IASB and endorsed by EFRAG (Biondi et al. 2020 ). Having said that, with regard to sustainability reporting at European level, EFRAG appears to have been also entrusted with the corporate sustainability standard setting. Yet, since the scope of the IASB activities is wider and potentially covers the entire globe (with companies, for instance, in Japan and China, among the others, applying IAS/IFRS), it is also worth analyzing the IASB initiatives on this topic so to propose a broader perspective. That said, IASB/IFRS Foundation focus is mostly on listed companies, whereas the aforementioned CSRD proposal should address also privately-held ones; this makes emerge the reasons that stand behind the difference in their current set objectives also in terms of different final adopter (Biondi et al. 2020 ; La Torre et al. 2020 ; Songini et al. 2021 ).

Both at international level, with regard to the activities of the IASB and the IFRS Foundation, and at European level, through EFRAG, the direction of corporate reporting seems to be going in an increasingly value-oriented direction that goes beyond the financial results and beyond the creation of value for shareholders alone (UK HM Treasury 2021 ).

IFRS Foundation has announced the establishment under its control of a new board, the ISSB “International Sustainability Standards Board,” which will be responsible for defining sustainability accounting standards to be applied in the coming financial years. This new board, whose members should possess specific expertise on ESG dynamics, will focus its drafting activity on material information for investors’ decisions and other stakeholders in the world capital markets and on the urgent need for better information about climate-related matters (Schaltegger 2020 ; Adebayo et al. 2021a , b ). In fact, the ISSB would initially focus on climate-related reporting, extending then its work towards the information needs of investors on other environmental, social, and governance (ESG) matters. EFRAG proposed to make its structure “dichotomous” as well, adding to the FRB “Financial Reporting Body”, the NFRB “Non-Financial Reporting Body” — both appointed to carry out the required technical work according to their respective assigned tasks. In this context, it is worth stressing the importance of the interconnections between IASB and EFRAG, since in case of a complete independent development of ESG reporting standards by these two important institutions, the related standards might turn out to be incoherent and hardly comparable — which is necessarily something to avoid (La Torre et al. 2020 ; Kirikkaleli et al. 2021 ; Songini et al. 2021 ).

More in detail, the IFRS Foundation/IASB, as of today, has highlighted the strategic macro-decisions that should guide the future action of the ISSB, defining guidelines at a global level and basing the new standards first of all on the climatic issue, to be extended to the whole sustainability/ESG sector in a broader sense. Furthermore, the creation of this new board has been announced at the UN Climate Change Conference (also known as COP26), held in November 2021. In essence, IFRS Foundation, by means of this and entrusting this board to set IFRS sustainability standards, will undergo a process of robust amendment of its governance, arranging its structure so to be better able to tackle the current and future ESG and sustainability challenges that the entire world has and will increasingly have to face (El Barnoussi 2020 ; García-Sánchez et al. 2020 ; Adebayo et al. 2021a , b ; Shan et al. 2021 ).

EFRAG, on the other hand, with the objective of addressing the action plan for financing sustainable growth and facilitating dialog among stakeholders (European Reporting Lab – EFRAG 2021 ), has already been:

promoting the attitude that should be adopted by corporations towards the interest and public welfare (i.e., “public good”), through the disclosure of quality information, that should be both “retrospective” and “forward-looking”;

calibrating the levels and boundaries of reporting on the uniqueness of each entity; and

recalling the concepts of double materiality and connectivity of information.

Please note that these mentioned points are key principles for drafting the most advanced global reports, such as integrated reporting. Moreover, EFRAG is pushing for producing an increasingly digitized and digitizable information that would definitely allow to overcome many anachronistic procedures still perpetrated in the accounting profession worldwide.

Conclusions

Underlining once again the apparent diversity, as of today, of set goals by the two institutions in discussion (i.e., EFRAG and IASB/ISSB), what does emerge at the moment is the willingness of both institutions to finally manage ESG dynamics also from an accounting and reporting perspective (UK HM Treasury 2021 ). In so doing, companies are increasingly required to provide high quality information that is also clear and comparable — potentially contrasting, subsequently, the “greenwashing” phenomenon. In this context, EFRAG concretely proposed a time plan of actions they have outlined and publicly declared (European Reporting Lab — EFRAG 2021 ) that covers the next 6 years of activity. By 2022, they shall provide the final draft of two “conceptual frameworks” and the “core” topical standards, to be applied to FY23 for reports to be published in 2024. EFRAG has also planned to treat the so-called advanced issues (if any) to be applied to FY25 and subsequent years, by 2024.

To conclude, all these sustainability ventures will, sooner or later, also reach small and medium-sized companies (i.e., “SMEs”) — mainly as the natural consequence of supply chain dynamics. Thus, the scope of application of the new sustainability reporting system shall potentially have a pervasive impact on the entire economic and social fabric of post COVID-19 Europe and the new millennium as well. Having said that, since this phenomenon is still evolving around the globe, from a legislative point of view, the matter in discussion is still in process and under scrutiny. Therefore, the snapshot should be taken as an overview of what will be potentially asked to companies in the coming future, being aware of the fact that radical changes to the above could be brought as well.

In fact, whether and what the actual impacts will be can only be defined in retrospect. Yet, it is worth underlining the actual (apparent) beginning towards a slightly broader and long-term vision of international institutions, making the principles of sustainability their own, without seeing them as the umpteenth “red tape” at global scale — moving, therefore, definitively on from a short termism attitude. That said, only by aligning integrated thinking with action will it be possible to definitively put in place sustainable and successful economic activities for all the communities involved. Otherwise, the price to be paid will be, once again, and increasingly unexpectedly, finding ourselves reliving devastating moments, similar to those that are still scourging the entire planet today, due to the ongoing pandemic crisis.

Availability of data and materials

All data are available in the main text and mentioned in the references.

Adebayo TS, Oladipupo SD, Adeshola I, Rjoub H (2021) Wavelet analysis of impact of renewable energy consumption and technological innovation on CO 2 emissions: evidence from Portugal. Environ Sci Pollut Res

Adebayo TS, Rjoub H, Akinsola GD, Oladipupo SD (2021) The asymmetric effects of renewable energy consumption and trade openness on carbon emissions in Sweden: new evidence from quantile-on-quantile regression approach. Environ Sci Pollut Res

Biondi L, Dumay J, Monciardini D (2020) Using the international integrated reporting framework to comply with EU Directive 2014/95/EU: can we afford another reporting façade? Meditari Account Res 28:889–914

Article Google Scholar

El Barnoussi A, Howieson B, Van Beest F (2020) Prudential application of IFRS 9: (Un)fair reporting in COVID-19 crisis for banks worldwide? Aust Account Rev 30:178–192

European Reporting Lab – EFRAG (2021) Final report on proposals for a relevant and dynamic EU sustainability reporting standard-setting. EFRAG,

García-Sánchez I-M, Raimo N, Marrone A, Vitolla F (2020) How does integrated reporting change in light of COVID-19? A revisiting of the content of the integrated reports. Sustainability. 12:7605

IFRS Foundation (2021). Sustainability reporting – Agenda Paper of Lee White, IFRS Advisory Council

Kirikkaleli D, Adebayo TS (2020) Do renewable energy consumption and financial development matter for environmental sustainability? New global evidence. Sustain Dev 29:583–594

Kirikkaleli D, Güngör H, Adebayo TS (2021) Consumption-based carbon emissions, renewable energy consumption, financial development and economic growth in Chile. Bus Strat Environ 2021:1–15

Google Scholar

Kose T, Agdeniz S (2021) Analysis of data about COVID-19 disease in integrated reporting. J Account Tax Stud

La Torre M, Sabelfeld S, Blomkvist M, Dumay J (2020) Rebuilding trust: sustainability and non-financial reporting and the European Union regulation. Medit Account Res 28:701–125

Schaltegger S (2020) Unsustainability as a key source of epi- and pandemics: conclusions for sustainability and ecosystems accounting. J Account Org Change 16:613–619

Shan S, Ahmad M, Tan Z, Adebayo TS, Li RYM, Kirikkaleli D (2021) The role of energy prices and non-linear fiscal decentralization in limiting carbon emissions: tracking environmental sustainability. Energy 234:121–243

Songini L, Pistoni A, Tettamanzi P, Fratini F, Minutiello V (2021) Integrated reporting quality and BoD characteristics: an empirical analysis. J Manag Govern

Tettamanzi P, Venturini G, Murgolo M (2021) Wider corporate reporting: La possibile evoluzione della Relazione sulla Gestione. Bilancio e Revisione. IPSOA - Wolters Kluwer

Tettamanzi P, Venturini G, Murgolo M (Forthcoming) Accounting for sustainability: la Convergente (?) Dialettica tra IASB e EFRAG. Bilancio e Revisione. IPSOA - Wolters Kluwer

UK Government (2021) COP26 explained. UN Climate Change Conference UK 2021

UK HM Treasury (2021) UK welcomes work to develop global sustainability reporting standards alongside 40 international partners. Gov.uk.

UN Climate Change (2021) The Glasgow climate pact – key outcomes from COP26. UNFCCC Sites and Platforms, Brazil

UN Climate Change (2021) COP26 outcomes: transparency and reporting. UNFCCC Sites and Platforms, Brazil

Download references

Author information

Authors and affiliations.

School of Economics and Management, LIUC – Cattaneo University, Varese, Italy

Patrizia Tettamanzi & Michael Murgolo

Department of Accounting, Bocconi University, Milan, Italy

Giorgio Venturini

You can also search for this author in PubMed Google Scholar

Contributions

This proposal of short discussion article was written only by the three aforementioned authors, i.e., Patrizia Tettamanzi (PT), Giorgio Venturini (GV), and Michael Murgolo (MM). More in detail, MM analyzed and interpreted the original documents drafted by IFRS Foundation and EFRAG. GV informed MM about the issue in analysis, giving him the documentary support needed for the first draft of the document. Besides, GV reviewed the initial work, proposing venues for necessary changes. PT as associate professor of Business Administration and PhD reviewed the final draft of the work, approving its submission. All authors read and approved the final manuscript.

Corresponding author

Correspondence to Michael Murgolo .

Ethics declarations

Ethics approval.

Not applicable.

Consent to participate

Consent to publish, competing interests.

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Tettamanzi, P., Venturini, G. & Murgolo, M. Sustainability and Financial Accounting: a Critical Review on the ESG Dynamics. Environ Sci Pollut Res 29 , 16758–16761 (2022). https://doi.org/10.1007/s11356-022-18596-2

Download citation

Received : 05 October 2021

Accepted : 06 January 2022

Published : 13 January 2022

Issue Date : March 2022

DOI : https://doi.org/10.1007/s11356-022-18596-2

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- ESG Dynamics

- Sustainability Reporting

- Environment and Climate

- Health Emergency

- Find a journal

- Publish with us

- Track your research

Accounting and Finance Thesis Topics

This page provides a comprehensive list of accounting and finance thesis topics designed to assist students in selecting an impactful subject for their thesis. Whether you are pursuing undergraduate, graduate, or postgraduate studies, the diverse array of topics presented here covers a broad spectrum of specialties within the field of accounting and finance. From traditional areas like audit and taxation to emerging fields like fintech and behavioral finance, this collection aims to cater to a variety of research interests and academic requirements. Each category is meticulously curated to inspire innovative thinking and encourage a deeper exploration of both established and contemporary issues in the discipline.

600 Accounting and Finance Thesis Topics

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% off with 24start discount code, browse accounting and finance thesis topics:.

- Accounting Thesis Topics

- Audit Thesis Topics

- Banking Thesis Topics

- Behavioral Finance Thesis Topics

- Capital Markets Thesis Topics

- Corporate Finance Thesis Topics

- Corporate Governance Thesis Topics

- Finance Thesis Topics

- Financial Economics Thesis Topics

- Financial Management Thesis Topics

- Fintech Thesis Topics

- Insurance Thesis Topics

- International Finance Thesis Topics

- Investment Thesis Topics

- Management Accounting Thesis Topics

- Personal Finance Thesis Topics

- Public Finance Thesis Topics

- Quantitative Finance Thesis Topics

- Risk Management Thesis Topics

- Taxation Thesis Topics

1. Accounting Thesis Topics

- The impact of artificial intelligence on financial reporting and compliance.

- Blockchain technology in accounting: disrupting traditional processes.

- The role of ethical leadership in promoting sustainable accounting practices.

- Comparative analysis of global accounting standards post-IFRS adoption.

- Cultural influences on multinational accounting practices.

- The future of green accounting in corporate sustainability initiatives.

- Digital currencies and their accounting implications within multinational corporations.

- The efficacy of automated accounting systems in small to medium enterprises.

- Forensic accounting as a tool against cyber financial fraud.

- Tax strategy and accounting ethics in the digital age.

- Non-profit accounting challenges in a post-pandemic world.

- Gig economy impacts on financial reporting and tax obligations.

- Continuous auditing in real-time financial data environments.

- Ethical conflicts in accounting decisions: a case study analysis.

- The integration of blockchain for transparency in financial auditing.

- Strategic management accounting techniques in agile organizations.

- Predictive analytics in accounting and its impact on business strategy.

- Cost management innovations in healthcare accounting.

- Regulatory impacts on financial disclosures and corporate accounting.

- Innovative financial planning tools for startup sustainability.

- The role of environmental, social, and governance (ESG) criteria in financial decision-making.

- Public sector accountability and accounting reforms.

- Big data analytics in financial statement analysis.

- Adapting accounting frameworks for emerging markets.

- The dynamics of accounting professionalism and ethical standards.

- Real-time financial reporting: challenges and advantages.

- Mergers and acquisitions: accounting for corporate restructuring.

- Artificial intelligence in audit operations: reshaping traditional frameworks.

- Corporate sustainability reporting: critical analysis of current practices.

- Tax evasion strategies and their impact on international accounting standards.

2. Audit Thesis Topics

- The effectiveness of continuous auditing in detecting and preventing fraud.

- Implementing a risk-based auditing framework in emerging markets.

- Enhancing corporate governance with robust audit committee functions.

- The comparative reliability of external audits versus internal controls.

- The impact of the latest regulatory frameworks on auditing standards.

- Ensuring auditor independence in a complex corporate milieu.

- Blockchain applications in enhancing audit trail transparency.

- Strategies for cybersecurity audits in financial institutions.

- Cultural impacts on audit practices in global organizations.

- The future of auditing: integrating real-time data analytics.

- The relationship between audit quality and investment decisions.

- Leveraging machine learning for enhanced audit precision.

- Auditing ethics in the face of financial technology innovations.

- The role of internal audits in reinforcing cybersecurity measures.

- Auditing challenges in decentralized platforms using blockchain technology.

- Comparative study of traditional and modern audit methodologies.

- The impact of data privacy regulations on audit practices globally.

- Developing effective audit strategies for cloud-based accounting systems.

- The role of audits in enhancing business resilience during economic downturns.

- Fraud detection techniques in an AI-driven audit environment.

- The effectiveness of environmental auditing in promoting corporate sustainability.

- Auditing for non-financial information: challenges and methodologies.

- Enhancing the transparency of public sector audits to improve trust.

- Implementing forensic auditing techniques in corporate fraud detection.

- The evolution of auditing standards in response to global financial crises.

- The role of technology in transforming audit documentation and reporting.

- Impact of auditor-client relationships on audit quality.

- Strategies for overcoming challenges in cross-border audit practices.

- Auditing supply chain operations for financial integrity and sustainability.

- The future of regulatory audits in a dynamically changing global market.

3. Banking Thesis Topics

- The future of digital banking post-COVID-19.

- Analyzing the impact of blockchain technology on international banking transactions.

- The role of central banks in managing digital currency implementations.

- Sustainable banking practices: integrating ESG factors into bank operations.

- The evolution of consumer banking behavior influenced by mobile technologies.

- Cybersecurity strategies in banking: preventing breaches in a digital age.

- The effectiveness of monetary policy in digital banking ecosystems.

- Banking regulations and their impact on global economic stability.

- Fintech innovations and their integration into traditional banking systems.

- The impact of banking deserts on rural economic development.

- Artificial intelligence in banking: reshaping customer service and risk management.

- The role of ethical banking in promoting financial inclusion.

- Impact of Brexit on UK banking: challenges and opportunities.

- Stress testing in banks: approaches and implications for financial stability.

- Consumer data protection in online banking: challenges and solutions.

- The influence of microfinancing on developing economies.

- The impact of interest rate changes on banking profitability.

- Role of banking in supporting sustainable energy financing.

- Technological disruptions in banking: a threat or an opportunity?

- The effect of global banking regulations on emerging market economies.

- Strategies for managing credit risk in post-pandemic recovery phases.

- The growing role of Islamic banking in the global finance sector.

- The impact of non-traditional banking platforms on financial services.

- Data analytics in banking: enhancing decision-making processes.

- Cross-border banking challenges in a globalized economy.

- The future of branchless banking: implications for customer engagement.

- Banking transparency and its effects on consumer trust.

- The role of banks in facilitating international trade.

- Innovations in mortgage banking and their impact on housing markets.

- The effects of banking consolidation on competition and service delivery.

4. Behavioral Finance Thesis Topics

- The psychological effects of financial losses on investment behavior.

- Behavioral biases in financial decision-making: a case study of stock market investors.

- The impact of social media on investor behavior and market outcomes.

- Cognitive dissonance and its effect on personal financial planning.

- The role of emotional intelligence in financial trading success.

- Exploring the herding behavior in cryptocurrency markets.

- Behavioral finance strategies to mitigate impulse spending.

- The influence of cultural factors on investment decisions.

- Psychological factors driving risk tolerance among millennials.

- The effect of behavioral finance education on individual investment choices.

- Overconfidence and trading: an analysis of its impact on stock returns.

- Decision-making processes under financial stress: a behavioral perspective.

- The role of behavioral factors in the success of financial advisement.

- The impact of behavioral insights on retirement savings plans.

- Anchoring bias in financial forecasting and market predictions.

- The role of optimism and pessimism in financial markets.

- Behavioral finance and its role in shaping sustainable investing.

- Understanding the gap between perceived and actual financial knowledge.

- Behavioral interventions to improve financial literacy.

- The influence of personality traits on financial decision-making.

- Behavioral economics: redesigning financial products for better decision outcomes.

- The effectiveness of nudge theory in personal finance management.

- The impact of financial anxiety on decision-making efficiency.

- The behavioral aspects of financial negotiation.

- Market sentiment analysis: behavioral finance in algorithmic trading.

- The psychological impact of financial news on market movements.

- Behavioral finance insights into crowd-funding behaviors.

- Ethical considerations in behavioral finance research.

- The influence of age and life stage on financial risk-taking.

- Behavioral finance in corporate decision-making: case studies of strategic financial planning.

5. Capital Markets Thesis Topics

- The future trajectory of global capital markets in the post-pandemic era.

- Impact of quantitative easing on emerging market economies.

- The role of technology in enhancing liquidity in capital markets.

- Analysis of market efficiency in different economic cycles.

- The effects of political instability on capital market performance.

- Environmental, Social, and Governance (ESG) criteria and their impact on capital market trends.

- Cryptocurrency as an emerging asset class in capital markets.

- The role of sovereign wealth funds in global capital markets.

- Algorithmic trading and its influence on market dynamics.

- The impact of international sanctions on capital markets.

- High-frequency trading: market benefits and systemic risks.

- The role of capital markets in financing green energy initiatives.

- Impact of fintech on traditional capital market structures.

- Corporate bond markets and their responsiveness to economic changes.

- The influence of central bank policies on capital market stability.

- Market anomalies and behavioral economics: exploring the deviations from market efficiency.

- The role of investor sentiment in capital market fluctuations.

- Crowdfunding as an alternative financing mechanism in capital markets.

- Regulatory challenges facing capital markets in developing countries.

- The future of securitization post-global financial crisis.

- Derivatives markets and their role in risk management.

- The impact of technology IPOs on market perceptions.

- Venture capital and its influence on market innovation.

- Corporate governance and its effect on equity prices.

- The role of market makers in maintaining market stability.

- Ethical investing and its traction in the capital market.

- The impact of demographic shifts on investment trends.

- The interplay between macroeconomic policies and capital market growth.

- Leveraging machine learning for capital market predictions.

- The role of media in shaping public perceptions of capital markets.

6. Corporate Finance Thesis Topics

- The impact of global economic shifts on corporate financing strategies.

- Analyzing the role of corporate finance in driving sustainable business practices.

- The influence of digital transformation on corporate financial management.

- Risk management in corporate finance during uncertain economic times.

- The effects of corporate financial restructuring on shareholder value.

- Financing innovation: How corporations fund new technology investments.

- The role of private equity in corporate finance.

- Strategies for managing corporate debt in a fluctuating interest rate environment.

- Impact of mergers and acquisitions on corporate financial health.

- ESG (Environmental, Social, and Governance) factors in corporate finance decisions.

- The future of corporate finance in the era of blockchain and cryptocurrencies.

- The role of financial analytics in optimizing corporate investment decisions.

- Corporate finance challenges in emerging markets.

- Venture capital and its impact on corporate growth.

- Corporate financial transparency and its effect on investor relations.

- The role of CFOs in navigating new global tax laws.

- Financial technology innovations and their implications for corporate finance.

- The impact of international trade agreements on corporate financing.

- Corporate finance strategies in the healthcare sector.

- The influence of shareholder activism on corporate financial policies.

- The future of corporate banking relationships.

- Capital allocation decisions in multinational corporations.

- The role of artificial intelligence in financial forecasting and budgeting.

- The impact of demographic changes on corporate finance strategies.

- Managing financial risks associated with climate change.

- The role of corporate finance in business model innovation.

- Financing strategies for startups versus established firms.

- The effect of corporate culture on financial decision-making.

- Corporate governance and its influence on financial risk management.

- The evolving landscape of securities regulations and its impact on corporate finance.

7. Corporate Governance Thesis Topics

- The impact of governance structures on corporate sustainability and responsibility.

- Board diversity and its effect on corporate decision-making processes.

- Corporate governance mechanisms to combat corruption and enhance transparency.

- The role of stakeholder engagement in shaping governance practices.

- Analyzing the effectiveness of corporate governance codes across different jurisdictions.

- The influence of technology on corporate governance practices.

- Governance challenges in family-owned businesses.

- The impact of corporate governance on firm performance during economic crises.

- Shareholder rights and their enforcement in emerging market economies.

- The future of corporate governance in the digital economy.

- The role of ethics in corporate governance.

- Corporate governance and risk management: interlinkages and impacts.

- The effects of regulatory changes on corporate governance standards.

- ESG integration in corporate governance.

- The role of internal audits in strengthening corporate governance.

- Corporate governance in non-profit organizations.

- The influence of activist investors on corporate governance reforms.

- The effectiveness of whistleblower policies in corporate governance.

- Cybersecurity governance in large corporations.

- Succession planning and governance in large enterprises.

- The impact of international governance standards on local practices.

- The role of governance in preventing financial fraud.

- Corporate governance in the fintech industry.

- The relationship between corporate governance and corporate social responsibility.

- The impact of global economic policies on corporate governance.

- Data privacy and security: Governance challenges in the information era.

- The role of governance in managing corporate crises.

- The impact of leadership styles on corporate governance effectiveness.

- Corporate governance and its role in enhancing business competitiveness.

- The evolving role of board committees in strategic decision-making.

8. Finance Thesis Topics

- Financial implications of global climate change initiatives.

- The future of financial markets in the face of geopolitical uncertainties.

- The impact of microfinance on poverty alleviation in developing countries.

- Cryptocurrency: emerging financial technology and its regulatory challenges.

- The role of financial institutions in fostering economic resilience.

- Innovations in financial products for an aging global population.

- The impact of digital wallets on traditional banking systems.

- Financial literacy and its role in promoting socio-economic equality.

- The effect of fintech on the global remittance landscape.

- Risk management strategies in finance post-global financial crisis.

- The influence of behavioral finance on investment strategies.

- The evolving role of central banks in digital currency markets.

- Financing sustainable urban development.

- The impact of artificial intelligence on personal finance management.

- Peer-to-peer lending and its effect on traditional credit markets.

- The role of finance in facilitating international trade and development.

- The implications of Brexit on European financial markets.

- Financial derivatives and their role in modern economies.

- The effects of sanctions on financial transactions and economic stability.

- The future of investment banking in a technology-driven world.

- Financial models for predicting economic downturns.

- The impact of financial education on consumer behavior.

- Securitization of assets: benefits and risks.

- The role of financial services in disaster recovery and resilience.

- Emerging trends in global investment patterns.

- Financial strategies for managing corporate mergers and acquisitions.

- The influence of cultural factors on financial systems and practices.

- The effectiveness of financial sanctions as a geopolitical tool.

- The future of financial privacy in an interconnected world.

- The role of finance in promoting renewable energy investments.

9. Financial Economics Thesis Topics

- The economic impact of quantitative easing in developed versus emerging markets.

- The implications of negative interest rates for global economies.

- Economic predictors of financial market behavior in crisis periods.

- The relationship between government debt and economic growth.

- Economic consequences of income inequality on national financial stability.

- The effects of consumer confidence on economic recovery.

- The role of economic policy in shaping housing market dynamics.

- The impact of global trade wars on financial economics.

- The influence of demographic shifts on economic policy and financial markets.

- Macroeconomic factors influencing cryptocurrency adoption.

- The role of economic theory in developing financial regulation.

- The impact of tourism economics on national financial health.

- Economic strategies for combating hyperinflation.

- The role of sovereign wealth funds in global economic stability.

- Economic analyses of environmental and resource economics.

- The implications of fintech on traditional economic models.

- Economic impacts of global pandemic responses by governments.

- The future of labor markets in a digitally transforming economy.

- Economic considerations in renewable energy finance.

- The economics of privacy and data security in financial transactions.

- The role of international economic organizations in financial regulation.

- Economic effects of technological innovation on traditional industries.

- The impact of economic sanctions on international relations and finance.

- The role of consumer spending in economic recovery phases.

- Economic policies for addressing wealth gaps.

- The economic impact of climate change on financial sectors.

- The role of economic research in crafting sustainable development goals.

- The economics of health and its impact on national economies.

- Global economic trends and their implications for financial forecasting.

- The relationship between educational economics and workforce development.

10. Financial Management Thesis Topics

- The strategic role of financial management in corporate sustainability.

- Impact of global financial regulations on corporate financial management.

- Financial management techniques for optimizing supply chain operations.

- The role of financial management in crisis recovery and resilience.

- Emerging technologies in financial management systems.

- The impact of corporate social responsibility on financial management strategies.

- Financial planning for long-term business growth in volatile markets.

- The influence of global economic conditions on financial management practices.

- Financial management challenges in the nonprofit sector.

- The role of financial management in mergers and acquisitions.

- The impact of digital currencies on corporate financial management.

- Financial risk management strategies in an era of global uncertainty.

- The role of financial management in enhancing operational efficiency.

- Financial management best practices in the tech industry.

- The impact of consumer behavior trends on financial management.

- Financial management in the healthcare sector: Challenges and strategies.

- The influence of artificial intelligence on financial decision-making processes.

- Financial management strategies for small and medium-sized enterprises (SMEs).

- The role of financial management in international expansion.

- Ethical considerations in financial management practices.

- Financial management in the energy sector: challenges and innovations.

- Financial strategies for managing environmental risks.

- The role of financial management in startup success and sustainability.

- The impact of financial transparency on corporate governance.

- Financial management and investor relations: integrating strategic communication.

- The role of financial management in educational institutions.

- Managing financial instability in emerging markets.

- Financial management practices in the gig economy.

- The role of financial managers in driving business model innovations.

- Financial management tools for effective capital allocation.

11. Fintech Thesis Topics

- The impact of blockchain on global payment systems.

- Regulation challenges for fintech innovations: A cross-country analysis.

- The role of fintech in democratizing access to financial services.

- Machine learning and artificial intelligence in predictive financial modeling.

- The evolution of peer-to-peer lending platforms and their impact on traditional banking.

- Cryptocurrency adoption: consumer behavior and market dynamics.

- The future of robo-advisors in personal finance management.

- The impact of mobile banking on financial inclusion in developing countries.

- Fintech solutions for microfinance: scalability and sustainability issues.

- Data privacy and security challenges in fintech applications.

- The role of fintech in enhancing cybersecurity in financial transactions.

- The impact of fintech on traditional banking employment.

- Regulatory technology (RegTech) for compliance management: trends and challenges.

- Fintech and its role in combating financial crime and money laundering.

- The influence of fintech on the insurance industry: insurtech innovations.

- Fintech investments: market trends and future prospects.

- The role of big data analytics in fintech.

- Digital wallets and the future of consumer spending behavior.

- Impact of fintech on wealth management and investment strategies.

- Challenges and opportunities of implementing distributed ledger technology in financial services.

- Consumer trust and fintech: building relationships in a digital age.

- The evolution of payment gateways: fintech at the forefront.

- Fintech’s impact on cross-border payments and remittances.

- The role of fintech in the development of smart contracts.

- The influence of fintech on financial market transparency.

- Fintech as a driver for financial sector innovation in emerging markets.

- The impact of artificial intelligence on risk assessment in fintech.

- Fintech and financial stability: an analysis of systemic risks.

- The role of fintech in streamlining government and public sector finance.

- Ethical considerations in fintech: balancing innovation with consumer protection.

12. Insurance Thesis Topics

- The future of insurance in the age of climate change.

- The impact of artificial intelligence on underwriting and risk management.

- Cyber risk insurance: emerging challenges and opportunities.

- The role of insurance in managing public health crises.

- Innovations in health insurance: technology-driven approaches to coverage.

- The evolution of automotive insurance in the era of autonomous vehicles.

- Insurance fraud detection using big data analytics.

- Regulatory challenges in the global insurance market.

- The influence of behavioral economics on insurance product design.

- The role of reinsurance in stabilizing insurance markets.

- Insurance and financial inclusion: strategies for reaching underserved communities.

- The impact of technological advancements on insurance pricing models.

- The role of insurance in disaster risk reduction and management.

- Customer data management in the insurance industry: privacy versus personalization.

- The future of life insurance: adapting to demographic shifts.

- The integration of IoT devices in home insurance policies.

- Blockchain applications in the insurance industry.

- The impact of social media on insurance marketing and customer engagement.

- Insurance as a tool for sustainable business practices.

- The role of insurance companies in promoting corporate social responsibility.

- The challenges of health insurance in a post-pandemic world.

- Emerging risks and insurance: addressing the needs of the gig economy.

- The role of insurance in mitigating financial risks associated with sports and entertainment.

- Ethical challenges in insurance: discrimination in risk assessment.

- The impact of global political instability on the insurance sector.

- Insurance products tailored for the elderly: opportunities and challenges.

- The role of insurance in fostering innovation in the construction industry.

- Insurance and climate resilience: protecting vulnerable communities.

- The evolving landscape of travel insurance amid global uncertainties.

- The role of insurance in the transition to renewable energy sources.

13. International Finance Thesis Topics

- The impact of currency fluctuations on international trade.

- Strategies for managing foreign exchange risk in multinational corporations.

- The effects of global economic sanctions on financial markets.

- The role of international financial institutions in economic development.

- Cross-border mergers and acquisitions: challenges and opportunities.

- The influence of geopolitical tensions on global financial stability.

- International tax planning and its implications for global investment.

- The future of international financial regulation in a post-Brexit Europe.

- The impact of emerging markets on global finance.

- Foreign direct investment trends and their economic impacts.

- The role of sovereign wealth funds in international finance.

- The challenges of implementing international accounting standards.

- The impact of international remittances on developing economies.

- The role of digital currencies in reshaping international finance.

- The effects of protectionist trade policies on global finance.

- International financial market trends and their implications for investors.

- The role of expatriate remittances in national economic stability.

- The impact of international trade agreements on financial services.

- Global risk management strategies in the finance sector.

- The role of green finance in promoting sustainable development.

- The impact of international environmental policies on financial strategies.

- The future of global banking in the context of rising nationalism.

- The role of international finance in disaster recovery and resilience.

- The influence of international finance on poverty reduction strategies.

- Strategies for financing international healthcare initiatives.

- The evolving role of Islamic finance in the global market.

- The impact of fintech on international banking and finance.

- Challenges in financing international infrastructure projects.

- The role of international finance in climate change mitigation.

- Ethical considerations in international finance: fostering global financial integrity.

14. Investment Thesis Topics

- The role of ESG criteria in investment decision-making.

- The impact of technological innovation on investment strategies.

- Market reaction to unexpected global events and its effect on investment portfolios.

- Behavioral biases in investment: a study of market anomalies.

- The future of real estate investment in a fluctuating economic landscape.

- The role of quantitative analysis in portfolio management.

- The impact of demographic changes on investment trends.

- Strategies for sustainable and responsible investing.

- The influence of regulatory changes on investment strategies.

- The role of artificial intelligence in enhancing investment decisions.

- Cryptocurrency investment: risks and opportunities.

- The impact of global trade tensions on investment strategies.

- Investment strategies for low interest rate environments.

- The role of crowdfunding in the investment landscape.

- The impact of social media on investor sentiment and stock prices.

- The effectiveness of passive versus active investment strategies.

- The role of venture capital in driving technological innovation.

- The future of bond markets in a changing economic context.

- The role of international investments in diversifying portfolios.

- Impact of inflation expectations on investment decisions.

- The evolving landscape of commodity investments.

- Investment opportunities in emerging markets.

- The impact of fiscal policy changes on investment strategies.

- The role of hedge funds in the current financial market.

- The influence of central bank policies on investment strategies.

- The role of pension funds in the global investment market.

- Ethical investing: balancing profit and principles.

- The future of investments in renewable energy.

- The impact of political stability on foreign investments.

- The role of technology in asset management and valuation.

15. Management Accounting Thesis Topics

- The role of management accounting in strategic decision-making.

- Cost management strategies in the era of global supply chain disruptions.

- The impact of digital transformation on management accounting practices.

- The role of management accounting in environmental sustainability.

- Performance measurement and management in diverse organizational settings.

- Risk management strategies in management accounting.

- The evolving role of management accountants in corporate governance.

- The impact of regulatory changes on management accounting.

- The role of management accounting in healthcare cost containment.

- The influence of management accounting on operational efficiency.

- Management accounting practices in nonprofit organizations.

- The role of cost analysis in pricing strategies.

- The impact of technological advancements on budgeting and forecasting.

- The effectiveness of management accounting tools in project management.

- The role of management accounting in mergers and acquisitions.

- The impact of cultural differences on management accounting systems.

- The role of management accounting in enhancing business resilience.

- The influence of management accounting on business model innovation.

- Management accounting in the digital economy: challenges and opportunities.

- Strategic cost management for competitive advantage.

- The role of management accounting in supply chain optimization.

- The future of management accounting in the context of AI and automation.

- The impact of financial technology on management accounting.

- The role of management accounting in crisis management and recovery.

- Performance metrics and their impact on organizational success.

- The role of management accounting in supporting sustainable practices.

- The impact of global economic conditions on management accounting.

- The role of predictive analytics in management accounting.

- The effectiveness of internal controls in management accounting.

- The role of management accounting in international business expansion.

16. Personal Finance Thesis Topics

- The impact of financial technology on personal savings strategies.

- Behavioral insights into personal debt management.

- The role of personal finance education in shaping financial literacy.

- The influence of economic downturns on personal investment choices.

- Retirement planning: trends and strategies in the current economic climate.

- The effectiveness of digital tools in personal budgeting and financial planning.

- Analyzing the gender gap in personal finance management.

- The impact of cultural factors on personal saving and spending habits.

- Personal finance challenges for the gig economy workers.

- The role of personal finance in achieving long-term financial security.

- Cryptocurrency as a personal investment: risks and rewards.

- The impact of peer-to-peer lending platforms on personal finance.

- The influence of social media on personal financial decisions.

- Ethical considerations in personal financial advice.

- The evolution of consumer credit markets and its impact on personal finance.

- Strategies for managing personal financial risk.

- The role of emergency funds in personal financial planning.

- The impact of student loans on financial planning for millennials.

- Personal finance strategies for different life stages.

- The effect of inflation on personal savings and investment strategies.

- The future of personal finance in the age of AI and automation.

- The role of insurance in personal financial planning.

- The impact of tax laws changes on personal finance strategies.

- The psychology of spending: understanding consumer behavior.

- Personal financial planning for expatriates: strategies and challenges.

- The role of estate planning in personal finance.

- Impact of healthcare costs on personal financial stability.

- The role of financial advisors in the era of self-directed financial planning.

- Financial planning for sustainable living: integrating environmental considerations.

- The challenges and opportunities in personal wealth building.

17. Public Finance Thesis Topics

- The role of public finance in addressing income inequality.

- Fiscal policies for sustainable economic growth.

- The impact of taxation on small businesses.

- Public finance management in times of economic crisis.

- The role of government spending in stimulating economic development.

- Strategies for managing national debt.

- The effectiveness of public welfare programs.

- The challenges of healthcare financing in public sectors.

- The impact of international aid on public finance.

- Public finance strategies for environmental conservation.

- The role of public finance in urban development.

- Tax evasion and its implications for public finance.

- The impact of public finance on education quality and access.

- Financing public infrastructure: challenges and solutions.

- The role of public finance in disaster management.

- The effectiveness of fiscal decentralization.

- Public finance reforms and their impact on service delivery.

- The challenges of pension financing in the public sector.

- The impact of political stability on public financial management.

- Public-private partnerships: financial implications and models.

- The role of transparency in public finance.

- The impact of corruption on public financial management.

- Financing renewable energy projects through public funds.

- The role of public finance in health care reform.

- The effectiveness of government subsidies in promoting economic sectors.

- The challenges of financing sustainable transportation systems.

- The impact of demographic changes on public finance.

- The role of digital technologies in improving public finance management.

- The global trends in public finance and their implications for domestic policy.

- The impact of climate change on public financial strategies.

18. Quantitative Finance Thesis Topics

- The application of machine learning algorithms in predicting stock market trends.

- The role of quantitative methods in risk management.

- Developing advanced models for credit risk assessment.

- The impact of high-frequency trading on market stability.

- The use of big data analytics in portfolio management.

- Quantitative approaches to asset pricing in volatile markets.

- The effectiveness of quantitative strategies in hedge funds.

- The role of algorithmic trading in enhancing market efficiency.

- Quantitative models for predicting bond market movements.

- The impact of quantitative finance on regulatory compliance.

- The application of blockchain technology in quantitative finance.

- The challenges of quantitative finance in cryptocurrency markets.

- The integration of environmental, social, and governance (ESG) factors in quantitative analysis.

- The role of quantitative finance in private equity valuations.

- Developing quantitative approaches for derivatives pricing.

- The impact of quantitative finance techniques on financial advising.

- Quantitative methods for assessing market liquidity.

- The role of sentiment analysis in quantitative finance.

- Quantitative trading strategies for commodities markets.

- The application of game theory in financial strategy.

- Quantitative finance and its role in insurance underwriting.

- The impact of geopolitical events on quantitative financial models.

- The use of quantitative finance in forecasting economic downturns.

- Machine learning models for real estate investment analysis.

- Quantitative finance techniques in sports betting markets.

- The impact of artificial intelligence on financial market predictions.

- Quantitative methods for managing currency exchange risks.

- The role of quantitative finance in managing pension fund assets.

- The effectiveness of quantitative models in emerging financial markets.

- The future of quantitative finance in a globally interconnected economy.

19. Risk Management Thesis Topics

- The role of risk management in enhancing corporate resilience.

- Cybersecurity risks in financial institutions: management strategies.

- The impact of climate change on risk management in insurance.

- Risk management techniques in the fintech sector.

- The effectiveness of enterprise risk management (ERM) frameworks.

- Risk management in global supply chains.

- The role of risk management in sustainable business practices.

- Financial risks associated with political instability.

- The challenges of operational risk management in complex organizations.

- Risk management strategies for digital transformation projects.

- The impact of regulatory changes on risk management practices.

- Risk assessment techniques for investment in volatile markets.

- The role of data analytics in risk identification and mitigation.

- Risk management considerations in mergers and acquisitions.

- The impact of reputation risk on corporate strategy.

- Risk management in the healthcare industry.

- The challenges of risk management in the energy sector.

- The role of risk management in nonprofit organizations.

- Implementing risk management in public sector entities.

- The future of risk management in the context of AI advancements.

- Credit risk management in banking post-global financial crisis.

- Risk management strategies for emerging technologies.

- The role of psychological factors in risk management decision-making.

- Legal risks in international business operations.

- The impact of cultural differences on risk management strategies.

- Environmental risk management and corporate responsibility.

- Risk management techniques for protecting intellectual property.

- The role of insurance in comprehensive risk management.

- The challenges of liquidity risk management in financial markets.

- The future of risk management education and training.

20. Taxation Thesis Topics

- The impact of digital economy on global taxation frameworks.

- Tax policy as a tool for economic recovery post-pandemic.

- The effectiveness of tax incentives in promoting renewable energy investments.

- The role of taxation in addressing wealth inequality.

- International tax competition and its implications for global economic stability.

- The challenges of implementing value-added tax (VAT) in developing countries.

- Tax evasion and its impact on national economies.

- The role of tax policy in encouraging corporate social responsibility.

- The impact of tax reforms on small and medium-sized enterprises.

- Comparative analysis of progressive versus flat tax systems.