Pharmaceutical Business Plan Template

Written by Dave Lavinsky

Pharmaceutical Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their pharmaceutical companies.

If you’re unfamiliar with creating a pharmaceutical business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a pharmaceutical business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Pharmaceutical Business Plan?

A business plan provides a snapshot of your pharmaceutical business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Pharmaceutical Company

If you’re looking to start a pharmaceutical business or grow your existing company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your pharmaceutical company to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Pharmaceutical Businesses

With regards to funding, the main sources of funding for a pharmaceutical business are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for pharmaceutical businesses.

Finish Your Business Plan Today!

How to write a business plan for a pharmaceutical company.

If you want to start a pharmaceutical company or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your pharmaceutical business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of pharmaceutical business you are running and the status. For example, are you a startup, do you have a company that you would like to grow, or are you operating pharmaceutical companies in multiple markets?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the pharmaceutical industry.

- Discuss the type of pharmaceutical business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of pharmaceutical company you are operating.

For example, you might specialize in one of the following types of pharmaceutical businesses:

- Generic Pharmaceutical Manufacturing : this type of pharmaceutical business develops prescription or over-the-counter drugs products that do not have patent protection.

- Vitamin & Supplement Manufacturing: this type of pharmaceutical company primarily develops products that contain ingredients intended to supplement the diet.

- Brand Name Pharmaceutical Manufacturing: this type of pharmaceutical business engages in significant research and development of patent-protected prescription and over-the-counter medications.

In addition to explaining the type of pharmaceutical business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of patents awarded, the extent of your product portfolio, reaching X number of distributors under contract, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the pharmaceutical industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the pharmaceutical industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section:

- How big is the pharmaceutical industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your pharmaceutical company? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: healthcare providers, chain pharmacies, independent retailers, and consumers.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of pharmaceutical business you operate. Clearly, individuals would respond to different marketing promotions than hospitals, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Pharmaceutical Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other pharmaceutical businesses.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes imported alternatives, herbal remedies, or customers’ nutritional self-care. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of products do they manufacture?

- What are their research and development capabilities?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide product development?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a pharmaceutical company, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of pharmaceutical business that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you manufacture patent-protected prescription medications, or a range of vitamins?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your pharmaceutical business. Document where your company is situated and mention how the site will impact your success. For example, is your pharmaceutical company located in an industrial district, near a major medical and/or scientific hub, or near input markets? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your pharmaceutical marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Advertise in trade publications

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your pharmaceutical company, including meeting with potential customers, creating and distributing product information, developing and manufacturing products, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to produce your Xth product, or when you hope to reach $X in revenue. It could also be when you expect to expand your pharmaceutical business to a new city.

Management Team

To demonstrate your pharmaceutical company’s potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing pharmaceutical businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a pharmaceutical business or successfully running a R&D company.

Financial Plan

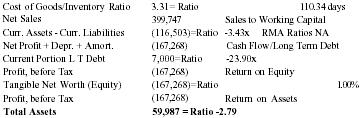

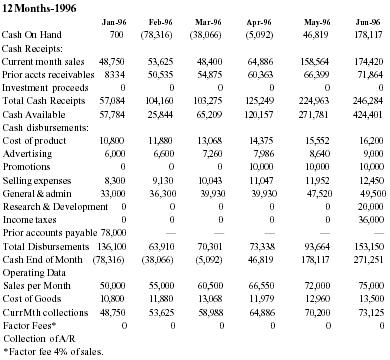

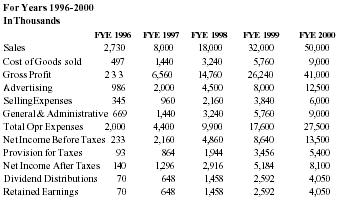

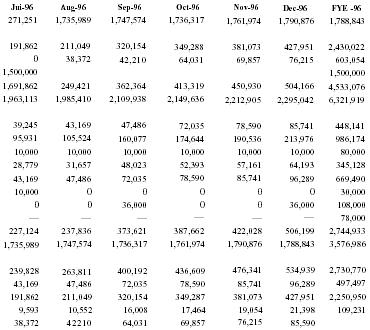

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions including your sales projections. For example, will you manufacture a line of general sales products, or will you specialize in manufacturing controlled drugs? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your pharmaceutical company, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a pharmaceutical company:

- Cost of equipment and supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your facility blueprint or a list of products you manufacture.

Writing a business plan for your pharmaceutical business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the pharmaceutical company industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful pharmaceutical company.

Don’t you wish there was a faster, easier way to finish your Pharmaceutical business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s business plan writers can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Business Plan Template for Pharmaceutical Companies

- Great for beginners

- Ready-to-use, fully customizable Subcategory

- Get started in seconds

Securing funding and navigating the highly regulated pharmaceutical industry can be a daunting task for any company. But with ClickUp's Business Plan Template for Pharmaceutical Companies, you can streamline the process and increase your chances of success!

Our template provides you with all the essential elements you need to create a comprehensive and compelling business plan, including:

- Strategic goals to guide your company's growth and development

- Financial projections to showcase the potential profitability of your products and services

- Market analysis to identify key trends, competitors, and target markets

- Operational plans to outline your manufacturing, distribution, and regulatory strategies

Don't miss out on the opportunity to attract investors and secure funding for your pharmaceutical company. Get started with ClickUp's Business Plan Template today and take your business to new heights!

Business Plan Template for Pharmaceutical Companies Benefits

A business plan template designed specifically for pharmaceutical companies offers a range of benefits, including:

- Streamlining the process of creating a comprehensive business plan, saving time and effort

- Providing a clear structure and framework for organizing key information and data

- Ensuring all critical components of a pharmaceutical business plan are included, such as market analysis, competitive analysis, and regulatory compliance

- Presenting a professional and polished document that is attractive to investors and lenders

- Helping pharmaceutical companies articulate their unique value proposition and competitive advantage in the market

- Guiding strategic decision-making and long-term planning for growth and success in the industry.

Main Elements of Pharmaceutical Companies Business Plan Template

ClickUp's Business Plan Template for Pharmaceutical Companies provides a comprehensive solution for creating and managing your pharmaceutical business plan. Here are the main elements of this template:

- Custom Statuses: Keep track of the progress of each section of your business plan with statuses like Complete, In Progress, Needs Revision, and To Do.

- Custom Fields: Add important details to your business plan, such as Reference, Approved, and Section, to ensure accurate documentation and easy reference.

- Custom Views: Access different views, including Topics, Status, Timeline, Business Plan, and Getting Started Guide, to organize and visualize your business plan from different perspectives.

- Collaboration Tools: Utilize ClickUp's collaboration features like comments, mentions, and task assignments to collaborate effectively with your team members and stakeholders.

- Document Management: Store and manage all relevant documents related to your business plan using ClickUp Docs, ensuring easy access and version control.

How To Use Business Plan Template for Pharmaceutical Companies

If you're in the pharmaceutical industry and need to create a business plan, the Business Plan Template for Pharmaceutical Companies in ClickUp can help you get started. Follow these five steps to develop a comprehensive plan for your company's success:

1. Company Overview

Begin by providing a clear and concise overview of your pharmaceutical company. Include details such as your mission statement, vision, values, and a brief history of your organization. Highlight your unique selling proposition and explain how your company stands out in the competitive pharmaceutical market.

Use the Docs feature in ClickUp to write a compelling company overview with all the necessary information.

2. Market Analysis

Conduct a thorough analysis of the pharmaceutical market to identify trends, opportunities, and potential challenges. Research your target audience, competitors, and industry regulations. Provide insights into market size, growth projections, and key market segments that you plan to target.

Utilize the Table view in ClickUp to organize and analyze your market research data effectively.

3. Product Portfolio

Outline your product portfolio and describe the pharmaceutical products or services you offer. Highlight their unique features, benefits, and potential impact on patients' lives. Discuss your research and development efforts, clinical trials, and any patents or intellectual property you have.

Create tasks in ClickUp to track your product development milestones and progress.

4. Marketing and Sales Strategy

Detail your marketing and sales strategies to reach your target audience and generate revenue. Identify your target market segments and outline your marketing channels, such as digital advertising, trade shows, or partnerships with healthcare providers. Define your pricing strategy, distribution channels, and sales forecasting.

Use the Gantt chart feature in ClickUp to visualize and track your marketing and sales activities over time.

5. Financial Projections

Provide financial projections that demonstrate the profitability and sustainability of your pharmaceutical company. Include a comprehensive analysis of your revenue streams, costs, and projected financial statements such as income statements, balance sheets, and cash flow statements. Consider factors such as research and development costs, manufacturing expenses, and pricing strategies.

Utilize the Dashboards feature in ClickUp to create visual representations of your financial data and track your progress towards financial goals.

By using the Business Plan Template for Pharmaceutical Companies in ClickUp and following these steps, you can create a comprehensive business plan that sets your pharmaceutical company up for success in the competitive industry.

Get Started with ClickUp’s Business Plan Template for Pharmaceutical Companies

Pharmaceutical companies can use the Business Plan Template for Pharmaceutical Companies in ClickUp to effectively outline their strategic goals and financial projections, as well as navigate the complex and highly regulated pharmaceutical industry.

First, hit “Add Template” to sign up for ClickUp and add the template to your Workspace. Make sure you designate which Space or location in your Workspace you’d like this template applied.

Next, invite relevant members or guests to your Workspace to start collaborating.

Now you can take advantage of the full potential of this template to create a comprehensive business plan:

- Use the Topics View to organize different sections of your business plan, such as market analysis, product development, and financial projections

- The Status View will help you track the progress of each section, with statuses like Complete, In Progress, Needs Revision, and To Do

- The Timeline View will allow you to set deadlines and milestones for each section of your business plan

- The Business Plan View provides a holistic overview of your entire plan, allowing you to easily navigate and make updates

- The Getting Started Guide View will provide step-by-step instructions on how to use the template and create an effective business plan

- Utilize custom fields like Reference, Approved, and Section to add additional information and categorize different sections of your plan

- Collaborate with team members to gather input, feedback, and revisions to ensure a comprehensive and well-rounded business plan

- Monitor and analyze the progress of each section to ensure your business plan is on track and meets the needs of investors and stakeholders.

- Business Plan Template for Hoteliers

- Business Plan Template for Music Teachers

- Business Plan Template for Vodafone

- Business Plan Template for Advertisers

- Business Plan Template for Mergers And Acquisitions Specialists

Template details

Free forever with 100mb storage.

Free training & 24-hours support

Serious about security & privacy

Highest levels of uptime the last 12 months

- Product Roadmap

- Affiliate & Referrals

- On-Demand Demo

- Integrations

- Consultants

- Gantt Chart

- Native Time Tracking

- Automations

- Kanban Board

- vs Airtable

- vs Basecamp

- vs MS Project

- vs Smartsheet

- Software Team Hub

- PM Software Guide

Try for Free

Step-by-Step Guide to Starting a Pharmaceutical Company

Preview the Next Big Thing with MSB Docs AI

AI Summary Beta

Starting a pharmaceutical company is a challenging but potentially rewarding venture. This summary will provide an overview of key considerations in starting such a business.

Introduction:

Starting a pharmaceutical company is promising but demands substantial time, effort, and resources. Success hinges on market understanding, regulatory compliance, and effective business models. With dedication and knowledge, anyone can embark on this journey.

Thorough research is critical. Dive into the industry, study competitors, and grasp relevant regulations. Analyze market trends, technological advancements, and your competitors’ strengths and weaknesses.

Understanding Regulations:

Pharmaceutical businesses are heavily regulated. Comprehend FDA and local regulations, and consider seeking expert guidance. Stay updated on legal changes, maintain industry standards, and document procedures to avoid legal complications.

Business Model:

Selecting the right business model is crucial. Options include contract manufacturing, retail, and franchising. Each has pros and cons, and your choice should align with your goals, start-up capacity, and customer service strategy.

Launching a pharmaceutical business requires substantial capital for equipment, research, marketing, staffing, and more. Seek funding through government grants, investors, loans, or personal savings, considering tax implications and potential incentives.

Inventory and Supply Chain:

Manage inventory based on business size and product type. Storage conditions and transportation must align with product requirements. Establish efficient supply chains to ensure timely product turnover.

Distribution:

Effective distribution networks are essential for reaching customers. Decide on distribution methods, whether through wholesalers, retailers, or online sales. Choose experienced distributors and continuously evaluate and improve distribution channels.

Technology:

Technology plays a crucial role in pharmaceuticals. Automation enhances efficiency and reduces errors. Invest in secure data storage, cybersecurity, and customer interaction technologies, like websites and social media, to build trust and competitiveness.

Operations:

Operational processes are the backbone of any business. Develop efficient protocols for inventory, production, quality assurance, and regulatory compliance. Quality assurance is paramount in pharmaceuticals.

Prospecting Strategies:

Marketing in the pharmaceutical industry must comply with strict regulations. Consider online advertising, networking, print ads, direct mail, and conferences. Tailor strategies to your target audience and budget.

Insurance and Security:

Protect your business with adequate insurance coverage, considering your company’s size and activities. Implement security measures like surveillance, data encryption, and biometric technology to safeguard assets and sensitive information.

Conclusion:

Starting a pharmaceutical company is a complex but achievable endeavor with careful planning, adherence to regulations, robust business models, and the right technology. Building a reliable distribution network and marketing strategy are vital. Ensure safety and security with insurance and security protocols. Regular monitoring and adaptation are key to success in this dynamic industry. Good luck on your journey!

Unlock the power of our AI Assistant in our cutting-edge digital competition cloud.

Join 10,000+ businesses trusting MSB Docs for contract collaboration.

Table of Contents

Introduction to Starting a Pharmaceutical Company

A pharmaceutical company can be an appealing business venture, as it can offer the potential of substantial revenue growth and a meaningful impact on people’s lives. There is no doubt that starting a pharmaceutical company requires a great deal of time, effort, and resources. However, with the right knowledge and dedication, starting a pharmaceutical company can be a rewarding experience.

It is important to have a thorough understanding of the market, regulations, and business models in order to be successful in this field. With the right combination of research, planning, and dedication, anyone can start a pharmaceutical company and potentially reap the rewards of being at the forefront of medical innovation.

Doing the necessary research is a vital step to starting your own pharmaceutical company. It is important to dive deep into the industry, research potential competitors, and understand the regulations that may affect the business. Research will help establish a strong foundation for a successful business model.

It’s important to understand the current market and how it is evolving. This should include a review of any new trends and technologies that can be used to differentiate the company from its competitors. The research should also include studying the current players in the market, their strengths and weaknesses, and how your company can compete effectively.

Regulations are an important factor to consider when starting a pharmaceutical company. Regulations vary by country, state, and province, so it is important to become familiar with the relevant local regulations. Depending on the scope of the business, some of the regulations may include workplace safety, environmental standards, labeling requirements, etc. It is important to consult legal experts to make sure you remain compliant with the applicable regulations.

Understanding Regulations

Operating a pharmaceutical business can be a daunting task as regulations are placed on the industry. It is important to understand all regulations that can potentially affect the business, such as those put forth by the FDA and other governing institutions. Additionally, having knowledge of the specific regulations in the state where the business is located is essential for success.

Navigating regulations can be a tricky process and may require assistance from an expert. The laws vary from state to state, making it difficult for business owners to be knowledgeable of the specifics. Consulting legal representatives or industry experts can be very beneficial when trying to stay in compliance.

Additionally, keeping up-to-date with any changes in the law is also important. This will help ensure that the business remains compliant and not subject to fines or penalties. Familiarizing oneself with industry standards and proper documentation procedures can go a long way into protecting the business from any potential legal complications.

Business Model for Pharmaceutical Companies

When it comes to running a successful pharmaceutical company, having the right business model in place is essential. There are several different types of business models available for companies in the pharmaceutical industry, and it can be difficult to determine which one is best for you. In this section, we’ll explore the different options and discuss some key considerations you should keep in mind when choosing your business model.

One of the most popular business models for pharmaceutical companies is the contract manufacturing model. This model involves outsourcing the production of your products to an experienced third-party contractor. In this arrangement, the product will be developed and manufactured according to your specifications, and you’ll only have to pay for the manufacturing services. This type of model is great for companies that are just starting out and don’t have the capacity to manage their own production capabilities.

Another option is the retail model, where you manufacturer and sell products directly to customers. This type of model works well for companies with a wide variety of products that require specialized marketing strategies and customer service. However, it requires a significant financial investment upfront and a lot of time commitment from management.

Finally, there’s the franchise model, where you partner with a larger pharmaceutical company to share resources and expertise. This type of model is great for companies that want to benefit from the resources of larger companies without having to build out their own operations.

No matter which business model you choose for your pharmaceutical company, it’s important to do your research and make sure it’s the right fit for your needs. Consider factors such as start-up costs, operational efficiency, and customer service when assessing different models. Additionally, it’s important to weigh the benefits and drawbacks of each model to ensure you’re making an informed decision.

Finance – Funding Requirements and Sources for Starting a Pharmaceutical Company

Starting a pharmaceutical company is no small task. In the modern age, it requires a significant investment of money and resources. Understanding the financial aspects of a pharmaceutical business is essential for success.

In order to launch a successful pharmaceutical business, a tremendous amount of capital will be required. This money will go towards all the necessary steps to get your business up and running, including: production equipment, research and development, marketing, employees, etc. The exact amount of money needed can vary greatly depending on the size and scope of your operations, but it’s safe to say that the cost of starting a business in this industry can be quite high.

When it comes to finding the money for your project, there are several options available. These include government grants, angel investors, venture capital firms, bank loans, and personal savings. Each of these sources carries its own advantages and disadvantages, so it’s important to do the research to find the best option for your specific needs.

Additionally, you should consider the tax implications of each funding source. Not only are specific laws and regulations in place for different types of funding, but there may also be certain deductions or credits available.

Finally, you should keep an eye out for potential incentives and subsidies from the government. Depending on where you are located, there may be programs available to help startup businesses in the pharmaceutical sector.

Funding a pharmaceutical business is a complex process, but it’s definitely achievable. With the right research and preparation, you can be sure to secure the capital you need for success.

Inventory and Supply Chain Considerations for Pharmaceutical Companies

When starting a pharmaceutical business, it’s critical to understand the inventory and supply chain considerations that go into making a successful venture. The necessary inventory components will vary on the size of the business, the scale of operations, and the products. It is important to understand the needs for purchasing, storage, shipping, and distribution.

For smaller businesses, it is important to purchase inventory in small amounts. This will help manage expenses and prevent product expiration. It also helps create flexibility if products or terms are updated frequently. For larger businesses, having sufficient inventory on hand is critical. An efficient supply chain is required to ensure product turnover happens regularly and in a timely manner.

Storage is another key consideration. Depending on the type of products being sold, different environmental conditions may be needed. Temperature control, special packaging, and other considerations must be taken into account. Products must also be protected from theft or damage. Knowing which facilities to use for storage, and the cost of transportation are also key considerations.

Shipping and distribution are two more important components. Clients need to receive the products as quickly as possible. To ensure this, it is essential to select the appropriate methods for transport and to manage the process appropriately. This includes selecting carriers, providing tracking information, and handling returns. Distribution involves getting the product to the end user in a timely, cost-effective manner.

Successfully managing the inventory and supply chain for a pharmaceutical business requires both knowledge and experience with the various processes and components. Having an understanding of these considerations is vital for running a successful venture.

Distribution: The Key to Reaching Customers

Getting products to customers is a critical factor in running a successful pharmaceutical business. Distributors are necessary for a company to reach their target markets effectively. Distribution networks can be complex and challenging to set up, but they are essential for a company’s success.

Once customers have been identified, a company must decide how products will reach them. Companies that distribute internationally require more complex systems than companies that stay local or regional. Different options include using a wholesaler or a third-party distributor, distributing directly to retailers or selling online. Each option has its own advantages and drawbacks, and should be carefully considered when developing a distribution plan.

When selecting distributors, it is important to look for ones with an established reputation, experience in similar products, and a good track record with other customers. Additionally, relevant certifications, such as Good Manufacturing Practices (GMP) certification, need to be taken into consideration. Once selected, distributors must be given the necessary information and resources to effectively market and sell the products.

Finally, setting up distribution channels is not a one-time process – regular evaluations and updates are necessary to ensure maximum customer reach and satisfaction. Distributors must be monitored, and customer feedback should be incorporated into the process. This feedback can help a company improve their product and service offerings to better serve their customers.

In the pharmaceutical industry, technology is vital. As the expectations around quality and delivery continue to increase, organizations need to be equipped with the right technologies and systems. Technology helps ensure that pharmaceutical companies are meeting all regulatory requirements, as well as providing products and services that are reliable and of a high standard.

When it comes to technology for pharmaceutical companies, there are several areas that need to be addressed. The first is automation. Automation can help streamline processes, improve production, and reduce errors. It can also help with inventory management, ensuring that products are quickly and accurately tracked.

Another area of technology is security. Pharmaceutical companies need to ensure that their data is securely stored and kept confidential. They must also have systems in place to detect any unauthorized access attempts. Companies should also investigate cyber insurance policies to provide additional protection.

Finally, pharmaceutical companies need to invest in customer interaction technologies. Having an online presence is essential to developing relationships with customers. This might include a website, social media pages, or even an app. All of these tools can help reach customers and build trust in the company.

By investing in the right technology, pharmaceutical companies can become more efficient and offer better customer service. Technology can also provide a competitive advantage over other companies in the market.

Operations for a Pharmaceutical Company

Operational processes are the backbone of any business, and this is especially true for a pharmaceutical company. Without efficient and effective operational processes in place, a company may struggle to survive. This section looks at what operational processes need to be considered when starting a pharmaceutical company.

The most basic operational processes involve setting up protocols for ordering and receiving inventory, controlling inventory, producing products, dealing with customer service issues, and managing finances. These processes must be able to respond to changing needs and be able to support long-term growth. An effective operational process also allows the company to remain competitive and profitable.

An important part of any operational process is quality assurance. Quality assurance involves procedures that are designed to ensure the safety and effectiveness of products. A company should have qualified personnel to inspect, test, and verify the quality of every product that is produced or sold. Quality assurance is absolutely essential for a successful pharmaceutical company.

Another key operational process for a pharmaceutical company is regulatory compliance. Regulations provide customers and other stakeholders with assurance that a company is adhering to accepted standards of practice and is providing safe products. In order to remain compliant, a company must always keep up with changes in regulations and make sure that their processes adhere to those regulations.

Having an effective and efficient operational process in place is essential for any business, especially a pharmaceutical company. With the right processes in place, a pharmaceutical company can remain competitive and profitable in the long run.

Prospecting Strategies for a Pharmaceutical Company

Marketing and promoting a pharmaceutical company can be quite complex due to the high level of regulations in the industry. Therefore, it is important to find marketing strategies that fit within the legal framework while still providing the visibility required to reach customers. Prospecting strategies for a pharmaceutical company can include techniques such as online advertising, networking, print advertising, direct mail and attending conferences.

For companies just starting out, online advertising is often an ideal option. There are several platforms available, including the increasingly popular social media marketing. This strategy allows companies to gain visibility without spending large amounts of money on advertising and can be tailored to reach a specific audience. It is also a good way to monitor website traffic and gauge customer interest in the products.

Networking is another powerful tool for a pharmaceutical company. Creating partnerships with other companies, medical professionals and research organizations can be beneficial in a number of ways. These partnerships can lead to new contacts, exchanging of knowledge and shared resources. It is also a great way to promote the brand and differentiate it from competitors.

Print advertising and direct mail campaigns can be useful to reach potential customers, although they can be expensive. These methods have the advantage of being able to target a specific demographic and reach people who may not be active online. Attending conferences is also a great way to create visibility and network with relevant individuals or organizations.

Insurance and Security

Starting a pharmaceutical business means taking measures to protect the company and its operations, and this includes insurance and security. It is important to ensure that your business is protected from any unexpected events and that you are able to meet requirements for the industry.

When it comes to insurance, the types and amount of coverage you need depend on a number of factors including the size of the company, the specific products you are manufacturing, and the type of distribution network used. For example, if you are selling products in both domestic and international markets you may need to have additional coverage. Additionally, you may need to acquire product liability insurance, property insurance, and more.

In terms of security, you need to protect your business from any potential theft or vandalism. You may want to consider investing in a surveillance system that monitors the premises in case of break-ins. You should also ensure that any confidential information is stored securely and encrypted to prevent any data breaches. You can also consider using biometric technology to further secure the premises and store confidential information.

By putting the right insurance and security measures in place, you can ensure that your business is protected from any potential harm. A well-thought-out security plan will help you protect your business from unforeseen risks and allow you to focus on running the best possible pharmaceutical company.

Starting a pharmaceutical company can be a daunting task, but with the right research, understanding of regulations, business model, financing, inventory strategy, distribution network, use of technology, operational processes, and marketing tactics, there is no reason why it cannot be successful. The key to success in this endeavor is careful planning and dedication. By following the steps detailed in this guide, you should be well-prepared to begin your journey to starting a successful pharmaceutical company.

Before jumping into anything too quickly, it is important to do your research and be sure that you understand all of the nuances and complexities involved. Companies operating in the pharmaceutical industry are heavily regulated, so it is critical to be aware of and comply with all laws and regulations. Additionally, establishing a strong business model and sound financials is of utmost importance when launching a new venture.

Having the right technology in place is essential to running a successful pharmaceutical business. By incorporating technologies such as artificial intelligence, robotics, and machine learning into operations, companies can become more efficient, reduce costs, and improve customer service. It is also important to remember that building a reliable distribution network and marketing strategy are integral parts of the success of any pharmaceutical business.

To ensure a safe and secure environment for your business, make sure to purchase the necessary insurance and adhere to appropriate security protocols. Finally, don’t forget to regularly monitor the progress of your business and adjust as necessary.

By following the steps outlined in this guide, you should have the knowledge and tools needed to create a successful pharmaceutical company.

Good luck and enjoy the journey!

FAQs about Starting a Pharmaceutical Company

1. what are the benefits of starting a pharmaceutical company.

Starting a pharmaceutical company can provide an opportunity to make a meaningful impact on healthcare and research, by providing innovative treatments and medications for medical conditions. It comes with many advantages such as revenue potential, global reach, and advancing the knowledge and effectiveness of medicines.

2. What research needs to be done when starting a pharmaceutical company?

When launching a pharmaceutical business, research should be conducted to gain a relevant and detailed understanding of the industry. This may include studying the science behind drugs, reviewing the market trends, analyzing competitors, and researching the regulations within the chosen countries or regions.

3. How do regulations affect a pharmaceutical business?

Regulations are an important consideration when setting up a pharmaceutical company – due to the safety and health effects of the products the company manufactures. Depending on the location and type of product, additional tests or licenses may be necessary to meet various regulatory requirements.

4. What types of business models are suitable for a pharmaceutical company?

There are several different business models that a pharmaceutical company may decide to pursue, including wholesalers, generic drug manufacturers, independent virtual companies, and branded drug companies. The choice of which model to pursue depends on the company’s goals, mission, and resources.

5. What does it take to finance a pharmaceutical company?

Starting a pharmaceutical business requires substantial capital investments for activities such as product development, approvals, production, marketing, and hiring employees. Depending on the size of the business, financing may be sourced from personal funds, venture capital investors, loans, or crowdfunding.

6. What inventory strategies should be considered for a pharmaceutical company?

The inventory management strategies for a pharmaceutical business should prioritize safety and efficiency. Companies should ensure they have the right medicines to meet customers’ needs, while avoiding overstocking and expiry. It’s also important to have a reliable and secure supply chain in place to reduce stockouts and waste.

7. What strategies are available to promote a pharmaceutical company?

Promoting a pharmaceutical business requires finding the right channels to reach the target customer base. Strategies may include in-person marketing, digital approaches such as website SEO, social media, email campaigns, and referral programs. Advertising and public relations may also be used to raise brand awareness.

Great, Thank you!

How to Start a Pharma Company in 10 Easy Steps

David Blok | Posted on September 19, 2023 | Updated on March 26, 2024

Introduction

Step 1: market research and pharmaceutical business ideas.

- Step 2: Creating a Business Plan

Step 3: Regulatory Compliance and Legalities

- Step 4: Team Building and Talent Acquisition

- Step 5: Location and Infrastructure

Step 6: Product Development

Step 7: clinical trials and approval process.

- Step 8: Manufacturing and Supply Chain Management

Step 9: Marketing and Sales

- Step 10: Scaling Your Business

- Frequently Asked Questions (FAQs)

Let’s face it: if you are reading this, you are one of two people: the entrepreneurial mind that dreams of building a business in an impactful industry, or you’re passionate about science and research and want to contribute to the better health of humanity.

Whether you envision yourself as a Pharma tycoon or simply long to casually drop ‘I make drugs for a living’ at dinner parties, the time has come for you to admit it – you want to build a Pharma company.

Why is a Pharmaceutical company a good investment?

Starting any company takes time, energy and money, but a Pharma business has even more to consider: it requires a combination of scientific expertise, business acumen, and regulatory knowledge. Whether you’re considering how to start a pharmaceutical business or exploring pharmaceutical business ideas you’re not just selling any products here, you’re impacting the health of people. I know what you are thinking: if it’s so difficult, why do people keep investing in Pharma?

Pharmaceutical manufacturing companies can be extremely profitable:

- These companies show resilience during market downturns, rising in R&D investments to stay competitive & flexible (Grand View Research Report, 2023).

- The industry has experienced significant growth during the past two decades, with Pharma revenues worldwide totaling 1.48 trillion dollars in 2022 (statista, 2024). Still don’t believe it? Check out this blog and discover India’s top Pharma Companies to find out h ow profitable pharma companies are in India.

Being such a lucrative market, it’s a natural good investment, especially if you have a good idea – which I’ll get to in the next chapter.

This brings us to our topic at hand, welcome to your comprehensive guide on how to make your venture a reality. In the upcoming sections, we’ll delve into the why’s and how’s of building a successful Pharma empire. Get ready for insights, anecdotes, and much more.

Let’s dive in!

The first step is always the hardest because there is nothing before it. On the flip side it’s a great opportunity to set the direction of your company. Your business is a blank canvas at this point, and you get to bring your vision to life, so the best way to set the wheel in motion is by understanding everything about the industry gap you are trying to fill, in practical terms, whether your idea is viable or not.

Before you dismiss market research as a formality, ask yourself: “Is there a chance my solution is old news compared to what’s already out there?”.

Unless you have the cure for cancer in your pocket, someone’s advancements in your field are worth taking a look at. At this stage, you should focus on two things:

- Understanding market trends and directions.

- Realizing if your big idea is profitable.

Market research will identify unmet needs within the healthcare system, such as patient preferences. By looking at emerging technologies, you can direct your research and development strategy.

Your company’s direction is in your hands at this point, and isn’t that exciting?

Where to start your research?

Start looking at insightful industry reports, academic journals, and the latest industry news, but remember to use credible and reputable sources.

The most important thing is to stay updated, especially on everything that concerns your big idea; market research will back it up. Staying on top of trends also ensures your product is aligned with market demand, and that you have a competitive edge, also called your unique selling proposition.

Step 2: Business Plan and Funding your Pharmaceutical Company

Once you’ve settled on an idea, it’s time to start shaping it into an actual enterprise. Welcome to a pivotal chapter: creating the blueprint of your operations, aka your business plan. Don’t have the faintest idea of what a business plan consists of? Pharmaoffer has got you covered.

Fundamentals of a bulletproof Business Plan:

- A market analysis – which you already did in Step 1.

- Outline of management and the company organization.

- All your products/services – which you probably already know.

- Customer segmentation.

- Marketing plan.

Pitch Perfect

Why is a detailed business plan crucial, you may ask? This plan isn’t just a formality; it’s your golden ticket. This single document is meant to convince stakeholders and investors that you’re not a risk; you’re a calculated and promising investment, which will increase trust and the chances of getting the funds you need.

So don’t be scared to dive deep into the big questions like who will benefit from your pharmaceutical innovations, and what makes it profitable. Paint the financial portrait of your venture with clarity—how will the funds be utilized, and what’s the return on investment? Venture capitalists, government grant applications, and loans are great routes to explore. Your business plan will prepare you to pitch your idea to the right people.

Okay, this is where it gets tricky, but it’s why pharmaceutical business entrepreneurship isn’t for everybody. You are too far along in this journey to stop now, so it’s better to keep going.

Regulating to triumph

We know that acronyms like FDA, GMP, and CEP may be scary, but like we said from the start of this journey: when it comes to the health of the population, you can’t risk it. Regulations ensure your company is ethical and safe. Dismissing them puts your entire operation at risk of getting a bad reputation, not to mention facing penalties later on. Oh, and besides, no funding without compliance is just not going to happen!

What is your business structure?

Now, let’s talk about how to set up and open a Pharma business. Should you go for an LLC (more partnership-oriented) or a corporation, and why does it matter?

The selection of a business structure is a crucial decision for a company because it impacts various aspects, including:

- Legal responsibilities.

- Liability protection.

- Ability to raise capital – we know this sounds like a broken record on this one, but money it doesn’t grow on trees, right?

Remember, it’s not just about paperwork; your business structure shapes the core of your company. Speaking of structure and shape, it’s time to shape your physical company.

Step 4: Building your A-team

You’re the mastermind behind this venture, but you don’t have to do everything yourself. Like a formula, it takes plenty of ingredients to make one solution. In this section, you’ll select the best people to represent and help grow your business.

The trick to knowing whom to hire is simple: point out the necessary fields for your business to run that you need to hire for, and find people who can excel at them. Think R&D, supply chain management, sales, and, of course, medical professionals. ´

Extra tip: remember that sometimes you don’t want to hire the best technical person, but someone who can complement your team’s attributes, like, for example, someone with a proven track record of adaptability and communication.

Step 5: Location, Location, Location

The perfect location is a no-brainer: it is the one closest to your potential partners. Places like research centers for experiments, hospitals for data, or universities for talent scouting are where you wanna be. Just think of how your idea can improve with these extra resources.

A place to call…office

Ideally, if you picture a creative and productive atmosphere, it won’t be a cramped space, poorly lit with bad chairs, that won’t cut it. Your facilities are the day-to-day of your operation, where some say, the real magic happens, so make sure your spaces are up-to code and optimized for the tasks at hand. Remember, a positive environment boosts morale and increases efficiency.

Admit it, you’ve been thinking of this since the very beginning of this adventure. After all, this is what you came here for. Whether it’s a new drug or medical device, the development phase is the fun, and most important part. Let your R&D work shine to bring your vision to life.

Trials and tribulations

Having a finished product means one thing, and one thing only in the Pharma world: clinical trials. Clinical trials aim to provide a scientific basis for advising and treating patients.

But don’t be discouraged if it doesn’t work out. Even when researchers don’t obtain the outcomes they predicted, the trials results can help point scientists in the correct direction of their research. Trials present their challenges, but as cliché as it is, every challenge is an opportunity in disguise and a testament to your team’s innovation capacities.

Think you heard enough about clinical trials? These are the final stages before your product enters the market, and needless to say, it won’t enter without the green light. How do you make sure it’s approved then?

- Rigorous protocol adherence.

- Collaboration with regulatory bodies.

- Scientifically proven efficacy and safety.

- Real-world testing for validation.

Extra tip: real-world testing is a good option to further validate and solidify product claims that may give you an interesting competitive edge.

Passing this frantic stage is a monumental milestone, and it’s one foot in the door of your Pharmaceutical business success. If you are in this stage, or just looking to dive deeper into the complexities of API’s clinical trials, check out our blog, API Clinical Trials: From Preclinical Trials to Post-Marketing Surveillance.

Step 8: Pharmaceutical Manufacturing and Supply Chain Management

Quality control isn’t just between your lab and office walls most of the time unless you manufacture everything in-house, but is that cost-effective?

We are not going to go into this question but leave it for a promising blog about the pros and cons of API in-house manufacturing or out-sourcing. This time we’re going to talk about the Pharmaceutical company’s supply chain.

As you need to make sure every substance you use is under the same quality control as your business, how can you be positive you are purchasing APIs from a qualified supplier?

We’re not gonna lie, unfortunately this step can be a dead end as many API manufactures aren’t registered in a public contact base.

You really need to know the business and ask around, a total nightmare. This is our mission statement: at Pharmaoffer we want to match the best certified API manufacturers with businesses like yours, so to provide resources for both and enrich Pharmaceutical business supply chain with qualified options.

Your supply ally

When choosing the right suppliers, the biggest worry is compliance standards, so make sure your supplier:

- Meets all compliance standards.

- Is up to speed with industry best practices.

- Has the means to make deliveries on schedule.

You have a finished product, your team is working and the place up and running, so it’s time to find some clients. We do this with a marketing and sales strategy.

What do people think of when they hear your company’s name? Do you have a logo? These are some of the questions you need to clear with the proper professionals.

Branding is understandably the last thing on your mind, but don’t make the mistake to overlook it indefinitely. Nowadays, if your business doesn’t look good it won’t be credible. Branding is how you present your company to the world. It’s your mission statement, your corporate culture, and your values. It will help you find your market and secure a strong position in it.

Getting the word out

Marketing is about business survival, there is no denying it. In this increasingly visual world it’s not enough to have a great product, you need to present it well to elevate it. The way you do so is with marketing tools.

Now don’t fall into cheap marketing tactics: in Pharma you can’t make any false claims, exaggerate benefits, or show dubious testimonials. This will kill your entire operation. Marketing in the Pharma sector demands a careful balance of awareness-raising and ethical considerations. Credibility is central, so keep it real, and let your amazing product and integrity attract customers.

Because we understand how complex marketing strategies can be, at Pharmaoffer we wrote you a startup guide to navigate online marketing in the pharmaceutical sector called Online marketing in pharma; where to start? Feel free to take a look.

Step 10: Scaling Your Pharmaceutical Business

You finally have a Pharma company, congratulations and we take no credit for it. Now that you have a growing business, the question is: How big do you wanna get? We’ve seen how much does it cost to start a pharmaceutical company and remember that scaling and it isn’t just about growth, it’s about smart growth. Scaling is about expanding your operation, and it should be a calculated decision.

To make the right move you need to be on top of market demand, KPIs tracking, and consult your team to know when it’s the right time to do it.Bigger the business, bigger the challenge.

Bigger the business, bigger the challenge

A bigger business is a complex one. From staffing to resource allocation, be prepared to adapt your business strategies as you expand.

Extra tip: keep your staff informed and let them be a part of the change. It will make them more involved in your business success.

You made it to the end yay!

We saw how to start a Pharmaceutical company investment which is no small endeavor, but it’s a rewarding one for sure! You are building something of your own, following your heart and creative dreams and the best of all, you’re saving lives while you do it, how great is that?

Okay, it’s time to get to work, so roll up those sleeves, and get started if you haven’t already. We have no doubts that if you pay attention to these 10 steps, you have what it takes to build your successful Pharmaceutical company.

Needing further assistance to find the right API suppliers for your business? Fill in the form to contact Pharmao ff er and schedule a free meeting to take your business to the next level.

Is it hard to start a pharmaceutical company?

Yes, but it's also rewarding. Be prepared for regulatory hurdles and significant initial investment.

How long does it take to launch pharma company?

On average, it could take 1–3 years, depending on the business model, licensing, and other factors.

Can I start a pharma company without a medical background?

Yes, although you'll need a team of experts in medical and scientific fields. Your role may be more focused on business strategy and growth.

What are the biggest challenges in starting a pharma company?

Regulatory compliance, securing funding, and market competition are some of the biggest hurdles you'll face.

- APIs & Manufacturing (15)

- Education & Career (8)

- Events & Exhibitions (3)

- Industry Insights & Trends (11)

- Interviews & Case Studies (9)

- Market Analysis & Data (14)

- Medicines & Access (17)

- Regulations & Standards (19)

- Sales & Marketing (15)

Latest posts

What is hyaluronic acid, shilpa medicare’s interview, choosing your pharmaceutical path: production, analytical testing, or formulation, from vision to reality: the developers behind pharmaoffer’s platform, chinese drug master file (cdmf), recommended blogs.

APIs & Manufacturing , Medicines & Access

Read time: 5 minutes

Understand how Hyaluronic Acid benefits pharma and cosmetics, its production, market trends, and regulatory requirements across major markets.

Education & Career , Interviews & Case Studies

Read time: 4 minutes

Discover how Shilpa Medicare has grown into a global pharmaceutical leader by focusing on innovation, sustainability, and social responsibility in the healthcare industry.

Education & Career

Thinking about a career in pharma but not sure where to start? Dive into this guide to explore different paths like production, testing, and formulation.

Read time: 3 minutes

Meet the brilliant minds behind Pharmaoffer’s platform. Discover how our developers turn big ideas into reality, driving innovation and efficiency in the pharma world.

Regulations & Standards

Read time: 6 minutes

Learn everything about Chinese Drug Master Files (cDMF) and how to navigate China’s pharmaceutical regulations. Learn key steps, benefits, and expert tips to ensure compliance and market entry success.

Top 10 Biggest CDMO Companies and Market Trends

Market Analysis & Data

Explore the Top 10 Pharmaceutical Companies in India for 2024. Uncover key insights into their financials, innovations, and global impact.

Pharmaoffer is a B2B platform where you can find all qualified API suppliers in one place

- Business Plans Handbook

- Business Plans - Volume 03

- Pharmaceutical Company Business Plan

Pharmaceutical Company

BUSINESS PLAN

PAIN AWAY LTD.

1117 High St. Poughkeepsie, NY 13495

The company described in this plan has moved beyond the initial start-up phase and is now seeking investors to finance its growth. Much of the plan, therefore, is geared toward persuading, explaining, and reassuring potential investors that the company (which produces a therapeutic, topical pain cream), is well-managed and stable. The in-depth analysis of the company's competitors is an outstanding feature of this plan, as is its market research.

EXECUTIVE SUMMARY/OVERVIEW

Competition.

- PROPERTY & FACILITIES

- PATENTS & TRADEMARKS

- RESEARCH & DEVELOPMENT

GOVERNMENT REGULATIONS

Insurance and taxes, corporate structure, risk factors.

- RETURN ON INVESTMENT AND EXIT

- ANALYSIS OF OPERATIONS & PROJECTIONS

FINANCIAL STATEMENTS

Type of business.

Non-prescription drug wholesalers; US SIC Code - 2834 Pharmaceutical Preparations.

Company Summary

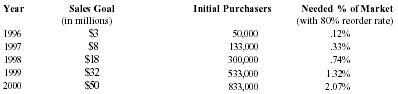

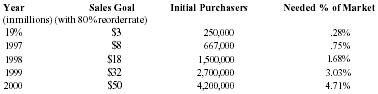

Pain Away Ltd. is a going concern, a Delaware corporation formed in January 1995 to manufacture and sell its premier launch product Pain Away, a topical pain remedy using FDA-approved homeopathic ingredients developed for the simple purpose of relieving pain. The company was formed by its parent S-corporation, Peale, Inc. in order to market products nationally and internationally. Peale, Inc. was formed in February 1994 to complete the development of the launch product. The formation of the company was a significant step in a 9-year process of refining and testing a homeopathic formula first used by company founder and CEO Robert Peale to alleviate his pain from carpal tunnel syndrome. The R&D phase of this product began when Mr. Peale purchased the original formula, did a thorough study of homeopathy, and refined the formula to its present marketable state. From the beginning of R&D, Mr. Peale worked within FDA guidelines in order to secure FDA registration. Then, in February 1994, the company was formed to finally manufacture and sell the product. Starting with only a handful of customers, including some professionals, chiropractors, physical therapists, etc., only 19 months of operation have yielded 12,000 individual customers with an 80% reorder rate. The current customer base now includes medical doctors from different specialties, sports trainers, and athletes, both professional and amateur. The company expects to show a profit in 1996 and estimates that it will be very profitable in 3 years.

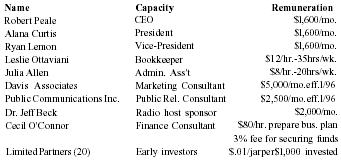

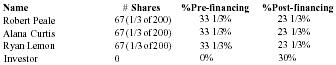

Mr. Peale is 49 years old and has a 25-year history in sales, sales management, and marketing for a tool distribution company. His deep study of homeopathic medicines started in 1985 and included studies in nutritional supplements. Mr. Peale has been invited to sit on a newly-formed FDA committee addressing the growing national interest in natural medicines.

Curtis Company president, Ms. Alana has 25 years of experience in retail and direct sales. She has been a senior sales director and sales trainer for Beautiful You Cosmetics, has owned and operated a retail sporting goods store, and has managed a 15 person, $1 million department for a major chain retailer. She also has some banking experience.

Vice-president of marketing, Ryan Lemon has 32 years of experience as production manager, buyer, sales manager, and marketing manager. He was director of marketing for Pilgrim Health and was responsible for their first launch into New Jersey which led to their first $18MM in sales (in 3 years). He has a BS degree in textile engineering and has also done independent marketing consulting.

Product and Competition

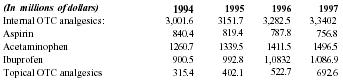

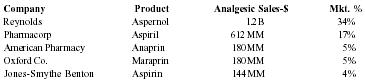

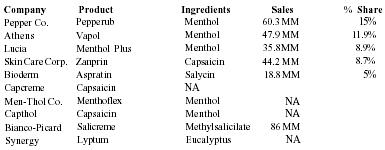

The R&D mission was to develop a greaseless, odorless, topical cream which was measurably more effective at relieving pain than any other OTC (over the counter) topical product. This mission has been accomplished. The company has collected anecdotal, testimonial, and uncontrolled medical study evidence that Pain Away is more effective than the leading topical analgesics such as Arthritin and others. The product's effectiveness in relieving pain is its most powerful benefit, besides the added benefits of it being greaseless and odorless. What distinguishes Pain Away from any other topical analgesic in this still-growing $402.1MM market is its advanced homeopathic formula - a refined blend of 11 FDA approved pure and natural ingredients. The typical OTC topical analgesic works to either block the sensation of pain or distract perception of deep pain by "counterirritating" another localized area near the pain. Pain Away's formula is different. Pain Away treats pain at its source. It stimulates improved circulation in the micro-capillary system in the ligaments and tendons, where most pain is felt. Pain-relief from Pain Away is the result of the body's own self-healing. It also can be applied several times a day because it is odorless and greaseless. The US pain management market ($15.2 billion by 1997) is a mature market with intense, established competition ("The Market for Pain Management Products in the US - Introduction, Drugs, Devices, Trends, and Market Structure," in FIND-SVP). With future pharmaceutical market growth dependent upon new and innovative product additions, Pain Away is entering the field at the right time. The company will distinguish itself and its market position by dedication to the development of only natural-ingredient products. Since its unique formula of ingredients already has FDA approval, the company aims to penetrate the OTC pharmaceutical market, where new products traditionally find success. Here Pain Away will compete with topical as well as internal analgesics, including aspirin, acetaminophin and ibuprofen. An estimated 4,000 people a year die from aspirin overdose. A condition known as "analgesic neuropathy" can result from extended or inappropriate use of analgesics. Medical studies linking heavy usage to health problems have affected aspirin, acetaminophin, and ibuprofen. Pain Away can be marketed as a substitute for (reducing overdose risk with internal analgesics), or as a supplement to (using Pain Away can reduce needed dosage of internal analgesics) internal analgesics when used for certain pain relief. Furthermore, Pain Away is not contraindicated for use with any other medication. This broad-based appeal is built upon the reliability of Pain Away's effectiveness in relieving pain, inflammation, and spasm associated with arthritis, bursitis, sciatic spasm, neck/back pain, tendonitis, tennis elbow, tension headache, achilles tendonitis, and carpal tunnel syndrome.

A second product, a natural anti-inflammatory nutritional support system formula known as "Pain Away Plus," will soon be marketed as a companion product to Pain Away. This multistaged formula is a combination of trace minerals, herbs, and a natural cartilage-derived substance. The company has long-term plans to develop more health-related products.

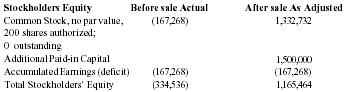

Funds Requested

Company principals have invested all available personal assets into the product development and operations to date. The need for capital is in the context of the readiness of the product for mass marketing. Management is seeking a $1,500,000 equity investment in exchange for a suggested 30% ownership of the company. All terms of financing are negotiable in order to meet the financial requirements of the investor.

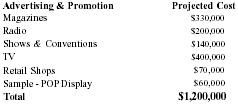

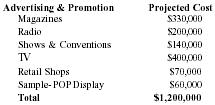

Use of Proceeds

Advertising & promotion campaign - $1,200,000 (see below); Market research - $300,000. The company anticipates the need for follow-on financing after 24 months of business.

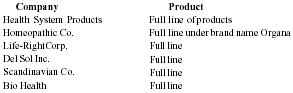

| Magazines | $330,000 |

| Radio | $200,000 |

| Shows & Conventions | $140,000 |

| TV | $400,000 |

| Retail Shops | $70,000 |

| Sample - POP Display | $60,000 |

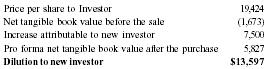

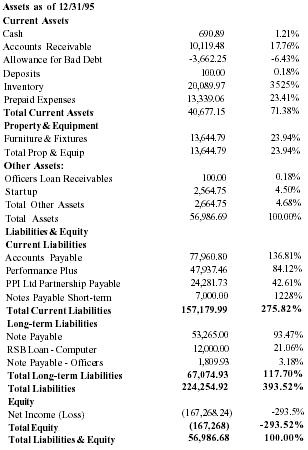

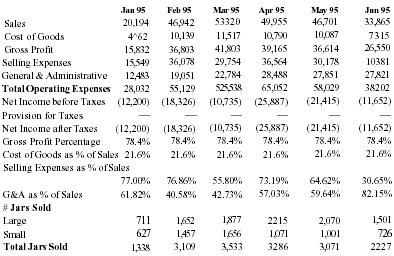

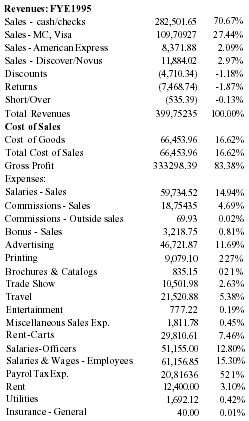

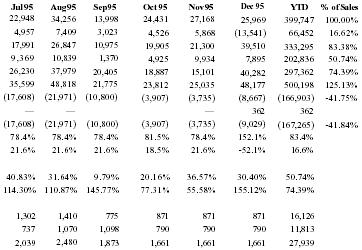

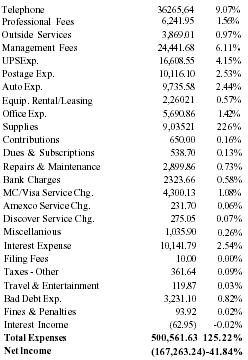

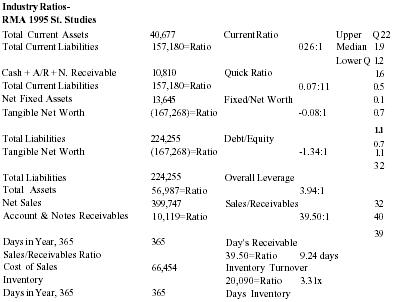

Financial History

| Sales | 543,633 |

| Net Income | (226,600) |

| Assets | 56,987 |

| Liabilities | 224,253 |

Sales were first made in 5/94 under Peale Inc. ($143,881). As sales expanded nationally, Pain Away Ltd was formed in January 1995. All sales since then have been under Pain Away Ltd.

Financial Projections

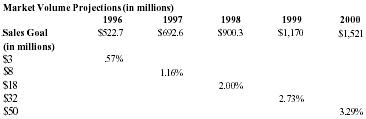

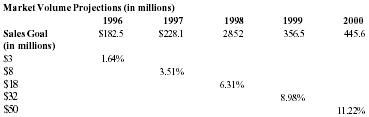

| Sales | 3,000,000 | 8,000,000 | 18,000,000 | 32,000,000 | 50,000,000 |

| Net Inc. | 360,000 | 2,160,000 | 4,860,000 | 8,640,000 | 13,500,000 |

With capital request accomodated, the company believes that Pain Away will jump in sales starting in 1996.

The company will attempt a public offering based on year 2000 earnings. If there is no public market and no prospect for a public market in the near future, then the company will offer to buy back the stock owned by the venture capitalist. A predetermined price could be set ahead of time, if desired by the venture capitalist.

The product effectiveness, evidenced largely through anecdotal evidence, personal testimonials, and repeat sales, has formed the basis for the future growth of the company. Together with a second, complementary product (nearly ready for market), the launch product will be aggressively mass marketed as a pain management system for the next five to ten years. Past and current sales have been to end-users, health professionals, and to some retail chains. The company and product are now poised for first stage expansion. Over 30 target wholesale markets have been identified. While the company uses its marketing strategy to enter these wholesale markets, simultaneous efforts will be made to develop research protocols. Management is confident that the anecdotal evidence and personal testimonials will be strengthened by controlled studies, designed to test the effectiveness of the product and demonstrate the physiological healing activity stimulated by the formula. With scientific credibility, the product will not only build its position in the $150 million homeopathic product category but will also strengthen its transition into the formidable mainstream topical analgesic category.

Future research is planned, based upon inquiry, in order to adapt the formula for animal use (Pain Away currently being tested on thoroughbred horses).

At the end of five years, the company intends to have at least one additional health product and should be able to go public off its revenues. The long-term goal for the company is to become an entrepreneurial leader in the development of natural products for various segments of the health care market. The company plans to capture enough share of the topical analgesic market to become either a viable joint venture partner or an acquisition candidate.