By visiting our site, you agree to our privacy policy regarding cookies, tracking statistics, etc.

- Case Studies

- Get in touch

Greggs: an agile approach to strategy & business model thinking

John Gregg founded his bakery business in 1939, selling eggs and yeast from his bicycle in Newcastle. The business grew, and his son Ian joined his father and mother, selling pies from his van to miners’ wives. They opened their first shop in Gosforth in 1951.

When John died in 1964, the bakery was taken over by Ian, and major expansion began, including the acquisitions of other bakeries such as the Bakers Oven chain from Allied Bakeries in 1994.

Greggs grew to be the largest bakery chain in the UK, home of the bacon sandwich and a coffee for two quid special offer which, disappointingly, is now £2.10 (a friend told me, honestly), famous for pies and pasties and everything you firmly resolved on December 31 would never touch your lips again.

A couple of years ago, Greggs fell victim to adverse PR about its product range and customer base. Oh how the Prêt crowd sniggered into their avocado and crayfish salads. Yet plucky old Greggs just got its head down and kept growing. ‘It’s a northern thing’ no longer serves as an explanation. The patronising notion that Greggs’s popularity is inversely proportional to the nation’s economic fortunes also fails to explain its steady expansion.

Today Greggs generate £1m a week from sales of coffee. It has repositioned the brand from an ordinary bakery-to-take-home to a high growth food-on-the-go entity, meeting changing customer demands and evolving food culture.

A new strategy was introduced in 2013 under CEO Roger Whitehouse, formerly Head of M&S Food, which focused on four pillars: Great tasting freshly prepared food; best customer experience; competitive supply chain; first class support teams.

Whitehouse introduced a ‘restless dissatisfaction’ approach to compliment the traditional business values, ensuring the business would never stand still after recovering from a period of stagnation. He implemented some radical changes, including closing the in-store bakeries, and introducing the ‘Balanced Choice’ range of products with less than four hundred calories, healthier options to the traditional product range.

And it’s worked. Having launched the first vegan sausage roll in January, last week the company announced a 50% rise in profits to £40.6m in the first half of 2019. The business is handing shareholders a £35m special dividend after total sales rose 14.7% to £546m.

In 2016, Greggs weren’t in the takeaway breakfast market but now only McDonalds sells more takeaway breakfasts. With a Fairtrade Expresso, it has overtaken Starbucks to become the third-largest takeaway coffee seller, behind Costa and McDonalds, while only Tesco sells more sandwiches.

So what are the lessons from the success of Greggs changing its business strategy and model that we take into our startup thinking?

1. Be agile in how you connect with customers

Greggs expects to pass 2,000 outlets this year, 65% are on high streets, with the remaining 35% located in retail and office parks and in travel locations such as railway stations and petrol forecourts. The aim is to change the emphasis of the business so that it is 60% non-high street by the time it has 2,500 shops.

Part of this is having many of its stores open earlier and close later, in order to target those going to and coming back from work, expanding its breakfast menu to suit, and with ‘Greggs à la carte’ stores to open late to 9pm to lure evening takeaway diners.

As well as its new drive-through locations, the company is trialing a click-and-collect service, as well home and office delivery by Just Eat and Deliveroo. They aim to integrate click-and-collect and delivery services with the company’s Greggs Rewards app, which offers free drinks and birthday treats.

Greggs has previously failed with new ideas such as Greggs Moment , a coffee shop-style outlet with seating, and the Greggs Delivered service, which is only available in Newcastle and Manchester city centres, three years after it launched. However, the business is now at a scale where it can experiment without too much risk.

Takeaway: Greggs route to market strategy is to based on expanding their reach to enhance customer convenience, a ‘fish where they swim’ strategy, reducing the barriers between themselves and their customers, uplifting the customer experience and making the ability to connect and purchase convenient.

2. Build your brand to face your market

Greggs has in recent years persistently bucked the wider trend on UK high streets, where most retailers are struggling to compete as sales shift online and the cost of running stores rises.

In 2013, Greggs began to transition out of the bakery market with the reasoning that it couldn’t compete with supermarkets, switching to focusing solely on the ‘food on the go’ market after discovering that 80% of its business was with that market. They stopped selling bread in 2015.

Greggs has worked hard at getting consumers to think about it as a food-on-the-go chain, developing ideas such as online ordering for collection and home delivery, developing strategic partnerships with their supply chain to focus on the four key pillars of their strategy.

They are more in touch with where the customers are today. It has managed to cater to new markets without being overly ambitious. The builder can still come off the building site and get a hot pasty, but there are also salads. The decor is still recognisable even if it has been upgraded and the older traditional customers still feel comfortable.

Takeaway: Many businesses want profit as their objective. But if you only focus on short-term wins and results, you get distracted from doing the work required to build the skills you need to grow and scale, and it’s the ability to scale that matters. The process is more important than the outcome at early stages of a change of strategy. Focus on getting good before you worry about getting big.

3. Look forwards, not backwards with your product offering

Greggs sells 1.5 million sausage rolls a week but created the new vegan option due to public demand after an online petition signed by 20,000 people. In recent years Greggs has been innovating within its product range to appeal to a broader range of customers. Its ‘Balanced Choice’ healthy eating range, introduced in 2014, offers options including wraps and salads, all below 400 calories. It also sells gluten-free and several vegan lines.

The company also believes it can take advantage of rising demand for food ‘customisation’, driven by allergies and ‘food avoidance’ preferences, and its stores now make sandwiches to request.

One in eight new customers have bought a vegan sausage roll in 2019, which has overtaken doughnuts and other pastries to become a bestseller. The traditional sausage rolls remain at number one – with its 96 layers of light, crisp puff pastry – but there are more vegan products in development, including a vegan doughnut. It’s worked, such that Ginsters released their own vegan product for the first time in its 52-year history.

Takeaway: Greggs has been bold in its response to the adverse publicity on its offering and changing food culture. Aligning your product strategy with a focused brand image and route to market is core to any business model.

4. Be clear about your marketing message & tone of voice

Before the Greggs vegan sausage rolls went on sale, TV presenter Piers Morgan sent out a tweet: Nobody was waiting for a vegan bloody sausage, you PC-ravaged clowns. The tone of the company’s response: Oh hello Piers, we’ve been expecting you – friendly but with a slight edge, was perfectly attuned to the ironic, self-confident marketing Greggs has adopted, a James Bond-inspired, droll putdown that was the perfect riposte.

Their hilariously portentous launch video – part of a build-up that parodied the release of a new iPhone model with journalists sent vegan rolls in mock iPhone packaging and stores sold sausage roll phone cases – meant that for days Twitter was engulfed with people talking about a £1 bakery product.

The vegan sausage roll campaign, officially launched to support the Veganuary campaign that encouraged people to give up animal products for a month, followed other memorable promotions include a Valentine’s Day campaign offering ‘romantic’ £15 candlelit dinners in Greggs shops, and a spoof ‘Gregory and Gregory’ event, and one faux pas: a 2017 advent calendar tableau of a sausage roll in a manger. After complaints Greggs apologised and reprinted with a different scene featuring Christmas muffins.

Takeaway: Greggs found its distinctive marketing style in 2012, when it saw off then-chancellor George Osborne’s proposed ‘pasty tax’ on hot takeaway food. Since then it has been consistent in its purposeful, structured and memorable content driven communication strategy, making the brand relevant to its target audience and differentiating its offering in an increasingly competitive market to reposition the brand.

5. Don’t let your business model become stale

Innovation can be about efficiency. Look at Ikea, and The Billy bookcase. It’s a bare-bones, functional bookshelf if that is all you want from it. The Billy isn’t innovative in the way that the iPhone is innovative. The Billy innovations are about working within the limits of production and logistics, finding tiny ways to shave more off the cost, all while producing something that does the job. It demonstrates that innovation in the modern economy is not just about snazzy new technologies, but also boringly efficient systems.

The Greggs shop environment has been improved and significant investments made in logistics and delivery systems to make them more efficient and scalable. In-store ordering moved to a centralised forecast and replenishment system rather than relying on shop teams filling in manual order forms, which resulted in order accuracy and improved availability for customers.

All shops are on a refurbishment programme (every seven years) to ensure they stay looking bright and welcoming. In-store point of sale and window displays remain key to Greggs’ marketing strategy, however, a loyalty app was also introduced.

Takeaway: innovation in Greggs is about efficiency, economy and effectiveness, searching for ways to make their products even better and affordable for their target market. A ‘back to basics’ focus on the business model reflects the culture and humility of the brand. Combined with brave decision making to implement change and execution in a consistent, simple and continuous manner has delivered the results.

6. Ensure your folks keep clear heads

Amidst the hullaballoo and the fury of the frantic activity in the coming and going of customers at busy times, staff have to keep a clear head. In the heat of the moment, they cannot get caught up in the intensity and frenzy. Resilience in times of peak demand is needed to keep the customer experience as fresh and stimulating as the steak bakes.

When you go to a Greggs, the staff are so engaged in what they do its untrue, they are like whirling octopus serving customers, and they do it with good humour, bantering with regulars, enjoying the success of seeing returning customers, before going again.

With 10% of profits going to the Greggs Foundation to help fund Breakfast Clubs for children and over £1m raised annually for Children in Need, the vegan pastry has helped change the perception of Greggs, but fundamentally it’s a people business, about delivering service, experience and the community it operates.

Takeaway: So, focused on a simple, core value proposition – reasonable quality food at reasonable prices, consistently produced and scaled – but the fundamental premise is to make customer experience the brand differentiator.

Many takeout food companies are head-on competition to Greggs, but due to its focused marketing strategies highlighting choice, quality, nutrition & easy access, the company is able to create sustainable advantage.

Changing lifestyles, changing eating habits and increasing health awareness factors are affecting the growth of the companies in this industry. Greggs has set its strategy from a customer’s point of view and with customer-based insights, to ensure the business model is as robust as it can be.

Adopt Greggs’ agile approach to strategy and business model thinking, to focus on the horizon and hold your vision. Do something everyday to move your business forward, and that makes you stand out from the crowd. A sheep has never stood out from another sheep, so don’t follow the herd blindly. People will take notice.

Ian Brookes

John Gregg founded his bakery business in 1939, selling eggs and yeast from his bicycle in Newcastle. The business grew,…

More insights from the team

Lessons in entrepreneurship from thomas telford.

The innovation mindset of Alan Turing

We’re ready to talk....

Wherever you are on your startup journey, get in touch and let’s unpack your thinking together and see where we can help turn your idea into a reality.

Greggs SWOT Analysis

Before we dive deep into the SWOT analysis, let’s get the business overview of Greggs. Greggs is a well-known British bakery chain specializing in savory and sweet products, including pastries, sandwiches, and drinks. Here’s a brief overview of the business:

- Greggs was founded by John Gregg as a single bakery in Gosforth, Newcastle upon Tyne, in 1939. It has since grown to become the largest bakery chain in the UK.

- Greggs is best known for its pastries, especially the sausage roll, which has become an iconic product for the brand.

- The product range includes sandwiches, salads, soups, sweets, drinks, and more.

- In recent years, Greggs has tried diversifying its product range to cater to a broader audience, including introducing vegetarian and vegan products like the Vegan Sausage Roll and Vegan Steak Bake.

- As of 2022, Greggs operates over 2,000 shops across the UK.

- Greggs’ outlets can be found on high streets, shopping centers, retail parks, airports, train stations, and other transport hubs.

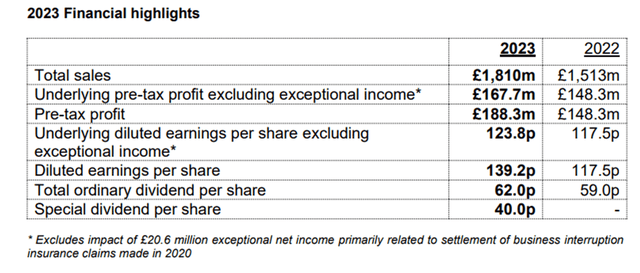

- Financial Performance : Total sales grew to £1,513 million in 2022 (2021: £1,230 million), a 23.0% increase on the level seen in 2021. Pre-tax profit for the year increased to £148.3 million (2021: £145.6 million), reflecting strong sales growth in the face of significant cost inflation and the removal of Government pandemic support.

Here is the SWOT analysis for Greggs

A SWOT analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business, project, or individual. It involves identifying the internal and external factors that can affect a venture’s success or failure and analyzing them to develop a strategic plan. In this article, we do a SWOT Analysis of Greggs.

SWOT Analysis: Meaning, Importance, and Examples

- Strong Brand Recognition: Greggs is one of the UK’s most recognized and beloved bakery brands. Its substantial brand equity means customers trust and are loyal to the brand.

- Diverse Product Range: While initially known for pastries, Greggs offers various products, from sandwiches to salads and drinks. This diversity caters to a broad spectrum of customer tastes and preferences.

- Adaptability to Consumer Trends: Greggs has demonstrated an ability to adapt to emerging consumer trends. Notable examples include the introduction of healthier food options and the successful launch of vegan products like the Vegan Sausage Roll.

- Expansive Retail Network: With over 2,000 outlets across the UK, Greggs has a wide-reaching presence, ensuring it’s easily accessible to a large population segment.

- Competitive Pricing: Greggs is known for offering quality products at competitive prices, making it an attractive option for value-seeking customers.

- Effective Marketing and Public Relations: Greggs has made headlines with innovative marketing campaigns like the Vegan Sausage Roll launch. These campaigns not only boost sales but also enhance brand visibility and engagement.

- Innovation in Service Delivery: Greggs has embraced technology by introducing its app with loyalty programs and mobile payment options. The company expanded its delivery partnerships to cater to changing consumer habits, especially during the pandemic.

- Dependence on the UK Market: Greggs operates predominantly in the UK, making it susceptible to market-specific risks, such as economic downturns or changes in UK regulations.

- Limited Global Presence: Unlike some competitors who have expanded internationally, Greggs has little presence outside the UK. This limits their growth potential in global markets.

- Perceived as Less Healthy: Greggs has historically been associated with pastries and baked goods, which aren’t always considered healthy options. While they’ve introduced healthier choices, overcoming this perception can be challenging.

- Vulnerability to Commodity Price Fluctuations: As a food retailer, Greggs is exposed to fluctuations in commodity prices (e.g., wheat, dairy). Significant price hikes can impact profitability if not managed efficiently.

- High Street Presence: Many Greggs outlets are situated on high streets. With changing retail trends and a shift towards online shopping, high street footfall has decreased in certain areas, posing challenges.

- Reliance on Physical Stores: Greggs’ business model heavily relies on physical store sales. This can be a limiting factor in an era of increasing digitalization and delivery services.

- Menu Complexity: With an expanding product range to cater to various customer needs, there’s a risk of menu complexity, which can strain operations and confuse customers.

Opportunities

- International Expansion: With a strong brand presence in the UK, Greggs could explore expanding into international markets, tapping into new customer bases and diversifying its revenue streams.

- Enhanced Digital Presence: Greggs can further invest in its digital platforms, introducing online ordering, expanding delivery options, or even exploring subscription models.

- Product Diversification: There’s scope for Greggs to expand its product range further, venturing into categories like evening meals, niche diet-based products (keto, gluten-free), or even branching into beverages more significantly.

- Sustainable Initiatives: With growing consumer emphasis on sustainability, Greggs can introduce more eco-friendly packaging, sustainable sourcing, and further its commitment to reducing carbon footprints, which can resonate positively with consumers.

- Partnerships and Collaborations: Greggs can explore partnerships with brands, celebrities, or influencers to launch exclusive products, enhancing its brand visibility and appeal.

- Expansion of Delivery and Drive-Thru: Building on its existing delivery partnerships, Greggs can further expand these services or even consider setting up more drive-thru outlets, catering to the on-the-go consumer.

- Loyalty and Subscription Programs: While Greggs already has a loyalty program through its app, there’s an opportunity to enhance this further, possibly exploring subscription models for regular customers.

- Health-Conscious Offerings: Building on its introduction of vegan and healthier options, Greggs can further tap into the health-conscious consumer market with more varied health-focused products.

- Pop-Up Stores and Experiential Retail: To boost its brand and reach out to newer audiences, Greggs can set up temporary pop-up stores in various locations or create experiential retail spaces that offer more than just food.

- Intense Competition: The food retail market in the UK is highly competitive, with many brands, both big and small, vying for consumer attention. The rise of artisanal bakeries and niche food outlets also poses a threat.

- Changing Consumer Preferences: The rapidly evolving food industry means consumer tastes and preferences can shift quickly. An increased focus on health, new dietary trends, or emerging cuisines can influence consumer choices.

- Economic Factors: Economic downturns or recessions can impact consumer spending, reducing sales, especially for discretionary items.

- Supply Chain Disruptions: Global events, such as pandemics, geopolitical tensions, or natural disasters, can disrupt supply chains, leading to increased costs or product shortages.

- Regulatory Changes: Changes in food regulations, health and safety standards, or employment laws can impose additional costs or operational challenges.

- Digital Disruption: The continuous growth of online food delivery platforms and meal kit services could divert consumers from traditional bakery outlets like Greggs.

- Rising Costs: Fluctuations in commodity prices, increased wages, or rent hikes can escalate operational costs, squeezing margins.

- Health and Nutritional Concerns: Growing awareness of health and nutrition means products high in sugar, salt, or fats could face criticism, leading to potential sales decline of certain items.

- Physical Retail Decline: The broader trend of declining footfall in traditional high street stores, in favor of online shopping or out-of-town retail parks, can pose challenges for Greggs’ store-based model.

Check out the SWOT Analysis of Global Businesses

Related posts.

Mattel SWOT Analysis

Lockheed Martin SWOT Analysis

SWOT Analysis of Customer Service

SWOT Analysis of a recruitment process

SWOT Analysis of a New Product Development

SWOT Analysis of Digital Marketing

SWOT Analysis of an insurance company

SWOT Analysis of a Supply Chain

Type above and press Enter to search. Press Esc to cancel.

What has contributed to Greggs’ high street success?

We recently included Greggs in a listicle of 18 brands with brilliant digital strategies.

With this month seeing annual sales pass the £1bn mark, the high street bakery chain is clearly doing something right – especially in the context of Britain’s flailing high streets.

So, what exactly has contributed to Greggs’ continued run of success? Here’s a run down of its winning strategy and what we can learn from it.

Re-positioning of brand

Greggs is the largest bakery chain in the UK, now with nearly 2,000 stores nationwide. This year, it saw sales climb nearly 10% in the seven weeks to 16 February, spurred on by press coverage related to its vegan sausage roll (more of that later).

However, Greggs’ popularity is certainly not down to ‘trending’ on Twitter; the chain had already cemented itself as a staple on the high street in the years prior to this.

Much of its success in recent years has been due to Roger Whiteside – who was appointed Chief Executive of Greggs in 2013 – and his repositioning of Greggs as a ‘food-to-go’ chain rather than a than a take-home bakery. So, instead of looking at the likes of Sainsbury’s and Tesco as competitors, Greggs has taken on the likes of Starbucks and Costa Coffee to target coffee drinkers and pastry fans. The premise is affordable and accessible food, at all times of day.

As well as expanding its hot drinks and breakfast offerings, Greggs has also generated favour with its ‘balanced choice’ range, which includes salads and other healthier choices. Alongside a very affordable price point, this has helped the chain to shake off its outdated and ‘stodgy’ image, and carve a new reputation as a rival to modern and desirable coffee brands.

Making the Balanced Choice… #staystrong pic.twitter.com/HMH6tIv0Cd — Greggs (@GreggsOfficial) January 15, 2018

Finding demand

Due to changing consumer habits and increasingly high costs, British retailers are struggling. Interestingly, Greggs is one of the brands to buck this trend, instead seeing increased share investment and strong turnover.

One of the reasons for this is how the bakery meets consumer demand. Instead of opening further branches in towns and high streets (where it already has a significant presence), it has placed more stores in airports, train stations, and other places where people want to grab-and-go. This is similar to M&S’ Food, which has targeted a boost from travel hubs.

The Financial Times reports that, in 2018, Greggs opened 146 shops and closed 50 . Furthermore, out of the 100 or more it expects to open this year, most are set to be in out-of-town retail sites and train stations rather than the high street.

A PR machine

Last year, an online petition by Peta was signed by 20,000 people, calling on Greggs to produce a vegan version of its bestselling sausage roll. As well as this growing demand for vegan options on the high street, Greggs also spotted a good opportunity for publicity, using the item’s launch to generate awareness and further sales.

Conveniently for Greggs, this was also enhanced by unwarranted publicity, partly stemming from Piers Morgan calling out the bakery for unnecessarily jumping on the ‘vegan’ bandwagon. He tweeted: “Nobody was waiting for a vegan bloody sausage, you PC-ravaged clowns.” However, as well as users and press picking up on the insult, a shrewd response from Greggs also ensured further attention.

Oh hello Piers, we've been expecting you — Greggs (@GreggsOfficial) January 2, 2019

This was not the first time that Greggs has turned around negative publicity; PR has been key to its marketing efforts over the years. In 2014, an offensive logo appeared on Google search results for the brand, alongside the slogan: “Providing s*** to scum for over 70 years”.

Instead of sidelining the embarrassment, Greggs quickly retorted, creating an amusing and smart conversation with Google on Twitter.

Hey @GoogleUK , fix it and they're yours!!! #FixGreggs pic.twitter.com/d5Ub7qtrLG — Greggs (@GreggsOfficial) August 19, 2014

This kind of publicity is not always accidental, however, with Greggs also launching deliberately controversial and silly campaigns off its own back. In 2017, it launched a limited edition advent calendar containing tokens for menu items behind each window. The fact that baby Jesus was replaced by a partially eaten sausage roll naturally drew attention from both consumers and the press . In 2018, Greggs also created a tongue-in-cheek campaign to launch its new summer menu, going undercover at a London food festival with the name ‘ Gregory and Gregory ’.

Going back to its vegan sausage roll then – in light of its other marketing stunts – the reaction was likely well planned for. The bakery also produced a launch campaign that emulated high tech (including sending journalists a sample in a box reminiscent of the iPhone).

Today doesn't just mark our first day back in the studio after the festive break, but also the launch of @GreggsOfficial 's vegan sausage roll! Does their PR campaign remind you of any brand in particular…?! https://t.co/I6LVMRtoYG #Greggs #Vegan #SausageRoll #Apple #Campaign pic.twitter.com/5uyokNdYCB — Firefly (@fireflycreate) January 3, 2019

Technology and innovation

Of course, PR isn’t the only thing that sells sausage rolls. Greggs certainly also works hard to prove its value for customers with a focus on technology and experience in-store. Free Wi-Fi in its cafes is a simple but hugely valuable feature, again allowing it to compete with the likes of Starbucks and Cafe Nero.

While Greggs might not be the kind of place to stay and linger, it does encourage customers to dine in certain branches. The company even employs bouncers to watch over late night crowds at weekends.

Further to this, the bakery has focused on refurbishing many of its branches in recent years. It reportedly revamped around 100 shops in 2018, as well as opening a number of brand new shops and introducing drive-thrus. These refurbishments involved a more modern and streamline design, emphasising its ‘on-the-go’ aspect.

Last year, Greggs also rolled out click-and-collect breakfasts in three of its Manchester branches. Though a tad gimmicky, the scheme does align with its ‘food on the go’ promise, helping to create even more convenience for consumers during the busy morning rush hour. Similarly, Greggs has also trialled with food delivery apps including Deliveroo, meaning that people don’t even have to leave their sofa to get a Greggs.

Elsewhere online, Greggs’ social media presence generates continuous levels of engagement, with the brand demonstrating a humorous and decidedly British tone of voice. This is especially the case on Twitter, where it focuses on a fun and engaging style of content.

Things I was supposed to do this weekend: 1. Join a gym 2. Drink more water 3. Update my CV Things I did this weekend: 1. Ate Steak Bakes in bed — Greggs (@GreggsOfficial) January 21, 2019

What’s next for Greggs?

Greggs’ vegan sausage roll proved to be so popular that it sold out in several branches across the UK.

But was it just a case of hype or has Greggs actually won over a new audience?

A bit of both, perhaps, as it is hard to ignore the growing demand for vegan and healthy options. However, with Greggs’ track record of tongue-in-cheek marketing, it seems that most consumers don’t really mind either way – especially when it (apparently) tastes as good as the real thing.

Leave a comment

You must be logged in to post a comment.

Information Age

Insight and Analysis for the CTO

Food on the go: Greggs bakes in digital transformation

As the largest bakery chain in the UK, with more than 1,700 shops, Greggs is a staple of the British high street. Starting as a single bakery in Newcastle upon Tyne in 1951, it has grown to a nationwide business with a turnover of £894 million.

But in search of further growth, Greggs is keen to shake off its humble bakery heritage as part of a mission to gain market share in the fast-moving food-on-the-go industry. Doing so has required a vast business transformation.

Unlike most food-on-the-go retailers, Greggs has traditionally been a vertically integrated business, with its own manufacturing facilities as well as its own shops. In 2013, its executive team embarked on a technology-enabled change programme that moved Greggs away from its origins as a centralised bakery business, harmonised processes and provided the foundations for growth.

‘We were stretched at the seams,’ says Tony Taylor, IT and business change director at Greggs. ‘You get to the point where your current infrastructure can’t support you anymore. You know that you’re going to have to make some form of a change. The programme has all been about changing the look of the 1,700 shops. We had a variety of different formats, looks and feels but very much a bakery heritage and decided to go with this food-on-the-go journey.’

Simplifying operations

To become a decentralised business, Greggs selected SAP’s business suite on HANA as the ERP basis of its programme to transform, simplify and standardise its operations. Systems integrator Keytree was engaged to oversee and implement multiple deployments over the past three years.

This has included a complete finance systems implementation, new procurement capabilities, the implementation of a customer interaction centre, cloud-based HR application SuccessFactors, source-to-contract requirements using Ariba solutions and, more recently, SAP’s forecast and replenishment solution.

In 2015, Greggs commenced the implementation of the latest release of SAP IS-Retail technology to improve stock forecasting and replenishment, including a completely redesigned shop user interface.

>See also: Digital skills gap: How to prepare a generation for the modern workplace

The latest phase of the transformation programme has involved extensive engagement of both shop and regional management teams at Greggs. The project has aimed to help maximise the efficiency and profitability of the Greggs shop network in order to reduce wastage and improve product availability.

More than 1,500 shops have converted to the new technology, with training delivered to more than 16,000 staff through the SuccessFactors learning management system.

‘We have made huge progress as we transform and centralise the business,’ says Roger Whiteside, Greggs’ chief executive. ‘We are investing over £25 million in processes and systems that will enable us to compete more effectively in the fast-moving food-on-the-go market. We have already seen substantial change throughout our estate as we simplify operations to deliver great-tasting food and a great retail experience.’

Rising to the challenge

Taylor attributes Whiteside’s championing of the transformation, along with others in the operating board, as a key factor in its success and a huge enabler in gaining acceptance for the programme across the organisation.

Such buy-in from the top of the business says to everyone that the executive team is paying attention. ‘If somebody wants to make a change that’s not standard, they have to tell people why because it will go to that operating board as something that will potentially impact us in the future,’ says Taylor.

With regard to the change management aspect in the shops themselves, Taylor says Greggs has taken ‘a fundamentally different approach’ to other transformation programmes in the retail industry.

‘Lots of programmes struggle because you tackle the big things and you can’t see the tangible benefits early, so people become sceptical. Through procurement, we were actually able to start to bring some tangible benefits.’

To get to thousands of people in an easy way, Taylor knew his team needed e-learning solutions that weren’t about ‘going to a location and getting killed by a PowerPoint presentation’ or just getting an email saying this is what’s happening.

Through SuccessFactors, the programme team could engage, measure and deliver training to people when they wanted it. The 17,000 employees in shops were able to complete training on computers in their back office at a time that suited their individual shop.

Taylor’s team also attempted to illuminate the visibility of the transformation programme wherever they could, including through the CEO’s speech at the annual conference, briefing sessions or through dedicated ‘change champions’.

>See also: What does the government’s Digital Strategy mean for the UK tech industry?

‘We built momentum on both training and communication, telling people this is what’s coming and this is what it’s all about,’ says Taylor. ‘When the CEO stands up at our annual conference and talks about the programme, directors mention it in their weekly or bi-weekly briefing notes and it’s mentioned in our annual report, people get used to it and get comfortable with it.’

James Holmes, programme manager for SAP transformation at Greggs, adds, ‘This project has always been ambitious, with so many outlets to be brought onto the system, at a rate of around 100 shops every week. Hitting the 1,500-shop landmark is a real achievement for us.

‘Despite the scope and size of this transformation, we have already seen encouraging results across the programme, and this gives us great confidence to continue working with Keytree on the deployment of the next phase of the programme, looking at production and warehousing in our supply chain.’

Foundation blocks

The main modular aspect of the transformation programme will be completed next year, although it will take a little longer to physically role out the changes.

That’s certainly not the end of Greggs’ transformation to a food-on-the-go retailer, however. This programme, which has grown Greggs’ IT team from 50 to 70 staff, provides the foundation blocks for the company’s continued evolution.

‘Across the country, we need to be able to create the opportunities to grow further,’ says Taylor. ‘We are looking at other opportunities. We opened our first drive-thru in June, and we are piloting click-and-deliver across the country. So we’re exploring a number of other initiatives to put our customers first and to be flexible, but it’s got to be relevant to Greggs as a food-on-the-go operator, not just because the competition are doing it.

‘So the transformation programme has been a foundation that will allow us to explore a number of different growth opportunities. But bedding it in is the most important thing first – rushing off to chase new technologies is not what the desire is here.’

The UK’s largest conference for tech leadership , Tech Leaders Summit , returns on 14 September with 40+ top execs signed up to speak about the challenges and opportunities surrounding the most disruptive innovations facing the enterprise today. Secure your place at this prestigious summit by registering here

Ben was Vitesse Media's editorial director, leading content creation and editorial strategy across all Vitesse products, including its market-leading B2B and consumer magazines, websites, research and... More by Ben Rossi

Related Topics

Related stories.

AI & Machine Learning

How insurtech is using artificial intelligence

Insurance technology (insurtech) is rapidly evolving, allowing for digitalisation of insurance sector processes. Here, we explore the role of AI in this trend

Aaron Hurst

Disruptive Innovation

The top 10 most innovative and disruptive Insurtech companies

There are a number of growing Insurtech companies, with many startups rapidly emerging to disrupt the market.

Rory Bennett

3 jobs in fintech hiring this week

With UK fintechs continuing to attract investment, here are the key factors driving growth in the space, and three fintech jobs being advertised right now

Aoibhinn McBride

6 payments technology companies disrupting the sector

Here are some companies that are making waves in the payments technology space, bolstering transaction processes for businesses

Want a new fintech job? These are the skills employers want now

Here are the most in-demand skills for fintech companies recruiting fresh talent, and some advertised tech vacancies open this week

Jennifer McShane

Greggs: Solid Results Underline Strength Of Business Model

- Greggs continues to experience substantial growth opportunities and has a proven business model.

- The company's 2023 preliminary results showed strong growth, with like-for-like sales increasing by 8.2% in the first nine weeks of the year.

- GGGSF's finances are attractive, with net cash and cash equivalents of £195.3m and a pre-tax profit margin of 10.4%.

Carl Court/Getty Images News

U.K. bakery chain Greggs ( OTCPK:GGGSF ) continues to power ahead and has substantial growth opportunities left to it.

My last piece on Greggs was my October buy note. Since then, the London-listed shares have moved up 14%.

A Recap on the Investment Case

Greggs is one of those culturally specific businesses that it helps to have seen in person to understand the appeal. That said, it is a pretty basic formula. The bakery chain enjoys economies of scale thanks to its large footprint in the U.K. It has expanded in multiple ways over the past decade or so beyond merely the store network: breakfast is now a bigger part of the offering (and it is now the U.K. market leader for to-go breakfasts), hot drinks have gained prominence and an app has likely helped the company boost sales.

Greggs' food tastes fine to me: I see it as more healthy than fast food from the likes of McDonald's ( MCD ), for example. Perhaps more importantly I also regard it as more filling. A steak bake sates my hunger for longer than a hamburger.

In fact, having written the above and then decided to compare the actual nutritional value (in absolute not pro rata weight terms) of a common item from both companies, Greggs does better on some things but McDonalds on others. Still, I think a lot of British consumers have less negative health connotations with Greggs than with many hot fast foods.

|

| |

Energy kJ | 1382 | 1768 |

Energy kcal | 329 | 423 |

Fat (G) | 22 | 23 |

of which Saturates | 12 | 8.3 |

Carbohydrate (G) | 24 | 28 |

of which Sugars | 0 | 3.2 |

Fibre (G) | unlisted | 2.2 |

Protein (G) | 9.4 | 25 |

Salt (G) | 1.6 | 1.8 |

Table compiled by author using data from company websites

Another important part of the value proposition here is convenience. Greggs has a large number of town and city centre locations. I can go in, order, pay in cash and often be out the door quickly (not obvious from the above picture, I grant).

For builders buying breakfast on the way to a construction site, for example, I think this is a significant benefit. McDonald's overly complicated instore screen-based ordering system and wait time can lead to less convenience in such situations.

So the Greggs model is basic but is proven, it works well and I think it has a long growth runway. Not only do I see ongoing growth opportunities in the U.K. but I think the model could be rolled out almost without significant change in Ireland, the Netherlands, Belgium (perhaps), Poland, parts of eastern Europe, Australia, New Zealand and South Africa.

Business Continues to Build Momentum

This month the company released its 2023 prelim results and they were strong.

Company prelim results announcement

It added that like-for-like sales in company-owned shops grew 8.2% in the first nine weeks of the current year.

What was behind the growth?

Basically Greggs just keeps rolling out a proven formula. 145 net new stores mean the estate ended 2023 at 2,473 shops - and I expect that to keep growing. The company is targetting 140-160 net openings this year and says there is a "clear opportunity" for significantly more than 3,000 U.K. shops over the longer term. That in itself could add around 25% to revenues in my view.

Evening trade has been growing, with 1,200 sites open till seven o'clock or later. Greggs' historic heartland was lunch, it then grew its breakfast offering and is now extending to dinnertimes. That should allow it to use the same existing infrastructure to support more sales.

It is expanding its logistics capacity with two new sites due to come onstream this year and has installed a fourth line at its main centralised production facility.

In the absence of an unforeseen event like a lockdown hurting demand, I expect Greggs to continue growing strongly in the next several years.

Finances are Attractive

The company ended last year with net cash and cash equivalents of £195.3m. Its financing needs are to a significant extent driven by its own choices about how fast to expand and it has managed that successfully for a long time: I expect that should remain the case.

Earnings per share grew last year and the company declared a special dividend.

The pre-tax profit margin last year was 10.4%. Compare that to 33.6% at McDonalds. While Greggs has moved to a model of both company-owned and franchised shops, at its heart the business model here is a commodity food production business vertically integrated with a branded retail offering. In business model terms that is significantly less financially attractive than the sort of licensing and franchising operations common to large U.S. fast food operators like McDonald's.

Still, I like Gregg's balance sheet, profitability and proven business model. Operating cashflows were £310m but net free cash flow was only £3.7m. Dividends (and a small number of share buybacks) contributed to outflows, but the other two main drivers were capex and repaying principal on lease liabilities, both of which I see as positive for the long-term investment case.

The declaration of a special dividend to distribute excess cash to shareholders further underlined the company's current robust financial position.

Valuation Looks Fair

Using post-tax earnings, Greggs now sells on a price-to-earnings ratio of 20.

For a solid company with strong growth prospects, I think that is fair but I do not think it is cheap. I do like the long-term outlook for the business, so I maintain my "buy" rating.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

About gggsf stock.

| Symbol | Last Price | % Chg |

|---|

More on GGGSF

Related stocks.

| Symbol | Last Price | % Chg |

|---|---|---|

| GGGSF | - | - |

Trending Analysis

Trending news.

- Business Cycle

- Business Environment

- Consumer Protection

- Corporate Responsibility

- External Influences

- Globalisation

- Government Influence

- International Business

- Financial Risk

- Investment Appraisal

- Sources of Finance

- Competitive Advantage

- Customer Focus

- International Marketing

- Market Research

- Marketing Planning

- Marketing Strategies

- Product Launch

- Product Life Cycle

- Product Portfolio

- Segmentation

- The Marketing Mix

- Continuous Improvement

- Customer Service

- Health and Safety

- Lean Production

- Location of Business

- Management of Change

- Merger and Acquisition

- New Product Development

- New Technology

- Product Development

- Production Process

- Research and Development

- Supply Chain

- Communications

- Developing People

- Equal Opportunities

- Managing Change

- Organising People

- Protecting People

- Recruitment and Selection

- Roles and Responsibilities

- Skills and Competencies

- Aims and Objectives

- Business Expansion

- Business Organisation

- Business Planning

- Business Start-Up

- Business Strategy

- Decision Making

- Sectors of Industry

- Stakeholders

- Strategic Planning

- Types of Organisation

- External environment

- External Environment

- eBook Collections

- Audio Case Studies

- Printed Books By Edition

- Terence Cuneo Eurostar Print

- Employee Retention

- HR Software

- Hybrid Working

- Managing People

- Motivating People

- Performance Management

- Recruitment

- Time Management

- Training and Development

- Business Acquisition

- Business Growth

- Business Plan

- Business Startup

- Entrepreneurship

- Small Business

- Strategic management

- Types of Business

- Accountants

- Bookkeeping

- Budgeting and Cash Flow

- Business Debt

- Business Financing

- Business Funding

- Business Insurance

- Business Investment

- Business Loans

- Business Payments

- Business Taxation

- Market Trading

- Advertising

- Affiliate Marketing

- Business Branding

- Business Events

- Content Marketing

- Conversion Rate Optimisation

- Customer Experience

- Digital Marketing

- Email Marketing

- Lead Generation

- Link Building

- Marketing Agencies

- Marketing Strategy

- Pay Per Click Advertising

- Public Relations

- Social Media

- Business Efficiency

- Business Innovation

- Business Location

- Business Management

- Business Security

- Manufacturing

- Outsourcing

- Project Management

- Quality Management

- The Supply Chain

- Business Law

- Coronavirus

- Finance & Economics

- Sustainable Business

- The Economy

- Stakeholder

- Ethical Business

- Business of Gambling

- Casino Bonuses

- Casino Games

- Casino Guides

- Mobile Gambling

- Online Casino

- Sports Betting

- Tips and Tricks

- Virtual Reality

- Gaming Accessories

- Mobile Gaming

- Online Gaming

- Video Games

- Online Learning

- Schools and Colleges

- Students and Teachers

- Studying Internationally

- Universities

- Writing Services

- Cosmetic Procedures

- Cannabidiol (CBD)

- Cannabis/Marijuana

- Dental Care

- Mental Health

- Office Wellbeing

- Relationships

- Supplements

- Banking and Savings

- Credit Cards

- Credit Score and Report

- Debt Management

- International Money Transfers

- Investments

- Payday Loans

- Personal Insurance

- Personal Law

- Motor Accidents

- Motor Finance

- Motor Insurance

- Motoring Accessories

- Celebrities

- Buying Selling and Renting Property

- Construction

- Property Cleaning

- Property Investments

- Property Renovation

- Business Travel

- Camping Activities

- Travel Guides

- Travel Safety

- Visas and Citizenship

- Antiques and Art

- TV, Film & Music

- Paralympics

- Mobile Apps

- Mobile Phone

- Photography

- Digital Transformation

- Crypto Exchange

- Crypto in Business

- Crypto Mining

- Crypto Regulation

- Crypto Trading

- Accessories

- Artificial Intelligence

- Programming

- Security & Privacy

- Software Development

- Web Analytics

- Website Design

- Website Development

- Website guides

- Website Hosting

- Guest Posting

- Editorial Links

- Writing and Publishing

- Homepage Links

- Membership Billing

- Membership Cancel

- Membership Invoice

- membership levels

- Your Profile

- Account Details

- Lost Password

No products in the basket.

Greggs: an agile approach to strategy & business model thinking

Posted on: August 7, 2019 in Strategy, growth & innovation

John Gregg founded his bakery business in 1939, selling eggs and yeast from his bicycle in Newcastle. The business grew, and his son Ian joined his father and mother, selling pies from his van to miners’ wives. They opened their first shop in Gosforth in 1951.

When John died in 1964, the bakery was taken over by Ian, and major expansion began, including the acquisitions of other bakeries such as the Bakers Oven chain from Allied Bakeries in 1994.

Greggs grew to be the largest bakery chain in the UK, home of the bacon sandwich and a coffee for two quid special offer which, disappointingly, is now £2.10 (a friend told me, honestly), famous for pies and pasties and everything you firmly resolved on December 31 would never touch your lips again.

A couple of years ago, Greggs fell victim to adverse PR about its product range and customer base. Oh how the Prêt crowd sniggered into their avocado and crayfish salads. Yet plucky old Greggs just got its head down and kept growing. ‘It’s a northern thing’ no longer serves as an explanation. The patronising notion that Greggs’s popularity is inversely proportional to the nation’s economic fortunes also fails to explain its steady expansion.

Today Greggs generate £1m a week from sales of coffee. It has repositioned the brand from an ordinary bakery-to-take-home to a high growth food-on-the-go entity, meeting changing customer demands and evolving food culture.

A new strategy was introduced in 2013 under CEO Roger Whitehouse, formerly Head of M&S Food, which focused on four pillars: Great tasting freshly prepared food; best customer experience; competitive supply chain; first class support teams.

Whitehouse introduced a ‘restless dissatisfaction’ approach to compliment the traditional business values, ensuring the business would never stand still after recovering from a period of stagnation. He implemented some radical changes, including closing the in-store bakeries, and introducing the ‘Balanced Choice’ range of products with less than four hundred calories, healthier options to the traditional product range.

And it’s worked. Having launched the first vegan sausage roll in January, last week the company announced a 50% rise in profits to £40.6m in the first half of 2019. The business is handing shareholders a £35m special dividend after total sales rose 14.7% to £546m.

In 2016, Greggs weren’t in the takeaway breakfast market but now only McDonalds sells more takeaway breakfasts. With a Fairtrade Expresso, it has overtaken Starbucks to become the third-largest takeaway coffee seller, behind Costa and McDonalds, while only Tesco sells more sandwiches.

So what are the lessons from the success of Greggs changing its business strategy and model that we take into our startup thinking?

1. Be agile in how you connect with customers

Greggs expects to pass 2,000 outlets this year, 65% are on high streets, with the remaining 35% located in retail and office parks and in travel locations such as railway stations and petrol forecourts. The aim is to change the emphasis of the business so that it is 60% non-high street by the time it has 2,500 shops.

Part of this is having many of its stores open earlier and close later, in order to target those going to and coming back from work, expanding its breakfast menu to suit, and with ‘Greggs à la carte’ stores to open late to 9pm to lure evening takeaway diners.

As well as its new drive-through locations, the company is trialing a click-and-collect service, as well home and office delivery by Just Eat and Deliveroo. They aim to integrate click-and-collect and delivery services with the company’s Greggs Rewards app, which offers free drinks and birthday treats.

Greggs has previously failed with new ideas such as Greggs Moment , a coffee shop-style outlet with seating, and the Greggs Delivered service, which is only available in Newcastle and Manchester city centres, three years after it launched. However, the business is now at a scale where it can experiment without too much risk.

Takeaway: Greggs route to market strategy is to based on expanding their reach to enhance customer convenience, a ‘fish where they swim’ strategy, reducing the barriers between themselves and their customers, uplifting the customer experience and making the ability to connect and purchase convenient.

2. Build your brand to face your market

Greggs has in recent years persistently bucked the wider trend on UK high streets, where most retailers are struggling to compete as sales shift online and the cost of running stores rises.

In 2013, Greggs began to transition out of the bakery market with the reasoning that it couldn’t compete with supermarkets, switching to focusing solely on the ‘food on the go’ market after discovering that 80% of its business was with that market. They stopped selling bread in 2015.

Greggs has worked hard at getting consumers to think about it as a food-on-the-go chain, developing ideas such as online ordering for collection and home delivery, developing strategic partnerships with their supply chain to focus on the four key pillars of their strategy.

They are more in touch with where the customers are today. It has managed to cater to new markets without being overly ambitious. The builder can still come off the building site and get a hot pasty, but there are also salads. The decor is still recognisable even if it has been upgraded and the older traditional customers still feel comfortable.

Takeaway: Many businesses want profit as their objective. But if you only focus on short-term wins and results, you get distracted from doing the work required to build the skills you need to grow and scale, and it’s the ability to scale that matters. The process is more important than the outcome at early stages of a change of strategy. Focus on getting good before you worry about getting big.

3. Look forwards, not backwards with your product offering

Greggs sells 1.5 million sausage rolls a week but created the new vegan option due to public demand after an online petition signed by 20,000 people. In recent years Greggs has been innovating within its product range to appeal to a broader range of customers. Its ‘Balanced Choice’ healthy eating range, introduced in 2014, offers options including wraps and salads, all below 400 calories. It also sells gluten-free and several vegan lines.

The company also believes it can take advantage of rising demand for food ‘customisation’, driven by allergies and ‘food avoidance’ preferences, and its stores now make sandwiches to request.

One in eight new customers have bought a vegan sausage roll in 2019, which has overtaken doughnuts and other pastries to become a bestseller. The traditional sausage rolls remain at number one – with its 96 layers of light, crisp puff pastry – but there are more vegan products in development, including a vegan doughnut. It’s worked, such that Ginsters released their own vegan product for the first time in its 52-year history.

Takeaway: Greggs has been bold in its response to the adverse publicity on its offering and changing food culture. Aligning your product strategy with a focused brand image and route to market is core to any business model.

4. Be clear about your marketing message & tone of voice

Before the Greggs vegan sausage rolls went on sale, TV presenter Piers Morgan sent out a tweet: Nobody was waiting for a vegan bloody sausage, you PC-ravaged clowns. The tone of the company’s response: Oh hello Piers, we’ve been expecting you – friendly but with a slight edge, was perfectly attuned to the ironic, self-confident marketing Greggs has adopted, a James Bond-inspired, droll putdown that was the perfect riposte.

Their hilariously portentous launch video – part of a build-up that parodied the release of a new iPhone model with journalists sent vegan rolls in mock iPhone packaging and stores sold sausage roll phone cases – meant that for days Twitter was engulfed with people talking about a £1 bakery product.

The vegan sausage roll campaign, officially launched to support the Veganuary campaign that encouraged people to give up animal products for a month, followed other memorable promotions include a Valentine’s Day campaign offering ‘romantic’ £15 candlelit dinners in Greggs shops, and a spoof ‘Gregory and Gregory’ event, and one faux pas: a 2017 advent calendar tableau of a sausage roll in a manger. After complaints Greggs apologised and reprinted with a different scene featuring Christmas muffins.

Takeaway: Greggs found its distinctive marketing style in 2012, when it saw off then-chancellor George Osborne’s proposed ‘pasty tax’ on hot takeaway food. Since then it has been consistent in its purposeful, structured and memorable content driven communication strategy, making the brand relevant to its target audience and differentiating its offering in an increasingly competitive market to reposition the brand.

5. Don’t let your business model become stale

Innovation can be about efficiency. Look at Ikea, and The Billy bookcase. It’s a bare-bones, functional bookshelf if that is all you want from it. The Billy isn’t innovative in the way that the iPhone is innovative. The Billy innovations are about working within the limits of production and logistics, finding tiny ways to shave more off the cost, all while producing something that does the job. It demonstrates that innovation in the modern economy is not just about snazzy new technologies, but also boringly efficient systems.

The Greggs shop environment has been improved and significant investments made in logistics and delivery systems to make them more efficient and scalable. In-store ordering moved to a centralised forecast and replenishment system rather than relying on shop teams filling in manual order forms, which resulted in order accuracy and improved availability for customers.

All shops are on a refurbishment programme (every seven years) to ensure they stay looking bright and welcoming. In-store point of sale and window displays remain key to Greggs’ marketing strategy, however, a loyalty app was also introduced.

Takeaway: innovation in Greggs is about efficiency, economy and effectiveness, searching for ways to make their products even better and affordable for their target market. A ‘back to basics’ focus on the business model reflects the culture and humility of the brand. Combined with brave decision making to implement change and execution in a consistent, simple and continuous manner has delivered the results.

6. Ensure your folks keep clear heads

Amidst the hullaballoo and the fury of the frantic activity in the coming and going of customers at busy times, staff have to keep a clear head. In the heat of the moment, they cannot get caught up in the intensity and frenzy. Resilience in times of peak demand is needed to keep the customer experience as fresh and stimulating as the steak bakes.

When you go to a Greggs, the staff are so engaged in what they do its untrue, they are like whirling octopus serving customers, and they do it with good humour, bantering with regulars, enjoying the success of seeing returning customers, before going again.

With 10% of profits going to the Greggs Foundation to help fund Breakfast Clubs for children and over £1m raised annually for Children in Need, the vegan pastry has helped change the perception of Greggs, but fundamentally it’s a people business, about delivering service, experience and the community it operates.

Takeaway: So, focused on a simple, core value proposition – reasonable quality food at reasonable prices, consistently produced and scaled – but the fundamental premise is to make customer experience the brand differentiator.

Many takeout food companies are head-on competition to Greggs, but due to its focused marketing strategies highlighting choice, quality, nutrition & easy access, the company is able to create sustainable advantage.

Changing lifestyles, changing eating habits and increasing health awareness factors are affecting the growth of the companies in this industry. Greggs has set its strategy from a customer’s point of view and with customer-based insights, to ensure the business model is as robust as it can be.

Adopt Greggs’ agile approach to strategy and business model thinking, to focus on the horizon and hold your vision. Do something everyday to move your business forward, and that makes you stand out from the crowd. A sheep has never stood out from another sheep, so don’t follow the herd blindly. People will take notice.

get in touch today

Greggs: The Strategic Issues Analysis Case Study

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

Introduction

Strategic issue diagnosis, external analysis, internal analysis, works cited.

Greggs is a popular business in the United Kingdom since it provides customers with high-quality food. The business has a rich history explaining how the company overcame various challenges. The current environment also offers many issues that should be properly managed. That is why the given report assesses strategic issues of Greggs and focuses on the internal and external conditions that determine how the organization develops.

Business Issues

The given company represents the UK food-on-the-go industry, and it is reasonable to consider its life cycle. The field has a vast history and was experiencing a dramatic increase pre-pandemic. For example, the UK market was worth £18.9 billion in 2019, but the crisis led to its estimated value of £15.6 billion in 2021 (Heath par. 2). That is why the industry is currently facing an economic downturn resulting in financial losses for individual businesses.

The life cycle of the selected organization also deserves attention. The company emerged 80 years ago when John Gregg started delivering fresh eggs and yeast by pushbike (Greggs, “Our History” par. 1). The first shop was opened ten years later, and it gave rise to a large system, including almost 2,000 stores today (Greggs, “Our History” par. 4). Throughout its history, Greggs attempted to satisfy customers’ needs and expectations, which explains the development of a vegetarian menu, free Wi-Fi, and so on (Greggs, “Our History” par. 2-3). This information demonstrates that the organization is ready to make strategic decisions to promote growth.

Cultural Issues

The cultural web is a helpful tool that relies on numerous elements to assess Greggs culture. Firstly, the Stories component reveals that the organization positions itself as a major employer and a provider of healthy food, while ordinary citizens appreciate it. Secondly, Greggs relies on many symbols to establish and distribute its cultural values. In particular, the company uses unique stores interior and exterior design, customized packages, and specific gift cards. The organization invests in marketing, meaning that Greggs advertisements appear at cars and on streets. Thirdly, routines and rituals represent the accepted norms and practices governing the workforce. The company has regular meetings for the board of directors, while rituals are developed for ordinary employees (Greggs, “People” par. 3-8). For instance, the business provides individual workers with a rewarding system, training and growth opportunities, and an equal environment.

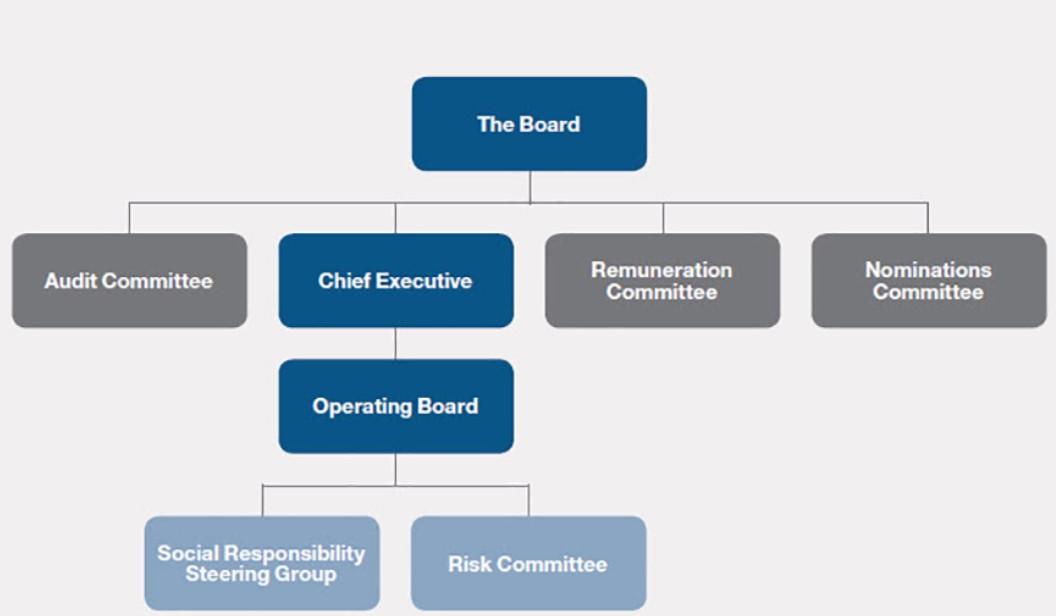

Fourthly, the organization relies on a specific control system to ensure that employees correctly perform their duties. Greggs provides its workers with competitive salaries and shares a part of the overall profits with them (“People” par. 5). Fifthly, the company’s power structure is represented by the board of directors, including eight highly skilled and experienced professionals. Finally, the business’s organizational structure consists of a few departments, each of which is responsible for a particular business area. This information concludes that Greggs is an example of task culture. The rationale behind this statement is that the organization is divided into departments, i.e., teams, and each of them is expected to solve issues within its responsibility area. All the teams and their members join their efforts to contribute to the business development.

Political/Governance Issues

Greggs has two groups of stakeholders, including internal and external ones. Internal stakeholders are employees and executives, while customers and suppliers represent outside ones. A mapping activity allows for identifying the meaning of these groups and how the business should address them. Executives have high interest and power, meaning that they should receive the most attention. Suppliers have low interest and power, and the company should monitor them. Low interest and high power characterize customers, and Greggs should keep them satisfied. Finally, employees feature high interest and low power, denoting that the organization should keep them informed.

A principal-agent issue emerges when it is necessary to hire new employees. Since managers cannot have exhaustive information about candidates’ performance, their hiring involves risks that can affect the entire organization. The organization tries to minimize these hazards and ensure all the employees effectively engage in performing their obligations. Competitive salaries and additional bonuses serve as an effective motivation for workers.

In addition to that, Greggs draws significant attention to corporate social responsibility. In 2021, it announced “The Greggs Pledge,” highlighting the objectives and positive changes that the business wants to achieve. In particular, the company advocates for stronger and healthier communities, promises to establish a carbon-neutral and zero-waste business, promotes diversity, and establishes sustainable operations (Greggs, “The Greggs Pledge” 4). These goals demonstrate that the organization understands its social responsibility and does its best to improve the world.

Macro Level Issues

The PEST analysis is helpful since it can reveal what specific political, economic, social, and technological forces affect the business. Firstly, the UK government is serious about food safety, meaning that Greggs should satisfy such standards to operate within this environment. Secondly, economic conditions significantly deteriorated when the COVID-19 pandemic shocked the world. The organization lost a significant part of its revenues and is currently struggling to reach pre-crisis levels. Thirdly, social forces are positive for Greggs because the organization has high brand awareness, and customers positively assess it. Fourthly, the company benefits from technological achievements because free Wi-Fi and online marketing tools attract more customers. Macro-level scenarios imply that the organization should use its internal and external strengths to mitigate adverse impacts of political and economic issues.

Market and Industry Analysis

Greggs relates to the strategic group of fast-food restaurants, meaning that the business should prioritize specific values. For instance, they are timely service, an efficient supply chain, and a professional workforce. Greggs offers products for the middle class, including representatives of all races, genders, and ethnicities. Simultaneously, the Five Forces analysis demonstrates that the organization’s position in the industry is challenging. The threat of new entrants is not high, but Greggs still has to invest in innovation and growth to have an advantage over new players. The bargaining power of suppliers is medium, and the organization should diversify its supply chain and cooperate with multiple partners to mitigate risks. Buyers have a significant force in the market, and Greggs should continue increasing its customer base to protect long-term development. The threat of substitutes is rather high, and the company should offer high-quality services and products to address it. Finally, Greggs should differentiate its brand to compete with numerous rivals.

Environment-Organization Fit

The selected company does its best to ensure that it positively affects the environment. Greggs scans for its impact on nature and develops specific goals to minimize this harm. In particular, the business announced that it would use less packaging, reduce carbon emissions, and decrease the amount of waste (Greggs, “The Greggs Pledge” 4). However, the company does not mention that it relied on Big Data and analytics to address the issues.

SBU Analysis

The organization consists of a few strategic business units, and thye join their efforts to create a value chain. In particular, there are three committees, including the audit, remuneration, and nominations ones (Greggs, “Board Committees”). Simultaneously, the Chief Executive Officer presides over the operating board with its responsibilities. The given value system implies that these bodies are responsible for different activities that are performed to ensure that Greggs can adequately offer service and products to customers.

Organizational Architecture

The previous section has already commented on what committees are involved in Greggs management. However, it is now reasonable to comment on what relationships exist among individual bodies. Horizontal links have occurred among the committees that are subordinate to the board of directors (see fig. 1). The synergy among all these establishments results in the fact that the business has a rather effective and clear organizational architecture.

Financial Resources

Financial analysis of the business reveals mixed results that deserve attention. On the one hand, the company’s financial report demonstrates that the 2021 total sales increased to £1,229.7 million from £811.3 million in 2020 (Greggs, “Annual Reports” 1). However, the price-to-earnings ratio is 20.82, which is significantly lower compared to the average industry value (Investing.com). These findings reveal that both positive and negative features can be found.

Integrative Internal Analysis

Greggs has a few generic strengths that allow it to withstand the crisis. Drawing attention to workforce training and development is one of them. Since the company has a skillful workforce, it can easily overcome different challenges. In addition to that, this characteristic feature provides the organization with numerous capabilities to develop and grow. Consequently, Greggs should invest more resources to attract and retain experienced employees.

The report has presented an analysis of Greggs as well as its external and internal environments. The COVID-19 pandemic brought many challenges, and the company was forced to deal with versatile consequences. However, the findings reveal that the organization has sufficient resources to mitigate the challenges. In particular, social and technological conditions, as well as an experienced workforce, provide Greggs with effective resources to keep developing.

Greggs. “Annual Reports and Accounts 2021.” Web.

“Board Committees.” Web.

“Our History.” Web.

“People.” Web.

“The Greggs Pledge.” Web.

Heath, Kim. “Will the UK Food-To-Go Market Get Back to Growth Post Pandemic?” AHDB, 2022.

Investing.com. “Greggs PLC.” 2022.

- Stonyfield: Corporate Social Responsibility

- The Zalora Company's Pricing Strategies

- FIFA’s Public Image: Issues and Mitigate the Damage

- Risk and Capital Budgeting: Impacts and How to Mitigate Risks

- Corporate Board Independence

- Nike: Corporate and Production Strategies

- Mondelez AAA Strategy Analysis

- The Johnson & Johnson Firm's Corporate Strategy

- Boston Consulting Group and Internal-External Portfolio Matrices

- ETA’s Swatch’s Business-Level Strategy

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2023, July 17). Greggs: The Strategic Issues Analysis. https://ivypanda.com/essays/greggs-the-strategic-issues-analysis/

"Greggs: The Strategic Issues Analysis." IvyPanda , 17 July 2023, ivypanda.com/essays/greggs-the-strategic-issues-analysis/.

IvyPanda . (2023) 'Greggs: The Strategic Issues Analysis'. 17 July.

IvyPanda . 2023. "Greggs: The Strategic Issues Analysis." July 17, 2023. https://ivypanda.com/essays/greggs-the-strategic-issues-analysis/.

1. IvyPanda . "Greggs: The Strategic Issues Analysis." July 17, 2023. https://ivypanda.com/essays/greggs-the-strategic-issues-analysis/.

Bibliography

IvyPanda . "Greggs: The Strategic Issues Analysis." July 17, 2023. https://ivypanda.com/essays/greggs-the-strategic-issues-analysis/.

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Business news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Business Resources

Resource Selections

Currated lists of resources

Edexcel A2 Business Unit 4a - Greggs Case Study Analysis

16th March 2014

- Share on Facebook

- Share on Twitter

- Share by Email

The Greggs plc case study toolkit can be ordered online here or by downloading and sending us this printable order form.

Mark's analysis of the SuperDry / SuperGroup case study from 2013 exam sittings can be obtained for free by completing this short online form - submit your details and the download details will be sent to you.

Jim co-founded tutor2u alongside his twin brother Geoff! Jim is a well-known Business writer and presenter as well as being one of the UK's leading educational technology entrepreneurs.

You might also like

Our subjects.

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

Press to search

Greggs uses Paragon’s route optimisation software to support business transformation

With the food-on-the-go sector rapidly expanding in the UK, specialists such as Greggs are facing growing pressure on their supply chains to meet changing customer demands.

Greggs has undertaken an ambitious £100 million investment to reshape its supply chain, supporting the transformation from a decentralised traditional bakery business into a centrally-run, food-on-the-go brand that can meet the choice and availability customers demand. The retailer has also expanded beyond its traditional place on the high street to new locations on retail and industrial parks, motorway service stations and travel hubs.

As a result of all these changes, distribution planning has become progressively more complex. Greggs’ team of transport planners uses Paragon’s route optimisation software extensively to simplify the planning process, target efficiency savings and maintain service standards.