For Our Products Enquiry Call US ! +91-941-420-6679

- UCM Quartz Grits & Powder

- UCM Quartz Granules

- UCM Quartz Sand

- UCM Potassium Feldspar

- Infrastructure

- Quartz Exporters

- Top 20 Quartz Exporting Countries

- Quartz Stone Manufacturing Process: Everything You Need to Know

How To Start A Mining Business In India (And Small Business Opportunities)

- Quartz Mines In India: An Overview Of Quartz Resources And Reserves

- Quartz Applications & Uses In Different Industries

- How To Start A Mining…

Are you looking for a new business opportunity? Then you can think about starting a mining company. According To InvestIndia , The mining industry in India was valued at $41.7 billion in 2014-15 and is estimated to reach $125 billion by 2025. Moreover, Mining contributes significantly to the Indian economy.

It usually requires extensive capital to start a mining company anywhere in the world and so it is in India, but you can receive amazing rewards from it at the end of the day. Also, there are many small businesses in the mining industry, which require fewer resources and capital. We will be focusing on them as well.

Small Business Opportunities

According to Wikipedia, Mining carried out on small scale contributes 6% to the entire cost of mineral production in India. Also, The Indian mining industry which ranges from large scale mineral drilling businesses to small scale equipment leasing businesses provides jobs to around 7 lakh individuals. Starting a mining business doesn’t necessarily mean that you should acquire a mineral mining region such as a quartz mine in Rajasthan. However, you will be able to provide a range of other services to small and large mining industries, which are essential for mining.

There are small to medium scale services and businesses in the mining industry, which require less capital and resources to be profitably functional and can help mining industries. Some of them are:

A) Equipment Based Services

- Equipment Sales: Mining requires lots of different types of tools and machinery. By dealing in equipment sales, you can choose the type of equipments or machinery you want to trade and build a business around it.

- Equipment Leasing Services: If you want to set up equipment based business on a small to medium scale, you can set up equipment leasing services.

- Equipment Repairing Services: To start this type of business, you require much less capital and resources. You would mostly need highly skilled labor to start equipment repairing services.

B) Transportation Services

- Logistic Services: Transporting minerals from mining sites is a huge challenge for any mining company. The mined minerals are loaded in huge trucks, rails or ships from the remote mining sites and sent to the industry for processing. You can start a transportation service to help mining industries with mineral transportation. At UCM LLP, we use local transportation services for transporting quartz from different mines to our industrial plant in Kishangarh.

- Labor Transportation Services: Mining companies need to work in remote areas such as ocean beds, deserts or forests. Labors and staff are required to be transported to such remote areas via helicopters, boats or ships. You can think of providing offshore transportation services.

C) Drilling Services

- Borehole Drilling Services: Sometimes Boreholes are drilled in order to mine the minerals. In such cases, high-pressure water jets are used to extract the minerals. By specializing in Borehole Drilling services, you can help the mining companies with mining through hydraulic channels.

- Mineral Exploration Services: Exploration is a popular niche in the mining industry. Mineral Explorers help the mining industries in locating mineral rich areas.

D) Consulting Business

- Recruitment Consultants: It is difficult to find the right employees for the mining industry and the traditional recruitment agencies usually can not help in recruiting specialized labors or staff for the mining industry. Hence you can open your own Mining Recruitment Consultancy.

- Financial Consulting: Financial consultants help the mining industry is seeking the right mining opportunities and earning a profit in the long term. They have financial consultants and analyzers who help the mining company in cost-effective and profitable mining.

- Project Consulting: Mining is carried out in different areas and changing the locations often can be daunting for the miners. In such cases, the company often takes help of mining consultants who help with the A-Z of the mining project and provide different information such as geological information, mineral information, exploration information and other information which is essential for mining minerals effectively.

E) Technological Services

- Software Development & Maintenance

- Equipment Testing

- Data Mining

F) Other Services

- Waste Management Services

- Medical Services

- Risk Assessment Services

- Power Supply

- Temporary Development

- Security And Safety

Mining companies are in need of these services to move forward with their business operations. Therefore, you will be able to offer them one or many of these services and make a decent amount of money. Since the mining companies don’t hesitate before they go ahead with massive financial transactions, you need to make sure that you document everything legally.

What is needed to start a mining company?

You should do heavy research before you start a mining business. During the research, you will need to speak to the right people and gather all the information needed to start business operations.

If you are thinking about drilling and manufacturing minerals, You should initially learn how to register your mining business . Then you will need to focus on how to supply and export the mined products in the local market. The export of minerals is generally essential for any minerals manufacturing industry. That’s where you need to take a look at the export license and the regulations associated with it. Export licenses are not too difficult to acquire if you are exporting mineral products because any government and likewise the Indian government usually encourages the export of most minerals because of an increase of foreign currency in the domestic government reserves.

At Unique Crystal Minerals LLP, a large scale quartz manufacturer in Rajasthan , We have been exporting quartz globally for the last many years, and we have not faced any major difficulties with Indian government norms or regulations. We are also proud to be one of the largest quartz exporters in India .

If you are not looking forward to drilling for the mineral directly, you can get in touch with mining companies and ask for the issues that they face. Then you will be able to provide the previously listed services, which mining companies can use to overcome the problems.

Mining Equipment

Once you decide to go ahead with mining, you should purchase appropriate mining equipment. This is where you should think about getting the best quality industrial pumps, drills and construction vehicles. At Unique Crystal Minerals LLP, we use most of the vehicles from JCB. We also rent some of the machinery to reduce expenses. These aren’t all the tools. You can get in touch with a professional service provider and figure out what tools you need. You can also learn more about them from the research you do. However, you must also make sure that you don’t go over your budget at the time of purchasing tools.

Hiring Employees

Once you purchase tools, you need to hire skilled employees to work for your mining company. You will need to hire a lot of people due to the nature of the work that you have to do. A lot of employees will be working for a manual labor job, who can assist you mine materials. However, you will also come across the need to hire experienced employees.

After hiring employees, you will have to provide them with accommodation near the mining site. You can find accommodation or build accommodation for them in a nearby town. In addition to that, you will also need to develop an office, where you can manage all administrative work.

Health And Safety

You should understand what health and safety measures you need to practice before you start the mining business. You should also provide appropriate training to all employees on how to use the tools and how to ensure their own safety.

How to make profits from the mining business?

Now you are all set to go ahead with your mining business. This is where you should understand how to make profits out of your business. There is a high possibility for you to make profits out of your business because you will be spending a relatively little amount of money on mining the minerals needed. You just need to mine minerals and sell them in the market at a higher price tag.

To maximize profits, you can figure out what the high demand minerals available for you to mine are. Then you will be able to receive higher profits out of what you sell. Minerals that generate higher profits are changing along with time as well. Therefore, you need to make sure that you have an up to date knowledge about them.

You will also have to come across a lot of challenges when you are managing the mining business. If you can strategically plan to overcome those challenges, the mining company you create can provide you with rewarding results at the end of the day.

Mining Challenges

There are many problems that you may face while starting a mineral mining business. From extensive capital to fluctuating mineral prices and from resource nationalism to frequently changing government policies, Drilling Minerals is definitely not for the weak-spirited person.

1) Initial Costs & Contacts

The costs required to set up a mineral mining business is quite high. You would need heavy capital for purchasing or leasing different equipment, hiring experienced labor, build relevant infrastructures such as processing plants, energy plants, and transportation models. In India, it’s very difficult to acquire mining licenses without contacts at different government levels.

2) Skilled Labour & Staff

Mining business requires highly skilled labor and staff to operate efficiently. Also, many people are not willing to work at mines or remote areas due to health hazards, accidental risks and low quality of life.

3) Fluctuating Mineral Prices

Mineral prices depend on different factors such as demand and supply, the cost of production, the global economy, etc. Varying mineral prices may make it difficult to always trade the minerals profitably.

Water is important for mining minerals at several sites. Such mining is usually carried out through hydraulic channels. Lack of water and implausibility of borehole drilling makes mining challenging in several areas in India.

5) Power Supply

It requires a huge amount of power supply to power the mining equipment. Lack of power supply in certain mining areas makes it difficult to mine minerals.

6) Government Regulations

With changing government policies, sometimes it gets really difficult to acquire a license to operate on a mine. Also, the government imposes certain rules and regulations for its own control of mines. This is popularly known as Resource Nationalism.

Some other challenges include

- Ensuring Worker safety and all legal procedures pertaining to them.

- Ensuring the waste is managed properly and the surrounding environment has not been harmed.

Starting a mineral mining business in India or anywhere in the world is interesting but quite challenging at the same time. Although if you are interested to start a business in this field, you can look at smaller business opportunities as well. If you are not well acquainted with the mining industry, you can start by providing smaller services required for the mining industry and then, later on, switch to drilling and mining minerals. You can contact me personally if you are interested in setting up a quartz manufacturing business in Rajasthan or nearby areas.

Author: Dinesh Agarwal

Dinesh Agarwal is the founder chairman of Unique Crystal Minerals LLP. He is working in the minerals industry for more than a decade now and is widely known in the Inidan state of Rajasthan for his industrial expertise.

Related Posts

Quartz Stone Manufacturing Process: Everything You Need to Know September 26, 2019

Top 20 Quartz Exporting Countries September 6, 2019

sir i want to gain knowledge in this industry . i want to do startup in my village . and there is already so many concrete mining so i also want to open a mining field and i don’t have any knowledge in this field so what to do can you help me out sir

Hello Faiz,

Please contact me at 9414206679

sir i want to start mining business in India, i am already working for mining company, what are the formalities to get into business

That was a beautiful description of the entirety of mining industry. I would like to know what I as a geology graduate can find easy, as compared to other guys from different backgrounds, willing to start this business. I s there any advantage a geology student can avail?

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Post comment

- WeChat: BADAL

India's Mining Sector: Towards a Sustainable and Equitable Future

Mining is an important activity for India. With 3527 mining leases for 40 major minerals, extending a total lease area of roughly 315,986 hectares, India is a major producer of crucial minerals. The mineral resource sector has the potential to impact environmental sustainability, social inclusion, and economic development.

The Mineral resource sector has played a vital role in the world economy and human development from time immemorial. The achievement of the United Nations' Sustainable Development Goals (SDGs) and the execution of the Paris Agreement is dependent on the sector. While the sector is diverse, it has the opportunity and potential for positive contribution to all 17 SDGs and the execution of the Paris Agreement. The sector's contribution to SDGs encompasses both, its role in advancing several SDGs as well as hindering the achievement of the SDGs and related targets. The world's population estimated to rise from over 7.8 billion to 9.6 billion by 2050 presents additional challenges on the sector in meeting the demands of the rising population and growing per capita consumption. While the introduction of global, national regulations and legislation in the last two decades has been remarkable, the implementation of the same varies greatly between regions, particularly in developing countries such as India.

Mining is an important activity for India. With 3527 mining leases for 40 major minerals, extending a total lease area of roughly 315,986 hectares, India is a major producer of crucial minerals such as chromite, iron ore, coal, and bauxite, among others. Mining contributes to 2.5 per cent of the Gross Domestic Product (GDP). The total mineral production is valued at 1,299,500 million, and 18,963,480 million of mineral exports in 2020. The mining sector plays a vital role in the national economy, employs more than half a million persons, and contributes to the country's revenue through exports, royalty (tax paid in return to the right to use), dead rent, cess, sales tax, and duties. Yet, the environmental (land degradation, land conversion, mine wastes, air pollution, groundwater depreciation, and pollution of water bodies) and social externalities associated with mining are of severe concern. 1 Land-use-related impacts, population displacement and resettlement, health-related impacts, social and cultural disruption, inequality, and conflicts appear to be the most concerning social impacts of mining in India. 2

The fact that much of the country's natural resources are located in forest-covered areas raises further environmental and socio-economic concerns. As one of the fastest-growing economies of the world, there is increased pressure for metals/minerals to meet the demands of an estimated 6 per cent growth in GDP, in the following decade. India's commitment to the Paris Agreement entails the requirement of crucial minerals for the transition to a lower-carbon economy. The 'Make in India' initiative for expansion of the industrial sector would further increase the mineral resources demand. Depletion of mineral reserves is an issue of concern already. Reports indicate a 15 per cent drop in iron ore production in 2018, with reserves in Goa expected to exhaust within a decade and an anticipated reduction in production from Odisha. 3 All these, demand the incorporation of sustainability and equity in the sector.

Mineral Resources and Sustainable Development

The mineral resource sector has the potential to contribute significantly to the achievement of the SDGs through socio-economic benefits, foreign exchange earnings, employment and livelihood, development of infrastructure, communication, provision of vital services, and supply of raw materials for green technologies. As mentioned earlier, the mineral resource sector has the potential to impact environmental sustainability, social inclusion, and economic development. The impacts on water, land, climate and humans as well as on flora, fauna that are reliant on these resources impacts environmental sustainability. The SDG6 (Clean Water and Sanitation), SDG15 (Life on Land), SDG7 (Energy Access and Sustainability), and SDG13 (Climate Action) are affected by this sector.

The mineral sector can pose challenges in terms of impact on livelihoods and human rights, provide economic opportunities to communities near the mines and beyond. An inclusive and equitable approach will help the sector towards achieving SDG1 (End Poverty), SDG5 (Gender Equality), SDG10 (Reduced Inequalities), and SDG16 (Peace, Justice and Strong Institutions). Generation of economic opportunities is also the key towards achieving SDG8 (Decent Work and Economic Growth). There are several direct and indirect economic benefits that can be accrued through this sector. The sector can drive innovation and result in the development of infrastructure for transportation, communication and help to develop energy and water infrastructure contribution to the SDG9 (Infrastructure, Innovation and Industrialization) targets. As the sector provides raw materials critical for development there is an opportunity for collaboration (SDG17: Partnership for the Goals) within and beyond the sector to minimize waste and act as a driver for reuse and recycle (SDG16: Responsible Consumption and Production) through a circular economy approach.

The main challenge in the integration of sustainable development in mineral resource extraction and production is on account of the non-renewable and finite nature of mineral resources further exacerbated by the dependence on other resources such as water, energy, land, etc., for extraction/processing. Global primary materials consumption is expected to increase two-fold by 2060, from 89 gigatonnes (Gt) in 2017. 4 Much of the mineral resource extraction is in developing countries and regions with poor human development indicators. Reinvestment of the revenue earned from mining for equity, sustainable development, maintaining the value of natural resources extracted and ensuring inter-generational equity is essential. Several studies reinforce non-renewable exhaustible mineral resources as finite shared inheritance and framing and accounting the proceeds from mineral exploitation can result in major improvements in natural resource management. 5 The three principles of physical sustainability, generational equity, and global equity for achieving sustainable development are thus imperative.

Environmental Legislations and Regulations Supporting Sustainable Development in the Indian Mining Sector

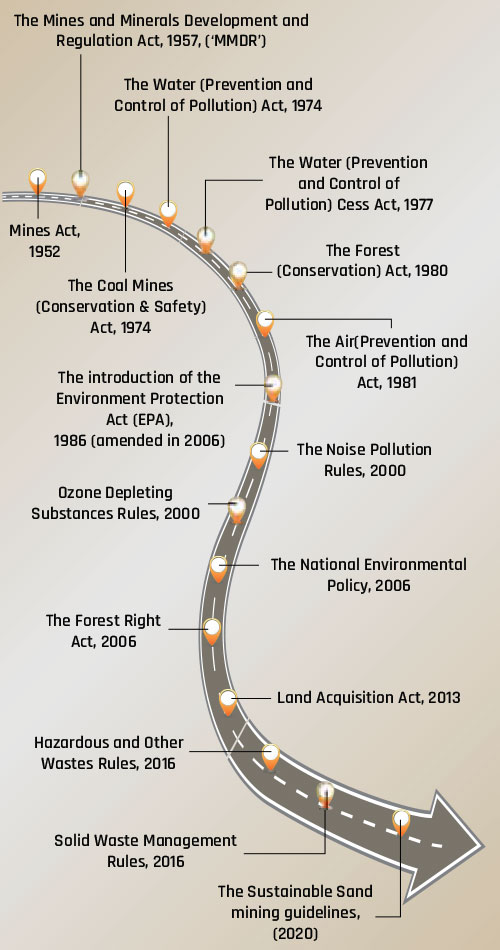

The Indian mining sector is mainly governed by the Mines Act, 1952 and the Mines and Minerals Development and Regulation Act, 1957, ('MMDR'). While the amendment of the MMDR, 1957 has been a watershed moment in the country in line with the Sustainable Development Framework, several environmental regulations existed since the 1970s. Some of the early enactments towards environmental protection have been the first steps in paving the path for sustainable development in the mining sector. The government policy in India in the initial years after independence considered minerals as a 'basic' and 'strategic' importance for the country. Hence, the sector was led in the absence of many environmental and social regulations. The environmental and social considerations gained impetus in the country with the participation of India in the UN conference on Human Environment, Stockholm, 1972. Several environmental enactments were a response to the implementation of the recommendations at the Stockholm Convention.

The Coal Mines (Conservation & Safety) Act, 1974, aimed at improving efficiency of coal, promoting technology for reducing damage to environment, conservation of coal resources and others. Some Acts (along with their associated rules) for management of the environment, applicable to the mines include—i) The Water (Prevention and Control of Pollution) Act, 1974; ii) The Water (Prevention and Control of Pollution) Cess Act, 1977; and iii) The Air (Prevention and Control of Pollution) Act, 1981. The introduction of the Environment Protection Act (EPA), 1986 (amended in 2006) and the Forest (Conservation) Act, 1980 aimed at monitoring mining activities for the protection of the environment during all the phases of a mineral resource extraction cycle including planning, production process, and closure. These paved the first step for acknowledging natural resources and society, incorporating two of the pillars of sustainable development. The National Environmental Policy, 2006, aimed at conserving environmental resources by increasing resource efficiency, promoting intergenerational equity, safeguarding the principles of good environmental governance, and promoting environmental protection.

Globalization, other developments internationally, and the country's commitment to Agenda 21, initiated the discourse on sustainable development in various sectors of the economy. Since 1994, Environmental Impact Assessments (EIA) and Clearances were made statutory for 29 activities including mining. The Forest (Conservation) Act, 1980; the Forest Right Act, 2006; and the Land Acquisition Act, 2013 are also important regulations. The Noise Pollution Rules, 2000; Ozone Depleting Substances Rules, 2000; Hazardous and Other Wastes Rules, 2016; Solid Waste Management Rules, 2016 are applicable for environmental management of the sector.

The Sustainable Sand Mining Guidelines (2020) aim to maintain and restore the ecology of the river and other sand sources through sustainable and environment-friendly management practices. The need of circular economy for the achievement of sustainable development, gained recognition. To expedite the transition from a linear to a circular economy, 11 committees led by the respective ministries (for addressing 11 focus sectors, one of them being scrap metals) have been formed.

Benefit Sharing for Sustainable Development and Equitable Future

Benefit sharing addresses the mismanagement of resource wealth in the mineral resource-rich districts of India that continue to rank low in human development indicators, widening adverse socio-economic externalities, 6 lacking alternate opportunities for economic development. Effective implementation of benefit-sharing strengthens the case for inclusive mineral development, retaining significant economic benefits in the region of mineral extraction and investing for the future. 7

From the mining companies' perspective, the Company's Act, 2013 mandated companies to share profit through Corporate Social Responsibility on developmental challenges and thus contribute towards development activities for building the social capital of the region.

The Mineral Foundation of Goa (MFG), a non-profit organization founded by nine Goan mining corporations to address social and environmental externalities in the State's mining belt, has completed several development projects and worked with the State for the benefit of the mining communities in Goa.

Sustainable development in the mining sector in India was first formally mandated with the MMDR amendment in 2015, following the recommendations of the Committee led by Anwarul Hoda in 2005. This led to the development of the District Mineral Foundations (DMFs) for driving sustainable development of the region and the people affected by mining. The creation of the DMF has been one of the most important steps towards institutionalizing benefit sharing in the Indian mining sector. The Act was further amended in 2020 to sustain mineral production and in 2021 to further boost mineral extraction.

The National Mineral Policy, 1993, an important legal framework for the mines and mineral sector stipulates provisions for regulation of minerals, reviewed as the National Mineral Policy, 2008 for the first time incorporated the need for sustainable mining to preserve and augment the exhaustible mineral reserves and optimal utilization of natural resources. It established all mining to be undertaken within the comprehensive Sustainable Development Framework, which includes guiding principles for effective closure of mines, with appropriate reclamation/rehabilitation for maintaining the ecological condition. The National Mineral Policy approved in February 2019 incorporates the public trust doctrine, intergenerational equity principle, and ownership of natural resources as commons. It holds the State as the trustee on behalf of the people to ensure future generations receive the benefit of inheritance calling for stringent regulations to ensure environmentally sustainable mining practices incorporating social and economic considerations.

Several jurisdictional deliberations have also led to the suspension of mining leases, compensation, and reassessment of environmental and social considerations often promoting sustainable development. These include the amendment of the MMDR, 1957; formulation of the National Mineral Policy (2019); incorporation of sustainable development activities in mining regions through the Maharashtra Mineral Development Fund (MDF), 1999; Odisha Mineral Bearing Areas Development Corporation (OMBADC), 2014; the Comprehensive Environmental Plan for Mining Impact Zone (CEPMIZ), 2014; the Goa Mineral Ore Permanent Fund Trust Scheme (2014) among several others. To ensure Intergenerational Equity (IE) and Sustainable Development, Goa's Permanent Fund—the first-of-its-kind in India, obligating the State and the Legislature on behalf of present-day and future generations to protect current resource wealth and ensure biological survival.

The Supreme Court judgment (1997), of 'Samata vs. State of Andhra Pradesh,' for the first time mandated 20 per cent of profits from mining for the development of mining-affected regions.

The Way Forward

Despite India's longstanding institutions for environmental protection, regulatory violations, poor implementation of environment and community rights, over-extraction, and illegal mining continue to anguish the sector. 8 Modest experience with benefit-sharing highlights inefficient management of funds, underutilization, inadequate participation of mining communities, lack of transparency, and need for enhancing governance. 9

The central role of political and administrative bodies has led to DMF funds to be considered as Government funds leading to poor utilization for the benefit of the mining regions. Several funds including the DMF, CEPMIZ, OBMADC, etc., suffer from the above. Transfer of DMF funds for other activities has led to the Government order (2021) reiterating the allocation of DMF funds for mine-affected regions and people. These demand adequate participation of the community affected by mining especially in decision making, transparency in the use of funds, enhanced capacities of local institutions, and good governance. Local institutions are inadequately represented or lack the capacities in decision making, planning, implementation, and monitoring. The Ministry of Mines in January 2019 recommends the engagement of Gram Sabhas in the planning activities of the DMF and several state DMF laws necessitate the same. Mining-affected people in most remote areas of India often lack access to technology, adequate information of these funds/initiatives, 10 and are unaware of their rights. Local institutions have low awareness, and lack the capacities to engage. While the legal institutions are in place enhancing the capacities of local institutions, and human capability is crucial and needs to be mandated within the sustainable development initiatives.

Transparency in the use of the funds for sustainable development is also questionable with very less information on the public domain regarding funds such as the Goa Mineral Ore Permanent Fund Trust, the CEPMIZ and even the DMF in many states. India is yet to adopt the Extractive Industries Transparency Initiative (EITI), the global standards of good governance ensuring transparency and accountability of the sector.

Regulations mandate socio-economic rehabilitation and environmental restoration of mined-out areas, especially post-closure of mines. Yet, there is a lack of evidence on the implementation of the same. Adequate funding provisions for post-mining rehabilitation and strict regulation of the same should be ensured. Appropriate monitoring mechanisms with community-based monitoring at the regional level are recommended in the mineral production, environmental and social regulation and sustainable development initiatives.

Stringent regulatory mechanisms are required in the sector. Illegal mining is a violation of Section 21 of the MMDR Act. Reports estimate the existence of almost 115,000 illegal mines. Poor implementation of environmental regulations in the legal mines continues.

Resource efficiency and circular economy can reduce the pressure on mineral resources through structural changes and technology while maintaining the growth potential. Life cycle management addresses the renewability of minerals and associated environmental issues during extraction, production, use, and waste management. Closing the resource loop through recycling, remanufacturing, slowing the resource loop through reuse, narrowing the resource flow through increased material productivity, improving assets, and changing the individual behaviour is necessary for the protection of virgin resources and efficient management of supporting resources.

To conclude, a holistic approach harmonizing all the facets of sustainable development in the mining sector must be aligned by the Government and the Industry.

[1] Ghosh, 1989; Bina Agarwal, 1992; Tiwari & Dhar 1994; Dhar, 2000; Ghose, 2000 [2] Saha et al., 2011; Singh & Singh, 2016; Bisht & Gerber, 2017 [3] FICCI, 2018 [4] OECD, 2021 [5] Basu & Pegg, 2020 [6] Basu and Pegg, 2020; CSE, 2011 [7] Söderholm & Svahn, 2015 [8] Shreshta Banerjee, 2020 [9] CSE, 2018; OXFAM, 2018; Joyita Ghose, 2018 [10] CSE, 2018

Article contributed by Ms Mary Abraham, Mu Gamma Consultants Pvt Ltd.

Subscribe to our Newsletter!

- Chemicals & Resources ›

Mining, Metals & Minerals

Mining industry in India - statistics & facts

Economic contribution of india's mining sector, indian mining companies, commercial coal mining, key insights.

Detailed statistics

Mining industry growth rate in India FY 2013-2023

Leading mining companies in India 2023, by market capitalization

Leading cement producing countries worldwide 2023

Editor’s Picks Current statistics on this topic

Mineral production value breakdown in India FY 2021-2022, by sector

Mineral ore and processed mineral export value from India FY 2011-2023

Further recommended statistics

- Premium Statistic Leading cement producing countries worldwide 2023

- Premium Statistic Global iron ore mine production 2023, by country

- Premium Statistic Global mica production 2023, by country

- Premium Statistic Global rare earth mine production 2023, by leading country

- Premium Statistic Global list of leading mining companies 2024, based on revenue

Major countries in worldwide cement production in 2023 (in million metric tons)

Global iron ore mine production 2023, by country

Major countries in iron ore mine production worldwide in 2023 (in million metric tons)

Global mica production 2023, by country

Leading countries based on the production of mica worldwide in 2023 (in metric tons)

Global rare earth mine production 2023, by leading country

Mine production of rare earths worldwide in 2023, by leading country (in metric tons REO)

Global list of leading mining companies 2024, based on revenue

Leading mining companies worldwide in 2024, based on revenue (in billion U.S. dollars)

- Premium Statistic Number of reporting mines in India FY 2014-2022

- Premium Statistic Mineral production value breakdown in India FY 2021-2022, by sector

- Premium Statistic Share of mineral production in India FY 2022, by state

- Premium Statistic Mining industry growth rate in India FY 2013-2023

- Basic Statistic Mining IIP in India FY 2010-2022

Number of reporting mines in India FY 2014-2022

Number of reporting mines in India from financial year 2014 to 2022

Breakdown of mineral production value in India in financial year 2021 and 2022, by sector

Share of mineral production in India FY 2022, by state

Distribution of mineral production in India in financial year 2022, by state

Annual growth rate of mine production in India from financial year 2013 to 2023

Mining IIP in India FY 2010-2022

Index of Industrial Production of the mining sector in India from financial year 2010 to 2022

Metallic minerals

- Premium Statistic Gold production volume in India FY 2012-2023

- Premium Statistic Silver mine production in India 2010-2021

- Premium Statistic Iron ore production volume in India 2010-2021

- Premium Statistic Silicon production volume India 2010-2023

- Basic Statistic Rare earths mine production in India 2010-2023

- Premium Statistic Zinc mine production in India 2020-2022

Gold production volume in India FY 2012-2023

Production volume of gold in India from financial year 2012 to 2021, with estimates until 2023 (in metric tons)

Silver mine production in India 2010-2021

Mine production of silver in India from 2010 to 2021 (in kilograms)

Iron ore production volume in India 2010-2021

Production volume of iron ore in India from 2010 to 2021 (in million metric tons)

Silicon production volume India 2010-2023

Production volume of silicon in India from 2010 to 2023 (in 1,000 metric tons)

Rare earths mine production in India 2010-2023

Mine production of rare earths in India from 2010 to 2023 (in metric tons REO)

Zinc mine production in India 2020-2022

Mine production of zinc in India from 2020 to 2022 (in 1,000 metric tons)

Non-metallic minerals

- Premium Statistic Coal production value India FY 2015-2023

- Premium Statistic Cement production volume in India FY 2008-2021

- Premium Statistic Diamond production volume in India FY 2012-2021

- Basic Statistic Limestone production value in India FY 2012-2023

- Premium Statistic Mica production volume India 2016-2023

- Premium Statistic Gypsum mine production volume in India 2010-2023

Coal production value India FY 2015-2023

Production value of coal in India from financial year 2015 to 2023 (in billion Indian rupees)

Cement production volume in India FY 2008-2021

Production volume of cement in India from financial year 2008 to 2021 with a forecast until 2022 (in million metric tons)

Diamond production volume in India FY 2012-2021

Production volume of diamonds in India from financial year 2012 to 2020, with an estimate for 2021 (in 1,000 carats)

Limestone production value in India FY 2012-2023

Production value of limestone in India from financial year 2012 to 2021, with estimates until 2023 (in billion Indian rupees)

Mica production volume India 2016-2023

Production volume of mica in India from 2016 to 2023 (in metric tons)

Gypsum mine production volume in India 2010-2023

Mine production volume of gypsum in India from 2010 to 2023 (in 1,000 metric tons)

- Basic Statistic Value of processed minerals exported from India FY 2016-2023

- Premium Statistic Value of ores and minerals exported from India FY 2023, by type

Value of processed minerals exported from India FY 2016-2023

Export value of processed minerals in India from financial year 2016 to 2023 (in million U.S. dollars)

Value of ores and minerals exported from India FY 2023, by type

Export value of ores and minerals in India in financial year 2023, by type (in million U.S. dollars)

Companies & employment

- Premium Statistic Leading mining companies in India 2024, by revenue

- Premium Statistic Leading mining companies in India 2023, by market capitalization

- Premium Statistic Leading mining companies in India 2023, by net income

- Premium Statistic Hindalco's revenue FY 2019-2023

- Premium Statistic Coal production of Coal India FY 2005-2024

- Premium Statistic Number of employees in the mining sector India FY 2017-2023

Leading mining companies in India 2024, by revenue

Leading mining and mineral companies in India in 2024, based on revenue (in billion U.S. dollars)

Leading mining and mineral companies in India as of October 2023, by market capitalization (in billion U.S. dollars)

Leading mining companies in India 2023, by net income

Leading mining and mineral companies in India in 2023, based on net income (in million U.S. dollars)

Hindalco's revenue FY 2019-2023

Revenue of Hindalco Industries Limited from financial year 2019 to 2023 (in billion Indian rupees)

Coal production of Coal India FY 2005-2024

Production volume of coal from Coal India Limited from financial year 2005 to 2024 (in million metric tons)

Number of employees in the mining sector India FY 2017-2023

Number of people employed by the mining sector in India from financial year 2017 to 2023 (in millions)

Further reports

Get the best reports to understand your industry.

- Coal mining worldwide

- Mining industry worldwide

- Environmental pollution in India

- Cement industry in India

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Switch language:

India’s new mining reforms explained

India’s mining industry is currently going through it’s greatest legislative shake up in a generation, with India’s Government claiming that reforming the sector is vital for the country’s economic growth. We look at what India’s mining reforms could mean for the industry.

- Share on Linkedin

- Share on Facebook

Speaking at the Global Mining Summit in December 2020, India’s Minister of Mines Pralhad Joshi reaffirmed the nation’s commitment to “structural reforms” to its mining sector, “to increase participation of the private sector in mineral exploration and redefine the norms of exploration for auction of mineral blocks, to ensure a seamless transition from exploration to production”.

India’s mining industry forms a major part of the nation’s economy, both in terms of its own contribution to GDP and its supplying the raw materials that underpin India’s considerable manufacturing and infrastructure industries. India is home to the fourth largest coal reserves in the world and also hosts significant sources of bauxite, diamonds, and titanium ore.

Go deeper with GlobalData

India Mining Industry Fiscal Regime Analysis including Governing Bo...

Data insights.

The gold standard of business intelligence.

Find out more

Why is India’s mining sector important?

India has ambitious plans for economic growth. Addressing the World Economic Forum in January 2018, Indian Prime Minister Narendra Modi expressed his driving desire: to make India a $5tn economy by 2025. It was a claim optimistically restated towards the end of 2020, following what could be considered a slight stumbling block to economic growth in the form of the Covid-19 pandemic.

“Today, our country is optimistic of the future, it is optimistic of reaching the $5tn target,” Modi said during an interview with India’s Economic Times .

“India is the third largest economy in terms of purchasing power parity. We want India to become the third largest in terms of current US dollar prices as well. The $5tn target will help us achieve that.”

It’s a bold target – becoming a $5tn economy in 2025 would require almost doubling the size of India’s economy in just five years – and it’s a target that the mining industry must play a key role in. The mining sector’s contribution to India’s GDP has been diminishing in recent years, which the Federation of Indian Mineral Industries attributed to the under-exploration of the nation’s “obvious geological potential” and a decreasing expenditure on exploration activities in the country.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

Joshi said that the mining industry will be core to reaching the $5tn goal, both in terms of its direct contribution to GDP as well as its ability to grow downstream industries and employment. But growing India’s mining industry to a point where it can support a wider push for rapid economic growth requires hefty capital investment from private players, underpinned by renewed support from the state.

Why are changes needed?

India’s mining law has remained relatively unchanged since the initial legislation governing the sector was introduced in 1957, with the Mines and Minerals (Development and Regulation) Act, or the MMDR Act. MMDR provides a regulatory framework that categorises minor minerals – those governed by state governments in accordance with delegated powers – and major minerals, the commodities overseen by India’s Central Government. Minor minerals include stones for building, clay, and sand, whereas major minerals include all minerals other than mineral oils, petroleum, and natural gas.

The pursuit of rapid economic growth in the next five years will require a strengthening across all of India’s industries. Currently, India imports coal from countries such as Australia, Indonesia, and South Africa – despite being host to globally significant sources of the fossil fuel itself. The country has already begun to open commercial coal mining to private players, in a move that will aim to keep coal imports at a low level and strengthen domestic production.

More general reforms to the mining law will hope to foster this competitiveness between public sector undertakings and private projects more broadly across the sector – something that has been missing from India’s industry.

“Our aim is to encourage industry players to adopt sustainable technology solutions including green mining, coal ash ponds, and other newer technology vehicles that can further accelerate the productivity with the economy of scale and also better environmental performance,” Secretary at the Ministry of Coal Anil Kumar Jain told a virtual CEO roundtable in November 2020.

What changes are being made?

India is moving quickly with plans to revamp its mining sector. The flurry of reforms proposed include amending two provisions in the MMDR Act that would free up around 500 potential mining sites that have been rendered inaccessible by existing regulatory frameworks.

Under current legislation, these potential leases have either surpassed the legal timeframe for the granting of a mining lease or cannot be reallocated at auction due to legislative red tape. These moves would essentially streamline the transition process between the various stages of mine development work, from exploration right through to production.

There are further proposals to create a better statutory definition of illegal mining. Previously, there has not been a distinction between illegal mining done outside a leasehold area and mining in violation of approvals and clearances within a mining lease area. Under new amendments, illegal mining and the government’s powers in tackling the practice will only apply to mining committed outside a lease area, rather than mining that breaches regulations within an otherwise permitted lease area.

Who wins, and what are the concerns?

India’s cabinet approved the mining reforms at a cabinet meeting in January 2021 chaired by Modi. The winners, simply, are mining companies. These reforms are largely targeted at streamlining the processes and opening up more sites in India to mine, while also levelling the playing field between private enterprise and state-owned endeavours.

Government-backed companies will be charged levies on the extension of mining leases, and the reforms also pave the way for the reallocation of non-producing blocks owned by government companies.

The changes to the definition of illegal mining also provide a somewhat controversial boon to mining companies. India’s mining law enables the government to recover 100% of the value of illegally extracted minerals.

Mining within a lease area will become exempt, meaning any violation within that area, be that over-extraction beyond the mining plan or otherwise, will no longer be considered illegal mining in the same sense. Critics fear this could be abused, with private enterprises potentially facing little pushback on poor environmental records or over-extraction.

The government has repeatedly pledged that these reforms will reduce environmental damage from the mining industry and will embed sustainability at the core of all operations. It hopes that a more competitive industry will stimulate innovations and promote the use of new technologies to enhance sustainability.

Modi’s government has also been criticised for proceeding with such sweeping reforms to the mining industry with minimal consultation. Proposals were publicly released in late August 2020, with the notice from the Ministry of Mines inviting comments from the public, states and territories, industry, and other stakeholders – but the timeframe given for feedback was just 10 days.

The Mineral Inheritors Rights Association, formed in March 2020 to push for transparency and accountability in India’s extractive industries, asserted that the 10-day period was a violation of India’s Pre-Legislative Consultation Policy.

“We are anguished to note that only 10 days have been provided for the proposed mining reforms that… would have huge implications across the country,” the association said in a statement. “What is even more disturbing and dangerous is that the state governments have not yet been consulted and a 10-day period for the states to respond undermines the federal spirit of this nation.”

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.

More Relevant

Liberia shuts down Bong Mines for environmental violations

Ghana to commission new mines for gold production boost, kumba plans $428m investment in uhdms technology at south african mine, horizon begins mining at boorara gold project in wa, sign up to the newsletter: in brief, your corporate email address, i would also like to subscribe to:.

MINE Australia : Mining Technology Focus (monthly)

MINE : Mining Technology Focus (monthly)

Thematic Take (monthly)

I consent to Verdict Media Limited collecting my details provided via this form in accordance with Privacy Policy

Thank you for subscribing

View all newsletters from across the GlobalData Media network.

Asking the better questions that unlock new answers to the working world's most complex issues.

Trending topics

AI insights

EY Center for board matters

EY podcasts

EY webcasts

Operations leaders

Technology leaders

EY helps clients create long-term value for all stakeholders. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate.

EY.ai - A unifying platform

Strategy, transaction and transformation consulting

Technology transformation

Tax function operations

Climate change and sustainability services

EY Ecosystems

EY Nexus: business transformation platform

Discover how EY insights and services are helping to reframe the future of your industry.

Case studies

Advanced Manufacturing

How a manufacturer eliminates cost and value leakages with AI-ML

03 Jul 2024 Vinayak vipul

How a young cement company grew 2.5x with organizational and functional transformation

05 Apr 2024 EY India

How a state government transformed into an ecotourism haven

12 Mar 2024 EY India

We bring together extraordinary people, like you, to build a better working world.

Experienced professionals

EY-Parthenon careers

Student and entry level programs

Talent community

At EY, our purpose is building a better working world. The insights and services we provide help to create long-term value for clients, people and society, and to build trust in the capital markets.

EY and iMocha report: 83% employees likely to stay with firms prioritizing a Skills-First approach

22 Aug 2024 EY India

uly 2024 recorded PE/VC Investments worth US$2.7 billion across 81 deals: EY-IVCA Report

14 Aug 2024 EY India

EY expands its EY ESG Compass platform with new innovative use-cases

06 Aug 2024 EY India

No results have been found

Recent Searches

Transforming healthcare in India with Generative AI

Leverage GenAI in Indian healthcare: a collaborative strategy for high-quality, accessible care, balancing potential with mindful tech integration. Learn more.

Sustaining India’s long-term economic growth: strengthening role of government finances

Discover the crucial role of government finances in sustaining India's growth and how fiscal strategies can propel long-term economic stability.

How petrochemical industry in India drives growth with investment and innovation

EY highlights how Indian petrochemical companies can navigate rising demands and global competition. Learn more.

Select your location

How process mining drives business excellence with data insights

Partner – Value Engineering (Automation, Artificial Intelligence and Process Mining)

- Link Copied

Process mining is a game-changing technology, which is reshaping industries and revolutionizing business processes.

- Process mining provides organizations with actionable insights for efficient business transformation by visualizing, monitoring, and improving real processes.

- The industry is witnessing rapid growth, with a market size of US$1.8 billion in 2023, projected to reach US$12.1 billion by 2028.

- The benefits of implementing process mining are multifold, offering organizations a valuable tool to gain transparency, improve efficiency, ensure compliance, and drive continuous process improvement.

I n today's fast-paced business landscape, organizations continually strive to enhance their operational efficiency and effectiveness through successful business transformation programs. Despite frequent declarations of commitment to lean practices, agility, and transformation, our experience indicates that most transformation projects encounter challenges and may falter. Process mining is a powerful tool that can help businesses address various challenges. These challenges include failure to set data-driven targets, lack of process transparency, ineffective change management, weak implementation strategies, and the inability to monitor real-time performance. By using process mining, businesses can gain insights into the business operations, identify bottlenecks and avenues for improvement, which can aid the organizations in enhancing their transformation programs.

At its core, process mining utilizes event logs and data analytics to discover, monitor, and improve real processes. This approach enables organizations to extract valuable insights from their existing digital footprints, providing a clear and transparent view of how their processes function. Through the analysis of event logs, which contain timestamps and other relevant information, process mining can visualize the steps involved in a process, identify variations, and highlight potential areas for improvement.

Figure 1: Process mining explained

Originally, process mining was used as a tool to investigate occasional process performance issues. However, it has now evolved into a comprehensive platform for monitoring and enhancing the execution of operational processes on a large scale. The process mining industry is experiencing rapid growth and is expected to continue expanding in the coming years. The market size of process mining is US$1.8 billion in 2023 and is anticipated to grow to US$12.1 billion by 2028, with a CAGR of 45.6% 1 .

Driving this growth, financial organizations are the largest consumers of process mining, benefiting significantly from its ability to optimize processes seamlessly and enhance customer satisfaction. The manufacturing industry is next in line to adopt process mining due to its stringent adherence to quality standards and a strong focus on waste reduction and quality enhancement, all facilitated by process mining. The healthcare sector is expected to experience exponential growth in process mining, driven by the increased usage of smart and wearable medical devices, and enhanced patient care with a simultaneous reduction in costs. Additionally, the retail industry is poised for substantial growth, leveraging the capabilities of process mining to improve the customer experience.

Key capabilities of process mining

Process mining offers transformative capabilities that impact various aspects of business operations. One fundamental aspect is automated process discovery , which utilizes event logs to visually represent the flow of a process, thereby pinpointing areas for improvement. Conformance checking ensures alignment with standard processes, highlighting deviations and ensuring compliance with rules and regulations. Performance mining examines process efficiency from diverse perspectives, unveiling bottlenecks, costly steps, and opportunities for automation. Variant analysis facilitates the comparison of process versions, revealing differences and suggesting data-driven improvements. Predictive process mining leverages AI/ML to anticipate delays, empowering teams to proactively adjust strategies. Lastly, action-oriented process mining translates diagnostics into actionable steps through automation solutions and streamlined workflows. Together, these capabilities drive transformative insights, enabling businesses to optimize their processes and enhance overall efficiency.

How process mining elevates the competitive position of businesses

Process mining has emerged as a transformative force, leaving a significant imprint on diverse aspects of business operations. According to a recent study, enterprises embracing process mining for end-to-end continuous improvement are projected to be 20% more profitable compared to their counterparts who do not adopt these practices 2 . Another study reveals that by 2025, 80% of organizations will integrate process mining capabilities into at least 10% of their business operations 3 .

To better illustrate the transformative impact, consider a real-world case of a major consumer healthcare company that embarked on their process mining journey three years ago. It strategically segregated its consumer goods business from its pharmaceutical operations. Additionally, it also aimed to enhance the application of process mining models to garner deeper process insights, streamlined operations and increased efficiency. Leveraging process mining, the company was able to navigate the transition phase more effectively and with greater efficiency. Eventually, the use of process mining evolved and expanded across multiple functions across the organization. Process mining provided the company with a more granular understanding of their operations and highlighting key areas for improvement.

Future horizons of process mining industry

In a world where business transformation is essential for staying competitive, process mining provides organizations with a data-driven approach to process optimization. Its ability to harness the power of data to drive operational improvements makes it an invaluable tool for businesses seeking to reach their full potential and remain at the forefront of their industries. With the process mining market expected to grow significantly in the coming years, organizations that embrace this technology will have a competitive edge and be better positioned to achieve competitive business operations.

- https://www.marketsandmarkets.com/Market-Reports/process-mining-market-176608355.html

- https://blog-idceurope.com/are-business-process-discovery-tools-worth-the-cost-and-the-effort/

- https://www.businesswire.com/news/home/20230406005258/en/ABBYY-Named-a-Leader-in-the-2023-Gartner%C2%AE-Magic-Quadrant%E2%84%A2-for-Process-Mining-Tools

Process mining is revolutionizing industries by optimizing operational processes and enhancing efficiency.

About this article

How EY can help

Intelligent automation consulting services

Discover how EY's intelligent automation team can help your business implement a holistic view of automation, process & service improvement with our intelligent automation consulting services.

Analytics Consulting Services

Discover how EY's analytics consulting services can help you apply analytics throughout your organization to help grow, protect and optimize your business.

Discover how EY's technology transformation team can help your business fully align technology to your overall purpose and business objectives.

Related articles

How skills-first transformation can unlock a new approach to talent potential

Discover the power of a Skills-First Transformation in unlocking untapped talent potential. Explore innovative approaches to unleash your workforce's capabilities.

Why GenAI is a top agenda for Indian CEOs: CEO outlook survey 2023

The latest EY report finds that CEOs recognize the potential of AI but are encountering significant challenges in developing AI strategies. Read more.

Pharma and healthcare for India@100: a century of change on the horizon

Unleashing India's pharma potential: Innovation, integration, and equitable healthcare access for a thriving future.

- Connect with us

- Our locations

- Legal and privacy

- Open Facebook profile

- Open X profile

- Open LinkedIn profile

- Open Youtube profile

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

- Screen Reader

- Skip to main content

- Text Size A

- Language: English

- Case Studies

- EXIM Procedure

Media & Events

- Image Gallery

- Media Coverage

Other Links

- GI of India

- Experience India

- Indian Trend Fair 2022

- India Organic Biofach 2022

- Gulfood Dubai 2023

INDIA ADDA – Perspectives On India

IBEF works with a network of stakeholders - domestic and international - to promote Brand India.

- Agriculture (21)

- Automobiles (18)

- Banking and Financial services (27)

- Consumer Markets (29)

- Defence (6)

- Ecommerce (18)

- Economy (56)

- Education (12)

- Engineering (5)

- Exports (19)

- Healthcare (19)

- India Inc. (6)

- Infrastructure (23)

- Manufacturing (18)

- Media and Entertainment (7)

- Micro, Small & Medium Enterprises (MSMEs) (14)

- Miscellaneous (29)

- Perspectives from India (30)

- Pharmaceuticals (3)

- Railways (4)

- Real Estate (12)

- Renewable Energy (13)

- Research and Development (2)

- Services (5)

- Startups (15)

- Technology (44)

- Textiles (4)

- Tourism (9)

RECENT POSTS

Mining sector reforms and the road ahead

- Jan 13, 2022, 13:00

Introduction

India is rich in natural resources, notably minerals, making the mining industry extremely valuable. The mining industry is heavily regulated, and the legal framework has changed significantly in the last five years, resulting in a more transparent and efficient system. India produces 95 minerals, including 4 fuel-related minerals, 10 metallic minerals, 23 non-metallic minerals, 3 atomic minerals and 55 minor minerals. India is one of the world's top producers of valuable minerals like chromite, iron ore, coal, and bauxite. Rajasthan is the highest contributor to minerals production in India, followed by Odisha. The mining acts and rules are being amended to ensure ease of doing business in this industry.

Source: Ministry of Mines- Annual report

Economic contributions (GDP, exports)

India's mining sector is one of the country's most important industries, and many industries rely on it for essential raw resources. The GVA for the Mining and Quarrying sector was reported at around US$ 54 billion for FY19. India is the world's second-largest coal producer and has the world's fifth-largest coal reserves. The cumulative growth rate from April to October 2020-21 is 11.4% higher than the corresponding period in the previous year. The Government has also supported the mining sector with the budgetary allocation to the Ministry of Mines of around US$ 117.6 million for FY20. India relies on imports more than it exports for the mining industry; however, exports have remained stable over the years. Exports in the mining sector stood at US$ 24.66 billion for FY 20.

Key Growth Drivers

Factors that led to the growth of the mining sector in India are as follow:

- Improved infrastructural development and automobile manufacture.

- The growth of the power and cement sector.

- Inclusion of the private sector in the mining industry has played a dominant role in increasing mineral production accounting for 67.33% of the total value.

- Since the Government took the initiative for policy reforms, there has been a noticeable shift in the mining industry, like relaxing mineral exploration norms.

- The Mines and Minerals Amendment Bill, 2021, has introduced various reforms and developments in the mining sector.

Recent Developments

India presents a major opportunity in terms of investment in the mining sector. Some of the recent trends are as follow:

- The National Mineral Exploration Trust (NMET) has approved 187 exploration projects with a total cost of Rs.895.72 crores (US$116.4 million), out of which 69 projects have already been finished, while 118 are still in the works.

- The Government of India intends to use the coal loading system at Paradip Port to boost coal transportation via the sea route and turn it into a coal hub.

- The Ministry of Mines has formed a Joint Venture company, Khanij Bidesh India Ltd (KABIL), with National Aluminium Company Ltd (NALCO), Hindustan Copper Ltd (HCL), and Mineral Exploration Corporation Ltd (MECL) as partners to ensure the nation's mineral security and achieve self-reliance in critical and strategic minerals.

- The development of 23 project works with a total length of 600.13 km under the CRIF plan in Madhya Pradesh has been approved with a budget outlay of Rs. 1,815 crores (US$ 236 million) for FY22.

Major government reforms & environmental considerations

India's central government and state governments are jointly responsible for the mining sector's administration. The industry is governed by a federal system that divides regulatory authorities and responsibilities between the central government and the respective state governments. The Mines and Minerals (Development and Regulation) Act 1957 (MMDR Act) was enacted by the Indian government as the primary legislation governing the mineral sector (other than petroleum and natural gas). Besides MMDR Act, the following rules and regulations establish the legal foundation for the mining industry:

- Mineral Concession Rules 1960 (MC Rules): These rules lay the foundation for granting concessions, rejecting applications, keeping accounts, and submitting reports to state governments.

- Mineral Conservation and Development Regulations (Mineral Conservation and Development Regulations): These regulations set the standards to be met to ensure that mining is done in a scientifically sound manner while also protecting the environment.

- Mineral (Auction) Rules 2015 (Auction Rules): These rules lay the foundation for granting significant mineral concessions through an online electronic auction.

- Mines Act: This Act establishes rules for mine worker safety and working conditions and provisions for mine administration and operation.

- Offshore Areas Mineral Concession Rules 2006 (OAMDR Rules): The process for granting and renewing mineral resource concessions in offshore areas is outlined in these guidelines.

The MMDR Act gives the central Government the authority to issue directives to state governments to ensure sustainable mineral development and reduction in the exploitation of air, ground, water, and noise. The following are some of the most important steps taken by the Government to protect environmental impacts of mining:

- Clearance under the Environment Protection Act 1986 and the Environment Protection Rules 1986, as amended from time to time, is in line with the Environment Impact Assessment Notification 2006.

- Clearance from the applicable State Pollution Control Board in accordance with the following:

- Water Act 1974.

- Air Act 1981.

- Hazardous and Other Wastes Rules 2016.

- Solid Waste Management Rule 2016.

- Noise Pollution Rules 2000.

- Construction and Demolition Waste Management Rules 2016.

- Ozone Depleting Substances Rules 2000.

Road Ahead

India has immense mineral potential, with mining licenses provided for a 50-year period that is both long and reliable. The strategic location of India allows convenience in exporting, and over the next 15 years, demand for certain metals and minerals are expected to rise significantly. The Government plans to introduce more mining reforms soon to promote the most efficient use of the country's natural resources. The implementation of the National Mineral Policy in 2019 presents a significant investment opportunity in India. Due to reforms such as the Make in India Campaign , Smart Cities, Rural Electrification, and a focus on building renewable energy projects under the National Electricity Policy, as well as increased infrastructure development, India's mining sector is expected to undergo significant changes in the coming years.

Not a member

Mining Plan Received

Total Visitors: 2 3 8 3 8 1 5

SENSEX 82,365.77

+ 231.16

NIFTY 25,235.90

+ 83.95

CRUDEOIL 6,201.00

-161.00

GOLD 71,660.00

-528.00

SILVER 83,300.00

-1,572.00

- Commodities

- Gold & Silver

- Gold rate today

- Silver rate today

- Top gainers today

- Top losers today

- Personal Finance

- Derivatives

- Stock Fundamentals

- Mutual Funds

- Day Trading Guide

- Budget 2024

- Macro Economy

- Agri Business

- World Economic Forum

- Business Laws

- Science and Technology

- Corporate File

- Current Account

- Flight Plan

- Technophile

- Money & Banking

- BL Explainer

- BL On Campus

- Data Stories

- Latest News

Get businessline apps on

Connect with us

TO ENJOY ADDITIONAL BENEFITS

- Real Estate

- Computers & Laptops

- Mobiles & Tablets

- Other Gadgets

- Social Media

- Today's Paper

- Subscription

Connect With Us

Get BusinessLine apps on

Chile welcomes Indian investment in mining, ready to negotiate economic partnership: Foreign Affairs Minister Alberto van Klaveren

Alberto van klaveren, foreign affairs minister of the south american country, who is in on three-day visit to india met his counterpart s jaishankar and interacted with corporates and film makers.

By Aneesh Phadnis

Chile, which holds vast copper and lithium deposits, is keen to diversify its trading partners and open the country for more investments.

Alberto van Klaveren, Foreign Affairs Minister of the South American country, who is in on three-day visit to India met his counterpart S Jaishankar and interacted with corporates and film makers.

Chile welcomes Indian investment in mining and is ready to negotiate a comprehensive economic partnership agreement with India, van Klaveren told businessline .

Chile Foreign Affairs Minister Alberto van Klaveren

- mining and quarrying

- BL Interview

You might also like

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.

- Access 10 free stories per month

- Access to comment on every story

- Sign up/Manage to our newsletters

- Get notified by email for early preview to new features, discounts & offers

Terms & conditions | Institutional Subscriber

We use cookies to ensure best experience for you

We use cookies and other tracking technologies to improve your browsing experience on our site, show personalize content and targeted ads, analyze site traffic, and understand where our audience is coming from. You can also read our privacy policy , We use cookies to ensure the best experience for you on our website.

- The Middle East and Africa

- Leaders Speak

- Brand Solutions

- New mining cess to tighten margins for steel producers: Icra

- Saurav Anand ,

- ETEnergyWorld

- Updated On Aug 27, 2024 at 07:40 AM IST

- By Saurav Anand ,

- Published On Aug 27, 2024 at 07:40 AM IST

All Comments

By commenting, you agree to the Prohibited Content Policy

Find this Comment Offensive?

- Foul Language

- Inciting hatred against a certain community

- Out of Context / Spam

Join the community of 2M+ industry professionals

Subscribe to our newsletter to get latest insights & analysis., download etenergyworld app.

- Get Realtime updates

- Save your favourite articles

- mining cess

- steel industry

- financial pressure

- operating margins

- secondary steel producers

- mining cess rate

- power sector

- cost pressures

- supply costs

- competitive landscape

- Business Today

- India Today

- India Today Gaming

- Cosmopolitan

- Harper's Bazaar

- Brides Today

- Aajtak Campus

- Budget 2024

- Magazine Cover Story Editor's Note Deep Dive Interview The Buzz

- BT TV Market Today Easynomics Drive Today BT Explainer

- Market Today Trending Stocks Indices Stocks List Stocks News Share Market News IPO Corner

- Tech Today Unbox Today Authen Tech Tech Deck Tech Shorts

- Money Today Tax Investment Insurance Tools & Calculator

- Mutual Funds

- Industry Banking IT Auto Energy Commodities Pharma Real Estate Telecom

- Visual Stories

INDICES ANALYSIS

Mutual funds.

- Cover Story

- Editor's Note

- Market Today

- Drive Today

- BT Explainer

- Trending Stocks

- Stocks List

- Stocks News

- Share Market News

- Unbox Today

- Authen Tech

- Tech Shorts

- Tools & Calculator

- Commodities

- Real Estate

- Economic Indicators

- BT-TR GCC Listing

Dantewada administration imposes Rs 1,620.5 crore fine on NMDC for mining law violations

The psu has termed the move “completely inappropriate” and claimed the penalty was imposed “solely and blindly without considering the facts and circumstances in the case”..

- Updated Aug 31, 2024, 2:06 PM IST

The Dantewada administration has imposed a Rs 1,620.5 crore penalty on the National Mineral Development Corporation (NMDC), a central PSU, for alleged violation of mining laws, officials said on August 31.

The PSU has termed the move “completely inappropriate” and claimed the penalty was imposed “solely and blindly without considering the facts and circumstances in the case”, PTI reported.

The NMDC has mining operations in Bailadila hills in Kirandul and the Bacheli area of Dantewada in the Bastar region in Chhattisgarh.

Dantewada collector Mayank Chaturvedi directed the NMDC to deposit the penalty amount within 15 days.

The letter, dated August 29, stated that iron ore mining leases have been approved for Deposit No 14 ML in an area of 322.368 hectares, Deposit No 14 NMZ in 506.742 hectares and Deposit No 11 in 874.924 hectares in Kirandul village under Bacheli tehsil of Dantewada to the NMDC.

Chaturvedi wrote that the NMDC’s clarifications to the show cause notices issued by district administration were unsatisfactory.

NMDC has violated section (4)(1) of the Chhattisgarh Mineral (Mining Transportation and Storage) Rules, 2009, and as per Rule (5) of the Chhattisgarh Mineral (Excavation, Transportation and Storage) Rules, 2009 and section 21(5) of the Mines and Minerals (Development and Regulation) Act, 1957, a total penalty of Rs 1,620.5 based on market value and royalty of the mineral is imposed, the letter said.

TOP STORIES

- Advertise with us

- Privacy Policy

- Terms and Conditions

- Press Releases

Copyright©2024 Living Media India Limited. For reprint rights: Syndications Today

Add Business Today to Home Screen

Saturday, August 31, 2024

Transnet signs R5bn loan with New Development Bank to improve its freight rail services

Finance Minister Enoch Godongwana welcomed world leaders and delegates to the 9th Annual Meeting of the New Development Bank. Picture: Vernon Pillay/Independent Newspapers

Published 9h ago

Transnet on Friday signed a R5 billion loan from the New Development Bank (NDB) at the opening of the bank’s 9th annual meeting, which started in Cape Town on Friday.

The loan agreement, which is guaranteed by the South African government, aims to lift the efficiency of South Africa’s freight rail systems, including improving its rail network, financing the overhaul of its locomotives, and helping fund new wagons.

South Africa’s buckling freight rail systems have in recent years become an impediment to the economy, with industry and mining groups having lost billions of rands of potential exports each year due to problems with the rail network. In July, the African Development Bank Group approved a $1bn (R18.85bn at the time) loan for its recovery and growth plan.

Since the NDB was established in 2015, it has become a formidable agent for infrastructure development finance among its member countries. These include South Africa, which has received $5.8bn (R102.3bn rand) in funding for 13 projects, including R3.2bn for Phase Two of the Lesotho Highlands Water Project, and R3.5bn for the Durban Container Berth Rebuild Project.

NDB president Dilma Rousseff said they were delighted to partner with Transnet in this “transformative initiative”.

“By modernising the freight rail sector, we aim to facilitate more efficient logistics operations that will benefit the entire region and align with our goal of investing in a sustainable future,” she said.

Transnet Group chief executive Michelle Phillips, who signed the loan for Transnet at the NDB meeting, said: “This investment is important for Transnet as we accelerate implementation of the Recovery Plan and economic reforms.”

The NDB was created in 2015 by Brazil, Russia, India, China and South Africa to mobilise resources for infrastructure and sustainable development projects in BRICS and other emerging market economies and developing countries.

Finance Minister Enoch Godongwana said the NDB needed to be “unwavering in its quest” to meet the UN’s Sustainable Development Goals, as developing countries were facing serious challenges in infrastructure and development funding in the context of the weak global growth environment, high interest rates, geopolitical tensions and climate change.

All these were exacerbating problems of poverty, unemployment and inequality in BRICS countries..

“As more African countries become members (of the NDB) we believe the bank can play an increasingly important role in provision of infrastructure,” said Godongwana.