Home » Letters » Bank Letters » Request Letter for Bank Statement for Visa Purpose

Request Letter for Bank Statement for Visa Purpose

Table of Contents:

- Sample Letter

Live Editing Assistance

How to use live assistant, additional template options, download options, share via email, share via whatsapp, copy to clipboard, print letter, application for issuance of bank statement for visa purpose.

To, The Branch Manager, _____________ (Bank Name) _____________ (Branch Name)

Date: __/__/____ (Date)

Subject: Application for issuance of Bank Statement for visa purpose

Respected Sir / madam,

I, _____________ (Account Holder’s Name) having ________ (type of account) account in your _______ (Branch address/name) branch bearing account number _______. I am writing this letter to request you to kindly issue me Bank statement of my ________ (type of account) account from __/__/_____ to __/__/____ (date) or last ______ (no. of months) months for _________ (country for visa application is submitting) visa purpose.

Your earliest support will be highly appreciated.

Yours truly,

__________(Signature) _________ (Name) _________ (Customer ID) _________ (Account number) _________ (Contact Number)

Live Preview

The Live Assistant feature is represented by a real-time preview functionality. Here’s how to use it:

- Start Typing: Enter your letter content in the "Letter Input" textarea.

- Live Preview: As you type, the content of your letter will be displayed in the "Live Preview" section below the textarea. This feature converts newline characters in the textarea into <br> tags in HTML for better readability.

The letter writing editor allows you to start with predefined templates for drafting your letters:

- Choose a Template: Click one of the template buttons ("Start with Sample Template 1", "Start with Sample Template 2", or "Start with Sample Template 3").

- Auto-Fill Textarea: The chosen template's content will automatically fill the textarea, which you can then modify or use as is.

Click the "Download Letter" button after composing your letter. This triggers a download of a file containing the content of your letter.

Click the "Share via Email" button after composing your letter. Your default email client will open a new message window with the subject "Sharing My Draft Letter" and the content of your letter in the body.

Click the "Share via WhatsApp" button after you've composed your letter. Your default browser will open a new tab prompting you to send the letter as a message to a contact on WhatsApp.

If you want to copy the text of your letter to the clipboard:

- Copy to Clipboard: Click the "Copy to Clipboard" button after composing your letter.

- Paste Anywhere: You can then paste the copied text anywhere you need, such as into another application or document.

For printing the letter directly from the browser:

- Print Letter: Click the "Print Letter" button after composing your letter.

- Print Preview: A new browser window will open showing your letter formatted for printing.

- Print: Use the print dialog in the browser to complete printing.

- Yes, you can specify the period for which you need the bank statement in your request letter for visa purposes.

- Yes, it's essential to mention the country for which you are applying for a visa to ensure the bank provides the appropriate statement format.

- You can typically request a bank statement covering the last few months or specify a particular duration depending on the visa requirements.

- Yes, it's advisable to include your contact details in the letter to facilitate communication with the bank regarding your request.

- Yes, you can authorize the bank to deduct any applicable charges for issuing the bank statement from your account.

Incoming Search Terms:

- request letter for bank statement for visa template

- how to get bank statement for visa application format

By lettersdadmin

Related post, request letter to bank for issuing cheque return memo – sample letter requesting for cheque bounce memo, request letter for issuance of account activity report – sample letter requesting for detailed account activity report, request letter to bank for changing communication mode – sample letter requesting for changing mode of communication (sms/email), leave a reply cancel reply.

You must be logged in to post a comment.

Request Letter to Principal for Organizing Science Fair – Sample Letter Requesting for Organization of Science Fair

Request letter for participation in cultural event – sample letter requesting for participation in cultural event, request letter for changing optional subject – sample letter to school principal requesting for change of optional subject, request letter for permission to start a new club – sample letter requesting to start a new club in school, privacy overview.

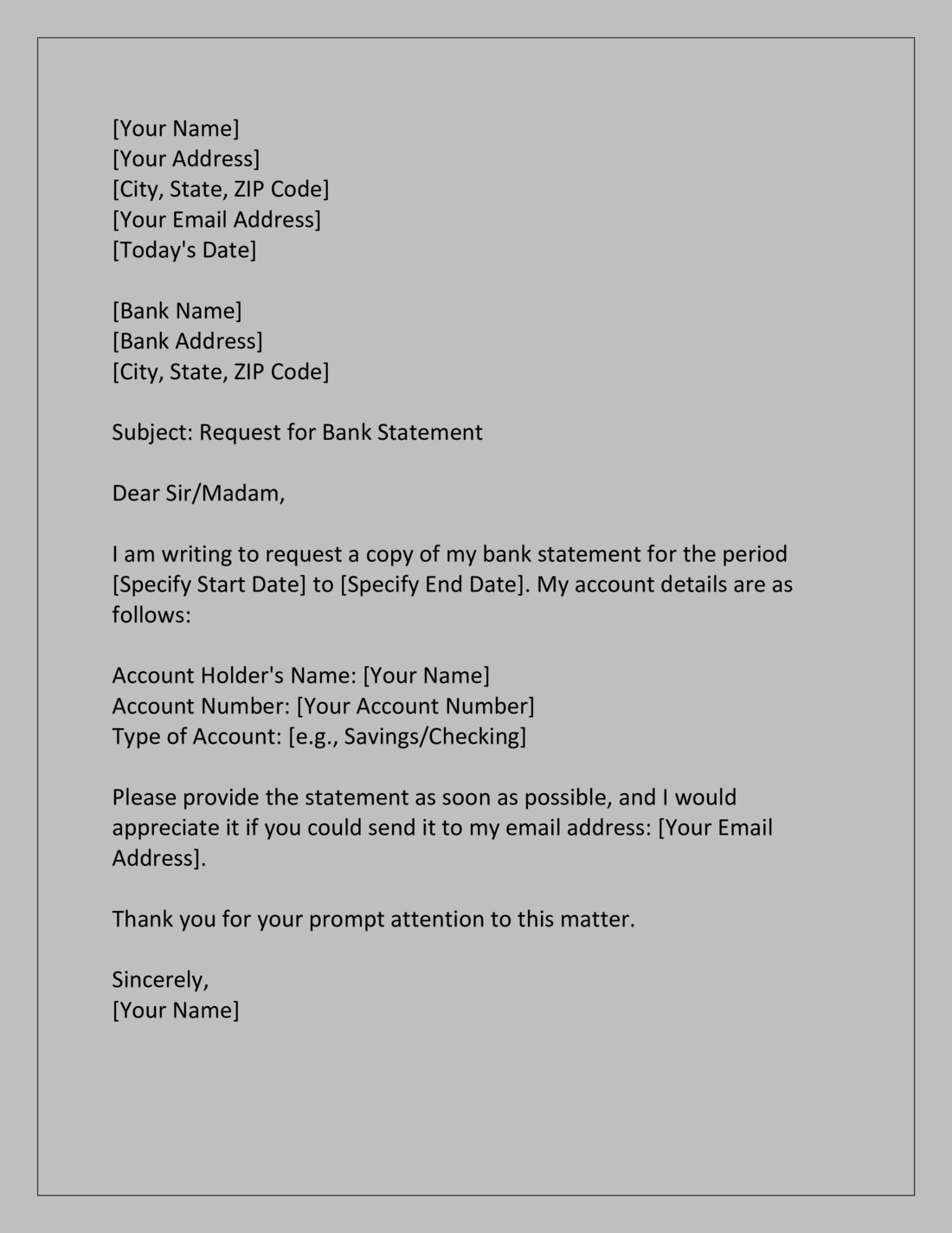

Application to Request Bank Statement (with Samples & PDFs)

I have listed sample templates to help you craft an effective and professional application to request bank statement.

Also, I would like to point out that you can also download a PDF containing all the samples at the end of this post.

Application for Requesting Bank Statement

First, find the sample template for application to request bank statement below.

Subject: Application to Request Bank Statement

Respected Sir/Madam,

I, [Your Name], am writing this letter to formally request a bank statement for my account. I am a loyal customer of your bank and have a savings/current account here. My account number is [Your Account Number].

I require the bank statement from [Start Date] to [End Date] for my personal record keeping and financial management. I would appreciate if you could issue the bank statement at the earliest possible convenience.

Also, I kindly request you to send the statement to my registered email address, which is [Your Email Address]. If that is not possible, I will be happy to collect the statement personally from the branch.

I understand that there might be charges associated with this service and I am willing to pay the necessary fees. I would be grateful if you could let me know the procedure and how to proceed further.

Thank you for your attention to this matter. I look forward to your prompt response.

Yours sincerely, [Your Full Name] [Your Contact Number] [Your Email Address] [Today’s Date]

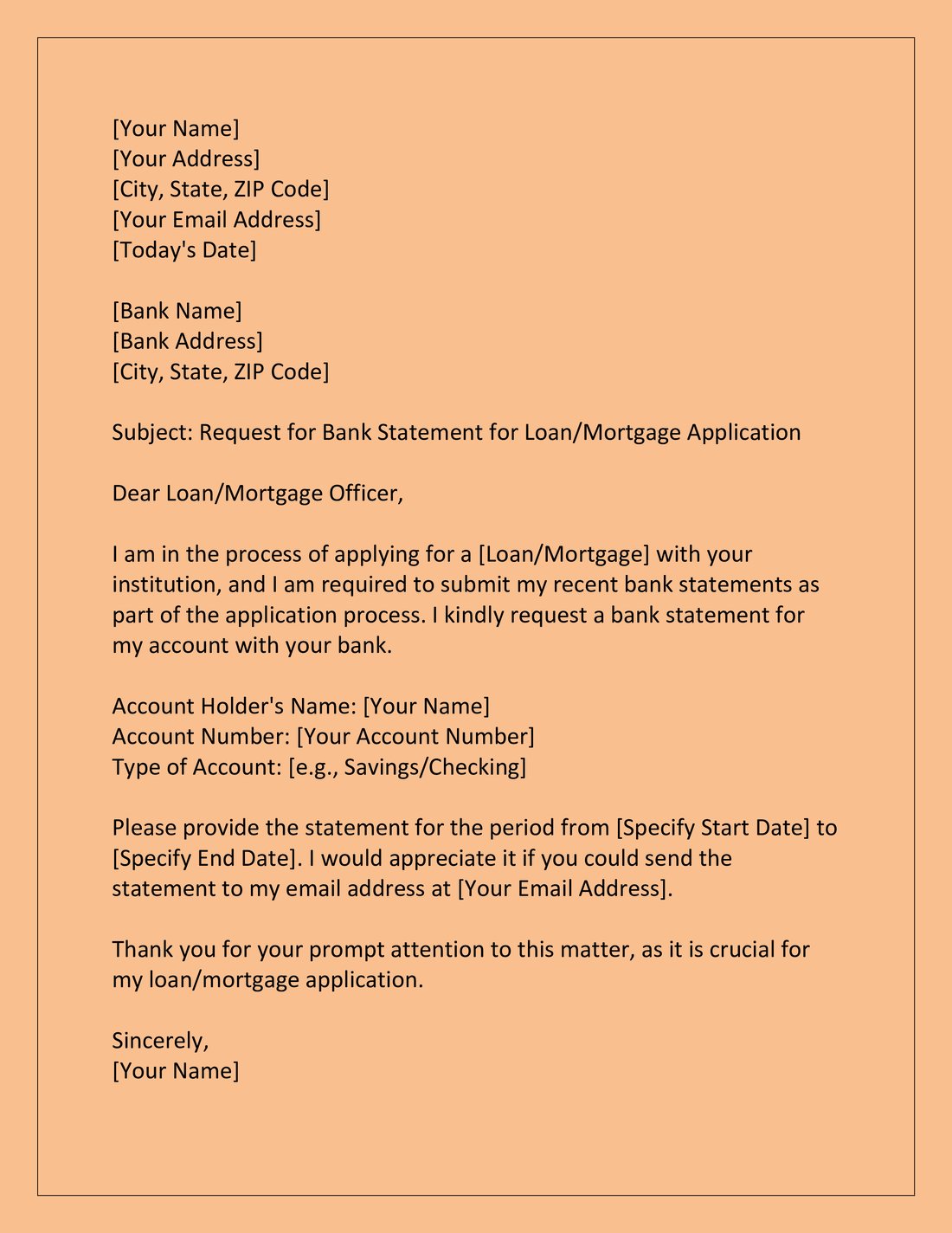

Application to Access Bank Statement for Home Loan Verification

To, The Branch Manager, [Bank Name], [Branch Name], [Branch Address],

I, [Your Name], holding a savings account with your esteemed bank, account number [your account number], would like to request access to my bank statement for the last six months. I need this statement for the verification of a home loan application that I have initiated with [Home Loan Provider’s Name].

As per the requirement of the loan provider, I need to submit my bank statement reflecting my financial transactions to assess my eligibility and repayment capacity for the home loan.

I would be grateful for your prompt assistance in this matter.

Thanking you,

[Your Name] [Your Address] [Your Mobile Number] [Your Email ID] [Date]

Application for Bank Statement SBI for Account Reconciliation

Subject: Application for Bank Statement for Account Reconciliation

My registered email address linked with the account is [Your Email Address], and the registered mobile number is [Your Mobile Number]. Kindly send the bank statement to my registered email address in PDF format. Alternatively, you can also send the statement through postal mail to my mailing address registered with the bank.

Thanking you in anticipation.

Yours faithfully, [Your Name] [Your Account Number] [Your Email Address] [Your Phone Number] [Date]

Application for 6 Month Bank Statement to Review Financial Health

Subject: Application for 6 Month Bank Statement to Review Financial Health

I would be grateful if you could provide the bank statement at the earliest. If possible, kindly send the statement to my registered email address [Your Email Address] or let me know when I can collect it from the branch personally.

Yours faithfully,

[Your Name] [Your Contact Number] [Your Email Address] [Your Address]

Application for Bank Statement of Current Account for Business Audit

Subject: Application for Bank Statement of Current Account for Business Audit

I am writing to request a bank statement of our current account (Account Number: [Account No.]) for the period of [starting date] to [ending date] as required for the purpose of a business audit that our company is undergoing. Our company, [Company Name], holds the aforementioned account in your esteemed bank.

The said statement is crucial for us to comply with the auditing requirements, and we need it at the earliest to facilitate a smooth audit process. Kindly arrange to provide the bank statement either through postal mail to our registered address or via email at [your email address].

We appreciate your prompt attention to this matter and look forward to your cooperation in providing the requested bank statement as soon as possible.

[Your Name] [Designation] [Company Name] [Company Address] [Phone Number] [Email Address]

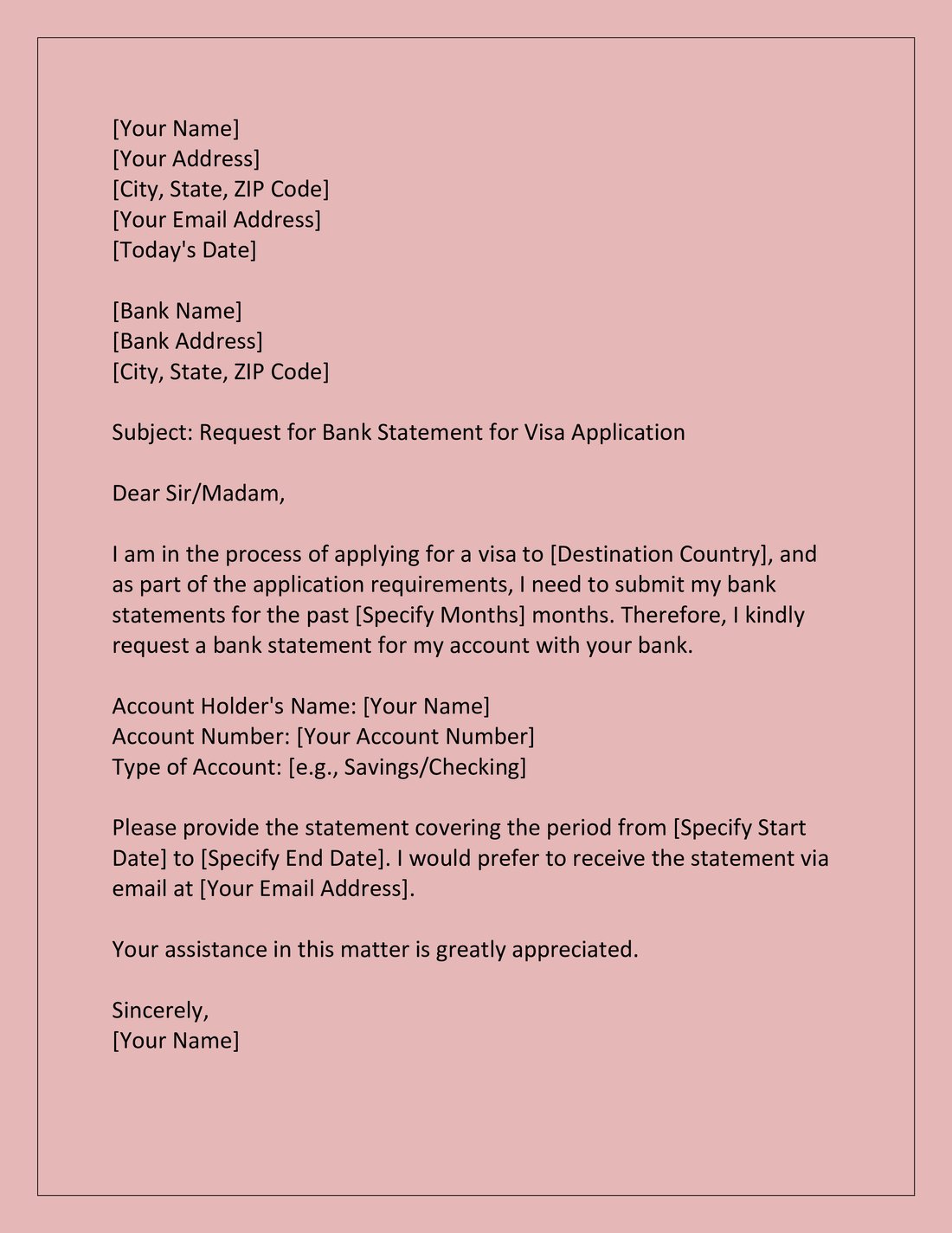

Bank Statement for Visa Application to Prove Financial Capability

To, The Branch Manager, [Bank Name], [Bank Branch], [Address]

Subject: Request for Bank Statement for Visa Application to Prove Financial Capability

I, [Your Name], holding a Savings Account (A/C No: XXXXXXXX) at your esteemed branch since [Date of Account Opening], would like to request a bank statement for my account for the past 6 months, starting from [Starting Date] to [Ending Date].

Thank you for your attention to my request. I look forward to receiving the bank statement soon.

How to Write Application to Request Bank Statement

Some writing tips to help you craft a better application:

View all topics →

And if you have any related queries, kindly feel free to let me know in the comments below.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

In this article

Bank Account Verification Letter for Sponsoring US Visa

Complete guide to providing a bank account verification letter to sponsor a US visa application

If you are sponsoring someone’s US visa application , you must send the applicant several documents, including a Bank Account Verification Letter.

The Bank Account Verification Letter for sponsoring a US visa serves to prove to the Embassy or Consular services that you are capable of supporting your guest financially during their time in the US.

Your bank has to issue your letter (it usually involves a fee) and you have to send it to the applicant abroad in advance of their visa application.

Bank Account Verification Letter for US Visa Sample

Here is a sample of how a Bank Account Verification Letter for US visa applications looks like. Normally, depending on the bank, there could be slight differences in form, but the main information should be included:

What Should Be Included in a Bank Account Verification Letter for Sponsoring a US Visa?

A Bank Account Verification Letter for sponsoring a US Visa should include the following:

- Your full name

- The full name(s) of the person/people you are sponsoring

- Your bank account number

- The date when you opened your bank account

- The type of bank account you have

- Your current balance

- Your average balance (usually taken from the last three, six, or twelve months)

How to Get a Bank Account Verification Letter for US Visa?

In order to receive a Bank Account Verification Letter for US Visa application, you have to contact your bank’s customer services. Explain what you need, and they will direct you to the competent authorities.

You can go to the bank in person, write an email, or write to them via their customer service chat centre on their website if one is available.

Things to remember:

- You will likely have to pay a fee for the letter (usually $10-$20)

- Some banks can issue the account verification letter through fax or mail if you are unable to request or receive it in person

- It will take at least one working day to issue the verification letter, so be prepared to return to the bank if you go there in person

- If you are receiving the letter by mail, factor in the time it will take to be delivered to you

- Make sure you have enough funds in your account to be considered eligible to sponsor your relative/friend

Who Has to Write the Bank Account Verification Letter?

It is your bank that writes the letter on your behalf. The letter has to be written on the bank’s letterhead, hold the bank stamp, as well as the signature from a bank officer or authority.

You don’t have to write the letter yourself since the bank should already have a procedure in place for this type of thing.

However, if your bank does not have a procedure already in place for a Bank Account Verification Letter for sponsoring a US visa, they may ask you to provide a sample letter or example.

Who Do I Send the Bank Account Verification Letter To?

You have to send the letter to the person who you are sponsoring, not the US Embassy, Consulate or Visa Application Center. Then, the applicant will submit the letter him/herself along with all the other US visa required documents .

What If My Bank Does Not Issue a Bank Account Verification Letter to Sponsor US Visa?

If your bank does not issue Bank Account Verification Letters, then it may be enough for you to submit your bank statements. However, talk to the bank’s customer care services, either way, to see whether they will issue such a letter.

If it is not at all possible for them to issue a verification letter, then the US visa applicant abroad can inquire with the US Embassy or Visa Application Center whether your bank statements are enough. They can also write a letter explaining why the document is missing.

What Else Do I Need For Sponsoring US Visa?

Along with the Bank Account Verification Letter, when you sponsor someone’s US visa application, you have to include the following documents as well:

- An invitation letter. You have to confirm that you are willing to host your relative or friend in the US, and that you have enough financial means to support them as well as room to host them for the entire period of their stay in the US.

- Letter for Affidavit. If you will help with the financial support of your guest, you must include proof of sufficient financial means to do so. This can be done by submitting your bank statements, which clearly state your funds.

- Letter of employment. You should also include a letter of employment, which proves you have a job as well as your salary

- Payslips. Include three to four of your most recent payslips

Talk to our experts

1800-120-456-456

- Application for Bank Statement - Format and Sample Letter

How to Write Application for Bank Statement?

When you need to obtain a bank statement for personal or official use, writing a formal application is essential. A bank statement is a document that outlines your financial transactions over a specific period. This document can be crucial for various purposes, including applying for loans, verifying income, or managing personal finances.

To request a bank statement, you should write a clear and concise application letter. This letter should include your account details, the period for which you need the statement and your contact information. In this article, we'll explore a straightforward format and provide a sample letter to help you draft an effective request. By following these simple steps, you can ensure your application is processed smoothly and promptly.

Did you Know? |

Who Can Open a Bank Account: Key Information to Consider Before Getting Started

Opening a bank account is accessible to everybody, including both children and adults. The Reserve Bank of India allows children to have joint accounts with an adult, which can be converted to individual accounts once they reach eighteen.

You don’t need to deposit money initially to open an account, as many banks offer zero-balance accounts. However, you will need to provide certain documents. Most banks require proof of identity and proof of address. The Aadhaar card is essential for all accounts due to national regulations. Other acceptable documents include a ration card, voter ID, passport, driver’s license, and PAN card for identity verification, and utility bills like electricity, phone, or gas bills for address proof. Ensure you complete all forms correctly and legibly to facilitate a smooth account setup.

Selecting Your Banking Partner

Selecting your banking partner is an important decision that can impact your financial well-being. Start by considering what services you need, such as savings accounts, loans, or online banking. Look for a bank that offers these services with favourable terms. Compare fees, interest rates, and customer service quality. It's also helpful to choose a bank with convenient branch locations or easy online access. Read reviews and ask for recommendations from friends or family to find a reliable bank. Making an informed choice ensures you have the right support for managing your money effectively.

How to Write Application for Bank Statement

Writing an application for a bank statement is straightforward. Follow these steps to ensure your request is clear and complete:

Start with Your Information : Begin by writing your name, address, email, and phone number at the top of the letter.

Date the Letter : Include the date on which you are writing the application.

Address the Letter : Write the branch manager's name and the bank’s branch address.

Write the Subject : Clearly state the purpose of the letter, such as "Application for Bank Statement."

Greeting : Use a formal salutation like "Dear (Branch Manager's Name),".

State Your Request : Mention that you are requesting a bank statement and provide your account details, including your name and account number.

Specify the Period : Indicate the period for which you need the statement, such as "from (Start Date) to (End Date)."

Preferred Format : Specify whether you need the statement in electronic format or a physical copy.

Mention Any Fees : If applicable, ask about any charges associated with obtaining the statement.

Closing : Thank the bank for their assistance and include a formal closing such as "Yours sincerely," followed by your name.

Format for Bank Statement Application

(Your Name) (Your Address) (City, State, ZIP Code) (Email Address) (Phone Number)

Date: (DD/MM/YYYY)

Branch Manager (Bank Name) (Branch Address) (City, State, ZIP Code)

Subject: Application for Bank Statement

Dear (Branch Manager's Name),

I am writing to request a copy of my bank statement for my account with your bank. My account details are as follows: Account Holder Name - (Your Name), Account Number - (Your Account Number). I would like the statement for the period from (Start Date) to (End Date). Please provide the statement in (desired format: e.g., electronic PDF or physical copy). If there are any charges associated with this request, kindly let me know.

Thank you for your assistance in this matter.

Yours sincerely, (Your Signature) (Your Name)

Sample Letters of Request for Bank Statement

Here are a few sample letters requesting bank statements to help you understand and use as a reference.

Application for Bank Statement for IT returns

Rakshita XYZ Villa 7th Cross Road, Bangalore [email protected] Phone no: xxxxxxxxxxx

Date: 16/09/2023

Branch Manager ABC Bank New Branch Bangalore

Subject: Request for Bank Statement for Income Tax Returns

I am writing to request a copy of my bank statement to complete my income tax returns. Please provide the statement for my account with your bank for the period from 1 April 2022 to 31 March 2023. My account details are as follows: Rakshita and Account Number - 33445566698768. I would prefer to receive the statement as a physical copy. If there are any charges associated with this request, kindly inform me.

Thank you for your assistance.

Yours sincerely, Rakshita

Application for Bank Statement for Loan Application

Mary WTY House Kochi, Kerala [email protected] Ph. No. 1234567890

Date: 30/06/2024

Branch Manager XYZ Bank City Branch Kochi, Kerala

Subject: Request for Bank Statement for Loan Application

I am writing to request a copy of my bank statement for the purpose of applying for a loan. Please provide the statement for my account with your bank for the period from 15/03/2024 to 30/06/2024. My account details are as follows: Account Holder Name - Mary and Account Number - 858564231759. I would appreciate it if you could provide the statement in electronic PDF to [email protected]. If there are any fees for this request, please let me know.

Yours sincerely, Mary

Application for Bank Statement for Scholarship

Mounika CGBH Bungalow 7th Cross Road, Chennai [email protected] Ph. No. 89875434689

Date: 08/08/2024

Branch Manager Yuwa Bank Chennai Branch Chennai, Tamil Nadu

I am writing to request a copy of my bank statement to support my scholarship application. Please provide the statement for my account with your bank covering the period from 08/08/2023 to 08/08/2024. My account details are as follows: Account Holder Name - Mounika and Account Number - 786546790098. I would prefer to receive the statement in physical copy. If there are any charges for this request, please inform me.

Yours sincerely, Mounika

Test Your Knowledge of Application for Bank Statement

To test your understanding of the Application For Bank Statement and the application process, complete the following tasks:

Task 1: Draft a formal application letter requesting a bank statement for visa application.

Find Out if You Got them All Right from the Answers Below:

Jeevan Phase 2, RT Block Mangalore [email protected] 8765490876

Branch Manager City Bank Ground Branch Mangalore

Subject: Request for Bank Statement for Visa Application

I am writing to request a copy of my bank statement to support my visa application. I need the statement for my account with your bank for the period from 30/06/2023 to 30/06/2024. My account details are as follows: Account Holder Name - Jeevan and Account Number - 567876549076. I would appreciate it if you could provide the statement in physical copy. If there are any charges for this request, please let me know.

Yours sincerely, Jeevan

Takeaways from This Page

When applying for a bank statement, it’s important to clearly state the purpose, such as for a visa, loan, or scholarship. Include your account details, like your name and account number, and specify the statement period you need. Indicate how you’d like to receive the statement, whether electronically or as a physical copy. Be aware of potential fees for this service and ask about them if needed. Provide accurate information to avoid delays and follow up if you don’t hear back in a reasonable time. Remember, banks require identification for security reasons and have strict privacy policies.

FAQs on Application for Bank Statement - Format and Sample Letter

1. What is a bank statement?

A bank statement is a document that summarises all transactions in your bank account over a specific period, including deposits, withdrawals, and account balances.

2. Why might I need to request a bank statement?

You might need a bank statement for various purposes, such as applying for a loan, visa, scholarship, or for personal financial management.

3. How do I request a bank statement?

To request a bank statement, write a formal application letter to your bank, including your account details, the period for which you need the statement, and your preferred format (electronic or physical).

4. Do I need to pay for a bank statement?

Some banks charge fees for issuing bank statements, especially if they are requested in physical form or for past periods. Check with your bank for details on any applicable fees.

5. What documents do I need to provide?

Typically, you will need to provide proof of identity and address. The Aadhaar card is often required in India, along with other documents like a passport or utility bills.

6. How long does it take to receive a bank statement?

Processing times can vary. Electronic statements are usually faster, often delivered within a few hours to a day, while physical statements might take several days to arrive.

7. Can I request a bank statement online?

Yes, many banks offer online banking services that allow you to request and download bank statements directly through their website or mobile app.

8. What should I do if there’s an error in my bank statement?

Contact your bank immediately to report any errors or discrepancies. Provide details of the issue and follow their instructions for correcting the mistake.

Home > Blog > Marriage Green Card

Bank Verification Letter for Sponsoring Visa

Last Updated On: March 15, 2024 | Published On: April 3, 2022

Bank verification letters are used for immigration purposes to demonstrate that you have available financial resources to support yourself or your immediate relatives on a visa in the United States. In this post, we will explore what components should be included in the bank verification letter to ensure the best chances of having the visa approved for yourself or your relative. Simplify the immigration process with VisaNation’s innovative software – schedule a consultation today!

Unlock Opportunities for Your Immigration With VisaNation’s Software Start Now

How Do I Get My Bank Verification Letter for Immigration Purposes?

The most efficient way to obtain your bank account verification letter is to contact your bank’s customer service department. (Another option is to reach out to them via online chat.) Have your account information readily available so they can confirm your identity over the phone or online. Ask the bank representative to mail/fax/email precisely what you need, and be sure they document it on official bank letterhead. Depending on the bank , there may be a fee to obtain the bank verification letter and processing times for generating the letter can vary. If you are having the letter mailed to the consulate, take into account mail delivery times. In the past, Bank of America required the consulate name when requesting the bank verification letter.

You should include the following information in the letter:

- Account holder’s full name

- Bank account number

- Date account was opened

- Type of bank account

- Current balance

- Average balance (can be taken from past 3, 6, 12 months)

If you are using this letter to sponsor a relative for an immigrant visa, you should send it to them, and they will submit it to immigration officials along with the other required visa forms.

Can a Non-Citizen Open a Bank Account in the U.S.? Check out our guide for answers.

Sample Bank Verification Letter

January 24, 2023 Regarding: Jose Gonzalez 2993 South Dixie Lane, Los Angeles, CA 90002 To Whom it May Concern: This letter serves to verify that Jose Gonzalez has an account with ABC Bank. He opened his savings account, number 33309XXXX, on 2/1/2004 and has a current balance of $50,990. His average balance has stayed consistent over the past 12 months. Should you need additional information regarding Jose Ganzalaz’s account, please get in touch with him directly. The account owner can provide information contained in their monthly statement. Regards, Jennifer Jones [signature] ABC Bank Officer

Frequently Asked Questions

What is the purpose of the bank verification for my visa application .

Immigration officials want to know that you have the financial fortitude to support the immigrant in the United States so that they do not become a public charge and financial burden to the government. That is why they want to see how much money you have in the bank to support yourself and any visa recipients.

What if my bank won’t give me a letter?

If your bank does not have a procedure for this type of letter, you can always send them a sample letter. If they still can’t accommodate your request, you can find out if submitting bank statements will be sufficient for the immigration requirements.

Who composes the bank verification letter?

The bank personnel should write in on official bank letterhead and include a signature from the bank officer.

Where do I send the letter?

You should send the letter to the intending immigrant you plan to sponsor. You can also send copies to the U.S. embassy and visa application center.

It’s Never Been Easier to Immigrate to the U.S. Start Now

What other documents do I need to sponsor a relative’s visa?

In addition to the bank verification letter, typically, when sponsoring a U.S. visa for someone else, you also need to include an invitation letter confirming that you are willing to sponsor them, an affidavit of support, a letter of employment, and sometimes payslips.

Is there a fee for a bank verification letter?

This will depend on your bank. Sometimes there is a fee (typically no more than $20), and sometimes they will issue it as a customer courtesy.

How recent does the letter need to be?

Inquire with the specific embassy or consulate to determine how recent the bank verification letter needs to be. Still, typically if it’s from the past three months, that should suffice.

Are you able to use the same bank verification letter for more than one visa application?

Yes, you can assume you have the amount required to satisfy each visa type.

How do I write a visa invitation letter for my relative?

Check out this guide “ How to Write an Invitation Letter for U.S. Visa”.

How We Can Help

Working with an experienced immigration attorney will not only likely expedite the process but will significantly reduce the chances of having your application denied. Trust your case with a team of professionals who have a demonstrated track record of securing approvals. Get started by scheduling a consultation today!

Share this article

- Citizenship

- Employment Based Immigration

- Family Based Immigration

- Immigration News

- Investment Based Immigration

- Marriage Green Card

- Other Immigration Matters

- PERM Labor Certification

- Perspectives

Immigration Tips

- What is a visa?

- Electronic Visa (eVisa)

- Visa on Arrival

- Appointment Required Visa

- Invitation Letter

- Arrival Card

- Passport Renewal

- Project Kosmos: Meet the man with the world's most challenging travel schedule

- Australia Visa and ETA requirements for US citizens explained

- Brazil eVisa for US citizens

- India Tourist Visa for UK citizens

- Possible B1/B2 Visa questions during the interview

Select Your Language

- Nederlandse

- 中文 (Zhōngwén), 汉语, 漢語

Select Your Currency

- AED United Arab Emirates Dirham

- AFN Afghan Afghani

- ALL Albanian Lek

- AMD Armenian Dram

- ANG Netherlands Antillean Guilder

- AOA Angolan Kwanza

- ARS Argentine Peso

- AUD Australian Dollar

- AWG Aruban Florin

- AZN Azerbaijani Manat

- BAM Bosnia-Herzegovina Convertible Mark

- BBD Barbadian Dollar

- BDT Bangladeshi Taka

- BGN Bulgarian Lev

- BIF Burundian Franc

- BMD Bermudan Dollar

- BND Brunei Dollar

- BOB Bolivian Boliviano

- BRL Brazilian Real

- BSD Bahamian Dollar

- BWP Botswanan Pula

- BZD Belize Dollar

- CAD Canadian Dollar

- CDF Congolese Franc

- CHF Swiss Franc

- CLP Chilean Peso

- CNY Chinese Yuan

- COP Colombian Peso

- CRC Costa Rican Colón

- CVE Cape Verdean Escudo

- CZK Czech Republic Koruna

- DJF Djiboutian Franc

- DKK Danish Krone

- DOP Dominican Peso

- DZD Algerian Dinar

- EGP Egyptian Pound

- ETB Ethiopian Birr

- FJD Fijian Dollar

- FKP Falkland Islands Pound

- GBP British Pound Sterling

- GEL Georgian Lari

- GIP Gibraltar Pound

- GMD Gambian Dalasi

- GNF Guinean Franc

- GTQ Guatemalan Quetzal

- GYD Guyanaese Dollar

- HKD Hong Kong Dollar

- HNL Honduran Lempira

- HTG Haitian Gourde

- HUF Hungarian Forint

- IDR Indonesian Rupiah

- ILS Israeli New Sheqel

- INR Indian Rupee

- ISK Icelandic Króna

- JMD Jamaican Dollar

- JPY Japanese Yen

- KES Kenyan Shilling

- KGS Kyrgystani Som

- KHR Cambodian Riel

- KMF Comorian Franc

- KRW South Korean Won

- KYD Cayman Islands Dollar

- KZT Kazakhstani Tenge

- LAK Laotian Kip

- LBP Lebanese Pound

- LKR Sri Lankan Rupee

- LRD Liberian Dollar

- LSL Lesotho Loti

- MAD Moroccan Dirham

- MDL Moldovan Leu

- MGA Malagasy Ariary

- MKD Macedonian Denar

- MNT Mongolian Tugrik

- MOP Macanese Pataca

- MUR Mauritian Rupee

- MVR Maldivian Rufiyaa

- MWK Malawian Kwacha

- MXN Mexican Peso

- MYR Malaysian Ringgit

- MZN Mozambican Metical

- NAD Namibian Dollar

- NGN Nigerian Naira

- NIO Nicaraguan Córdoba

- NOK Norwegian Krone

- NPR Nepalese Rupee

- NZD New Zealand Dollar

- OMR Omani Rial

- PAB Panamanian Balboa

- PEN Peruvian Nuevo Sol

- PGK Papua New Guinean Kina

- PHP Philippine Peso

- PKR Pakistani Rupee

- PLN Polish Zloty

- PYG Paraguayan Guarani

- QAR Qatari Rial

- RON Romanian Leu

- RSD Serbian Dinar

- RUB Russian Ruble

- RWF Rwandan Franc

- SAR Saudi Riyal

- SBD Solomon Islands Dollar

- SCR Seychellois Rupee

- SEK Swedish Krona

- SGD Singapore Dollar

- SHP Saint Helena Pound

- SLL Sierra Leonean Leone

- SOS Somali Shilling

- SRD Surinamese Dollar

- SVC Salvadoran Colón

- SZL Swazi Lilangeni

- THB Thai Baht

- TJS Tajikistani Somoni

- TOP Tongan Pa anga

- TRY Turkish Lira

- TTD Trinidad and Tobago Dollar

- TWD New Taiwan Dollar

- TZS Tanzanian Shilling

- UAH Ukrainian Hryvnia

- UGX Ugandan Shilling

- USD United States Dollar

- UYU Uruguayan Peso

- UZS Uzbekistan Som

- VND Vietnamese Dong

- VUV Vanuatu Vatu

- WST Samoan Tala

- XAF CFA Franc BEAC

- XCD East Caribbean Dollar

- XOF CFA Franc BCEAO

- XPF CFP Franc

- YER Yemeni Rial

- ZAR South African Rand

- ZMW Zambian Kwacha

Apply for and track your visa with our new app!

Download Now

Visa requirements: Bank statements and financial evidence

International travel often entails more than packing your bags and boarding a plane. One of the key steps in preparing for your journey is applying for the necessary visas and travel documents .

A critical component of many visa applications is bank statements . Bank statements serve as proof of your financial stability and ability to support yourself during your travels .

In this guide, we will navigate the intricacies of submitting bank statements and financial proof for visa applications, ensuring your documents tick all the right boxes for a smooth process.

Why submit bank statements for visa applications

Bank statements are a snapshot of your financial stability . They provide visa authorities with evidence of your ability to pay for your trip, ties to your home country, and your intention to return home.

A well-prepared bank statement can significantly impact the outcome of your visa application. Visa authorities scrutinize bank statements to assess:

Trip details: The dates you plan to travel, where you will stay during your visit, if you have travel insurance, the main purpose of your trip (e.g., tourism, business, family visit), and any planned activities.

Current balance: Ensuring you have enough money to cover your stay and pay for your entire trip without burdening the host country.

Stable financial history: A steady income and savings indicate that you're temporarily visiting for your indicated travel purpose, not to seek employment or live in the country illegally.

Genuineness: Regular transactions and consistent balances reflect the authenticity of your financial standing and daily life back home.

Estimating the right amounts for your trip

Budgeting for your trip is crucial, and understanding how much money you should have in your account will strengthen your application.

However, there’s usually no one-size-fits-all amount for how much you should have in your account , as it varies based on your personal situation and the nature of your visit.

A general guideline is to have two times as much in your bank account than your trip's estimated cost to demonstrate financial stability.

For example, if you estimate your trip will cost US$2,000, aiming for a bank balance of at least US$4,000 over the last few months is wise. This shows you have the necessary funds to support yourself during your stay without a fixed minimum requirement.

Recommended daily amounts for popular destinations

While there’s generally no fixed amount you must have for most countries, here are our recommendations for daily funds for some of the most popular destinations.

These are guidelines to help you plan. However, the actual amount you need may vary based on the country you’re visiting, your itinerary, the length of your stay, and personal spending habits.

United Kingdom Standard Visitor Visa

For the UK Standard Visitor Visa , we recommend showing a daily budget of £100-150 (about US$125-200) .

The United Kingdom can be expensive for visitors, especially in major cities like London. Budgeting towards the higher end allows for a comfortable experience, including dining in restaurants and visiting paid attractions.

Schengen Visas

For visas for Schengen countries, we recommend showing a daily budget of €100-120 (about US$110-130) or €60-70 with pre-booked accommodations or family stay.

This budget is suitable for experiencing the Schengen area's diverse cultures and attractions. The lower range assumes significant costs like accommodation are already covered.

The Schengen area encompasses various countries with differing cost of living standards, so adjustments may be needed based on specific destinations.

Canada Visitor Visa

For the Canada Visitor Visa we recommend a daily budget of CA$100-150 (about US$75-110) or less if you’re staying with family or friends.

Canada offers many natural and urban experiences, from the Rocky Mountains to cities like Toronto and Vancouver. This budget should cover modest accommodations, food, local transportation, and attraction entry fees.

United States B1/B2 Visa

A daily budget of US$100-200 is recommended for the US B1/B2 Visa application.

The United States offers many attractions across its vast territory, from natural parks to bustling cities. This budget range caters to entry fees, accommodation, meals, and some shopping. Costs can vary significantly between cities and rural areas, with major cities like New York and San Francisco being on the higher end of the spectrum.

Australia Visitor Visa

For those planning a trip down under with an Australia Visitor Visa , it's wise to show a budget of at least AU$200-250 (about US$130-160) daily.

This budget range ensures a well-rounded and enjoyable visit, allowing travelers to explore Australia's stunning landscapes, rich cultural heritage, and bustling urban life without financial stress.

Key elements of a bank statement for visa applications

When preparing your bank statement for a visa application, ensure it:

Includes the essential details: Always make sure it shows the account holder’s full name, account number, amount of money available, transactions, dates, and currency.

Is recent: Statements should be no older than three to six months to reflect your current financial situation. Most countries specify how far back you need to go.

Shows sufficient balance: Your balance should cover your estimated expenses, including flights, accommodation, daily spending, and emergency funds.

Is printed or electronic (not handwritten) with official bank letterhead and info: Many banks offer downloadable statements with the financial institution's official name, logo, and contact details.

For some countries, it’s a requirement that electronic bank statements must be stamped on each page or accompanied by a supporting letter. However, if this is the case, it will be mentioned during the application process.

If you’re being sponsored by someone else

If an official financial sponsor covers part or all of your trip expenses, this can sometimes also be presented as proof of your financial resources.

Make sure to include bank statements from your sponsor, usually a family member or host, following the guidelines mentioned in the previous paragraphs and showing enough funds and income to cover your entire trip.

As part of this, a letter from your host/sponsor should be included in your application and disclose the following details:

Your full name and the full name and contact information of your sponsor

The nature of your relationship

A copy of their valid passport

The date the letter was written

The duration of the sponsorship

The exact amount of funds being provided or a declaration that the sponsor will cover all your expenses

If you can’t prove you have enough funds for the trip

If you're unable to show adequate funds for your trip, consider doing the following:

Adjust your travel plans to fit your current budget, such as shortening the duration of your trip .

Seek financial support from a family member to enable your trip within your financial constraints. Make sure to submit their details and bank statements to prove their ability to pay on your behalf.

Delay your travel plans until you've saved enough funds for the journey.

Simplifying your travel preparation

By understanding what's required and planning accordingly, you can ensure your financial documentation strengthens your application.

We’re here to support you every step of the way. If you have any questions about the above visa applications or financial requirements, let us know via online chat or message us on WhatsApp .

Related Articles

The UK ETA: A necessary security measure, or a political and economic tool?

iVisa Ultimate Discount

test test test

[Top-5] Bank Statement Request Letter Format (Download in Word-.docx)

1. basic bank statement request letter.

If you’re searching for a Basic Bank Statement Request Letter, you’ll find it here. This letter is a simple yet essential tool for formally requesting your bank’s financial statement, tailored to your specific requirements.

✪ DOWNLOAD IN WORD

File Format: Word

2. Bank Statement Request Letter for Visa Application

If you’re searching for a Bank Statement Request Letter for Visa Application, you’ve come to the right place. This document simplifies the process, allowing you to formally request your bank statement, a vital requirement for your visa application, ensuring a smooth and successful application.

3. Bank Statement Request Letter for Mortgage or Loan Application

When you need a Bank Statement Request Letter for Mortgage or Loan Application, our template is your solution. This letter streamlines the process, enabling you to request your bank statement with ease, a crucial step in securing your mortgage or loan approval.

4. Bank Statement Request Letter for Business Purposes

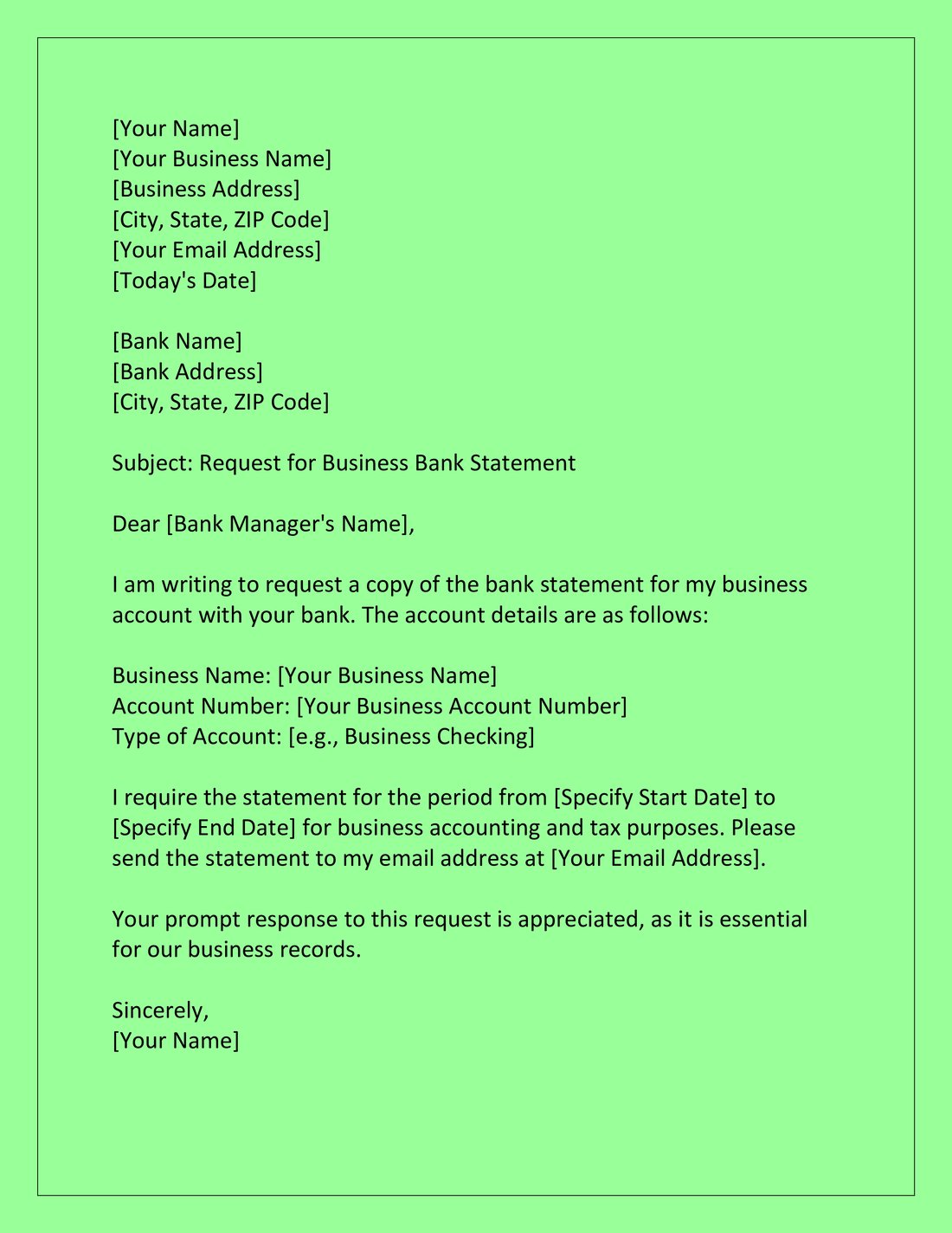

When you need a Bank Statement Request Letter for Business Purposes, our template is here to assist you. This letter is a valuable resource for formally requesting your business’s financial statement from the bank, ensuring you have the essential documentation required for various business needs and decisions.

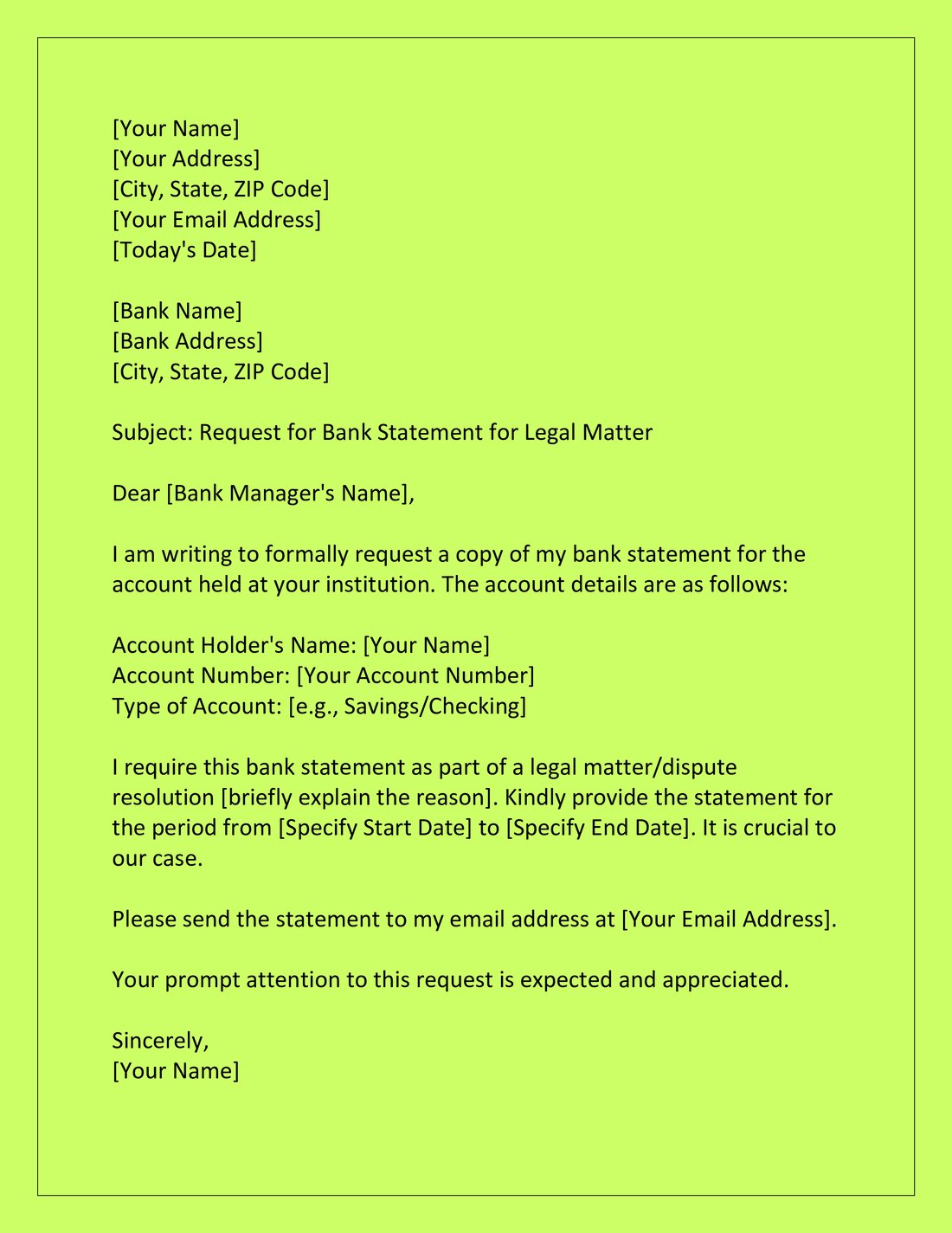

5. Bank Statement Request Letter for Legal or Dispute Resolution

If you’re searching for a Bank Statement Request Letter for Legal or Dispute Resolution, you’re in the right place. This letter serves as a critical tool for formally requesting financial records from your bank, essential for building a strong case or resolving disputes with precision and efficiency.

Nazim Khan (Author) 📞 +91 9536250020 [MBA in Finance]

Nazim Khan is an expert in Microsoft Excel. He teaches people how to use it better. He has been doing this for more than ten years. He is running this website (TechGuruPlus.com) and a YouTube channel called "Business Excel" since 2016. He shares useful tips from his own experiences to help others improve their Excel skills and careers.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Notify me of new posts by email.

- Application for Bank Statement

Some people need to follow their bank activity by requesting bank statements. A bank statement is a crucial document that is required to obtain information about previous transactions, obtain loans, track vendor payments, and so on. Every month, the bank sends it to the account holder. Let us have a look at this article to understand how to draft an application for bank statement, as well as the guidelines to follow and several sample letters.

Bank Statement

A bank statement is a formal document that contains information about all transactions that occurred over a specific time period. A bank account statement usually summarizes the following:

- Every deposit, withdrawal, and transfer

- During the period, interest was earned.

- Charges for services or penalties

- Balances at the beginning and end

It assists account holders in keeping track of their costs, income, bank fees, interest gained, suspicious activities, and so on. Every month, banks typically email the monthly bank statement to their customers’ registered email addresses. Customers can also pick up their monthly bank statements from the branch. The consumer must submit an application for bank statement to the bank manager in order to do so.

Guidelines to Write an Application for Bank Statement

Formal letter writing is used to seek a bank statement letter. It should be written in a professional tone and in a business structure. The following guidelines will help you create a suitable application for bank statement requests.

- Appreciate the bank for its customer service help.

- Explain why you’re obtaining the bank statement.

- Mention and emphasize the account holder’s identification and account number information.

- Mention the needed bank statement’s beginning and closing dates.

- Indicate whether your problem requires immediate attention and why.

- Enter your postal or email address if you require an original copy.

- Keep things simple and to the point.

- Use polite, professional words and tone.

Format for an Application for Bank Statement

The Branch Manager

Bank Address

Subject: Request for bank account statement from period ______ to _______

Body of the Letter: The body should include information such as the bank account number, account details, the reason for obtaining the statement, the period for which the statement is required, and so on.

Complimentary Closing

Name and Address

Enclosures, if any

Application for Bank Statement Samples

Sample 1 – application for bank statement for it returns.

Bank of India

25 th July 2022

Subject: Request for Bank Account Statement for IT Return Filing

Respected Sir/Madam,

My name is Ramesh Patel, and I have a savings bank account at your branch. I am writing this letter requesting you to provide me with the Bank Statement from 1 st January 2022 to 31 st March 2022, as I have to file my IT returns for FY 2021-22. My account number is ___________ and I have also attached a copy of my passbook for your reference.

I respectfully request that you send me my bank account statement for the aforementioned period as soon as possible. Please perform the necessary and obey.

Thanking you,

Yours Sincerely,

Ramesh Patel

(Attach a copy of the Passbook)

Explore More Sample Letters

- Leave Letter

- Letter to Uncle Thanking him for Birthday Gift

- Joining Letter After Leave

- Invitation Letter for Chief Guest

- Letter to Editor Format

- Consent Letter

- Complaint Letter Format

- Authorization Letter

- Apology Letter Format

- Paternity Leave Application

- Salary Increment Letter

- Permission Letter Format

- Enquiry Letter

- Cheque Book Request Letter

- Application For Character Certificate

- Name Change Request Letter Sample

- Internship Request Letter

- Application For Migration Certificate

- NOC Application Format

- Application For ATM Card

- DD Cancellation Letter

Sample 2 – Application for Bank Statement for Credit Card

State Bank of India

5 th April 2022

Subject: Requesting letter for Bank Statement

Dear Sir/Madam,

I’d like to advise you that I have an account in your branch under the name (account holder name.) I need my account statement for the last six months (mention dates) because I am applying for a credit card that requires a six-month account statement. My account information is as follows:

Account Holder’s Name:

Account number: XXXXXXXXXX

Aadhar Number:

Phone number: 9742XXXXXX

It would be extremely kind of you if you could do the necessary as soon as possible. I would want to thank you for your cooperation.

Sample 3 – Application for Bank Statement for Loan

Janalakshmi Sahakari Bank

Liberty Garden Branch

15 th August 2022

Subject: Requesting letter for Bank Statement for loan approval

I would like to bring to your kind notice that, I am (Mention your name) maintaining a savings account. I have an account with your bank with the account number XXXXXXXXXXX5673, and I need a bank statement for the last six months (1/12/2021 to 1/05/2022). I’m looking for a car loan and need to provide my most recent 6-month bank account statement.

Here are my bank account details –

Account Holder:

Account Number:

Account Type:

Linked Mobile No:

As a result, I ask that you please send me the bank account statement as soon as feasible. I will appreciate your prompt response on this matter.

Thanking You

Frequently Asked Questions

Q1. What are the reasons for requesting a bank statement?

Answer. Account holders require a bank statement. People require bank statements for a variety of reasons, including loan applications, scholarship applications, IT return filing, visa applications, higher education, and to offer verification for various transactions.

Q2. What documents are needed for a bank statement?

Answer. A bank statement requires some general financial documents. The account holder’s name, account number, account type, a mobile number linked to the account, and email address are all necessary. You are also aware that you will require a bank statement application in conjunction with these documents.

Customize your course in 30 seconds

Which class are you in.

Letter Writing

- Letter to School Principal from Parent

- ATM Card Missing Letter Format

- Application for Quarter Allotment

- Change of Address Letter to Bank

- Name Change Letter to Bank

- Application for School Teacher Job

- Parents Teacher Meeting Format

- Application to Branch Manager

- Request Letter for School Admission

- No Due Certificate From Bank

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

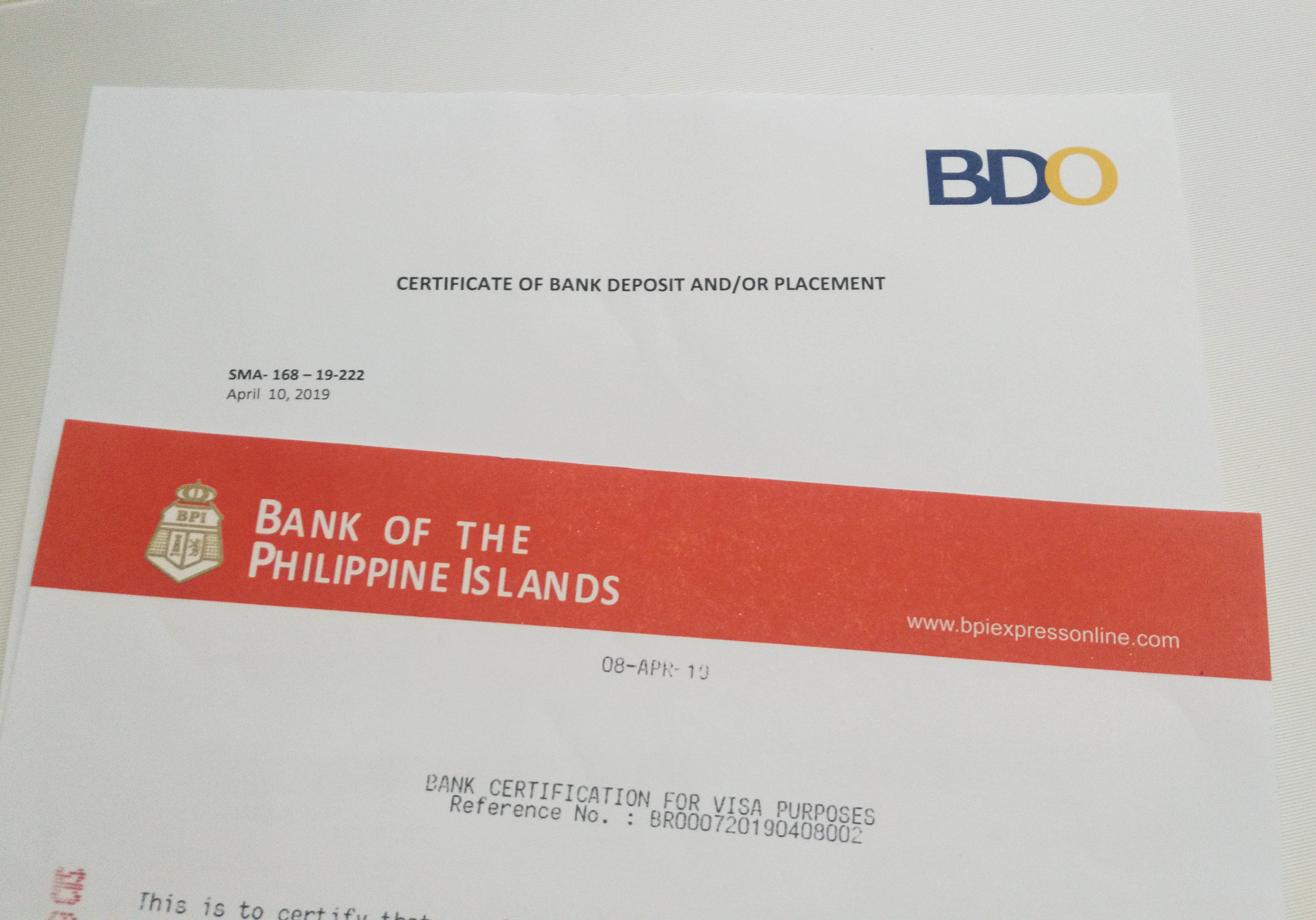

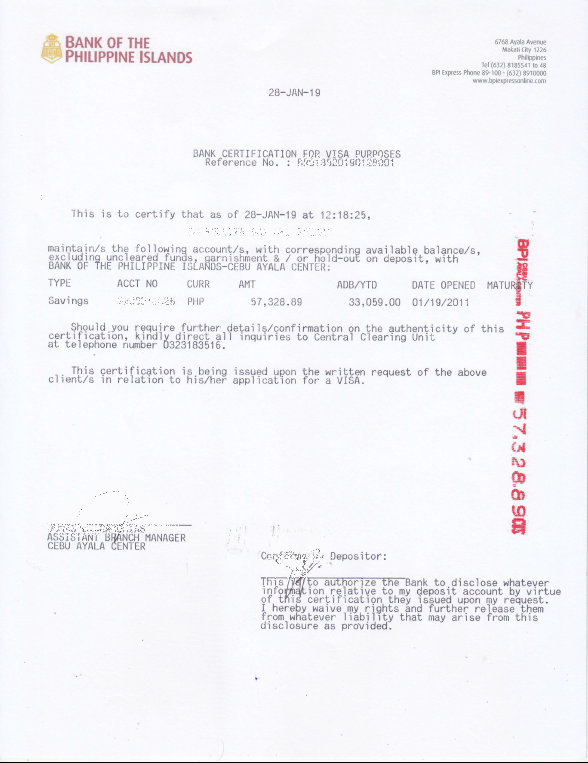

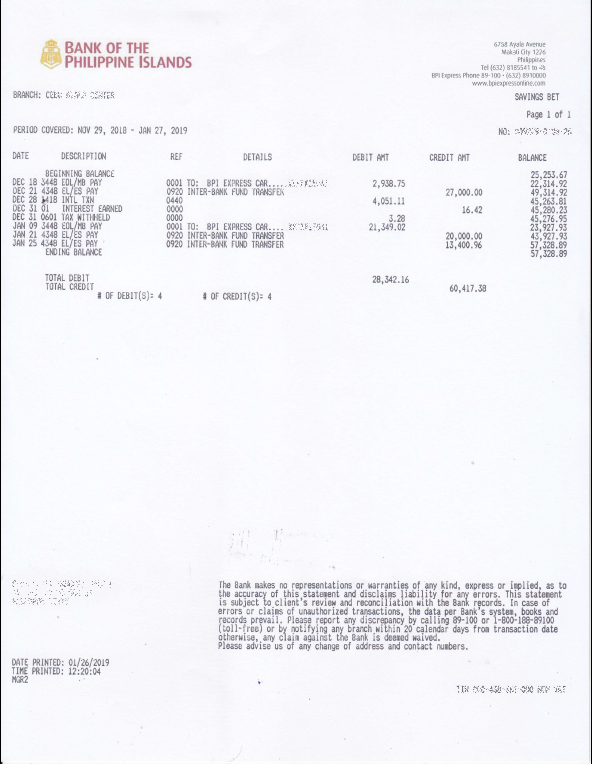

BANK CERTIFICATE vs BANK STATEMENT: What’s the Difference? Which is Needed for Visa Application?

Proof of funds, often called show money , is one of the most common and the most important requirements in visa applications.

Whether you’re applying for a Korean visa, Japanese visa, UK visa, Canadian visa, Australian visa, or Schengen visa, you will need to submit documents that will prove that you have the financial means to support your trip.

Two of the documents you can use are bank certificate and bank statement. These are very different documents. But what’s the difference? And which of them can give you better chances of approval?

WHAT'S COVERED IN THIS GUIDE?

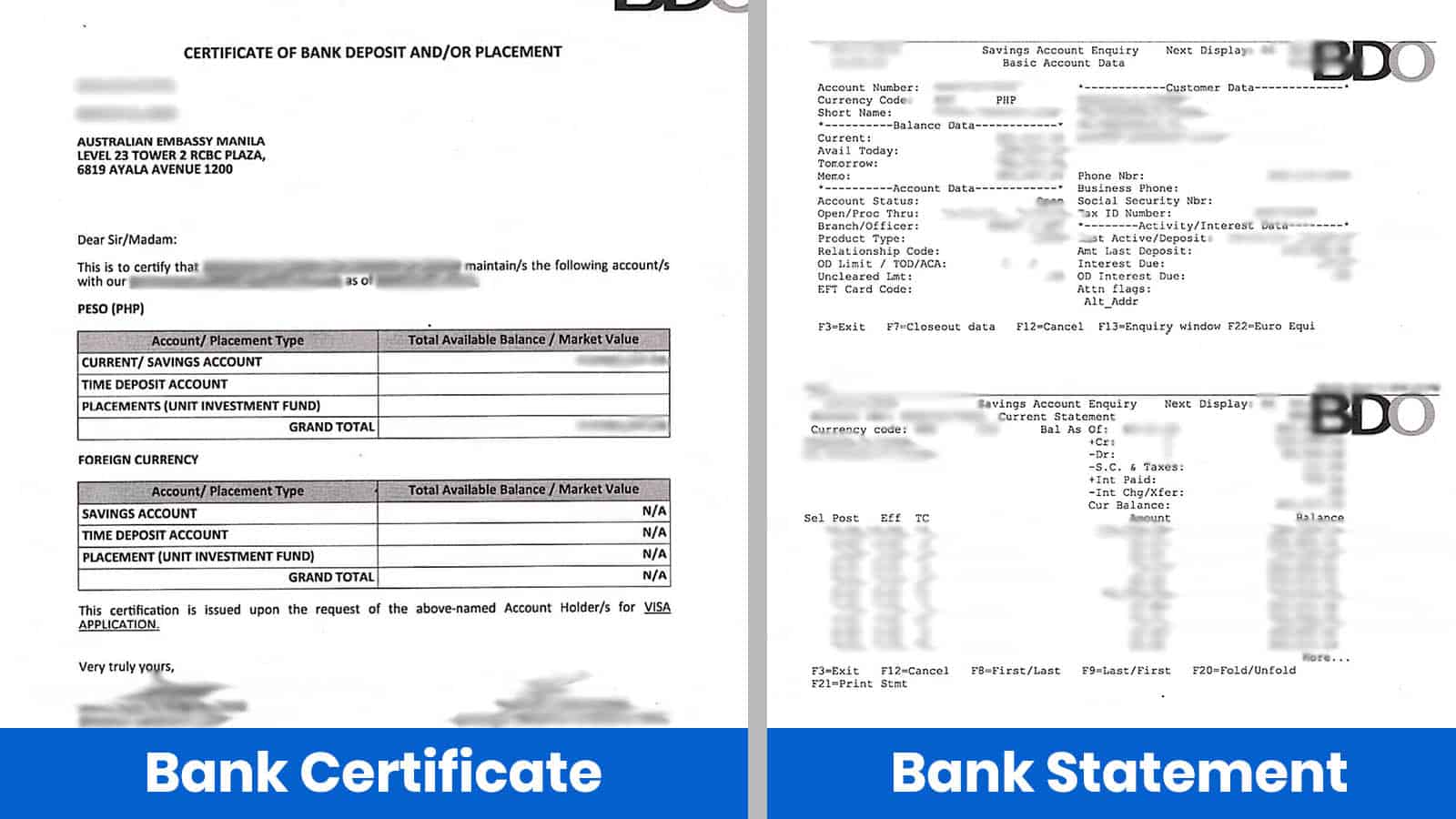

Bank Certificate vs Bank Statement

- A bank certificate is usually a one-page document that certifies that you have an account with that branch. Often, the latest available balance is indicated. But in some banks, you can request that some details be included.

- A bank statement is a detailed record of the balance and the transactions on that account within a specified period of time. It includes the amounts deposited into, the amounts withdrawn from, and even the interests gained by that account, and the corresponding dates.

Which is better for visa application?

Embassies have varying sets of requirements that they need visa applicants to meet. What’s better is whatever is required by the embassy. For example:

- For Japan visa, only a bank certificate is required.

- For Australian visa and Canadian visa, only a bank statement is required.

- For Korean visa, Chinese visa, Schengen visa and many other visas, BOTH a bank certificate AND a bank statement are required.

For bank statements, the number of months to be covered varies. Some embassies need to see the transactions within the past three months (Korea), some four months (Canada), and others six months (Schengen: Greek, Italian, French; China). It’s usually specifically indicated in the list of visa requirements.

However, in most cases, it’s a great idea to submit both rather than just one.

How to get a bank certificate or bank statement?

Just head over to your bank and request for it.

Different banks have different rules. For example, in my experience with BDO, I always had to go to the specific branch where I opened my account. I can’t get a bank certificate or bank statement from any other branch.

On the other hand, with BPI, I can get a bank certficate/statement from any of their branch. I don’t need to travel to my main branch to request for it.

Service fees usually apply. Try to get a copy of the official receipt too because some embassies require that it be attached to the actual document.

How much money should I have on my bank account to have my visa application approved?

We answered that and many other questions about SHOW MONEY in this post: SHOW MONEY FOR VISA APPLICATION & IMMIGRATION!

Related Visa and Immigration Posts

- SHOW MONEY for Visa Application & Immigration

- Why Having a SPONSOR can be BAD for Visa Application & Immigration

- Common Reasons why Visa Applications are DENIED !

- How to Prepare for VISA APPLICATION (Long Term Tips)

- FIRST TIME ABROAD : Immigration Tips

- How to Avoid Getting OFFLOADED : Immigration Requirements & Tips

2020 • 1 • 8

More Tips on YouTube ⬇️⬇️⬇️

Is this post helpful to you?

Related Posts:

- JAPAN VISA REQUIREMENTS & Application for Tourists

- TAIWAN VISA-FREE Entry Requirements (Until July 2020)

- SOUTH KOREA VISA APPLICATION FORM

- JAPAN VISA FOR VISITING FRIENDS OR RELATIVES: Requirements & Steps

- VISA APPLICATION DENIED: 10 Common Reasons and How to Avoid Them

- JAPAN VISA: LIST OF TRAVEL AGENCIES Accredited by the Embassy

- SAMPLE COVER LETTERS for VISA APPLICATION: Korea, Schengen, Australia

- NO MORE STICKER: How to Download & Print KOREAN VISA GRANT NOTICE

- Recent Posts

- 2024 Cebu Pacific Promos & PISO SALE with Number of Seats Available - 7 September 2024

- U.S. VISA APPLICATION Requirements & Interview Questions in the Philippines - 4 August 2024

- WHERE TO SHOP IN BANGKOK • Top 8 Shopping Centers and Malls - 29 July 2024

Hello, i have asked various bloggers but no reply. re schengen visa: can i submit the downloadable e-certificate and e-statement from digital banks such as CIMB, ING, Tonik apps? I don’t have a physical bank. Thank you.

We don’t know for sure because we haven’t tried digital banks. But tinatanggap naman nila yung e-statement ng BPI na downloaded lang din (although nagsusubmit din kasi kami ng physically signed na bank certificate kasabay nun so baka kaya ganun).

I know someone na nagsubmit ng printed out na PayPal transactions sa Norwegian embassy, tinanggap naman daw. Pero di ko alam if tinatanggap talaga nila in general or sinwerte lang sya.

Thank you and more power!

hi! do you have an idea how long is the validity of bank cert/statement (Korean visa)? for example bank statement is dated Aug 1, can I still use it for my visa application by September?

Hi Angela, one of the designated agencies we talked to before told us, ideally it should be issued within a month prior to application date.

Not sure if that still holds true now.

Hello tintwagan ba ang bank para iclarify if naka enroll ka sa bank na yun? For tourist vis aapplication

From your experience po,when you request for your BDO bank certificate / bank statement..ilang days po nila marelease after your request..thank you

Usually same day. Hihintayin mo lang, ipiprint na nila. Pero may time na pinabalik ako the next day. haha. Pero ngayon iniinsist ko talaga na same day.

Hi, not sure kung mari-replyan pa to. Hopefully yes. So I have separate banks for my savings (Ficco) and for my salary(BPI). My BPI would usually be in zero balance since I withdraw my money for bills and savings. Should I only provide the FICCO transactions when applying for visa?

Hi Ellie, this reply is probably too late. But if I were in your shoes, I’d submit both with a letter of explanation or cover letter.

Hi. Ask ko lang po if indicated ba sa Bank Statement the dates when you deposit or withdraw? Thank you

Hi. Can I use credit card as proof of funds in Japan Visa application

Featured On

We heard you!

Your comment is now queued for moderation! We’ll try to get back to you soonest. While waiting, follow us on these channels.

Subscribe on Youtube! Follow us on Instagram!

Essential Letter of Support for Visa Application Template

In this article, I’ll guide you through a detailed, step-by-step process to write an effective letter of support for a visa application, including customizable templates to get you started.

Letter of Support Generator

*Disclaimer: This is a tool to assist in drafting a letter. Ensure all information is correct and seek legal advice if necessary before submitting any official documents.

Key Takeaways: Understanding the Purpose: Learn what a letter of support for a visa application is and why it’s important. Step-by-Step Guide: Follow a comprehensive guide to writing an effective letter. Free Template: Use the provided template to simplify your writing process. Real-Life Examples: Gain insights from examples based on actual experiences. Tips for Success: Discover key tips to enhance your letter’s impact.

Understanding the Purpose

A letter of support for a visa application is a document that provides additional assurance and details about the applicant.

It typically comes from a friend, family member, or employer and offers insights into the applicant’s character, purpose of visit, and plans during the stay.

Why is it Important?

- Strengthens the Application: It adds credibility to the applicant’s intentions.

- Personal Touch: Offers a personalized perspective on the applicant.

- Addresses Potential Concerns: Helps clarify any uncertainties visa officers might have.

Step-by-Step Guide to Writing the Letter

Trending now: find out why.

1. Start with Personal Details:

- Your name, address, and contact information.

- Your relationship with the applicant.

2. Introduction of the Applicant:

- Full name of the applicant as in their passport.

- Your personal connection and how long you’ve known them.

3. Purpose of Visit:

- Clearly state the reason for the applicant’s visit (e.g., tourism, business, family visit).

- Mention the planned duration and dates if known.

4. Assurances and Support:

- Confirm your support (accommodation, financial, etc.).

- Address the applicant’s plan to return to their home country.

5. Closing Remarks:

- Reiterate your support and confidence in the applicant.

- Provide your availability for further queries.

6. Signature:

- Sign the letter to authenticate it.

Sample of Letter of Support for Visa Application

[Your Full Name] [Your Address] [City, State, Zip] [Email Address] [Phone Number] [Date]

To Whom It May Concern,

I am writing to support the visa application of [Applicant’s Full Name]. My name is [Your Name], and I am a [Your Relationship with the Applicant] of [Applicant’s Name] for [Number of Years/Months].

[Applicant’s Name] intends to visit [Country] for [Purpose of Visit], from [Start Date] to [End Date]. During their stay, they plan to [Briefly Describe Activities or Plans].

I would like to assure that [Applicant’s Name] will be staying with me at my residence located at [Your Address]. I am fully prepared to provide for their needs during their visit, including accommodation and financial support if necessary.

I am confident that [Applicant’s Name] will comply with all the visa regulations and return to [Applicant’s Home Country] as planned. Please feel free to contact me if you need further information or clarification.

Thank you for considering this application.

Sincerely, [Your Signature] [Your Full Name]

Real-Life Example

In my experience, a well-drafted letter played a pivotal role in the successful visa application of my friend, Maria. Her purpose was to attend a conference, and the letter highlighted her professional background and the importance of the event in her career, which added significant value to her application.

List of Essential Elements:

- Clear Purpose: Indicate the specific reason for the visit.

- Personal Connection: Show your genuine relationship with the applicant.

- Support Details: Mention how you will support the applicant during their stay.

- Return Assurance: Highlight the applicant’s intent to return to their home country.

Tips for Success

- Be Honest: Provide truthful information.

- Keep It Concise: Stick to relevant details.

- Professional Tone: Maintain a formal and respectful tone.

- Proofread: Check for errors before sending.

Visa Application Checklist Generator

Related posts.

- 3 Letter of Support for Visa Templates: Must-Haves

- Sample Immigration Letter Of Support For A Friend: Free & Effective

- Sample Letter for Visa Application for Family: Free & Effective

Frequently Asked Questions (FAQs)

Q: What is a Letter of Support for a Visa Application?

Answer: A letter of support for a visa application is a document provided by someone who knows the applicant, often a friend or family member, to help strengthen their visa application.

In my experience, this letter detailed my relationship with the applicant, their purpose of visit, and my assurance of their compliance with visa terms. It made a significant difference in the approval process.

Q: How do I write an effective Letter of Support?

Answer: To write an effective letter of support, include specific details about your relationship with the applicant, the purpose of their visit, and their character.

When I wrote one, I made sure to emphasize how well I knew the applicant and their reasons for traveling. Keeping the letter concise, factual, and heartfelt is key.

Q: Who should write the Letter of Support?

Answer: Ideally, the letter of support should be written by someone who has a close relationship with the applicant, such as a family member, friend, or employer.

When I needed one, I asked my brother, who is a U.S. citizen, to write it. His status and our familial relationship added weight to the application.

Q: Is a Letter of Support mandatory for a visa application?

Answer: A letter of support is not always mandatory, but it can be incredibly beneficial. In my case, while it wasn’t required, it significantly helped in demonstrating my ties and intentions.

It acts as a character reference and can provide additional assurance to the visa officers about the applicant’s credibility.

Q: What information should be included in the Letter of Support?

Answer: The letter of support should include the writer’s relationship to the applicant, the purpose of the visit, the applicant’s intended length of stay, and any assurances regarding adherence to visa regulations.

When I wrote one, I also included details about my financial support and accommodation for the applicant, which provided further evidence of a well-planned visit

Exceptionally informative and well-organized, providing straightforward advice and useful strategies for composing an effective visa application support letter

I found the guidelines on writing a strong letter to support a visa application incredibly helpful and easy to follow!

Great work! I’ll definitely share this with my friends and recommend it personally. I’m sure they will find this website beneficial.

It is actually a nice and useful piece of information. I am happy that you shared this helpful info with us. Please keep us informed like this. Thank you for sharing.

I’m impressed by how much thought you put into this post.

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Please update your browser.

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

Update your browser

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

We’ve signed you out of your account.

You’ve successfully signed out

We’ve enhanced our platform for chase.com. For a better experience, download the Chase app for your iPhone or Android. Or, go to System Requirements from your laptop or desktop.

How to submit Immigration Bank Letter Requests

Please turn on javascript in your browser.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Immigration Bank Letter Requests

What is an immigration bank letter.

JPMC Customers may request a US Immigration Bank letter to assist with meeting US Immigration application requirements. The letter will only include the specific account information outlined below on JPMorgan Chase Bank, NA letter head.

- Account Owner

- Account Type

- Last 4 digits of account number (full account number will not be provided)

- Current Balance

- 12-month average balance

- 12 month total credits/deposits

NOTE: Deposit activity can be found in Chase Bank account statements. Requestors should consult with their attorney or the immigration office to determine requirements.

How can I send a request?

For faster processing, please access the web-based network of our vendor, Billing Solutions, Inc. at www.bankvod.com/immigration to send your request and sign an authorization form.

What information is required for a requestor to receive an Immigration Bank Letter?

These are the mandatory requirements to receive an Immigration Bank Letter:

- Customer first and last name

- Email address (Email address must match your Chase.com profile)

- Account Type (Checking, Savings, Money Market, or CD)

- Account Number

NOTE: We won't complete requests with only name and/or email address.

How long does it take to complete a request?

Your request will be emailed to you within 3-5 business days.

Can the bank send the letter to another address or contact?

New and outstanding requests can be delivered to the address or email address listed on your account. These requests can't be addressed to and/or mailed to third parties, (embassies, immigration offices, etc.).

If you have questions or don't have access to a computer, please go to a local banking center or call us at 1-800-550-8509. We are available Monday through Friday, 8 AM to 9 PM Eastern Time.

Chase Survey

Your feedback is important to us. Will you take a few moments to answer some quick questions?

You're now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

- Schengen Visa - Start Here

- Guides Comprehensive Step-By-Step Guides About the Schengen Visa Requirements & Application Process

- Statistics Get the latest and most up-to-date Schengen Visa and Europe tourism statistics

Home > Blog > Guides > Schengen Visa Bank Statements

Schengen Visa Bank Statements

on 22 Nov, 2021

Guide – Bank Statements For Your Schengen Visa Application

What are the bank statements for your schengen visa application.

A bank statement is a document (also known as an account statement) that contains the summary of your financial transactions (bank balance, deposits, charges, withdrawals, interests earned on the account, etc.) that occurred at a certain bank during a month (most of the time it is one month, but it could be one quarter in some cases).

A bank statement is a document that provides a full overview of your account for a specific period.

Some banks can record your statements on file for at least five years, sometimes longer. A one-month statement doesn’t necessarily last from the first to last day of a calendar month.

Some banks can also track your account from the fifth day of a month to the fourth day of the following month.

Submitting the bank statements as proof of financial means is a mandatory requirement when applying for a Schengen Visa, no matter your employment status or your purpose of entry into the Area.

Some Embassies/Consulates require the statements of the last 3 months while some others require the statements of the last 6 months.

However, no matter the Embassy you apply to, we recommend that you submit your bank statements for the last 6 months – more is better.

Please be aware of the following rules when applying for a Schengen Visa:

- If you are able to cover all of the expenses for your trip yourself, then you must submit your own bank statements

- If you have a sponsor, you will have to provide both your bank statements and the ones of your sponsor (all of them for the last 6 months) – together with your sponsorship letter and other mandatory requirements.

The main purpose of these documents is to prove that you have enough funds to support all of the expenses during your stay within Europe. They are a key element during your Schengen Visa application process .

Please note that providing bank statements from only yourself or yourself and your sponsor that cumulatively show that you do not have enough funds on your account can cost you the approval of the Schengen Visa.

These documents will show the Schengen Visa officers not only the type of transactions that occurred within your account, but also the details of those transactions (for example, the name of the person or the institution that transferred money into your account).

This is the main reason why we do not recommend you borrow money from your parents, relatives, or friends so that you can have a higher amount of “show money” (the colloquial term used to indicate the funds that you must have when you travel in order to get a Visa) .

The Schengen Visa officers are experts at spotting irregularities and this can lead to the rejection of your Schengen Visa. They will also check on your account the opening date because a new account may raise suspicions.

Note : You can submit the statements corresponding to more bank accounts.

For example, you can submit the statements corresponding to your both current and savings account. Or, you can submit the statements corresponding to accounts opened in different countries (e.g., you are a Filipino citizen resident in India and submit bank statements corresponding to the accounts you hold in India and the Philippines).

You can also submit the bank statements related to a joint account (whether you opened the joint account together with a relative or a business partner).

Important: If you are self-employed, you must also submit a company bank statement for the last 6 months and a copy of your business license. This is a mandatory requirement for applicants who are running their own businesses.

Thus, there are two categories of bank statements you must submit if you’re self-employed: personal and company bank statements. Both of them are important as part of the Schengen Visa application process.

The Importance Of The Bank Statements For Your Schengen Visa

You may ask yourself why it is so important to the Embassies/Consulates that you submit the bank statements together with the rest of your documents. Below you will find the answers:

- Your bank balance (as well as the one of your sponsor – if you have one) will show the Visa officers you have enough funds to cover your basic travel expenses and other needs.

In case you are still asking yourself ” Why do I need to prove that I have enough money to spend during my trip? ” the answer is: ” The Schengen Visa officers want to ensure that you won’t be a burden for the countries within the Schengen Region and you have enough financial means to support yourself in an emergency ”.

- They provide strong evidence of your intentions to return to your country of residence, by showing you have current living expenses and salary operating out of your account – Bear in mind that most of the rejected Schengen Visa applicants were not able to prove that they intend to go back to their country of residence after their journey in the Schengen Region.

How To Get A Bank Statement For Your Schengen Visa Application?

There are two ways you can get the bank statements of the latest 6 months:

1. Getting the bank statements online

The online mode refers to the electronic version of your bank statements that you can get in a PDF format once you login to your account through the bank’s net banking portal or mobile banking app.

After you download the PDF file (not a screenshot), you can print it off and submit it to the Embassy/Consulate together with your other documents.

Here are the steps you should follow:

- Log into your bank account – You can do it directly from your computer or using a mobile banking app.

- Select “Statements” (“Bank Statement” or “E-Statements”) – Although every bank is different and the Internet banking portals are not identical, you should easily find the option that allows you to download your statements.

- Select the appropriate account (in case you have more than one account at the same bank) and the statement period (you can also submit statements from multiple accounts, but each one must have a 6 months minimum of statements).

- The bank should send the list of statements for the selected period on the email address corresponding to your account – or you can download it directly as a PDF if your bank Internet portal allows you to do that.

- Print off the statement (colour printing is preferred).

Remember that most of the banks allow you to access a one-month bank statement meaning that you will have to download and print off six different statements (of the latest 6 months).

2. Getting the bank statements offline

There are a few banks that do not provide the option to download or print the statements via net banking portal or mobile banking app. If your bank is one of them, you have two options:

- Send a letter or email or call to your bank and ask for your statements of the last 6 months (you should receive them by email) – this step does require a lot of verification as it is virtual.

- Visit your bank branch and request the statements you need over the counter.

Remember that you also have two options when submitting the bank statements together with all the rest of the documents for your Schengen Visa application:

- Submit the account statements you got after following one of the methods mentioned above.

- Submit the bank statements with the authorised signature of the bank (you can ask one of the representatives of your bank to sign and stamp each one of them).

Providing bank statements that have the evidence and proof of the bank with authorised signature is NOT mandatory and no Embassy/Consulate mentions that specifically.