How to Start a Currency Trading Business

If you've ever traveled outside the country, you know exchange rates can kill you, but only if the foreign currency is worth more than your home country's currency. For example, if $1 will only buy £0.70, then you're effectively "trading down," assuming costs for goods and services are relatively equal in both countries.

But, you can take advantage of these same exchange rates, and make a profit, if you own a currency trading business. Foreign exchange trading involves buying and selling foreign currency to make money off an international foreign exchange market. Since the value of the world's currencies are constantly changing, the purpose of the business is to time the buying and selling of currencies, trading one against another, so that the company profits from currency swings with minimal losses (called "drawdown").

You may also be interested in additional home business ideas .

Ready to turn your business idea into a reality? We recommend forming an LLC as it is the most affordable way to protect your personal assets. You can do this yourself or with our trusted partner for a small fee. Northwest ($29 + State Fees) DIY: How to Start an LLC

Start a currency trading business by following these 10 steps:

- Plan your Currency Trading Business

- Form your Currency Trading Business into a Legal Entity

- Register your Currency Trading Business for Taxes

- Open a Business Bank Account & Credit Card

- Set up Accounting for your Currency Trading Business

- Get the Necessary Permits & Licenses for your Currency Trading Business

- Get Currency Trading Business Insurance

- Define your Currency Trading Business Brand

- Create your Currency Trading Business Website

- Set up your Business Phone System

We have put together this simple guide to starting your currency trading business. These steps will ensure that your new business is well planned out, registered properly and legally compliant.

Exploring your options? Check out other small business ideas .

STEP 1: Plan your business

A clear plan is essential for success as an entrepreneur. It will help you map out the specifics of your business and discover some unknowns. A few important topics to consider are:

What will you name your business?

- What are the startup and ongoing costs?

- Who is your target market?

How much can you charge customers?

Luckily we have done a lot of this research for you.

Choosing the right name is important and challenging. If you don’t already have a name in mind, visit our How to Name a Business guide or get help brainstorming a name with our Currency Trading Business Name Generator

If you operate a sole proprietorship , you might want to operate under a business name other than your own name. Visit our DBA guide to learn more.

When registering a business name , we recommend researching your business name by checking:

- Your state's business records

- Federal and state trademark records

- Social media platforms

- Web domain availability .

It's very important to secure your domain name before someone else does.

Find a Domain Now

Powered by godaddy.com, what are the costs involved in opening a currency trading business.

The costs for starting a currency trading business are minimal. All you need is a computer and access to a FOREX trading platform. Expect to pay between $500 and $2,500 for a computer. Higher end computers are sometimes necessary if you plan on doing high volume trading. In this case, your computer costs could exceed $5,000-$10,000.

What are the ongoing expenses for a currency trading business?

Ongoing expenses for a currency trading business include a fast internet connection and computer maintenance, including regular software upgrades. Even with these costs, you should pay no more than $1,000 per year. If you are a broker, your costs may exceed several thousand dollars per month in server costs, software maintenance and upgrades, and servicing traders who use your platform.

Who is the target market?

If you are running a currency trading business for yourself, you have no customers. If you grow into a broker or market-maker, your customers are other traders and sometimes other brokers.

How does a currency trading business make money?

Currency trading businesses make money from the rise in currencies they invest in. Specifically, traders hope that the price of the currency they just bought will rise relative to the one they just sold. If you are a broker, you charge other traders a fixed or variable spread commission for trading. Some companies act as "pass through" entities for large market-makers, and only charge a fraction of a pip commission so that their traders can pay a thin spread that is only usually offered to very large or institutional investors.

If you are brokering for other traders, you can charge between 0 and 4 pips per trade. Since this is a very competitive industry, if you charge higher than the average for brokers, make sure you offer value-added services for traders.

How much profit can a currency trading business make?

If you are trading currencies, your revenues can fluctuate depending on market conditions, but generally a trader will earn between $50,000 and $150,000 per year, gross. This means a company employing 5 traders can expect to gross up to $750,000 per year. However, very successful traders can earn much more.

A broker or market maker may earn between $500,000 and $10 million or more per year.

How can you make your business more profitable?

Create a platform that other traders want to use. This market is driven by low trading costs and fast execution service. These are the two areas you should spend most of your time improving. This business also has a reputation among some traders for shady broker practices. Being transparent with your customers and explaining your trading practices, avoiding slippage in your buy and sell orders, and not using markup to boost profits, are all things that will keep your customers coming back to you and thus increase long-term profits for your company.

Want a more guided approach? Access TRUiC's free Small Business Startup Guide - a step-by-step course for turning your business idea into reality. Get started today!

STEP 2: Form a legal entity

One crucial aspect that cannot be overlooked when starting your currency trading business is the importance of establishing a solid business foundation. While sole proprietorships and partnerships are the most common entity types for small businesses, they're a far less stable and advantageous option than LLCs.

This is because unincorporated business structures (i.e., sole proprietorships and partnerships) expose you as an owner to personal liability for your business's debts and legal actions, while LLCs protect you by keeping your personal assets separate from your business's liabilities.

In practice, this means that if your currency trading business were to face a lawsuit or incur any debts, your savings, home, and other personal assets could not be used to cover these costs. On top of this, forming your business as an LLC also helps it to appear more legitimate and trustworthy.

More than 84% of our readers opt to collaborate with a professional LLC formation service to kickstart their venture. We've negotiated a tailored discount for our readers, bringing the total down to just $29.

Form Your LLC Now

Note: If you're interested in more information before getting started, we recommend having a look at our state-specific How to Start an LLC guide (DIY) or our in-depth Best LLC Services review (for those opting for a professional service).

STEP 3: Register for taxes

You will need to register for a variety of state and federal taxes before you can open for business.

In order to register for taxes you will need to apply for an EIN. It's really easy and free!

You can acquire your EIN through the IRS website . If you would like to learn more about EINs, read our article, What is an EIN?

There are specific state taxes that might apply to your business. Learn more about state sales tax and franchise taxes in our state sales tax guides.

STEP 4: Open a business bank account & credit card

Using dedicated business banking and credit accounts is essential for personal asset protection.

When your personal and business accounts are mixed, your personal assets (your home, car, and other valuables) are at risk in the event your business is sued. In business law, this is referred to as piercing your corporate veil .

Open a business bank account

Besides being a requirement when applying for business loans, opening a business bank account:

- Separates your personal assets from your company's assets, which is necessary for personal asset protection.

- Makes accounting and tax filing easier.

Recommended: Read our Best Banks for Small Business review to find the best national bank or credit union.

Get a business credit card

Getting a business credit card helps you:

- Separate personal and business expenses by putting your business' expenses all in one place.

- Build your company's credit history , which can be useful to raise money later on.

Recommended: Apply for an easy approval business credit card from BILL and build your business credit quickly.

STEP 5: Set up business accounting

Recording your various expenses and sources of income is critical to understanding the financial performance of your business. Keeping accurate and detailed accounts also greatly simplifies your annual tax filing.

Make LLC accounting easy with our LLC Expenses Cheat Sheet.

STEP 6: Obtain necessary permits and licenses

Failure to acquire necessary permits and licenses can result in hefty fines, or even cause your business to be shut down.

State & Local Business Licensing Requirements

Certain state permits and licenses may be needed to operate a forex trading business. Learn more about licensing requirements in your state by visiting SBA’s reference to state licenses and permits .

Most businesses are required to collect sales tax on the goods or services they provide. To learn more about how sales tax will affect your business, read our article, Sales Tax for Small Businesses .

Services Contract

FOREX trading businesses should require clients to sign a services agreement before starting a new project. This agreement should clarify client expectations and minimize risk of legal disputes by setting out payment terms and conditions, service level expectations, and intellectual property ownership.

Informed Consent Agreement

It is recommended to provide clients with informed consent agreements to decrease legal liability and encourage transparency.

STEP 7: Get business insurance

Just as with licenses and permits, your business needs insurance in order to operate safely and lawfully. Business Insurance protects your company’s financial wellbeing in the event of a covered loss.

There are several types of insurance policies created for different types of businesses with different risks. If you’re unsure of the types of risks that your business may face, begin with General Liability Insurance . This is the most common coverage that small businesses need, so it’s a great place to start for your business.

Another notable insurance policy that many businesses need is Workers’ Compensation Insurance . If your business will have employees, it’s a good chance that your state will require you to carry Workers' Compensation Coverage.

FInd out what types of insurance your Currency Trading Business needs and how much it will cost you by reading our guide Business Insurance for Currency Trading Business.

STEP 8: Define your brand

Your brand is what your company stands for, as well as how your business is perceived by the public. A strong brand will help your business stand out from competitors.

If you aren't feeling confident about designing your small business logo, then check out our Design Guides for Beginners , we'll give you helpful tips and advice for creating the best unique logo for your business.

Recommended : Get a logo using Truic's free logo Generator no email or sign up required, or use a Premium Logo Maker .

If you already have a logo, you can also add it to a QR code with our Free QR Code Generator . Choose from 13 QR code types to create a code for your business cards and publications, or to help spread awareness for your new website.

How to promote & market a currency trading business

If you are promoting your services to other brokers, the best way to advertise is through FOREX forums, newsletters, and alternative investing websites and newsletters. You can also buy pay-per-click advertisements and run solo ads. The important thing to remember is FOREX and currency trading is an alternative investment for many people. So, advertise in places where your target market is likely to be hanging out.

How to keep customers coming back

Attracting and keeping customers is simple. This is a very competitive industry, so keep your spreads lower than your competition. Constantly check market rate spreads as they change periodically.

STEP 9: Create your business website

After defining your brand and creating your logo the next step is to create a website for your business .

While creating a website is an essential step, some may fear that it’s out of their reach because they don’t have any website-building experience. While this may have been a reasonable fear back in 2015, web technology has seen huge advancements in the past few years that makes the lives of small business owners much simpler.

Here are the main reasons why you shouldn’t delay building your website:

- All legitimate businesses have websites - full stop. The size or industry of your business does not matter when it comes to getting your business online.

- Social media accounts like Facebook pages or LinkedIn business profiles are not a replacement for a business website that you own.

- Website builder tools like the GoDaddy Website Builder have made creating a basic website extremely simple. You don’t need to hire a web developer or designer to create a website that you can be proud of.

Recommended : Get started today using our recommended website builder or check out our review of the Best Website Builders .

Other popular website builders are: WordPress , WIX , Weebly , Squarespace , and Shopify .

STEP 10: Set up your business phone system

Getting a phone set up for your business is one of the best ways to help keep your personal life and business life separate and private. That’s not the only benefit; it also helps you make your business more automated, gives your business legitimacy, and makes it easier for potential customers to find and contact you.

There are many services available to entrepreneurs who want to set up a business phone system. We’ve reviewed the top companies and rated them based on price, features, and ease of use. Check out our review of the Best Business Phone Systems 2023 to find the best phone service for your small business.

Recommended Business Phone Service: Phone.com

Phone.com is our top choice for small business phone numbers because of all the features it offers for small businesses and it's fair pricing.

Is this Business Right For You?

This business is ideal for individuals who love high-risk businesses. You must be willing to work long hours, be good with numbers, and be willing to learn about and understand various trading algorithms. You should also be passionate about world economies.

Want to know if you are cut out to be an entrepreneur?

Take our Entrepreneurship Quiz to find out!

Entrepreneurship Quiz

What happens during a typical day at a currency trading business?

A currency trading business starts early. Traders start trading currencies as soon as a market opens. The FOREX market technically does not close, since it is global. However, markets in one part of the world do close. It's just that, when they do, another market opens for business. So, currency trading companies can theoretically work 24/7.

The day starts with a basic analysis of the markets, which includes current news stories, trends in the market, and an analysis of the company's own capital and trading positions. Any open positions are checked and any closed positions are accounted for.

The company's trading managers and representatives set their initial buy-in prices and stop-losses. They also check and monitor their margin or leverage. Leverage is often used in currency trading because currency price fluctuations are generally small. Leverage of 50:1 or 100:1 is not uncommon. This means a trader can control or trade $100 for every $1 of the company's own capital.

What are some skills and experiences that will help you build a successful currency trading business?

You will need at least amateur-level knowledge of the currency markets. Working under a successful currency trader helps, but is not mandatory. There are no laws governing who can and cannot trade in the FOREX markets for business purposes. You will need proper licensing, however, if you want to become a broker or market-maker. You will also need cash reserves and a bond to guaranty your customers' funds.

What is the growth potential for a currency trading business?

Growth potential is unlimited. A currency trading company can be as small as one person or it can grow into a broker or market-maker, offering trading services to other people.

TRUiC's YouTube Channel

For fun informative videos about starting a business visit the TRUiC YouTube Channel or subscribe to view later.

Take the Next Step

Find a business mentor.

One of the greatest resources an entrepreneur can have is quality mentorship. As you start planning your business, connect with a free business resource near you to get the help you need.

Having a support network in place to turn to during tough times is a major factor of success for new business owners.

Learn from other business owners

Want to learn more about starting a business from entrepreneurs themselves? Visit Startup Savant’s startup founder series to gain entrepreneurial insights, lessons, and advice from founders themselves.

Resources to Help Women in Business

There are many resources out there specifically for women entrepreneurs. We’ve gathered necessary and useful information to help you succeed both professionally and personally:

If you’re a woman looking for some guidance in entrepreneurship, check out this great new series Women in Business created by the women of our partner Startup Savant.

What are some insider tips for jump starting a currency trading business?

Start with small lot sizes and keep sufficient cash reserves. Most traders only trade with 5%-10% of their total tradeable capital. They employ leverage to make significant gains.

How and when to build a team

Build a team only if you want to become a broker or market-maker in the industry. You will need a small team of professionals who are also skilled in currency trading, customer service, and web design. You should build out your team when you have enough money to do so. Most currency trading companies start small, as professional traders. Consider doing the same.

Useful Links

Industry opportunities, real world examples, further reading.

- Forex Trading Is A Business

- 10 Things You Should Know Before Starting A Forex Trading Career

- Top 10 Forex Broker And Platforms To Trade Online

Have a Question? Leave a Comment!

Find out about our latest product updates as well as trending topics in the business world

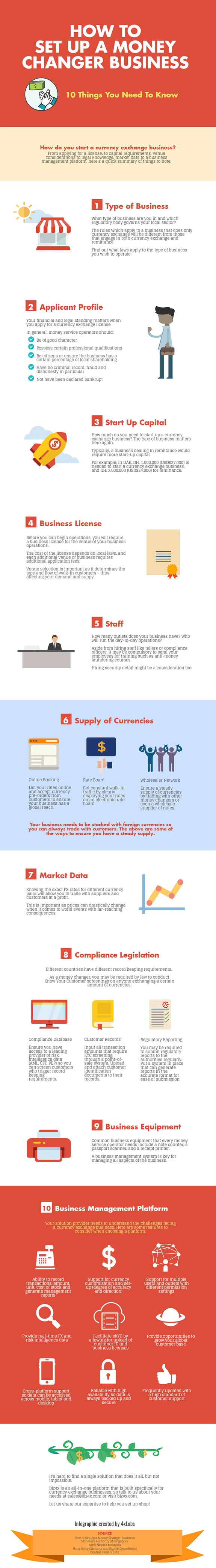

How to Set Up a Money Changer Business

Thinking about starting up a currency exchange business and uncertain about how to proceed? Not to worry, we’ve got you covered!

The key thing to note is that laws governing the set up of a currency exchange business differ from country to country and are constantly evolving due to the economic and global situation in the world today. Laws regulating money services businesses are generally concerned with two things: anti-money laundering and countering the financing of terrorism. While this article will not exhaustively go into the minute details of setting up a currency exchange business, it will outline the general considerations that one should have before starting a money changer or currency exchange business citing specific examples from a number of countries.

1. Type of Business

Who is the governing authority when it comes to the currency exchange sector in your country? In Singapore, it is the Monetary Authority of Singapore , in Malaysia it is Bank Negara Malaysia , in Hong Kong it is the Customs and Excise Department , and in UAE it is the Central Bank of the UAE . Going to the websites of these regulatory authorities will often yield detailed application forms, and legislations you should be familiar with before starting a currency exchange business.

Our white paper, The Changing Compliance Landscape for Money Changers - An Overview in 8 Jurisdictions has more info on this topic. The rules that govern your business will always depend on your type of business, for example, do you only do currency exchange, or are you involved in remittance? The types of business activities you are involved in will determine which set of rules the regulatory authority will apply to you.

1. Applicant Profile

Most regulatory bodies would mandate that the applicant is of a good financial and legal standing before granting them a license. In Singapore, you would need to be of a "good character" and 51% of equity needs to belong to Singapore citizens, among other stipulations.

In UAE, they refer to a successful applicant as being "of good conduct and behaviour" without any criminal background, and a clean financial record, with 60% shares owned by UAE nationals. In Hong Kong and Malaysia, only someone who is a "fit and proper person" will qualify.

Generally, someone who is involved in this line of business, should not have any criminal record related to dishonesty or fraud, needs to be of good financial standing, and must never have been declared bankrupt. Most, if not all countries, would have particular laws about citizenry and professional qualifications too.

Your citizenship and local ownership plays a large part here in determining whether or not your license application is successful.

3. Capital Requirement

As with all companies, to start a currency exchange business, you would require some start-up capital. In Singapore, the minimum capital requirement is S$100,000 (~USD$74,000) if you are going to be involved in remittance, while in the UAE, you would require DH. 1,000,000 (~ USD$27,000) for a currency exchange business, and DH. 2,000,000 (~ USD$54,000) if you were to engage in remittance activities. In Malaysia, start-up capital for a basic money changing and remittance businesses starts from 2,000,000 RM (~ USD$47,000), and goes up to 12,000,000 RM (~ USD$2.8 million) for wholesalers.

4. Business License

Before one can operate a currency exchange business, an application for a license, as well as a place of operations are needed. Successful application of a license depends on the ability to satisfy the above two criteria when it concerns the background of the applicant and the capital requirement as previously discussed. For Hong Kong, the validity period of a license will be 2 years, and applicants would have to pay a fee of HK$3,310 (~ USD $420) and HKD$2,220 (~ USD $280) for each additional business premise.

In Singapore, this is a new application fee of SGD$200 (~ USD $150), a first place of business for SGD$0 (~ USD$960) and an additional place of business for SGD$1,000 (~ USD$740) each. In the UAE, the period of validity for a license is 1 year, and additional places of business would require an increase in the earlier mention paid-up capital by 10%.

In Malaysia, the license would cost 500 RM, with the principal place of business being RM$500 (~ USD $120), additional branches being another RM$500, and a fee for a batch of money service business agents (max 20) that are attached to an office being RM$500. In Singapore and Malaysia, the granted license needs to be displayed prominently at the premises. For UAE, a notice advising customers of the need to obtain an official receipt, and that all rates need to be prominently displayed must be clearly exhibited.

The process of applying for a business license can be a lengthy process. Once again, the type of business, whether or not you are focused on currency exchange or remittance alone, or both, will determine what requirements need to be fulfilled in terms of security and compliance before a license is issued.

While you may not need a large number of staff for your currency exchange business when you first start out, you may eventually decide to hire as business grows. Such staff may include a teller to handle customer transactions and currency requests. In certain countries, it is also mandatory to appoint someone like a compliance officer.

Some countries such as the Philippines also require that you send staff working in currency exchange outlets for anti-money laundering training courses. Depending on the size of your operations and the local laws that govern your industry, you will not only need to hire, but also train staff members to take on these jobs.

6. Source of Funds

Aside from the initial start-up capital that is required, your bureau de change, money changer, currency exchange or foreign exchange houses would all need a source of foreign currency to be able to carry on with their daily operations. When it comes to the supply of foreign currencies, tourists or locals exchanging currencies with you might be a source, but this would not be a stable supply.

It is hard to predict the amount of walk-in traffic, as well as the type of currency they may want to sell for local dollars. Certainly, knowledge of the local market and state of tourism helps - perhaps seasonally you may get more tourists from a certain nationality, and thus have a greater supply of that currency. Location as well determines the types of customers (local, tourist, corporates), and supply of currency you will receive. For example in the city centre, you will see more tourists, versus the residential suburbs where currency exchange houses cater more to locals.

One possibility to increase your supply of foreign currency might be to profile your business online through a website, or a platform that helps you to list your rates on a global directory with booking capabilities, so customers from all over the world can lock in your live rates and pre-order currency from you.

Rate Board.

To get more walk-in traffic for a steady supply of currencies, it helps to display a rate board of your Buy / Sell rates so potential customers can quickly and easily refer to the information. In some countries, it is mandatory to display this information in an obvious and clear location. Instead of entering rates into separate systems, having one platform where you can set up currencies (normal, inverse, degree of accuracy in decimal places) and choose to display them in multiple places whether online or on a rate board would not just be convenient, but effective in attracting more customers.

Wholesaler Network.

Aside from customers however, you will certainly need a more stable and steady supply of currency by trading through your money changer networks, which might be other money changers like yourself or even a wholesale supplier of notes. Consider a platform that can facilitate this process by connecting you with these partners and allowing you to do eKYC - upload and share licenses and ID documents of customers and suppliers with relative ease.

Knowing when to replenish your stock of currencies for all your different outlets is important as well. Having a point-of-sale system that is able to track all customer transactions, stock, cost and price of currencies in all your outlets in real time will allow you to keep tabs on the amount of stock of foreign currencies at all times, so you know when you are in short supply or have an excess of a certain type of currency. This would allow you to transfer currencies between outlets, or reach out to other suppliers and wholesalers before you are short of a particular currency. As such, your point-of-sale system should allow you to generate stock, transactions as well as profit and loss reports, for all or individual currency exchange outlets, whether daily or across a time period that you can define.

7. Market Data

The purpose of all businesses is to make a profit so you can make a living. Aside from having a POS system that tracks all transactions, stocks, profits and losses, you also need access to live market data to help you make the pricing decisions that can make or break your business.

FX Rates. Knowing the exact FX rates for different currency pairs will allow you to trade with suppliers and customers at a profit, especially when prices can drastically increase or fall when it comes to world events with far-reaching consequences such as Brexit, or surprise election results in different parts of the world. In the event where you do not have access to such live rates, you may find yourself trading at a loss if caught off guard. Choose a platform that can provide you with Bid, Ask, Open, High, Low prices for the currency pairs you are tracking, in multi-table format for easy comparison, which is updated in real time.

8. Compliance Legislation

As a money service business, you need to conduct Know Your Customer checks on anyone that is exchanging a large sum of currencies. Different countries have different record keeping requirements. In Singapore, it is SGD$5,000 (~ USD$3,675), in Malaysia it is MYR$3,000 (~ USD$700), in Hong Kong it is HKD$8,000 (~ USD$1,023), and in UAE it is AED$2,000 (~ USD$545). Any customers who request to exchange this amount or more would be subject to KYC background checks, and money service operators would have to obtain a copy of their identification documents. In general, a risk weighted approach is favoured by the authorities, where money changers, while subject to certain rules, also need to assess the risk of dealing with each customer accordingly. For example, a customer may be exchanging a sum of money under the record keeping trigger amount, but if that customer is repeatedly changing amounts frequently that culminate in a large sum, or for currencies that are linked to conflict zones, the money service operators might need to be more diligent about KYC screening.

Customer Records.

A point-of-sale system that allows you to create a customer record and upload soft copies of IDs would greatly facilitate record keeping especially when it concerns performing necessary KYC checks. This is especially so if they are regular customers or even corporate entities. A good platform would also allow for the grouping of customers, based on their behaviour, demographic or other similar factors. Suspicious transactions and individuals can thus be grey or black listed, so money service operators can monitor these customers more closely when they request for currency exchange services. Such a system would make it easy for you to flag any suspicious transactions for regulatory authorities, so as not to get into trouble when it comes to preventing money laundering or terrorist financing.

Compliance.

How would a money changer do their due diligence then? Simply running a Google search is hardly enough - it puts your business at great risk. Regulatory authorities sometimes recommend certain data providers for their compliance database or risk management solutions. Some of these include Thomson Reuters, Dow Jones and Lexis-Nexis. These data providers have world-leading risk intelligence databases that are updated daily with global data when it comes individuals or corporates that have been grey or black listed for anti-money laundering, terrorist financing, or placed on watch lists for being politically exposed individuals. For example, Thomson Reuters has a global database of more than 3 million results with 100,000 different sources. It includes lists from 240 countries in 60 languages from every category of crime such as Anti-Money Laundering (AML), Counter the Financing of Terrorism (CFT) and Politically Exposed Persons (PEP) lists, as well as the Specially Designated Nationals, Blocked Persons (SDN) and US Office of Foreign Assets Control (US OFAC) lists. Money changers using a solution that provides them with access to such compliance data can quickly and easily screen customers against such a compliance database, as well as print or file these results, so that they can prove they have done their due diligence in the event of an audit.

Regulatory Reporting.

Often, regulatory authorities mandate that currency exchange businesses submit reports to them in a certain format. Rather than filling out forms yourself, you might want to have a system in place that can automatically generate these country specific-reports for you. In Singapore, this would be the MA03 report and in Malaysia, it would include the MSB03 and MSB4A reports. Having such a system would make it a breeze for you to submit these reports.

9. Business Equipment

As a currency exchange business, you will require certain equipment for your daily operations. Common physical business equipment that every money service operator possesses include a note counter, a passport scanner, and a receipt printer. A platform that is built specifically to meet the needs of currency exchange businesses will also be a key asset in streamlining your business operations.

10. Business Management Platform

While you may be familiar with the laws governing currency exchange businesses when you first apply for a license, world events can lead to rapid changes in legislation that regulates your business. Being on top of such changes is important, hence it's crucial to ensure that your solution provider understands the challenges and changing requirements due to new laws that your business may be subjected to.

Frequency of Updates.

How often is your choice of platform updated? Two weeks, a year or never? Is it a deployed solution or a web-based solution that can be frequently upgraded? A platform that has regular product updates and new releases is critical to ensuring that your business is constantly leveraging the latest that technology has to offer. It can also mean that your solutions provider is constantly innovating and staying up-to-date with local legislation so you have a platform that is fully equipped to deal with modern day challenges.

Customer Support.

Just having a frequently updated platform might not be enough though. Being able to turn to a resource when you need to troubleshoot issues, or learn how a new feature works is essential when choosing a platform for your business. Does your solution provider offer documentation, in-person, email, chat and phone support? Are they only available during working hours or do they offer 24/7 support as well? It is useful to understand these things, and clarify the Service Level Agreement before subscribing to any platform or service.

High Availability.

In the event of a power outage, will your data be safely backed-up for restoration later? Reliability is important, and making sure you have a system that you can depend on at all times is critical. Ensure that your solutions provider whether on-premise or cloud-based, has multiple dependable data centers, with redundant power across multiple regions, so you can rest assured that your data will always be safe and secure. Aside from high availability, having a platform that encrypts your data would be ideal for the security of your business as well.

Multi-Platform Support.

How many ways can you access your data? Is it only available through log in on a desktop, or can you also access your data on the go through mobile devices like your tablet and your handphone? While it might be difficult to access the full feature set on mobile devices, having access to some of your data, so that you have a broad overview and insight to how your business is doing, even when you are traveling would be useful. Cross-platform support would thus be an ideal feature for your currency exchange platform to have.

Multi-Outlet Management.

While it might be fine when you are just starting out in your money changing business to have a platform that only supports data for a single currency exchange outlet, you may find that a problem as business continues to grow and you open up more foreign exchange houses in different locations. A myriad of factors goes into pricing decisions for different currency exchange outlets, hence you would want to keep data and pricing information about your stock of currencies, as well as expenses separate from the other business locations that you own. At the same time, you would still require a system that allows you to not just oversee business activities in one outlet, but across multiple outlets as well, by generating management reports that give you a holistic view on how all your outlets are doing.

Multi-User Support.

With multiple outlets, comes the need for multi-user support as well. How many registered users can your platform of choice support? How many users can sign in at the same time using a single log in? These and more are questions that need to be answered by your solutions provider. Different employees play different roles in your business, hence the currency exchange platform that you choose needs to support the customisation of permissions. A teller might only be able to access the transactions input dashboard, while a compliance officer might only be granted access to the risk management database and certain compliance reports. An administrator should be able to access all features as well as assign different users to different roles.

User-friendly.

Is your currency exchange platform of choice easy to use and does it have all the features you need in an accessible dashboard? Having an all-in-platform allows you manage the multiple facets of your business all through a single console, be it business management, live rates, compliance data, customer acquisition or more.

In summary, when it comes to setting up a money changer or currency exchange business, there are a number of prerequisites that need to be met before one is able to obtain a license - these criteria tend to trend along similar lines in many countries from start-up capital to an applicant's background. Aside from this however, having a successful currency exchange may also depend on one's choice of business management platform. In summary, a good platform needs to have the following features:

- - Support set-up and customisation of currencies and rates be it in different directions (normal or inverse), degree of accuracy etc.

- - Support multiple users, concurrent logins and multiple outlets, as well as track every transaction that is recorded and all activity and adjustments to stock or currency price made by these users.

- - Record separate cost/buy/sell prices, amount and unit of stock when it comes to foreign currencies for individual outlets, as well as when, why and who updated the information

- - Facilitate eKYC by recording customer name and details, allow for uploading of ID documents, that can be easily accessed and assigned to recorded transactions

- - Necessitate compliance checks every time a customer exchanges more than a required record keeping amount

- - Generate daily transaction reports showing customer and outlet details, stock and profit/loss reports for individual or all outlets

- - Provide different permission levels for different employees

- - Provide some regulatory reporting for the market you are operating in

- - Provide real-time FX rates for pricing and trading decision

- - Provide a compliance database with constantly updated data so you can screen customers against AML, CFT, PEP and other international sanctions list.

- - Provide opportunities for acquiring new customers be it posting rates online or offline, or accepting currency booking requests

It's hard to find a single solution that does it all, but not impossible. Biz4x is an all-in-one platform that is built specifically for currency exchange businesses, so talk to us about your needs and let us know how we can help you in setting up a currency exchange business. Reach out to us at [email protected] and start a free trial!

Join Biz4x to start growing your business

Sign up for a free trial today.

- Mobile wallet

- Money transfer

- Payment acceptance

- Currency exchange

- Business ledger

- Ewallet development

- P2P payment app development

- Fintech software development

- Enterprises

- Payment Solution Provider (MENA)

- Digital wallet for MPAY

- Mobile money processing for Paywell

- Knowledge base

How to Start a Currency Exchange Business: Tips and Tricks to Succeed

Whether you have experience traveling internationally, you’re probably familiar with the impact of exchange rates on your budget. For example, if you exchange a currency and receive only 0.70 pounds for 1 dollar, it means that you’re effectively “trading down” the value of your money.

By buying low and selling high, charging a commission, and acting as intermediaries for large market-makers, businesses take advantage of exchange rates and establish successful businesses. In this article, we will provide you with the tools and the knowledge you need to thrive in this competitive industry.

Key takeaways

- An exchange rate is a rate at which one currency is exchanged for another currency.

- The foreign exchange market share is projected to experience significant growth.

- Starting a currency exchange business involves compliance with various legal and regulatory requirements, that may vary depending on your location.

Table of contents

Understanding the currency exchange market

Before delving into the complexity of starting a currency exchange business, it’s important to have a solid understanding of the currency exchange market.

What is the forex market?

The foreign exchange market, also known as Forex, is the largest and most liquid financial market in the world. It involves the buying and selling of various currencies with the aim of making a profit from exchange rate movements. Currency pairs are the foundation of the currency exchange market. For example, the EUR/USD pair represents the exchange rate between the Euro and the US Dollar.

Currency exchange software

Get a powerful foundation for your foreign exchange business

What are the functions of currency trading?

Many countries and central banks hold foreign currencies as international reserves, which can facilitate international trade. Some countries buy and sell foreign currencies to maintain a certain exchange rate. It’s also worth noting that some countries have been accused of manipulating exchange rates to make their exports more attractive.

The currency exchange market statistics

The foreign exchange market share is projected to experience significant growth. As per research , the Forex market can reach USD 1127.03 by 2028, exhibiting a GAGR of 7.62% during the forecast period.

Source: Business Research Insights

This growth is expected to continue as the global economy becomes more interconnected and the demand for currency exchange services remains strong.

Market movements or fluctuations play an important role in currency exchange. Exchange rates are constantly changing due to various factors such as interest rates, inflation, political stability, and economic performance. These factors can give currency traders the opportunity to buy currencies at a lower rate and sell them at a higher rate to make a profit. However, it’s important to keep in mind that currency exchange involves risks, and it’s important to develop a reliable currency exchange system to protect your business from potential losses.

Benefits of starting a currency exchange business

Starting a currency exchange business can offer several benefits. Here are some key advantages:

- Lucrative market

Currency exchange is a vital service in international trade and travel, making it a potentially profitable business. As people travel abroad or engage in global transactions, they require local currency, and currency exchange businesses provide a convenient and reliable solution.

- High demand

With globalization and increased international travel, the demand for currency exchange services remains consistently high. Regardless of economic conditions, people need to convert their money into different currencies, creating a steady stream of customers.

- Stable income

Currency exchange businesses generate revenue through the spread between buying and selling rates. This provides a stable income stream since the business earns a profit on each transaction. Even during economic downturns, currency exchange remains essential, making it a relatively resilient industry.

Develop your own neobank

Flexible and scalable ledger layer platform to build a digital retail bank on top of it.

- Scalability and growth potential

Currency exchange businesses have the potential for expansion and growth. You can establish multiple branches in different locations, tapping into various markets and catering to a broader customer base. As your business reputation and customer trust grow, you can attract more clients and increase your profitability.

- Diversification opportunities

Currency exchange businesses often offer additional services, such as international money transfers, traveler’s checks, and prepaid travel cards. By diversifying your range of services, you can cater to a wider customer base and generate additional revenue streams.

- International connections

Operating a currency exchange business provides opportunities for networking and building connections with other businesses involved in international trade and travel. These connections can lead to partnerships and collaborations, further enhancing your business prospects.

Steps to starting your own currency exchange business

Now that you have a solid understanding of the currency exchange market and the benefits of starting a currency exchange business, let’s explore the step-by-step process of setting up your own venture.

Research and analysis for your currency exchange business

The first step in starting a currency exchange business is conducting thorough research and analysis. This stage is crucial for gaining insights into the Forex market, understanding your target customers, and identifying potential competitors. Here are a few key aspects to consider during this phase:

Market analysis

Analyze the currency exchange market in your target location. Identify the demand for currency exchange services, the existing competition, and any gaps in the market that you can capitalize on.

Customer research

Understand the needs and preferences of your target customers. Determine the types of customers you want to cater to, such as tourists, international businesses, or individuals sending money abroad.

Financial analysis

Conduct a financial analysis to determine the initial investment required, projected revenue, and potential profitability of your currency exchange business. This analysis will help you create a solid business plan and secure funding if necessary.

Mobile wallet Platform

Get a flexible backend mobile payment solution

Legal and regulatory requirements for a currency exchange business

Starting a currency exchange business involves compliance with various legal and regulatory requirements. These requirements may vary depending on your location, so it’s important to consult legal professionals or regulatory authorities to ensure you meet all the necessary obligations. Find below some common legal and regulatory aspects to consider.

Forex regulations in the EU

In the European Union (EU), forex regulations are primarily governed by the Markets in Financial Instruments Directive (MiFID) and its subsequent revisions, such as MiFID II.

MiFID II is a comprehensive regulatory framework that applies to investment firms and trading venues operating in the EU. It aims to enhance transparency, investor protection, and market integrity. MiFID II covers various financial instruments, including forex.

Currency exchange regulations in the United Kingdom

The Financial Conduct Authority ( FCA ) is the regulatory body responsible for overseeing financial markets and firms in the United Kingdom. This includes banks, insurance companies, investment firms, asset managers, and other financial institutions.

Firms need to meet specific regulatory requirements, such as maintaining appropriate levels of capital, adhering to conduct standards, and providing adequate consumer protection.

Currency exchange regulations in the USA

Currency exchange regulations in the United States are primarily governed by the federal government through various agencies, including the Financial Crimes Enforcement Network (FinCEN) and the Office of the Comptroller of the Currency (OCC).

There is also the BSA, a federal law that establishes requirements for financial institutions, including currency exchange businesses, that are used to prevent money laundering and other financial crimes.

Currency exchange regulations in the Kingdom of Saudi Arabia

The CMA ( Capital Market Authority ) is the government body that regulates the Saudi capital market. By the way, the CMA, along with the Ministry of Interior, Ministry of Culture and Information, Ministry of Commerce and Investment, and The Saudi Arabian Monetary Authority (SAMA), have established a committee to monitor the currency exchange activities in the country.

Forex regulations in the MENA region

To start a currency exchange business in this region, you need to know Sharia, its principles, and the fundamental religious concept of Islam, which provides guidance on religious obligations, social interactions, economic practices, and ethical conduct.

All business and financial contracts in Islamic finance must conform to Shari’a rules . Basic prohibitions in Islamic finance are:

- Interest or riba

Sharia finance forbids loans and investments that charge or pay interest (riba), so individuals looking for Islamic Forex brokers want interest-free options.

- Excessive risk or gharar

Islamic finance discourages excessive uncertainty or speculation (gharar) in transactions. Contracts must be clear, transparent, and based on tangible underlying assets.

- Speculation or gam bling

Sharia-compliant finance avoids involvement in gambling, alcohol, pork, that are considered forbidden in Islam, and other things considered unethical or harmful.

In order to ensure that financial mechanisms and transactions are in accordance with Shari’a, they must be approved by Shari’a Supervisory Boards (SSB). The SSB seal of approval is obligatory to ensure that financial instruments and transactions comply with Shari’a principles.

Despite the regulations for currency exchange businesses vary from country to country, there are several key regulations that tend to be applicable in most jurisdictions. For example, Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations

As a business owner, you need to provide robust AML and KYC policies and procedures to prevent money laundering and comply with regulatory guidelines. Implement customer identification and verification processes to ensure transparency in your currency exchange operations.

Determine exchange rates and set up a tracking system

Determining exchange rates and setting up a tracking system are essential tasks for managing a currency exchange business.

Determine exchange rates

- Monitor market trends. Stay updated on currency exchange rate fluctuations by monitoring financial news, economic indicators, and market trends. Factors like interest rates, geopolitical events, and economic data can impact exchange rates.

- Use reliable data sources. Utilize reputable financial data sources, such as financial news websites, central bank websites, or currency exchange rate providers, to obtain accurate and real-time exchange rate information.

Set up a tracking system

- Record transactions. Develop a standardized process to record each transaction, including the amount and type of currency exchanged, the exchange rate used, and any associated fees or commissions.

- Use financial reports. Utilize financial reports generated by your tracking system to assess revenue, expenses, profit margins, and other key performance indicators. This will help you identify areas for improvement and make informed decisions to optimize your business operations.

- Conduct regular audits. Perform periodic audits to reconcile currency inventory, transactions, and financial records to ensure accuracy and detect any discrepancies or irregularities.

By actively monitoring exchange rates and implementing a robust tracking system, you can effectively manage your currency exchange business, optimize profitability, and provide competitive rates to your customers.

Find a technology solution provider for a currency exchange business

When it comes to acquiring a technology solution for a foreign exchange business, there are two primary approaches that should be considered.

The first is to develop a software solution from scratch, which is a time-consuming and expensive process.

The second approach is to find a technology solution provider that offers a pre-built solution that can be customized to meet the specific needs of the business.

SDK.finance offers robust payment software for building a currency exchange system on top. Our currency exchange solution can help you streamline operations, reduce costs, speed time to market, and compete in a competitive marketplace.

Key features of SDK.finance currency exchange software

SDK.finance currency exchange software offers a range of key features that facilitate efficient and secure currency exchange operations:

- Real-time exchange rates

- Transaction management

- Compliance and security

- Effective transaction accounting

- Customer relationship management (CRM) tools

After authorization, you have the ability to create any system currencies -real or any objects which you are going to count in your mobile wallet platform like points, coins, bonuses etc. To begin, you must first create an issuer, which will result in the generation of an ID utilized in scenarios where currency specification is necessary.

Watch our demo video of the SDK.finance Platform to explore how manage currencies and digital assets, configure exchange rates, monitor system accounts within one system. The SDK.finance Platform is a FinTech multitool helping businesses of all sizes launch their financial and payment products in record time:

Starting a foreign currency exchange business can be a complex process, but with careful planning and execution, it can be a profitable venture. By understanding the currency exchange market, conducting thorough research, and complying with legal requirements, you can set a strong foundation for your business.

You can start developing a currency exchange business from scratch or use a software provider to speed up the launch process. With the SDK.finance real-time transaction currency exchange software you can start a currency exchange business faster and give your customers access to up-to-date financial information.

What is money exchange system?

Banks, hotels, and resorts may also provide currency-changing services. Currency exchanges make money by charging a nominal fee and through the bid-ask spread in a currency.

What are the two main functions of the foreign exchange market?

The basic function of the foreign exchange market is to transfer purchasing power between countries, i.e., to facilitate the conversion of one currency into another. The transfer function is performed through the credit instruments like, foreign bills of exchange, bank draft and telephonic transfers.

What is the Forex market?

The foreign exchange market, also known as Forex, is the largest and most liquid financial market in the world. It involves the buying and selling of various currencies with the aim of making a profit from exchange rate movements.

How does a currency trading business make money?

Forex trading companies make money from the rise of currencies they invest in. Specifically, traders hope that the price of the currency they just bought will rise relative to the currency they just sold. As a broker, you charge other traders a fixed or variable spread commission for trading. Some firms act as "pass-through" entities for large market makers and charge only a fraction of a pip commission, allowing their traders to pay a small spread that is normally only offered to very large or institutional investors.

Ready to get started? Talk to our experts!

By pressing “Send” button you confirm that you have read and accept our Privacy Policy and Terms & Conditions

You may also like

Privacy overview.

Get instant access to detailed competitive research, SWOT analysis, buyer personas, growth opportunities and more for any product or business at the push of a button, so that you can focus more on strategy and execution.

Table of contents, step-by-step guide to launching a currency exchange business.

- 16 April, 2024

Understanding Currency Exchange Business

Before diving into the process of starting a currency exchange business, it’s essential to understand the importance of currency exchange and conduct a thorough market analysis.

Importance of Currency Exchange

The foreign exchange market, also known as Forex, is the largest and most liquid financial market in the world. It plays a crucial role in international trade and travel, facilitating the exchange of various currencies ( SDK.finance ). Currency exchange businesses provide a vital service by allowing individuals and businesses to convert one currency into another for various purposes such as travel, commerce, and investments.

Starting a currency exchange business can offer several benefits. Firstly, it provides an opportunity to generate revenue through the spread between buying and selling rates. This means that the business earns a profit on each transaction, creating a stable income stream ( SDK.finance ). Additionally, running a currency exchange business allows for networking and building connections within the financial industry.

Market Analysis for Currency Exchange

Conducting a comprehensive market analysis is essential for understanding the current landscape of the currency exchange industry. It helps identify potential competitors, target market segments, and market trends. Additionally, a market analysis provides valuable insights into the demand for currency exchange services and the potential growth opportunities.

Researching the market size and forecasted growth can provide valuable information for business planning. According to forecasts, the foreign exchange market share is projected to experience significant growth, reaching USD 1127.03 billion by 2028, with a compound annual growth rate (CAGR) of 7.62% during the forecast period ( Source ). This indicates that the currency exchange industry presents a promising opportunity for entrepreneurs.

Furthermore, it is important to analyze the services offered by competitors and identify any gaps or areas for differentiation. Currency exchange businesses often offer additional services, such as international money transfers, traveler’s checks, and prepaid travel cards, to cater to a wider customer base and generate additional revenue streams ( SDK.finance ). Understanding the competitive landscape and market trends will help you formulate a solid business plan and develop strategies to stand out in the market.

By understanding the importance of currency exchange and conducting a thorough market analysis, you can position your currency exchange business for success. The next steps involve addressing legal and regulatory requirements, setting up your business, considering operational aspects, and implementing effective marketing and growth strategies. For more information on these topics, be sure to explore the relevant sections of this article.

Legal and Regulatory Requirements

When starting a currency exchange business, there are important legal and regulatory requirements that must be met to ensure compliance and operate the business smoothly. This section will cover two key aspects: licensing for currency exchange and compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

Licensing for Currency Exchange

Obtaining a currency exchange license is a crucial step in starting a currency exchange business. In the United States, a currency exchange license is required by state and federal law for any business providing check-cashing services for a fee that is not a bank. This license ensures that the business meets the necessary regulatory standards and operates legally. The specific requirements for obtaining a currency exchange license may vary by state, so it’s important to check with the city’s business licenses, permits, and tax department to understand the requirements in your area ( CorpNet ).

In addition to the currency exchange license, certain businesses that offer services beyond check cashing, such as auto registration and transfers, credit card cash advance, bill pay, wire transfers, photocopies, and prepaid phone cards, may require additional types of business licenses to sell those services or products. It is crucial to be aware of all the requirements and ensure compliance with the necessary regulations ( CorpNet ).

It is important to note that the currency exchange license requires annual renewal. To maintain compliance, it is essential to stay aware of the renewal dates and promptly submit the renewal form to avoid any lapse in licensing. Having a valid license showcases compliance with federal and state regulations for safety, cleanliness, and honesty, which helps establish trust with customers and enhances the credibility and reliability of the currency exchange business ( CorpNet ).

Compliance with AML and KYC Regulations

As a currency exchange business, it is crucial to comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These regulations are put in place to prevent money laundering, terrorist financing, and other illicit activities. Compliance with AML and KYC regulations is essential to ensure the integrity of the financial system and protect against potential risks.

To comply with AML and KYC regulations, currency exchange businesses need to take several steps. This includes obtaining a license from the appropriate regulatory authority, such as the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) in Canada, registering with provincial regulatory authorities, and obtaining any necessary business licenses or permits. The specific requirements may vary depending on the country or region where the currency exchange business is located. It is important to research and understand the regulations specific to your jurisdiction to ensure compliance ( Quora ).

By adhering to AML and KYC regulations, currency exchange businesses contribute to the global effort of combating financial crimes. It helps maintain the credibility and trustworthiness of the business while safeguarding the financial system.

Understanding and fulfilling the legal and regulatory requirements for a currency exchange business is vital to establish a solid foundation for your business operations. In addition to licensing and compliance with AML and KYC regulations, it is essential to develop a comprehensive currency exchange business plan , secure funding, choose the right location, and consider operational considerations as outlined in other sections of this article. Proper planning and adherence to regulations will set you on the path to building a successful and profitable currency exchange business.

Setting Up Your Business

When starting a currency exchange business, several key steps need to be taken to ensure a successful launch. This section will guide you through the process of developing a business plan, funding your currency exchange business, and choosing the right location.

Developing a Business Plan

Before diving into any business venture, it’s essential to develop a comprehensive business plan . This document serves as a roadmap for your currency exchange business, outlining your goals, strategies, and financial projections. A well-crafted business plan will help you secure funding, make informed decisions, and stay on track as your business grows.

Your business plan should include a thorough market analysis, identifying your target customers, competitors, and industry trends. Understanding the market dynamics will allow you to position your currency exchange business effectively and develop strategies to gain a competitive edge. Consider factors such as market demand, customer preferences, and potential partnerships to strengthen your business model.

Funding Your Currency Exchange Business

Securing adequate funding is crucial for starting and operating your currency exchange business. Depending on the scale of your operations, you may need funds for licensing fees, rent, equipment, staffing, marketing, and initial cash reserves. There are several options available to fund your currency exchange business:

Personal Savings: Utilize your personal savings to provide initial capital for your business. This option gives you full control and avoids the need to pay interest or share profits with external investors.

Business Loans: Explore loans from financial institutions that specialize in small business funding. Presenting a well-prepared business plan and demonstrating your understanding of the currency exchange industry will increase your chances of securing a loan.

Investors: Consider seeking investors who are interested in supporting your currency exchange business. Prepare a compelling pitch that highlights the potential profitability and growth prospects of your venture. Investors can provide not only financial backing but also valuable industry expertise and connections.

Grants and Government Programs: Research grants and government programs that support small businesses in the financial sector. These programs often provide funding or resources for entrepreneurs starting businesses in specific industries or target demographics.

Remember to carefully plan your financial needs and consider the long-term sustainability of your currency exchange business when determining the funding sources that work best for you.

Choosing the Right Location

Selecting the right location for your currency exchange business is a critical decision that can significantly impact its success. Factors to consider when choosing a location include:

Market proximity: Your business location should be easily accessible to your target market. Analyze the demographics and characteristics of your customer base to identify areas where your currency exchange services will be in high demand. According to Epos Now , 93% of consumers travel 20 minutes or less for everyday purchases, so positioning your business in close proximity to your target market is essential.

Competition: Research existing currency exchange businesses in your desired location. Assess their services, pricing, and customer base to determine if there is room for your business to thrive. Differentiating yourself from competitors through exceptional service or unique offerings can give you a competitive advantage.

Operating costs: Evaluate the costs associated with running your currency exchange business in different locations. Consider factors such as rent, utilities, taxes, and any additional fees or permits required. Balancing cost considerations with the potential revenue generation is crucial for long-term profitability.

Visibility and foot traffic: Choose a location that provides high visibility and attracts significant foot traffic. A well-positioned currency exchange business can benefit from spontaneous walk-in customers who may require immediate currency exchange services.

Security: Ensure that your chosen location offers a safe and secure environment for both your business and customers. This is particularly important when dealing with valuable currencies.

For more detailed guidance on choosing the right location for your currency exchange business, refer to our article on currency exchange business requirements .

By developing a business plan, securing funding, and carefully selecting the right location, you are setting a solid foundation for your currency exchange business. These steps will help you establish a clear vision, obtain the necessary resources, and position your business for long-term success in the competitive currency exchange industry.

Operational Considerations

When starting a currency exchange business, there are several operational considerations that need to be taken into account to ensure smooth and secure operations. These considerations include equipment and software needs, staffing and training, as well as transaction procedures and security.

Equipment and Software Needs

To run a currency exchange business efficiently, appropriate equipment and software are essential. This may include:

- Currency counting machines to accurately count and verify banknotes.

- Secure storage systems to safeguard cash and prevent unauthorized access.

- Computer systems equipped with currency exchange software to manage transactions, track exchange rates, and generate reports.

- Reliable internet connectivity for online transactions and real-time exchange rate updates.

Investing in high-quality equipment and software ensures accurate and efficient currency exchange operations, enhancing customer satisfaction and reducing the chances of errors. For more information on setting up a currency exchange business, refer to our article on how to set up a currency exchange business .

Staffing and Training

Staffing plays a crucial role in the success of a currency exchange business. Hiring knowledgeable and trustworthy employees who are familiar with currency exchange procedures and regulations is essential. These employees should possess strong mathematical skills, attention to detail, and excellent customer service abilities.

Providing comprehensive training to your staff is vital to ensure they understand the currency exchange processes, compliance requirements, and transaction procedures. Training should cover areas such as verifying customer identities, handling different currencies, calculating exchange rates, and following anti-money laundering (AML) and know your customer (KYC) regulations. By investing in proper training, you can ensure that your staff is equipped to handle transactions efficiently and provide excellent customer service.

For additional information on the legal and regulatory requirements of a currency exchange business, refer to our article on currency exchange business requirements .

Transaction Procedures and Security

Establishing well-defined transaction procedures and implementing robust security measures are critical for the success and trustworthiness of your currency exchange business. This includes:

- Verifying the identity of customers through proper identification documents and following KYC regulations.

- Monitoring transactions for suspicious activities, such as large transactions or frequent exchanges, as part of AML compliance.

- Reporting any suspicious transactions to the relevant authorities.

- Implementing secure payment gateways and encryption technologies to protect customer information and funds.

- Regularly updating software and security systems to address potential vulnerabilities and prevent data breaches.

By prioritizing transaction security and following regulatory guidelines, you can build a reputation for your currency exchange business as a trusted and reliable service provider.

As you navigate the operational considerations of your currency exchange business, it is crucial to stay informed about industry best practices, technological advancements, and regulatory changes. Adapting to evolving market demands and maintaining a strong focus on operational efficiency and security will contribute to the long-term success of your currency exchange business.

Marketing and Growth Strategies

To ensure the success and profitability of your currency exchange business, it’s crucial to implement effective marketing and growth strategies. This section will explore three key strategies: attracting customers online, offering additional services, and expanding your business.

Attracting Customers Online

In today’s digital age, having a strong online presence is essential for attracting customers to your currency exchange business. Here are some effective ways to reach your target audience online:

Build an online community: Establish a presence on social media platforms and engage with your target audience through regular updates, informative content, and responding to customer inquiries. Consider creating a blog where you can share insights and tips related to currency exchange. Building a community can help establish your business as a trusted authority in the industry ( Quora ).

Advertising: Consider online advertising to increase your visibility and attract potential customers. Options include search engine marketing (SEM) and social media advertising. While advertising may involve some costs, it can be an effective way to reach a wider audience and generate leads. However, make sure to carefully plan your advertising strategy and target your ads to the right audience to maximize your return on investment.

Referral programs: Encourage satisfied customers to refer your currency exchange business to their friends and family. Offer incentives, such as referral bonuses or discounts, to motivate them to spread the word about your services. Word-of-mouth recommendations can be powerful in attracting new customers.

Additional Services Offered

To cater to a wider customer base and generate additional revenue streams, consider offering additional services alongside currency exchange. Some common additional services offered by currency exchange businesses include:

International money transfers: Provide a convenient and secure platform for customers to transfer money internationally. Partnering with established payment providers or developing your own transfer system can help you offer competitive rates and attract customers who require international remittance services.

Traveler’s checks: Offer traveler’s checks, which provide a safe and convenient alternative to carrying large amounts of cash while traveling. Ensure your business has the necessary infrastructure and partnerships to issue and redeem traveler’s checks.

Prepaid travel cards: Provide prepaid travel cards that allow customers to load multiple currencies onto a single card. These cards offer convenience and security for travelers, as well as the ability to lock in favorable exchange rates.

By diversifying your services, you can attract a broader range of customers and increase your revenue potential. However, it’s important to thoroughly research and understand the regulatory requirements and operational considerations associated with each additional service.

Expanding Your Business

Once your currency exchange business is established and thriving, you may consider expanding your operations to reach a larger market. Here are some strategies for business expansion:

Opening additional branches: Identify high-demand areas and consider opening new branches in those locations. Conduct thorough market research to assess the potential demand and competition in each target area.

Online presence: Expand your reach by offering online currency exchange services. Develop a user-friendly and secure online platform where customers can conveniently exchange currencies and access additional services.

Partnerships: Explore partnerships with other businesses in the travel and finance industries. Collaborating with airlines, hotels, and travel agencies can help you tap into their customer base and increase your brand exposure.

Franchising: If you have a successful business model and brand, franchising can be a viable option for expanding your currency exchange business. Franchising allows you to leverage the entrepreneurial spirit and resources of franchisees to establish new locations.

Expanding your business requires careful planning, financial resources, and a thorough understanding of the target market. Conduct a comprehensive analysis of the potential risks and rewards before embarking on any expansion strategy.

By implementing effective marketing strategies, offering additional services, and considering expansion opportunities, you can position your currency exchange business for long-term growth and profitability. Regularly assess market trends and customer needs to stay ahead of the competition and adapt your strategies accordingly.

Financial Planning and Costs

When starting a currency exchange business, careful financial planning is essential to ensure a successful and profitable venture. This section will discuss the various aspects of financial planning and costs involved in setting up a currency exchange business.

Start-up Costs Breakdown