What are Financial Statements?- #1 Financial Statements Example – Cash Flow Statement

- #2 Financial Statements Example – Income Statement

- #3 Financial Statements Example – Balance Sheet

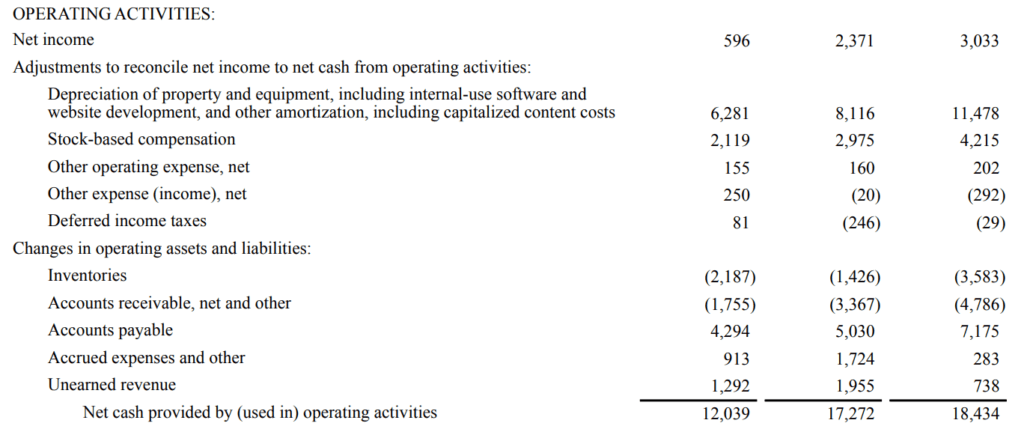

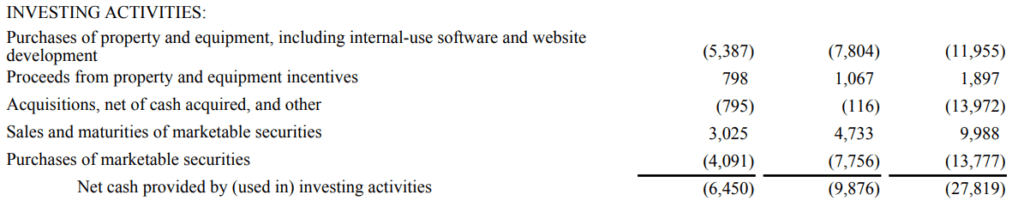

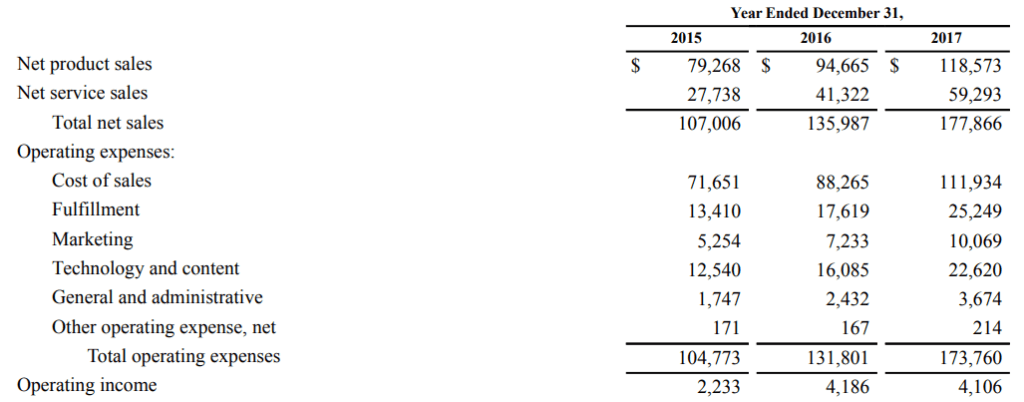

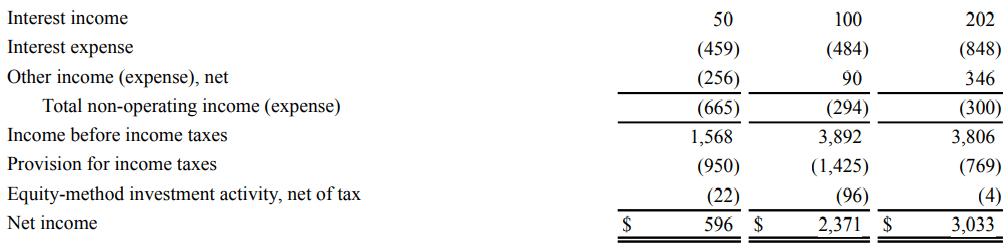

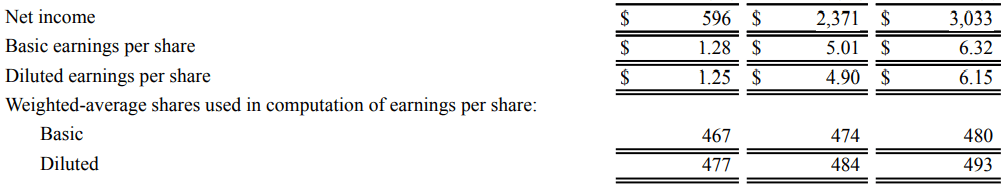

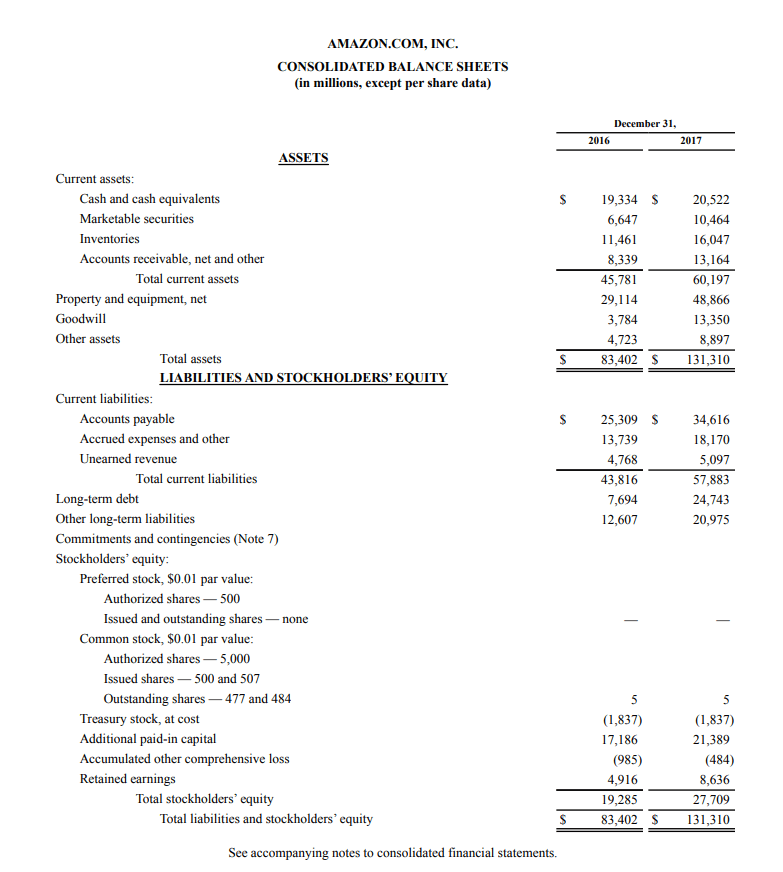

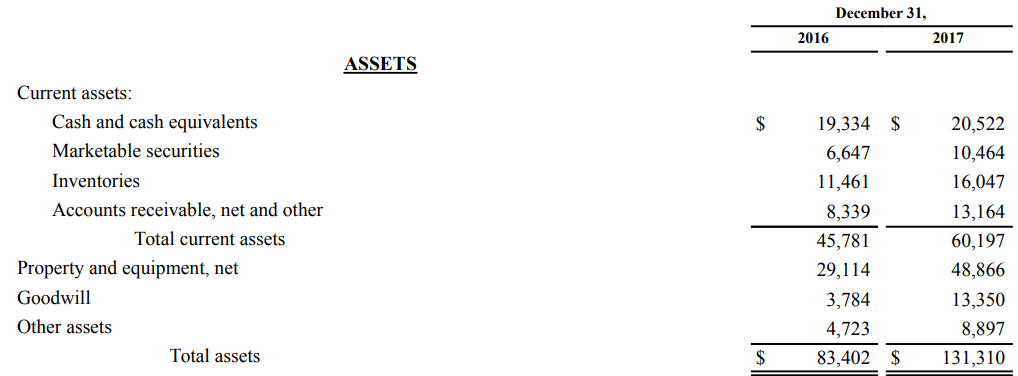

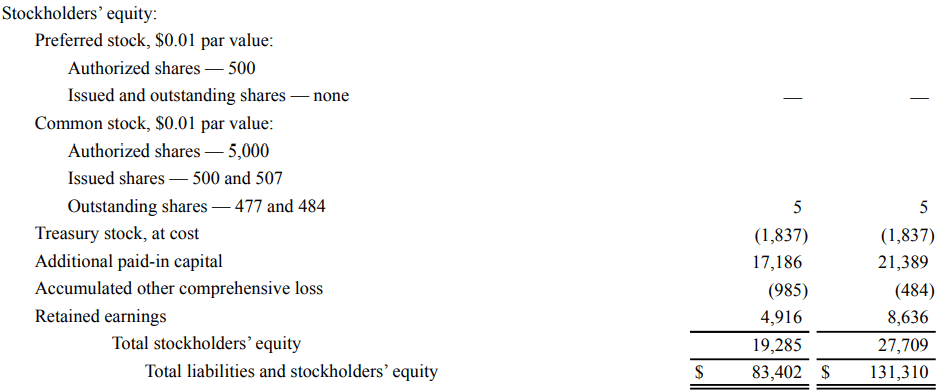

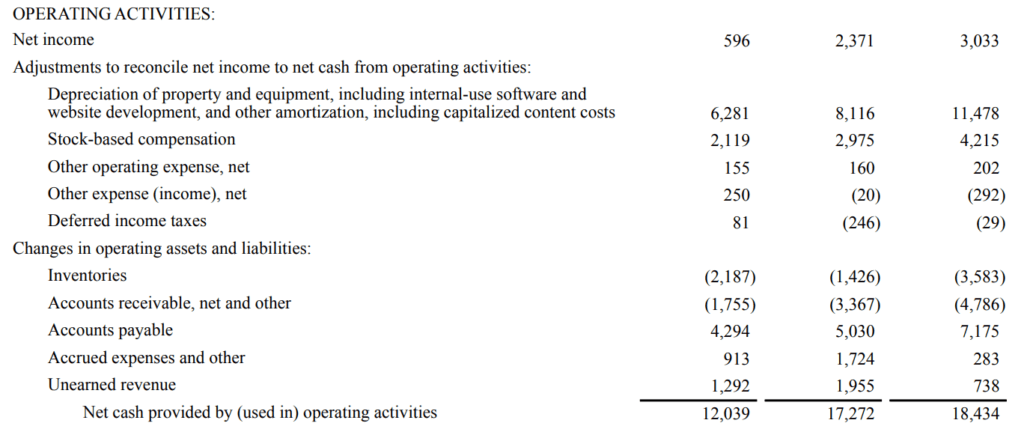

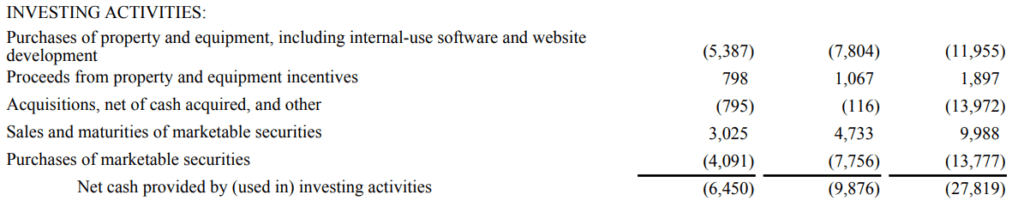

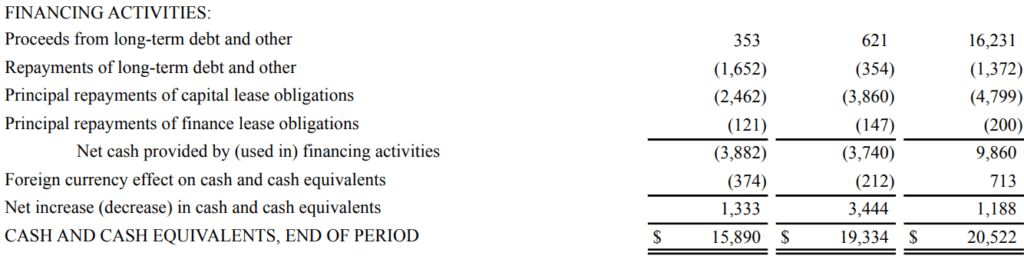

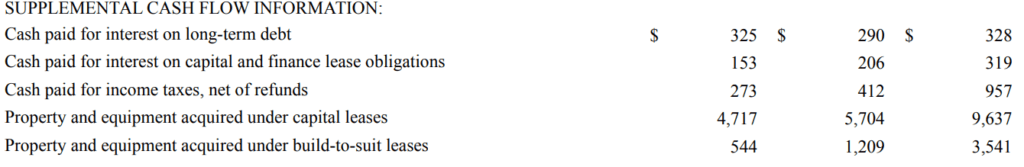

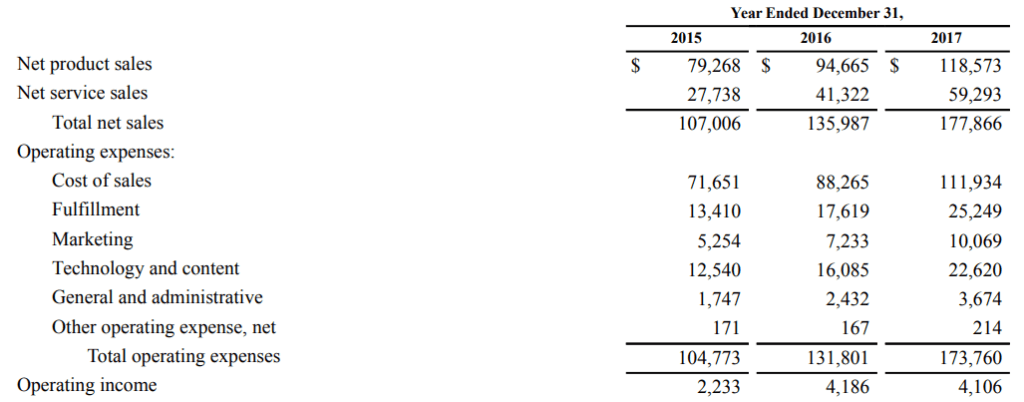

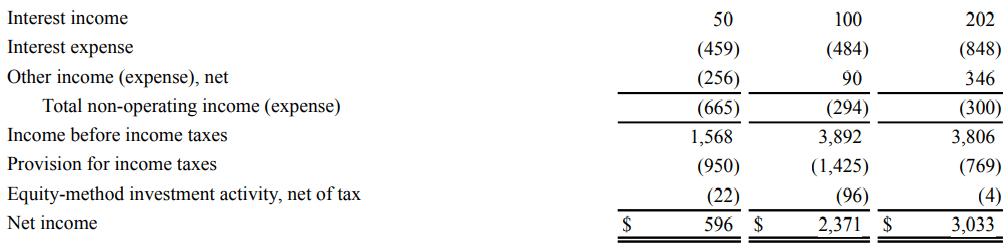

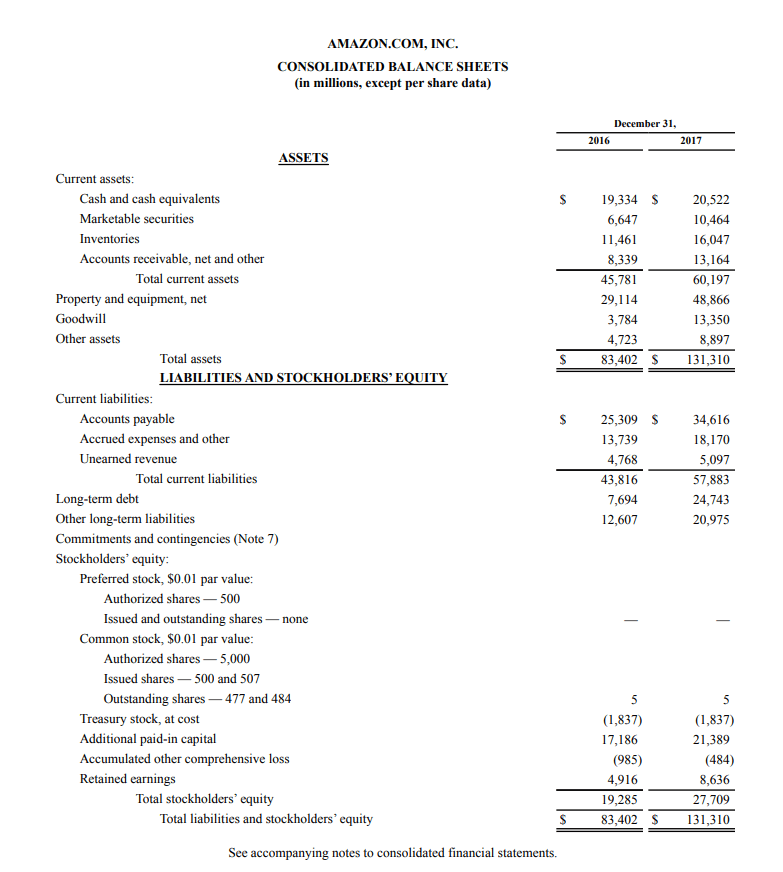

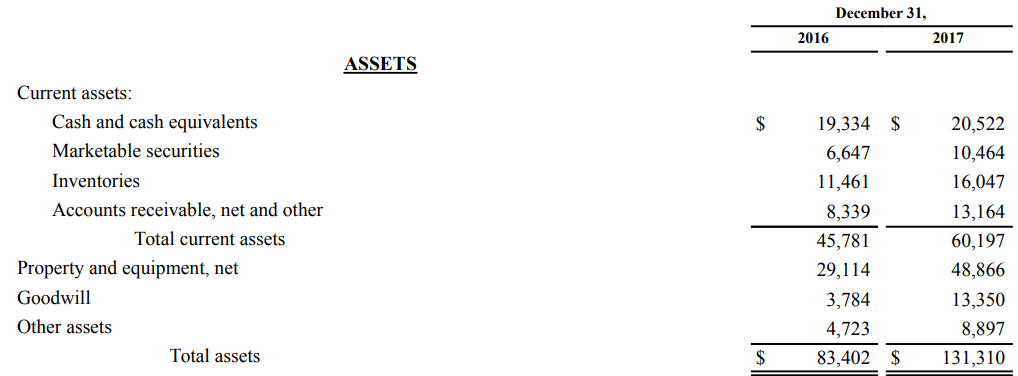

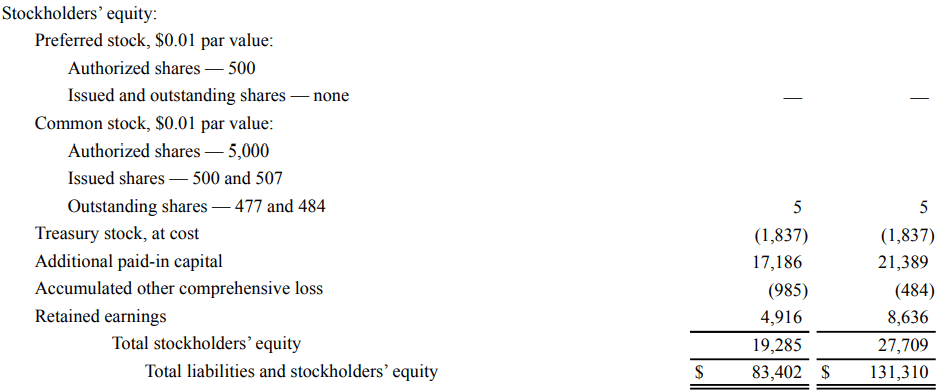

Additional ResourcesFinancial statements examples – amazon case study. An in-depth look at Amazon's financial statements Financial statements are the records of a company’s financial condition and activities during a period of time. Financial statements show the financial performance and strength of a company . The three core financial statements are the income statement , balance sheet , and cash flow statement . The three statements are linked together to create the three statement financial model . The analysis of financial statements can help an analyst assess the profitability and liquidity of a company. Financial statements are complex. It is best to become familiar with them by looking at financial statements examples. In this article, we will take a look at some financial statement examples from Amazon.com, Inc. for a more in-depth look at the accounts and line items presented on financial statements. Learn to analyze financial statements with Corporate Finance Institute’s Reading Financial Statements course!  #1 Financial Statements Example – Cash Flow StatementThe first of our financial statements examples is the cash flow statement. The cash flow statement shows the changes in a company’s cash position during a fiscal period. The cash flow statement uses the net income figure from the income statement and adjusts it for non-cash expenses. This is done to find the change in cash from the beginning of the period to the end of the period. Most companies begin their financial statements with the income statement. However, Amazon (NASDAQ: AMZN) begins its financial statements section in its annual 10-K report with its cash flow statement.  The cash flow statement begins with the net income and adjusts it for non-cash expenses, changes to balance sheet accounts, and other usages and receipts of cash. The adjustments are grouped under operating activities , investing activities , and financing activities . The following are explanations for the line items listed in Amazon’s cash flow statement. Please note that certain items such as “Other operating expenses, net” are often defined differently by different companies: Operating Activities: Depreciation of property and equipment (…) : a non-cash expense representing the deterioration of an asset (e.g. factory equipment). Stock-based compensation : a non-cash expense as a company awards stock options or other stock-based forms of compensation to employees as part of their compensation and wage agreements. Other operating expense, net: a non-cash expense primarily relating to the amortization of Amazon’s intangible assets . Other expense (income), net: a non-cash expense relating to foreign currency and equity warrant valuations. Deferred income taxes : temporary differences between book tax and actual income tax. The amount of tax the company pays may be different from what it shows on its financial statements. Changes in operating assets and liabilities : non-cash changes in operating assets or liabilities. For example, an increase in accounts receivable is a sale or a source of income where no actual cash was received, thus resulting in a deduction. Conversely, an increase in accounts payable is a purchase or expense where no actual cash was used, resulting in an addition to net cash. Investing Activities: Purchases of property and equipment (…): purchases of plants, property, and equipment are usages of cash. A deduction from net cash. Proceeds from property and equipment incentives: this line is added for additional detail on Amazon’s property and equipment purchases. Incentives received from property and equipment vendors are recorded as a reduction in Amazon’s costs and thus a reduction in cash usage. Acquisitions , net of cash acquired, and other: cash used towards acquisitions of other companies, net of cash acquired as a result of the acquisition. A deduction from net cash. Sales and maturities of marketable securities : the sale or proceeds obtained from holding marketable securities (short-term financial instruments that mature within a year) to maturity. An addition to net cash. Purchases of marketable securities: the purchase of marketable securities. A deduction from net cash. Financing Activities: Proceeds from long-term debt and other: cash obtained from raising capital by issuing long-term debt. An addition to net cash. Repayments of long-term debt and other: cash used to repay long-term debt obligations. A deduction from net cash. Principal repayments of capital lease obligations: cash used to repay the principal amount of capital lease obligations. A deduction from net cash. Principal repayments of finance lease obligations: cash used to repay the principal amount of finance lease obligations. A deduction from net cash. Foreign currency effect on cash and cash equivalents : the effect of foreign exchange rates on cash held in foreign currencies. Supplemental Cash Flow Information: Cash paid for interest on long-term debt: cash usages to pay accumulated interest from long-term debt. Cash paid for interest on capital and finance lease obligations: cash usages to pay accumulated interest from capital and finance lease obligations. Cash paid for income taxes , net of refunds: cash usages to pay income taxes. Property and equipment acquired under capital leases: the value of property and equipment acquired under new capital leases in the fiscal period. Property and equipment acquired under build-to-suit leases: the value of property and equipment acquired under new build-to-suit leases in the fiscal period. #2 Financial Statements Example – Income StatementThe next statement in our financial statements examples is the income statement. The income statement is the first place for an analyst to look at if they want to assess a company’s profitability . Want to learn more about financial analysis and assessing a company’s profitability? Financial Modeling & Valuation Analyst (FMVA)® Certification Program will teach you everything you need to know to become a world-class financial analyst!  The income statement provides a look at a company’s financial performance throughout a certain period, usually a fiscal quarter or year. This period is usually denoted at the top of the statement, as can be seen above. The income statement contains information regarding sales , costs of sales , operating expenses, and other expenses. The following are explanations for the line items listed in Amazon’s income statement: Operating Income (EBIT): Net product sales: revenue derived from Amazon’s product sales such as Amazon’s first-party retail sales and proprietary products (e.g., Amazon Echo) Net services sales: revenue generated from the sale of Amazon’s services. This includes proceeds from Amazon Web Services (AWS) , subscription services, etc. Cost of sales: costs directly associated with the sale of Amazon products and services. For example, the cost of raw materials used to manufacture Amazon products is a cost of sales. Fulfillment: expenses relating to Amazon’s fulfillment process. Amazon’s fulfillment process includes storing, picking, packing, shipping, and handling customer service for products. Marketing : expenses pertaining to advertising and marketing for Amazon and its products and services. Marketing expense is often grouped with selling, general, and administrative expenses (SG&A) but Amazon has chosen to break it out as its own line item. Technology and content: costs relating to operating Amazon’s AWS segment. General and administrative : operating expenses that are not directly related to producing Amazon’s products or services. These expenses are sometimes referred to as non-manufacturing costs or overhead costs. These include rent, insurance, managerial salaries, utilities, and other similar expenses. Other operating expenses, net: expenses primarily relating to the amortization of Amazon’s intangible assets. Operating income : the income left over after all operating expenses (expenses directly related to the operation of the business) are deducted. Also known as EBIT . Net Income: Interest income: income generated by Amazon from investing excess cash. Amazon typically invests excess cash in investment-grade , short to intermediate-term fixed income securities , and AAA-rated money market funds. Interest expense : expenses relating to accumulated interest from capital and finance lease obligations and long-term debt. Other income (expense), net: income or expenses relating to foreign currency and equity warrant valuations. Income before income taxes : Amazon’s income after operating and non-operating expenses have been deducted. Provision for income taxes: the expense relating to the amount of income tax Amazon must pay within the fiscal year . Equity-method investment activity, net of tax: proportionate losses or earnings from companies where Amazon owns a minority stake . Net income: the amount of income left over after Amazon has paid off all its expenses. Earnings per Share (EPS): Basic earnings per share : earnings per share calculated using the basic number of shares outstanding. Diluted earnings per share: earnings per share calculated using the diluted number of shares outstanding.  Weighted-average shares used in the computation of earnings per share: a weighted average number of shares to account for new stock issuances throughout the year. The way the calculation works is by taking the weighted average number of shares outstanding during the fiscal period covered. For example, a company has 100 shares outstanding at the beginning of the year. At the end of the first quarter, the company issues another 50 shares, bringing the total number of shares outstanding to 150. The calculation for the weighted average number of shares would look like below: 100*0.25 + 150*0.75 = 131.25 Basic: the number of shares outstanding in the market at the date of the financial statement. Diluted : the number of shares outstanding if all convertible securities (e.g. convertible preferred stock, convertible bonds ) are exercised. #3 Financial Statements Example – Balance SheetThe last statement we will look at with our financial statements examples is the balance sheet. The balance sheet shows the company’s assets , liabilities , and stockholders’ equity at a specific point in time. Learn how a world-class financial analyst uses these three financial statements with CFI’s Financial Modeling & Valuation Analyst (FMVA)® Certification Program !  Unlike the income statement and the cash flow statement, which display financial information for the company during a fiscal period, the balance sheet is a snapshot of the company’s finances at a specific point in time. It can be seen above in the line regarding the date. Compared to the Cash Flow Statement and Statement of Income, it states ‘December 31, 2017’ as opposed to ‘Year Ended December 31, 2017’. By displaying snapshots from different periods, the balance sheet shows changes in the accounts of a company. The following are explanations for the line items listed in Amazon’s balance sheet:  Cash and cash equivalents : cash or highly liquid assets and short-term commitments that can be quickly converted into cash. Marketable securities: short-term financial instruments that mature within a year. Inventories : goods currently held in stock for sale, in-process goods, and materials to be used in the production of goods or services. Accounts receivable , net and other: credit sales of a business that have not yet been fully paid by customers. Goodwill : the difference between the price paid in an acquisition of a company and the fair market value of the target company’s net assets. Other assets: Amazon’s acquired intangible assets, net of amortization. This includes items such as video, music content, and long-term deferred tax assets. Liabilities: Accounts payable : short-term liabilities incurred when Amazon purchases goods from suppliers on credit. Accrued expenses and other: liabilities primarily related to Amazon’s unredeemed gift cards, leases and asset retirement obligations, current debt, acquired digital media content, etc. Unearned revenue : revenue generated when payment is received for goods or services that have not yet been delivered or fulfilled. Unearned revenue is a result of revenue recognition principles outlined by U.S. GAAP and IFRS . Long-term debt: the amount of outstanding debt a company holds that has a maturity of 12 months or longer. Other long-term liabilities: Amazon’s other long-term liabilities, which include long-term capital and finance lease obligations, construction liabilities, tax contingencies, long-term deferred tax liabilities, etc. (Note 6 of Amazon’s 2017 annual report). Stockholders’ Equity: Preferred stock : stock issued by a corporation that represents ownership in the corporation. Preferred stockholders have a priority claim on the company’s assets and earnings over common stockholders. Preferred stockholders are prioritized with regard to dividends but do not have any voting rights in the corporation. Common stock : stock issued by a corporation that represents ownership in the corporation. Common stockholders can participate in corporate decisions through voting. Treasury stock , at cost: also known as reacquired stock, treasury stock represents outstanding shares that have been repurchased from the stockholder by the company. Additional paid-in capital : the value of share capital above its stated par value in the above line item for common stock ($0.01 in the case of Amazon). In Amazon’s case, the value of its issued share capital is $17,186 million more than the par value of its common stock, which is worth $5 million. Accumulated other comprehensive loss: accounts for foreign currency translation adjustments and unrealized gains and losses on available-for-sale/marketable securities. Retained earnings : the portion of a company’s profits that is held for reinvestment back into the business, as opposed to being distributed as dividends to stockholders. As you can see from the above financial statements examples, financial statements are complex and closely linked. There are many accounts in financial statements that can be used to represent amounts regarding different business activities. Many of these accounts are typically labeled “other” type accounts, such as “Other operating expenses, net”. In our financial statements examples, we examined how these accounts functioned for Amazon. Now that you have become more proficient in reading the financial statements examples, round out your skills with some of our other resources. Corporate Finance Institute has resources that will help you expand your knowledge and advance your career! Check out the links below: - Financial Modeling & Valuation Analyst (FMVA)® Certification Program

- Financial Analysis Fundamentals

- Three Financial Statements Summary

- Free CFI Accounting eBook

- See all accounting resources

- Share this article

Create a free account to unlock this TemplateAccess and download collection of free Templates to help power your productivity and performance. Already have an account? Log in Supercharge your skills with Premium TemplatesTake your learning and productivity to the next level with our Premium Templates. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs. Already have a Self-Study or Full-Immersion membership? Log in Access Exclusive TemplatesGain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more. Already have a Full-Immersion membership? Log in Login to your accountChange password, your password must have 8 characters or more and contain 3 of the following:. - a lower case character,

- an upper case character,

- a special character

Password Changed SuccessfullyYour password has been changed Create a new accountCan't sign in? Forgot your password? Enter your email address below and we will send you the reset instructions If the address matches an existing account you will receive an email with instructions to reset your password Request UsernameCan't sign in? Forgot your username? Enter your email address below and we will send you your username If the address matches an existing account you will receive an email with instructions to retrieve your username  Cookies Notification Our site uses Javascript to enchance its usability. You can disable your ad blocker or whitelist our website www.worldscientific.com to view the full content.Select your blocker:, adblock plus instructions. - Click the AdBlock Plus icon in the extension bar

- Click the blue power button

- Click refresh

Adblock Instructions- Click the AdBlock icon

- Click "Don't run on pages on this site"

uBlock Origin Instructions- Click on the uBlock Origin icon in the extension bar

- Click on the big, blue power button

- Refresh the web page

uBlock Instructions- Click on the uBlock icon in the extension bar

Adguard Instructions- Click on the Adguard icon in the extension bar

- Click on the toggle next to the "Protection on this website" text

Brave Instructions- Click on the orange lion icon to the right of the address bar

- Click the toggle on the top right, shifting from "Up" to "Down

Adremover Instructions- Click on the AdRemover icon in the extension bar

- Click the "Don’t run on pages on this domain" button

- Click "Exclude"

Adblock Genesis Instructions- Click on the Adblock Genesis icon in the extension bar

- Click on the button that says "Whitelist Website"

Super Adblocker Instructions- Click on the Super Adblocker icon in the extension bar

- Click on the "Don’t run on pages on this domain" button

- Click the "Exclude" button on the pop-up

Ultrablock Instructions- Click on the UltraBlock icon in the extension bar

- Click on the "Disable UltraBlock for ‘domain name here’" button

Ad Aware Instructions- Click on the AdAware icon in the extension bar

- Click on the large orange power button

Ghostery Instructions- Click on the Ghostery icon in the extension bar

- Click on the "Trust Site" button

Firefox Tracking Protection Instructions- Click on the shield icon on the left side of the address bar

- Click on the toggle that says "Enhanced Tracking protection is ON for this site"

Duck Duck Go Instructions- Click on the DuckDuckGo icon in the extension bar

- Click on the toggle next to the words "Site Privacy Protection"

Privacy Badger Instructions- Click on the Privacy Badger icon in the extension bar

- Click on the button that says "Disable Privacy Badger for this site"

Disconnect Instructions- Click on the Disconnect icon in the extension bar

- Click the button that says "Whitelist Site"

Opera Instructions- Click on the blue shield icon on the right side of the address bar

- Click the toggle next to "Ads are blocked on this site"

System Upgrade on Tue, May 28th, 2024 at 2am (EDT) World Scientific Series in Modern Finance: Advanced Topics in Finance for the Academician and Practitioner: Volume 1Cases in financial management. - Edited by:

- Ivan E Brick ( Rutgers Business School at Newark and New Brunswick, USA ) and

- Harvey A Poniachek ( Rutgers Business School at Newark and New Brunswick, USA )

- Add to favorites

- Download Citations

- Track Citations

- Recommend to Library

- Description

- Supplementary

Cases in Financial Management provides original case studies in corporate finance that are based on actual corporate events, and on the authors' teaching and consulting experiences. Accompanied by sophisticated and detailed proposed solutions, this case book sheds great clarity on the application of financial management and market principles for both students and professionals, including consultants, accountants and attorneys who are advising corporate clients. Sample Chapter(s) Preface Case 1: Advanced Micro Devices, Inc.: Financial Statement Analysis and Risk Assessment - Advanced Micro Devices, Inc.: Financial Statement Analysis and Risk Assessment (Ivan E Brick and Harvey A Poniachek)

- Trade Corporation SA (TradeCo) (Michael Samonas)

- Intel Corporation: Financial Modeling and Capital Funding Decisions (Harvey A Poniachek)

- Time Value of Money — Concepts and Applications. A Case Study: The General Motors Company Defined Benefit Pension Plan (Ivan E Brick and Mark W Guthner)

- Investors Bank and the Capital Asset Pricing Model (Ivan E Brick)

- Case Study on Cost of Capital (Roger J Grabowski and Todd Fries)

- Vitamin Shoppe Capital Budgeting Case (Ivan E Brick)

- A Scenario Analysis Case Study of Clavius Electronics Components, Inc. (Main Investment Rules) (Ronald Richter and Arthur S Guarino)

- ConocoPhillips: Real Options and Capital Budgeting (Harvey A Poniachek)

- Rutgers University's Pathway to Complete Renewable Electricity Generation (Mark Rodgers and Rosa Oppenheim)

- Microsoft Corporation Notes Offering Valuation (Harvey A Poniachek)

- PepsiCo, Inc. Stock Valuation (Harvey A Poniachek)

- Salesforce.Com Inc. Acquisition of Slack Technologies Inc.: Valuation of Firms (Harvey A Poniachek)

- Celgene Corporation: A Pharmaceutical Case Study in Financial Planning and Analysis (Lisa S Kaplowitz)

- Johnson & Johnson Capital Structure and Funding Decisions (Harvey A Poniachek)

- Starbucks Coffee Company: A Comprehensive Financial Analysis (Armand Gilinsky, Jr. and Raymond H Lopez)

- Starbucks: Dividends, Repurchases, or Lattes? (Susan White)

- Gateway Computers: Financing an Acquisition (Susan White)

- JetBlue Airways Corporation Aircraft Leasing versus Buying (Ivan E Brick and Harvey A Poniachek)

- Warrants and Convertibles (Elizabeth Chorvat and Terrence Chorvat)

- Gemini Electronics Company: Principles of Working Capital Management (Ronald Richter and Arthur S Guarino)

- Gadgets Co: Trade Finance Case Study (Alisa Rusanoff)

- The Takeover of Sterling Drug Company (Ingo Walter)

- The Acquisition of Bioverativ, Inc. by Sanofi, SA (Harvey A Poniachek)

- Green Landscape Inc., Leveraged Buyout (LBO) (Chris Droussiotis)

- Bank of America: Financial Options and Corporate Finance (Harvey A Poniachek)

- Commodity Risk at Domino's (Susan Hume)

- Financial Distress and Ch 11 Reorganization ()

- Apple Takes a Bite Out of Financing Using Interest Rate Swaps (Susan Hume)

- The Thor Corporation (Anoop Rai)

- Colgate-Palmolive Company's Risk Management (Harvey A Poniachek)

- Chapter 11 Case Study: Pacific Drilling, SA (Frank A Oswald, Edward D Wu, and Eitan E Blander)

- The Essentials of Business Formation and Choice-of-Entity Issues (Jay Soled)

- Determining Transfer Pricing Profits and Losses (Robert A Feinschreiber and Margaret Kent)

- FUJIFILM's Management of Research and Development Tax Credit (Peter F De Nicola)

Readership: Students, consultants, accountants and attorneys who are advising corporate clients. FRONT MATTER- Ivan E. Brick and

- Harvey A. Poniachek

- Pages: i–xxii

https://doi.org/10.1142/9789811216749_fmatter - About the Editors

- About the Contributors

Part I IntroductionCase 1: advanced micro devices, inc.: financial statement analysis and risk assessment. https://doi.org/10.1142/9789811216749_0001 - Introduction

- Financial Statement Analysis

- Risk Assessment

- Advanced Micro Devices, Inc. and Its Business

- The Assignment

Case 2: Trade Corporation SA (TradeCo)- Michael Samonas

- Pages: 19–26

https://doi.org/10.1142/9789811216749_0002 - General Information about Trade Corporation SA

- Bond Loan Term Sheet

- Problem Formulation

Case 3: Intel Corporation: Financial Modeling and Capital Funding Decisionshttps://doi.org/10.1142/9789811216749_0003 - Financial Planning and Funding Policy

- Intel’s Business

Part II Cost of CapitalCase 4: time value of money — concepts and applications. a case study: the general motors company defined benefit pension plan. - Mark W. Guthner

- Pages: 35–52

https://doi.org/10.1142/9789811216749_0004 - General Motors Company Defined Benefit Pension Plan

- Time Value of Money

Case 5: Investors Bank and the Capital Asset Pricing Model- Ivan E. Brick

- Pages: 53–60

https://doi.org/10.1142/9789811216749_0005 - Primer on the CAPM

- Investors Bank — Cost of Equity

Case 6: Case Study on Cost of Capital- Roger J. Grabowski and

- Pages: 61–105

https://doi.org/10.1142/9789811216749_0006 - Capital Structure — Weight of Debt and Equity

- Estimating the Cost of Common Equity

- Estimating the Cost of Debt

- Determination of the WACC

Part III Capital BudgetingCase 7: vitamin shoppe capital budgeting case. https://doi.org/10.1142/9789811216749_0007 Vitamin Shoppe is a retailer of over 17,000 nutritional supplements sold through its brick-and-mortar retail stores, e-commerce division, and manufacturing division. It was founded by Jeffrey Horowitz in 1977. The first store was located on the East Coast in New York City. There are over 775 Vitamin Shoppe stores nationwide (including in Puerto Rico) and its market share is 2.7%. Its main brick-and-mortar retail competitor, GNC, has a market share of 3.5%. Other mortar and brick competitors include Whole Foods, Natural Grocers, Sprouts Farmers Market, Vitamin World, Costco, Wal-Mart, Rite-Aid, CVS, and Walgreens. Vitamin Shoppe has launched its e-commerce store, vitaminshoppe.com, which operates as its own entity. The main competitors to vitaminshoppe.com are bodybuilding.com and vitaminworld.com. Other internet and mail order companies that directly compete with vitaminshoppe.com are Amazon.com, Puritan’s Pride, Vitacost.com, Bodybuilding.com, Doctors Trust, Swanson, and iHerb. As of December 31, 2016, Vitamin Shoppe has a total of 3,887 full-time and 1,616 part-time employees. Exhibit 1 provides a summary of key income statistics based upon the SEC 10K report that company filed for fiscal year 2016… Case 8: A Scenario Analysis Case Study of Clavius Electronics Components, Inc.- Ronald Richter and

- Arthur S. Guarino

- Pages: 115–121

https://doi.org/10.1142/9789811216749_0008 - Current Situation

- Price per Connector

- Quantity Demanded

- Fixed Costs (Overhead)

- Variable Costs per Connector

- Capital Required

- Net Working Capital Investment

- Other General Assumptions

Case 9: ConocoPhillips: Real Options and Capital Budgetinghttps://doi.org/10.1142/9789811216749_0009 - ConocoPhillips

- Traditional Capital Budgeting

- Real Options

- Appendix A. Initial Case

- Appendix B. Three Years Delay

Case 10: Rutgers University’s Pathway to Complete Renewable Electricity Generation- Mark Rodgers and

- Rosa Oppenheim

- Pages: 137–146

https://doi.org/10.1142/9789811216749_0010 - The Challenge

- What We Know About Rutgers University

- Additional Assumptions

- Appendix A. Linear Programming Tutorial

Part IV Valuation of Financial Assets, Projects, and FirmsCase 11: microsoft corporation notes offering valuation. https://doi.org/10.1142/9789811216749_0011 Mr. Andrew Dow has been Senior Managing Director at J. P. Morgan Securities LLC’s fixed income division for the past 5 years. He earned an undergraduate degree in mathematics from Rutgers and an MBA in finance from Wharton Business School over a decade ago. Since graduation, he has worked in the financial services industry, which includes investments analysis, risk management, design, and development of fixed income trading systems. He has extensive experience interacting with senior investment and trading personnel on performance evaluation and risk attribution of fixed-income investments, and thorough working knowledge of the industry’s databases and programming skills. Andrew was a senior member of the fixed-income investment team and was responsible for quantitative analysis, risk assessment, and measurement. He provided investment and market expertise to the trading desk and bank management, and quantitative analyst of fixed income, develops quantitative techniques, and supports the investment process and hedging through duration and liability matching… Case 12: PepsiCo, Inc. Stock Valuationhttps://doi.org/10.1142/9789811216749_0012 - Financial Data

- Appendix A. Valuation of Common Stocks

- The Income Approach

- The Market Approach

- Asset-Based Valuation

- Closing Comment

- Appendix. Unlevered and Relevered Betas

Case 13: Salesforce.Com Inc. Acquisition of Slack Technologies Inc.: Valuation of Firmshttps://doi.org/10.1142/9789811216749_0013 - Salesforce to Acquire Slack for $27.7 Billion

- Valuation Methodologies

- Appendix. Selected Historical Consolidated Financial Data of Slack

Case 14: Celgene Corporation: A Pharmaceutical Case Study in Financial Planning and Analysis- Lisa S. Kaplowitz

- Pages: 211–220

https://doi.org/10.1142/9789811216749_0014 - The Company

- Review of Historic Performance

- Forecasting for Next Year

Part V Long-Term FinancingCase 15: johnson & johnson capital structure and funding decisions. https://doi.org/10.1142/9789811216749_0015 - The Trade-off Theory of Capital Structure

- Alternative Theories

- Leverage and the Cost of Capital

- Johnson & Johnson Business

Case 16: Starbucks Coffee Company: A Comprehensive Financial Analysis- Armand Gilinsky, Jr. and

- Raymond H. Lopez

- Pages: 243–268

https://doi.org/10.1142/9789811216749_0016 - The Starbucks Story

- Starbucks Business

- Product Supply

- Beverage Consumption in the United States

- Competition

- Financial History

- Financial Performance

- Starbucks Management Expectations

- The Final Challenge

Case 17: Starbucks: Dividends, Repurchases, or Lattes?- Susan White

- Pages: 269–292

https://doi.org/10.1142/9789811216749_0017 - Starbucks’ Business

- Starbucks’ Strategy

- Starbucks’ Risks

- The Industry

- Starbucks’ Performance

- Stock Repurchases and Dividends

- Starbucks’ Financing Policy

- Growth or Value? Future Yields?

Case 18: Gateway Computers: Financing an Acquisitionhttps://doi.org/10.1142/9789811216749_0018 - Gateway Products

- Gateway Development and Intellectual Property

- Industry Competition

- eMachines Acquisition

- Gateway’s Operations and Financial Results

- Gateway’s Past Financing

- Gateway’s Current Financing

- Which Financing and How Much?

Case 19: JetBlue Airways Corporation Aircraft Leasing versus Buyinghttps://doi.org/10.1142/9789811216749_0019 - Part I. Leasing Versus Borrowing

- Part II. JetBlue Airways Corporation

- Part III. The Assignment

Case 20: Warrants and Convertibles- Elizabeth Chorvat and

- Terrence Chorvat

- Pages: 323–354

https://doi.org/10.1142/9789811216749_0020 This case addresses securities that allow the holders to acquire stock directly from the issuing corporation either by purchase (warrants) or by exchanging convertible debt of the corporation for its stock. One can deem warrants and convertible debt as two different types of the same category of securities. That is, convertible notes can be thought of as debt with an embedded warrant allowing one to view both of them as securities that allow the holder to purchase stock directly from the issuer. The case discusses when a corporation might want to issue these types of securities and examines in particular the issuances of convertible debt by Amazon and Tesla. These two examples illustrate different strategies for the use of these securities. Part VI Short-Term FinanceCase 21: gemini electronics company: principles of working capital management. https://doi.org/10.1142/9789811216749_0021 - Company History

- Current Condition

- Accounts Receivable

- Accounts Payable

- Financial Statements

- Principles of Working Capital Management

Case 22: Gadgets Co: Trade Finance Case Study- Alisa Rusanoff

- Pages: 373–382

https://doi.org/10.1142/9789811216749_0022 - Business Description

- Company Weaknesses

- Company’s Strengths

- The CFO Outlines the Following Difficulties That Gadgets Co Is Currently Facing

- Appendix: Informational Section

Part VII Mergers and AcquisitionsCase 23: the takeover of sterling drug company. - Ingo Walter

- Pages: 385–391

https://doi.org/10.1142/9789811216749_0023 - The Companies

- Buy-Side Advisory

- The Response (Defenses)

- Defense Advisory (Compensation)

- Ensuing Events

- The Outcome

- The Controversy

Case 24: The Acquisition of Bioverativ, Inc. by Sanofi, S.A.https://doi.org/10.1142/9789811216749_0024 - Assignment Questions and Required Analysis

- The Tender Offer and Merger Agreement

- Background of the Offer and Merger Discussion

- Reasons for Recommendation by Bioverativ Board

- Bioverativ Management Projections

- Fairness Opinions of Financial Advisors

- Detailed Discussion

Case 25: Green Landscape Inc., Leveraged Buyout (LBO)- Chris Droussiotis

- Pages: 449–453

https://doi.org/10.1142/9789811216749_0025 - Company Background

- LBO Transaction Overview

Part VIII Corporate Risk ManagementCase 26: bank of america: financial options and corporate finance. https://doi.org/10.1142/9789811216749_0026 - Introduction to Options

- Bank of America Corporation

- Appendix. Introduction to Hedging Using Financial Instruments

Case 27: Commodity Risk at Domino’shttps://doi.org/10.1142/9789811216749_0027 - Domino’s and the Futures Markets: Less Talk, More Delivery?

- Hedging the Price of Cheese

Case 28: Apple Takes a Bite Out of Financing Using Interest Rate Swapshttps://doi.org/10.1142/9789811216749_0028 - Financing Background

- Interest Rate Swap — What Is It?

- The Swap Rate and Yield Curve — How Are They Determined? Why Are They Important?

- An Example of a 5-Year Fixed Interest Rate Swap

- More About Swap Fixed Rates and the Forward Market

- Putting It All Together — Swap Fixed and Floating Rates

- Common Interest Rate Swap Lingo

Case 29: The Thor Corporationhttps://doi.org/10.1142/9789811216749_0029 Richard Mawby, Treasurer of the Thor Corporation, scheduled a meeting with his three junior associates to discuss the recent turbulence in the foreign exchange markets. In particular, he was worried about the exposure of the company’s receivables and payables denominated in foreign currencies… Case 30: Colgate-Palmolive Company’s Risk Managementhttps://doi.org/10.1142/9789811216749_0030 - Corporate Risk Management Approaches

- Colgate-Palmolive Company and Risk Management

Part IX Other Corporate IssuesCase 31: chapter 11 case study: pacific drilling, s.a.. - Frank A. Oswald ,

- Edward D. Wu , and

- Eitan E. Blander

- Pages: 525–554

https://doi.org/10.1142/9789811216749_0031 Chapter 11 of the Bankruptcy Code is entitled Reorganization and provides a mechanism by which companies can reorganize their capital structure and make certain operational adjustments, all while under the protection of the automatic stay. It is applicable in virtually all industries and has been used by corporations in a wide range of fields… Case 32: The Essentials of Business Formation and Choice-of-Entity Issueshttps://doi.org/10.1142/9789811216749_0032 - Summary of Tax Landscape

- Summary of Legal Concerns

Case 33: Determining Transfer Pricing Profits and Losses- Robert A. Feinschreiber and

- Margaret Kent

- Pages: 575–580

https://doi.org/10.1142/9789811216749_0033 - Transfer Pricing Methodologies

- Purposes of Ascertaining Transfer Pricing

- The Rancher — Underling Fact Pattern

- Rancher’s Land Utilization

- The Production Process

- The Rancher’s Enterprises and Structure

- The Assignment: Transfer Pricing Considerations

Case 34: FUJIFILM’s Management of Research and Development Tax Credit- Peter F. De Nicola

- Pages: 581–590

https://doi.org/10.1142/9789811216749_0034 - FUJIFILM’s Section 41 Experience

BACK MATTERhttps://doi.org/10.1142/9789811216749_bmatter Professor Ivan Brick joined Rutgers Business School, Newark and New Brunswick, in 1978. He has been the Chair of the Finance and Economics department since 1996. Professor Brick has published numerous papers in academic journals, such as the Journal of Finance , Journal of Financial Quantitative Analysis , International Economic Review , Review of Economics and Statistics , Journal of Industrial Economics , Journal of Corporate Finance , and Financial Management . His research interests include corporate finance, optimal security design and corporate governance. Currently, he is an associate editor for the Review of Quantitative Finance and Accounting . Previously, he has served as an Associate Editor of Financial Management and Multinational Finance Journal . Professor Brick has received several teaching awards at the Rutgers Business School. He received the "Outstanding Educator Award" by the 1995 Executive MBA Class. Professor Brick was awarded the "Farrokh Langdana Excellence in Teaching Award" by the 2011 MBA Class. In 2012, the Newark Undergraduate Program awarded him the Dean's Advisory Council Award for the "Most Knowledgeable Finance Professor", "The Most Caring Finance Professor", as well as "The Most Motivational Finance Professor". For his outstanding service, Professor Brick was awarded the RBS Dean's Service Award in 2013 and 2016. Professor Brick received the designation of Dean's Professor of Business in the fall of 2017. Professor Harvey A Poniachek is a PhD economist, University at Albany of the State University of New York, with corporate experience in consulting, banking and financial markets, professor of corporate finance and economics and is author of books and professional articles. He is currently an Assistant Professor of Professional Practice of Finance & Economics at Rutgers Business School. Previously, he was the Director of Valuation Services at RSM McGladrey, Inc. New York, involved in valuation of financial derivatives, private equity, and inter-company pricing. He has worked for the US Treasury Department as Lead Economist in the area of transfer pricing, and was engaged in valuation of intellectual property and tangible assets; was Senior Manager and Economist at E&Y; and VP & Economist at Bank of America, where he gained extensive experience in the banking industry and capital markets, and advised multinational companies and senior management on currency and money market trends, trading strategies, foreign country risk and opportunities. Professor Poniachek has taught corporate finance, financial management, international finance and economics at New York University's Stern School of Business, the City University of New York's Baruch College, and at Pace University, Lubin School of Business. He has published widely, with his published works including books, such as Mergers and Acquisitions (World Scientific); International Corporate Finance (Routledge, London); Cases in International Finance (John Wiley); and Direct Foreign Investment in the United States (Simon & Schuster), chapters in books, including "The International Financial Markets" in Handbook of International Business (John Wiley) and "Foreign Exchange Rate Determination in International Finance Handbook (John Wiley), and articles, such as "Medtronic Revisited: Outcome Under OECD's BEPS Recommendations", Bloomberg BNA, Tax Management Transfer Pricing Report ; "A New Paradigm for Intellectual Property Ownership and the Implication on MNEs' Intercompany Transactions", International Transfer Pricing Journal , BNA; and "Coping with Expanding State Transfer Pricing Rules", The CPA Journal .  Related Books Lecture Notes in Behavioral Finance Behavioral Finance Financial Strategies and Topics in Finance Valuation and Financial Forecasting Stock Markets and Corporate Finance Global Corporate Finance Corporate Policies in a World with Information Asymmetry Lectures on Corporate Finance Finance in Non-financial Problems The Singapore Blue Chips The Great Recession An Introduction to Accounting and Managerial Finance Case Studies for Corporate Finance Advances in Quantitative Analysis of Finance and Accounting World Scientific Reference on Contingent Claims Analysis in Corporate Finance Lecture Notes in Introduction to Corporate Finance M&A for Value Creation in Japan Metals and Energy Finance- Browse All Articles

- Newsletter Sign-Up

- 17 Sep 2024

- Cold Call Podcast

Fawn Weaver’s Entrepreneurial Journey as an Outsider in the Spirits IndustryIn 2017 Fawn Weaver launched a premium American whiskey brand, Uncle Nearest. It became the fastest growing and most awarded whiskey brand in America, despite the challenges Weaver faced as a Black woman and outsider to the spirits industry, which is capital-intensive, highly regulated, competitive, and male-dominated. In October 2023, Weaver announced plans to expand into cognac with the goal of building the next major alcoholic beverages conglomerate. But the company was still heavily reliant on capital. How could Weaver convince new investors that her plans for cognac would yield success? Harvard Business School senior lecturer Hise Gibson discusses Weaver’s leadership style, growth strategies, and her use of storytelling to connect customers with her brand in the case, "Uncle Nearest: Creating a Legacy."  - 29 Aug 2024

- Research & Ideas

Shoot for the Stars: What to Know About the Space EconomyOuter space has come a long way since the 1960s. Matthew Weinzierl explains the current state of the space economy, highlighting the various opportunities for businesses hidden among the stars.  Reading the Financial Crisis Warning Signs: Credit Markets and the 'Red-Zone'While fears about slowing economic growth have roiled stock markets in recent weeks, credit markets remain stable and bullish, and a recession hasn't materialized as some analysts predicted. Robin Greenwood discusses the market conditions that are buoying the economy—and risk signals to watch.  Angel City Football Club: A New Business Model for Women’s SportsAngel City Football Club (ACFC) was founded in 2020 by venture capitalist Kara Nortman, entrepreneur Julie Uhrman, and actor and activist Natalie Portman. As outsiders to professional sports, the all-female founding team had rewritten the playbook for how to build a sports franchise by applying lessons from the tech and entertainment industries. Unlike typical sports franchises that built their teams and track records over many years before extending their brand beyond a local base, ACFC had inverted the model, generating both global and local interest in the club during its first three years. The club’s early success was reflected in its market valuation of $250 million as of its sale in July 2024 — the highest in the National Women’s Soccer League. Equally important, ACFC had started to bend the curve toward greater pay equity in women’s sports — the club’s ultimate goal. But the founders knew there was much more to do to capitalize on the club’s momentum. As they developed ACFC’s first three-year strategic plan in 2024, they weighed the most effective ways to build value for the franchise. Was it better to allocate the incremental budget to investments in digital brand building or to investments in the on-field product? Senior Lecturer Jeffrey Rayport is joined by case co-author Nicole Keller and club co-founder Kara Nortman to discuss the case, “Angel City Football Club: Scoring a New Model.”  Watching for the Next Economic Downturn? Follow Corporate DebtRising household debt alone isn't enough to predict looming economic crises. Research by Victoria Ivashina examines the role of corporate debt in fiscal crashes since 1940.  Forgiving Medical Debt Won't Make Everyone HappierMedical debt not only hurts credit access, it can also harm one's mental health. But a study by Raymond Kluender finds that forgiving people's bills—even $170 million of debt—doesn't necessarily reduce stress, financial or otherwise.  Weighing Digital Tradeoffs in Private EquityPrivate equity firms often streamline the operations of portfolio companies, but cost-cutting isn't the only road to efficiency. The right technology improvements can increase the value of PE investments, says research by Brian Baik and Suraj Srinivasan.  Non-Fungible Tokens (NFTs) and Brand BuildingNon-fungible tokens (NFTs), which allow individuals to own their digital assets and move them from place to place, are changing the interaction between consumers and digital goods, brands, and platforms. Professor Scott Duke Kominers and tech entrepreneur Steve Kaczynski discuss the case, “Bored Ape Yacht Club: Navigating the NFT World,” and the related book they co-authored, The Everything Token: How NFTs and Web3 Will Transform The Way We Buy, Sell, And Create. They focus on the rise and popularity of the Bored Ape Yacht Club NFTs and the new model of brand building created by owning those tokens.  Are Management Consulting Firms Failing to Manage Themselves?In response to unprecedented client demand a few years ago, consulting firms went on a growth-driven hiring spree, but now many of these firms are cutting back staff. David Fubini questions whether strategy firms, which are considered experts at solving a variety of problems for clients, are struggling to apply their own management principles internally to address their current challenges.  How Natural Winemaker Frank Cornelissen Innovated While Staying True to His BrandIn 2018, artisanal Italian vineyard Frank Cornelissen was one of the world’s leading producers of natural wine. But when weather-related conditions damaged that year’s grapes, founder Frank Cornelissen had to decide between staying true to the tenets of natural wine making or breaking with his public beliefs to save that year’s grapes by adding sulfites. Harvard Business School assistant professor Tiona Zuzul discusses the importance of staying true to your company’s principles while remaining flexible enough to welcome progress in the case, Frank Cornelissen: The Great Sulfite Debate.  Central Banks Missed Inflation Red Flags. This Pricing Model Could Help.The steep inflation that plagued the economy after the COVID-19 pandemic took many economists by surprise. But research by Alberto Cavallo suggests that a different method of tracking prices—a real-time model—could predict future surges better.   What Your Non-Binary Employees Need to Do Their Best WorkHow can you break down gender boundaries and support the non-binary people on your team better? A study by Katherine Coffman reveals the motivations and aspirations of non-binary employees, highlighting the need for greater inclusion to unlock the full potential of a diverse workforce.  How One Insurtech Firm Formulated a Strategy for Climate ChangeThe Insurtech firm Hippo was facing two big challenges related to climate change: major loss ratios and rate hikes. The company used technologically empowered services to create its competitive edge, along with providing smart home packages, targeting risk-friendly customers, and using data-driven pricing. But now CEO and president Rick McCathron needed to determine how the firm’s underwriting model could account for the effects of high-intensity weather events. Harvard Business School professor Lauren Cohen discusses how Hippo could adjust its strategy to survive a new era of unprecedented weather catastrophes in his case, “Hippo: Weathering the Storm of the Home Insurance Crisis.”  When Does Impact Investing Make the Biggest Impact?More investors want to back businesses that contribute to social change, but are impact funds the only approach? Research by Shawn Cole, Leslie Jeng, Josh Lerner, Natalia Rigol, and Benjamin Roth challenges long-held assumptions about impact investing and reveals where such funds make the biggest difference.  More Than Memes: NFTs Could Be the Next Gen Deed for a Digital WorldNon-fungible tokens might seem like a fad approach to selling memes, but the concept could help companies open new markets and build communities. Scott Duke Kominers and Steve Kaczynski go beyond the NFT hype in their book, The Everything Token.  How Can Financial Advisors Thrive in Shifting Markets? Diversify, Diversify, DiversifyFinancial planners must find new ways to market to tech-savvy millennials and gen Z investors or risk irrelevancy. Research by Marco Di Maggio probes the generational challenges that advisory firms face as baby boomers retire. What will it take to compete in a fintech and crypto world?  ‘Not a Bunch of Weirdos’: Why Mainstream Investors Buy CryptoBitcoin might seem like the preferred tender of conspiracy theorists and criminals, but everyday investors are increasingly embracing crypto. A study of 59 million consumers by Marco Di Maggio and colleagues paints a shockingly ordinary picture of today's cryptocurrency buyer. What do they stand to gain?  Money Isn’t Everything: The Dos and Don’ts of Motivating EmployeesDangling bonuses to checked-out employees might only be a Band-Aid solution. Brian Hall shares four research-based incentive strategies—and three perils to avoid—for leaders trying to engage the post-pandemic workforce.  Elon Musk’s Twitter Takeover: Lessons in Strategic ChangeIn late October 2022, Elon Musk officially took Twitter private and became the company’s majority shareholder, finally ending a months-long acquisition saga. He appointed himself CEO and brought in his own team to clean house. Musk needed to take decisive steps to succeed against the major opposition to his leadership from both inside and outside the company. Twitter employees circulated an open letter protesting expected layoffs, advertising agencies advised their clients to pause spending on Twitter, and EU officials considered a broader Twitter ban. What short-term actions should Musk take to stabilize the situation, and how should he approach long-term strategy to turn around Twitter? Harvard Business School assistant professor Andy Wu and co-author Goran Calic, associate professor at McMaster University’s DeGroote School of Business, discuss Twitter as a microcosm for the future of media and information in their case, “Twitter Turnaround and Elon Musk.”  The Opioid Crisis, CEO Pay, and Shareholder ActivismIn 2020, AmerisourceBergen Corporation, a Fortune 50 company in the drug distribution industry, agreed to settle thousands of lawsuits filed nationwide against the company for its opioid distribution practices, which critics alleged had contributed to the opioid crisis in the US. The $6.6 billion global settlement caused a net loss larger than the cumulative net income earned during the tenure of the company’s CEO, which began in 2011. In addition, AmerisourceBergen’s legal and financial troubles were accompanied by shareholder demands aimed at driving corporate governance changes in companies in the opioid supply chain. Determined to hold the company’s leadership accountable, the shareholders launched a campaign in early 2021 to reject the pay packages of executives. Should the board reduce the executives’ pay, as of means of improving accountability? Or does punishing the AmerisourceBergen executives for paying the settlement ignore the larger issue of a business’s responsibility to society? Harvard Business School professor Suraj Srinivasan discusses executive compensation and shareholder activism in the context of the US opioid crisis in his case, “The Opioid Settlement and Controversy Over CEO Pay at AmerisourceBergen.”  - SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

HBS Case Selections NIO: A Chinese EV Company's Global Strategy- William C. Kirby

- Noah B. Truwit

India: Will the Giant Emerge?- Christian H.M. Ketels

- Radhika Kak

JPMorgan Chase in Paris- Joseph L. Bower

- Dante Roscini

- Elena Corsi

- Michael Norris

OpenAI: Idealism Meets Capitalism- Shikhar Ghosh

- Shweta Bagai

Generative AI and the Future of Work- Christopher Stanton

- Matt Higgins

Copilot(s): Generative AI at Microsoft and GitHub- Frank Nagle

- Shane Greenstein

- Maria P. Roche

- Nataliya Langburd Wright

- Sarah Mehta

Innovation at Moog Inc.- Brian J. Hall

- Ashley V. Whillans

- Davis Heniford

- Dominika Randle

- Caroline Witten

Innovation at Google Ads: The Sales Acceleration and Innovation Labs (SAIL) (A)- Linda A. Hill

- Emily Tedards

Juan Valdez: Innovation in Caffeination- Michael I. Norton

- Jeremy Dann

UGG Steps into the Metaverse- Shunyuan Zhang

- Sharon Joseph

- Sunil Gupta

- Julia Kelley

Metaverse WarsRoblox: Virtual Commerce in the Metaverse- Ayelet Israeli

- Nicole Tempest Keller

Timnit Gebru: "SILENCED No More" on AI Bias and The Harms of Large Language Models- Tsedal Neeley

- Stefani Ruper

Hugging Face: Serving AI on a PlatformSmartOne: Building an AI Data Business- Karim R. Lakhani

- Pippa Tubman Armerding

- Gamze Yucaoglu

- Fares Khrais

Honeywell and the Great Recession (A)- Sandra J. Sucher

- Susan Winterberg

Target: Responding to the Recession- Ranjay Gulati

- Catherine Ross

- Richard S. Ruback

- Royce Yudkoff

Hometown Foods: Changing Price Amid Inflation- Julian De Freitas

- Jeremy Yang

- Das Narayandas

Elon Musk's Big BetsElon Musk: Balancing Purpose and RiskTesla's ceo compensation plan. - Krishna G. Palepu

- John R. Wells

- Gabriel Ellsworth

China Rapid Finance: The Collapse of China's P2P Lending Industry- Bonnie Yining Cao

- John P. McHugh

Forbidden City: Launching a Craft Beer in China- Christopher A. Bartlett

- Carole Carlson

Booking.com- Stefan Thomke

- Daniela Beyersdorfer

Innovation at Uber: The Launch of Express POOL- Chiara Farronato

- Alan MacCormack

Racial Discrimination on Airbnb (A)- Michael Luca

- Scott Stern

- Hyunjin Kim

Unilever's Response to the Future of Work- William R. Kerr

- Emilie Billaud

- Mette Fuglsang Hjortshoej

AT&T, Retraining, and the Workforce of Tomorrow- Joseph B. Fuller

- Carl Kreitzberg

Leading Change in Talent at L'Oreal- Lakshmi Ramarajan

- Vincent Dessain

- Emer Moloney

- William W. George

- Andrew N. McLean

Eve Hall: The African American Investment Fund in Milwaukee- Steven S. Rogers

- Alterrell Mills

United Housing - Otis GatesThe Home Depot: Leadership in Crisis Management- Herman B. Leonard

- Marc J. Epstein

- Melissa Tritter

The Great East Japan Earthquake (B): Fast Retailing Group's Response- Hirotaka Takeuchi

- Kenichi Nonomura

- Dena Neuenschwander

- Meghan Ricci

- Kate Schoch

- Sergey Vartanov

Insurer of Last Resort?: The Federal Financial Response to September 11- David A. Moss

- Sarah Brennan

Under Armour- Rory McDonald

- Clayton M. Christensen

- Daniel West

- Jonathan E. Palmer

- Tonia Junker

Hunley, Inc.: Casting for Growth- John A. Quelch

- James T. Kindley

Bitfury: Blockchain for GovernmentDeutsche Bank: Pursuing Blockchain Opportunities (A)- Lynda M. Applegate

- Christoph Muller-Bloch

Maersk: Betting on BlockchainYum! Brands- Jordan Siegel

- Christopher Poliquin

Bharti Airtel in AfricaLi & Fung 2012- F. Warren McFarlan

- Michael Shih-ta Chen

- Keith Chi-ho Wong

Sony and the JK Wedding Dance- John Deighton

- Leora Kornfeld

United Breaks GuitarsDavid dao on united airlines. - Benjamin Edelman

- Jenny Sanford

Marketing Reading: Digital MarketingSocial Strategy at Nike- Mikolaj Jan Piskorski

- Ryan Johnson

The Tate's Digital TransformationSocial strategy at american express, mellon financial and the bank of new york. - Carliss Y. Baldwin

- Ryan D. Taliaferro

The Walt Disney Company and Pixar, Inc.: To Acquire or Not to Acquire?- Juan Alcacer

- David J. Collis

Dow's Bid for Rohm and HaasFinance Reading: The Mergers and Acquisitions ProcessApple: Privacy vs. Safety? (A)- Henry W. McGee

- Nien-he Hsieh

- Sarah McAra

Sidewalk Labs: Privacy in a City Built from the Internet UpData Breach at Equifax- Suraj Srinivasan

- Quinn Pitcher

- Jonah S. Goldberg

Apple's CoreDesign Thinking and Innovation at AppleApple Inc. in 2012Iz-Lynn Chan at Far East Organization (Abridged)- Anthony J. Mayo

- Dana M. Teppert

Barbara Norris: Leading Change in the General Surgery Unit- Boris Groysberg

- Nitin Nohria

- Deborah Bell

Adobe Systems: Working Towards a "Suite" Release (A)- David A. Thomas

- Lauren Barley

Home Nursing of North CarolinaCastronics, llc, gemini investors, angie's list: ratings pioneer turns 20. Basecamp: Pricing- Frank V. Cespedes

- Robb Fitzsimmons

J.C. Penney's "Fair and Square" Pricing StrategyJ.c. penney's 'fair and square' strategy (c): back to the future. Osaro: Picking the best path- James Palano

- Bastiane Huang

HubSpot and Motion AI: Chatbot-Enabled CRMGROW: Using Artificial Intelligence to Screen Human Intelligence- Ethan S. Bernstein

- Paul D. McKinnon

- Paul Yarabe

GitLab and the Future of All-Remote Work (A)- Prithwiraj Choudhury

- Emma Salomon

TCS: From Physical Offices to Borderless WorkCreating a virtual internship at goldman sachs. - Iavor Bojinov

- Jan W. Rivkin

Starbucks Coffee Company: Transformation and Renewal- Nancy F. Koehn

- Kelly McNamara

- Nora N. Khan

- Elizabeth Legris

JCPenney: Back in Business- K. Shelette Stewart

- Christine Snively

Arup: Building the Water Cube- Robert G. Eccles

- Amy C. Edmondson

- Dilyana Karadzhova

(Re)Building a Global Team: Tariq Khan at TekManaging a global team: greg james at sun microsystems, inc. (a). Organizational Behavior Reading: Leading Global TeamsRon ventura at mitchell memorial hospital. Anthony Starks at InSiL Therapeutics (A)- Gary P. Pisano

- Vicki L. Sato

Wolfgang Keller at Konigsbrau-TAK (A)The 2010 Chilean Mining Rescue (A)IDEO: Human-Centered Service Design- Ryan W. Buell

- Andrew Otazo

- Benjamin Jones

- Alexis Brownell

Midland Energy Resources, Inc.: Cost of Capital- Timothy A. Luehrman

- Joel L. Heilprin

Globalizing the Cost of Capital and Capital Budgeting at AES- Mihir A. Desai

- Doug Schillinger

Cost of Capital at Ameritrade- Mark Mitchell

- Erik Stafford

Finance Reading: Cost of CapitalCircles: series d financing. - Paul W. Marshall

- Kristin J. Lieb

- William A. Sahlman

- Michael J. Roberts

Andreessen HorowitzEntrepreneurship Reading: Partnering with Venture Capitalists David Neeleman: Flight Path of a Servant Leader (A)Coach Hurley at St. Anthony High School- Scott A. Snook

- Bradley C. Lawrence

Shapiro Global- Michael Brookshire

- Monica Haugen

- Michelle Kravetz

- Sarah Sommer

Kathryn McNeil (A)- Joseph L. Badaracco Jr.

- Jerry Useem

Carol Fishman Cohen: Professional Career Reentry (A)- Myra M. Hart

- Robin J. Ely

- Susan Wojewoda

Alex Montana at ESH Manufacturing Co.Michelle Levene (A)- Tiziana Casciaro

- Victoria W. Winston

John and Andrea Rice: Entrepreneurship and Life- Howard H. Stevenson

- Janet Kraus

- Shirley M. Spence

Partner CenterAcademia.edu no longer supports Internet Explorer. To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser . Enter the email address you signed up with and we'll email you a reset link.  Case Study on Fundamentals of FINANCIAL MANAGEMENT Case studies are a form of problem-based learning, where you present a situation that needs a resolution. A typical business case study is a detailed account, or story, of what happened in a particular company, industry, or project over a set period of time. The learner is given details about the situation, often in a historical context. The key players are introduced. Objectives and challenges are outlined. This is followed by specific examples and data, which the learner then uses to analyze the situation, determine what happened, and make recommendations. The depth of a case depends on the lesson being taught. A case study can be two pages, or 20 or more pages. A good case study makes the reader think critically about the information presented, and then develop a thorough assessment of the situation, leading to a well-thought-out solution or recommendation. Pick a company with which you are familiar (preferably the one you wrote about for your first paper), either by working for it or by a close family member working for it. Write a paper about it with the following sections: Related Papers Sreeramana Aithal Many business schools have adopted case method in management research and in teaching pedagogy with the belief that it is a most powerful way to study and learn new lessons required to identify, understand, and solve the problems in the process of managing and leading the organizations. Analysing business cases of companies force students to grapple with exactly the kinds of situations, decisions, and dilemmas managers confront every day. A good business case will include the problem, identify all the possible options to solve the problem, and provides adequate information along with uncertainties to the decision-makers to choose which course of action will be best for the organisation. Case analysis is a participatory method in which the students play a lead role in their own and each other's learning. The instructors moderate the discussions ask questions, monitors the dialogue, supports debate, and records the frameworks used for analysing situations, concepts, models, strategies used in the problem of the system/organization to engage students in a decision-making process of a challenging, interactive learning environment. Both types of cases can be analysed in a classroom setup provided the instructor finds them as appropriate for the topic and subject under discussion. Company analysis is a powerful tool in developing both research case study and teaching case study in business management subject. In this paper, we have discussed the case studies based on company analysis, case studies published by top publishers on company analysis, difference between research case study and teaching case study, company analysis as a methodology in management research, an effective method of developing research case studies based on company analysis using a framework for research case study based on company analysis, and the possible recommendations based on analysis. Nadine Álvarez Montoya Rossad Ferdinand Marlisa Abdul Rahim Social science researchers have made wide use of case study method to investigate contemporary real-life situations and provide the basis for the application of ideas and extension of methods. Hence, this article discusses several aspects of case study method in business. These include the definition, types and design of case study. It also confers on data collection method in case study that discusses in detail about interview, observation, and document analysis. The quality in case study and previous research that relate with case study also converse in this article. This study contributes and assists individuals or researchers to obtain ideas particularly in studies of real-life context governing social issues and problems. Journal of Management Education Journal Of Business Management & Social Sciences Research sita ramanjaneyulu mantha Management Education is dynamic in nature and need diverse information to handle different management problems. Management student’s should undergo in depth training to learn the management concepts. To understand the peculiar situations and to handle them effectively, case studies are widely used. The case study method helps the students in developing wisdom and gives lot of scope for application of knowledge. The purpose of the case method is to bring into the classroom “a chunk of reality, ”which is complex and multi faced, it follows that teaching cases should present, as a whole, a balanced view of the many dimensions of the organizational life. Assessment of Qualitative SAGE Research Methods Foundations [online] Mark N K Saunders , Bill Lee Despite having a relatively recent history compared to other social sciences, the business and management field has proliferated into a number of largely independent disciplines. These include: accounting; corporate governance; entrepreneurship; finance; human resource management; international business and international management; leadership; management and business history; marketing and retail; operations and logistics; organizational behaviour; public management and governance; and strategy. Each of these disciplines has its own methodological predilections and as a corollary, a view of what constitutes a case study, where case studies should feature in a research project and the relative usefulness of case study research. Given this breadth of disciplines, only a provisional definition of a case study will be provided at this point; namely, a case study is research into a phenomenon, organization, process, or event that is studied as a unit of analysis that is interesting in its own right. Rather than attempting to summarise all that has been written about case studies across the management disciplines, this entry will elaborate upon thinking around this definition using the metaphor of a kaleidoscope. Robert Klonoski While case studies appear frequently in business classrooms as learning exercises, they appear only infrequently in scholarly journals as an accepted basis on which to demonstrate a theory or test a hypothesis. While scholars have contributed much in recent years to improving the rigor and design of business case studies, this research approach may yet be underutilized. The academic approach to the study of law in the US and England draws heavily on the use of case studies; management scholars may benefit from an understanding of the ways in which lawyers construct, analyze, and draw lessons from cases. Loading Preview Sorry, preview is currently unavailable. You can download the paper by clicking the button above. Case Studies - Financial Management | Business Studies (BST) Class 12 - Commerce PDF Download | 1 Crore+ students have signed up on EduRev. Have you? | | As a student of business studies, you are expected to learn about the various aspects of management, such as planning, organizing, staffing, directing, and controlling. Case studies are an essential part of the Class 12 Business Studies curriculum as they provide students with an opportunity to apply theoretical knowledge to practical situations. Let's see some Case Study Questions on Financial Management of Business Studies.  Q. 1. Arun is a successful businessman in the paper industry. During his recent visit to his friend’s place in Mysore, he was fascinated by the exclusive variety of incense sticks available there. His friend tells him that Mysore region in known as a pioneer in the activity of Agarbathi manufacturing because it has a natural reserve of forest products especially Sandalwood to provide for the base material used in production. Moreover, the suppliers of other types of raw material needed for production follow a liberal credit policy and the time required to manufacture incense sticks is relatively less. Considering the various factors, Arun decides to venture into this line of business by setting up a manufacturing unit in Mysore. In context of the above case: - Identify of the above case:

- Identify the three factors mentioned in the paragraph which are likely to affect the working capital requirements of his business.

- Investment decision has been taken by Arun. Investment decision seeks to determine as to how the firm’s funds are invested in different assets. It helps to evaluate new investment proposals and select the best option on the basis of associated risk and return. Investment decision can be long term or short-term. A long-term investment decision is also called a Capital Budgeting decision

- The three factors mentioned in the paragraph which are likely to reduce the working capital requirements of his business are as follows:

- Available of raw material:

- Production cycle:

- Credit availed:

Q. 2. ‘Adwitiya’ is a company enjoying market leadership in the food brands segment. It’s portfolio includes three categories in the Foods business namely Snack Foods, Juices and Confectionery. Keeping in the with the growing demand for packaged food it now plans to introduce ready-To-Eat Foods. Therefore, the company has planned to undertake investments of nearly Rs. 450 crores for its new line of business. As per the current financial report, the interest coverage ratio of the company and return on investment is higher. Moreover, the corporate tax rate is high. - As a financial manager of the company, which source of finance will you opt for debt or equity, to raise the required amount of capital? Explain by giving any two suitable reasons in support of your answer.

- Why are the shareholder’s of the company like to gain from the issue of debt by the company?

1. As a financial manager of the company, I will opt for debt to raise the required amount of capital. I support my decision by giving the following reasons: 2. The shareholders of the company are likely to gain from the issue of debt by the company because the return on investment is higher. It helps a company to take advantage of trading on equity to increase the earnings per share. Q. 3. Computer Tech Ltd., is one of the leading information technology outsourcing services providers in India. The company provides business consultancy and outsourcing services to its clients. Over the past five years the company has been paying dividends at high rate to its shareholders. However, this year, although the earnings of the company are high, its liquidity position is not so good. Moreover, the company plans to undertake new ventures in order to expand its business. - Give any three reasons because of which you think Computer Tech Ltd. has been paying dividends at high rate to its shareholders over the past five years.

- Comment upon the likely dividend policy of the company this years by stating any two reasons in support of your answer.

- Cash flow position:

- Access to capital market:

- This year the company is likely to follow a conservative dividend policy because of the following reasons:

- The cash flow position of the company is not god and dividends are paid in cash.

- The company may like to retain profits to finance its expansion projects. Retained profits do not involve any explicit cost and are considered to be the cheapest source of finance.

Q. 4. Bhuvn inherited a very large area of agricultural land in Haryana after the death of his grandfather. He plans to sell this piece of land and use the money to set up a small scale paper factory to manufacture all kinds of stationary items from recycled paper. Being an amateur in business, he decides to consult his friend Subhash who works in a financial consultancy firm. Subhash helps him to prepare a blue print of his future business operations on the basis of sales forecast in next five years. Based on these estimates, he helps Bhuvan to assess the fixed and working capital requirements of business. - Identify the type of financial service that Subhash has offered to Bhuvan.

- Briefly state any four points highlighting the importance of the type of financial service identified in part (a)

- Financial planning is the type of financial service that Subhash has offered to Bhuvan.

- The four points highlighting the importance of financial planning are as follows:

- It ensures smooth running of a business enterprise by ensuring availability of funds at the right time.

- It helps in anticipating future requirements of a funds and evading business shocks and surprises.

- It facilitates co-ordination among various departments of an enterprise like marketing and production function, through well-defined policies and procedures.

- It increases the efficiency of operations by curbing wastage of funds, duplication of efforts, and gaps in planning.

Q. 5. ‘Madhur Milan’ is a popular online matrimonial portal. It seeks to provide personalized match making service. The company has 80 offices in India, and is now planning to open offices in Singapore, Dubai and Canada to cater to its customers beyond the country. The company has decided to opt for the sources of equity capital to raise the required amount of capital. - Identify and explain the type of risk which increases with the higher use of debt.

- Explain briefly any four factors because of which you think the company has decided to opt for equity capital.

- Financial risk of the company increases with the higher use of debt. This is because issue of debt involves fixed commitment in terms of payment of interest and repayment of capital. Financial risk refers to a situation when a company is unable to meet its fixed financial charges.

- The factors because of which the company has decided to opt for equity capital are as follows:

- Capital market conditions:

- Fixed operating cost:

Q. 6. Wooden Peripheral Pvt. Ltd. is counted among the top furniture companies in Delhi. It is known for offering innovative designs and high quality furniture at affordable prices. The company deals in a wide product range of home and office furniture through its eight showrooms in Delhi. The company is now planning to open five new showrooms each in Mumbai and Bangalore. In Bangalore it intends to take the space for the showrooms on lease whereas for opening showrooms in Mumbai, it has collaborated with a popular home furnishing brand, ‘Creations.’ - Identify the factors mentioned in the paragraph which are likely to affect the fixed capital requirements of the business for opening new showrooms both in Bangalore and Mumbai separately.

- “With an increase in the investment in fixed assets, there is a commensurate increase in the working capital requirement.” Explain the statement with reference to the case above.

1. The fixed capital requirements of Wooden Peripheral Pvt. Ltd. for opening new showrooms in Bangalore will be relatively less as its taking space on lease, so only rentals have to be paid. Similarly, its fixed capital requirement for opening showrooms in Mumbai will be reduced as its going to share the costs with another company through collaboration. 2. It’s true that, “ With an increase in the investment in fixed assets, there is a commensurate increase in the working capital requirements,” Like in the above case, Wooden Peripheral Pvt. Ltd. is planning to investment in new showrooms. Consequently, its requirement of working capital will increase s it will need more money to stock goods, pay electricity bills and salaries to staff. Also, it intends to take the space for the showrooms I Mumbai on lease so it will have to pay rentals. Q. 7. Krishna Ltd. is manufacturing steel at its plant at Noida. Due to economic growth, the demand for steel is also growing. The company is planning to set up a new steel plant at Gurgaon. It needs Rs. 800 crore to start the new plant. It decides to raise Rs. 300 crore through debentures, Rs. 200 crore through long-term loan from banks and Rs. 200 crore by issue of equity share to the public. It decided to finance the remaining amount by utilizing its reserves and surplus. - State the importance of financial planning for this company.

- What is the capital structure of this company? Explain.

- Identify the financial decision involved when the company decides to raise Rs. 800 crore from different sources of funds.

- How will the dividend decision of Krishna Ltd. be affected? Explain. (6 marks)

- Financial planning will help the company in avoiding business shocks and surprises. It will reduce waste and duplication of efforts.

- Capital structure refers to the mix between owners funds and borrowed funds. It is calculated as debt equity ratio

i.e., Debit. Equity For Krishna Ltd. Debt = Debentures + Long tgerm loans from banks = 300 + 200 = Rs. 500 crore. Equity = Share capital + Reserves and surplus (or retained earnings) = 200 + 100 = Rs. 300 crores. Therefore, debt equity ratio = 500 = 1.67 : 1 - Financing decision

- Since the company have growth opportunities of setting up a new steel plant at Gurgaon, it retains Rs. 100 crore out of profits to finance the required investment. So, it is likely to pay less dividend. However, since the company makes more debt financing than funding through equity, it implies that cash flow position of the company is strong. Therefore, it can pay higher dividend.