Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Published: 01 April 2019

Infrastructure for sustainable development

- Scott Thacker ORCID: orcid.org/0000-0003-2683-484X 1 , 2 ,

- Daniel Adshead 2 ,

- Marianne Fay 3 ,

- Stéphane Hallegatte ORCID: orcid.org/0000-0002-1781-4268 3 ,

- Mark Harvey 4 ,

- Hendrik Meller 5 ,

- Nicholas O’Regan 1 ,

- Julie Rozenberg 3 ,

- Graham Watkins 6 &

- Jim W. Hall 2

Nature Sustainability volume 2 , pages 324–331 ( 2019 ) Cite this article

11k Accesses

392 Citations

114 Altmetric

Metrics details

- Civil engineering

- Developing world

- Sustainability

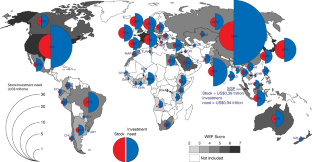

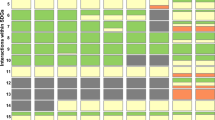

Infrastructure systems form the backbone of every society, providing essential services that include energy, water, waste management, transport and telecommunications. Infrastructure can also create harmful social and environmental impacts, increase vulnerability to natural disasters and leave an unsustainable burden of debt. Investment in infrastructure is at an all-time high globally, thus an ever-increasing number of decisions are being made now that will lock-in patterns of development for future generations. Although for the most part these investments are motivated by the desire to increase economic productivity and employment, we find that infrastructure either directly or indirectly influences the attainment of all of the Sustainable Development Goals (SDGs), including 72% of the targets. We categorize the positive and negative effects of infrastructure and the interdependencies between infrastructure sectors. To ensure that the right infrastructure is built, policymakers need to establish long-term visions for sustainable national infrastructure systems, informed by the SDGs, and develop adaptable plans that can demonstrably deliver their vision.

This is a preview of subscription content, access via your institution

Access options

Access Nature and 54 other Nature Portfolio journals

Get Nature+, our best-value online-access subscription

$29.99 / 30 days

cancel any time

Subscribe to this journal

Receive 12 digital issues and online access to articles

$119.00 per year

only $9.92 per issue

Buy this article

- Purchase on Springer Link

- Instant access to full article PDF

Prices may be subject to local taxes which are calculated during checkout

Similar content being viewed by others

Sustainable Development Goals (SDGs): Are we successful in turning trade-offs into synergies?

Modelling six sustainable development transformations in Australia and their accelerators, impediments, enablers, and interlinkages

Advancing equitable health and well-being across urban–rural sustainable infrastructure systems

Data availability.

The data that support the findings of this study are available within the paper and its Supplementary Information .

Carse, A. in Infrastructures and Social Complexity: A Companion (eds Harvey, P. et al.) (Routledge, 2016).

Pederson, P., Dudenhoeffer, D., Hartley, S. & Permann, M. Critical Infrastructure Interdependency Modeling: A Survey of US and International Research (Idaho National Laboratory, 2006).

A National Infrastructure for the 21st Century (Council for Science and Technology, 2009).

Frischmann, B. M. Infrastructure: The Social Value of Shared Resources (Oxford Univ. Press, 2012).

Allen, S. Points and Lines: Diagrams and Projects for the City (Princeton Architectural Press, 1999).

Erickson, P., Kartha, S., Lazarus, M. & Tempest, K. Assessing carbon lock-in. Environ. Res. Lett. 10 , 084023 (2015).

Article Google Scholar

Weinberger, R. & Goetzke, F. Unpacking preference: how previous experience affects auto ownership in the United States. Urban Stud. 47 , 2111–2128 (2010).

Clark, S. S., Seager, T. P. & Chester, M. V. A capabilities approach to the prioritization of critical infrastructure. Environ. Syst. Decis. 38 , 339–352 (2018).

Steinbuks, J. & Foster, V. When do firms generate? Evidence on in-house electricity supply in Africa. Energy Econ. 32 , 505–514 (2010).

Fischer, M. M. Innovation, Networks, and Knowledge Spillovers, Selected Essays (Springer, 2006).

Fujita, M., Krugman, P. R. & Venables A. J. The Spatial Economy: Cities, Regions, and International Trade (MIT press, 2001).

The Sustainable Infrastructure Imperative: Financing for Better Growth and Development. The 2016 New Climate Economy Report (The Global Commission on the Economy and Climate, 2016).

Scholz, M. & Lee, B. H. Constructed wetlands: a review. Int. J. Environ. Stud. 62 , 421–447 (2005).

van der Kamp, G. & Hayashi, M. The groundwater recharge function of small wetlands in the semi-arid Northern Prairies. Great Plains Res. 8 , 39–56 (1998).

Google Scholar

Dadson, S. J. et al. A restatement of the natural science evidence concerning catchment-based ‘natural’ flood management in the UK. Proc. R. Soc. A 473 , 20160706 (2017).

Lewis, T. G. Critical Infrastructure Protection in Homeland Security: Defending a Networked Nation (Wiley, 2006).

Rinaldi, S. M., Peerenboom, J. P. & Kelly, T. K. Identifying, understanding, and analyzing critical infrastructure interdependencies. IEEE Contr. Syst. Mag. 21 , 11–25 (2001).

Bollinger, L. & Dijkema, G. Evaluating infrastructure resilience to extreme weather – the case of the Dutch electricity transmission network. Eur. J. Transp. Infrastruct. Res. 16 , 214–239 (2016).

Global Infrastructure Outlook: 2017 (Global Infrastructure Hub, 2017).

Bhattacharya, A. et al. Delivering on Sustainable Infrastructure for Better Development and Better Climate (Brookings Institution, 2016).

Ascensão, F. et al. Environmental challenges for the Belt and Road Initiative. Nat. Sustain. 1 , 206–209 (2018).

Private Participation in Infrastructure (PPI) Annual Report: 2017 (The World Bank, 2017).

World Bank Press Release 2015/041/EAP (The World Bank, 2014).

Better Infrastructure, Better Economy (European Investment Bank, 2017).

African Economic Outlook: 2018 (African Development Bank, 2018).

Adam, M. C. & Bevan M. D. Public Investment, Public Finance, and Growth: The Impact of Distortionary Taxation, Recurrent Costs, and Incomplete Appropriability (International Monetary Fund, 2014).

Inclusive Green Growth: The Pathway to Sustainable Development (The World Bank, 2012).

Connecting People, Creating Wealth: Infrastructure for Economic Development and Poverty Reduction (Department for International Development, 2013).

Ruan, Z., Wang, C., Ming Hui, P. & Liu, Z. Integrated travel network model for studying epidemics: interplay between journeys and epidemic. Sci. Rep. 5 , 11401 (2015).

Article CAS Google Scholar

Pfeiffer, A., Hepburn, C., Vogt-Schilb, A. & Caldecott, B. Committed emissions from existing and planned power plants and asset stranding required to meet the Paris Agreement. Environ. Res. Lett. 13 , 054019 (2018).

Gaynor, C. & Jennings, M. Gender, Poverty and Public Private Partnerships In Infrastructure, (PPPI) . Annex on Gender and Infrastructure (The World Bank, 2004).

Bajar, S. & Rajeev, M. The impact of infrastructure provisioning on inequality in India: does the level of development matter? J. Comp. Asian Dev. 15 , 122–155 (2016).

Hall, J. W., Nicholls, R. J., Tran, M. & Hickford, A. J. The Future of National Infrastructure: A System Of Systems Approach (Cambridge Univ. Press, 2016).

Fuso Nerini, F. et al. Mapping synergies and trade-offs between energy and the Sustainable Development Goals. Nat. Energy 3 , 10–15 (2018).

Bhaduri, A. et al. Achieving sustainable development goals from a water perspective. Front. Environ. Sci. 4 , 64 (2016).

Transport and Sustainable Development Goals Transport and Communications Bulletin for Asia and the Pacific No. 87 (United Nations Economic and Social Commission for Asia and the Pacific, 2017).

Weitz, N., Carlsen, H., Nilsson, M. & Skånberg, K. Towards systemic and contextual priority setting for implementing the 2030 agenda. Sustain. Sci. 13 , 531–548 (2018).

Straub, S. Infrastructure and Development: A Critical Appraisal of the Macro Level Literature (The World Bank, 2008).

Lee, K., Miguel, E. & Wolfram, C. Appliance ownership and aspirations among electric grid and home solar households in rural Kenya. Am. Econ. Rev. 106 , 89–94 (2016).

Banister, D. & Berechman, Y. Transport investment and the promotion of economic growth. J. Transp. Geogr. 9 , 209–218 (2001).

Duranton, G. & Venables, A. J. Place-based Policies for Development World Bank Policy Research Working Paper 8410 (The World Bank, 2018).

Mathur, V. K. Human capital-based strategy for regional economic development. Econ. Dev. Q. 13 , 203–216 (1999).

Venables, A. J., Laird, J. & Overman, H. Transport Investment and Economic Performance: Implications for Project Appraisal (Department for Transport, 2014).

N ew Urban Agenda A/RES/71/256 (United Nations, 2017).

Hall, J. W. et al. Strategic analysis of the future of national infrastructure. Proc. Inst. Civ. Eng. Civ. Eng. 170 , 39–47 (2017).

Otto, A. et al. A quantified system-of-systems modeling framework for robust national infrastructure planning. IEEE Syst. J. 10 , 385–396 (2016).

Allenby, B. & Chester, M. V. Reconceptualizing infrastructure in the Anthropocene. Issues Sci. Technol. 34 , 3 (2018).

Adshead, D. et al. Evidence-based Infrastructure: Curaçao National Infrastructure Systems Modelling to Support Sustainable and Resilient Infrastructure Development (United Nations Office for Project Services, 2018).

Chester, M. V. & Allenby, B. Toward adaptive infrastructure: flexibility and agility in a non-stationarity age. Sustain. Resilient Infrastruct. https://doi.org/10.1080/23789689.2017.1416846 (2018).

Siew, Y. J. R., Balatbat, M. C. A. & Carmichael, D. G. A review of building/infrastructure sustainability reporting tools (SRTs). Smart Sustain. Built Environ. 2 , 106–139 (2013).

Final Report: Recommendations of the Task Force on Climate-Related Financial Disclosures (Task Force on Climate-Related Financial Disclosures, 2017).

Strategic Infrastructure Planning: International Best Practice (OECD, 2017).

How to Design an Infrastructure Strategy for the UK (Institute for Government, 2017).

The Global Competitiveness Report 2017–2018 (World Economic Forum, 2017).

Download references

Acknowledgements

We appreciate the contributions of the Infrastructure Transitions Research Consortium, which is funded by the Engineering and Physical Sciences Research Council by grants EP/101344X/1 and EP/N017064/1. S.T. thanks the United Nations Office for Project Services, specifically R. Jones, G. Morgan, S. Crosskey and T. Sway for providing useful suggestions that improved this manuscript.

Author information

Authors and affiliations.

United Nations Office for Project Services (UNOPS), Copenhagen, Denmark

Scott Thacker & Nicholas O’Regan

University of Oxford, Oxford, UK

Scott Thacker, Daniel Adshead & Jim W. Hall

World Bank, Washington, DC, USA

Marianne Fay, Stéphane Hallegatte & Julie Rozenberg

Department for International Development (DFID), London, UK

Mark Harvey

German Agency for International Cooperation (GIZ), Bonn, Germany

Hendrik Meller

Inter-American Development Bank (IADB), Washington, DC, USA

Graham Watkins

You can also search for this author in PubMed Google Scholar

Contributions

S.T. designed the study. D.A., S.T. and J.W.H. performed most of the analyses. J.W.H., S.T. and D.A. wrote most of the manuscript. All authors contributed to the development of the manuscript through methodological advice, analysis, comments and edits to the text and figures.

Corresponding author

Correspondence to Scott Thacker .

Ethics declarations

Competing interests.

The authors declare no competing interests.

Additional information

Publisher’s note: Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Supplementary information.

Supplementary Table 1 and 2

Supplementary Table 3

Additional data (qualitative)

Rights and permissions

Reprints and permissions

About this article

Cite this article.

Thacker, S., Adshead, D., Fay, M. et al. Infrastructure for sustainable development. Nat Sustain 2 , 324–331 (2019). https://doi.org/10.1038/s41893-019-0256-8

Download citation

Received : 29 August 2017

Accepted : 25 February 2019

Published : 01 April 2019

Issue Date : April 2019

DOI : https://doi.org/10.1038/s41893-019-0256-8

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

This article is cited by

Mainstreaming systematic climate action in energy infrastructure to support the sustainable development goals.

- Louise Wernersson

- Simon Román

- Daniel Adshead

npj Climate Action (2024)

Social consequences of planned relocation in response to sea level rise: impacts on anxiety, well-being, and perceived safety

- Stacey C Heath

Scientific Reports (2024)

Climate threats to coastal infrastructure and sustainable development outcomes

- Amelie Paszkowski

- Jim W. Hall

Nature Climate Change (2024)

Solid-state lithium-ion batteries for grid energy storage: opportunities and challenges

- Yu-Ming Zhao

Science China Chemistry (2024)

The role of the waste sector in the sustainable development goals and the IPCC assessment reports

- Romana Kopecká

- Marlies Hrad

- Marion Huber-Humer

Österreichische Wasser- und Abfallwirtschaft (2024)

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

Sign up for the Nature Briefing newsletter — what matters in science, free to your inbox daily.

The vital role of infrastructure in economic growth and development

In 1956, in an America recovering from the economic and psychological consequences of World War II, President Dwight D. Eisenhower signed into effect a bill that authorised the construction of an interstate highway system. The lasting effects of that decision were profound for both the American economy and the morale of its people. Eisenhower predicted that government investment in infrastructure had the power to stimulate the economy in the short-term and create the conditions for longer-term prosperity and growth for future generations. Today, Eisenhower’s decision to invest in public infrastructure is regarded as a key factor that contributed to the era of American prosperity that followed.

The COVID-19 pandemic has produced similar conditions of global upheaval not seen since the 1940s. The stress placed on our structural systems has revealed their vulnerabilities and limitations, and the impact on our global economy is likely to be long-lasting. Subsequently, this is a period of great uncertainty but also great possibility. We have collectively been presented with an opportunity for what the World Economic Forum has called a global ‘Great Reset’ . Now is the time to take stock of where we are and decide where we’d like to be.

As G20 economies continue to stabilise, the emphasis in spending will naturally shift from mitigating the immediate crisis of the pandemic to an investment in stimulating economic recovery and facilitating medium and long-term growth and stability. The present challenge for the world’s nations is to best direct their limited resources where they will have the greatest impact.

The case for infrastructure investment as a stimulus

Infrastructure investment has a strong impact on economic growth, as evidenced by a 2020 GI Hub study that found the economic multiplier for public investment (including infrastructure) is 1.5 times greater than the initial investment in two to five years – much higher than other forms of public spending.

The study also showed that the infrastructure outcome was a factor that influenced the positive effect of the investment.

This analysis suggests that infrastructure investment can play a key role in supporting economic recovery and stability, however simply investing in infrastructure is insufficient. It needs to be the right kind of infrastructure that has transformative outcomes for the people and the planet.

View more in our Knowledge Hub

Our Knowledge Hub is a library of resources from the GI Hub and other organisations across the infrastructure ecosystem.

The right kind of infrastructure

In order to have the greatest impact on stimulating economic recovery in the short-term and lasting stability in the long-term, infrastructure should be sustainable, resilient and inclusive. This type of transformative infrastructure can help produce prosperity for all.

Transformative infrastructure is infrastructure that provides lasting social and economic value for everyone, produces long-term prosperity for future generations and creates the conditions to transition towards a resource-efficient, sustainable economy. It's designed with the flexibility to respond to future trends and challenges, able to adapt to technological improvements, and incorporate better solutions as they become available. Transformative infrastructure is therefore longer lasting and more resilient, meaning it can adapt to crises better and provide more benefits over time versus more traditional infrastructure.

Transformative infrastructure is socially inclusive. Its design is guided by the notion of being beneficial to the greatest number of people. Infrastructure designed and implemented in this way will provide maximal utility to the largest number of people, increasing its stimulus effect and facilitating the goal of a more equitable world.

The next step

In November 2021, the GI Hub launched our newest resource, Transformative Outcomes Through Infrastructure . Its purpose is to uncover the G20 priorities that underlie the USD3.2 trillion of infrastructure investments announced post-COVID, and to help direct future spending into areas that could yield the greatest possible benefits for people and the planet.

With conscious decision-making we can plan, design and procure infrastructure projects that have the capacity to be resilient, sustainable and inclusive. This can allow us to realise the immediate short-term benefits of infrastructure investment in stimulating the economy across a range of markets and regions, and maximise the benefits and longevity of that investment going forward, all while moving towards a greener, equitable future.

Infrastructure Monitor

Infrastructure Monitor identifies and analyses global trends in private investment in infrastructure to inform future investment and policy.

Pipeline Access

Pipeline Access is a directory of project pipelines that enables government and industry to track projects and assemble market analyses.

Subscribe to our newsletter

Our twice-monthly newsletter shares the latest news from across the infrastructure ecosystem, and notifies you of new initiatives and tools from the GI Hub.

Why Infrastructure Matters: Rotten Roads, Bum Economy

Subscribe to the brookings metro update, robert puentes robert puentes nonresident senior fellow - brookings metro @rpuentes.

January 20, 2015

- 12 min read

Cities, states and metropolitan areas throughout America face an unprecedented economic, demographic, fiscal and environmental challenges that make it imperative for the public and private sectors to rethink the way they do business. These new forces are incredibly diverse, but they share an underlying need for modern, efficient and reliable infrastructure.

Concrete, steel and fiber-optic cable are the essential building blocks of the economy. Infrastructure enables trade, powers businesses, connects workers to their jobs, creates opportunities for struggling communities and protects the nation from an increasingly unpredictable natural environment. From private investment in telecommunication systems, broadband networks, freight railroads, energy projects and pipelines, to publicly spending on transportation, water, buildings and parks, infrastructure is the backbone of a healthy economy.

It also supports workers, providing millions of jobs each year in building and maintenance. A Brookings Institution analysis Bureau of Labor Statistics data reveals that 14 million people have jobs in fields directly related to infrastructure. From locomotive engineers and electrical power line installers, to truck drivers and airline pilots, to construction laborers and meter readers, infrastructure jobs account for nearly 11 percent of the nation’s workforce, offering employment opportunities that have low barriers of entry and are projected to grow over the next decade.

Important national goals also depend on it. The economy needs reliable infrastructure to connect supply chains and efficiently move goods and services across borders. Infrastructure connects households across metropolitan areas to higher quality opportunities for employment, healthcare and education. Clean energy and public transit can reduce greenhouse gases. This same economic logic applies to broadband networks, water systems and energy production and distribution.

Big demographic and cultural changes, such as the aging and diversification of our society, shrinking households and domestic migration, underscore the need for new transportation and telecommunications to connect people and communities. The percentage of licensed drivers among the young is the lowest in three decades, as more of them use public transit and many others use new services for sharing cars and bikes. The prototypical family of the suburban era, a married couple with school-age children, now represents only 20 percent of households, down from over 40 percent in 1970. Some 55 percent of millennials say living close to public transportation is important to them, according to a recent survey by the Urban Land Institute.

Yet unlike Western Europe and parts of Asia, the United States still has a growing population. We’ve added 25 million people in the past 10 years. This tremendous growth, concentrated in the 50 largest metropolitan areas, will place new demands on already overtaxed infrastructure. Metropolitan areas must be ready to adapt not only to serve millions of new customers but also to help poorer residents, many of whom are jobless, have the best chance possible to find work.

A recent Brookings analysis found that only a quarter of jobs in low-skill and middle-skill industries can be reached within 90 minutes by a typical metropolitan commuter. Successful cities will be those that connect workers to jobs and close the digital divide between high-income and low-income neighborhoods. The White House notes that broadband speeds have doubled since 2009 and that more than four out of five people now have high-speed wireless broadband, adoption rates for low-income and minority households remains low (about 43 and 56 percent, respectively.)

Our economy is changing as fast as our society. Over 83 percent of world economic growth in the next five years is expected to occur outside the United States, and because of rapid globalization, it will be concentrated in cities. This offers an unprecedented opportunity for American businesses to export more goods and services and to create high-quality jobs at home. It also amplifies the importance of our seaports, air hubs, freight rail, border crossings and truck routes, which move $51 billion worth of goods quickly and efficiently each day in the complex supply chains of the modern economy.

The diverse energy boom also disrupts our infrastructure. Natural gas needs new truck, pipeline and rail networks. Rooftop solar panels have rattled electric utilities, which are scrambling to find ways to incorporate and store the energy they produce while keeping the grid operating. At the same time, finding the money to pay for the development of a smart electricity grid and for clean energy presents challenges, as hundreds of thousands of small and large projects are projected to come online in coming decades.

High-profile natural disasters, such as Hurricane Sandy, drew attention to problems with water infrastructure. Overwhelmed waste water systems, washed-out roads, shorted electrical circuitry and flooded train stations not only highlighted the economy’s reliance on these networks, but also revealed their poor condition. The nation’s water systems are now being rebuilt. Cities are working to capture storm and rain water rather than building costly pipes to sluice it away. The Center for an Urban Future recently described how New York City plans to spend $2.4 billion over 18 years in so-called “green” infrastructure such as rooftop vegetation, porous pavements, and soils to soak up rain.

Over and above the new types of needed infrastructure is a big change in how projects are financed.

Despite the importance of infrastructure, the U.S. has not spent enough for decades to maintain and improve it. It accounts for about 2.5 percent of the economy, compared to about 3.9 percent spent in Canada, Australia and South Korea, 5 percent for Europe and 9-12 percent in China. The McKinsey Global Institute estimates that the U.S. must spend at least $150 billion more a year on infrastructure through 2020 to meet its needs. This would add about 1.5 percent to annual economic growth and create at least 1.8 million jobs.

Split between Republicans and Democrats, the federal government appears incapable of doing this. For the foreseeable future, the Highway Trust Fund, the State Revolving Funds for water and others will face cuts and squeezed budgets. Other experiments, such as a National Infrastructure Bank, seem prohibitively complex in the current political environment. And of course, rising interest costs on federal debt, increases in entitlement spending and declining traditional revenue sources such as the gasoline tax mean that competition for limited resources is fiercer than ever.

Some cities and states are enjoying budget surpluses because property and sales tax revenues. But most localities will take years to build back their reserves, repay additional debt incurred during the recession and pay for deferred maintenance on infrastructure. Unfunded pension obligations and other debts facing all levels of government mean there just aren’t the public funds to pay for necessary infrastructure. And though interest rates remain at historically low levels, the ability of many governments to borrow from capital markets is hindered by debt caps and weak credit ratings.

Despite gradual acceptance in the past decade that infrastructure is vital to economic growth, debate of spending remains an amorphous and simplistic. Infrastructure is made up of interrelated sectors as diverse as a water treatment plant is from an airport, a wind farm, a gas line or a broadband network. The focus on infrastructure in the abstract led to unrealistic silver-bullet policy solutions that fail to capture the unique and economically critical attributes of each. In reality, each infrastructure sector involves fundamentally different design frameworks and market attributes. And they are owned, regulated, governed and operated by different public and private entities.

The federal role should not be exaggerated. American infrastructure in selected, built, maintained, operates and paid for in a diverse and fragmentary fashion. For certain sectors, such as transportation and water, federal spending is relatively high, averaging $92.15 billion each year from 2000 to 2007. But even there, according to the Congressional Budget Office, Washington’s share of spending never topped 27 percent. For other sectors, such as freight rail, telecommunications, and clean energy, the federal role is more limited.

So what does all this mean and how are we going to pay for what we need?

Roads, bridges and transit must be paid for largely from public funds. Ballot measures have been important for fund raising, particularly at the local level, because general obligation bonds require popular approval. That’s how regions and municipalities pay for public transit systems, bridges, road construction, water and sewer improvements and a host of other infrastructure projects. Many cities are following this trend. Those places, especially in Westerns cities such as Los Angeles, Phoenix and Salt Lake City, are taxing themselves, dedicating substantial local money and effectively contributing to the construction of the nation’s infrastructure.

Metropolitan transportation initiatives are popular among voters. According to the Center for Transportation Excellence, 71 percent of measures were passed in 2014 as were 73 percent in 2013. While state level ballot measures on infrastructure spending are far less common, in 2013, eight states voted to raise taxes for such projects. This includes both conservative strongholds such as Wyoming and Democrat-controlled legislatures in states such as Maryland.

A number of cities are using market mechanisms that capture the increased value in land that accrues from infrastructure. This provides a more targeted way to finance new or existing transportation projects by matching the benefit from infrastructure with its cost. These techniques include impact fees where land developers are assessed a charge to support associated public infrastructure improvements, generally local roads and public works like sidewalks. The lease or sale of air rights is another practice that has been used by to finance development around transit stations for decades, famously around Grand Central Station in New York, and more recently in Boston and Dallas.

Another growing trend is the use of tax increment financing districts. These TIFs support infrastructure projects by borrowing against the future stream of additional tax revenue the project is expected to generate. Examples include a TIF used to pay for improvements at the Atlantic Station project in Atlanta and Portland, Ore.,’s similar strategy to fund its streetcar by creating a local improvement district that leveraged the economic gains of nearby property owners.

For its part, the federal government can allow greater flexibility for states and cities to innovate on projects that connect metros. Passenger Facility Charges used to fund airport modernization are artificially capped at $4.50 and do not begin to cover the airport’s operating and long-term investment costs. Busy airports could be freed to meet congestion and investment costs by removing the caps. Archaic restrictions on interstate highways tolls could also be lifted. Metropolitan and local leaders, with the states, are in the best position to determine which segments of road could best raise revenue.

Other infrastructures could be public-private partnerships. These often complex agreements allow the public sector to bring in private enterprises to take an active role during the life of the infrastructure asset. At their heart, these partnerships share risk and costs of design, construction, maintenance, financing and operations.

The public-sector interest in partnerships is propelled by the shortage of money. Ever since the recession, many states and local governments have been plagued by high debt, low credit ratings and limited options to borrow. PPPs are not “free money,” but they can offer benefits such as better and faster completion of the project, more budgetary accountability and overall savings.

Partnerships with the private sector are not appropriate for all infrastructure sectors or projects. Some may not be profitable enough to attract investors. Green infrastructure or public parks, for example, may lack a revenue stream. Private conservancies maintain and oversee parks in New York, Pittsburgh, Houston and St. Louis, but they are all nonprofit organizations set up solely for that purpose and do not help spread risk.

The best infrastructure projects for private sector involvement are those with a clear revenue stream from rate-payers, such as water infrastructure and toll roads. The private sector can bring in new technologies for metering and billing that can improve services. Thoughtful procurement can also facilitate projects that do not include ratepayers. Nearly any project can be suitable for a private partnership as long as there is a mechanism to spread risk among all parties, even without user fees. So-called availability payment models allow the public sector to pay a recurring user fee for the use of an asset based on its condition and accessibility. These payments are a form of debt since but require continuous public expenditure and a binding budgetary obligation.

It would help spur public-private partnerships if there were standard contracts and pricing, risk sharing and returns. In the past, Washington has set these kinds of standards for such vast areas of the consumer market as housing and small business. But the federal government appears unlikely to do so for infrastructure investment. A mix of public, private and civic bodies will have to do so instead.

An emerging example is the West Coast Infrastructure Exchange, a collaboration between California, Oregon, Washington and British Columbia standardizing transparency, contracts, labor and risk allocation. The goal is to build a market for projects. By sharing details, project finance and delivery methods can be scaled and replicated.

If successful, the WCX could be a model for other state, city and metro infrastructure exchanges. Each exchange could focus on the infrastructure delivery and finance strategies suited to the culture, traditions and needs of the region it serves. An East Coast or Mid-Atlantic Exchange could focus on rebuilding coastlines and climate resiliency after Hurricane Sandy, or on transportation projects that cross state borders. A Midwestern Exchange might focus on water infrastructure in a largely slow growth environment or on projects with Canada. A Southern Exchange might facilitate new infrastructure to accommodate fast growth and new manufacturing, supply chains and movement of goods. Regardless of their focus, exchanges could be linked through a project clearinghouse to share data, information and best practices.

Energy, telecommunications and freight rail will remain dominated by the private sector typically with federal and state regulatory oversight. But there will also be new types of public and private relationships in these sectors, too. For example, while broadband networks are still delivered by private companies, local governments recognize that this kind of network access is equally important to the future economic success of households as well as businesses. So as cities such as Los Angeles explore ways to extend broadband to all homes, they also are working to figure out the financing arrangements and business opportunities for firms interested in developing those networks.

The trade and logistics industry is highly decentralized, with private operators owning almost all trucks and rails, and the public sector owning roads, airports, and waterway rights. Unlike such countries as Germany, Canada and Australia, the U.S. does not have a unified strategy that aligns disparate owners and interests around national economic objectives. Innovative partnerships are therefore necessary to make freight movements in and around big cities more efficient and reliable. The CREATE program in Chicago aligns several such interests in a citywide effort to relieve freight and passenger bottlenecks that cause delays. The $2.5 billion for the program will come from a mix of traditional sources (federal grants), private investments (railroads), state loans (bonds) and existing local sources.

It is clear that projects are becoming more complex. There is not one-size-fits-all form of financing for them. It very much depends on the place, time and particulars of each project. The level of private engagement will depend on market and business opportunities.

In many respects, America’s ability to realize its competitive potential depends on making smart infrastructure choices. These must respond to economic, demographic, fiscal, and environmental changes if they are to help people, places and firms thrive and prosper.

This commentary was originally published by the Washington Examiner .

Infrastructure

Brookings Metro

William H. Frey

June 6, 2024

Joseph W. Kane

Anthony F. Pipa

June 4, 2024

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here .

Advertisement

Infrastructure development in India: a systematic review

- Original Paper

- Published: 14 October 2023

- Volume 16 , article number 35 , ( 2023 )

Cite this article

- A. Indira ORCID: orcid.org/0000-0003-1189-5922 1 &

- N. Chandrasekaran ORCID: orcid.org/0000-0002-0076-2019 2

373 Accesses

Explore all metrics

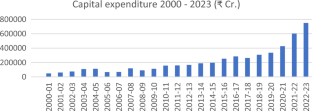

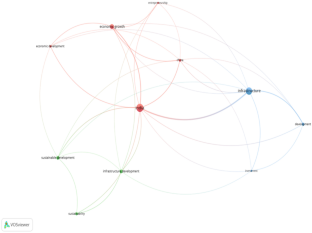

It is now well-accepted that infrastructure development is essential for the growth of any economy. Successive governments in India, both at the Union and State level have given a thrust towards increased budgetary spending on infrastructure to help economic growth. On the eve of the 75th year of independence, there is a reiteration for long-term initiatives, including focused programs for roads, railways, airports, waterways, mass transport, ports, and logistics to further boost infrastructure spending. Keeping this in mind, the authors sought to systematically review the literature on how infrastructure development has unfolded in India between the years 2000–2022. The study shows that with diverse economic growth in India, there is interest in infrastructure development aligned with public interests. Infrastructure development is contextual and location-specific. Access to infrastructure positively impacts social and economic outcomes. There is however growing concern for sustainable development with rapid urbanization.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price excludes VAT (USA) Tax calculation will be finalised during checkout.

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Source Handbook of Statistics on Indian Economy, 2021–22, Table 93

Source Author

Similar content being viewed by others

Infrastructure, Utilities and Services: Theoretical Keystones

Infrastructure and Regional Economic Growth in the One Belt and One Road Regions: A Dynamic Shift-Share Approach

Screaming Urbanization and Infrastructural Gap in South Asia: A Critical Analysis

Agarchand, N., Laishram, B.: Sustainable infrastructure development challenges through PPP procurement process: Indian perspective. Int. J. Manag. Proj. Bus. 10 (3), 642–662 (2017)

Google Scholar

Aschauer, D.A.: Is public expenditure productive? J. Monet. Econ. 23 (2), 177–200 (1989)

Asher, S., Garg, T., Novosad, P.: The ecological impact of transportation infrastructure. Econ. J. 130 (629), 1173–1199 (2020)

Azam, M.: The role of migrant workers remittances in fostering economic growth: the four Asian developing countries’ experiences. Int. J. Soc. Econ. 42 (8), 690–775 (2015)

Barman, H., Nath, H.K.: What determines international tourist arrivals in India? Asia Pac. J. Tourism Res. 24 (2), 180–190 (2019)

Bhattacharyay, B.N., De, P.: Promotion of the trade and investment between people’s Republic of China and India: toward a regional perspective. Asian Dev. Rev. 22 (1), 45–70 (2005)

Chakravorty, U., Pelli, M., Ural Marchand, B.: Does the quality of electricity matter? Evidence from rural India. J. Econ. Behav. Organ. 107 , 228–247 (2014)

Chatterjee, E.: The politics of electricity reform: evidence from West Bengal, India. World Dev. 104 , 128–139 (2018)

Chaudhuri, S., Roy, M.: Rural-urban spatial inequality in water and sanitation facilities in India: a cross-sectional study from household to national level. Appl. Geogr. 85 , 27–38 (2017)

Dasha, R.K., Sahoo, P.: Economic growth in India: the role of physical and social infrastructure. J. Econ. Policy Reform 13 (4), 373–385 (2010)

Datta, S.: The impact of improved highways on indian firms. J. Dev. Econ. 99 (1), 46–57 (2012)

Deichmann, U., Lall, S.V., et al.: Industrial location in developing countries. World Bank. Res. Obs. 23 (2), 219–246 (2008)

Desai, S., Joshi, O.: The Paradox of declining female work participation in an era of economic growth. Indian J. Lab. Econ. 62 (1), 55–71 (2019)

Dutta, A., Bouri, E., et al.: Commodity market risks and green investments: evidence from India. J. Clean. Prod. 318 , 128523 (2021)

Economic, Survey: 2000-01, Ministry of finance, Government of India, Chap. 9, (2023). https://www.indiabudget.gov.in/budget_archive/es2000-01/chap91.pdf ,. Accessed on June 15,

Economic, S.: 2022-23, Ministry of finance, Government of India, (2023). https://www.indiabudget.gov.in/economicsurvey/doc/eschapter/echap12.pdf ,. Accessed on June 15

Fan, S., Hazell, P., Haque, T.: Targeting public investments by agro-ecological zone to achieve growth and poverty alleviation goals in rural India. Food Policy 25 (4), 411–428 (2000)

Gardas, B.B., Raut, R.D., Narkhede, B.: Evaluating critical causal factors for post-harvest losses (PHL) in the fruit and vegetables supply chain in India using the DEMATEL approach. J. Clean Prod. 199 , 47–61 (2018)

Ghosh, B., De, P.: Investigating the linkage between infrastructure and regional development in India: era of planning to globalization. J. Asian Econ. 15 (6), 1023–1050 (2005)

Hirschman, A.O.: The Strategy of Economic Development. Yale University Press, New Haven (1958)

Hulten, C.R., Bennathan, E., Srinivasan, S.: Infrastructure, externalities, and economic development: a study of the Indian manufacturing industry. World Bank. Econ. Rev. 20 (2), 291–308 (2006)

Hutchison, N., Squires, G.: Financing infrastructure development: time to unshackle the bonds? J. Prop. Invest. Financ. 34 (3), 208–224 (2016)

Jain, M.: Contemporary urbanization as unregulated growth in India: the story of census towns. J. Econ. Behav. Organ. 107 , 228–247 (2018)

Kaul, H., Gupta, S.: Sustainable tourism in India. Worldw. Hosp. Tour. Themes 1 (1), 12–18 (2009)

Kennedy, L.: Regional industrial policies driving peri-urban dynamics in Hyderabad, India. Cities 24 (2), 95–109 (2007)

Krishnamurthy, R., Desouza, K.C.: Chennai, India. Cities 42 , 118–129 (2015)

Kumar, H., Singh, M.K., et al.: Moving towards smart cities: solutions that lead to the smart city transformation framework. Technol. Forecast. Soc. Chang. 153 , 119281 (2020)

Lei, L., Desai, S., Vanneman, R.: The impact of transportation infrastructure on women’s employment in India. Fem. Econ. 25 (4), 94–125 (2019)

Mahalingam, A.: PPP experiences in Indian cities: barriers, enablers, and the way forward. J. Constr. Eng. Manag. 136 (4), 419–429 (2010)

Maparu, T.S., Mazumder, T.N.: Transport infrastructure, economic development and urbanization in India (1990–2011): is there any causal relationship? Transp. Res. Part A: Policy Pract. 100 , 319–336 (2017)

Mitra, A., Nagar, J.P.: City size, deprivation and other indicators of development: evidence from India. World Dev. 106 , 273–283 (2018)

Moench, M.: Responding to climate and other change processes in complex contexts: challenges facing development of adaptive policy frameworks in the Ganga Basin. Technol. Forecast. Soc. Chang. 77 (6), 975–986 (2010)

Nakamura, H., Nagasawa, K., et al.: Principles of infrastructure-case studies and best practices. Asian Development Bank Institute and Mitsubishi Research Institute Inc, Tokyo, pp 52–96 (2019)

Orgill-Meyer, J., Pattanayak, S.K.: Improved sanitation increases long-term cognitive test scores. World Dev. 132 , 104975 (2020)

Pal, S.: Public infrastructure, location of private schools and primary school attainment in an emerging economy. Econ. Educ. Rev. 29 (5), 783–794 (2010)

Parikh, P., Fu, K., et al.: Infrastructure provision, gender, and poverty in Indian slums. World Dev. 66 , 468–486 (2015)

Parwez, S.: A conceptual model for integration of indian food supply chains. Global Bus. Rev. 17 (4), 834–850 (2016)

Patel, U.R., Bhattacharya, S.: Infrastructure in India: The economics of transition from public to private provision. J. Comp. Econ. 38 (1), 52–70 (2010)

Pesaran, M., Hashem; Shin, Y., Smith, R.J.: Bounds testing approaches to the analysis of level relationships. J. Appl. Econ. 16 , 289–326 (2001)

Pradhan, R.P., Arvin, M.B., et al.: Sustainable economic development in India: The dynamics between financial inclusion, ICT development, and economic growth. Technol. Forecast. Soc. Chang. 69 , 120758 (2021)

Rasul, G., Sharma, E.: Understanding the poor economic performance of Bihar and Uttar Pradesh, India: A macro-perspective. Reg. Stud. Reg. Sci. 1 (1), 221–239 (2014)

Rud, J.P.: Electricity provision and industrial development: Evidence from India. J. Dev. Econ. 97 (2), 352–367 (2012)

Sahoo, P., Dash, R.K.: India’s surge in modern services exports: Empirics for policy. J. Policy Model 36 (6), 1082–1100 (2014)

Sati, V.P.: Carrying capacity analysis and destination development: A case study of Gangotri tourists/pilgrims’ circuit in the Himalaya. Asia Pac. J. Tour. Res. 23 (3), 312–322 (2018)

Sharma, M., Joshi, S., et al.: Internet of things (IoT) adoption barriers of smart cities’ waste management: An indian context. J. Clean Prod. 270 , 122047 (2020)

Shenoy, A.: Regional development through place-based policies: Evidence from a spatial discontinuity. J. Dev. Econ. 130 , 173–189 (2018)

Sohail, M., Miles, D.W.J., Cotton, A.P.: Developing monitoring indicators for urban micro contracts in South Asia. Int. J. Project Manag. 20 (8), 583–591 (2002)

Sudhira, H.S., Ramachandra, T.V., Subrahmanya, M.H.B.: Bangalore. Cities 24 (5), 379–390 (2007)

Sun, Y., Ajaz, T., Razzaq, A.: How infrastructure development and technical efficiency change caused resources consumption in BRICS countries: Analysis based on energy, transport, ICT, and financial infrastructure indices. Resour. Policy 79 , 102942 (2022)

Thomas, A.V., Kalidindi, S.N., Ananthanarayanan, K.: Risk perception analysis of BOT road project participants in India. Constr. Manag. Econ. 21 (4), 393–407 (2003)

Thomson, E., Horii, N.: China’s energy security: Challenges and priorities. Eurasian Geogr. Econ. 50 (6), 643–664 (2009)

Vidyarthi, H.: Energy consumption and growth in South Asia: Evidence from a panel error correction model. Int. J. Energy Sect. Manag. 9 (3), 295–310 (2015)

Yadav, V., Karmakar, S., et al.: A feasibility study for the locations of waste transfer stations in urban centers: A case study on the city of Nashik, India. J. Clean Prod. 126 , 191–205 (2016)

Zhang, X., Fan, S.: How productive is infrastructure? A new approach and evidence from rural India. Am. J. Agric. Econ. 86 (2), 492–501 (2004)

Download references

Author information

Authors and affiliations.

Centre for Budget and Policy Studies, M.N.Krishna Rao Road, Basavanagudi, Bengaluru, India

Operations Management, IFMR GSB - Krea University, Sri City, A.P., India

N. Chandrasekaran

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to A. Indira .

Additional information

Publisher’s note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Indira, A., Chandrasekaran, N. Infrastructure development in India: a systematic review. Lett Spat Resour Sci 16 , 35 (2023). https://doi.org/10.1007/s12076-023-00357-5

Download citation

Received : 19 June 2023

Revised : 19 June 2023

Accepted : 20 September 2023

Published : 14 October 2023

DOI : https://doi.org/10.1007/s12076-023-00357-5

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Infrastructure spending

- Infrastructure development

- Economic growth

JEL classification

- Find a journal

- Publish with us

- Track your research

Infrastructure Development and Economic growth: Prospects and Perspective

P. Rao , B. Srinivasu

Jan 15, 2013

Influential Citations

Quality indicators

Journal Of Business Management & Social Sciences Research

Key takeaway

Infrastructural development plays a crucial role in promoting economic growth and reducing poverty and deprivations in a country..

Infrastructure is the prerequisite for the development of any economy. Transport, telecommunications, energy, water, health, housing, and educational facilities have become part and parcel of human existence. It is difficult to imagine a modern world without these facilities. These are vital to the household life as well as to the economic activity. Infrastructure plays a crucial role in promoting economic growth and thereby contributes to the reduction of economic disparity, poverty and deprivations in a country. Greater access of the poor to education and health services, water and sanitation, road network and electricity is needed to bring equitable development and social emposwerment. It is an important pre-condition for sustainable economic and social development. Infrastructural investments in transport (roads, railways, ports and civil aviation), power, irrigation, watersheds, hydroelectric works, scientific research and training, markets and warehousing, communications and informatics, education, health and family welfare play a strategic but indirect role in the development process, but makes a significant contribution towards growth by increasing the factor productivity of land, labour and capital in the production process, especially safe drinking water and sanitation, basic educational facilities strongly influence to the quality of life of the people. This study establishes the relationship between infrastructure and economic growth using growth theories by empirical evidences. Finally it concludes infrastructure and poverty reduction in the Indian context.

Essays on public infrastructure investment and economic growth

- Original file (PDF) 46.2 MB

- Cover image (JPG) 15.6 KB

- Full text (TXT) 143 B

- MODS (XML) 11.5 KB

- Dublin Core (XML) 5.4 KB

- NDLTD (XML) 6.5 KB

- Report accessibility issue

2014 Theses Doctoral

Essays on Infrastructure and Development

Tompsett, Anna

Spending on infrastructure accounts for several percentage points of global world product, reflecting its perceived importance to growth and development. Previous literature has made limited progress in providing unbiased estimates of its impacts, or causal evidence about policy changes that can alter this impact. Primarily, this is because of the selection problem: locations in which infrastructure is built differ from those in which it is not built. This dissertation provides evidence towards three important questions related to infrastructure and development. First, what role does manmade transport infrastructure play in determining and maintaining patterns of economic geography? Second, to what degree does the relocation of economic activity in response to changes in the transport infrastructure network affect estimates of the economic impact of those changes? Third, what is the effect of involving beneficiary communities in decision-making on projects to improve local infrastructure? To address the selection problem, Chapters 2 and 3 exploit quasi-experimental variation in distance to a land transport route created by the opening and location of bridges over major rivers in the historical United States, using a new dataset containing every bridge built over the Mississippi and Ohio rivers. Chapter 4 presents evidence from a randomized experiment in Bangladesh.

- Sustainability

More About This Work

- DOI Copy DOI to clipboard

The widespread economic benefits of infrastructure development

Infrastructure development plays a key role in ensuring fast economic growth and alleviating poverty in South Africa. South Africa has a good core infrastructure network such as a transport system, power, communications network, sewage and water. However, while there is a good core network, previously disadvantaged areas and rural areas don’t have the same adequate infrastructure as developed communities due to high social inequality. The core difference between these communities affects the citizens who reside there but also the economic development of South Africa.

Below, we will explore how various sectors can benefit from infrastructure development.

The energy sector

In modern society, energy is vital as it plays a role in most human activities and helps improve the standard of living. Energy makes life easier and is needed for sectors to run smoothly. Most rural areas don't have adequate energy infrastructure, which hinders productivity within the areas and limits any contribution to the economy. This is why the DBSA is focused on creating an inclusive and integrated rural economy through energy infrastructure . To do this, we plan to develop and finance infrastructure projects that will offer everyone in South Africa access to affordable, reliable, modern and, more importantly, sustainable energy. This will help power the country and ensure economic growth in bo th rural and urban areas.

Water and sanitation sector

Water is a basic need for human survival. While a large number of South Africans have access to safe, clean drinking water through pipe systems, there is a large number of citizens who live in informal settlements and rural areas who don’t have access to potable water. Investing in water and sanitation is an effective way of improving the economy. It will allow communities to live healthily, improve the health sector, and improve productivity in the country. Water affects the health sector and has a ripple effect on education, construction, manufacturing, and more. With integrated infrastructure planning , various sectors can benefit and thrive, ensuring economic growth beneficial for all citizens. The DBSA understands the importance of access to clean, safe, quality water. This is why we work to ensure that water is available for citizens and facilitate sustainable management of water and sanitation for South Africans.

The transport sector

Transportation is fundamental for a booming economy. It helps transport goods and services and enables people to access work, schools and recreational activities, which also play a role in the economy. Without any improvement, the transport system will hinder continuous economic growth, especially in rural areas. A well-developed transport system will ensure the sustainable development of the economy throughout South Africa. At the DBSA, we invest in transport systems that will ensure all citizens experience safe, efficient and sustainable systems in their communities, pushing economic activity and increasing job opportunities.

When it comes to infrastructure spending, ICT is an important addition that must be prioritised. The digital space continues to improve and grow, and for South Africa to compete and trade effectively with other countries, there needs to be adequate infrastructure development. It will also help create jobs, improve efficiency within the economy and boost productivity in all sectors. The DBSA knows the impact of infrastructure development on economic growth, particularly with ICT, which is why we assist in guiding businesses in modernising their infrastructure and giving support for business innovation.

Social sector

Health, housing and education play a prominent role in the economy and improving quality of life. While the social sector is improving, it needs infrastructure development for human development in South Africa. This will ensure quality education for citizens, which will help improve the unemployment rate, alleviate poverty and ensure economic growth. Infrastructure improvement in the health system will ensure doctors and nurses aren’t overworked, efficient equipment, and quality healthcare for all citizens. With the help of DBSA, citizens can benefit from alleviated poverty, job creation, proper housing conditions and quality health care.

Final thoughts

Infrastructure development is key in developing South Africa and its economy. Our main objective at DBSA is to assist in ensuring impactful development finance solutions for South Africa and Africa as a whole, which will help improve the quality of health care and a healthy economy. To do that, we need project funding from the public and private sector in helping create a better Africa.

Essay On Importance Of Infrastructure

Infrastructure is any man-made structure built to make human life easier. This includes sewers, water and power lines, buildings and facilities. It builds a physical image of an economy of a certain place. It is an investment for the improvement of the economy. Infrastructure is essential to a nation for it can provide quality education, health care and protection, transportation, more resources, easier travelling, trades, business. It could also connect peoples, support communities, generate job. Infrastructure could support these making it able to boost an economy with ease. Educational facilities, hospitals and also military installations are examples of infrastructure. So does roads, railroads, airports, and ports which then supports local and international travel. With infrastructure that supports transportation, trades are also possible with local and …show more content…

It would also make local businesses grow and expand. Infrastructure comes with innovation since it is a cause of the increasing number of infrastructure built as the time progresses. Infrastructures come in different types and functions but it is mainly to help build a nation. It acts as the framework in a community. It could support almost everything in the community from its citizen’s basic living needs to boosting its economy. It bring convenience to human life. Innovation is the process of improving the quality of an equipment, material, or infrastructure. It also represents the development of a certain area. A well-developed area is innovated in terms of infrastructures and man-power. Philippines have reached a milestone in developing the country. It is one of the countries in East Asia who achieved a title of “fast growing economy” in the year 2017. It is undeniable that Philippines have developed a lot throughout the

How Has The Canadian Pacific Railway Affected Canada's History?

With their province’s involvement in the newly built infrastructure, it would help

Ethos Pathos And Logos In Comeback

“The government can borrow at very low rates and build highways and bridges, improve ports, clean up waterways, repair dams, extend commuter railways—in short, undertake a whole raft of public projects that enhance productivity, create jobs, and stimulate spending” (Morris 105). Charles R. Morris uses punctuation in order to create meaning to infrastructure. Informing the reader what it does in order to build America and extend the job market. This emphasis placed on the different forms of infrastructure brings the third portion of the four key parts of America's growth to the audience; “an infrastructure build” (Morris 145-146). The writer presents these topics in a chronological order that makes it easy for the reader to comprehend that oil did the exact opposite of what everyone else was expecting.

Rhetorical Analysis Of State Of The Union Address

Reminding congress that the US “used to b No. 1 in the world in infrastructure” but has “sunk to 13th in the world” serves to bolster his argument for investing in the US infrastructure. This reality undermines the seemingly prosperous image the US tends to claim it has and urges Congress to work towards bettering its nation’s infrastructure. The US loses face at its fall in rank, this sort of shame caused by the degradation of the US position motivates congress to prove that the US has not declined in its ability and standing as a country. Thus, nationalistic sentiments to defend the image of their country arise and act as a tool to enable effective solutions to pressing issues, which, in this case, is

DBQ Essay: The Erie Canal

New York, the city of dreams, the land of riches, all because of the great canal. Begun in the 1817 and opened in its entirety 1825, the Erie Canal is considered the engineering marvel of the 19th century and will be that way for many years to come. The canal was 363 miles long and connected New York to the Great Lakes. The once derided as "Clinton's Folly" which is now known as the Erie Canal alternated by creating a vibrant economy, spreading religion, and growth in population along the new transportation network.

Industrial Revolution Dbq Essay

While some might argue that Industrialization had primarily negative consequences for society because of the dangerous working conditions with no compensation for injury, it was actually a positive thing for society. Industrialization’s positive effects were that there were more jobs, child labor laws were created, and there was better transportation. The first thing was that more jobs were introduced. This made it easier for people to provide for their family, and although everyone had to work, they were all able to get a job so they could work.

Book Review Of Rampage The Social Roots Of School Shootings

The infrastructure

Essay: Sex Trafficking In Atlanta

Development of an area can easily affect the society of that area. The landscape influences a society. Things like airports, roads, economic status can also change society. Atlanta has been largely impacted by its airport and its economic status. Atlanta has one of the largest sex trafficking cities, and child sex trafficking is a large problem in Atlanta.

Railroads And Its Impact On The Development Of Washington

The Washington state railroads had a monumental impact on the development of Washington. The first Transcontinental Railroad, the Northern Pacific, was built, uniting the western half of America, including Washington State, with the eastern half. Radical thinkers such as Governor Stevens proposed a direct connection from the East to the untouched resources of the West. The United Sates government supported the railway lines by providing state grants. They gave the railroad millions of acres of land in the undeveloped West.

Compare And Contrast The Tang And Song Dynasty

The developmental jobs and task created allowed for income and market economy to expand for china. They went further as to trade on land or sea throughout the eastern hemisphere. To travel they needed a ship or a boat to trade long distantly over sea. The increase production of trade allowed for China to make a social change.

How Did The Industrial Revolution Dbq

The Industrial Revolution began in England in the 1700’s within the textile industry. The Industrial Revolution was the transition to new manufacturing processes by using different machines. Before the Industrial Revolution people made different things by hand or simple tools. For example, people wove textiles by hand, and after the Industrial Revolution machines were used instead. The Industrial Revolution began in England because of many reasons.

Regional And Economic Growth In The 1800's

Regional & Economic Growth Assessment The North and South were both different and similar in how they operated. They were mostly based on the categories of transportation, agriculture, geography/climate, labor/industry, and society during the early 1800’s. These categories decided how much the North and South would progress as the country continued to grow. Geography/Climate In the North, they had all the four seasons of fall, winter, spring, and summer.

Transportation DBQ Essay

The US went through revolutionary advancements in transportation from 1800 to 1840. The transportation improvements had substantial effects on the economy and also individual development. People could now buy goods that were made in places faraway because access was easier to towns and cities and people’s experiences grew as they were able to be more mobile (309). The roads were inadequate in 1800, so the federal government funded the National Road in 1808 to establish its dedication to improve the roads in the nation and so then by 1839 the East and West would be tied together (309). Commerce was still inadequate even with the National Road funded which improved transportation.

Essay On The Impact Of Railroads In America

The Tremendous Impact of Railroads on America In the late 19th century, railroads propelled America into an era of unprecedented growth, prosperity, and convenient transportation. Prior to the building of the railroads, America lacked the proper and rapid transportation to make traveling across the country economical or practical. Lengthy travel was often cumbersome, costly, and dangerous.

Transportation In The 1800s Essay

The building of roads, canals and railroads played a large role in the United States during the 1800s. They served the purpose of connecting towns and settlements so that goods could be transported quickly and more efficiently. These goods could be transported fast, cheap and in safe way through the Erie Canal that was built to connect the Great Lakes to New York. Railroads were important during Civil War as well, because it helped in the transportation of goods, supplies and weapons when necessary. These new forms of transportation shaped the United States into the place that it is today.

Essay On Road Construction

An introduction to highway building: Although there are many methods to constructing a road, all are based on the principle that geographical objects are removed and replaced with harder and more wear-resistant materials. The pre-existing rock and earth is removed by digging or explosions. Tunnels, embankments and bridge are then added when necessary. The material that the road is being constructed from is then laid by various pieces of equipment, which will be looked at in greater detail in this assignment. The construction management of roads has become increasingly more difficult as larger structures are constantly being required in increasingly short amounts of time.

More about Essay On Importance Of Infrastructure

Related topics.

- International Monetary Fund

- Human geography

- Taylor & Francis

The critical role of infrastructure for the Sustainable Development Goals

The critical role of infrastructure for the Sustainable Development Goals is an essay written by The Economist Intelligence Unit and supported by UNOPS, the UN organisation with a core mandate for infrastructure. The research uses three pillars—the economy, the environment and wider society—as well as the overarching theme of resilience through which to assess the role of infrastructure in meeting global social and environmental goals.

- Marianne Fay, chief economist for climate change, World Bank

- Jim Hall, director and professor of climate and environmental risks, Environmental Change Institute, University of Oxford

- Mark Harvey, head of profession (infrastructure), UK Department for International Development

- Morgan Landy, senior director of global infrastructure and natural resources, International Finance Corporation

- Virginie Marchal, senior policy analyst, Environment Directorate, OECD

- Jo da Silva, founder and director, International Development, Arup

- Graham Watkins, principal environmental specialist, Inter-American Development Bank

Introduction

From the water we drink to the way we travel to work or school, infrastructure touches every aspect of human life. It has the power to shape the natural environment—for good or for ill. As the world’s population expands, urbanisation accelerates and emerging middle classes in developing countries demand more services, the need for infrastructure is rising rapidly. Meanwhile, increasingly severe weather events and rising sea levels pose direct threats to infrastructure assets and the critical services these provide, with lack of precise knowledge about future climate change making long-term planning increasingly difficult.

So how can we address these challenges? Many argue that the answer lies in new approaches to sustainable infrastructure development. The New Climate Economy’s Sustainable Infrastructure Imperative sees investing in sustainable infrastructure as “key to tackling the three central challenges facing the global community: reigniting growth, delivering on the Sustainable Development Goals, and reducing climate risk in line with the Paris Agreement.” 3

Indeed, the Paris Agreement, the 2030 Agenda for Sustainable Development—which supports the Sustainable Developments Goals (SDGs) developed by UN member states—the New Urban Agenda and the Sendai Framework for Disaster Risk Reduction all require investments that deliver climate-resilient infrastructure that supports sustainable development.

Among the SDGs, SDG 9 explicitly refers to building resilient infrastructure. However, all the goals are underpinned by infrastructure development. “Infrastructure is really at the centre of the delivery of the SDGs,” says Virginie Marchal, senior policy analyst in the OECD’s Environment Directorate. She cites inequality as a key example. “How can you make sure that by building the right type of infrastructure you not only have a positive impact on the environment and meet climate goals but you also contribute to reducing inequality within societies?”

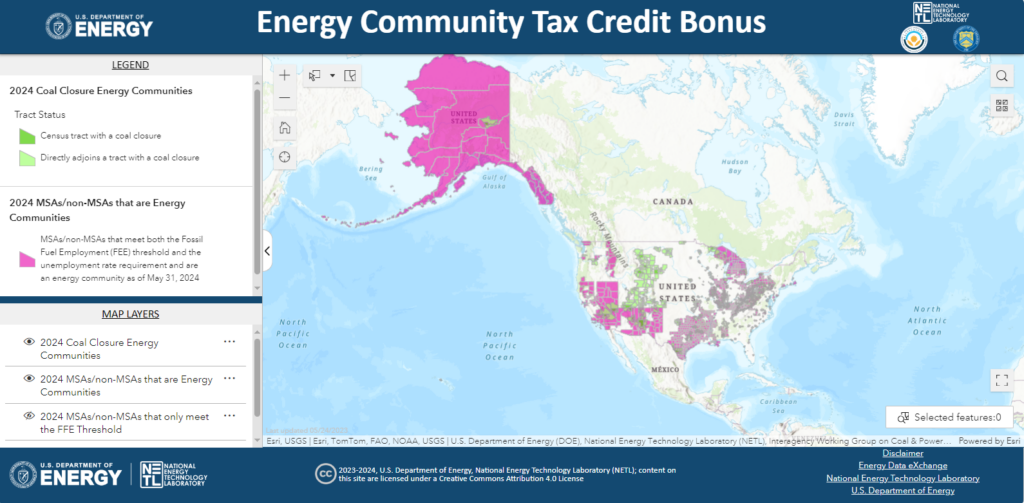

Achieving SDG 10—reduced inequalities—means meeting a number of the other SDGs. For example, SDG 6—availability and sustainable management of water and sanitation for all—demands investments in infrastructure of at least US$114bn a year, according to the World Bank. 4 When it comes to meeting SDG 7—access to affordable, reliable, sustainable and modern energy for all—investments needed include US$52bn per year to achieve universal electrification by 2030, only half of which is covered by planned investments. 5 And by helping empower women and girls, infrastructure contributes to meeting the objectives of SDG 5.

But what do we mean by “sustainable infrastructure”? First, while they offer solutions to sustainable development, infrastructure assets can have negative impacts. For example, infrastructure is responsible for more than 60% of global greenhouse gas (GHG) emissions. 6 The construction of large infrastructure assets, such as dams and railways, can disrupt and displace communities.

Sustainable infrastructure therefore needs to be planned, designed, delivered, managed and decommissioned to minimise its negative impacts and maximise its positive impacts. Meanwhile, infrastructure assets—throughout their entire lifecycle—should have positive impacts on the economy, society and the environment.

In this essay, Chapter 1 discusses the benefits of infrastructure, Chapter 2 examines the barriers to delivering sustainable infrastructure, and Chapter 3 highlights solutions and best practices.

The dividends

Delivering economic gains.

Investments in infrastructure will be instrumental in meeting the SDGs. By creating jobs and economic activity, infrastructure enables development. It also provides the services that underpin the ability of people to be economically productive, for example via transport. “The transport sector has a huge role in connecting populations to where the work is,” says Ms Marchal.

Infrastructure investments help stem economic losses arising from problems such as power outages or traffic congestion. The World Bank estimates that in Sub-Saharan Africa closing the infrastructure quantity and quality gap relative to the world’s best performers could raise GDP growth per head by 2.6% points per year. 7

In the US, it is estimated that about 63m full-time jobs in industries such as tourism, retail, agriculture and manufacturing depend on the quality, safety and reliability of transport infrastructure. 8 And McKinsey Global Institute analysis suggests that increasing infrastructure investment by 1% of GDP could create major new job opportunities across the world (see chart 1). 9

The failure of infrastructure is also a useful indicator of its economic value. For example, in 2013, when the Dawlish sea wall in south-west England was destroyed during storms, the repairs to the wall itself cost £35m, but the loss of a critical transport connection to the south west of England was estimated to cost the UK economy £1.2bn. 10

Infrastructure itself can also become more economically productive. The McKinsey Global Institute estimates that increasing the productivity of infrastructure can cut spending needs by 40%. Steps it recommends include optimising portfolios to avoid investing in projects that fail to meet needs or deliver sufficient benefits, streamlining processes, and implementing measures that increase the performance of existing assets. 11

Protecting the natural environment

From renewable energy to transport systems, the environmental benefits of infrastructure are manifold. For example, in the US, estimates are that if someone commuting 20 miles a day switches from driving to public transportation, it would lower their carbon footprint by 4,800 pounds annually. 12 Sustainable infrastructure assets can help to address climate and natural disasters, reduce greenhouse gas emissions and contamination, manage natural capital, and enhance resource efficiency. “The infrastructure built in the next five years will determine how we meet the Paris climate goals,” says Ms Marchal. “It’s a threat but also a huge opportunity for countries to leapfrog to infrastructure that is fit for climate.”

Professor Hall cites transportation as a tool in fossil-fuel reduction. “The transport sector needs to be largely electrified,” he says. “Whether you bank on electric vehicles or invest in mass transport in urban areas, it’s fundamental.”

Technology will facilitate significant environmental gains. In power infrastructure, for example, smart meters allow energy utilities to manage consumption patterns, creating price incentives to use electricity outside peak times, enabling them to reduce reliance on the more polluting “peaker plants” that supplement supply at peak demand times and that usually generate power using fossil fuels. 13

Integrating green infrastructure such as trees, plantings and forests into the portfolio of assets can improve air quality and contribute to removing carbon dioxide from the atmosphere or, in the case of mangroves, increasing flood protection and preventing soil erosion. Green roofs act as giant sponges, soaking up stormwater before it pollutes rivers and lakes, assist with flood control and, collectively, can reduce temperatures in cities during the summer. For example, one simulation study found that covering half of the available surfaces in downtown Toronto with green roofs would cool the city by up to 2˚C in some areas. 14

However, Professor Hall argues that efforts to increase investments in green infrastructure should not eclipse work to ensure that traditional infrastructure is sustainable. This includes addressing the emissions created by constructing and operating infrastructure. Erecting and running buildings, for example, consumes 36% of the world’s energy and produces some 40% of energy-related carbon emissions, according to estimates by the International Energy Agency, a research group. Meanwhile, while regulations are being introduced in many countries to reduce the environmental impact of construction, emissions generated by existing infrastructure must also be managed. In the developed world, for example, only about one in 100 buildings is replaced by a new one every year. 15

“If we focus only on green infrastructure, we lose sight of the amount that’s being spent on grey infrastructure and the potential for locking in patterns of development that may or may not be sustainable,” Professor Hall says.

Underpinning social progress

From schools, hospitals and roads to power and water networks, sustainable infrastructure enables governments and the private sector to provide services that contribute to sustainable individual livelihoods, as well as broader economic growth, while improving quality of life and enhancing human dignity. As part of this, ensuring equitable access to these services is critical, an aspiration enshrined in many of the SDGs, which call for basic services such as health, education, shelter, water and sanitation to be available to all.