The Endowment Model and Modern Portfolio Theory

We develop a dynamic portfolio-choice model with illiquid alternative assets to analyze the “endowment model,” widely adopted by institutional investors such as pension funds, university endowments, and sovereign wealth funds. In the model, the alternative asset has a lock-up, but can be liquidated at any time by paying a proportional cost. We model how investors can engage in liquidity diversification by investing in multiple illiquid alternative assets with staggered lock-up expirations, and show that doing so increases alternatives allocations and investor welfare. We show how illiquidity from lock-ups interacts with illiquidity from secondary market transaction costs resulting in endogenous and time-varying rebalancing boundaries. We extend the model to allow crisis states and show that increased illiquidity during crises causes holdings to deviate significantly from target allocations.

For helpful comments, we thank an anonymous Associate Editor, two anonymous referees, Patrick Bolton, Bruno Biais (Editor), Winston Dou, Thomas Gilbert, Harrison Hong, Steve Kaplan, Monika Piazzesi, Jim Poterba, Tom Sargent, Mark Schroder, and Luis Viceira; seminar participants at Columbia University; and participants at the European Finance Association and NBER New Developments in Long-Term Asset Management conferences. We thank Matt Hamill and Ken Redd of NACUBO and John Griswold and Bill Jarvis of Commonfund for assistance with data. Dimmock gratefully acknowledges financial support from the Singapore Ministry of Education research grant R-315-000-133-133. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research.

MARC RIS BibTeΧ

Download Citation Data

- February 13, 2019

- June 24, 2021

- December 29, 2021

Published Versions

Stephen G. Dimmock & Neng Wang & Jinqiang Yang, 2024. " The Endowment Model and Modern Portfolio Theory, " Management Science, vol 70(3), pages 1554-1579.

Conferences

More from nber.

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

- Search Menu

Sign in through your institution

- Browse content in Arts and Humanities

- Browse content in Archaeology

- Anglo-Saxon and Medieval Archaeology

- Archaeological Methodology and Techniques

- Archaeology by Region

- Archaeology of Religion

- Archaeology of Trade and Exchange

- Biblical Archaeology

- Contemporary and Public Archaeology

- Environmental Archaeology

- Historical Archaeology

- History and Theory of Archaeology

- Industrial Archaeology

- Landscape Archaeology

- Mortuary Archaeology

- Prehistoric Archaeology

- Underwater Archaeology

- Zooarchaeology

- Browse content in Architecture

- Architectural Structure and Design

- History of Architecture

- Residential and Domestic Buildings

- Theory of Architecture

- Browse content in Art

- Art Subjects and Themes

- History of Art

- Industrial and Commercial Art

- Theory of Art

- Biographical Studies

- Byzantine Studies

- Browse content in Classical Studies

- Classical History

- Classical Philosophy

- Classical Mythology

- Classical Numismatics

- Classical Literature

- Classical Reception

- Classical Art and Architecture

- Classical Oratory and Rhetoric

- Greek and Roman Epigraphy

- Greek and Roman Law

- Greek and Roman Papyrology

- Greek and Roman Archaeology

- Late Antiquity

- Religion in the Ancient World

- Social History

- Digital Humanities

- Browse content in History

- Colonialism and Imperialism

- Diplomatic History

- Environmental History

- Genealogy, Heraldry, Names, and Honours

- Genocide and Ethnic Cleansing

- Historical Geography

- History by Period

- History of Emotions

- History of Agriculture

- History of Education

- History of Gender and Sexuality

- Industrial History

- Intellectual History

- International History

- Labour History

- Legal and Constitutional History

- Local and Family History

- Maritime History

- Military History

- National Liberation and Post-Colonialism

- Oral History

- Political History

- Public History

- Regional and National History

- Revolutions and Rebellions

- Slavery and Abolition of Slavery

- Social and Cultural History

- Theory, Methods, and Historiography

- Urban History

- World History

- Browse content in Language Teaching and Learning

- Language Learning (Specific Skills)

- Language Teaching Theory and Methods

- Browse content in Linguistics

- Applied Linguistics

- Cognitive Linguistics

- Computational Linguistics

- Forensic Linguistics

- Grammar, Syntax and Morphology

- Historical and Diachronic Linguistics

- History of English

- Language Acquisition

- Language Evolution

- Language Reference

- Language Variation

- Language Families

- Lexicography

- Linguistic Anthropology

- Linguistic Theories

- Linguistic Typology

- Phonetics and Phonology

- Psycholinguistics

- Sociolinguistics

- Translation and Interpretation

- Writing Systems

- Browse content in Literature

- Bibliography

- Children's Literature Studies

- Literary Studies (Asian)

- Literary Studies (European)

- Literary Studies (Eco-criticism)

- Literary Studies (Romanticism)

- Literary Studies (American)

- Literary Studies (Modernism)

- Literary Studies - World

- Literary Studies (1500 to 1800)

- Literary Studies (19th Century)

- Literary Studies (20th Century onwards)

- Literary Studies (African American Literature)

- Literary Studies (British and Irish)

- Literary Studies (Early and Medieval)

- Literary Studies (Fiction, Novelists, and Prose Writers)

- Literary Studies (Gender Studies)

- Literary Studies (Graphic Novels)

- Literary Studies (History of the Book)

- Literary Studies (Plays and Playwrights)

- Literary Studies (Poetry and Poets)

- Literary Studies (Postcolonial Literature)

- Literary Studies (Queer Studies)

- Literary Studies (Science Fiction)

- Literary Studies (Travel Literature)

- Literary Studies (War Literature)

- Literary Studies (Women's Writing)

- Literary Theory and Cultural Studies

- Mythology and Folklore

- Shakespeare Studies and Criticism

- Browse content in Media Studies

- Browse content in Music

- Applied Music

- Dance and Music

- Ethics in Music

- Ethnomusicology

- Gender and Sexuality in Music

- Medicine and Music

- Music Cultures

- Music and Religion

- Music and Media

- Music and Culture

- Music Education and Pedagogy

- Music Theory and Analysis

- Musical Scores, Lyrics, and Libretti

- Musical Structures, Styles, and Techniques

- Musicology and Music History

- Performance Practice and Studies

- Race and Ethnicity in Music

- Sound Studies

- Browse content in Performing Arts

- Browse content in Philosophy

- Aesthetics and Philosophy of Art

- Epistemology

- Feminist Philosophy

- History of Western Philosophy

- Meta-Philosophy

- Metaphysics

- Moral Philosophy

- Non-Western Philosophy

- Philosophy of Science

- Philosophy of Language

- Philosophy of Mind

- Philosophy of Perception

- Philosophy of Action

- Philosophy of Law

- Philosophy of Religion

- Philosophy of Mathematics and Logic

- Practical Ethics

- Social and Political Philosophy

- Browse content in Religion

- Biblical Studies

- Christianity

- East Asian Religions

- History of Religion

- Judaism and Jewish Studies

- Qumran Studies

- Religion and Education

- Religion and Health

- Religion and Politics

- Religion and Science

- Religion and Law

- Religion and Art, Literature, and Music

- Religious Studies

- Browse content in Society and Culture

- Cookery, Food, and Drink

- Cultural Studies

- Customs and Traditions

- Ethical Issues and Debates

- Hobbies, Games, Arts and Crafts

- Natural world, Country Life, and Pets

- Popular Beliefs and Controversial Knowledge

- Sports and Outdoor Recreation

- Technology and Society

- Travel and Holiday

- Visual Culture

- Browse content in Law

- Arbitration

- Browse content in Company and Commercial Law

- Commercial Law

- Company Law

- Browse content in Comparative Law

- Systems of Law

- Competition Law

- Browse content in Constitutional and Administrative Law

- Government Powers

- Judicial Review

- Local Government Law

- Military and Defence Law

- Parliamentary and Legislative Practice

- Construction Law

- Contract Law

- Browse content in Criminal Law

- Criminal Procedure

- Criminal Evidence Law

- Sentencing and Punishment

- Employment and Labour Law

- Environment and Energy Law

- Browse content in Financial Law

- Banking Law

- Insolvency Law

- History of Law

- Human Rights and Immigration

- Intellectual Property Law

- Browse content in International Law

- Private International Law and Conflict of Laws

- Public International Law

- IT and Communications Law

- Jurisprudence and Philosophy of Law

- Law and Politics

- Law and Society

- Browse content in Legal System and Practice

- Courts and Procedure

- Legal Skills and Practice

- Legal System - Costs and Funding

- Primary Sources of Law

- Regulation of Legal Profession

- Medical and Healthcare Law

- Browse content in Policing

- Criminal Investigation and Detection

- Police and Security Services

- Police Procedure and Law

- Police Regional Planning

- Browse content in Property Law

- Personal Property Law

- Restitution

- Study and Revision

- Terrorism and National Security Law

- Browse content in Trusts Law

- Wills and Probate or Succession

- Browse content in Medicine and Health

- Browse content in Allied Health Professions

- Arts Therapies

- Clinical Science

- Dietetics and Nutrition

- Occupational Therapy

- Operating Department Practice

- Physiotherapy

- Radiography

- Speech and Language Therapy

- Browse content in Anaesthetics

- General Anaesthesia

- Browse content in Clinical Medicine

- Acute Medicine

- Cardiovascular Medicine

- Clinical Genetics

- Clinical Pharmacology and Therapeutics

- Dermatology

- Endocrinology and Diabetes

- Gastroenterology

- Genito-urinary Medicine

- Geriatric Medicine

- Infectious Diseases

- Medical Toxicology

- Medical Oncology

- Pain Medicine

- Palliative Medicine

- Rehabilitation Medicine

- Respiratory Medicine and Pulmonology

- Rheumatology

- Sleep Medicine

- Sports and Exercise Medicine

- Clinical Neuroscience

- Community Medical Services

- Critical Care

- Emergency Medicine

- Forensic Medicine

- Haematology

- History of Medicine

- Browse content in Medical Dentistry

- Oral and Maxillofacial Surgery

- Paediatric Dentistry

- Restorative Dentistry and Orthodontics

- Surgical Dentistry

- Browse content in Medical Skills

- Clinical Skills

- Communication Skills

- Nursing Skills

- Surgical Skills

- Medical Ethics

- Medical Statistics and Methodology

- Browse content in Neurology

- Clinical Neurophysiology

- Neuropathology

- Nursing Studies

- Browse content in Obstetrics and Gynaecology

- Gynaecology

- Occupational Medicine

- Ophthalmology

- Otolaryngology (ENT)

- Browse content in Paediatrics

- Neonatology

- Browse content in Pathology

- Chemical Pathology

- Clinical Cytogenetics and Molecular Genetics

- Histopathology

- Medical Microbiology and Virology

- Patient Education and Information

- Browse content in Pharmacology

- Psychopharmacology

- Browse content in Popular Health

- Caring for Others

- Complementary and Alternative Medicine

- Self-help and Personal Development

- Browse content in Preclinical Medicine

- Cell Biology

- Molecular Biology and Genetics

- Reproduction, Growth and Development

- Primary Care

- Professional Development in Medicine

- Browse content in Psychiatry

- Addiction Medicine

- Child and Adolescent Psychiatry

- Forensic Psychiatry

- Learning Disabilities

- Old Age Psychiatry

- Psychotherapy

- Browse content in Public Health and Epidemiology

- Epidemiology

- Public Health

- Browse content in Radiology

- Clinical Radiology

- Interventional Radiology

- Nuclear Medicine

- Radiation Oncology

- Reproductive Medicine

- Browse content in Surgery

- Cardiothoracic Surgery

- Gastro-intestinal and Colorectal Surgery

- General Surgery

- Neurosurgery

- Paediatric Surgery

- Peri-operative Care

- Plastic and Reconstructive Surgery

- Surgical Oncology

- Transplant Surgery

- Trauma and Orthopaedic Surgery

- Vascular Surgery

- Browse content in Science and Mathematics

- Browse content in Biological Sciences

- Aquatic Biology

- Biochemistry

- Bioinformatics and Computational Biology

- Developmental Biology

- Ecology and Conservation

- Evolutionary Biology

- Genetics and Genomics

- Microbiology

- Molecular and Cell Biology

- Natural History

- Plant Sciences and Forestry

- Research Methods in Life Sciences

- Structural Biology

- Systems Biology

- Zoology and Animal Sciences

- Browse content in Chemistry

- Analytical Chemistry

- Computational Chemistry

- Crystallography

- Environmental Chemistry

- Industrial Chemistry

- Inorganic Chemistry

- Materials Chemistry

- Medicinal Chemistry

- Mineralogy and Gems

- Organic Chemistry

- Physical Chemistry

- Polymer Chemistry

- Study and Communication Skills in Chemistry

- Theoretical Chemistry

- Browse content in Computer Science

- Artificial Intelligence

- Computer Architecture and Logic Design

- Game Studies

- Human-Computer Interaction

- Mathematical Theory of Computation

- Programming Languages

- Software Engineering

- Systems Analysis and Design

- Virtual Reality

- Browse content in Computing

- Business Applications

- Computer Security

- Computer Games

- Computer Networking and Communications

- Digital Lifestyle

- Graphical and Digital Media Applications

- Operating Systems

- Browse content in Earth Sciences and Geography

- Atmospheric Sciences

- Environmental Geography

- Geology and the Lithosphere

- Maps and Map-making

- Meteorology and Climatology

- Oceanography and Hydrology

- Palaeontology

- Physical Geography and Topography

- Regional Geography

- Soil Science

- Urban Geography

- Browse content in Engineering and Technology

- Agriculture and Farming

- Biological Engineering

- Civil Engineering, Surveying, and Building

- Electronics and Communications Engineering

- Energy Technology

- Engineering (General)

- Environmental Science, Engineering, and Technology

- History of Engineering and Technology

- Mechanical Engineering and Materials

- Technology of Industrial Chemistry

- Transport Technology and Trades

- Browse content in Environmental Science

- Applied Ecology (Environmental Science)

- Conservation of the Environment (Environmental Science)

- Environmental Sustainability

- Environmentalist Thought and Ideology (Environmental Science)

- Management of Land and Natural Resources (Environmental Science)

- Natural Disasters (Environmental Science)

- Nuclear Issues (Environmental Science)

- Pollution and Threats to the Environment (Environmental Science)

- Social Impact of Environmental Issues (Environmental Science)

- History of Science and Technology

- Browse content in Materials Science

- Ceramics and Glasses

- Composite Materials

- Metals, Alloying, and Corrosion

- Nanotechnology

- Browse content in Mathematics

- Applied Mathematics

- Biomathematics and Statistics

- History of Mathematics

- Mathematical Education

- Mathematical Finance

- Mathematical Analysis

- Numerical and Computational Mathematics

- Probability and Statistics

- Pure Mathematics

- Browse content in Neuroscience

- Cognition and Behavioural Neuroscience

- Development of the Nervous System

- Disorders of the Nervous System

- History of Neuroscience

- Invertebrate Neurobiology

- Molecular and Cellular Systems

- Neuroendocrinology and Autonomic Nervous System

- Neuroscientific Techniques

- Sensory and Motor Systems

- Browse content in Physics

- Astronomy and Astrophysics

- Atomic, Molecular, and Optical Physics

- Biological and Medical Physics

- Classical Mechanics

- Computational Physics

- Condensed Matter Physics

- Electromagnetism, Optics, and Acoustics

- History of Physics

- Mathematical and Statistical Physics

- Measurement Science

- Nuclear Physics

- Particles and Fields

- Plasma Physics

- Quantum Physics

- Relativity and Gravitation

- Semiconductor and Mesoscopic Physics

- Browse content in Psychology

- Affective Sciences

- Clinical Psychology

- Cognitive Psychology

- Cognitive Neuroscience

- Criminal and Forensic Psychology

- Developmental Psychology

- Educational Psychology

- Evolutionary Psychology

- Health Psychology

- History and Systems in Psychology

- Music Psychology

- Neuropsychology

- Organizational Psychology

- Psychological Assessment and Testing

- Psychology of Human-Technology Interaction

- Psychology Professional Development and Training

- Research Methods in Psychology

- Social Psychology

- Browse content in Social Sciences

- Browse content in Anthropology

- Anthropology of Religion

- Human Evolution

- Medical Anthropology

- Physical Anthropology

- Regional Anthropology

- Social and Cultural Anthropology

- Theory and Practice of Anthropology

- Browse content in Business and Management

- Business Strategy

- Business Ethics

- Business History

- Business and Government

- Business and Technology

- Business and the Environment

- Comparative Management

- Corporate Governance

- Corporate Social Responsibility

- Entrepreneurship

- Health Management

- Human Resource Management

- Industrial and Employment Relations

- Industry Studies

- Information and Communication Technologies

- International Business

- Knowledge Management

- Management and Management Techniques

- Operations Management

- Organizational Theory and Behaviour

- Pensions and Pension Management

- Public and Nonprofit Management

- Social Issues in Business and Management

- Strategic Management

- Supply Chain Management

- Browse content in Criminology and Criminal Justice

- Criminal Justice

- Criminology

- Forms of Crime

- International and Comparative Criminology

- Youth Violence and Juvenile Justice

- Development Studies

- Browse content in Economics

- Agricultural, Environmental, and Natural Resource Economics

- Asian Economics

- Behavioural Finance

- Behavioural Economics and Neuroeconomics

- Econometrics and Mathematical Economics

- Economic Systems

- Economic History

- Economic Methodology

- Economic Development and Growth

- Financial Markets

- Financial Institutions and Services

- General Economics and Teaching

- Health, Education, and Welfare

- History of Economic Thought

- International Economics

- Labour and Demographic Economics

- Law and Economics

- Macroeconomics and Monetary Economics

- Microeconomics

- Public Economics

- Urban, Rural, and Regional Economics

- Welfare Economics

- Browse content in Education

- Adult Education and Continuous Learning

- Care and Counselling of Students

- Early Childhood and Elementary Education

- Educational Equipment and Technology

- Educational Strategies and Policy

- Higher and Further Education

- Organization and Management of Education

- Philosophy and Theory of Education

- Schools Studies

- Secondary Education

- Teaching of a Specific Subject

- Teaching of Specific Groups and Special Educational Needs

- Teaching Skills and Techniques

- Browse content in Environment

- Applied Ecology (Social Science)

- Climate Change

- Conservation of the Environment (Social Science)

- Environmentalist Thought and Ideology (Social Science)

- Management of Land and Natural Resources (Social Science)

- Natural Disasters (Environment)

- Pollution and Threats to the Environment (Social Science)

- Social Impact of Environmental Issues (Social Science)

- Sustainability

- Browse content in Human Geography

- Cultural Geography

- Economic Geography

- Political Geography

- Browse content in Interdisciplinary Studies

- Communication Studies

- Museums, Libraries, and Information Sciences

- Browse content in Politics

- African Politics

- Asian Politics

- Chinese Politics

- Comparative Politics

- Conflict Politics

- Elections and Electoral Studies

- Environmental Politics

- Ethnic Politics

- European Union

- Foreign Policy

- Gender and Politics

- Human Rights and Politics

- Indian Politics

- International Relations

- International Organization (Politics)

- Irish Politics

- Latin American Politics

- Middle Eastern Politics

- Political Methodology

- Political Communication

- Political Philosophy

- Political Sociology

- Political Behaviour

- Political Economy

- Political Institutions

- Political Theory

- Politics and Law

- Politics of Development

- Public Administration

- Public Policy

- Qualitative Political Methodology

- Quantitative Political Methodology

- Regional Political Studies

- Russian Politics

- Security Studies

- State and Local Government

- UK Politics

- US Politics

- Browse content in Regional and Area Studies

- African Studies

- Asian Studies

- East Asian Studies

- Japanese Studies

- Latin American Studies

- Middle Eastern Studies

- Native American Studies

- Scottish Studies

- Browse content in Research and Information

- Research Methods

- Browse content in Social Work

- Addictions and Substance Misuse

- Adoption and Fostering

- Care of the Elderly

- Child and Adolescent Social Work

- Couple and Family Social Work

- Direct Practice and Clinical Social Work

- Emergency Services

- Human Behaviour and the Social Environment

- International and Global Issues in Social Work

- Mental and Behavioural Health

- Social Justice and Human Rights

- Social Policy and Advocacy

- Social Work and Crime and Justice

- Social Work Macro Practice

- Social Work Practice Settings

- Social Work Research and Evidence-based Practice

- Welfare and Benefit Systems

- Browse content in Sociology

- Childhood Studies

- Community Development

- Comparative and Historical Sociology

- Disability Studies

- Economic Sociology

- Gender and Sexuality

- Gerontology and Ageing

- Health, Illness, and Medicine

- Marriage and the Family

- Migration Studies

- Occupations, Professions, and Work

- Organizations

- Population and Demography

- Race and Ethnicity

- Social Theory

- Social Movements and Social Change

- Social Research and Statistics

- Social Stratification, Inequality, and Mobility

- Sociology of Religion

- Sociology of Education

- Sport and Leisure

- Urban and Rural Studies

- Browse content in Warfare and Defence

- Defence Strategy, Planning, and Research

- Land Forces and Warfare

- Military Administration

- Military Life and Institutions

- Naval Forces and Warfare

- Other Warfare and Defence Issues

- Peace Studies and Conflict Resolution

- Weapons and Equipment

- < Previous chapter

- Next chapter >

2 Modern Portfolio Theory

- Published: February 2013

- Cite Icon Cite

- Permissions Icon Permissions

This chapter surveys modern portfolio theory, which is one of the most spectacular developments of finance in the last 50 years. It starts with the basic one-period setup under the assumption of normality with the successive contributions including the basic Markowitz mean-variance framework, the efficient frontier, and the Sharpe-Lintner capital asset pricing model. Utility and risk aversion are also discussed. The chapter then discusses the multiperiod extension and Merton's optimal asset allocation. The second part of the chapter shows how to extend the framework to allow for parameter uncertainty. In that process, the chapter also briefly reviews needed concepts such as the predictive density, shrinkage, and how the Bayesian framework allows the incorporation of prior views to improve on the precision of estimates necessary in the portfolio construction process.

Personal account

- Sign in with email/username & password

- Get email alerts

- Save searches

- Purchase content

- Activate your purchase/trial code

- Add your ORCID iD

Institutional access

Sign in with a library card.

- Sign in with username/password

- Recommend to your librarian

- Institutional account management

- Get help with access

Access to content on Oxford Academic is often provided through institutional subscriptions and purchases. If you are a member of an institution with an active account, you may be able to access content in one of the following ways:

IP based access

Typically, access is provided across an institutional network to a range of IP addresses. This authentication occurs automatically, and it is not possible to sign out of an IP authenticated account.

Choose this option to get remote access when outside your institution. Shibboleth/Open Athens technology is used to provide single sign-on between your institution’s website and Oxford Academic.

- Click Sign in through your institution.

- Select your institution from the list provided, which will take you to your institution's website to sign in.

- When on the institution site, please use the credentials provided by your institution. Do not use an Oxford Academic personal account.

- Following successful sign in, you will be returned to Oxford Academic.

If your institution is not listed or you cannot sign in to your institution’s website, please contact your librarian or administrator.

Enter your library card number to sign in. If you cannot sign in, please contact your librarian.

Society Members

Society member access to a journal is achieved in one of the following ways:

Sign in through society site

Many societies offer single sign-on between the society website and Oxford Academic. If you see ‘Sign in through society site’ in the sign in pane within a journal:

- Click Sign in through society site.

- When on the society site, please use the credentials provided by that society. Do not use an Oxford Academic personal account.

If you do not have a society account or have forgotten your username or password, please contact your society.

Sign in using a personal account

Some societies use Oxford Academic personal accounts to provide access to their members. See below.

A personal account can be used to get email alerts, save searches, purchase content, and activate subscriptions.

Some societies use Oxford Academic personal accounts to provide access to their members.

Viewing your signed in accounts

Click the account icon in the top right to:

- View your signed in personal account and access account management features.

- View the institutional accounts that are providing access.

Signed in but can't access content

Oxford Academic is home to a wide variety of products. The institutional subscription may not cover the content that you are trying to access. If you believe you should have access to that content, please contact your librarian.

For librarians and administrators, your personal account also provides access to institutional account management. Here you will find options to view and activate subscriptions, manage institutional settings and access options, access usage statistics, and more.

Our books are available by subscription or purchase to libraries and institutions.

| Month: | Total Views: |

|---|---|

| October 2022 | 13 |

| November 2022 | 18 |

| December 2022 | 2 |

| January 2023 | 5 |

| February 2023 | 3 |

| March 2023 | 9 |

| April 2023 | 10 |

| May 2023 | 6 |

| June 2023 | 2 |

| July 2023 | 3 |

| August 2023 | 3 |

| September 2023 | 6 |

| October 2023 | 9 |

| November 2023 | 7 |

| December 2023 | 13 |

| January 2024 | 7 |

| February 2024 | 2 |

| March 2024 | 12 |

| April 2024 | 10 |

| May 2024 | 21 |

| June 2024 | 7 |

| July 2024 | 4 |

| August 2024 | 15 |

| September 2024 | 2 |

- About Oxford Academic

- Publish journals with us

- University press partners

- What we publish

- New features

- Open access

- Rights and permissions

- Accessibility

- Advertising

- Media enquiries

- Oxford University Press

- Oxford Languages

- University of Oxford

Oxford University Press is a department of the University of Oxford. It furthers the University's objective of excellence in research, scholarship, and education by publishing worldwide

- Copyright © 2024 Oxford University Press

- Cookie settings

- Cookie policy

- Privacy policy

- Legal notice

This Feature Is Available To Subscribers Only

Sign In or Create an Account

This PDF is available to Subscribers Only

For full access to this pdf, sign in to an existing account, or purchase an annual subscription.

Model-based vs. agnostic methods for the prediction of time-varying covariance matrices

- Original Research

- Published: 13 September 2024

Cite this article

- Jean-David Fermanian 1 na1 ,

- Benjamin Poignard 2 , 3 na1 &

- Panos Xidonas ORCID: orcid.org/0000-0003-3325-1474 4 na1

This article is written in memory of Harry Markowitz, the founder of modern portfolio theory. We report a few human perspectives of his character, we review a large number of his contributions, published both in operations research and finance oriented journals, and we focus on one of the most critical, and still open, portfolio theory issues, the forecast of covariance matrices. Our contribution in this paper is placed exactly towards this direction. More specifically, we compare the performances of several approaches to predict the variance-covariance matrices of vectors of asset returns, through simulated and real data experiments: some dynamic models such as Dynamic Conditional Correlation (DCC) and C-vine GARCH on one side, and several agnostic methods (Average Oracle, usual “Sample” matrix) on the other side. The most robust methods seem to be DCC and the Average Oracle approaches.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

S&P 500 indices excluding Etsy Inc., SolarEdge Technologies Inc., PayPal, Hewlett Packard Enterprise, Under Armour (class C), Fortive, Lamb Weston, Ingersoll Rand Inc., Ceridian HCM, Linde PLC, Moderna, Fox Corporation (class A and B), Dow Inc., Corteva Inc., Amcor, Otis Worldwide, Carrier Global, Match Group, Viatris Inc.

i.e., the likelihood used to estimate the parameters that define the correlation dynamics, after the plug-in of first stage estimates of the parameters related to volatilities.

The package can be found on https://cran.r-project.org/web/packages/VineCopula/index.html .

https://github.com/Benjamin-Poignard/vine-GARCH .

Aas, K., Czado, C., Frigessi, A., & Bakken, H. (2009). Pair-copula constructions of multiple dependence. Insurance: Mathematics and Economics, 44 (2), 182–198.

Google Scholar

Aielli, G. P. (2013). Dynamic conditional correlation: On properties and estimation. Journal of Business & Economic Statistics, 31 (3), 282–299.

Article Google Scholar

Anderson, T., & Amemiya, Y. (1988). The asymptotic normal distribution of estimators in factor analysis under general conditions. The Annals of Statistics, 16 (2), 759–771.

Arnott, R. D., Hsu, J. C., Liu, J., & Markowitz, H. (2015). Can noise create the size and value effects? Management Science, 61 (11), 2569–2579.

Arnott, R. D., Harvey, C. R., & Markowitz, H. (2018). A backtesting protocol in the era of machine learning. Available at SSRN 3275654 .

Bai, J., & Liao, K. (2016). Efficient estimation of approximate factor models via penalized maximum likelihood. Journal of Econometrics, 191 (1), 1–18.

Bauwens, L., Laurent, S., & Rombouts, J. V. (2006). Multivariate Garch models: A survey. Journal of Applied Econometrics, 21 (1), 79–109.

Bedford, T., & Cooke, R. M. (2002). Vines-a new graphical model for dependent random variables. The Annals of Statistics, 30 (4), 1031–1068.

Billio, M., Caporin, M., & Gobbo, M. (2006). Flexible dynamic conditional correlation multivariate Garch models for asset allocation. Applied Financial Economics Letters, 2 (02), 123–130.

Bongiorno, C., Challet, D., & Loeper, G. (2023). Filtering time-dependent covariance matrices using time-independent eigenvalues. Journal of Statistical Mechanics: Theory and Experiment, 2023 (2), 023402.

Brechmann, E. C., & Joe, H. (2015). Truncation of vine copulas using fit indices. Journal of Multivariate Analysis, 138 , 19–33.

Brechmann, E. C., & Schepsmeier, U. (2013). Modeling dependence with c-and d-vine copulas: The R package CDVine. Journal of Statistical Software, 52 , 1–27.

Brechmann, E. C., Czado, C., & Aas, K. (2012). Truncated regular vines in high dimensions with application to financial data. Canadian Journal of Statistics, 40 (1), 68–85.

Cambanis, S., Huang, S., & Simons, G. (1981). On the theory of elliptically contoured distributions. Journal of Multivariate Analysis, 11 (3), 368–385.

Cao, W., Wang, D., Li, J., Zhou, H., Li, L., & Li, Y. (2018). BRITS: Bidirectional recurrent imputation for time series. In: Bengio, S., Wallach, H., Larochelle, J., Grauman, K., Cesa-Bianchi, N., Garnett, R. (Eds.), Advances in Neural Information Processing Systems, 31, (NeurIPS 2018) .

Caporin, M., & McAleer, M. (2013). Ten things you should know about the dynamic conditional correlation representation. Econometrics, 1 (1), 115–126.

Chan, L. K., Karceski, J., & Lakonishok, J. (1999). On portfolio optimization: Forecasting covariances and choosing the risk model. The Review of Financial Studies, 12 (5), 937–974.

Chiu, T. Y., Leonard, T., & Tsui, K. W. (1996). The matrix-logarithmic covariance model. Journal of the American Statistical Association, 91 (433), 198–210.

Czado, C. (2019). Analyzing dependent data with vine copulas . Lecture Notes in Statistics (Vol. 222). Springer.

Czado, C., Schepsmeier, U., & Min, A. (2012). Maximum likelihood estimation of mixed C-vines with application to exchange rates. Statistical Modelling, 12 (3), 229–255.

Das, S., Markowitz, H., Scheid, J., & Statman, M. (2010). Portfolio optimization with mental accounts. Journal of Financial and Quantitative Analysis, 45 (2), 311–334.

De Nard, G., Ledoit, O., & Wolf, M. (2021). Factor models for portfolio selection in large dimensions: The good, the better and the ugly. Journal of Financial Econometrics, 19 (2), 236–257.

De Nard, G., Engle, R. F., Ledoit, O., & Wolf, M. (2022). Large dynamic covariance matrices: Enhancements based on intraday data. Journal of Banking & Finance, 138 , 106426.

Derumigny, A., & Fermanian, J. D. (2017). About tests of the “simplifying’’ assumption for conditional copulas. Dependence Modeling, 5 (1), 154–197.

Diebold, F. X., & Mariano, R. S. (1995). Comparing predictive accuracy. Journal of Business & Economic Statistics, 13 (3), 253–263.

Dissmann, J., Brechmann, E. C., Czado, C., & Kurowicka, D. (2013). Selecting and estimating regular vine copulae and application to financial returns. Computational Statistics & Data Analysis, 59 , 52–69.

Elton, E. J., Gruber, M. J., & Spitzer, J. (2006). Improved estimates of correlation coefficients and their impact on optimum portfolios. European Financial Management, 12 (3), 303–318.

Elton, E. J., Gruber, M. J., Brown, S. J., & Goetzmann, W. N. (2009). Modern portfolio theory and investment analysis . John Wiley & Sons.

Embrechts, P., McNeil, A., & Straumann, D. (2002). Correlation and dependence in risk management: Properties and pitfalls. Risk Management: Value at Risk and Beyond, 1 , 176–223.

Engle, R. (2002). Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics, 20 (3), 339–350.

Engle, R., & Colacito, R. (2006). Testing and valuing dynamic correlations for asset allocation. Journal of Business & Economic Statistics, 24 (2), 238–253.

Engle, R. F., Shephard, N., & Sheppard, K. (2007). Fitting and testing vast dimensional time-varying covariance models. NYU Working Paper No. FIN-07-046.

Engle, R. F., Ledoit, O., & Wolf, M. (2019). Large dynamic covariance matrices. Journal of Business & Economic Statistics, 37 (2), 363–375.

Fermanian, J. D., & Malongo, H. (2017). On the stationarity of dynamic conditional correlation models. Econometric Theory, 33 (3), 636–663.

Francq, C., & Zakoian, J. M. (2019). GARCH models: Structure, statistical inference and financial applications . John Wiley & Sons.

Friedman, J., Hastie, T., & Tibshirani, R. (2008). Sparse inverse covariance estimation with the graphical lasso. Biostatistics, 9 (3), 432–441.

Fung, D. S. (2006). Methods for the estimation of missing values in time series. Thesis, Edith Cowan University.

Gerber, S., Markowitz, H. M., Ernst, P. A., Miao, Y., Javid, B., & Sargen, P. (2022). The Gerber statistic: A robust co-movement measure for portfolio optimization. Journal of Portfolio Management, 48 , 87–102.

Gijbels, I., Omelka, M., & Veraverbeke, N. (2015). Partial and average copulas and association measures. Electronic Journal of Statistics, 9 (2), 2420–2474.

Graham, J. W. (2012). Missing data: Analysis and design . Springer Science & Business Media.

Greco, S., Matarazzo, B., & Słowiński, R. (2013). Beyond Markowitz with multiple criteria decision aiding. Journal of Business Economics, 83 , 29–60.

Guerard Jr, J. B. (2011). Harry Markowitz. In Profiles in Operations Research: Pioneers and Innovators (pp. 643–658). Springer.

Guerard, J. B., Jr., Markowitz, H., & Xu, G. (2015). Earnings forecasting in a global stock selection model and efficient portfolio construction and management. International Journal of Forecasting, 31 (2), 550–560.

Guerard, J. B., Jr., Markowitz, H., Xu, G., & Wang, Z. (2018). Global portfolio construction with emphasis on conflicting corporate strategies to maximize stockholder wealth. Annals of Operations Research, 267 (1), 203–219.

Guerard, J. B., Jr., Xu, G., & Markowitz, H. (2021). A further analysis of robust regression modeling and data mining corrections testing in global stocks. Annals of Operations Research, 303 (1), 175–195.

Hafner, C. M., & Franses, P. H. (2009). A generalized dynamic conditional correlation model: Simulation and application to many assets. Econometric Reviews, 28 (6), 612–631.

Hansen, P., Lunde, A., & Nason, M. (2003). Choosing the best volatility models: The model confidence set approach. Oxford Bulletin of Economics and Statistics, 65 (s1), 839–861.

Hansen, P., Lunde, A., & Nason, M. (2011). The model confidence set. Econometrica, 79 (2), 453–497.

Honaker, J., King, G., & Blackwell, M. (2011). Amelia II: A program for missing data. Journal of Statistical Software, 45 , 1–47.

Jacobs, B. I., Levy, K. N., & Markowitz, H. M. (2004). Financial market simulation. The Journal of Portfolio Management, 30 (5), 142–152.

Jacobs, B. I., Levy, K. N., & Markowitz, H. M. (2005). Portfolio optimization with factors, scenarios, and realistic short positions. Operations Research, 53 (4), 586–599.

Jacobs, B. I., Levy, K. N., & Markowitz, H. M. (2006). Trimability and fast optimization of long-short portfolios. Financial Analysts Journal, 62 (2), 36–46.

Jacobs, B. I., Levy, K. N., & Markowitz, H. M. (2010). Simulating security markets in dynamic and equilibrium modes. Financial Analysts Journal, 66 (5), 42–53.

Jin, H., Markowitz, H., & Yu Zhou, X. (2006). A note on semivariance. Mathematical Finance: An International Journal of Mathematics, Statistics and Financial Economics, 16 (1), 53–61.

Joe, H. (2006). Generating random correlation matrices based on partial correlations. Journal of Multivariate Analysis, 97 (10), 2177–2189.

Joe, H., & Kurowicka, D. (2011). Dependence modeling: Vine copula handbook . World Scientific.

Kim, J. O., & Curry, J. (1977). The treatment of missing data in multivariate analysis. Sociological Methods & Research, 6 (2), 215–240.

Kroll, Y., Levy, H., & Markowitz, H. M. (1984). Mean-variance versus direct utility maximization. The Journal of Finance, 39 (1), 47–61.

Kurowicka, D. (2010). Optimal truncation of vines. In Dependence modeling: Vine copula handbook (pp. 233–247) World Scientific.

Kurowicka, D., & Cooke, R. (2003). A parameterization of positive definite matrices in terms of partial correlation vines. Linear Algebra and its Applications, 372 , 225–251.

Kurowicka, D., & Cooke, R. (2006). Completion problem with partial correlation vines. Linear Algebra and its Applications, 418 (1), 188–200.

Lam, C. (2020). High-dimensional covariance matrix estimation. Wiley Interdisciplinary Reviews: Computational Statistics, 12 (2), e1485.

Ledoit, O., & Wolf, M. (2003a). Honey, i shrunk the sample covariance matrix. UPF Economics and Business Working Paper No. 691.

Ledoit, O., & Wolf, M. (2003b). Improved estimation of the covariance matrix of stock returns with an application to portfolio selection. Journal of empirical finance, 10 (5), 603–621.

Ledoit, O., & Wolf, M. (2012). Nonlinear shrinkage estimation of large-dimensional covariance matrices. The Annals of Statistics, 40 (2), 1024–1060.

Ledoit, O., & Wolf, M. (2017). Nonlinear shrinkage of the covariance matrix for portfolio selection: Markowitz meets goldilocks. The Review of Financial Studies, 30 (12), 4349–4388.

Ledoit, O., & Wolf, M. (2020). Analytical nonlinear shrinkage of large-dimensional covariance matrices. The Annals of Statistics, 48 (5), 3043–3065.

Ledoit, O., & Wolf, M. (2021). Shrinkage estimation of large covariance matrices: Keep it simple, statistician? Journal of Multivariate Analysis, 186 , 104796.

Ledoit, O., & Wolf, M. (2022). The power of (non-) linear shrinking: A review and guide to covariance matrix estimation. Journal of Financial Econometrics, 20 (1), 187–218.

Levy, H., & Markowitz, H. M. (1979). Approximating expected utility by a function of mean and variance. The American Economic Review, 69 (3), 308–317.

Lewandowski, D., Kurowicka, D., & Joe, H. (2009). Generating random correlation matrices based on vines and extended onion method. Journal of Multivariate Analysis, 100 (9), 1989–2001.

Li, W., Gao, J., Li, K., & Yao, Q. (2016). Modeling multivariate volatilities via latent common factors. Journal of Business & Economic Statistics, 34 (4), 564–573.

Little, R. J., & Rubin, D. B. (2019). Statistical analysis with missing data (Vol. 793). John Wiley & Sons.

Markowitz, H. (1959). Portfolio selection: Efficient diversification of investments . John Wiley.

Markowitz, H. (2014). Mean-variance approximations to expected utility. European Journal of Operational Research, 234 (2), 346–355.

Markowitz, H., Todd, P., Xu, G., & Yamane, Y. (1993). Computation of mean-semivariance efficient sets by the critical line algorithm. Annals of Operations Research, 45 , 307–317.

Markowitz, H., Guerard, J., Xu, G., & Beheshti, B. (2021). Financial anomalies in portfolio construction and management. The Journal of Portfolio Management, 47 (6), 51–64.

Markowitz, H. M. (1952). Portfolio selection. The Journal of Finance, 7 (1), 77–91.

Markowitz, H. M. (1956). The optimization of a quadratic function subject to linear constraints. Naval Research Logistics Quarterly, 3 (1–2), 111–133.

Markowitz, H. M. (1976). Investment for the long run: New evidence for an old rule. The Journal of Finance, 31 (5), 1273–1286.

Markowitz, H. M. (1999). The early history of portfolio theory: 1600–1960. Financial Analysts Journal, 55 (4), 5–16.

Markowitz, H. M. (2002). Efficient portfolios, sparse matrices, and entities: A retrospective. Operations Research, 50 (1), 154–160.

Markowitz, H. M. (2005). Market efficiency: A theoretical distinction and so what? Financial Analysts Journal, 61 (5), 17–30.

Markowitz, H. M. (2008). CAPM investors do not get paid for bearing risk: A linear relation does not imply payment for risk. Journal of Portfolio Management, 34 (2), 91.

Markowitz, H. M. (2009). Proposals concerning the current financial crisis. Financial Analysts Journal, 65 (1), 25–27.

Markowitz, H. M. (2013). How to represent mark-to-market possibilities with the general portfolio selection model. Journal of Portfolio Management, 39 (4), 1.

Markowitz, H. M., & Perold, A. F. (1981). Portfolio analysis with factors and scenarios. The Journal of Finance, 36 (4), 871–877.

Markowitz, H. M., & Van Dijk, E. L. (2003). Single-period mean-variance analysis in a changing world (corrected). Financial Analysts Journal, 59 (2), 30–44.

Markowitz, H. M., Blasi, J. R., & Kruse, D. L. (2010). Employee stock ownership and diversification. Annals of Operations Research, 176 (1), 95–107.

Meinshausen, N., & Bühlmann, P. (2006). High-dimensional graphs and variable selection with the lasso. The Annals of Statistics, 34 (3), 1436–1462.

Neyman, J., & Scott, E. L. (1948). Consistent estimates based on partially consistent observations. Econometrica: Journal of the Econometric Society, 16 , 1–32.

Pakel, C., Shephard, N., Sheppard, K., & Engle, R. F. (2021). Fitting vast dimensional time-varying covariance models. Journal of Business & Economic Statistics, 39 (3), 652–668.

Pan, V. Y., & Chen, Z. Q. (1999). The complexity of the matrix eigenproblem. In Proceedings of the Thirty-First Annual ACM Symposium on Theory of Computing (pp. 507–516).

Poignard, B., & Fermanian, J. D. (2019). Dynamic asset correlations based on vines. Econometric Theory, 35 (1), 167–197.

Pourahmadi, M. (1999). Joint mean-covariance models with applications to longitudinal data: Unconstrained parameterisation. Biometrika, 86 (3), 677–690.

Pourahmadi, M. (2011). Covariance estimation: The GLM and regularization perspectives. Statistical Science, 26 (3), 369–387.

Roy, A. D. (1952). Safety first and the holding of assets. Econometrica: Journal of the Econometric Society, 1 , 431–449.

dos Santos, P. (2021). Impacts of missing data in risk management. Thesis, University Paris.

Serre, D. (2000). Matrices: Theory and applications. Graduate texts in mathematics.

Sharpe, W. F. (1963). A simplified model for portfolio analysis. Management Science, 9 (2), 277–293.

Van Buuren, S., & Oudshoorn, K. (1999). Flexible multivariate imputation by MICE . TNO.

Williams, P. M. (1996). Using neural networks to model conditional multivariate densities. Neural Computation, 8 (4), 843–854.

Xidonas, P., & Mavrotas, G. (2014). Multiobjective portfolio optimization with non-convex policy constraints: Evidence from the Eurostoxx 50. The European Journal of Finance, 20 (11), 957–977.

Xidonas, P., Mavrotas, G., Zopounidis, C., & Psarras, J. (2011). IPSSIS: An integrated multicriteria decision support system for equity portfolio construction and selection. European Journal of Operational Research, 210 (2), 398–409.

Xidonas, P., Mavrotas, G., Hassapis, C., & Zopounidis, C. (2017). Robust multiobjective portfolio optimization: A minimax regret approach. European Journal of Operational Research, 262 (1), 299–305.

Xidonas, P., Steuer, R., & Hassapis, C. (2020). Robust portfolio optimization: A categorized bibliographic review. Annals of Operations Research, 292 (1), 533–552.

Zou, H., Hastie, T., & Tibshirani, R. (2006). Sparse principal component analysis. Journal of Computational and Graphical Statistics, 15 (2), 265–286.

Download references

Author information

Jean-David Fermanian, Benjamin Poignard and Panos Xidonas have contributed equally to this work.

Authors and Affiliations

ENSAE-CREST, Finance Department, 5 av. Henry le Chatelier, 91120, Palaiseau, France

Jean-David Fermanian

Osaka University, Graduate School of Economics, 1-7, Machikaneyama, Toyonaka, 560-0043, Osaka, Japan

Benjamin Poignard

RIKEN-AIP, Tokyo, Japan

ESSCA School of Management, 55 quai Alphonse Le Gallo, 92513, Paris, France

Panos Xidonas

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Panos Xidonas .

Ethics declarations

Conflict of interest.

The authors declare that have no conflicts of interest to disclose.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

A Vines and partial correlations

This section emphasizes how to specify a relevant set of partial correlations by considering a graphical approach based on vines. Even if it largely takes up and updates Appendix B in Poignard and Fermanian ( 2019 ), we have recalled all these elements for the sake of self-consistency and to help readers. A general presentation of vine models can be found in Czado ( 2019 ).

1.1 A.1 Vines

Let \({{\mathcal {N}}}\) be a set of n elements. By definition, \(T = ({{\mathcal {N}}},{{\mathcal {E}}})\) is a tree with nodes \({{\mathcal {N}}}\) and edges \({{\mathcal {E}}}\) if \({{\mathcal {E}}}\) is a subset of unordered pairs of \({{\mathcal {N}}}\) with no cycle and if there is a path between each pair of nodes. Moreover, vines on n elements are undirected graphs that nest sets of some connected trees \(T_1,\ldots ,T_{n-1}\) , where the edges of tree \(T_j\) are the nodes of tree \(T_{j+1}\) , \(j=1,\ldots ,n-2\) . A regular vine (R-vine) on n elements is a vine in which two edges in tree \(T_j\) are joined by an edge in tree \(T_{j+1}\) only if these edges share a common node, for any \(j=1,\ldots ,n-2\) . A formal definition is given below. See Joe and Kurowicka ( 2011 ) for a survey and additional results.

Definition 1

\(V\left( n\right) \) is a labeled regular vine on n elements if:

\(V\left( n\right) = \left( T_1,T_2,\ldots ,T_{n-1}\right) \) .

\(T_1\) is a connected tree with nodes \({{\mathcal {N}}}_1 = 1,2,\ldots ,n\) and edges \({{\mathcal {E}}}_1\) . For \(i=2,\ldots ,n-1\) , \(T_i\) is a connected tree with nodes \({{\mathcal {N}}}_i = {{\mathcal {E}}}_{i-1}\) , and the cardinality of \({{\mathcal {N}}}_i\) is \(n-i+1\) .

If a and b are nodes of \(T_i\) connected by an edge in \(T_i\) , where \(a = \{a_1,a_2\}\) and \(b = \{b_1,b_2\}\) , then exactly one of the \(a_i\) equals one of the \(b_i\) . This is the proximity condition.

We consider only regular vines in this paper, and the properties we state hereafter are true for such vines implicitly. There are \(n(n-1)/2\) edges in a regular vine on n variables. An edge in tree \(T_j\) is an unordered pair of nodes of \(T_j\) , or equivalently, an unordered pair of edges of \(T_{j-1}\) . The degree of a node is the number of edges incident with it.

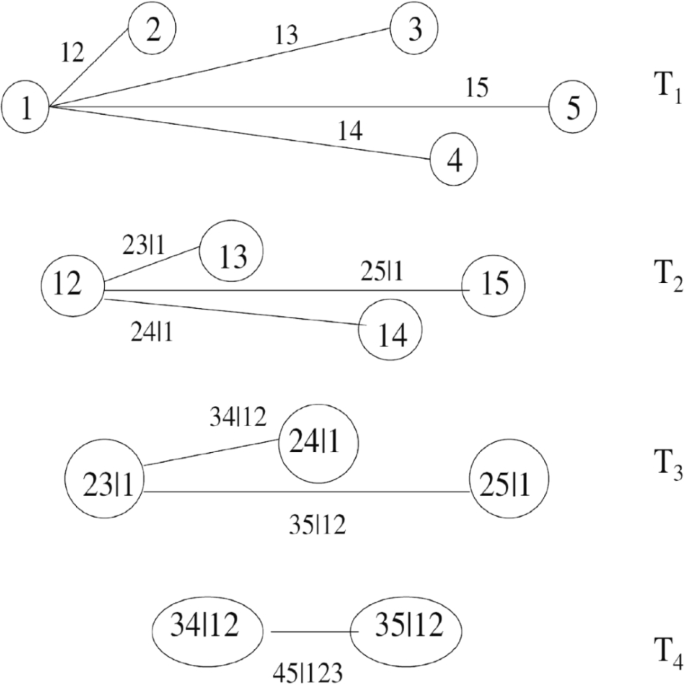

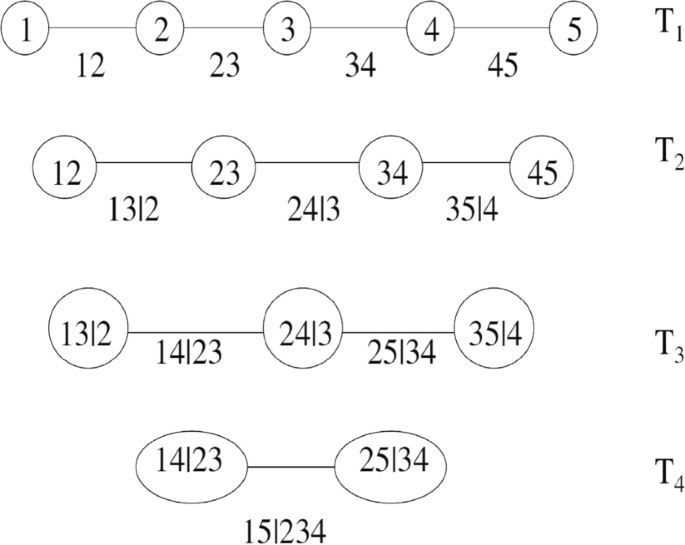

Two particular cases of R-vines are important, traditionally. A regular vine is called a canonical vine (C-vine) if each tree \(T_i\) has a unique node of degree \(n-i\) , i.e., a node with maximum degree. A regular vine is called a D-vine if all nodes in \(T_1\) have degree not higher than 2.

The variables reachable from a given edge via the membership relation are called the constraint set of that edge. When two edges are joined by an edge of the next tree, the intersection of the respective constraint sets are the conditioning variables , and the symmetric differences of the constraint sets are the conditioned variables . With the notations of point 3 of the previous definition, at tree \(T_i\) , say \(a_1 = b_1\) , and \(a_1\) is a common element of a and b . This means that, at tree \(T_{i+1}\) , \(a_1\) enters the conditioning set of \(\left( a_2,b_2\right) \) . Thus, we define the conditioning and conditioned sets formally as follows.

Definition 2

For \(e \in {{\mathcal {E}}}_i,\,i \le n-1\) , the constraint set associated with e is the complete union of the elements in \(\{1,\ldots ,n\}\) that are reachable from e by the membership relation. It is denoted by \(U^{\star }_e\) .

Definition 3

For \(i=1,\ldots ,n-1\) , if \(e \in {{\mathcal {E}}}_i\) , it connects two elements j and k in \({{\mathcal {N}}}_i\) and it can be written \(e=\left\{ j, k\right\} \) . The conditioning set associated with e is \(L_e:= U^{\star }_j \cap U^{\star }_k\) , and the conditioned set associated with e is a pair \(\left\{ C_{e,j},C_{e,k}\right\} := \left\{ U^{\star }_j {\setminus } L_e,U^{\star }_k {\setminus } L_e\right\} \) .

Obviously, since the edges of a given tree \(T_i\) are the nodes of \(T_{i+1}\) , the same concepts of constraint/conditioning/conditioned sets apply to all the nodes in a vine.

(Bedford & Cooke, 2002 ) Let a regular vine on n variables. Then,

The total number of edges is \(n(n-1)/2\) ;

Two different edges have different constraint sets;

Each conditioned set is a doubleton and each pair of variables occurs exactly once as a conditioned set;

If \(e\in {{\mathcal {E}}}_i\) , then \(\# U^{\star }_e=i+1\) , \(\# L_e = i-1\) ;

If two edges have the same conditioning set, then they are the same edge.

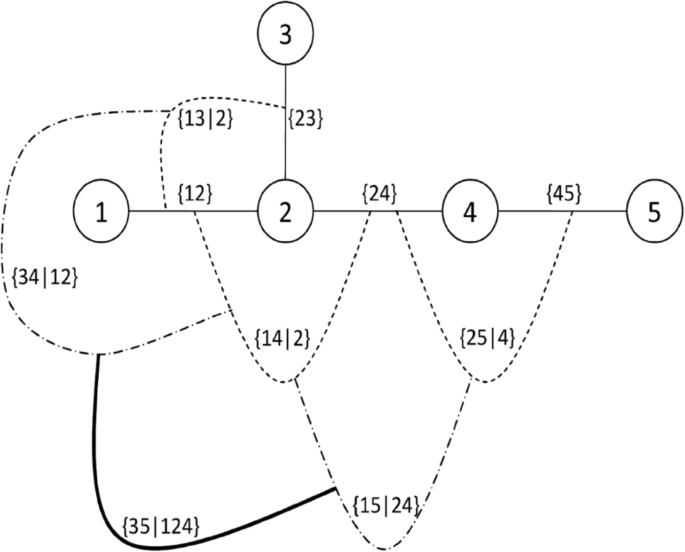

In a regular vine, the edges of \(T_{m+1}\) (equivalently the nodes of \(T_{m+2}\) ) will be denoted by \(e=(a_j, a_k | b_1,\ldots ,b_m)\) , where \(a_j\) , \(a_k\) and the \(b_l\) , \(l=1,\ldots ,m\) are different elements in \(\{1,\ldots ,n\}\) . This notation means that the conditioning set of e is \(L_e=\{b_1,\ldots ,b_m\}\) , and the conditioned set of e is \(\{a_j,a_k\}\) . Both C-, D- and R-vine and the concepts above can be visualized on Figs. 1 , 2 and 3 .

To have the intuition, keep in mind that a node represents a random variable, and an edge between two nodes means we will specify the dependence between these two particular nodes, in general through a copula (that will be reduced to a partial correlation hereafter). Such copulae have to be defined afterwards, but, for the moment, assume this can be done easily. Typically, the goal is to describe the joint law of the n asset returns. For instance, in Fig. 1 , the five nodes in \(T_1\) may be the asset returns \(r_{i}\) , \(i=1,\ldots ,5\) , associated to stock indices. The first tree tells us we will specify the dependencies between \(r_1\) and the other returns \(r_i\) , \(i>1\) . Here, we select 1 as the core index (the “main factor”) in this portfolio. Once we have controlled the \(T_1-\) related dependencies, the new nodes in \(T_2\) are conditional asset returns given \(r_1\) . We select asset 2 given 1 as the “most relevant” one. The new edges tell us we focus now on conditional copulae between the latter node and the returns \(r_j\) given \(r_1\) , \(j=2,\ldots ,5\) . And we go on with \(T_3\) , dealing with the asset returns \(r_j\) given \(r_1\) and \(r_2\) , \(j=3,4,5\) , etc. With such a C-vine and a set of convenient bivariate copulae, we obtain the joint law of \((r_1,\ldots ,r_5)\) by gathering and multiplying conveniently all the (conditional) copulae we haver considered above. This is the simplest way of building vines. Obviously, more complex structures may be relevant too, as in the R-vine of Fig. 3 . With heterogeneous portfolios, for instance, it would be fruitful to particularize several nodes in \(T_1\) . See Aas et al. ( 2009 ) for other insights. In terms of model specification, the first chosen trees are crucial because they correspond to our intuitions (our “priors”) about the most important linkages among the assets in the portfolio. Moreover, from some level on and in practice, it is often possible and useful to assume no dependencies: see the “r-vine free” property in Definition 5 below.

Example of a C-vine on five variables. Lecture: the two nodes (1, 2) and (1, 3) in \(T_2\) are connected by the edge (2, 3|1), whose constraint set is \(\{1,2,3\}\) , conditioned set is \(\{2,3\}\) and conditioning set is \(\{1\}\)

Example of a D-vine on five variables. Lecture: the two nodes (1, 3|2) and (2, 4|3) in \(T_3\) are connected by the edge (1, 4|2, 3), whose constraint set is \(\{1,2,3,4\}\) , conditioned set is \(\{1,4\}\) and conditioning set is \(\{2,3\}\)

Example of a R-vine on five variables. The solid, dotted, dashed-dotted and black solid lines correspond to the edges of \(T_1\) , \(T_2\) , \(T_3\) and \(T_4\) respectively

The next section focuses on how such vines are related to some subsets of the partial correlations that are associated to a random vector.

1.2 A.2 Partial correlations

Let \({{\varvec{X}}}=(X_1,\ldots ,X_n)\) be a n -dimensional random vector, \(n\ge 2\) , with zero mean. For any indices i , j in \( \{1,\ldots ,n\}\) , \(i\ne j\) and any subset \(L\subset \{1,\ldots ,n\}\) , for which i and j do not belong to L , \(\rho _{i,j | L}\) is called the partial correlation of \(X_i\) and \(X_j\) , given \(X_k\) , \(k\in L\) . It is the correlation between the orthogonal projections of \(X_i\) and \(X_{j}\) on \(< X_k, k\in L >^{\perp }\) , the orthogonal of the subspace generated by \(\{X_k,\,k\in L\}\) . When L is empty, then \(\rho _{i,j|\emptyset } = \rho \left( X_i,X_j\right) :=\rho _{i,j}\) is the usual correlation. Note that, if the random vector \({{\varvec{X}}}\) is normal, then its partial correlations correspond to some conditional correlations.

Interestingly, partial correlations can be computed from usual correlations with a recursive formula. Let \(\left( i,j,k\right) \) be any set of distinct indices, and L be another (possibly empty) set of indices that is disjoint from \(\left( i,j,k\right) \) . Following Lewandowski et al. ( 2009 ), we have

Assume we know the usual correlations \(\rho _{i,j}\) , for any couple ( i , j ), \(i\ne j\) . We check easily that any partial correlation can be calculated by invoking ( .1 ) several times with increasing subsets L . Actually, the opposite property is true if we start from a convenient subset of partial correlations. Indeed, the edges of a regular vine on n elements may be associated with the partial correlations of a n -dimensional random vector in the following way: for \(i = 1,\ldots ,n-1\) , consider any \(e \in {{\mathcal {E}}}_i\) , the set of edges at tree \(T_i\) . Let \(\left\{ j,k\right\} \) be the two conditioned variables of e , and \(L_e\) its conditioning set. We associate the partial correlation \(\rho _{j,k|L_e}\) to this node. Kurowicka and Cooke ( 2006 ) call this structure a partial correlation vine specification , that is simply a R-vine for which any edge is associated to a number in \(\left]-1,1\right[\) . Actually, all positive definite correlation matrices may be generated by setting a (fixed) R-vine on n variables, and by assigning different partial correlations to all the nodes of this vine. This means setting \(\rho _{e}\) to any \(e \in \overset{n-1}{\underset{i=1}{\cup }} {{\mathcal {E}}}_i \) , and these partial correlations may be chosen in \(\left]-1,1\right[\) arbitrarily . This is the content of Corollary 7.5 in Bedford and Cooke ( 2002 ).

(Bedford & Cooke, 2002 ) For any regular vine on n elements, there is a one-to-one mapping between the set of \(n \times n\) positive definite correlation matrices and the set of partial correlation specifications for the vine.

In other words, any set of \(n(n-1)/2\) partial correlations that are deduced from a regular vine induce a true correlation matrix. Actually, the formulas ( .1 ) above enable to build such \(n\times n\) correlation matrices based on \(n(n-1)/2\) arbitrarily chosen partial correlations : see Kurowicka and Cooke ( 2003 ), Joe ( 2006 ). For a given partial correlation vine, some explicit algorithms map the (usual) correlations and the underlying partial correlations: see Lewandowski et al. ( 2009 ). Such algorithms are available in the R-package called “vine-copula”. See Brechmann and Schepsmeier ( 2013 ), for instance.

Definition 4

Let a vine \(V(n)=(T_1,T_2,\ldots ,T_{n-1})\) . The set of partial correlations associated to this vine is denoted by \({\tilde{C}}_{V(n)}:=\left( C(T_1),C(T_2),\ldots ,C(T_{n-1})\right) \) . Denote by \(R\left( {\tilde{C}}_{V(n)}\right) \) the set of usual correlations that are deduced from \({\tilde{C}}_{V(n)}\) .

Theorem 2 means that, whatever the values of the partial correlations \({\tilde{C}}_{V(n)} \) associated to a regular vine V ( n ), we get a true correlation matrix with the coefficients \(R\left( {\tilde{C}}_{V(n)}\right) \) . Since a standardized gaussian random vector is fully specified by its correlation matrix, we obtain its joint law once we have chosen a partial correlation vine specification. At the opposite, for any gaussian vector, there are many corresponding partial correlation vine specifications. In a gaussian world, we recover the interpretation of vines as descriptors of random vector distributions. But more generally, partial correlation vine specifications can be associated to any random vector, just to describe its correlation matrix (when it exists).

To illustrate these ideas, let us revisit Fig. 1 under a partial correlation point of view: an associated partial correlation vine will specify the set of partial correlations \(\left\{ \rho _{12}, \rho _{13},\rho _{14},\rho _{15}, \rho _{23|1},\rho _{24|1}, \rho _{25|1},\rho _{34|12}, \rho _{35|12},\rho _{45|123}\right\} ,\) that is sufficient to recover the correlation matrix between the five assets. To interpret such numbers, consider linear regressions of some conditioned sets on their conditioning sets. For instance, the node (1, 2) and the node (1, 3) are connected, and the model will specify the partial correlation \(\rho _{12|3}\) . This is the correlation between the residuals of the linear regressions of \(r_2\) and \(r_3\) on \(r_1\) . Roughly, this measures to what extent \(r_2\) and \(r_3\) are “dependent” given \(r_1\) . In practical terms, an econometrician could classify the portfolio components by their (a priori) order of importance. This order may depend on the final phenomenon that is modelled. For instance, if the portfolio payoff depends strongly on emerging markets, it may be relevant to select “Russia” or “Brazil” first instead of “the USA”. Intuitively, the latter strategy is intermediate between a factor model where we would regress any asset return on a few pre-specified ones, and a PCA where the factors are linear combinations of all returns.

This way of interpreting C-vines has to be revisited with D-vines or even general R-vines. Roughly, D-vines are based on an ordered vision of dependencies across asset returns: any asset is associated to one or two neighbors, with whom correlations are relatively strong. Once they are controlled, the main remaining risk is measured by the correlation with (one or) two other known assets, etc. Such a linear view of the strength of dependencies is probably unrealistic in finance. At the opposite, R-vines allow very general and flexible hierarchies and orders among the sequences of partial correlations of interest. Virtually, they allow to integrate any a priori “prior” information, as long as it is consistent with the proximity condition.

For the sake of parsimony, it would be interesting to cancel (or to leave constant, at least) all partial correlations associated to a vine, after some given level r . When zero partial correlations are assumed after the latter level, we would like to know whether the corresponding (usual) correlations depend on the trees \(T_r,T_{r+1},\ldots ,T_{n-1}\) that could be built above.

Definition 5

We say that a vine is r -VF (VF for vine-Free) if

for any alternative vine \(V'(n):= (T_1,T_2,\ldots ,T_{r-1},T'_r,\ldots ,T'_{n-1})\) , where the partial correlations associated to the edges of \(T'_k\) , \(k\ge r\) , are zero.

If a vine is r -VF, once the partial correlations are zero above the level r , the correlations are independent on the way this vine has been built from this level. This r -VF property actually holds for any R-vine. This is a consequence of Theorem 2.3 in Brechmann and Joe ( 2015 ). They observed that the density of an underlying Gaussian vector is not altered when choosing arbitrary trees \(T_{r+1},\ldots ,T_{n-1}\) with associated zero partial correlations.

B Choice of the vine structure and truncation

In this section, we discuss the selection of a suitable vine structure in the case of high-dimensional portfolios (hundreds of assets). To shrink the number of parameters and the numerical noises due to the accumulation of statistical errors with the sequential inference procedure, two approaches can be employed:

The top-down approach of Lewandowski et al. ( 2009 );

The bottom-up approach of Dissmann et al. ( 2013 ).

In case (ii), an algorithm is available in the R vine-copula package. Footnote 3 Nonetheless, its objective is to select the whole model, i.e., the vine structure and the families of bivariate copulas together under the simplifying assumption (Derumigny & Fermanian, 2017 ). This is probably excessive because we simply aim to extract a vine structure that would allow “truncation” after some stage, i.e., to assume bivariate independence copulas in the copula-vine model from some tree on.

Case (i) may be interesting in our context because the truncation order is based on partial correlations and we do not need to specify the bivariate copula families of the model. Nonetheless, the code of this algorithm is currently not available on the web.

Beside, for the arbitrary R-vine with truncation, the approach in Kurowicka ( 2010 ) relies on Pearson product moment correlations. Czado et al. ( 2012 ) proposed an intensive application of some model selection test (Clarke’s test) to choose the best vine structure. In the same spirit, Brechmann et al. ( 2012 ) considered a Vuong test-based procedure, a technique that requires the likelihood function at each tree level.

We could propose an alternative method that should be relevant for C-vine model selection: in a bottom-up approach, select the threshold level based on empirical partial correlations, without depending on any parametric copula family. Indeed, on any node of the vine, say ( i , j | D ), it is always possible to empirically evaluate the partial correlation between \(X_i\) and \(X_j\) given the other returns \(X_k\) , \(k\in D\) (calculate the empirical correlation between the residuals of the linear regressions of \(X_i\) or \(X_j\) on \({{\varvec{X}}}_D\) ). This may be questionable because low partial correlations do not mean low levels of dependence strictly speaking. Nonetheless, this method would yield a convenient “proxy” in the case of vine-GARCH models, for which the focus is on partial correlation and not on the joint law of returns. In practice, we could consider that all the bivariate copulas in the vine will be the independence copula from level k when the average partial correlation calculated on all nodes of tree k are lower than a threshold (0.1, for instance).

Finally, it is worth summarizing the three methods implemented in the vine-GARCH package Footnote 4 to select the central nodes for C-vines up to a user-specified level:

The average empirical Kendall’s tau (AKT) between \((z_{kt})_{t=1,\ldots ,T}\) and the other components \((z_{jt})_{t=1,\ldots ,T}\) , \(j\ne k\) , that is \(\max _k\sum _{j \le N, j \ne k}|{{\widehat{\tau }}}_{kj}|\) with \({{\widehat{\tau }}}_{kj}\) the usual empirical estimator of the Kendall’s tau. The variable with the highest AKT is selected as the central node of \(T_1\) ; the central node of \(T_2\) is the variable with the second highest AKT; all other subsequent central nodes are set according to this criterion.

The average linear correlation coefficient (ALC) between \((z_{kt})_{t=1,\ldots ,T}\) and the other components \((z_{jt})_{t=1,\ldots ,T}\) , \(j\ne k\) , that is \(\max _k\sum _{j \le N, j \ne k}|{{\widehat{\rho }}}_{kj}|\) , where \(\rho _{kj}\) denotes the linear correlation coefficient between \(z_{kt}\) and \(z_{jt}\) . Then, the variable with the highest ALC is selected as the central node of \(T_1\) ; the central node of \(T_2\) is the variable with the second highest AKT; etc.

The average conditional Kendall’s tau non-parametric estimator that builds upon the work of Gijbels et al. ( 2015 ), Section 3.2. More precisely, the selection of the central node in tree \(T_1\) is performed by computing \(\max _k\sum _{j \le N, j \ne k}|{{\widehat{\tau }}}_{kj}|\) , where \({{\widehat{\tau }}}_{kj}\) is the empirical estimator of Kendall’s tau. Then, conditional to the variable selected as the central node in tree \(T_1\) , say l , we compute \(\max _{k \in \{1,\ldots ,N\}{\setminus } \{l\}}\sum _{j \in \{1,\ldots ,N\}{\setminus } \{l\}, j \ne k}|{{\widehat{\tau }}}_{kj|l}|\) , where \({{\widehat{\tau }}}_{kj|l}\) is the estimator of the conditional Kendall’s tau computed according to formulas (3.4)-(3.5) in Gijbels et al. ( 2015 ). Then, one can proceed in an iterative manner to select the central nodes in \(T_3,\ldots ,T_{N-1}\) , where the conditional Kendall’s tau will be \({{\widehat{\tau }}}_{kj|L}\) with \(|L|>1\) . When one aims to select all of the central nodes of the vine, the method may actually be time-consuming and unstable when the dimension N is large since the conditioning set of indices L in \({{\widehat{\tau }}}_{kj|L}\) becomes larger, which alters the precision of the non-parametric estimator (indeed, it involves some kernel smoothing products that may be unstable for L large). Therefore, this method should be used with truncation, that is when it is reasonable to assume some level r , typically \(r=3,4\) , from where the structure of the C-vine can be arbitrarily set as it does not alter the computation of the classic correlations due to the r -vine free property. The choice of r is clearly user-specified and depends on the data.

C Practical considerations

In light of the curse of dimensionality problem, we propose to rely on the iterative node-by-node procedure described in Section 3.3 in Poignard and Fermanian ( 2019 ) for the estimation of the simplified C-vine GARCH model: 3 parameters only need to be estimated for each partial correlation process; a recursion is employed up to the last tree in the non-truncated case or up to a user-specified tree (usually up to \(T_2\) or \(T_3\) ) in the truncated case. In the non-truncated case, this iterative procedure consists of \(N(N-1)/2\) optimization problems, corresponding to the estimation of the bivariate dynamics associated with any edge of the vine: the \(N-1\) edges of the first tree (and, thus, the correlation dynamics of \(T_1\) ) can be estimated independently. Then, the \(N-2\) partial correlation dynamics of \(T_2\) can be estimated independently, given the dynamic partial correlation processes estimated in \(T_1\) . In the truncated case, this iterative procedure is performed up to the desired level of truncation, i.e., the level from which the edges are set as zero or as constant (mean) partial correlations. This estimation strategy allows to break the curse of dimensionality. Indeed, the estimation of a non-truncated simplified C-vine model necessitates the “brute-force” full estimation of \(O(N^2)\) parameters by optimization, a typically unfeasible task in practice. Note that the node-by-node procedure can be employed in the simplified C-vine model only, due to the absence of cross-effects.

In Table 19 , we report the time required for the estimation of each variance-covariance model and the average oracle for S&P 500 and MSCI portfolios. For both datasets, we use the same in-sample periods as in Sect. 4 . These figures were obtained on a Mac-OS Apple M1 Ultra with 20 cores and 128 GB Memory. The version of the Matlab software is 9.12.0.1975300 (R2022a) Update 3 equipped with the Parallel Computing Toolbox, Version 7.6. To assess the sensitivity of the iterative procedure for the C-vine GARCH, the estimation is performed up to trees \(T_3\) and \(T_4\) with the following structure:

MSCI: when up to \(T_3\) , we set USA in \(T_1\) , Germany in \(T_2\) and Japan in \(T_3\) ; when up to \(T_4\) , we set USA in \(T_1\) , Germany in \(T_2\) , Japan in \(T_3\) and Italy in \(T_4\) .

S&P 500: when up to \(T_3\) , we set Berkshire Hathaway in \(T_1\) , JPMorgan in \(T_2\) and Apple in \(T_3\) ; when up to \(T_4\) , we set Berkshire Hathaway in \(T_1\) , JPMorgan in \(T_2\) , Apple in \(T_3\) and Exxon in \(T_4\) .

The time requirement for estimating the parametric C-vine GARCH is larger due to the need to compute, for each t , the innovation variables of the partial correlation process. The latter task requires the conditional marginal variances and the conditional correlations, which are deduced from partial correlations. This stage is not required in the non-parametric approach. The figures in Table 19 relate to time estimation only, not the time required for generating the correlation matrix from the partial correlation matrix process, which is independent of the truncation level. For the MSCI portfolio, this time approximately 5 s, whereas for the S&P 500 portfolio, it is 19 min and 30 s.

Concerning AO, the computation cost comes from the diagonalizations of B empirical ( N , N )-covariance matrices. Using an usual method as the QR algorithm or the “Divide and Conquer” method, the cost a obtaining the eigenvalues of a single matrix is \(O(N^3)\) (Pan & Chen, 1999 ). Thus, taking into account the estimation stage of these B covariance matrices, implementing the AO method has a cost of order \(O(BN^2T+BN^3)\) .

Another point worth mentioning is the treatment of missing values in financial datasets, even if we have not met missing values in Sect. 4 . This problem has fuelled a large amount of academic literature: see the reference textbooks Graham ( 2012 ), Little and Rubin ( 2019 ), for instance. In the case of covariance matrix estimation, pairwise deletion can be applied (Kim & Curry, 1977 ), followed by some projection on the space of positive definite matrices. Beside, numerous “imputation” of “completion” methods have been proposed to fill the gaps directly in datasets: "last observation carried forward", linear or Brownian bridge interpolation, nearest neighbors averaging, singular spectrum analysis, Iterative PCA, etc. See dos Santos ( 2021 ) and the references therein, e.g. Notably, Cao et al. ( 2018 ) proposed to impute missing values with bidirectional recurrent dynamics obtained through some neural networks. Missing values can also been predicted by fitting a parametric data-generating model with the observations, at the price of misspecification risk: Amelia (Honaker et al., 2011 ), multivariate imputation by chained equations (Van Buuren & Oudshoorn, 1999 ), etc. See the survey of Fung ( 2006 ).

Rights and permissions