How to Create a Cash Flow Forecast

10 min. read

Updated May 3, 2024

A good cash flow forecast might be the most important single piece of a business plan . All the strategy, tactics, and ongoing business activities mean nothing if there isn’t enough money to pay the bills.

That’s what a cash flow forecast is about—predicting your money needs in advance.

By cash, we mean money you can spend. Cash includes your checking account, savings, and liquid securities like money market funds. It is not just coins and bills.

Profits aren’t the same as cash

Profitable companies can run out of cash if they don’t know their numbers and manage their cash as well as their profits.

For example, your business can spend money that does not show up as an expense on your profit and loss statement . Normal expenses reduce your profitability. But, certain spending, such as spending on inventory, debt repayment, and purchasing assets (new equipment, for example) reduces your cash but does not reduce your profitability. Because of this, your business can spend money and still be profitable.

On the sales side of things, your business can make a sale to a customer and send out an invoice, but not get paid right away. That sale adds to the revenue in your profit and loss statement but doesn’t show up in your bank account until the customer pays you.

That’s why a cash flow forecast is so important. It helps you predict how much money you’ll have in the bank at the end of every month, regardless of how profitable your business is.

Learn more about the differences between cash and profits .

- Two ways to create a cash flow forecast

There are several legitimate ways to do a cash flow forecast. The first method is called the “Direct Method” and the second is called the “Indirect Method.” Both methods are accurate and valid – you can choose the method that works best for you and is easiest for you to understand.

Unfortunately, experts can be annoying. Sometimes it seems like as soon as you use one method, somebody who is supposed to know business financials tells you you’ve done it wrong. Often that means that the expert doesn’t know enough to realize there is more than one way to do it.

- The direct method for forecasting cash flow

The direct method for forecasting cash flow is less popular than the indirect method but it can be much easier to use.

The reason it’s less popular is that it can’t be easily created using standard reports from your business’s accounting software. But, if you’re creating a forecast – looking forward into the future – you aren’t relying on reports from your accounting system so it may be a better choice for you.

That downside of choosing the direct method is that some bankers, accountants, and investors may prefer to see the indirect method of a cash flow forecast. Don’t worry, though, the direct method is just as accurate. After we explain the direct method, we’ll explain the indirect method as well.

The direct method of forecasting cash flow relies on this simple overall formula:

Cash Flow = Cash Received – Cash Spent

And here’s what that cash flow forecast actually looks like:

Let’s start by estimating your cash received and then we’ll move on to the other sections of the cash flow forecast.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Forecasting cash received

You receive cash from three primary sources:

1. Sales of your products and services

In your cash flow forecast, this is the “Cash from Operations” section. When you sell your products and services, some customers will pay you immediately in cash – that’s the “cash sales” row in your spreadsheet. You get that money right away and can deposit it in your bank account. You might also send invoices to customers and then have to collect payment. When you do that, you keep track of the money you are owed in Accounts Receivable . When customers pay those invoices, that cash shows up on your cash flow forecast in the “Cash from Accounts Receivable” row. The easiest way to think about forecasting this row is to think about what invoices will be paid by your customers and when.

2. New loans and investments in your business

You can also receive cash by getting a new loan from a bank or an investment. When you receive this kind of cash, you’ll track it in the rows for loans and investments. It’s worth keeping these two different types of cash in-flows separate from each other, mostly because loans need to be repaid while investments do not need to be repaid.

3. Sales of assets

Assets are things that your business owns, such as vehicles, equipment, or property. When you sell an asset, you’ll usually receive cash from that sale and you track that cash in the “Sales of Assets” section of your cash flow forecast. For example, if you sell a truck that your company no longer needs, the proceeds from that sale would show up in your cash flow statement.

Forecasting cash spent

Similar to how you forecast the cash that you plan on receiving, you’ll forecast the cash that you plan on spending in a few categories:

1. Cash spending and paying your bills

You’ll want to forecast two types of cash spending related to your business’s operations: Cash Spending and Payment of Accounts Payable. Cash spending is money that you spend when you use petty cash or pay a bill immediately. But, there are also bills that you get and then pay later. You track these bills in Accounts Payable . When you pay bills that you’ve been tracking in accounts payable, that cash payment will show up in your cash flow forecast as “payment of accounts payable”. When you’re forecasting this row, think about what bills you’ll pay and when you’ll pay them. In this section of your cash flow forecast, you exclude a few things: loan payments, asset purchases, dividends, and sales taxes. These will show up in the following sections.

2. Loan Payments

When you make loan repayments, you’ll forecast the repayment of the principal in your cash flow forecast. The interest on the loan is tracked in the “non-operating expense” that we’ll discuss below.

3. Purchasing Assets

Similar to how you track sales of assets, you’ll forecast asset purchases in your cash flow forecast. Asset purchases are purchases of long-lasting, tangible things. Typically, vehicles, equipment, buildings, and other things that you could potentially re-sell in the future. Inventory is an asset that your business might purchase if you keep inventory on hand.

4. Other non-operating expenses and sales tax

Your business may have other expenses that are considered “non-operating” expenses. These are expenses that are not associated with running your business, such as investments that your business may make and interest that you pay on loans. In addition, you’ll forecast when you make tax payments and include those cash outflows in this section.

Forecasting cash flow and cash balance

In the direct cash flow forecasting method, calculating cash flow is simple. Just subtract the amount of cash you plan on spending in a month from the amount of cash you plan on receiving. This will be your “net cash flow”. If the number is positive, you receive more cash than you spend. If the number is negative, you will be spending more cash than you receive. You can predict your cash balance by adding your net cash flow to your cash balance.

- The indirect method

The indirect method of cash flow forecasting is as valid as the direct and reaches the same results.

Where the direct method looks at sources and uses of cash, the indirect method starts with net income and adds back items like depreciation that affect your profitability but don’t affect the cash balance.

The indirect method is more popular for creating cash flow statements about the past because you can easily get the data for the report from your accounting system.

You create the indirect cash flow statement by getting your Net Income (your profits) and then adding back in things that impact profit, but not cash. You also remove things like sales that have been booked, but not paid for yet.

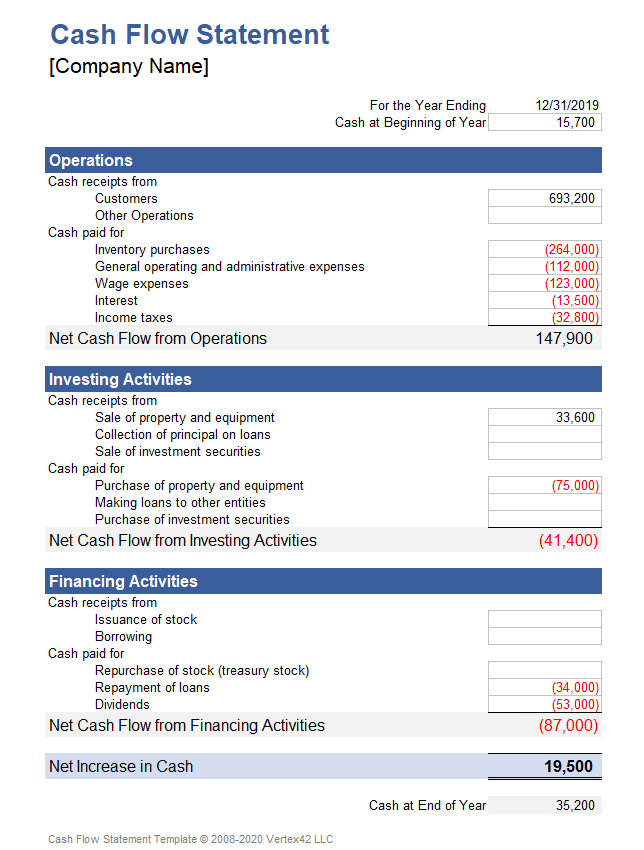

Here’s what an indirect cash flow statement looks like:

There are five primary categories of adjustments that you’ll make to your profit number to figure out your actual cash flow:

1. Adjust for the change in accounts receivable

Not all of your sales arrive as cash immediately. In the indirect cash flow forecast, you need to adjust your net profit to account for the fact that some of your sales didn’t end up as cash in the bank but instead increased your accounts receivable.

2. Adjust for the change in accounts payable

Very similar to how you make an adjustment for accounts receivable, you’ll need to account for expenses that you may have booked on your income statement but not actually paid yet. You’ll need to add these expenses back because you still have that cash on hand and haven’t paid the bills yet.

3. Taxes & Depreciation

On your income statement, taxes and depreciation work to reduce your profitability. On the cash flow statement, you’ll need to add back in depreciation because that number doesn’t actually impact your cash. Taxes may have been calculated as an expense, but you may still have that money in your bank account. If that’s the case, you’ll need to add that back in as well to get an accurate forecast of your cash flow.

4. Loans and Investments

Similar to the direct method of cash flow, you’ll want to add in any additional cash you’ve received in the form of loans and investments. Make sure to also subtract any loan payments in this row.

5. Assets Purchased and Sold

If you bought or sold assets, you’ll need to add that into your cash flow calculations. This is, again, similar to the direct method of forecasting cash flow.

- Cash flow is about management

Remember: You should be able to project cash flow using competently educated guesses based on an understanding of the flow in your business of sales, sales on credit, receivables, inventory, and payables.

These are useful projections. But, real management is minding the projections every month with plan versus actual analysis so you can catch changes in time to manage them.

A good cash flow forecast will show you exactly when cash might run low in the future so you can prepare. It’s always better to plan ahead so you can set up a line of credit or secure additional investment so your business can survive periods of negative cash flow.

- Cash Flow Forecasting Tools

Forecasting cash flow is unfortunately not a simple task to accomplish on your own. You can do it with spreadsheets, but the process can be complicated and it’s easy to make mistakes.

Fortunately, there are affordable options that can make the process much easier – no spreadsheets or in-depth accounting knowledge required.

If you’re interested in checking out a cash flow forecasting tool, take a look at LivePlan for cash flow forecasting. It’s affordable and makes cash flow forecasting simple.

One of the key views in LivePlan is the cash flow assumptions view, as shown below, which highlights key cash flow assumptions in an interactive view that you can use to test the results of key assumptions:

With simple tools like this, you can explore different scenarios quickly to see how they will impact your future cash.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- Profits aren’t the same as cash

Related Articles

8 Min. Read

How to Forecast Personnel Costs in 3 Steps

5 Min. Read

How to Highlight Risks in Your Business Plan

9 Common Mistakes with Business Financial Projections

4 Min. Read

How to Create an Expense Budget

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Prepare a Cash Flow Statement

- 07 Dec 2021

Cash flow statements are one of the three fundamental financial statements financial leaders use. Along with income statements and balance sheets, cash flow statements provide crucial financial data that informs organizational decision-making. While all three are important to the assessment of a company’s finances, some business leaders might argue cash flow statements are the most important.

Business owners, managers, and company stakeholders use cash flow statements to better understand their companies’ value and overall health and guide financial decision-making. Regardless of your position, learning how to create and interpret financial statements can empower you to understand your company’s inner workings and contribute to its future success.

Related: The Beginner's Guide to Reading & Understanding Financial Statements

Here’s a look at what a cash flow statement is and how to create one.

Access your free e-book today.

What Is a Cash Flow Statement?

A cash flow statement is a financial report that details how cash entered and left a business during a reporting period .

According to the online course Financial Accounting : “The purpose of the statement of cash flows is to provide a more detailed picture of what happened to a business’s cash during an accounting period.”

Related: How to Read & Understand a Cash Flow Statement

Since cash flow statements provide insight into different areas a business used or received cash during a specific period, they’re important financial statements when it comes to valuing a company and understanding how it operates.

A typical cash flow statement comprises three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

How to Create a Cash Flow Statement

1. Determine the Starting Balance

The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. This value can be found on the income statement of the same accounting period.

The starting cash balance is necessary when leveraging the indirect method of calculating cash flow from operating activities. However, the direct method doesn’t require this information.

2. Calculate Cash Flow from Operating Activities

One you have your starting balance, you need to calculate cash flow from operating activities. This step is crucial because it reveals how much cash a company generated from its operations.

Cash flow from operations are calculated using either the direct or indirect method.

Direct Method

The direct method of calculating cash flow from operating activities is a straightforward process that involves taking all the cash collections from operations and subtracting all the cash disbursements from operations. This approach lists all the transactions that resulted in cash paid or received during the reporting period.

Indirect Method

The indirect method of calculating cash flow from operating activities requires you to start with net income from the income statement (see step one above) and make adjustments to “undo” the impact of the accruals made during the reporting period. Some of the most common and consistent adjustments include depreciation and amortization.

Related: Financial Terminology: 20 Financial Terms to Know

Both the direct and indirect methods will result in the same number, but the process of calculating cash flow from operations differs.

While the direct method is easier to understand, it’s more time-consuming because it requires accounting for every transaction that took place during the reporting period. Most companies prefer the indirect method because it's faster and closely linked to the balance sheet. However, both methods are accepted by Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

Related: GAAP vs. IFRS: What Are the Key Differences and Which Should You Use?

3. Calculate Cash Flow from Investing Activities

After calculating cash flows from operating activities, you need to calculate cash flows from investing activities. This section of the cash flow statement details cash flows related to the buying and selling of long-term assets like property, facilities, and equipment. Keep in mind that this section only includes investing activities involving free cash, not debt.

4. Calculate Cash Flow from Financing Activity

The third section of the cash flow statement examines cash inflows and outflows related to financing activities. This includes cash flows from both debt and equity financing—cash flows associated with raising cash and paying back debts to investors and creditors.

When using GAAP, this section also includes dividends paid, which may be included in the operating section when using IFRS standards. Interest paid is included in the operating section under GAAP, but sometimes in the financing section under IFRS as well.

5. Determine the Ending Balance

Once cash flows generated from the three main types of business activities are accounted for, you can determine the ending balance of cash and cash equivalents at the close of the reporting period.

The change in net cash for the period is equal to the sum of cash flows from operating, investing, and financing activities. This value shows the total amount of cash a company gained or lost during the reporting period. A positive net cash flow indicates a company had more cash flowing into it than out of it, while a negative net cash flow indicates it spent more than it earned.

Cash Flow Statement Example

To help visualize each section of the cash flow statement, here’s an example of a fictional company generated using the indirect method.

Go to the alternative version .

This cash flow statement is for a reporting period that ended on Sept. 28, 2019. As you'll notice at the top of the statement, the opening balance of cash and cash equivalents was approximately $10.7 billion.

During the reporting period, operating activities generated a total of $53.7 billion. The investing activities section shows the business used a total of $33.8 billion in transactions related to investments. The financing activities section shows a total of $16.3 billion was spent on activities related to debt and equity financing.

At the bottom of the cash flow statement, the three sections are summed to total a $3.5 billion increase in cash and cash equivalents over the course of the reporting period. Therefore, the final balance of cash and cash equivalents at the end of the year equals $14.3 billion.

Financial Decision-Making

Whether you’re a manager, entrepreneur, or individual contributor, understanding how to create and leverage financial statements is essential for making sound business decisions.

The statement of cash flows is one of the most important financial reports to understand because it provides detailed insights into how a company spends and makes its cash. By learning how to create and analyze cash flow statements, you can make better, more informed decisions, regardless of your position.

Are you interested in gaining a toolkit for making smarter financial decisions and the confidence to clearly communicate them to key stakeholders? Explore Financial Accounting —one of three courses comprising our Credential of Readiness (CORe) program —to discover how you can unlock critical insights into your organization’s performance and potential. Not sure which course is right for you? Download our free flowchart .

Data Tables

Company a - statement of cash flows (alternative version).

Year Ended September 28, 2019 (In millions)

Cash and cash equivalents, beginning of the year: $10,746

OPERATING ACTIVITIES

Investing activities, financing activities.

Increase / Decrease in Cash and Cash Equivalents: 3,513

Cash and Cash Equivalents, End of Year: $14,259

Go back to the article .

About the Author

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Our qualifications

- Getting started

- Your career

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- ACCA apprenticeships

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member communities

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- Affiliate video support

- An introduction to professional insights

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

- Example of a cashflow

- Business Finance

- Business plans and cashflow

- Back to Business plans and cashflow

- Writing your business plan

- Example of a business plan

As well as your business plan, a set of financial statements detailing you cashflow is essential. This will provide details of actual cash required by your business on a day-to-day, month-to-month and year-to-year basis.

The needs of a business constantly change and your cashflow will highlight any shortfalls in cash that will need to be bridged. Many established, viable, and even profitable businesses fail due to cash not being available when they need it most.

Good cashflow management is critical to running a successful business. You must be able to pay your bills while you await payment from your customers. There are many well-documented cases of businesses failing not because they weren't profitable but due to poor cashflow management.

You're in business to make a profit. It's a simple principle, but one that can occasionally become lost amid dreams of building multinational empires worth millions of pounds. You won't be able to stay in business, however, unless you have cash, hence the famous adage 'cash is king'.

There will probably be a time lag between your business providing its goods or services and getting paid. This means you have to make sure there is sufficient cash in your company's bank account for it to pay all its bills in the meantime – whether these relate to invoices from suppliers, employees' wages, rent, rates, tax, VAT or anything else.

Even if your business is profitable, there may be times when you are short of cash because you are awaiting payment for a large order. This is likely to be a particular problem during your first year when you are building up your business and don't have regular cash inflows.

The general principle of cashflow management is that you should speed up your cash inflows (customer payments, interest from bank accounts etc) and slow down your cash outflows within reason (purchase of stock and equipment, loan repayments and tax charges etc) as much as possible.

It can be difficult to affect your outflows other than extending your credit terms with your suppliers, which will often occur on fixed dates in the month and your employees and suppliers might also not take too kindly to you delaying payment to them. But there is more scope for you to improve your cash inflows.

This could mean billing regularly, chasing bad debt, selling your debt to a third party (factoring), negotiating extended credit terms with suppliers, managing your stock effectively (which could entail ordering little and often) and giving your customers 30-day payment terms.

Also, as businesses naturally have peaks and troughs, it is important that you put money away during the peaks so that you can dip into it during the troughs.

It is a good idea to think about investing in some accounting software to help you manage your cashflow. There are many software providers: an internet search should reveal the most common. Most provide software that can help you with cashflow analysis and forecasting, so that your business is never caught short of cash in the bank. Your accountant should be able to help advise you on which software package to buy.

How to use the cashflow forecast template

Our cashflow template will show you how a cashflow works and should be amended to suit your own business.

All figures to be entered are actual cash. This includes bank payments and receipts, cheques, bank transfers, cash payments and receipts – all of these should be included in your opening balance.

Then complete the shaded area opening balance, which includes bank, loan and cash balances and should be put in the sheets:

- monthly cashflow forecast

- monthly actual cashflow

This provides the starting point for the rest of the cashflow. Next, input your month 1 forecast – all the sales broken down into the elements of your particular business – and do the same for expenditure. Base your figures on your own experience and what you forecast to receive or pay. The sections can be amended to reflect your business's requirements.

Repeat this process for the actual cashflow; here the figures you input are based on actual. This should then automatically be displayed in the third sheet:

- monthly cashflow forecast/actual comparison

This is where the real analysis work is done and will determine the accuracy of your forecast figures. The forecasts sheet should be used to determine when you may have a cash shortfall before the event arises and will help determine whether you will need to obtain additional funding.

Download the cashflow template from 'Related documents'.

Related documents

Download EXCEL 93KB

ACCA Cashflow Template

Advertisement

- ACCA Careers

- ACCA Career Navigator

- ACCA Learning Community

Useful links

- Make a payment

- ACCA-X online courses

- ACCA Rulebook

- Work for us

Most popular

- Professional insights

- ACCA Qualification

- Member events and CPD

- Supporting Ukraine

- Past exam papers

Connect with us

Planned system updates.

- Accessibility

- Legal policies

- Data protection & cookies

- Advertising

- Search Search Please fill out this field.

What Is Cash Flow?

- Formula & Calculation

Understanding Cash Flow

- Financial Statement

- Analyzing Cash Flows

Example of Cash Flow

The bottom line.

- Corporate Finance

Cash Flow: What It Is, How It Works, and How to Analyze It

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Cash flow is the net cash and cash equivalents transferred in and out of a company. Cash received represents inflows, while money spent represents outflows. A company creates value for shareholders through its ability to generate positive cash flows and maximize long-term free cash flow (FCF) . This is the cash from normal business operations after subtracting any money spent on capital expenditures (CapEx) .

Key Takeaways

- Cash flow is the movement of money in and out of a company.

- Cash received signifies inflows, and cash spent is outflows.

- The cash flow statement is a financial statement that reports a company's sources and use of cash over time.

- A company's cash flow can be categorized as cash flows from operations, investing, and financing.

Investopedia / NoNo Flores

Formula and Calculation of Cash Flow

You can easily calculate a company's cash flow using the formula below. To do this, make sure you locate the total cash inflow and the total cash outflow.

CF = TCI - TCO

- TCI = Total cash inflow

- TCO = Total cash outflow

Cash flow refers to the money that goes in and out of a business. Businesses take in money from sales as revenues (inflow) and spend money on expenses (outflow). They may also receive income from interest, investments, royalties , and licensing agreements and sell products on credit. Assessing cash flows is essential for evaluating a company’s liquidity , flexibility, and overall financial performance.

Positive cash flow indicates that a company's liquid assets are increasing, enabling it to cover obligations, reinvest in its business, return money to shareholders, pay expenses, and provide a buffer against future financial challenges. Companies with strong financial flexibility fare better, especially when the economy experiences a downturn, by avoiding the costs of financial distress .

Cash flows are analyzed using the cash flow statement , which is a standard financial statement that reports a company's cash source and use over a specified period. Corporate management, analysts, and investors use this statement to determine how well a company earns to pay its debts and manage its operating expenses. The cash flow statement is an important financial statement issued by a company, along with the balance sheet and income statement.

Cash Flow Statement

The cash flow statement acts as a corporate checkbook to reconcile a company's balance sheet and income statement . The cash flow statement includes the bottom line , recorded as the net increase/decrease in cash and cash equivalents (CCE) .

The bottom line reports the overall change in the company's cash and its equivalents over the last period. The difference between the current CCE and that of the previous year or the previous quarter should have the same number as the number at the bottom of the statement of cash flows.

Types of Cash Flow

Cash flows from operations (cfo).

Cash flow from operations (CFO) describes money flows involved directly with the production and sale of goods from ordinary operations. Also known as operating cash flow , CFO indicates whether or not a company has enough funds coming in to pay its bills or operating expenses .

Operating cash flow is calculated by taking cash received from sales and subtracting operating expenses that were paid in cash for the period. Operating cash flow is recorded on a company's cash flow statement, indicates whether a company can generate enough cash flow to maintain and expand operations, and shows when a company may need external financing for capital expansion.

Cash Flows From Investing (CFI)

Cash flow from investing (CFI) or investing cash flow reports how much cash has been generated or spent from various investment-related activities in a specific period. Investing activities include purchases of speculative assets , investments in securities, or sales of securities or assets.

Negative cash flow from investing activities might be due to significant amounts of cash being invested in the company, such as research and development (R&D) , and is not always a warning sign.

Cash Flows From Financing (CFF)

Cash flows from financing (CFF) shows the net flows of cash used to fund the company and its capital. CFI is also commonly referred to as financing cash flow . Financing activities include transactions involving issuing debt, equity, and paying dividends.

Cash flow from financing activities provides investors insight into a company’s financial strength and how well its capital structure is managed.

How to Analyze Cash Flows

Using the cash flow statement in conjunction with other financial statements can help analysts and investors arrive at various metrics and ratios used to make informed decisions and recommendations.

Below is Walmart's ( WMT ) cash flow statement for the fiscal year ending on Jan. 31, 2024. All amounts are in millions of U.S. dollars.

Investments in property, plant, and equipment (PP&E) and acquisitions of other businesses are accounted for in the cash flow from the investing activities section. Proceeds from issuing long-term debt, debt repayments, and dividends paid out are accounted for in the cash flow from the financing activities section.

Walmart's cash flow was positive, showing an increase of $1.09 billion, which indicates that it retained cash in the business and added to its reserves to handle short-term liabilities and fluctuations in the future.

How Are Cash Flows Different Than Revenues?

Revenue is the income earned from selling goods and services. If an item is sold on credit or via a subscription payment plan, money may not yet be received from those sales and are booked as accounts receivable. These do not represent actual cash flows into the company at the time. Cash flows also track outflows and inflows and categorize them by the source or use.

What Is the Difference Between Cash Flow and Profit?

Cash flow isn't the same as profit. Profit is specifically used to measure a company's financial success or how much money it makes overall. This is the amount of money that is left after a company pays off all its obligations. Profit is found by subtracting a company's expenses from its revenues.

What Is Free Cash Flow and Why Is It Important?

Free cash flow is left over after a company pays for its operating expenses and CapEx. It is the remaining money after items like payroll, rent, and taxes. Companies are free to use FCF as they please.

Do Companies Need to Report a Cash Flow Statement?

The cash flow statement complements the balance sheet and income statement. It is part of a public company's financial reporting requirements since 1987.

Why Is the Price-to-Cash Flows Ratio Used?

The price-to-cash flow (P/CF) ratio is a stock multiple that measures the value of a stock’s price relative to its operating cash flow per share. This ratio uses operating cash flow , which adds back non-cash expenses such as depreciation and amortization to net income.

P/CF is especially useful for valuing stocks with positive cash flow but are not profitable because of large non-cash charges .

Cash flow refers to money that goes in and out. Companies with a positive cash flow have more money coming in, while a negative cash flow indicates higher spending. Net cash flow equals the total cash inflows minus the total cash outflows.

U.S. Securities and Exchange Commission. " Beginners' Guide to Financial Statements ."

U.S. Securities and Exchange Commission. " Explanation of Non-GAAP and Other Financial Measures ."

U.S. Securities and Exchange Commission. " Form 10-K ," Page 5.

FASB. " Summary of Statement No. 95 ."

:max_bytes(150000):strip_icc():format(webp)/Understanding-the-Cash-Flow-Statement-Color-fc25b41daf7d45e3a63fd5f916fbf9ee.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

.png)

Cash Flow Forecasting: A How-To Guide (With Templates)

Janet Berry-Johnson, CPA

Reviewed by

May 30, 2023

This article is Tax Professional approved

Most small business owners just want their accounting done so they can focus on doing what they love. But tracking and forecasting cash flow—despite the time and effort required—is essential for starting, operating, and expanding a business.

I am the text that will be copied.

In 2018, CB Insights analyzed 101 failed startups and found that running out of cash was the second most common cause of failure, impacting 29% of businesses.

To avoid that fate, you need a cash flow forecast to help you estimate how much your cash outflows and inflows will affect your business.

What is a cash flow forecast?

A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out based on past business performance.

It’s not uncommon for a business to experience a cash shortage, even when sales are good. This usually happens when customers are allowed to pay after the product or service is delivered. In cases like these, a business owner must plan how they will cover costs before receiving the payment.

For example, say Hana Enterprises ships $50,000 worth of security products to customers in January, along with invoices that are due in 30 days. The company will have $50,000 of revenues for the month but won’t receive any cash until February. On paper, the business looks healthy, but all of its sales are tied up in the accounts receivable. Unless Hana Enterprises has plenty of cash on hand at the beginning of the month, they will have trouble covering their expenditures until they start receiving cash from clients.

With a cash flow forecast, you ignore sales on credit, accounts payable, and accrued expenses, instead focusing on the revenue you actually expect to collect and the expenses you actually expect to pay during a given period. You can also use the information provided on past cash flow statements to estimate your expenses for the period you’re forecasting for.

( If you just want to dive into cash flow forecasting, check out our free cash flow forecast template . )

The benefits of cash forecasting

Cash forecasting may sound like something boring that accountants do in big companies. Not so! It’s absolutely essential for every single business. Here’s why:

- It helps you identify potential problems. Cash forecasting can help you predict the months in which you’re likely to experience a cash deficit and make necessary changes, like changing your pricing or adjusting your business plan.

- It decreases the impact of cash shortages. When you can predict months in which you might experience a cash shortage, you can take steps to plan for them. You might save more in months where you have a surplus, step up your receivables collection efforts, or establish a line of credit with your bank to guarantee enough working capital to last the period.

- It keeps suppliers and employees happy. Late payments and missing paychecks damage your reputation with suppliers and employees. When you can predict how much money you’ll have on hand in any given month, you can confirm that you’ll be able to meet your payroll obligations and pay suppliers by the due date.

Free cash flow forecast template

To make this a lot easier, we’ve created a business cash flow forecast template for Excel you can start using right now.

Access Template

The template has three essential pieces:

- Beginning cash balance. This is the actual cash you expect to have on hand at the beginning of the month. It should include bank accounts, PayPal, Venmo, anything you use that’s currently holding just business funds. This information can be found on your balance sheet .

- Sources of cash. These are all of your cash inflows each month. It can include cash sales, receivables collections, repayments from money you’ve loaned out, etc.

- Uses of cash. This is every expense your business may incur, including payroll, payments to vendors, utilities, rent, loan payments, etc.

Here’s an example of a completed cash flow projection for a three month period:

Hana Enterprises, Inc.

Cash Flow Projection

January to March 2022

As you can see from the example above, Hana Enterprises expects to have a cash shortage in March. This results from a negative net cash flow (when more cash goes out than comes in). Knowing that information ahead of time, the company can take steps to prevent the shortage from occurring.

Hana Enterprises has several options to avoid this shortage in March. They might secure a line of credit from the bank, purchase fewer computers in February, negotiate longer payment terms from vendors, contact late-paying customers to speed up the collection of receivables, or take other cost-cutting measures to reduce their overhead expenses.

When you’re ready to get started, download your copy of the cash flow forecasting sheet here .

How Bench can help

Use Bench’s simple, intuitive platform to get all the information you need to project your cash flow. Each month, your transactions are automatically imported into our platform then categorized and reviewed by your personal bookkeeper. Bench helps you stay on top of your business’s top expenses so you can make informed budgeting decisions on the fly. Explore our platform with a free tour today .

Tips for improving your cash flow spreadsheet

Keep in mind: a cash flow forecast isn’t something you create once a year and never look at again. It’s a living, breathing business tool you should review and update on a monthly basis.

Though projections are helpful, they can’t perfectly predict the future. As the months pass, you should expect to see that your projections aren’t quite matching up with your actual results. That means it’s time to re-run your forecast to take into account these differences.

To improve the accuracy of your cash flow worksheet, consider the following:

- Account for extra pay periods. If you pay employees bi-weekly, make sure your projection takes into account any months with three payrolls.

- Remember annual payments. If certain insurance policies, subscriptions, or other expenses are paid annually rather than monthly, be sure to include them in your spreadsheet.

- Remember estimated tax payments. For most calendar-year businesses, estimated tax payments are due on April 15th, June 15th, September 15th, and January 15th.

- Don’t forget about savings. Try to allocate a portion of any cash surpluses to save for lean months.

- Identify seasonal fluctuations. If you’re expecting a period of time with lower sales, make sure your forecast reflects this so you can have enough cash on hand to ramp up when business picks up again.

- Don’t forecast too far out. Creating a rolling 12-month cash flow forecast that you update at the end of each month can help you identify issues before your business faces financial troubles, but don’t try to forecast more than 12 months out. The longer the reporting period you want to forecast, the more likely you’ll end up spending a lot of time creating a cash flow projection that doesn’t provide any useful information.

Your cash flow forecast is key to good cash flow management . Try to account for all cash sources and uses in your projection and maintain an emergency fund or backup plan to ensure you don’t get sidelined by slow-paying customers or unexpected expenses. When you do, this simple but valuable tool can help you keep an eye on cash and ensure you don’t compromise growth or put your business in jeopardy.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

Free Cash Flow Forecast Templates

By Andy Marker | June 24, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve compiled the most useful free cash flow forecast templates, including those for small businesses, nonprofits, and personal cash flow forecasting, as well tips for performing a cash flow forecast.

Included on this page, you'll find a simple cash flow forecast template and a small business cash flow projection template , as well as the benefits of cash flow forecasting .

What Is a Cash Flow Forecast Template?

A cash flow forecasting template allows you to determine your company’s net amount of cash to continue operating your business. The template provides a way to examine day-by-day, month-by-month, quarter-by-quarter, or year-over-year projected cash receipts and cash payments as compared to your operating expenses and other outflows.

Use the preset criteria in a template to take the guesswork out of cash flow forecast requirements. You can then use the forecast to provide your company (or third parties) with a clear picture of your projected business costs. While cash flow forecasting allows you to look at projected cash flow, you can also track the actual cash flow for any chosen time period (i.e., daily, weekly, monthly, quarterly, or yearly).

To learn more about cash flow forecasting and to view examples, visit " How to Create a Cash Flow Forecast, with Templates and Examples ."

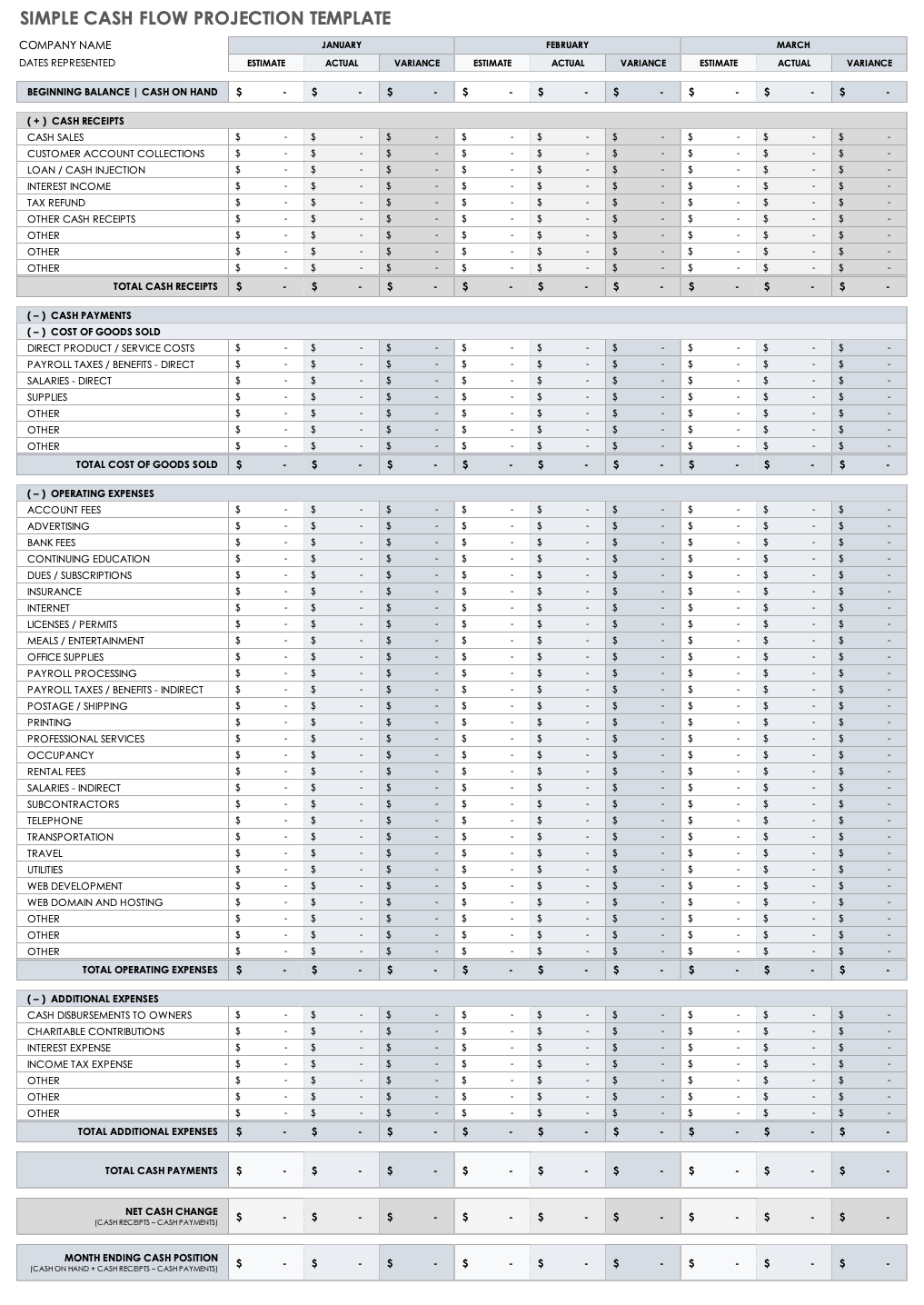

Simple Cash Flow Forecast Template

Use this basic template to gain monthly insight into your company’s cash flow and ensure you have sufficient funds to continue operating. Fill in your information for beginning balance (cash on hand), cash receipts and disbursements (R&D), operating expenses, and additional expenses. The template will auto-tally the monthly net cash change and month ending cash position columns. Use this information to forecast how long your cash will last, and whether you need to obtain additional financing.

Download Simple Cash Flow Projection Template - Excel

Small Business Cash Flow Projection Template

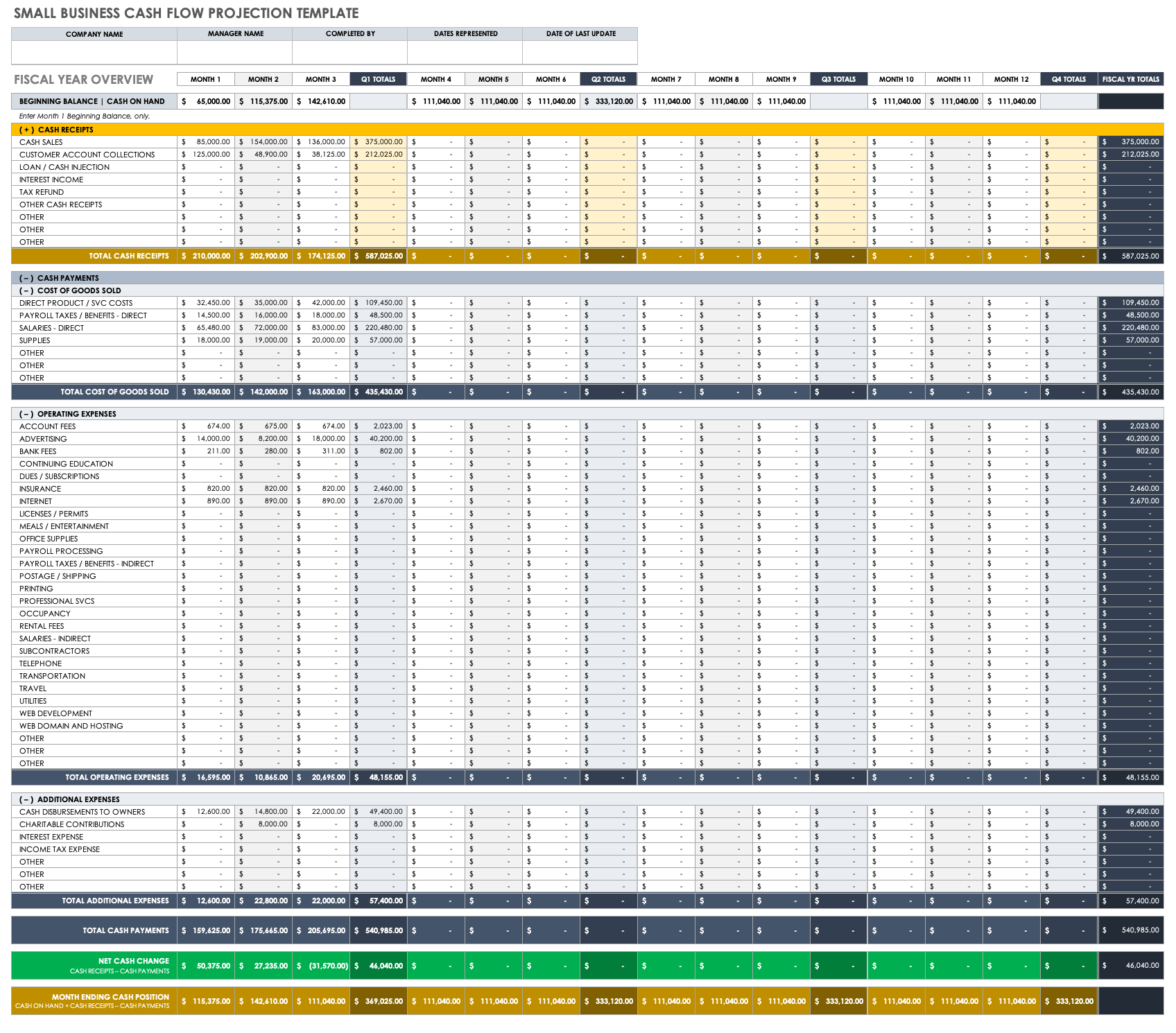

Use this cash flow projection template, designed for small businesses, to determine whether or not your business has adequate cash to meet its obligations. The monthly columns provide a big picture of how long funds should last, and the tallies for cash receipts, cash paid out, and other operating figures allow you to identify any potential shortfalls of your cash balances. This small business cash flow template also works with projected figures for a small business plan.

Download Small Business Cash Flow Projection Template - Excel

12-Month Cash Flow Forecast Template

Track your company’s overall cash flow with this easily fillable 12-month cash flow forecast template. This template includes unique expected and actual cash-on-hand details for the beginning of each month, which you can use to ensure that you can pay all employees and suppliers. Enter cash receipts and cash paid out figures to determine your end-of-month cash position. The monthly details of this forecast template allow you to track — at a glance — any threats to your company’s cash flow.

Download 12-Month Cash Flow Forecast Template

Excel | Smartsheet

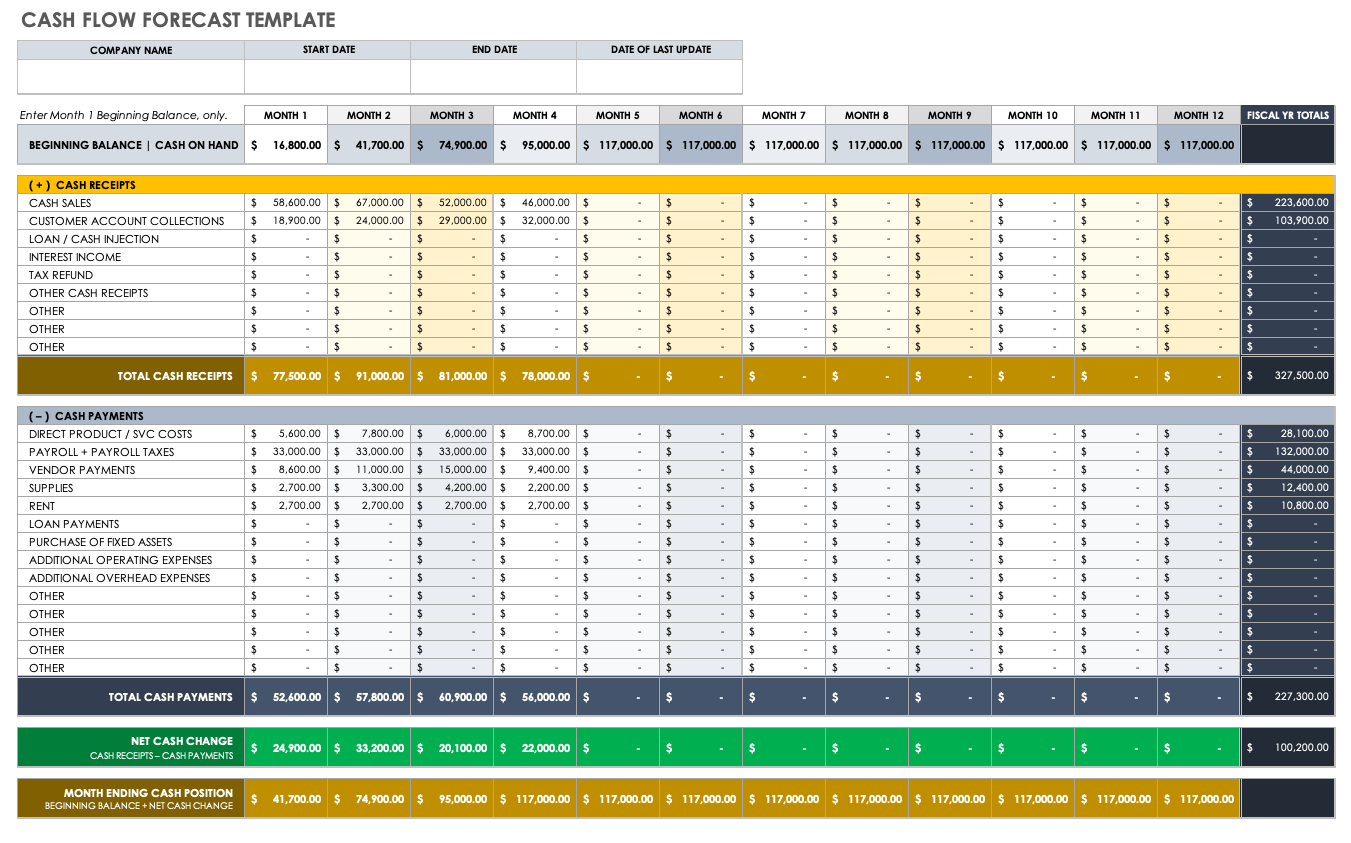

Cash Flow Forecast Template

This simple cash flow forecast template provides a scannable view of your company’s projected cash flow. Sections include beginning and ending cash balances, cash sources, cash uses, and cash changes during the month. These details provide an accurate picture of your company’s projected month-by-month financial liquidity. Ultimately, this template will help you identify potential issues that you must address in order for your business to remain on sound fiscal footing.

Download Cash Flow Forecast Template - Excel

Daily Cash Flow Forecast Template

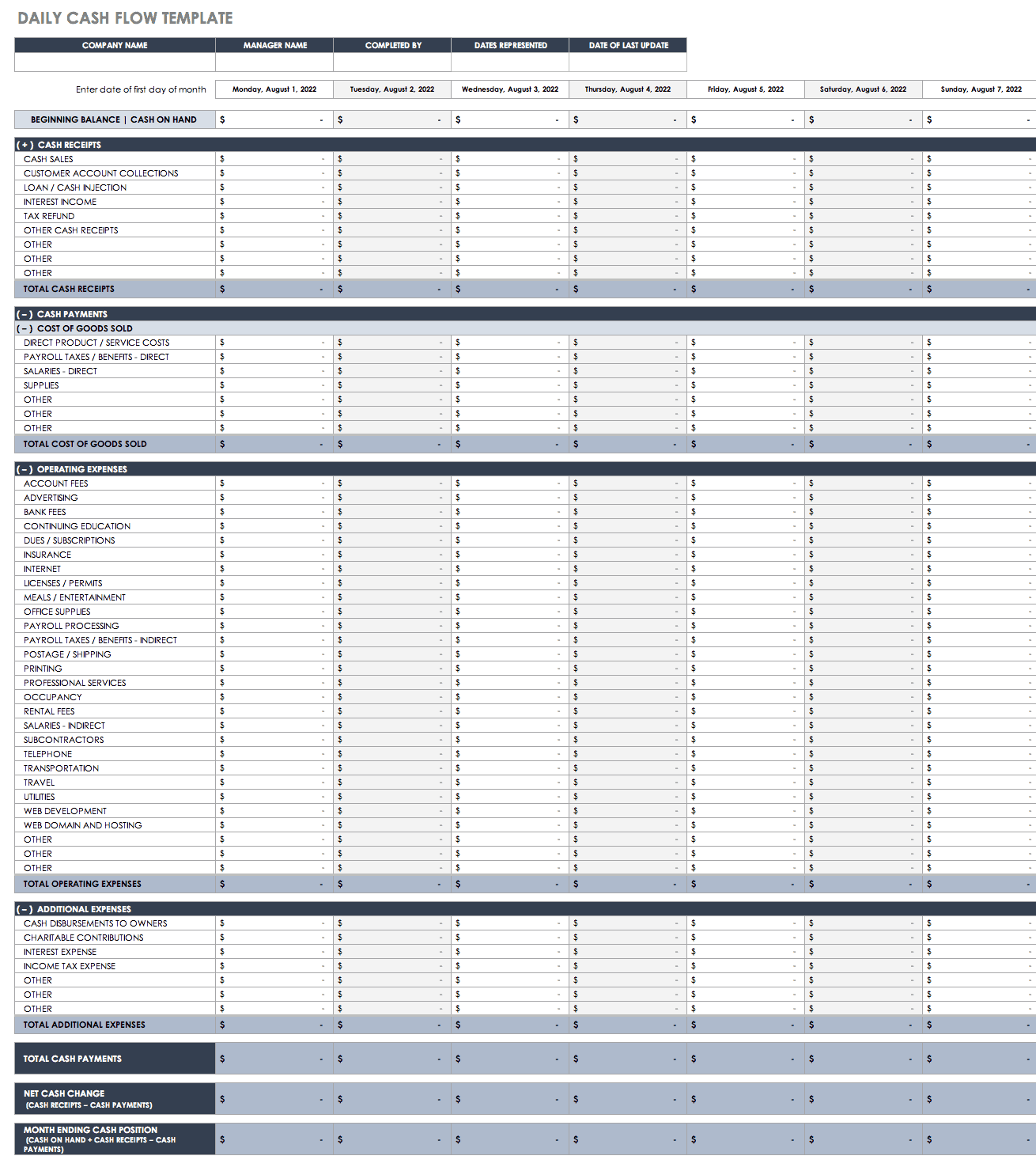

Use this daily cash flow forecast template to get a pulse on your business’ short-term liquidity. Daily cash flow forecasts are particularly helpful in determining that everything is accounted for and for avoiding any shortfalls. The template calculates cash payments against operating expenses to provide a daily net cash change and month-ending cash positions. This template has everything you need to get a day-by-day perspective of your business’s financial performance and outlook.

Download Daily Cash Flow Forecast Template

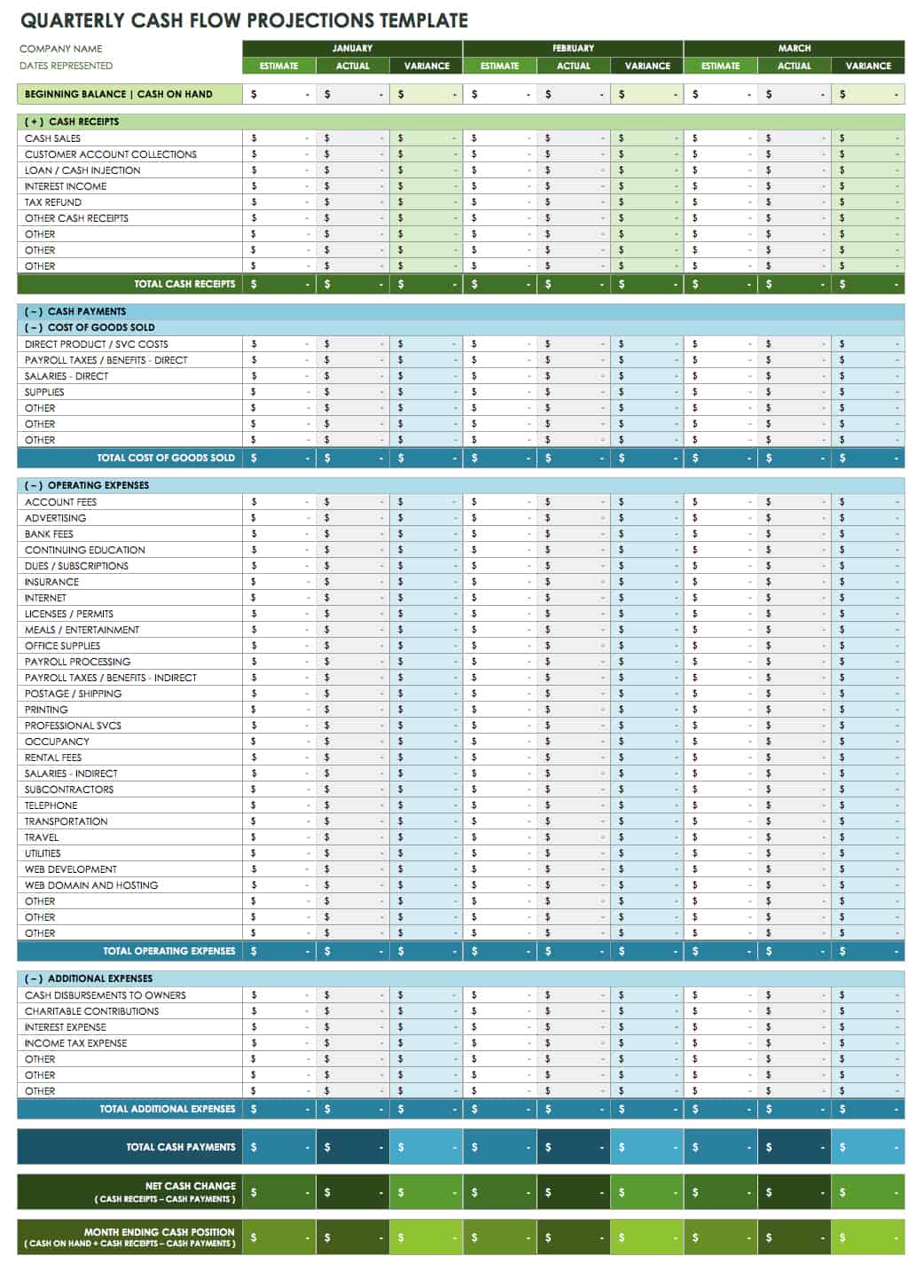

Quarterly Cash Flow Projections Template

Keep quarterly tabs on your cash flow with this customizable template. Use the quarter-by-quarter tabs to quickly detect any problems with a variety of factors, such as late customer payments and their potential impact on your business. This quarterly cash flow projections template is perfect for determining how any given variable might affect future financial planning.

Download Quarterly Cash Flow Projections Template

Excel | Smartsheet

Three-Year Cash Flow Forecast Template

Get the big picture of your company’s long-term cash flow with this three-year cash flow forecast template. The spreadsheet provides separate tabs for a current cash flow statement, as well as 12-month cash flow and three-year cash flow projections. Enter year-by-year operations, investing activities, and financing details to see your year-over-year net increases or decreases. You can save this template as an individual file with customized entries, or share it with other business units or departments that need to provide cash flow details.

Download Three-Year Cash Flow Forecast Template

Discounted Cash Flow Forecast Template

Designed around the concept of discounted cash flow (DCF) valuation based on future cash flows, this template allows you to perform an analysis to determine your business’ true value. You’ll find year-by-year rows, their respective incomes (cash inflow), expenses (fixed and variable), cash outflow, net cash, and DCF details (present value and cumulative present value), and actual present value, all of which culminates in net present value. This DCF forecast template is also ideal for determining the value of a potential investment.

Download Discounted Cash Flow Template

Excel | Smartsheet

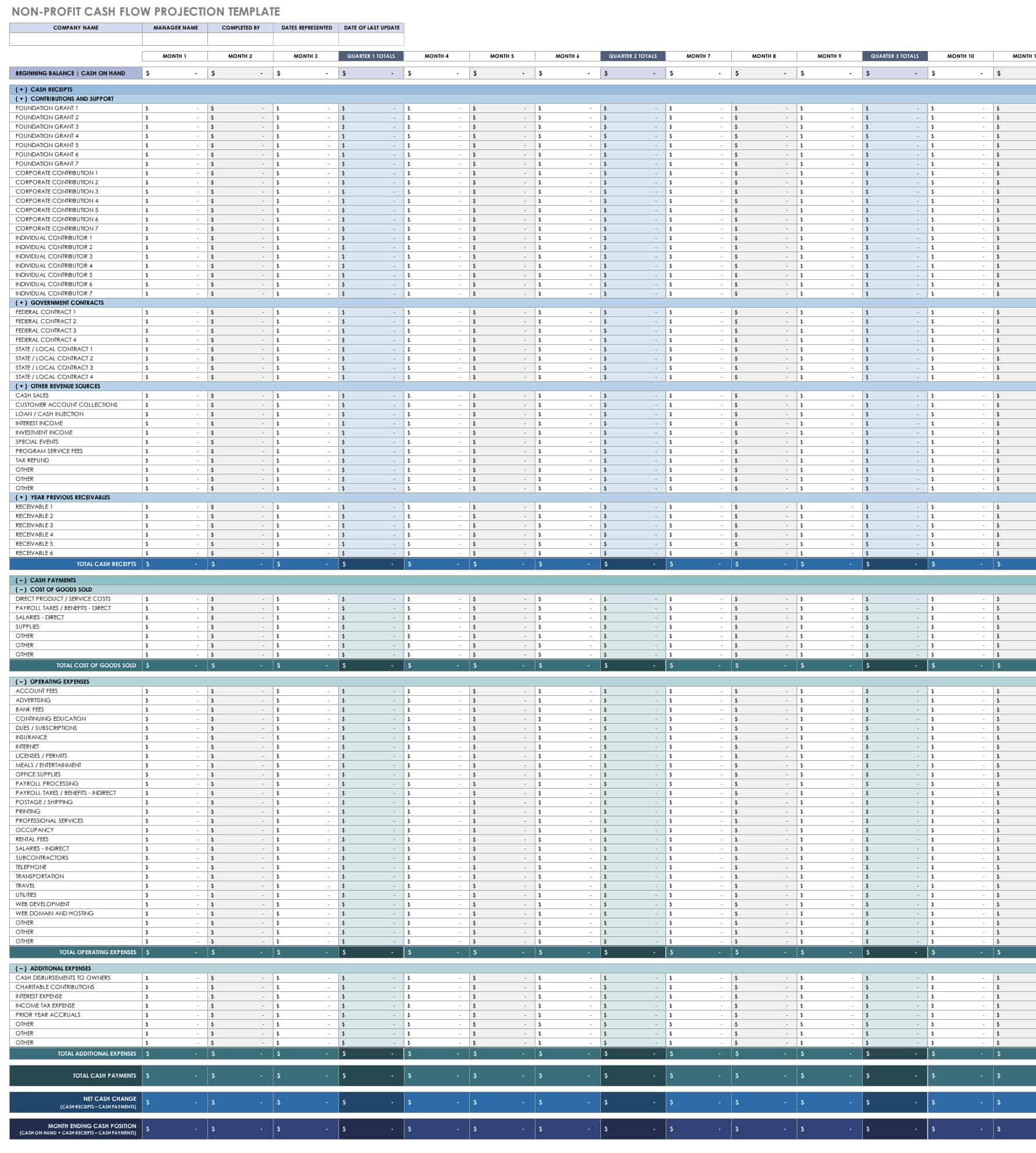

Nonprofit Cash Flow Projection Template

Use this template to determine whether your nonprofit will have enough cash to meet its financial obligations. There are sections for cash receipts, contributions and support, government contracts, other revenue sources, and receivables from previous years. This template is completely customizable, and provides insight into monthly and yearly carryover, so you can keep tabs on your rolling cash balance.

Download Nonprofit Cash Flow Projection Template

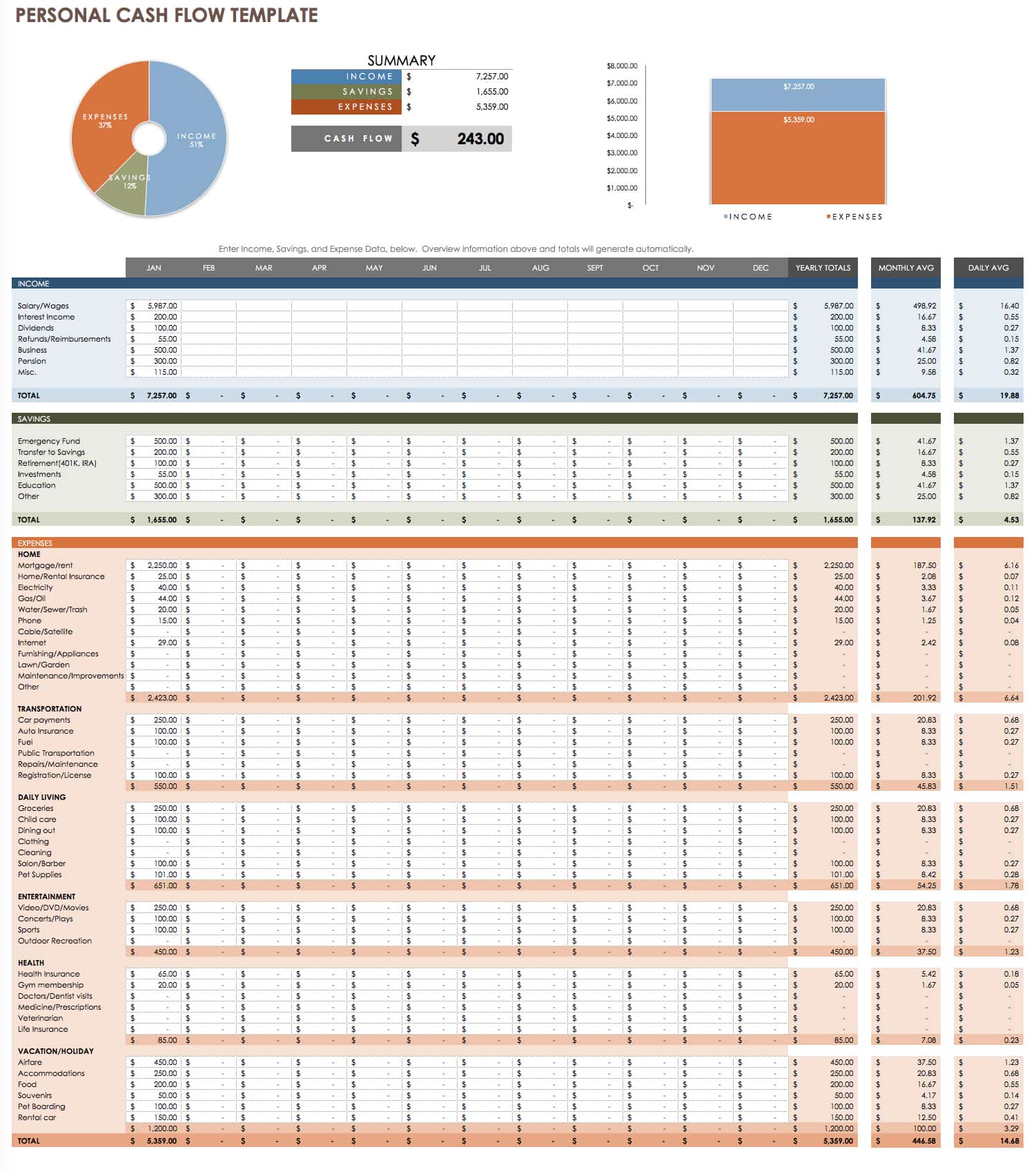

Personal Cash Flow Forecast Template

Manage your financial outlook with this personal cash flow forecast template. Compare your personal income to your expenses, with the additional factor of savings. The automatic pie chart provides insight into whether you’re spending above your means. Enter your income, savings, and expense data to get a comprehensive picture of your short and long-term cash flow.

Download Personal Cash Flow Forecast Template

Creating a Cash Flow Forecast

In order to set yourself up for success, you must be realistic when forecasting cash flows. You can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. For instance, knowing when your business will receive payments and when payments are due to outside vendors allows you to make more accurate assumptions about your final funds during an operating cycle. Estimated cash flows will always vary somewhat from actual performance, which is why it’s important to compare actual numbers to your projections on a monthly basis and update your cash flow forecast as necessary. It’s also wise to limit your forecast to a 12-month period for greater accuracy (and to save time). On a monthly basis, you can add another month to create a rolling, long-term projection.

A cash flow forecast may include the following sections:

- Operating Cash: The cash on hand that you have to work with at the start of a given period. For a monthly projection, this is the cash balance available at the start of a month.

- Revenue: Depending on the type of business, revenue may include estimated sales figures, tax refunds or grants, loan payments received, or incoming fees. The revenue section covers the total sources of cash for each month.

- Expenses: Cash outflows may include your salary and other payroll costs, business loan payments, rent, asset purchases, and other expenditures.

- Net Cash Flow: This refers to the closing cash balance, which reveals whether you have excess funds or a deficit.

Keep in mind that while many costs are recurring, you also need to consider one-time costs. Additionally, you should plan for seasonal changes that could impact business performance, as well as any upcoming promotional events that may boost sales. Depending on the size and complexity of your business, you may want to delegate the responsibility of creating a cash flow forecast to an accountant. However, small businesses can save time and money with a simple cash flow projections template.

The Benefits of Cash Flow Forecasting

Regardless of the reporting period, or granularity , you choose for your cash flow forecast, you should take into account important cash flow forecast-specific factors, such as seasonal trends, to gain a clear picture of your company’s finances. Accurate cash flow forecasting can enable you to do the following:

- Anticipate any cash-balance shortfalls.

- Verify that you have enough cash on hand to pay suppliers and employees.

- Call attention to customers not paying on time, and eliminate cash flow discrepancies.

- Act proactively, in the event that cash flow issues will adversely affect budgets.

- Notify stakeholders, such as banks, who might require such forecasting for loans.

Tips for Improving Cash Flow Forecasting

Whether you are a large or small business and want a day-by-day or three-year picture of your company’s projected cash flow,keep the following tips in mind:

- Pick the Right Cash Flow Forecasting Template: There are templates available for a variety of forecasting needs, including those for organization size and one that provides short or long-term insights. Select a template that’s suitable to your particular cash flow forecasting needs.

- Use a Discounted Cash Flow (DCF) Template: If you are looking to estimate the current value of your company, based on the time value of money (the benefit of receiving cash infusions sooner than later), you’ll want to do a DCF.

- Enter Variables Accurately: Inflows and outflows can change on a literal dime. Ensure that you tally all beginning balances (cash on hand), cash receipts and disbursements (R&D), and operating expenses correctly. These numbers provide the big-picture net cash change and your ultimate cash position.

- Choose the Right Forecasting Horizon: The margin of error when using a three-year cash flow forecasting template is greater than performing a daily cash flow forecast. When choosing a template, keep in mind the time-period for the forecast.

- Consider Seasonal Fluctuations: If your cash flow fluctuates by season (tax, interest, larger annual payments, etc.), incorporate those details into your cash flow forecast. This will ensure that one quarter’s inflow doesn’t positively or negatively affect another in your forecast.

Discover a Better Way to Manage Cash Flow Forecasts and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Any articles, templates, or information provided by Smartsheet on the website are for reference only. While we strive to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, articles, templates, or related graphics contained on the website. Any reliance you place on such information is therefore strictly at your own risk.

These templates are provided as samples only. These templates are in no way meant as legal or compliance advice. Users of these templates must determine what information is necessary and needed to accomplish their objectives.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Business Plan Cash Flow Template

Identify the operating period, establish sales forecast for the period, calculate cost of goods sold, determine gross profit, identify expected operating expenses.

- 2 Utilities

- 4 Marketing

- 5 Insurance

Calculate net income before taxes

Estimate income tax expense, calculate net income, adjust for non-cash expenses, approval: cash flow calculations.

- Calculate net income before taxes Will be submitted

- Estimate income tax expense Will be submitted

- Calculate net income Will be submitted

- Adjust for non-cash expenses Will be submitted

Determine changes in working capital

Calculate cash flow from operating activities, identify investing activities, calculate cash flow from investing activities, identify financing activities, calculate cash flow from financing activities, reconcile beginning and ending cash balances, approval: final business plan cash flow template.

- Calculate cash flow from operating activities Will be submitted

- Calculate cash flow from investing activities Will be submitted

- Calculate cash flow from financing activities Will be submitted

- Reconcile beginning and ending cash balances Will be submitted

Take control of your workflows today.

More templates like this.

Sign up for our newsletter for product updates, new blog posts, and the chance to be featured in our Small Business Spotlight!

How to create a cash flow projection (and why you should)

For small business owners, managing cash flow (the money going into and out of your business) can be the difference between a thriving, successful company and filing for chapter 11 (aka bankruptcy).

In fact, one study showed that 30% of businesses fail because the owner runs out of money, and 60% of small business owners don’t feel knowledgeable about accounting or finance .

Understanding and predicting the flow of money in and out of your business, however, can help entrepreneurs make smarter decisions, plan ahead, and ultimately avoid an unnecessary cash flow crisis.

After all, knowing whether the next month will see a financial feast or famine can help you make better decisions about spending, saving, and investing in your business today.

One way to do this (without hiring a psychic)? Cash flow projection.

What is cash flow projection?

Cash flow projection is a breakdown of the money that is expected to come in and out of your business. This includes calculating your income and all of your expenses, which will give your business a clear idea on how much cash you'll be left with over a specific period of time.

If, for example, your cash flow projection suggests you’re going to have higher than normal costs and lower than normal earnings, it might not be the best time to buy that new piece of equipment.

On the other hand, if your cash flow projection suggests a surplus , it might be the right time to invest in the business.

Cash flow projections: The basics

In order to properly create a cash flow forecast, there are two concepts you should be aware of: accounts receivable (cash in) and accounts payable (cash out)

- Accounts Receivable: refers to the money the business is expecting to collect, such as customer payments and deposits, but it also includes government grants , rebates, and even bank loans and lines of credit .

- Accounts Payable: refers to the exact opposite—that is, anything the business will need to spend money on. That includes payroll , taxes, payments to suppliers and vendors, rent, overhead, inventory, as well as the owner’s compensation.

A cash flow projection (also referred to as a cash flow forecast) is essentially a breakdown of expected receivables versus payables. It ultimately provides an overview of how much cash the business is expected to have on hand at the end of each month .

Cash flow projections typically take less than an hour to produce but can go a long way in helping entrepreneurs identify and prepare for a potential shortfall, and make smarter choices when running their business.

Send invoices, estimates, and other docs:

- via links or PDFs

- automatically, via Wave

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for the first 10 transactions of each month of your subscription, then 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions for the US and Canada . See Wave’s Terms of Service for more information.

Send invoices, get paid, track expenses, pay your team, and balance your books with our financial management software.

How to calculate your cash flow projection

Calculating your cash flow projection can seem intimidating at first, but once you start pulling together the necessary information, it isn’t so scary. Let’s walk through the first steps together.

1. Gather your documents

This includes data about your business’s income and expenses.

2. Find your opening balance

Your opening balance is the balance in your bank at the start of a period. (So, if you’ve just started your business, this is zero.)

Your closing balance is the amount in your bank at the end of the period.

So the opening balance in one month should equal the closing balance at the end of the previous month. But more on this later.

3. Receivables (money received/cash in) for next period

This is an estimate of your anticipated sales (such as invoices you expect to be paid, or payments made on credit), revenue, grants , or loans and investments.

4. Payables (money spent/cash out) for next period

Again, this is an estimate. You should consider things like materials, rent, taxes, utilities, insurance, bills, marketing, payroll, and any one-time or seasonal expenses.

“Seasonality can have a material effect on the cash flow of your business,” Andy Bailey, CEO of Petra Coach, wrote in an article for Forbes . “A good cash flow forecast will anticipate when cash outlays and cash receipts are higher or lower so you can better manage the working capital needs of the company.”

5. Calculate cash flow

Now, let’s bring it all together using this cash flow formula : Cash Flow = Estimated Cash In – Estimated Cash Out

6. Add cash flow to opening balance

Now, you’ll want to add your cash flow to your opening balance, which will provide you with your closing balance.

Put it all together: How a cash flow projections look on paper

In practical terms, a cash flow projection chart includes 12 months laid out across the top of a graph, and a column on the left-hand side with a list of both payables and receivables.

Here are all the categories you’ll need for your cash flow projection:

- Opening balance/operating cash

- Money received (cash sales, payments, loans, investments, etc.

- Money spent (expenses, materials, marketing, payroll and taxes, bills, loans, etc.)

- Totals for money received and money spent, respectively

- Total cash flow for the period

- Closing balance

This column typically begins with “operating cash”/opening balance or unused earnings from the previous month. For example, if your cash flow projection for January suggests a surplus of $5,000, your operating cash for February is also $5,000.

Below operating cash, list all expected accounts receivable sources—such as sales, loans, or grants—leaving a space at the bottom to add them all up.

Next, list all potential payable items—such as payroll, overhead, taxes, and inventory—with another space to add their total below.

Once you have your numbers prepared, simply subtract the total funds that are likely to be spent from the cash that is likely to be received to arrive at the month’s cash flow projection.

Once you’ve calculated your monthly cash flow, take the final number and list it at the top of the next month’s column under operating cash, and repeat the process until you’ve got a forecast for the next 12 months.

After the end of each month, be sure to update the projection accordingly, and add another month to the projection.

If you’re a Wave customer and you prefer to use a ready-made chart to help you create your projection, you can pull your financial data from the Reports section of Wave and feed it into this cash flow forecast template .

Be realistic with your cash flow forecast

Cash flow projections are only as strong as the numbers behind them, so it’s important to be as realistic as possible when putting yours together.

For example, being overly generous in your sales estimates can compromise the accuracy of the projection.

Furthermore, if you provide customers with a 30-day payment schedule and a majority pay on the last possible day, make sure that cycle is accurately reflected in your projection.

On the payables side of the equation, try to anticipate annual and quarterly bills and plan for an increased tax rate if the business is likely to reach a new tax level.

Those who pay their staff on a bi-weekly basis also need to keep an eye out for months with three payroll cycles, which typically occurs twice each year.

“Monthly or quarterly forecasts generally are more useful for stable, established businesses,” Bailey also wrote . “Weekly projections will be essential for companies scaling up or going through significant changes, such as a restructuring or merger/acquisition.”

“We like to encourage business owners—especially those who are starting out—to create a 13-week forecast for cash,” William Lieberman, the Managing Partner of The CEO’s Right Hand, told Forbes . “Each week, update the forecast based on what happened the previous week and extend the forecast window by one more week. In this way, you can keep a close watch on exactly what’s coming in and going out so you can be more proactive in addressing potential cash crunches.”

Those who want to be extra cautious with their projections can even include an “other expenses” category that designates a certain percentage of revenues for unanticipated costs. Putting aside some extra cash as a buffer is especially useful for those building their first projections, just in case they accidentally leave something out.

What now: Use your cash flow forecast to make data-driven decisions

Building the cash flow projection chart itself is an important exercise, but it’s only as useful as the insights you take away from it. Instead of hiding it away for the remainder of the month, consult your cash flow projection when making important financial decisions about your business.

If, for example, you anticipate a deficit in the months ahead, consider ways to cut your costs , increase sales, or save surpluses to help make up the difference. If you notice that payments often come in late, consider introducing a late penalty for bills past due.

You can also consult your cash flow projection to determine the best time to invest in new equipment, hire new staff, revise your pricing and payment terms, or when to offer promotions and discounts.

Have clients that regularly procrastinate on payments? Check out these tactics to get your clients to pay you faster .

Improving the accuracy of cash flow projections over time

Once you’re in the habit of creating cash flow projections, it becomes easier to improve their accuracy over time.

Comparing projections to actual results can help you improve the accuracy of your cash flow projections, and help identify longer-term patterns and cycles. Seasonal changes in revenue, patterns that contribute to late payments, and opportunities to cut costs will all become more apparent with each new cash flow projection.

While all these benefits won’t come all at once, entrepreneurs can use their cash flow projection to become better operators and better decision makers with each passing month.

Cash flow projection FAQs

How do cash flow projections affect business decisions, and how can small business owners improve their accuracy.

Cash flow projections play a key role in how you make business decisions by giving you important info on the movement of money in and out of your business You can up their accuracy by regularly updating projections, comparing them to actual results, and adjusting for any discrepancies. This helps you make smart choices about spending, saving, and investing in your business.

What industry-specific factors should small business owners consider in cash flow projections?

Small business owners need to consider various industry-specific factors when creating cash flow projections. For instance, seasonal changes in revenue, payment cycles, and market trends can significantly impact cash flow. By analyzing these factors, you can tailor your projections to better reflect the realities of your industry and adjust your strategies accordingly.

How can small business owners make sure their cash flow projections are reliable?

Small business owners often face challenges in making cash flow projections due to uncertainties in revenue, expenses, and market conditions. To ensure reliability, you should try to be realistic in your estimates, account for potential fluctuations, and regularly update your projections based on actual performance. Additionally, seeking advice from financial experts and using tools like cash flow forecasting templates can help with these challenges and improve the accuracy of projections over time.

Related Posts

Made for small business owners, not accountants.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.

- Cashflow management

How to create a cashflow plan and why it's so important

A cash flow plan helps those responsible to make optimal decisions because it shows how the cash situation will develop in the coming months . Here we show you how to create and work with a cash flow plan.

Cash flow plan: Definition

A cash flow plan shows the current and future cash position of a company. It shows the expected cash flows on a monthly, weekly or even daily basis. The cash flows represent all income and expenses of the company that are related to its operating activities.

To create a cash flow plan, you need to have insight into all the business accounts of a company where transactions take place. Each transaction is a cash flow, where an outgoing cash flow is an expense and an incoming cash flow is a revenue.

By subtracting these expenses from the income each month, week or day, you get the expected cash balance, which can be either positive or negative, i.e. a surplus or a deficit.

If the cash balance is regularly negative, a cash shortage occurs, which in the worst case leads to insolvency. The cash flow plan helps to identify cash shortages at an early stage so that you have enough time to act.

Cash flow plan in 3 steps

Revenue & expenses from the last 6 months up to now.

If you have never prepared a cash flow plan before, we recommend that you first get an overview of your past cash situation. This will help you later to make better estimates for your expected income and expenses.

Go through all your bank statements from the last six months and divide the different income and expenses into categories, for example:

- Revenue from sales

- Income from financial investments

- Tax refunds

- Revenue from licences

- Other revenues

- Salary payments and wages

- Expenses for marketing

- General expenses (electricity, bin collection, etc.)

- Fees for software subscriptions and licenses

- Investments

- Tax payments

For each month, add up the individual transactions in each category, e.g. all salary payments to your employees in the category "Salary payments and wages". You then enter the result for the respective month in a table.

Proceed in this way for each category so that at the end you have an overview of the past six months.

Calculate the cash balance for each month

Then deduct the expenses from the revenues in each month:

- Balance per month = Total revenue in month - total expenses in month

- You offset the result against the cash balance of the previous month and then get the total cash balance, which shows you how much cash you have available in total for the respective month:

- Total cash balance = Cash balance from previous month + cash balance from current month

Anticipate future cash flows

Once you have calculated the cash balance for the past six months, take a closer look at the values in the individual categories: In some cases, you will find that the expenses are the same or vary only slightly from month to month, e.g. salary payments and fees for software subscriptions.

You now enter these recurring expenses in your table for the coming months, because you can assume that they will remain the same. For all other categories where the values fluctuate strongly, you derive estimated values.

For the expected revenues, take into account how customer demand will develop. If you assume that this will increase, enter a larger value for revenue from sales in the coming months.